Working with Payment Holiday

This section explains about the payment holiday definitions and processing of the same under various circumstances.

Payment Holiday for scheduled payments can be declared by triggering the UPDATE-PAYMENT.HOLIDAY activity (the same can be achieved from the Arrangement Overview page through Request Payment Holidays) and by setting the relevant holiday related attributes as explained in Configuring Payment Holiday. The above said UPDATE-PAYMENT- HOLIDAY activity can be simulated and also be converted to live.

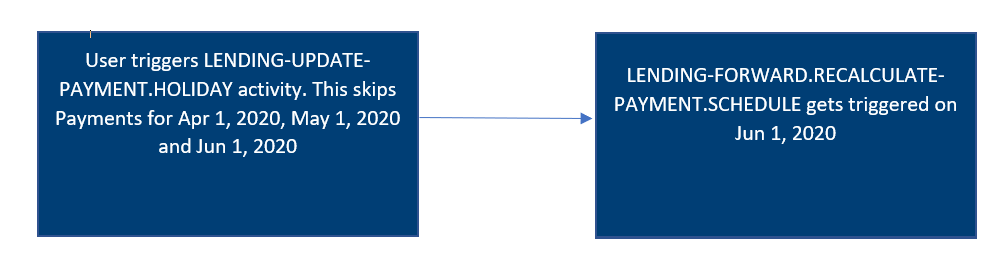

The flexible repayment achieved using a payment holiday is explained in the below workflow:

A loan is created on 1st Jan, 2020 for one year having payments due every month. Assume the customer decides to skip the schedules for the month of April, May and June. The system achieves this flexible repayment through the below flow of activities.

Defining Holiday

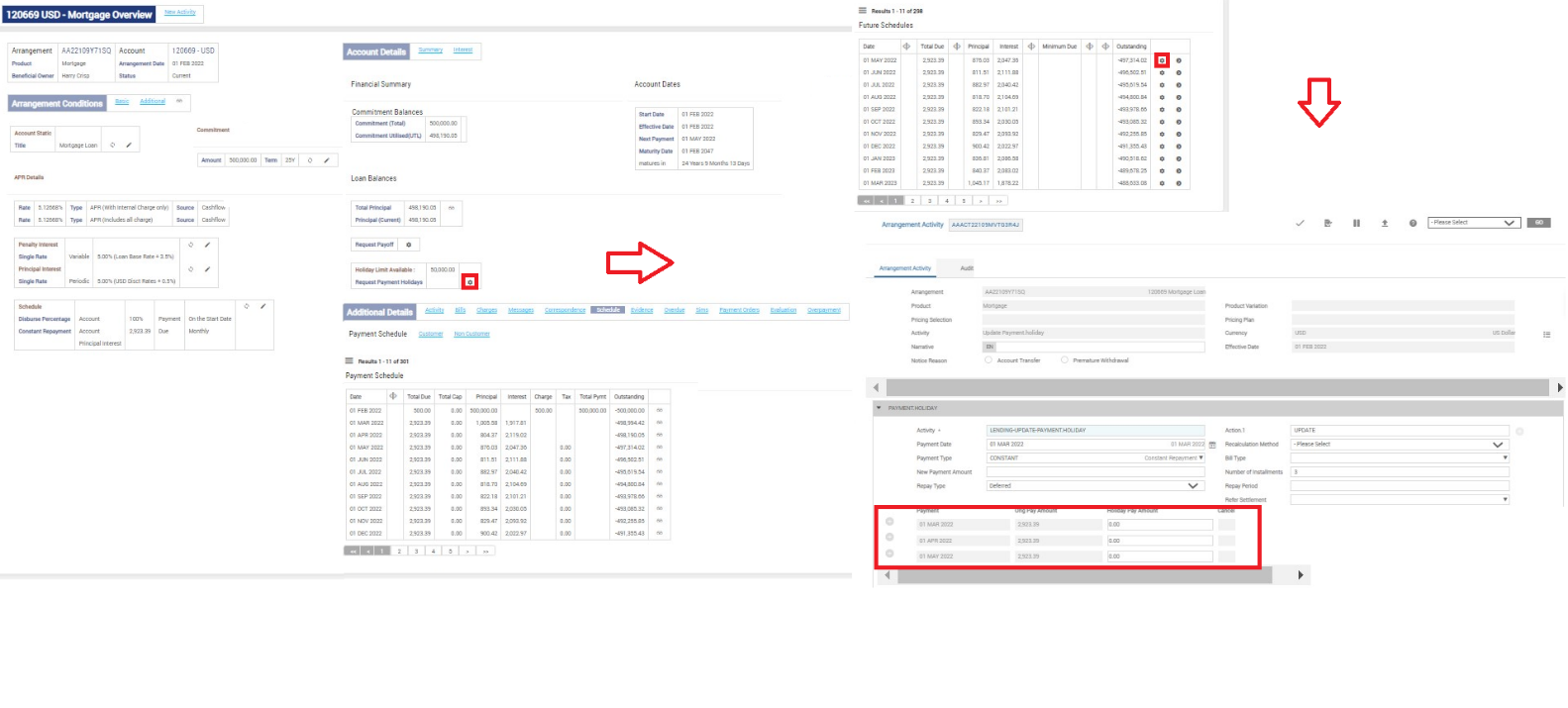

Banks or FIIs can define the payment holiday on an arrangement for Instalment Deferral or Decrease, by using the LENDING-UPDATE-PAYMENT.HOLIDAY activity or accessing the Request Payment Holiday field in the Arrangement Overview page and there by providing the Payment Type or Bill Type, Number of Installments and the New Payment Amount fields as required.

The payment holiday is defined based on the Payment Type or Bill Type, so that, all the components of the specified Bill Type or Payment Type are subjected to the Payment Holiday, unless a restriction is defined though the Payment Schedule product condition. Read Restriction in Flexible Repayment in Payment Holiday for more information.

Banks or FIIS can reduce the repayment amount for a particular period by capturing the New Payment Amount and Number of Installments.

