Working with Hybrid pool

The below are the different process to create a hybrid cash pool:

| Process | Activity | System/User |

|---|---|---|

| Create pool in pending live | BUNDLE-NEW.OFFER-ARRANGEMENT | Orchestration service |

| Create accounts in pending live | ACCOUNTS-NEW.OFFER-ARRANGEMENT | Orchestration service |

| Set go live date for pool | BUNDLE-UPDATE.LIVE.DATE-PRODUCT.BUNDLE | User |

| Set go live date for accounts in pool (be spoke) | BUNDLE-RESTRUCTURE-BUNDLE.HIERARCHY | User |

| Bring accounts to Live | ACCOUNTS-NEW-ARRANGEMENT | Scheduled by orchestration service and processed by COB orchestration process |

| Bring pool to live | BUNDLE-NEW-ARRANGEMENT | CB orchestration process |

| Add standalone account | ACCOUNTS-TRANSFORM-ARRANGEMENT | Scheduled by orchestration service and processed by COB orchestration process |

| Remove pool account | ACCOUNTS-TRANSFORM-ARRANGEMENT | Scheduled by orchestration service and processed by COB orchestration process |

| Close pool account | ACCOUNTS-SETTLE-PAYOFF | Scheduled by orchestration service and processed by COB orchestration process |

This section describes the steps and sequences to be followed, to manually create the various account part of a BN pool structure.

The navigation is as follows,

- Select the Customer>Drilldown to their SCV>Product Catalog.

- Select Product Catalog from the User Menu

Create CT accounts in the desired currencies.

- Switch off settlement instructions on pay-in and pay-out sides.

Create a new bundle arrangement under the master account product.

- Attach the CTs to the product bundle.

- Identify the currency of the master account and choose the corresponding CT account to be the recipient of the bundle.

Create summary or transaction account in the order of the hierarchy.

- The parent must be created first before creating the child.

- If TR1 has its parent as CS1, which has its parent as SA1, then SA1 is created, followed by CS1 and then TR1.

- Once an account is created, its parent can only be set or changed through the purpose built internal restructuring activity.

- Normal Update-Account activity cannot be used.

- Similarly, once an account is created, the bundle arrangement (master account) and link account number (CT account) can be updated through the purpose built External Restructuring Activity.

- Normal Update-Account activity cannot be used.

- Switch off settlement instructions on pay-in and pay-out sides.

- Once the required transaction accounts are created, use Update-Settlement activity on the CT accounts and relevant CS or SA to specify their default settlement account and in the case of CS or SA and TR, the default counter booking account.

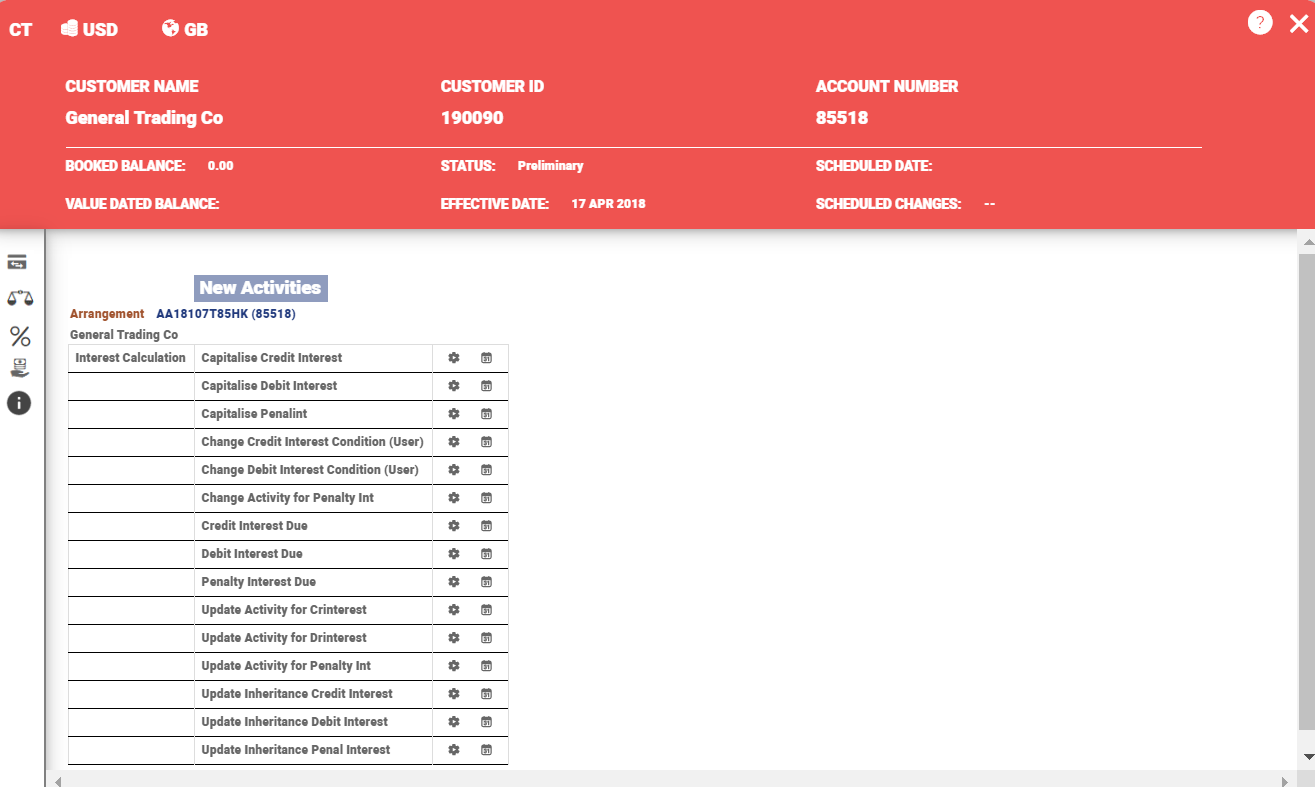

- Once the accounts are created, the normal workflow on updating their conditions are to be followed through the arrangement overview. The new activity drilldown links to setup,

- Bank interest or fees or schedule and settlement

- Internal interest or fees or schedule and settlement conditions.

Generating IBAN

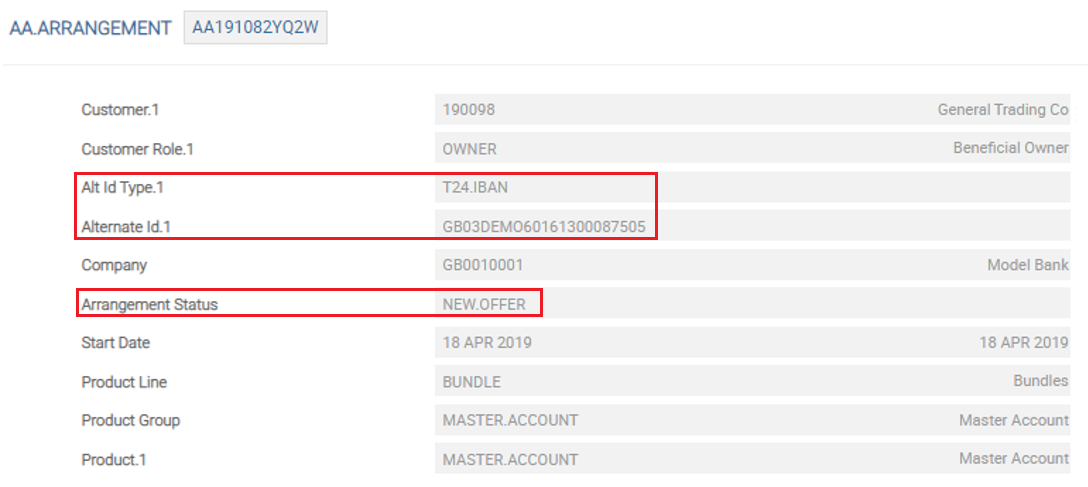

When the Bundle for the master account product is created in Draft status and when it is subsequently moved to the New Offer status, the IBAN is generated based on the values defined for Generate Iban and Alt Id Type. The IBAN can be seen in the AA.ARRANGEMENT record of the underlying contract.

As displaying the entire IBAN Value on the card is not feasible, it displays few characters of IBAN and appends it with three dots , for example, GB12DEMO60161300087537 is displayed as GB12DEMO6061…; on hovering over the text it displays the full string value.

The Alternate Id Type and Alternate Id of the Alt Id Types can be viewed in the expand header of each card. For the accounts other than master, T24.IBAN value gets displayed on the card instead of Account ID. If T24.IBAN value is available, the Alt Acct Type and Alt Acct Id get displayed on the expand card header.

When creating the CT accounts except for Limit (in case of MCCFor SCCF or MCF or SCF) is updated, no other special attribute needs to be specified to attach it to a master account, since it is done through the UPDATE-PRODUCT.BUNDLE activity. The user does this activity directly on the bundle arrangement (master account).

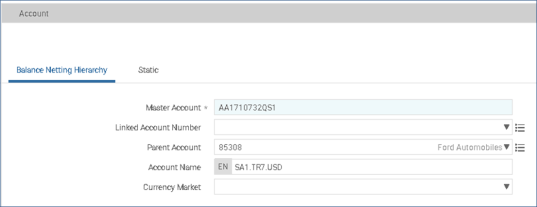

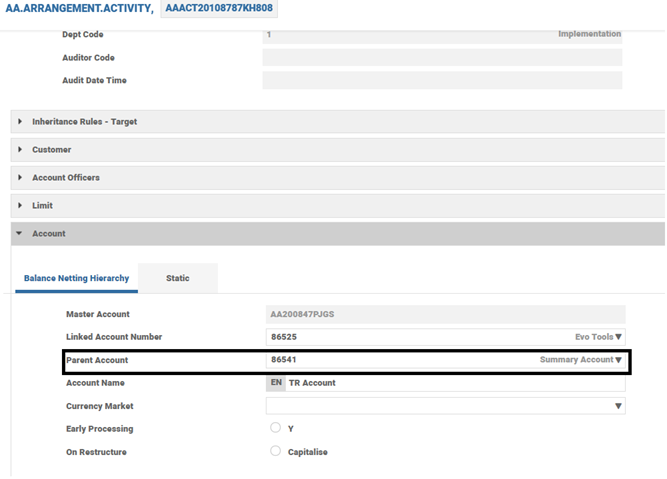

Once the CTs and MAs are created, when creating SA or CS or TR or MTR, it is important to capture the pool and hierarchy details via the purpose built attributes in Account property.

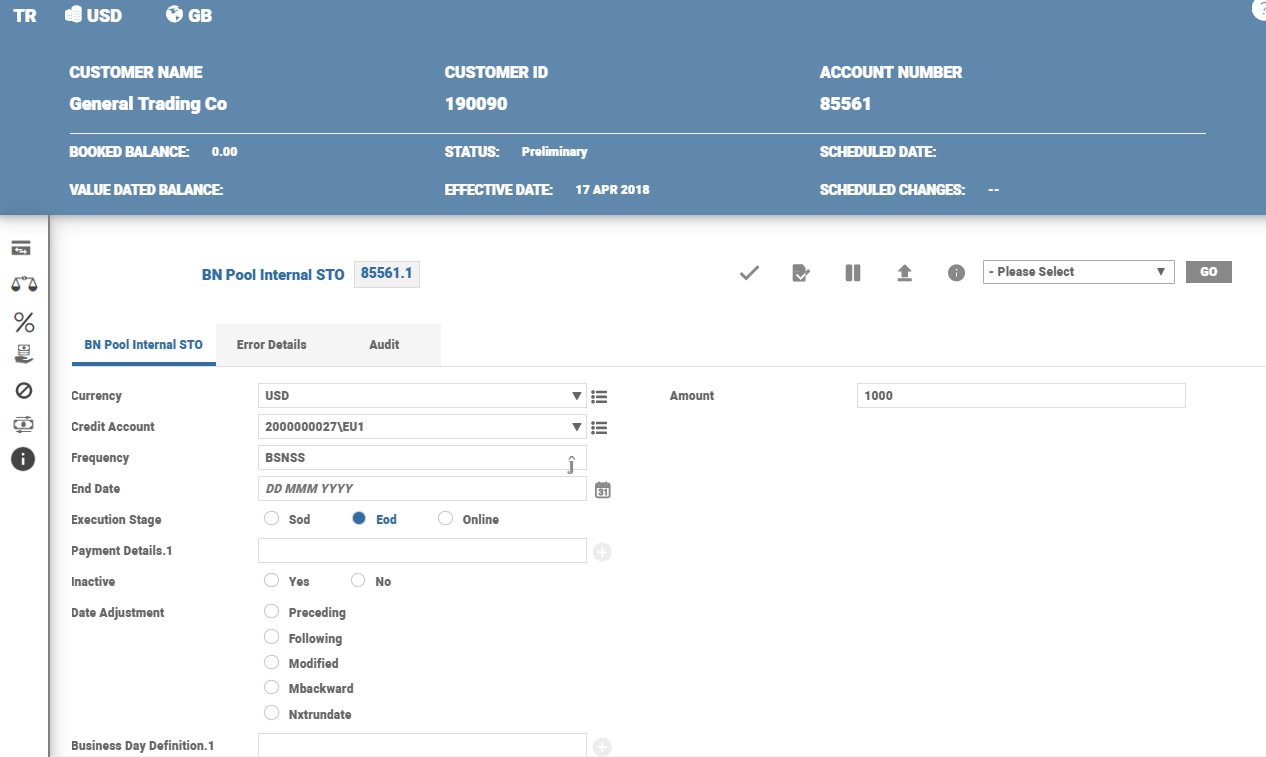

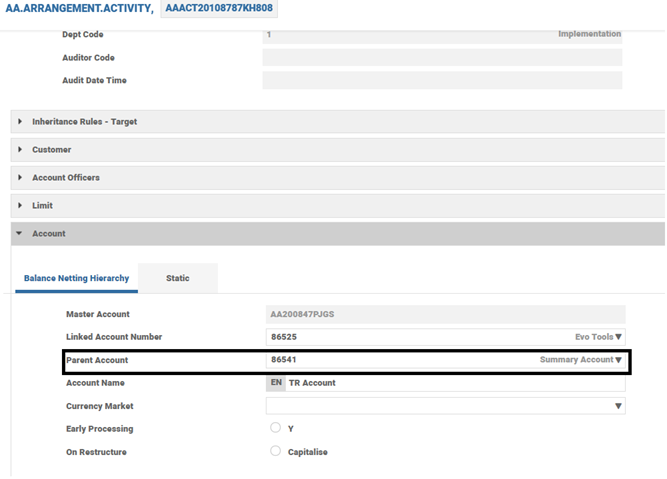

The following is a screenshot of a TR being created new, attached to an existing Pool under SA1 as its parent. The navigation for this could either be from the Product Catalog or the Master Account Overview.

The Master account is the bundle arrangement.

- If the account added or created is in a different Temenos Transact company than the master account, then the master account reference must be captured suffixed with its company mnemonic. In the example above, since the master account is in Temenos Transact Company BNK, it must be captured as AA1710732QS1/BNK for the system to recognise it.

- Linked Account number is the CT Account. If left blank and if a valid CT in this currency exists, then the system would default it.

- If a value is entered, the system validates that it is a valid participant in this Bundle Arrangement and that its currency matches this account’s currency.

- Parent account is used to capture the parent in the hierarchy. It is an optional field and when left blank, it mean the account being created would be added to the pool directly under the master account level.

- If a value is entered, the system would validate that it is,

- A valid member of the Bundle Hierarchy

- An allowed parent of this account

- Enabled for multi-currency if its currency is different from that of this account’s currency

In case of opening CS or SA, the above rules hold true except for the Linked Account Number (for which input is allowed).

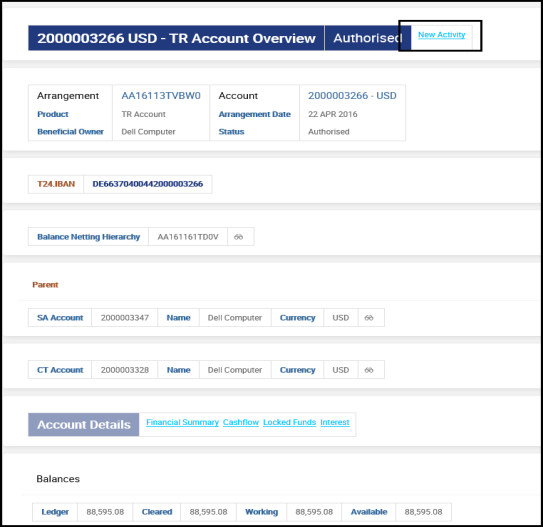

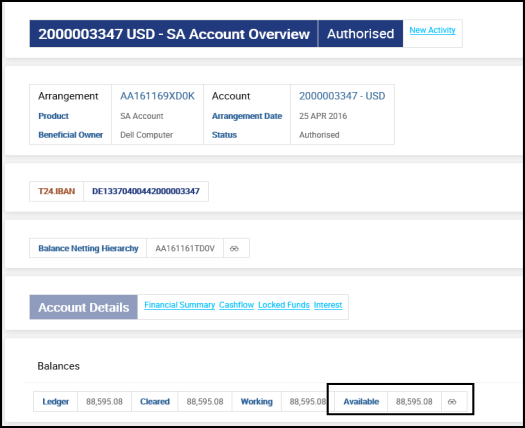

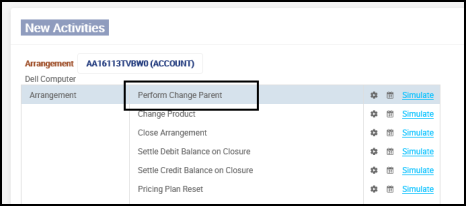

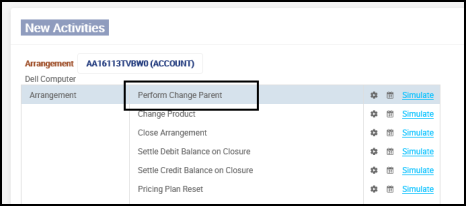

The accounts in the BN pool can be internally moved (at any point). To facilitate this, the ACCOUNTS-CHANGE.PARENT-ARRANGEMENT activity is initiated from the New Activity menu.

During this process happens, the balances from the previously linked parent account is also transferred.

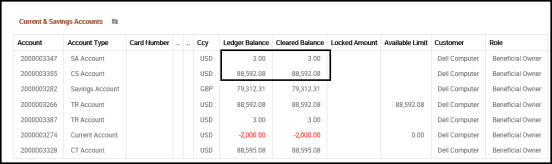

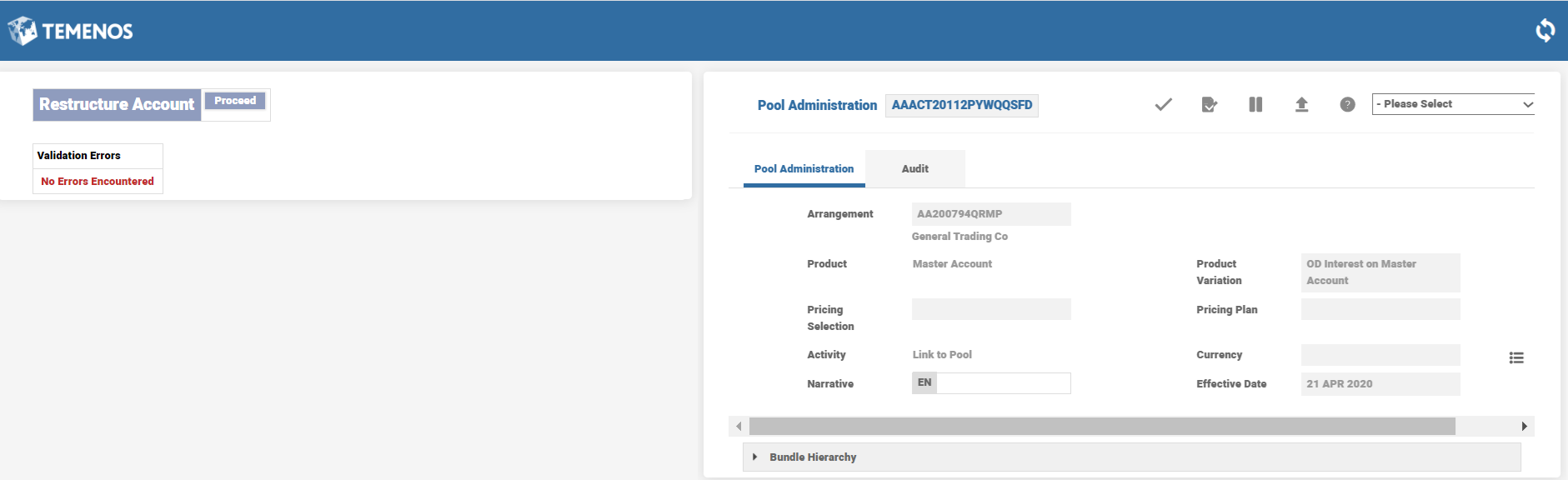

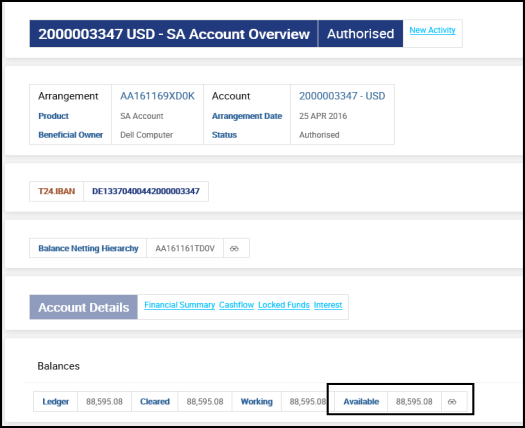

The above screenshot shows a TR account linked to SA account 2000003347. The SA and linked TR account’s balances are the same.

From the New Activity menu in the TR account, the User activity ACCOUNTS-CHANGE.PARENT-ARRANGEMENT is initiated.

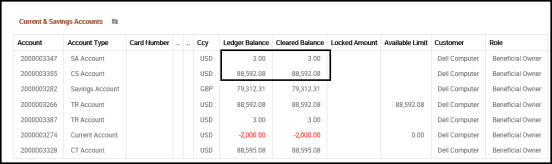

For a restructuring, this activity runs at COB, hence, the Effective Date needs to be day + 1. The new parent account is changed to 2000003355, which is the new SA account. After authorisation and a COB is run, the restructure process is initiated.

The above screenshot shows that the balance (USD 88,592.08) is moved from (2000003347) to (2000003355) account.

