Charge Off

Banks can charge off the principal balance of a loan for a variety of reasons. Banks examine the loans and determine if a borrower is at high risk and if loan repayment is deemed ‘doubtful’ and/or the loan is under collateralized. In these situations bank charge off the loan principal.

This can be a partial charge off, a series of partial charge off transactions, or a total charge off. The loan may or may not be in non-accrual status when processing a partial charge off.

The customer is also unaware that his loan has been charged off; the customer’s loan record remains intact and payments are processed accordingly.

Product Lines

The following Product Lines use the Charge Off Property Class:

- Lending

Property Class Type

The Charge Off Property Class uses the following Property Class types:

- Dated

- Tracking

Property Type

The Charge Off Property Class is associated with the PRODUCT.ONLY Property Type. Properties can be created and maintained by users.

Balance Prefix and Suffix

The Charge Off Property Class is not associated with balance prefix and suffix.

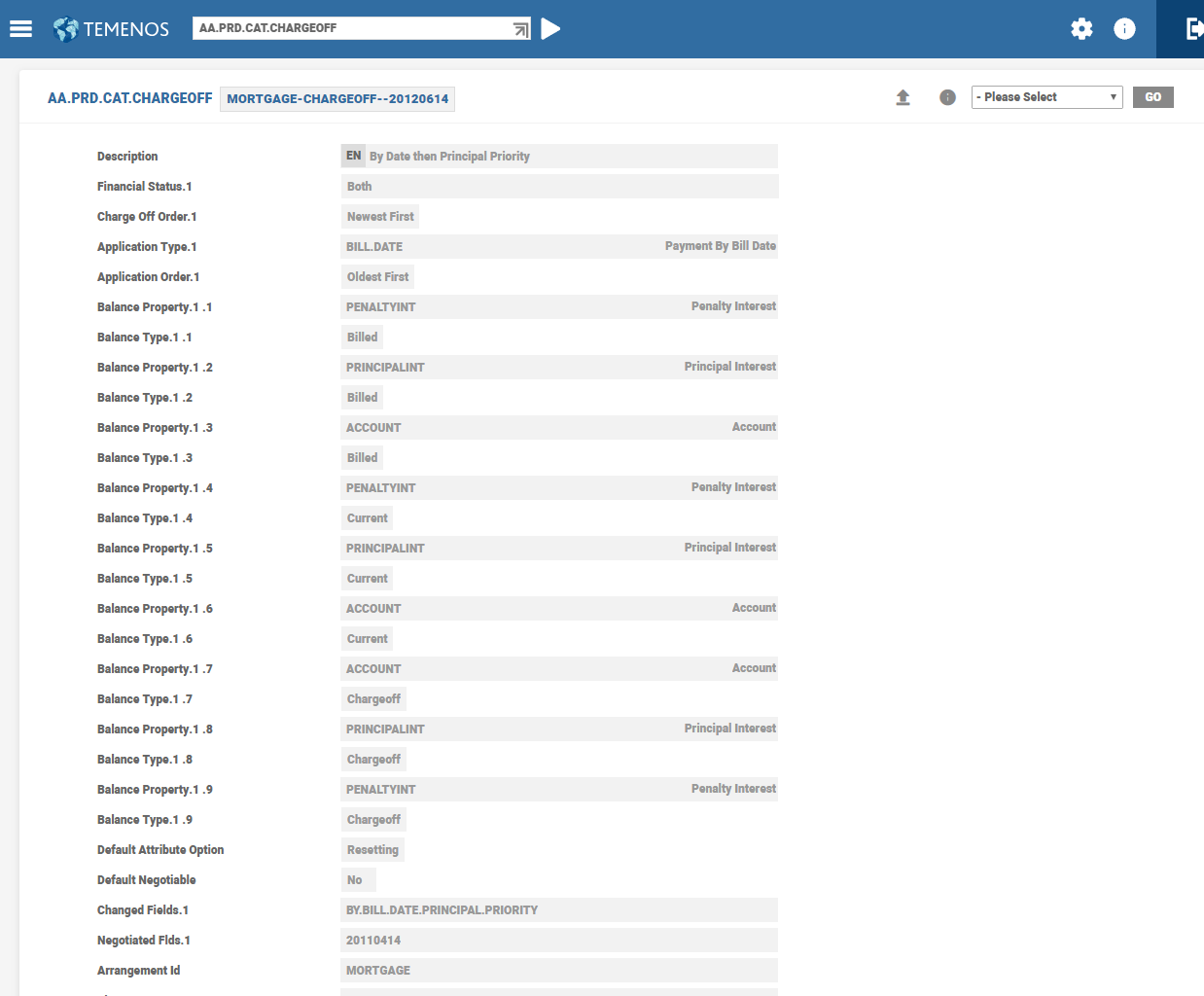

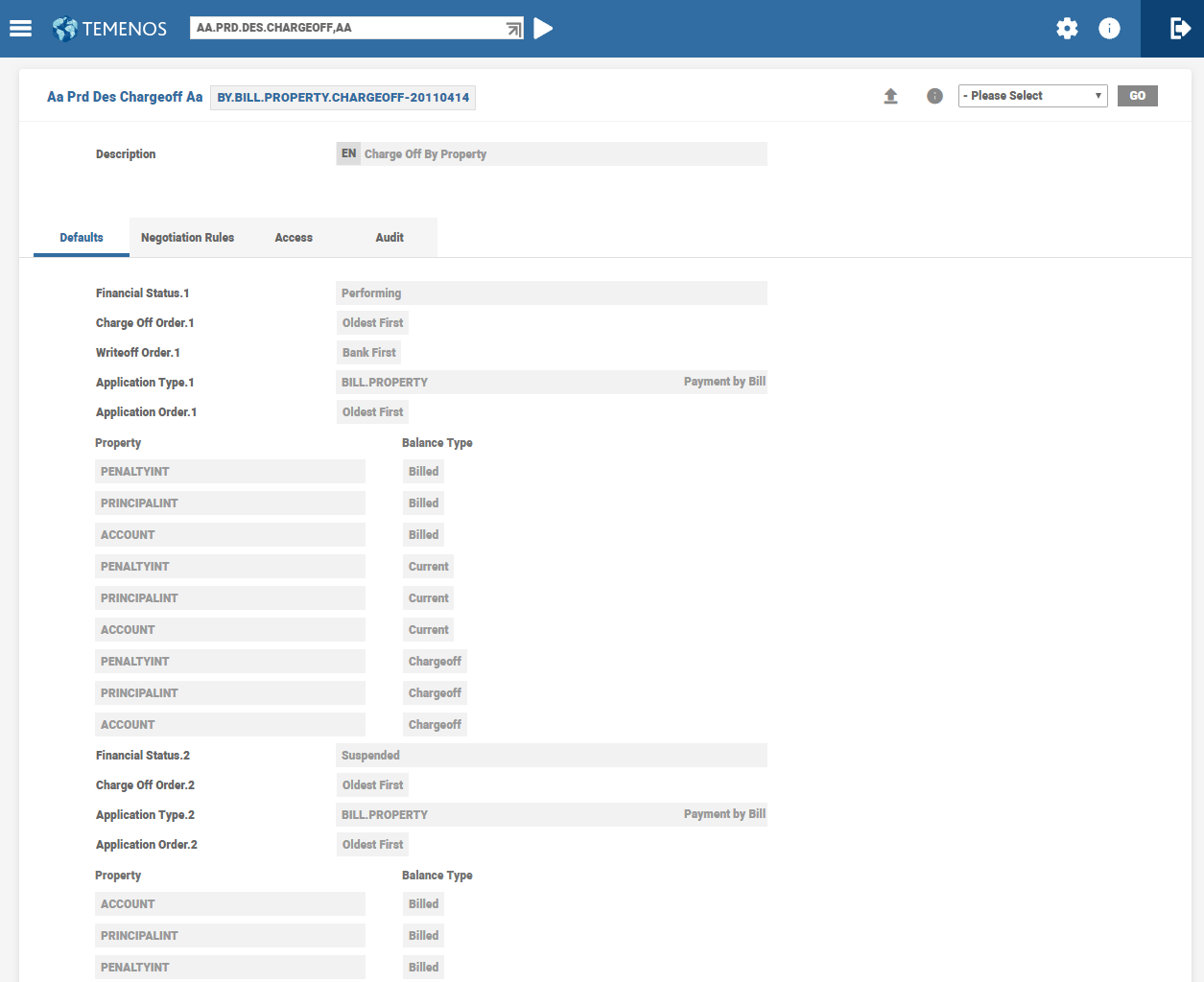

Attribute level explanation of the Product Condition is given below.

Allows the user to specify different credit allocation based on arrangement's financial status, that is, based on arrangement being suspended or not. Available options are:

- Both - Only one credit allocation is applied irrespective of arrangement being suspended or not. If, selected then no other option can be specified.

- Performing - Specifies credit allocation to be applied on the arrangement when it is not suspended. Both is not allowed and system insists to define Suspend if not defined.

- Suspended - Specifies credit allocation to be applied on the arrangement when it is suspended. Both is not allowed and system insists to define Performing if not defined.

When an arrangement is charged-off this attribute specifies the order in which the Arrangement should be charged off. Available options are:

- OLDEST.FIRST – Due or Overdue balances are charged off first prior to Current balances

- NEWEST.FIRST - Current balances gets charged off first prior to Due or Overdue balances

When the Charge Off amount is to be written-off this field provides an option to first write-off the charged-off balance or bank's balance. Available options are:

- BANK.FIRST - Bank balance is first written-off for the write-off amount.

- BANK.LAST - Charged-off is first written-off for the write-off amount.

Allows the user to designate if the banks balances are settled by bill or by Property. Has to be a valid record in AA.PAYMENT.RULE.TYPE

Allows the user to specify the order in which credit allocation has to be applied on the bills. This is similar to the field APPICATION.ORDER in PAYMENT.RULES. Available options are:

- OLDEST.FIRST - Credit allocation starts from oldest bills and move towards latest bill.