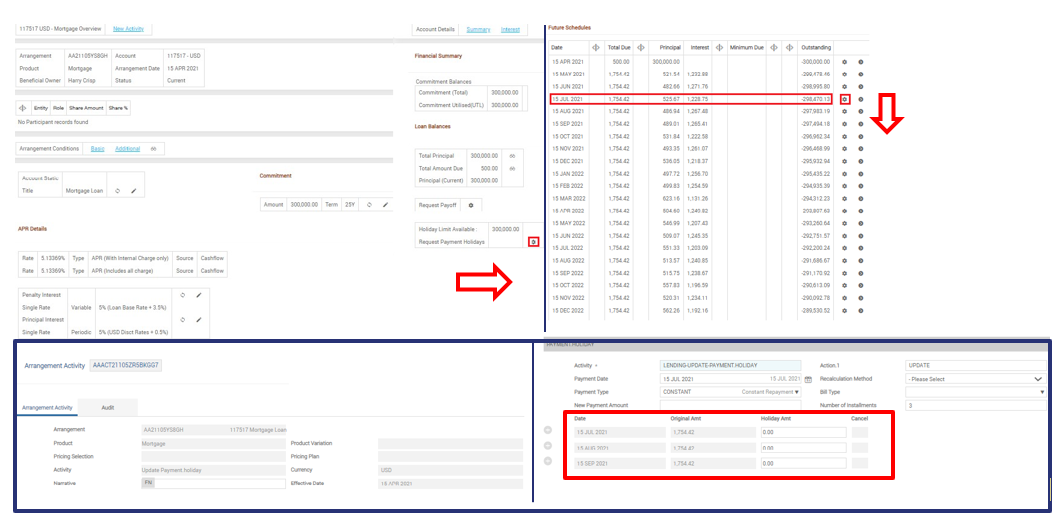

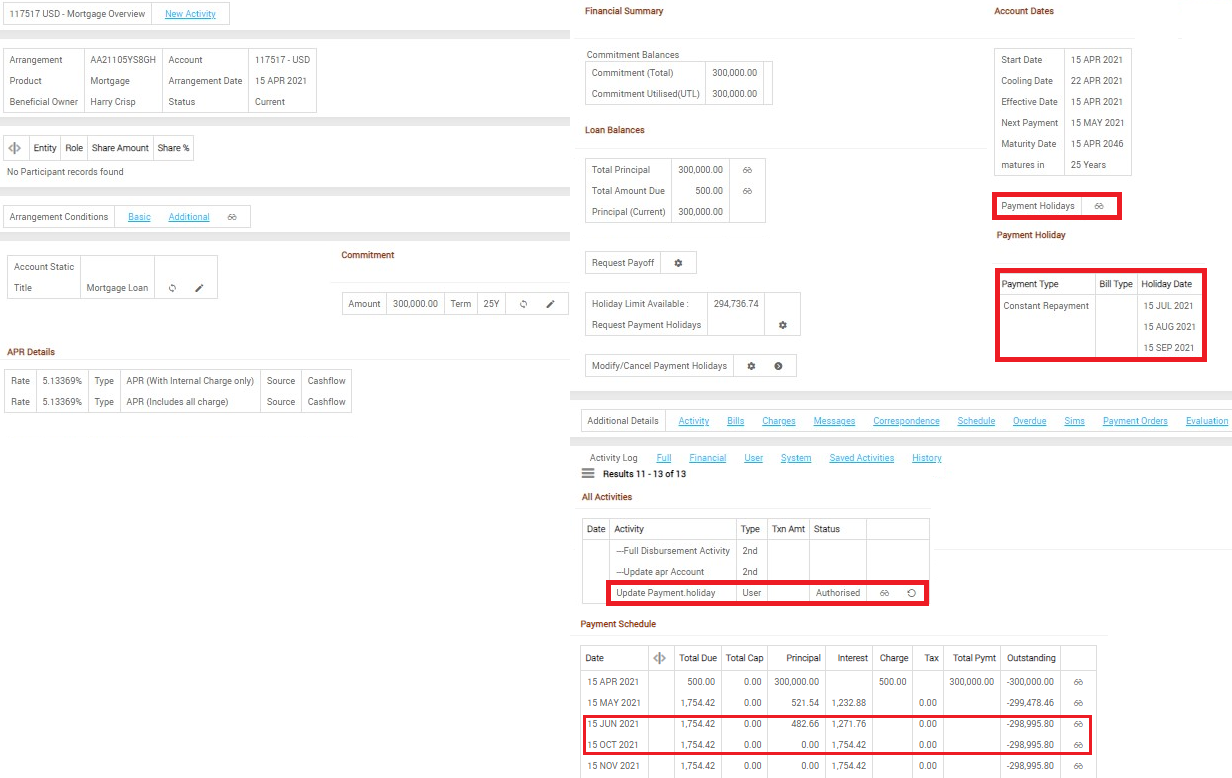

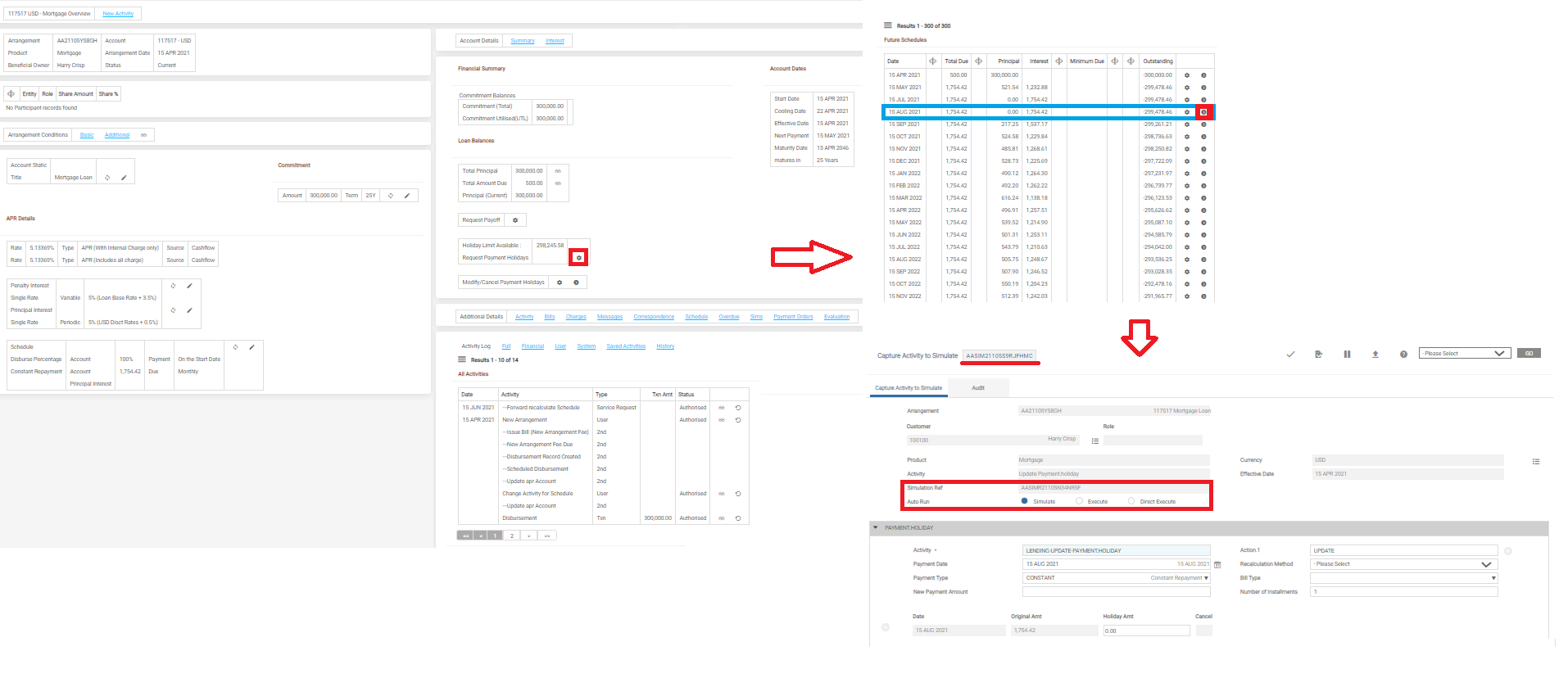

The below screenshot displays the payment holiday that can be declared by enabling the Request Payment Holidays field in the Arrangement Overview page. Here, the user has selected to apply Payment Holiday for three installments from the schedule due on Jul 15, 2021.

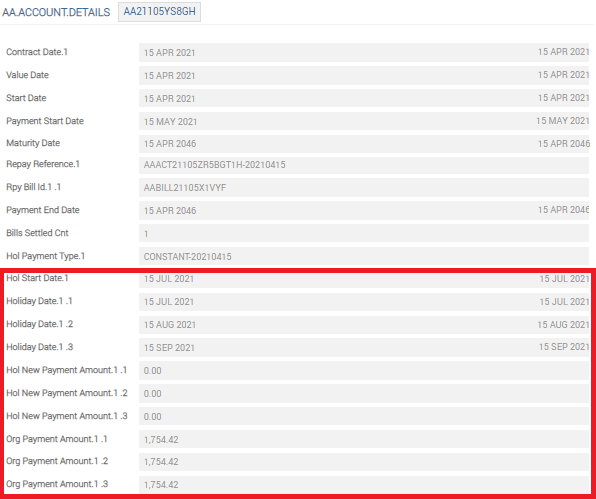

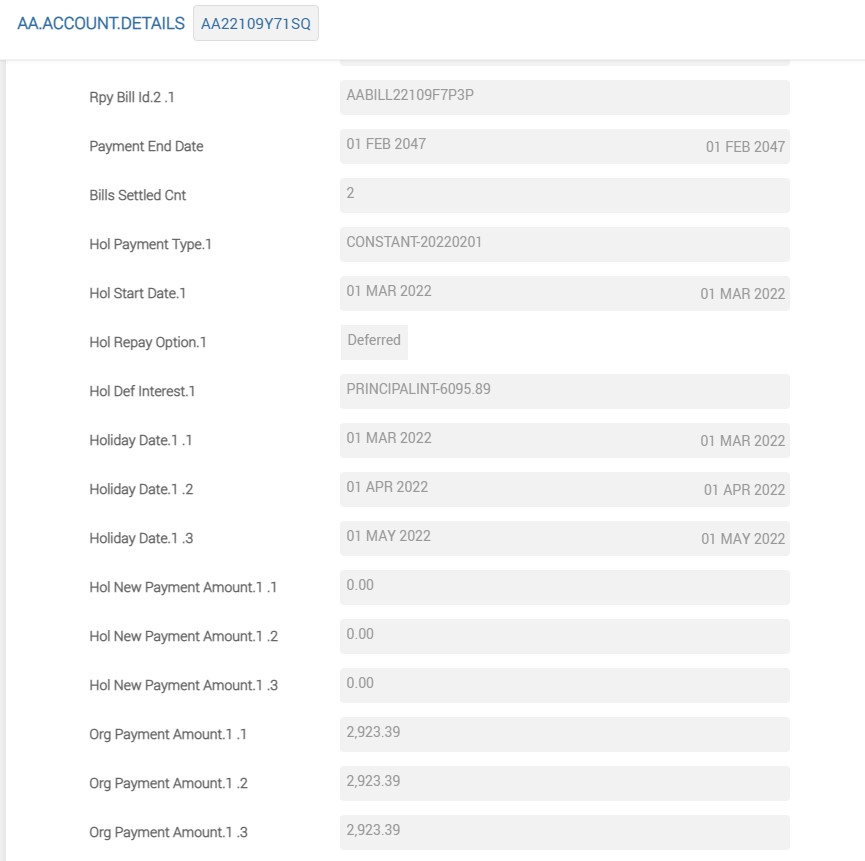

The payment holiday details are captured in AA.ACCOUNT.DETAILS, whenever a payment holiday is defined as shown below for the specified example.

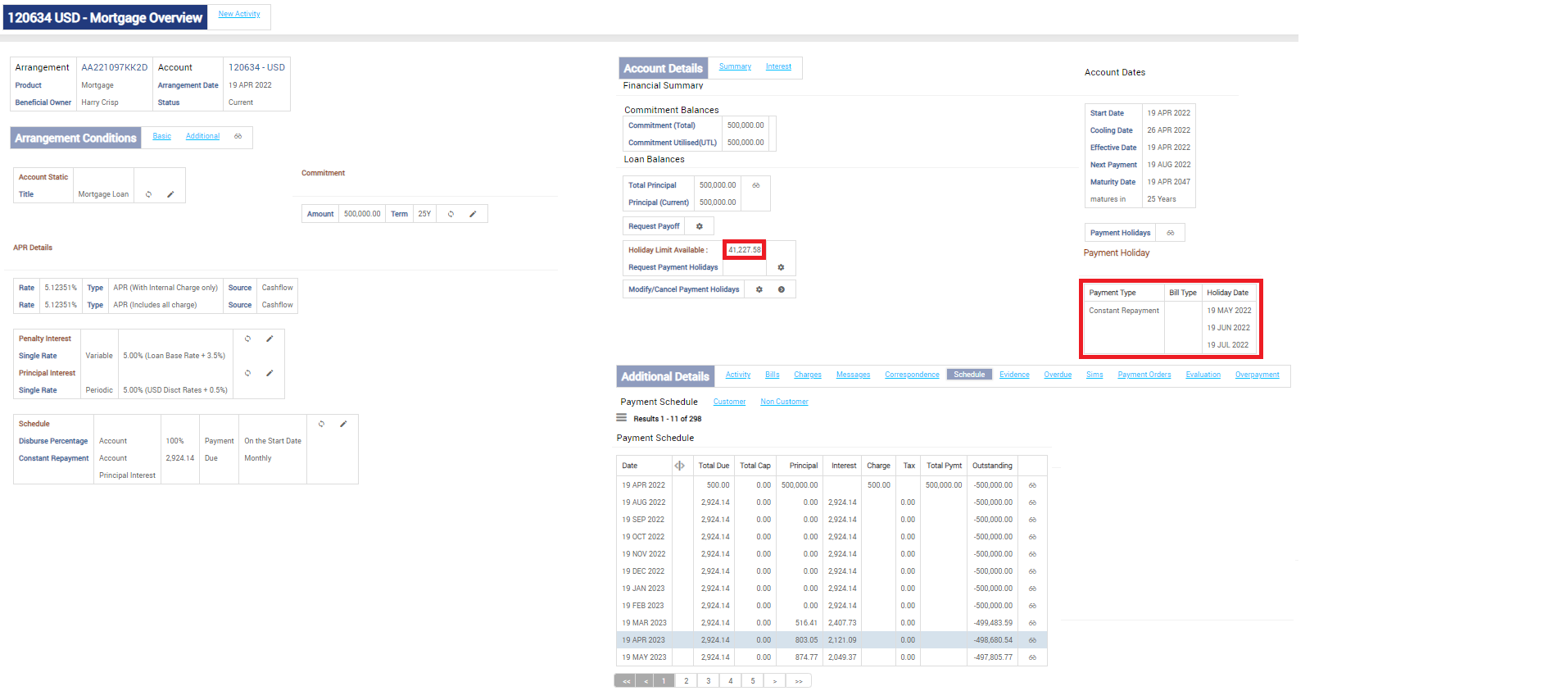

The details of the holiday is evident in the Payment Holiday drill down in the Arrangement Overview page.

Simulating Payment Holiday

The system allows simulation of a payment holiday, to understand the impact of the payment holiday on the arrangement and then execute the same (instead of directly executing the same). In the below screenshot the user selects the Request Payment Holiday option in the Arrangement Overview page, from where Apply Payment Holiday simulation for the installment of the month Aug 2021 was selected.

The payment holiday simulation results are available under the Simulation tab in the Arrangement Overview page. The details of the simulation are stored in the $SIM files that can be used for further actions. The simulation results are printable and helps the banks to take the holiday execution forward.

Repayment of Holiday Interest

The system continues to accrue interest even during a payment holiday. This accrued interest is automatically collected in the upcoming installment/s immediately after the regular payment resumes.

The user has an option to repay the holiday interest as an additional schedule over a specific period or until maturity. This is achieved by using the Payment Holiday attributes, Repay Type, Repay Period and Refer Settlement (Read Payment Holiday Attributes for more information)

This section describes the Payment Holiday to reduce the repayment amount and defer the interest over a period.

- Consider a payment in which the monthly instalment is 120 (70 principal and 50 interest) and the payment rule is set to service the interest first.

- If the payment is decreased from 120 to 70, the interest is billed fully and remaining towards the principal or any other component as defined. Thus, there is no accrued holiday interest for processing and trying to defer the holiday interest raises an error.

- If the instalment is decreased from 120 to 40, the interest is partially billed for 40 against accrual of 50. The system tracks the unbilled interest portion for the entire holiday period and considers the same for processing holiday interest after the payment holiday period, based on the Repay Type, Repay Period and Refer Settlement fields in Payment Holiday Transaction Class.

- Consider a payment in which the monthly instalment is 120 (70 principal and 50 interest) and the payment rule is set to service the principal first.

- If the instalment is decreased from 120 to 60, the interest is billed fully and remaining towards the principal or any other component as defined. Thus, there is no accrued holiday interest for processing and trying to defer the holiday interest raises an error.

When a payment holiday is declared for May, June and July installment with Repay Type left blank (that is, the system first adjusts the accrued holiday interest, before the adjusting the normal interest due and principal) the system adjusts the interest accrued during the holiday period, immediately after the defined Payment Holiday.

