Account

AA products which are account based, use the Account Property Class to create the associated account record for an arrangement of the product.

This Property Class manages the descriptive and classification details of an arrangement and is used to create and maintain the account record that is related to the arrangement.

Although account names are account specific, the user can also default the generic titles from the product and replace or give additional details at the arrangement level.

Product Lines

The following Product Lines use the Account Property Class:

- Accounts

- Agent

- Asset Finance

- Deposits

- External Accounts

- Facility

- Insurance External Product

- Lending

- Rewards

- Safe Deposit Box

Property Class Type

The Account Property Class uses the following Property Types:

- Dated

- Enable External

- Enable External Financial

- Enabled For Memo

- Variations Supported

All attributes in the Account Property are stored at the arrangement level and do not track the underlying product.

Property type

Creation of Temenos Transact Account

- When the user creates a financial arrangement, the system generates a Temenos Transact account record. The account record generated is allocated a standard Temenos Transact account number according to the rules defined in the COMPANY application.

- The ACCOUNT application needs to be configured to generate IDs automatically, for the arrangement module to generate an account record.

- The Account record is built by mapping the relevant fields from the DEPT.ACCT.OFFICER, CUSTOMER, ACCOUNT and LIMIT properties of the arrangement into the layout of the account record.

- The Account record created cannot be modified directly using the ACCOUNT application, instead the associated properties have to be modified using the appropriate maintenance activities from AA.ARRANGEMENT.ACTIVITY. The Account record holds the arrangement number in the Arrangement ID field.

- The difference between the arrangement account records and Temenos Transact accounts are as follows:

- There is no CONDITION.GROUP allocated.

- The Interest and Charges module does not apply to these accounts.

Using the Arrangement Account in Other Temenos Transact Applications

- In order to pay funds into or withdraw funds from an arrangement, any existing Temenos Transact application that allows an account to be defined, can be used, for example FUNDS.TRANSFER or TELLER.

- In the application, the user can specify the account number, mnemonic, any alternate account ID linked or the arrangement number, when the arrangement is in the same company as the transaction. To use the arrangement account in an application, in a different financial company to the arrangement, the actual account number is the only option allowed.

- The Alternate Acc IDs field is set to Y in ACCOUNT.PARAMETER to specify the arrangement number or an Alternate Account Number.

- The FUNDS.TRANSFER application can be used to drawdown and commit or deposit funds to an arrangement. The Debit.Acct.No and Credit.Acct.No are used to debit or credit the account record associated to AA.ARRANGEMENT respectively.

Balance Prefix and Suffix

Account Property Class holds the below Balance Prefix:

- Lending - Current, Due, Aged, Unspecified, Unallocated Debit, Available

- Deposits - Current, Due, Aged, Unspecified, Unallocated Debit, Expected, Payable

- Accounts - Current, Unspecified, Unallocated Debit

- Agent - Unspecified

- Asset Finance - Current, Due, Aged, Unspecified, Advance Payment, Residual

- Safe Deposit Box - Current, Unspecified, Expected, Unallocated Debit

- External Financial - Current, External

- Current Principal Balance

For a loan contract, the current principal reflects the amount that has been disbursed and is not yet due to be repaid. The current principal is identified with a prefix ‘CUR’.

- Due Principal Balance

For a loan contract, the due principal reflects the loan amount that has been disbursed and is now due for repayment. The due principal is identified with a prefix ‘DUE’.

- Aged Principal Balance

For a loan contract, the aged principal balance reflects the due amounts of the loan that has aged, according to the stages defined in Overdue property condition.

Due balances are aged, when the date since the bill that generated the due balance, passes the number of days specified in the Overdue property condition. The billed balance assumes the associated status defined in the condition record. For a single arrangement, there may be several aged and due balances reflecting the different ages of the outstanding bills.

The aged principal balance is identified with a prefix of the associated status in the OVERDUE property.

- Unallocated Credit Balance

The unallocated credit balance reflects general credits made to the arrangement. This balance is also used to hold payments made against future or issued bills prior to the due date. If the practice (defined in PAYMENT.RULES property) requires that advanced payments not repaying the current principal, then, the repayment amount is allocated to the unallocated credit balance. The unallocated credit balance is identified with a prefix ‘UNC’.

- Unallocated Debit Balance

The unallocated debit balance reflects general debits made to the arrangement. It is identified with a prefix ‘UND’.

- AVL - Available Balance

This is used for scheduled disbursement. It indicates the loan amount available for disbursement. This is a contingent credit balance on the loan which is credited when the disbursement bill is made payable.

The Deposits Product Line can have the following balance prefixes:

- Expected Principal Balance

When a new arrangement is created, system credits this balance type to indicate the pending payment is awaited from the customer. Currently, the sign is positive. The expected principal is identified by the balance prefix ‘EXP’.

- Current Principal Balance

The current principal balance reflects the payment made by the customer towards the deposits. It may or may not be equal to the expected balance. It is identified by the balance prefix ‘CUR’.

- Aged Expected Balance

This is used in cases where the customer has not made payments on time and expected principal becomes overdue.

- Unallocated Credit Balance

The unallocated credit balance reflects the general credit made to the arrangement. This balance holds the additional payments made against the deposits. For example, when a new deposit new arrangement is created for 25000 USD and customer makes a payment of 50000 USD. In this case, it is possible to post 25000 USD in UNC balance.

- Current Account Balance

When a current or savings account is created, it is possible for the debits and credits for these account to update the relevant account balances. All interest calculations are done based on these balances.

- Current Principal Balance

The current principal reflects the amount that has been. The current principal is identified with a prefix ‘CUR’.

- Current Commitment Balance

The current commitment balance reflects the value of the asset. If the customer makes any advance payment , the commitment balance is reduced to this ADV balance while authorising the asset finance contract.

- Due Principal Balance

The due principal reflects the balance which is due for repayment and is identified with a prefix ‘DUE’.

- Aged Principal Balance

The aged principal balance reflects the due amounts of the lease contract that has aged, according to the stages defined in Overdue property condition and is identified with a prefix of the associated status in the OVERDUE property.

- Unallocated Credit Balance

The unallocated credit balance reflects general credits made to the arrangement. This balance is also used to hold payments made against future or issued bills prior to the due date and is identified with a prefix ‘UNC’.

- Advance Payment

The Advance payment balance type reflects the down payment or advance payment amount received from the customer and is identified with a prefix ‘DUE’. Advance payment balance, if any, is reduced from the commitment balance during Asset finance contract creation.

- Residual

Residual balance type reflects the residual balance used at the time of maturity and is identified with a prefix ‘RES’.

Attributes associated with the Account Property Class are described below.

In an AA product, the Category is used for reporting (that is, balance sheet) purposes only. Usually, a category is allocated to a specific product or family of products, although this is not mandatory. The category can be amended, if required, at the arrangement level.

Although account names are account specific, generic titles can be defaulted from the product in the Account Title field and can be replaced or given additional detail at the arrangement level.

