Working with Scheduling Payments

The following section describes the process of scheduling payments.

Scheduling Payments

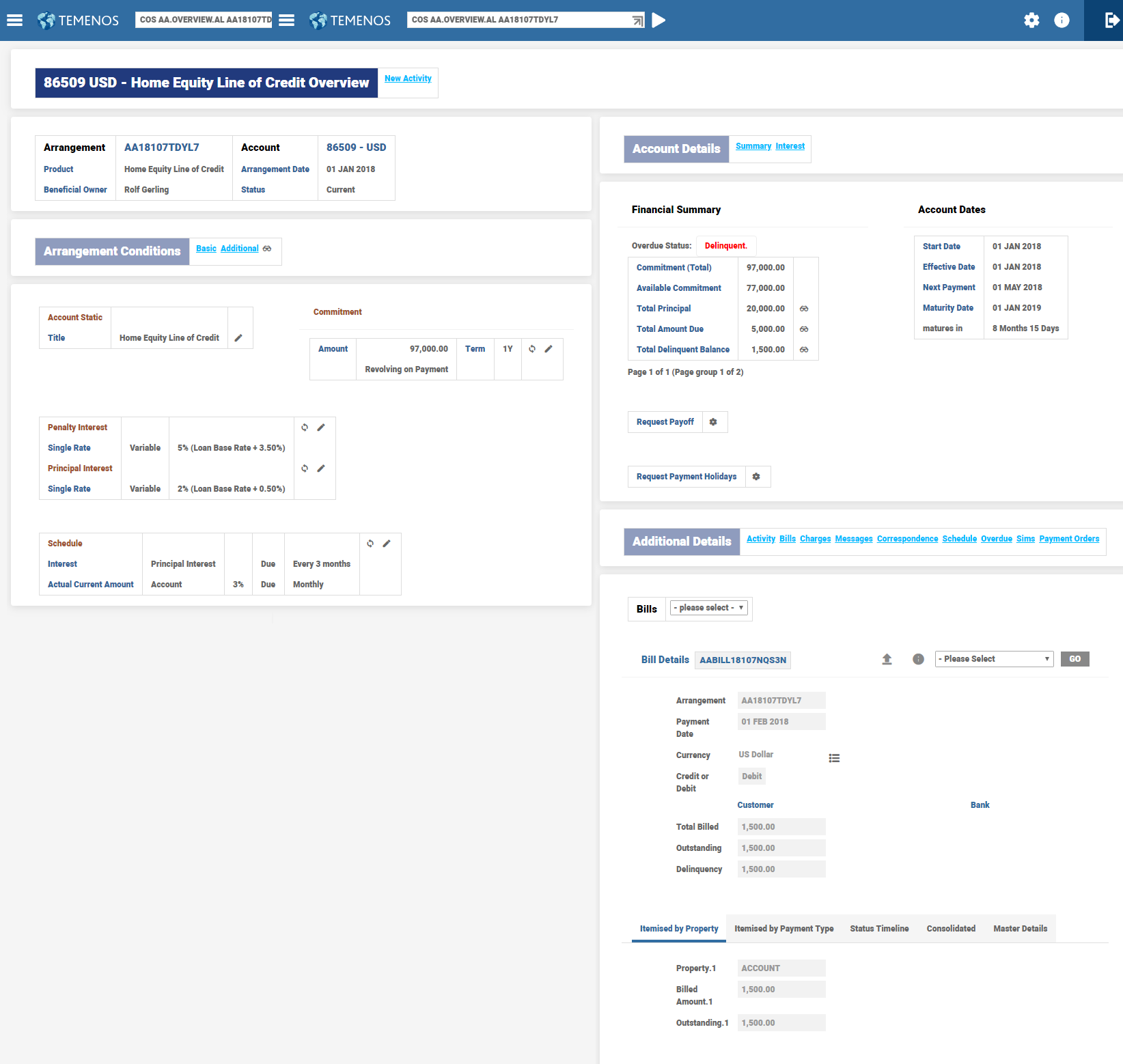

Bills are generated on the scheduled date (or in advance based on the Inadv field in payment schedule).

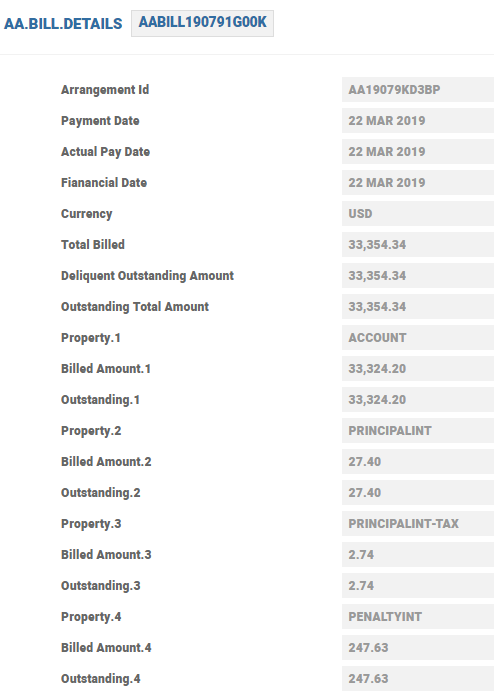

The bills generated on the payment schedule is stored in AA.BILL.DETAILS record.

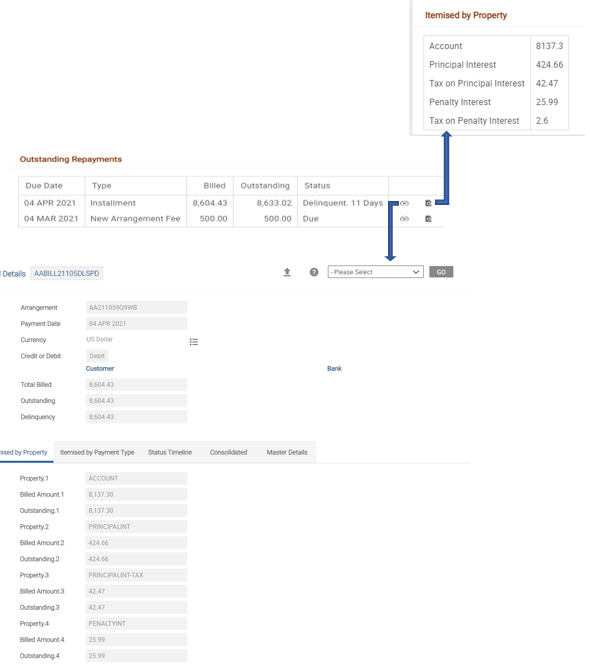

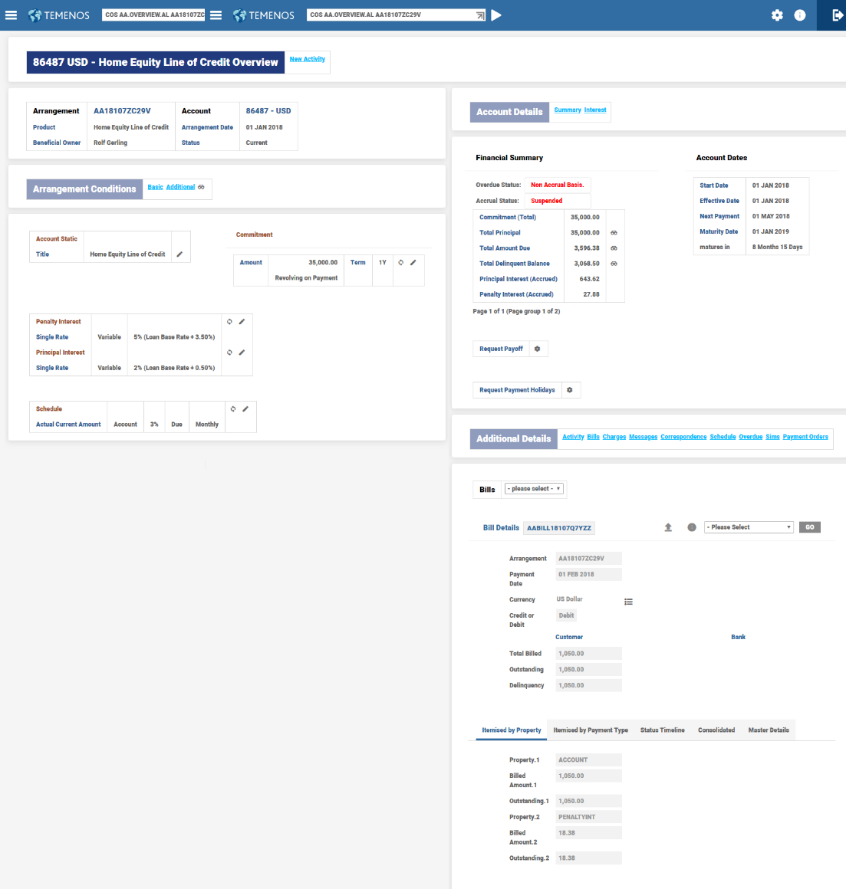

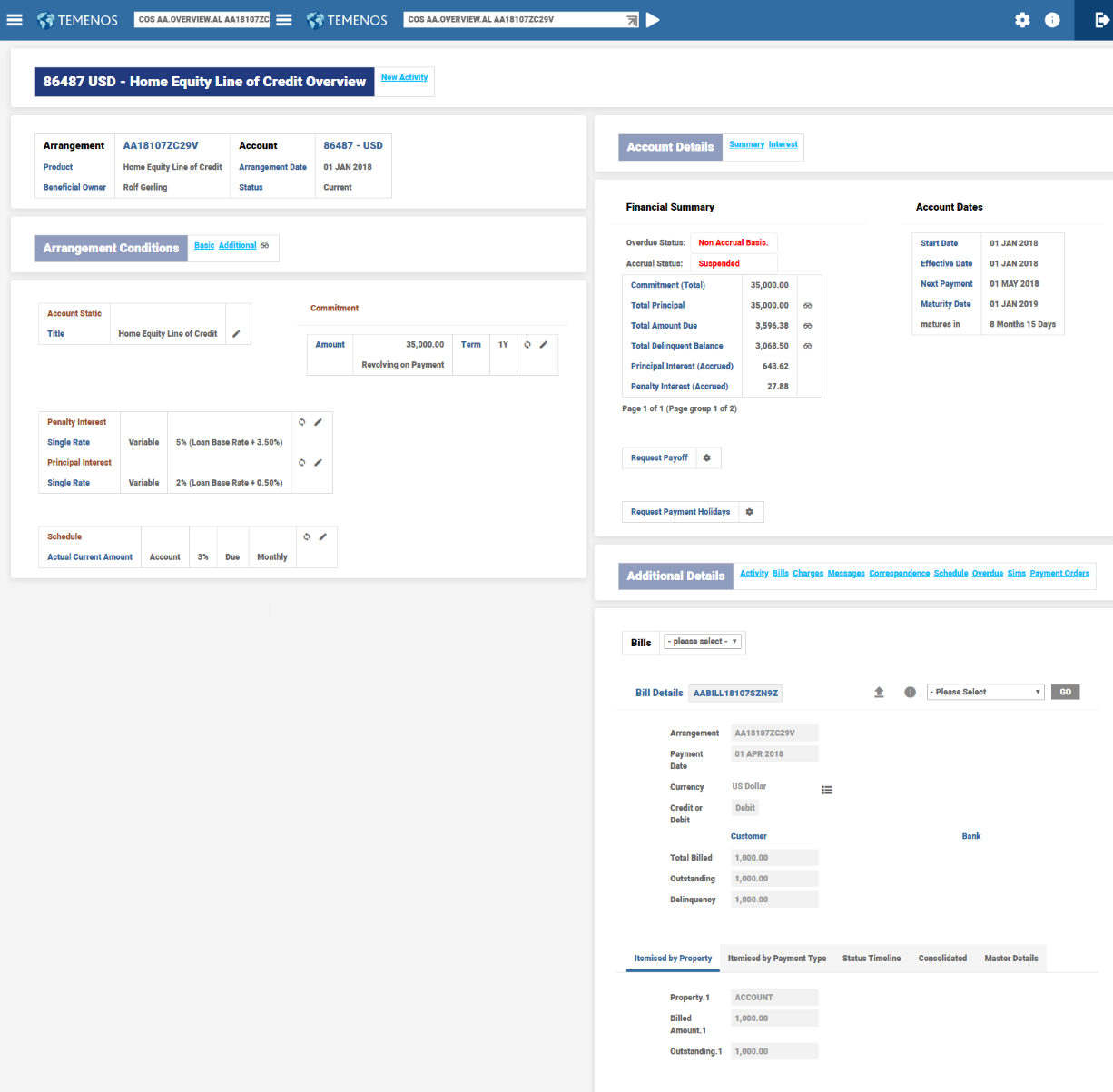

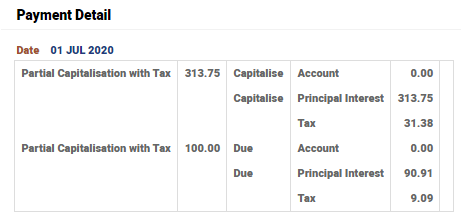

In the outstanding bills enquiry of the loan, the outstanding amount is inclusive of the tax amount on accrued penalty interest only when Tax Inclusive field is set as Yes in a payment rule of the product. The details can be read through the drilldown as shown below.

The bill details include the billed components. The tax related components for the bill are listed in the drilldown next to the bill details.

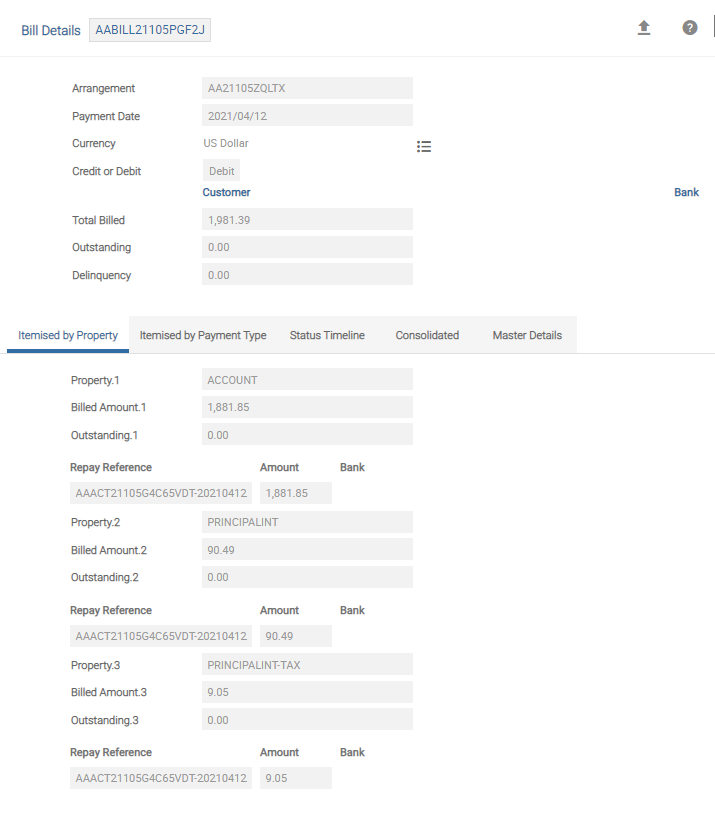

An illustration of another contract where a bill is settled is shown below. The details of the principal, interest and the tax settled are seen in the AA.BILL.DETAILS.

When a bill is deferred for a specific payment type, the defer date is updated in the AA.BILL.DETAILS record based on the Defer Period in the Payment Schedule.

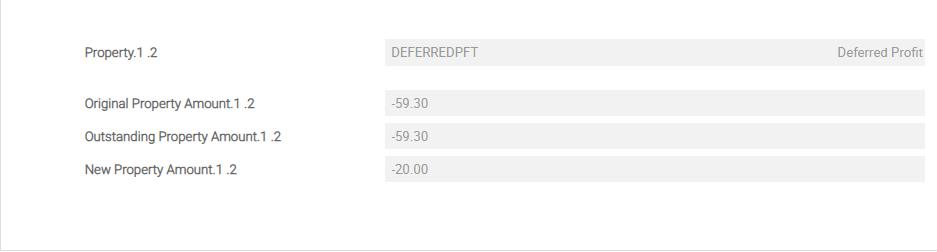

The property specific original amount that is the outstanding property amount is indicated in the bill. Any adjustments are also seen in the record.

The bill details displays three sets of fields:

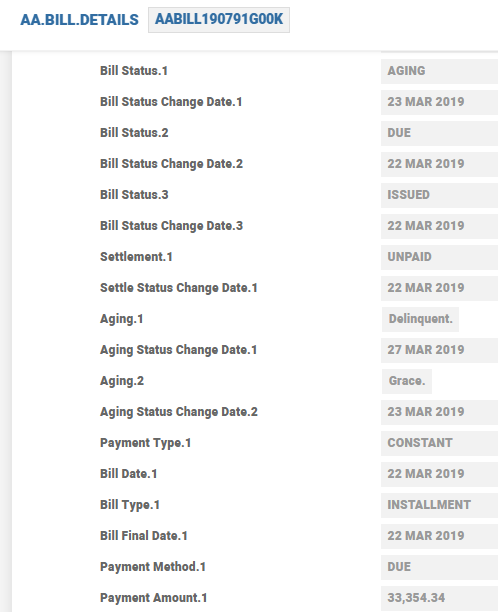

- Bill Status field - takes the values ISSUED, DUE, AGING and SETTLED based on the life-cycle of the bill. For example, when the bill is deferred, the Bill Status has the value DEFER after being issued and before becoming DUE.

- Settle Status field - updates as UNPAID and then as REPAID when the bill is settled.

- Aging Status field - takes the values GRACE, DEL, NAB, etc., and finally SETTLED. Note that GRACE, DEL, and NAB values are given based on the overdue

When the bill is paid or made due in advance and the payment bill is generated but paid after the cooling period if any, the MAKEDUE.ADVANCE Activity is scheduled one day after the cooling period. Any interest or principal changes through the Activity affects the interest and the final interest in the Tot Due Amt field of AA.INTEREST.ACCRUALS. The difference is paid or made due immediately.

The AA.BILL.DETAILS record stores the Property wise outstanding balances and ageing status. Read the Payment Schedule Property Class user guide for more information.

The below screen shot displays the bill details that contain multiple properties, billed amount and outstanding amount.

The below screenshot displays the ageing information, bill status and settle status.

The aging references are stored along with bill references and payment indicator.

Pre - Notification and Finalisation of Payment

Loan customers are advised N number of days in advance of an upcoming payment. From the notification date, the customers can choose to make changes to their upcoming payment till the bill amount is finalised. Upon reaching the finalisation date, no further changes are allowed for the upcoming payment and system triggers settlement processing for claiming funds from clearing. In case of no finalisation date, then the upcoming payment amount can be modified until the day before the payment date.

This functionality is achieved through Payment Schedule Property Class through the Bill Produced and Finalise Bills attributes. The period defined in Finalise Bills should be less than Bill Produced.

Scenario: Consider the following conditions.

| Attribute | Value |

|---|---|

| Payment date for a scheduled payment | 14-May-2020 |

| Bill Produced | 10D |

| Finalise Bills | 2D |

Ten working days (10D) prior to the payment date of 14-May-2020 is 30-Apr-2020 and the bill is issued on 30th Apr 2020 and the payment amount can be modified either by way of increasing or decreasing it until 12-May-2020

- In TBC, it is possible to notify the customer in advance about an upcoming payment in the loan. The system generates an event to notify the customer in advance about the scheduled instalment. Notifications to the customer based on events in the loan must be handled through external delivery subsystem.

- The billed amount for loan contracts in TBC can be settled as follows upon reaching the finalisation date:

- Capitalised to the same loan account or

- Forwarded as a settlement request by publishing an event to an account or beneficiary outside the TBC.

