Introduction to Pricing Grids

The Rate Cards/Pricing Grids feature defines interest and fee pricing with complex pricing criteria for the financial products to,

- Manage interest rate as fixed or variable rate based on index plus margin and allow periodic revision of rates.

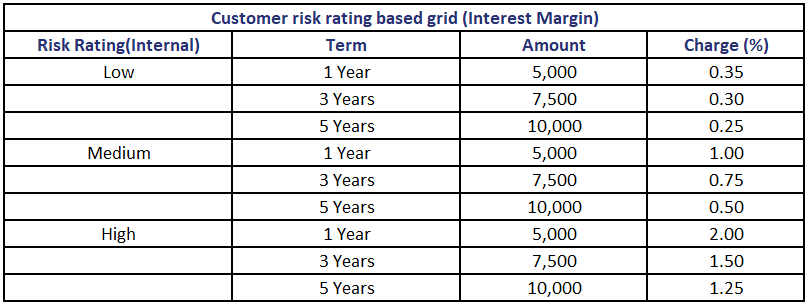

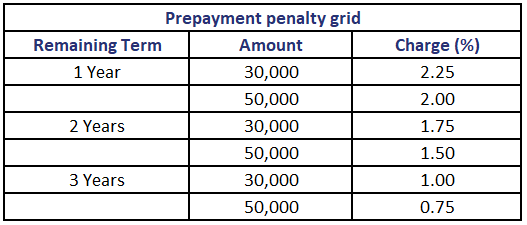

- Manage fees, margin/rate tiers based on the term of the agreement, amount, LVR (Loan-to-Value Ratio), asset class/type, balances, customer ratings, and so on.

- Define various pricing mechanisms such as relationship, regional/location based.

It allows the user to setup various pricing models for financial products like, Asset Finance, Lending, Deposits, Accounts. The pricing can be determined based on combination of customer data, product association, and/or transaction data.

- Customer data includes risk rating, customer relationship, segmentation, location (ST.ORGANISATION.CODE), financial ratios.

- Product association includes LVR, agreement term and amount, asset class/type, and asset usage for asset-based finances.

- Transaction data includes prepay-penalty based on remaining term, upfront fees based of term and amount, and so on.

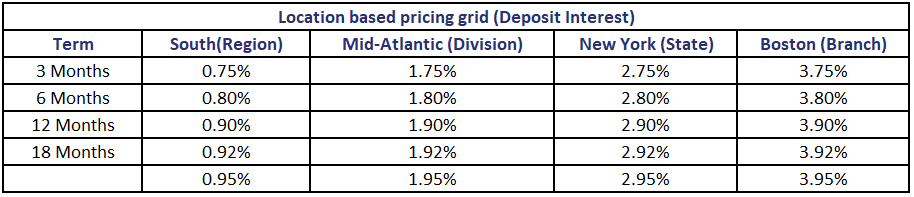

The interest rate can be defined with term and location such as Region/Division/State/Branch as shown below.

|

Term |

South (Region) |

Mid-Atlantic (Division) |

New York (State) |

Boston (Branch) |

|---|---|---|---|---|

|

0 – 12M |

0.75% |

1.75% |

2.75% |

3.75% |

|

12M – 24M |

0.8% |

1.8% |

2.8% |

3.8% |

|

24M – 36M |

0.90% |

1.90% |

2.90% |

3.90% |

|

36M – 60M |

0.92% |

1.92% |

2.92% |

3.92% |

|

Above 60M |

0.95% |

1.95% |

2.95% |

3.95% |

Interest and Charges property classes are enhanced to support Pricing Grids product line based pricing for interest and charges as described below.

|

Interest Rates |

Charges/Commissions |

|---|---|

|

|

|

|

Product Line Attributes

The PRICING.GRIDS product line supports the following line attributes,

- Optional Currency - Supports optional currency-specific product conditions.

- No Arrangements - Arrangements cannot be created.

- Version Enabled - Supports versioning, that is, system maintains the version for each proof and publish of the product.

Product Configuration

This section describes the configuration of Pricing Grids products.

The Pricing Grid property class is a mandatory property class in the PRICING.GRIDS product line. Only one Pricing Grid property can be defined in a Pricing Grids product. Read Pricing Grid for more information on Pricing Grid property class and attributes.