- NEWEST.FIRST - Credit allocation starts from latest bill and move towards oldest bill.

Allows the user to specify the Property for which credit allocation to be applied and the sequence is the order in which properties are specified. Only Account and Interest properties are allowed.

Each ACCOUNT Property and each INTEREST Property which exists in the Product must be specified in this multi-valued set twice (once for the Bank balance and once for the Charge Off balance

Allows the user to specify the order of credit allocation on the balance types and the sequence is the order in which balance types are repaid. Available options are:

- BILLED - All of the due or overdue balances are to be settled

- CURRENT - Current Bank balances are to be settled

- CHARGEOFF - Charged off balances are to be settled.

- When a loan is charged-off, the borrower is unaware of this action, and continues to receive his regular billing notices. As a result, when a loan is fully or partially charged off, there is a requirement to maintain two sets of books;

- Customer record (that is, the customer’s view of the balances and bills)

- Bank record (that is, the bank’s view of the balances)

- Prior to a Charge Off, the customer record and the bank record are the same (and therefore there is only one set of books). However once a loan is partially or fully charged off, the views are different.

Customer Record

- Since a customer is unaware of a Charge Off, copying the balances prior to the Charge Off Activity creates a shadow record. This becomes the customer record and does not include any of the effects of the Charge Off.

- Bills and Payments continue to be processed normally against this customer record.

Bank Record

- Existing balances (Customer balance less Charge Off amount) continue to be referred to as the bank record. As the arrangement advances, it also contains the interest accrual for bank balance and charged-off balance separately.

- When a Lending Product with Charge Off Property is proofed and published, the system automatically creates the below balance type records to maintain customer, bank and Charge Off balances. Except bank balances, other balance type records, which are created by the system are of contingent nature.

|

Bank Balances |

Charge Off Balances |

Customer Balances |

|---|---|---|

| CUR<ACCOUNT> | CUR<ACCOUNT>CO | CUR<ACCOUNT>CUST |

| DUE<ACCOUNT> | DUE<ACCOUNT>CUST | |

| <AGE><ACCOUNT> | <AGE><ACCOUNT>CUST | |

| UNC<ACCOUNT> | UNC<ACCOUNT>CUST | |

| ACC<INTEREST> | ACC<INTEREST>CO | ACC<INTEREST>CUST |

| DUE<INTEREST> | DUE<INTEREST>CUST | |

| <AGE><INTEREST> | <AGE><INTEREST>CUST |

The Charge off balances are maintained in CUR<ACCOUNT>CO. This balance type holds the cumulative amount that’s been charged off against an account. ACC<INTEREST> CO is used for posting the accrued interest on charged off balances (CUR<ACCOUNT>CO)