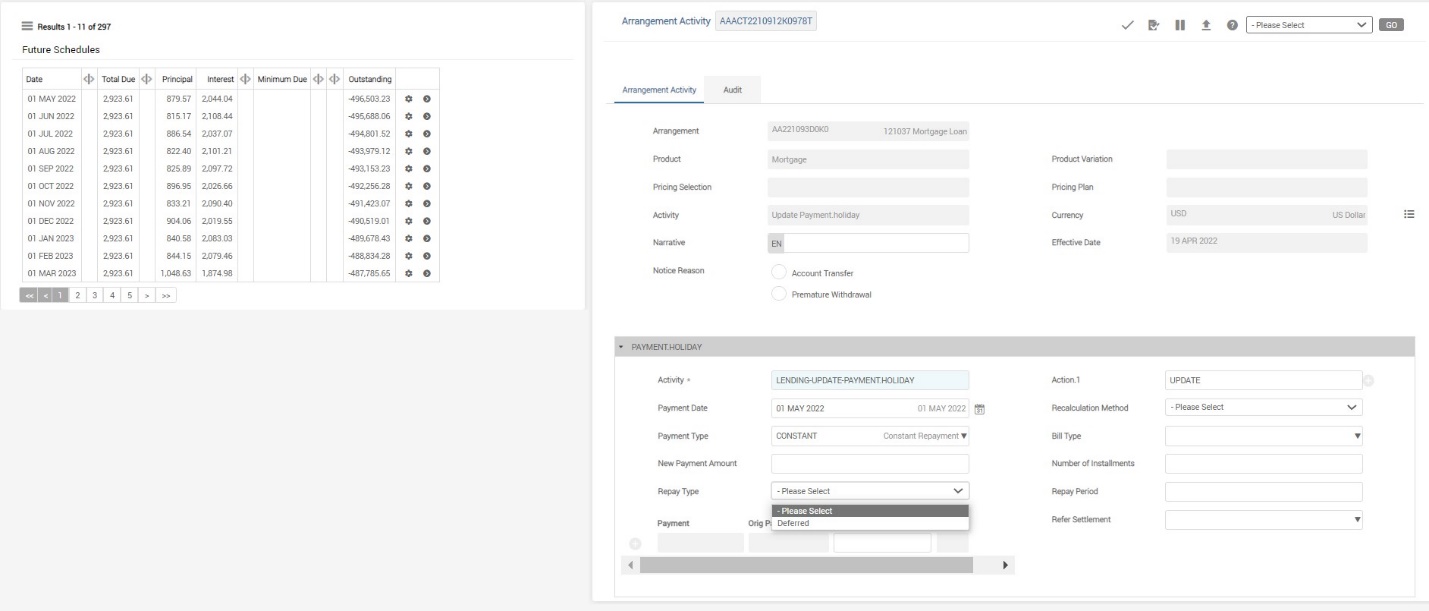

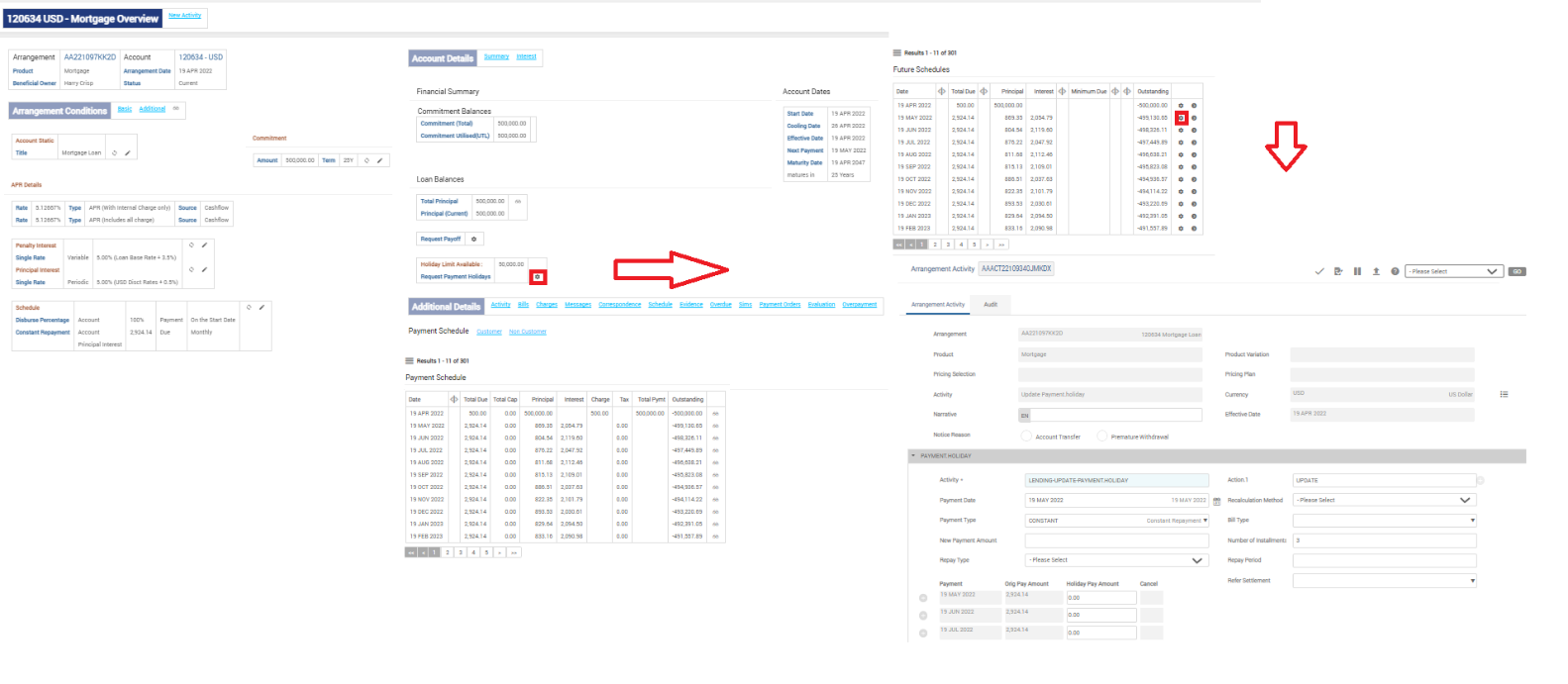

In the above example, it can be observed that the instalments due for the months May, Jun and Jul are skipped and as per the schedule it is observed that the interest component is adjusted first, from the month of Aug 2022 (instalment date immediately after the Payment Holiday) to Feb 2023.

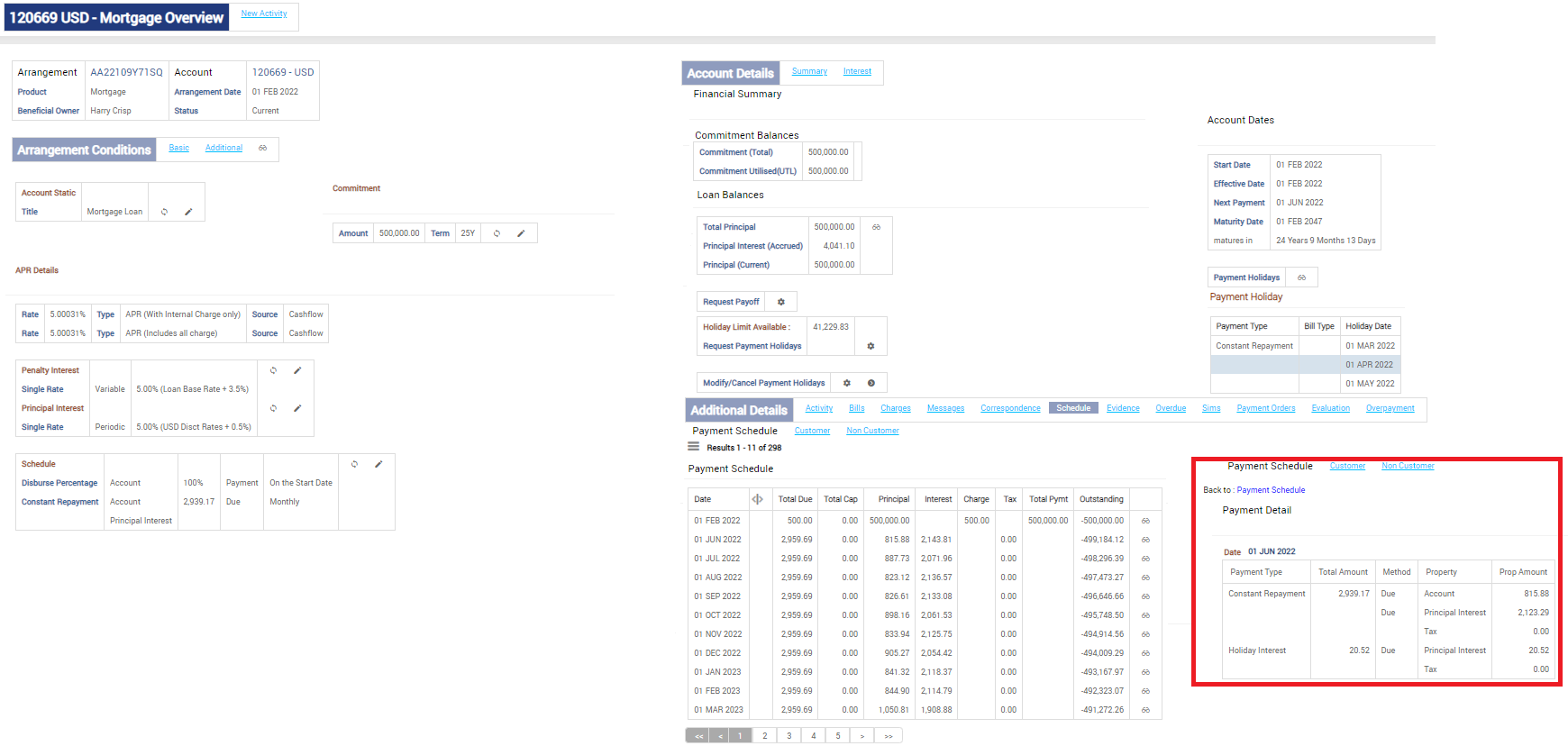

Consider a payment holiday for the months of Mar, Apr and May installments with Repay type set as Deferred and Repay Period left blank. The system collects the interest accrued during the payment holiday namely the Holiday Interest, scheduled equally throughout the life of the loan.

Here, it can be observed that the instalments due for the months Mar, Apr and May 2022 are skipped and as per the schedule it is observed that the holiday interest is equally collected throughout the life of the arrangement.

The interest accrued during the holiday period is USD 6095.89 (as seen in AA.ACCOUNT.DETAILS) and the remaining number of instalment is 297 (that is, (25*12) months – 3 Months= 297 Months). Thus, the Holiday Interest is 6095.89/297 = USD 20.52 per month, till maturity.