The Short Title field is an abbreviation of the account title and is used for enrichment.

The Currency Market of an arrangement can currently be set to ‘1’ only, and Position Type can be set only to ‘TR’.

Attributes used in account definition at arrangement level is described below.

Product definition defaults Account Title and Short Title and can be overridden if allowed by the product attribute control settings. Customer Reference allows a reference known by the customer of the arrangement, to be specified for information.

The following options are available for specifying alternate access references for the account.

Mnemonic field is an alternate key which can be defined by the user to reference the account. This is the name of the arrangement.

Alternate.ID field is multi-valued in ACCOUNT.PARAMETER, which is linked to the ALT.ACCT.PARAMETER file where alternative references can be specified.

This is used to record other references by which the arrangement may also be referred.

If an IBAN number has to be generated for this product, then the value has to be set to ‘Yes’ against Generate IBAN field. The number is auto generated for accounts that are created under this product.

Specifies if the account is off-balance or on-balance.

Off-balance accounts maintain principal balance in CUR<ACCOUNT>INF balance type as opposed to CUR<ACCOUNT> balance type.

Valid options are as follows:

Memo - Indicates the account is an off-balance account. When set to ‘Memo’, the system expects a special balance type CUR<ACCOUNT>INF with reporting type set to ‘Internal’. Only the following accounts can be set to Memo:

- AR accounts if BN (Balance Netting) is installed in the company.

- External Financial Accounts (XP).

- Null - Indicates the account is a real account.

Participation - This option enables the bilateral loan to have accounting for the borrower and the investor balances.

For loan securitisation, Balance Treatment should be set to Participation. As soon as loan is booked with Balance Treatment as Participant, Transact maintains separate records for the borrower and the investor. Until the loan is securitised, the bank itself is the investor.

Specifies if accounting can be directly raised (either within Temenos Transact or outside of Temenos Transact) to the account. This is mapped to EXTERNAL.POSTING in base account record. Valid options are as follows:

- Yes - Accounting can directly be raised to the account. Null also indicates the same functionality as selecting ‘Yes’.

- No - Accounting cannot be directly raised to the account. Any accounting on this account can only happen as a result of a posting happening on one of its child accounts.

Specifies if the account supports multiple or single currency. Valid options are as follows:

- Yes - Account supports multiple currencies and accounting respects an entry in a different currency and starts maintaining balance.

- No - Account does not support multiple currencies. Null also indicates the same functionality as selecting ‘No’.

The possible values for On Restructure are as follows:

- Capitalise - Internal restructure capitalises the current period interest and charges defined in the payment schedule condition.

- Null - Internal Restructure does not capitalise the current period interest and charges defined in the payment schedule condition.

Indicates that the schedule has to be processed intra-day instead of, during the scheduled Close of Business. Early Schedule processing is the process of scheduling interest and charges on the scheduled date but earlier than the COB. This process gives flexibility to the financial institutions in dealing with interdependencies between Temenos Transact and other systems with respect to interest and charges posting.

The HVT flag if set to ‘Yes’ Iindicates whether if the account is a High Volume Transaction account. This is applicable for Accounts product line.

Passbook field in the Account Property Class, controls the printing of the passbook for an account. It is valid for any arrangement contract with a category code defined in the SAVINGS record of ACCOUNT.CLASS application.

It is possible to change the value of the Passbook field from ‘Yes’ to ‘No’, and ‘No’ to ‘Yes’ for the existing arrangement, through update Activity - ACCOUNTS-UPDATE-<ACCOUNT>.

Base Date Type field is used by AA to calculate several of the other Date fields of the arrangement and accepts values : ‘Agreement’ or ‘Start’ (Agreement is the default).

- Agreement option results in other dates being calculated based upon the effective date of the New-Arrangement activity.

- Start option results in other dates being recalculated when the first Disburse or Deposit activity occurs.

Anniversary field is used to store the anniversary of the account for restriction purposes and its value is stored in the format <MM DD>. In conjunction with restrictions, this field can also be used for general configuration across all AA.PERIODIC.ATTRIBUTES classes.

Date Convention and Date Adjustment settings indicate the action which can be taken if the derived date is a non-working day. There are four Date Convention options.

- Backward - the payment date moves backward to the last working day.

- Calendar - the payment date does not move regardless of whether it is on a working day.

- Forward - the payment date moves forward to the next working day.

- Forward Same Month - the payment date moves forward to the next working day provided it is within the same month. If it is not within the same month, it is possible for the payment date to move backward to the last working day.

For all date conventions except ‘Calendar’, Date Adjustment is used to specify whether the new date represents an adjustment of the ‘Value date’ of the entries or an adjustment of the ‘Period’ (both value and processing dates).

The holiday schedule for the country of an arrangement’s currency is referred to for determining the non-working days. The user can also specify the countries whose calendars need to be checked for holiday validation in the Bus Day Centres field. In this case, the user must include the countries of all the calendars that are to be evaluated including the country of the arrangement currency explicitly. To ease this situation, the user can add only those country holiday calendars (excluding the arrangement currency's country) that must be populated in Bus Day Centres and use the ARRANGEMENT CURRENCY value in the Other Bus Day Centre field. In this case, the holiday calendar of the arrangement's currency is also considered along with the holiday calendars of the countries specified in Bus Day Centres.

In case of month end schedules please refer Month End Repayment Schedule in Payment Schedule property class.

While entering new arrangement for account creation, system updates this field based on the value specified in the product condition of Account property class.

If this field has 'YES' as value, then the balance details of this account is not maintained within Temenos Transact and it is held by an external DDA system. Within Temenos Transact, only static information of this account is maintained.

If this field has the default NULL value, then it is like a normal Temenos Transact account, so and the balances are maintained by Temenos Transact.

Indicates the number of months (which can carry any values between 1 and 99) without customer activity before an arrangement account is declared as ‘Inactive’. Based on this value, only the arrangement accounts are marked as ‘Inactive’. This field is mutually exclusive with Dormancy property class.

This provides the user with the option to specify the basis for deriving the future event dates. This definition is currently used for deriving dates of Change Product, Rollover or Renewal and Periodic reset events only. The values allowed are as follows:

- Previous – Last adjusted event date is used for deriving subsequent event date(s)

- Base – Last unadjusted event date provided by user is used for deriving subsequent event date(s)

- Null - Change Product, Rollover or Renewal events Base date is used for deriving every event date(s)

Periodic reset event actual date is used for deriving every event date(s)

This field is optional, multi-valued, has no default value,and does not allow duplicates . It specifies the conditions under which account details or details of entries over the account are to be included; in an end of day report for referral to the account officer responsible. Referral conditions can be defined depending on transaction such as transaction code, amount and sign, or the balance of the account. The code has to be a valid record in REFERAL Table

An arrangement can be linked to customer's portfolio reference (SEC.ACC.MASTER ID) using this field. When the portfolio is linked, the arrangement is also taken into consideration during portfolio valuation for the customer. This is not relevant for product conditions. The portfolio reference has tp belong to the customer of the arrangement.

