Introduction to Fiduciary Deposits

Fiduciary deposits take deposit orders from customers and place them individually or in groups with foreign institutions that may be either external or a member of the same group as the deposit unit. This feature discusses the various parameter setting necessary to place a fiduciary order.

Product Configuration

The initial applications populated are listed below.

FD.PARAMETERFD.ACTIVITYFD.ADVICESFD.CHARGE.PARAMETERFD.COMMISSION.TYPEFD.CUST.DETAILSFD.FID.CURRENCYFD.TXN.CODESFD.MATURITY.DATESFD.PLACEMENT.PROFILEFD.BANK.DETAILSFD.STANDARD.PERIODSFD.RATE.DEVIATION

Fiduciaries use the CUSTOMER.CHARGEapplication for amending charges by customer or by group. Therefore, the following application must be setup:

| Files | Records |

|---|---|

CONDITION.PRIORITY

|

Record FIDUCIARY |

FD.GEN.CONDITION

|

Default record 099 must be defined (user – defined record). |

FD.GROUP.CONDITION

|

Default record 099 must be defined (for fiduciary type, fixed or notice) (user-defined record). |

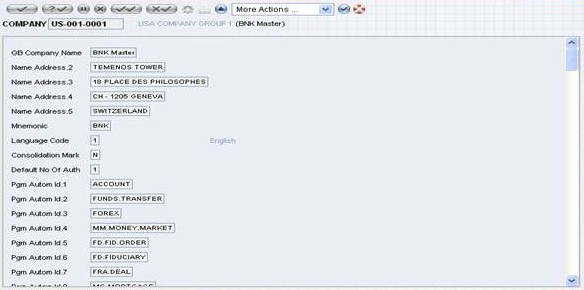

Once these are defined, the user must run (from within Temenos Transact) the INSTALL.FID.CUST.CHARGES program to update the CUSTOMER.CHARGE records. For automatic ID generation, the two main application to be setup in the COMPANY application are FD.FID.ORDER and FD.FIDUCIARY.

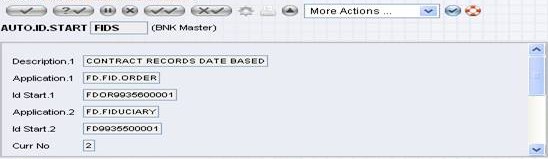

The user must add or create an AUTO.ID.START record to initialise the first ID by setting the Application field to FDOR and the Id Startfield to display as FDOR9935600001 for FD.FID.ORDER. For FD.FIDUCIARY these must be FD and display as FD9935500001 respectively.

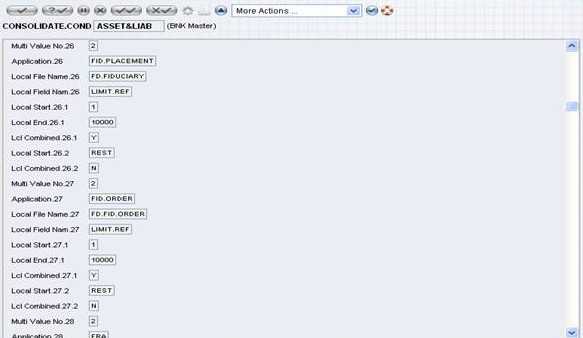

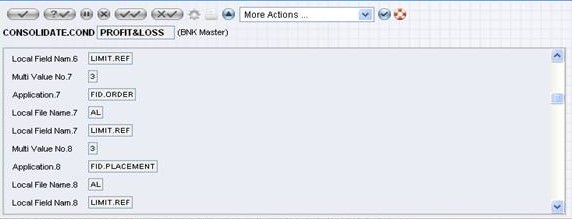

The above two applications must be added to the CONSOLIDATE.COND file to include in the general ledger.