Consider a loan arrangement of USD 5000 at 5%, starting from Nov 2020, to be repaid in 12 monthly installments. The repayment start month is Dec 2020 and ends by Nov 2021 (that is, 12 monthly installments). The Payment type defined is Constant/Annuity and the Recalculate Method after defining Payment Holiday is Payment.

|

Schedule Months |

TOTAL Repayment |

Instalment |

Principal |

Interest |

Payment Holiday Interest |

Payment Holiday Accrued Interest |

Payment Holiday Accrued Interest Cumulative |

Outstanding |

|---|---|---|---|---|---|---|---|---|

|

12/2020 |

428.07 |

428.07 |

407.24 |

20.83 |

|

|

|

4592.76 |

|

01/2021 |

0 |

0 |

0 |

0 |

|

19.14 |

19.14 |

4592.76 |

|

02/2021 |

0 |

0 |

0 |

0 |

|

19.14 |

38.28 |

4592.76 |

|

03/2021 |

0 |

0 |

0 |

0 |

|

19.14 |

57.42 |

4592.76 |

|

04/2021 |

592.18 |

585 |

565.86 |

19.14 |

7.18 |

|

50.24 |

4026.9 |

|

05/2021 |

592.18 |

585 |

568.22 |

16.78 |

7.18 |

|

43.06 |

3458.68 |

|

06/2021 |

0 |

0 |

0 |

0 |

0 |

14.41 |

57.48 |

3458.68 |

|

07/2021 |

0 |

0 |

0 |

0 |

0 |

14.41 |

71.89 |

3458.68 |

|

08/2021 |

0 |

0 |

0 |

0 |

0 |

14.41 |

86.3 |

3458.68 |

|

09/2021 |

1191.37 |

1162.6 |

1148.19 |

14.41 |

28.77 |

|

57.53 |

2310.49 |

|

10/2021 |

1191.37 |

1162.6 |

1152.97 |

9.63 |

28.77 |

|

28.76 |

1157.52 |

|

11/2021 |

1191.10 |

1162.34 |

1157.52 |

4.82 |

28.76 |

|

0 |

0 |

- The instalment amount is USD 428.07 initially.

- Payment holiday is declared for Jan, Feb and Mar.

- The monthly accrued interest during holiday period is accumulated to a total of USD 57.42.

- This amount is scheduled as an additional installment for holiday interest till maturity.

- The holiday installment amount is USD 7.18 and is scheduled from April till maturity.

- Another payment holiday is declared for Jun, Jul and Aug.

- The outstanding holiday interest is 43.06 and a new holiday starts.

- The holiday interest accumulated during the second payment holiday is moved to HOL<INTEREST> balance type at the end of the payment holiday.

- The outstanding HOL<INTEREST> pending to be billed at the end of second payment holiday is USD 86.3.

- This amount is scheduled as an additional installment for holiday interest till maturity.

- The holiday installment amount is USD 28.77 and is scheduled from Sep till maturity.

IFRS Contract with EB Cashflow having Payment Holiday

Consider a scenario where the loan has a monthly interest accrual of 30 and bank has defined a holiday for three instalments. The holiday interest is set to be collected over the four subsequent cycles.

|

Scenario |

ACC <Interest> |

HOL <Interest> |

DUE Regular <Interest> |

DUE Holiday <Interest> |

Total DUE Interest |

|---|---|---|---|---|---|

|

Holiday granted for 3 months at the beginning of the month |

|

||||

|

Day 1 |

1 Dr |

0 |

0 |

0 |

0 |

|

Day 30 |

30 Dr |

0 |

0 |

0 |

0 |

|

End of 1st month/Day 30 |

30 Dr |

0 |

0 |

0 |

0 |

|

End of 2nd Month |

60 Dr |

0 |

0 |

0 |

0 |

|

End of 3rd Month |

90 Dr |

0 |

0 |

0 |

0 |

|

SOD of 3rd Month End |

0 |

90 Dr |

0 |

0 |

0 |

|

End of Holiday

|

|||||

|

End of 4th Month |

30 Dr |

90 Dr |

0 |

0 |

0 |

|

Bill raised at the SOD of 4th month |

0 |

67.5 Dr |

30 Dr |

22.5 (holiday interest is calculated based as Tot Residual Balance/ 4) |

52.5 Dr |

|

Bill raised at the SOD of 5th month |

0 |

45 Dr |

30 Dr |

22.5 Dr |

52.5 Dr |

|

Bill raised at the SOD of 6th month |

0 |

22.5 Dr |

30 Dr |

22.5 Dr |

52.5 Dr |

|

Bill raised at the SOD of 7th month |

0 |

0 |

30 Dr |

22.5 Dr |

52.5 Dr |

The LENDING-UPDATE-PAYMENT.HOLIDAY is a cashflow type activity. Thus, when Update Holiday is triggered, in the above scenario the cashflow handoff happens as projected below.

|

Timeline |

Cashflow handoff (Overall Interest) |

|---|---|

|

In the above illustration consider that the PH was sanctioned on Apr 1 for three instalments |

|

|

30th Mar |

0 |

|

30th Apr |

0 |

|

30th May |

0 |

|

30th June |

52.5 |

|

30th July |

52.5 |

|

30th Aug |

52.5 |

|

30th Sept |

52.5 |

Impact of Change Schedule in Payment Holiday

When the bank/FIIs defines the Repay Period as Deferred, the holiday interest linked to Payment Type or Bill Type gets deferred for the specified period as mentioned in the Repay Period. At the end of holiday period, the system generates a holiday interest payment type automatically for the holiday interest balances associated with the loan and schedule the holiday interest Payment Type by mirroring the schedule associated with the Interest Property in the Payment Type or Bill Type (as defined during UPDATE-PAYMENT.HOLIDAY Activity). Read Payment Type for Holiday Interest for more information.

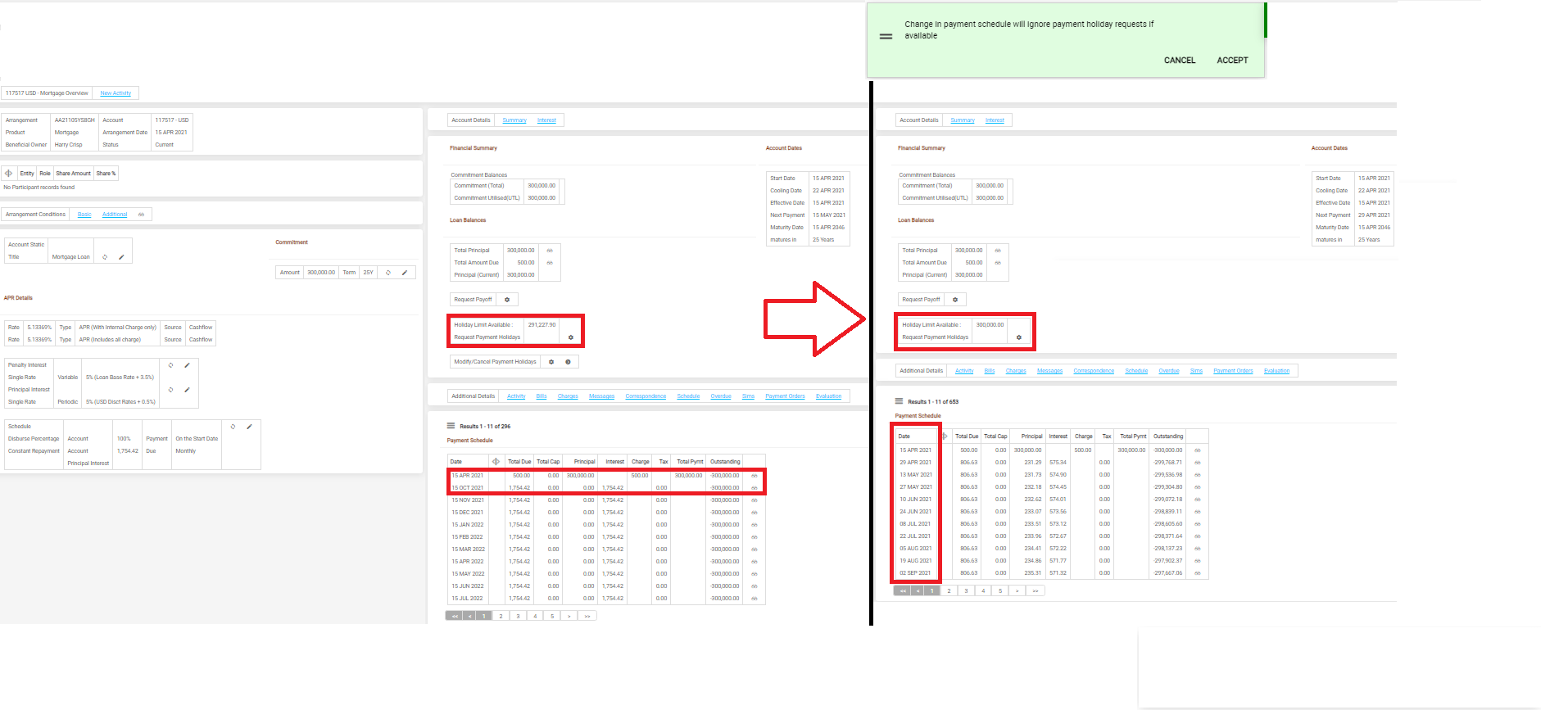

Once the Payment Holiday is defined, any change in the schedule (frequency change, bill type change, payment type change, start/end dates), cancels or voids all the future Payment Holiday defined (cancels the existing payment holiday). That is, if an arrangement is in a Payment Holiday Period or has defined a Payment Holiday Period for a future date, the change in schedule cancels all the payment holidays from the date of change of schedule.

An override is raised by the system for modification in the schedule of loan carrying Payment Holiday or having a future date Payment Holiday. Fresh holiday instructions need to be declared, if necessary for additional bills.

For example, during a payment holiday, if the user tries to change the future schedule dates of the loan, then the existing payment holiday from the current date is cancelled by the system and user should request a fresh payment holiday for the recent holiday.

The same holds good when there is payment holiday scheduled in future and the payment schedule is changed prior to that scheduled payment holiday.

A mortgage arrangement of USD 300,000 for 25 years, is opened and disbursed as on Apr 15, 2021. Repayment is set as monthly, and Payment Type set as Constant.

As per the customer request, the bank/FIIs applied for a Payment Holiday, from May to Sep. Now the customer requests a change in the repayment schedule of the arrangement from monthly to bi-weekly, before the payment holiday gets exhausted. This results in raising an override stating 'Change in payment schedule will ignore payment holiday requests if available' and there by makes all the existing Payment Holiday defined as void.

Payment Holiday Dates

The following section describes backdated and future dated payment holidays with illustrations.

Back Dated Payment Holidays

When a customer is unable to repay his loan and has missed few installments, it is possible that the bank declares those missed installments as payment holidays and restructures the loan. In this scenario, the holiday start date cannot be less than the Activity effective date. For the holiday start to be backdated, the Activity has to be run backdated. This means that, the bank or FIIs can provide a Back Dated Payment Holiday, if the LENDING-UPDATE-PAYMENT.HOLIDAY activity is also back dated.