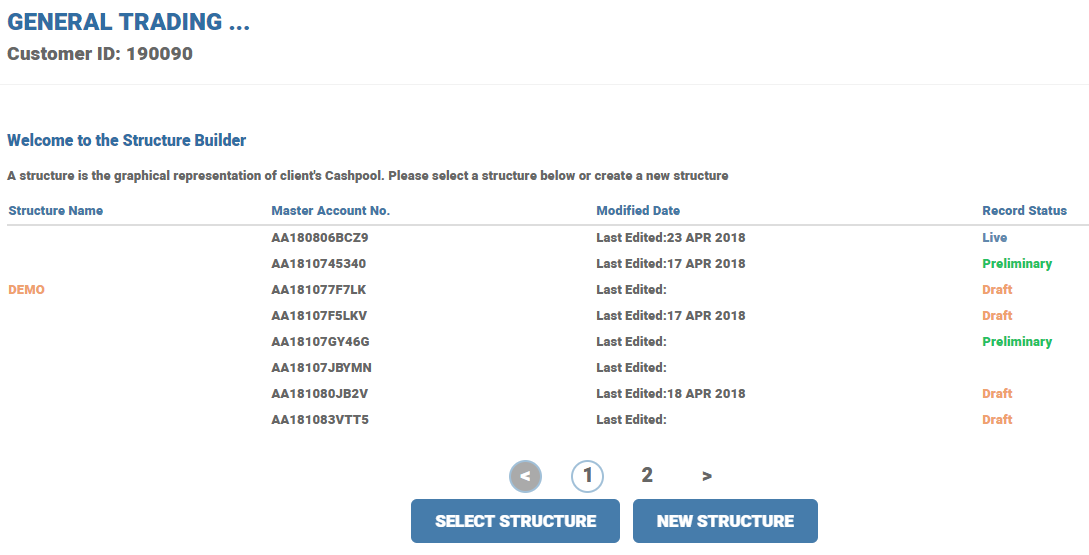

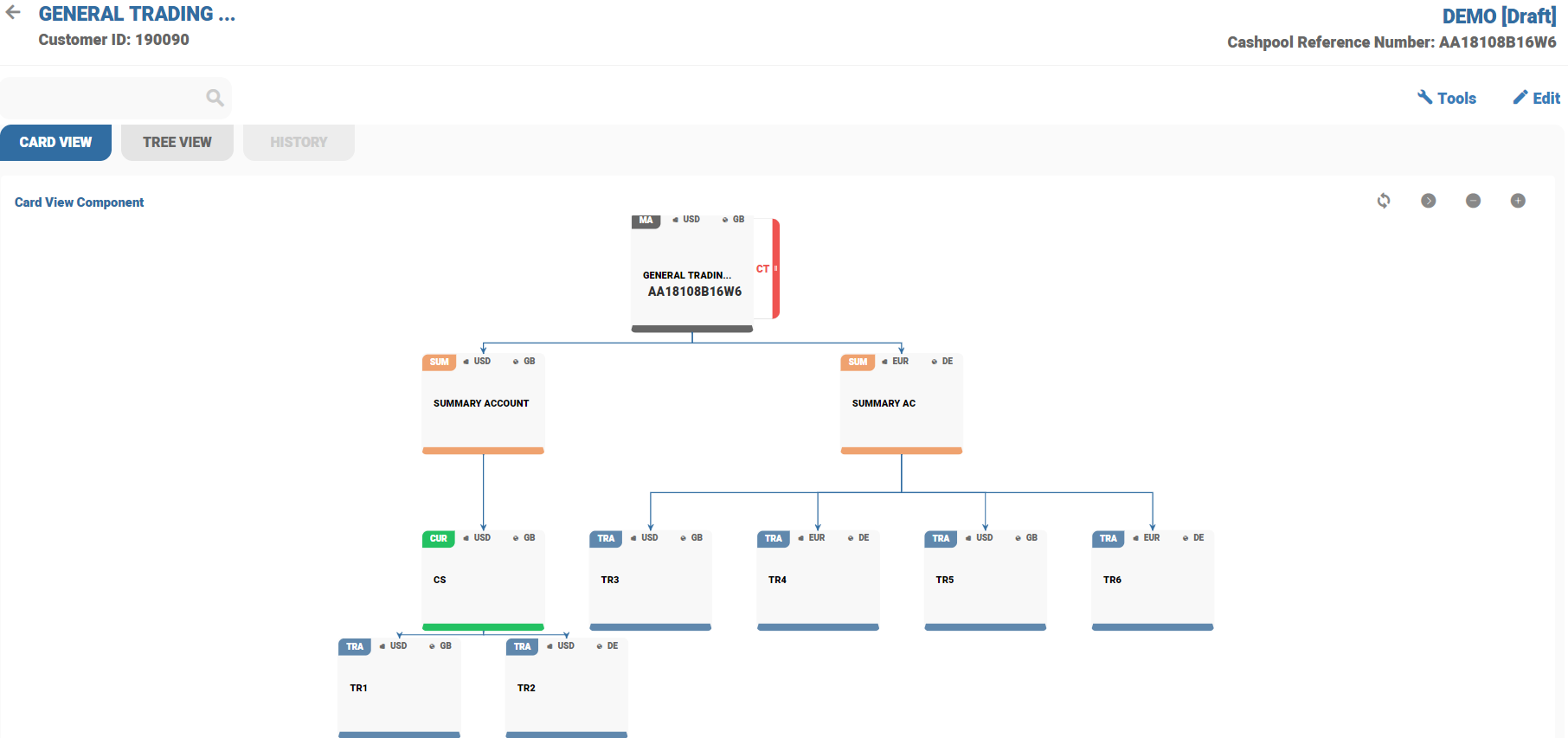

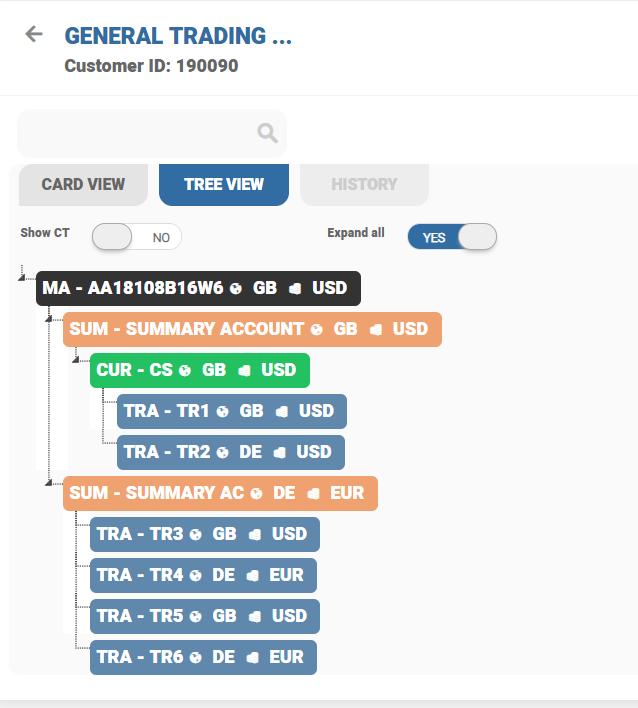

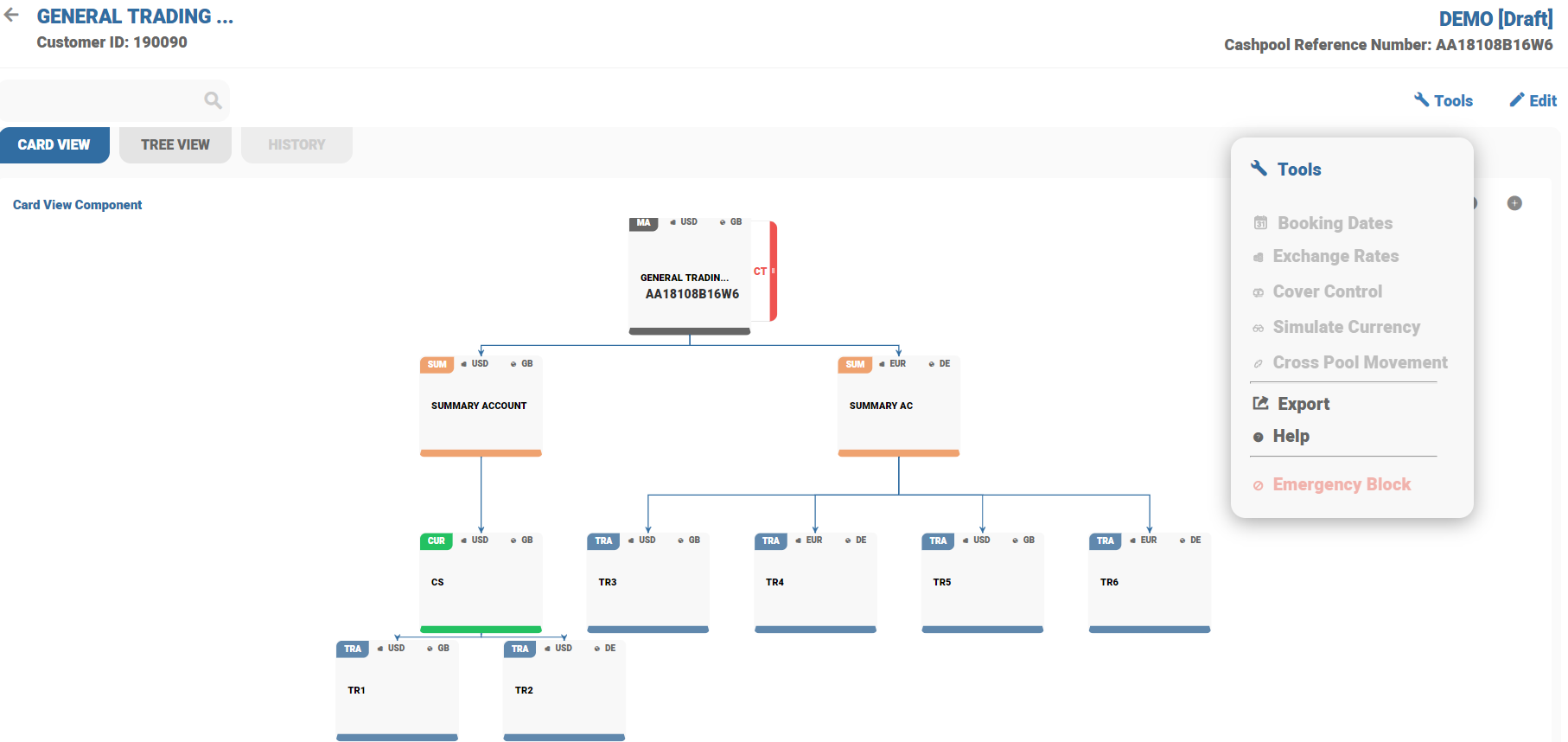

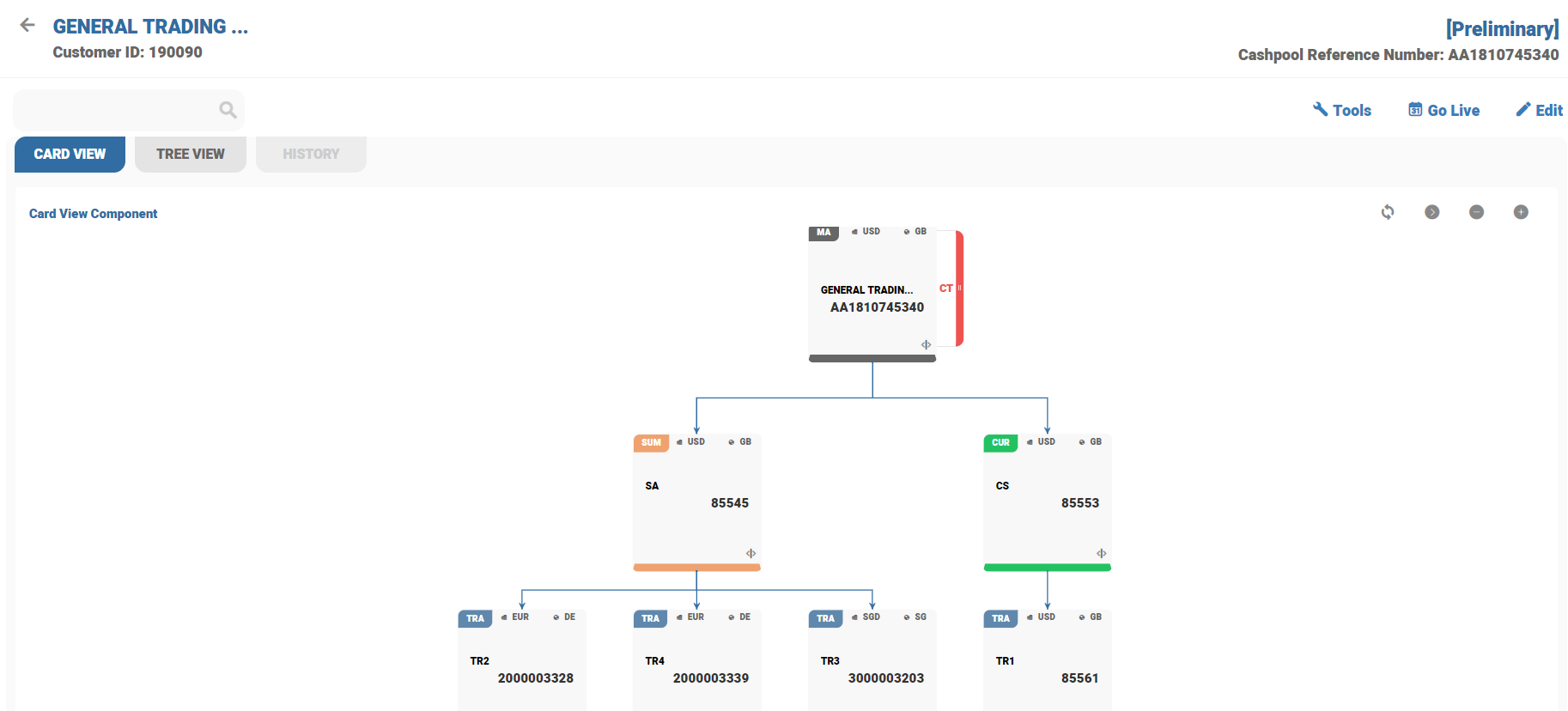

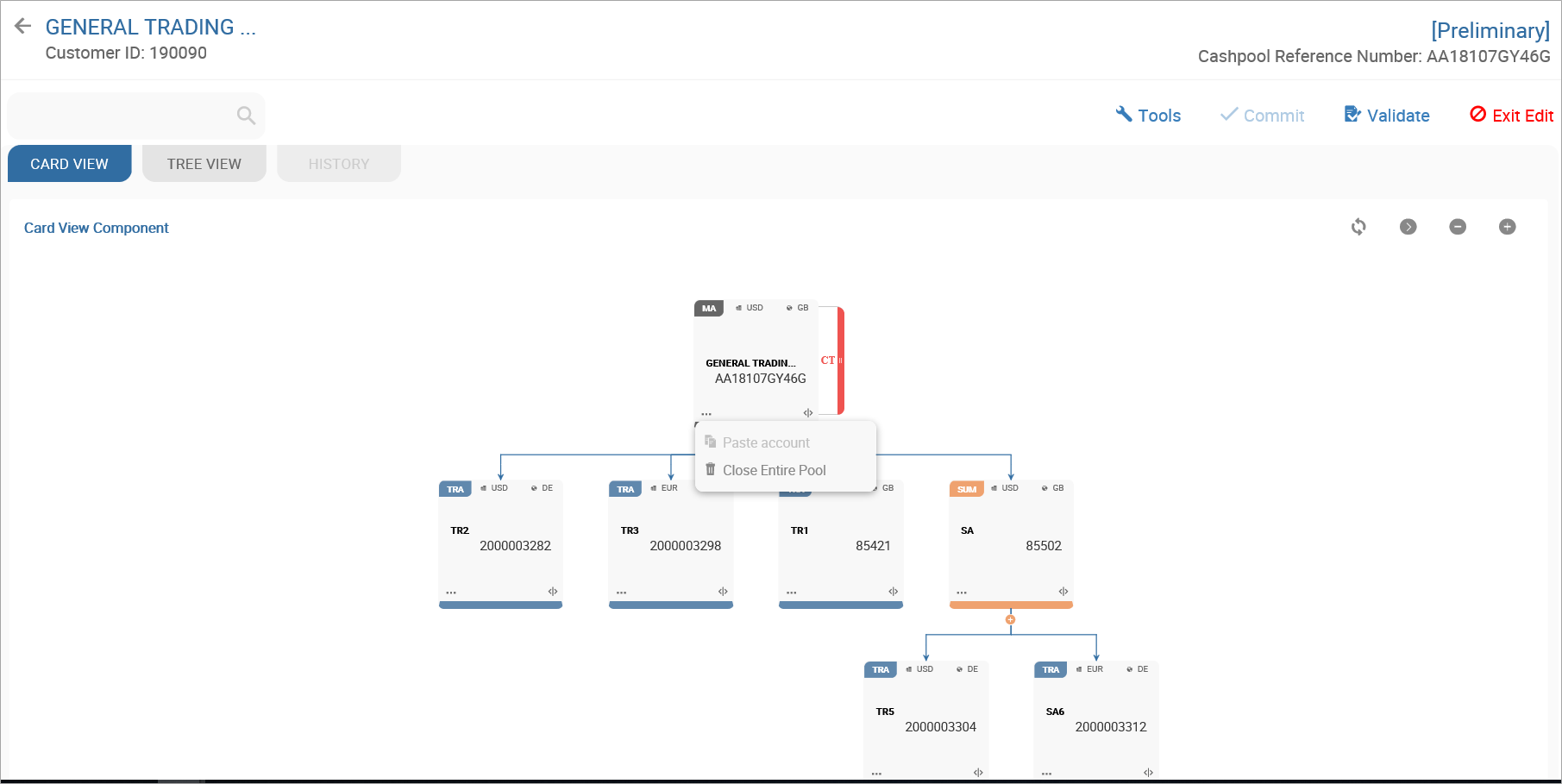

This section enables the user to understand creation of BN pool.

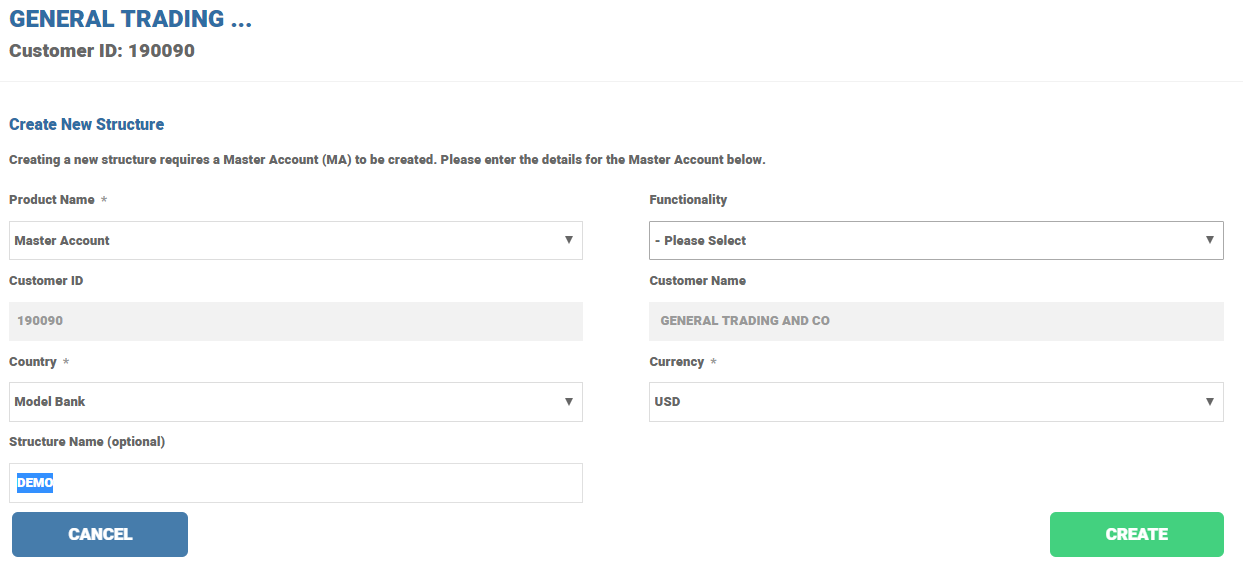

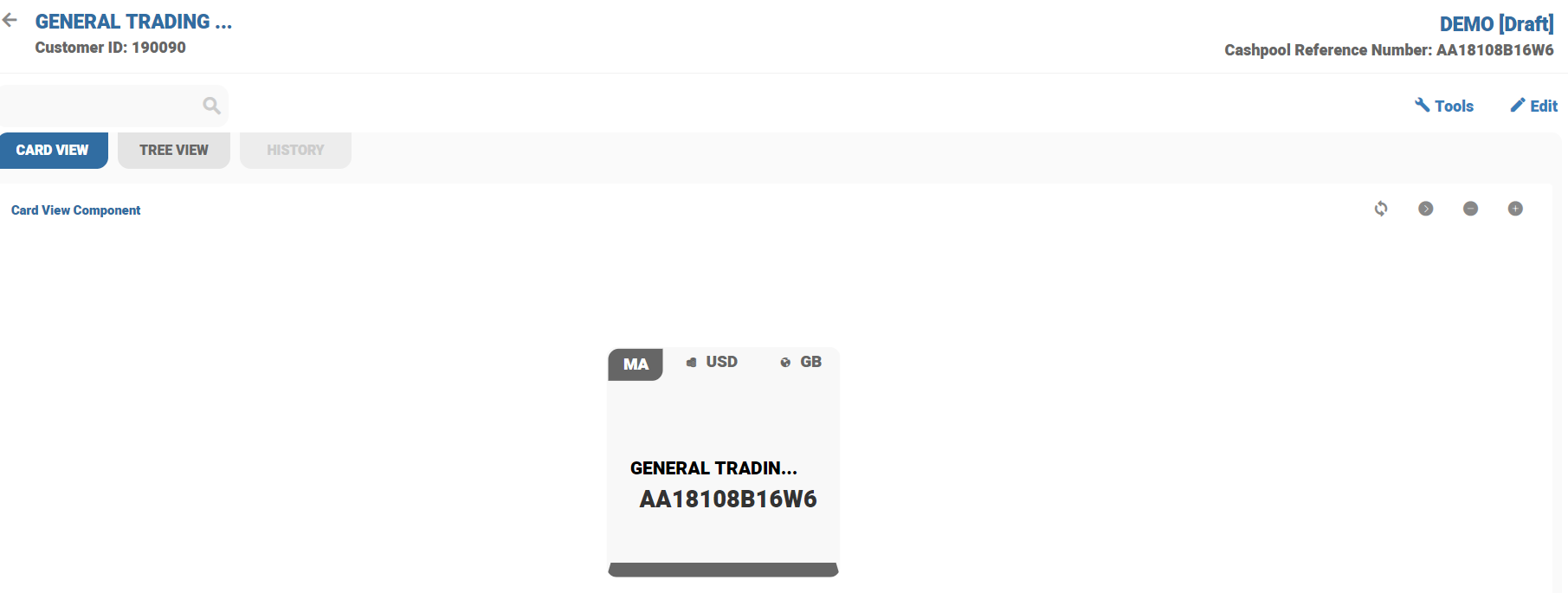

BN structure creation process starts from creating a master arrangement in a draft status. The user can provide the necessary details to create the master arrangement by selecting the NEW STRUCTURE tab in Graphical User Interface (GUI). Mandatory information is Product Name, Country (on which the Master arrangement is created), Currency (master account) and Structure Name (optional).

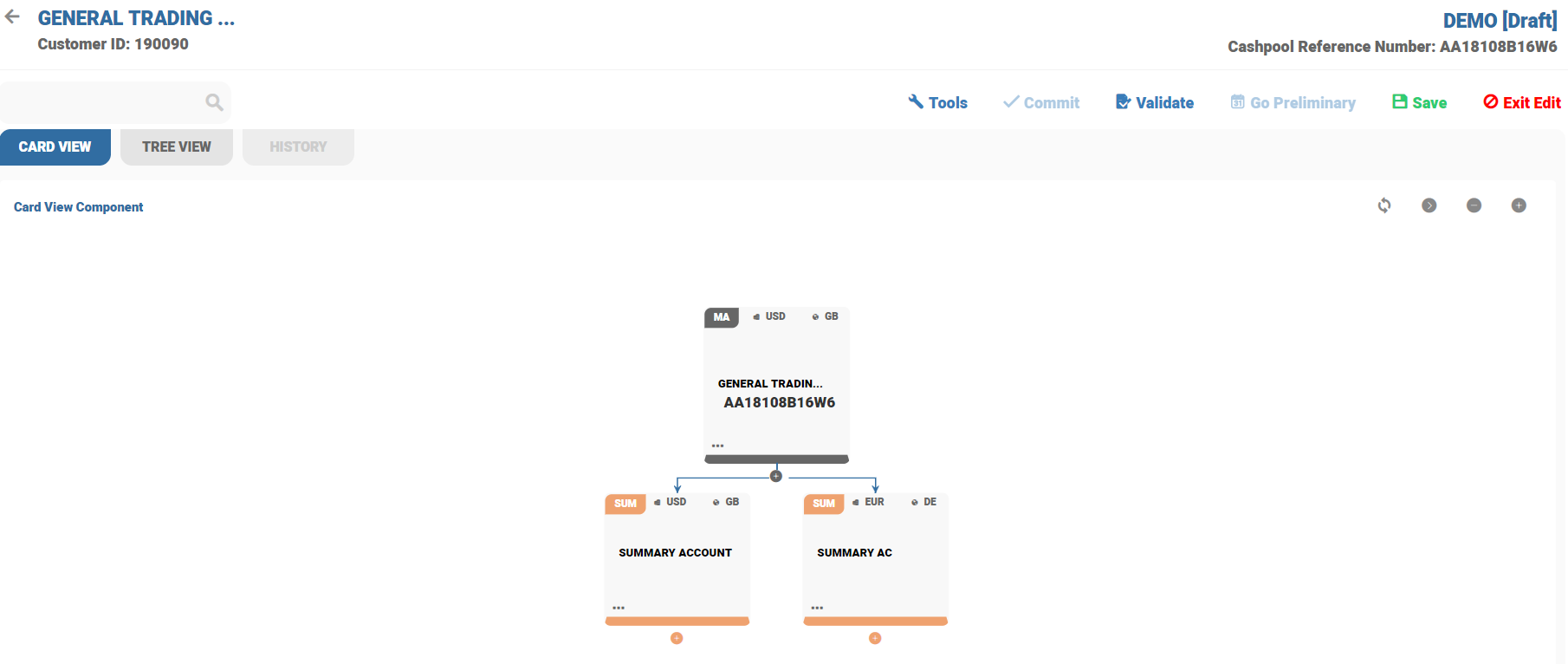

To create a new BN structure, from the GENERAL TRADING screen,

- Click NEW STRUCTURE.

- Enter the mandatory information and then click CREATE. The master arrangement is created in view mode.

- Click

to add new accounts to BN structure. The

to add new accounts to BN structure. The  symbol is enabled.

symbol is enabled.

- Click

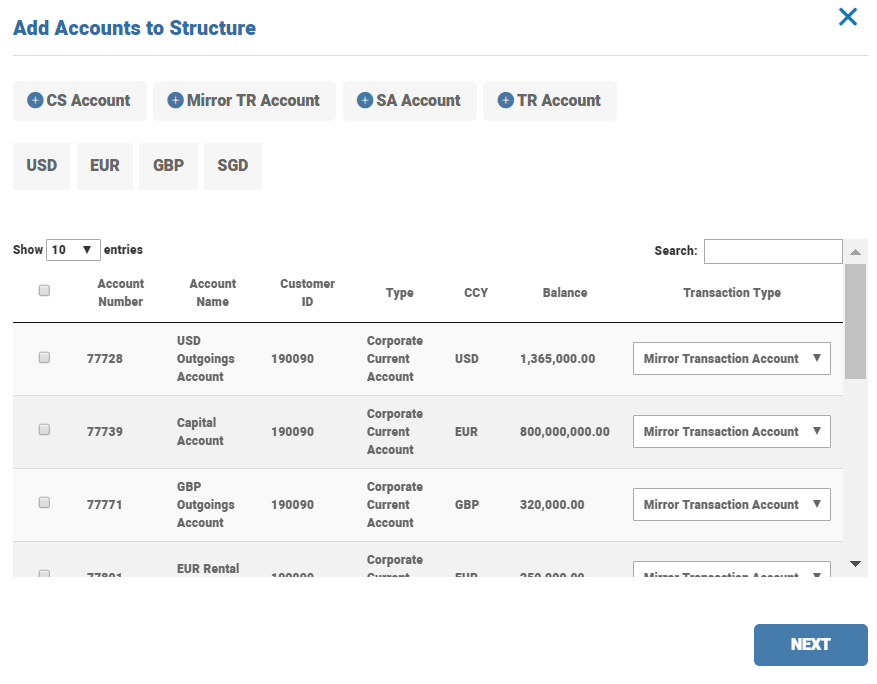

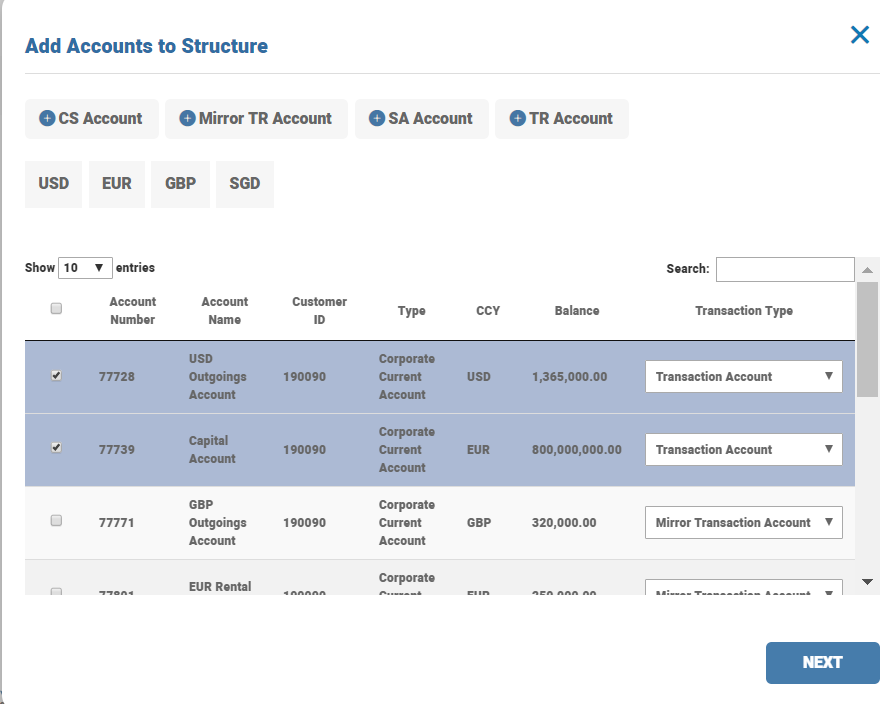

to add new accounts to the BN structure. The Add Account to Structure pop-up window opens.

to add new accounts to the BN structure. The Add Account to Structure pop-up window opens. - Select the respective account type to add a new accounts to the pool.

Standalone accounts can be selected and added to the BN structure by filtering the accounts by Currency.

- Click

to add multiple accounts to the pool.

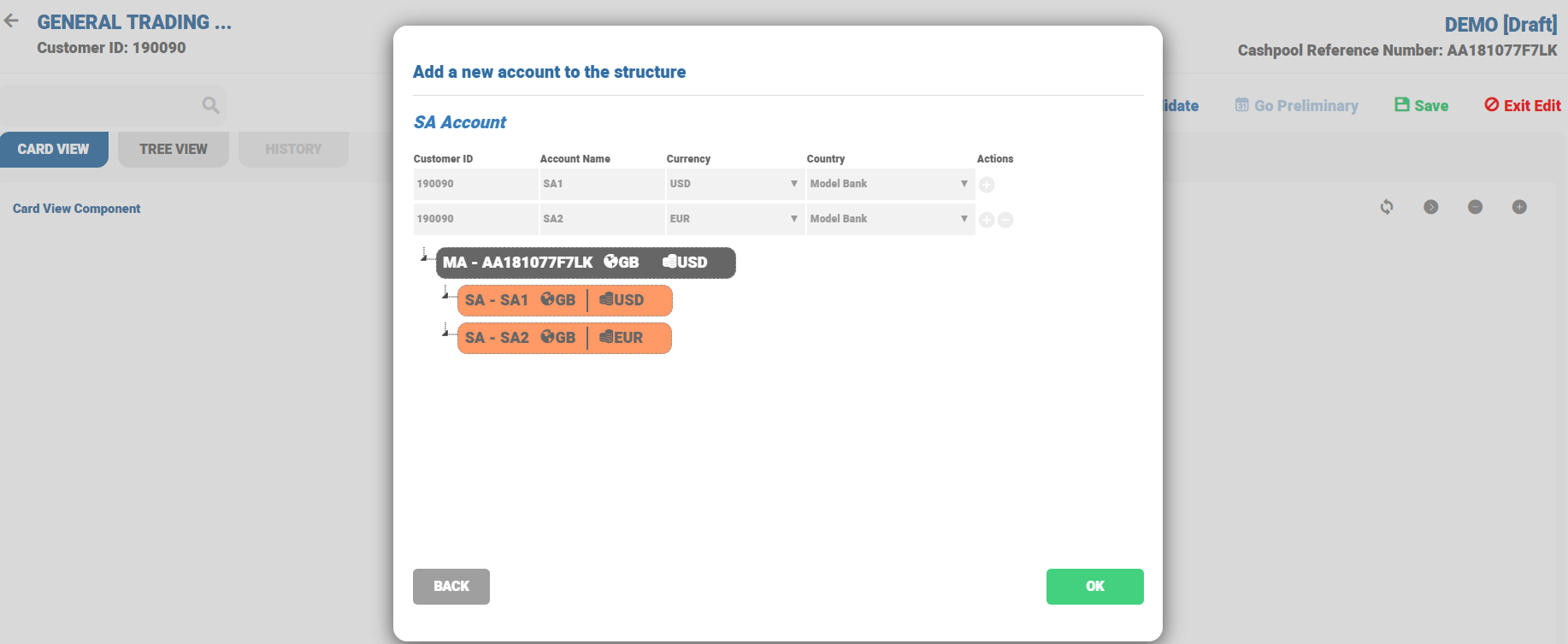

to add multiple accounts to the pool. Example: To add two SA accounts, select the currency and company from the drop-down list. Once the account placed holder is created, click OK to create the placeholder card in GUI.

- Click Save to save the BN pool structure in GUI. GUI passes the information to Temenos Transact to store the placeholder details. The user can save the changes in GUI after the BN pool structure is approved by corporate. When the user saves the Master arrangement in GUI, Temenos Transact does not any validation.

The BN structure can be edited and updated with new accounts and removal account by selecting the edit options. The Draft BN structure can be edited with the following details.

- Adding new placeholders

- Removing placeholder accounts

- Changing Parent details

- Adding Standalone accounts

- Adding a new parent placeholder for child accounts

Click Validate and Commit. The CT placeholders are created automatically. CT account is opened in Master account company for each currency of TR accounts.

To disconnect account placeholder, Click  on each cards. The account card is removed immediately from the BN pool structure. When the Summary Account (SA) or Currency Summary (CS) placeholders are removed from BN pool, the child accounts are linked to the immediate parent. The parent accounts can be removed along with the child accounts from BN pool.

on each cards. The account card is removed immediately from the BN pool structure. When the Summary Account (SA) or Currency Summary (CS) placeholders are removed from BN pool, the child accounts are linked to the immediate parent. The parent accounts can be removed along with the child accounts from BN pool.

To add standalone accounts to BN pool, click  on the respective cards.

on the respective cards.

Standalone accounts can be added under SA and CS account or directly under the master arrangement without any parent. Until the BN pool becomes live, the standalone account terms and conditions remains the same. Once the live date reaches, the account is converted to TR and the new product conditions applies. The account number remains the same as standalone account and only the change product activity is triggered.

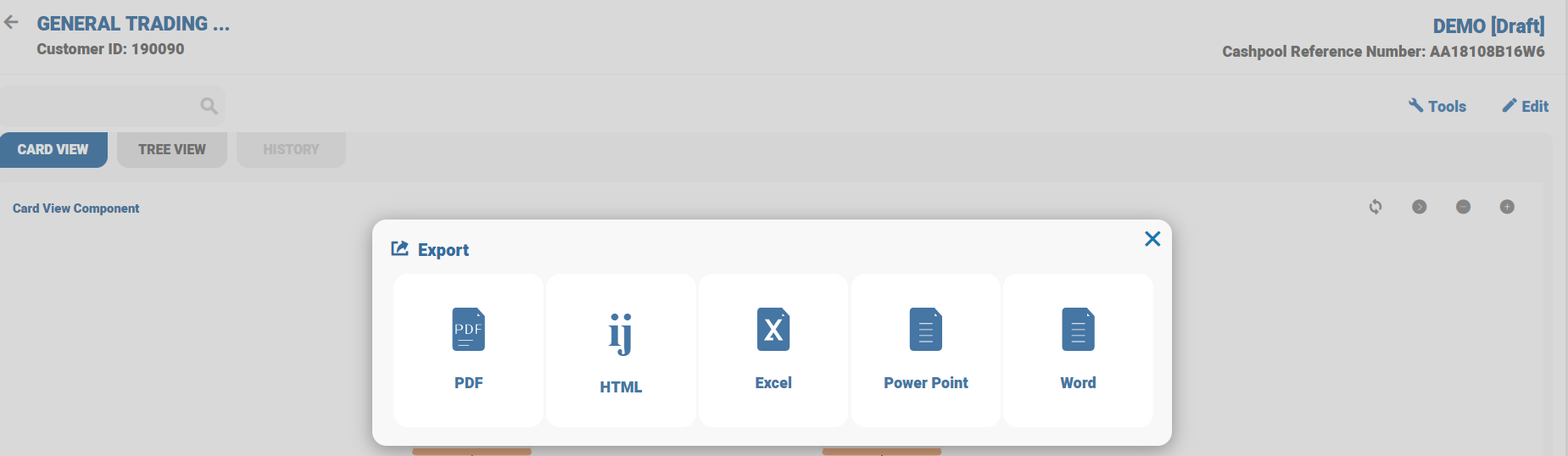

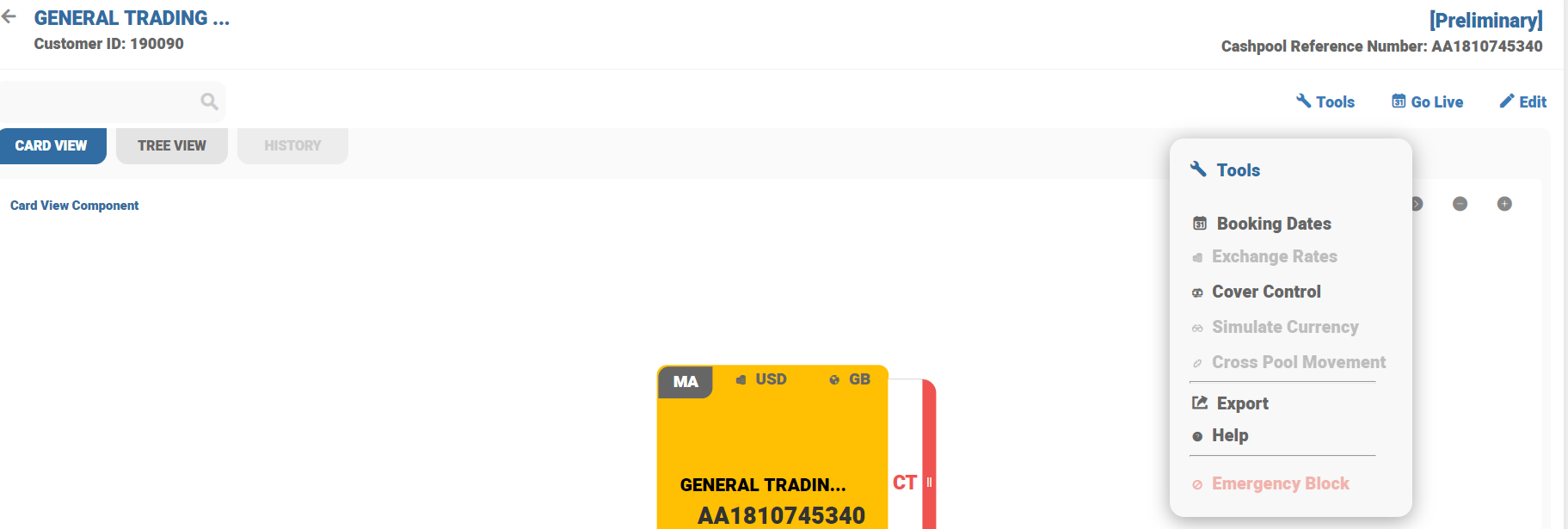

Go to Tools > Export. The BN structure can be exported as PDF, HTML, Excel, Power Point and Word. The exported BN structure is produced with the corporate customer for any modifications or changes in the structure. BN structure can be exported during Draft, Preliminary and Live status.