Holds the date of the latest internal restructuring of the network of parent accounts above this account, that is, the latest date when the network of parent accounts above this account, was changed. If the back value date of the statement entry is prior to this date, then the statement entry copied to the parent account is adjusted to this date. The original statement entry is not impacted.

Holds the latest restructuring date of the network of parent accounts above this account. It is set to the date when an account was added to the network of parent accounts as either a direct or indirect parent of this account. If the back value date of the statement entry is prior to this date, then the transaction is rejected with an error message.

The currency market to be used for merging balances in multi-currency accounts and limit validations is indicated against this field. If it is not entered, the currency market of the account is used.

Indicates if account is a contingent account created for limit balance purposes.

Read Accounts user guide, overdraft limits section for more information.

Indicates the number of days in advance to request a new drawdown offer. An Override is provided if the period between the trade date and the effective date is less than the number specified here. The notice days can be entered as a number of business working days (W) or calendar days (C/number). The values allowed for this field range from 0 to 999, decimal numbers are not allowed for this field. Any value other than the allowed one results in an error message.

- If the user prefers to mention two working days, then it is 2W.

- If the user prefers to mention two calendar days, then it is 2C/2.

Indicates the initiation type for the Drawdown Completion Stage. This specifies the conversion of the offer arrangement into a live arrangement. The following are the possible options.

- Auto – Drawdown is activated automatically on the effective date.

- Manual – User activates the drawdown manually on or before the effective date.

At the arrangement level, a posting restriction code (defined in POSTING.RESTRICT) can be used to restrict the following:

- All Debits

- All Credits

- All Transactions

Other fields defined related to Posting Restriction multi-value group are:

Used to specify from when posting restriction is applicable for the arrangement. When start date is a future date, then during Start of Day (SOD), base account is updated with posting restriction.

There are two ways to effect the restriction immediately.

- When the Start date is left blank, then the restriction is effected immediately.

- When the Start date is defined as current system date, then restriction is effected immediately.

It is not allowed to be prior to:

- Arrangement start date

- Current system date, if arrangement activity date is backdatedIt is not allowed to update start date, once restriction is active.

Used to specify when posting restriction finishes.

- When expiry date is a future date, then during start of day, posting restriction is removed from base account record.

- When expiry date is not defined, then it is meant that the posting restriction is for the entire life of arrangement.

Pre-defined set of blocking code that are defined in EB.LOOKUP ( BLOCK.REASON.CODES or UNBLOCK.REASON.CODES virtual table) is linked to each posting restriction. Each blocking or unblocking code is linked to corresponding posting restriction by defining them in posting restriction table without which the system does not allow to link the blocking or unblocking code.

Used to capture free text information.

The incoming and outgoing payments in an account/deposit can be restricted from/to only pre-defined counter accounts, which are added during account/deposit opening and maintenance processes. The following associated set of multi-value fields are used to define the nominated counter accounts for an account or deposit arrangement.

- Counterparty Type – This field is used to indicate the type of transactions for which the nominated counter account restriction is applicable in an arrangement. The valid options for this field are:

- Pay.in – The nominated counter account restriction is applied only to debit transactions.

- Pay.out - The nominated counter account restriction is applied only to credit transactions.

- Both – The nominated counter account restriction is applied to both debit and credit transactions.

- Blank – This is the default option, and no nominated counter account restriction is applied.

- Counterparty – This field records a beneficiary as the nominated counter accounts for that arrangement. Only a beneficiary record can be attached as the nominated counter account.This field forms part of an associated multi-value against the Counterparty Type, enabling the user to specify the counter account for that Counterparty Type. It is possible to attach more than one counter account for a particular type. Based on the Counterparty Type setup, the system can evaluate if:

- Payment is received only from those counter account/s when Counterparty Type is Payin

- Payment is sent to only those counter account/s when Counterparty Type is Payout

- Payment is sent to/received from only those counter account/s when Counterparty Type is Both

- There is no evaluation done when the Counterparty Type is Blank / not set.

- The above fields for nominated counter accounts are available only for Accounts and Deposit product lines. The system raises an error if these fields are used in other product lines.

- The associated multi-value field set for Nominated Counterparty cannot be multi-valued when the Counterparty Type is set to Both or Blank.

- When automatic settlement is defined using payment order, then based on the value in Counterparty Type, the system validates if the beneficiary provided in the settlement condition is one of the Counterparty in the account condition.

