Interest

The Interest Property Class is used for all interest definition and processing in AA. A Temenos Transact product defined and processed in AA can have multiple interest properties defined (For example: principal interest, penalty interest, commission, etc.). The number of interest properties is determined by the users defining the products.

Product Lines

The following Product Lines use the Interest Property Class:

- Accounts

- Bundle

- Deposits

- Facility

- Lending

Property Class Type

The Interest Property Class uses the following Property Class Types:

- Currency Specific

- Dated

- Enable External

- Enable External Financial

- Enabled For Memo

- Forward Dating

- Inheritance

- Multiple

- Tracking

- Variations Supported

Property Type

The Interest Property Class is associated with the following Property Types:

- Accrual by Bills

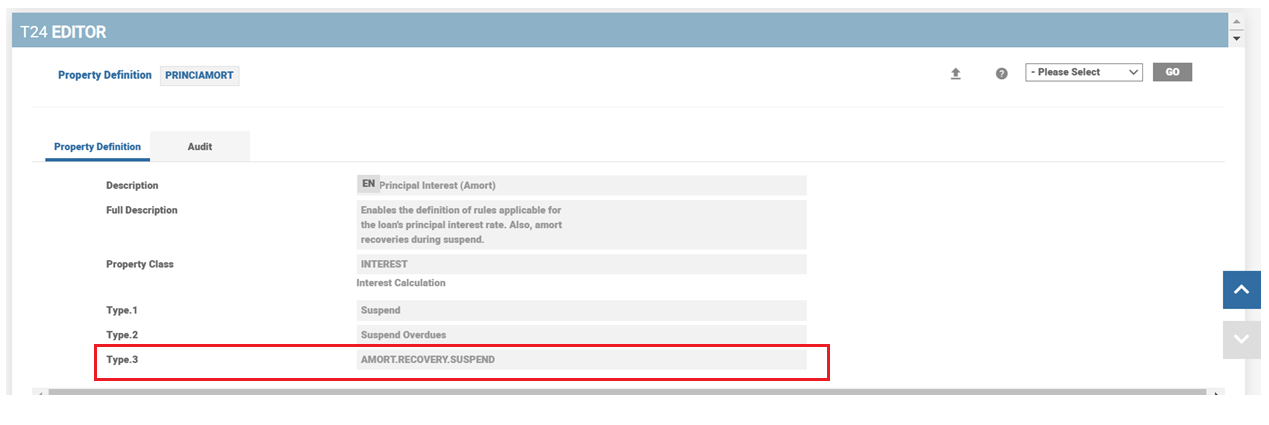

- Amort Recovery Suspend (applicable only for Lending Product Line)

- Forward Dated

- Inheritance Only

- Memo Only

- Residual Accrual

- Suspend

- Suspend Overdue

- Variance

- Variation

This Property Type is applicable only for Accounts Product Line. An Interest Property with Property Type as Memo Only can calculate memo type of interest only on real balances of account. The memo interest cannot be capitalised on real account but they can made due or pay.

- It is possible to have more than one instance of an Interest Property Class. This could comprise of examples such as Loan Interest, Penalty Interest or Overdue Interest.

- This is defined in the attribute type with a value of MULTIPLE.

The FORWARD.DATED TYPE in the Property Class controls and allows the user to introduce a new definition at the arrangement level, it can be dated.

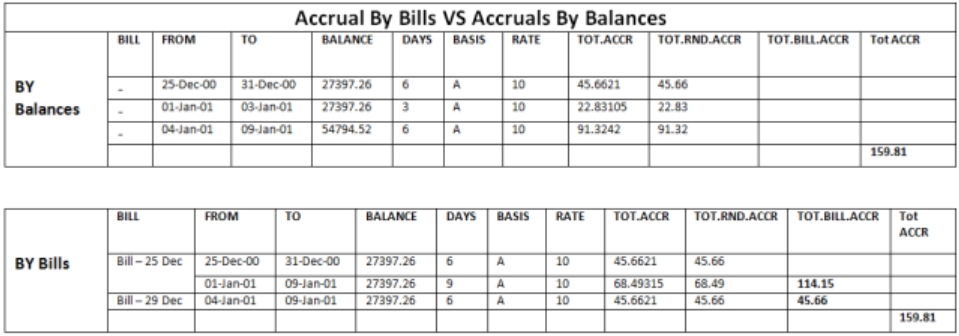

The user can select Accrue by Bills from Property Type attribute in AA.PROPERTY to store accrued penalty interest in the individual bills.

- Normally accruals are processed on the whole balance, but if Interest Property is set as Accrual by Bills, then the AA.ACCRUE.BILLS routine is called after normal accrual process is completed to update bill details with accruals corresponding to that bill.

- The following example shows calculations based on both accrual methods (accrual based on balances and accrual based on each bills separately).

In AA, the bank can configure penalty interest calculation either on the total overdue amount or on individual overdue bills. When the configuration is to calculate on individual bills, the system applies the penalty rate on the overdue amount of each bill separately. When there is a penalty rate change, the system applies the new rate to all the overdue bills from the rate change date. Read Accrual by Bills section for more information.

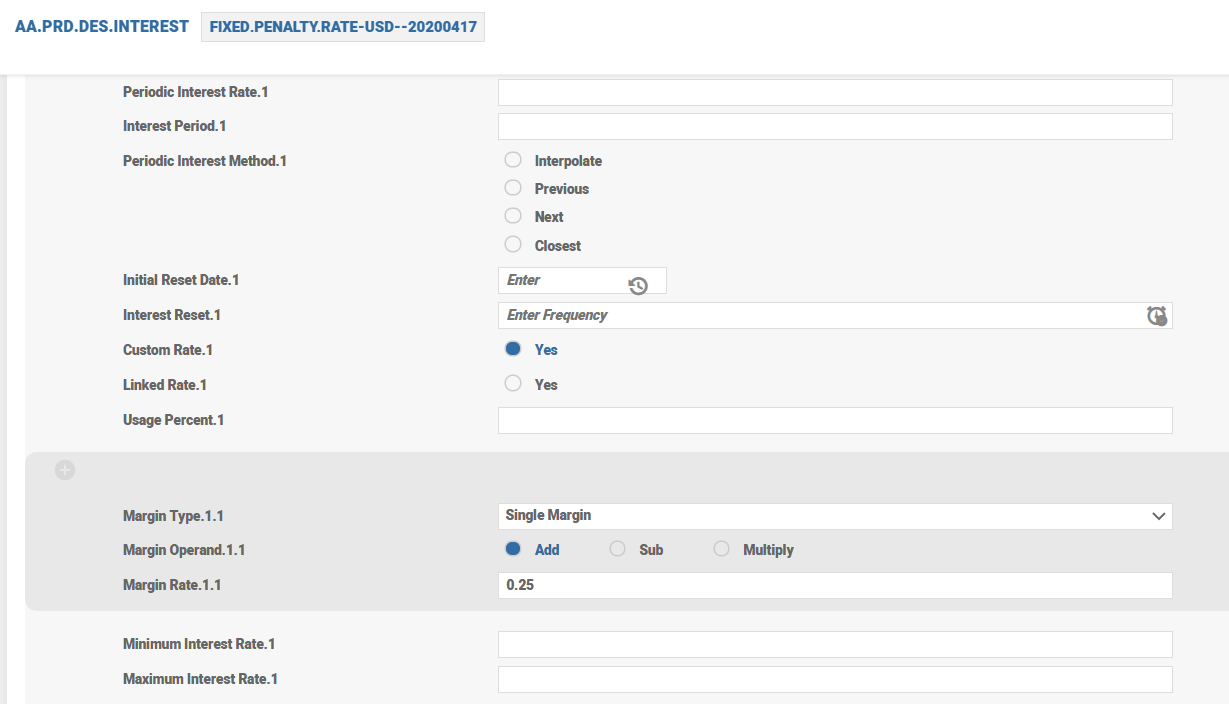

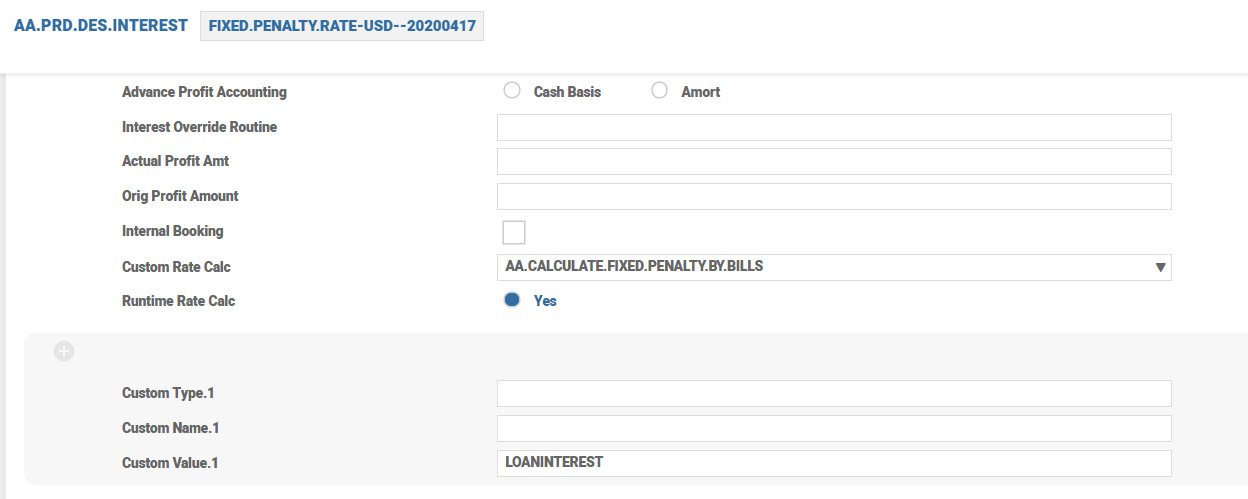

If the bank prefers to apply the rate change only to the new overdue bills and chooses the old rate to continue for the existing bills, then it can configure the penalty interest using the AA.CALCULATE.FIXED.PENALTY.BY.BILLS custom routine.

The custom rate routine takes the Loan Interest Property as input custom value. The Loan Interest rate is the base rate and the margin defined in the Penalty Interest Property is the spread. The system calculates the effective Penalty Rate based on this.

The bank has to configure the Penalty Interest condition as follows. To enable the custom routine, the following fields have to be set:

- Custom – Yes

- Custom Rate Calculation – AA.CALCULATE.FIXED.PENALTY.BY.BILLS

- Custom Value – The Loan Interest Property based on which the penalty rate is calculated

- Run Time Rate Calc – Yes

Read Custom Rate Calculation section for more information on custom interest rate routines.

Migration

While migrating data from the legacy system, the bank migration team needs to take a note of this. Since this routine uses historic rates to calculate penalty interest for overdue bills, all the historic rates for the Penalty and Loan Principal Interest Property must be migrated.

Read Historic Data and Conditions for more information.

The following sections describe the penalty interest rate calculation based on the periodic loan interest and margin setup.

Consider the following penalty interest setup. The penalty interest of a contract follows loan interest plus a margin of 2.5%. The configuration is as follows:

- Margin Operand – Add

- Margin Rate – 2.5

- Penalty Interest - Fixed per Bill

The loan interest is based on the LIBOR 1M rate and is reset every month on the 11th day. The loan contract starts on 10 April, 2021. The loan interest effective rate (in percentage) as on contract creation is 5.00 and the effective rate after the margin (added) is 7.50.

Consider that there are three bills outstanding for repayment by the customer as on 18 July, 2021.

- Bill 1 dated 10 May, 2021 – USD 450.00

- Bill 2 dated 10 June, 2021 – USD 450.00

- Bill 3 dated 10 July, 2021 – USD 450.00

Since the rate reset frequency is monthly on the 11th day, the recalculated rates (in percentage) are as follow:

- Penalty rate recalculated on 11 May, 2021 – 5.20 + 2.50 = 7.70

- Penalty rate recalculated on 11 June, 2021 – 5.70 + 2.50 = 8.20

- Penalty rate recalculated on 11 July, 2021 – 4.30 + 2.50 = 6.80

With the given setup, the system uses the following rate percentage to calculate and accrue penalty on each bill every day until the customer repays the bills.

- 7.50 for bill 1 dated on 10 May 2021

- 7.70 for bill 2 dated on 10 June 2021

- 8.20 for bill 3 dated on 10 July 2021

It is evident that 6.80% is not used for accrual of any of the bills since there are no outstanding bills after the rate change date. The system uses this rate for penalty calculation for any overdue bills produced in the future until the next rate recalculation.

Consider the following penalty interest setup. The penalty interest of a contract follows loan interest minus a margin of 2.5%. The configuration is as follows:

- Margin Operand – Sub

- Margin Rate – 2.5

- Penalty Interest - Fixed per Bill

The loan interest is based on the LIBOR 1M rate and is reset every month on the 11th day. The loan contract starts on 10 April, 2021. The loan interest effective rate (in percentage) as on contract creation is 5.00 and the effective rate after the margin (subtracted) is 2.50.

Consider that there are three bills outstanding for repayment by the customer as on 18 July, 2021.

- Bill 1 dated 10 May, 2021 – USD 450.00

- Bill 2 dated 10 June, 2021 – USD 450.00

- Bill 3 dated 10 July, 2021 – USD 450.00

Since the rate reset frequency is monthly on 11th day, the recalculated rates (in percentage) are as follow:

- Penalty rate recalculated on 11 May, 2021: 5.20 - 2.50 = 2.70

- Penalty rate recalculated on 11 June, 2021: 5.70 - 2.50 = 3.20

- Penalty rate recalculated on 11 July, 2021: 4.30 - 2.50 = 1.80

With the given setup, the system uses the following rate (in percentage) to calculate and accrue penalty on each bill every day until the customer repays the bills.

- 2.50 for bill 1 dated on 10 May, 2021

- 2.70 for bill 2 dated on 10 June, 2021

- 3.20 for bill 3 dated on 10 July, 2021

It is evident that 1.80% is not used for accrual of any of the bills since there are no outstanding bills after the rate change date. The system uses this rate for penalty calculation for any overdue bills produced in the future until the next rate recalculation.

Consider the following penalty interest setup. The penalty interest of a contract follows loan interest with margin setup as follows:

- Margin Operand – Multiply

- Margin Rate – 50

- Penalty Interest - Fixed per Bill

The loan interest is based on the LIBOR 3M rate and is reset every three months on the 11th day. The loan contract starts on 10 April, 2021. The loan interest effective rate (in percentage) as on contract creation is 5.00 and the penalty effective rate after the margin (multiplied) is: 5% * 150% = 7.5%

Consider that there are three bills outstanding for repayment by the customer as on 18 July, 2021.

- Bill 1 dated 10 May, 2021 – USD 450.00

- Bill 2 dated 10 June, 2021 – USD 450.00

- Bill 3 dated 10 July, 2021 – USD 450.00

Consider that the bank changes Margin Rate from 50 to 75 on 15 June, 2021. So. for bills becoming overdue after this date, the penalty rate (in percentage) is: 5 * 175 = 8.75

Since the rate reset frequency is every three months, on 11th day, the recalculated rates are as follow:

Penalty rate (in percentage) recalculated on 11 July, 2021 – 4.30 * 175 = 7.525

With the given setup, the system uses the following rate (in percentage) to calculate and accrue penalty on each bill every day until the customer repays the bills.

- 7.50 for bill 1 dated on 10 May, 2021

- 7.50 for bill 2 dated on 10 June, 2021

- 8.75 for bill 3 dated on 10 July, 2021

It is evident that 7.525% is not used for accrual of any of the bills since there are no outstanding bills after the rate change date. The system uses this rate for penalty calculation for any overdue bills produced in the future until the next rate recalculation.

Balance Prefix and Suffix

| Product Line | Balance Prefix | Balance Suffix |

|---|---|---|

| Lending | Accrued | Suspend |

| Due | Customer | |

| Aged | Chargeoff | |

| Deferred | ||

| Residual | ||

| Receivable | ||

| ACR - Amortisation balance generated for recovery balance. | ||

| RSP - Recoveries During Suspend | ||

| Holiday | ||

| Deposits | Accrued | |

| Payable | ||

| Deferred | ||

| Due | ||

| Accounts | Accrued | Suspend |

| Due | ||

| Deferred | ||

| Payable |

The attributes of the Interest Property Class are explained below.

- Most Interest conditions are set at Product level, but there is the option to negotiate all of some of the attributes within the INTEREST Property at arrangement level if this is required.

