Introduction to Accounting Unit

Accounting Unit (AU) module provides the ability to produce multiple sets of balanced financial reports for a single business entity. Although, the AU module is designed to handle multiple reporting requirements, the Singapore Asian Currency Unit (ACU) or Domestic Banking Unit (DBU) regulations are used in this guide. For example, the Monetary Authority (MAS) in Singapore requires banks to keep separate accounting books for business operations of ACU and DBU. Accounting book is used to describe a balanced set of financial reports. MAS requires all the operations and events to be traceable either in ACU or DBU.

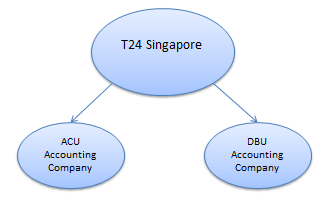

All ACU and DBU activities are reported separately on a weekly and monthly basis to differentiate the activities. In Singapore, the Singapore Dollar (SGD) and Brunei Dollar (BDN) are mandatory DBU currencies and all other currencies are described as ACU. According to the basic reporting rule, any transaction involving a DBU currency must be reported in the DBU accounting books and under any circumstances, it cannot be reported in the ACU accounting books. It is permissible to allocate a non DBU currency to either ACU or DBU accounting book. Therefore, a single business entity produces two sets of balanced books when they perform transactions in the ACU and DBU currencies. The following diagram shows the Singapore operational company and the ACU and DBU accounting companies. For example, at the operational company level, interest and charges are setup. The actual accounting entries are raised in the ACU or DBU Company.

Product Configuration

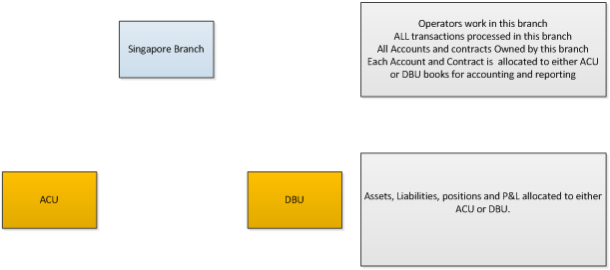

An accounting company is setup when a Temenos Transact Company (business entity) needs to produce more than one set of financial reports with each set allocated to an accounting company. Transaction input takes place in the parent Temenos Transact Company. Accounting companies are linked to a normal Temenos Transact parent company. For example, the Singapore Company is the business entity with the following two accounting companies linked to it:

- Onshore accounting company (DBU)

- Offshore accounting company (ACU)

A set of parameter tables is used to define the rules that determines which accounting company is allocated. These rules can be setup for each relevant Temenos Transact application.

Parent Company Functionality (Business Entity):

- Configuration and parameterisation of the system is at the parent company level.

- User logs are captured in the parent company.

- Transactions are entered in the parent company.

Accounting Company:

- Accounting entries are allocated to an individual accounting company.

- Accounts and transactions are allocated to the relevant accounting company.

- Currency position records are raised for the relevant accounting companies.

- Directly signing into an accounting company is not allowed.