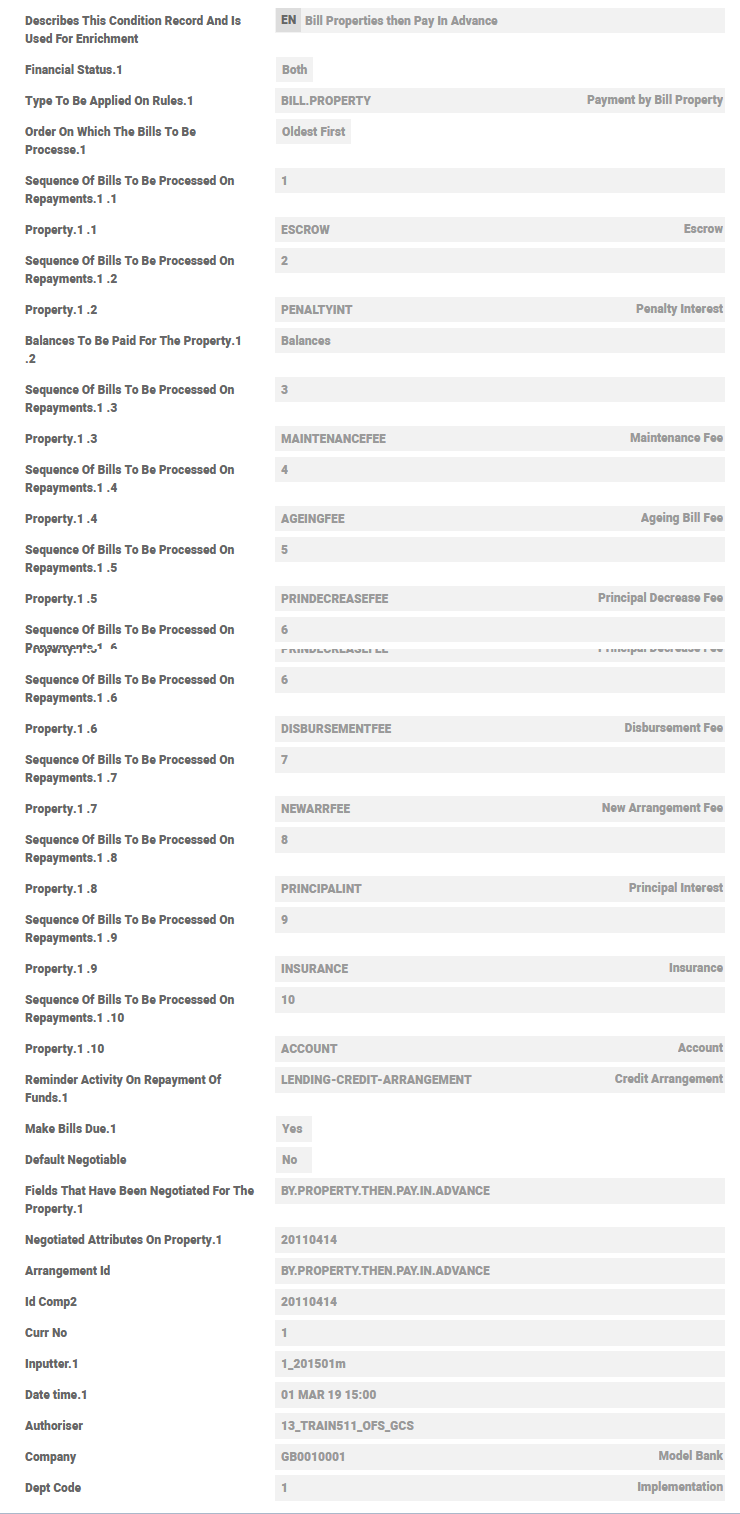

- There can be different payment orders for setting bank balances and customer balances. This is based upon the value of the book balances and the status of the loan (For example, Partially Charged Off, Fully Charged Off or Non-Accrual).

- Payment allocation for customer balances is done based on the definition in payment rules. Bank and Charge Off balances are appropriated based on the definition in Charge Off Property Class.

- Similar to Payment Rules, Charge Off Property Class also allows the user to define the order in which Bank and Charge Off balances need to be appropriated and the order can be defined differently based on status of the loan, that is, Performing or Suspended.

- In addition to the above, the Charge.Off.Order field in Charge Off Property Class allow users to set the order in which Account balances get appropriated upon charging off a Loan.

- Similar to Charge Off, Payment rules Property Class, besides defining the order in which customer balances are to be impacted, allows definition of different orders based on status of the loan.

- With the introduction of both Charge Off (CO) and Customer (CUST) balances, it is necessary to accrue both Charge Off and Customer interest on the corresponding balances separately.

- This implies there are three accrual balances per Interest Property and each accrues interest at the same rate but based upon their balance.

- For example, when ACC<INTEREST> is accrued on CUR<ACCOUNT>, then ACC<INTEREST>CUST is accrued on CUR<ACCOUNT>CUST.

- Though multiple interest accruals are done based on different balances, definition of source balance for each type of accrual is not required.

| Property | Source | |

|---|---|---|

| Configuration | INTEREST | CURACCOUNT |

| Accruals | ACCINTEREST | CURACCOUNT |

| ACCINTERESTCO | CURACCOUNTCO | |

| ACCINTERESTCUST | CURACCOUNTCUST |

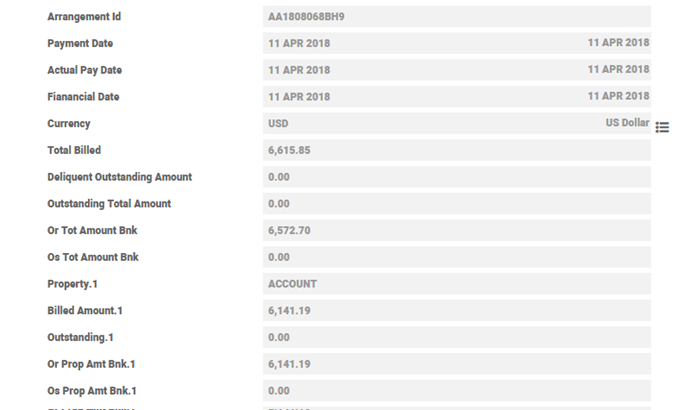

In case, a loan is in Charge Off status, AA.BILL.DETAILS is updated with both the Customer Due Amounts and the Bank Due Amounts. This level of detail is required, as it is used during the dual payment application.

Make Due Accounting

Each time a principal or interest is made due, AA raises entries that credit current balances (that is, CUR<ACCOUNT> and ACC<INTEREST>) and debit due balances (that is, DUE<ACCOUNT> and DUE<INTEREST>). Once a Charge Off has occurred, these debits and credits happen on the Customer Balances (that is, the CUST versions) and Bank balances.

Apply Payment Accounting

Although dual accounting is required for applying a credit to the loan, it is complicated by the fact that a different payment order is required and Charge Off balances need to be credited once the bank balances have been exhausted.

Ageing Accounting

When configured to do so through Overdue Property Class, each time that principal or interest is aged, AA raises entries that credit the existing due or delinquent balances (For Example, DUE<ACCOUNT> or DEL<INTEREST>) and debit the next ageing balance (For Example, DEL<ACCOUNT> and DEL<INTEREST>). Because of this internal accounting (which many other Banking systems do not do), Temenos Transact raises bank entries as well as the customer entries.

Credit or Debit Arrangement Accounting

- When a LENDING-CREDIT-ARRANGEMENT is processed, the amount credited to UNC<ACCOUNT> also credits UNC<ACCOUNT>.CUST.