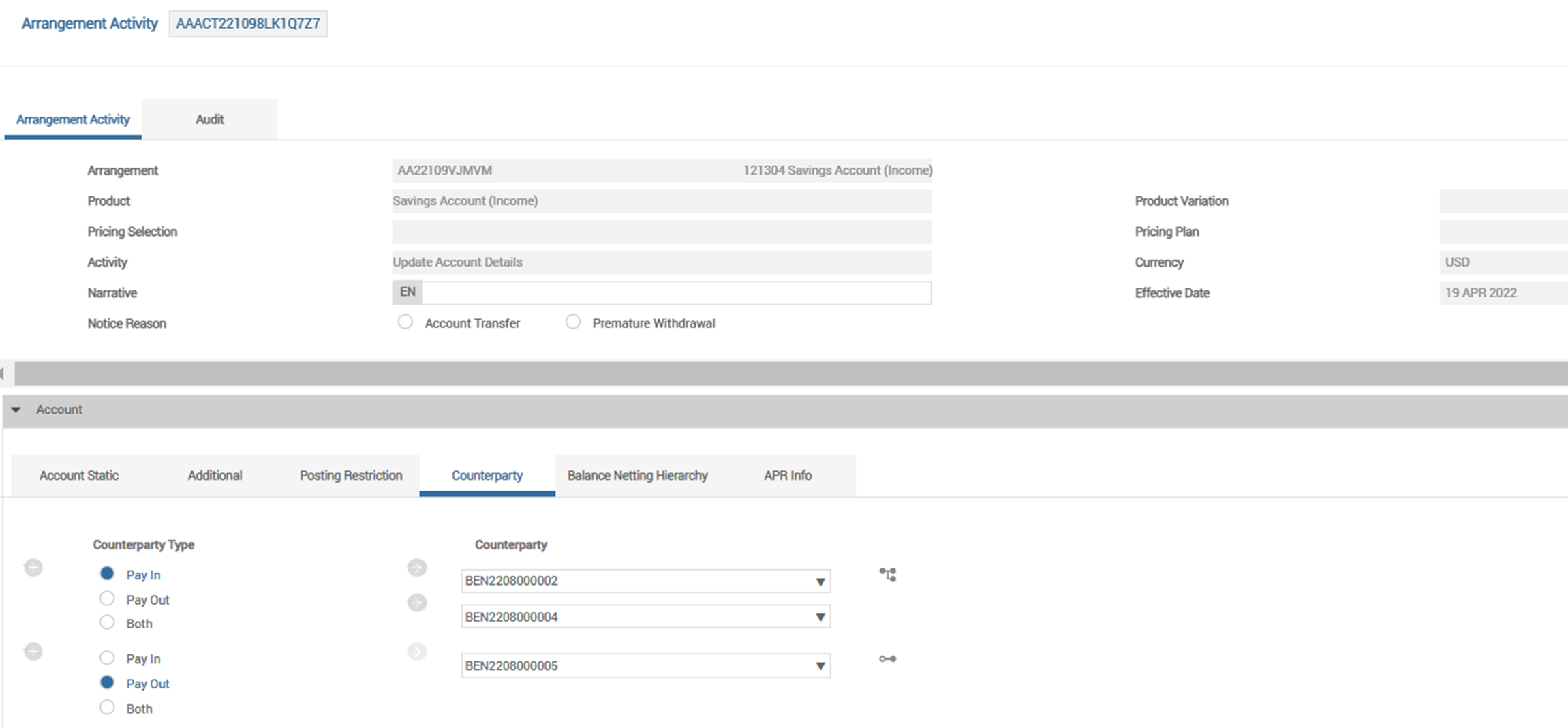

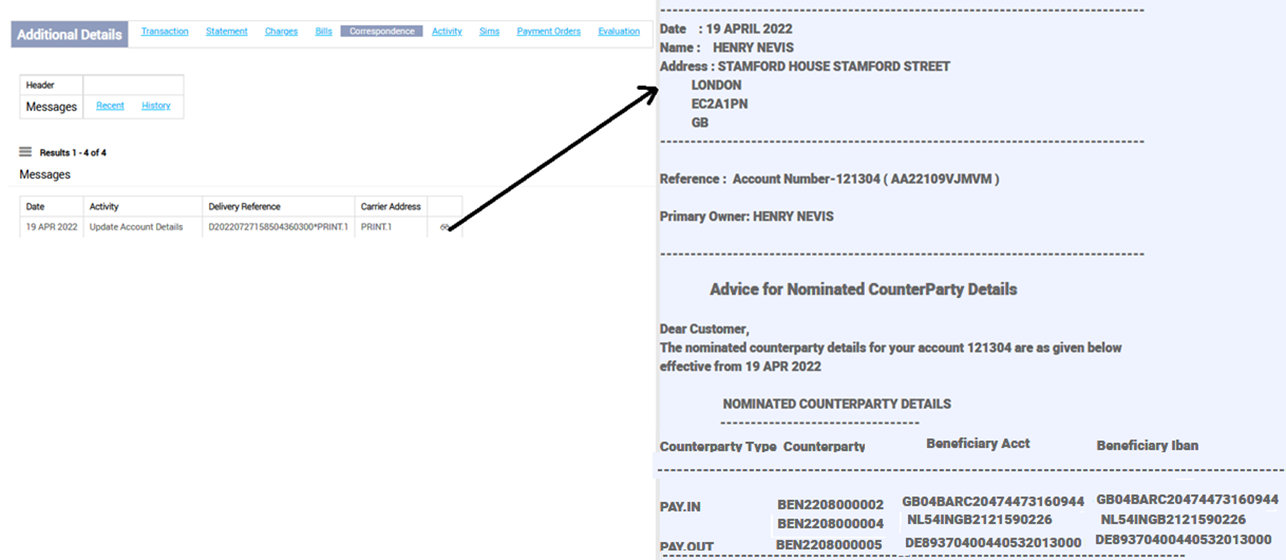

Consider an account is created with nominated counter accounts as follows:

- For debit transactions - BEN2208000002 and BEN2208000004

- For credit transactions - BEN2208000005.

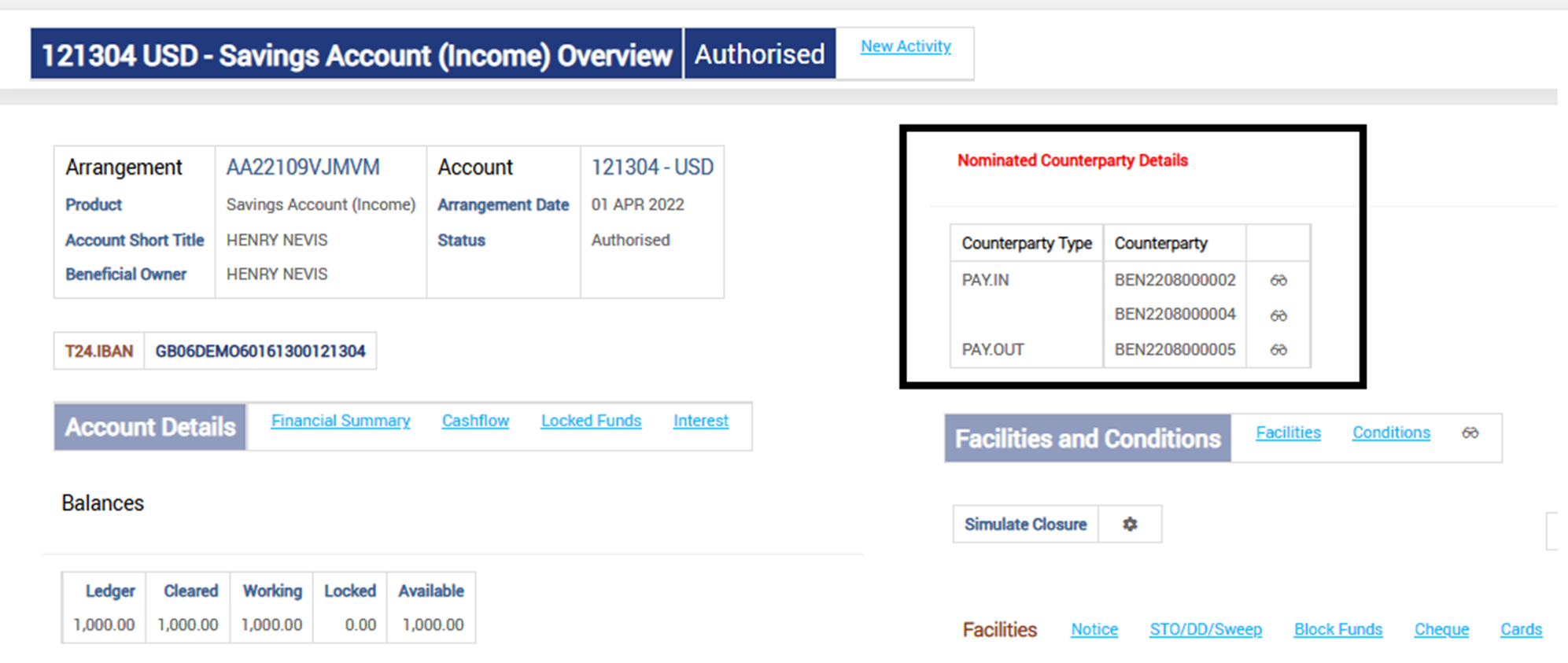

The Arrangement Overview is updated with the nominated counter account details as below.

