Configuring Payment Holiday

The system can be configured to allow modifications to the scheduled payments by either skipping or modifying the payment amount. This type of flexible repayment is achieved by using the Payment Holiday Transaction Class. There are no product conditions required and each time the conditions have to be captured afresh by the user.

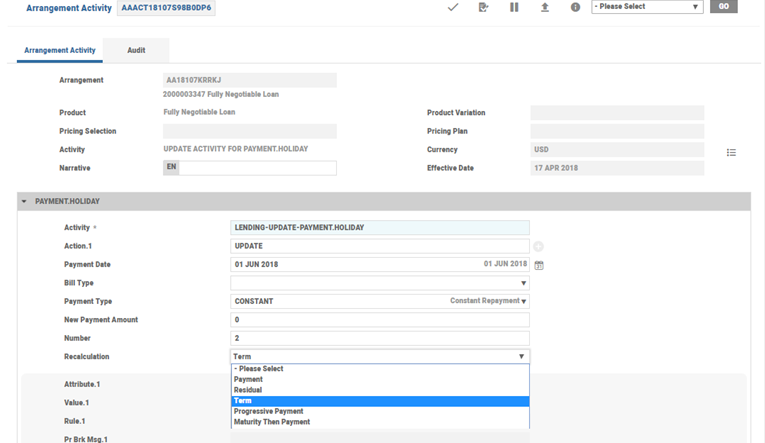

Flexible repayment instructions are captured using the LENDING-UPDATE-PAYMENT.HOLIDAY activity and any subsequent changes to the flexible repayment are made through the LENDING-CHANGE-PAYMENT.HOLIDAY activity.

Defining Payment Holiday

Using the LENDING-UPDATE-PAYMENT.HOLIDAY activity, the user can define a payment holiday based on the Payment Type or Bill Type. The user, further has to define the Number of Instalments and the New Payment Amount (if the New Payment Amount is a Reduced Payment Amount than the Original Payment Amount).

- New Payment Amount - Determines the reduced repayment amount (the field is optional, if left blank the entire payment is considered)

- Number of Instalments - Determines the installments that need to be skipped or should have a reduced repayment amount.

- Recalculation – Allows the user to define the type of recalculations on the schedule, due to the payment holiday definition. The Recalculation options are Payment, Residual, Term, Progressive Payment and Maturity Then Payment (Read Recalculation Based on Activities in Payment Schedule)

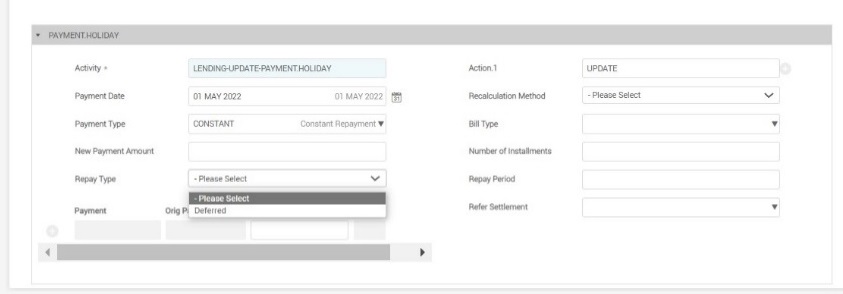

In the screenshot below, the options to recalculate during the payment holiday and defer holiday interest period are illustrated.

Defining Multiple Payment Holiday

When the user defines multiple holiday payments with multiple start dates, then the payment schedule projection honours all the payment holidays.

Amending Payment Holiday

Amendments to the existing holiday payments definition can be made using the LENDING-CHANGE-PAYMENT.HOLIDAY Activity.

Restricting Items from Payment Holiday

If some payment type or bills types have to be restricted, it can be defined in the Payment Schedule conditions using the Hol Restrict Type and Hol Restrict Item set of fields. The user has to choose the restriction on holiday processing based on either the property class, property, bill type or payment type.

Consider a scenario, if the Charge property class is selected for restriction, then flexible repayment is not allowed for any of the scheduled charges. This can be achieved by setting Hol Restrict Type as Property Class and Hol Restrict Item as CHARGE.

Read Restriction in Flexible Repayment in Payment Holiday for more information.

Repayment of Holiday Interest

During a payment holiday, the system continues to accrue interest as per the original configuration. The holiday interest accrued during the payment holiday period is collected in the first upcoming schedule post holiday. When the accrued interest breaches the permissible amount of the first upcoming schedule post holiday, the accrued interest is moved to the subsequent bills.

