Working with Loan Charge-off

Key Features

Charge-off is different from writing off the arrangement. The key features of charge-off are:

- A full or multiple partial charge-off transaction is possible.

- The interest on the charge-off balance should accrue, but is not passed to income.

- Reversal of charge-off transactions is possible

- Removal from charge-off or partial removal from charge-off (that is, a lessening of the charge-off amount) is possible as well.

- Dual accounting –that is, having two sets of books, the customer record vs. the bank record and applying payments independently to the two records.

The charge-off feature is available for the Lending Product Line. The Charge-off Property has to be included in the product for charging off an account.

The LENDING-CHARGEOFF-ARRANGEMENT Activity Class is used for charge-off of an arrangement. The complete outstanding in the loan is charged off.

It is possible to charge off a loan, in parts. The LENDING-CHARGE-OFF-ACCOUNT Activity Class is used to charge-off the Account Property balance, based on the charge-off order. This is used to both charge-off an amount of principal (that is, increase charge-off amount) and to reduce the charge-off (that is, decrease the charge-off amount) if required. If a loan is being charged-off for the first time, this Activity is responsible for creating the charge-off balances as well as the customer’s shadow balances.

For handling charge-off under certain specific regulations (FASB), the bank user uses the CHARGEOFF-REPORTING activity.

The features related to handling charge-off under FASB regulations are not applicable for loans in TBC.

For loan contracts, apart from the customer balances, it is possible to store two separate balances, the bank balances along with the charge-off balances.

When a Lending Product with Charge-off Property is proofed and published, the system automatically creates the balance type records to maintain charge-off balances along with the customer and bank balances.

- For a loan that is charged off, for CUR<ACCOUNT>, the balances prior to the Charge-off Activity is stored as a shadow CUR<ACCOUNT>CUST.

- The charge-off amount is stored in CUR<ACCOUNT>CO and the amount under banks book is stored as CUR<ACCOUNT>.

- The CUR<ACCOUNT>CO charge-off balance, is the contingent balance and CUR<ACCOUNT>CUST is a balance used for internal purpose and CUR<ACCOUNT> is only non-contingent in nature.

- When the LENDING-CREDIT-ARRANGEMENT activity is processed, the amount credited to UNC<ACCOUNT> is also credited to UNC<ACCOUNT>CUST.

- When the LENDING-DEBIT-ARRANGEMENT activity is processed, the amount debited from UNC<ACCOUNT> is also be debited from UNC<ACCOUNT>CUST.

To complete the accounting to update the balances in a charged-off loan, the TBC generates an event, which can be captured by the connected external GL (General Ledger) system.

When a loan is charged-off, the borrower is unaware of this action, and continues to receive regular billing notices. As a result, when a loan is fully or partially charged off there is a situation to maintain two sets of books:

- A customer record (that is, the customer’s view of the balances and bills)

- A bank record (that is, the bank’s view of the balances).

Prior to the charge-off, the customer and the bank records are the same (and therefore there is only one set of books). However once a loan is partially or fully charged off, the views are different.

Banks generally don’t communicate charge-off decision to the customers. So, a customer is unaware of a charge-off. Copying the balances prior to the Charge-off Activity creates a shadow record. This now becomes the customer record and does not include any of the effects of the charge-off. The bills and payments continue to be processed normally against this customer record. The payments received have to be apportioned as per the Payment Rules according to the customer. The customer balances are apportioned in this repayment order.

For a full or complete charge-off using the LENDING-CHARGEOFF-ARRANGEMENT activity, there are no bank balances. The BNK balances are zero in this case.

A charge-off creates the shadow balances for the customer record that do not include the effects of the charge-off (that is, the customer is completely unaware). As a result, the existing balances (customer balance less charge-off amount) continue to be referred to as the bank record and includes the effects of the charge-off (for example, the charged-off balance). As the arrangement advances, it also contains the interest accrual on the bank balance and charged-off balance separately. Additionally payments to the loan are allocated in a different manner on the bank record than on the customer record. This is based upon the value of the book balances and the status of the loan (for example, partially charged-off, fully charged-off or non-accrual).

Internal inquiry screens display both the customer and the bank record, once a loan is partially or fully charged off. Reports breakdown the information this way as well – including both the bank balances and the customer balances.

The CUR<ACCOUNT>CO and each ACC<INTEREST>CO balance corresponds to the charge-off balance for the principal and the interest respectively. The system creates these balances by appending a CO at the end of each balance type.

To complete the accounting to update the balances in a charged-off loan, the TBC generates an event, which can be captured by the connected external GL (General Ledger) system.

Multiple Interest Accruals

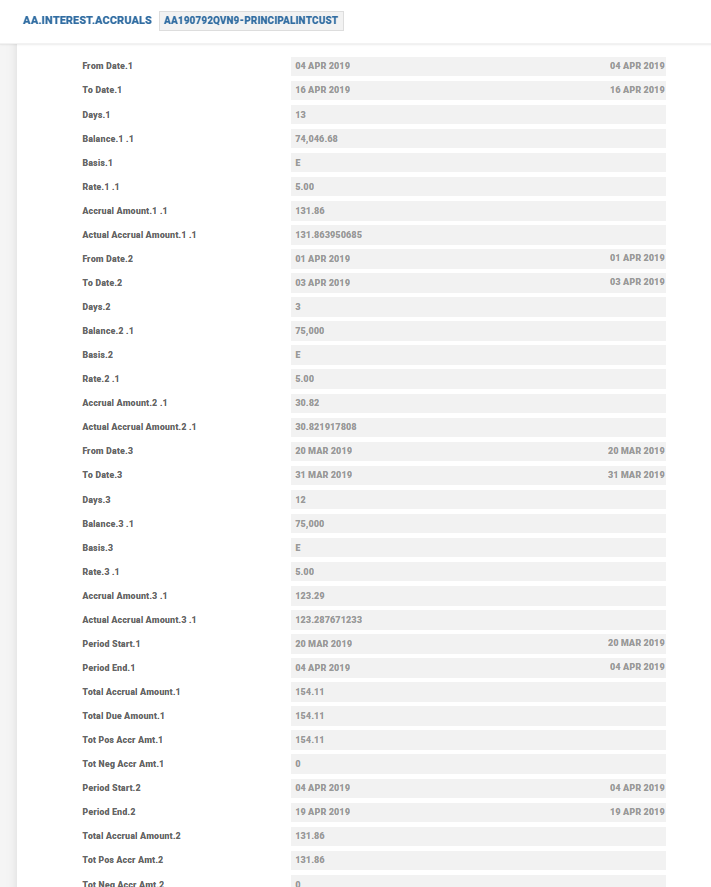

For a full charge-off, the system accrues interest for charge-off and the customer balances namely CO and CUST balances. There is no bank balance to accrue interest for the BNK balances.

For a partial charge-off (charge-off in parts), the system accrues interest for bank balance (for example, CUR<ACCOUNT>), charge-off and the customer balances. The system also accrues interest for the chargeoff and customer balances namely CO and CUST balances.

It is necessary to accrue both charge-off and customer interest on the corresponding balances separately.

When a loan contract in TBC is charged-off, the TBC generates an event, which can be captured by the connected external GL (General Ledger) system to complete the accounting and balance updates.

During a full charge-off, the arrangement balances are moved to the Chargeoff PL. As part of shadow accounting, CUR<ACCOUNT>CUST and CUR<ACCOUNT>CO balances are maintained during a full Chargeoff. This results in the accrual of balances per Interest Property for each of this principal balance. Each of them accrues interest at the same rate but based upon their balance. ACC<INTEREST>CUST is accrued on CUR<ACCOUNT>CUST and ACC<INTEREST>CO is accrued on CUR<ACCOUNT>CO.

Product configuration contains:

| Property | Source |

|---|---|

| INTEREST | CURACCOUNT |

Corresponding Accruals in a full charge-off loan are:

| Balance | Source |

|---|---|

| ACCINTERESTCO | CURACCOUNTCO |

| ACCINTERESTCUST | CURACCOUNTCUST |

In a partial charge-off, there are three balances: CUR<ACCOUNT>, CUR<ACCOUNT>CUST, CUR<ACCOUNT>CO. Hence, there are three accrual balances per Interest Property and each accrues interest at the same rate but based upon their balance. ACC<INTEREST> is accrued on CUR<ACCOUNT> then ACC<INTEREST>CUST is accrued on CUR<ACCOUNT>CUST. Though multiple interest accruals are done based on different balances, definition of source balance for each type of accrual is not required.

The interest is calculated on:

| Property | Source |

|---|---|

| INTEREST | CURACCOUNT |

Corresponding accruals in a partial charge-off loan are:

| Balance | Source |

|---|---|

| ACCINTEREST | CURACCOUNT |

| ACCINTERESTCO | CURACCOUNTCO |

| ACCINTERESTCUST | CURACCOUNTCUST |

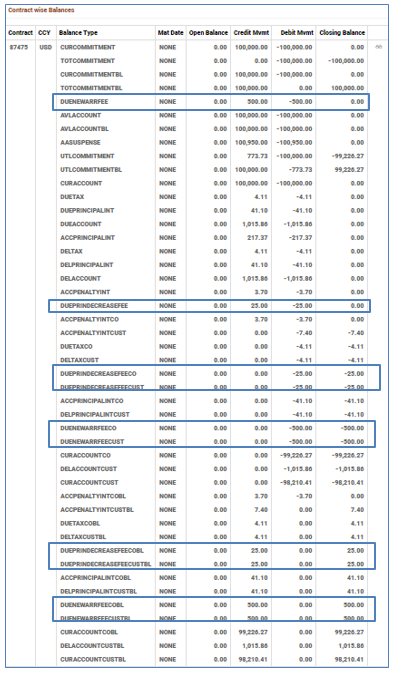

Product Setup and Charge-off Balances

When a Lending Product with Charge-off Property is proofed and published, the system automatically creates the below balance type records to maintain customer, bank and charge-off balances. Except bank balances, other balance type records which are created by system are contingent in nature.

| Bank Balances | Charge-off Balances | Customer Balances |

|---|---|---|

| CUR<ACCOUNT> | CUR<ACCOUNT>CO | CUR<ACCOUNT>CUST |

| DUE<ACCOUNT> | DUE<ACCOUNT>CUST | |

| <AGE><ACCOUNT> | <AGE><ACCOUNT>CUST | |

| UNC<ACCOUNT> | UNC<ACCOUNT>CUST | |

| ACC<INTEREST> |

ACC<INTEREST>CO |

ACC<INTEREST>CUST |

| DUE<INTEREST> | DUE<INTEREST>CUST | |

| <AGE><INTEREST> | <AGE><INTEREST>CUST |

- CUR<ACCOUNT>CO balance type holds the cumulative amount that’s been charged-off against an account.

- ACC<INTEREST>CO balance type is used for posting the accrued interest on charged-off balances namely CUR<ACCOUNT>CO.