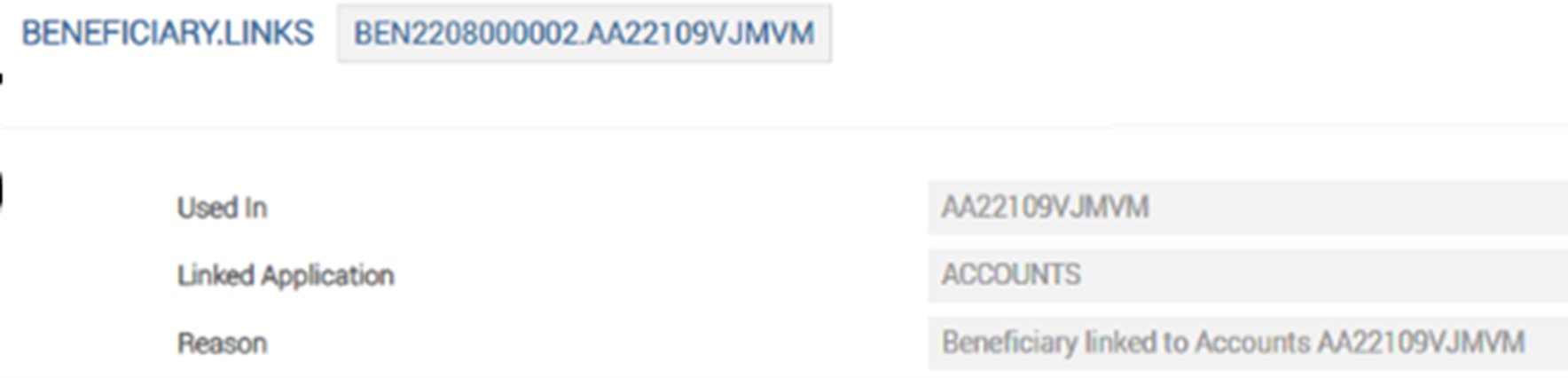

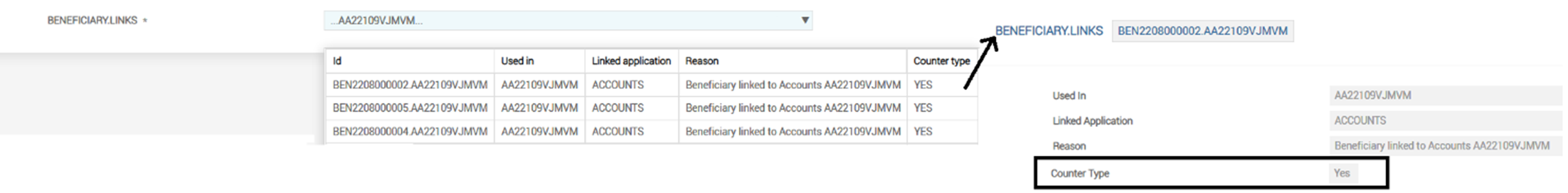

The BENEFICIARY.LINKS table is updated with records of the beneficiaries defined in the Settlement condition for the account/deposit. This is irrespective of the account/deposit having a nominated counter account.

When an account/deposit has a nominated counter party updated, the BENEFICIARY.LINKS table is updated with Counter Type as Yes whilst for beneficiary update in the Settlement condition, the Counter Type field is not populated.

In the above illustration , the BENEFICIARY.LINKS application is updated with records of the nominated counter accounts for the arrangement. The Counterparty Type field is set to indicate that the beneficiaries are nominated counter accounts for the arrangement.

Such a beneficiary added for the purpose of counter accounts has the Internal Flag set in BENEFICIARY application. This flag indicates that the beneficiary record can be purged when there are no accounts/contracts linked to the beneficiary for processing.

It is possible to trigger notifications for a change in the nominated counterparty and/or a change in the beneficiary details of the nominated counterparty by a suitable configuration in an account or a deposit arrangement.

The Activity Messaging condition for the account is configured to notify the customer about the nominated counter account details for the arrangement when the account condition is updated.

When the nominated counterparty details are updated/changed in an arrangement, the system generates a notification which is available in the Correspondence tab of the Arrangement Overview page.