When the payment holiday is declared, the system can be configured to collect the accrued interest during the holiday period as a separate schedule by setting Repay Type as Deferred.

- When Repay Type is left blank, the accrued interest is collected in upcoming schedules as a priority but when it is set as Deferred, the holiday period’s accrued interest is billed as a separate item in the payment schedule. The system automatically moves the holiday interest accrued to a separate balance type and starts billing it in a separate payment type after the payment holiday.

- Repay Period - Specifies the number of billing cycles required to collect the accrued holiday interest. When left blank, the holiday interest is collected as schedules till maturity.

- Refer Settlement Type - Reuses the settlement instructions of another existing payment type.

Read Repayment of the Accrued Holiday Interest for more information.

Balance Type for Holiday Interest

It is possible to collect the interest accrued during the payment holiday as a separate schedule. Read Flexible Repayment Definition in Payment Holiday Property Class for more information.

When the system is configured to collect the payment holiday interest in a specific schedule, the system should bill the holiday interest separately. It automatically moves the interest accrued during the payment holiday to a separate balance type to achieve this separate billing. The unbilled accrual during the payment holiday is moved from ACC <Interest> to HOL <Interest> (that is, from Accrued Interest Balance Type to Holiday Interest Balance Type).

The holiday interest accrued during the holiday is moved to the HOL<INTEREST> balance type using the LENDING-DEFER-PAYMENT.HOLIDAY activity.

To complete the accounting related to balance updates for holiday interest, the TBC generates an event, which can be captured by the connected external GL (General Ledger) system.

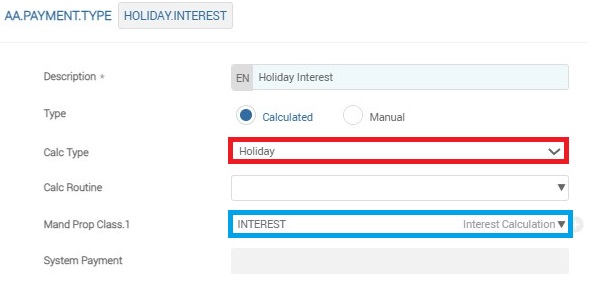

Payment Type for Holiday Interest

The HOL<INTEREST> holiday interest is billed as a separate component in the payment schedule automatically under the Payment Type that has the Calc Type as Holiday.

Ensure that the Combine Bill At Parent field is set to Yes for HOLIDAY.INTEREST Payment type for combining the holiday interest and other payment types.

When a holiday is declared for more than one interest property, separate payment types are scheduled for each of the interest property. The holiday interest is scheduled in the same frequency in which the original interest is collected and the number of schedules are based on the Repay Period specified. When left blank the schedules continue till maturity. This interest can be collected from the same settlement instruction as that of Payment Type given in Refer Settlement Type.

The system schedules the Forward Recalculate Activity at the end of the holiday period to update the Payment Schedule for the holiday interest component.

The repayment of the interest accrued during the payment holiday starts immediately after payment holiday or grace period ends. The system schedules an activity for changing the payment schedule to accommodate the HOLIDAY.INTEREST payment type on the last day of the defined payment holiday. The HOLIDAY.INTEREST Payment Type is set up in such a way that the Start Date of the HOLIDAY.INTEREST Payment Type is the immediate next due date (as that of the Payment Type or Bill Type defined in the Payment Holiday) after the payment holiday.

The user can amend the details of the holiday interest payment that is automatically scheduled after the holiday interest schedule is updated in the arrangement (after the holiday period).

Defining Payment Holiday Limit

When the customer opts for a flexible payment, the bank may choose to place a control on the amount of flexibility used by the customer. The bank can control the repayment amount that is being skipped or reduced during a payment holiday. This control can be configured in the Payment Schedule condition at the product or arrangement levels.