Dual Billing

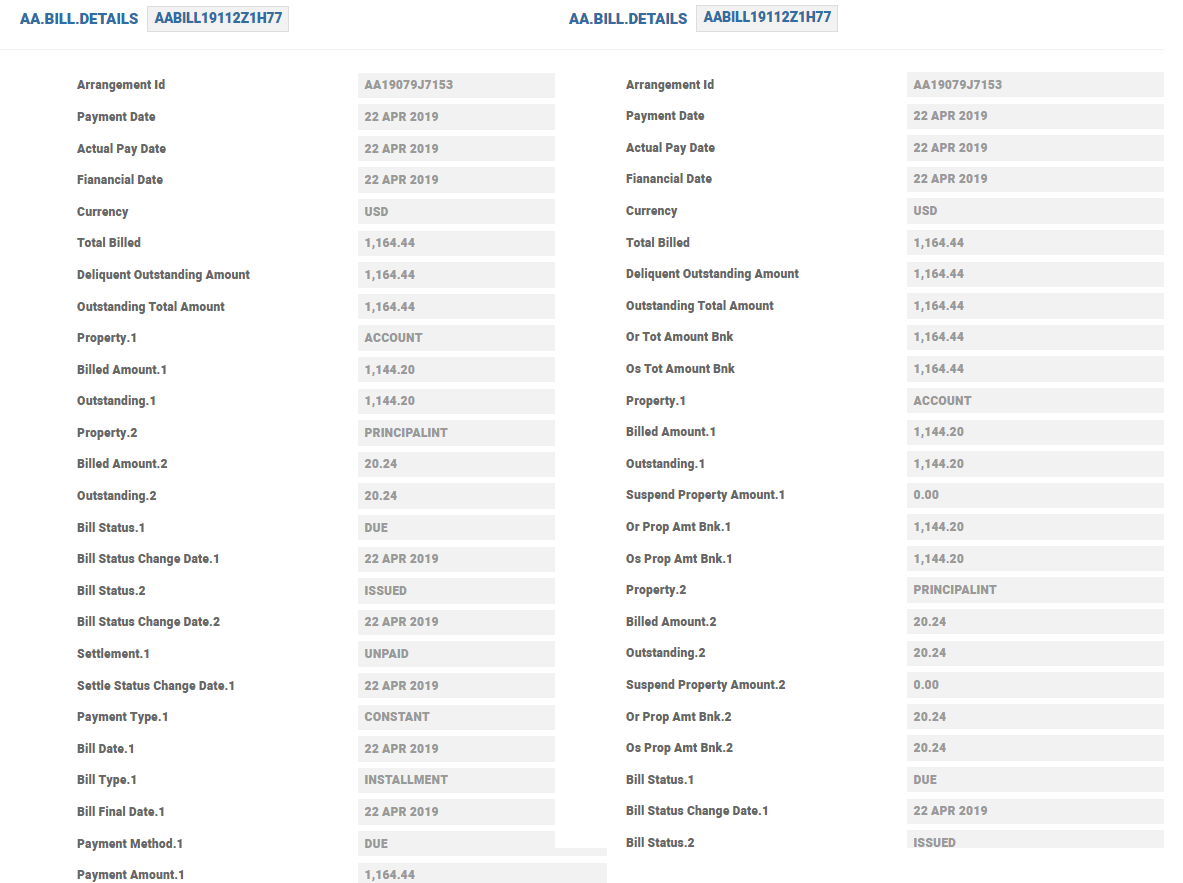

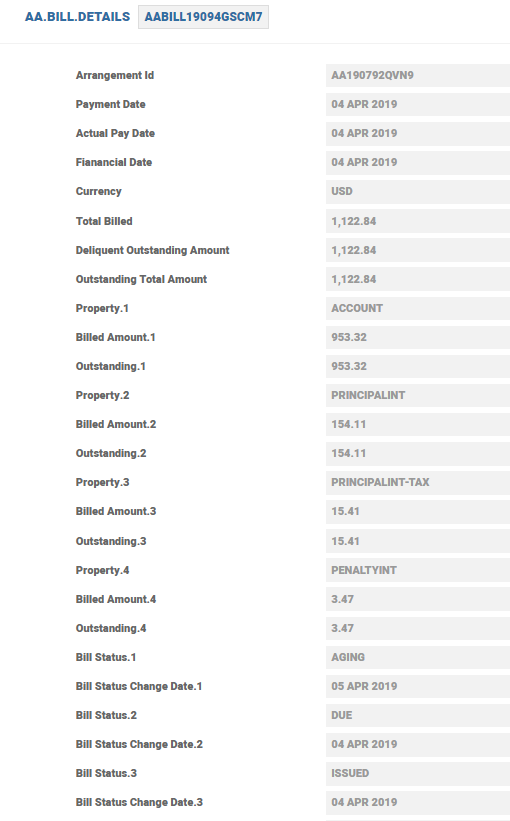

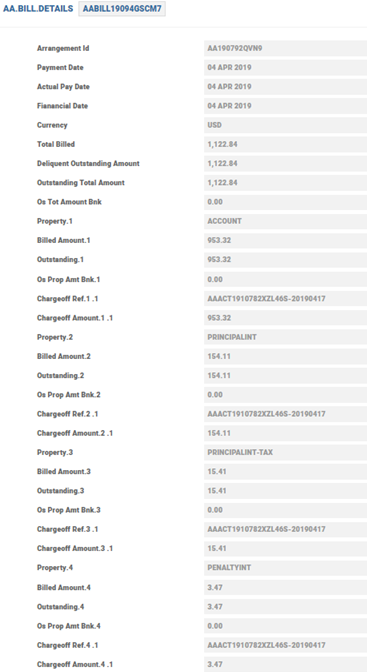

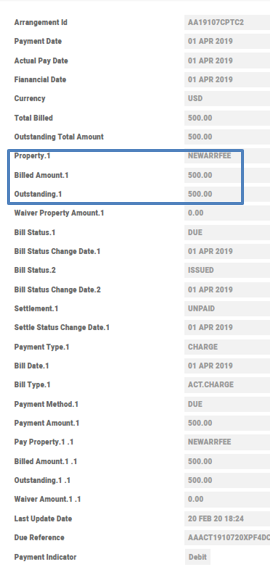

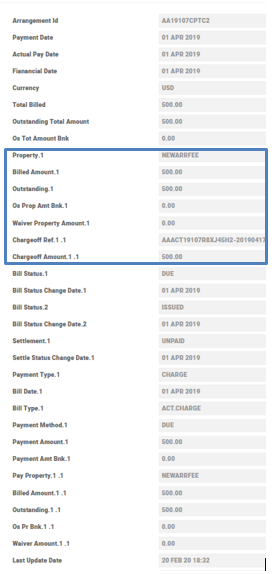

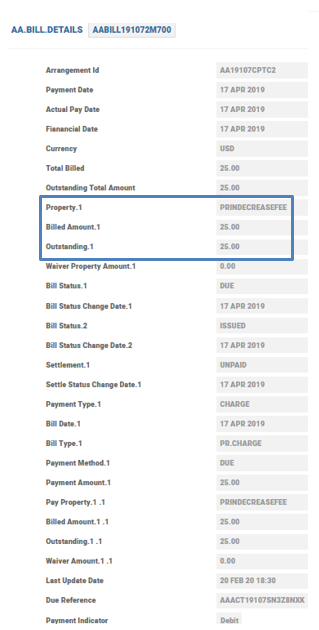

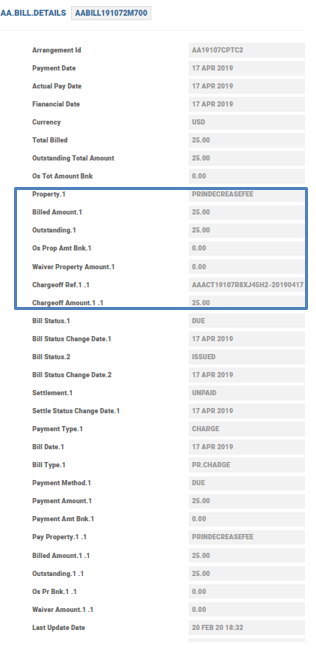

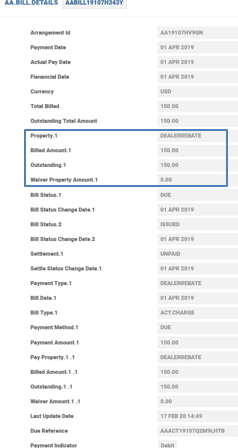

In the case where a loan is in Charge-Off status, AA.BILL.DETAILS is updated with both the customer and the bank due amounts.

- For a complete charge-off, the reflection of the charge-off billing is found in the billed balances. The bank amount is zero

- For a partial charge-off, two sets of figures (the customer and bank amounts) are calculated and stored on the bill. The customer and the bank amounts differ due to the effect of the charged-off principal as well as the alternate way of applying credits to the arrangement.

Illustration of Partial Charge-off

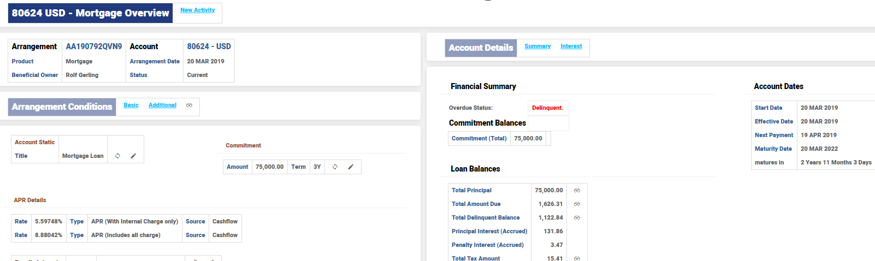

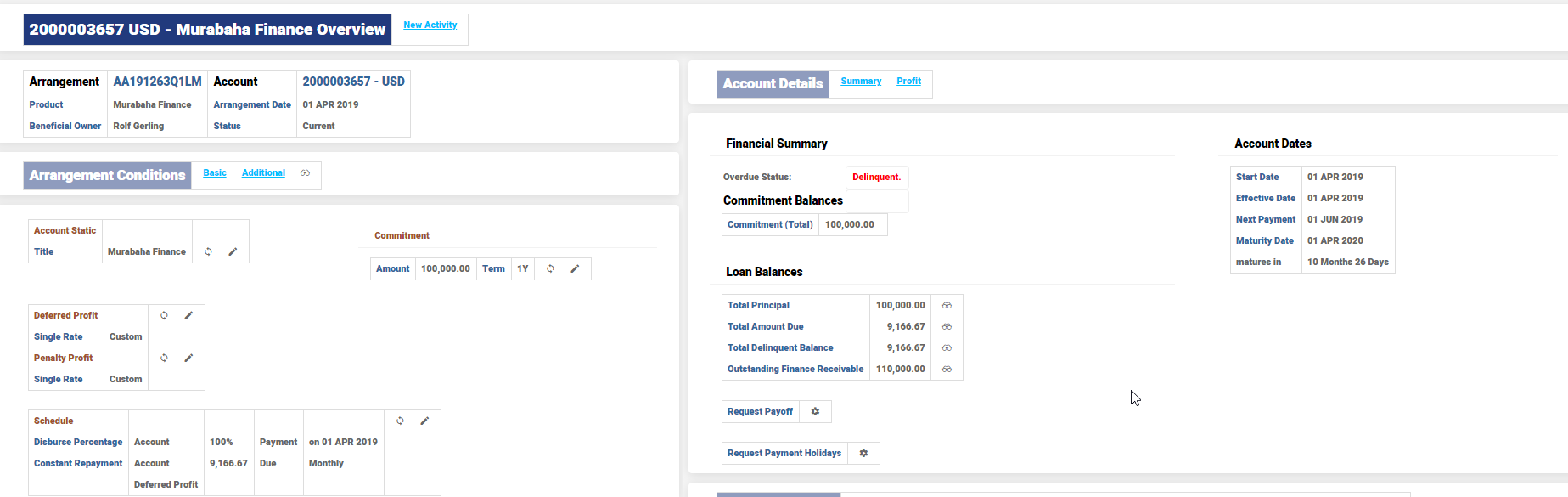

The changes that happen in an arrangement when a charge-off is performed is illustrated with the help of the below example.

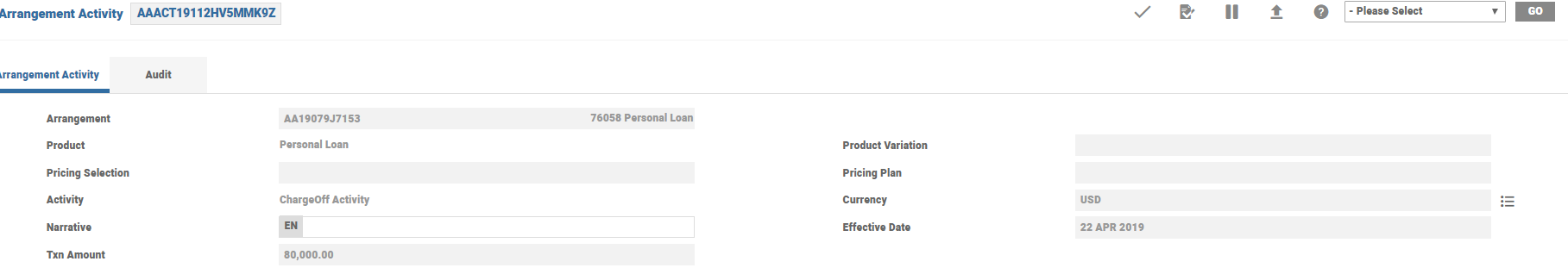

The arrangement is in delinquent status and is being charged off using the LENDING-CHARGEOFF-ACCOUNT Activity giving the transaction amount as 80,000 USD. This means 80,000 USD of principal is charged off.

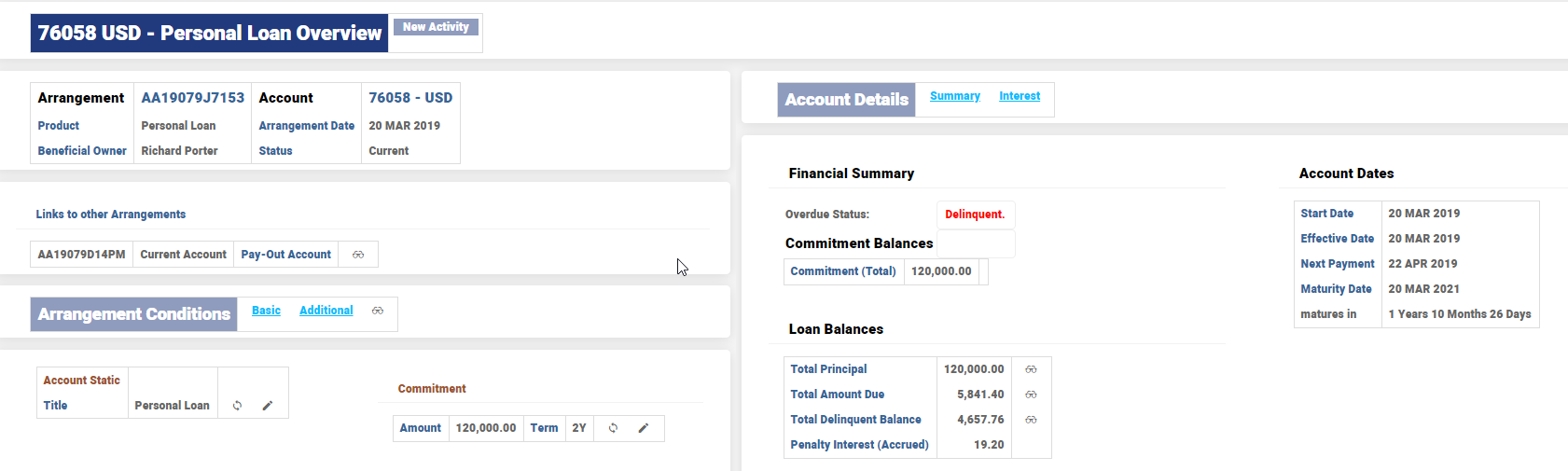

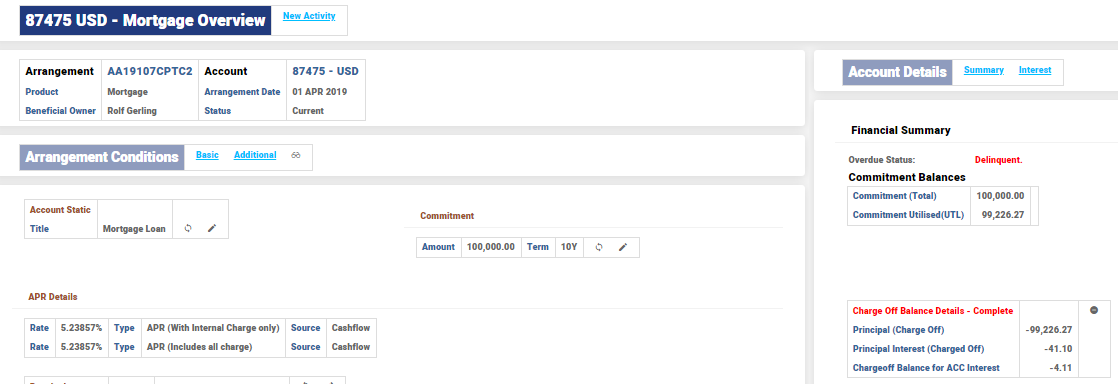

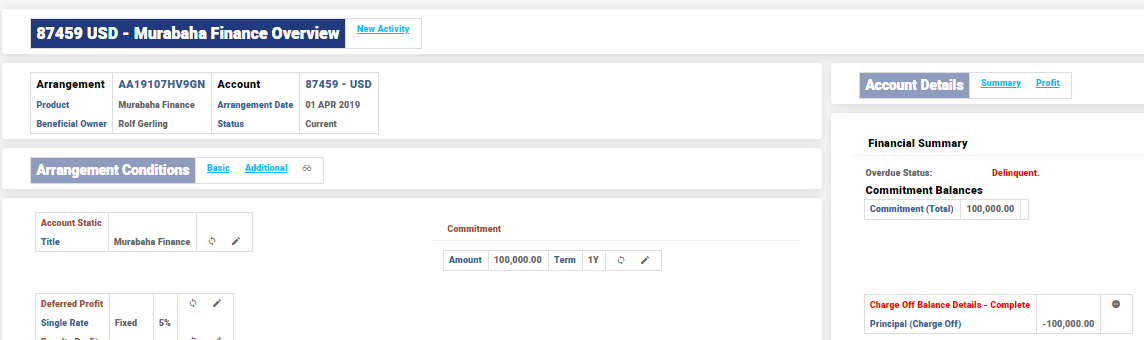

The Loan Arrangement Overview is displayed below.