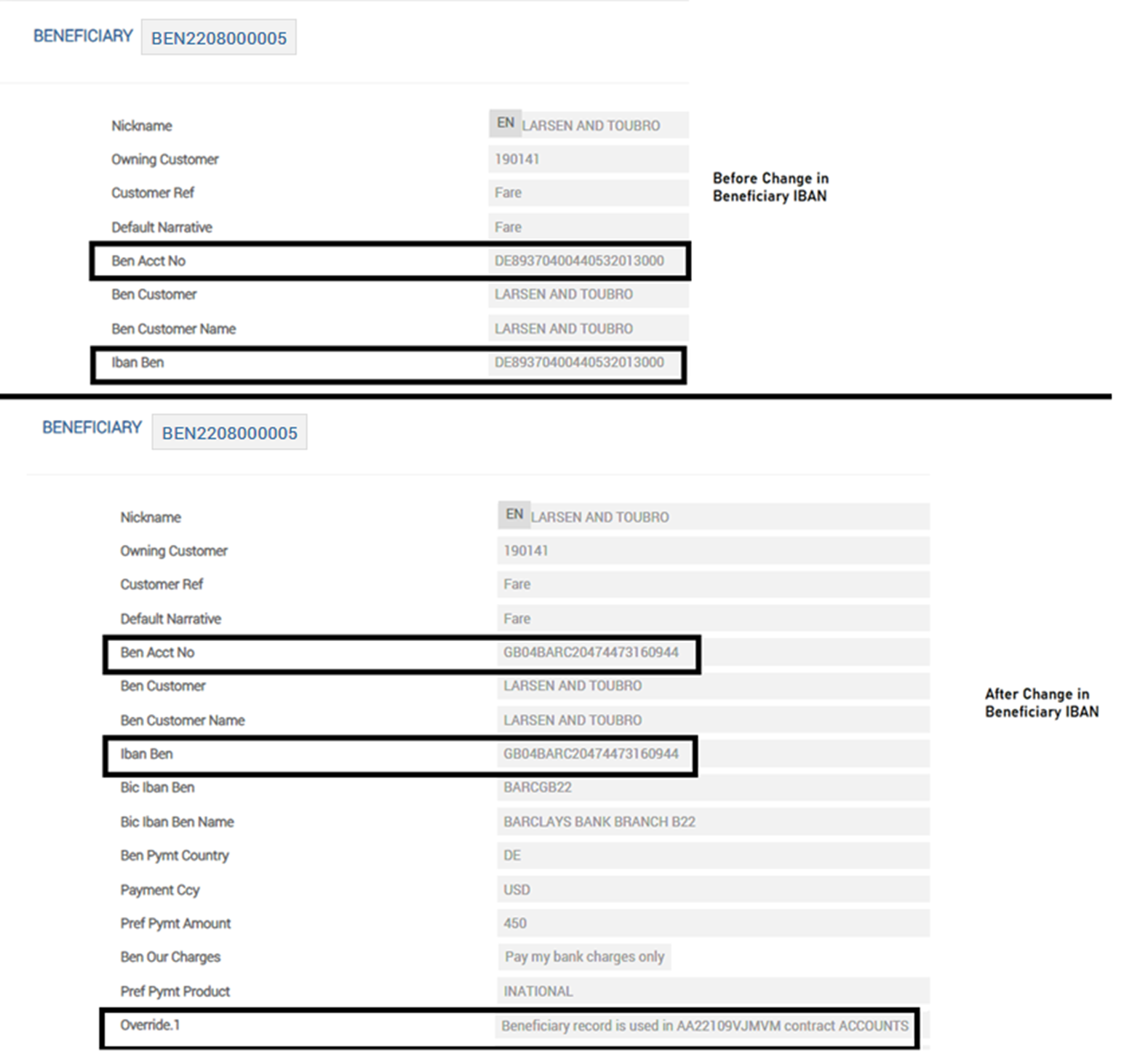

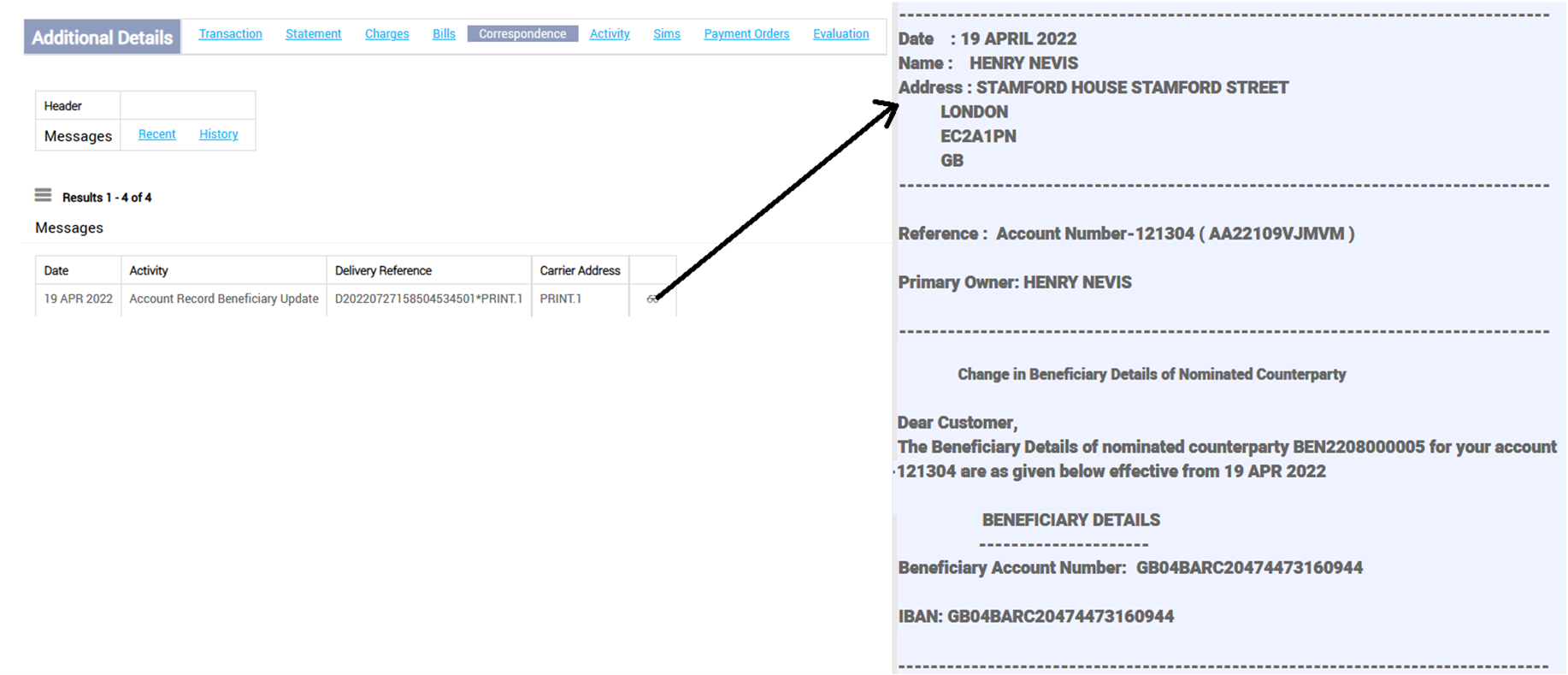

The Activity Messaging condition for the account is configured to notify the customer when there is a change in the beneficiary details (such as Beneficiary IBAN/ Account number). This notification is configured using the named non-financial activity to record the event of beneficiary update triggered from the TEC.ITEM released for the BENEFICIARY-SERVICE Event Type.

The IBAN of the BEN2208000005 beneficiary, which is a nominated counter account for the arrangement in the previous illustration arrangement, is changed in the BENEFICIARY application.

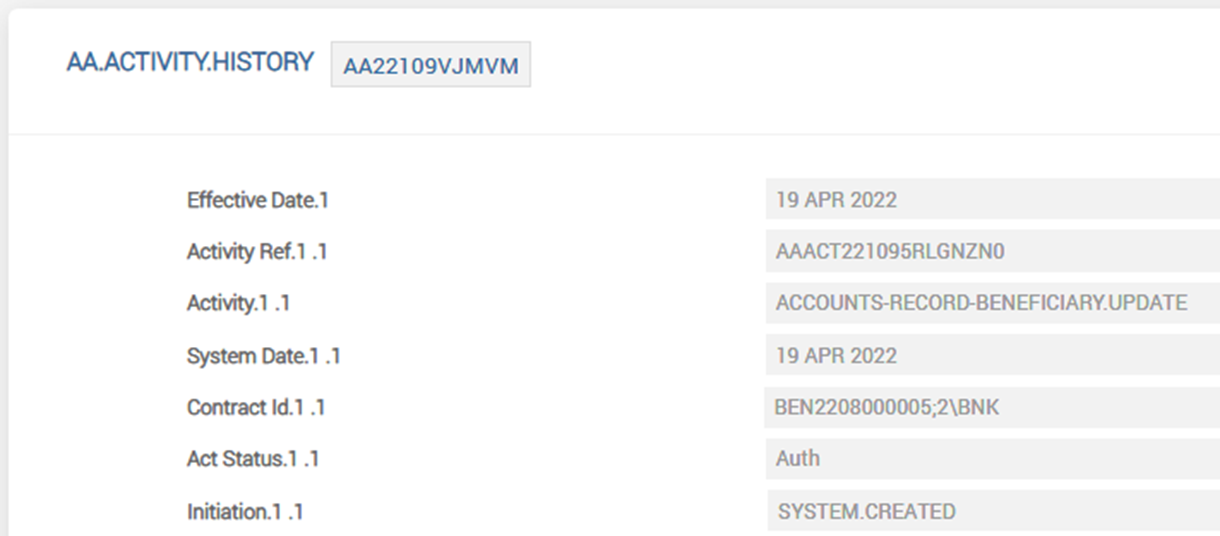

The ACCOUNTS-RECORD-BENEFICIARY.UPDATE non-financial activity is triggered in the AA arrangement (as per the Activity Mapping definition) when the beneficiary details are modified.