Periodic Attribute Class

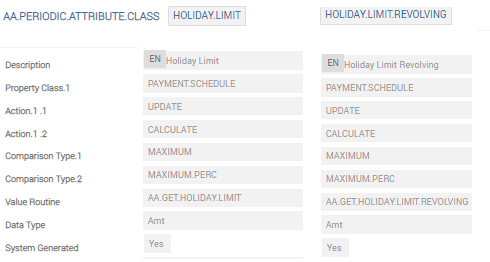

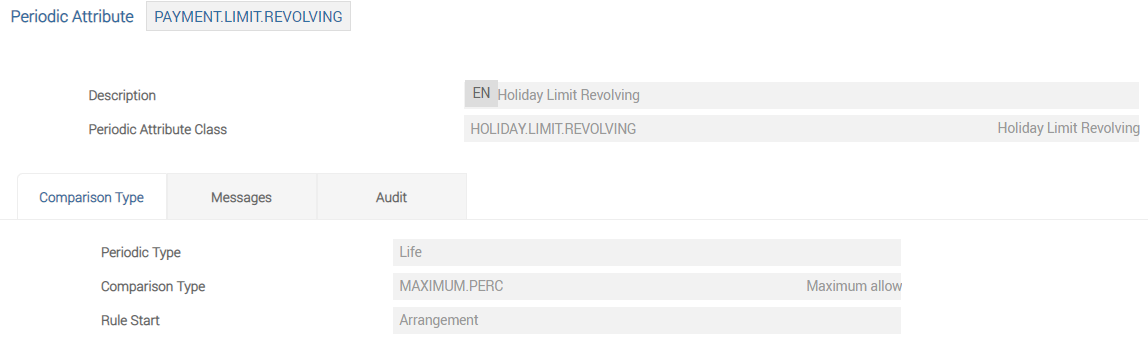

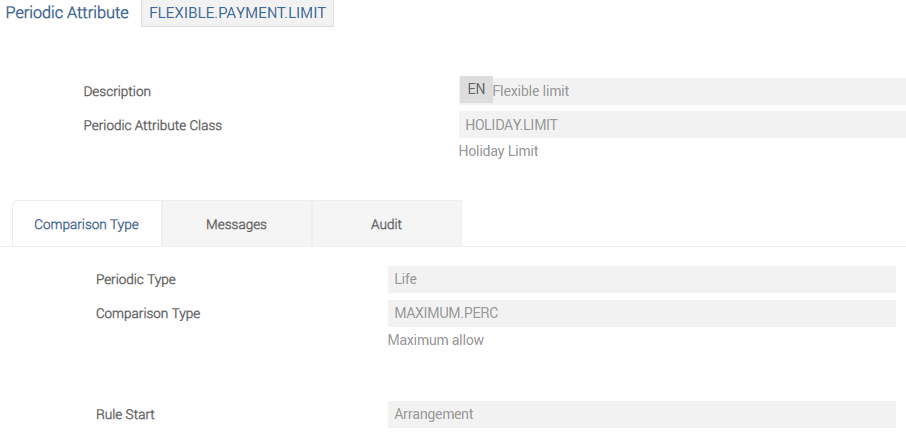

The HOLIDAY.LIMIT and the HOLIDAY.LIMIT.REVOLVING periodic attribute classes are used to define the flexible payment limit.

- HOLIDAY LIMIT - Calculates the maximum amount or maximum percentage of amount taken as payment holiday when utilising a flexible payment.

- HOLIDAY LIMIT REVOLVING - Calculates the maximum amount or percentage that can be taken as a payment holiday where the holiday limit available is reinstated during further ad hoc payments.

Periodic Attribute

The banks or FIIs can define periodic attributes from the Periodic Attribute Classes. The periodic attribute controls the rule and its impact on the product through fields like:

- Periodic Type - Determines the period for which the Rule should be active on the Product. The options are Life, Initial, Repeating, Rolling, Current and Assessment Period.

- Comparison Type – Evaluates rules by comparing the values captured by the user against the arrangement values with the comparison type defined here. This should be a valid record in EB.COMPARISON.TYPE.

- Rule Start Date - Determines the date from which the Rule should be made effective. The options are Arrangement, Agreement, Start, Anniversary and Cooling Off.

Other attributes are not mandatory. Read Periodic Rules for more information.

The PAYMENT.LIMIT.REVOLVING periodic attribute is configured in the Payment Schedule condition to restrict the Payment Holiday Limit to a maximum amount or maximum percentage defined by the banks or FIIs. This rule is configured to be effective on an arrangement from the Arrangement Effective date throughout the life of the arrangement.

This rule allows to reinstate the Payment Holiday Limit during any adhoc or excess payment over and above the due amount.

The FLEXIBLE.PAYMENT.LIMIT periodic attribute is configured in the Payment Schedule condition to restrict the Payment Holiday Limit to a maximum amount or maximum percentage defined by the banks or FIIs. This rule is configured to be effective on an arrangement from the Arrangement Effective date throughout the life of the arrangement.