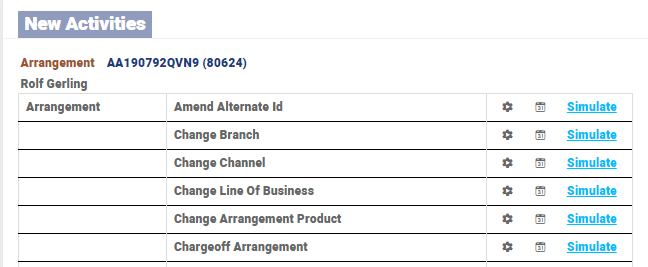

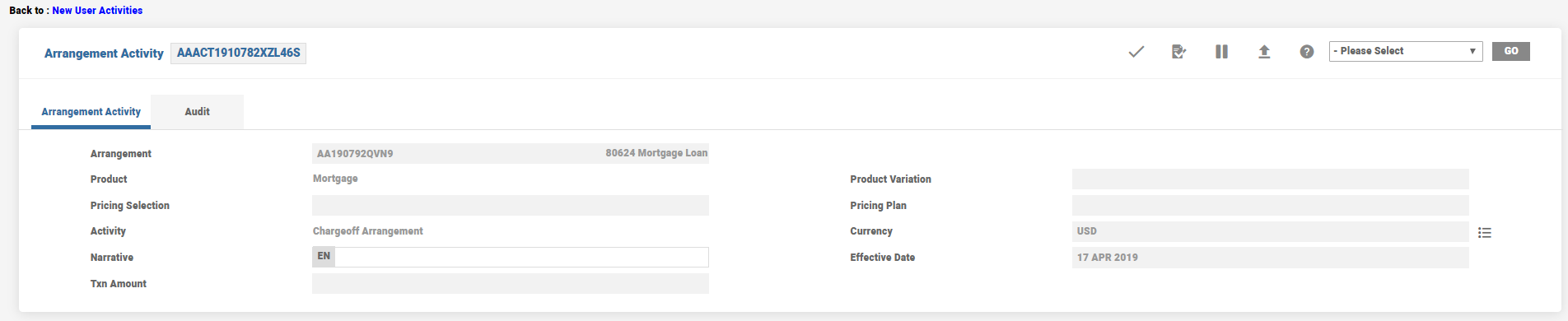

The Charge-off Activity is shown below.

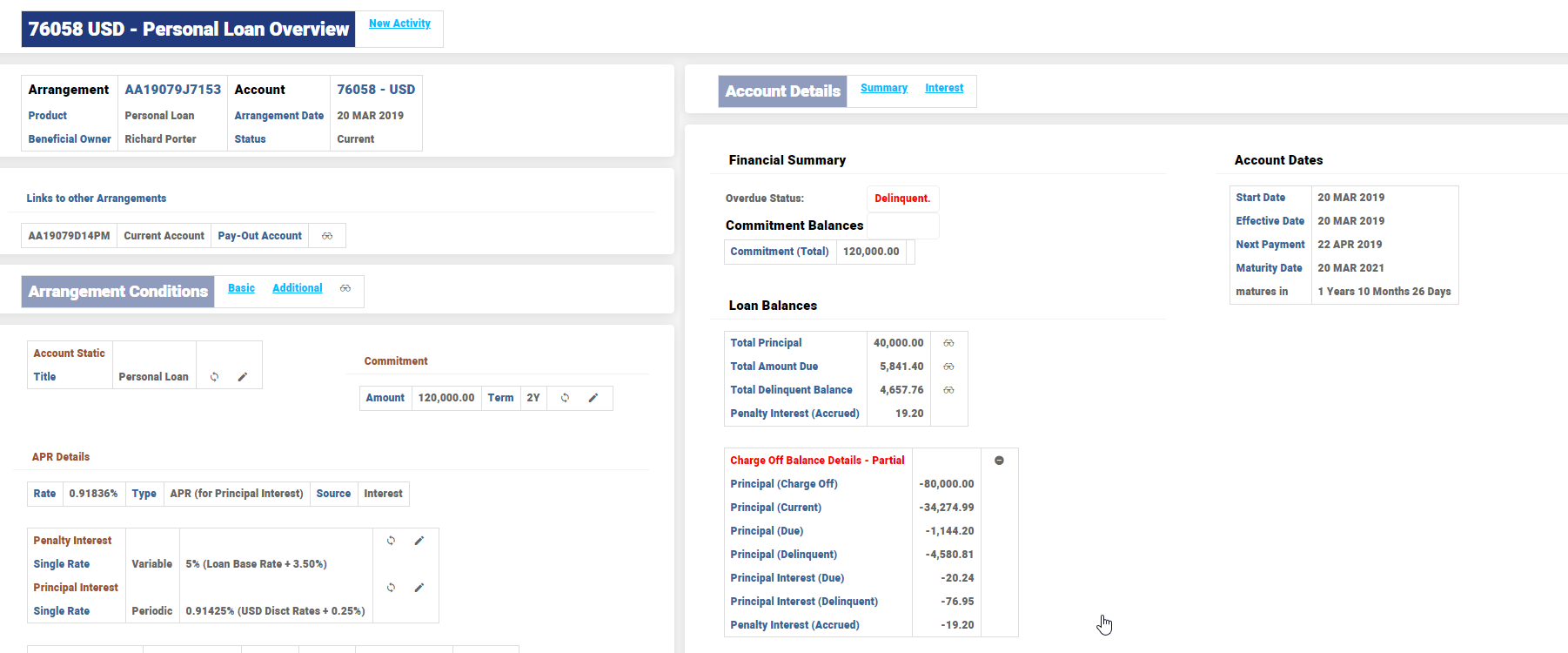

The Loan Arrangement Overview After Charge-off is shown below.

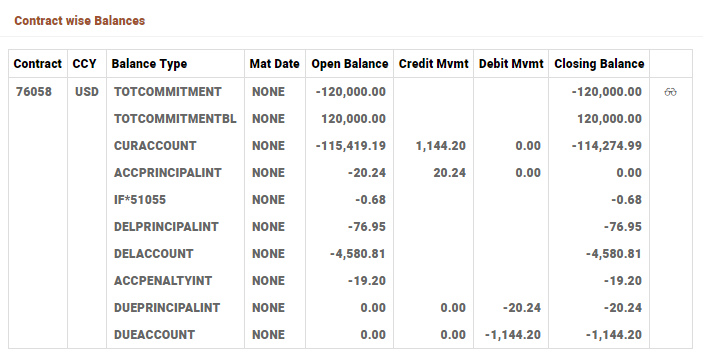

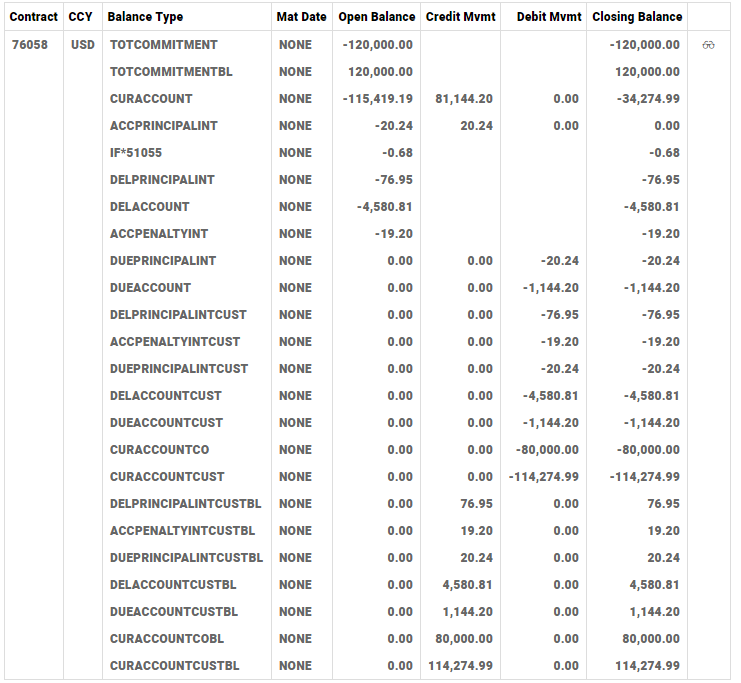

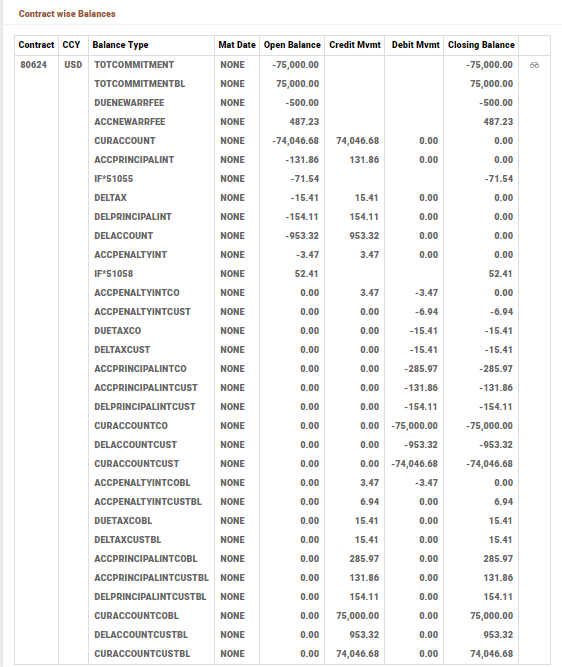

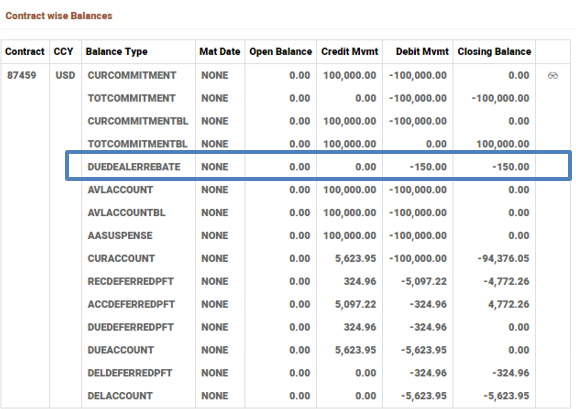

The ECB balances before charge-off of 80,000 is shown below.

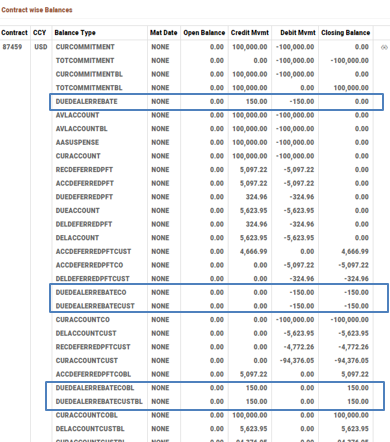

The ECB balances after charge-off of 80,000 is shown below. Note that the arrangement balances have changed as a result of the charge-off.

On bill generation, AA.BILL.DETAILS is updated with both the customer and the bank due amounts for each of these accruals.

AA.BILL.DETAILS stores the bank related fields that get updated on and after the charge-off of an arrangement. Once the charge-off is done, then the customer balances are stored in existing amount related fields and bank balances are stored in the BNK (bank) fields.

Overdue processing is triggered based on the bills getting aged. The Os Prop Amt and Or Prop Amt fields of the bill are based on the customer balances(original amount) and regular overdue processing is triggered for the same.

| Balance type | AA.BILL.DETAILS |

|---|---|

| CUR<ACCOUNT> | Os Prop Amt Bnk

Or Prop Amt Bnk |

| CUR<ACCOUNT>CUST | Os Prop Amt

Or Prop Amt |

Key Features of Full/Complete Charge-off

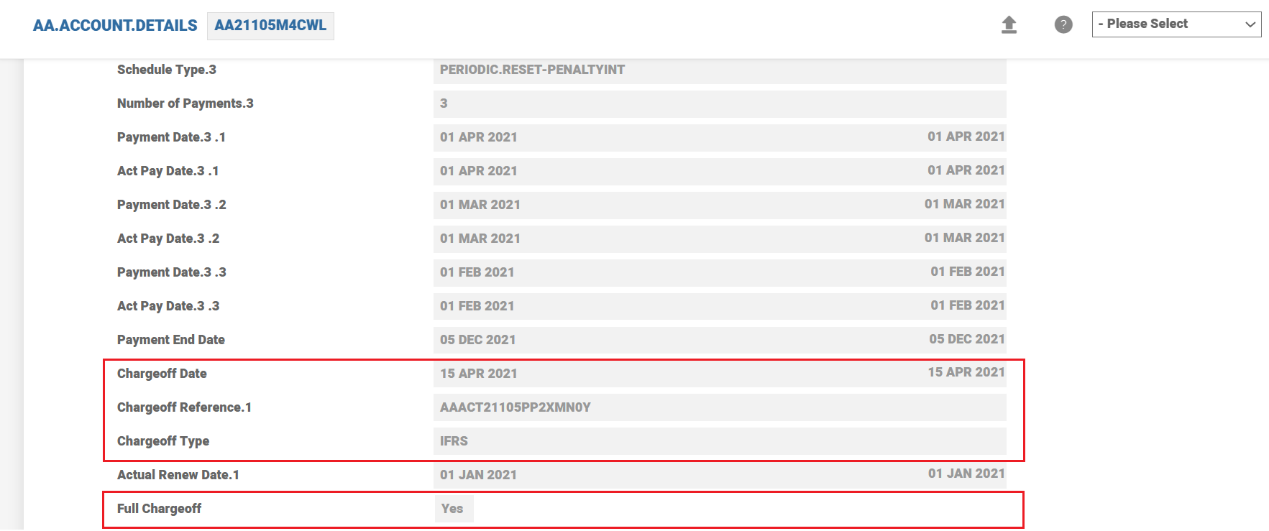

A complete charge-off is done using the LENDING-CHARGEOFF-ARRANGEMENT activity. After a complete charge-off is made in the arrangement, the Full Chargeoff field in the AA.ACCOUNT.DETAILS application displays Yes.

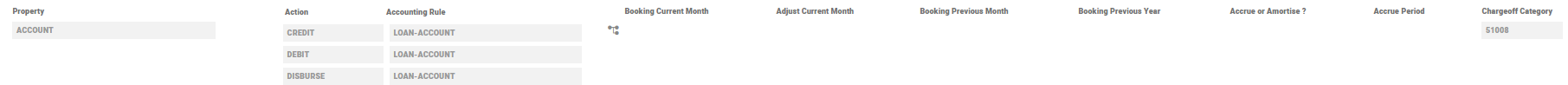

During charge-off, the loan principal is charged off to the PL Category assigned to the Account property class. The interest is charged off to the PL Category assigned to the Interest property class. Any tax is charged-off to the PL Category assigned to the Tax property class.

When this activity is executed, the system performs the below validations and results in error in below scenarios:

- The bank performs the charge off after clearing any outstanding credit balances of the loan (like UNC/INV/AVL). Hence if there are any credit balances available during a charge-off, the system raises the following error.