The system generates a notification, about the change in the IBAN of the beneficiary which is available in the Correspondence tab of the Arrangement Overview page.

Attributes related to balance netting are described below.

- Balance Treatment attribute allows to define an Account product to be off-balance sheet.

- When this is set, during Proof and Publish, and at arrangement level, system expects a Balance Type for the Account property with a suffix ‘INF’ and that balance type has to be set with Reporting Type as ‘Internal’. For example, if BALANCE is the name of the Account property, then this AC balance type is ‘CURBALANCEINF’.

- Even if an account is set as Off- Balance (Memo), it is a fully operational account from a customer perspective (Cheques can be issued, incoming or outgoing payments can be handled as usual).

- All transactions posted are converted to a memo posting on this account and the real entry diverted to the linked real account (specified in Linked AC Number).

- All Interest and Fees specified on this Memo Account is treated as Memo Interest or Fees. The system automatically suppresses any real accounting to the PL and Payables or Receivables.

It is still possible to specify capitalisation frequencies for these Memo Interest or Fees

Read Settlement Property Class for more information.

- Link Ac Number attribute is used to specify any diversion account, at the arrangement level.

- This then gets mapped to the Auto Pay Acct field in account record.

- For a normal AR account to have Link AC Number populated would simply translate into the Auto Pay Account feature (where the incoming Real entry is simply diverted to the linked account).

Read Financial Accounting user guide to know more on Memo Accounting Entry for Transaction Accounts.

- Parent Account attribute is used to specify any parent account within a bundle hierarchy, at the arrangement level.

- Input in this attribute is not allowed if the arrangement is not part of a bundle hierarchy.

- These memo accounts can be on their own or as part of a bundle (Balance Netting) hierarchy

Read Balance Netting user guide for more information.

- When part of a hierarchy, they can either be the accounts on which transactions are done performed or as a Summary Account.

- When defined as a Transaction Account, it is important that they are linked to a Real Account for funds diversion so as to reflect the aggregate position per currency. The Link AC Number attribute is used for that purpose.

The External Posting attribute is used to control who can raise postings on the account.

- If it is set to ‘No’, the system does not post the transactions directly on these accounts; and that any posting on these accounts is only a result of a posting happening on one of their child transaction accounts; or, as a result of funds diversion from a memo transaction to an On-balance account.

- The term External means any application outside the core accounting engine, which means even AA’s own schedule processing cannot raise any accounting that hits the Principal Balance of that account (for example, Capitalise ).

- The system, uses the Link Ac Number, to do memo posting on the TR account and a real posting on the relevant CT account, when a credit or debit hits a TR account.

Using the PARENT.ACCOUNT at every level (TR, CS, SA and etc), the system also knows to raise memo posting on the parent accounts as well.

Memo Dr on TR1

Real Dr on CT1

Memo Dr on CS1 (because it is defined as the PARENT.ACCOUNT in TR1)

Memo Dr on SA1 (because it is defined as the PARENT.ACCOUNT in CS1)

- When a transaction is done on the TR, it can be observed that it is reflected as a memo on the TR, memo on SA and a real posting on the CT. Individual Posting is reflected on the Linked AC Number (CT Account). The relevant balances are also updated in EB.CONTRACT.BALANCES.

- Multi.Currency attribute allows to enable a memo account to maintain balances (ACCT.BALANCE.ACTIVITY and EB.CONTRACT.BALANCES) in currencies other than the currency of the account itself.

- A multi-currency summary account in a Balance Netting Hierarchy can have children belonging to any currency.

- Whenever a transaction hits the child, it gets replicated at the parent summary level. If this parent summary account is enabled for multi-currency, then system starts to maintain its balance based on the incoming currency.

- Accruals and Capitalisation or Make-Due or Pay still happens only in the currency of the account but the system can convert the balances across currencies into the account currency and aggregate them as the source balance.

- Balance Conversion Mktattribute can be optionally used to dictate the rates with which this Conversion (both at Limit Check and Interest Processing) happens.

The following attributes in Account property class are better captured at the arrangement level:.

- Bundle Arrangement - used to capture the Arrangement reference of the Bundle Hierarchy

- Link AC Number - the On-balance sheet diversion account

- Parent Account - Parent account within the Bundle Hierarchy (Input is allowed only if Bundle Arrangement is specified)

- Lease Type - It is used to differentiate the type of asset finance agreements. The available options are: Operating, Finance. The accounting for an arrangement is differentiated based on the option selected in the Lease Type attribute.

- Asset Reference - It is used to specify the asset ID that is linked to the asset finance arrangement. It is an arrangement level attribute and if specified, then it must be a valid entry in the Fixed Asset Management module.

- Asset Class - It is used to specify the asset type and high-level classification of the asset. It refers to the data from the Asset Type attribute in Fixed Asset Management module and it is defaulted based on the asset selected in Asset Reference.

- Asset Type - It is used to specify the asset class and high-level classification of the asset. It refers to the data from the Asset Class attribute in Fixed Asset module and it is defaulted based on the asset selected in the Asset Reference attribute.

- Pay to Supplier - It is used to specify whether the purchase of the asset occurs automatically by paying the supplier when the asset is not already purchased when the arrangement is activated. The available options are:

- Yes - Indicates the Asset Purchase occurs automatically by issuing the payment to the supplier during the activation and the Asset status moves to ‘Purchased’.

- No or Blank – Indicates that during the activation, the Asset Purchase does not occur automatically if the asset is not already purchased and the contract activation is blocked.

The account officer information can be updated in Account condition level instead of Officers condition. The Primary Officer, Other Officer, Officer Role, and Notes attributes in the Account condition help to update the primary officer, other officer and role of the other officer in the arrangement.

- Primary Officer

The primary officer responsible for the product or arrangement can be specified and the officer record must be available in the DEPT.ACCT.OFFICER application. The primary officer is used as the ACCOUNT.OFFICER in the created ACCOUNT record.

If values for Primary Officer are not provided in the arrangement, and if the same is available for the customer, then the system defaults the officer for the customer's arrangements.

- Other Officer

Additional officers (Other field) who can assist with a product or arrangement can be specified. The officer record must be available in the DEPT.ACCT.OFFICER application. This field is part of a multi-value set of fields with associated Role and Notes.