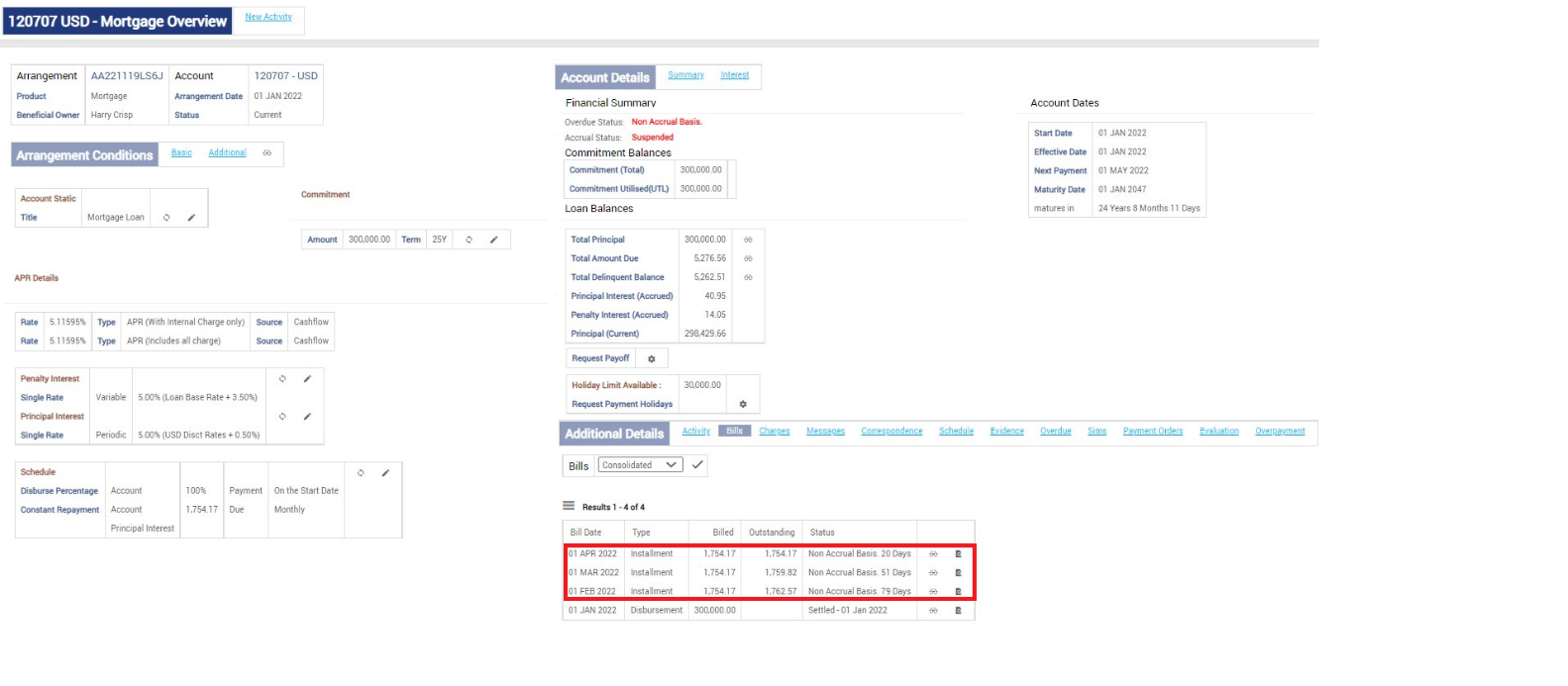

Consider a mortgage that is in NAB status due to outstanding bills.

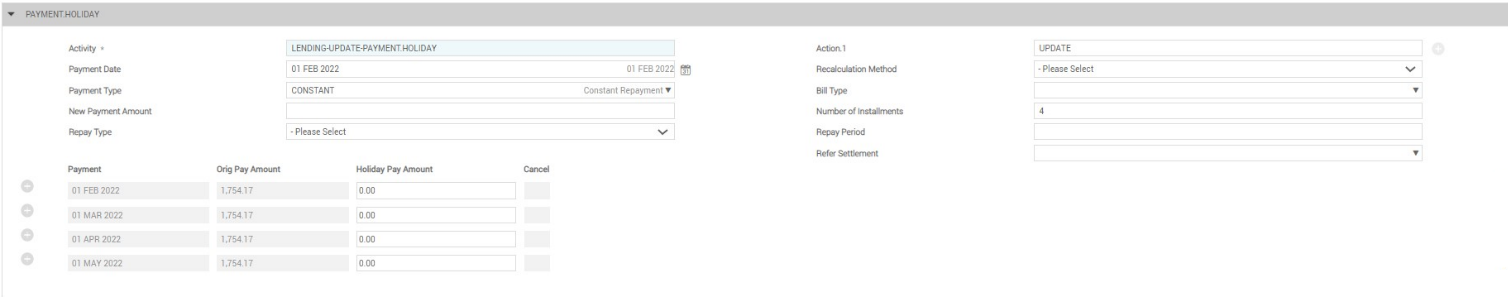

Now the customer approaches the bank/FII requesting for a back dated payment holiday, from Feb 1, 2022 to May 1, 2022 and the same gets approved. Accordingly, bank/FIIs agrees for the same.

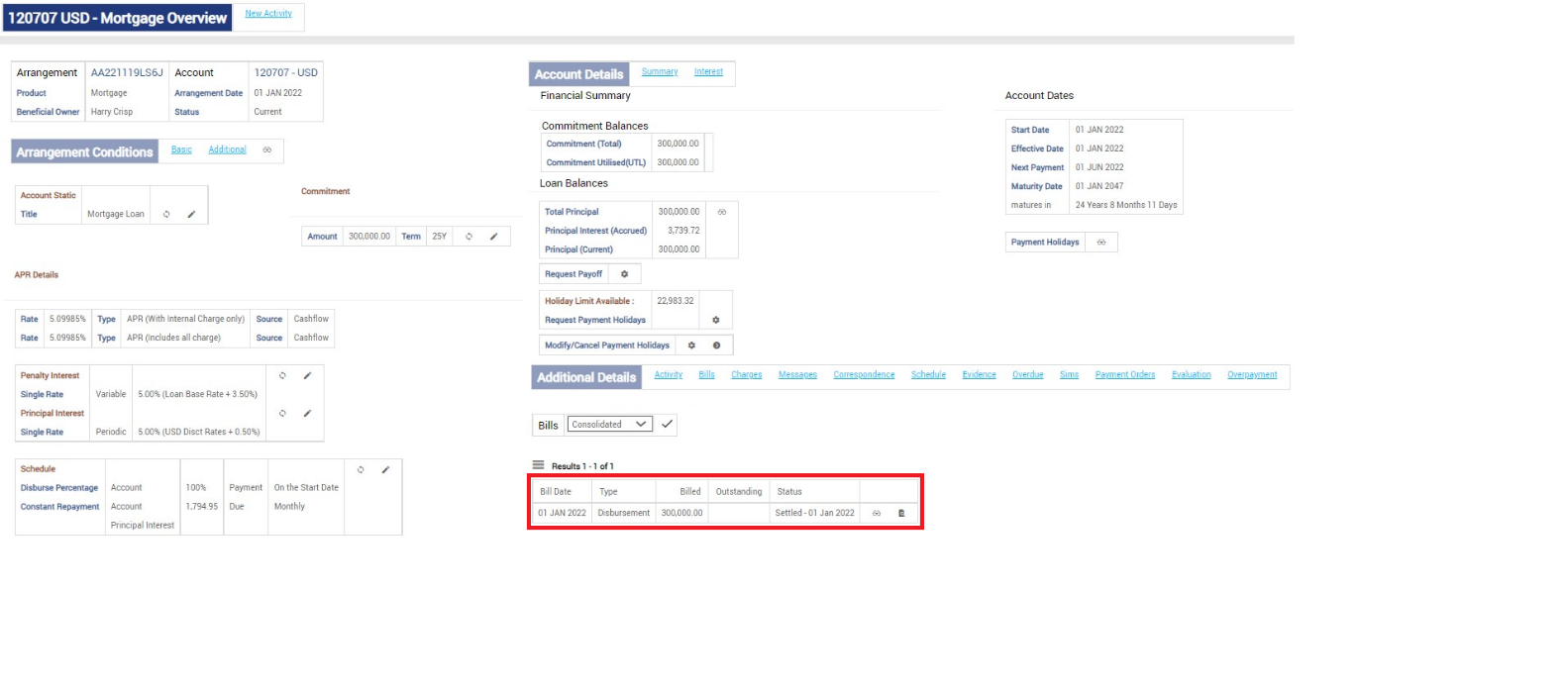

After the payment holiday is declared, the customer does not miss any payment and his overdue status is reassessed based on the new schedule. The loan is not in NAB status after this restructure of declaring a back value dated payment holiday.

Future Dated Payment Holiday

If the start date is in the future, then the base date for holiday payment calculation, is the previous payment date of the holiday start date.

Amending Payment Holiday

Payment holiday definition can be reversed, by reversing the actual activity. Any amendments to the existing holiday payments definition can be made by using the CHANGE-PAYMENT.HOLIDAY activity. This functionality helps the bank/FIIs to modify or cancel an already defined Payment Holiday.

Payment Holiday Limit

Payment Holiday Limits allow the bank/FIIs to provide flexible payment or payment holiday options to the customer, by either reducing the repayment amount or by skipping the same, upto a defined limit agreed by the bank/FIIs and the customer. The Payment Holiday limit can be defined by configuring the Payment Schedule Condition as explained in Payment Holiday Limit.

When the repayment obligation is reduced or skipped for a customer, the system compares the amount reduced from the original repayment and with that of the available payment limit defined. An error or an override can be defined, if the limit is breached as per the banks/FIIs convenience.

There can be situations, when the schedule payment amount may change due to changes in rate of interest, term or cancelling the declared holiday in the loan. In such circumstances, the system automatically updates the Payment Holiday limit based on the new payment amount and triggers an alert to the customer when the limit is breached.

Consider the following conditions:

- The maximum limit for flexible repayment is USD 30000

- Every month instalment is due for USD 10000.

Consider a contract, having a term of one year for USD 120000 as on Jan 1,2020. The customer now requests for a payment holiday of the entire installment, for the months of Apr, May and Jun. Accordingly bank sanctions the payment holiday. Thus the Payment Holiday Limit now is USD 30000 and the Utilised Payment Holiday Limit is USD 30000.

Later the customer approaches the bank requesting for cancelation of the Payment Holiday, for Jun. This is approved by the bank and thereby the Available Payment Holiday limit becomes USD 10000 and Utilised Payment Holiday Limit now is USD 20000.

Now, the bank decides to increase the interest for the said contract, after Apr. This results in increasing the payment amount from USD 10000 to USD 11000 for the month of May. Since the month of May is within the defined Payment Holiday, the Utilised Payment Holiday Limit increases to USD 21000 and the Available Payment Holiday limit becomes USD 9000.