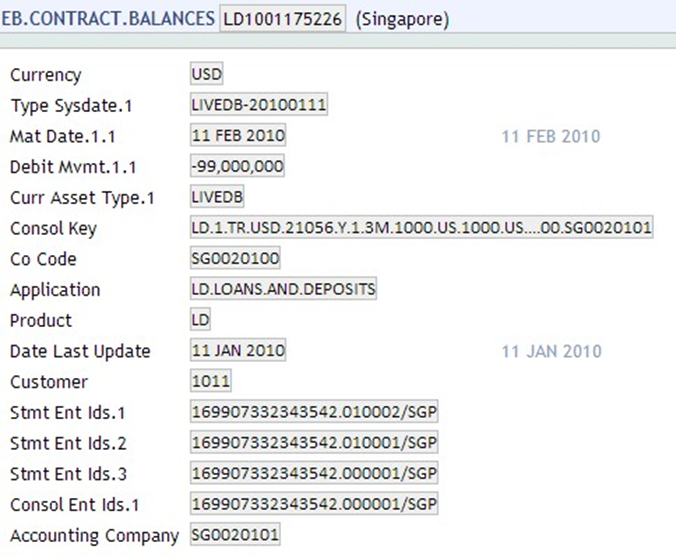

All accounts and contracts are entered into and owned by the parent company. The system records the accounting company for each asset and liability and profit and loss item, on the related record of the contract in EB.CONTRACT.BALANCES. According to the allocation rules, the accounting company is set to default for creating a new account. It can also be manually entered for accounts in non-mandatory currencies. For example, it is permissible to have an account in a non-DBU currency allocated to either the onshore or offshore accounting company.

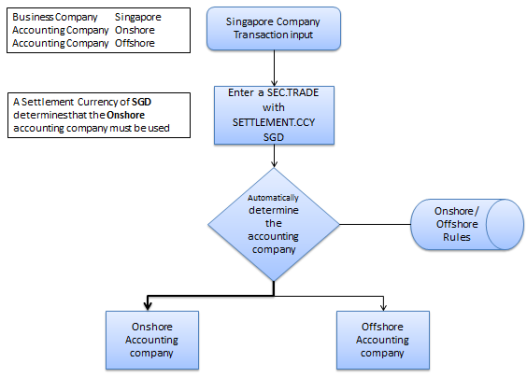

The following diagram provides a simple example of a transaction being processed in the Singapore Company, with the transaction automatically allocated to the onshore (DBU) accounting company. This happens when the allocation rules are setup such that all transactions involving a mandatory onshore currency are booked into the onshore accounting company.

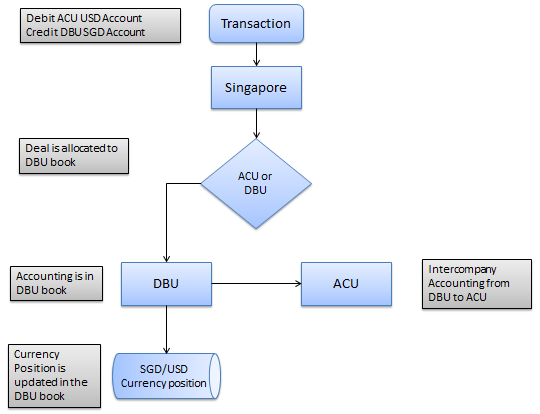

One of the fundamental rules of ACU or DBU is not to have DBU (onshore) currency positions in the ACU (offshore) books. Onshore currency amounts are exchanged into an offshore currency amount before using it for offshore business. The currency exchange must be initiated in the onshore accounting company, so it can be reported in the onshore books. Currency positions and P&L are raised in the accounting company allocated to the transaction.

The diagram below shows how Temenos Transact intercompany accounting works in relation to ACU or DBU using a transaction, which is debiting a USD ACU account and crediting a SGD DBU account. As an onshore (DBU) account is used, the transaction is allocated to the onshore (DBU) accounting company.

The configurations required for the Accounting Unit module is explained below.

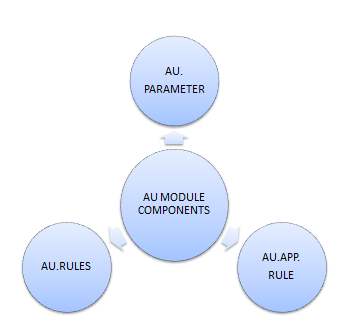

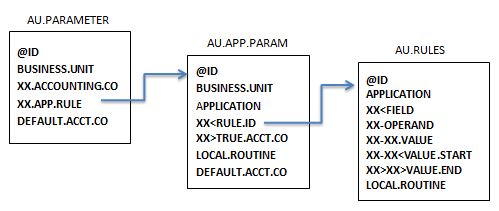

The following diagram shows the applications that are used to configure the rules for multiple accounting companies (ACU or DBU).