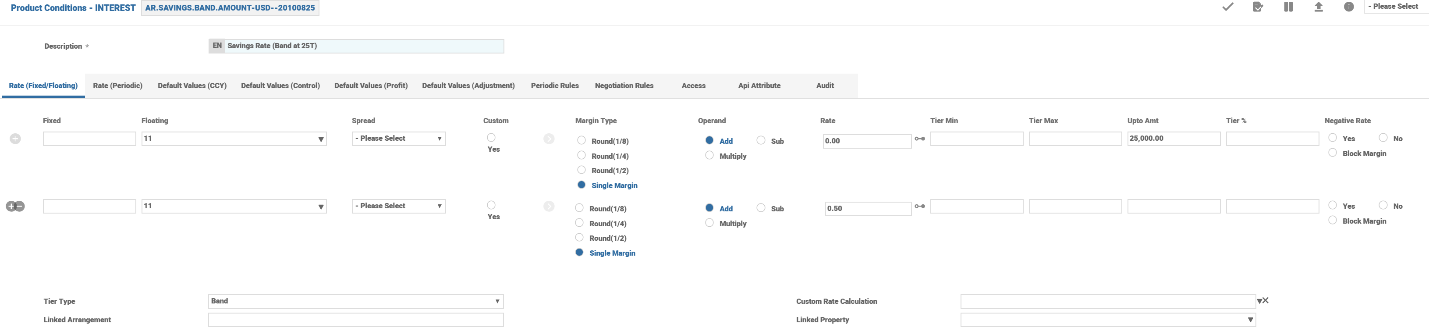

- Temenos Transact supports three basic types of interest : Fixed, Floating, and Periodic. Each of these interest types can include one or more margins and can be specified in a tiered structure

- Following are the related attributes.

- Rate (Fixed/Floating)>Fixed

- Rate (Fixed/Floating)>Floating

- Rate (Periodic)>Index

Fixed - A fixed rate is directly entered by the user into Fixed attribute. This rate must be entered as positive numbers unless a negative rate is allowed.

- Floating - A floating interest rate is tied to a variable base rate (that is, BASIC.INTEREST) and is entered in the Floating attribute. During interest calculations, Temenos Transact uses the currency specific rate applicable for the calculation date (that is, the rate used for the calculation changes whenever the base rate is changed).

- Spread - It is possible to specify that the rate for a given tier be Linked, by setting this field to Yes. This can be mixed with normal rate calculations as well. When the Spread is set to Yes, system expects that an arrangement reference is given in the Linked Arrangement field along with the Interest Property to be linked to.

- Margin Type – It allows to define whether there are single or multiple margins. This attribute is part of a multi-value set of Fixed attributes . It is also part of a sub-value set with Operand and Rate.

- Operand - The options are ADD or SUB. This indicates whether the Rate should be added or subtracted from the Floating or Periodic Rate. This attribute is part of a multi-value set of Fixed attributes. It is also part of a sub-value set with Margin Type and Rate and input is only allowed if a rate is entered in Rate.

- Rate – It allows to define the margin rate that can be used to adjust the specified rate of interest and to appropriately reflect any rate profit realised. The result is the nominal rate of interest. Temenos Transact allows for the following margin configuration:

- Single or Multiple Margins (Margin Type field)

- Rate Adjustment Method (Operand field)

- This is part of a multi-value set of Fixed attributes. It is also part of a sub-value set with Margin Type and Operand.

- Linked Property - This attribute is used to specify the Interest Property of the linked arrangement that should be referred for getting the Interest rate.

- Upto Amt relates to the Tier Type attribute and amounts can be entered if either BAND or LEVEL are selected. This attribute is part of a multi-value set of Fixed attributes.

- Periodic Index - A periodic rate is tied to an index ( For example: EURIBOR) which is dependent on a period of time (For example: term) and possibly an amount.

- The periodic interest index is entered into the Periodic Index attribute. This is input as the 2 digit number at the beginning of the PERIODIC.INTEREST ID, for example, 01 may indicate that the EURIBOR rate should be used.

- The periodic rate applicable for the contract is determined at the time of arrangement creation.

- This rate can be reset on a predetermined frequency.

- Periodic Period Type: This allows the user to specify which period is used to fetch interest rate from the PERIODIC.INTEREST table.

- Available options are:

- Maturity

- Renewal

- Reset Period

- Periodic Period

- Available options are:

- When the attribute value is Null or Periodic Period, then Temenos Transact uses the period defaulted by Temenos Transact in Interest Period attribute.

- Initial Reset Date: This attribute is available in the interest multi-value set to capture the first reset date.

- Interest Period - If not entered the system defaults values in the following order:

- Manual input.

- Change Period from Change Product Property Class.

- Term defined in Term Amount Property Class.

- Periodic Interest Method - Interest selection method if the term is not found on the index. The options are:

- Interpolate Rate

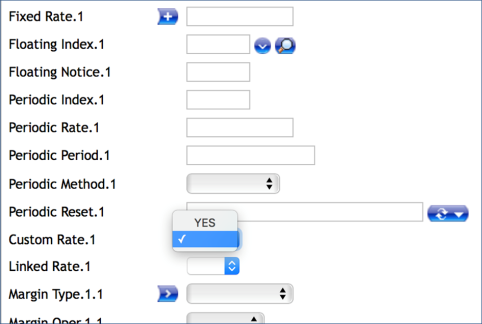

- Periodic Reset – A Reset period can be selected using the pop up box at the end of the attribute. Reset frequency is based on the date convention, date adjustment and business day centres. For example, if periodic reset is set as every month on last day and in ACCOUNT Property, Date Convention set as Forward Same Month and Date Adjustment set as Period, the date of periodic interest reset is forwarded to the same month if it falls on a holiday and moves backward if it cannot forwarded within the same month.

The following details are captured and passed to the TERMRATE API to obtain the daily compounded Risk Free Rates (RFRs). The periodic interest index is entered into Periodic Index attribute. The daily rate is tied to the RFR Index in the PERIODIC.INTEREST table.

- Rfr Convention - Defines the market convention to be used for rate calculation.

- Rfr Lookback Days - Defines the number of lookback days. The formula uses n number of days earlier than the Interest Period Date. For example, if Interest Period Date is 5, January and Rfr Lookback Days is 2 days, then calculate the RFR rate from 3, January from the PI table.

- Rfr Lookback Type - Defines the convention where the RFR rate from N Lookback days is used for every day in the current interest period. Lookback can be of two types:

- Narrow Definition - Applies original interest period’s day count to the lookback rate used for this day (that is, if Wednesday’s rate is used for Friday, applies the Friday’s weight, three days, to Wednesday’s rate).

- Observation Shift - Applies the original day count of the lookback rate (that is, if Wednesday’s rate is used for Friday, applies the Wednesday’s own weight, one day, and does not use Friday’s day count for it).

- Rfr Spread Treatment - Defines the spread to be included or excluded in the calculation. Based on this definition, spread is either calculated before or after the compounded rate.

- Spread Exclusive - Compounds the rate and adds the spread separately.

- Spread Inclusive - Compounds the rate and adds the spread together.

- Rfr Calc Method - Defines the calculation method to be considered to arrive at the final compounded rate based on which final payment amounts are derived. RFRs are compounded on a daily basis in order to arrive at a final rate and the applications refer to this rate to be used in the arrangements.

- Compound – In this method, the individual RFR rate is compounded daily to calculate the cumulative interest. This method is more accurate in compounding interest when principal remains unchanged during the interest period.

- NCCR - In this method of calculating RFR rate using Non-Cumulative Compounded Rate (NCCR), the daily RFR rate is derived in multiple steps as listed below. This method is more accurate in compounding interest when the principal changes during the interest period.

- Step 1 - Compounding Rate - This is the annualised cumulative compounded rate (ACR) used to calculate NCCR.

- Step 2 - Deriving unannualised cumulative compounded rate (UCR) - The compounded rate is unannualised by multiplying with the business day convention, that is, the number of calendar days in the interest period is divided by the market convention for quoting the number of days in the year (360, 365, and so on).

- Step 3 - Calculating NCCR - The UCR for the given business day is subtracted from the UCR of the previous business day and multiplied with the market convention for quoting the number of days in a year (360, 365, and so on), the result of which is divided by the day count for the given business day.

- Simple - In this method, RFR rates are sourced daily and multiplied by the outstanding principal.

- Amount – In this method, to calculate interest accrual, the daily RFR rate is multiplied by both principal and total accrued interest. This method is more accurate in compounding interest when the principal changes during the interest period. The Compound Type attribute is mandatory for amount compounding and the value must be set as Daily. The Rfr Period Day Cnt attribute must be set as Today.

- Rfr Period Day Count - Controls the way in which the last available RFR is treated in the compounding process for the period end date.

- FULL - Calculates the compounding rate for the entire interest period given using the last available rate.

- TODAY - Calculates the compounded rate from Period Start Date to only up to the current day.

- Rounding Rule - Defines the number of decimal places to round each calculation. This attribute is linked to the EB.ROUNDING.RULE table. There should be an entry defined in EB.ROUNDING.RULE for the number of decimals of the RFR rate and the same entry should be entered to the Rounding Rule attribute.

- Rfr Flooring – Defines the option to floor either individual daily rates or calculated average rate. The available options are:

- Daily - The floor is placed on the underlying daily rate, that is, if the singular day rate is negative, then the day rate considered for average rate calculation is floored rate.

- Average – The floor is placed on the overall average rate . Even negative raw rates are considered for the calculation before calculating the average rate. This option is not allowed when Rfr Spread Treatment is set as Inclusive and Tier Negative Rate is set as Floor.

- Base Min Rate - Defines the specific rate that needs to be floored on the daily or compounded RFR rate.

- The Tier Min Rate attribute defines the flooring value, if the rate to be floored is All in Rate (margin included in the rate).

- RFR supports only natural rounding.

- The new attributes added are allowed for modifications only during the beginning of the capitalisation period.

- Accrue By Bills Interest property type is not supported by RFR functionality.

- Adjust Type (Adjustments of Interest) and Advance of Interest (Accounting Mode) are not supported for RFR functionality.

- In the Tier Interest Configurations, multiple Periodic Indexes are allowed, but for RFR processing, validation permits only the same index record.

- Fixed Interest Rate on contracts is not supported for RFR processing.

- The Linked Arrangement and Linked Property functionality are not allowed for RFR processing.

- Pre-notice cannot be configured for maturing arrangements in Activity Messaging property conditions as it is not possible to determine the final interest rate on the defined pre-notification days.

- Due to functional limitations, the Tier Min Rate and Tier Max Rate attributes are restricted for (Rfr Calc Method) amount calculation method.

- The Rfr Flooring and Base Min Rate attributes are inter-linked and are mandatory when one of the attribute is set.

- The Block Margin option in the Tier Negative Rate attribute is not supported for RFR functionality.

- When Tier Negative Rate is set as No or Floor Margin, the Tier Min Rate attribute cannot be defined as negative value.

- When Rfr Flooring is defined and both Base Min Rate and Tier Min Rate attributes are left blank or null, then zero flooring continues. When Rfr Flooring is left blank, flooring does not happen at all.

The Usage Percentage attribute is used specify the percentage of the base rate has to be considered calculating the effective rate for the interest tier. This applies to fixed, floating, periodic, and linked or can be custom defined based on any algorithm. This can further be adjusted by means of margin definition. The effective rate is arrived at after applying the usage percentage on the reference rate.

Example

- Floating Rate – 2%

- Usage % – 60

- Margin – .30%

- Margin type – Add

- Effective rate = (2*60%) + 0.30% = 1.5%

Pricing considerations / discount is applied on top of the adjusted effective rate. For example, if a loan product offers a benefit to reduce .35%, then the effective rate on that arrangement is 1.15% (continuing with the previous example)

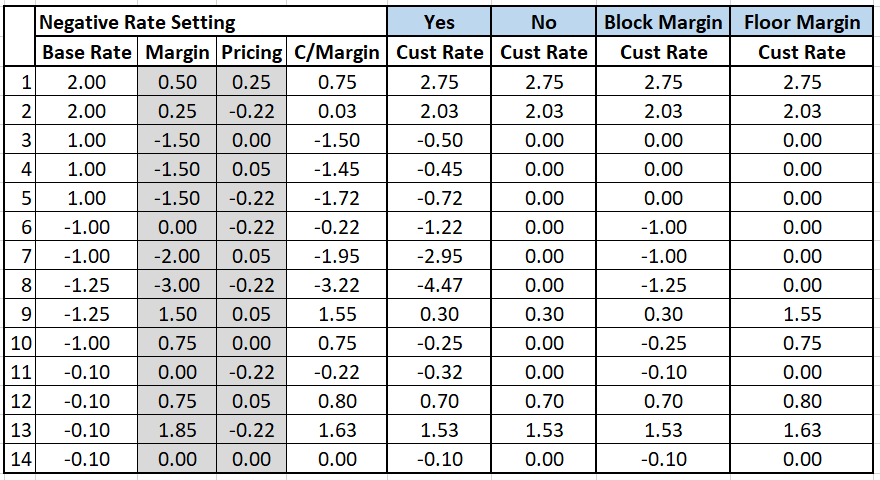

- It is possible to set the control and functionality of how negative rates operate within each individual multiple tier. Irrespective of single, band or level, the Tier Negative Rate attribute can have four settings. Related attribute is Negative Rate.

- Blank or No - Indicates that negative rates cannot be input and if a rate becomes negative as a result of the reference rate or an additional margin the derived rate is set as zero.

- Yes - Indicates that negative rates can be input and the reference rate or the additional margin can make the derived rate more negative.

- Block Margin - Indicates that negative rates can be used but the following conditions apply:

- If the reference rate is positive and the margin makes the rate negative then the derived rate is set as zero.

- If the reference rate is negative and the margin makes the rate more negative than the margin is ignored and the reference rate (negative in this case) is used.

- Floor Margin - Indicates that negative rates can be used but the following conditions apply:

- If the reference rate is positive and the margin makes the rate negative, then it is set to zero.

- If the reference rate is negative and the margin makes the rate more negative, then it is set to zero.

- If the reference rate is negative and the margin is positive, then the system ignores the original negative reference rate and uses the margin.

- If the reference rate is negative and there is no customer margin, then it is set to zero.

An example of Floor Margin processing in comparison with other attributes are as follows:

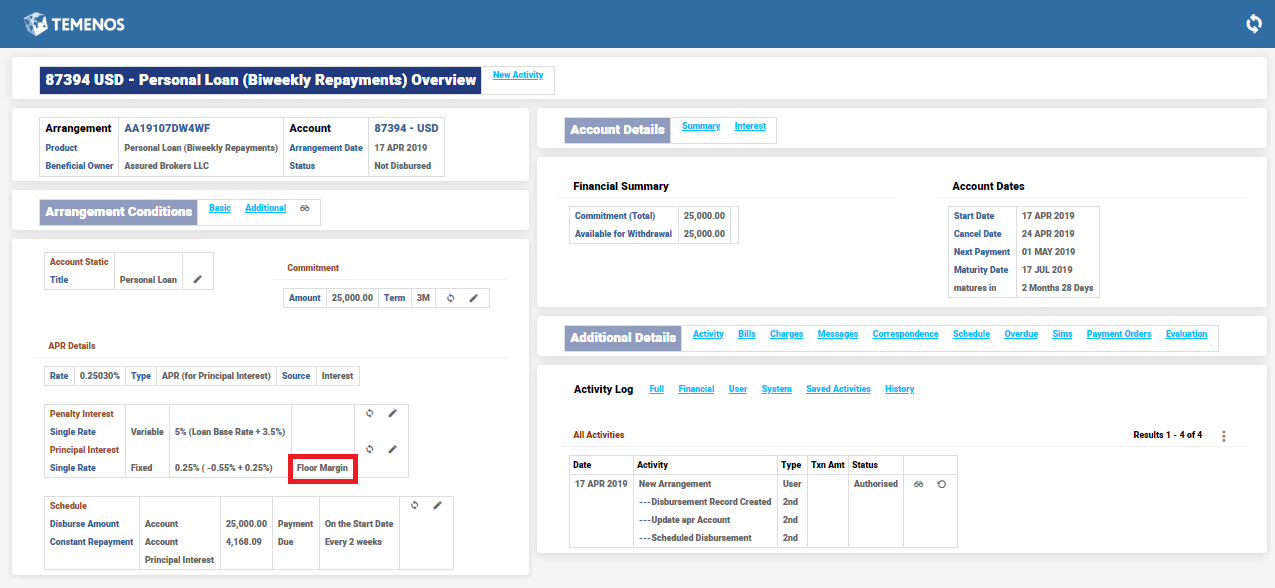

The above selection of the setting in the Negative Rate field within Interest Property Condition helps display an enrichment value on the Negative Rate field, both within the product as well as on the existing arrangements. The enrichment informs the use of that negative rate attribute, which has been selected on the AA overview screens of Lending, Deposits, Accounts and Bundle (Cash Management – Master Accounts Overview screens).