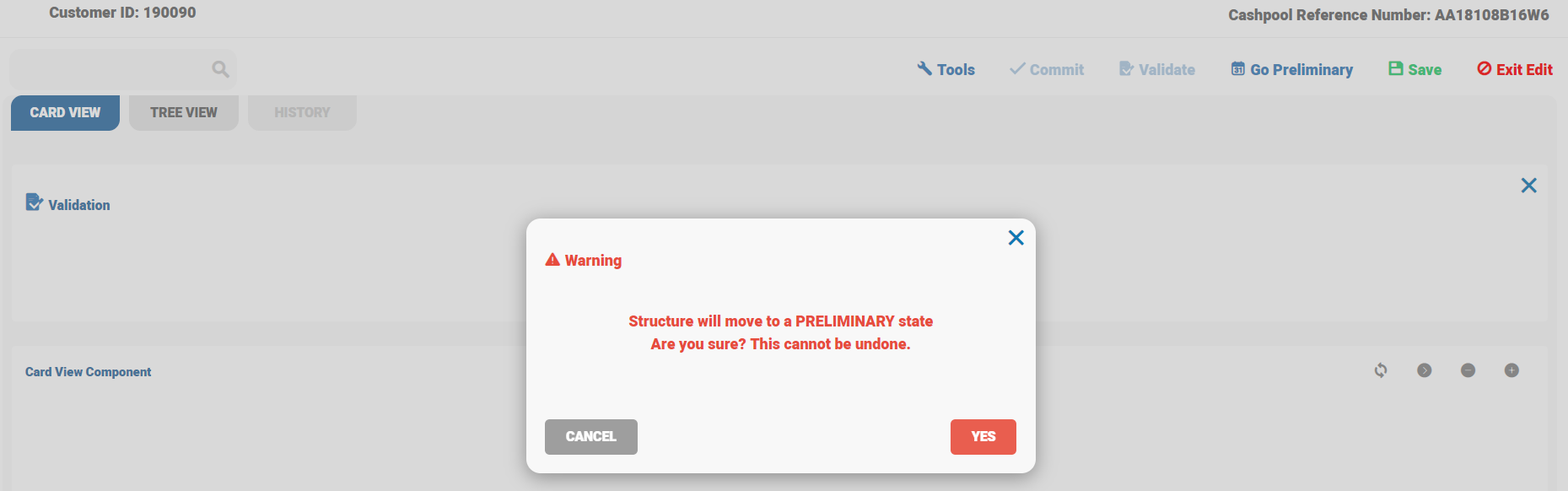

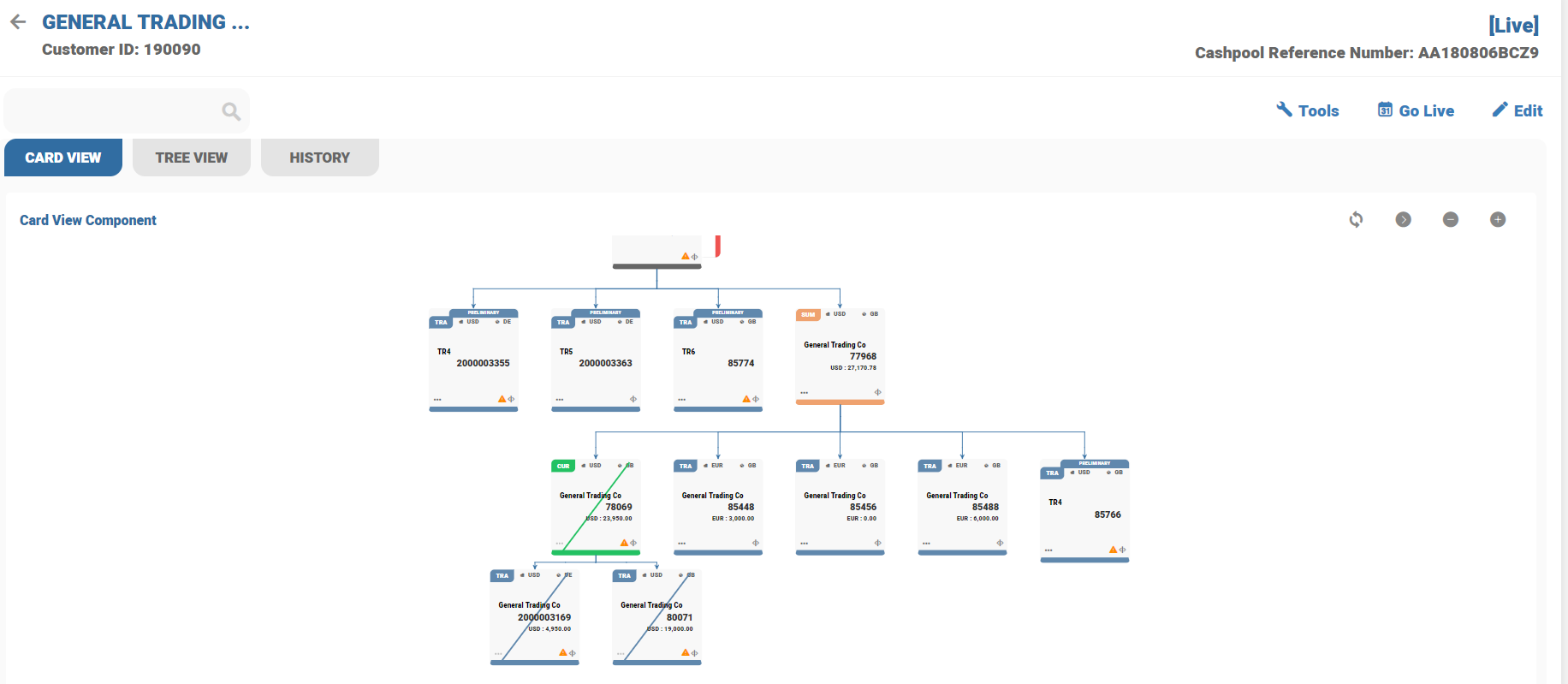

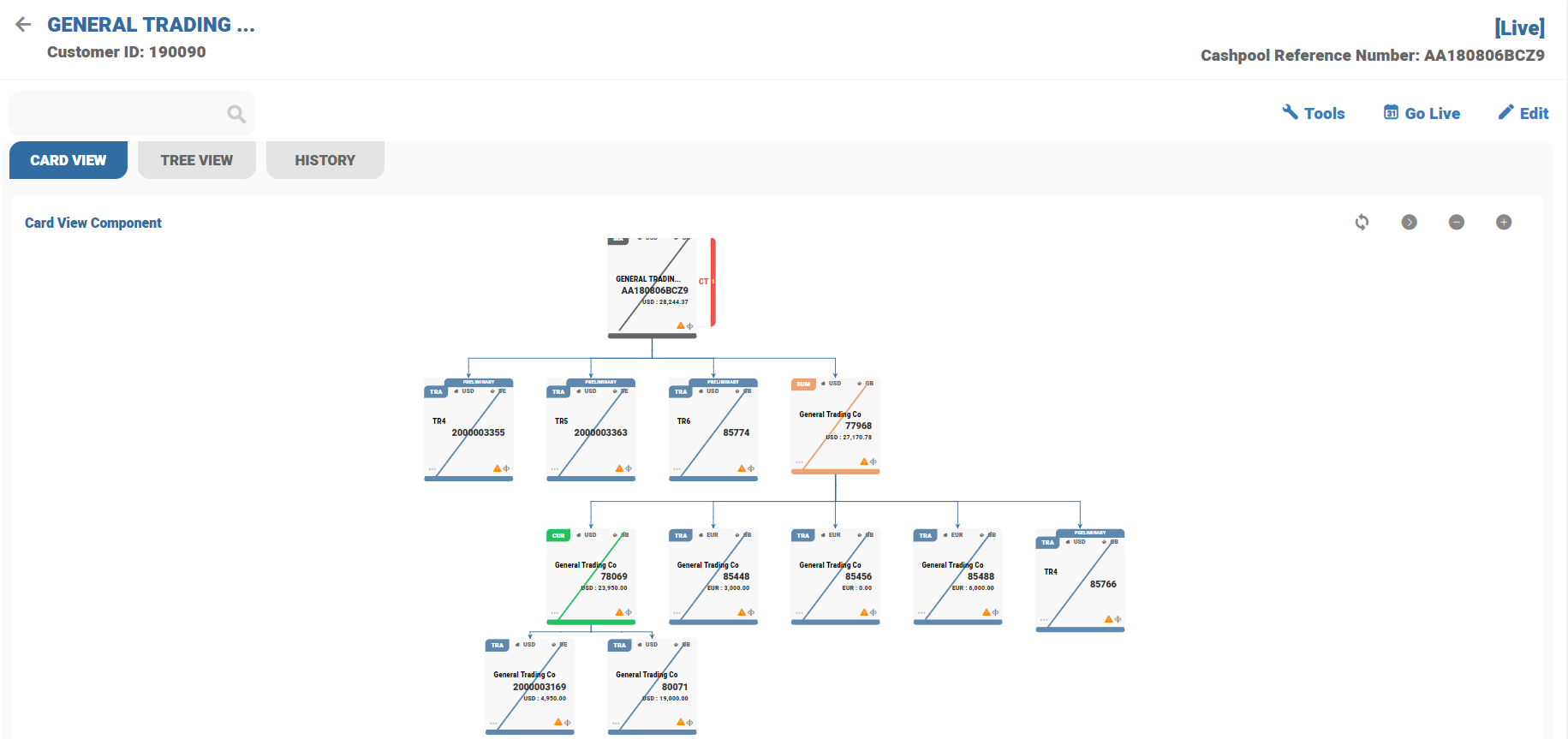

When the corporate is satisfied with the BN structure, click Edit > Go Preliminary to move the pool to preliminary. To move the pool to Preliminary status, the Pool Orchestration Service is run after committing the Activity. Once the Go Preliminary is triggered on a particular BN pool, the user can click  on top-left and GUI displays the GUI landing page.

on top-left and GUI displays the GUI landing page.

Once the preliminary process completed, the status of BN pool structure is moved and updated as Preliminary. Account number is generated on each placeholder and appears on each cards. Temenos Transact generates CT account automatically for each currency of TR accounts.

Click Edit to update the Terms and Conditions.

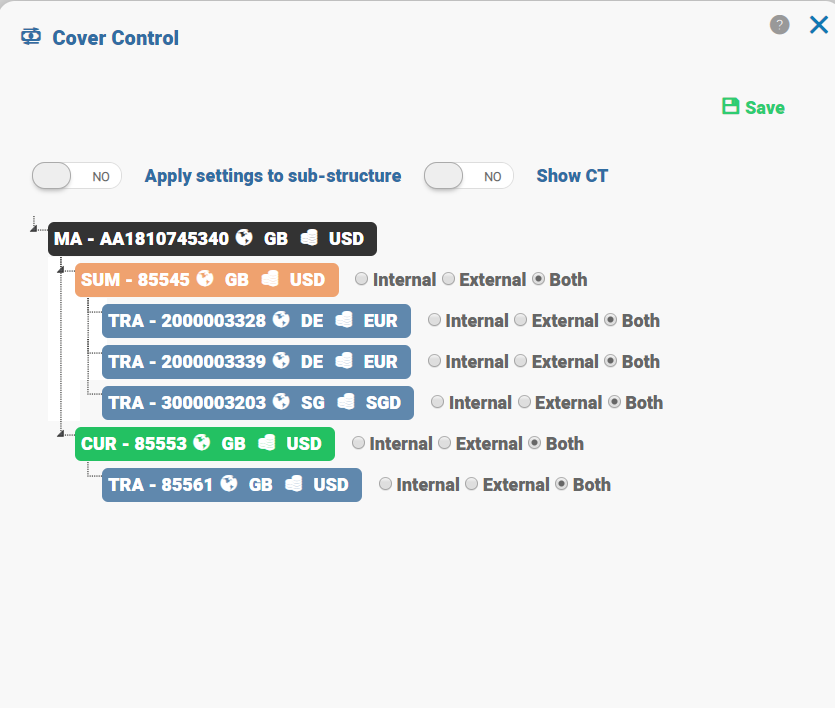

This section enables maintenance of cover control

This option is available in Tools menu. Click Edit to update the cover control setup. Accounts part of BN pool are listed as tree view and the changes can be updated in each account. Cover control on CT accounts are not applicable and hence the options are not enabled. Enable Apply settings to sub-structure to copy the cover control setup to child accounts.

Credit check is set for internal or external transactions or both. When the options is Null, the credit is applied during the transaction processing. Click Save to update the changes in Temenos Transact.

Click Edit to add new SA,CS,TR or MTR accounts in preliminary BN structure. The similar process is followed in Draft to add new accounts in preliminary. The user can commit the changes once the placeholders are created. Once the BN pool is committed in GUI, account number is generated immediately in Temenos Transact and appears on each card. The user can update the terms and conditions for the new account created in BN Pool.

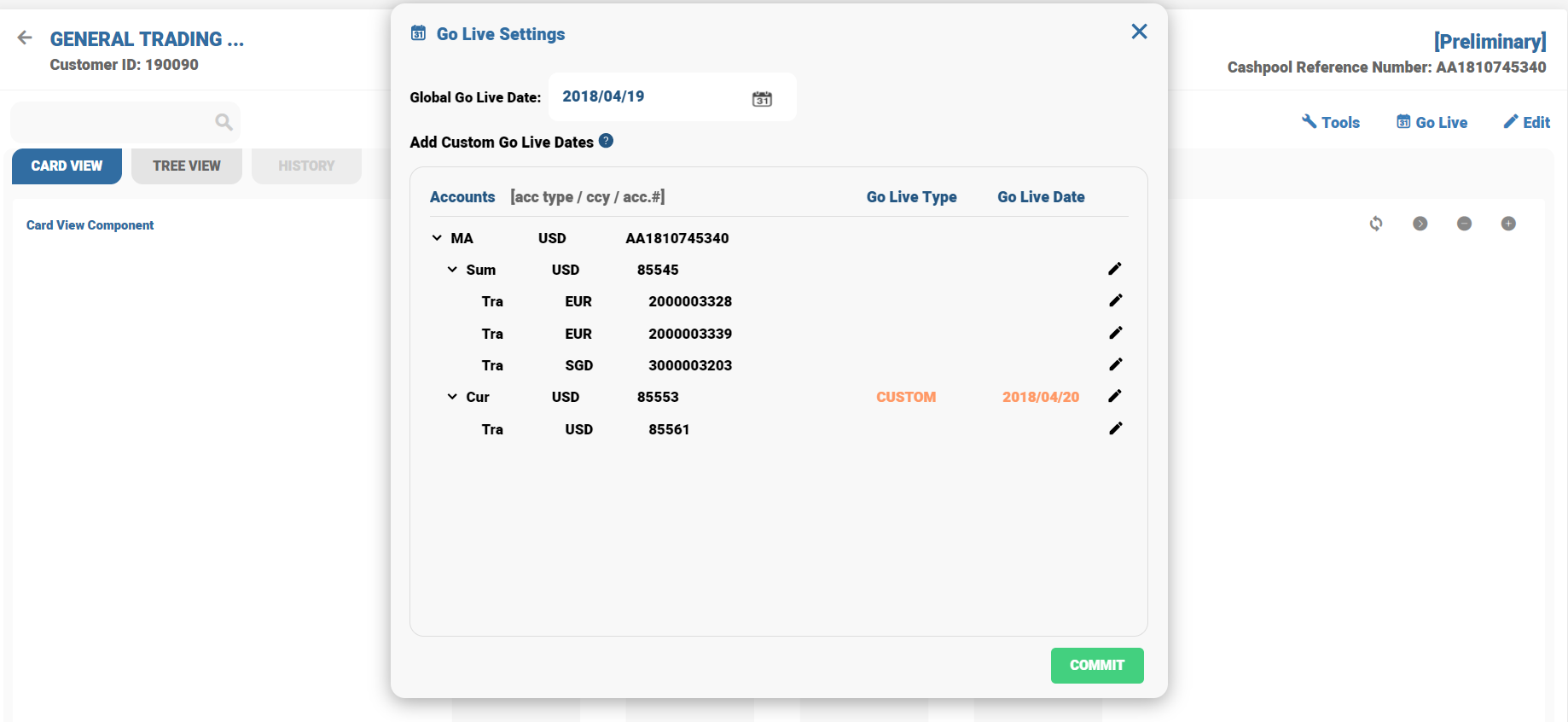

To sets the Global Go Live Date from CARD VIEW Click Go Live on top-right of the BN Pool structure in GUI.

In the below screen, the Global Go Live is set for Bundle arrangements and the custom Go Live date option is for individual accounts part of BN Pool structure. Set the Global Go Live Date first and then the customer go live date, else an error message is displayed. Custom Go Live date is an optional input, participant accounts in BN pool goes live with the same date as Master or Bundle go live. When the go live date is set for individual accounts, then the accounts are live only on that particular date. Transactions are not allowed until the accounts are moved to LIVE.

The Custom go live date can be the same as Master live date as or later than Master live date. Temenos Transact displays an error message when the customer go live date is before Master live date.

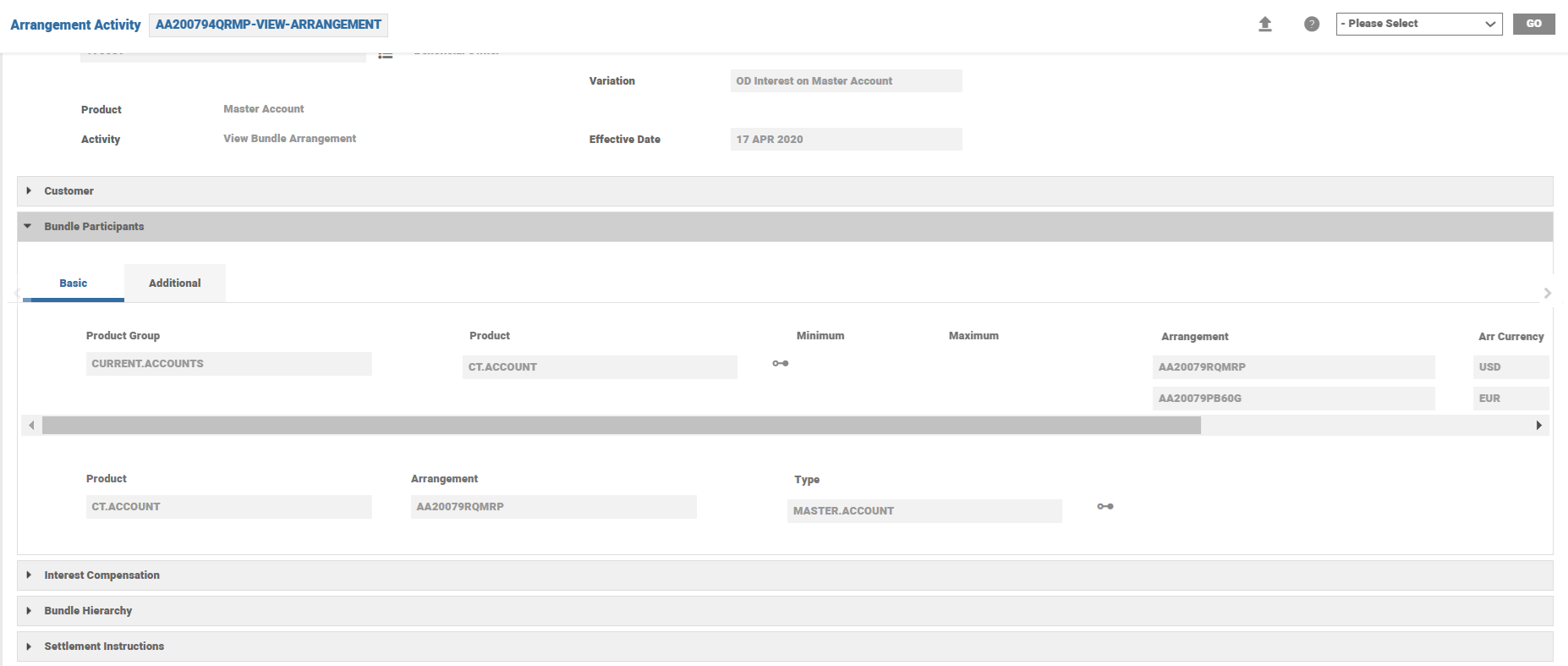

This section enables maintenance of CT Accounts

CT Account

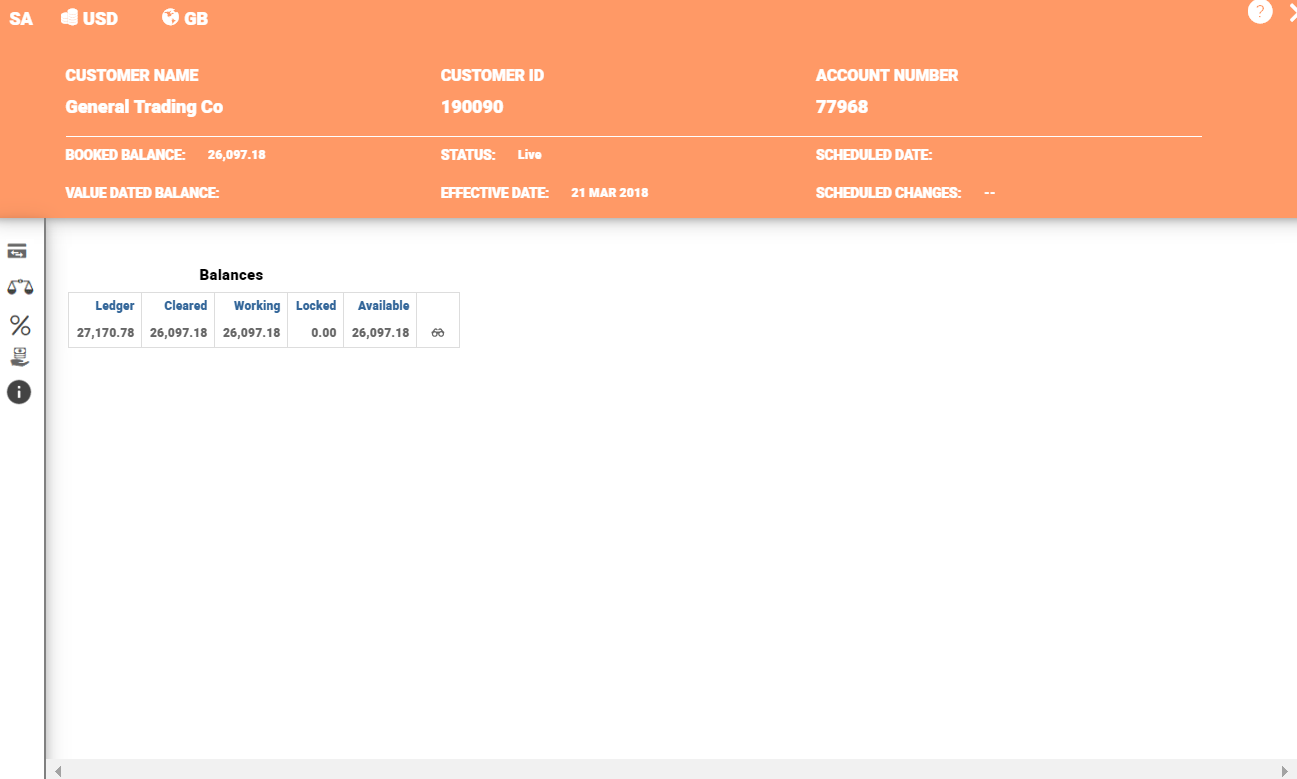

CT accounts provides static information of accounts such as CUSTOMER NAME, CUSTOMER ID, ACCOUNT NUMBER, STATUS and SCHEDULED CHANGES. CT expand card also has an option to setup or amend the interest conditions. When the limit is available for the CT account, GUI allows editing of limit on CT accounts.

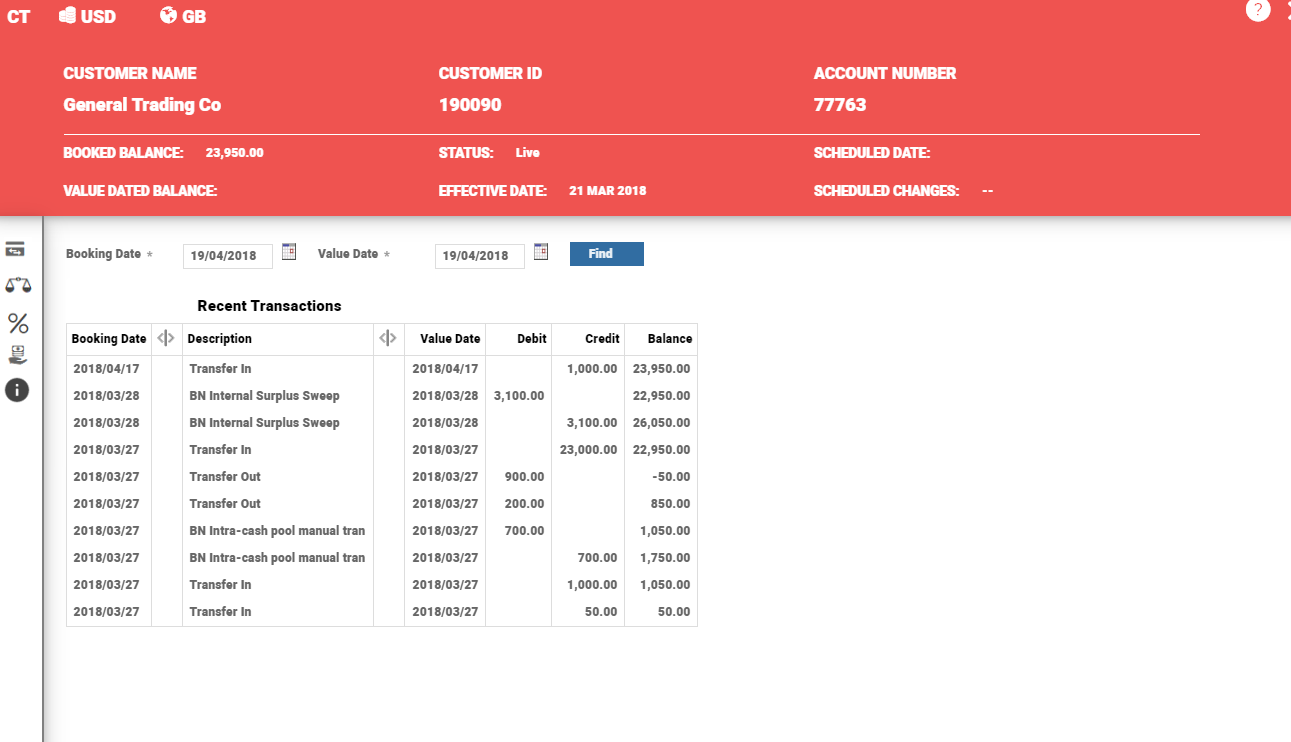

CT Account Transactions

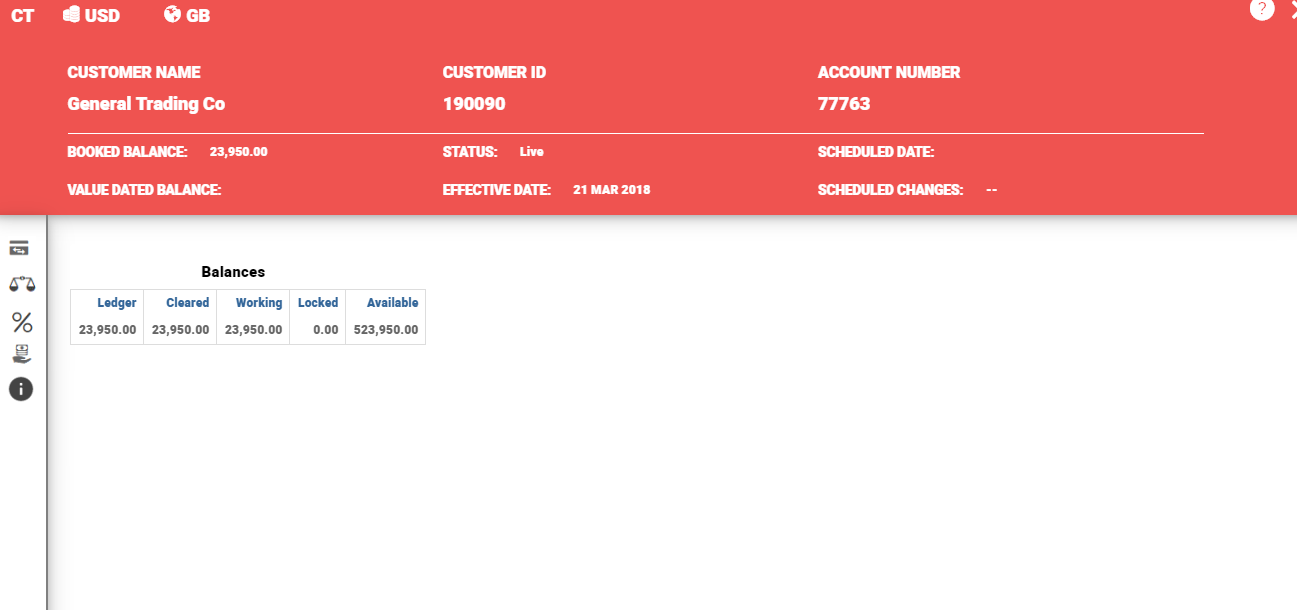

CT Account balances

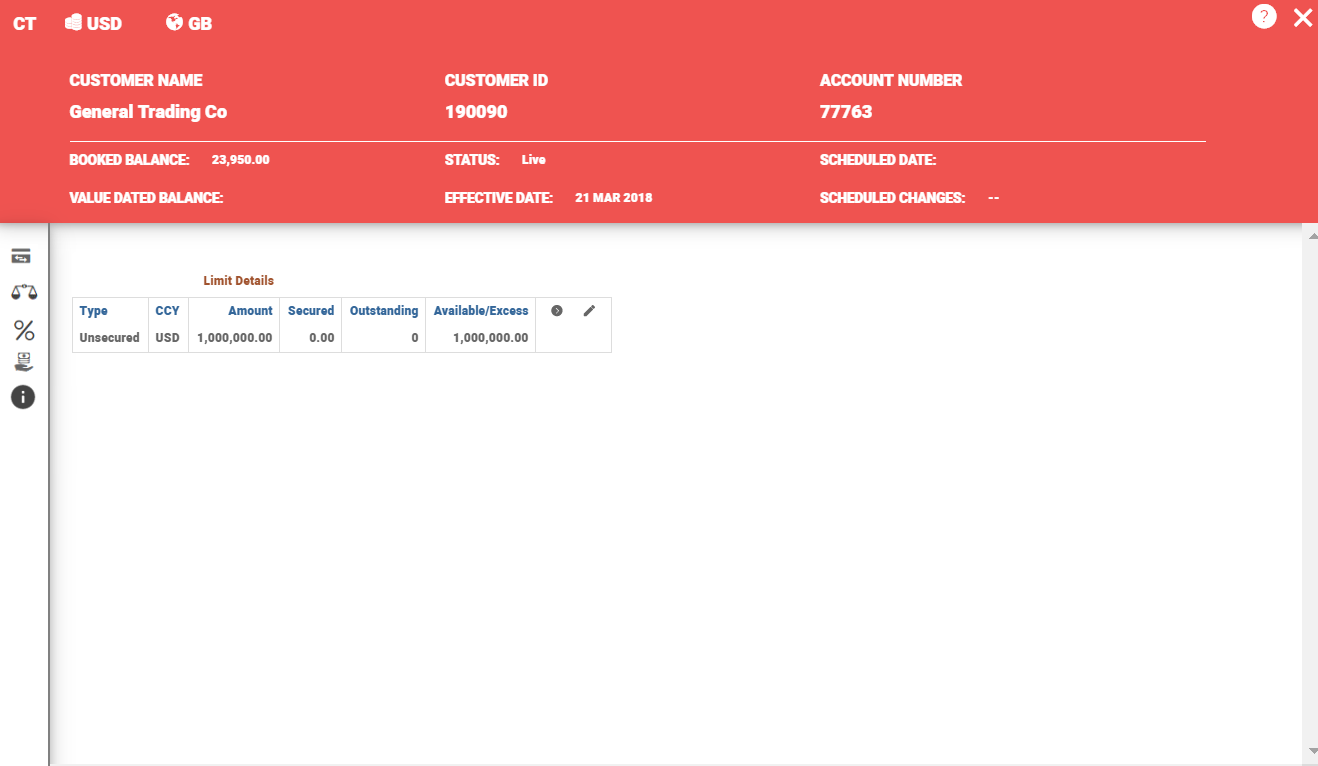

Limit Conditions

To update or amend the limit records, click Edit. Once the changes and amendments are done, click Commit to submit the changes in Temenos transact.