- When LENDING-DEBIT-ARRANGEMENT is processed, the amount debited from UNC<ACCOUNT> is also be debited from UNC<ACCOUNT>.CUST.

Extra-Ordinary Income

- In case of customer fully repaying the loan, there is a remainder on the loan, due to the lesser bank interest that is accruing as a result of the charged off principal.

- The remainder or difference ends up in the ACC<INTEREST>-CO balance and this amount should be debited and then credit PL (Profit and Loss) as Extraordinary Income.

- This scenario occurs only when the calculation source for the Interest Property is defined as Total Outstanding principalthat is, Current + Due and Age Principal.

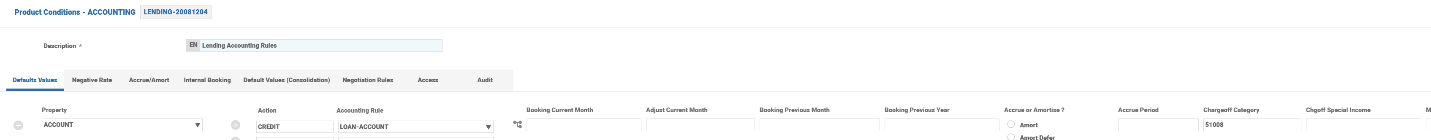

- P&L for extra-ordinary income has to be defined in Chgoff Special Income field of Accounting Property Class.

Product Setup

- Charge Off feature is available for Lending Product Line. The Charge Off Property has to be included in the Product for charging off an account. The LENDING-CHARGEOFF-<Account> Activity is used to do Charge Off.

- Balance types required to maintain customer, bank and charge off balances are automatically created during proof and publish process.

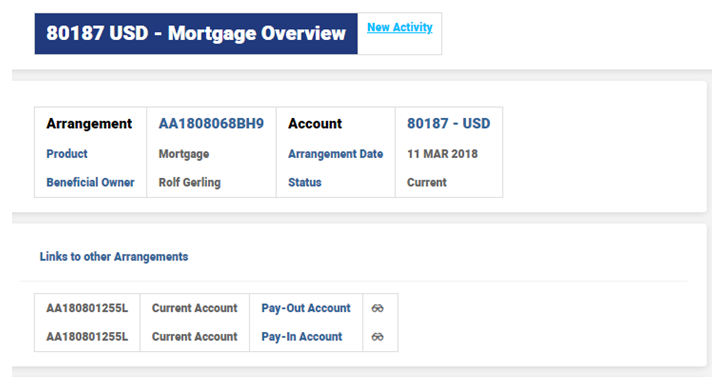

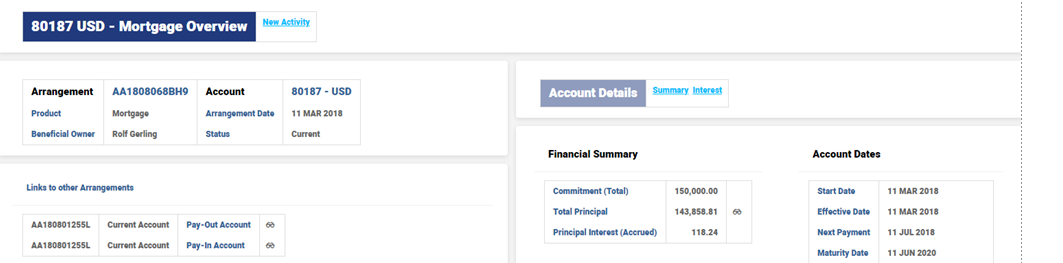

Mortgage Arrangement is created on 11 March for USD 150,000.