- Null – No enrichment is displayed

- Yes – Enrichment will display No Floor

- No – Enrichment displays Absolute Floor

- Block Margin – Enrichment displays Block Margin

- Floor Margin – Enrichment displays Floor Margin

- A margin rate can be used to adjust the specified rate of interest and to appropriately reflect any rate profit realised. The result is the nominal rate of interest which is stored in Effective Rate attribute.

- Temenos Transact allows for the following margin configuration:

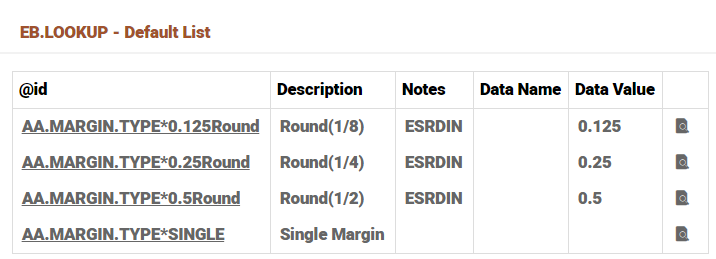

- Single or Multiple Margins – the attributes for margin are a multi-value set for multiple margin types. The types available are defined in the AA.MARGIN.TYPE virtual table in EB.LOOKUP.

- Examples may be a Corporate or Treasury margin.

- Rate Adjustment Method – this is defined in Operand attribute with the following options:

- Add to rate.

- Subtract from rate.

- Multiply (that is, the nominal rate is [100+Margin] % of the specified interest rate).

- The actual margin is defined in Rate.

Interest rate change of an arrangement is possible by adjustment set of associated multi-value attributes. The Type attribute allows the user to select whether they are adjusting the final rate or overriding it with a fixed rate.

Allows an adjustment in the given or calculated Interest rate using Adj Operand and Adj Margin. The operands can be add, subtract or multiply and the adjust margin is applied accordingly. Default Values (Adjustment)>Type is a related attribute.

- Allows to input the final rate of interest to be applied. This means any interest rate given or calculated is overridden or ignored and the Interest rate is picked up from Override Rate.

- Adjustment Reason attribute records the reason for the change in interest. The AA.ADJUSTMENT.REASON virtual table allows the adjustment reasons to be pre-configured.

- An adjustment set either as Adjust or as Override expires on the fixed date given in the Expiry Date attribute.

- Related Attributes are:

- Default Values (Adjustment)>Adj Operand

- Default Values (Adjustment)>Adj Margin

- Default Values (Adjustment)>Override Rate

- Default Values (Adjustment)>Adjustment Reason

- Default Values (Adjustment)>Expiry Date

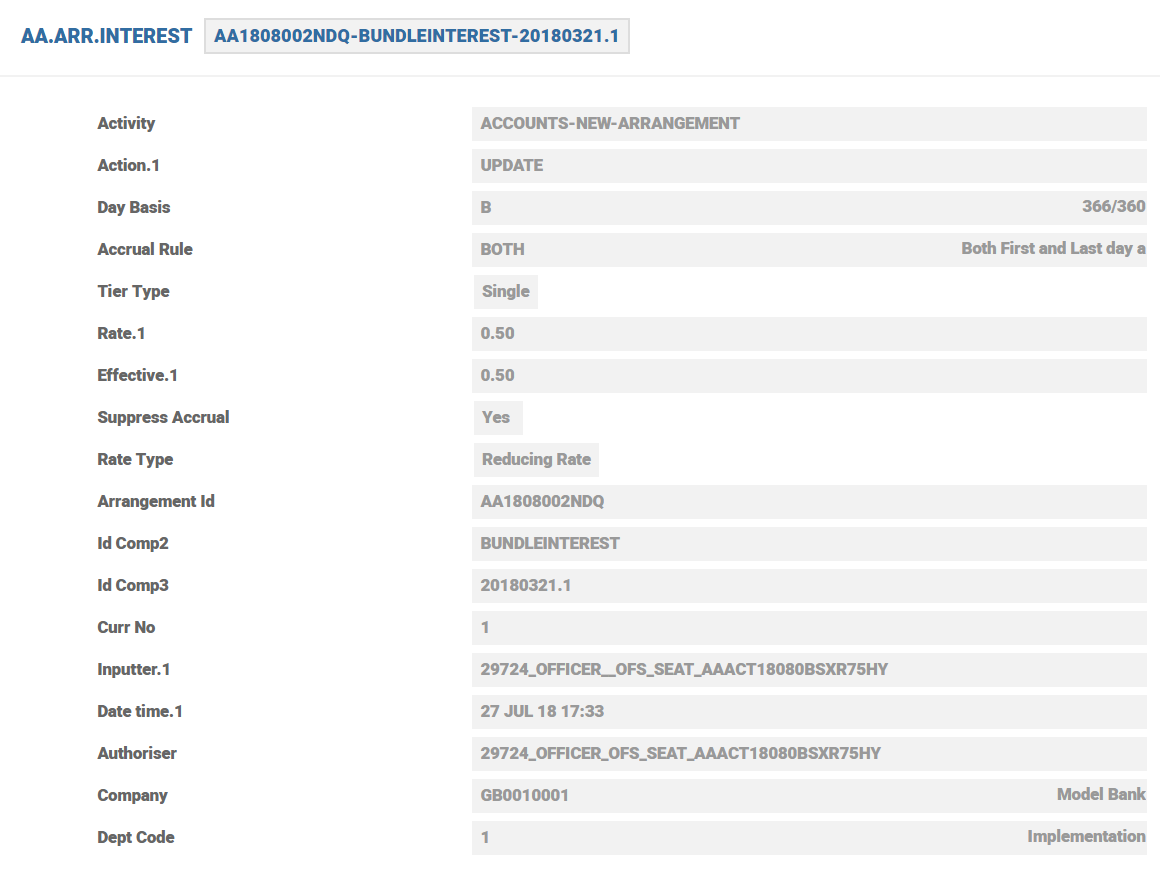

- AA.ARR.INTEREST records the details of the Interest rate adjustment or override if any.

- The AA.ARR.INTEREST record is seen belowThese adjustments are on top of the neg

Temenos Transact supports the compounding of both debit and credit interest in Compounding attribute. The following compound frequencies are supported:

- Daily (D) – Interest is compounded 365/6 times a year.

- Annual (M12) – Interest is compounded once per year.

- Semi-Annual (M06) – Interest is compounded 2 times a year.

- Quarterly (M03) – Interest is compounded 4 times a year.

- Monthly (M01) – Interest is compounded 12 times a year.

- Bi-Monthly (M02) – Interest is compounded 6 times a year.

- Twice-Monthly (TWMTH) – Interest is compounded 24 times a year.

- Weekly (WEEK) – Interest is compounded 52 times a year.

- Bi-Weekly (WEEK2) – Interest is compounded 26 times a year.

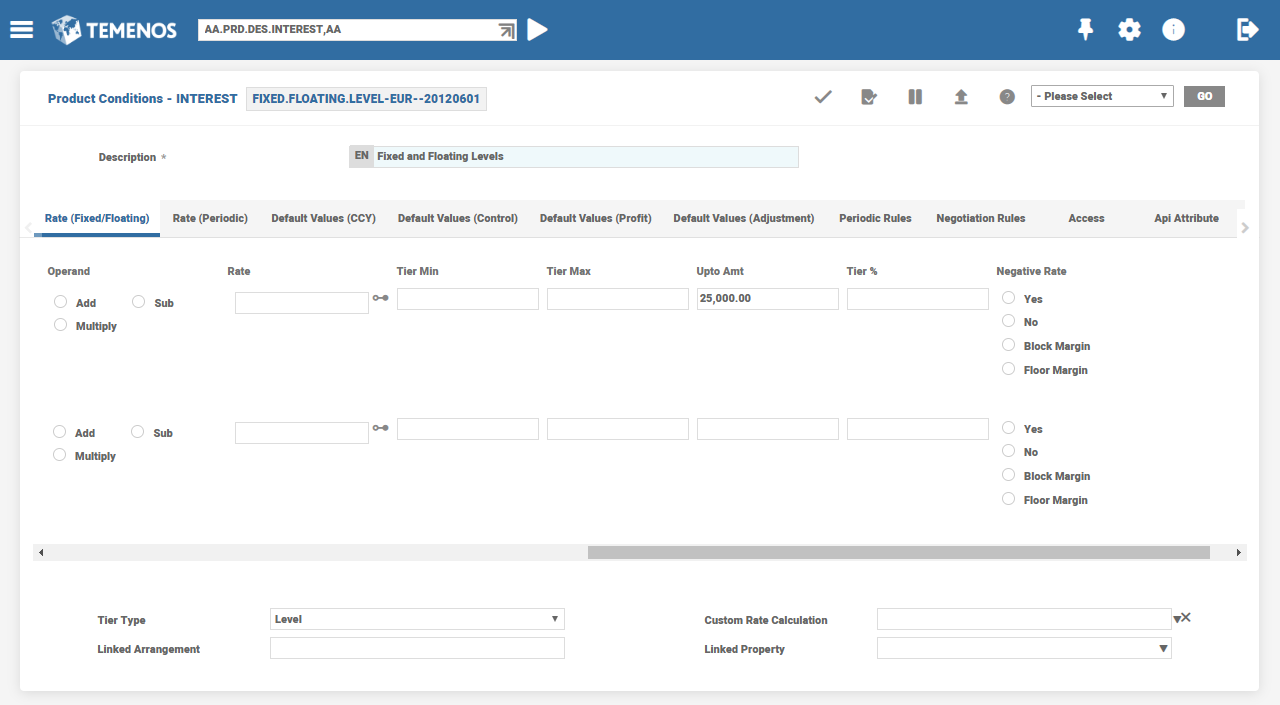

Temenos Transact allows for the definition of different types of interest rates. There are three types of tiers: Band, Level and Single and these are selected in Tier Type attribute.

When the option Single is selected, a single nominal interest rate applies for the entire balance amount.

- By specifying level tiers a product can be defined which calculates interest at different rates depending on the balance amount. A single rate of interest gets selected and applied based upon the balance amount.

- For a deposit you might want to have a higher rate of interest for accounts which maintain higher credit balances. Conversely, for a loan product, a higher rate of interest can be charged for accounts with higher debit balances.

- For example, assuming a credit balance of 15,000 and level interest which specifies an applicable rate of 10 per cent up to 10,000 and 15 per cent above 10,000. A single rate of 15 per cent gets applied to the entire amount of 15,000.

- Banded tier interest typically results in a blended interest rate. This is similar to Level tiers, but allows for the interest rate of each tier to be applied to the portion of the balance that falls within the tier.

- For example, assuming a credit balance of 15,000 and banded interest which specifies an applicable rate of 10 per cent up to 10,000 and 15 per cent above 10,000. Two calculations can be performed (that is, 10 per cent on 10,000 and 15 per cent on 5,000).

- Each tier is specified by defining the amount up to which the interest rate applies. Additionally, each tier can be of a different interest rate type (that is, fixed, floating, or periodic).

- In each case the attributes Fixed through to Upto Amt are part of a multi-value set of attributes and can be utilised if either LEVEL or BAND are selected. The rate to be applied to the calculation amount is specified in the Upto Amt attribute.

- It is possible to control the interest rate of an account during its lifetime using Tier Min and Tier Max. This is applicable for variable and periodic or rates and allows the tier rate to be controlled.

In the interest condition , for tiered interest rate setup, the user has to specify either TIER.MIN.RATE/TIER.MAX.RATE or periodic attributes to determine the effective rate of the respective tiers. If both are provided, the effective rate for that tier is determined by comparing the value of the greater option to the specified floating rate.

- We can also define interest condition such that different rates are applied for different percentage of the loan amount. This can be achieved by multi-valuing the Tier % attribute and giving an absolute value. The total of every multi-value of this attribute should result to 100.

- Related Attributes are

- Rate (Fixed/Floating)>Tier Min

- Rate (Fixed/Floating)>Tier Max

- Rate (Fixed/Floating)>Tier %

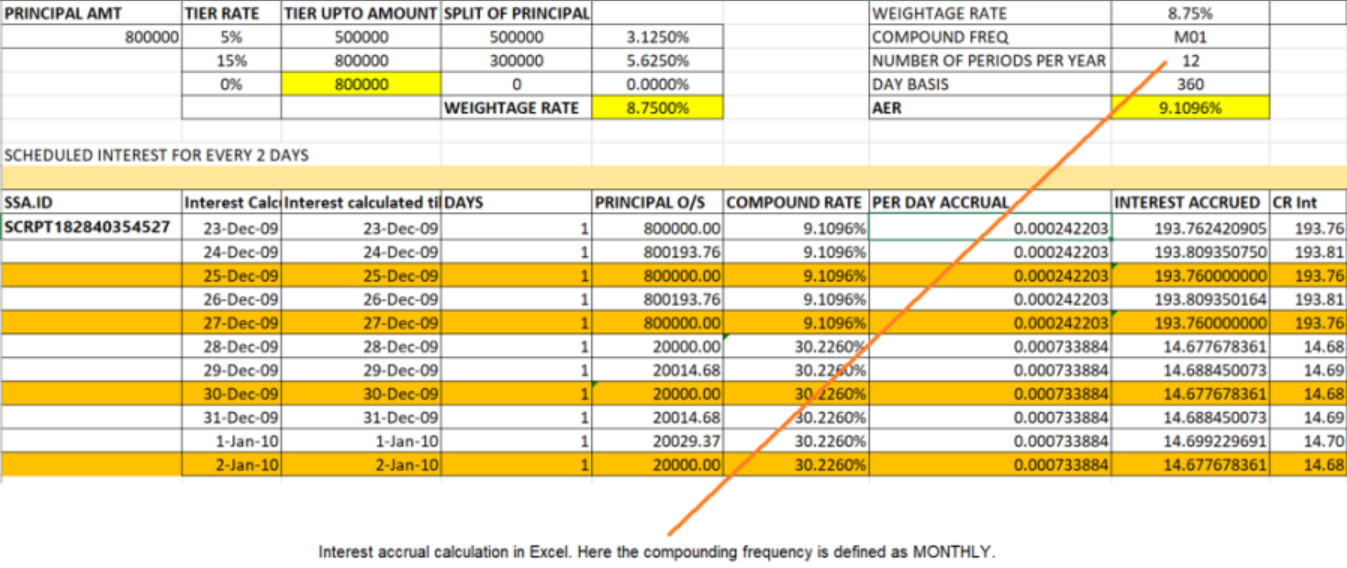

- The Interest Property Class facilitates to define compounding interest effect based on weighted rate method for interest rate tier type BAND.

- The formula to calculate the weighted rate is:

- Weighted Rate = ∑i=1n (Weight i* Rate i) / Balance

- Where, the Weight i is the part of the balance used for the accrual on the specific tier i.

- The daily accruals happens based on the example shown below.

- An account balance of €800,000 is available during COB. The Interest Product Condition is defined as Band with the following rates:

| Tier Number | Threshold | Rate% |

|---|---|---|

| 1 | 500,000 | 5 |

| 2 | >500,000 | 15 |

The weighted rate is calculated as shown below.

| Weight 1 = | 500,000 / 800,000 |

| Weight 2 = | (800,000 – 500,000) / 800,000 = 300,000 / 800,000 |

| Weighted Rate | Weight 1 * Rate 1 = [(500,000 * 5) + (300,000* 15) + ] / 800,000 = 8.75 |

| Interest accrual for the day | Interest = Balance (800,000 ) * Weighted Rate / Denominator = 800,000 * 8.75/ 360 / 100 = 193.76 |

Click here to view the excel formula embedded for in-depth details.

A user routine can be attached in the Refer to Routine attribute to calculate the tier amount for interest calculation.

The parameters of the hook routine are listed below:

|

Parameter |

IN/OUT |

Description |

|---|---|---|

| ARRANGEMENT.ID | IN | Arrangement Id |

| EFFECTIVE.DATE | IN/OUT | The effective date for details requested.Return date separated by FM if there are multiple dates |

| TIER.AMOUNT | OUT | Tier Amount Separated by VM Marker. If multiple dates then each tier set will be separated by FM |

Using Calc Threshold attribute, a user can specify that interest can only be calculated if a balance threshold is surpassed. For credit interest, the user can specify the minimum balance which must be maintained. For debit interest, the user can specify the maximum debit balance for which interest cannot be calculated.