- When there is a charge with outstanding pay balance, the arrangement cannot be charged off. The pay balance must be cleared and then charge-off should be triggered in the system.

- Post charge-off, the banks do not prefer to disburse any further loans or increase the loan commitment further. Hence, the disbursement activity is not allowed after the charge off.

- During the cooling and cancel period, the loan charge-off is not allowed.

- Any income to the arrangement is booked to the Chargeoff PL of that Property

- An arrangement that has undergone partial charge-off can undergo full charge-off, but an arrangement that is completely charged off cannot be charged off further.

- Loans cannot go to negative rate when loan is in charge-off.

- Dormant loans cannot be charged off.

- When an arrangement has a charge set to amortise, the charge cannot be charged off. The system raises an error when the user tries to do a full charge-off when there is a charge amortisation in progress.

- During charge-off, the system calculates the penalty interest if this has been configured and this helps the bank to access the real charge-off amount for all the property.

Consider a loan that has few bills outstanding and is delinquent.

Perform a charge-off.

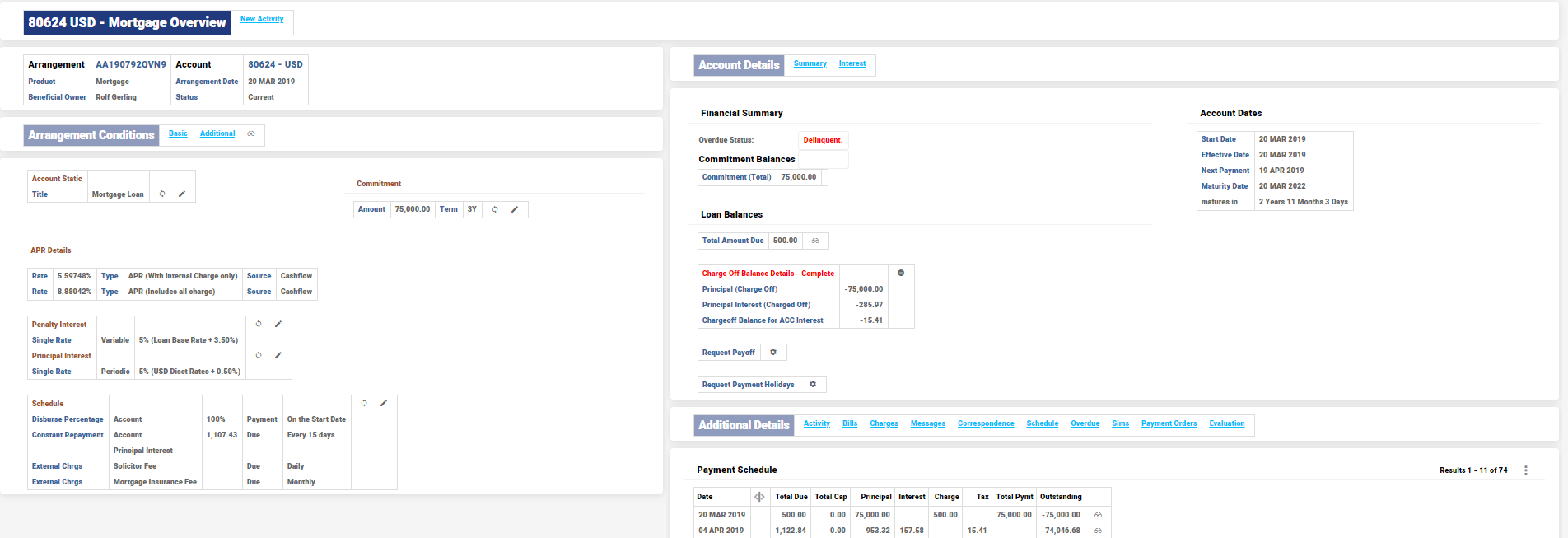

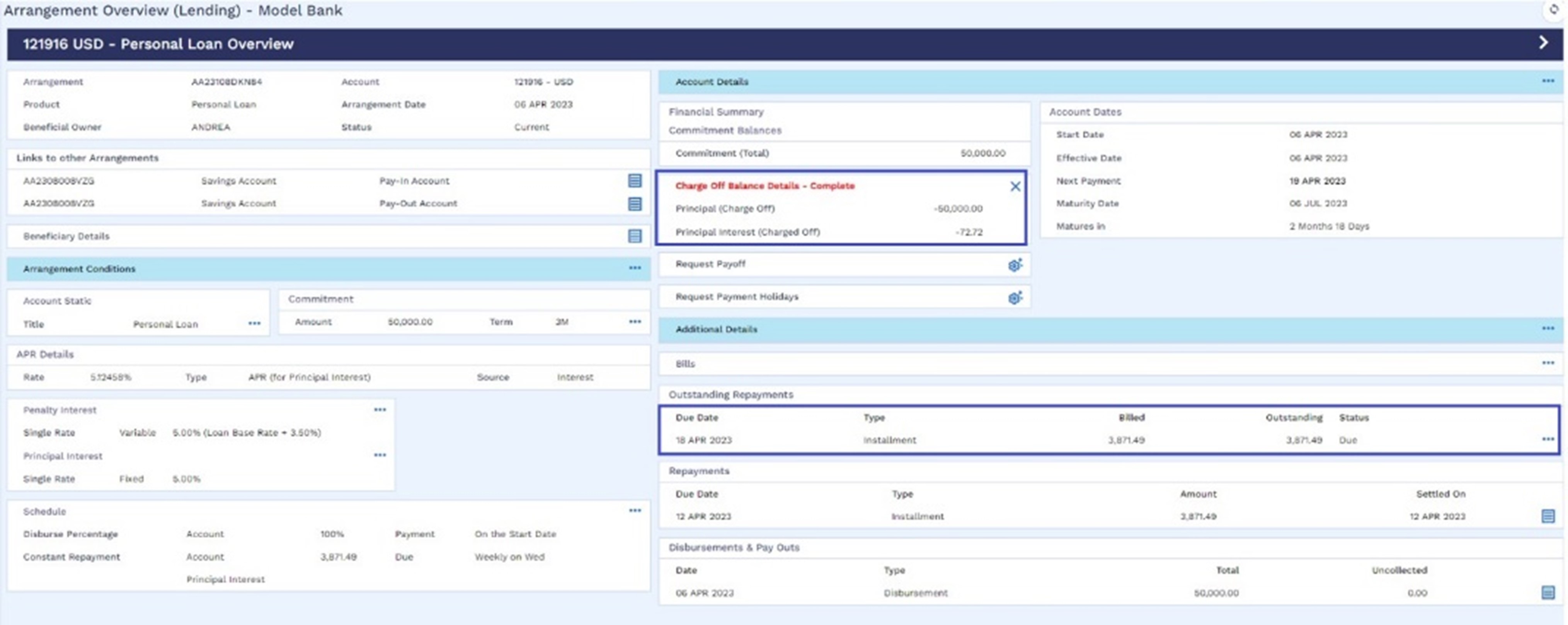

The charged-off arrangement is shown below.

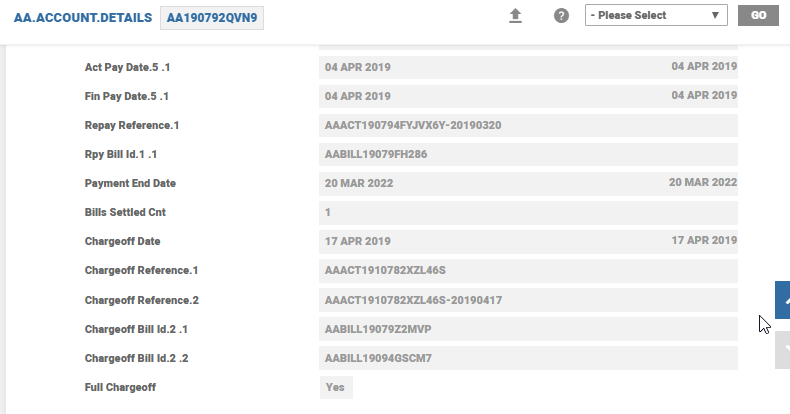

The charge-off information in AA.ACCOUNT.DETAILS is as shown below.

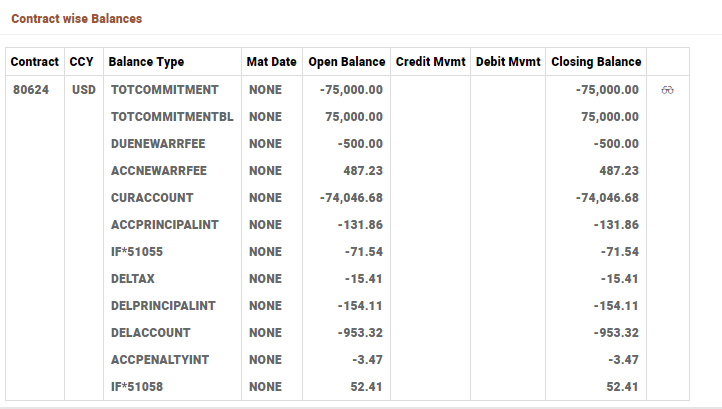

The loan principal balances and billed interest balances are moved to Chargeoff PL and are stored in CO and CUST balances as off-balance sheet items.

Here, the sum is:

- ACCPRINCIPALINTCO=ACCPRINCIPALINTCUST+DELPRINCIPALINTCUST

- CURACCOUNTCO=DELACCOUNTCUST+CURACCOUNTCUST

A bill that was already generated is also updated with the charge-off information. In a full charge-off, the BNK balances for the Property after charge-off is zero. The billed amount and outstanding balance here represents the CUST balance, as shown below

After a charge-off, the interest accruals are under CUST and CO balances.

An arrangement with interest and charge bills is being fully charged off, including all interest and charges in the bills along with outstanding principal. Any Activity Charge, Periodic Charge and Rule break charge are also charged off. This is subject to certain evaluation:

- The system evaluates if there are any pay charges outstanding and raises an error to indicate that the same must be settled.

- The system evaluates if there is charge collected that is undergoing amortisation, then the system doesn’t allow to charge off that arrangement.

Consider an arrangement that has been charged off.

During a charge-off, charge bills are also charged off.

A rule break that is being charged off is shown below.

The balances after the charge-off, also reflects the charges being charged off.

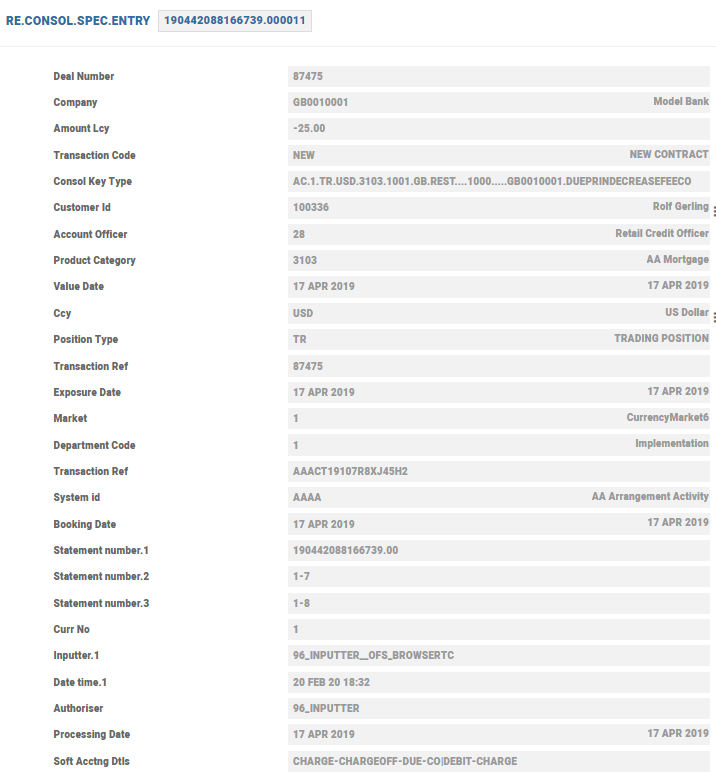

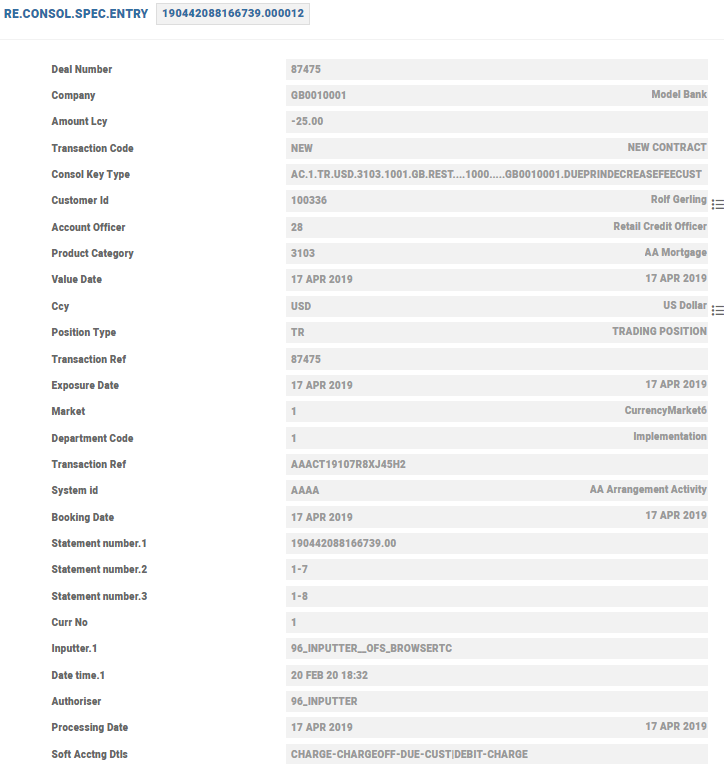

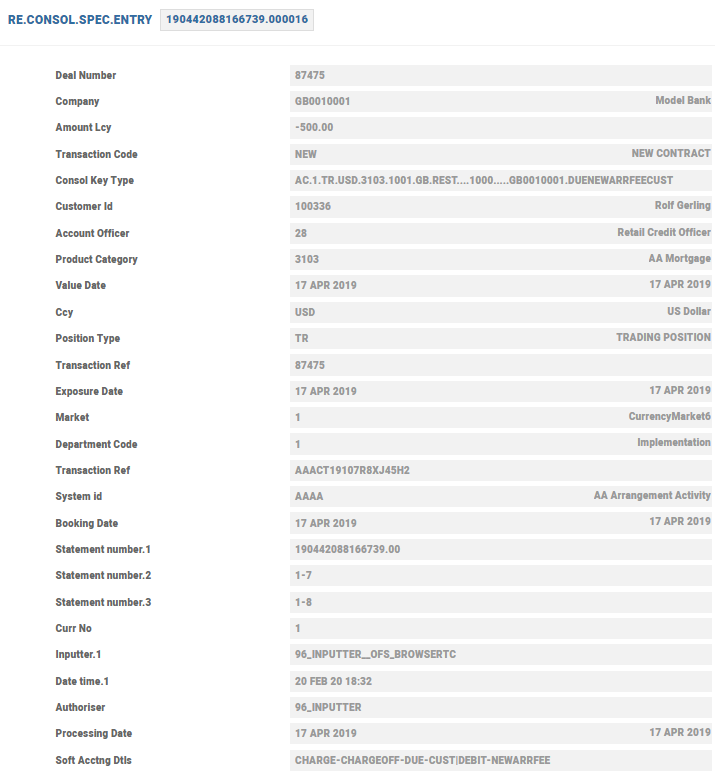

RE.CONSOL.SPEC.ENTRY is generated during the charge-off of the principal decrease fee, a rule break fee.