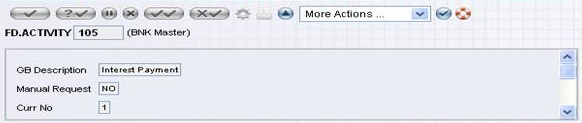

FD.ACTIVITY

This FD.ACTIVITY application is used to specify internal activities of the life cycle of fiduciaries and give a language description for system enrichment purposes. The records must be in place before instigating any deals.

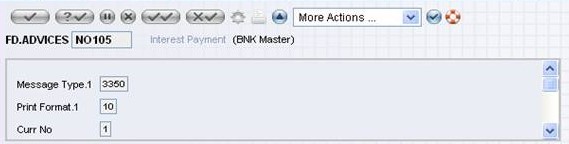

FD.ADVICES

This application creates an interface for a fiduciary activity either to the delivery system or to a deal slip. The key is made of two parts, two letters and a three-figure number. The first of the two letters specifies the fiduciary type (fixed or notice) and the second whether the deal is at the placement or order stage (P or O). The three-figure number is a ID on the FD.ACTIVITY application. This means that for each activity the user can issue one of four separate advices dependent on stage and type. Instead of giving a Message Type and Print Format, the user can give the key to another record on FD.ADVICES and it uses the Message Type and Print Format from that record.

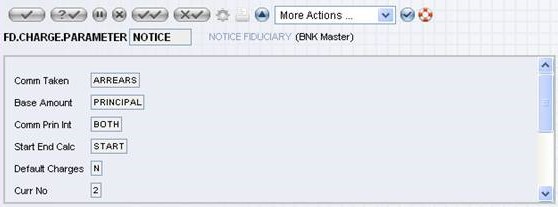

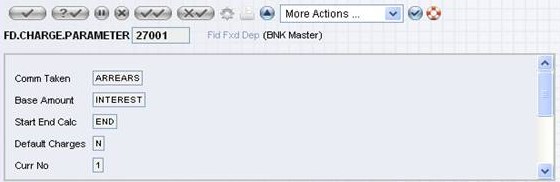

FD.CHARGE.PARAMETER

For each deal category or for fixed or notice deals, the commission charge settings can be set in FD.CHARGE.PARAMETER. Commission can be taken in advance or arrears based on either the principal interest or income.

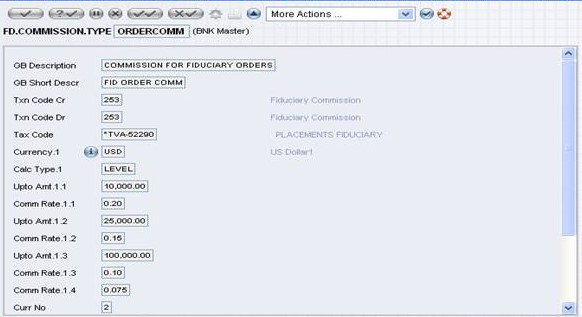

FD.COMMISSION.TYPE

When entering an order from a customer, the commission basis can be specified in FD.COMMISSION.TYPE. Standard and specific types can be defined. The charging of tax and the basis for the commission are defined here. The following calculation types are defined as:

- Flat - implies the same commission rate irrespective of the amount.

- Level - flat rate depending on which level the amount falls.

- Band - implies a level, except that the charge is on a climbing scale (for example, 0.5% for first 100,000, then 0.3% for next 400,000 and 0.2% after that).

It also specifies whether commission type calculates against the amount deposited in the fiduciary or the customer's overall business with the bank.

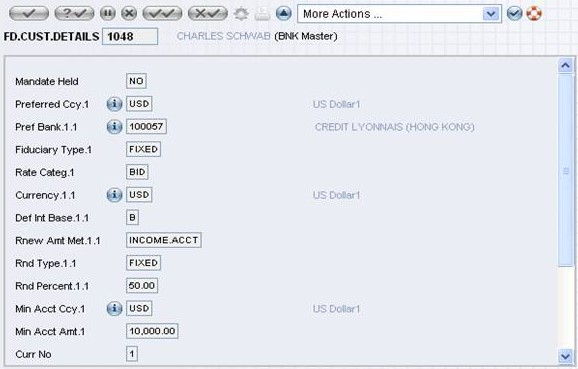

FD.CUSTOMER.DETAILS

A record for each customer dealing with Fiduciaries must be created on FD.CUST.DETAILS applicationThe ID of this application must be a valid record on the CUSTOMER application. Each customer of the bank has specific needs with regard to deposits placed on their behalf.