The periodic attribute defined in the Payment Schedule condition is evaluated every time a new payment holiday is declared. These periodic attributes can also allow banks to create period-based rules (for example USD 1000 Flexible Payment Amount Limit per year) by configuring the Periodic Type (in the Periodic Attribute) and the available flexible payment limit gets checked every time a payment holiday or flexible payment is requested for the given period (the Period can be Life, Initial, Repeating, Rolling, Current and Assessment Period). For a revolving Holiday Limit, any excess repayment over and above the due amount replenishes the flexible payment limit (to the extent of the initial limit value defined).

The utilisation of the Payment Holiday Limit, is based on scheduled bill and how much the customer has paid for the Scheduled Bill. Read Payment Holiday Limit for more information. The Payment Holiday limit is evaluated whenever there is a change in Payment Schedule like a change in the repayment amount due to the change in the interest rate.

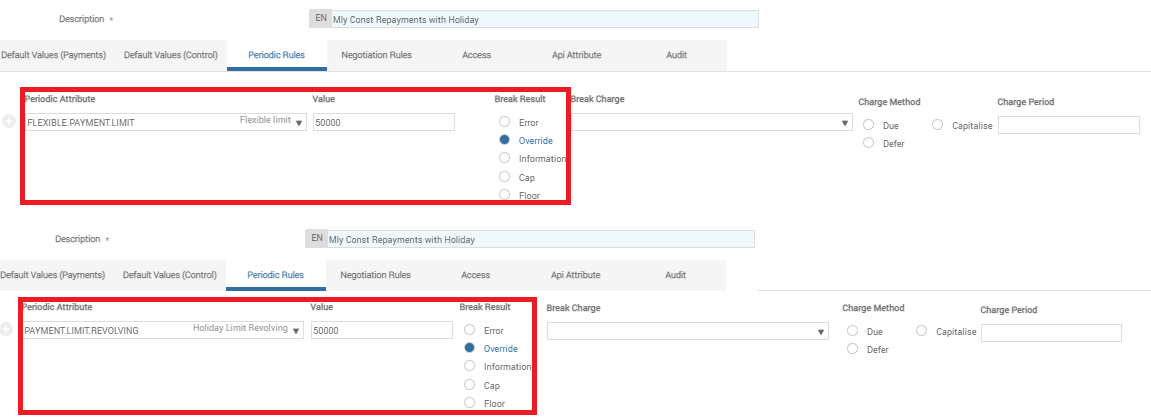

Configuring Payment Holiday Limit

The Payment Holiday Limit can be any of the following:

- Fixed amount - When the Payment Holiday limit is configured as a fixed amount, the system allows the banks or FIIs to provide payment holiday to the customer upto the defined Fixed Payment Holiday Limit.

- Percentage based on a balance type

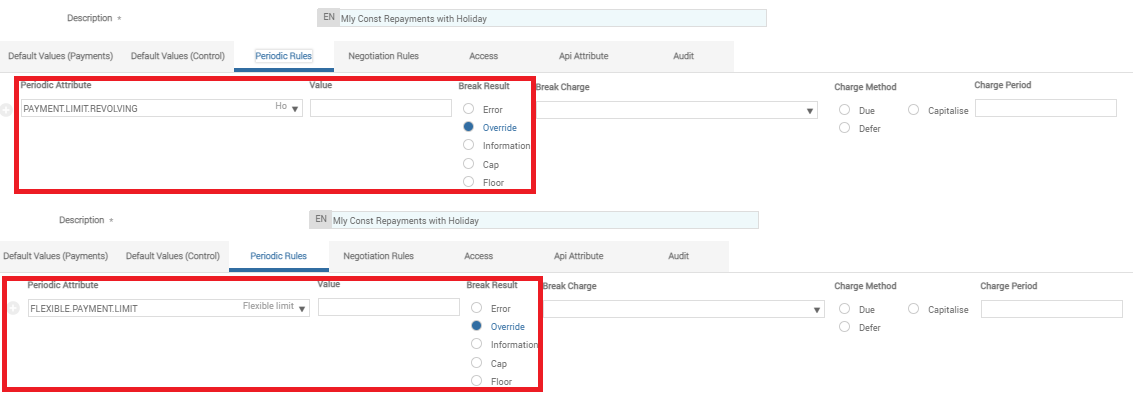

For configuring a Fixed Payment Holiday Limit, the FLEXIBLE.PAYMENT.LIMIT/PAYMENT.LIMIT.REVOLVING periodic attribute is set up as follows, in the Periodic Rule Tab of Payment Schedule Product Condition of the product.