- Officer Role

Each additional officer must have a specified role. The roles are user defined and specified in EB.LOOKUP. This field is part of a multi-value set of Other and Notes fields.

- Notes

The user can enter any notes related to the other officer. This field is part of a multi-value set of fields with Other.1 and Role fields.

When the product has both the ACCOUNT and OFFICERS properties while creating the product, the fields enabled in the Account condition are disabled and the Officer condition must be used in the arrangement.

If the product has only the Account product condition, the Officer related fields in the Account condition can be used in the arrangement.

Periodic Attribute Classes

Full Deposit - Periodic rule to control the deposit of full commitment amount.

Actions

The Account Property Class supports the following actions:

| Action Name | Description |

|---|---|

| ACTIVATE | Used to activate an asset finance contract |

| ADJUST.BILL | Used to adjust the account balance in a bill. |

| ADVANCE.REPAY | Used when balances are paid in advance. |

| AGE.BILLS | Used to age the Account balances that are overdue |

| ALLOCATE | Used for Balance Update in Account |

| AUTO.CLOSE | Used to auto close dormant account |

| AUTO.CLOSE.VALIDATE | Used to validate the account to be closed |

| BALANCE.MOVEMENT | Used during migration from AC to AR Account for Account balance movements. |

| BALANCE.TRANSFORM | Used to raise entries for CUR<ACCOUNT> to AASUSPENSE |

| CANCEL.ADVANCE | Used for moving the advance payment to UNC |

| CANCEL.DEPOSIT | Used during cancellation of a deposit arrangement |

| CANCEL.LENDING | Used during cancellation of a loan arrangement |

| CAPTURE.BILL | Captures the Account details of the bills to be generated for the Lending, Deposits, Savings and Accounts product lines. |

| CHANGE | Used to update changes in the Account condition |

| CHARGEOFF | Used to chargeoff the balances |

| CHECK.CANCEL | Used to check for cancel period while funding or disbursing in an arrangement |

| CHECK.MEMO | Used to check memo account |

| CLOSURE.VALIDATE | Used to check the closure validations |

| CR.MOVEMENT | Applies the credits to the arrangement Account Product Line for the current account balance. |

| CREATE.INVOICE.BALANCE | Used to Create invoice balance based on working balance |

| CREATE.INVOICE.BILL | Used to Issue bill for invoice balance |

| CREATE.RESIDUAL | Used during creation of the residual amount of amortisation |

| CREDIT | Applies the unallocated amount from a credit to the[GPD1] arrangement , to the unallocated credit balance of the arrangement. |

| CREDITPRENOTE | Used when during Credit action when Temenos Transact is either shadow or DDA |

| DATA.CAPTURE | Used during data capture from legacy account to AR Account |

| DEBIT | Applies the unallocated amount from a debit to the arrangement to the unallocated debit balance of the arrangement. |

| DELINK | Used in Balance Netting to delink an account |

| DEPOSIT | Used during Deposit in Account |

| DISBURSE | Used when a loan is disbursed. The action results in the current balance of the account property being debited. |

| DR.MOVEMENT | Applies the debits to the arrangement Account Product Line for the current account balance. |

| EXPIRE.BILL | Used in Expire Bill Action for Account Property Class |

| FORCE.CLOSE | Used to clear external balances and force close an arrangement |

| FORCE.SUSP.TRANSFORM | Used in Suspense for all forms of interest and charges in payment schedule |

| FORCECREDIT | Used in Force Credit action of external DDA |

| FORCEDEBIT | Used in Force Debit action of external DDA |

| FUTURECREDIT | Used in future dated Force Credit action of external DDA |

| FUTUREDEBIT | Used in future dated Force Debit action of external DDA |

| ISSUE.CLOSURE.BILL | Used to issue closure bill for an arrangement |

| MAINTAIN | Used whenever one of the properties linked to the Temenos Transact ACCOUNT record (CUSTOMER, DEPT.ACCT.OFFICER, LIMIT, ACCOUNT) is modified. The action does not generate any accounting movement but updates the related Temenos Transact ACCOUNT record to reflect the values for the arrangement property. This results in the creation of a Temenos Transact arrangement account when the New-Arrangement activity is processed. A scheduled MAINTAIN account activity LENDING-MAINTAIN-ACCOUNT is raised for the future effective date, that is processed in the Start of Day of the effective date. The MAINTAIN activity updates the ACCOUNT record with the future dated changes. |

| MAKE.DUE | Applies the amount of principal due to be repaid to the DUE account property balance and reduces the current account property by the amount to be made due. The amount to be made due is determined from the associated bill that is being made due. |

| MOVE.BALANCE | Used as a routine to move the PAY account balance to an internal account |

| OFFSET.INVOICE.BALANCE | Used to Offset the invoice balance based on capitalise amount |

| PAY | Used in Payout action for Accounts |

| RECEIVE | Used in to Receive funds in an Account |

| REDEEM | Used when an arrangement is matured and balances are to be redeemed to customer. |

| REPAY | Allocates an amount of principal to be repaid to the appropriate account balance. Depending on the PAYMENT.RULE applied, the repayment is made against billed or current amounts.Processing determines the amount and balance to be credited based on the PAYMENT.RULE definition and can result in credit being applied to the CUR, DUE or AGED balances of the account property. |

| REPOSSESS.ASSET | Used while returning the Asset for repossession |

| RESERVEFUNDS | Used for Debit action when Temenos Transact is either shadow or DDA |

| RESIDUAL | Used to allocate Residual funds in an amortisation schedule. |

| RESTRUCTURE | Used in Balance Netting to restructure an arrangement. |

| SETTLE.SUSP | Used when suspended balances are settled |

| TRANSFORM | Used to raise entries for AASUSPENSE to CUR<ACCOUNT>INF |

| UPDATE | Used to apply the changes to the Account property attributes and does not result in any accounting updates. |

| UPDATE.APR | Used to update the Annual Percentage Rate (in APR calculation) – that is the Apr Type and Apr Rate fields in the Account condition for account arrangements. In loans and deposits, this activity updates the APR only for non-cashflow type of activity classes (that is, activity classes with Activity Type not set to Cashflow). |

Accounting Events

The following actions generate accounting events as defined in Accounting field.

- ACTIVATE

- CANCEL.ADVANCE

- CREDIT

- CR.MOVEMENT

- DEBIT

- DR.MOVEMENT

- DISBURSE

- MAINTAIN

- MAKE.DUE

- REPAY

- CAPTURE.BILL

- ADJUST.BILL

- REPOSSESS.ASSET

- RESIDUAL

- AGE.BILLS

- ADVANCE.REPAY

Limits Interaction

The Account property does not directly interact with the LIMITS system, but the associated arrangement account record is closely linked.

The Limit Property Condition specifies the LIMIT.REFERENCE to be used for the arrangement product and this is the limit reference used in the related ACCOUNT record.

In this topic