Minimum Payment Amount

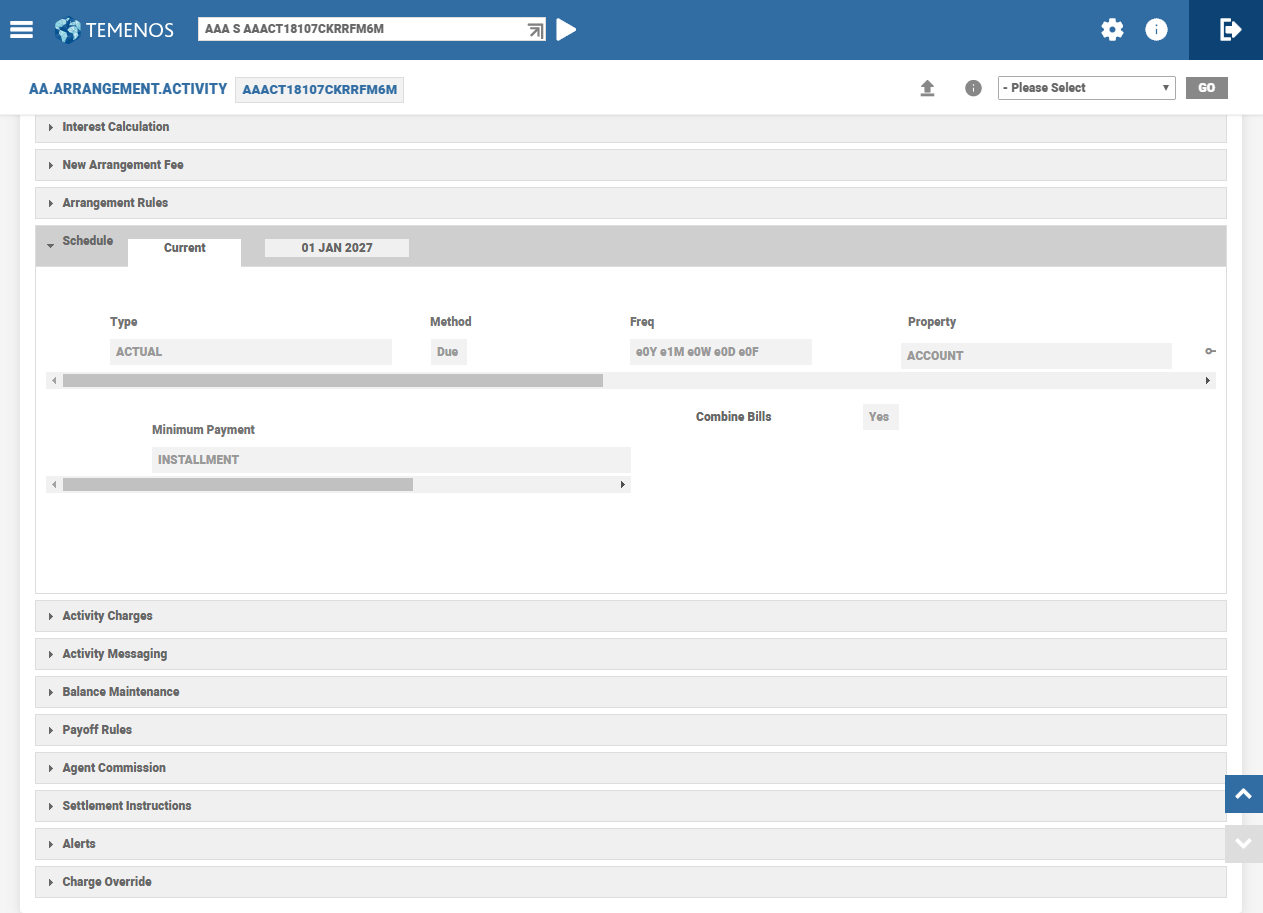

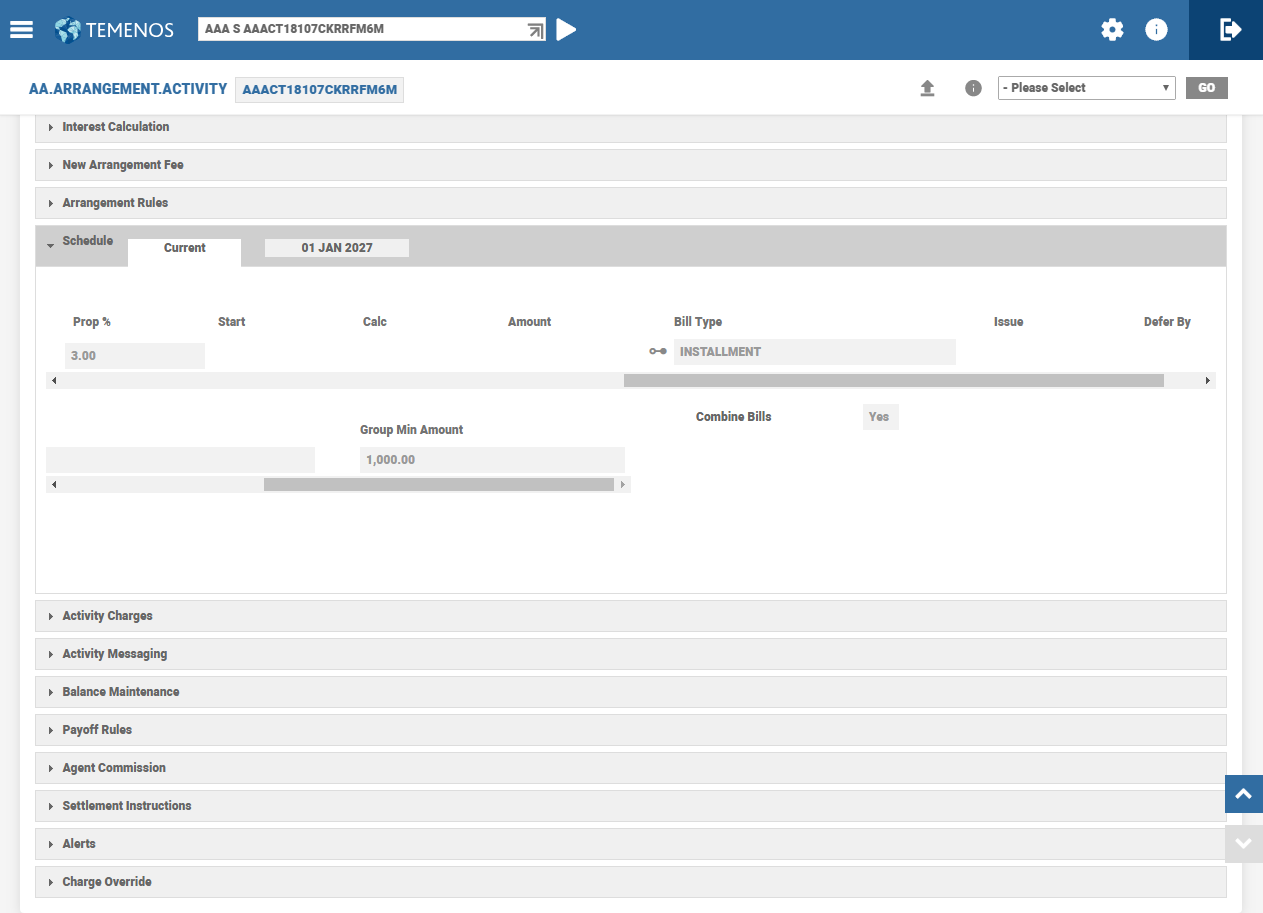

The user can setup bill type wise minimum payment amount using the Group Bill Type and Group Min Amount fields.

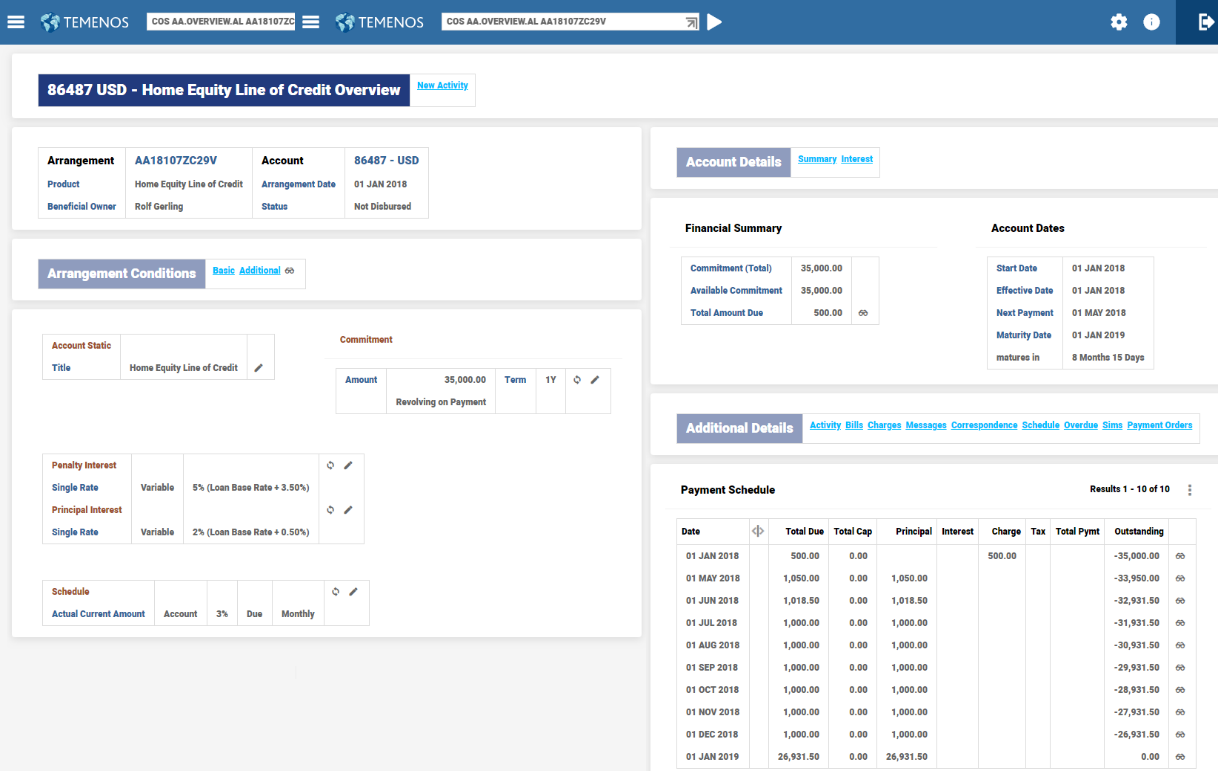

- Create an LOC Product with

- 3% principal repayment, monthly

- Monthly minimum payment of 1000

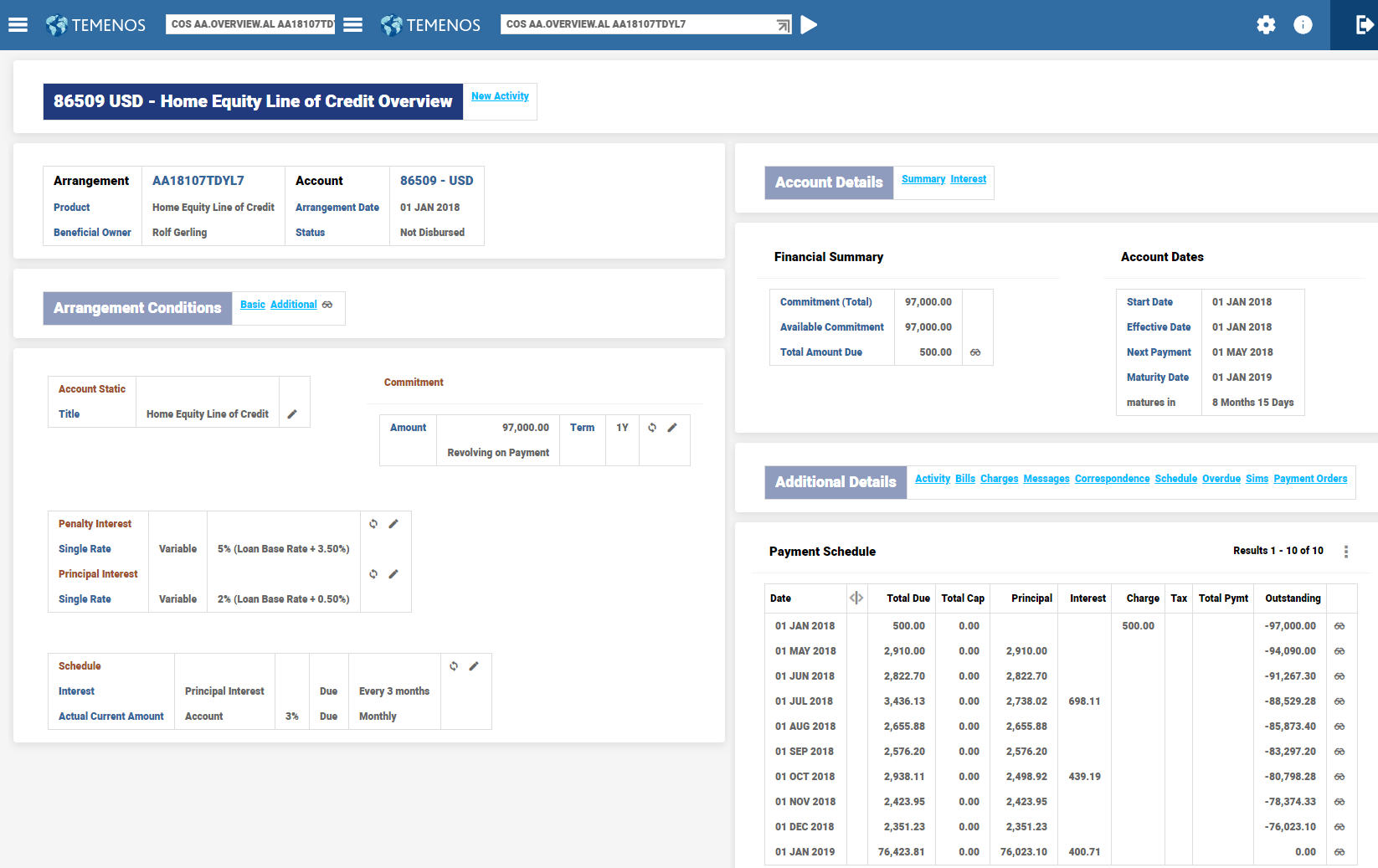

- Create an arrangement with 3% principal repayments with monthly frequency.

- View the Payment Schedule projection when the loan is not disbursed.

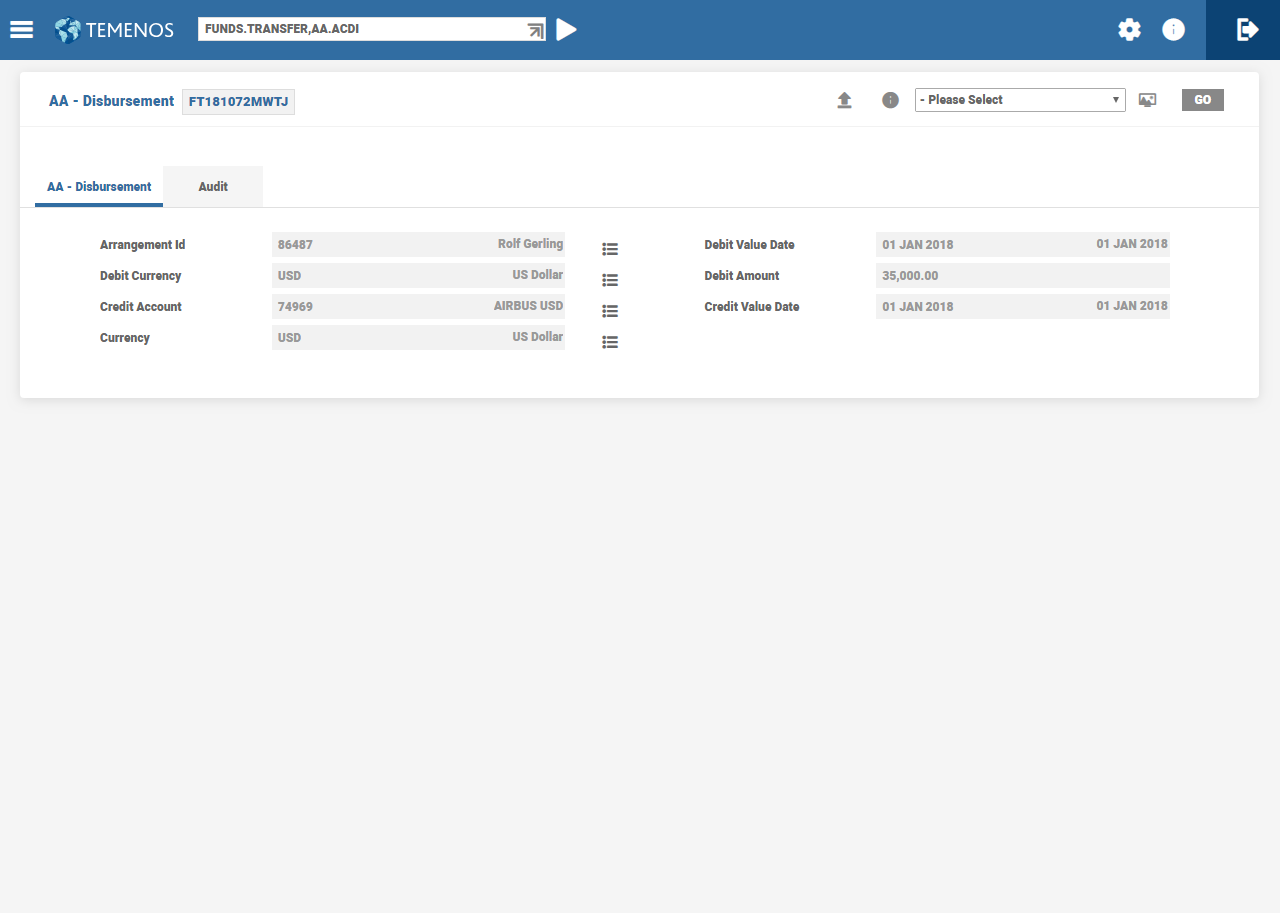

- Make a disbursement of 34T as of arrangement start date.

- View the Payment Schedule projection after the disbursement is authorised.

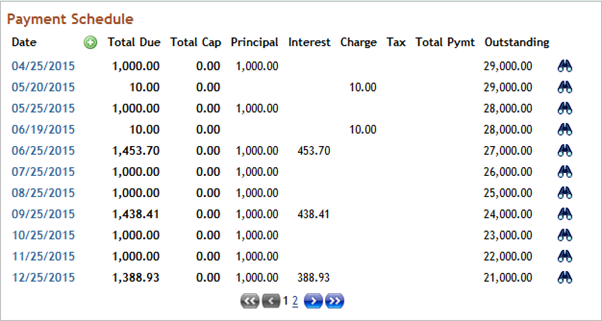

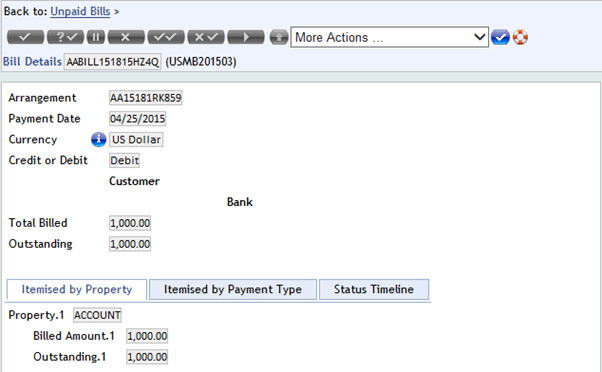

- View in detail the 04/25 bill.

- The outstanding amount was 34,000 and the interest percentage is 3%, which is 1,020. The calculated amount is greater than the minimum payment amount of 1,000 and hence the calculated amount is billed.

- View in detail the 05/25 bill.

- Here, the calculated amount is 989. The calculated amount is less than the minimum payment amount of 1000 and hence the minimum amount is billed.

- Create a LOC Product with

- 3% principal repayment, monthly

- Actuals of interest accrued, quarterly. Interest rate is 6%

- Monthly minimum payment of 1500

- View the Payment Schedule projection when the loan is not disbursed.

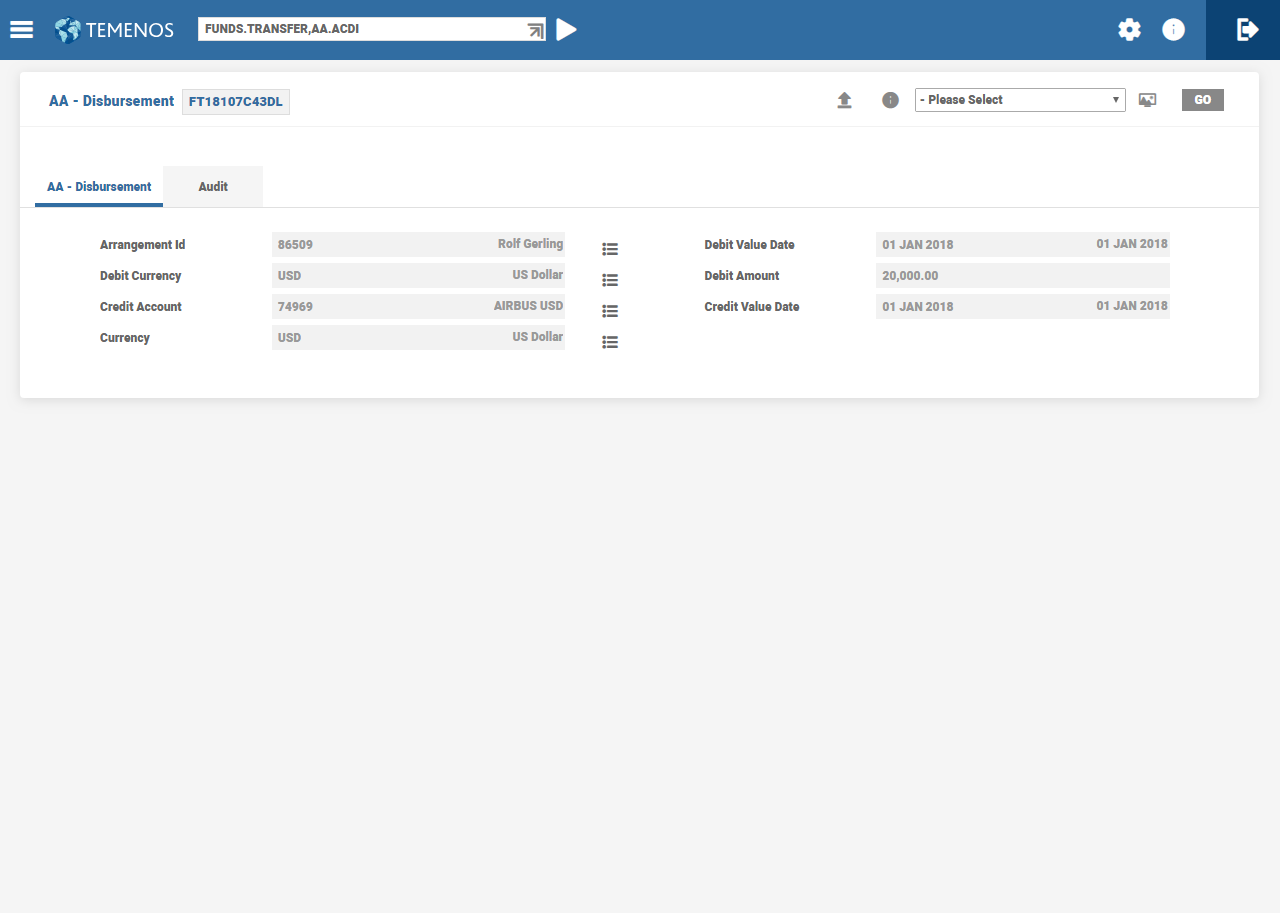

- Make a disbursement for 20T as of arrangement start date.