As per the above setup, the system is configured to raise an override for Payment Holiday Limit above USD 50,000.

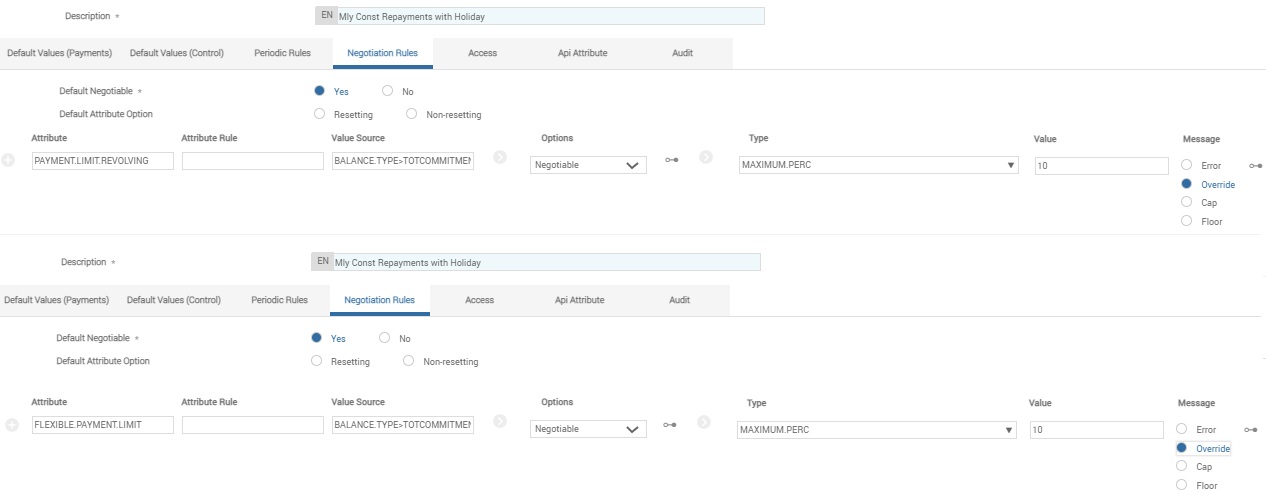

For configuring a Payment Holiday Limit based of a Balance Type (that is, a percentage of the Balance Type), the FLEXIBLE.PAYMENT.LIMIT/PAYMENT.LIMIT.REVOLVING periodic attribute is set up as follows in the Periodic Rule tab of Payment Schedule Product Condition of the product.

Then in the Negotiation Rule tab, the following configuration is followed to set up a Payment Holiday Limit, which is 10% of the Total Commitment (TOTCOMMITMENT) Limit.

Any Payment Holiday limit above the defined value raises an override.

It has to be noted that, the Payment Limit Revolving periodic attribute is used to reinstate the payment holiday limit balance, during the adhoc or excess payment over and above the due amount. The banks or the FIIs can configure:

- Different percentage in the Nr Value

- Different evaluation source balance in the Nr Value Source (for example, CURACCOUNT)

That is, in the Negotiable Rules tab the Value Source, Options, Type, Value, and Message controls the Payment Holiday Limit and the related message to be displayed if the limit is breached.