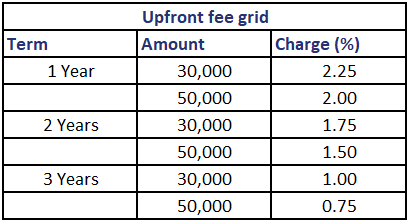

Below are some sample model grids.

Read Introduction to Product Builder for more information on product construction and configuration process.

Illustrating Model Parameters

The Pricing Grids product condition is defined with the criteria (data elements like finance amount, term, asset class/type, location, LVR) and the targets components (target elements like fixed rate, margin rate, charge amount, charge percentage).

Read Data and Target Elements for more information on data and target elements.

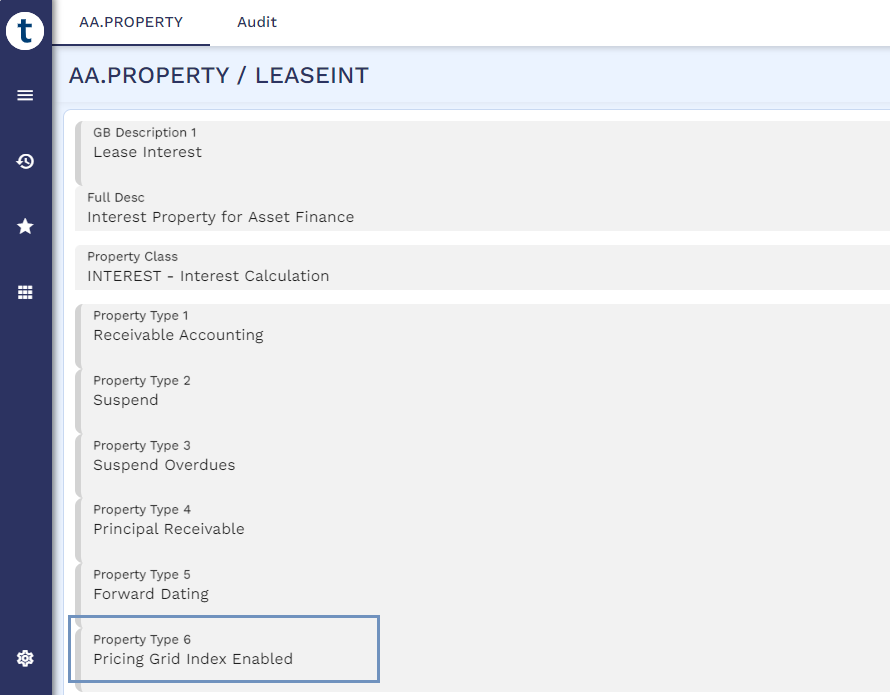

To use the Pricing Grid product as index in the Interest and Charge condition of a financial product, Property Type of Interest and Charge properties of the financial product must be set as Pricing Grid Index Enabled. Otherwise, the Pricing Grids functionality cannot be used in the financial products.

The Pricing Grids product is defined as the index in the Interest and Fee condition of the financial product to calculate interest rate, margin rate, and fee.

Read Interest Property Class in Rate Grid for more information on pricing grid related/user set of attributes in Interest condition.

Read Charge Property Class in Fee Grid for more information on pricing grid related attributes in Charge condition.

Illustrating Model Products

The below model products are reference products for the user to use, amend, or refer to create new Pricing Grids products.

|

Product ID |

Product Feature / Attribute |

|---|---|

|

PG001 (Interest Rate based on LVR) |

This grid is based on LVR (Loan to value Ratio) to define the interest rate. |

|

PG002 (All-in-Rate based on LVR) |

This grid is based on the LVR (Loan to value Ratio) to define the interest rate, margin rate, and the usage percent with the usage percent basis as All-in-Rate. |

|

PG004 (Margin based on Asset Type) |

This grid is based on asset type (Asset Finance specific) to define the margin rate, that is, margins are managed based on asset types like electric car and car. |

|

PG006 (Fee based on Amortised Term) |

This grid is based on amortised term to define the charge amount. |

|

PG007 (Fee based on the Finance Amount) |

This grid is based on finance amount to define the charge percentage, tier minimum charge, and tier maximum charge. |

|

PG009 (Location based Grid) |

This grid is based on term and locations to define the interest rate. |

In this topic