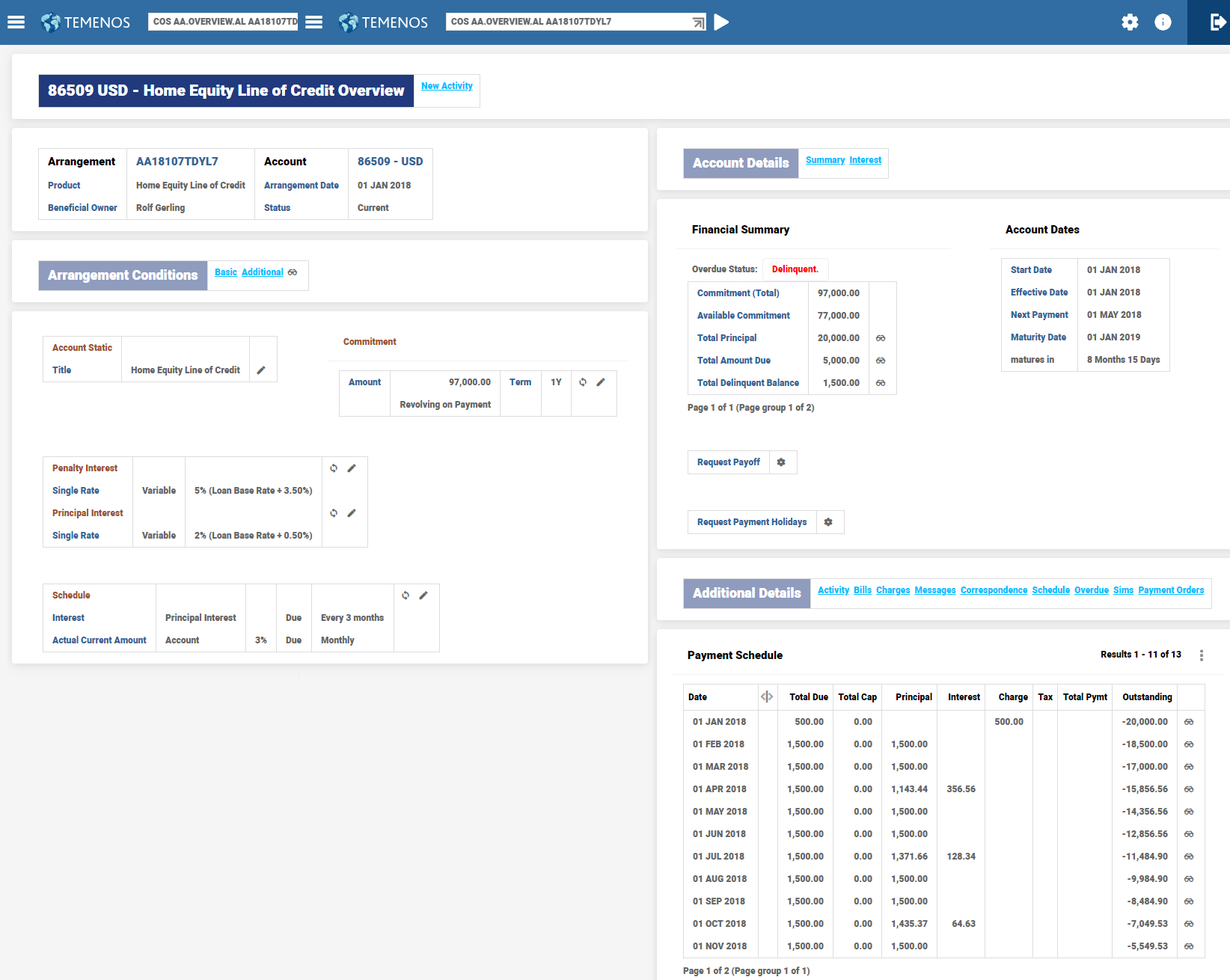

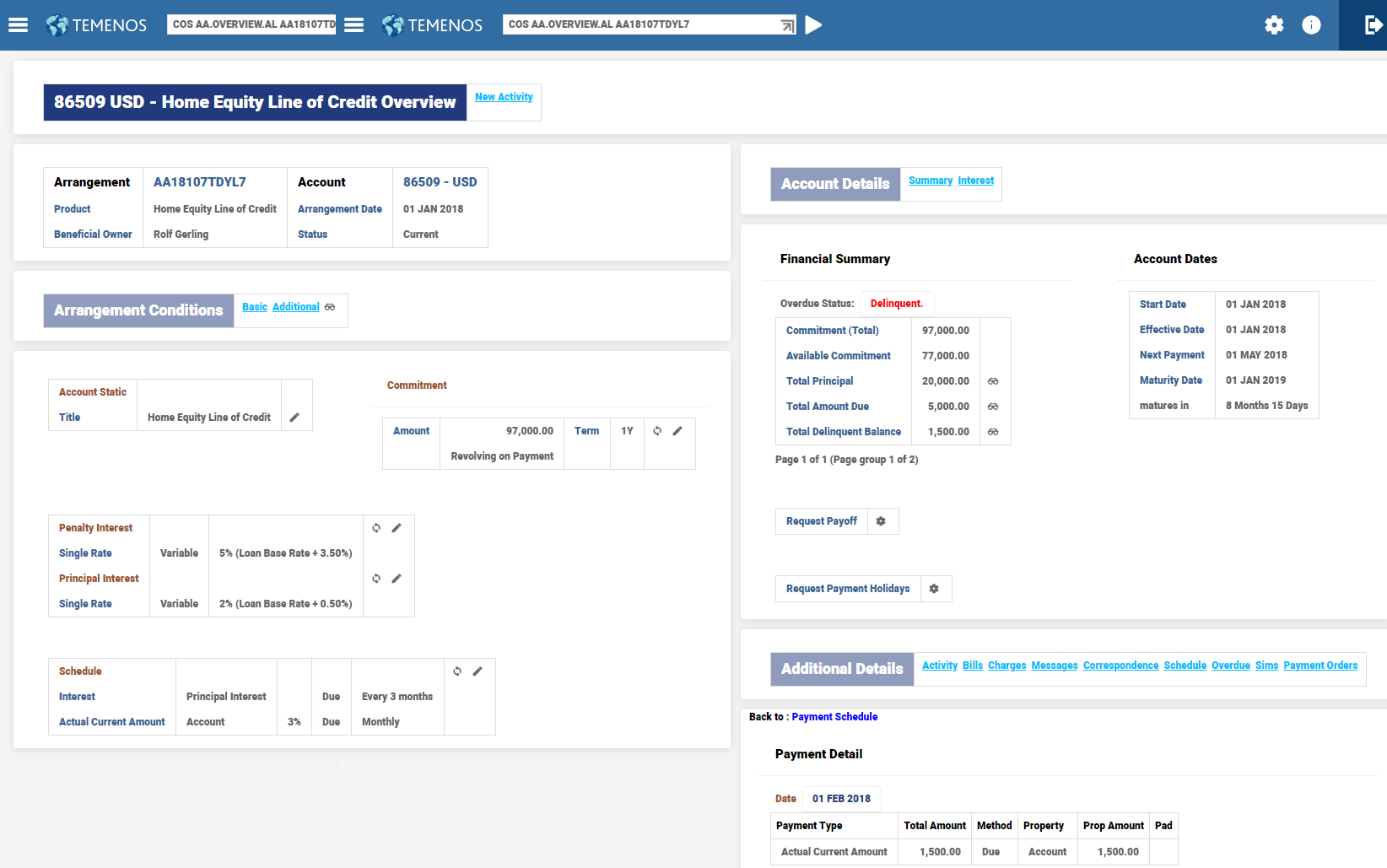

- View the Payment Schedule projection after the disbursement is authorised.

- View in detail the 05/30 bill.

- View the actual bill raised for 05/30.

- View in detail the 07/30 bill.

- Here, 3% of outstanding principal is 510 (17,000 * 3%). The interest balance is 299.18. The cumulated amount is 809.18. Since this is less than the minimum payment amount of 1,500, the bill is produced for the minimum amount. The difference amount of 690.82 is added to the Account Property.

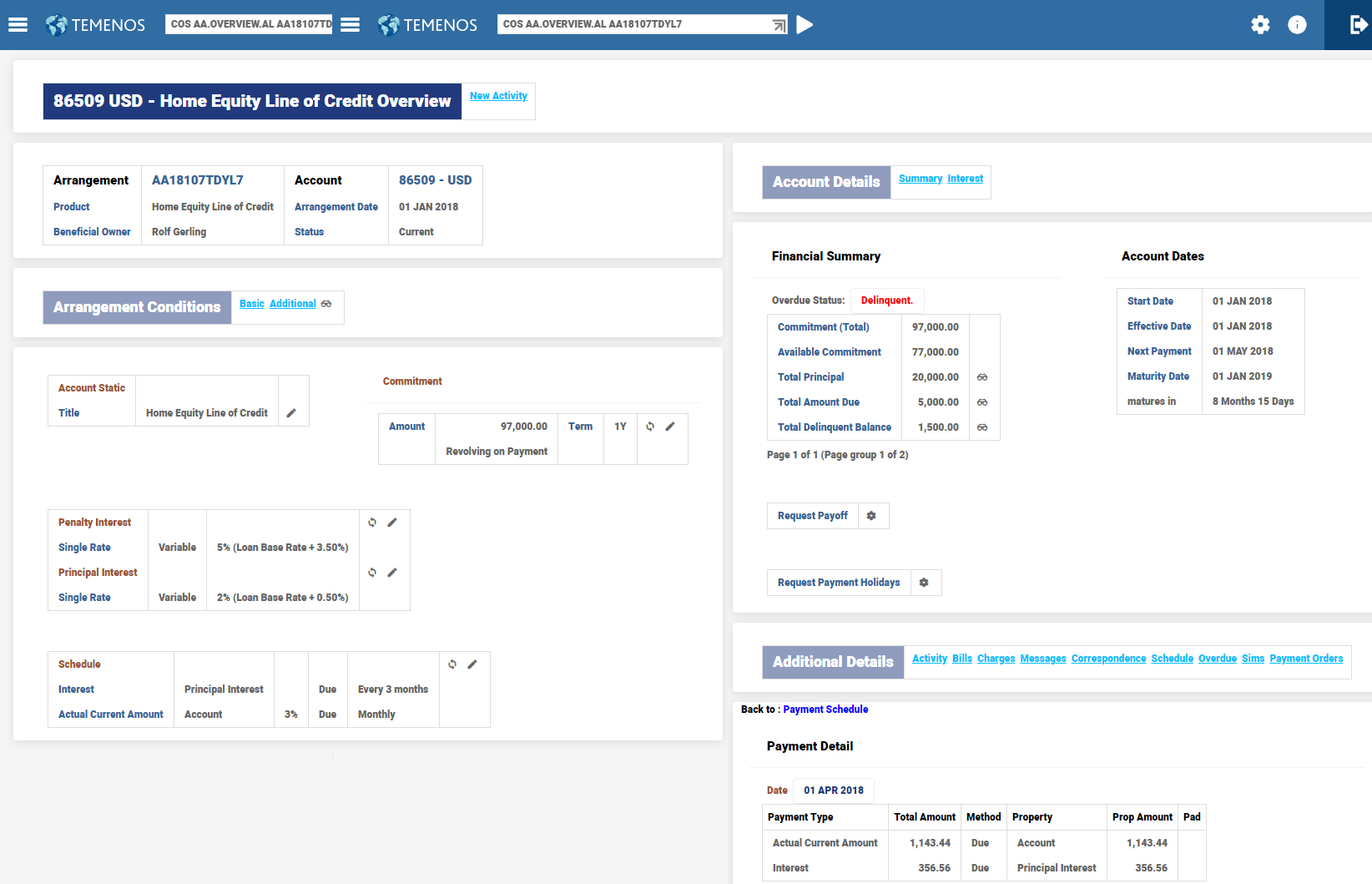

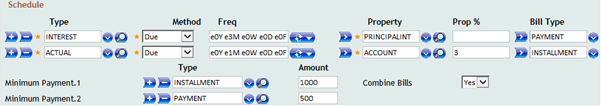

- Create a LOC Product with

- 3% principal repayment, payable monthly, with bill type as INSTALLMENT.

- Actuals of interest accrued, payable quarterly, with bill type as PAYMENT.

- Interest rate is 6%.

- Minimum payment amount for INSTALLMENT bill type and PAYMENT is 1,000 and 500, respectively.

- View the Payment Schedule projection before the loan is disbursed.

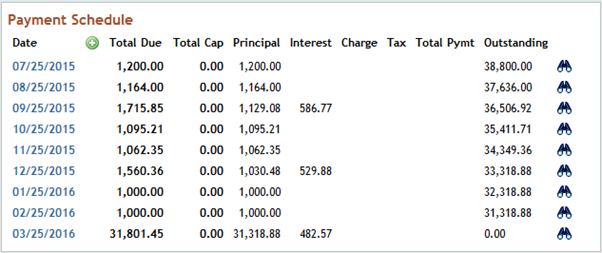

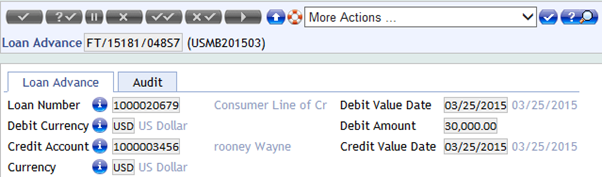

- Loan is disbursed for 30T as of arrangement start date.

- View the Payment Schedule projection after the disbursement transaction is authorised.

- View in detail the 04/25 bill.

- Here, the calculated amount is 900 (30,000 * 3%) and hence the bill is raised for the minimum amount of 1,000.

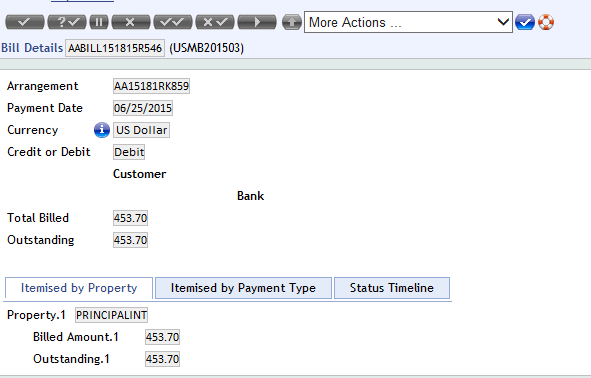

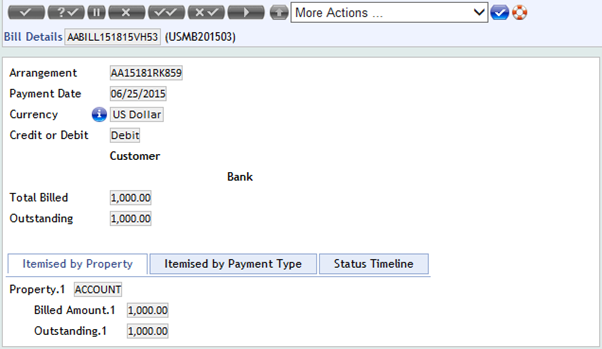

- View in detail 06/25 bills

- There are two bills, one for INTEREST and the other for ACCOUNT.

- Interest Bill: Although minimum amount of 500 was defined for interest, the billing has happened only for the actual accrued amount. This is because, there was no account Property defined for the bill type.

- Account bill: The calculated amount is less than the minimum amount of 1,000 and hence the bill is made due for a 1,000.

Fixed Equal Repayment

For the loan arrangements with Fixed Equal Payments(FEP), a Minimum Invoice Component (MIC) can be configured at the Product definition level or at the arrangement level. At the loan agreement stage, it is possible to indicate that though loan is of FEP type, certain mandatory component(s) (such as interest and charges) are invoiced fully.

MIC is used to define the components that are to be invoiced fully. The Account Property cannot be defined as an MIC. The Interest Property can be defined as an MIC. When the charge is part of the FEP amount, but interest alone is defined in MIC, an override is raised.

- When the FEP amount is less than the total MIC amount (sum of the Property amounts defined in MIC), the total MIC amount is billed.

- When the FEP amount is more than the total MIC amount (sum of the Property amounts defined in MIC), the FEP amount is billed. For example, Interest component is alone specified as MIC component.

- When the FEP amount is less than the accrued interest, the accrued interest is billed.

- When the FEP amount is greater than the accrued interest, the original FEP amount is billed.

If FEP is unable to cover the components in the Payment Schedule, then the order of invoicing is charge, interest and principal.

- Any charge amount that cannot be billed, is foregone if the charge is not part of MIC.

- Any interest amount that is accrued but not billed, gets carried forward to the next period.

In certain activities, recalculate options affect FEP schedules as follows:

The term is calculated based on the FEP amount. If the term cannot be calculated, then it is updated as blank resulting in the contract becoming a call contract.

Annuity amount is calculated. If Term is not available, it raises an error.

Residual amount is calculated using the FEP amount defined in the Actual Amount attribute and current term. If Term is not available, an error pop ups.

For a Product with Maximum Term Cap defined, when the term is recalculated based on the FEP amount captured or it breaches the cap, the system caps maturity date to the maximum term and calculates the annuity amount. The annuity amount gets updated.

Even if the term cannot be calculated, the system caps the maturity date to the maximum term and calculates the annuity amount.

Recalculation on Arrangements with Forward Dated Conditions

When there are forward dated conditions in a loan contract and the user triggers an activity such as prepayment or disbursement or change in the interest and so on, the system allows the recalculation of ‘Term’ or ‘Payment’ or ‘Maturity then payment’ based on the setup in the Recalculate attribute of the Payment Schedule condition.

Consider the following example to understand how the term recalculation works when there is forward dated condition in payment schedule condition:

| Loan Details | |

| Created on | Jul 10, 2020 |

| Amount | 36,000 |

| Term | 3Y |

| Payment | Monthly |

| Interest Rate | |

| Jul 10, 2020 to Jul 9, 2021 | 2% |

| Jul 10, 2021 to Jul 10, 2023 | 3% (variable rate) |

| Payment Amount | |

| For the first year | 1000 |

| From the second year, until maturity | 1100 |

The following sections describe the prepayment calculation when the prepayment amounts are:

When the prepayment amount = 10000

- The system first calculates a maturity date based on the first condition, that is, payment amount of 1000 and derives a maturity date, say Dec 10, 2022.

- From Jul 10, 2021(the forward condition date), the system considers the outstanding as of Jul 10, 2021 and uses 1100 as the payment amount and derives a maturity date, say Nov 10, 2022.

- Finally, the system updates Nov 10, 2022 as the maturity date.

When the prepayment amount = 40000

- Similar to the above scenario, the system first calculates a maturity date based on the first condition, that is, the payment amount of 1000 and derives a maturity date, say Jun 1, 2021

- The forward condition is applicable only from Jul 10,2021. Since the recalculated term ends before the start of the forward condition, the maturity date is updated as Jun 1, 2021.

Most banks set the interest rate for loan contracts months in advance and store these rates as forward dated interest conditions in the loan arrangement. When the maturity date is set to cap at a maximum term for a loan contract with forward dated conditions, and if the term is recalculated based on the current payment amount and it breaches the cap, the system caps the maturity date to the maximum term and recalculates the payment amount.

Consider the following examples to understand how the recalculation of “Maturity then payment” works when there are forward dated conditions in the loan contract.

The following section illustrates the scenario where the recalculated maturity date is less than or equal to maximum term.

|

Loan Details |

|

|

Created on |

Apr 1, 2022 |

|

Term Amount |

|

|

Amount |

USD 100,000 |

|

Maturity date |

May 1, 2023 |

|

Cap on the maturity date |

2 years (that is, it cannot exceed beyond April 1, 2024). |

|

Payment Schedule |

|

|

Payment |

Monthly |

|

Payment amount |

USD 8149.33 |

|

The disbursement, change schedule, apply rate and change interest activities are set to recalculate the “Maturity then payment” in the payment schedule condition. |

|

|

Interest Rate |

|

|

Apr 1, 2022 to May 1, 2023 |

10% |

|

Day basis |

E |

At the time of arrangement creation, the maturity date is calculated as May 1, 2023. On Apr 2, 2022, the user inputs a forward dated BASIC.INTEREST record with rate as 25% effective from May 1, 2022. On running COB, when the Apply Rate activity is triggered, the system recalculates the term as Jun 1, 2023 based on the forward dated interest condition from May 1, 2022.

On Apr 19, 2022, the user inputs a forward dated BASIC.INTEREST record for the floating index used in the arrangement with effective date as Aug 1, 2022 for a rate of 30%. When the Apply Rate activity is triggered during COB, the system recalculates the term as Jul 1, 2023 based on the forward dated interest condition.