Controlling Payment Holidays Count

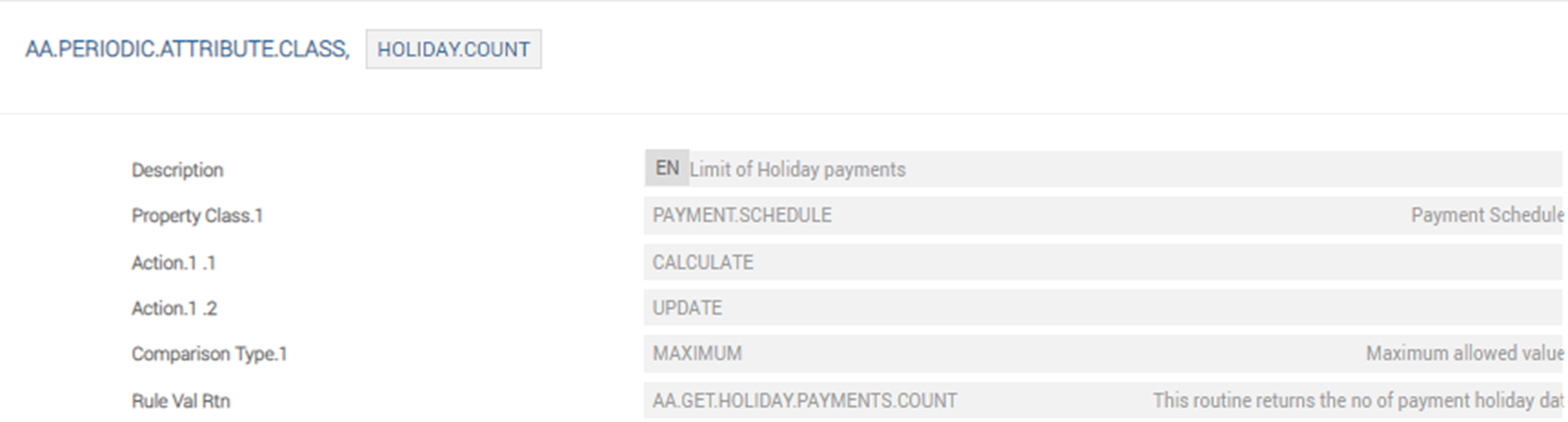

Banks/FIIs can implement a control on the number of payment holidays, for a given Bill type or Payment type defined in an arrangement for a period by configuring the periodic attribute of the HOLIDAY.COUNT periodic attribute class in the Payment Schedule condition at the product or arrangement levels.

Defining Periodic Attribute Class

The HOLIDAY.COUNT periodic attribute class is used to define the number of payment holidays within a period.

It evaluates the number of holidays defined in an arrangement from AA.ACCOUNT.DETAILS and there by implements the restriction on the definition of payment holidays. During a rule evaluation, the system excludes any cancelled payment holiday, while ascertaining the overall payment holiday count for the period.

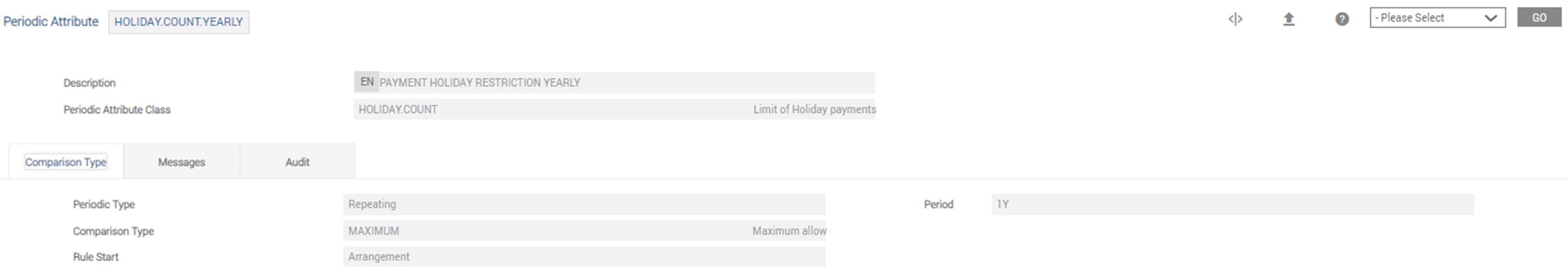

Defining Periodic Attribute

Banks/FIIs can define periodic attribute from the periodic attribute classes and these periodic attributes control the rule and its impact on the products. Read Periodic Rules for more information.

The user configures the HOLIDAY.COUNT.YEARLY periodic attribute in the Payment Schedule condition to restrict the number of payment holidays defined in a year, as required by the banks or FIIs. This rule is configured to be effective on an arrangement from the Arrangement Effective date and the rule repeats every year.