Arrangement Date: 11th March

Current Date: 12th April

Charge Off Date: 11th April

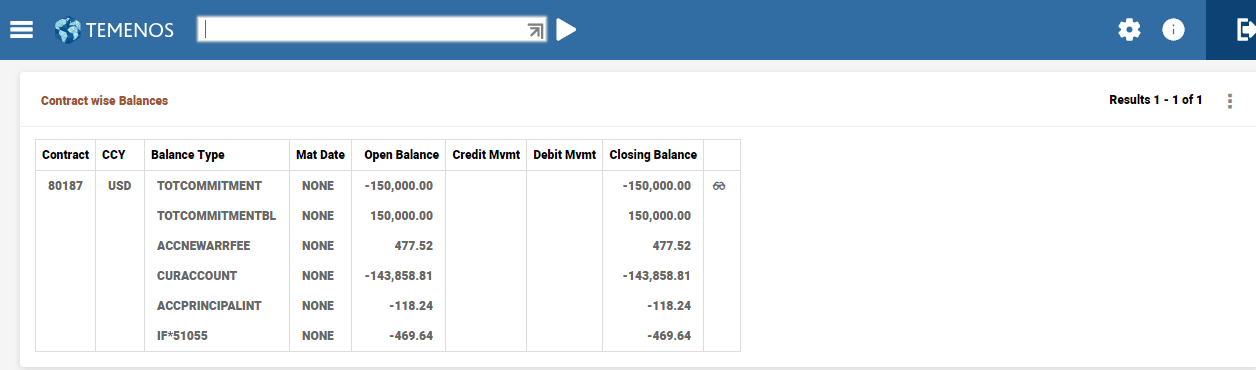

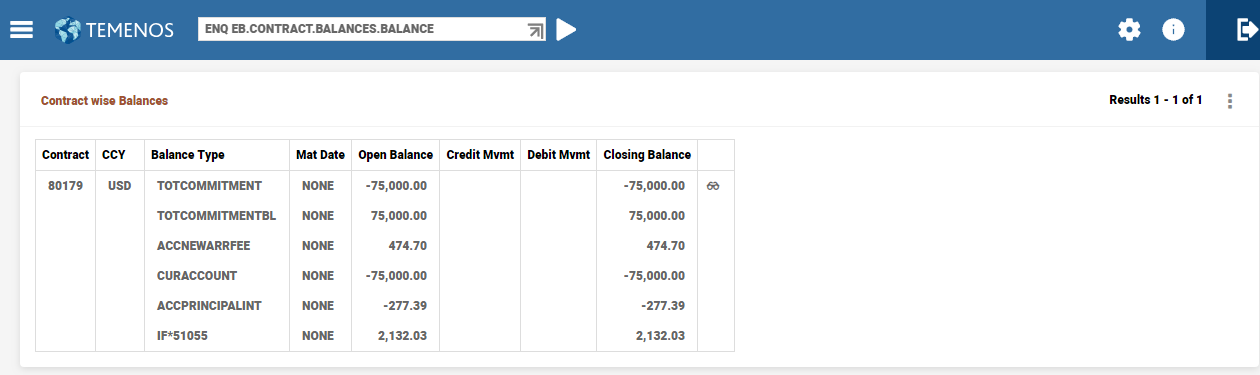

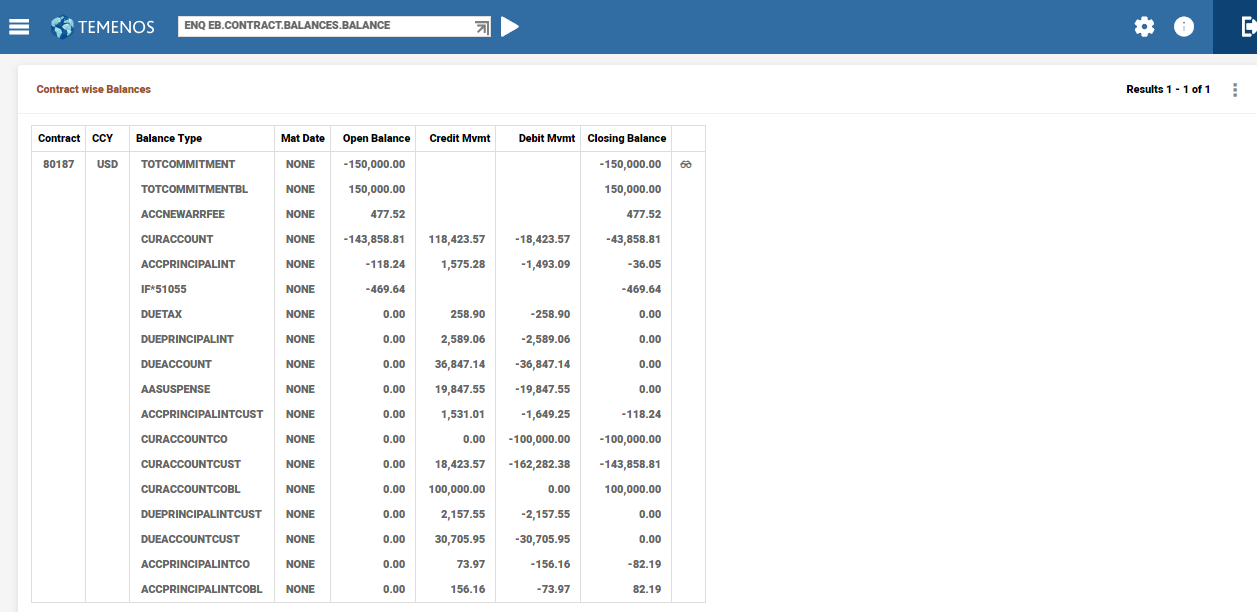

Below screenshot shows the balances before Charge Off. Since Charge Off is not performed, the system maintains one set of balances.