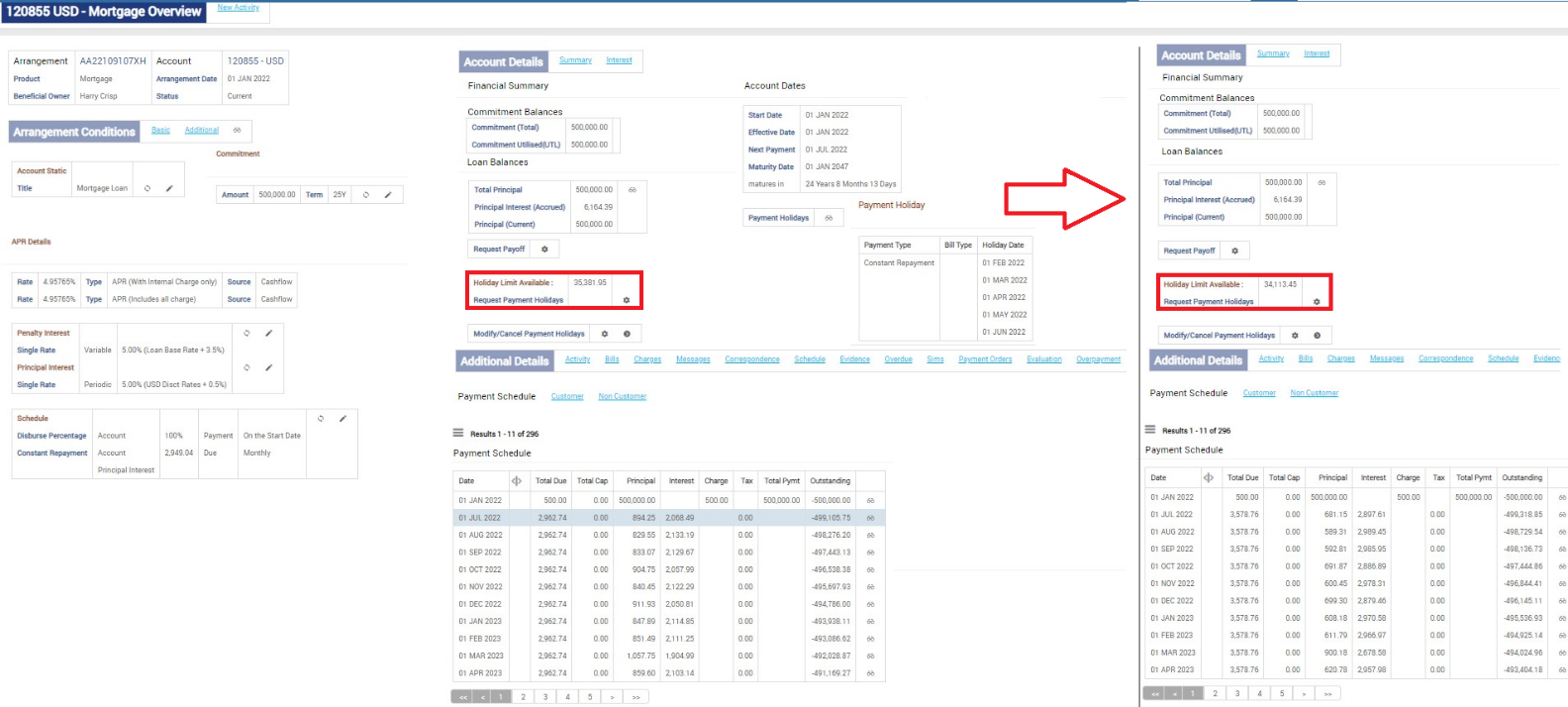

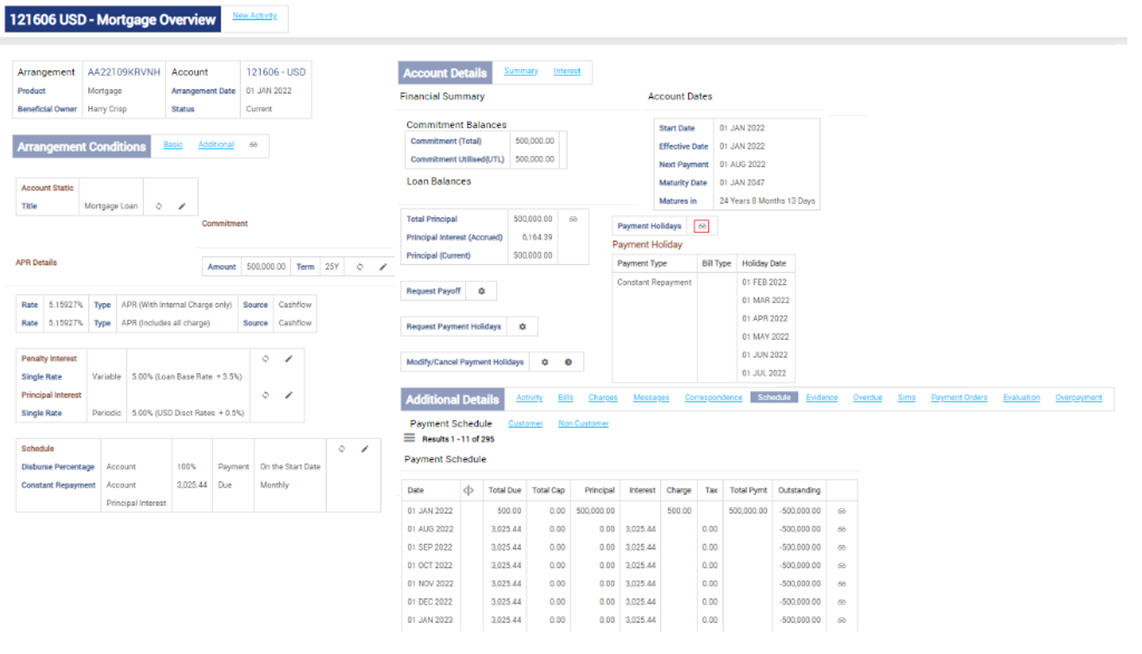

A mortgage arrangement of USD 500,000 for 25 years, is opened and disbursed as on Jan 1, 2022. The Payment Holiday Limit for the arrangement is set at USD 50,000.

A Payment Holiday is applied on the arrangement, for the months of Feb to Jun 2022, for the Payment Type Constant, Repay type Deferred and Repay Period left blank (that is, the system collects the interest accrued during the Payment Holiday or Holiday Interest, equally throughout the life of the loan).

The bank as on Apr 19, 2022 decides to increase the margin of the interest from 0.50 to 25.00.

This in turn affects the scheduled payments from Apr 19,2022 and the same can be seen in the schedule of the arrangement. However as the arrangement is in the Payment Holiday Period (that is, from Feb to Jun 2022), the said increase in the interest, is adjusted with Payment Holiday limit. The same can be observed, by the reduction of Available Payment Holiday limit from USD 35.381.95 to USD 34.113.45 as shown below.

Consider a loan having a Payment Holiday Limit of USD 3000 and monthly installment of USD 4500. In this scenario, while placing a Payment Holiday request, the system displays an error message, as the available Payment Holiday Limit is less than the monthly instalment and thus the New Payment Amount field should be entered maximum to the extent of 3000 USD.

Revolving Payment Holiday Limit

A Payment Holiday Limit can be configured to reinstate to its initial defined Payment Holiday limit, due to adhoc or excess repayments, over and above the due amount. This can be configured as defined in the Payment Holiday Limit in Payment Holiday configuration. Upon creation of an arrangement, the customer can request for a repayment holiday. The system evaluates the Repayment Holiday Limit for the product and accordingly reduces or skips the repayment obligation, as per the Flexible Payment Limit available. For revolving Payment Holiday Limit, any excess payment towards the principal, results in the evaluation of the Available Payment Holiday Limit with that of the Payment Holiday Limit defined and there by restoring the Payment Holiday limit to the extend of the defined Payment Holiday Limit (This is termed as Limit Restoration). The Available Holiday Limit is updated online and the same is evident in the Arrangement Overview page. This process can be understood from the scenarios below.

Consider a one year loan, starting from Jan 1, 2021, for an amount of USD 120000. The monthly repayment is say USD 10000 and Payment Holiday Limit USD 30000.

After settling the bills of Jan, Feb and March, the customer requests for a payment holiday on Mar 20 for next two bills. As the payment holiday is given for USD 20000, the holiday limit is reduced to USD 10000. When the customer makes a repayment of USD 50000 towards the principal of the loan on Mar 25, it reinstates the Payment Holiday Limit to its initial defined Payment Holiday Limit of USD 30000.

Consider a loan account in overdue status for USD 4500. The Payment Holiday Limit for the said loan is defined as USD 5000 and the Available Payment Holiday Limit for the loan as of now, is USD 2000.

The customer now approaches the bank for an excess payment of USD 6000.

The system adjusts excess payment, against the overdue amount of USD 4500 and the remaining amount of USD 1500 is used to replenish the Available Payment Holiday Limit (maximum to the extend of the initial defined Payment Holiday Limit of USD 5000). The New Available Payment Holiday Limit is USD 3500.

Consider a loan having Payment Holiday Limit of USD 5000 and monthly installment amount of USD 4500. The customer holds an excess amount of USD 6000 in his loan account.

Now the customer requests a Payment Holiday for the coming two months, summing to an amount of USD 9000 (that is, 2*USD 4500=USD 9000). The customer expects the same to be approved (as he holds an excess amount of USD 6000 in his loan account and has a Payment Holiday limit of USD 5000), however the system raises an error, as the system while defining the Payment Holiday checks the Payment Holiday limit and the customer only has a Payment Holiday Limit of USD 5000.

Controlling Payment Holidays Count

Banks/FIIs can control the number payment holidays allowed in an arrangement by configuring the HOLIDAY.COUNT periodic attribute in the Payment Schedule product condition. (Read Controlling Payment Holidays Count Configuration for more information)

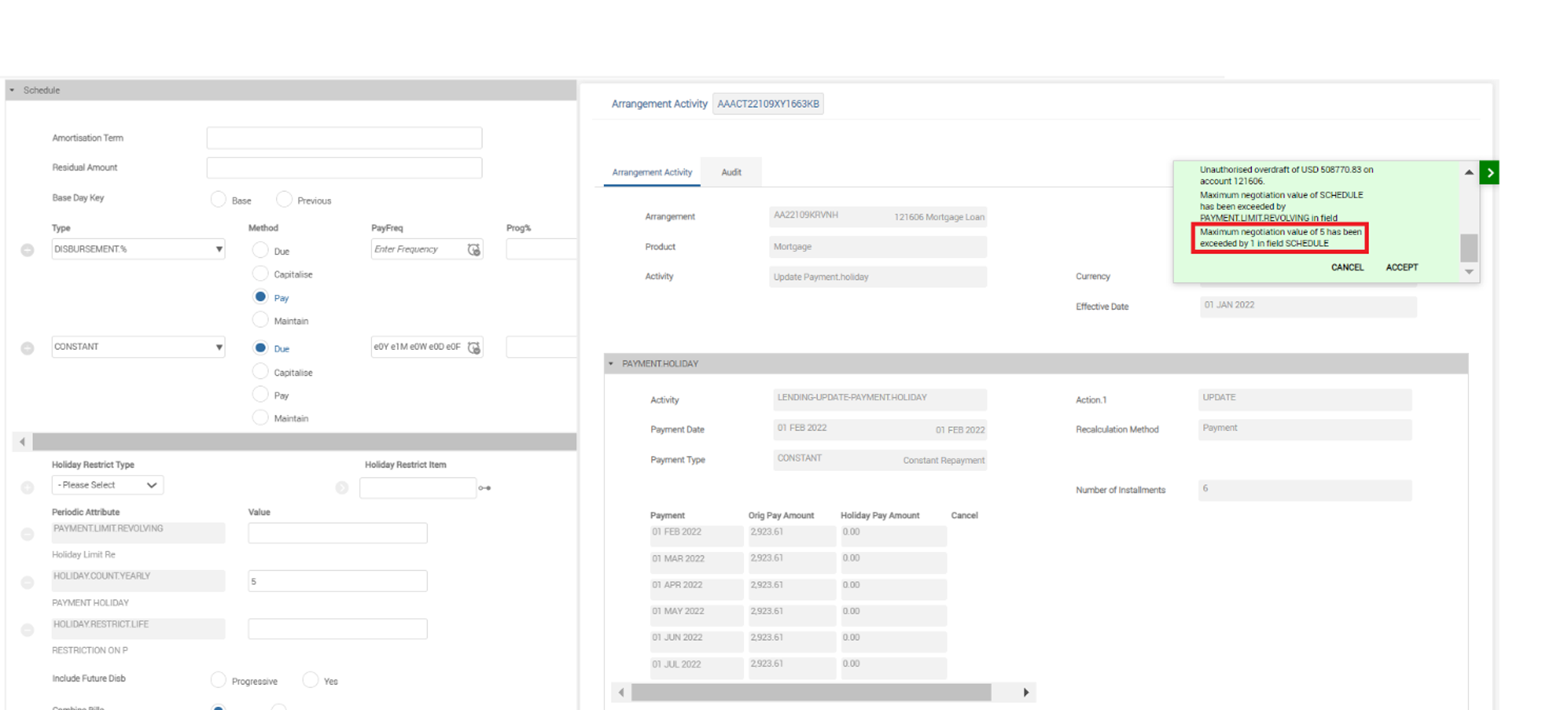

Consider a mortgage arrangement in Lending product line, where the number of payment holidays that can be defined in a year is restricted to five (using the HOLIDAY.COUNT.YEARLY periodic attribute). If the user defines more than the stipulated payment holidays, the system raises an override.

When the customer tries to define a payment holiday for six instalments, the system displays the following override message: Maximum negotiable value of 5 has been exceeded by 1 in field SCHEDULE.