Banks that they trust can be specified as those they do not wish to be used. Limits are set on how much can be placed with specific institutions. Specific rate category, margin on interest, interest calculation method and rounding type may be defined by fiduciary type or category.

FD.FID.CURRENCY

It is likely that the treasury department does not make placements with other institutions for small or odd currency amounts. The FD.FID.CURRENCY application provides a means of restricting orders to minimum amounts (defined by fiduciary type or category and tenor for fixed orders or tenor event for notice orders) and for amounts above that minimum for which the multiples can be placed (defined by fiduciary type or category and ranges of amounts). An override is generated if a non-standard amount is inputted.

FD.TXN.CODES

Rather than hard coding the transaction codes that are used for events within the Fiduciary Deposits (FD) module, the SYSTEM record on FD.TXN.CODES allows the user to specify which transaction codes are used for which event. This application has only one record called SYSTEM and cannot be modified once it is created.

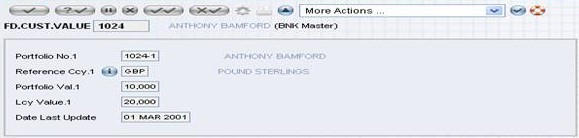

FD.CUST.VALUE

The FD.CUST.VALUE is a LIVE file that holds the last calculated value of the total assets or liabilities for each fiduciary customer. It is updated monthly in the COB routine FD.EOD.UPDATE.CUST.VALUE.

FD.MATURITY.DATES

In order to group a maximum of orders with the same maturity date and to generate bigger volume, standard maturity days can be defined by year or month and currency (individually for only a set of specific currencies, or for all currencies except some special ones for which specific dates are set).

When a frequency (like, 1M, 3M and 6M) is used to enter in the maturity of a contract, the system calculates the resulting date by taking into account the holidays in the country related to the deal currency.

It then compares this date with the dates stored in the corresponding record of FD.MATURITY.DATES (these dates may have to be converted to working dates) and chooses one according to the adjustment rules defined in the Matdates field of FD.PARAMETER application.

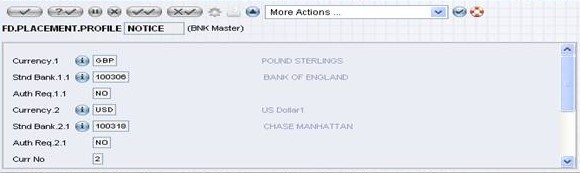

FD.PLACEMENT.PROFILE

The back-office process around a fiduciary placement consists of checking and eventually changing the settlement instructions proposed by the system. As there are only small risks involved by a Fiduciary deposit and as most of the Fiduciary deals are always placed with the same depositories, they often need not be checked.

It is possible to list depositories, defined by deposit type and currency, for which no additional check is required by the back-office once the dealer has approved the placement.

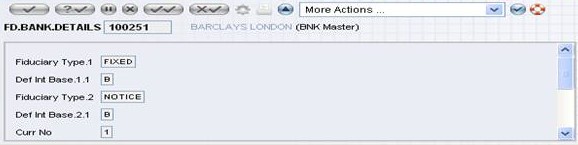

FD.BANK.DETAILS

The ID of this FD.BANK.DETAILS application must be a valid bank recorded on the CUSTOMER application. Each fiduciary bank may have specific practices such as interest calculation method with regard to deposits placed with them.

FD.STANDARD.PERIODS

The FD.STANDARD.PERIODS application allows the user to record, by company and upper limit of tenor (in number of days), the tenor code (TERM) of a renewed deposit for the calculation of its maturity date.