Interest Conditions

Click Interest conditions on CT account in expand view, the version of Interest calculations are launched. The interest activity can be set with immediate effort or for a future effective date. On committing the changes, GUI passes the information to Temeons Transact to update interest details.

Summary Account/Currency Summary

SA account provides the static information of accounts such as CUSTOMER NAME, CUSTOMER ID, ACCOUNT NUMBER, STATUS and SCHEDULE CHANGES. It provides the combined balances of all the child accounts linked under the SA accounts. It is multi-currency accounts; hence, any allowed currencies can be linked to SA. When the SA account is having a multi-currency child accounts, then the balance is combined to SA account currency. SA expand card can setup or amend interest conditions and internal cover control.

When the user clicks on Interest condition, the respective version is launched to update the internal interest conditions. Manage Limit option allows the user to setup the internal and external cover control. Manage limit version is launched and the GUI allows to update and commit the changes.

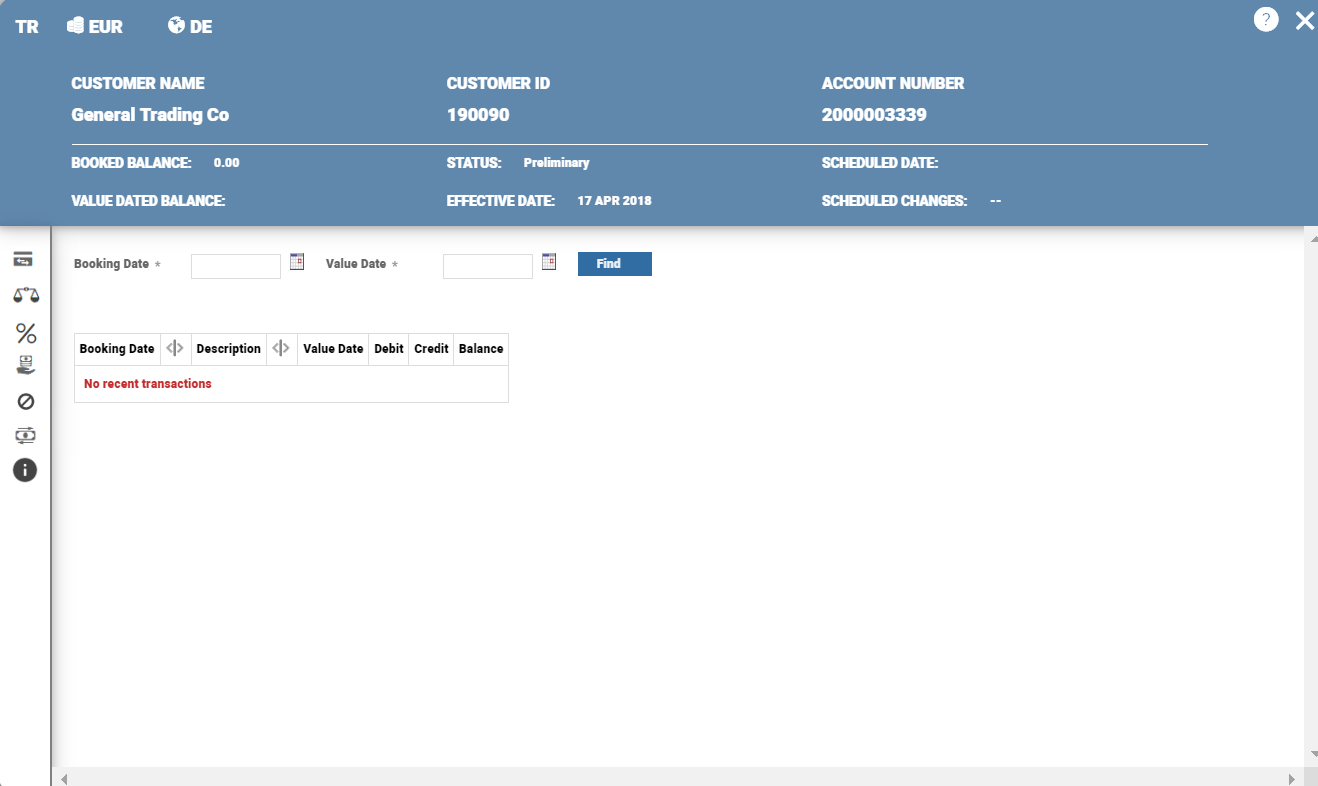

TR Account

Expanded view of TR account provides the static information of accounts such as CUSTOMER NAME, CUSTOMER ID, ACCOUNT NUMBER, STATUS and Schedule Changes. TR account provides the balances and transactions of the respective TR accounts. The user can view the transactions by providing the start and end date. TR expand card can setup or amend interest conditions and internal cover control.

When the user clicks on Interest condition, the respective version is launched to update the internal interest conditions. Manage Limit option allows the user to setup the internal and external cover control. Manage limit version is launched and the GUI allows to update and commit the changes.

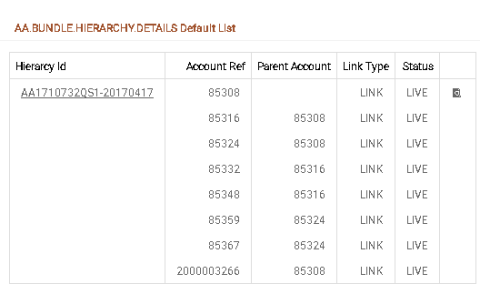

TR Account Transfer Services

Setting Future Internal STO/Sweeps

On selecting the Transfer services, the process remains the same. Refer Transact process flow.

When the CT Accounts are created (except for Limit in case of MCCF or SCCF or MCF or SCF) are updated, no other special attribute is specified to attach it to a master account using the UPDATE-PRODUCT.BUNDLE activity. The user does it directly on the bundle arrangement (master account).

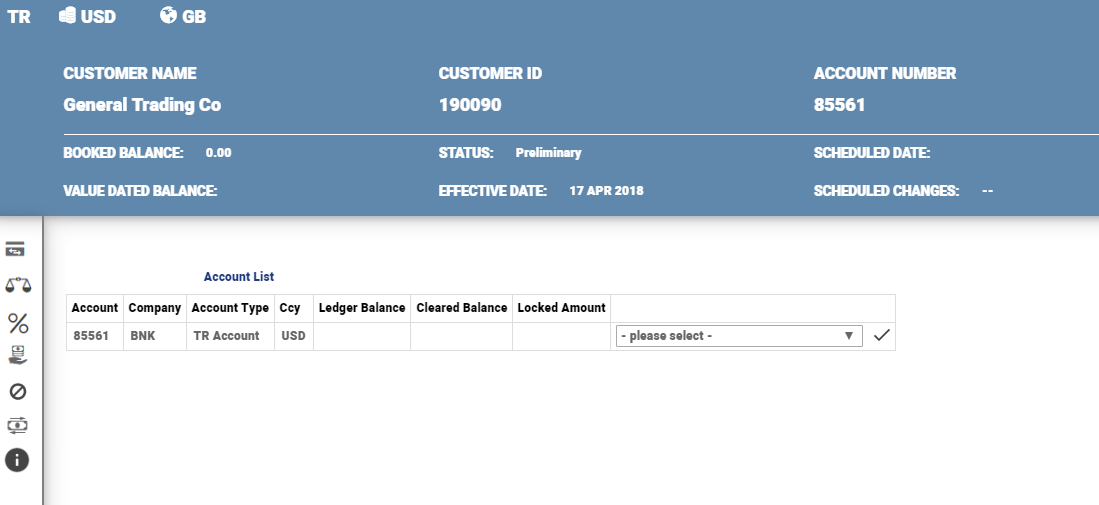

When the CTs and MAs are created and when creating (SA or CS or TR or MTR), the pool and hierarchy details should be captured using the purpose built attributes in Account property.

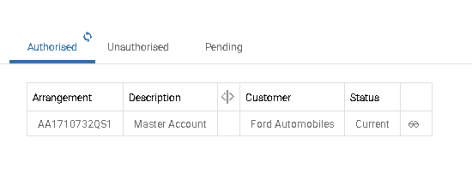

The below screenshot shows a new TR attached to an existing pool under SA1 as its parent. The navigation for this is from the Product Catalog or the Master Account Overview.

The master account is the bundle arrangement.

When the account added or created is in a Temenos Transact company different from the master account, the master account reference should be captured and suffixed with its company mnemonic. In the above screenshot, since the master account is in Temenos Transact company BNK, it must be captured as AA1710732QS1/BNK for the system to identify.

Linked Account Number is the CT account. If this field is left blank and when a valid CT in this currency exists, then the system defaults it.

- When a value is entered in this field, the system checks if it is a valid participant in the bundle arrangement and currency matches the account’s currency.

Parent Account is used to capture the parent in the hierarchy. It is an optional field and when left blank, the account created is added to the pool directly under the master account level. When a value is entered in this field, the system validates if it is,

- A valid member of the bundle hierarchy

- An allowed parent of this account

- Enabled for multi-currency (if the currency is different from that of the account’s currency)

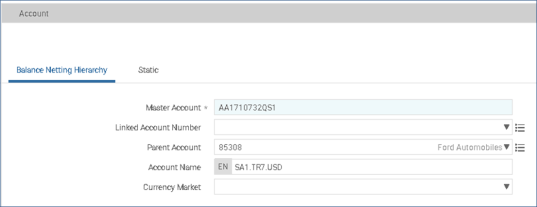

The AA.BUNDLE.HIERARCHY.DETAILS (system maintained table) is used for any investigation or analysis purposes or to know the pool structure on a given date.

85308 is the top most summary account and the grand parent of 85332, 85348, 85359 and 85367 (all from the same company) and also a parent of 2000003266 (from a different company). This illustrates that the pool hierarchy can contain accounts across borders (Temenos Transact companies or books).

Posting transactions on a BN pool is possible through the transaction account (that has External Posting set as Yes).

Whenever a transaction is posted in a TR account, the core accounting engine does the following:

- Makes a posting on the TR as a memo posting and diverts it as a real entry in the corresponding CT account (specified in Link AC Number field in Account Property)

- Replicates the same memo entry in the parent of the TR (specified in the Parent Account field in Account Property) and its parent and so on up to the top level parent.

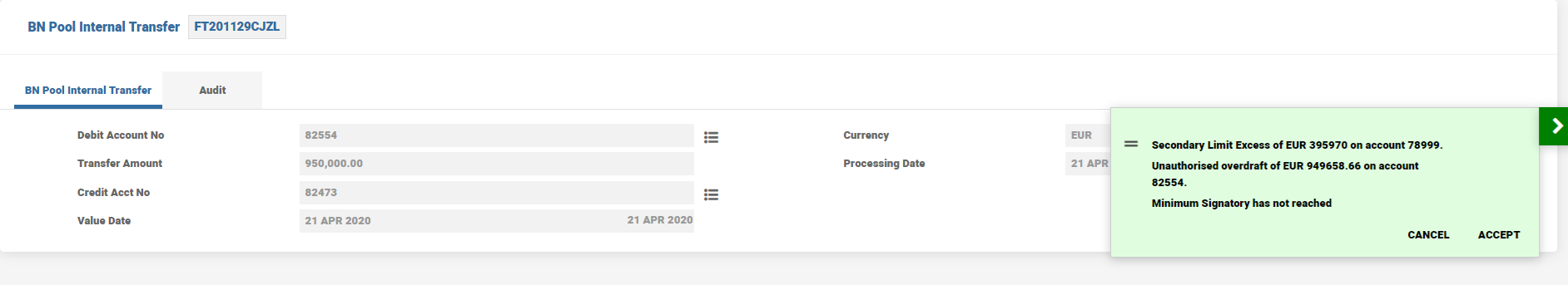

Internal or external transactions are controlled by the Transaction Type attribute in TRANSACTION table. This and the internal cover control attributes in Limit property class drives the validations on these transactions for TR or CS and SA accounts.

Internal transactions initiated between TR accounts, which are part of the same BN structure are located in different companies. The applications which are used for transactions, (FUNDS.TRANSFER, STANDING.ORDER or AC.CASH.POOL) can pass the accounting entries with the processing date, taking into consideration the company’s system date of the TRs and the CTs involved into the transaction.

The process by which the processing date is passed to accounting entries are consider the setting in INTERCO.PARAMETER.

A BN structure is present in the system with two transactions accounts opened in different core banking companies and one currency top account linked to the TRs located in another company. The below accounts and opened

| Account Type | Company Name | System Date |

|---|---|---|

| CT account (100001) | Temenos core banking Norway company | 25/10/2017 |

| TR account (100002) | Temenos core banking Norway Sweden | 23/10/2017 |

| TR account (100003) | Temenos Core Banking Norway Finland | 24/10/2017 |

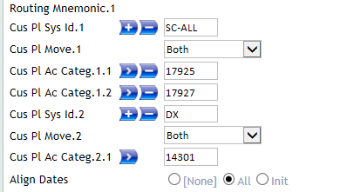

An internal transaction is initiated through the FUNDS.TRANSFER application between the TR accounts (100002 and 100003). The transaction is initiated from the Temenos core banking Norway company and the system is set to use the PDA accounting mode. The Align Dates field is set to All in INTERCO.PARAMETER application.

The system checks the core banking company system date of (TR and CT) account, and picks the latest date to be passed to the accounting engine as processing date. In this case, the accounting entries to (TR 100002, TR 100003 and CT 100001) are posted with a processing date as 25th October 2017, (which is the latest among all three accounts involved in the transaction). The system does not take into consideration the system date of the core banking company for the currency summary accounts and summary accounts.

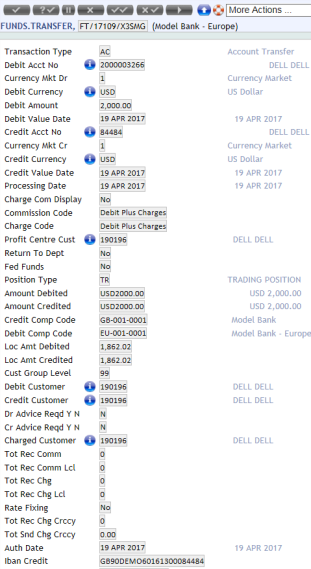

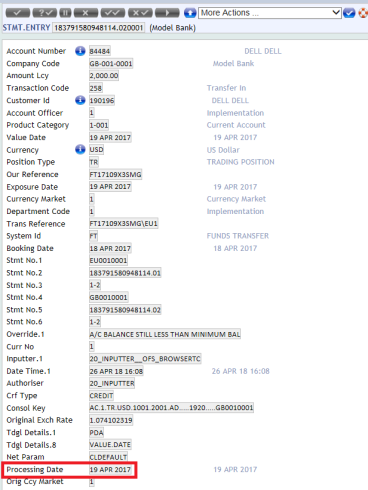

A funds transfer is initiated in the system between the below accounts:

| Account Number | Company Name | System Date |

|---|---|---|

| 84484 | Temenos Model Bank Company | 18/04/2017 |

| 2000003266 | Temenos Model Bank – Europe Company | 19/04/2017 |

The Value Dtd Acctng Y/N field is set to Pda in both companies and the Align Dates field is set to All.

The funds transfer is initiated from Temenos Model Bank- Europe Company.

The balances in the accounts (84484 and 2000003266) are is 0 and a credit of USD 10,000 (before initiating the funds transfer) respectively.

As the system date in the Temenos Model Bank Company is earlier than the one in the Temenos Model Bank –Europe, the Processing Date is set to 19 APR 2017 in the STMT.ENTRY for the account 84484.

The system takes the latest processing date between the two, as the option all is setup.

Funds are booked under RECEIVE asset type until the date in the Temenos Model Bank Company changes to 19 APR 2017.

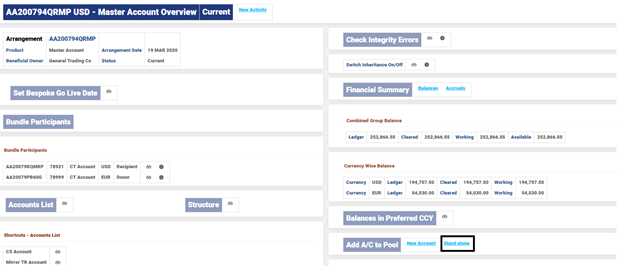

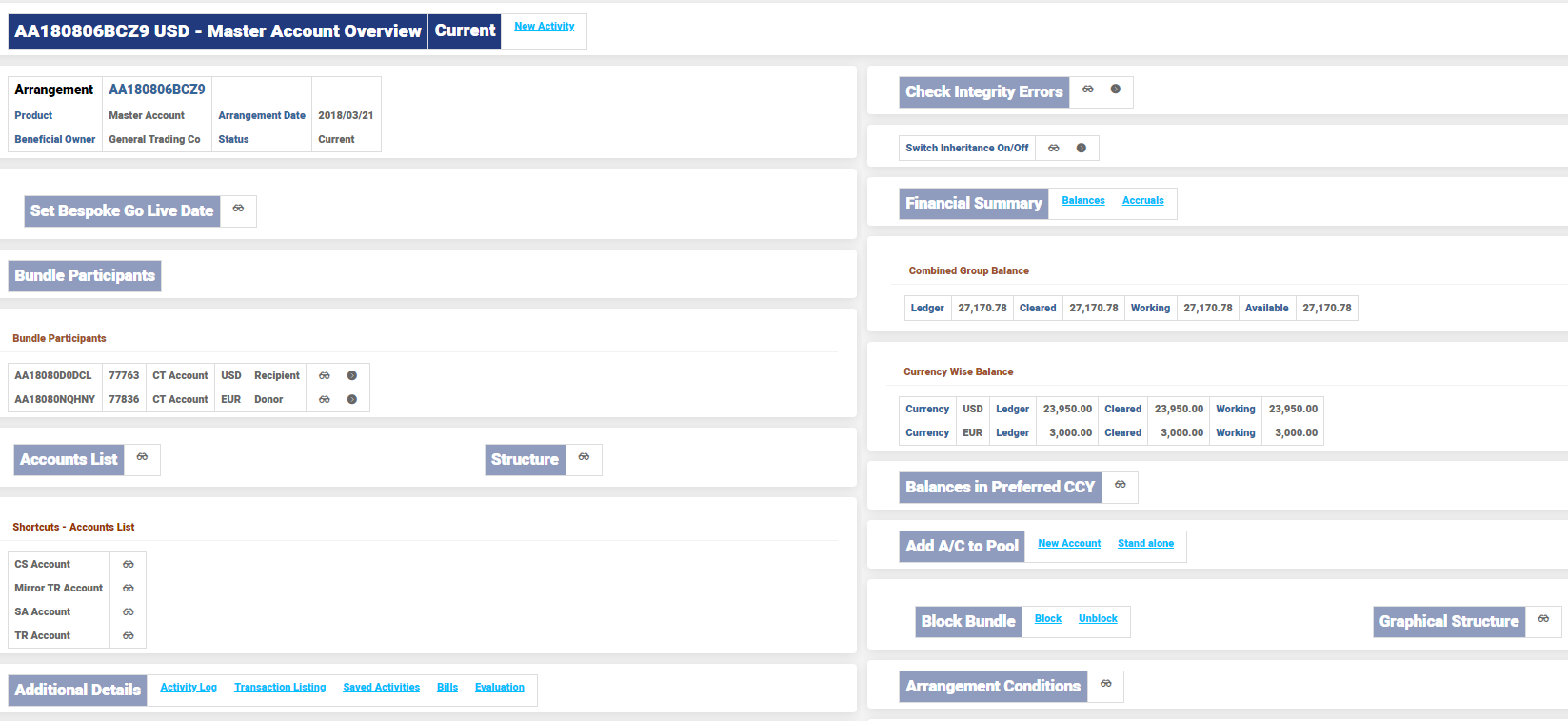

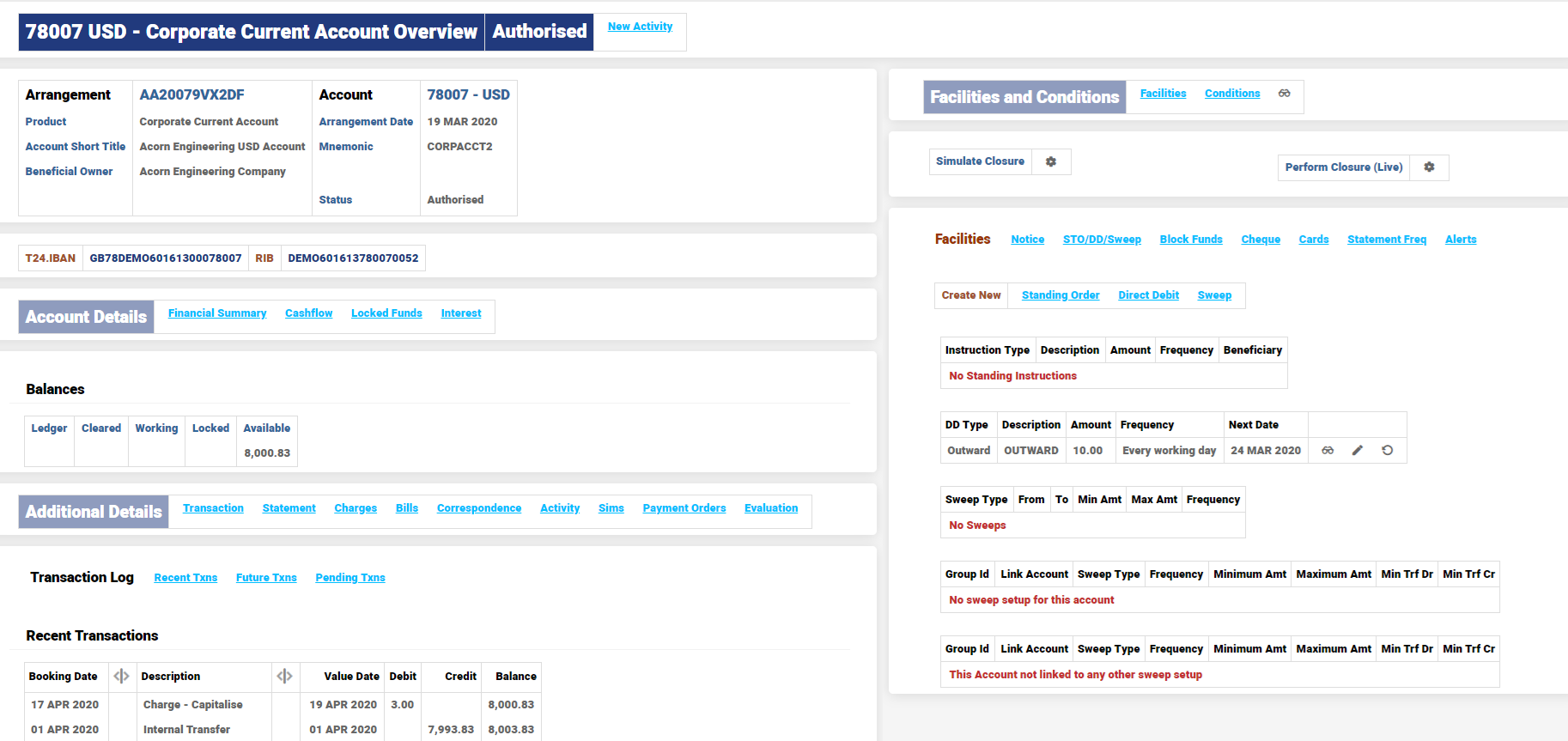

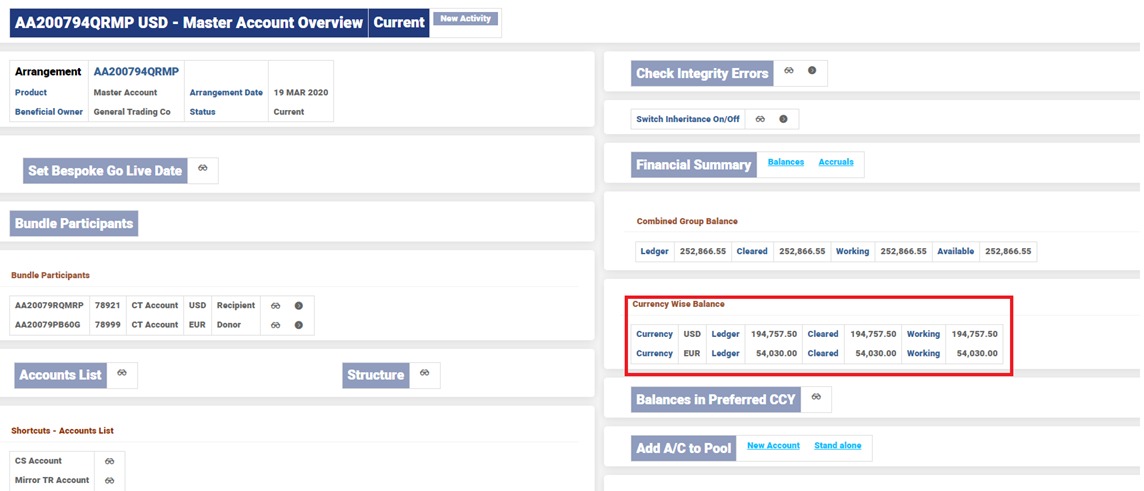

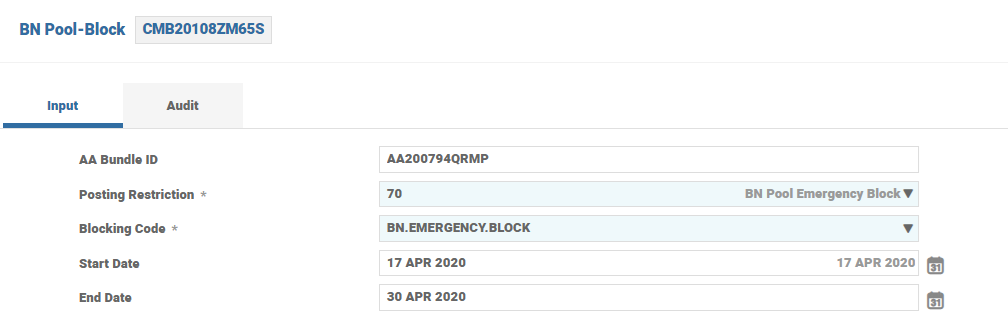

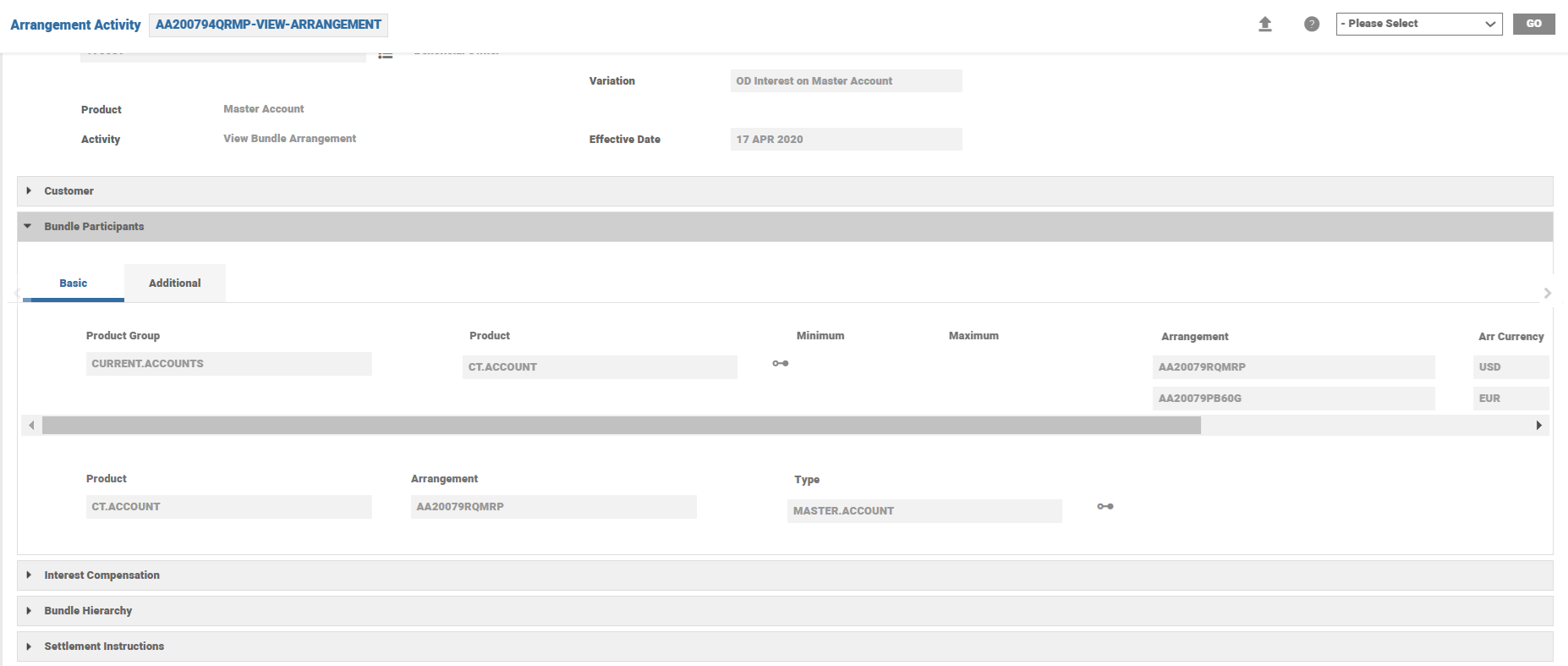

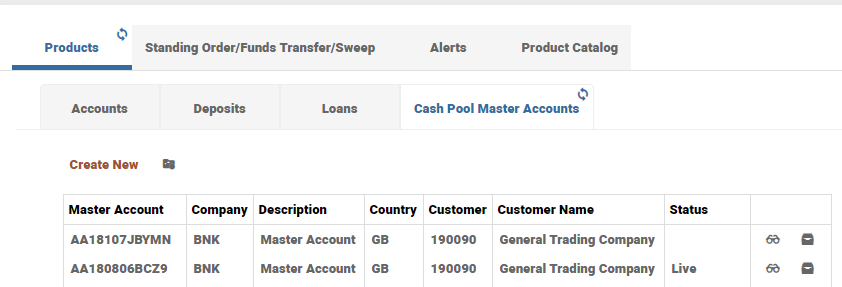

When a pool structure (bundle arrangement) is created, subsequent maintenance activities either at Pool or individual account level can be carried out from the bundle arrangement overview.