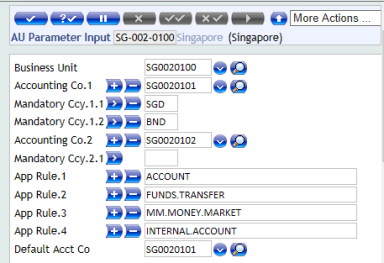

The system uses the AU.PARAMETER table to hold the information required to determine accounting entries allocated to the accounting company.

The record ID to AU.PARAMETER is the business company that needs to be split into accounting companies. This record has the following:

- The business unit company code, and company codes of the accounting companies are linked to it.

- The record IDs are created in the

AU.APP.RULEapplication. - Mandatory currencies for a specific accounting company.

- The ID of the default accounting company where the transaction is entered. This accounting company may or may not meet any of the rules that have been defined.

The following screenshot shows an example record.

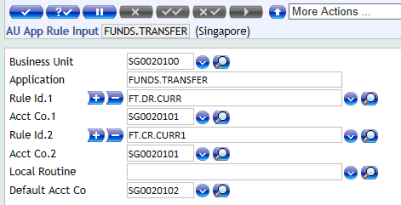

This table is used to hold all the individual rules created for an application that are specific to an individual business unit. The system checks the rules in chronological order, until a rule is met.

The record has the following:

- Business unit company code.

- Group of rules that apply to the Temenos Transact application.

- Individual rules record IDs.

- If the rule is true, the corresponding result for each rule determines the accounting company that needs to be applied.

- A field to provide a local routine to return the accounting company, which are used instead of

AU.RULES. - A default accounting company.

The following screenshot shows an example record for FUNDS.TRANSFER.

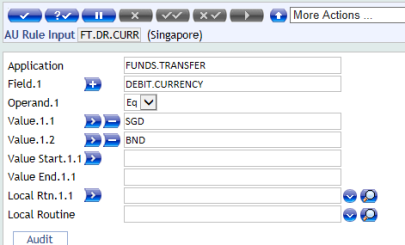

This application is used to create individual rules for an application.

The record has the following fields:

- Application

- Decision fields (for the rules)

- Local Routine (used instead of the Decision fields)

The following screenshot shows the fields in the AU.RULES application.

The following diagram shows the link between the tables.

The COMPANY.CREATE application is used to create new companies. The business company is created first, followed by the accounting companies.

In the below example, values are shown based on the company created using an established lead company.

| Field | Example value | Comments |

|---|---|---|

| @ID | SG0020100 | New business unit (lead company) code |

| Company Name | Singapore branch | |

| Name Address | Singapore | |

| Mnemonic | SGP | Mnemonic for this business unit (lead company) |

| Financial Com | SG0020100 | Financial code for this business |

| Financial Mne | SGP | Mnemonic for the business unit |

| Sub Division Code | 0100 | Subdivision code for the new company |

| Default Company | SG0020100 | Company code of the business unit to which the accounting unit belongs |

| Consolidation Mark | N |

To create an accounting company, the user needs to enter the following fields in COMPANY.CREATE.

| Field | Example value | Comments |

|---|---|---|

| @ID | SG0020101 | Company code for accounting unit |

| Company Name | Singapore DBU | |

| Name Address | Singapore | |

| Mnemonic | DBU | Mnemonic for accounting company |

| Financial Com | SG0020100 | Company code of the business unit to which the accounting company belongs |

| Financial Mne | SGP | Mnemonic of the business unit to which the accounting company belongs |

| Sub Division Code | 0101 | Subdivision code for the new accounting company |

| Default Company | SG0020100 | Company code of the business unit to which the accounting unit belongs |

| Consolidation Mark | A |

- If these companies are created in a single company environment, CREATE.MASTER.COMP.BATCH from the command line is run. This adds the mnemonic to the existing batch record for the original company.

- To know more information on creating new companies, refer to Multi Company user guide.