The following section illustrates the scenario where the recalculated maturity date is capped at maximum term, and new payment amount is calculated.

|

Loan Details |

|

|

Created on |

Apr 1, 2022 |

|

Term Amount |

|

|

Amount |

USD 200,000 |

|

Maturity date |

Feb 1, 2024 |

|

Cap on the maturity date |

2 years (that is, it cannot exceed beyond Apr 1, 2024). |

|

Payment Schedule |

|

|

Payment |

Monthly |

|

Payment amount |

USD 11,429.36 |

|

The disbursement, change schedule, apply rate and change interest activities are set to recalculate the “Maturity then payment” in the Payment Schedule condition. |

|

|

Interest Rate |

|

|

Apr 1, 2022 to Feb 1, 2024 |

25% |

|

Day basis |

E |

At the time of arrangement creation, the maturity date is calculated as Feb 1, 2024. On Apr 2, 2022, the user inputs a forward dated BASIC.INTEREST record with rate as 30% effective from May 4, 2022. On running COB, when the Apply Rate activity is triggered, the system recalculates the term as Mar 1, 2024 based on the forward dated interest condition from May 4, 2022.

On Apr 19, 2022, the user inputs a forward dated BASIC.INTEREST record for the floating index used in the arrangement with effective date as Jul 1, 2022 for a rate of 40%. When the Apply Rate activity is triggered during COB,

- The system recalculates and caps the maturity date as Apr 1, 2024 and proceeds to recalculate the payment amount based on the forward dated interest conditions.

- Therefore, the payment schedule has two installment amounts from Apr 1, 2022 till April 1, 2024:

- USD 11,429.36 from Apr 1, 2022 to Jul 1, 2022.

- USD 12,015.33 from Aug 1, 2022 to Apr 1, 2024.

The following section illustrates the scenario where the recalculation takes place with increasing interest rates and new payment amount is calculated upon every rate change.

|

Loan Details |

|

|

Created on |

Apr 1, 2022 |

|

Term Amount |

|

|

Amount |

USD 300,000 |

|

Maturity date |

Mar 1, 2024 |

|

Cap on the maturity date |

2 years (that is, it cannot exceed beyond Apr 1, 2024). |

|

Payment Schedule |

|

|

Payment |

Monthly |

|

Payment amount |

USD 16,555.40. |

|

The disbursement, change schedule, apply rate and change interest activities are set to recalculate the “Maturity then payment” in the payment schedule condition. |

|

|

Interest Rate |

|

|

Apr 1, 2022 to Feb 1, 2024 |

25% |

|

Day basis |

E |

At the time of arrangement creation, the maturity date is calculated as Mar 1, 2024. On Apr 2, 2022, the user inputs a forward dated BASIC.INTEREST record with rate of 40% effective from May 4, 2022. On running COB, when the Apply Rate activity is triggered,

- The system recalculates and caps the maturity date at April 1, 2024 and proceeds to recalculate the payment amount based on the forward dated interest condition.

- Therefore, the payment schedule has two installment amounts from Apr 1, 2022 till Apr 1, 2024:

- USD 16,555.40 from Apr 1, 2022 to May 1, 2022.

- USD 18,225.07 from Jun 1, 2022 to April 1, 2024.

On Apr 19, 2022, the user inputs a forward dated BASIC.INTEREST record for the floating index used in the arrangement with effective date as July 1, 2022 for a rate of 55%. When the Apply Rate activity is triggered during COB,

- The system cannot recalculate the term based on the forward dated interest condition as the maturity date is capped on Apr 1, 2024. Therefore, the system proceeds to recalculate the payment amount.

- The payment schedule has three installment amounts from Apr 1, 2022 till Apr 1, 2024:

- USD 16,555.40 from Apr 1, 2022 to May 1, 2022.

- USD 18,225.07 from Jun 1, 2022 to Jul 1, 2022.

- USD 20,460.02 from Aug 1, 2022 to Apr 1, 2024.

Zero Payment

During zero payment, either the payment frequency can be skipped of the end date mentioned in the End Date field or date in the Start Date field can be defined for skipping interim payments. In both the cases, the system calculates the amount in the Calc Amount field after considering the skipped installments (zero payments).

For an Annuity arrangement having a payment term of one year, if two regular payments are skipped in the middle of the payment period, the system calculates the payment amount for the remaining 10 payments considering the two zero payments and calculation logic equates the payment amount for the arrangement.

In the following example, payments are skipped on 6th, 7th, 9th and 11th month. However, the system projects the schedule for the arrangement by adjusting the skipped installment amounts for the rest of the payment period using its calculation logic.

The below screen shot displays the AA.PRD.DES.PAYMENT.SCHEDULE record.

The below screen shot displays the Enquiry schedule projection

Disbursement Linked Payments

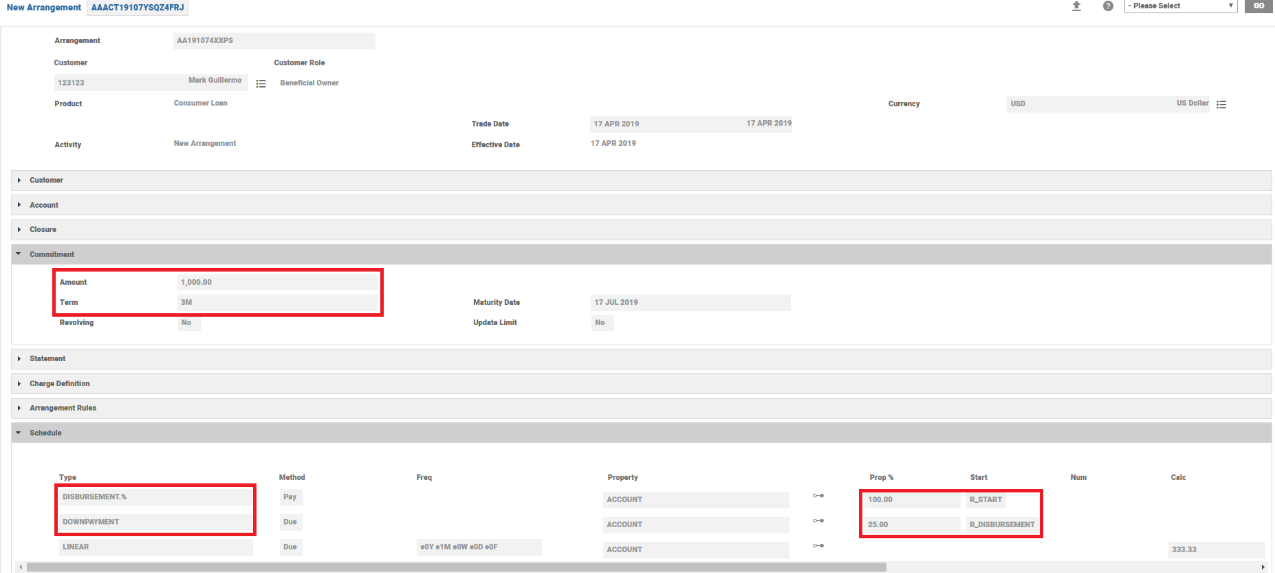

- When a loan product has to collect principal (down) payments along with disbursement, it can be set-up using the DISBURSEMENT relative date option and a TRANSACTION based Payment type.

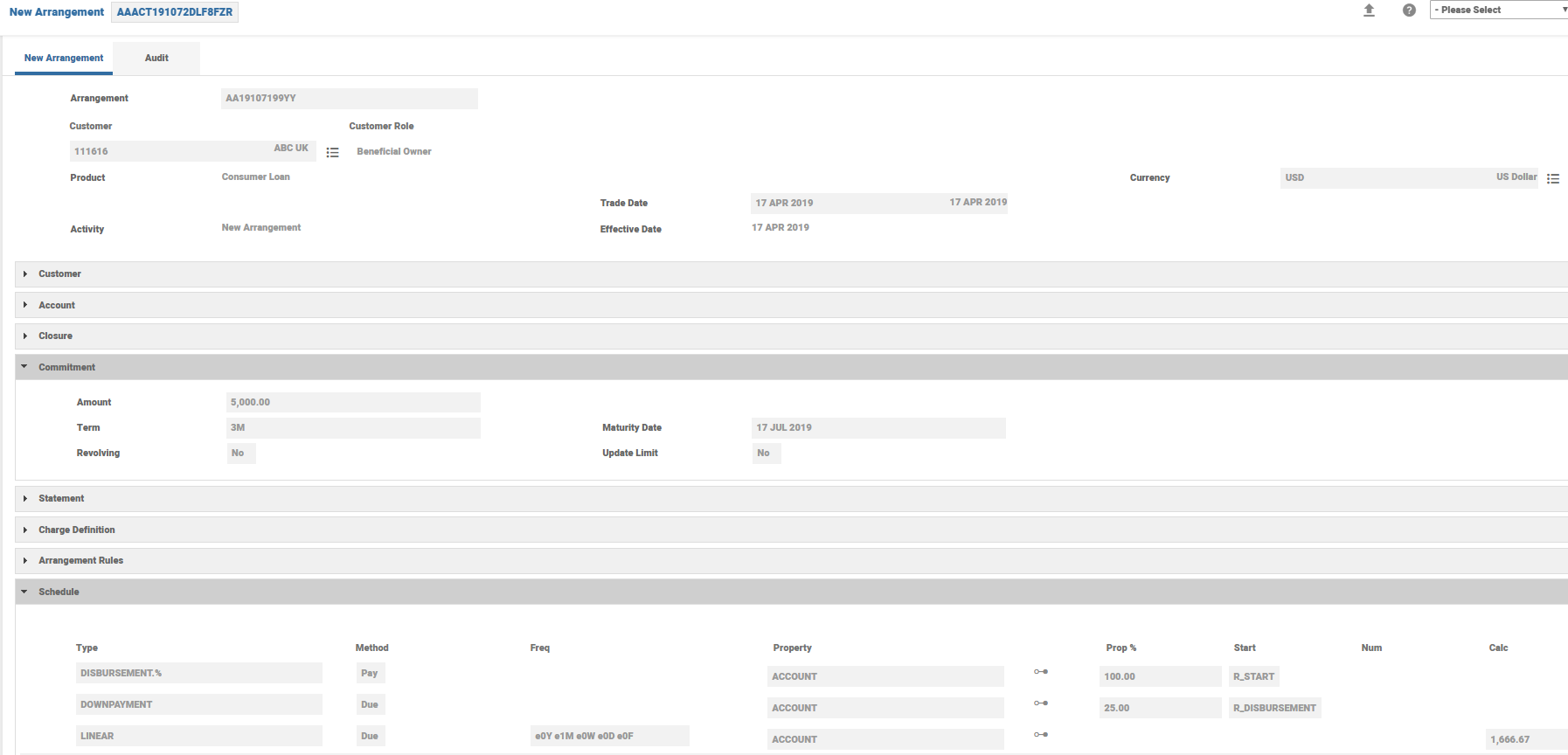

- The consumer loan product in model bank illustrates this set-up where a downpayment of 25% is collected for each disbursement and the rest of the payments are collected on 30, 60 & 90th day.

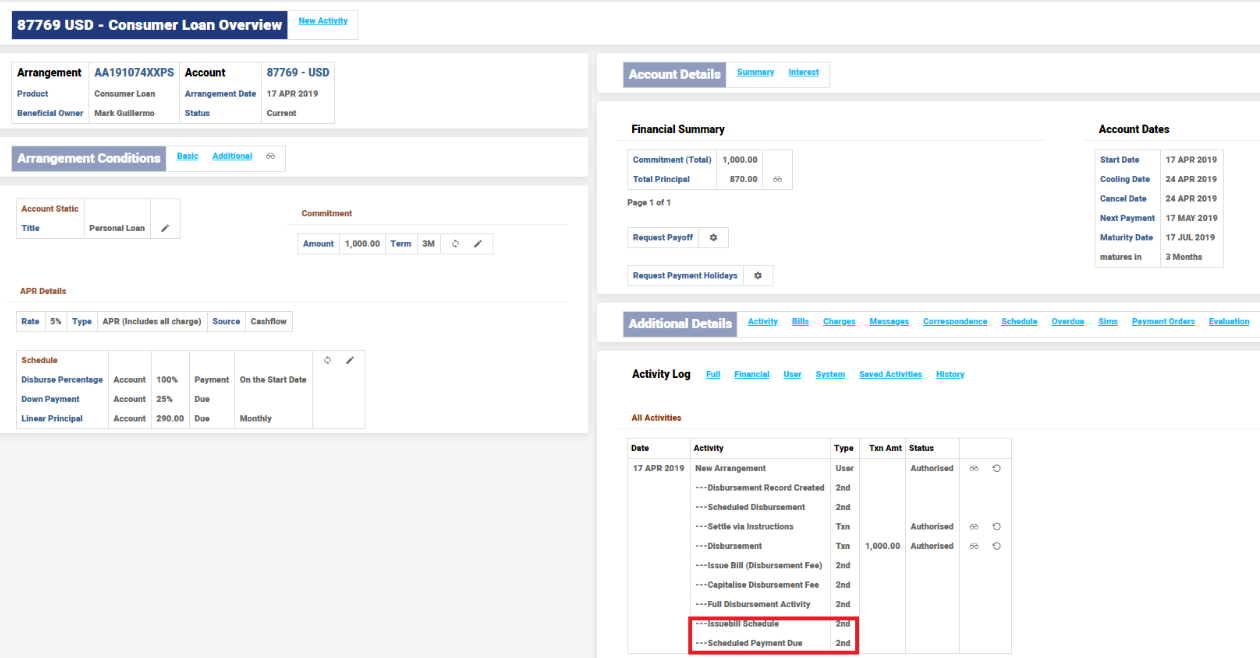

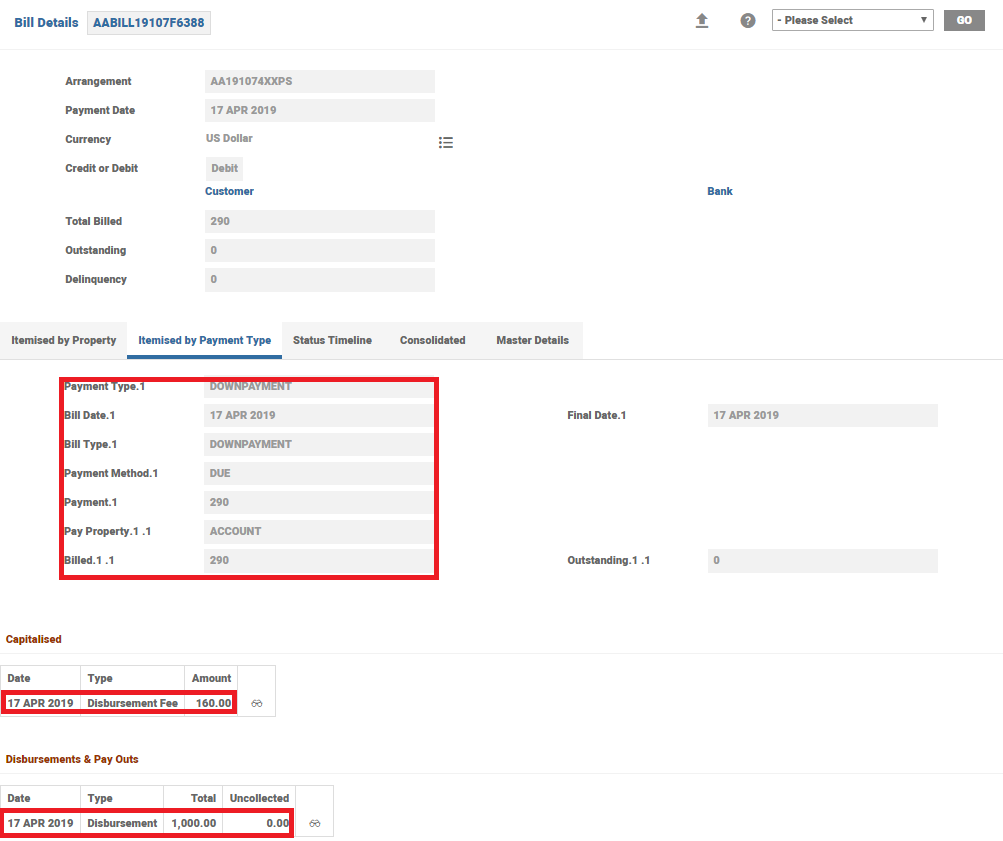

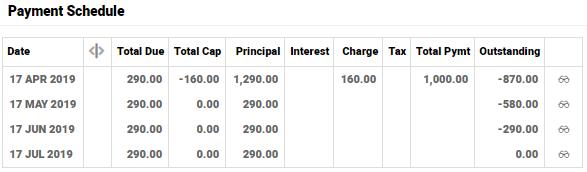

- An arrangement is created for USD 1000 and is fully disbursed (automatically)

- The disbursement fee is calculated on each disbursement and is capitalised.

- 20% for loans upto 500

- 16% for loans above 500 but less than1000

- 8% for loans above 1000

25% of the disbursed amount plus the charge is collected as downpayment and is billed online.

- The net CUR account movement is 1160

- 25% of the movement ,that is, 290 is calculated as a payment bill and is raised along with this disbursement.

The features related to automatic disbursement are not applicable for loans in TBC.