For charge-off books it is as shown below.

For customer books it is as shown below.

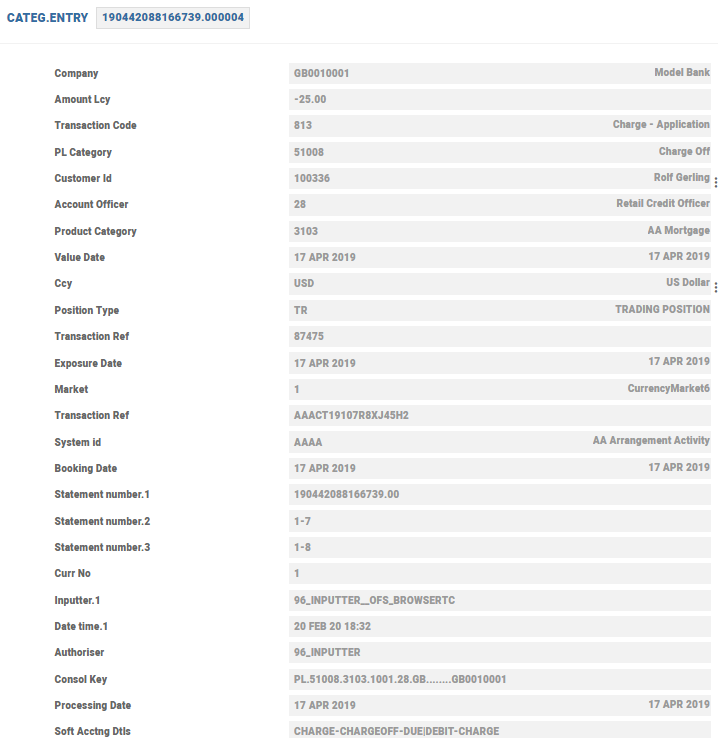

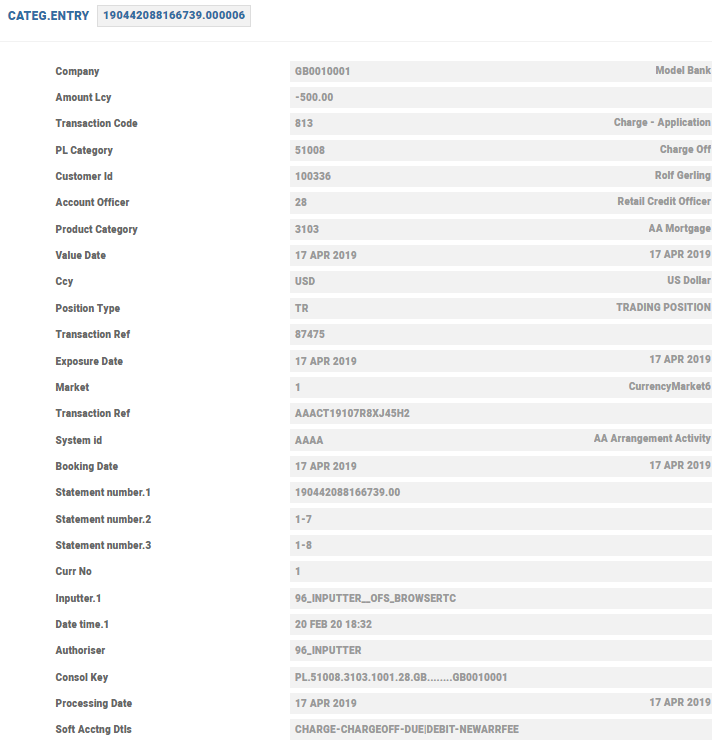

Activity Charge for charge-off books is shown below.

Activity Charge for customer books is shown below

The charge-off entries for the charge debited in the banks PL are as follows:

For the Rule break fee:

For the Activity Charge:

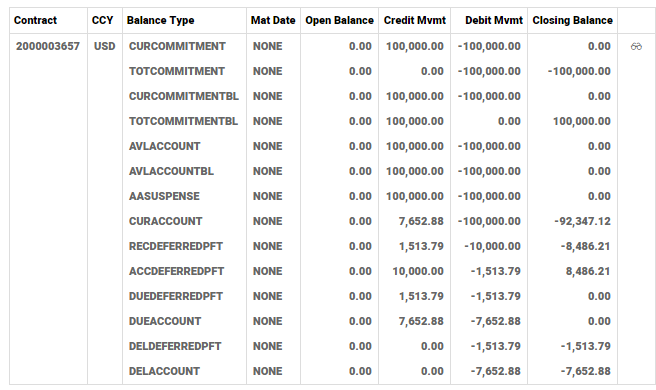

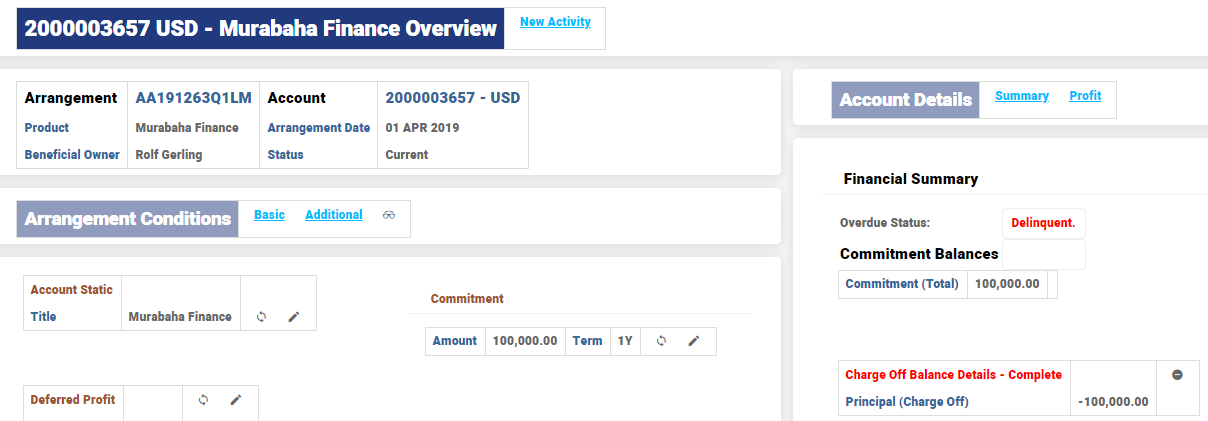

It is possible to setup upfront profit in loan arrangements. For such a loan, the interest is collected upfront and is booked to the PL over a period as accruals. Read Islamic Finance-Upfront Sale for more information.

The below arrangement has upfront bills with outstanding bills.

This arrangement has a profit amount of 10,000 USD that is collected for a year’s tenure.

The upfront profit is booked between RECDEFERREDPFT and ACCDEFERREDPFT at the time of booking the arrangement.

- DR RECDEFERREDPFT -10,000

- CR ACCDEFERREDPFT 10,000

During accruals, the profit is booked between ACCDEFERREDPFT and PL

- DR ACCDEFERREDPFT -48.84

- CR PL 48.84

The accruals for the month are -1513.79 and the balance in ACCDEFERREDPFT is 8486.21 at the end of month.

On the due date of the profit, the accruals of the month are posted to the RECDEFERREDPFT from DUEDEFERREDPFT

- DR DUEDEFERREDPFT -1513.79

- CR RECDEFERREDPFT 1513.79

As a result of this, RECDEFERREDPFT has a balance of -8486.21

|

Time |

Head |

Movement |

Balances |

|---|---|---|---|

|

Creation |

RECDEFERREDPFT |

-10,000 |

-10,000 |

|

Creation |

ACCDEFERREDPFT |

10,000 |

10,000 |

|

Monthly Accrual |

ACCDEFERREDPFT |

-1513.79 |

8486.21 |

|

Due date |

RECDEFERREDPFT |

1513.79 |

8486.21 |

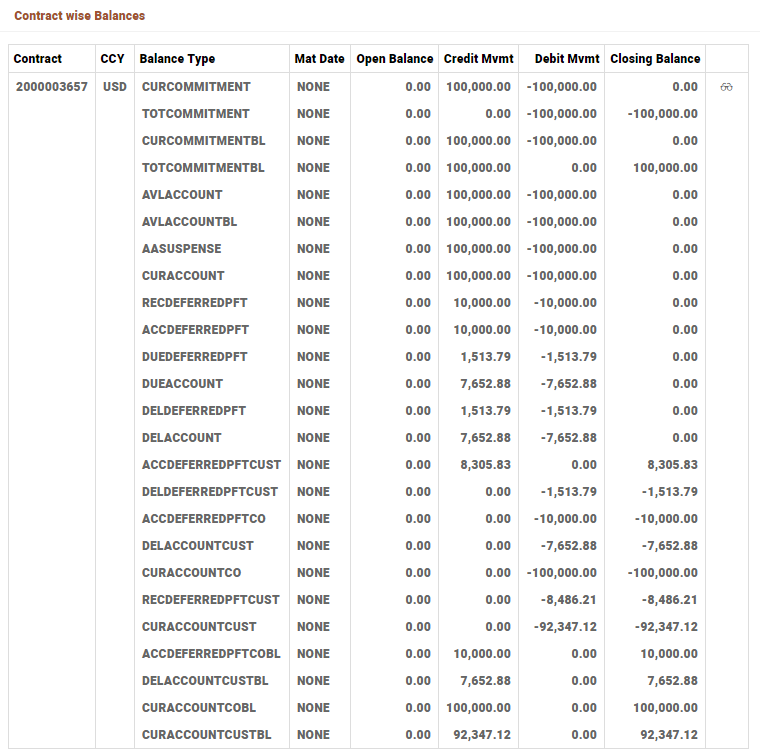

The arrangement is now charged off.

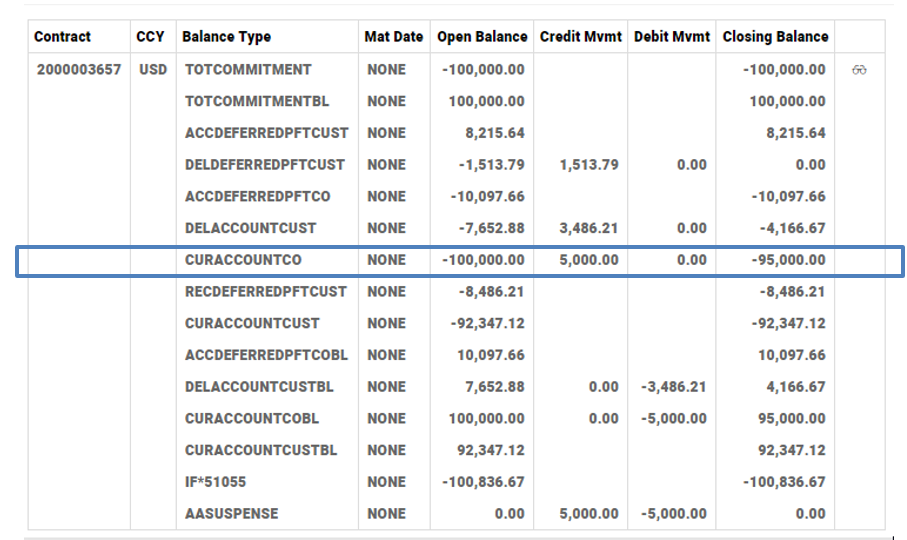

The balances from CURACCOUNT have moved to CURACCOUNTCO. A part of the principal amount is billed already. So CURACCOUNTCUST+DELACCOUNTCUST amounts to the total principal.

The bill is in delinquent status from the customer perspective and the balance is stored in DELDEFERREDPFTCUST as -1513.79.

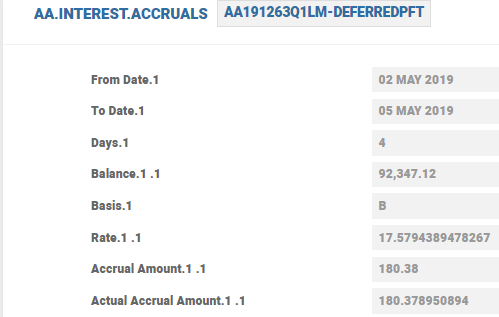

The RECDEFFEREDPFTCUST gives the outstanding amount as per customer, -8,486.21 that is pending receivable. There are four days accrual after the last bill date for 180.38 that has resulted in the ACCDEFERREDPFTCUST is 8305.83 (8,486.21-180.38).

|

Time |

Head |

Movement |

Balances |

|---|---|---|---|

|

Creation |

RECDEFERREDPFT |

-10,000 |

-10,000 |

|

Creation |

ACCDEFERREDPFT |

10,000 |

10,000 |

|

Monthly Accrual |

ACCDEFERREDPFT |

-1513.79 |

8486.21 |

|

Due date |

RECDEFERREDPFT |

1513.79 |

8486.21 |

|

4 days accruals after due date |

ACCDEFERREDPFT |

-180.37 |

8305.83 |

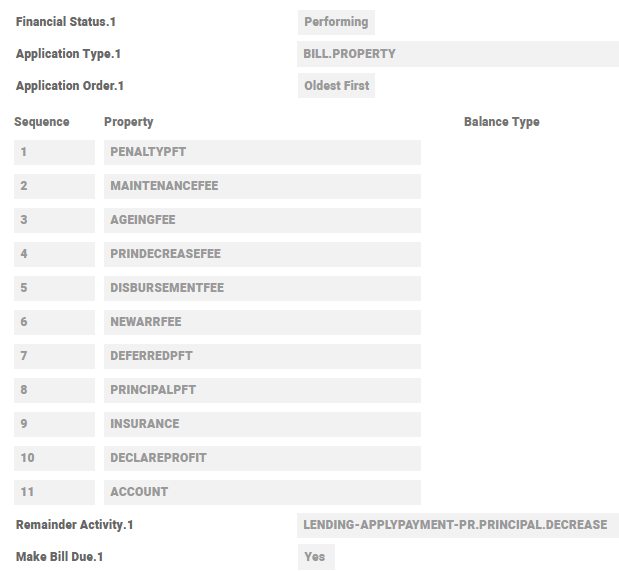

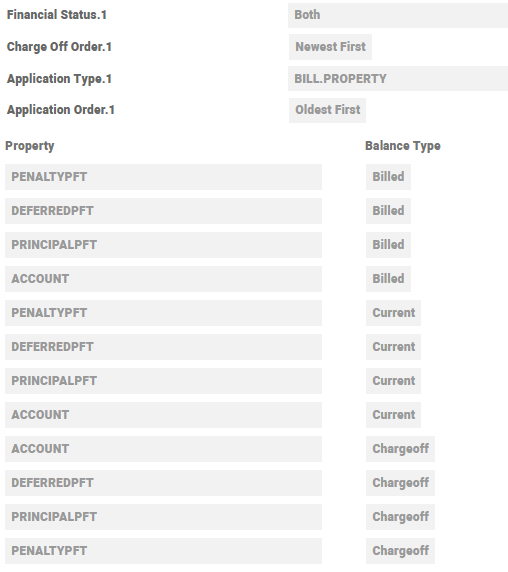

A repayment received in the upfront profit loan arrangement is allocated as per the payment rule given below.