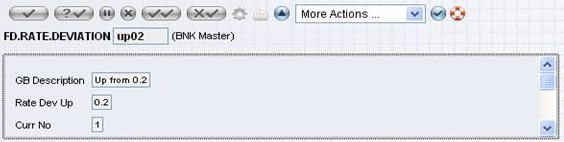

The FD.RATE.DEVIATIONapplication allows the user to record the rate fluctuations (up and down) over which an automatic interest rate change may be applied to notice contracts done inside the group.

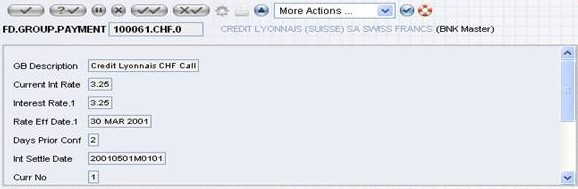

FD.GROUP.PAYMENT

When dealing in placements that are at call or have a defined notice period, there must be agreed dates when interest is to be settled. Banks usually have pre-defined arrangements for each type stating at what interval interest is settled. Temenos Transact also needs to be advised of changes to the rates that affect call or notice placements made with external banks. This is catered in the FD.GROUP.PAYMENT table where the rates and interest details of the banks can be stored and updated.

Banks may need to maintain a record of a range of fixed term deposits which are offered by different institutions. The FD.GROUP.PAYMENT application allows to enter the details of fixed term deposits. The ID of the record is in the BANK.CURRENCY.TERM format, where TERM is the term of a deposit. The term can be days, weeks or months.

100461.USD.12M

100461.USD.12D

100461.GBP.3W

If the ID has a term, then Days Prior Conf and Auto Chg Rate fields are no-input fields. The Int Day Basis field holds a valid interest day basis supported by the FD module. The Holiday Calendar field accepts any calendar including region value (example, US00) and Val Date Offset is used to arrive at the value date of a record in FD.FID.ORDER.

FD.GROUP.PLACEMENT

This is a live concat file in which each record only contains a key. It is used to associate groups and placement banks with the corresponding FD.FID.ORDER deals that are placed there. The ID is made up of four parts separated by dots. The first part is the placement bank, the second is the currency, the third is the number of days and the fourth is the FD.FID.ORDER number.

The data is held this way (opposed to a key and a list of multi-valued keys to FD.FID.ORDER) as it is quicker and this application is generally used in time critical COB processing.

FD.GROUP.TODAY

Similar to the FD.GROUP.PLACEMENT application, this is a live concat file with each record containing only a key. The ID is similar to FD.GROUP.PLACEMENT except that there is no fourth part where the Deal number is. This application is used to list all the banks whose FD.GROUP.PAYMENT records have changed. Once the details in the FD.FID.ORDER and FD.FIDUCIARY are updated, the record is deleted.

Illustrating Model Parameters

The model parameters for Fiduciary Deposits are explained below:

FD.PARAMETER

This is the main parameter application with the only record SYSTEM. The parameter that allows the user to specify the different category codes (for both deposit and placement) by fiduciary type (Fixed or Notice). The P/L codes and accrual cycles are set in this file. At this level, it is possible to set whether accruals must be calculated for commissions on notice contracts. It is possible to configure the system to integrate the processing of payment to the counterparty bank through the centralized PAYMENT.ORDER (PO).

FD.CHARGE.PARAMETER

This application is used to define the default charge details used for calculating the commission amount payable by the customer on a fiduciary order. The parameters can be defined at the level of the category, code of the order, or the order type (Fixed /Notice).

FD.PLACEMENT.PROFILE

This application is used to define the depositories for which no back-office intervention is required by deposit type and currency. This file is used by the program FD.FIDUCIARY to define whether the placement updated by the dealer requires additional checks from the back-office or not. In other terms, depending on whether the depository used for the placement is defined in the FD.PLACEMENT.PROFILE application or not, the status of the record in FD.FIDUCIARY is either live or unauthorised.

Illustrating Model Products

Model products are not applicable for this module.

In this topic