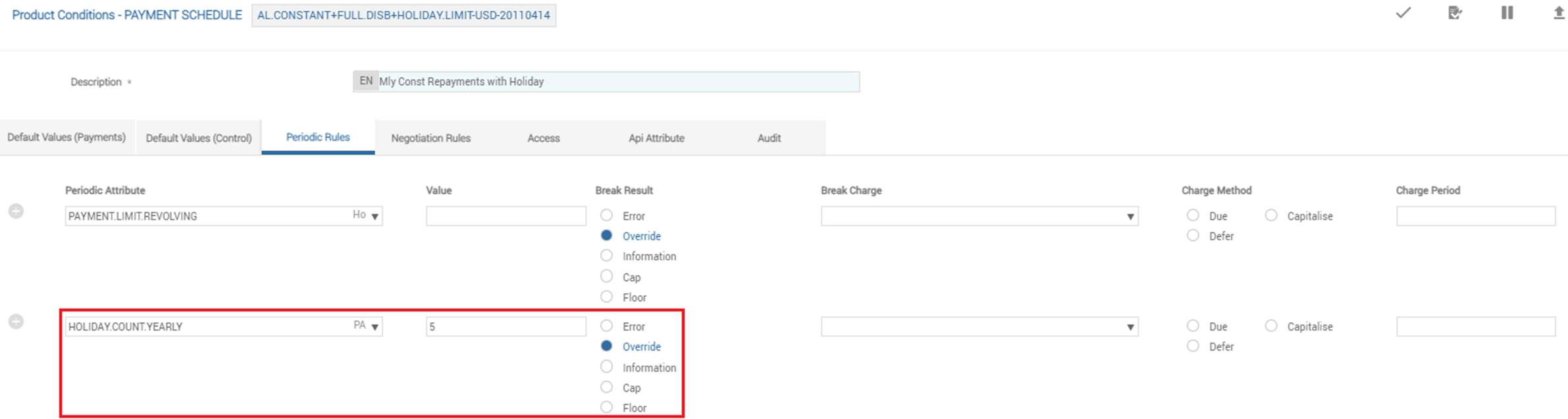

Configuring Holiday Count

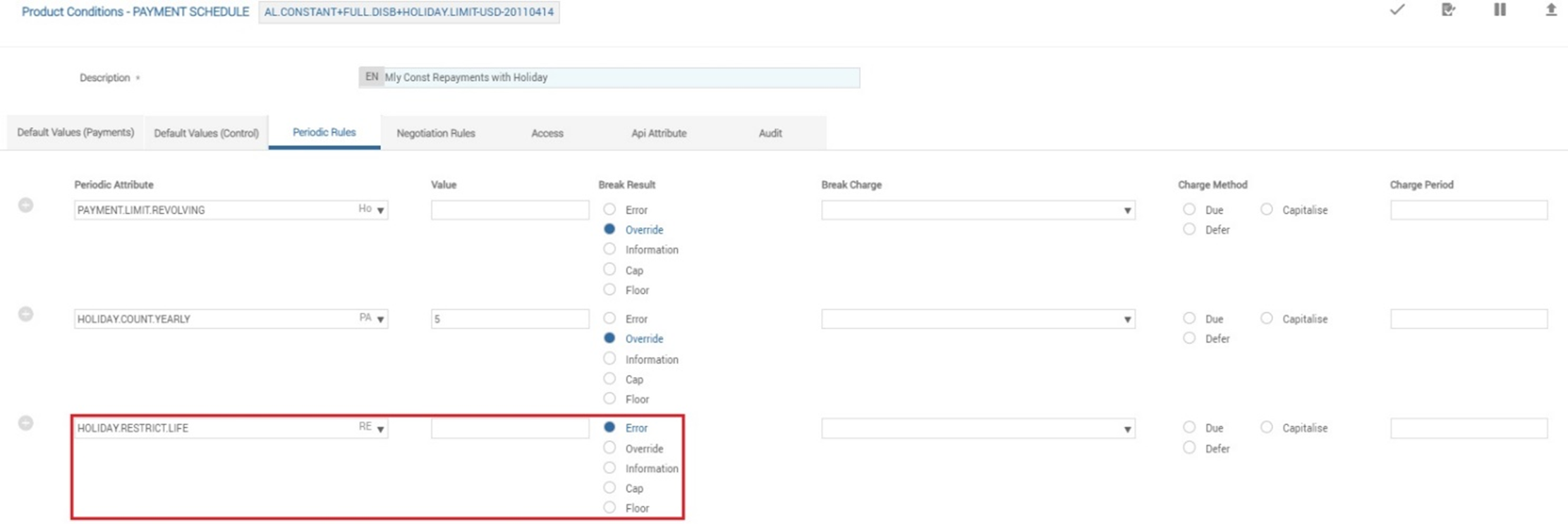

For restricting the number of payment holidays for a particular year, HOLIDAY.COUNT.YEARLY is set up as follows in the Periodic Rule tab of Payment Schedule product condition.