- When accruing interest, Temenos Transact must determine which amounts to include in each day’s balance, the actual days to include in the period (For example: first day, last day) and how to round any calculations. Temenos Transact allows users to define the calculation method to use, by specifying an accrual rule in EB.ACCRUAL.PARAM.

- Users can define the following in Accrual Rule attribute.

- First Day Inclusive (Yes or No)

- Last Day Inclusive (Yes or No)

- Rounding Rule (Natural, Down, Up, Currency, None)

- Intermediate Calculation Rounding (Yes or No)

- Credit value date adjustment

- Debit value date adjustment

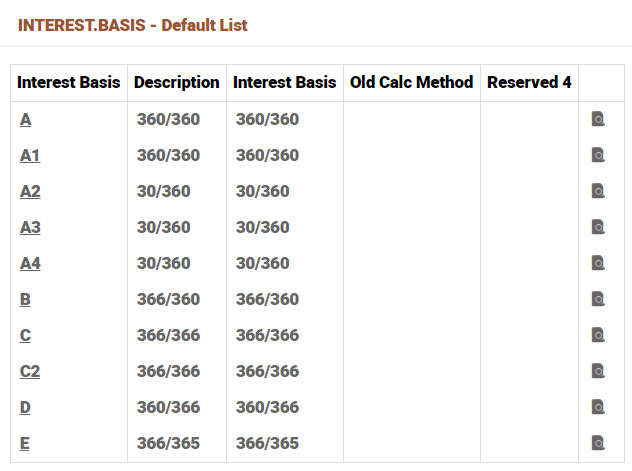

- Temenos Transact can calculate interest based on day basis types which are defined in the Interest Basis application and these values are stored in the Day Basis attribute.

- Each Interest Day Basis type is represented as a numerator and denominator.

- Numerator (interest days)

- 360 – Each month is considered to have 30 days

- 366 – The exact number of days are used

- Denominator (days in the year)

- 360 – Each year is considered to have 360 days

- 365 – Each year is considered to have 365 days

- 366 – The exact number of days in the year are used (365 or 366)

Temenos Transact allows the following interest day basis types:

Temenos Transact provides several ways to control the interest rate of an account during its lifetime.

- Tier Minimum or Maximum - For each tier defined, a user can specify a Tier.Min and/or Tier.Max for the tier. This is applicable for variable and periodic rates and allows the tier rate to be controlled.

- Rate Increase and Rate Decrease - Through periodic rules, users can control the increase and decrease of the overall rate during a period of time (for example: per month, per year, account lifetime, etc).

- Rate Cap and Rate Floor - Through periodic rules, users can control the maximum (cap) and minimum (floor) rates that apply to a balance amount.

- Suppress Accrual - A non-mandatory attribute that accepts the options yes or alternate or Info Only. It indicates whether accruals needs to be Suppressed or Accrual should be done for the Alternate Interest Property.

- When the value is set as Yes by the system if the Donor Accrual attribute is set as Suppress for any product or arrangement in INTEREST.COMPENSTION Property of a Bundle arrangement.

- When the value is set as alternate for a Property then the accrual is suppressed for the Property for which it is set and accrual happens for the alternate property which is set in Activity Restriction.

- When the value is set as Info.Only the interest is calculated by the system, but no accounting entries are passed.

- When the value is left blank there is no suppression of accrual.

-

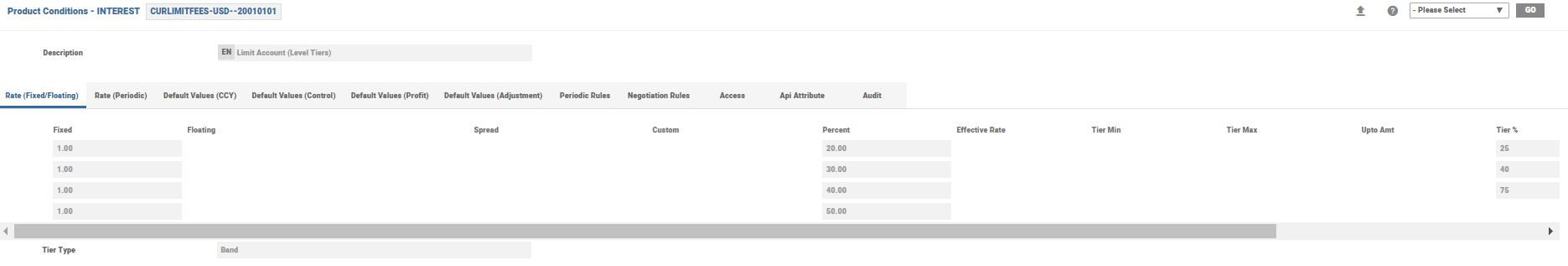

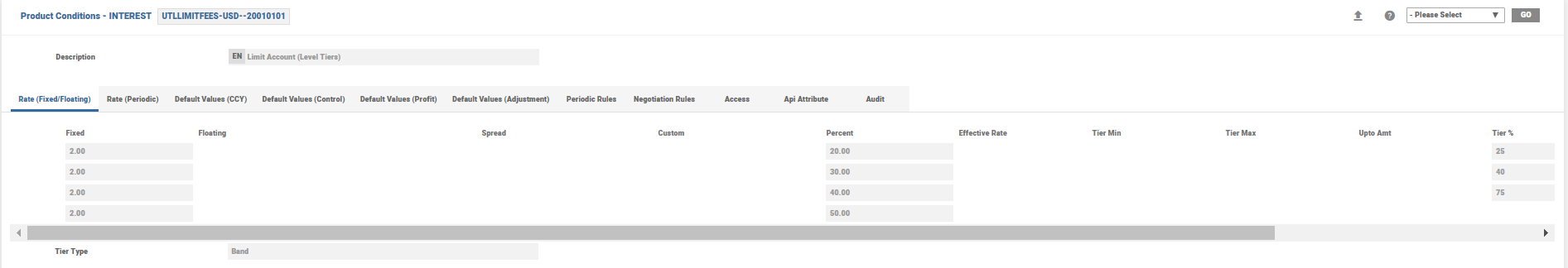

Refer Limit - For the arrangements under the Accounts product line, accounts can be linked to LIMIT to have different calculation rates of debit interest for the accrual interest calculations. Allowing the three-tiered definitions in Interest property conditions is based on the following configuration. When Refer Limit is set as:

- Yes – Only two tiers are allowed for the tiered definitions. The first tiered amount rate would refers to the amount utilised within the limit and the latter to the overdraft.

- Include Temp Limit – Three tier definitions are allowed. The first tiered amount rate would refers to the amount utilised within the limit, second tier applies to the temporary limit amount and last third to the overdraft amount.

If the Refer Limit field is left blank, tiered Interest conditions definitions are not allowed.

The Tier Amount attribute cannot be defined in the Interest property conditions when Refer Limit is used .

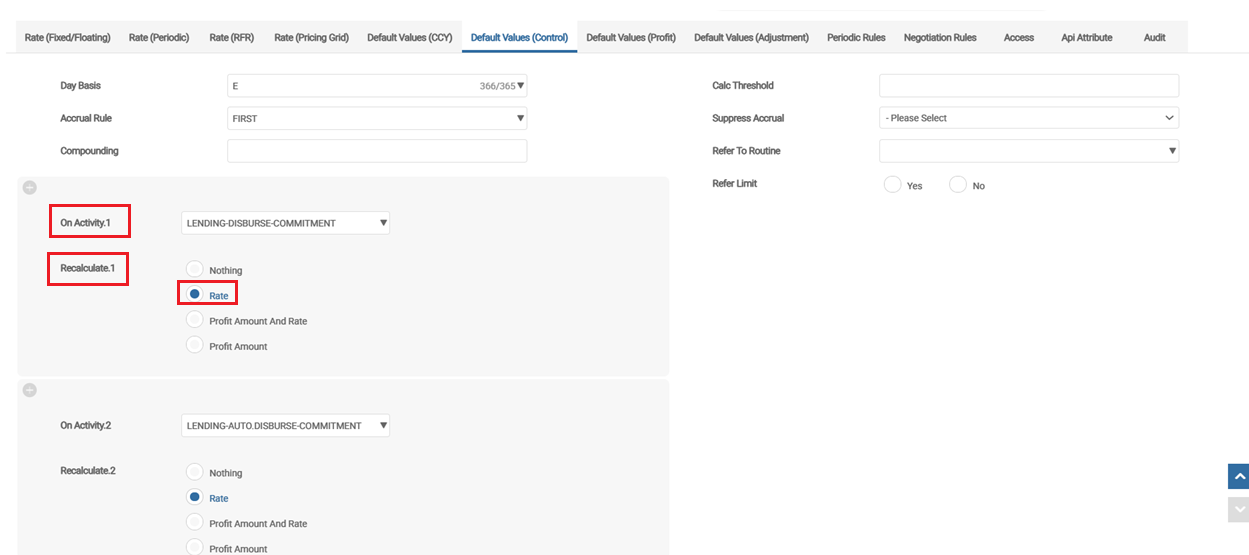

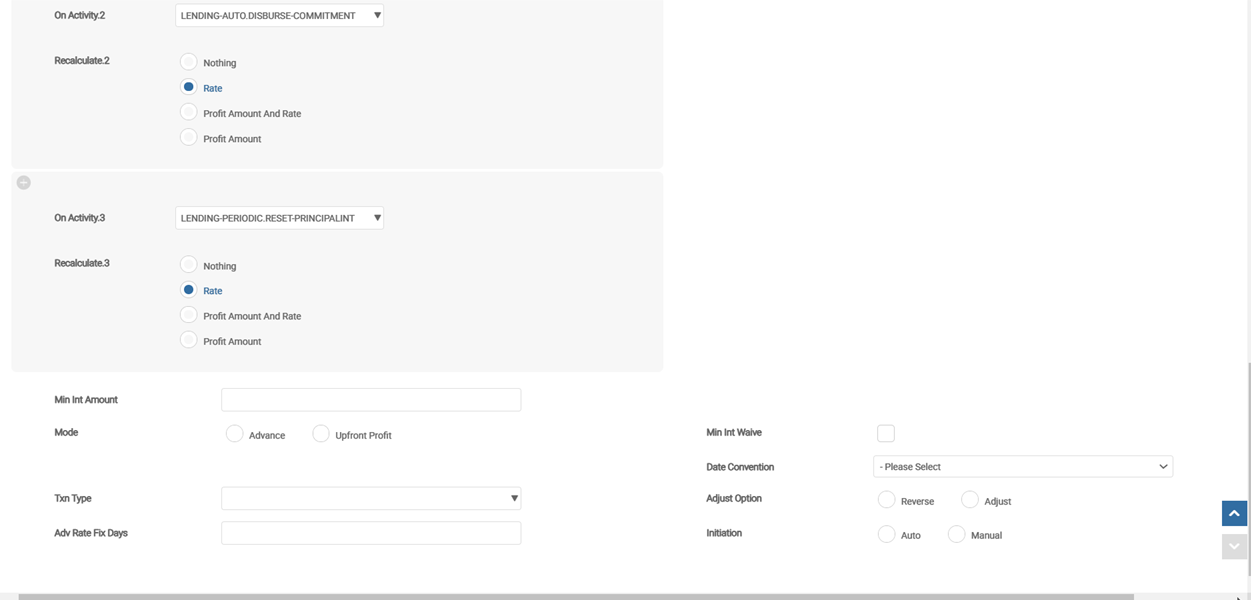

- On Activity - When the periodic interest rate needs to be recalculated for certain activities, this attribute in combination with Recalculate may be used to setup the activity for which interest needs to be recalculated

- Validation Rules

- Applicable only for Periodic interest rate recalculation

- Must be a valid Activity in AA.ACTIVITY

- Recalculate - Related to ON.ACTIVITY Activity, when set to RATE, system recalculates Periodic rate when the Activity setup in On Activity is processed. When the value is Nothing, periodic rate is not recalculated when the Activity setup in On Activity is processed

- Validation Rules

- Mandatory when On Activity is setup

- On Activity attribute and Recalculate in Interest Property Class is enhanced to allow user to define when to recalculate Profit Amount.

- All activities which can result in payment schedule recalculation can be configured to recalculate Profit Amount that is, activities with payment schedule calculate and update action.

- Min Int Amount - This attribute indicates the minimum interest amount to be posted for an arrangement or account.

- When the calculated interest amount is less than the amount specified in this field, system waives the interest amount or adjusts the interest amount based on the option set in the Min Int Waive field

- Defines the minimum interest amount that is compared to the system calculated interest amount. If the interest calculated is less than the minimum amount set, then based on the waive setup field, either the min interest amount is applied or it is waived.

- Min Int Waive - This field indicates if the calculated interest amount has to be waived or adjusted.

- When the value is set to Yes, then the system waives the interest amount if it is less than the Min Int Amount specified.

- When Null value is set and if the calculated interest amount is less than the Min Int Amount specified, then system posts the minimum interest amount.

- Defines if the calculated interest amount goes below minimum interest amount set in the Min Int Amount field, if the system waives the interest amount or posts the minimum amount.

- Mode - Specifies the way in which accounting entries are raised. Decides if it has to be discounted or be a fixed type of interest.

- Upfront Profit – Interest amount is collected at the beginning of the contract.

- None – Denotes conventional interest-bearing contract.

- Advance – This is the discounted interest, and the interest amount is collected in advance before the interest periods.

The Risk-Free Rates functionality does not support advance or upfront interest.

- Date Convention - Specifies the date convention to be followed for the reset frequency that is, if the cycled Periodic Reset date falls on a non-working day, the reset date is moved based on the option chosen. Allowed Values are as follows

- Arrangement or Null – Based on the date convention specified in the Account Property Class.

- Periodic Interest – Based on the convention used by the index that is, the Periodic Interest record.

- Forward Same Month convention for Monthly periods and Forward convention for all other periods if USE.LAST.WORKING.DAY is set to Y.

- Forward Convention for all periods if USE.LAST.WORKING.DAY is not set.

- Txn Type - This attributes allows a valid record from the FT.TXN.TYPE.CONDITION application

- Adjust Option - Allows the user define if the accrual calculation can be adjusted or reversed.

- It is possible to allow an arrangement to be suspended even if interest is being capitalised when the Property Type is designated as SUSPEND in AA.PROPERTY.

Consider an example where USD 1000.00 is already suspended. Now, on schedule date, as interest is set to capitalise, this USD 1000.00 is reversed from the suspension category and booked under P&L and the entries for capitalisation are - credit the accrual category if Interest Property and debit the current balance of Account Property.

For deposits and savings plan products, interest is paid to the customer periodically or on contract maturity based on the type of contract. Interest can also be capitalised such that interest amount is added to the principal to be paid to the customer. The same is paid from PAY balance of Interest Property.

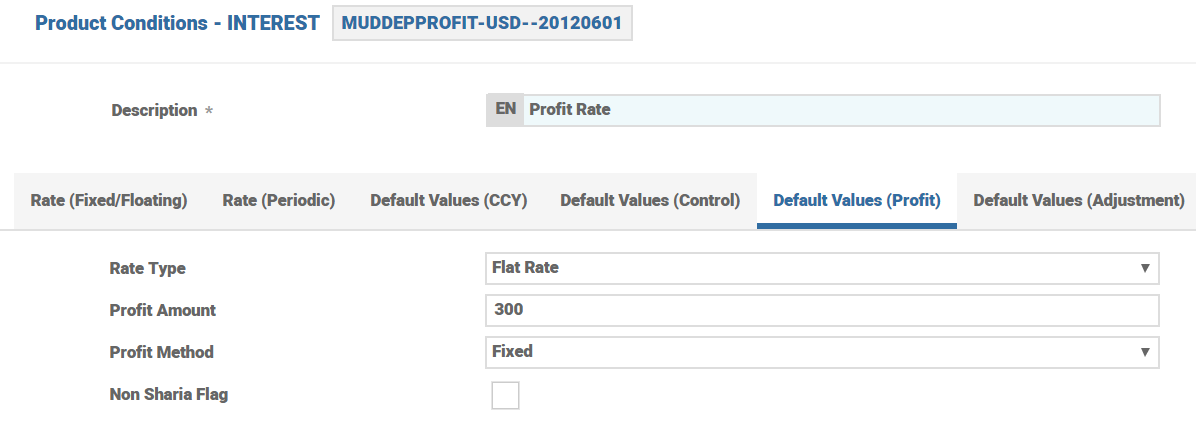

- Interest property class in AA allows calculation of interest amount based on Flat rate and Reducing Rate. It provides an option to fix the total interest amount calculated during contract creation regardless of any change to the loan parameters which affects the profit or interest calculation.