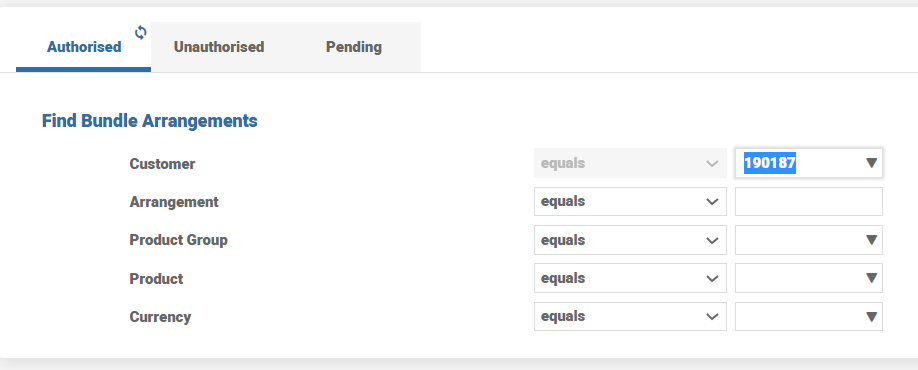

Find Bundle Arrangement

The spectacles icon takes the user to the arrangement overview

Bundle Arrangement Overview

The New Activity lists the user activities that are performed at the bundle level. This is used to launch the Update Product Bundle activity to add more CTs to the master account.

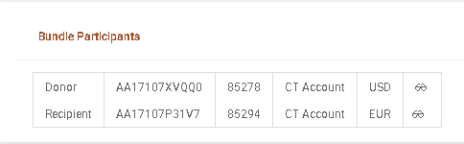

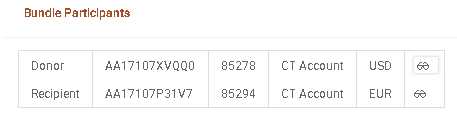

The Bundle Participants section lists the CT accounts that are part of the master account. The spectacles icon drills down to the respective CT account arrangement overview

The Hierarchy section of the bundle arrangement overview lists the various accounts that are part of the hierarchy. The spectacles icon drills down to the respective account arrangement overview.

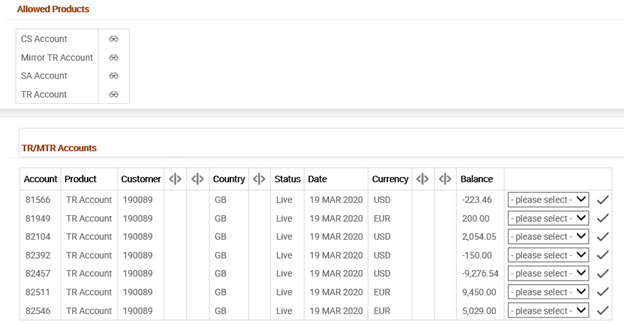

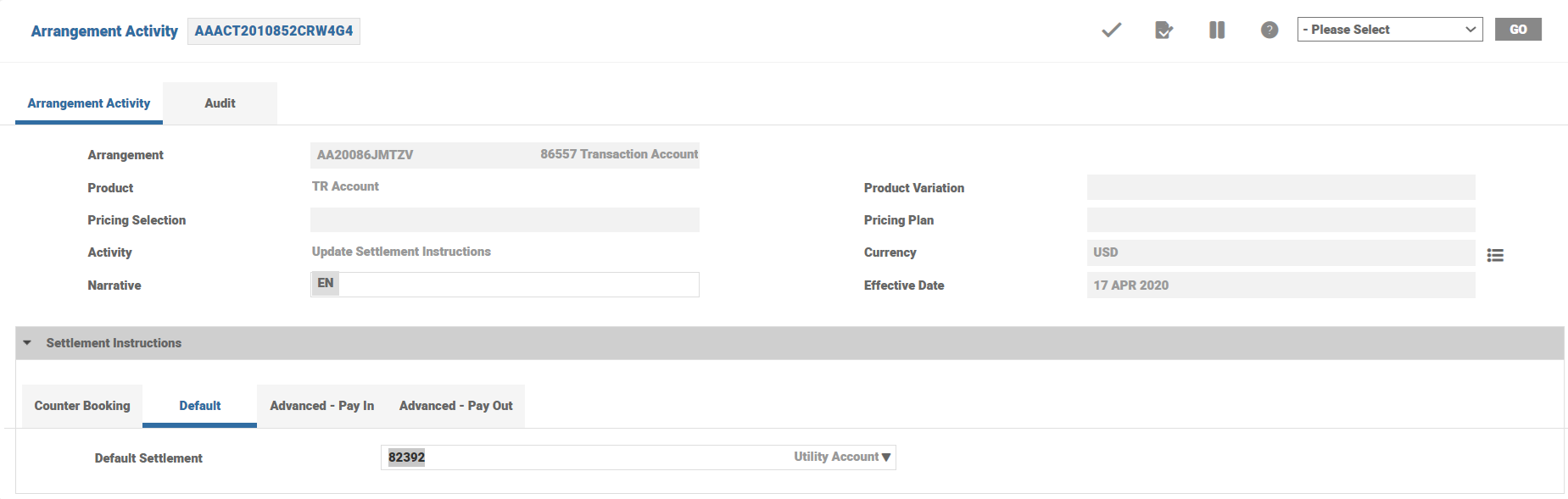

The Add A/C to Pool tab allows user to add different types of accounts to the pool. This is to provide easy access from the bundle overview and requires customisation of the enquiry based on the products displayed.

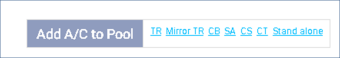

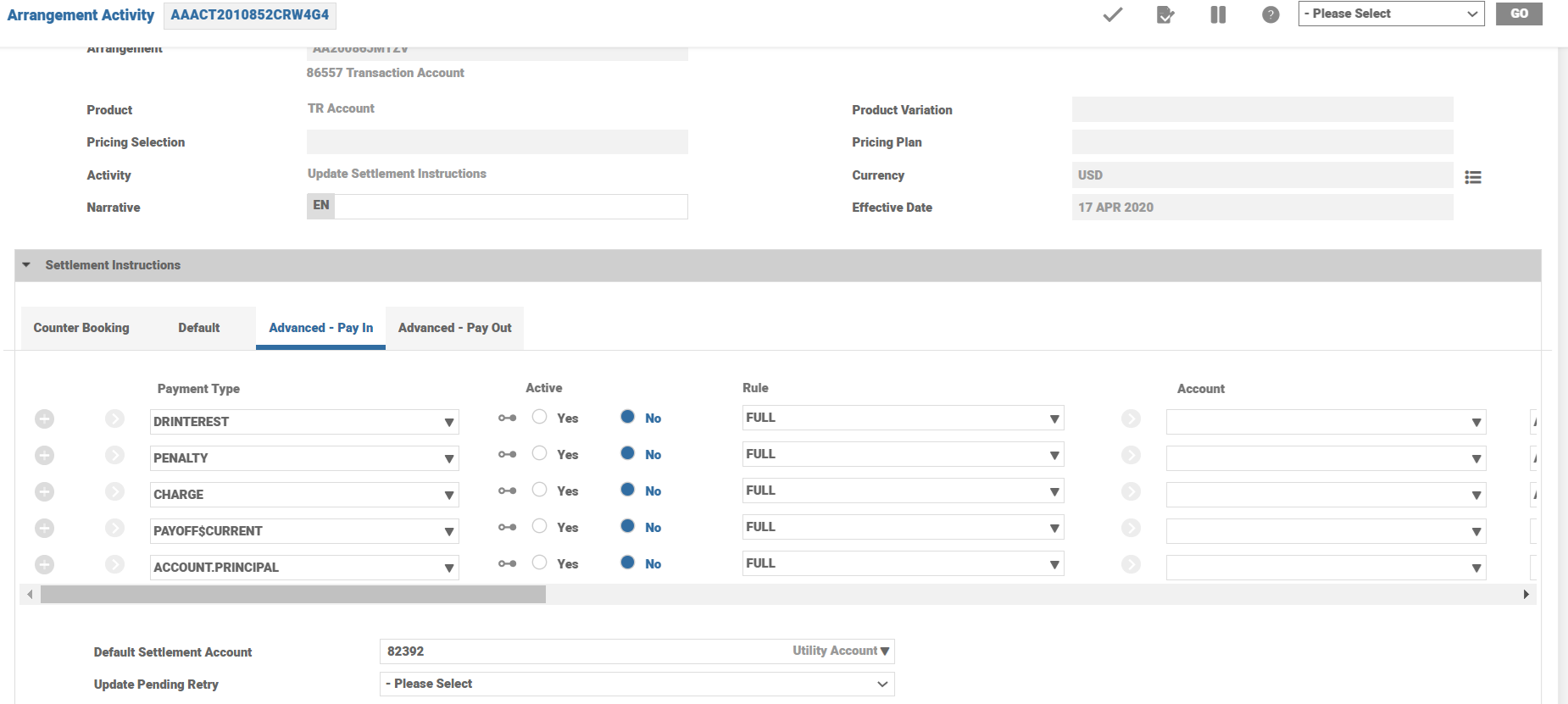

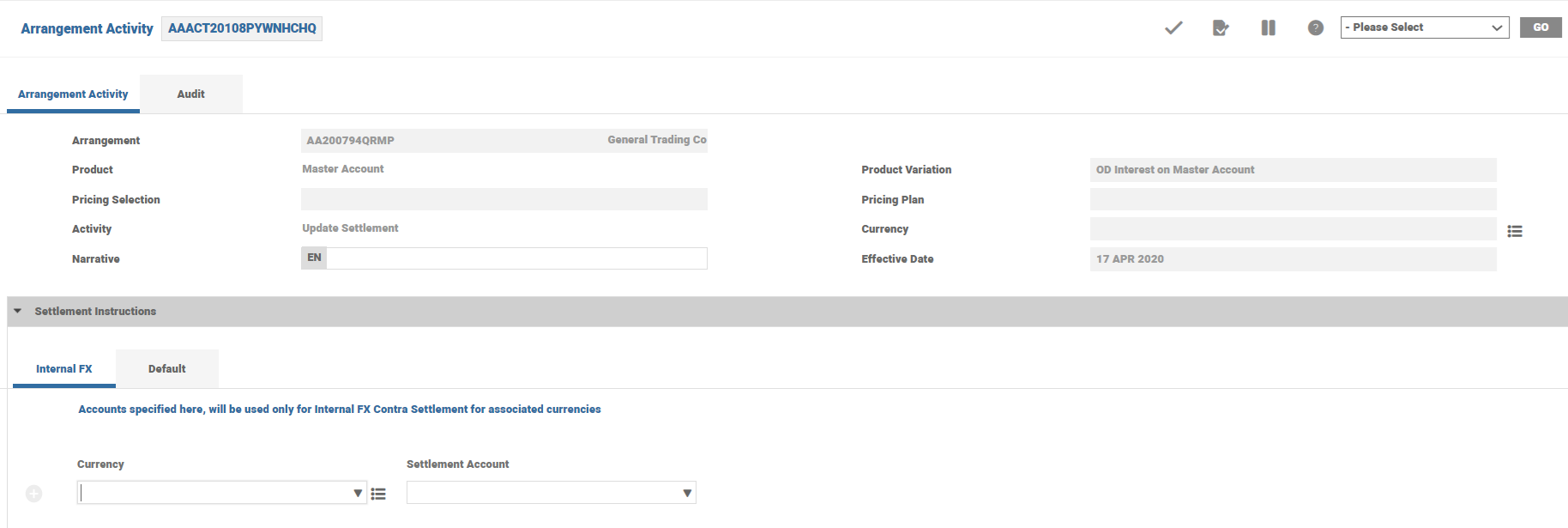

The settlement property specifies the default settlement (in the case of CS/SA/CT) and counter booking account (in the case of TR/CS/SA). Navigate from the bundle overview into the respective account overview, the user can launch Update-Settlement activity from the New Activity List.

For example, counter booking for a TR account.

New Activity List

The below screenshot shows a default settlement account for a CS

When the settlement account is specified, the relevant pay in or pay out settlement instructions need to be switched on by setting the value to Yes.

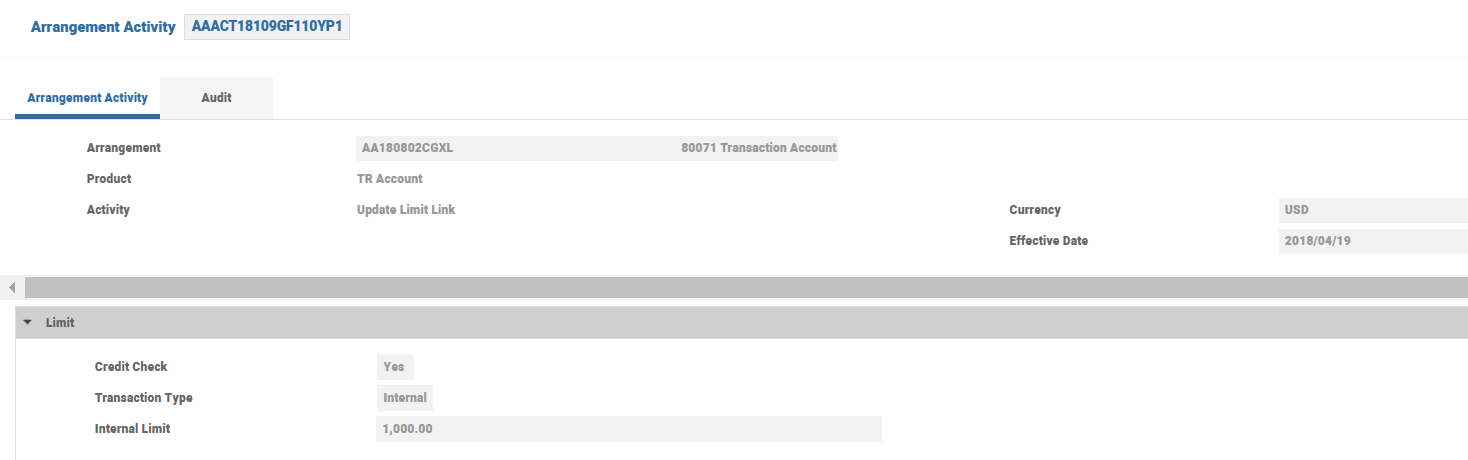

The user navigates to the respective account arrangement overview and New Activity List to launch the Update Limit activity to set internal limit for a TR/CS/SA.

The below screenshot shows an internal limit on a TR

Setting the Internal Limit to 1,000.00 results in the maximum debit balance on this account to be 5,000.00.

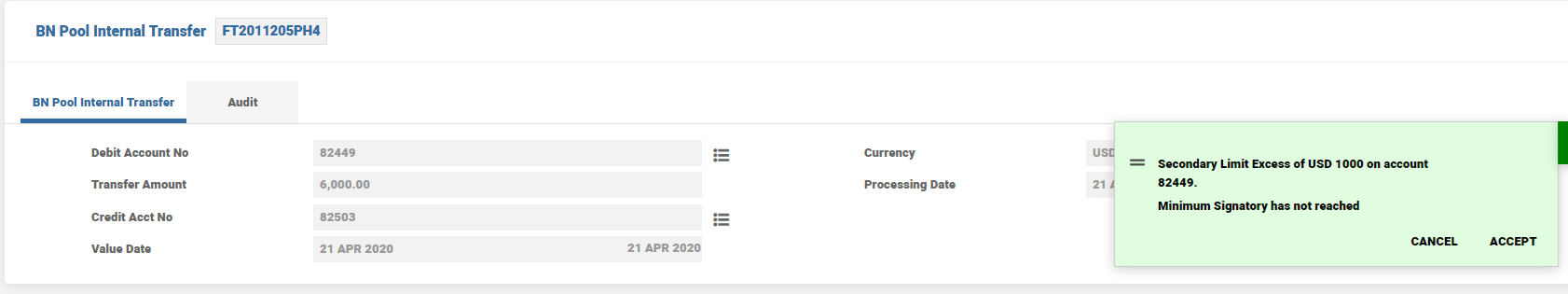

Even though the Group Balance is close to 1 Million USD + 10 Million in Credit Facility, debiting USD 6,000.00 from this Account would result in the following override message.

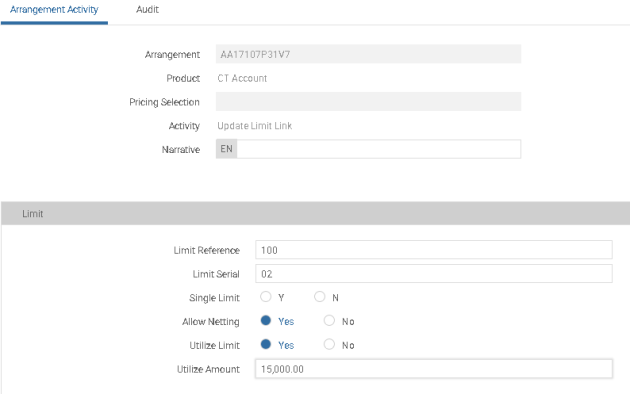

To set a restriction of limit utilisation by a CT on shared limit, the user can navigate to the respective Account Arrangement Overview and select the New Activity List to launch the Update Limit activity.

The below screenshot shows Bundle Participants in bundle overview:

The below screenshot shows a New Activity on CT Account Overview

Update limit to restrict maximum utilisation of the available balance by the EUR CT to EUR 15,000.00.

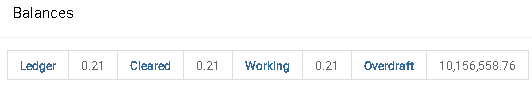

The financial summary of the EUR CT is shown below:

The account balance of the EUR TR is shown below:

Debiting EUR 20,000.00 from TR results in this limit excess message on the EUR CT account 85294.

An existing active account can be added as a part of the administration.

This account could have been in Temenos Transact for a number of months or years and was previously operating as a fully functional operational account, (processing regular transaction such as, debits and credits). The account has active direct debits, standing orders or any other service that Temenos Transact offers attached to the account.

A number of validations and processes are done to transfer to the BN Pool. The AA.ACTIVITY.CLASS record ACCOUNTS-TRANSFORM-ARRANGEMENT is used to facilitate and control this unique process.

This process is in simulation mode or as a live activity with the following validations and actions:

- To facilitate this and the process to happen during COB, the Effective Date activity should be forward dated by at least one day.

- When moving into the BN pool, the account must transition from an on-balance to an off-balance type account (internal type).

- During the process, the correct transformation (TR) account should be selected.

The below validations are required:

- The system validates all the services currently attached to the account and produce a statement that needs manual correction.

- The system validates the authorised BN agreement defined.

Bundle Arrangement

- This field used to define and validate that a BN Pool structure is available and this is the master account that ultimately this account is attached to.

- When this validation fails, error appears.

Linked Ac Number

This field validates and checks the diversion account defined.

- This diversion account (currency top) is defaulted by the system.

- When this validation fails, error appears.

When the TRANSFORM activity is authorised, the activity is scheduled to run on the defined effective date.

During the close of business (COB), the system automatically transforms the product and actions the following events:

| Interest all types (credit or debit or special) |

|

| Tax on interest | When defined, the system calculates all tax up to this point on each individual property. |

| Charges all types (periodic or scheduled or activity) |

|

| Tax on charges | The system calculates all tax up to this point on all charge properties. |

| Evaluate all activity restrictions | Per product definition, any defined rules need to be honoured. |

| Evaluate and generate any associated messaging | Per product definition activity messaging generates the appropriate advice. |

| Evaluate all current core services attached | A validation report is generated. |

| When the calculated balance is negative, validation shows an error. |

|

When the COB is complete, the account is a part of the BN account and its balance is seen in all the relevant hierarchy of accounts.

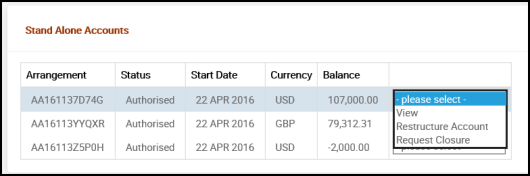

The standalone link is used to transform a standalone account in the Master Account Overview screen.

This enquiry produces the following results.

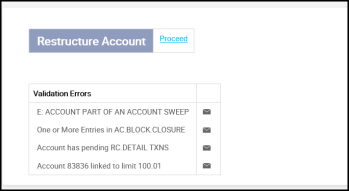

Select Restructure Account and the following validations appears.

When the required validations are corrected, the activity is scheduled to be processed during COB.

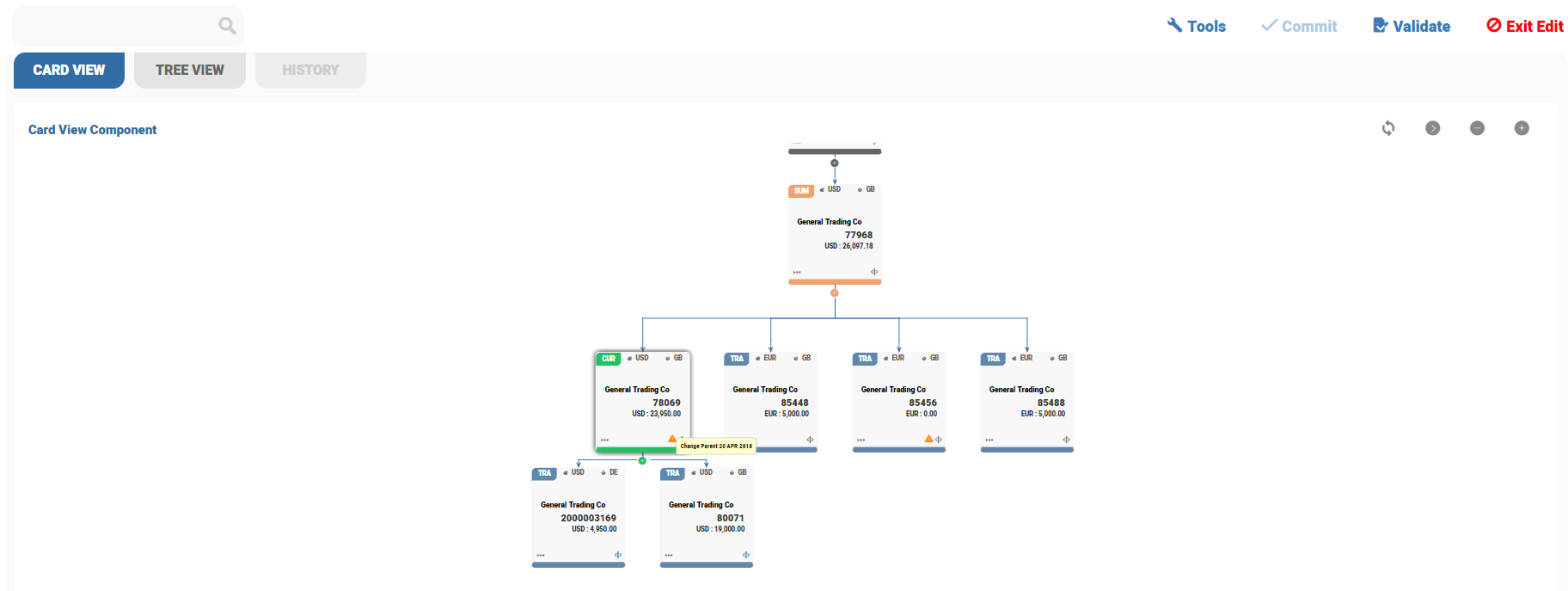

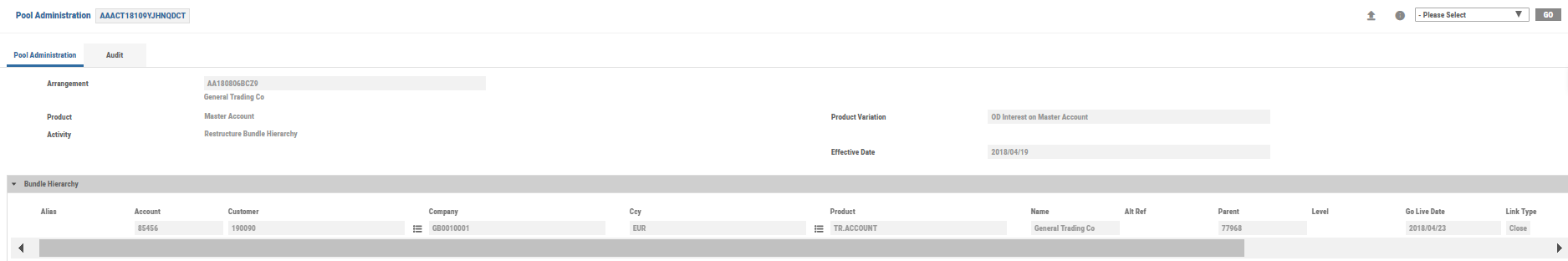

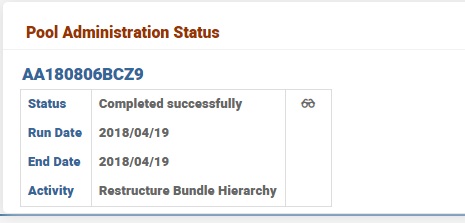

The accounts in the BN pool can be internally moved at any point. To facilitate this, the activity ACCOUNTS-CHANGE.PARENT-ARRANGEMENT is initiated from the New Activity menu.

When this process happens, the balances from the previously linked parent account is also be transferred.

The above screenshot sows a TR is linked to SA account (2000003347) and this SA account has the same balance as the linked TR account.

New Activity menu from the TR account, the User activity ACCOUNTS-CHANGE.PARENT-ARRANGEMENT can be initiated.

For restructuring, this activity happen during COB, hence, the Effective Date should be day +1.

The new parent account is changed to 2000003355, which is a new SA account.

After authorisation and a COB is run, the restructure process is initiated.

A balance of USD 88,592.08 is moved from (2000003347) to (2000003355) account.