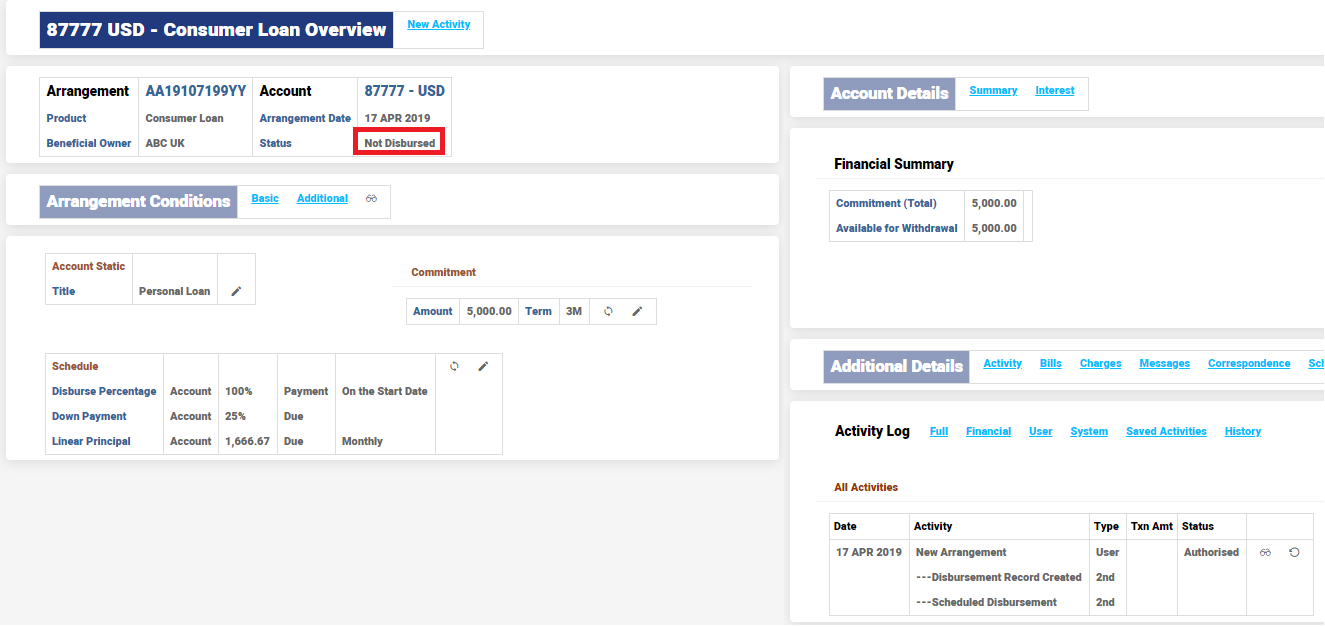

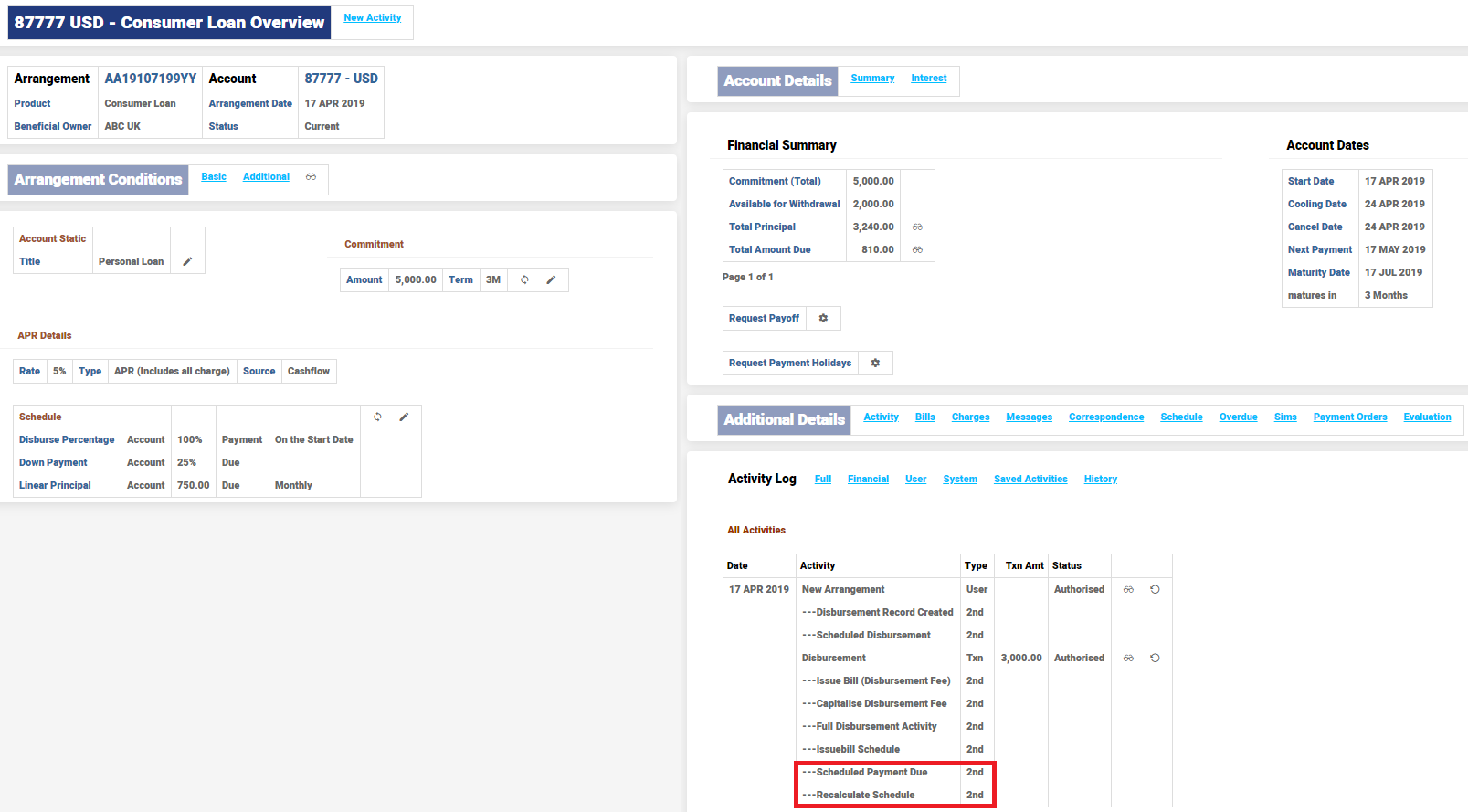

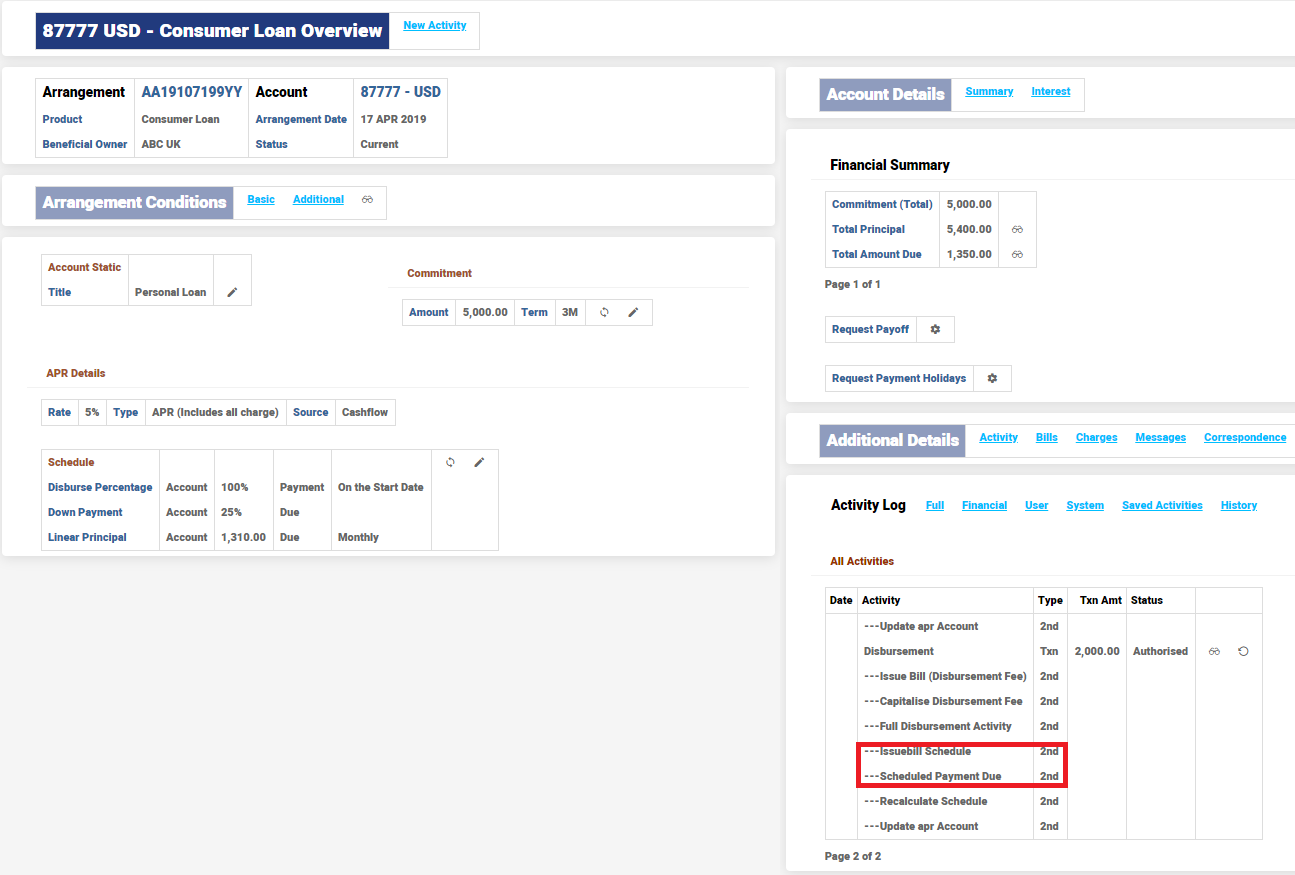

- An arrangement created for USD 5000

- The disbursement fee is calculated on each disbursement and is capitalised.

- 20% for loans upto 500

- 16% for loans above 500 but less than1000

- 8% for loans above 1000

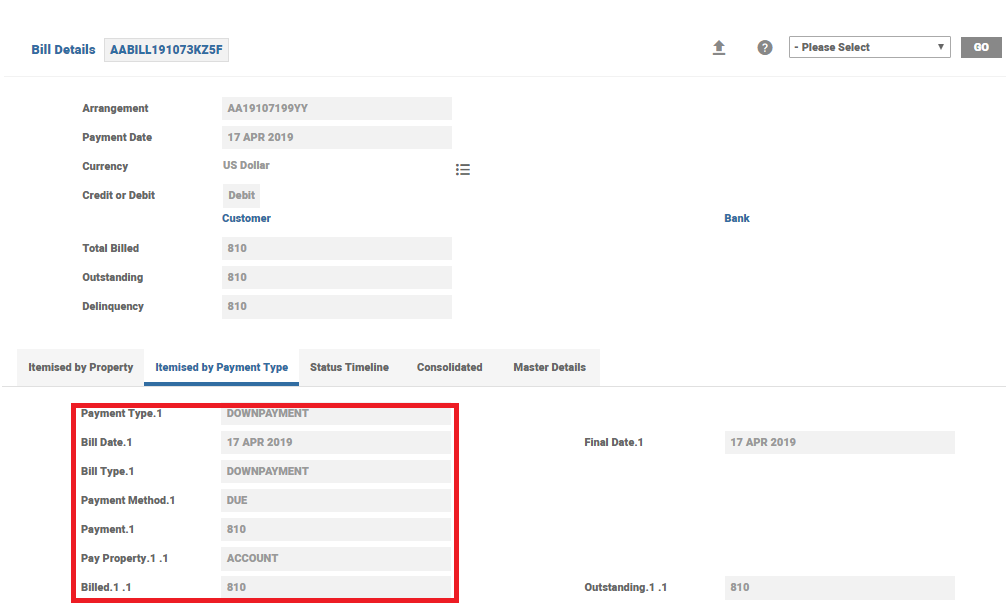

- 25% of the disbursed amount plus the charge is collected as downpayment and is billed online.

- The disbursements are done manually

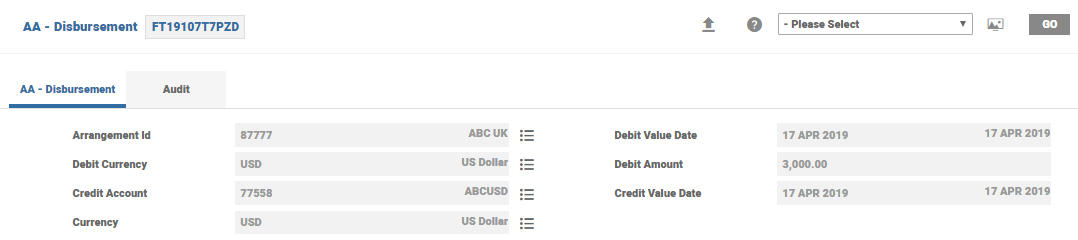

- First Disbursement for 3000

- Net movement in CUR balance is 3,240

- 25% of the movement, that is, 810 is calculated as a payment bill and is raised along with this disbursement.

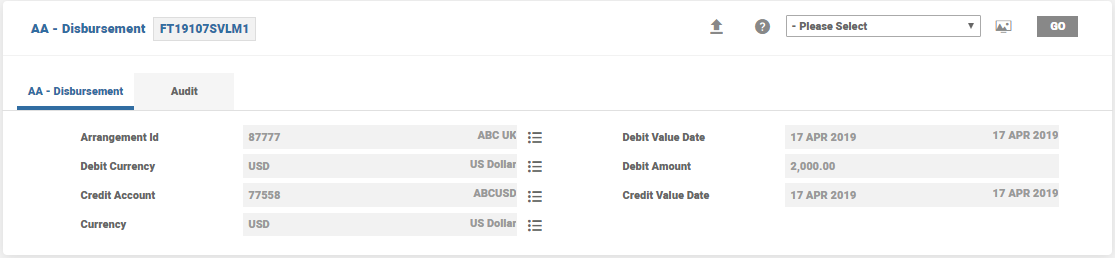

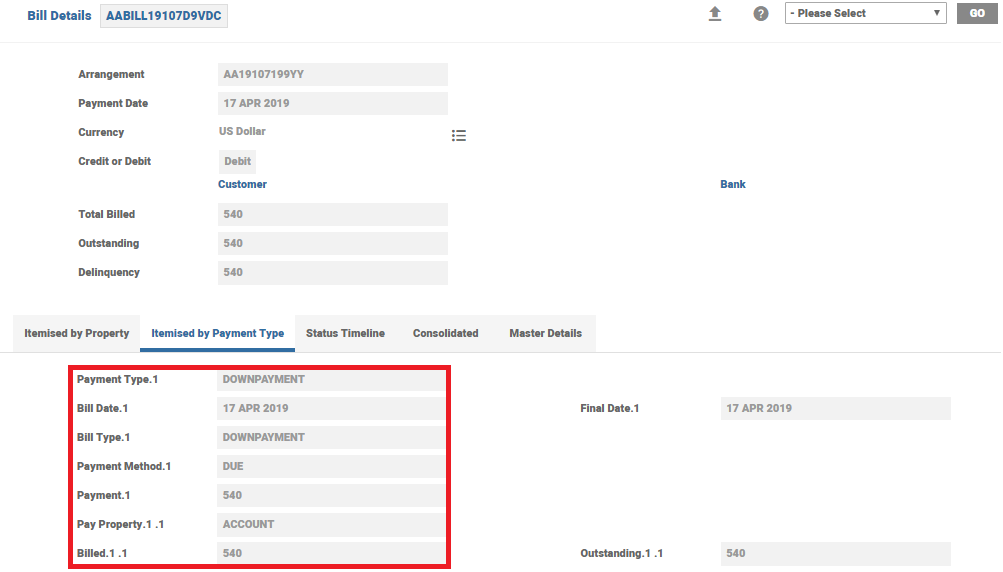

- Second and final disbursement for 2000

- New movement in CUR balance is 2160

- 25% of the movement, that is, 540 is calculated as a payment bill and is raised along with the second disbursement.

- First Disbursement for 3000

Progressive Payments

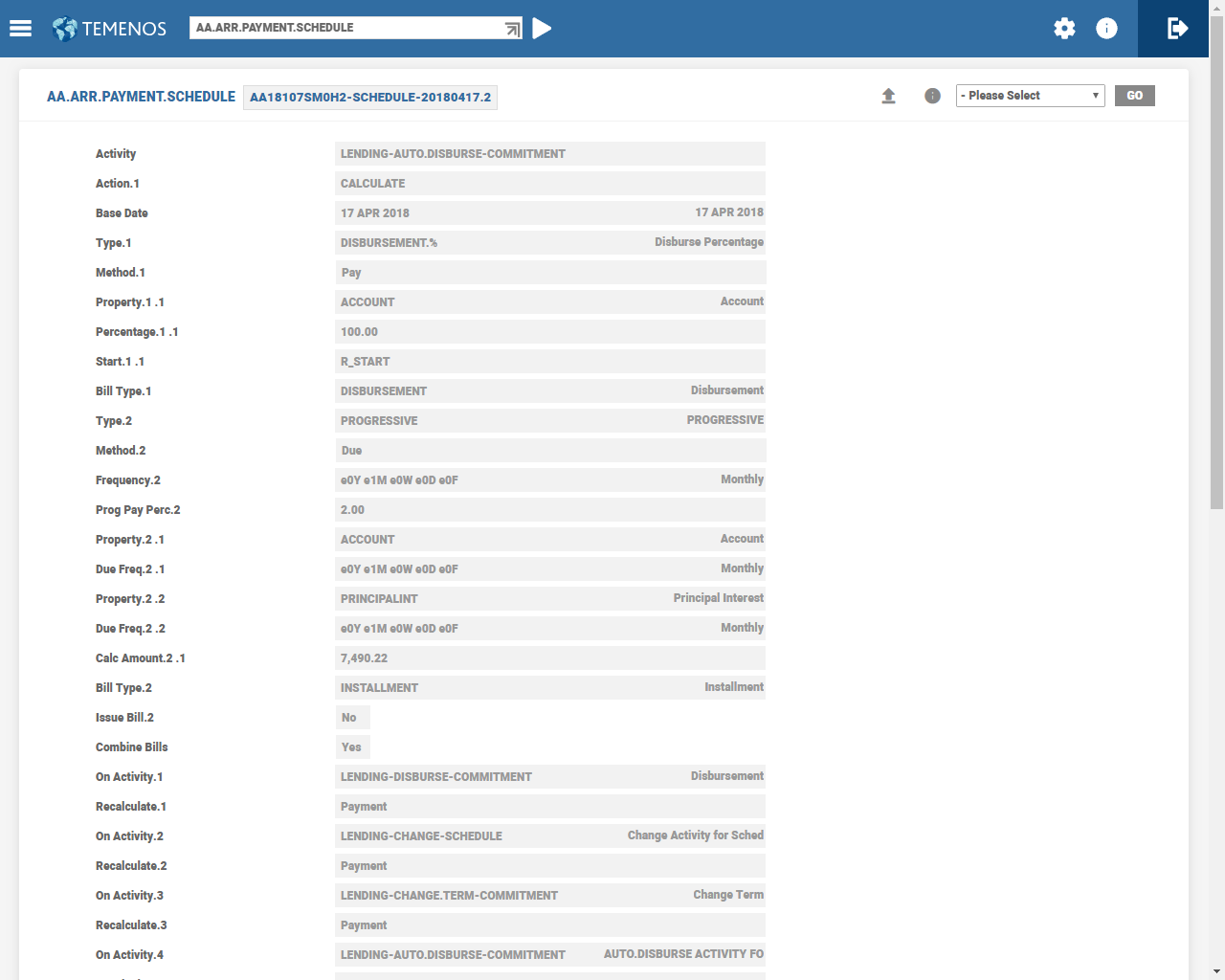

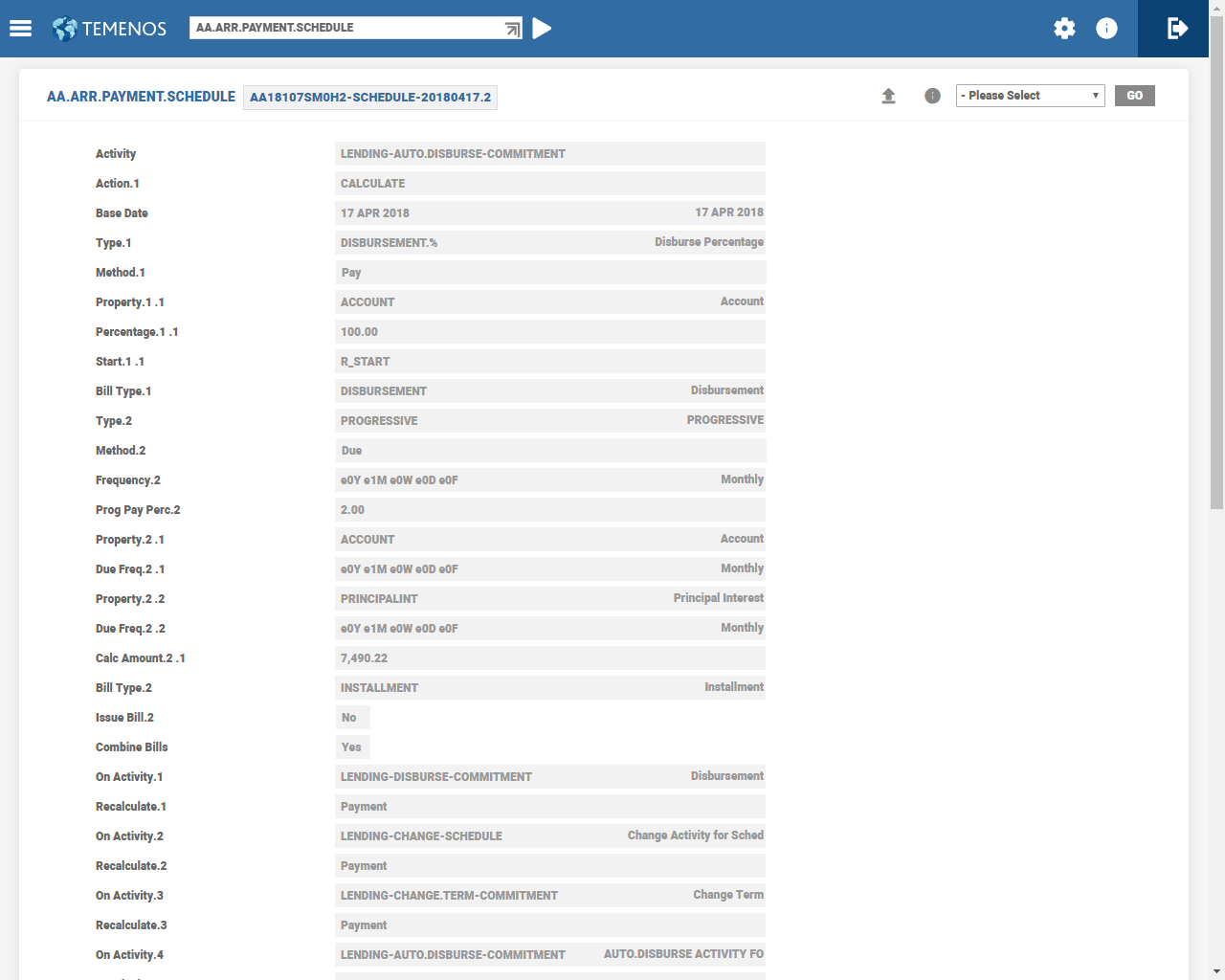

The repayment amount in the Calc Amount field can be recalculated upon every repayment. The PROGRESSIVE.PAYMENT value in the Recalculate attribute increments the Calc Amount by the progressive percentage. The On Activity attribute in the Payment Schedule should include the LENDING-MAKEDUE-PAYMENT.SCHEDULE Activity to recalculate the PROGRESSIVE.PAYMENT.

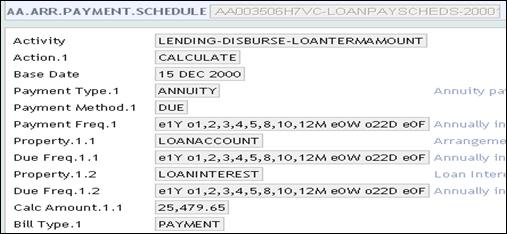

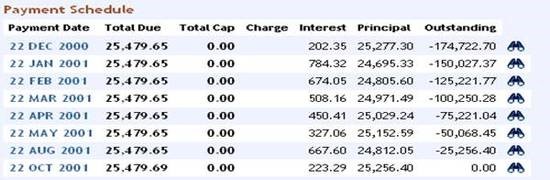

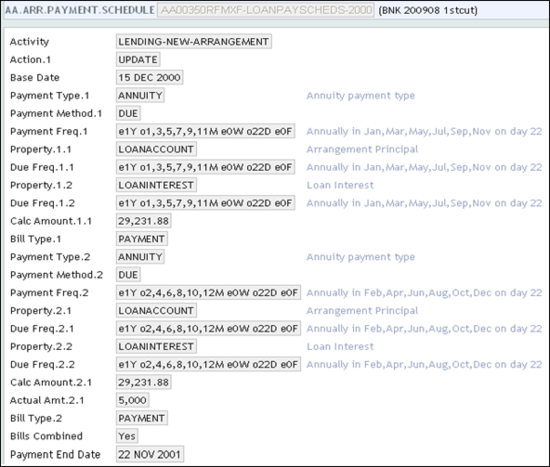

In the example AA.ARR.PAYMENT.SCHEDULE, the Payment Freq attribute is set to 1M and the rate is 2%. This results in the amount calculated each month to increase by 2% every month.