- Additionally when the interest or/ profit amount has to be recalculated on exceptional cases, the On Activity and Recalculate attributes in Interest condition can be configured to recalculate interest or profit amount.

- Profit Amount : User can define the Total interest or profit amount for the arrangement or contract. This attribute is mandatory when Rate .Type is Flat Amount.

- Based on the value given, the value in the Calc .Profit. Amt attribute is calculated at arrangement or contract level which can be edited by the user.

- Profit Method : allows user to specify whether interest method is fixed life of the arrangement or contract. Available values are:

- Fixed – Fix the total profit amount regardless of any change to loan parameters.

- Null – Is treated as a normal interest bearing property.

- Non Sharia Flag -– Income or expense is posted to internal account category specified in Accounting condition instead of PL categories

- Related attributes:

- Default Values (Profit)>Rate Type

- Default Values (Profit)>Profit Amount

- Default Values (Profit)>Profit Method

- Default Values (Profit)>Non Sharia Flag

During the respite period, in upfront profit contracts with flat rate or flat amount of profit, it is possible to book the income received in advance to the income (PL) over the respite period.

Advance Profit Accounting in the Interest condition can have one of the following values:

- Amort - When set to Amort, the income received gets booked to the PL over the respite period.Applicable for upfront contracts with flat rate or flat amount of profit. This is not applicable for reducing rate of profit contracts.

- Left blank or set as Cash Basis - The income is credited to the PL on the same day of receipt of the income (on the respite date) and the accrual continues on the outstanding principal.

Recalculating Profit

For upfront profit contracts, the profit amount is calculated and agreed upfront. In case of certain business activities, it is possible to recalculate the profit. This is achieved using the On Activity and Recalculate attributes in Interest condition.The different types of upfront profit contracts and profit recalculation are detailed below.

Flat Amount of Profit

The profit amount agreed upfront can be changed using Change Profit Activity (LENDING-CHANGE-INTEREST).

Reducing Rate

The user can define the activites for which profit amount should be recalculated using On Activity and Recalculate set of fields in Interest Condition. On occurrence of these activities, the interest/profit amount is recalculated for the contract.

Flat Rate of Profit

An upfront profit contract can have a flat rate of profit defined with or without scheduled disbursements. When a contract is booked in the system, the profit is calculated based on the scheduled disbursements in the arrangement. If there are no scheduled disbursement, the upfront profit is calculated on the TOT<TERM.AMOUNT> (total commitment).

For example, when the contract is booked and if there is disbursement scheduled only for a part of the commitment amount (that is, only 70% of the commitment is scheduled for disbursement and remaining 30% is not scheduled for disbursement), the profit is calculated only for that part of the scheduled disbursement in the contract (70% in this example).

It is possible to recalculate the profit of the contract on occurrence of specific activities. The user can define the activities for which profit amount should be recalculated using On Activity and Recalculate set of fields in Interest Condition. For a multiple disbursement contract, when disbursement activity is part of this profit recalculation, the profit is determined based on the Include Future Disb field.

- When Include Future Disb is not set, the profit calculation is only for the disbursed amount

- When Include Future Disb is set, the profit recalculation considers future scheduled disbursements also

For example, on 15 Mar, 20 when a contract is booked with the below scheduled disbursements the profit is 4,607.64. The calculation is as show below.

|

Disb Date |

Amount |

No. of days |

Profit Calculation |

Profit amount |

|---|---|---|---|---|

|

18-Mar-20 |

25000 |

348 |

25000*5%*(348+1)/360 |

1211.81 |

|

10-Apr-20 |

75000 |

325 |

75000*5%*(325+1)/360 |

3395.83 |

On 18 Mar, 20 during the first disbursement and recalculation of profit is set for disbursement activity:

- When Include Future Disb is not set, the profit is recalculated as 1211.81

- When Include Future Disb is set, the profit is recalculated as 4.607.64

Recalculation of profit is triggered on occurrence of activities specified in the On Activity and Recalculate set of fields in Interest condition.

- LENDING-NEW-ARRANGEMENT

- LENDING-AUTO.DISBURSE-TERM.AMOUNT

- LENDING-DISBURSE-TERM.AMOUNT

- LENDING-CHANGE-PAYMENT.SCHEDULE

- LENDING-RENEGOTIATE-ARRANGEMENT

- LENDING-CHANGE-INTEREST

- LENDING-CHANGE.TERM-TERM.AMOUNT

- LENDING-TAKEOVER-ARRANGEMENT

A custom routine can be attached to Interest condition of upfront profit contracts with flat rate of profit, to define the conditions for recalculation of the profit amount in the contract.

Profit will not be not recalculated for activities other than the activities listed. An override appears while creating the product condition or arrangement condition indicating the same.

For example, when recalculate rrofit is set for change product activity, an override appears stating that interest will not be recalculated for the activity.

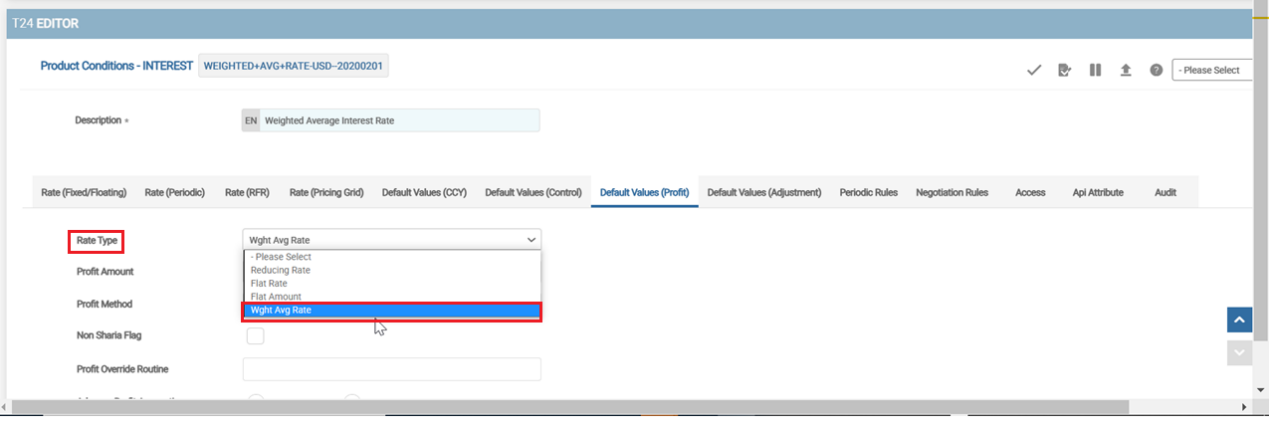

A Weighted Average Rate (WAR) has to be calculated where loans are being disbursed in multiple tranches, each having its own interest rate. This has to be applied to the contract after each disbursement. Even though from customer perspective a single effective rate is seen, the WAR method ensures that individual disbursement rates are provided for any new amount disbursed and effective rate re-calculated using WAR method, considering these disbursement rates. Also, by using this Interest Type, the periodic reset of the rates is possible and when that is set the existing WAR rate is overwritten.

Weighted Average Rate Type

The Weighted Average Rate Type of Interest condition enables the calculation of the weighted average rate, which determines the actual effective rate of the arrangement.

This Wght Avg Rate option is allowed only for Periodic Interest type definition. Validations are set to raise errors whenever the user is trying to define:

- Fixed Rate

- Floating Index

- Custom Rate

- Linked Rate

- Adjust Type set as OVERRIDE .

- Risk Free Rate

- Even though for periodic interest multiple tiers are allowed when the Allow Amt is set as No, but still it is restricted for WAR.

Subject to negotiation rules, a contract can be changed at any time from/to weighted average rate to any of the available options of Rate Type enabled for the Product Line. If such a change happens, an override message is displayed.

Weighted Average Rate Calculation

While defining the interest details, in order for the WAR to get recalculated each time a disbursement happens or when a rate reset event is scheduled, the following configuration is required:

On Activity should be set to (RECALCULATE) Rate for disbursement and rate reset activities .

WAR Calculation Routine

The AA.CALCULATE.WEIGHTED.AVERAGE.RATE routine calculates Weighted Average Rate based on the below formula:

Where:

- Disbursement interest rate

- Disbursement/Outstanding amount

The above formula can be simplified, so that the routine does not check historical information related to individual disbursements and rates applicable/disbursement.

Where:

= Current calculated weighted average rate.

= Previous calculated weighted average rate.

= Previous outstanding principal (before current disbursement/repayment).

= Current amount disbursed.

Read Weighted Average Rate to know how this feature works for loans disbursed in multiple tranches.

- Where the account has been set as a Memo account (Balance Treatment in ACCOUNT property set to Memo), any Interest property in the Account is treated as a Memo interest.

- During accruals, accounting is suppressed automatically so as not to post anything on the Accrued Balance or the PL.

- However, AA Interest Accruals are still maintained by the system.

- It is still possible to specify Capitalisation or Make Due frequencies for such Interest.

- During Make Due processing, it triggers the settlement of such accrued interest between the Settlement Account and a Counter Booking Account (Read Settlement Property Class for more details)

- Custom Rate is yet another type of Source Rate calculation (others being Fixed or Floating or Periodic or Linked Rate) in the Interest Property Class.

- It can be enabled by setting the Custom Rate attribute to Yes as part of the Tier multi-value set.

- Run Time Rate Calc - When the attribute is checked the rate is not stored in the Effective Rate attribute, instead system calculates the rate in runtime.

- The Currency, Fixed/Floating and Rate/Index attributes can be used to configure custom values to be used by the API.

- The CUSTOM RATE CALC API is invoked by the core interest processing at the time of Change Interest Activity and also during Accrual or Cap or Make Due Processing when it has to derive the interest rate dynamically.

- This run time calculation is controlled by the Run Time Rate Calc attribute being set to Yes.

- An example implementation of this Custom Rate calculation is given below as used by the Balance Netting Cash Pool.

- In the case of multi-currency AR Accounts (Memo) and in multi-Currency Interest compensation, Currency weighted average rate calculation can be used.

- Main Account Currency is USD and the following is the Currency wise Balance (either as a Multi Currency memo account or as Participants in an Interest Comp pool).

- USD Balance: 1000

- EUR Balance: 2000 (FX Rate 1 EUR=1.23USD)

- GBP Balance: 5000 (FX Rate 1 GBP=1.4USD)

- The following is the setup in the Custom Type or /Name/ or Value set of Attributes where Type = Currency, Name = Fixed or Floating and Value – a Rate or an Index.

- USD 0.9

- Margin of 0.5 negotiated for this Account

- EUR 0.75

- GBP 0.3

- Interest can be set to be calculated as follows:

- Total Balance: USD 19,400 (USD 10,000 + (EUR 2,000 * 1.23) + (GBP 5,000 * 1.4)

- Currency Weight (% of the Currency balance against the total balance)

- USD Balance: 51.54639175 %

- EUR Balance: 12.37113402 %

- GBP Balance: 36.08247423 %

- Currency weighted Interest Rate

- 0.664948 ((51.54639175 * 0.9) + (12.37113402 * 0.75) + (36.08247423 * 0.3))/100

- Effective Interest Rate

- 1.164948 (0.664948 + 0.5 Margin on USD)

- Related Attributes are:

- Default Values (Ccy)>Run Time Rate Calc

- Default Values (Ccy)>Currency

- Default Values (Ccy)>Fixed/Floating

- Default Values (Ccy)>Rate/Index

A custom routine can be attached to Interest condition in the Interest Override Routine attribute for upfront profit contracts with flat rate of profit. This routine can be used to define the conditions for calculation of the profit amount in the contract. The parameters of the routine are listed below:

|

Parameter |

IN/OUT |

Description |

|---|---|---|

| ARRANGEMENT.ID | IN | The arrangement ID of the contract |

| INT.PROPERTY.ID | IN | The name of the interest property for which profit is to be calculated |

| INTEREST.RECORD | IN | The interest property record for the interest property for which profit is to be calculated |

| INT.PROPERTY.DATE | IN | The date for which the processing is happening for the interest property |

| TOTAL.PROFIT | OUT | The profit amount calculated by the local routine. |

| CALC.ERR | OUT | Error flag to indicate that there has been an error during calculation. If this flag is returned by the routine, then system will ignore the local routine calculation amount and proceed with the system calculated profit amount. |

- In the Cash-Basis income recognition method, when an interest repayment is made on a suspended loan, the repayment amount is recognised to income even when the underlying loan continues to be in a impaired or suspended state due to lack or uncertainty in capital or principal recovery. This approach is considered aggressive under certain regulations and therefore a conservative Cost-Recovery income recognition method is introduced.

- In the Cost-Recovery method, the repaid or recovered interest on a suspended loan is not recognised to income immediately, rather maintained under a Recovery during Suspend balance (RSP).

- Only when the bank decides to resume the loan to accruing basis (moved out of suspend state), the RSP portion of the loan is amortised to income on a straight line basis until the loan end date.

For a suspended loan, in order to define a cost recovery method, property Type has to be set as Amort Recovery Suspend as shown below.

Interest Repayments/Recoveries for Suspended Loans

When interest payments are received on suspended (non-accrual) loans, and the bank uses the Cost-Recovery method, the interest portion of the payment gets posted to a separate balance rather than income. The Recoveries During Suspend (RSP) balance type that represents the interest repayment amount made on suspended loan is used for this.

Based on the amount allocated by the payment rule for the interest component configured under the Cost-Recovery method, the RSP balance is generated.

Accounting Entries

Accounting Entries – Previously the amount allocated for the property was credited to the P/L Account in Cash-Basis method. Now,

| Dr | Cr |

|---|---|

| ACC <Interest> SP | RSP <Interest> |

Resume – Amortisation of Recovered Balance

During resume, the RSP portion of the loan is amortised over the remaining life of the loan on straight-line basis. The ACR balance type is used earn the income under straight line basis using the EB.ACCRUAL application.

- ACR –Represents the unamortised recovery amount which is realised to income when the loan is resumed.

Amortisation can happen in the following two ways based on the residual period left for maturity. When the option in Accounting is:

- Amort - Calculates and amortises until maturity based on either straight line or interest method (if reporting conditions are configured suitably)

- Amort Defer – Amortises the entire balance on the date of maturity.

- The Accrue Amort field in Accounting is used for interest defined under Cost-Recovery method for defining the amortisation style for RSP balance during Resume.

- Only the MATURITY option is allowed under Amort period.

- The Amort Catgeory attribute is used to specify the P/L category to be used for booking.

Accounting Entries

When resume is triggered, the following accounting entries are posted.

| Dr | Cr |

|---|---|

| RSP <INTEREST> | ACR <INTEREST> |

As per the amortisation type, ongoing entries between Unamortised Income and P/L are generated by EB.ACCRUAL.

| Dr | Cr |

|---|---|

| ACR <INTEREST> | Income A/c |

Additional entries

Applicable in case of certain scenarios (Read Working with Loan Charges for more information)

| Dr | Cr |

|---|---|

| ACR <Interest> SP | ACR <Interest> |

| RSP <Interest> | ACR <Interest> |

Additionally an EB.ACCRUAL record is generated during subsequent resume (Refer illustration in Working with Loan Charges )

Suspend Balance movement for any remaining amount in SP (interest income suspended but not recovered during resume

| Dr | Cr |

|---|---|

| ACC <Interest> SP | P/L account |

The following fields in AA.PRD.DES.INTEREST table defines the parameters for calculating the interest on loans:

- Prior Days - Fixes the interest rates on the loan contracts in advance of the loan effective date. The rate has to be fixed prior to the user providing the number of days. The number of days can have a C or W suffix indicating calendar days and working days respectively. For example, if the Prior Days field is set to 2W, then the interest rate is fixed on T-2 working days, where T represents the effective date of rate adjustment or loan effective date.

- Bus Day Centres - Captures the country codes whose calendars must be checked for validating holidays if advance rate fixing is to be done on a working day. It is a multi-value field and thus multiple country’s calendar can be used for holiday validation during advance rate fixing.

The Bus Day Centres field in the interest condition captures the country codes whose calendars must be checked to validate holidays if interest rate fixing is setup in advance and on a working day. The codes must be a valid entry in the REGION and HOLIDAY table.

It is a multi-value field and thus multiple calendar codes can be input for verifying holidays during interest rate fixing. In case of multiple calendar, the system checks for the common working days among the calendars and arrives at the interest rate fix date.