The balances of the same loan arrangement after a couple of days are;

|

Time |

Head |

Movement |

Balances |

|---|---|---|---|

|

Creation |

RECDEFERREDPFT |

-10,000 |

-10,000 |

|

Creation |

ACCDEFERREDPFT |

10,000 |

10,000 |

|

Monthly Accrual |

ACCDEFERREDPFT |

-1513.79 |

8486.21 |

|

Due date |

RECDEFERREDPFT |

1513.79 |

8486.21 |

|

6 days accruals after due date |

ACCDEFERREDPFT |

-270.56 |

8215.64 |

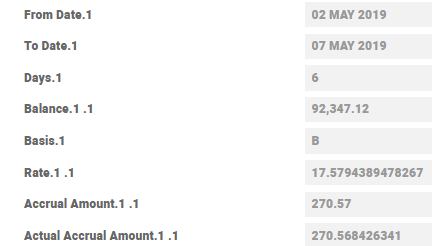

The same update is in the AA.INTEREST.ACCRUALS as shown below.

A payment of 5000 on the arrangement and this is apportioned against the CUST and CO balances as per the Payment Rules and Chargeoff Rules respectively.

In customer perspective, the Payment Rules apportions the payment towards to DEFFEREDPFT first and then the ACCOUNT Property as seen below.

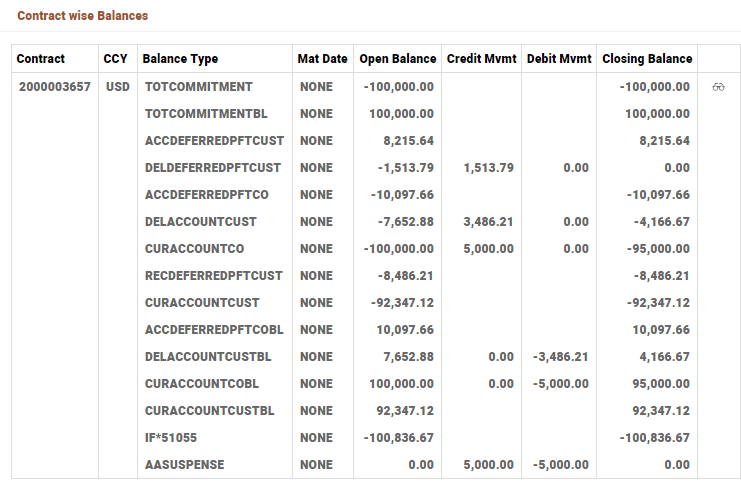

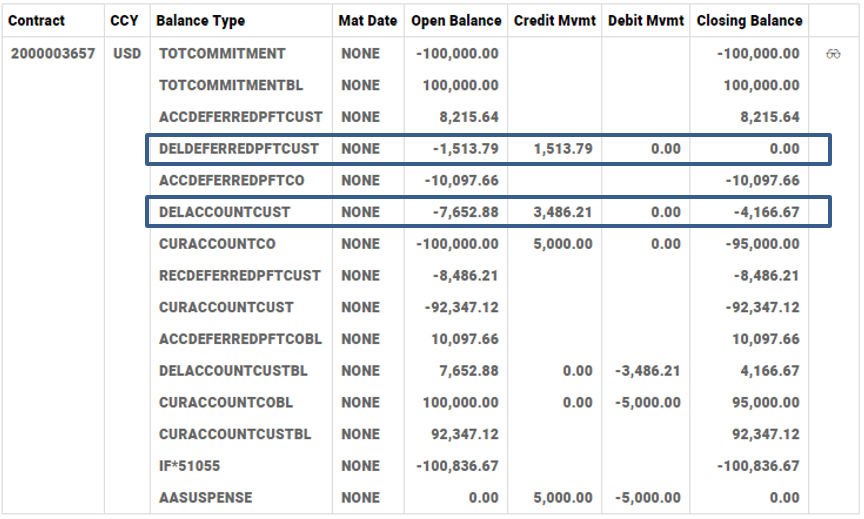

The same is reflected in arrangement balances as shown below.

In charge-off perspective, the repayment works as explained below.

The Charge-off condition governs the repayment rule for charge off balances. The Charge-off condition for the upfront profit loan is given below.

In this arrangement, the loan is fully charged off. So the Billed and Current Balance Type options do not have any impact and the system apportions the payment for the CHARGEOFF balance type. Thus, the full payment of 5000 is apportioned to the ACCOUNT balance. This can be seen in the screenshot below.

In banks’ books repayment is as explained below.

The repayment is received in the banks’ book against the CHARGEOFF PL as indicated in Accounting Condition.

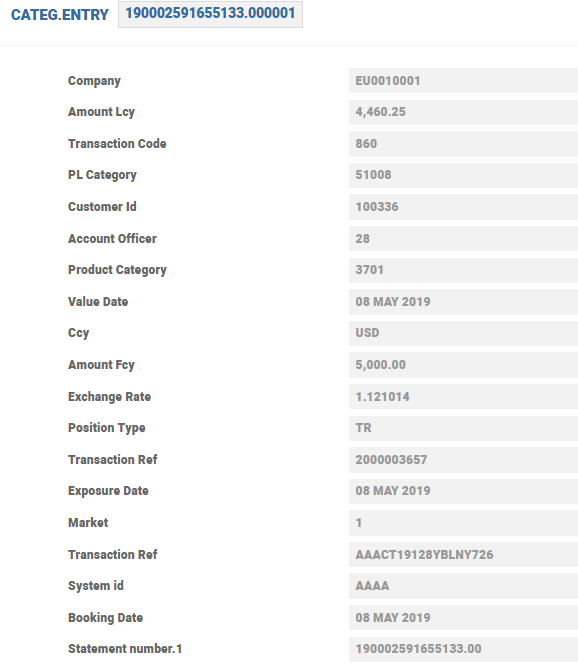

The repayment of 5000 is credited to the PL indicated in this accounting condition as seen below.

In the contract below, a charge booked at the time of arrangement creation is shown. The impact on the charge bill during a charge-off is shown in the subsequent screenshots

The arrangement balances before a charge-off are shown below.

The arrangement balances after charge-off as shown below.

A comparison of the bill details before and after the charge-off is shown below:

The accounting entries in charge-off are as follows:

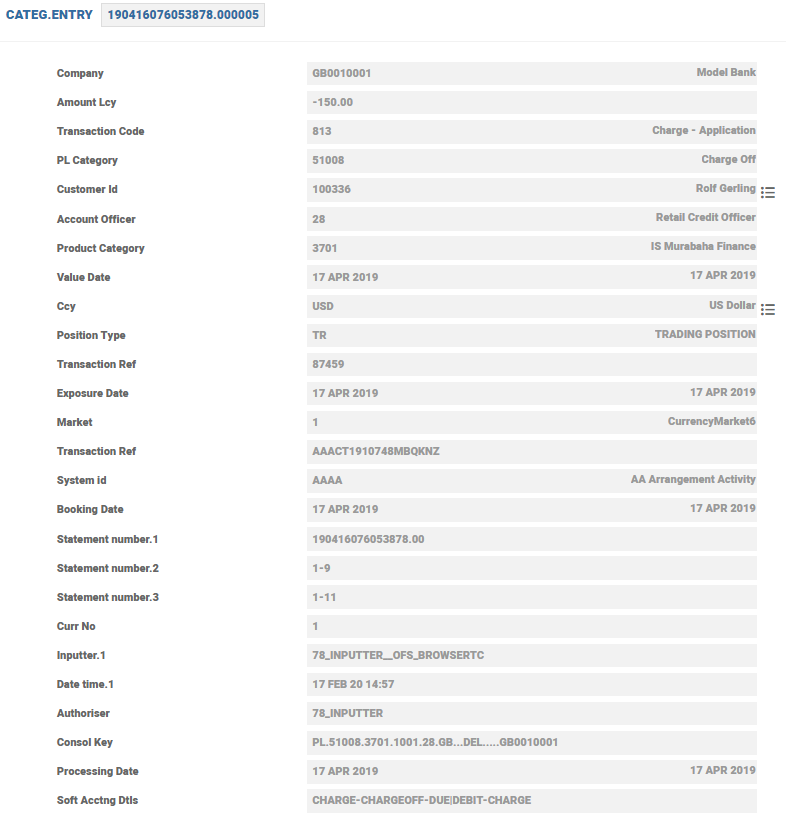

The charge-off entry in the PL, is a debit to the banks PL as seen in CATEG.ENTRY.

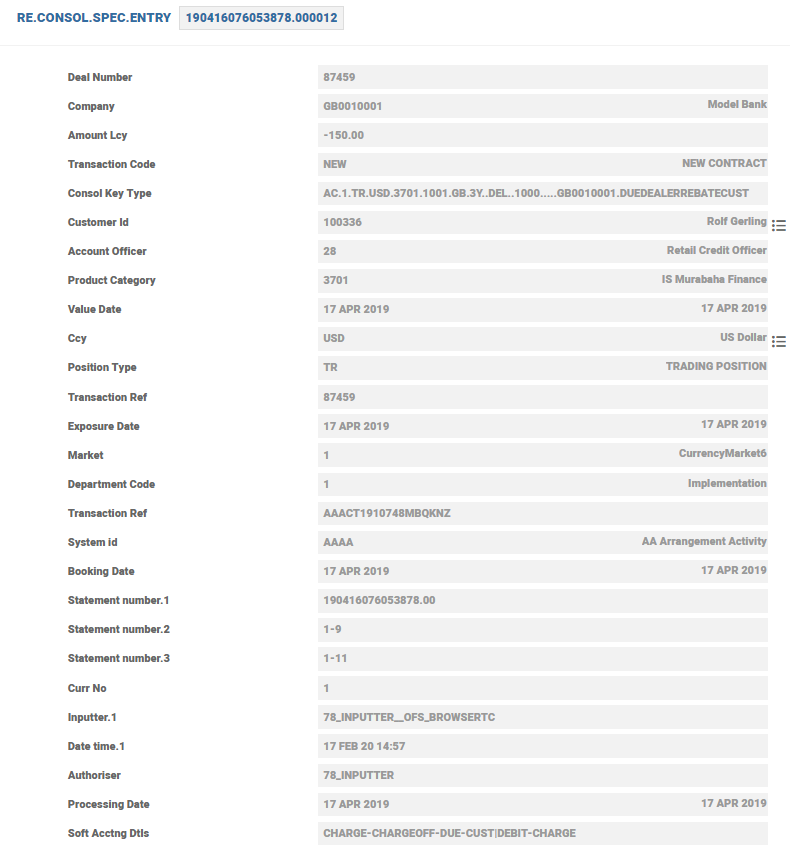

The charge-off entries to bank and customer books are as RE.CONSOL.SPEC.ENTRY.

In the charge-off books, the CO entry is as shown below.

In the customer books, the CUST entry is as shown below.

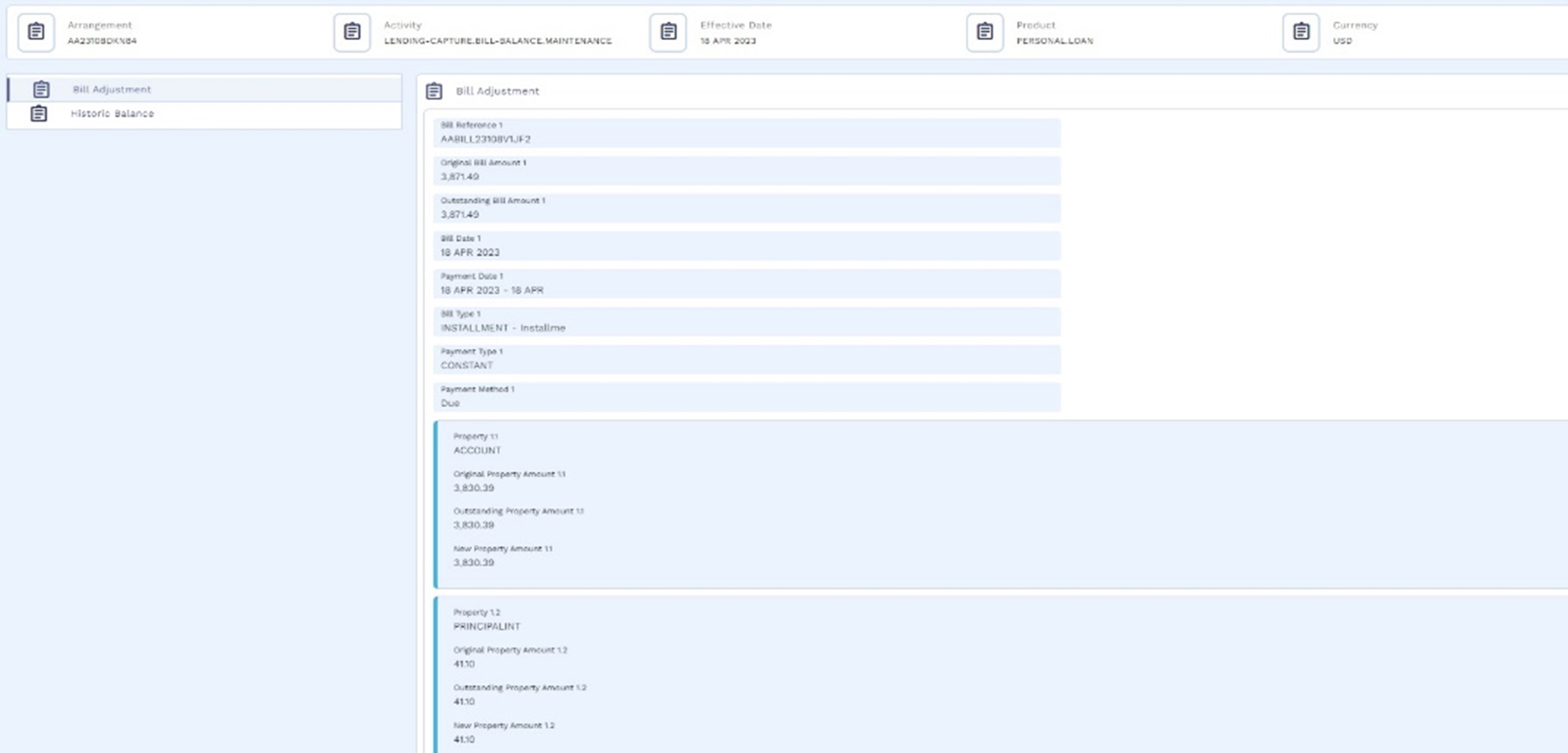

In a business situation where the bank user must capture a bill in a loan that has undergone charge-off, the user can do so with the capture bill (LENDING-CAPTURE.BILL-BALANCE.MAINTENANCE) activity on such a loan. This activity can be used only for the arrangement that has undergone a full charge-off (LENDING-CHARGEOFF-ARRANGEMENT). As a result of this bill capture activity, the system releases the bill and balances in the customer books and the charge-off books.