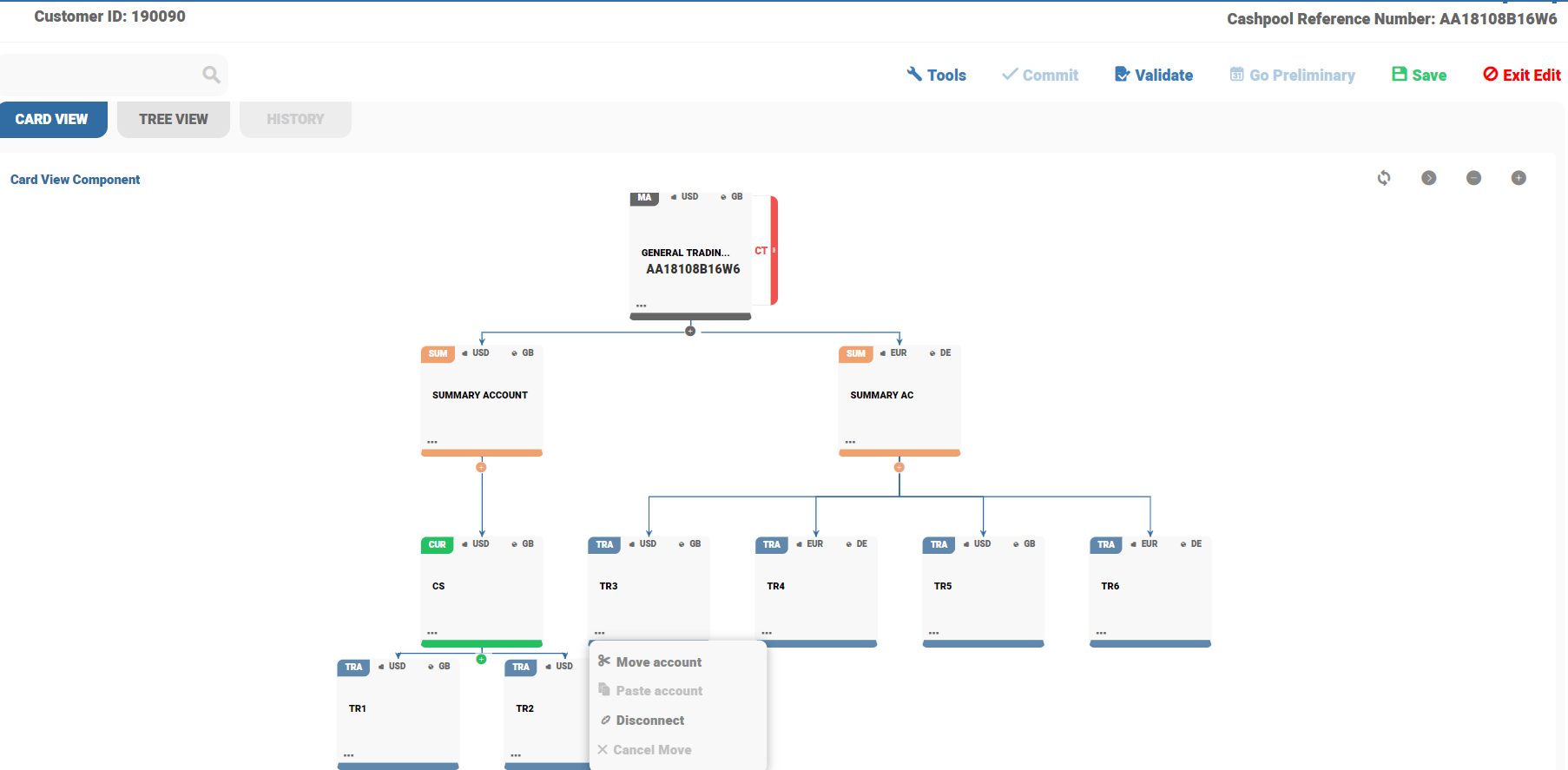

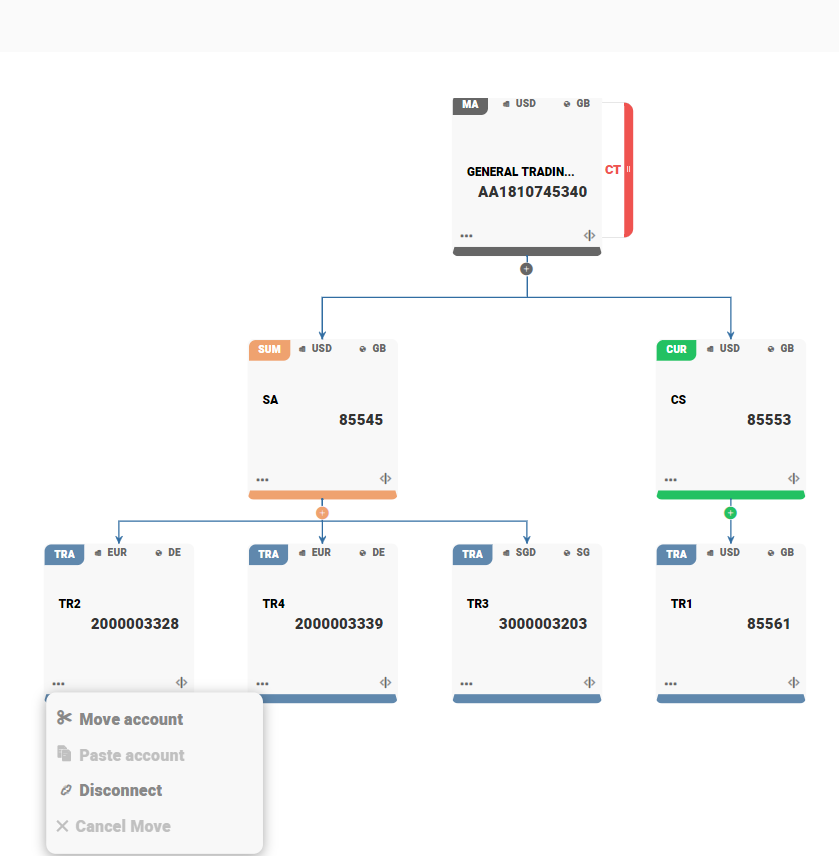

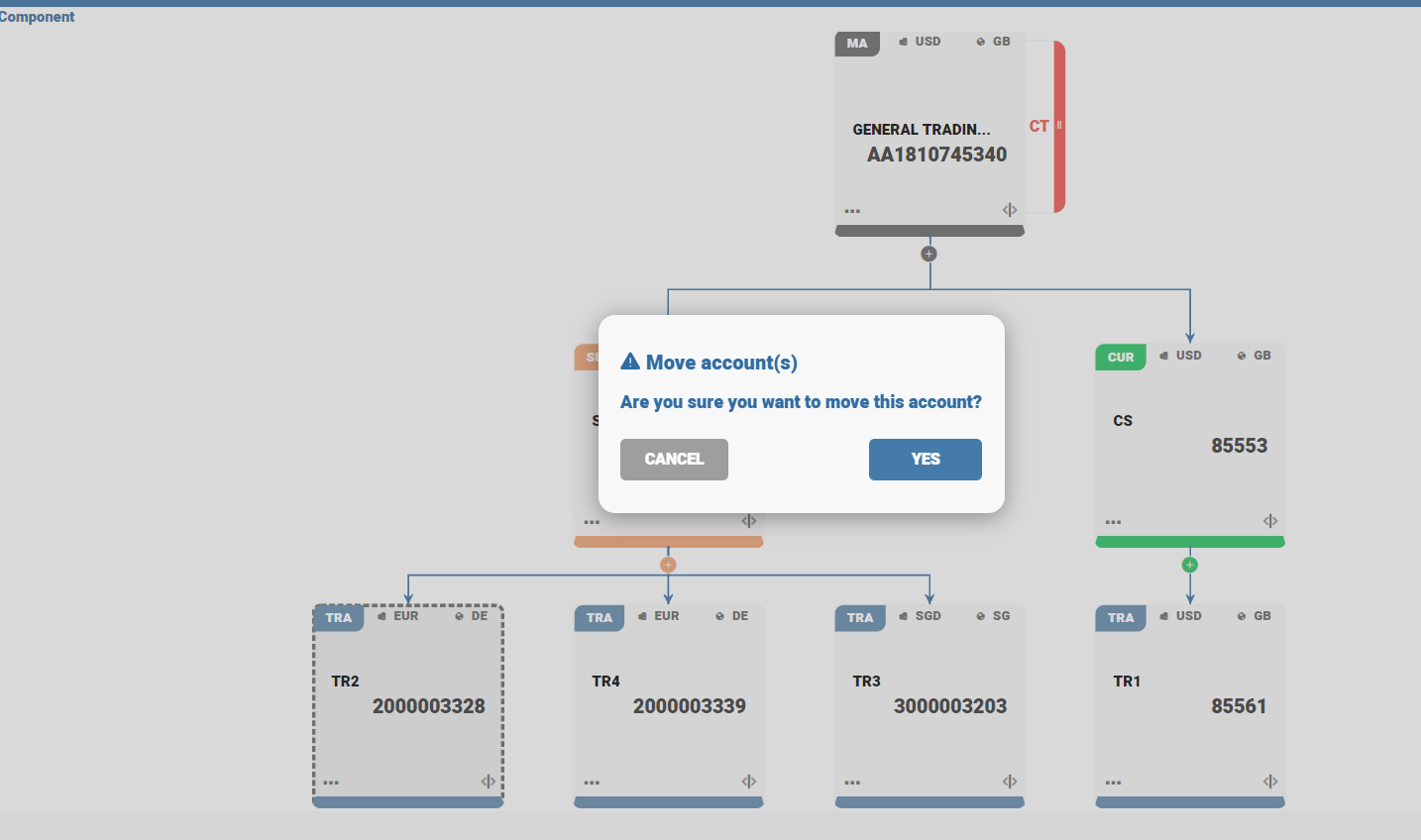

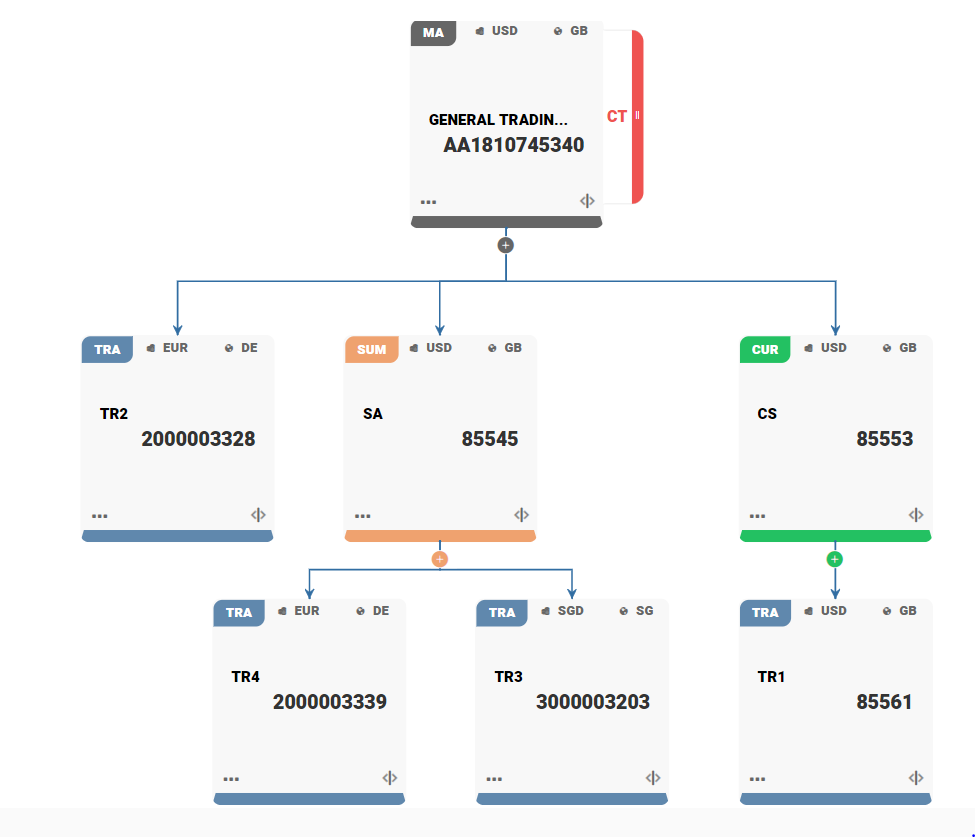

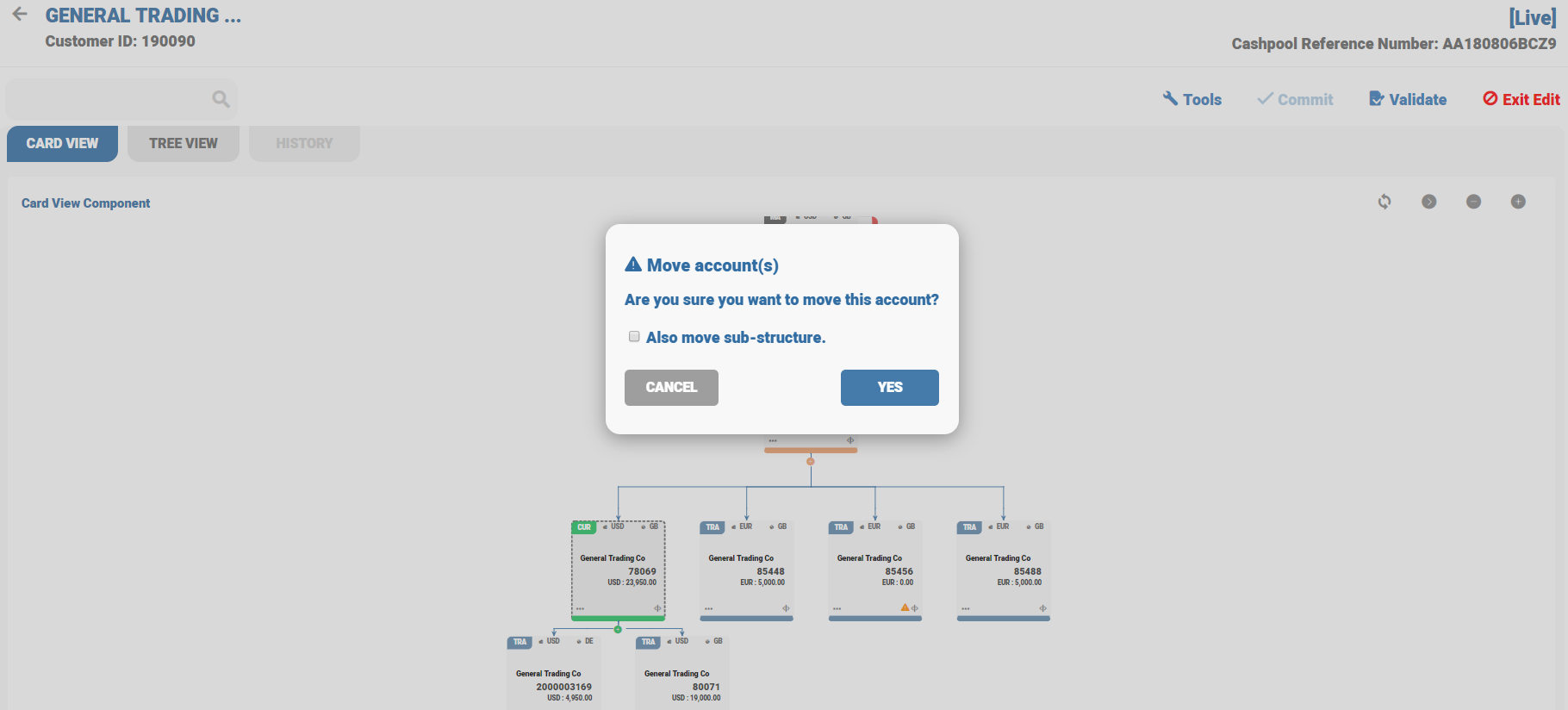

BN Pool accounts can be moved from one parent account to another parent accounts. To move an account, select the respective account, click  and click Move account. Once the account is selected to move, select the target account and click Paste. When the account is already in Draft or Preliminary, the account is moved to the target parent immediately.

and click Move account. Once the account is selected to move, select the target account and click Paste. When the account is already in Draft or Preliminary, the account is moved to the target parent immediately.

Select the target parent account and click Paste. When the account is in preliminary, the account is moved to the target parent account immediately.

Account 2000003328 is moved to the new parent, that is, bundle arrangement.

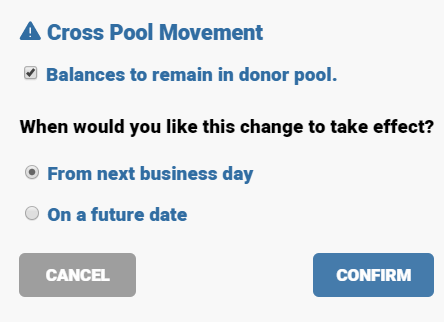

If the account is in Live, then the account is moved on the next working day or with a future business date. The account remains with the existing parent, terms and conditions remains the same. Once the system reaches the schedule date, the account is moved to the new parent.

Intra-cash pool movement of the Sub-structure (GUI)

To move the sub-structure from one parent to another parent account, right-click the account that needs to be moved the new parent. New dialog box appears with confirmation, whether the account wants to be moved with sub-structure or only with the selected account. By clicking on Also move sub-structure, the entire sub-structure is moved to the new parent.

Temenos Transact scheduled a new activity and the account is moved on the scheduled date. Hover on the card to view the change parent details.

Financial institutions collect charges on master cash pool account, which is the master arrangement for the pool hierarchy, even when master cash pool account is a non-financial product.

Temenos core banking suite levies charges on master cash pool account (non-financial product) by extending the functionality of some of the property class to the bundle product line.

The charges levied on master cash pool account is posted to the nominated financial settlement account.

- Bundle account /master account detail = Arrangement No AA17132HJ8T0

- Settlement account detail = Arrangement No AA171323JK92, account no 85073

- CT account detail = Arrangement NO AA17131SVQ33, account no 85057

- For the above master account following charges are configured

- Subscription and setup fees are fixed as USD 1000 and EUR 500 respectively.

The below screenshot shows the Master Account overview:

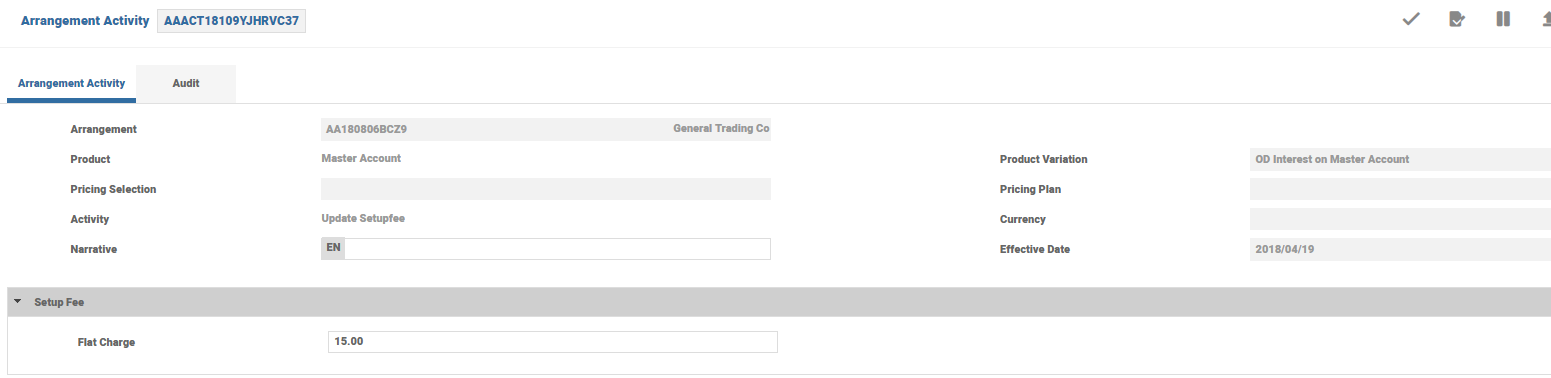

The setup fee is configured as fixed amount of EUR 500 for this bundle accouent.

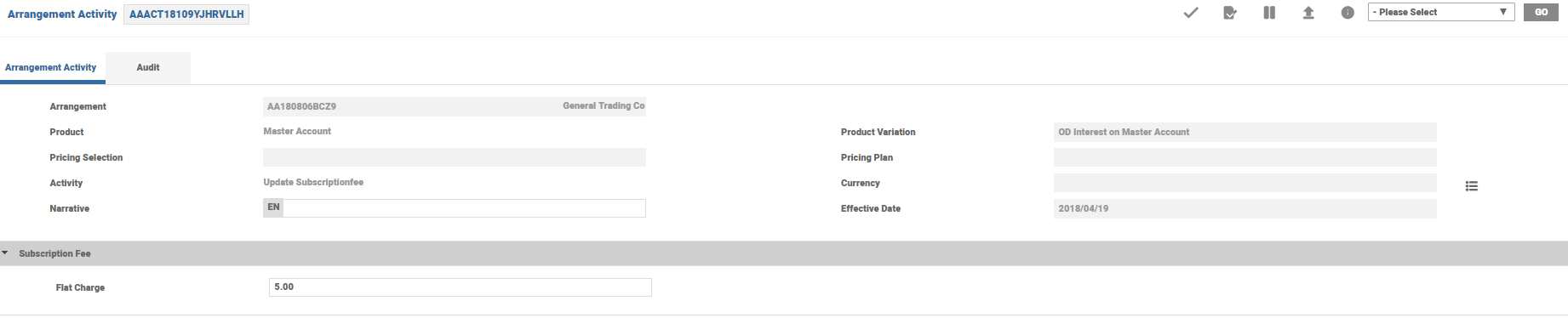

Subscription fee is configured as fixed amount of USD 10000 for this bundle account.

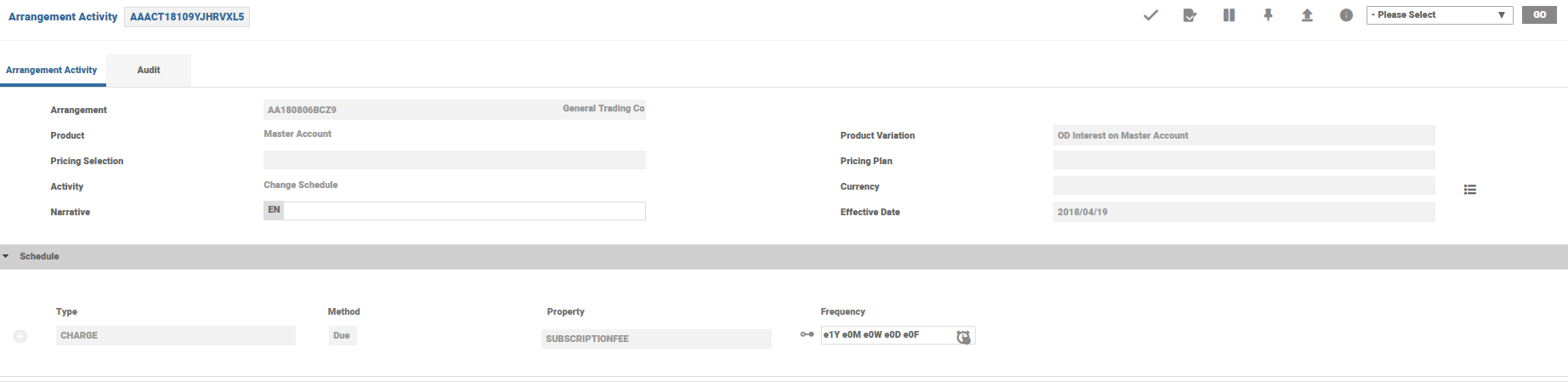

Schedule for collection of subscription fees is 3 days.

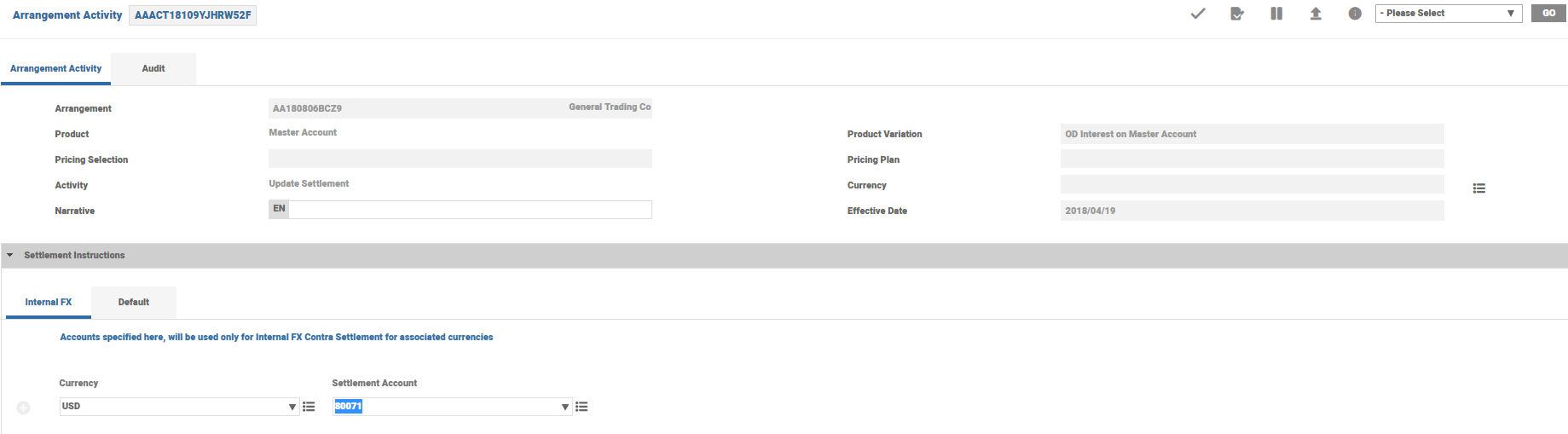

Defined default settlement account is 85073.

Defined settlement account 85073

Charges are levied on master account, debited to default settlement account as shown below:

The system is enhanced with a functionality to perform intra cash pool transactions between transaction accounts, which are in different currencies without affecting the currency top accounts’ balance. The functionality is called back-to-back FX and based on it, manual (FUNDS.TRANSFER) and automated (AC.CASH.POOL) transfers are executed as a balanced batch. These transactions are performed between four accounts, (two for each currency involved in the transaction). The Back-to-Back FX field in FT.TXN.TYPE.CONDITION and AC.SWEEP.TYPE applications allows the system to perform these transactions.

When a FUNDS.TRANSFER record or AC.CASH.POOL transaction is set up in the system (with the transaction type as FT.TXN.TYPE.CONDITION and Back-to-back FX field set as Yes, in AC.SWEEP.TYPE record), the system requests for another pair of accounts in the same currencies, as the ones set in the debit and credit fields. The other pair of accounts are called contra booking settlement accounts.

The counter booking settlement accounts can be attached at the master account bundle arrangement level or manually entered in the FUNDS.TRANSFER or AC.CASH.POOL records. The accounting core posts entries in all four accounts involved in the transaction, balancing the entries in each currency.

A user defines a manual transfer by debiting TR (12345) in EUR and crediting TR (67899) in USD for EUR 1,000.

The back-to-back FX functionality requests two other TR accounts in EUR (22333) and USD (44555) to be entered in the transaction, to post the entries as a balanced batch.

The exchange rate (EUR/USD) is 1,081177 and the accounting entries are:

| Account Number | DR/CR | Amount |

| 12345 | DR | EUR 1,000 |

| 67899 | CR | USD 1,0811.77 |

| 22333 | CR | EUR 1,000 |

| 44555 | DR | USD 1,0811.77 |

The balances of the CT accounts in EUR and USD do not change, as the debit and credit entries in each currency are balanced.