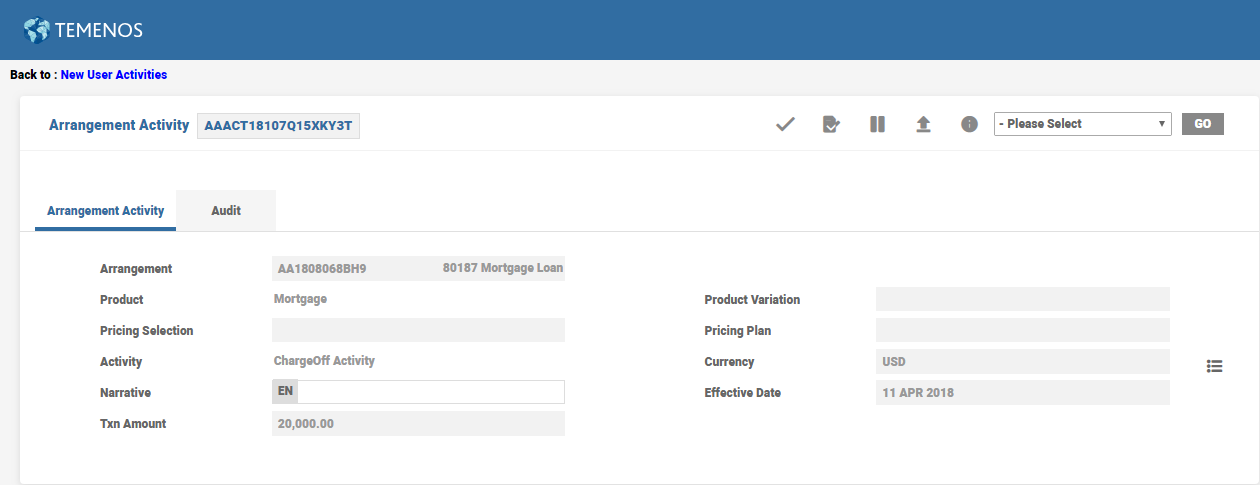

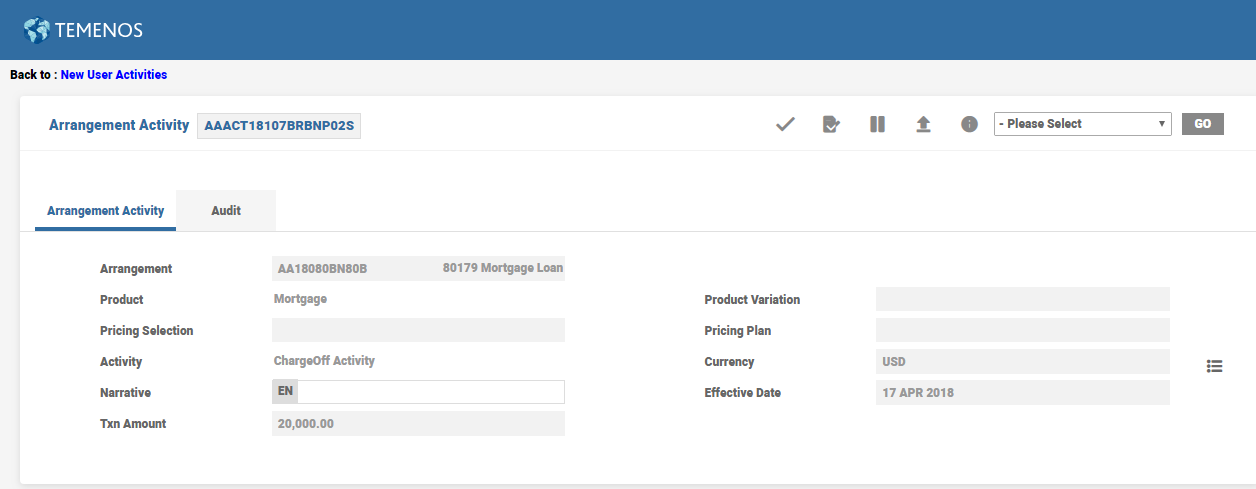

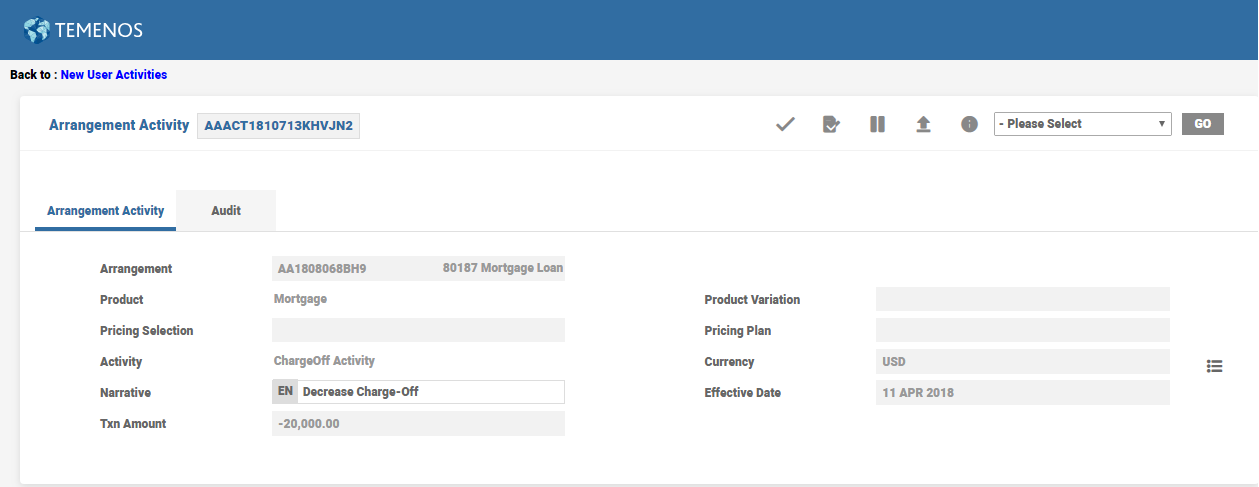

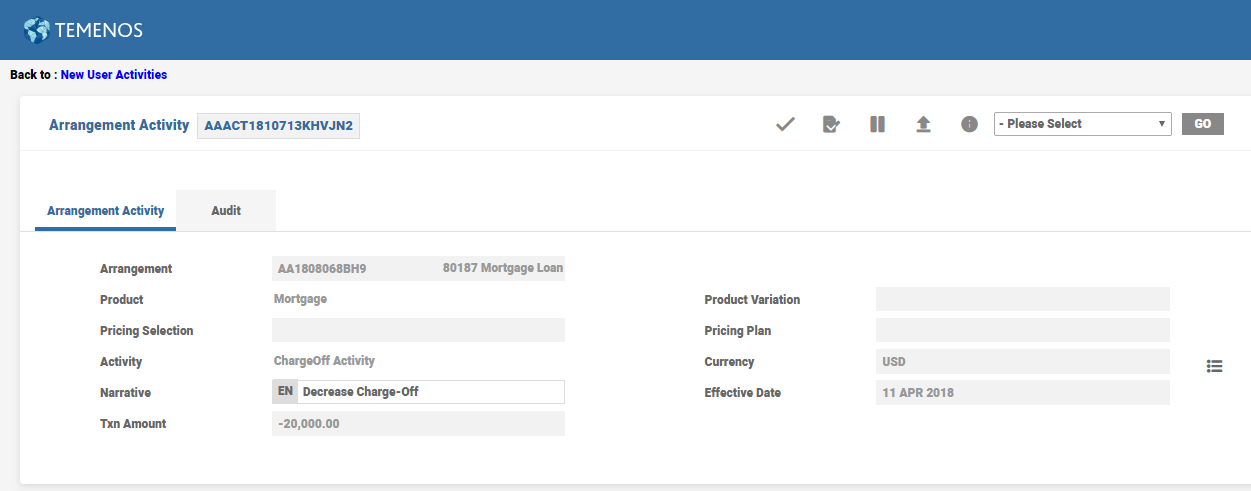

Charge-Off Activity is performed on 11th April for 20,000 USD.

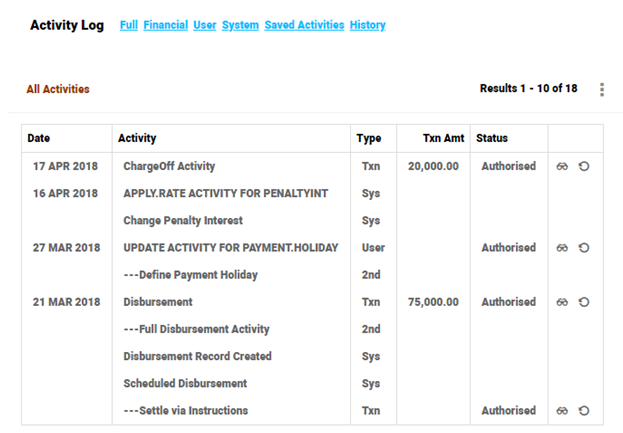

The Activity Log screen is shown below.