As per the calendar mentioned in this field, if the rate fixing date falls on a holiday, then the rate fixing activity is scheduled on the previous working day.

If this field is left blank the system uses the value in the Bus Day Centers field defined in the Account Condition. In case, if Bus Day Centers field is not defined in Account Condition, then the system defaults the country calendar of the arrangement currency to Bus Day Centers field in Account Condition.

Any changes made to the field does not have any impact on the rate fix activity if it has already been scheduled. The changes are implemented from the next cycle.

If the Prior Days field indicates the calendar days, then the system does not check for the Bus Day Centres field in the interest condition for calculating the holidays.

The interest rate fixing activity always look backwards to the previous working day and not forward when it is a holiday.The AA application allows the user to calculate, accrue and apply interest settled by, or to the, customer. The Non-Customer Facing Interest (NCFI) functionality allows the user to raise internal or non-customer facing fees or interest at contract or arrangement level. This allows the bank to accrue it on a regular frequency.

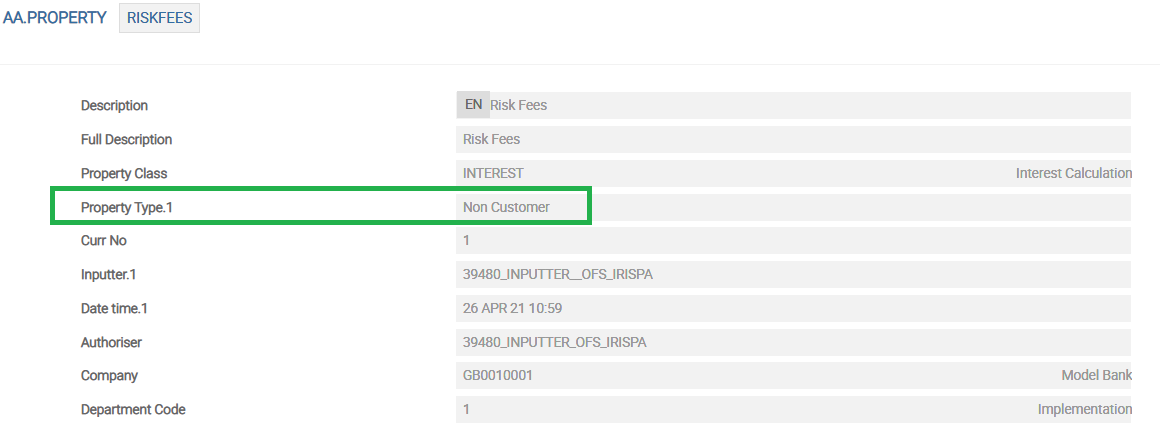

To define a fees or margin as a NCFI property, the Interest Property Type should be set as NON CUSTOMER as shown below.

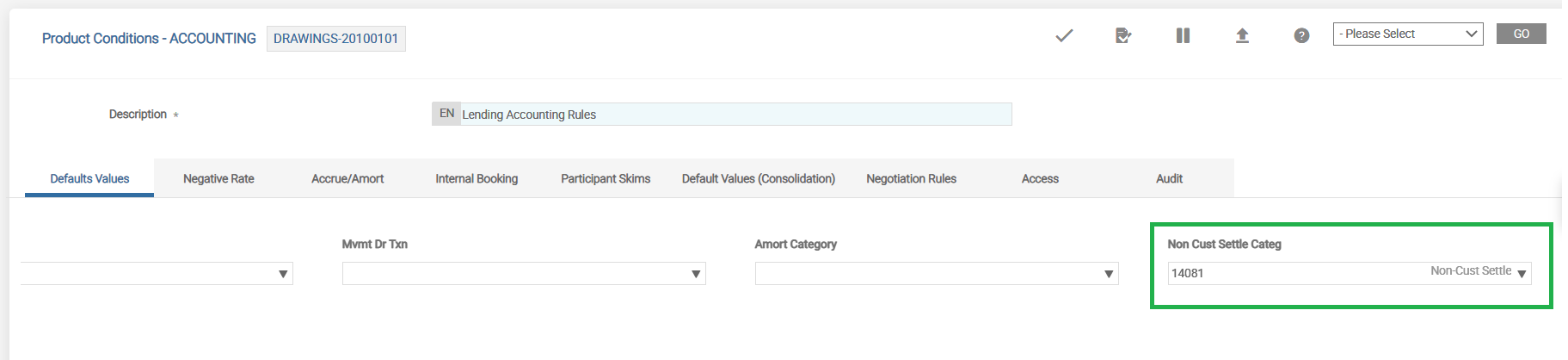

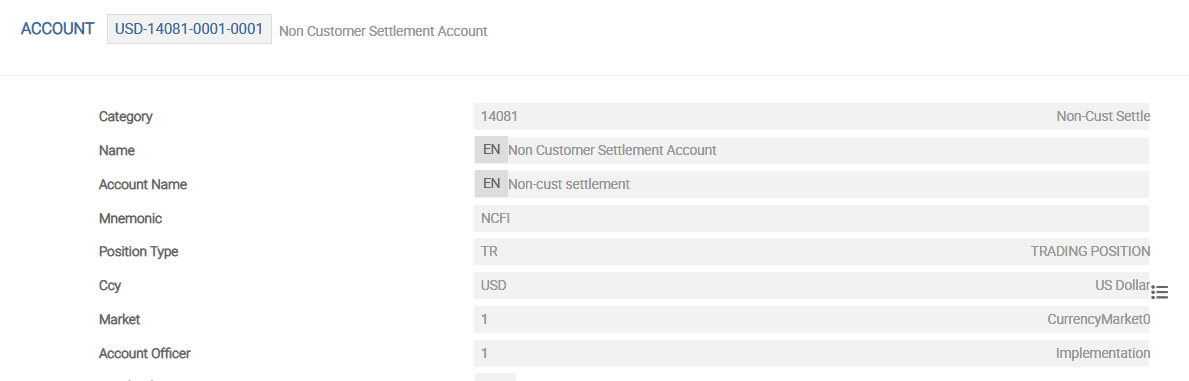

- The Non Cust Settle Categ or PC Non Cust Settle Categ attribute, in Accounting Product Condition, allows the user to define the Internal/PL category against which the due or pay type NCFI needs to be settled.This step is mandatory if the product involves a NCFI property.

- The user has to also create an internal account for the category defined, currency wise, to settle the NCFI.

- As NCFI are internal to the bank,

- Mnemonic cannot be set to capitalise or deferred.

- An internal or PL category needs to be specified in the Accounting condition of the product.

- The type of bill raised is, Internal.

- NCFI can either be made due or set as payable, with the help of Payment Schedule Property class.

- Once the bills are generated, they are settled automatically with the help of the Non Cust Settle Categ defined in Accounting Product Condition. The status of the bill is moved to SETTLED. If the bill is a:

- Due Bill - The account belonging to that category is debited and the bill is settled. A separate transaction like funds transfer, has to be done to receive the amount from the respective non-customer, and credit it to the non-customer settlement category account.

- Pay Bill - The account belonging to that category is credited and the bill is settled. A separate transaction like funds transfer , has to be done to payout to the respective non-customer from the non-customer settlement category account.

- The limitation of NCFI is that it can be setup only through Payment Schedule Property class.

When the interest property is a forward-dated property and when there is a change in the floating-rate used in the arrangement, the system triggers the Activity Class <Product Line>-APPLY.RATE-INTEREST to create a forward-dated interest condition. This is effective from the future effective date of the BI record, that is, the date on which the rate has to take effect.

The system uses the ‘Activity Class <Product Line>-APPLY.RATE-INTEREST’ to differentiate the regular interest rate change activity and the special processing that is done for creating a forward-dated condition while applying the new rate.

The benchmark indices such as LIBOR, EURIBOR, etc. are released everyday and the rates are updated in Transact. The periodic interest rates of contracts attached to these benchmark indices which have their interest reset frequency on that day must be repriced with the new rates either online or during COB at the end of the day. In case of online repricing of interest rates, banks prefer the reset to happen immediately when the respective index rates are uploaded in Transact irrespective of the other indices. For example, if the LIBOR rates are uploaded every day at 10 A.M. and the EURIBOR rates at 11 A.M, then the online interest rate reset for all the contracts which follow the LIBOR and EURIBOR index has to happen at 10 A.M. and 11 A.M. respectively.

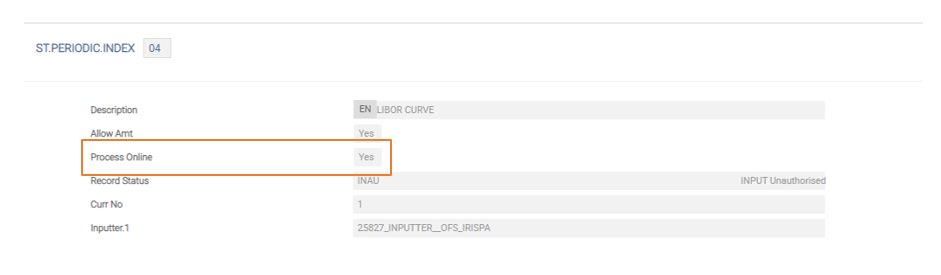

- ST.PERIODIC.INDEX acts as an index for the PERIODIC.INTEREST table. The ID for the index can be a number and can hold any value from 00 to 99.

- The Process Online field in ST.PERIODIC.INDEX table is set as Yes to enable intraday periodic repricing.

The value entered in the Process Online field cannot be changed once it is set. For this reason, if the user prefers to have two contracts using same reference rate indices(one with online rate repricing and the other without it) the user must create two separate indices for the same benchmark rates.

The value entered in the Process Online field cannot be changed once it is set. For this reason, if the user prefers to have two contracts using same reference rate indices(one with online rate repricing and the other without it) the user must create two separate indices for the same benchmark rates. - User must run the service ‘AA. ONLINE.INTEREST. RESET’ to enable the intraday periodic repricing online.

- The bank creates a separate batch and service to use separate services to reprice its LIBOR and EURIBOR contracts.

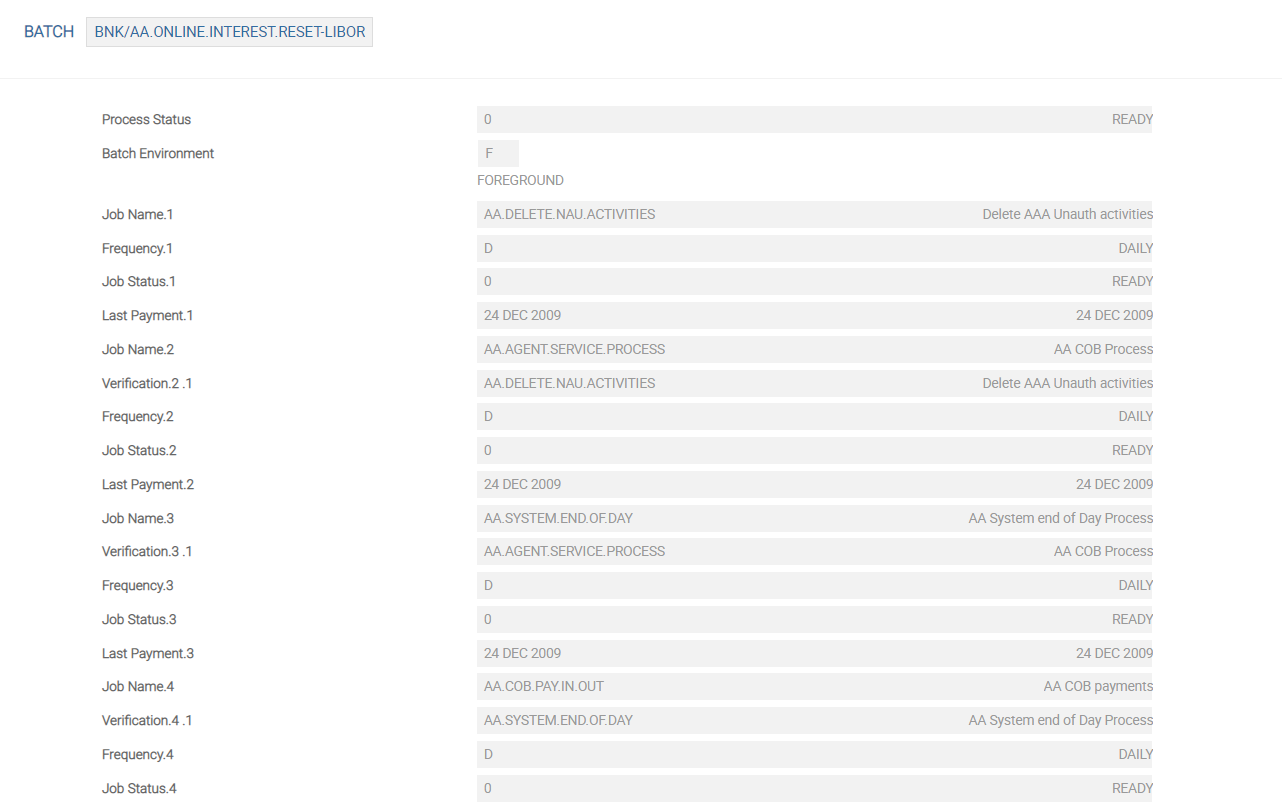

The banks can create a batch record called AA. ONLINE.INTEREST. RESET-LIBOR in the BATCH application for repricing the LIBOR contracts and can create a batch record with another name AA. ONLINE.INTEREST. RESET-EURIBOR for repricing the EURIBOR contracts.

The user can set the name of the batches.

The user can set the name of the batches. - The system creates a service in TSA.SERVICE once a BATCH record is created.

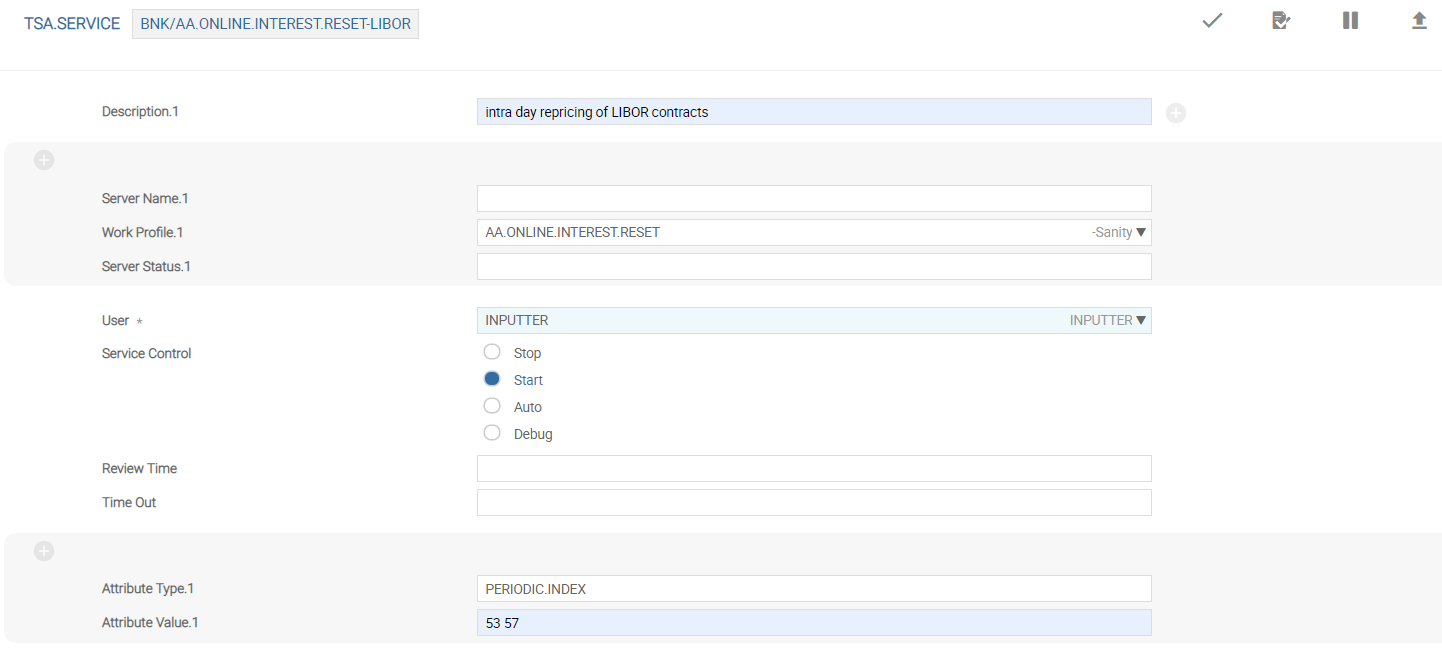

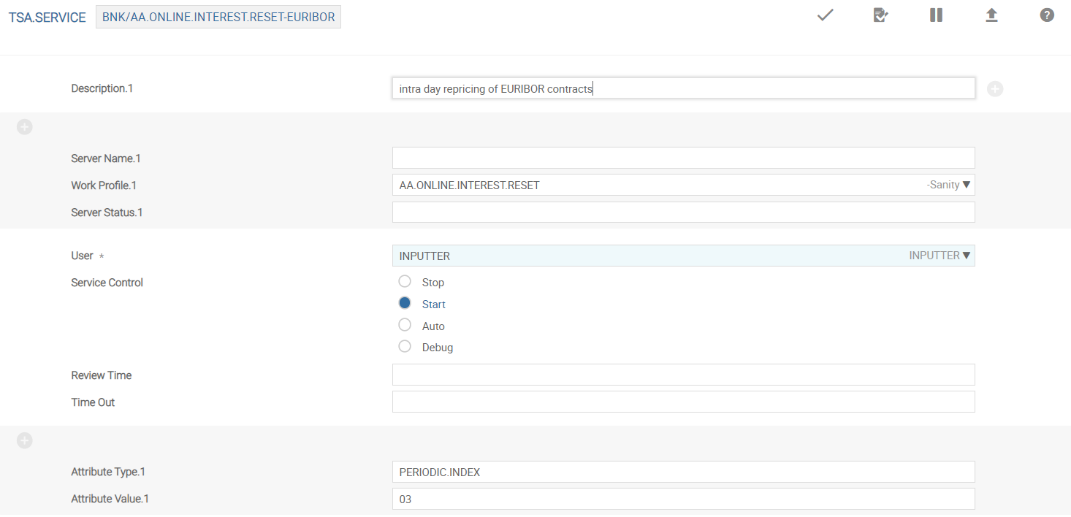

- The services created in TSA.SERVICE for online interest reset and the corresponding batch record created previously should have the same name that is, in the above example a service called AA.ONLINE.INTEREST.RESET-LIBOR and AA. ONLINE.INTEREST.RESET-EURIBOR is created for resetting the LIBOR and EURIBOR indices respectively).