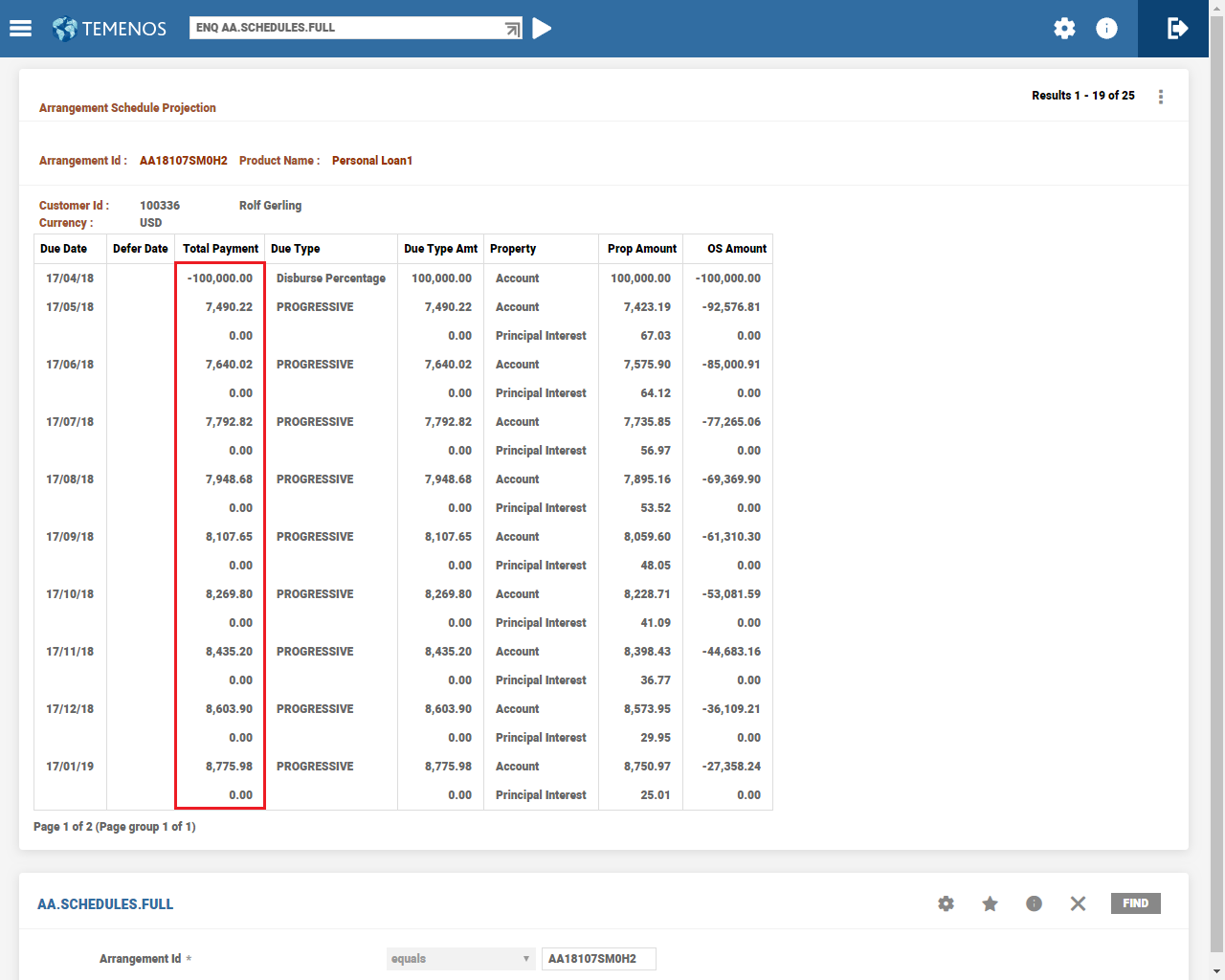

The below ENQ AA.SCHEDULES.FULL enquiry shows the calculated amount for future payments for the above arrangement. This has been increased every month.

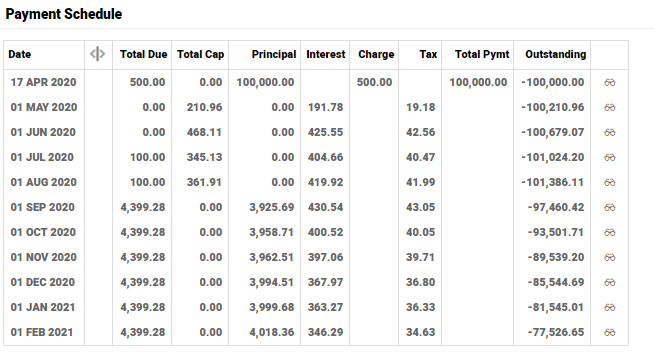

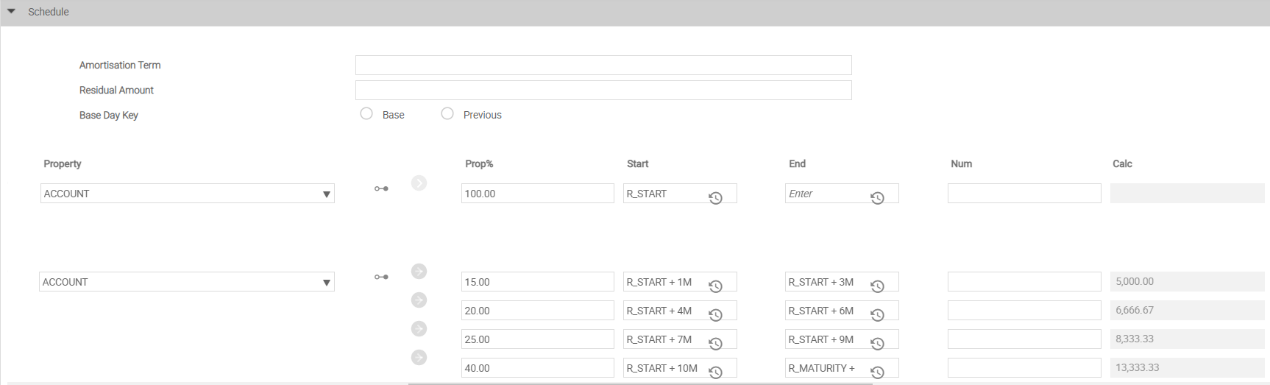

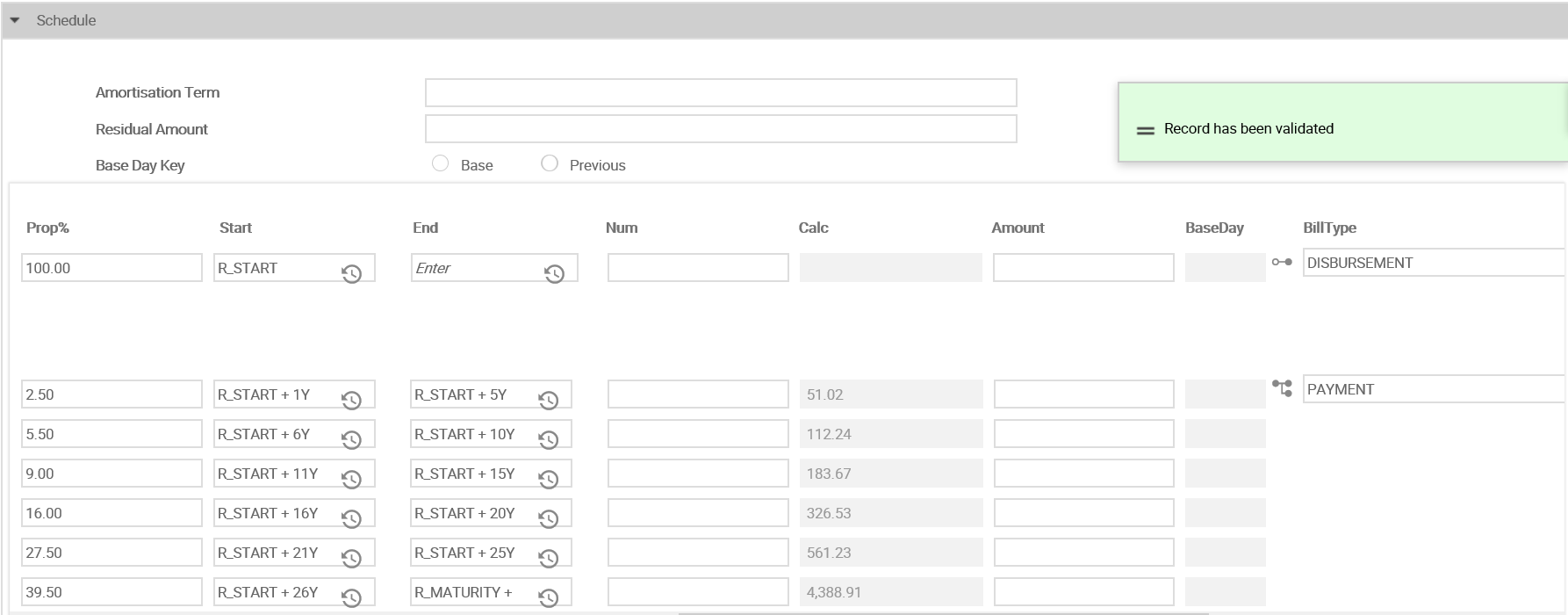

Percentage Calculation for Principal-only Payments

The total granted loan amount can be linearly distributed as Principal-only repayment for the percentage defined for the amortisation period as per the repayment frequency.

When a percentage is defined in the Max Percentage attribute, the repayment percentage of original loan principal definition is restricted to maximum of percentage defined. Amortisation Schedule is 100% but the calculation percentage is restricted to the defined percentage.

For example, if loan offered to customer was an Interest Subsidy loan, then it is convenient to collect the Principal-only repayments.

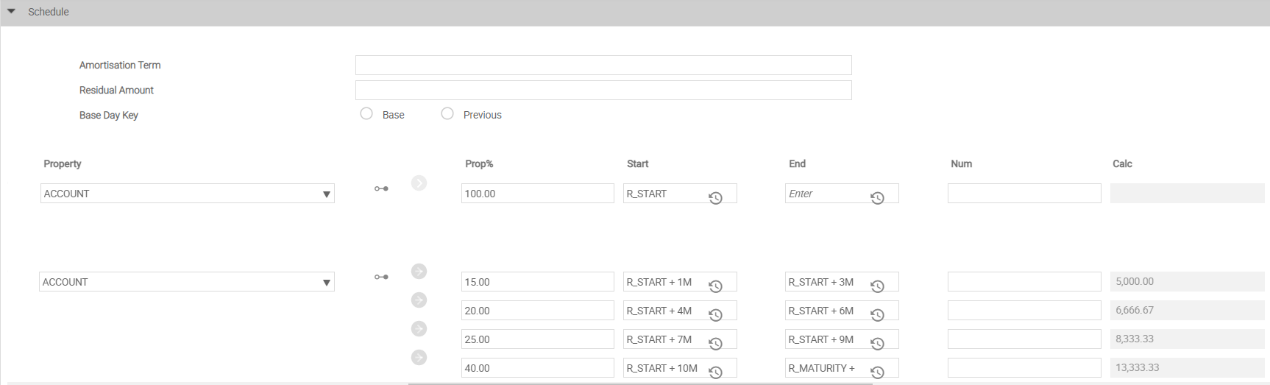

Consider the following example.

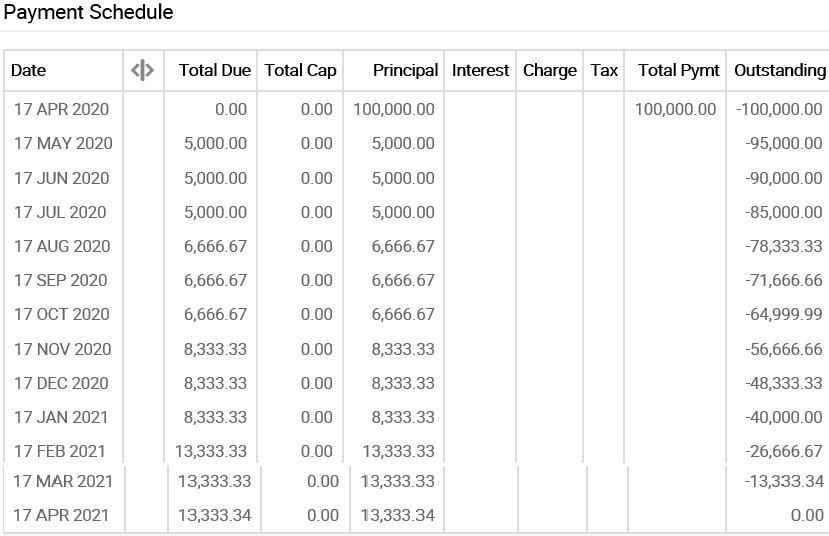

- Loan Amount = USD 100,000 on 17 April 2020

- Term = 1year

- Payments = Principal-only

- CALC Type = Percentage

- Repayment Frequency = Monthly

- Max Percentage = 100

Amortisation Schedule is as follows:

- 15% of 100,000 on the first three payments - 15,000 / 3 = 5000

- 20% of 100,000 on the next three - 20,000 / 3 = 6666.67

- 25% of 100,000 on the next three - 25,000/3 = 8333.33

- 40% of 100,000 on the last three - 40,000 / 3 = 13,333.33

| Amortization date | Total amount per period | Repayment Percentage of original loan principal, % per period |

|---|---|---|

| 17 May 2020 | 15000 | 15 |

| 17 June 2020 | ||

| 17 July 2020 | ||

| 17 Aug 2020 | 20000 | 20 |

| 17 Sep 2020 | ||

| 17 Oct 2020 | ||

| 17 Nov 2020 | 25000 | 25 |

| 17 Dec 2020 | ||

| 17 Jan 2021 | ||

| 17 Feb 2021 | 40000 | 40 |

| 17 Mar 2021 | ||

| 17 Apr 2021 |

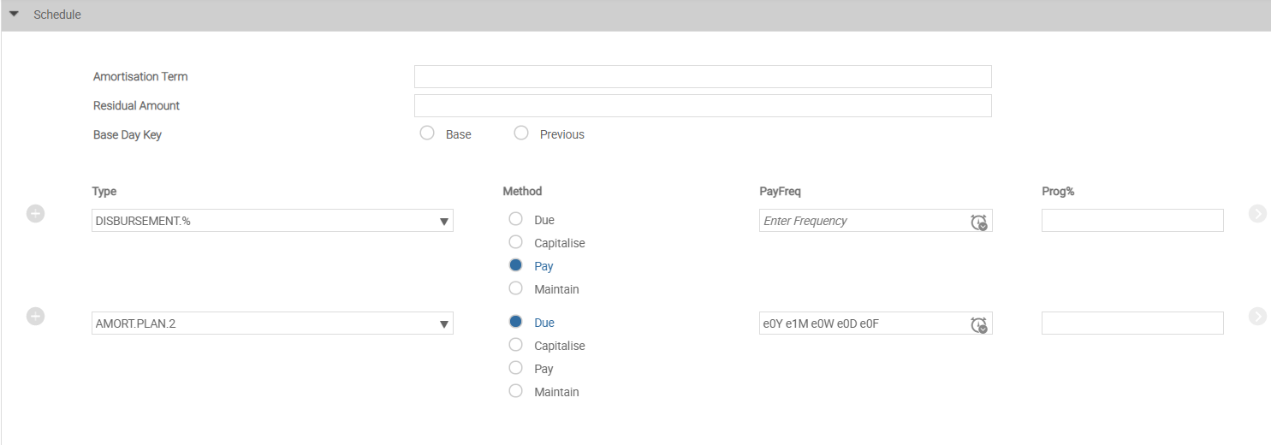

The above amortisation conditions can be defined as follows in Payment Schedule product conditions.

Overriding the Capitalisation Amount

The capitalisation process can make an account overdrawn, but such a scenario can optionally be restricted to the extent of available balance on the account. However, this functionality cannot be extended to user-defined checks, for example, a minimum amount definition that might be required for the customer for his living, like a sustenance amount. The system considers the entire available balance during capitalisation.

In order to overcome this, an option is provided to validate any other user defined conditions that might be required during capitalisation. During capitalisation of bills, the system validates if the payment type is set as Cap and Inv Alt Payment Method and a user routine is attached in Alt Payment Routine.

When both these conditions are satisfied, the available balance and the capitalisation amount are handed over by the core routine to the user attached API. The API further validates and decides if the bill should be capitalised or invoiced.

Consider the pre-conditions listed above are met.

A customer has a credit balance of Rs 5000. There is a user definition to have a balance Rs 7000 and above for his sustenance. A debit interest bill is processed for Rs 500.

In the above scenario since the sustenance balance is greater than the available balance, the entire billed amount is moved to Inv.

Defining Future Conditions at the Arrangement Level

The Type field with FORWARD.DATED value in the AA.PROPERTY.CLASS record allows the user to introduce a new definition at the arrangement level, it will be dated. Once captured with a future date, the system automatically schedules this and during close of business the Scheduled Activity is processed by applying the new condition to the arrangement.

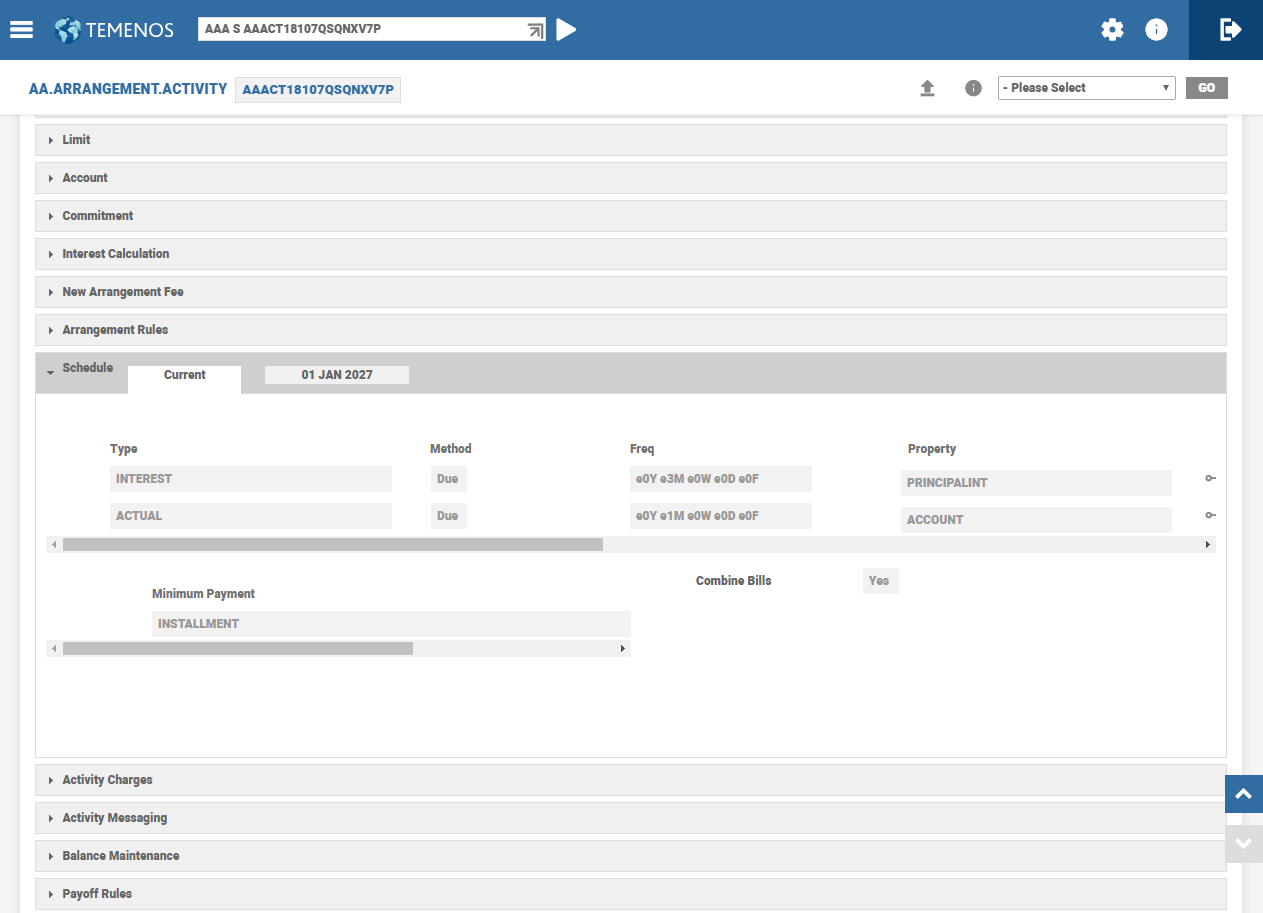

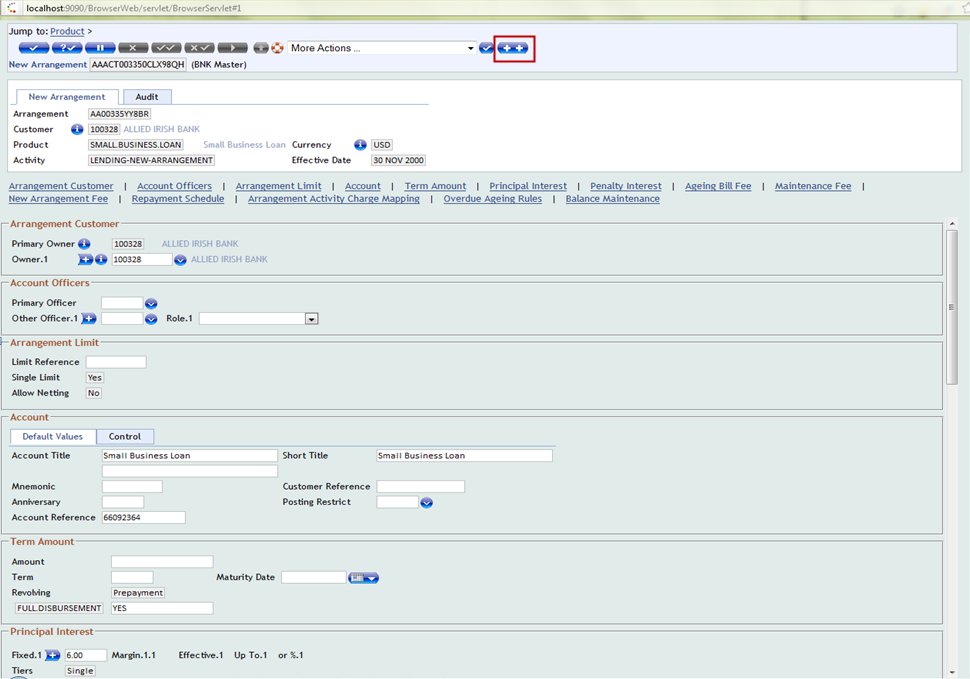

A Show tabs for expansion icon is provided in the tool bar of AA.ARRANGEMENT.ACTIVITY and AA.SIMULATION.CAPTURE screens. It helps the user to identify the property for which the future dated condition can be added.