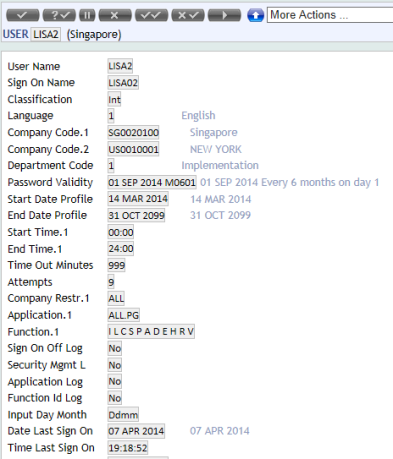

In the user profile, add only the parent company details.

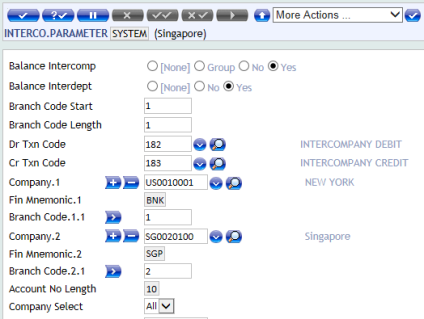

The Company Select field in the INTERCO.PARAMETER is set to ALL. This allows the user to view the entries allocated to an accounting company.

In addition to using rules based on fields in the Temenos Transact applications, users can use a local routine to allocate contracts and accounts to an accounting company.

The AU.AMT.CCY routine is used in the following example.

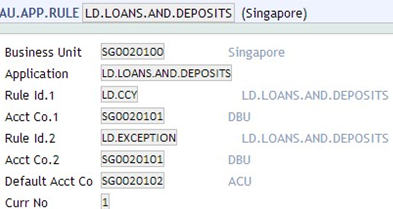

- The

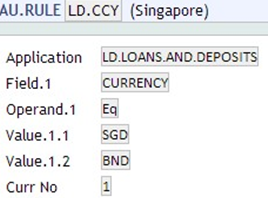

AU.APP.RULEforLD.LOANS.AND.DEPOSITSis configured for two rules, such as LD.CCY and LD.EXCEPTION.

- The following are the two records in

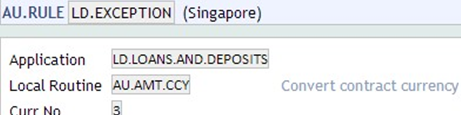

AU.RULE. - The LD.EXCEPTION record is configured in

AU.RULEto use the AU.AMT.CCY routine and perform complex allocation tasks.

This routine is used to classify LD contracts for ACU or DBU and is dependent on category, sector code and amount of the transaction.

| Rule 1 |

Select and check all LD and MM loan transactions for the following:

|

Book into DBU |

| Rule 2 | Select and check all LD and MM loan transactions for the following:

|

Book into ACU |

The routine passes the following arguments.

| Routine | Function |

|---|---|

| AU.RULE.ID | Record ID of the AU.RULE |

| R.RULE | Allocation rule record |

| CONTRACT.ID | The underlying LD or MM contract ID |

| R.CONTRACT | Contains the necessary record values for the respective Contract ID, which is further used to make an amount check based on customer sector, the category of the loan and the term amount of the loan or MM. |

The routine returns the following argument:

- RESULT – set to 1 for true and 0 for false

- It displays the default return result false

The routine gets the customer sector for the customer on contract and verifies it against these sector codes 900/903/904/998/999.

| If the | Then |

|---|---|

| Sector does not match the list | The category of the load is checked against the range 21051 to 21056. |

| Sector and category checks pass | The amount of the loan is converted into a USD equivalent and if it is less than 100 million USD, it returns the result ‘True’. |

In this case, the AU.AMT.CCY routine checks all non-SGD and BND currency loans and makes an amount check based on customer sector, category of the loan, and term amount of the loan.

The following screenshot shows the contract is allocated correctly.

Illustrating Model Parameters

This section covers the model parameters required for the AU module.

| S.No. | Parameters | Description |

|---|---|---|

| 1. | AU.PARAMETER

|

|

Illustrating Model Products

Model Products are not applicable for this module.

In this topic