In AA, a new under this product,

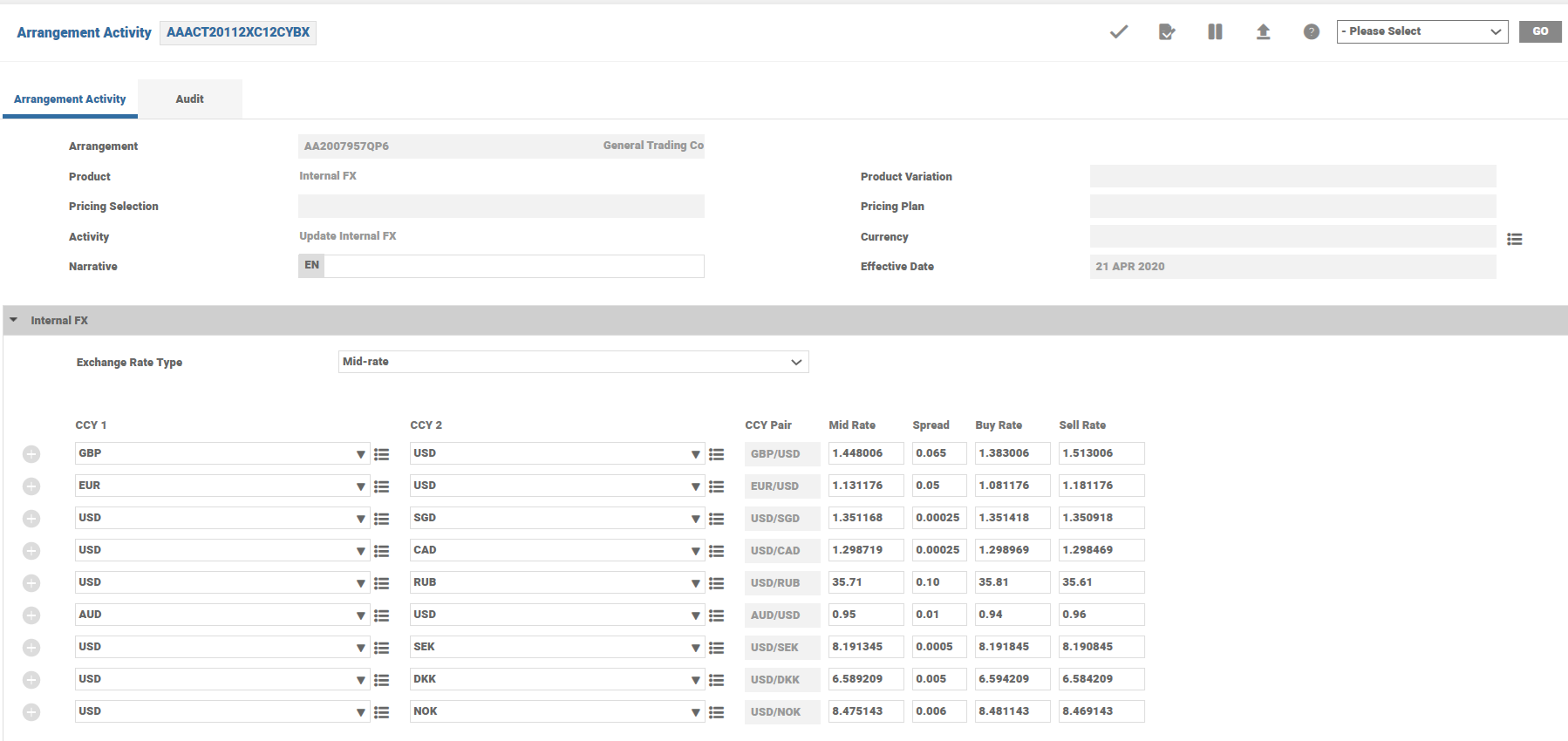

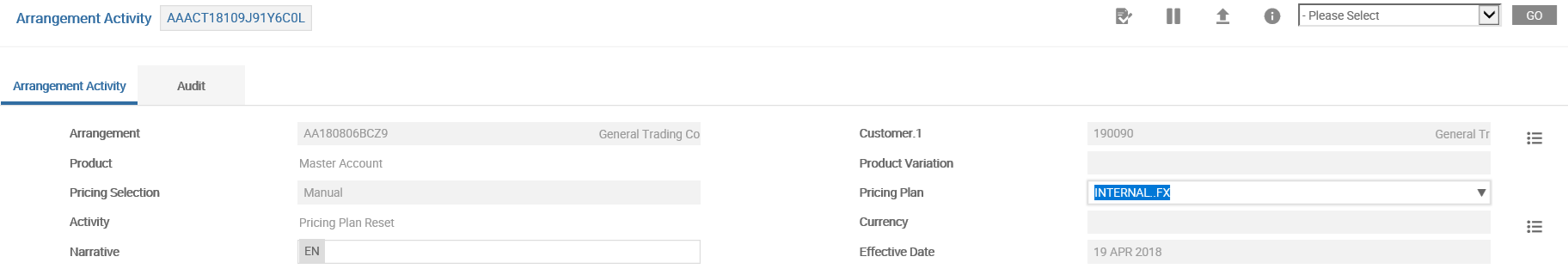

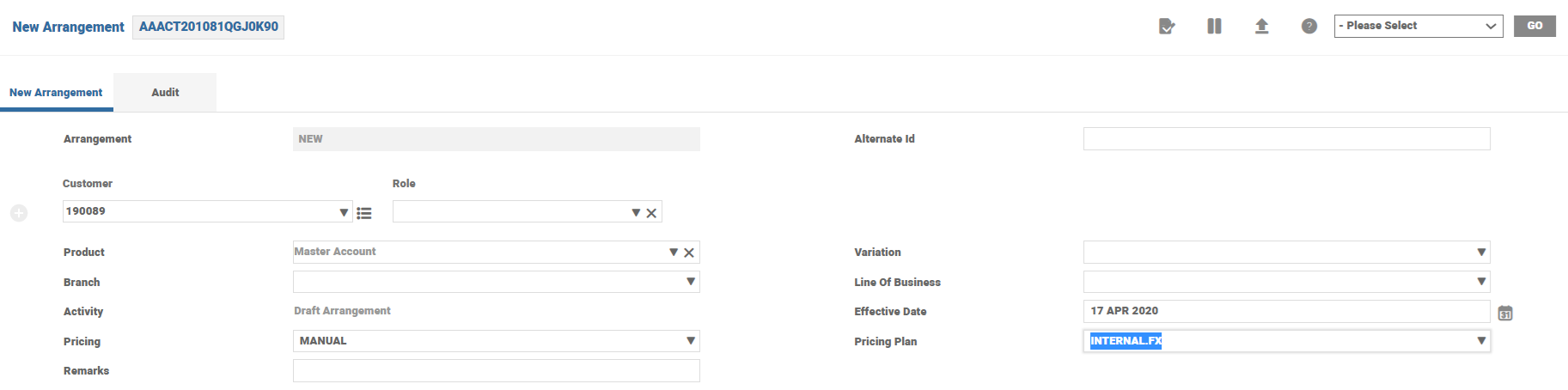

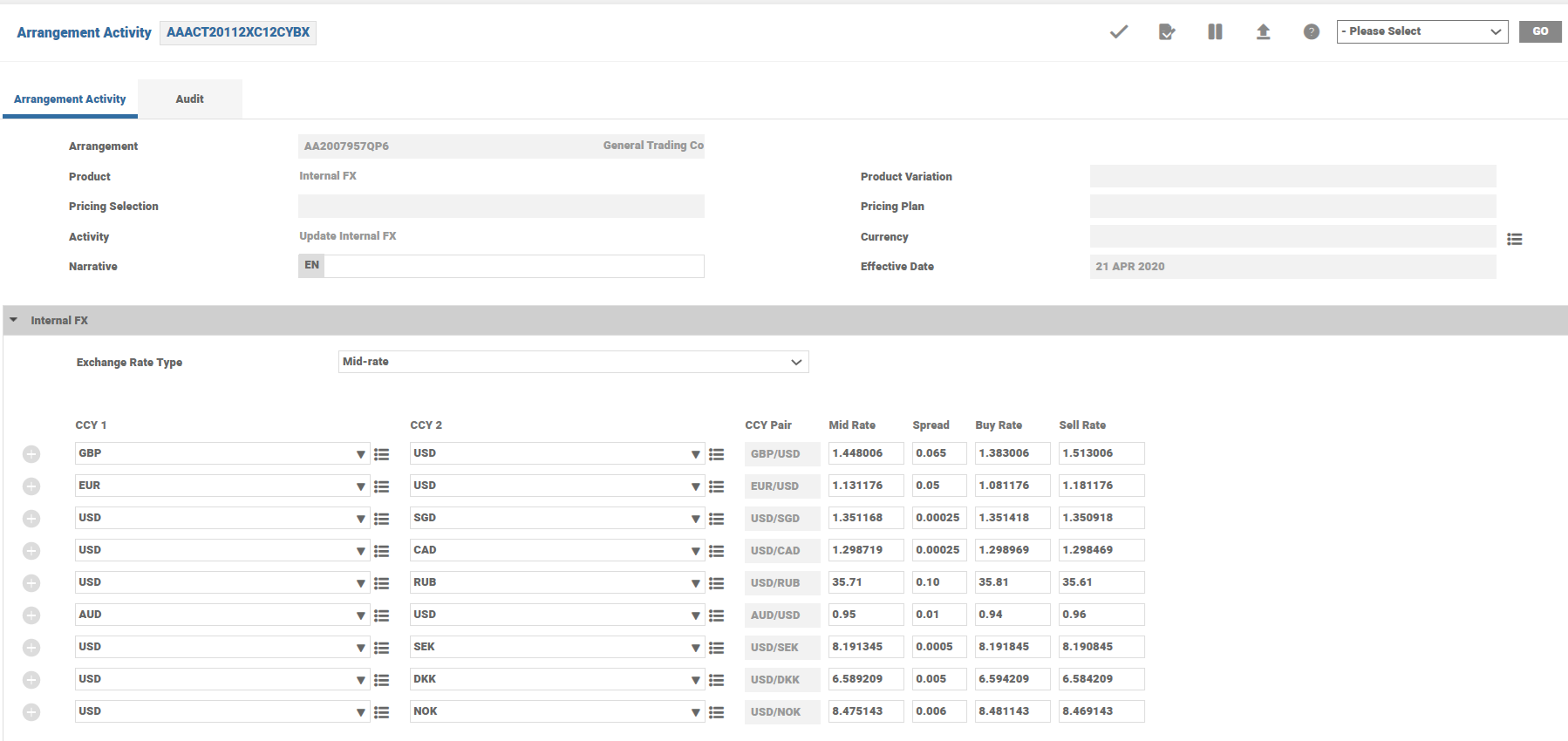

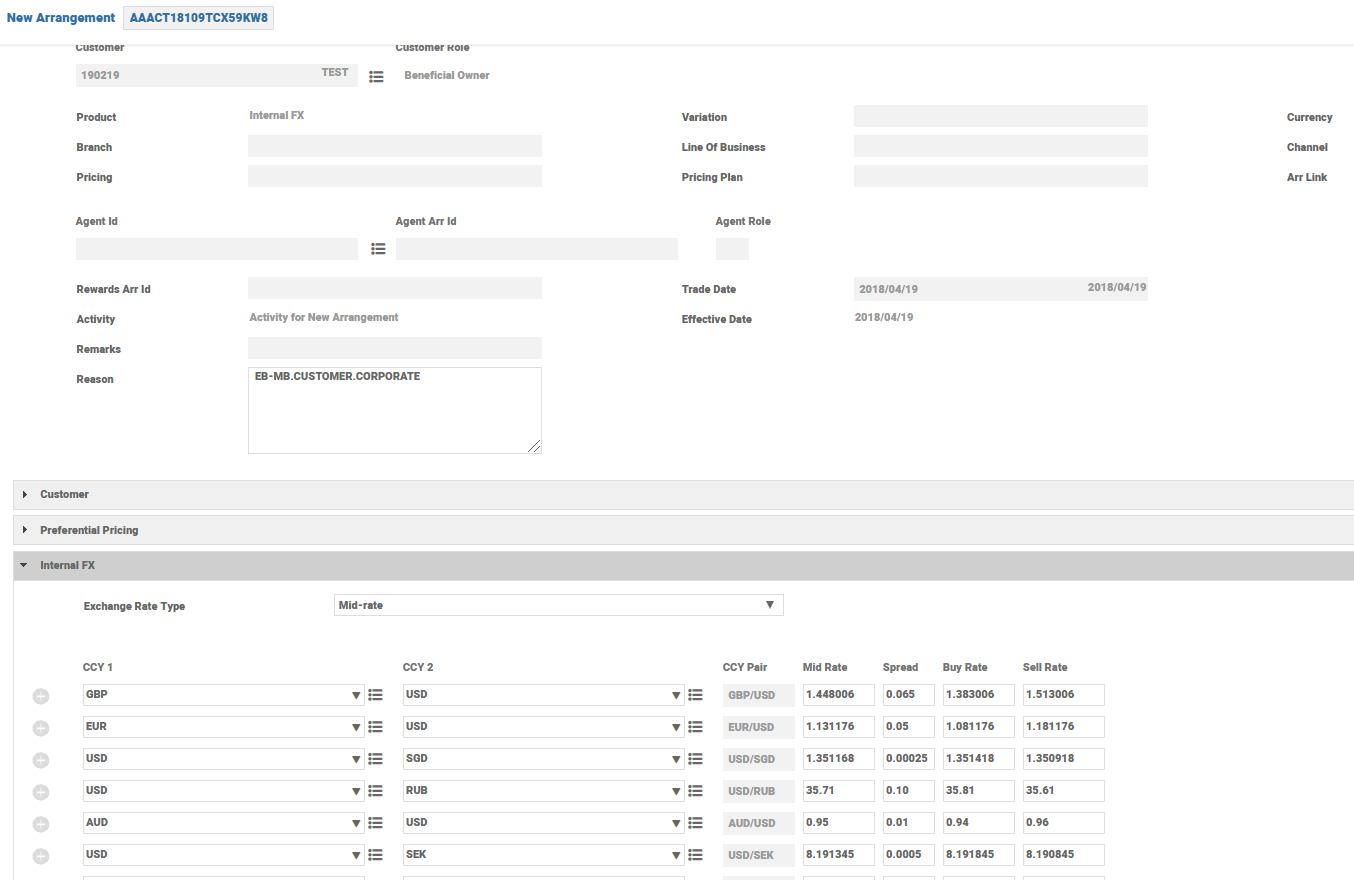

The user defines the exchange rates for each currency pair (that is used when the system performs intra-cash pool transactions), under the Preferential Pricing product line, called INTERNAL FX.

These can be defined as product conditions under the INTERNAL FX product.

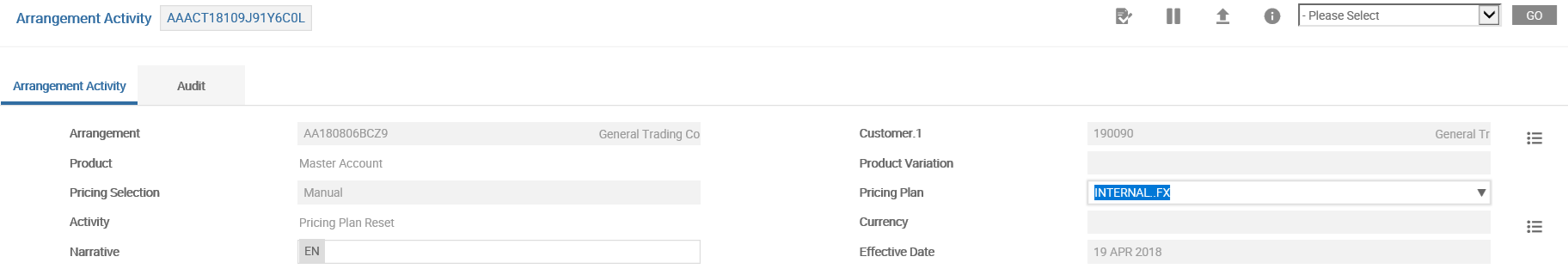

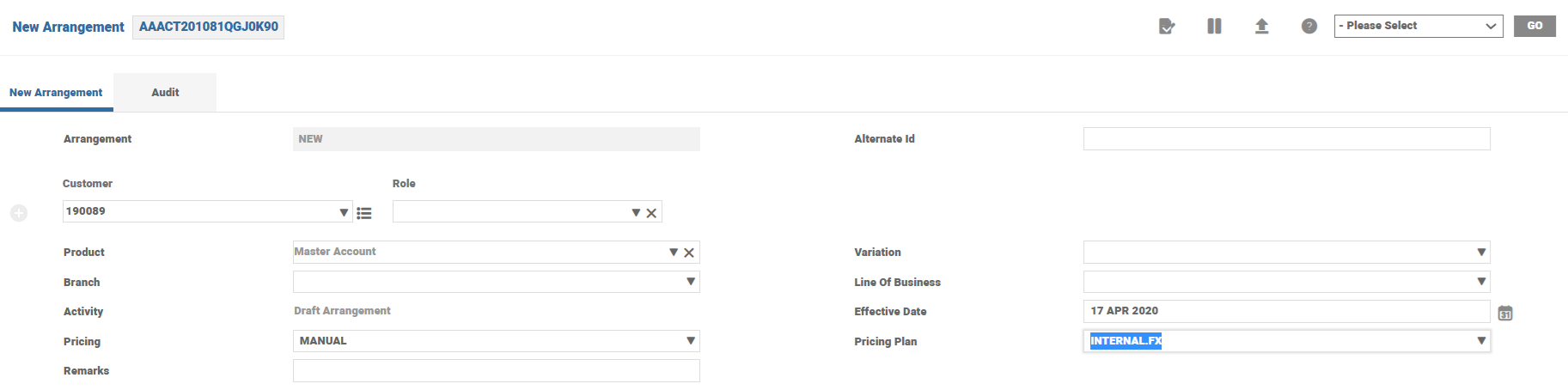

The user opens an FX preferential pricing for the specific customer for which a new master account bundle arrangement is opened, after defining the exchange rates.

For example, internal FX preferential pricing plan is attached to a Customer 190198.

After a preferential pricing plan is opened for the Customer, it is attached when opening the master account bundle arrangement. It is a mandatory step.

When internal transactions are performed using FUNDS.TRANSFER or AC.CASH.POOL applications, the system uses the exchange rates defined for this product.

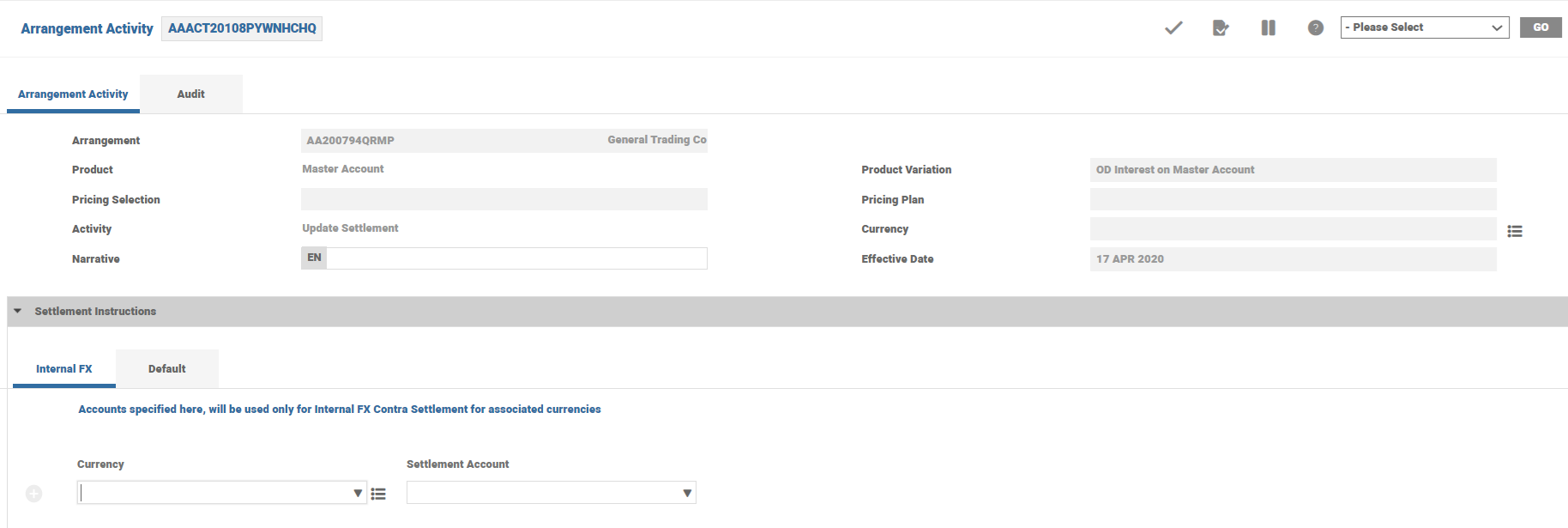

When a new Master Account Bundle Arrangement is opened for a specific customer, the user can define counter-booking settlement accounts for each currency.

The settlement accounts can only be TR in that specific currency.

After defining the settlement accounts, when the user enters an intra-cash pool transaction between accounts in different currencies, (using the FUNDS.TRANSFER or AC.CASH.POOL applications), they are defaulted in the specific fields.

The balances of the CT accounts in EUR and USD do not change, as the debit and credit entries in each currency are balanced.

In AA, a new under this product,

The user defines the exchange rates for each currency pair (that is used when the system performs intra-cash pool transactions), under the Preferential Pricing product line, called INTERNAL FX.

These can be defined as product conditions under the INTERNAL FX product.

The user opens an FX preferential pricing for the specific customer for which a new master account bundle arrangement is opened, after defining the exchange rates.

For example, internal FX preferential pricing plan is attached to a Customer 190198.

After a preferential pricing plan is opened for the Customer, it is attached when opening the master account bundle arrangement. It is a mandatory step.

When internal transactions are performed using FUNDS.TRANSFER or AC.CASH.POOL applications, the system uses the exchange rates defined for this product.

When a new Master Account Bundle Arrangement is opened for a specific customer, the user can define counter-booking settlement accounts for each currency.

The settlement accounts can only be TR in that specific currency.

After defining the settlement accounts, when the user enters an intra-cash pool transaction between accounts in different currencies, (using the FUNDS.TRANSFER or AC.CASH.POOL applications), they are defaulted in the specific fields.

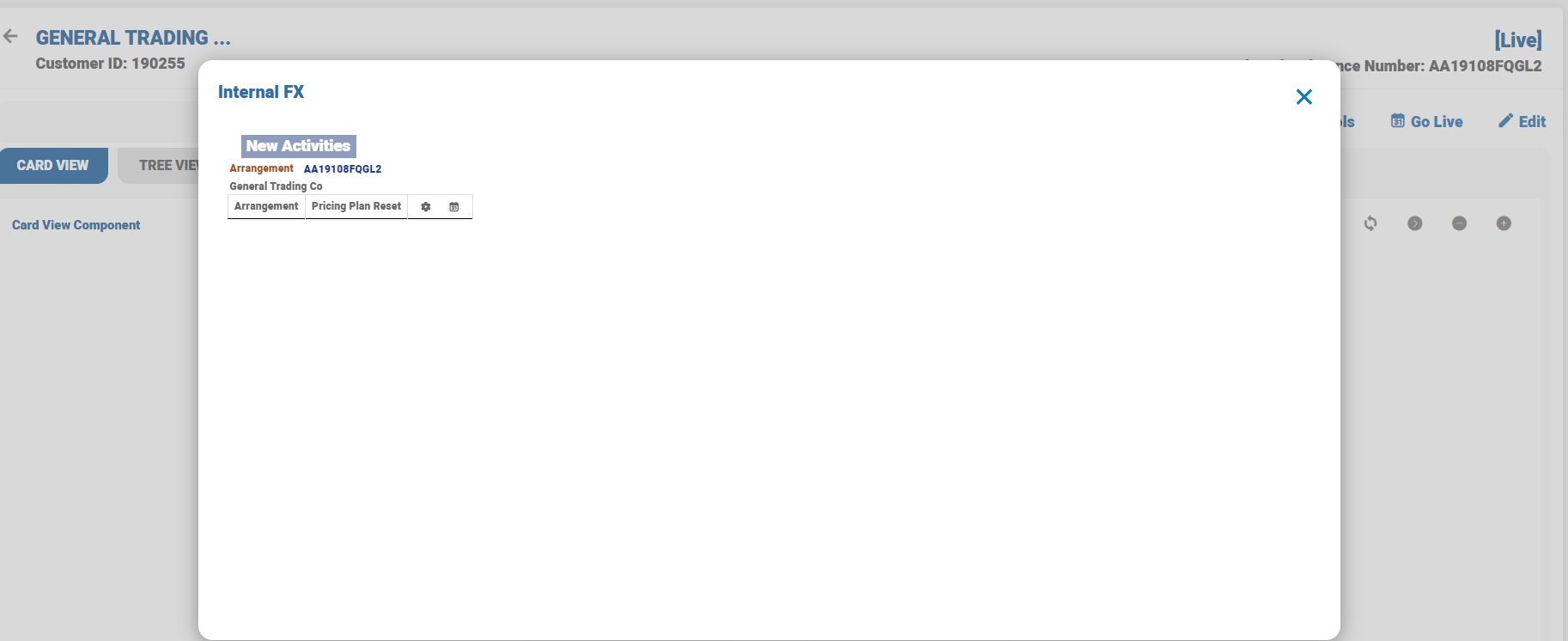

Go to Tool Menu > Internal FX.

Click Do Activity Today icon to setup the internal FX rates.

When the user updates rate through Preferential Pricing FX condition, (with a date effective in the future), the new rates are available to all TRs from that date.

When the user updates rate in Preferential Pricing FX condition, with a date effective in the past (T-3),

- Existing transfers are not recalculated.

- New internal FX transactions takes rates effective as of the booking date.

The system automatically closes the pricing arrangement on static review, if the customer is no longer eligible for this pricing arrangement

- This would happen as the Eligibility rules for the Internal FX Pricing arrangement are the same as that of the Master Account.

- When a customer is not eligible to open a master account, the customer is not eligible to have an internal FX pricing arrangement either.

The transfer between two TR accounts belonging to the same pool but different currency results in the following: (The transfer is manual (through FT) or automated (standing orders or sweeps))

- Pool balance is not changed

- Currency position is not created in the bank’s books

- This means, the debit is balanced against another TR belonging to the debit TR currency and the credit is balanced against another TR belonging to the credit TR currency.

- The user (corporate customer) specified internal FX rate is used as the exchange rate for the currency conversion

| DR | CR |

|---|---|

| EUR TR 1,000.00 | Contra EUR TR 1,000.00 |

| Contra USD TR 1,250.00 | USD TR 1,250.00 |

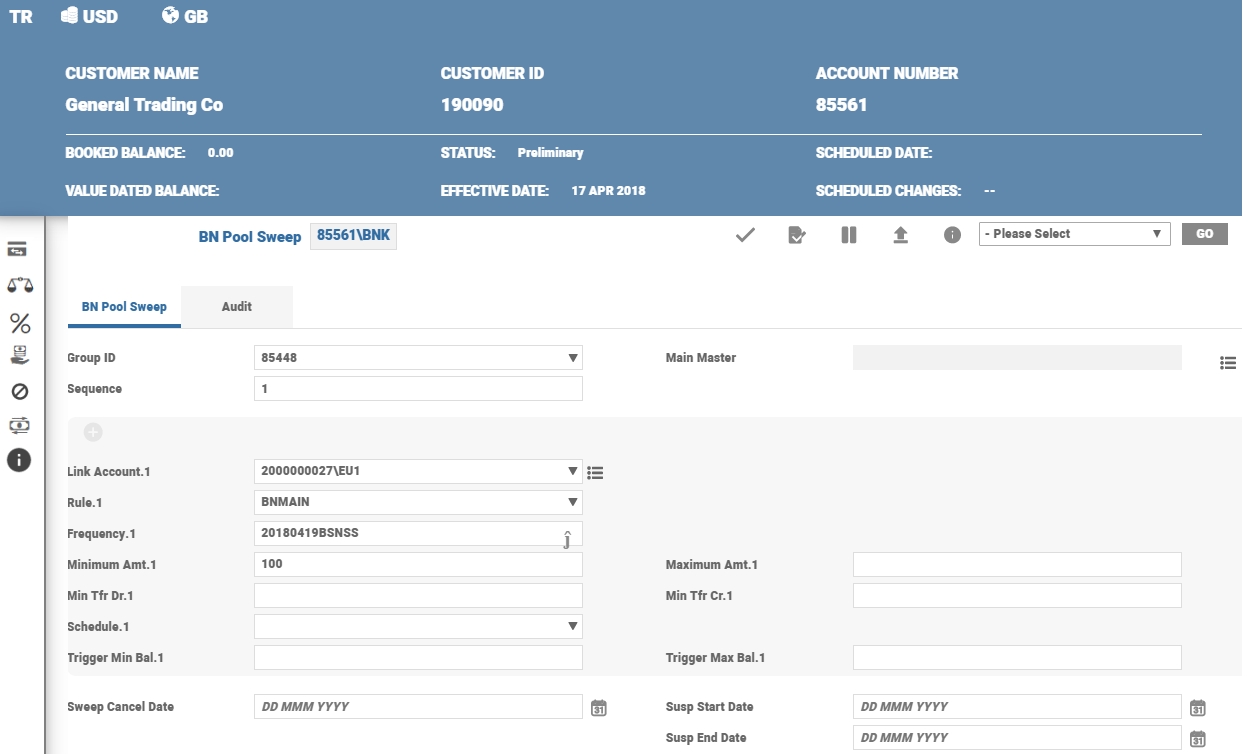

This functionality allows the user to setup balance sweeps between TR’s, which are part of the same BN structure and are in the same currency.

The validations introduced in AC.CASH.POOL, along with the change made in TRANSACTIONS and AC.SWEEP.TYPE application are:

- The account number in @ID of

AC.CASH.POOLand Link Account field are TR members of the same BN pool (or a member of the BN pool at the date defined in the Frequency field and if not, raises an error message alternatively). The system validates this when the internal sweep is defined, based on the Next Run Date given by the value entered in the Frequency field. - The accounts involved in the transfer are open in the same currency.

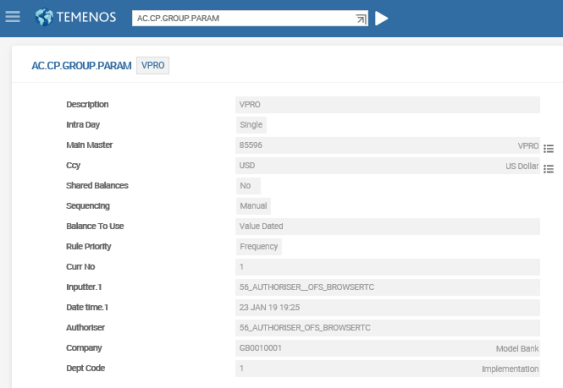

When the records are set in TRANSACTIONS, AC.SWEEP.TYPE and AC.CP.GROUP.PARAM applications, the user can define a sweep record for maintenance, surplus or zero balancing type.

The user can defines the below details:

- The minimum balance to be maintained (in case of maintenance sweep or zero-balancing)

- The maximum balance to be maintained (in case of surplus sweep or zero-balancing)

- Frequency

- Maximum amount to be transferred

- Minimum amount to be credited (for maintenance sweeps)

- Minimum amount to be debited (for surplus sweeps)

- Schedule (intraday or end of day)

- Sweep cancel date

- Sweep suspense start date and end date (the period when the sweep is suspended, if applicable).

Example:

The below examples enables the user to understand the setting up of sweeps:

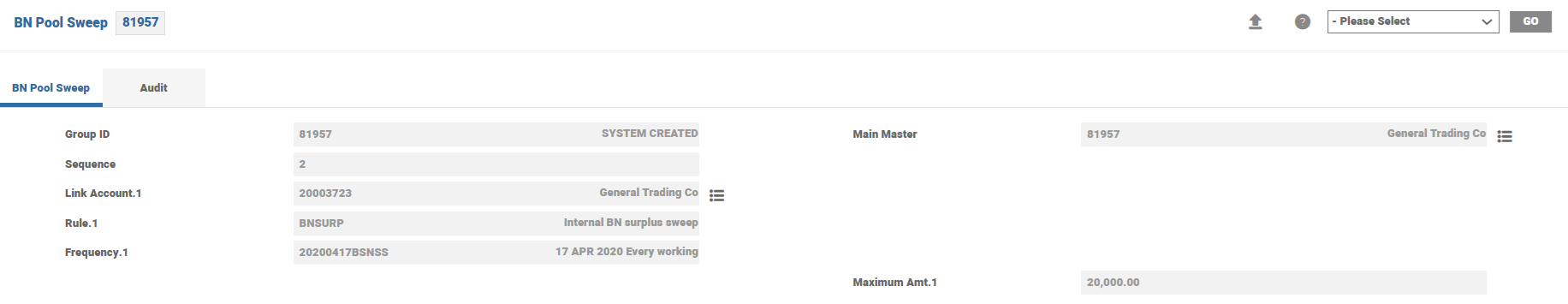

A surplus sweep record is created for two TR accounts, which are part of the same BN structure and are in the same currency. The source account (84506) and the link account has a balance of EUR 1000 and EUR 2000 respectively.

The record is created to maintain the source account’s (84506) balance at a maximum amount of EUR 500, by entering this value in Maximum Amt.1 field.

The user creates the surplus sweep relationship by setting the TR 84506 as link account and subsequently selecting the BNSURP option in the Rule.1 field.

The user sets the date when the sweep is run by selecting a predefined value in the Frequency field. In the presented example it is weekly, that is, every Friday.

As the balance of the TR account 84565 exceeds the maximum amount that is maintained, the system moves the surplus amount (500 EUR) from the source account into the link account (TR 84506).

In accordance with the set frequency, the system checks the balance of the source account until the cancel date is met (if applicable). If the balance of the source account exceeds the set amount, the difference is moved into the link account.

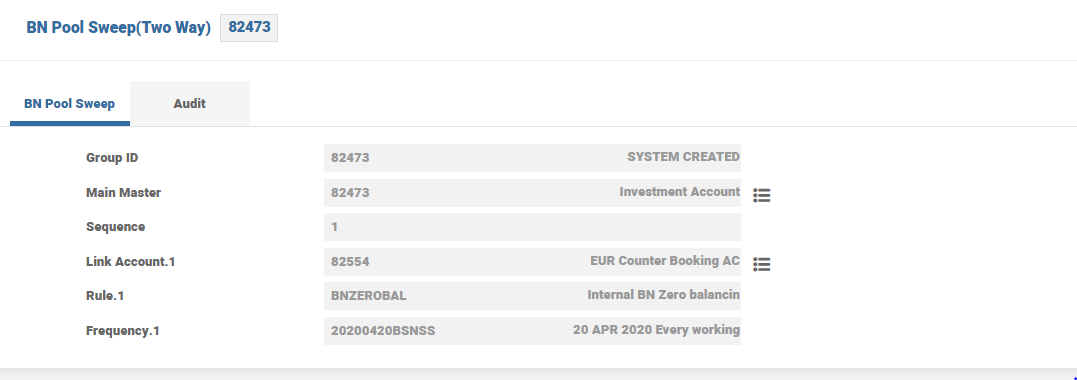

A zero balancing sweep record is created for two TR accounts, which are part of the same BN structure and are in the same currency.

The record is created to maintain the source account’s balance (84565) as zero. This is done by setting the Minimum Amt.1 and Maximum Amt.1 fields’ value as zero.

The user creates the zero balance sweep relationship by setting the TR 84506 as link account and subsequently selecting the BNZEROBAL option in the Rule.1 field.

The user sets the sweep, which is run by selecting a value in the Frequency field, in the presented example it is daily, that is, every business day.

In accordance with the set frequency, the system checks the balance of the source account until the cancel date is met (if applicable). If the balance of the source account is different from zero, it is adjusted as follows:

- If the balance exceeds zero, then the difference is moved into the link account.

- If the balance is below zero, then the difference is swept from the link account.