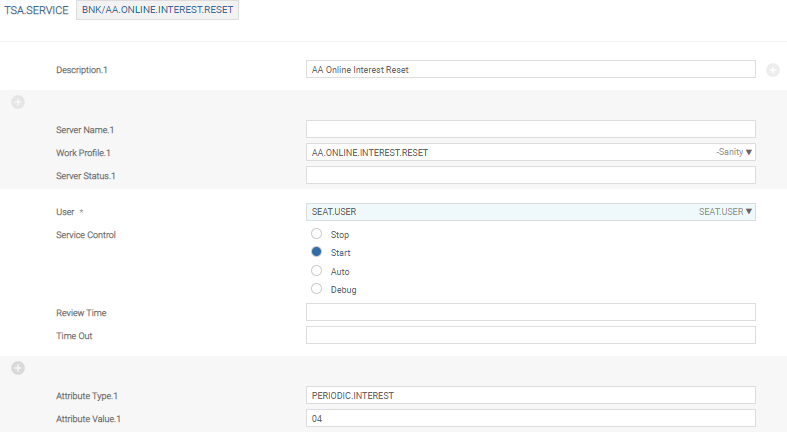

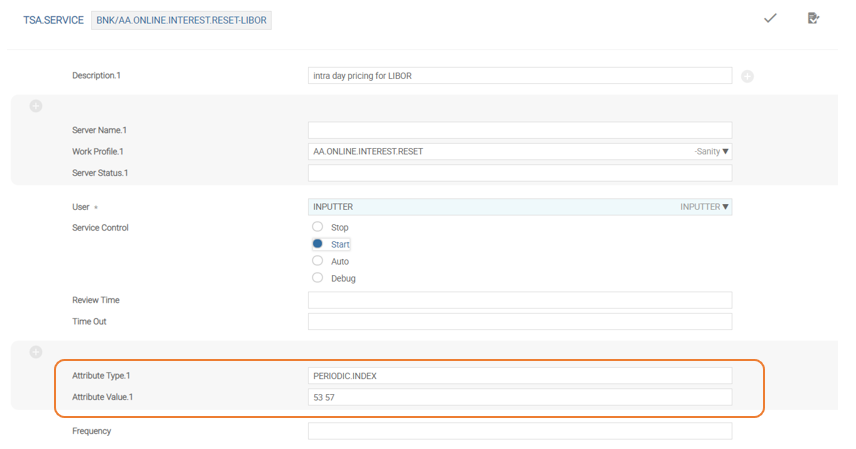

- TSA.SERVICE has two fields to define the parameters for rate revision.

- Attribute Type stores the parameter name which is unique to that TSA.SERVICE. For interest reset, the field is set as PERIODIC.INDEX.

- Attribute Value stores the value of the corresponding parameter defined in Attribute Type. This field has the index number for the periodic index. Only those indices whose value are defined in this field have their interest rates repriced when the service is runThe Process Online field in ST.PERIODIC.INDEX is as Yes for online reset of interest rates, else the rates are reset during COB even if the index value is mentioned here.

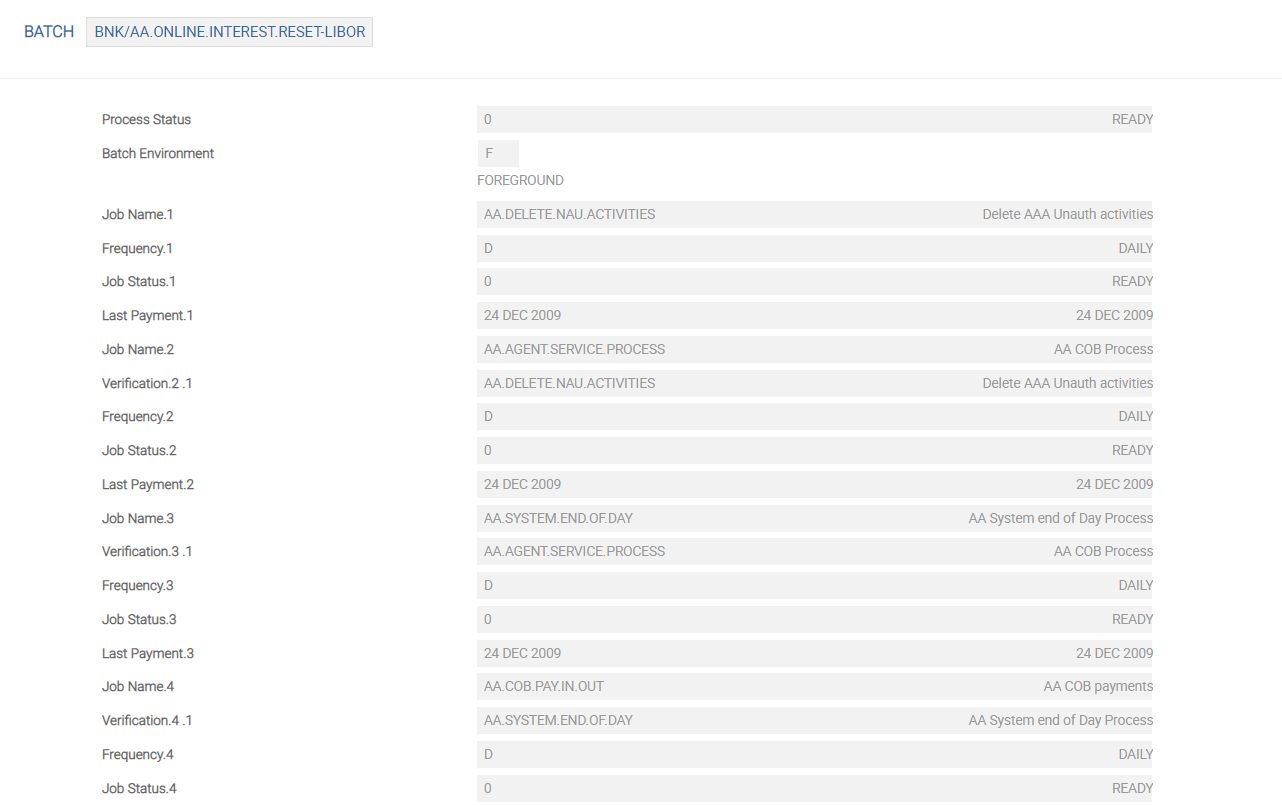

- Multiple index values can be given by separating the values with a space. The screenshots below shown an example 53 57 for denoting two LIBOR indices and 03 for an EURIBOR index.

- The system automatically picks up all the contracts which are set for online interest reset (irrespective of the index value) for repricing if the Attribute type and Attribute Value fields are left blank.

- Intra-day Periodic Repricing allows the bank to reset and fix the periodic interest rates for the loan contracts both ONLINE and during COB.

- For all the arrangements where the interest properties need to be reset online (the benchmark index has the Process Online field set to ‘Yes’), the Process Online field in AA.ARRANGEMENT is updated. It is a system updated field and shows the name of the interest properties for which the rates are to be repriced online.

- If the arrangement does not have any interest properties for which the rates are to be repriced online, Process Online won’t show up in AA.ARRANGEMENT.

- TSA.SERVICE allows the bank to reset and fix the periodic interest rates of the loan contracts online, based on their respective indices. When the rates are set to be repriced online, all the contracts for which the rates are to be repriced on that day are updated with the new interest rates when the respective benchmark rates for that day are input in Transact.

- When the new benchmark rates are input in Transact, the respective service in TSA.SERVICE runs online. The service can be scheduled or run manually as per the requirement of the bank.

Consider the following example where the bank chooses to reset the interest rates (online) of all the contracts which follow the LIBOR indices namely 53 and 57.

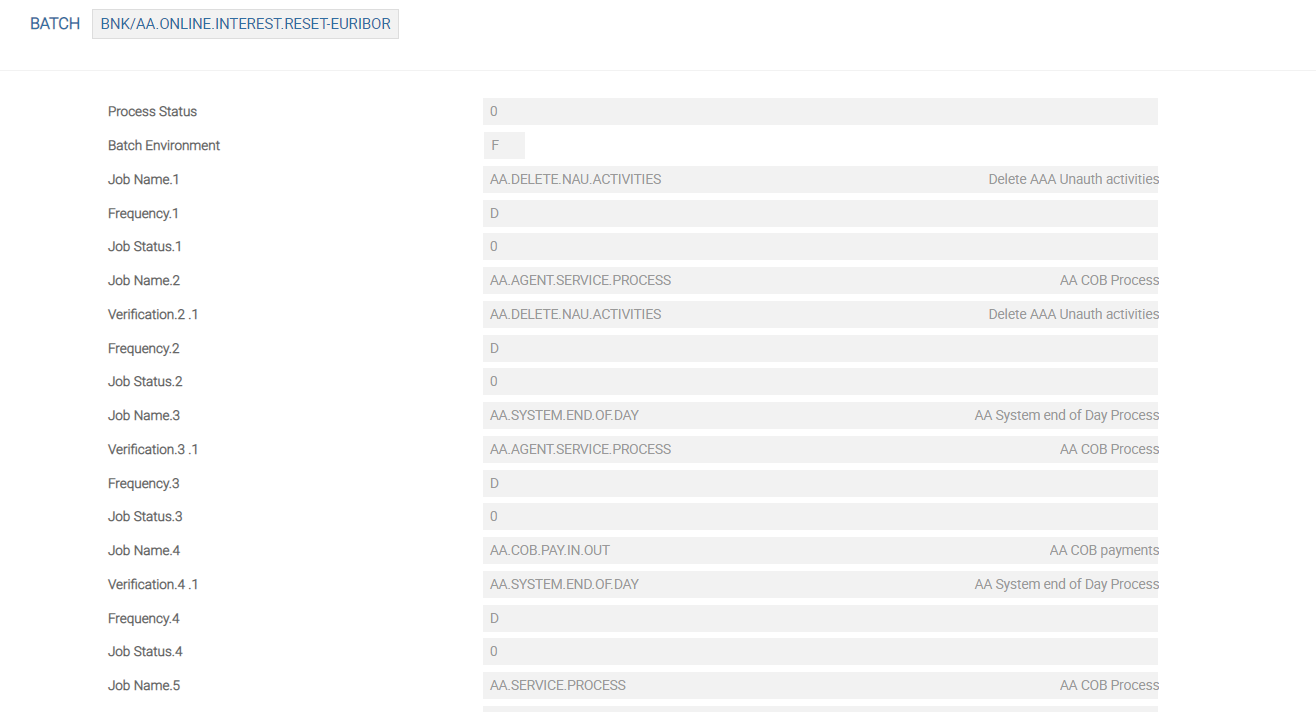

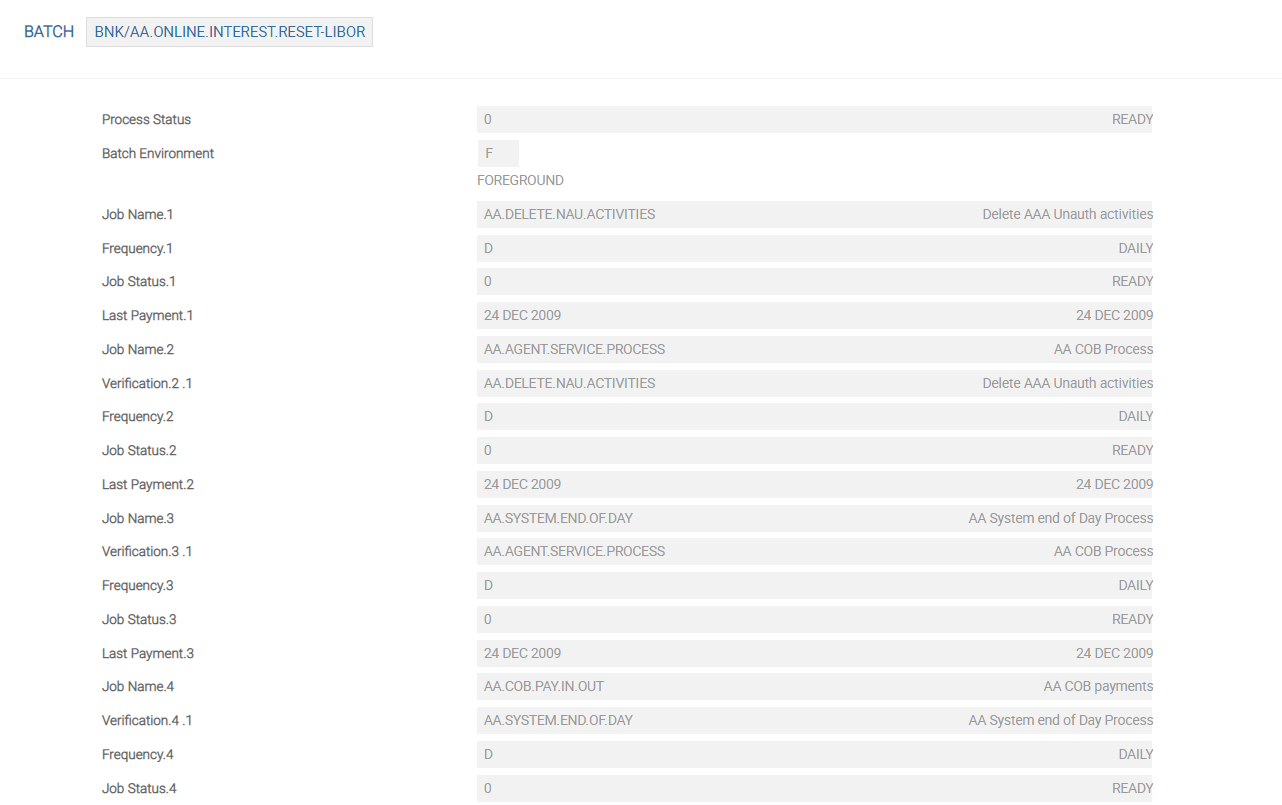

- The bank creates a batch record in the BATCH application. The name of the BATCH record can be XXX/AA.ONLINE.INTEREST.RESET-LIBOR where XXX denotes the company code. The screenshot below shows a batch record named BNK/AA.ONLINE.INTEREST.RESET-LIBOR being created.

- A service with the same name as the batch record must be created in TSA.SERVICE. The screenshot below shows the service name as BNK/AA.ONLINE.INTEREST.RESET-LIBOR , the Attribute Type field set as PERIODIC.INDEX and the Attribute Value field set as 53 and 57 (indices values).