Defining Restriction on Consecutive Payment Holidays

The system supports restriction of payment holiday in parallel (that is, if an arrangement is within a payment holiday, further definition of a payment holiday is restricted, unless and until the current payment holiday period has expired), through the HOLIDAY.RESTRICT.LIFE periodic attribute, configured in the Payment Schedule product condition (Read Payment Holiday Configuration for more information).

The system restricts definition of parallel payment for payment holidays having Repay Type as Deferred, without the configuration of the Periodic Attribute in the Payment Schedule product condition.

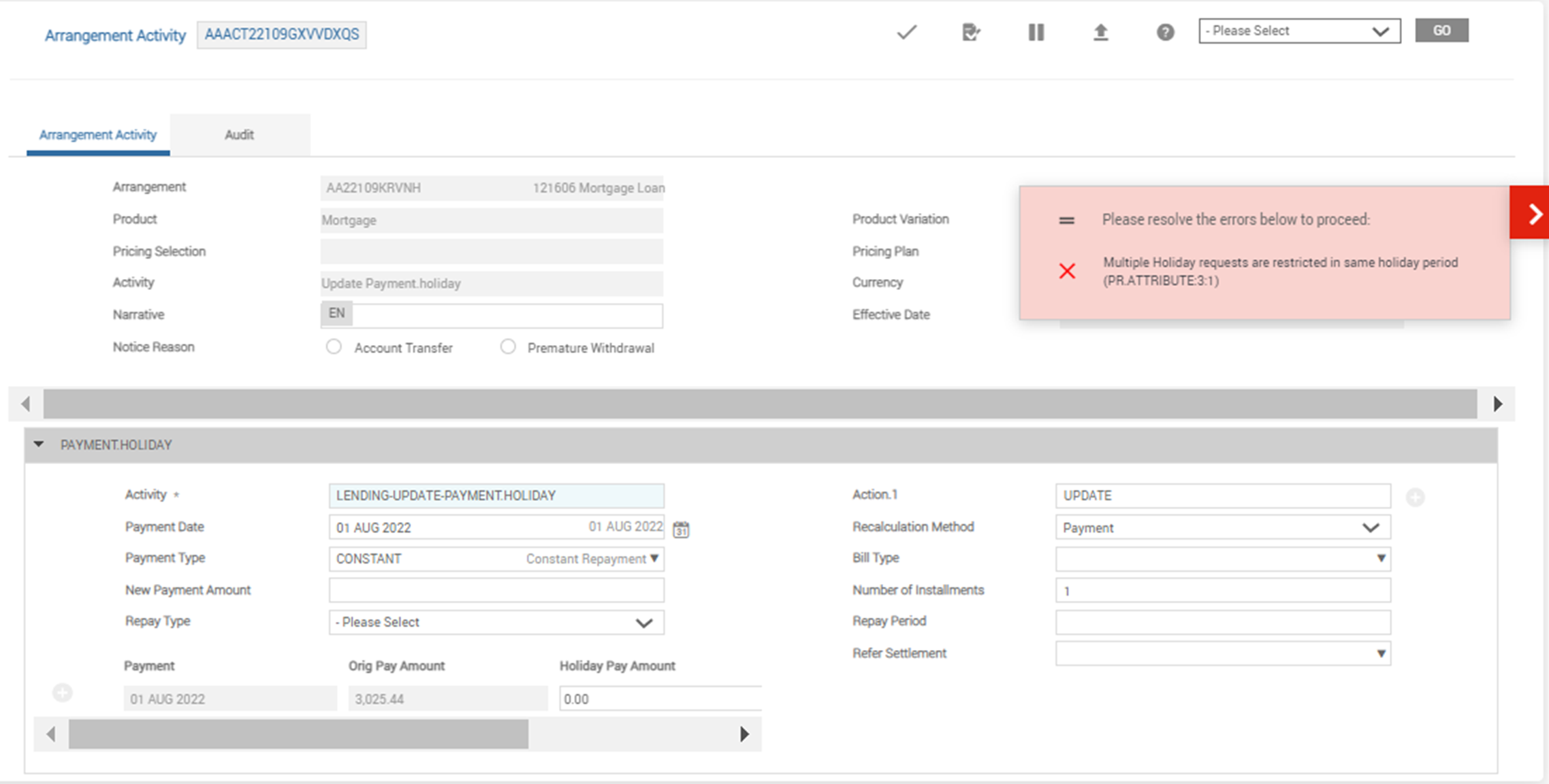

Consider a mortgage arrangement in Lending product line with HOLIDAY.RESTRICT.LIFE periodic attribute configured to raise an error, while defining a parallel payment holiday. Payment Holiday is already defined for the months of February, March, April, May, June and July.

The system’s current date is April 19, 2022 and the user tries to define a payment holiday for the month of August. The system displays the following error: Multiple Holiday requests are restricted in same holiday period.

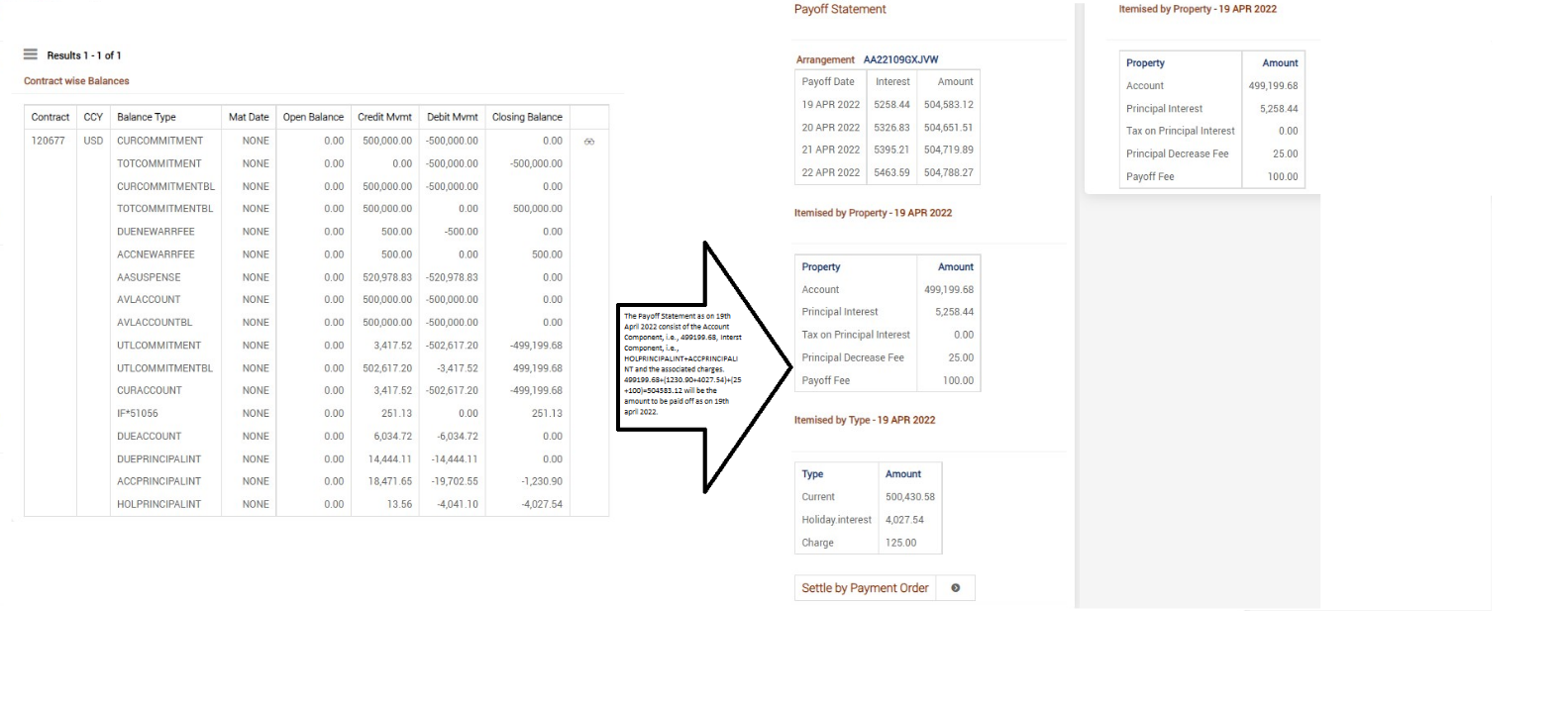

Paying-off during Payment Holiday

Payoff Simulation and Direct Payoff of the loan arrangement, in a holiday or grace period, as well as, the loan arrangement carrying the unbilled holiday interest, is possible. The payoff statement is generated for the entire loan outstanding including the accrued holiday interest and due holiday amount.

Consider that a user triggers a payoff on a loan which is within the payment holiday period. The principal is 1000, due interest amount is 200, accrued interest is 50 and holiday interest balance is 20 (holiday balance represents accrued holiday interest which is yet to be billed).

The loan payoff simulation generates a payoff statement reflecting the holiday interest property along with the property like principal, interest and any fees or charges.

For the above example a payoff statement is generated with the components below.

- Payoff amount = 1270

- Account = 1000

- Interest = 270 (that is, Due Interest Amount=200, Accrual Interest=50 and Holiday Interest= 20)

Payoff bill includes the holiday interest accrual as part of the overall payoff bill.

Consider a user triggers payoff on a loan after payment holiday period ends. The principal is 1000, due interest is 205 (that is, Due interest for the current bill is 200 and the due Holiday Interest is 5), accrued interest is 50 and holiday interest balance is 15 (holiday balance represents accrued holiday interest which is yet to be billed).

The loan payoff simulation generates a payoff statement reflecting the holiday interest property along with the property like principal, interest and any fees or charges.

For the above example a payoff statement will be generated with the components below.

- Payoff amount = 1270

- Account = 1000

- Interest = 270 (that is, Due Interest Amount=205, Accrued Interest=50 and Holiday Interest=15)

Payoff bill includes the due holiday interest amounts and holiday interest accrual as part of the overall payoff bill.