Future dated condition can either be given by specifying the date of required change or by specifying relative date like ARRANGEMENT / START + 1 month.

- Click the Show tabs for expansion icon in the tool bar.

The Show tabs for expansion icon is disabled after displaying Current tab for the property to which Future Date Conditions are allowed.

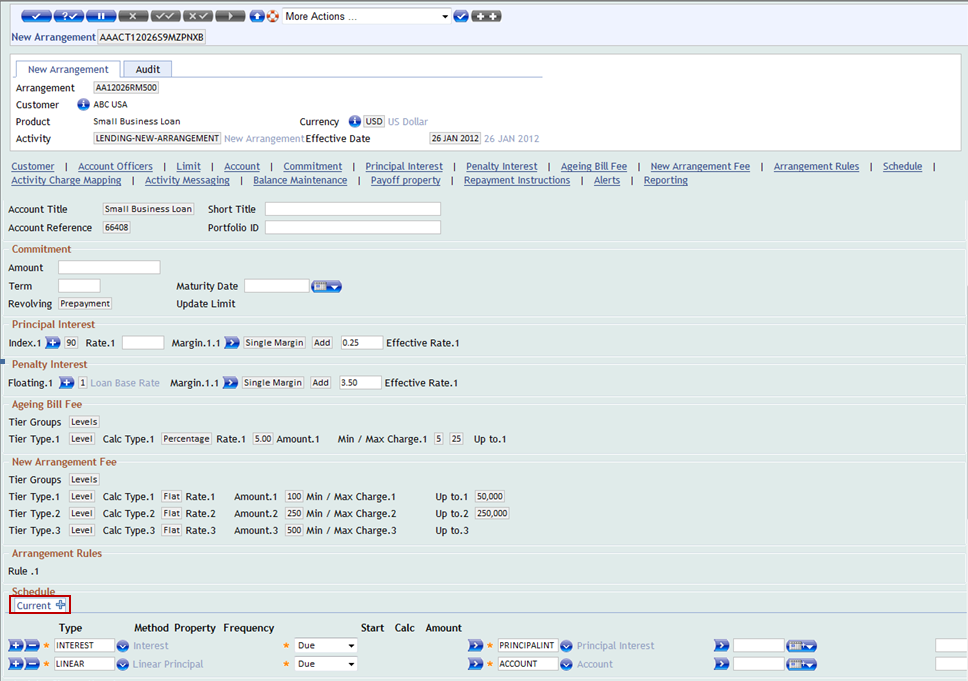

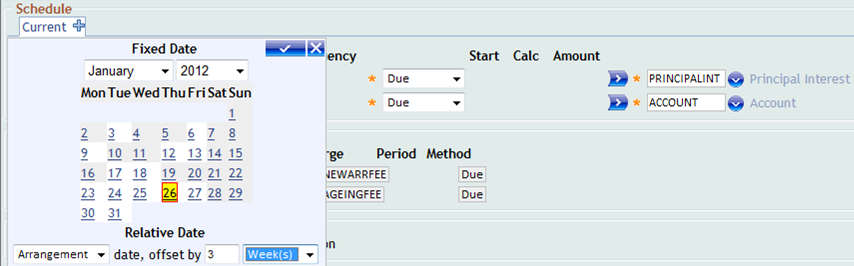

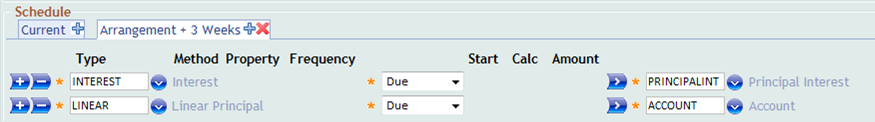

- Click Expand icon from Current tab to add Future Date Conditions. An Option for selecting Fixed Date and Relative Date pops up on the screen.

- Select month and year for Fixed Date and Arrangement or Start date, offset by day(s), week(s), month(s) and year(s) for Relative Date.

- Click to confirm the selection. The selected options will be displayed as the description of the Future Date Conditions tab.

Additional Payments

Additional scheduled payments can be included in the PAYMENT.SCHEDULE Property. Additional payment is defined as the payment scheduled over and above the regular payments.

Additional payments can be given by adding a payment type, and it can be either ad hoc (single) or regular and the amount should be specified in the Actual Amt attribute. The system calculates the Calc Amount field taking into account the additional payment(s) specified.

It is possible to have

- Regular additional payment- An additional payment amount is specified on a recurring basis, such as annually. This amount applies over and above the regular installment amount.

- Regular special payment - An actual payment amount is specified for a regular installment. This amount replaces the regular installment amount.

- The additional amount is paid over and above the normal loan installment. When an additional amount is set in a repayment schedule, the remaining instalments are automatically calculated by the system.

- These payments can be in the middle of an Annuity schedule, or a Single Line Amortisation (SLA) schedule (equivalent to Linear payment type). When the payments are added to such a schedule, the payment amount is calculated to take into account the additional payment(s).

The below screen shot displays the AA.PRD.DES.PAYMENT.SCHEDULE.

The below screen shot displays additional payments every 3 months in the Payment Schedule.

Special Payments

Special payment is the actual amount specified by the user to substitute the regular installment amount for the specific period, either single or regular. This amount has to be specified in the Actual Amt attribute. In the example below, it is possible to schedule the Actual Amt for the specified periods, which substitutes the system Calc Amount. In this case, the system calculates the Calc Amount considering the user scheduled Actual Amt.

The below screen shot displays the AA.PRD.DES.PAYMENT.SCHEDULE record.

Deferred Payments

The Defer Period attribute in the Payment Schedule Property Class is used to define deferred payments. It defines how long the scheduled payment should be deferred from original cycled date.

- Date Convention - Forward

- Date Adjustment - Period

- Bill is raised on 2nd Feb with Payment Date as 2nd Feb, Actual Pay Date as 1st Feb, Financial Date as 2nd Feb and Defer Date as 8th Feb.

- Defer Date is calculated as 5 days from Actual Pay Date, which is 6th Feb. As it is holiday, the system again applies Date Convention on top of this date. Hence, the value of Defer date in this case is 8th Feb.

- For Defer Activity (processed on 2nd Feb), accounting entries are raised with Value date as Financial Date.

- The MAKEDUE or CAPITALISE Activity is processed on the Defer Date, which is 8th Feb. Here, the accounting entries are moved to nullify DEF entries and raise real statement entries.

- Date Convention - Forward

- Date Adjustment - Value

- Bill is raised on 2nd Feb with Payment Date as 2nd Feb, Actual Pay Date as 1st Feb, Financial Date as 2nd Feb and Defer Date as 8th Feb.

- Defer Date is calculated as 5 days from Actual Pay Date, which is 6th Feb. As it is holiday, it will again apply Date Convention on top of this date. Hence, Defer date in this case is 8th Feb.

- For Defer Activity (processed on 2nd Feb), accounting entries will be raised with Value date as Financial Date.

- The MAKEDUE or CAPITALISE Activity is processed on the Defer Date which is 8th Feb. Here, accounting entries will be moved to nullify DEF entries and raise real statement entries.

The accounting related features and processing are handled by an external GL system for loans in TBC. Therefore, to complete the accounting related to deferred payments, the TBC generates an event, which can be captured by the connected external GL (General Ledger) system.

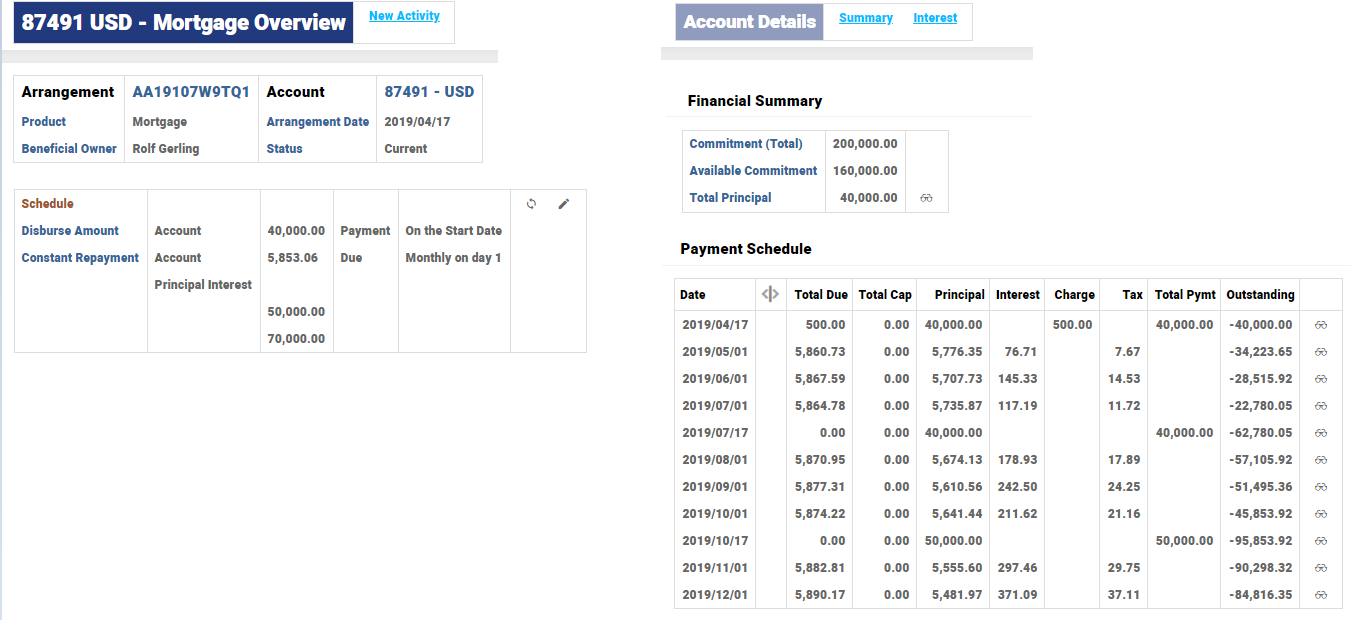

Installment Amount for Multiple Disbursement

Loans can have the calculated installment amount as a constant (same) amount based on the full principal amount and the accrued interest on the outstanding principal balance. This constant installment amount is the same amount from the first to the final installment amount as per the payment schedule. The Include Future Disb (INCLUDE.PRIN.AMOUNTS) field is set to Yes only when the installment amount is required to be constant from start date until the maturity date of the contract. Any principal disbursement or repayment scheduled in the future is taken into consideration for the calculation of installment.

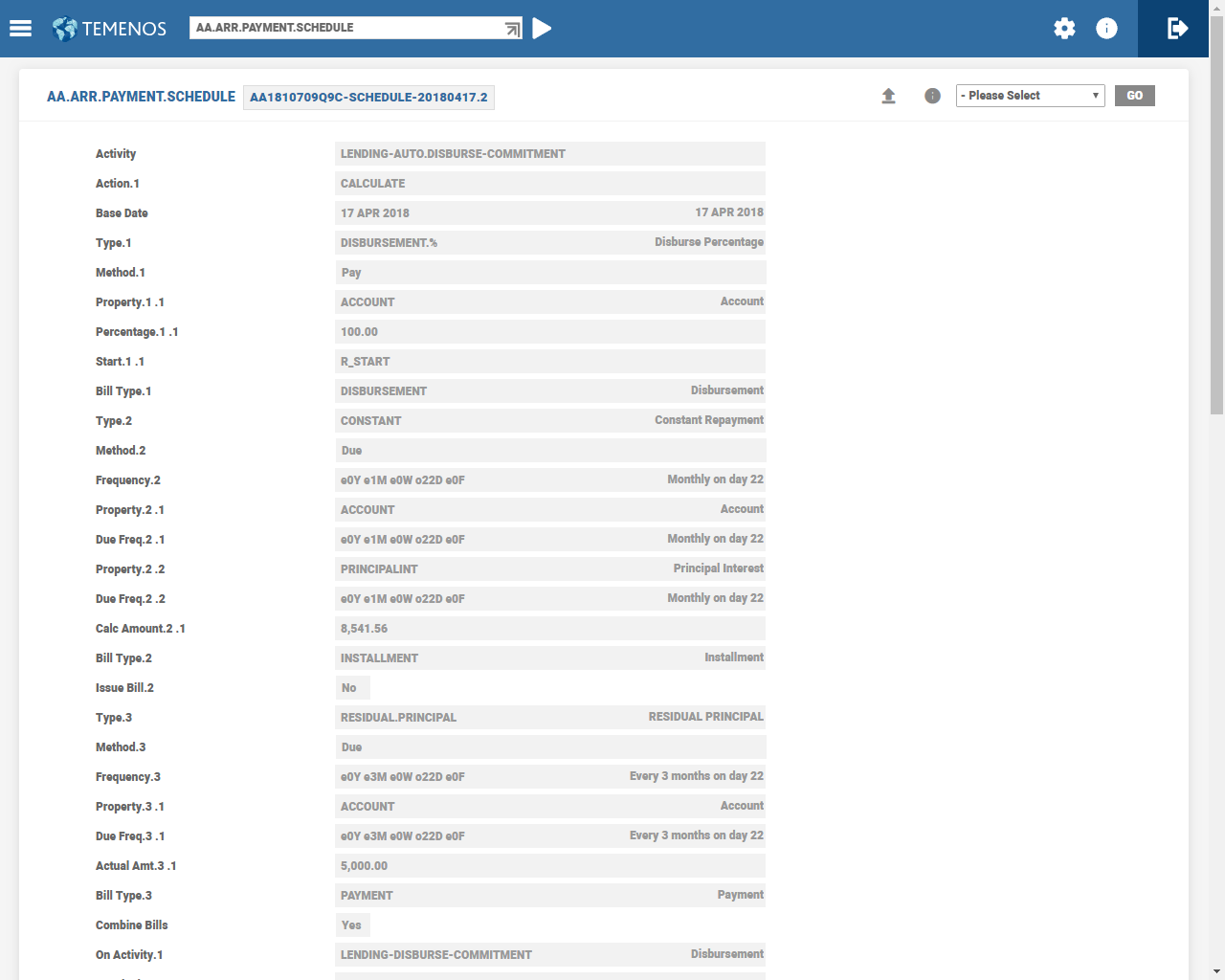

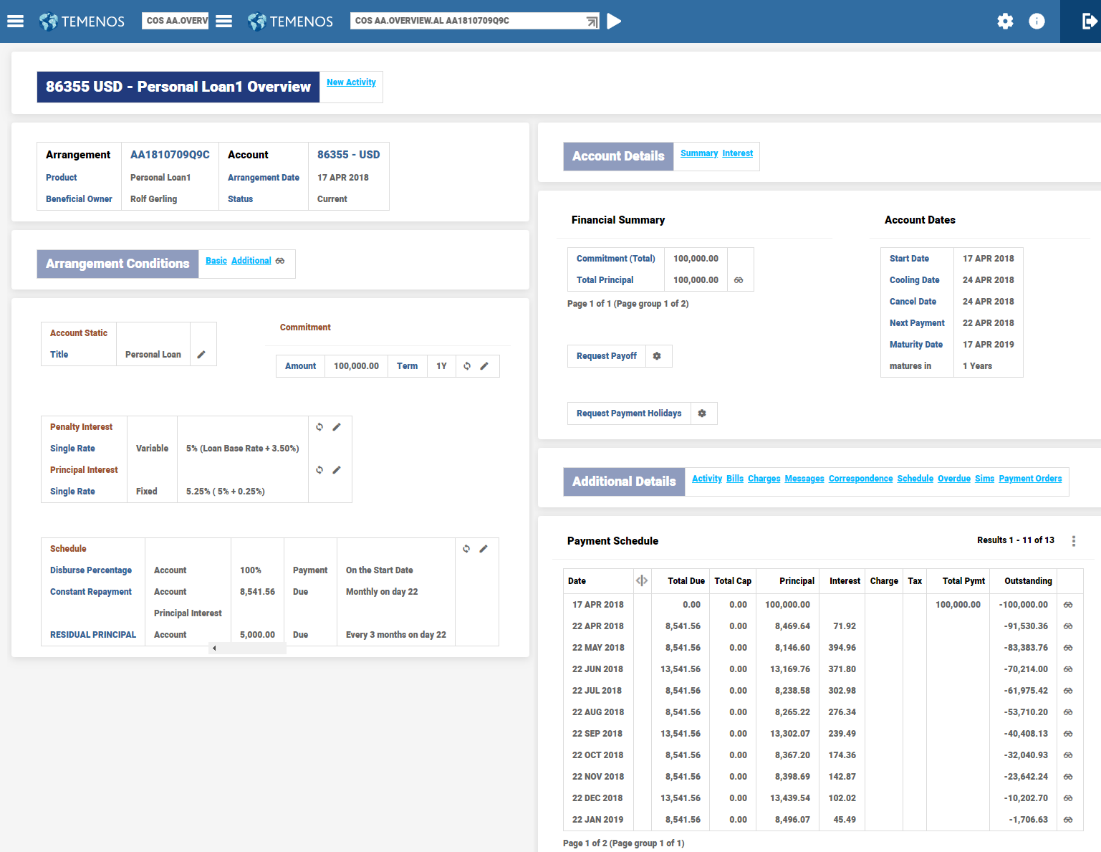

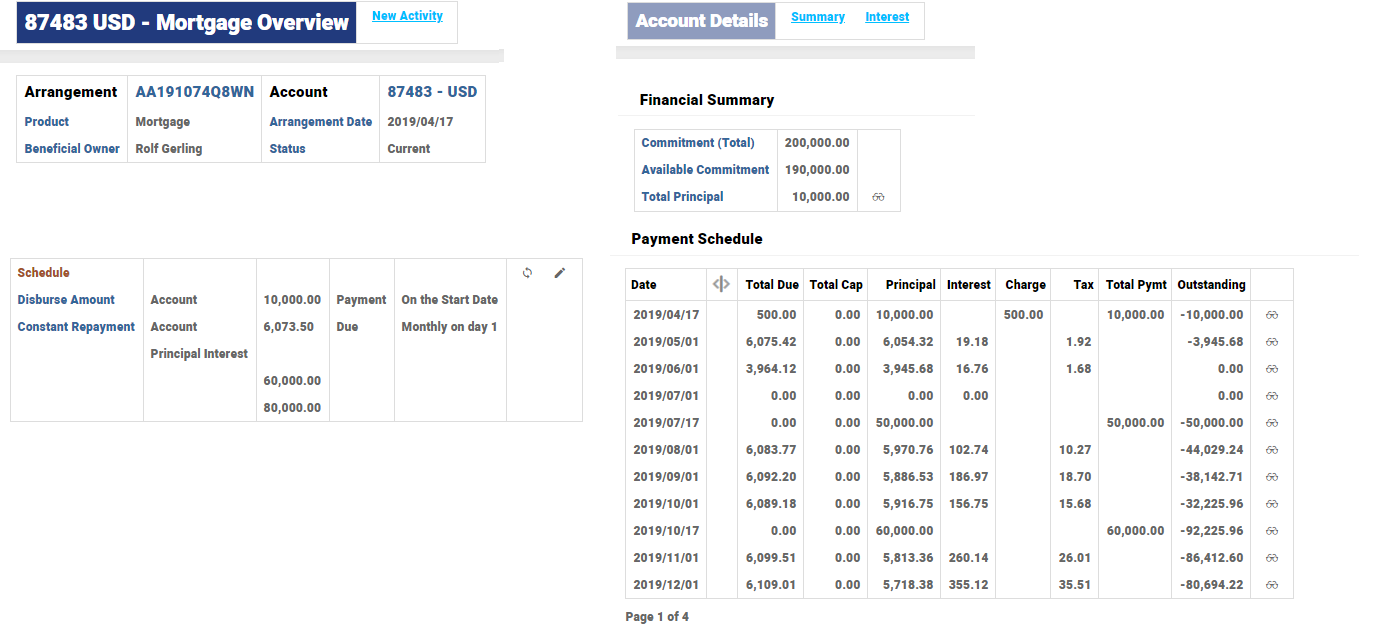

Given below is an illustration of the loan that has scheduled disbursements with loan installments set for annuity repayment. Here the user has opted for installment calculations to consider future disbursements.

The schedules are built considering the future disbursements as well.

In the below illustration, the scheduled disbursement is planned, but the total outstanding is repaid before the second disbursement. Hence the second installment is a reduced amount to repay the outstanding and third installments is zero. Regular repayments start after the next disbursement is carried out.

When the flag for considering future disbursements is set, the system adjusts the installment amount automatically during loan life cycle stages. For example, change in disbursement dates, disbursement amount or disbursement percentage, interest rate revisions, maturity date change, payment holiday, change in schedules, prepayments, special payments, special schedules like interest only or principal only, tax or charge included installments, capitalisation of dues during overdue, charge-off, write-off.

During the loan takeover from legacy system, the users set this field as yes to calculate the installment amount considering the future disbursements.