Consider a scenario of dispute with the customer and the contract is charged off. The bank prefers to collect some charges or re-raise a bill that was previously paid, due to a customer dispute. In this case, the bank user can capture the bill and record it as an outstanding amount with the customer.

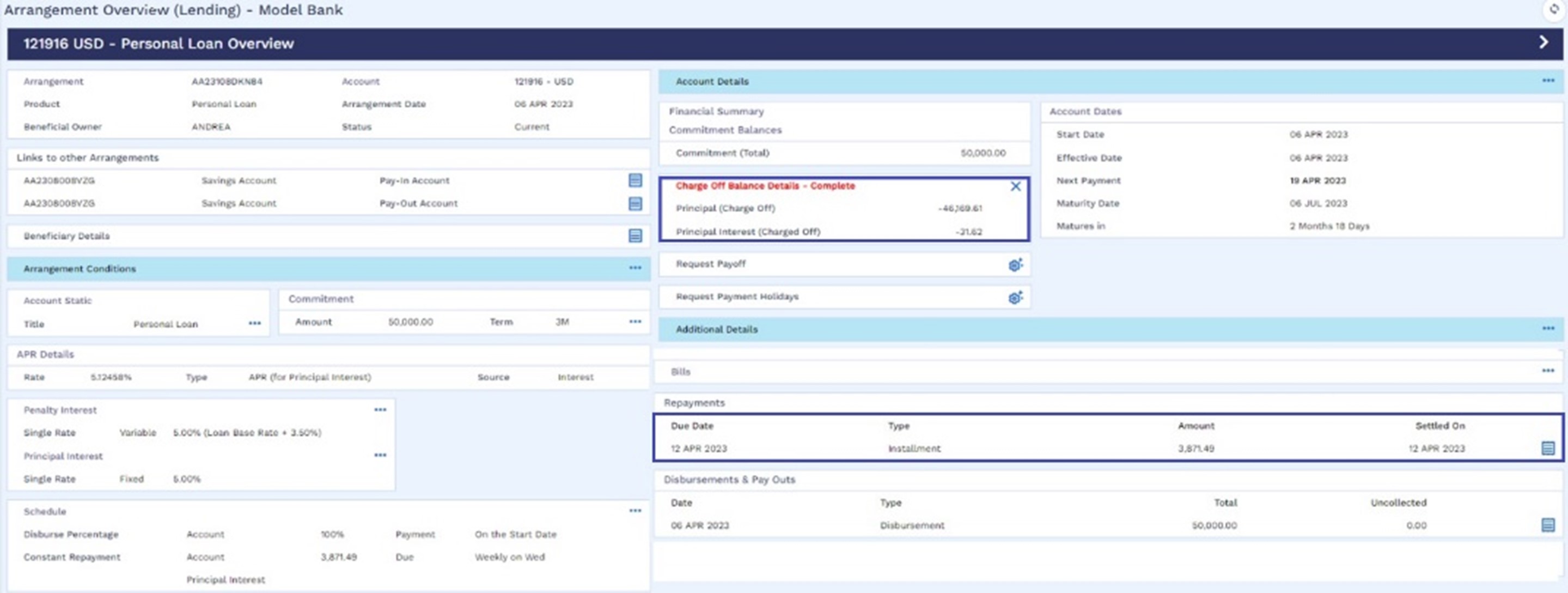

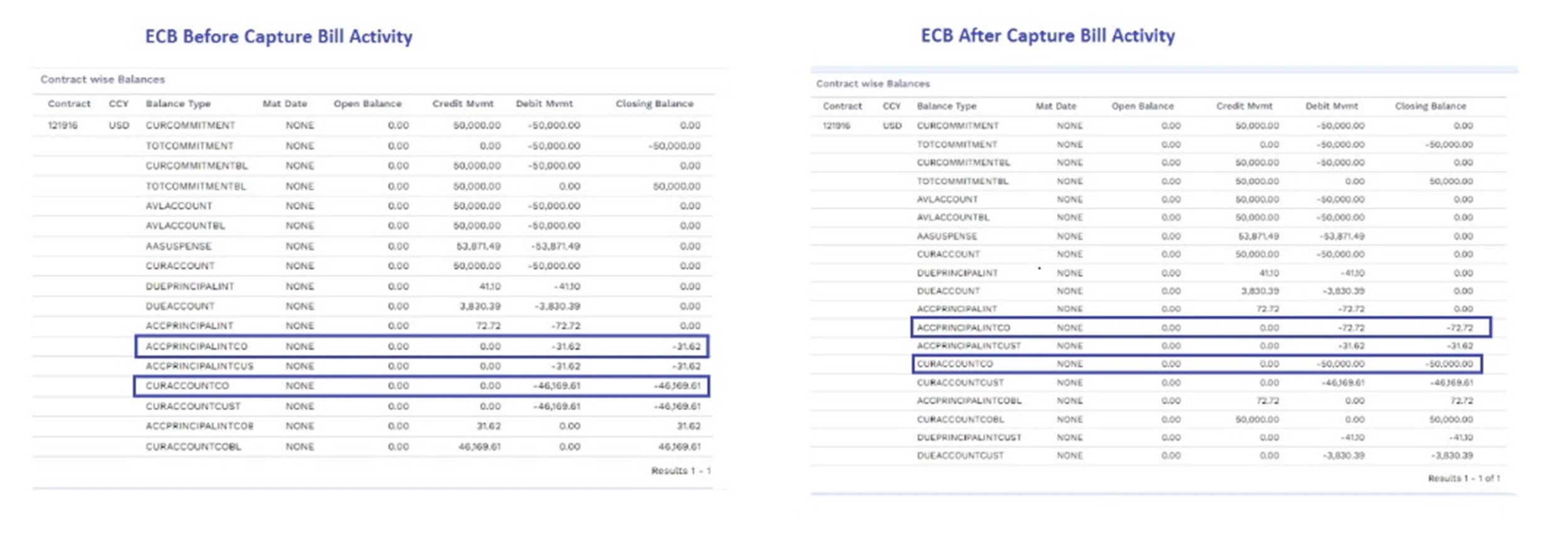

Consider a loan that is fully charged off using the LENDING-CHARGEOFF-ARRANGEMENT activity. The balances charged-off include the principal and interest as highlighted below.

- Charge-off principal - 46,369.61 (Outstanding principal).

- Charge- off interest - 31.62 (Accrued interest amount after the first installment).

This loan has only one installment bill which is already settled.

In this example, the client has raised a dispute with the bank on the 3871.49 bill dated Apr 12, 2023. So, the bank decides to refund the bill. At a later date, the claim is proved false and the bank wanted to raise the bill with the same amount for the customer.

The user captures the bill in this charged-off loan using the LENDING-CAPTURE.BILL-BALANCE.MAINTENANCE activity. The details of Bill Type, Payment Type, Payment Method, Payment amount, Property, Original Property Amount, and New Property Amount are entered based on the first installment bill details.

Though the bill is to claim the dues that were refunded earlier, the capture bill can be raised only for the current value date (not forward or back-valued) for the required payment type, bill type, and the bill amount for the components required. The bill date must also be the current date (not forward or back-valued).

Post capture bill activity, a due bill is created, and the system automatically updates the respective charge-off balances and customer balances in ECB.

Post capture bill activity:

- The charge-off principal is updated as 50000 (46169.61 + 3830.39)

- The charge-off interest is updated as 72.72 (31.62 + 41.10).

When an activity is triggered back-valued after this capture bill activity, the capture bill activity is also effectively reversed and replayed. As the bill is a manually created bill, the components of the bill do not undergo a change but the bill is reversed and replayed staying unaffected.

When a loan contract in TBC is charged-off, the TBC generates an event, which can be captured by the connected external GL (General Ledger) system to complete the accounting and balance updates.

Handling Charge-off under FASB Regulations

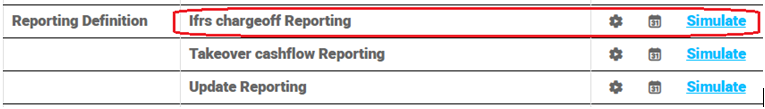

In order to provision loan under FASB, the user can trigger the LENDING-CHARGEOFF-REPORTING activity and specify the required charge-off amount or percentage.

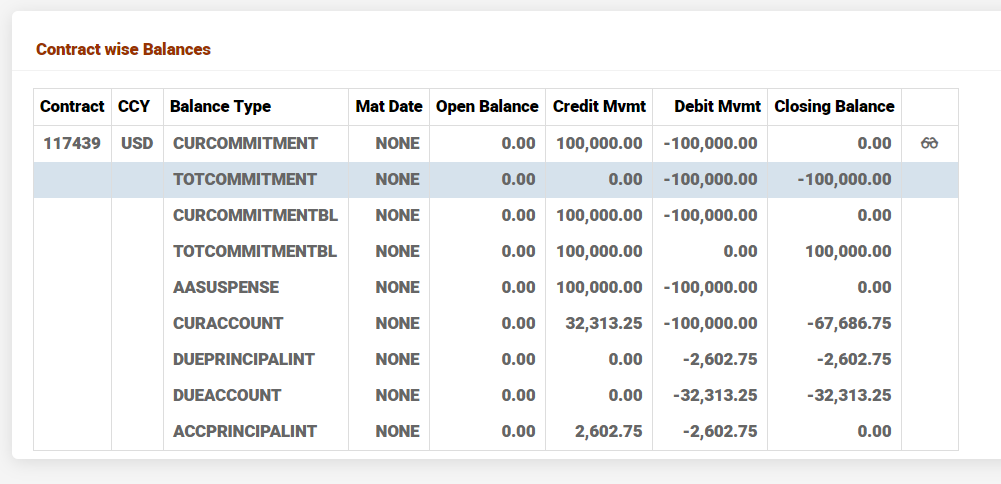

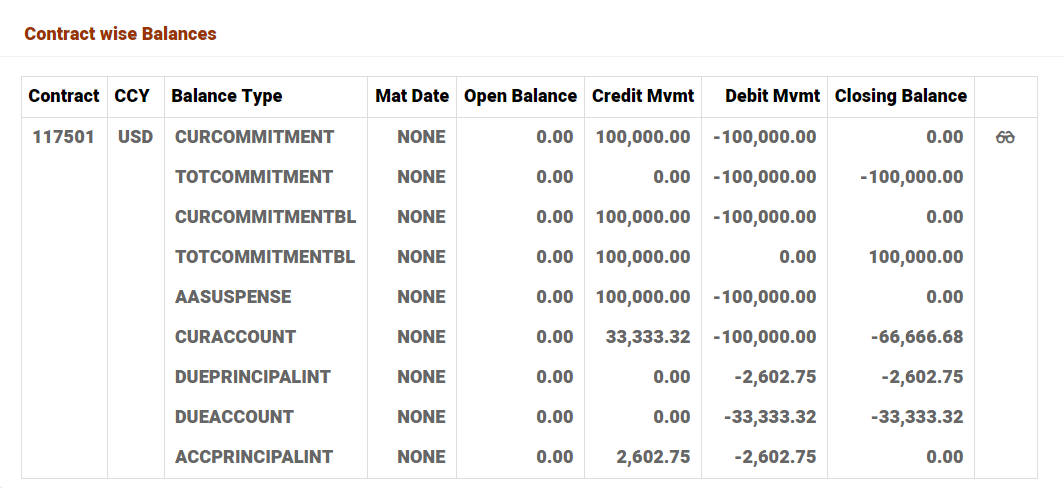

Consider a delinquent loan with the balances stated below.

The user triggers the Charge Off Reporting activity from the New Activities menu on the loan overview screen.

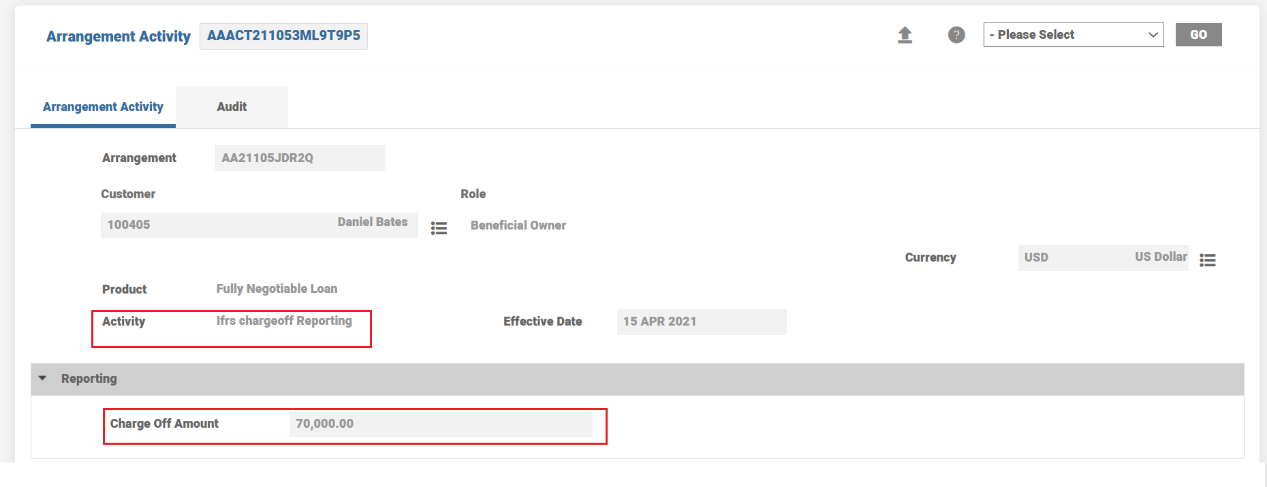

The user inputs the required Charge off Amount for partial charge-off of the loan.