Defining Restriction on Consecutive Payment Holidays

Parallel payment holiday (that is, if an arrangement is within a payment holiday period and the user tries to further define a payment holiday, before the current payment holiday period is completed) is restricted when the Repay Type field is set as Deferred in the Payment Holiday Transaction Class. When Repay Type is set blank, the user can define a parallel payment holiday.

However, the banks/FIIs can implement restrictions on the definition of parallel payment holiday when Repay Type is blank, through the periodic attribute of the HOLIDAY.RESTRICT periodic attribute class.

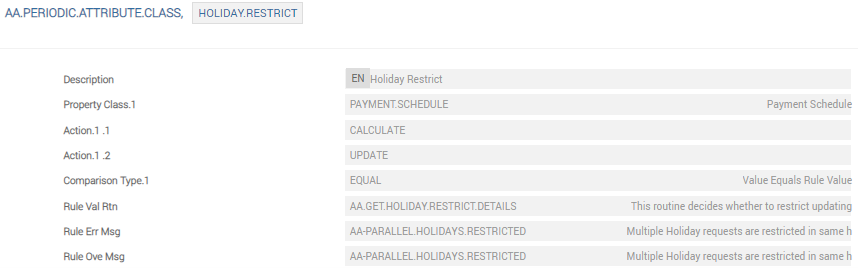

Defining Periodic Attribute Class

The HOLIDAY.RESTRICT periodic attribute class is used to restrict payment holidays defined in parallel to an existing payment holiday.

The HOLIDAY.RESTRICT periodic attribute class evaluates the existing defined payment holiday dates from AA.ACCOUNT.DETAILS with that of the current activity date of payment holiday definition and there by implements the restriction, if required.

Defining Periodic Attribute

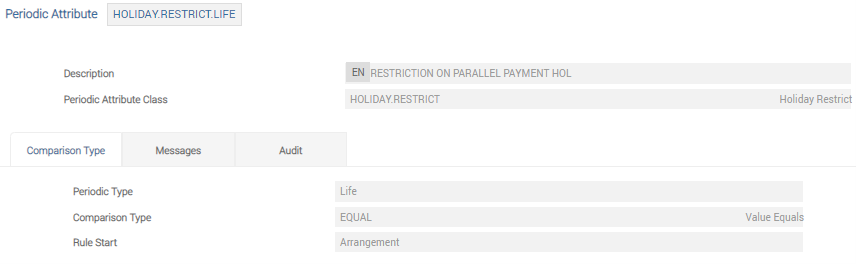

The user configures the HOLIDAY.RESTRICT.LIFE periodic attribute in the Payment Schedule condition to restrict any parallel payment holiday, that is, if an arrangement is within a payment holiday period the system restricts defining further payment holiday, unless the existing payment holiday period is completed. This rule is configured to be effective on an arrangement from the arrangement effective date, throughout the life of the arrangement.

The periodic attribute defined in the Payment Schedule condition evaluates the current system date and existing holiday dates in AA.ACCOUNT.DETAILS when a new payment holiday is declared. These restrictions on applying the payment holiday can be configured for different periods (for example, the life of arrangement, a period from renewal of the arrangement, repeating for period and so on) by configuring the Periodic Type and Rule Start Date in the AA.PERIODIC.ATTRIBUTE.

However, configuring the Periodic Type as Initial, doesn’t impose any restriction of definition of consecutive payment holiday as defined above.

Configuring Holiday Restriction

For restricting the parallel payment holidays throughout the life of the arrangement, HOLIDAY.RESTRICT.LIFE is set up as follows in the Periodic Rule tab of Payment Schedule product condition.

- The Pr Value for the Periodic Attribute should be Null.

- The system restricts definition of parallel payment for payment holidays having Repay Type as Deferred, without the configuration of the Periodic Attribute in the Payment Schedule product condition.

Cancelling Skipped Schedules

It allows the user to cancel the skipped schedules, through the LENDING-CHANGE-PAYMENT.HOLIDAY activity. However, cancellation is only allowed, when the upcoming holidays post cancellation is consecutive and it cannot be on an ad-hoc basis.

Read Cancellation of Holidays Declared for more information.

Paying-off during Payment Holiday

It is possible to payoff a loan in a holiday or grace period and/or a loan carrying the unbilled holiday interest. The payoff statement is generated for the entire loan outstanding including the accrued holiday interest and due holiday amount.

The Payment Rules used for payoff should include the holiday interest component. This enables the system to include the pending HOL<INTEREST>. Read Payment Rules for more information.

In this topic