The user can multi-value the Attribute Type field to give the indices one by one or the user can define multiple indices at once in the Attribute Value field by using a ‘space’.

The user can multi-value the Attribute Type field to give the indices one by one or the user can define multiple indices at once in the Attribute Value field by using a ‘space’.

When this service runs, the system resets(online) the interest rates of all the arrangements following the LIBOR indices 53 and 57 which have their interest reset frequency as that day.

The bank creates a batch and service with the name XXX/AA.INTEREST.RESET.ONLINE-EURIBOR to reset all the contracts which are set be repriced online and those that follow the EURIBOR index with the respective indices in the Attribute Value field.

Banks use this option when the bank wants to define different interest rates in a contract and to choose the highest or lowest rate among the defined rates to calculate the interest. The calculation of the highest or lowest rate can include the pricing spread based on the configuration. The available options are:

- Highest

- Lowest

Archival of Interest Accruals

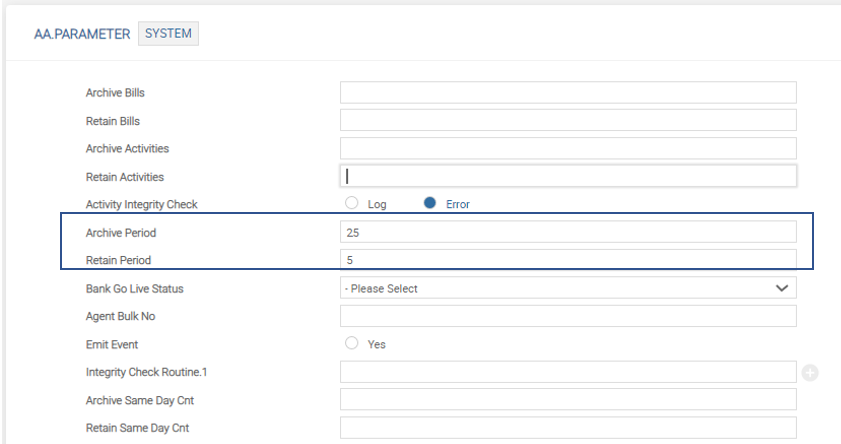

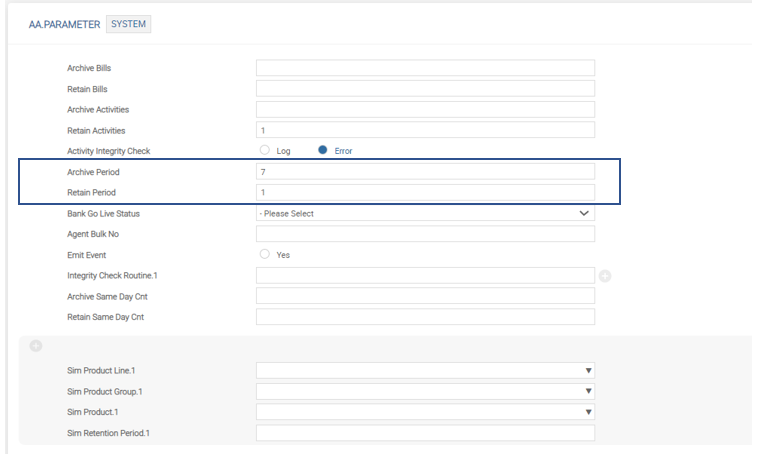

Banks can archive the interest accruals to improve the performance of the system by configuring the following attributes in the AA.PARAMETER table:

- Archive Period (ARCHIVE.PERIOD) - This field denotes the threshold value for the Period Start and Period End set of values that are to be moved from AA.INTEREST.ACCRUALS application to AA.INTEREST.ACCRUAL.HIST table. As an example, if the value stated in this field is 25, when the Period Start count in the AA.INTEREST.ACCRUALS record has crossed 25, it marks the table for archiving. The archiving process is run as a part of the AA.ARCHIVE.SERVICE service, which can be triggered either online or during COB. When this service is run, the system moves the 25 Period Start and Period End set of values along with their corresponding From Date and To Date set of values to the AA.INTEREST.ACCRUAL.HIST application.

- Retain Period (RETAIN.PERIOD) - This field indicates the number of Period Start and Period End set of values that need to be retained in the AA.INTEREST.ACCRUALS table, when the archiving is performed .It prevents the AA.INTEREST.ACCRUALS table from getting empty by retaining a certain number of Period Start and Period End set of values in the live table (AA.INTEREST.ACCRUALS). As an example, the user may prefer to archive when the Period Start and Period End count is greater than 25 (set in Archive Period field). But, they user may choose to retain the last 5 Period Start and Period End set of values along with their respective From Date and To Date set of values, so that there is some residual content in the live table and it is not completely empty.

In this case, after 31 periods the system archives 26 periods and retains five periods.

- The system raises an error when the Retain Period value is greater than Archive Period value.

- If Archive Period is set, then Retain Period must be set to at least 1. There is no error validation for this setup. But this configuration should be done to ensure that the interest accruals live record is not completely empty.

- If Archive Period is set and Retain Period is left blank, then the system automatically defaults the value in the Retain Period to 1.

- Both these fields are not no-change fields. They can be modified at a later stage as well. In such cases, the already archived records are left undisturbed.

- The archival process for interest accruals can be done only for arrangements with multiple schedules (that is, multiple Period Start and Period End entries) and not arrangements with only one schedule (till maturity). This is because at least the current period (Period Start and Period End) should be available in the live interest accruals record.

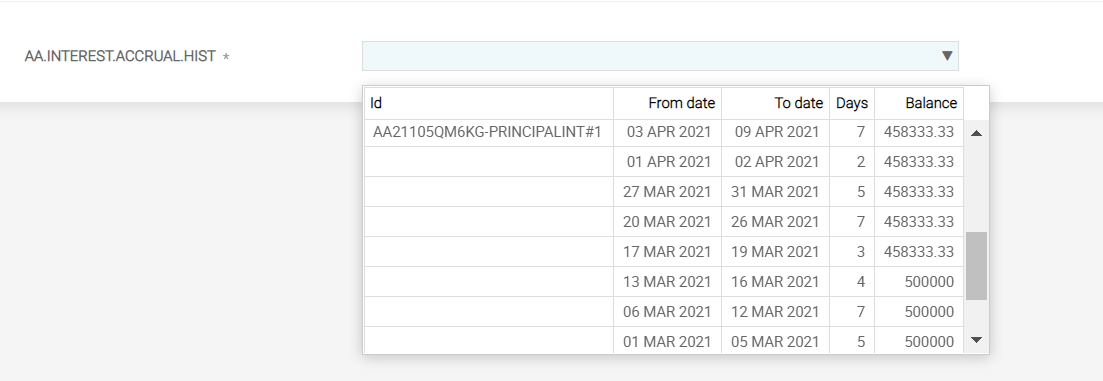

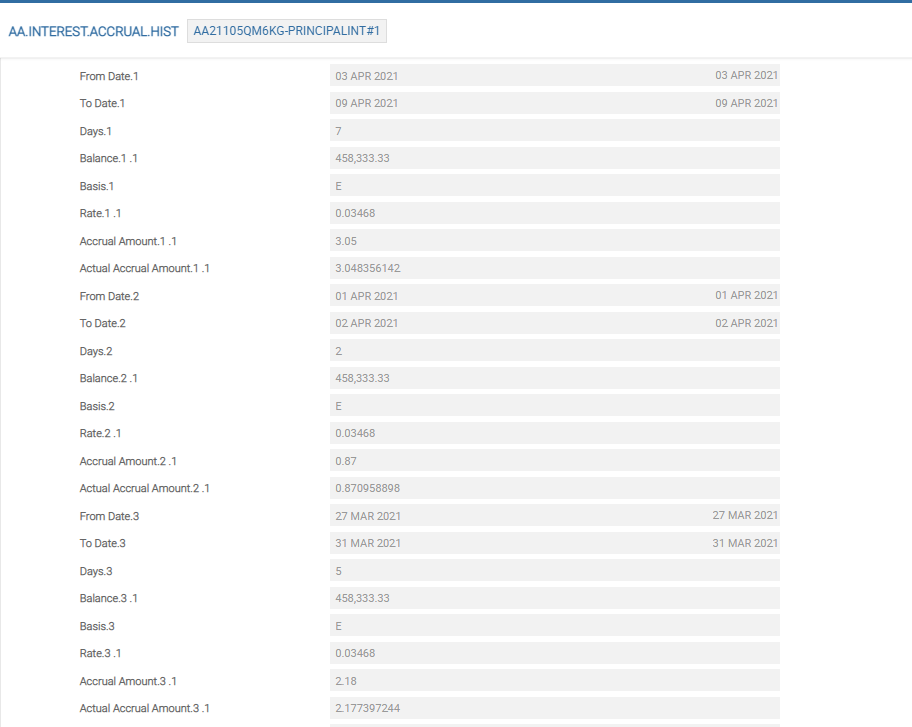

- For each archival, the system creates a unique ID in the AA.INTEREST.ACCRUAL.HIST table and the format of this ID is: <AA.INTEREST.ACCRUALS record ID>#n, where n denotes the sequence number of the archival process.

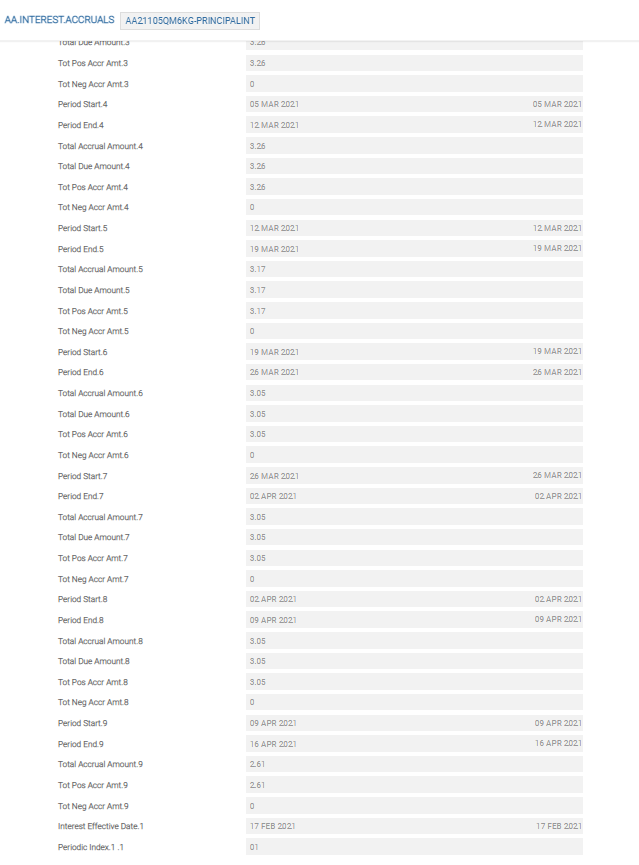

In the illustration given below, the Archive Period is set to 7 and Retain Period is set to 1.

In this scenario, the archival takes place only when there are nine Period Start and Period End set of values in AA.INTEREST.ACCRUALS. This is because Retain Period is set as 1. The threshold for archival is seven. On the eighth Period Start and Period End entry, the number of entries that can be archived effectively is 8-1=7. Therefore, the threshold limit for the archival to take place is yet to be exceeded. Only when there are nine Period Start and Period End set of values, the threshold limit exceeds (as the effective number of Period Start entries to be archived is 9-1=8).

The following screenshot shows the AA.INTEREST.ACCRUALS before the archival takes place and it can be seen that there are nine Period Start and Period End set of values.

After the archival service (BNK/AA.ARCHIVE.SERVICE) is triggered either online or during COB, the system archives the Period Start and Period End set of values with their corresponding From Date and To Date set of values in the AA.INTEREST.ACCRUAL.HIST application.

The system retains the last one Period Start and Period End set of values with their respective From Date and To Date set of values in the AA.INTEREST.ACCRUALS application.

Add Interest Property to Existing Arrangements

The financial institutions can add the Interest property to the existing arrangements of the Accounts, Deposits, and Lending product lines using the Add New Property, New Prop Avl, and New Prop Avl Date fields in AA.PRODUCT.MANAGER.

Read Add New Property for more information on the configuration.

Periodic Attribute Classes

| Attribute | Description |

|---|---|

| Maximum Rate | The maximum rate for life |

| Minimum Rate | The minimum rate for life |

| Rate Decrease | The rate decrease tolerance value |

| Rate Decrease 1y | The rate decrease per year |

| Rate Increase | The rate increase tolerance value |

| Rate Increase 1y | The rate increase per year |

Actions

Individual AA.PROPERTY.CLASS.ACTION records control which Product Line it’s associated to.

The INTEREST Property supports the following actions:

| Action Name | Description |

|---|---|

| ACCRUE | This action can be initiated by the system or manually as part of the ACCRUE-INTEREST Activity. This results in calculation of the accrued interest amount to the requested effective date and the generation of accounting entries. |

| ADJUST | This action can be initiated by the system. This results in calculation of the accrued interest amount to the requested effective date and the generation of accounting entries |

| ADJUST.BILL | Used to adjust the bills for the applicable Interest. |

| ADJUST.PERIODS | To adjust the Interest applicable for the underlying product line. |

| ADVANCE.RESET | To pre-define the frequency for the periodic interest rate reset. |

| AGE.BILLS | Used to age the applicable Interest that are overdue. |

| ALLOCATE | It updates the bills when the underlying activity is triggered. Based on the interest amount the outstanding bill amounts and status would be updated. |

| ALTERNATE | The accrual is suppressed for the Property for which it is set and the accrual happens for the alternate property which is set in Activity Restriction. |

| CAPITALISE | This can be initiated by the system. This results in calculation of the accrued charges to requested effective date and generation of accounting entries. |

| CAPTURE.BILL | Used to capture the Interest details on the bills. |

| CHARGEOFF | Used in the charge-off action on the Interest component. |

| CHECK.PROJECTION | To check for the accrual projection of the Interest component online. |

| CREDIT | This action applies the unallocated amount from a credit to the arrangement to the unallocated credit balance of the arrangement. |

| DATA.CAPTURE | This action is used in capturing the information on Interest when records are migrated from Legacy to AA. |

| DEBIT | This action applies the unallocated amount from a debit to the arrangement to the unallocated debit balance of the arrangement. |

| DEFER.CAPITALISE | Defer the capitalisation of the accured Interest. |

| DEFER.MAKEDUE | Defer the make due of the accrued interest. |

| LINK.UPDATE | To specify the Interest Property of the linked arrangement that should be referred for getting the Interest rate. |

| MAINTAIN | To maintain the Interest component of Source and Target for the Bundle product. |

| MAKE.DUE | This action applies the amount of interest due to be repaid to the DUE interest property. The amount to be made due is determined from the associated BILL that is being made due. |

| MOVE.BALANCE | Action routine to move the PAY interest balance to an internal account. |

| PAY | For the Payout of the Interest component. |

| PAYOFF.CAPITALISE | To capitalise the interest payoff. |

| PERIODIC.RESET | This action is used for the periodic reset of the Interest rates. |

| PROJECT.ACCRUE | Used to project the accrual of the applicable interest. |

| REPAY | This action allocates the amount of interest to be repaid to the appropriate account balance. Depending on the PAYMENT.RULE applied the interest is made against billed or current amounts. |

| RESUME | To resume the accural and capitalisation of the Interest component. |

| SUSPEND | Suspend the accrual and capitalisation of the interest component. |

| UPDATE | This action is initiated manually and allows the user to change any of the INTEREST attributes. This action is initiated as part of the NEW-ARRANGEMENT and UPDATE- INTEREST Activities. |

| UPFRONT.PROFIT | To collect the applicable interest amount at the beginning of the underlying contract. |

Accounting Events

The following actions generate accounting events as defined in the Attribute Accounting attribute.

- ACCRUE

- ADJUST

- CAPITALISE

- DEFER.MAKEDUE

- DEFER.CAPITALISE

- MAKE.DUE

- REPAY

- SUSPEND

- RESUME

- DEBIT

- CREDIT

- CAPTURE.BILL

- ADJUST.BILL

- PAY

- PAYOFF.CAPITALISE

Limits Interaction

For an arrangement under the ACCOUNTS Product Line, it is possible to link the first tier amount of debit interest to the LIMIT record attached. It can be achieved by setting the Refer Limit attribute in the INTEREST Property Condition to YES. This functionality can be enabled only if the LIMIT is managed by AA.

In this topic