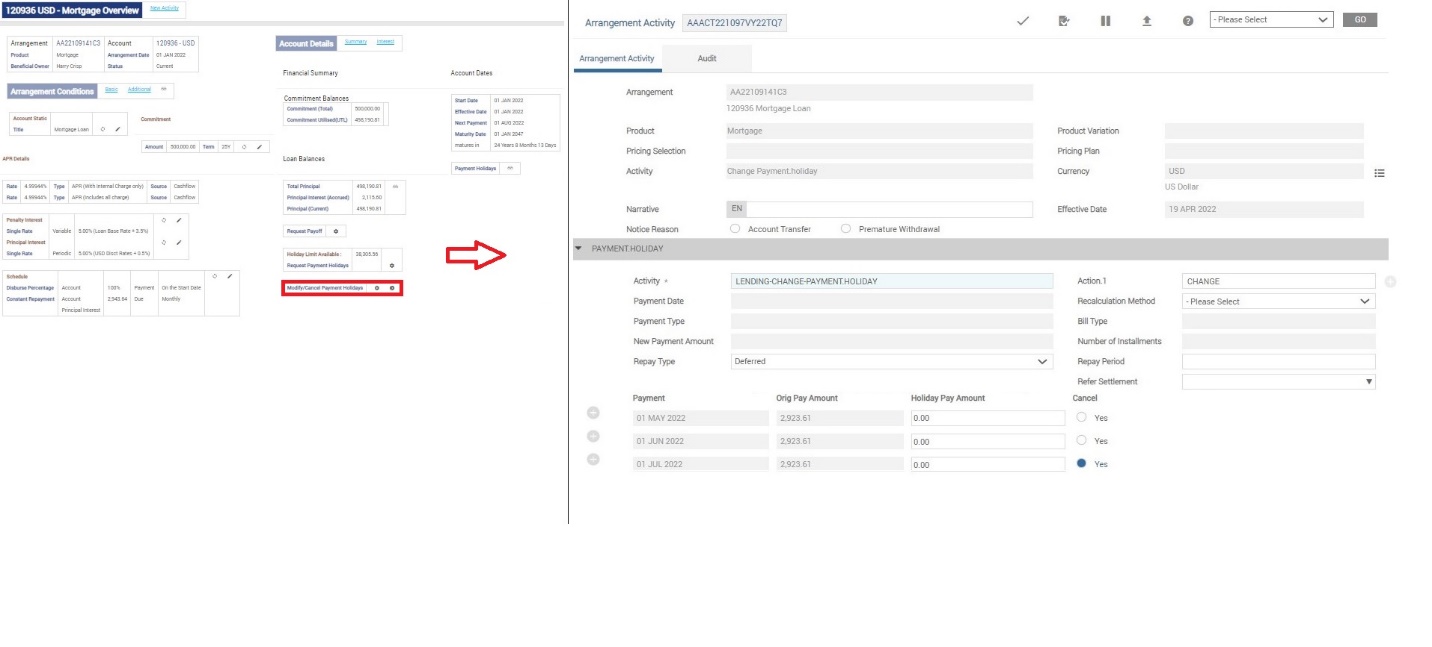

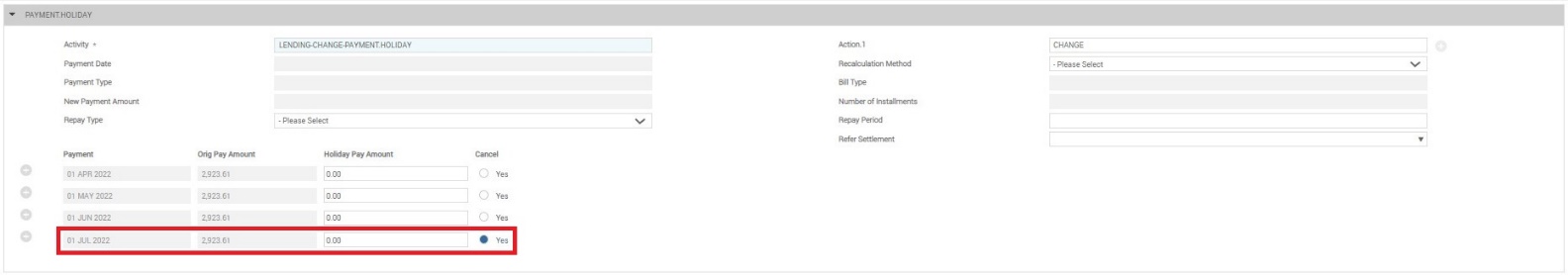

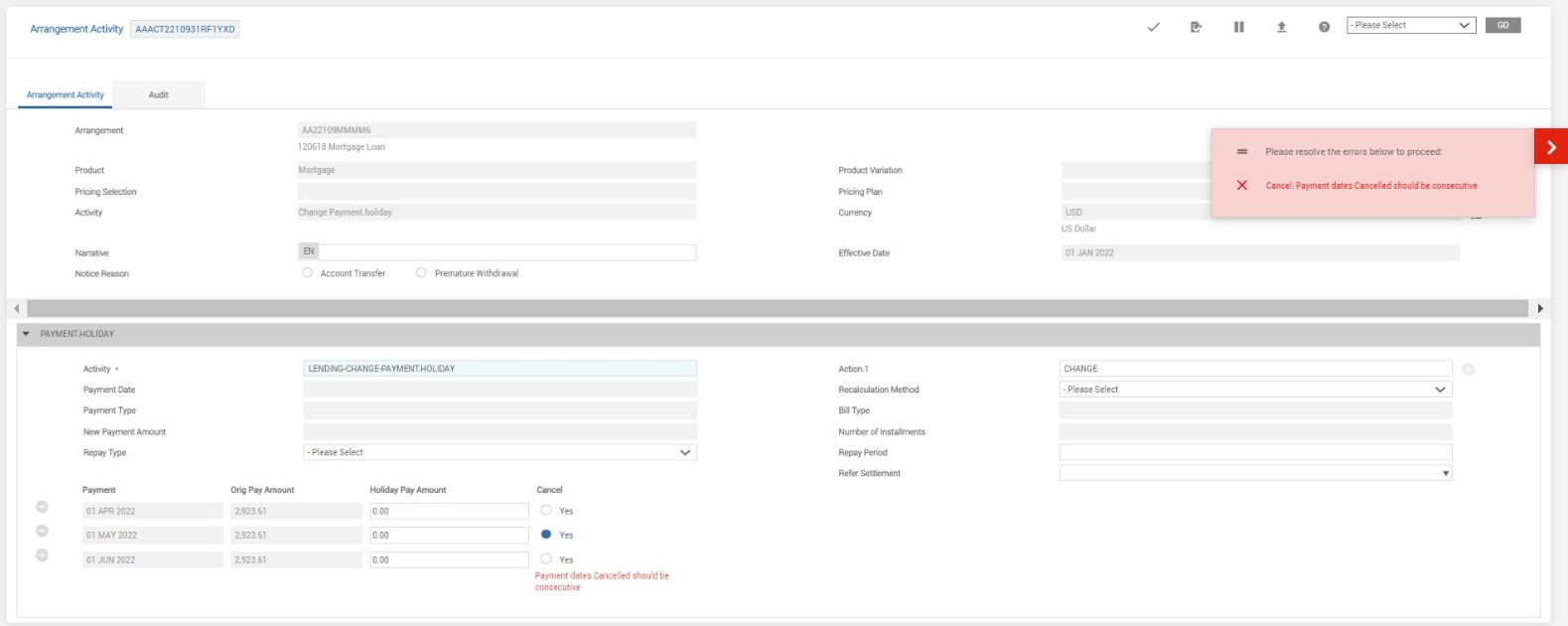

Cancelling Holidays Declared

The user has an option to cancel or shorten the holidays declared, through Modify/Cancel Payment Holidays field in the Arrangement Overview page. The system triggers LENDING-CHANGE-PAYMENT.HOLIDAY when a payment holiday is modified or cancelled.

The payment holiday can be fully cancelled or modified to cancel specific number of holidays. But this cancellation should be consecutive. Out of four schedules marked as holiday, it is possible to:

- Cancel first

- Cancel last

- Cancel first few

- Cancel last few

But it is not possible to cancel the holidays in between or in a random order.

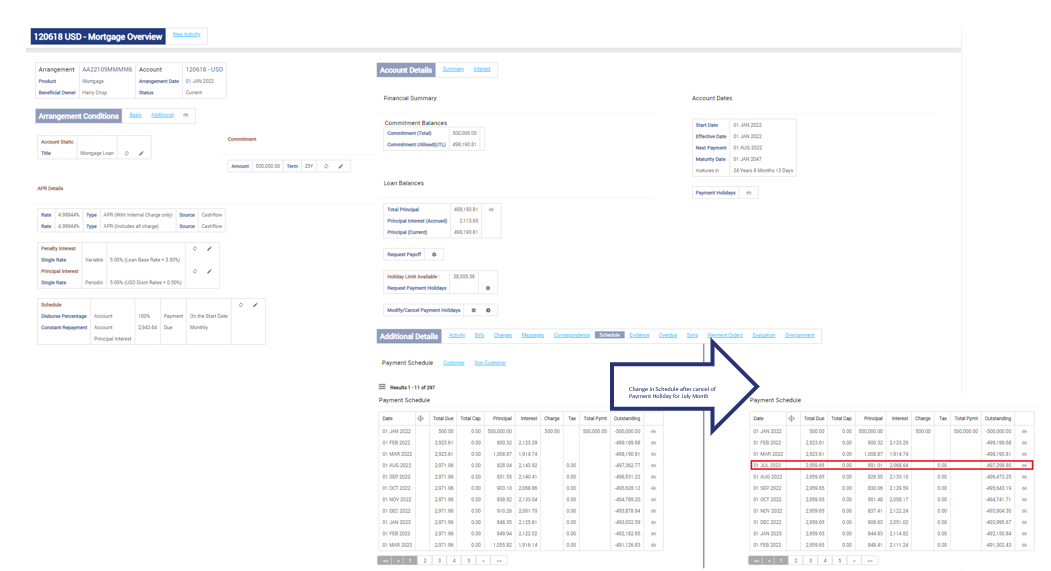

Change in schedule after cancel of payment holiday for Jul is:

Cancellation or shortening of holidays can be done only for consecutive schedules and error is raised when the user attempts to cancel the non – consecutive holidays.

Payment Holiday During Migration

The system allows migrations of loans under active Payment Holiday definitions. There are possibly two scenarios to be considered during migration or upgrade of loans.

- Loan under payment holiday period at the time of migration

- Loan completed grace or holiday period repaying holiday interest at the time of migration

Legacy Migration

The migration sequence in case of legacy loans with payment holiday is as follows:

- Takeover arrangement

- Capture outstanding loan bills and balances

- If the loan is migrated during the holiday period, capture accrued interest (Holiday Interest).

- Capture any future holidays using ‘Update Holiday’ and recalculate options can be configured suitably.

Upgrading Clients

For a customer upgrade to a loan product having payment holiday functionality,

- Cancel existing holiday instructions

- Re-configure fresh holiday instruction with defer option.

Legacy Migration

The migration sequence in case of legacy loans with payment holiday are as follows.

- Takeover Arrangement

- Capture outstanding loan bills and balances including the Holiday Interest due and accrued

- Update ‘Schedule’ for ‘Holiday Interest’ and specify start and end dates based on the period over which the holiday interest is billed

Upgrading Clients

For a customer upgrade to a loan product having Payment Holiday,

- The accrue interest is billed fully at the end of the Holiday Period

- The holiday Instructions are performed if needed with Holiday functionality in the New Loan Product.

- If bank perform upgrade after the end of holiday period and before billing of accrued holiday interest and wishes to use deferred functionality, then they can reverse the earlier holiday requests and reconfigure fresh holiday instructions with defer option.

The Update Holiday activity allows Payment Holiday to be defined for a repayment scheduled on loan takeover or migration date.

Consider a scenario where the loan takeover or migration date - May 1, 2021, as per the original schedule, and last repayment date is Nov 1, 2021

The user triggers Payment Holiday on May 1, 2021 for the repayment scheduled on the same day (May 1, 2021) with recalculation option as Term. The repayment due for May 1 is considered as a holiday by the system and extends the schedule to Dec 1, 2021 (as term is recalculated).

This illustrates the EB Cashflow update for migration during holiday. Consider a loan with a monthly interest accrual of 30 and bank has defined a holiday for three instalments. Holiday interest is set to be collected over the four subsequent cycles, if migration happens during the holiday period on the said loan. In this case, the pre-migration interest is handled through a separate property and the property is excluded from EIR calculation.

|

Timeline |

Accrual |

Handoff |

|---|---|---|

|

Month 1 |

30 |

NA |

|

||

|

Month 2 (Holiday) |

PHINT – 30 MIGRPHINT -30 |

NA |

|

Month 3 (Holiday) |

PHINT – 60 MIGRPHINT -30 |

NA |

|

End of Holiday period. Here both pre and post migration interest portion are assumed to set as deferred and repaid over 4 billing cycles. The overall pre migrated holiday interest (MIGRPHINT) is split across 4 cycles at 30/4=7.50 The overall post migrated holiday interest (PHINT) is split across 4 cycles at 60/4 = 15 |

||

|

Month 4 |

|

PHINT – 15; MIGRPHINT – 7.50 (Exclude from EIR) |

|

Month 5 |

|

PHINT – 15; MIGRPHINT – 7.50 (Exclude from EIR) |

|

Month 6 |

|

PHINT – 15; MIGRPHINT – 7.50 (Exclude from EIR) |

|

Month 7 |

|

PHINT – 15; MIGRPHINT – 7.50 (Exclude from EIR) |

In this topic