Agent Commission

For the agents to receive commission payments, the financial arrangement and the product associated to it need to have the Agent Commission Property Class included in the arrangement.

Product Lines

The following Product Lines use the Agent Commission Property Class:

- Accounts

- Deposits

- External Product Line

- Facility

- Lending

- Safe Deposit Box

Property Class Type

The Agent Commission Property Class uses the following Property Class types:

- Dated

- Enable External

- Enable External Financial

- Multiple

- Non Tracking

Property Type

There is no associated Property Type with this Property Class.

Balance Prefix and Suffix

Agent Commission Property Class is not associated with any balance prefix and suffix.

- To process commissions, agents have an individual arrangement created for themselves under the Agent Product Line. There is no restriction to the amount of agent arrangements they can have. But the individual arrangements are different products and each one of them has its own terms and conditions agreed with the financial institution.

- Whenever agents generate new business from their customers, a financial arrangement is created. It can be in either Lending, Deposits or Accounts product line.

- For the agents to receive commission payments, the financial arrangement and the product associated to it must have the Agent Commission property installed.

- When the financial arrangement is initially created, the system dynamically builds the Agent Commission property and populates it with the Product Commission values.

- Using Agent Commission the user can:

- Record the agent and the agent arrangement for a given financial arrangement

- Monitor the default events that trigger commissions

- Events can be related to online or scheduled commissions.

- For online commissions, the system defaults the business activity’s description .

- For scheduled commission, the system defaults the frequency’s description .

- It is possible to provide a spread over the default commission rates.

- Margin Operand

- Margin Rate

- Margin Percent

- It is possible to provide an overriding amount, as against the predefined commission calculation.

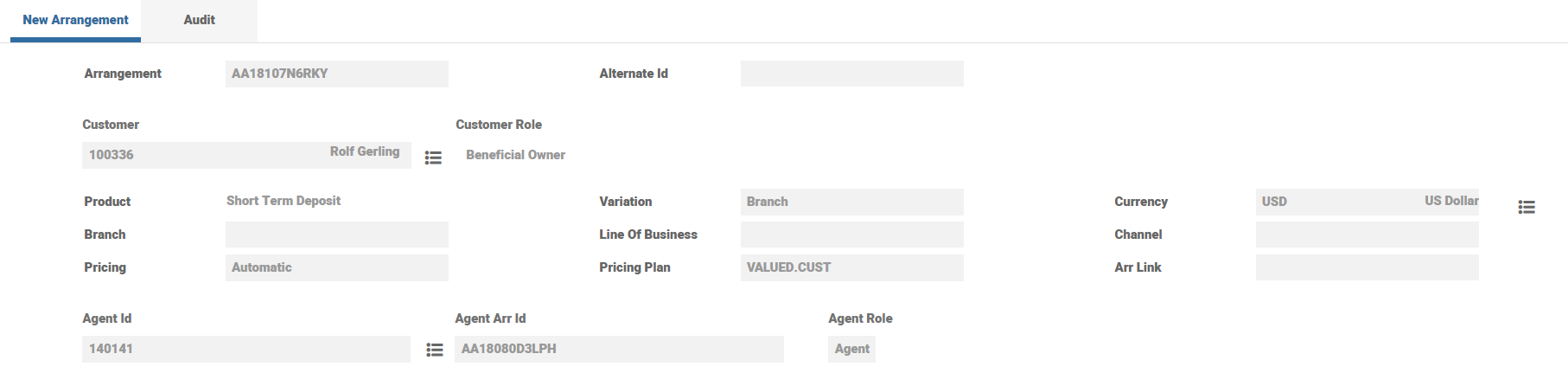

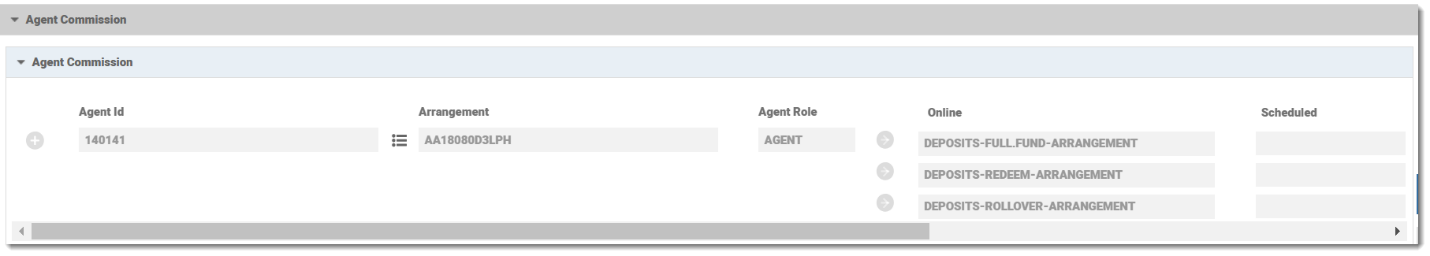

A sample financial arrangement with the default Agent Commission is shown below.