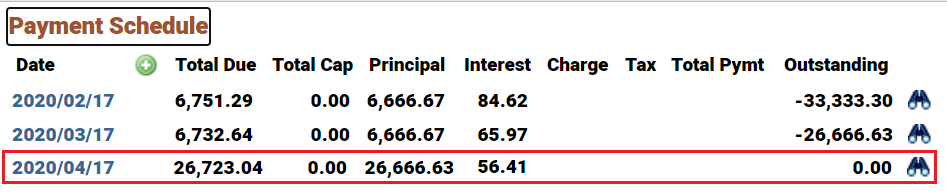

Residual Principal in Payment Schedule

The residual amount can be set over the life of a loan contract. When set, it is included in the Principal component of the last installment and the Total Due amount is also adjusted to reflect the residual amount along with other scheduled payments.

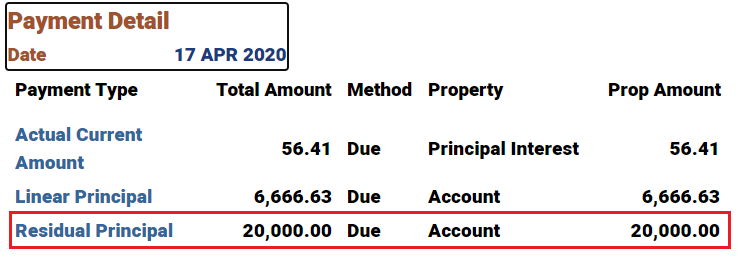

The schedule projector includes the residual amount against the Total Due and Principal components and the payment schedule enquiry displays the details of each component.

The Payment Schedule projector is updated with the residual amount against the last installment and it is included in the Total Due amount as well as the Principal component of the installment.

The drill down on the installment detail shows the break-up of the Total Due amount and it includes the residual amount as a separate line item. Further, as the Principal component also includes the residual amount, the same is seen as a separate entry against the Account Property as shown below.

Read the Payment Schedule Property Class for information on the Residual Amount attribute.

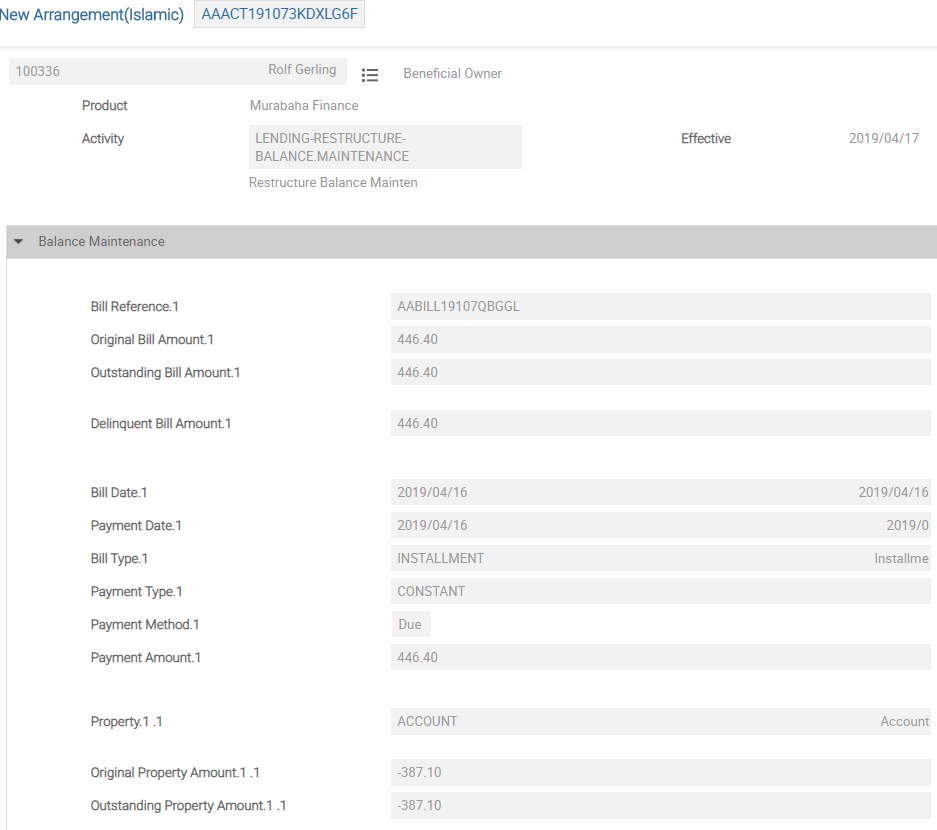

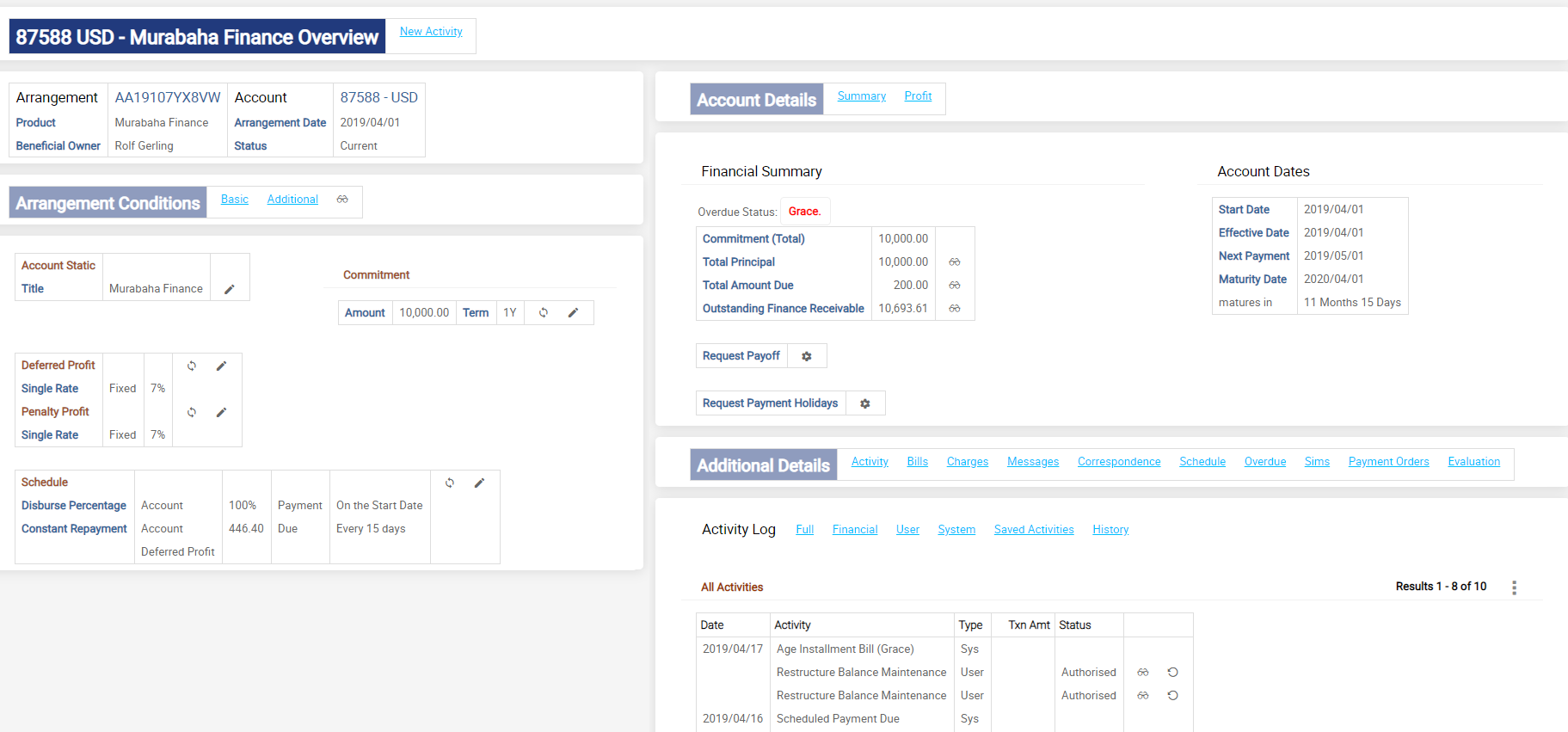

Adjust Balance for Upfront Profit

For a finance in which upfront profit is collected, when the customer indicates his inability to repay a loan, the user can adjust the balance and recalculate the upfront profit using the LENDING-RESTRUCUTRE-BALANCE.MAINTENANCE Activity Class. The system raises the accounting entries and updates the interest files. The system recalculates the profit after the restructure. This functionality is currently limited to Account and Interest (upfront profit) Property Class alone.

Do a restructure balance maintenance activity and reduce the profit amount for the outstanding bill.

In the below example, the upfront profit is reduced from $59.30 to $20.

The arrangement overview after the restructure balance maintenance activity, which reduce the profit amount for the outstanding bill is shown below.

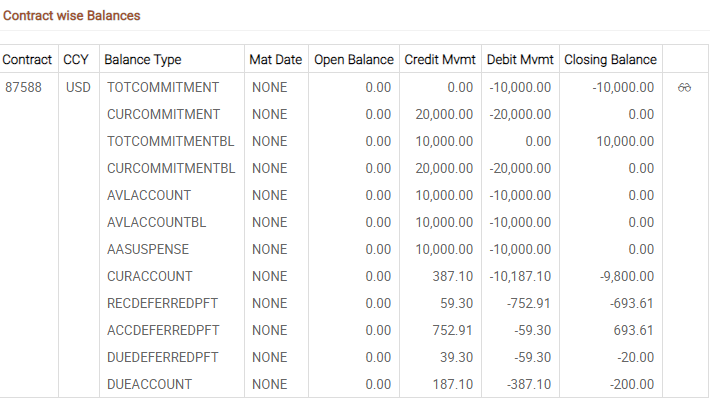

EB.CONTRACT balances depicts the below entries has performed in the arrangement.

The system has re-initiated the REC and ACC profit balances and reduced the DUE balance.

| Event | Balance type | ECB amount |

|---|---|---|

| Disbursement | RECINTEREST | -$713.61 |

| ACCINTEREST | $713.61 | |

| During Issue Bill | RECINTEREST | -$654.31 |

| ACCINTEREST | $654.31 | |

| DUEINTEREST | $59.3 | |

| Restructure activity - New outstanding amount is $20 instead of $59.3 | RECINTEREST | -$693.61 |

| ACCINTEREST | $693.61 | |

| DUEINTEREST | $20 |

The accounting related features and processing are handled by an external GL system for loans in TBC. Therefore, to complete the accounting related to adjustment of upfront profit amount, the TBC generates an event, which can be captured by the connected external GL (General Ledger) system.

After the restructure balance maintenance, the system reduces the profit amount of the current bill and this has been included in the upfront profit amount.

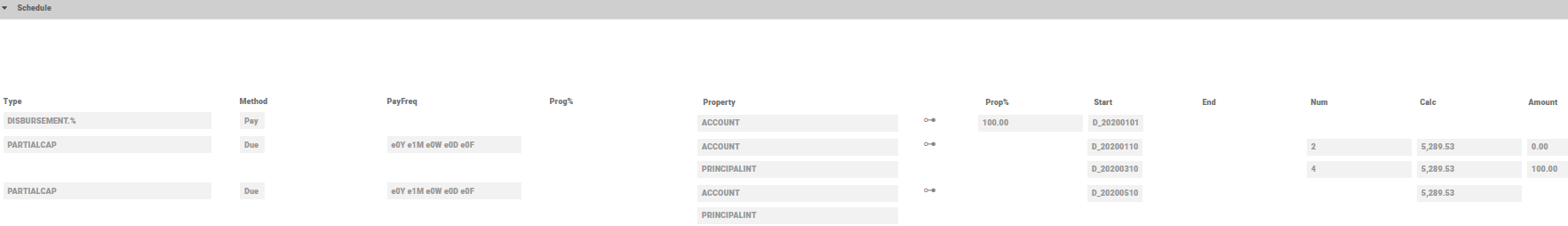

Partial Capitalisation of Interest Accruals

In an interest bearing arrangement with Annuity payment type, with Due and Cap setup, the actual amount indicated in the Payment Schedule is only made due and any remaining interest accruals is capitalised. This can be a partial or full capitalisation of interest accrual for that period.

For this kind of repayment patterns, The Alt Payment Method field in AA.PAYMENT.TYPE should be set as Due and Cap. In such Payment Types, in the Payment Schedule, the Payment Method should be set as Due and an Actual Amt can be specified. This Actual Amt is made due on the schedule date.

- When the Actual Amt is zero, all the accruals for that period is capitalised.

- When the Actual Amt is more than zero, that amount is made due and any remaining accruals for that period is automatically capitalised due to the principal.

Two separate bills are raised when the accruals are made due and capitalised. The Actual Amt mentioned is made due and follows the overdue cycle for non-repayments. The remaining accruals are capitalised and a capitalised bill is raised for this part.

When the system automatically calculates the instalment amount by itself, a separate set of associated multi-value fields should be defined with the same Payment Type and the Actual Amt should be left blank.

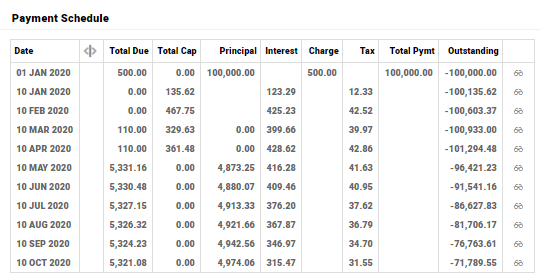

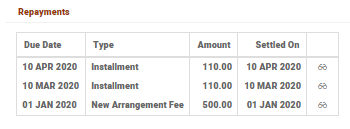

Illustration of a Mortgage Loan

In this illustration, there is a mortgage loan with the first two instalments as full capitalisation (Actual Amt is 0), the next two instalments make the amount as 100 and remaining is capitalised (Actual Amt is 100).

For this arrangement, there is a schedule built and the interest component with tax is fully capitalised for the first two schedules. The next two schedules have partial capitalisation. The amount 100, mentioned in the Payment Schedule is made due for interest accruals and the corresponding tax is also made due. The remaining accruals for the period and their respective tax component is capitalised to the principal of the arrangement.

When the Payment Type has Tax Inclusive set to No, the tax component is not included in the amount.

Separate bills are raised for the capitalised and the due component of the instalment. The capitalisation component is immediately settled and the actual amount component is made due. The actual amount component is made due for the instalment amount and If the instalment bill is not settled, this instalment bill undergoes ageing based on the overdue configuration

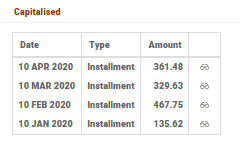

This arrangement also has fully capitalised interest for the first two schedules. The next two schedules have partial capitalisation. In this Payment Type, the Tax Inclusive attribute is set as Yes.

The Payment Schedule is shown below:

When the Payment Type has Tax Inclusive set to Yes, the actual amount mentioned is inclusive of tax as seen below:

Assigning Default Values to Payment Schedule Conditions

It is possible to pre-construct the schedule configurations and set defaults in the Payment Schedule conditions of the arrangement. Banks can offer a unique amortisation plan to customers to repay a specific different percentage of the principal-only repayment over a certain period, for the granted loan amount. This could be tedious to define it every time at the arrangement creation. The option of setting default values to Payment Schedule feature minimises the overwhelming operations maintenance overhead when a unique percentage has to be populated for arrangements without having to repeat them for every arrangement.

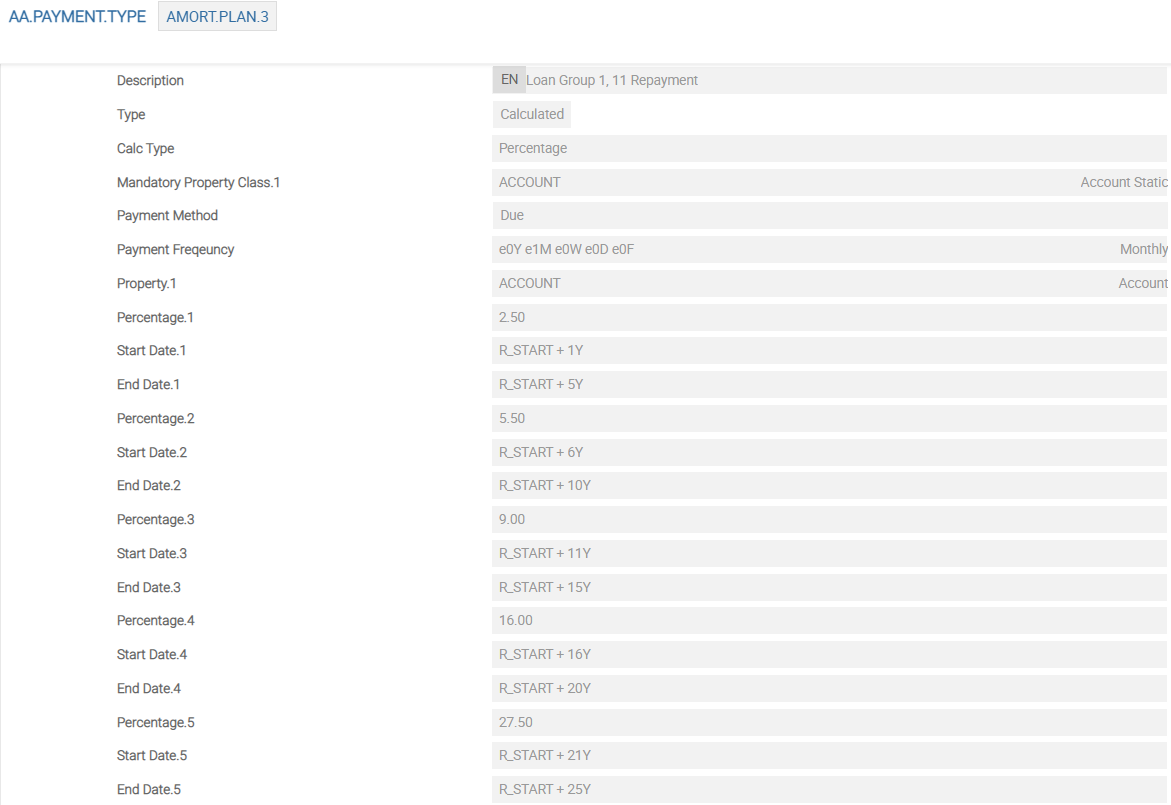

Consider the following example. Create an AA.PAYMENT.TYPE record called AMORT.PLAN.3 for a Personal Loan product as follows.

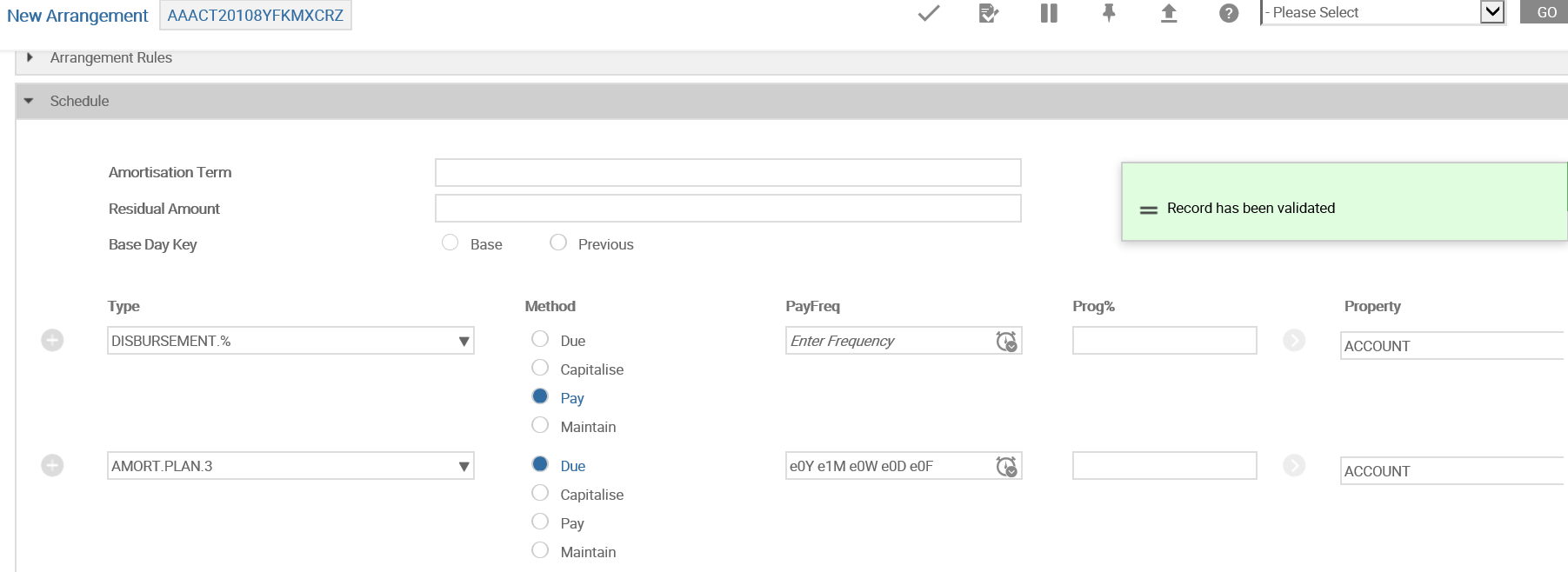

A new arrangement is created and the above configured AMORT.PLAN.3 is chosen for Payment Type for Schedule conditions.

The amortisation plan configured in the AA.PAYMENT.TYPE is assigned as default to the respective attributes in the Schedule conditions using an API at validate .

In this topic