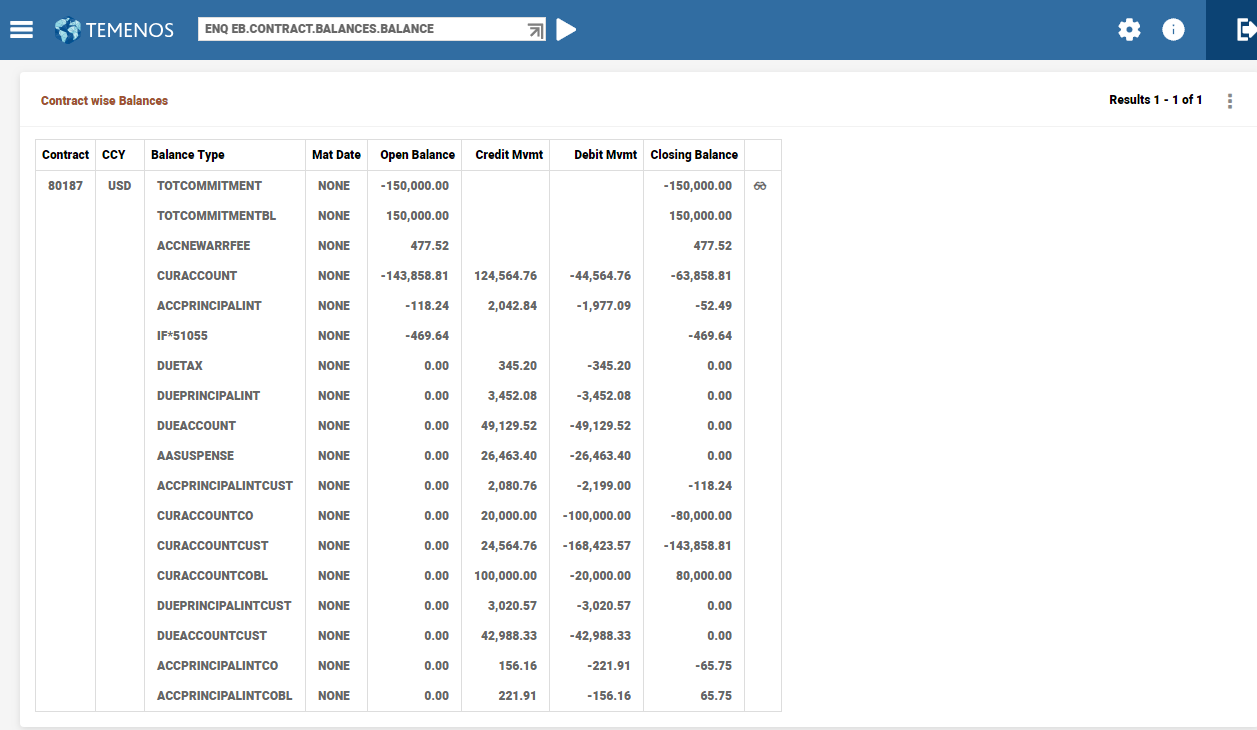

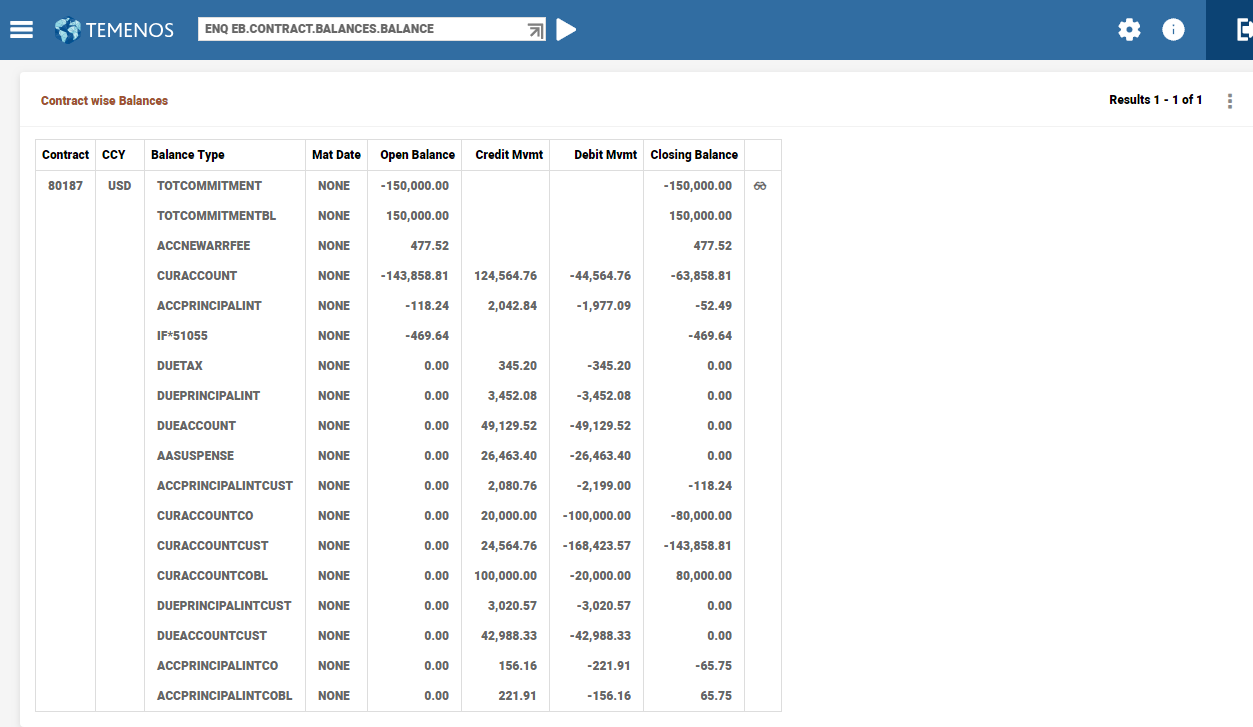

Below screenshot shows the balances after Charge Off done for 20,000 USD.

CURACCOUNT and ACCPRINCIPALINT represent the bank balances.

CURACCOUNTCUST and ACCPRINCIPALINTCUST represent the customer balances and these are merely a copy of the bank balance before Charge Off.

CURACCOUNTCO represents the balance of the Charge Off.

In this example, Charge Off done for 20,000 USD is debited from Charge Off category parameterized in accounting condition and credited towards bank balance (CURACCOUNT).

Mortgage Arrangement created for USD 100,000.

Arrangement Date: 29 March

Current Date: 18 April

Charge Off Date: 17 April

Loan is partially charged off for USD 20,000 on 17, April.

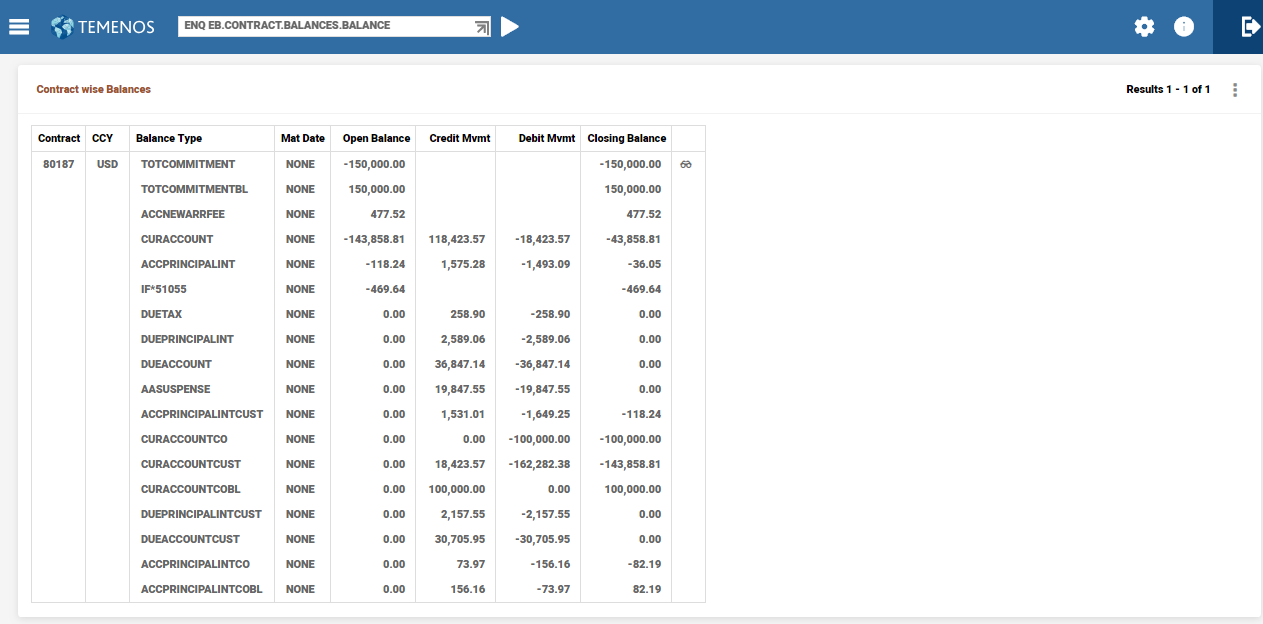

Below shows the contract balances after Charge Off:

- Existing balances before Charge Off is copied to customer balances (Suffixed with ‘CUST’)

- Charge Off amount USD 20,000 is captured in Charge Off balance (Suffixed with ‘CO’)

- Charge Off amount is appropriated towards bank balances based on the order defined in Charge Off Property Class, which is ‘Oldest First’. In this example, USD 18,090 is allocated towards DELACCOUNT and remaining 1,910 USD is allocated towards CURACCOUNT.

After Charge Off, three interest accruals are performed on bank balance, customer balance and charge Off balance. Accruals on bank balance and charge Balance can be inquired through Charge Off Details enquiry available in Arrangement Overview screen.

Accruals on customer balance are displayed in the Financial Summary enquiry available in Arrangement Overview. Financial Summary enquiry shows the customer balances after Charge Off. Repayment of 20,500 USD is done to settle the outstanding due amounts. Bills are marked settled after repayment. Bill record with both bank and customer balances is updated.

AA.BILL.DETAILS

Payment Rules Condition

Charge Off Condition

Repayment amount is appropriated on customer balances based on the definition in Payment Rules condition. Bank balances are impacted based on the definition in Charge Off condition.

| Customer Balance Allocation | Bank Balance Allocation | ||

|---|---|---|---|

| DELACCOUNTCUST | 18,090 USD | DELPRINCIPALINT | 1,910 USD |

| DELPRINCIPALINTCUST | 1,910 USD | ACCPRINCIPALINT | 240 USD |

| CURACCOUNT | 17,850 USD | ||

| Total | 20,000 USD | Total | 20,000 USD |

Balance 500 USD is settled towards charge (NEWARRFEE). Increase Charge Off is done for another 50,000 USD.

Balances after increase Charge Off, CURACCOUNT balance is credited for 50,000 USD and CURACCOUNTCO is debited for 50,000 USD.

Another 30,000 USD repaid towards loan results in balances getting impacted as below.

| Customer Balance Allocation | Bank Balance Allocation | ||

|---|---|---|---|

| CURACCOUNTCUST | 30,000 USD | CURACCOUNT | 12,150 USD |

| ACCPRINCIPALINTCO | 60 USD | ||

| CURACCOUNTCO | 17,790 USD | ||

| Total | 30,000 USD | Total | 30,000 USD |

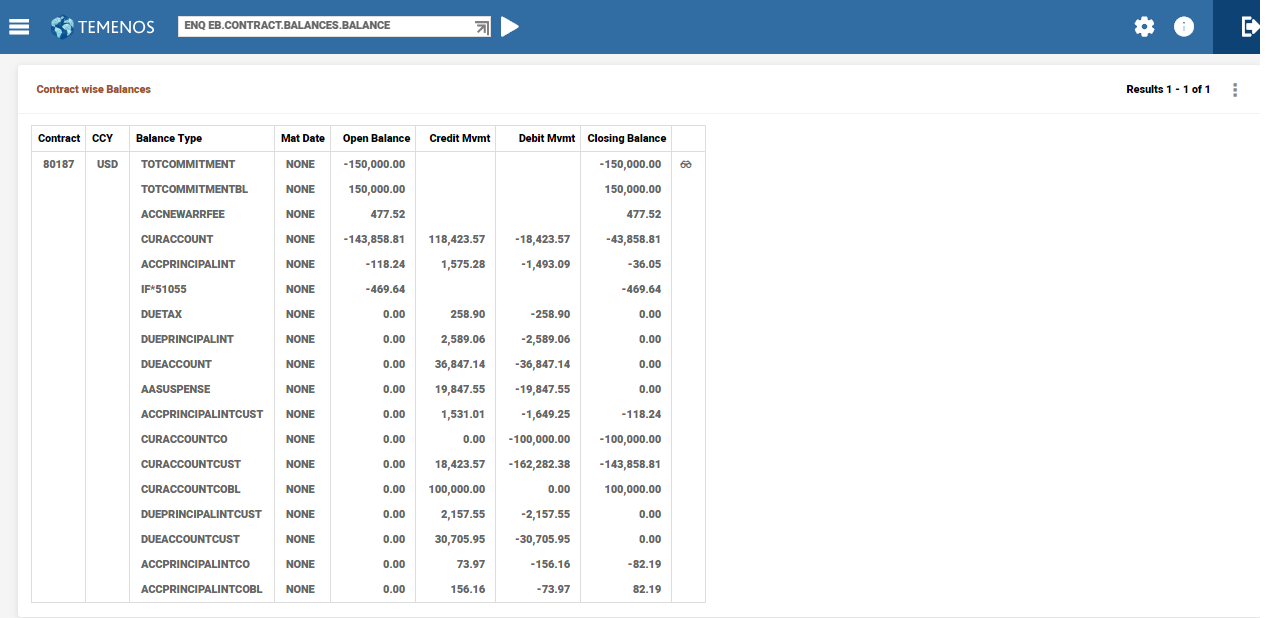

Decrease Charge Off for 20,000 USD

After Decrease Charge Off, CURACCOUNT is debited and CURACCOUNTCO is credited for 20,000 USD.

Add Charge Off Property to Existing Arrangements

The financial institutions can add the Charge Off property to the existing arrangements of the Lending product line using the Add New Property, New Prop Avl, and New Prop Avl Date fields in AA.PRODUCT.MANAGER.

Read Add New Property for more information on the configuration.

Periodic Attribute Classes

The Charge Off Property Class is not associated with any Periodic Attribute Class.

Actions

Individual AA.PROPERTY.CLASS.ACTION records control which Product Line it’s associated.

The Charge Off Property Class performs the following actions:

| Action | Description |

|---|---|

| ALLOCATE.PAYMENT | This is used to allocate payments |

| EVALUATE | This is used to evaluates the Chargeoff status |

| UPDATE | This is used to update the Chargeoff Conditions |

Accounting Events

The Charge Off Property Class does not perform any Actions that generate accounting events.

Limits Interaction

The Charge Off Property Class does not perform any Actions that impact the Limits system.

In this topic