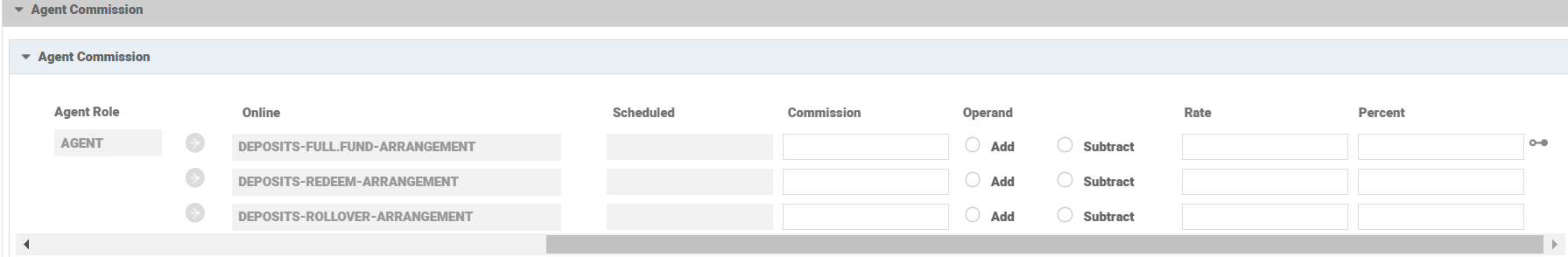

- By default, commissions are paid out based on the amount and rate defined at the agent arrangement. Users can change the default commission calculation method at the financial arrangement using the Fixed Amount, Margin Operand, Margin Rate and Margin Percent attributes

- The Agent.ID field holds the agent number, and has to be a value from the CUSTOMER table. The system defaults it from the Agent.ID attribute of AA.ARRANGEMENT.ACTIVITY record.

- Agent Arrangement ID holds the Agent’s arrangement ID, which is used to baseline the commissions that have to be calculated. It has to be a valid AA.ARRANGEMENT from the Agent Product Line and the system defaults it from the AA.ARRANGEMENT.ACTIVITY.

- The following attributes are system updated attributes.

- Online: It holds the business activity that has to trigger an online commission payment. This is a valid record of the AA.ACTIVITY table.

- Scheduled: It holds the frequency name for which a scheduled online commission payment has to be triggered. This is a valid record of EB.LOOKUP*AA.AGENT.COMMISSION.FREQUENCY table.

It is possible to override an amount for a specific commission that has been pre-defined at Product Group or Product level using the Fixed Amount attribute.

- The Margin Operand, Margin Rate and Margin Percent attributes are used to define a margin on a predefined commission rate.

- Margin Operand accepts either one of the following:

- Add

- Subtract

- Margin Operand applies the margin defined in Margin Rate or Margin Percent to the predefined commission rate.

- Margin Rate is used to define a rate that is applied over the default commission rate to calculate the actual commission for a financial arrangement. The rate can be added or subtracted depending on the setting in the Margin Operand attribute.

- The margin can also be entered as a percentage using the Margin Percent attribute. The system either adds or subtracts the percentage defined to the predefined commission rate depending on the value set in Margin Operand. This is to calculate the actual commission of a financial arrangement.

Add Agency Commission Property to Existing Arrangements

The financial institutions can add the Agency Commission property to the existing arrangements of the Accounts, Deposits, and Lending product lines using the Add New Property, New Prop Avl, and New Prop Avl Date fields in AA.PRODUCT.MANAGER.

Read Add New Property for more information on the configuration.

Periodic Attribute Classes

There are no periodic attribute classes for the Agency Commission Property Class

Actions

Individual AA.PROPERTY.CLASS.ACTION records control which product line it is associated. The Agent Commission property supports the following Actions:

| Action Name | Description |

|---|---|

| CALCULATE | To calculate the agent's commission based on the pre-defined conditions for calcuating the commission. |

| HANDOFF | To schedule agent commission processing. This creates an agent event record on the scheduled processing date with the details that are used for calculating the underlying charge. Commission is calculated on the applicable balance based on whichthe underlying charge is calculated and the frequency of commission payment is monthly. |

| SEND.EVENT | To send information on the event raised by financial arrangement to raise commission in agent arrangement. |

| UPDATE | The UPDATE action is initiated manually and allows the user to change any of the Agent Commission attributes. This action can be initiated as part of the New-Arrangement and Update-Agent Commission activities. |

Accounting Events

Agent Commission Property Class does not perform any Actions that generate accounting events.

Limits Interaction

Agent Commission Property Class does impact the Limits system.

In this topic