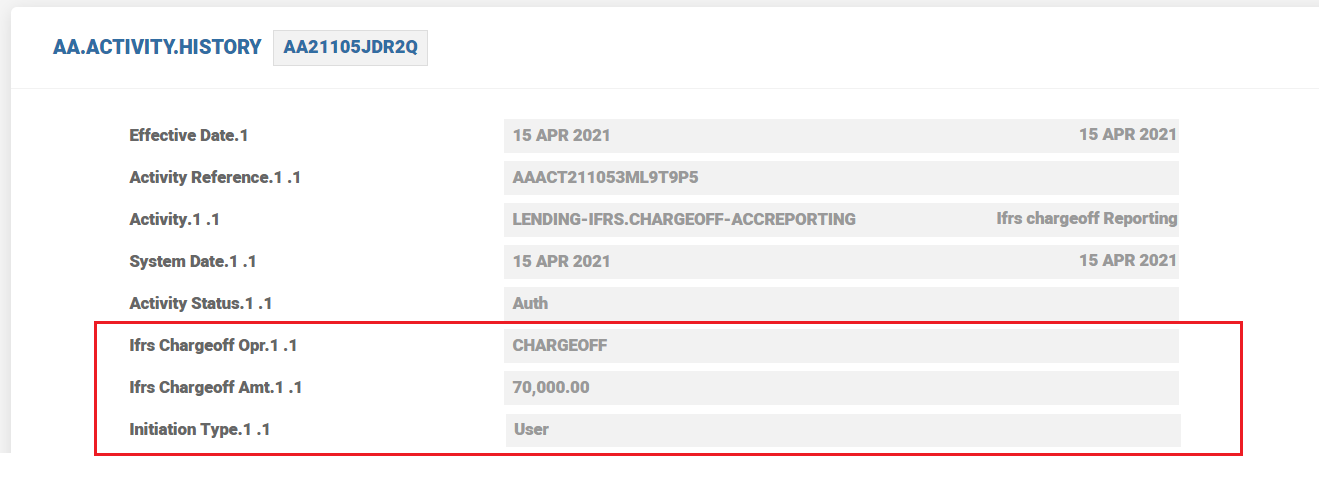

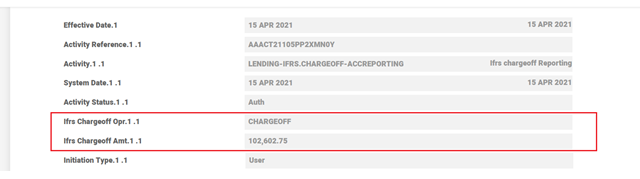

Charge off details updated in AA.ACTIVITY.HISTORY are shown below:

Charge off details updated in AA.ACCOUNT.DETAILS are shown below:

Consider a delinquent loan with the balances stated below.

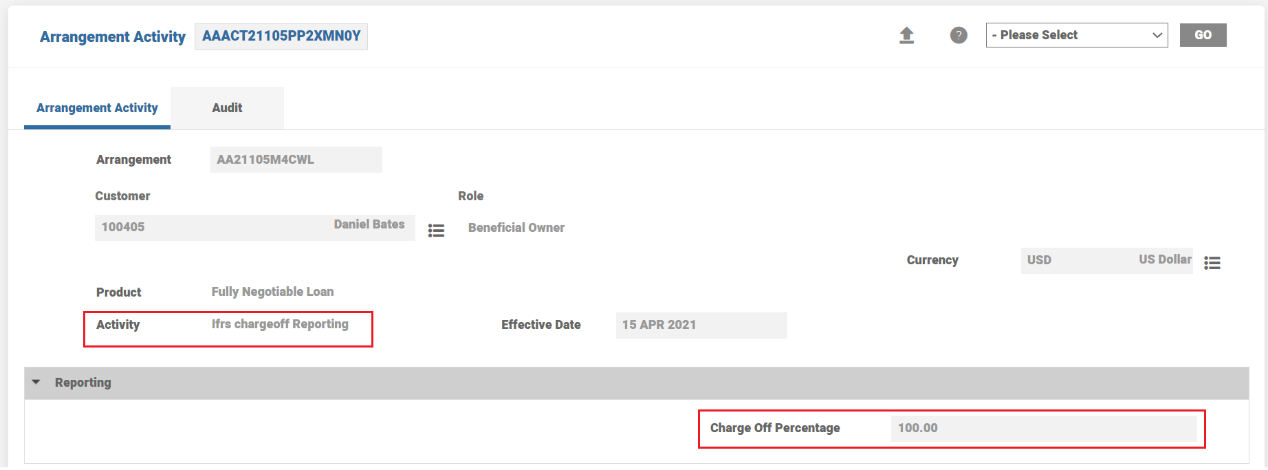

The user prefers to fully charge-off the loan and provides the Charge off Percentage as 100.

The charge off details updated in AA.ACTIVITY.HISTORY are shown below.

The percentage is converted to amount by an API and stored.

Charge off details updated in AA.ACCOUNT.DETAILS are shown below:

The table below depicts how the IFRS operation is carried out.

|

AA Activity |

IFRS Operation |

Description |

|---|---|---|

|

LENDING-IFRS.CHARGEOFF-REPORTING |

CHARGE OFF |

Indicates the loan is charged-off for the first instance. |

|

|

CHARGE OFF INCREASE |

Indicates loan is charged- off for an additional amount from earlier levels. |

|

|

CHARGE OFF DECREASE |

Indicates loan charge-off amount is decreased by specifying a negative amount. |

|

LENDING-APPLYPAYMENT-PAYMENT.RULES ENDING- |

RECOVERY |

Indicates a repayment made on the loan. |

|

LENDING-WRITE.OFF-BALANCE.MAINTENANCE |

WRITE OFF |

Indicates loan has been completely written off |

|

|

WRITE OFF PARTIAL |

Indicates a partial write off scenario which instead of entire loan only certain bills and/or balances are written off on contract. |

|

|

ADJUSTMENT |

Indicates any bill and/or balance adjustments made on the contract. |

|

LENDING-MATURE-ARRANGEMENT |

MATURE |

Indicates loan has matured |

|

LENDING-RESUME-ARRANGEMENT |

RESUME |

Indicates loan is resumed |

The following section provides examples of using SUSPEND.STATUS and CHARGEOFF.STATUS periodic attributes

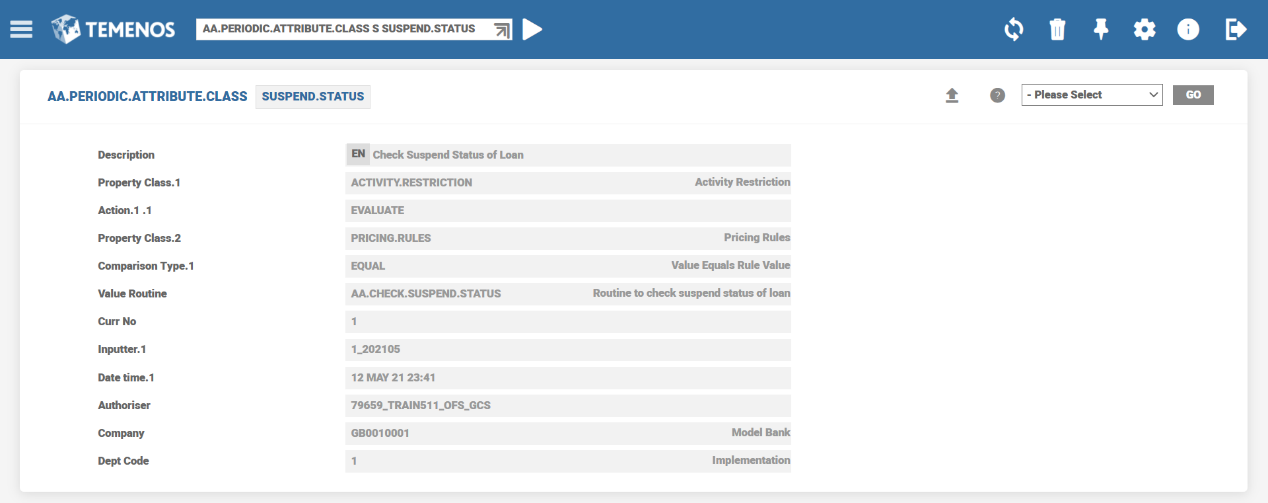

The SUSPEND.STATUS periodic attribute allows the user to evaluate if loan is suspended or not and suitably configures any activity restrictions based on the suspense status of the loan. The evaluation is done based the suspend information stored in AA.ACCOUNT.DETAILS and allows the bank user to configure an error/override in the Activity Restriction condition.

Consider an example in which user needs to restrict a charge-off operation on a performing loan which is not suspended. If this periodic attribute is configured at product or arrangement level, then a user cannot trigger the charge off activity on a loan which is not suspended.

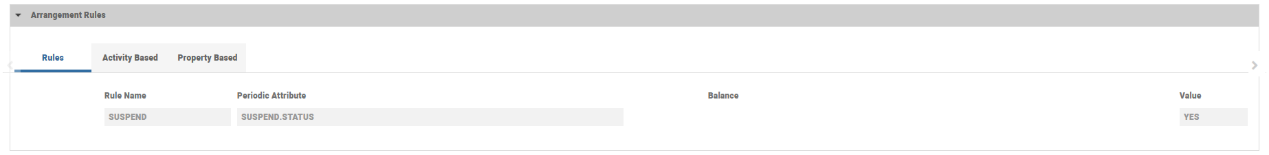

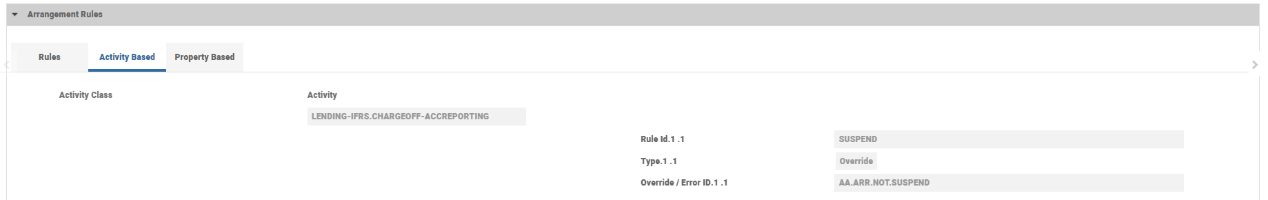

A rule is configured to check if the loan is in suspended status or not.

The rule is evaluated when an activity (charge off activity is considered in the case below) is triggered and based on the evaluation result an override (or error) is raised. Additionally, a rule break charge is applied if necessary.

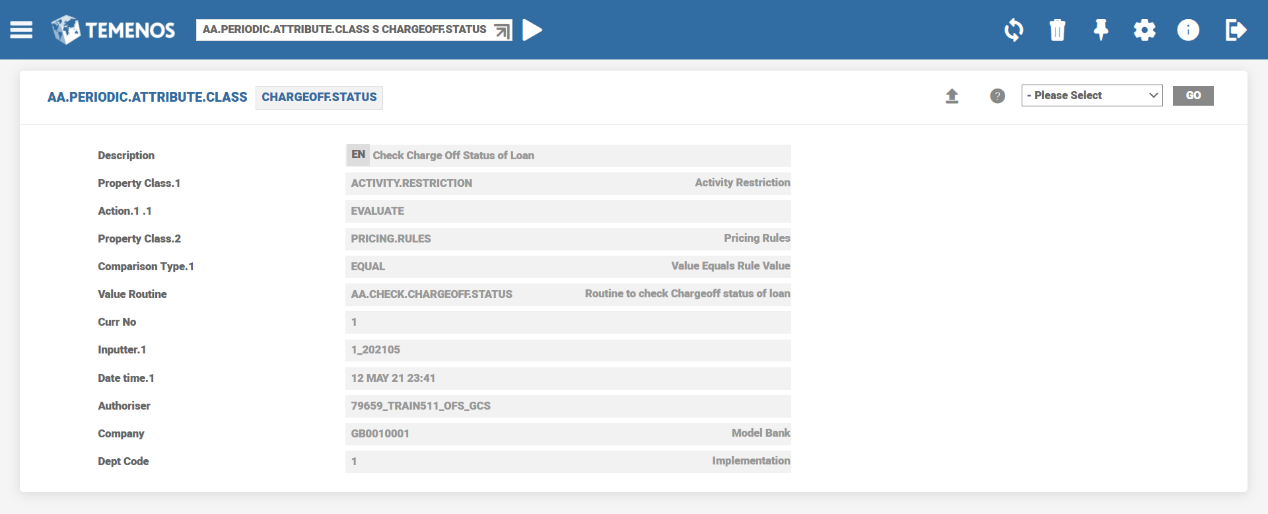

This periodic attribute allows the user to evaluate and place activity restrictions based on the charge off status of the loan. This evaluates the charge off information in AA.ACCOUNT.DETAILS and allows the bank user to configure an error/override in Activity Restriction condition, based on the charge off status of the loan.

Consider an example in which user needs to restrict a resume operation on a charged-off loan. If this periodic is configured at product or arrangement level, then the user cannot trigger resume on a loan which is fully and/or partially charged-off.

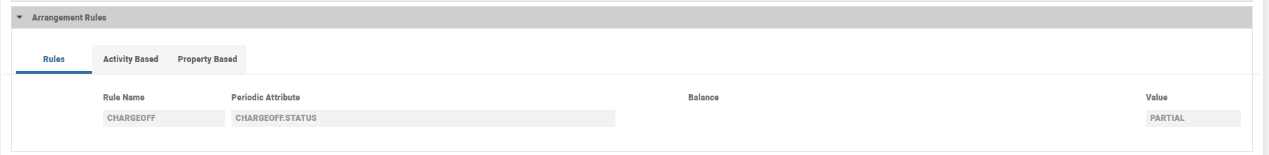

A rule is configured to check if the contract is in suspended status or not. The rule can be configured to evaluate if loan is fully or partially charged-off.

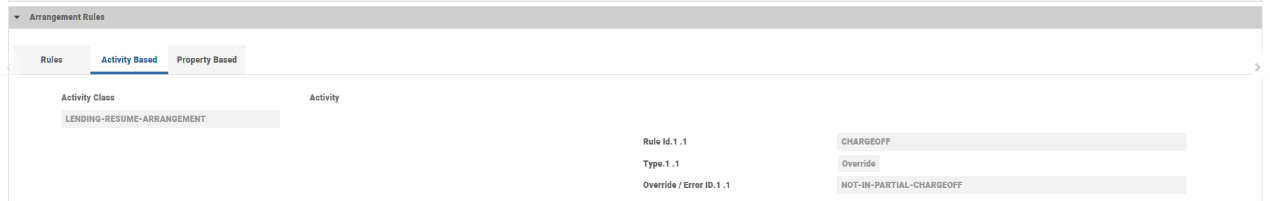

The rule is evaluated when an activity (resume activity is considered in the case below) is triggered and based on the evaluation result an override (or error) is raised. Additionally, a rule break charge is applied if necessary.

The features related to handling charge-off under FASB regulations are not applicable for loans in TBC.

In this topic