Setting up Balance Sweeping

The below scenarios explains the setting up of sweeps:

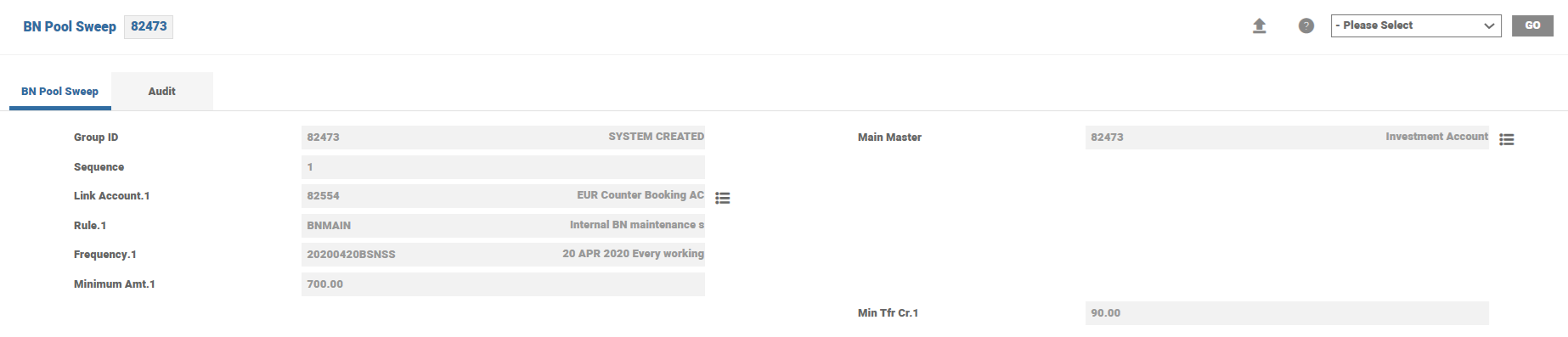

A maintenance sweep record is created for two transaction accounts, which are part of the same BN pool and in the same currency. The source and link account has balances as 500 EUR and 2000 EUR respectively.

The record is created to maintain the balance of the source account (84565) as 700 EUR. This is done by setting the amount value in the Minimum Amt.1 field.

The user creates the maintenance sweep relationship by setting the TR 84506 as link account and subsequently selecting the BNMAINT option in the Rule.1 field.

The user sets the date when the sweep is run, by selecting the value in the Frequency field. In the presented example, it is set as daily, that is, every business day.

Enter Min. Tfr Cr 1 for 50 EUR, the user applies restrictions for creation of sweeps for a smaller amount. The sweep takes place if the sweep amount is greater than 50 EUR.

Also, the user sets a ceiling of 5000 EUR on the amount that is swept or transferred by entering this value in the Up to Amount.1 field.

This sweep does not run between (01 November 2018 to 29 November 2018), as the user has specified these dates in the Susp Start Date and Susp End Date fields.

The system checks the balance of the source account every business day until the user decides to cancel the sweep, (as cancel date is not set for this sweep).

As the balance of the TR account 84565 is below the minimum amount that is maintained, the system sweeps 200 EUR from the link account crediting the amount into the source account.

After the sweep transaction is done, the balance of the two TR accounts are updated as follows:

- Available balance for the TR account 84565 is 700 EUR

- Available balance for the TR account 84506 is 1800 EUR

- Sweep transaction transfers 200 EUR from the link account to the source account

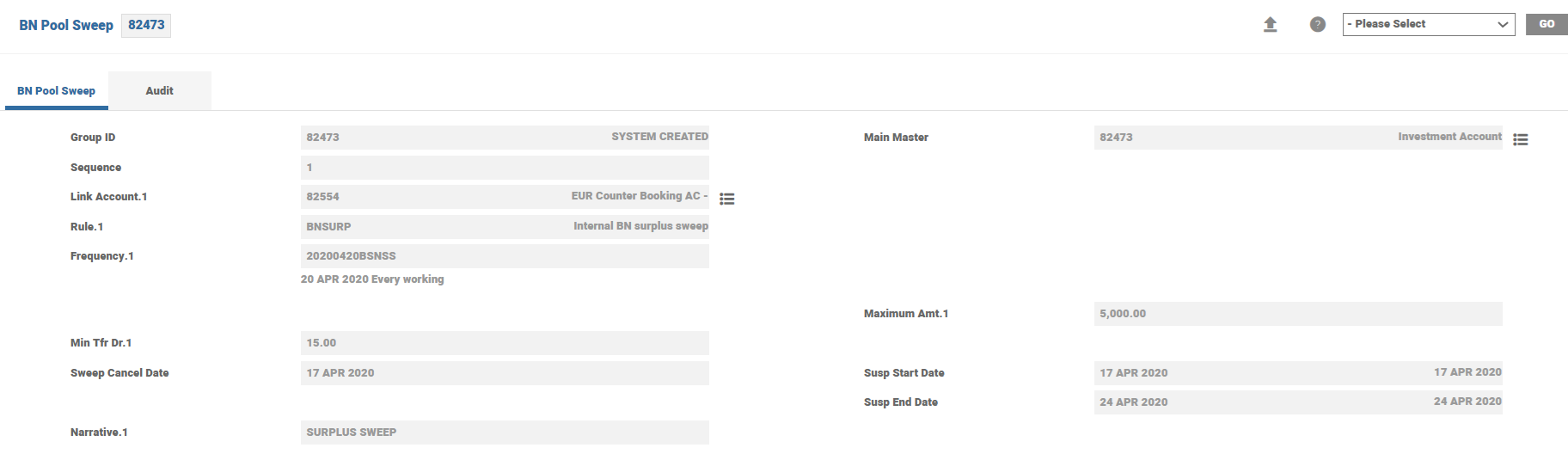

A surplus sweep record is created for two transaction accounts, which are a part of the same BN Pool and in same currency. The source and link account has balances as 1900 EUR and 2000 EUR respectively.

The record is created for the balance of the source account (84565) that is maintained at 1000 EUR by setting the amount value in the Maximum Amt.1 field.

The user creates the surplus sweep relationship by setting the TR 84506 as link account and selecting the BNSURP option in the Rule.1 field.

The user sets when the sweep should be run by selecting a standard value in the Frequency field. In this example, the user has set it as daily, that is, every business day.

Completing the field named ‘Min. Tfr Dr 1’ for 15 EUR, the user applies restrictions for the creation of sweeps for a smaller amount. The sweep takes place if the sweep amount is greater than 15 EUR.

This sweep is not run between (04 January 2018 and 04 February 2018), as the user has specified these dates in the Susp Start Date and Susp End Date fields.

The sweep record is automatically cancelled after 04 May 2018, as this date is specified in the Sweep Cancel Date field.

As the balance of TR account 84565 exceeds the maximum amount set to be maintained, the system moves the surplus amount from the source account crediting the link account.

After the sweep transaction is done the balance of the TR accounts is updated as follows:

- Available balance for the TR account 84565 is 1000 EUR

- Available balance for the TR account 84506 is 2900 EUR

- Sweep transaction transfers 900 EUR from the source account into the link account

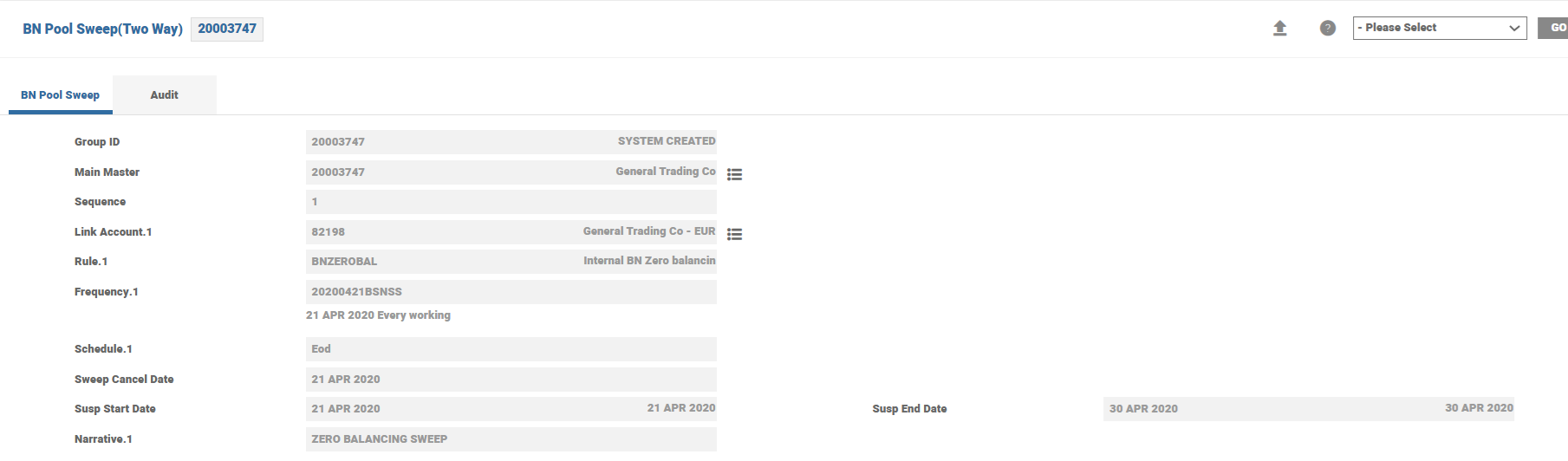

A zero balance sweep record is created for the source account (84565) and the balance is maintained as zero. This is done by setting the Minimum Amt.1 and Maximum Amt.1 fields’ value as zero.

The user creates the zero balance sweep relationship by setting the TR 84506 as link account and selecting the BNZEROBAL option in the Rule.1 field.

The user sets when the sweep should be run by selecting a standard value in the Frequency field. In this example, the user has set it to weekly, which is every monday.

This sweep is not run (between 09 July 2018 and 07 September 2018), as the user has specified these dates in the Susp Start Date and Susp End Date fields respectively.

The sweep record is cancelled automatically after 22th of November 2018 as this date is specified in the Sweep Cancel Date field.

The system checks the balance of the source account according to the frequency set until the cancel date is met. If the balance of the source account is different from zero, it is adjusted as follows:

- If the balance exceeds zero, the difference is moved into the link account.

- If the balance is below zero the difference is swept from the link account.

The AC.SWEEP.TYPE application is improved, when defining the sweep types to be used in a sweep record, to offer the possibility to consider the balance of the entire Cash Pool or the currency position when the system triggers the sweeping transaction.

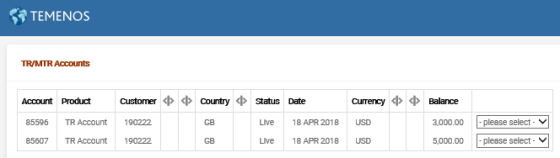

A BN pool structure is created in the system, having the following accounts and balances:

- Master account - AA181081MPX8

- Currency top account USD - 85577 with a total balance of 8000 USD

- Currency top account EUR- 85588 with a balance of 0 EUR

- Transaction account USD - 85596 with a balance of 3000 USD

- Transaction account USD - 85607 with a balance of 5000 USD

- Transaction account EUR - 85618 with a balance of 0 EUR

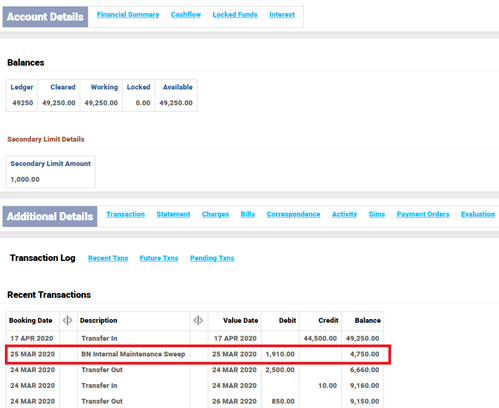

A cash pool group (VPRO) is created in the system in the AC.CP.GROUP.PARAM application.

A maintenance sweep instruction is created in the system, using the sweep type (BNMAIN-CT), where the Pool Sweep field is set to Currency.

The sweeping record is set between (transaction 85596 and a stand-alone account 75914) to maintain a minimum balance of 10000 USD.

When the Pool Sweep field is set as Currency , the system considers the entire USD currency position in the pool and evaluates how much the system needs to sweep.

In this case, the entire USD currency position in the pool is 8000 USD and the system is set to maintain a minimum of 10000 USD, (that is, the system sweeps 2000 USD in the transaction account mentioned as a sweeping account).

As a result, the USD currency position in the pool becomes 10000 USD.

A maintenance sweep record type is created in the system by setting the Pool Sweep field as Cash Pool.

A BN pool structure is created in the system with the following accounts and balances:

- Master account - AA181081MPX8 (USD) with a total balance of 10260 USD (the total balances of the CT accounts converted to USD

- Currency top account USD - 85577 with a total balance of 8000 USD

- Currency top account EUR- 85588 with a balance of 2000 EUR

- Transaction account USD - 85596 with a balance of 3000 USD

- Transaction account USD - 85607 with a balance of 5000 USD

- Transaction account EUR - 85618 with a balance of 2000 EUR

A cash pool group (VPRO) is created in the system in the AC.CP.GROUP.PARAM application.

A maintenance sweeping instruction is created in the system, using the sweep type (BNMAIN-CT), where the Pool Sweep field is set to Cash Pool.

The sweeping record is set between a transaction (85596) and stand-alone account (75914) to maintain a minimum balance of 10000 USD.

Considering that the option Cash Pool is setup, the system considers the entire cash pool balance in the nominated currency (USD) and evaluates how much the system needs to sweep. In this case, the entire balance of the cash pool is 10260 USD and the system is set to maintain a minimum of 10000 USD, (that is, the system is sweeps 260 USD in the transaction account mentioned as a sweeping account.

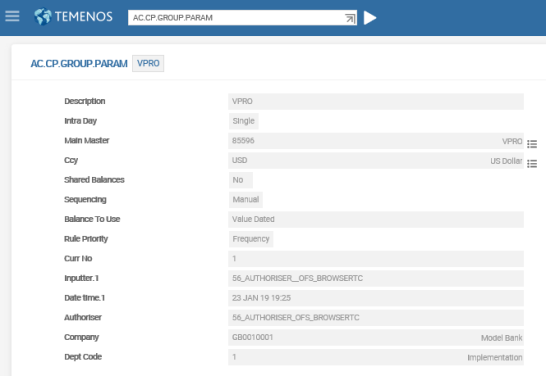

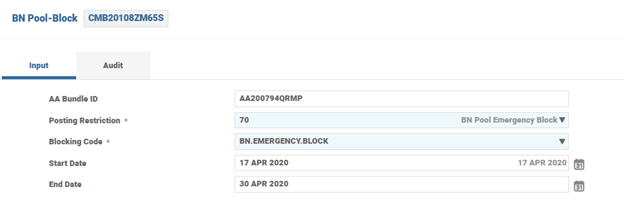

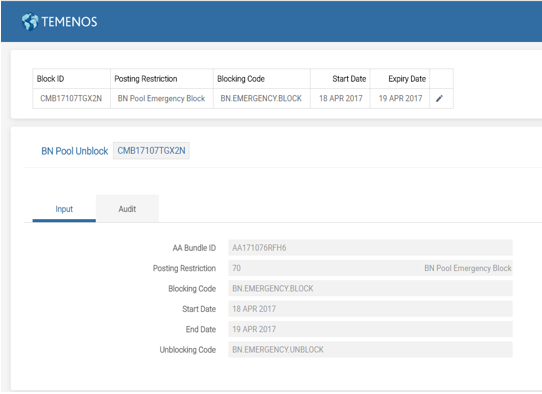

In the CUSTOMER.MASS.BLOCK application, the user can provide the AA Bundle Arrangement ID in the AA Bundle ID field to block all the accounts, which are part of that bundle for transaction processing.

In case of BN, by entering the AA Bundle Arrangement ID and committing the record, all currency top accounts, which are part of that bundle is blocked for transaction processing (posted against transaction accounts, which are part of the same BN structure).

Example: A BN structure is created in the system with master account arrangement bundle ID as AA171075RFH6.

This bundle arrangement has two currency top accounts: AA17107RHMWK (EUR) and AA17107BB6H6 (USD).

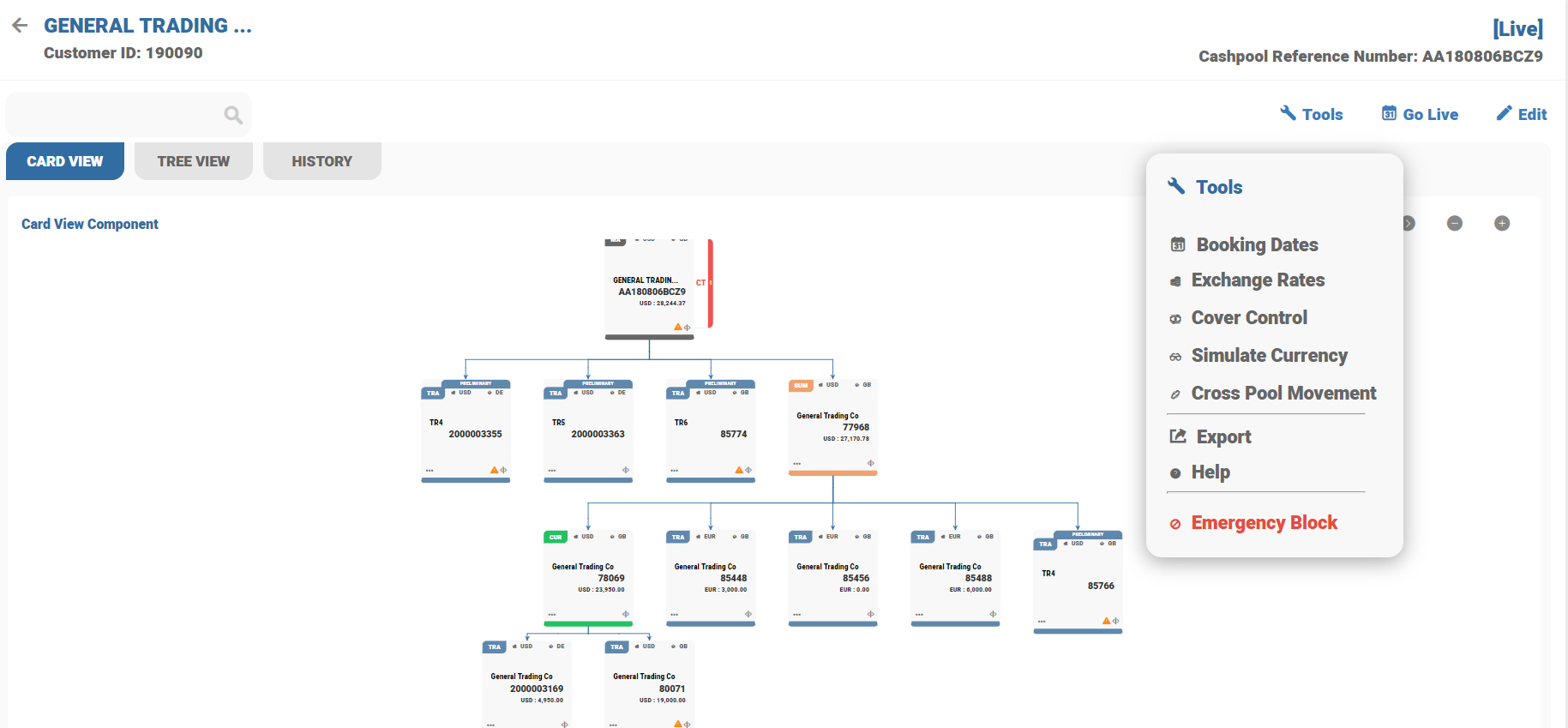

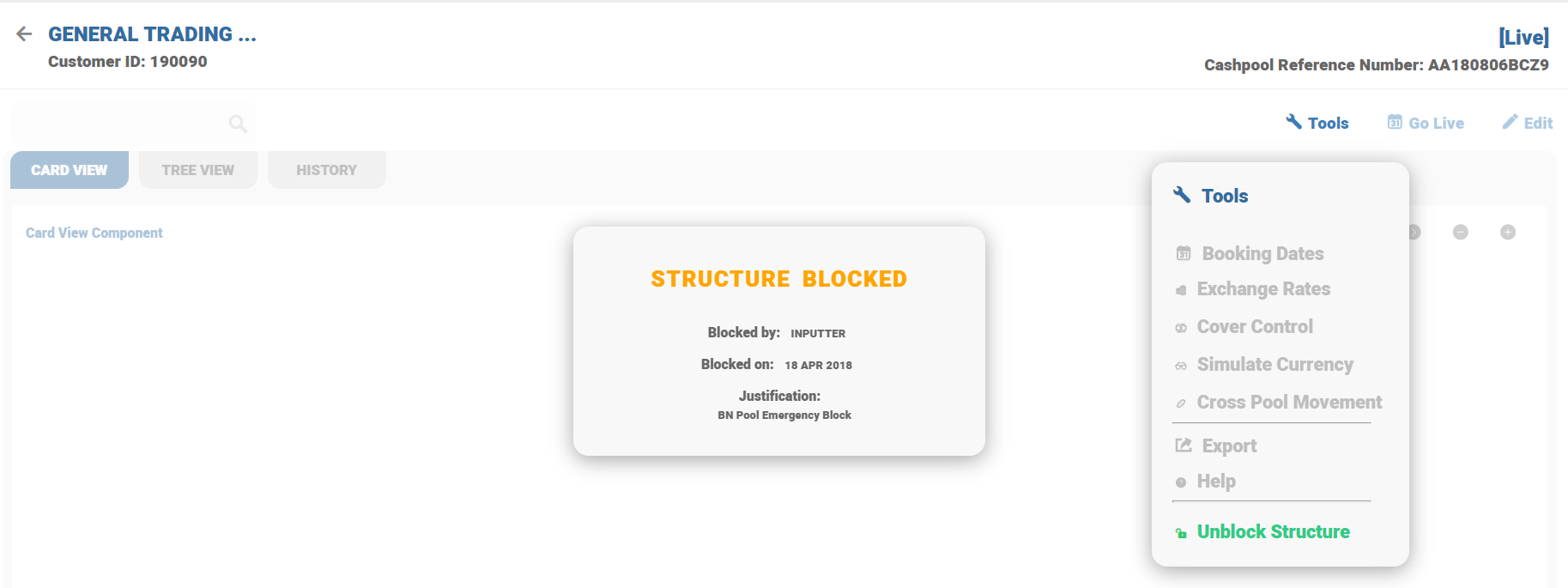

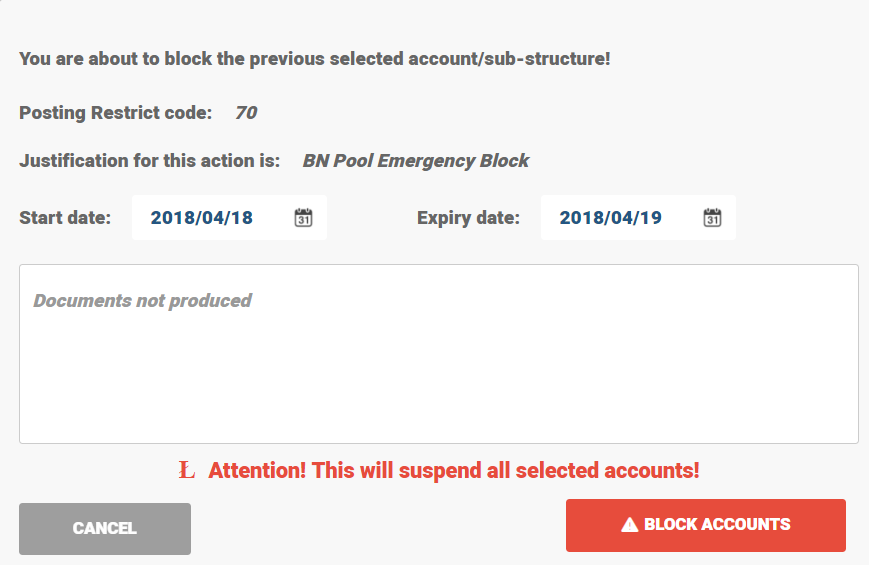

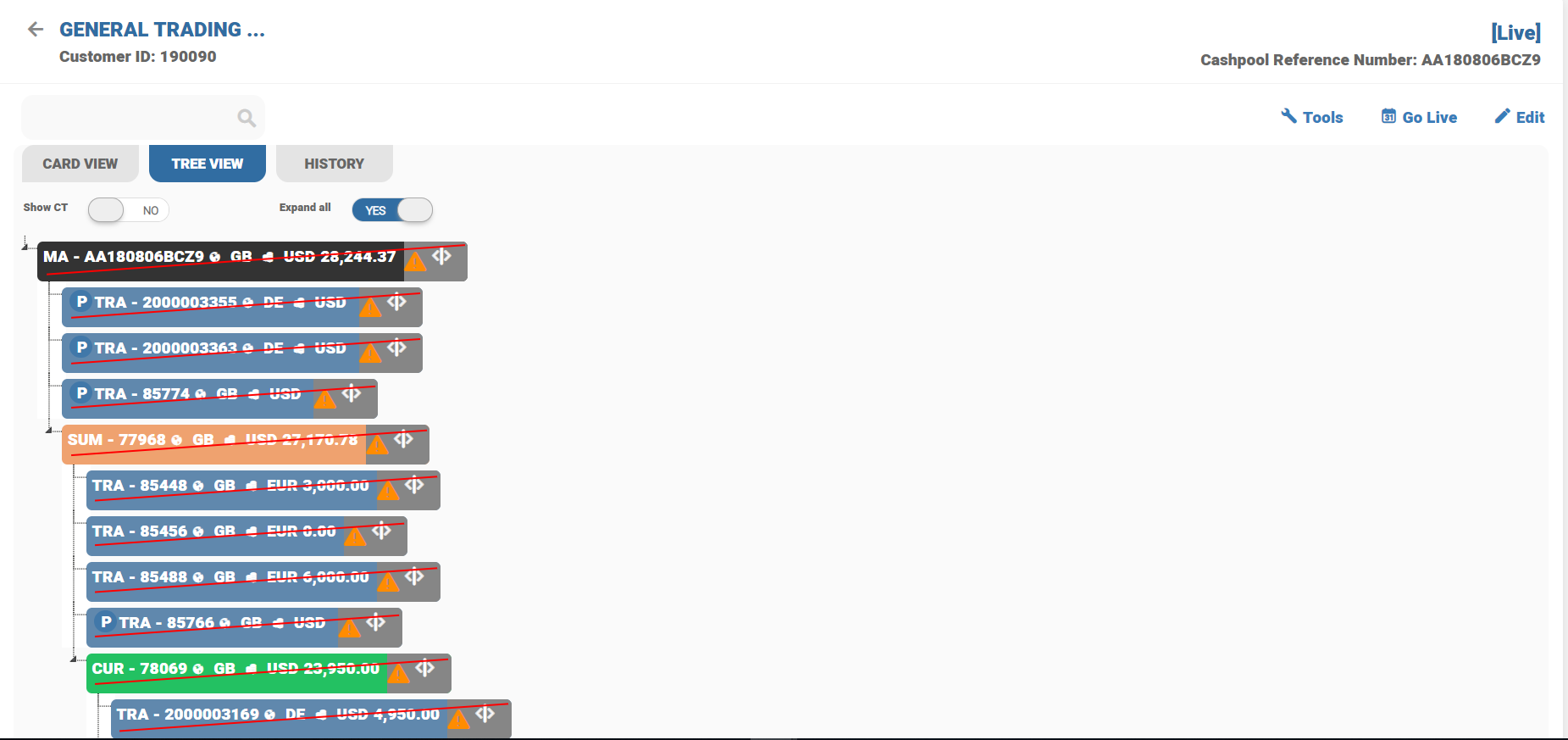

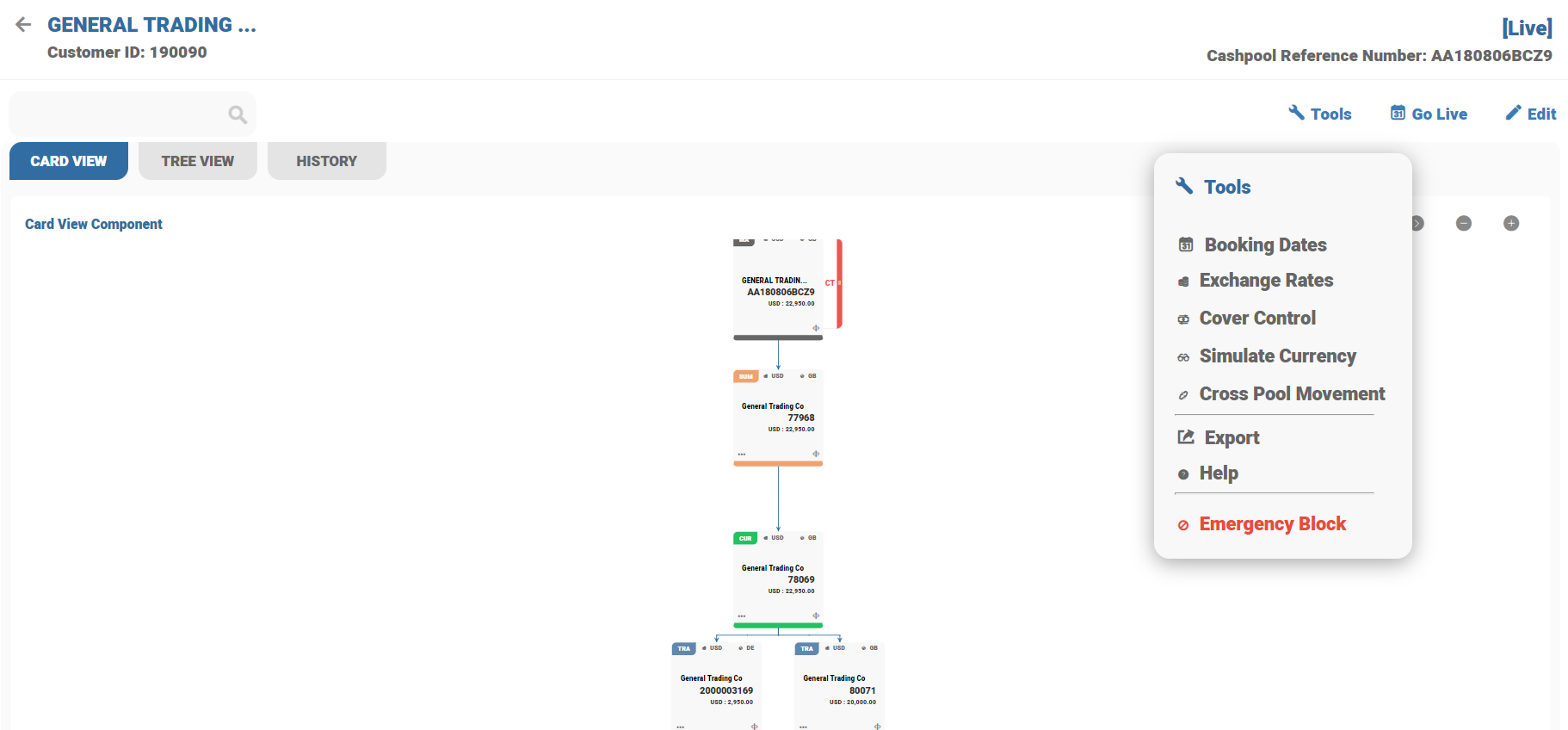

Block Entire Cashpool structure (GUI)

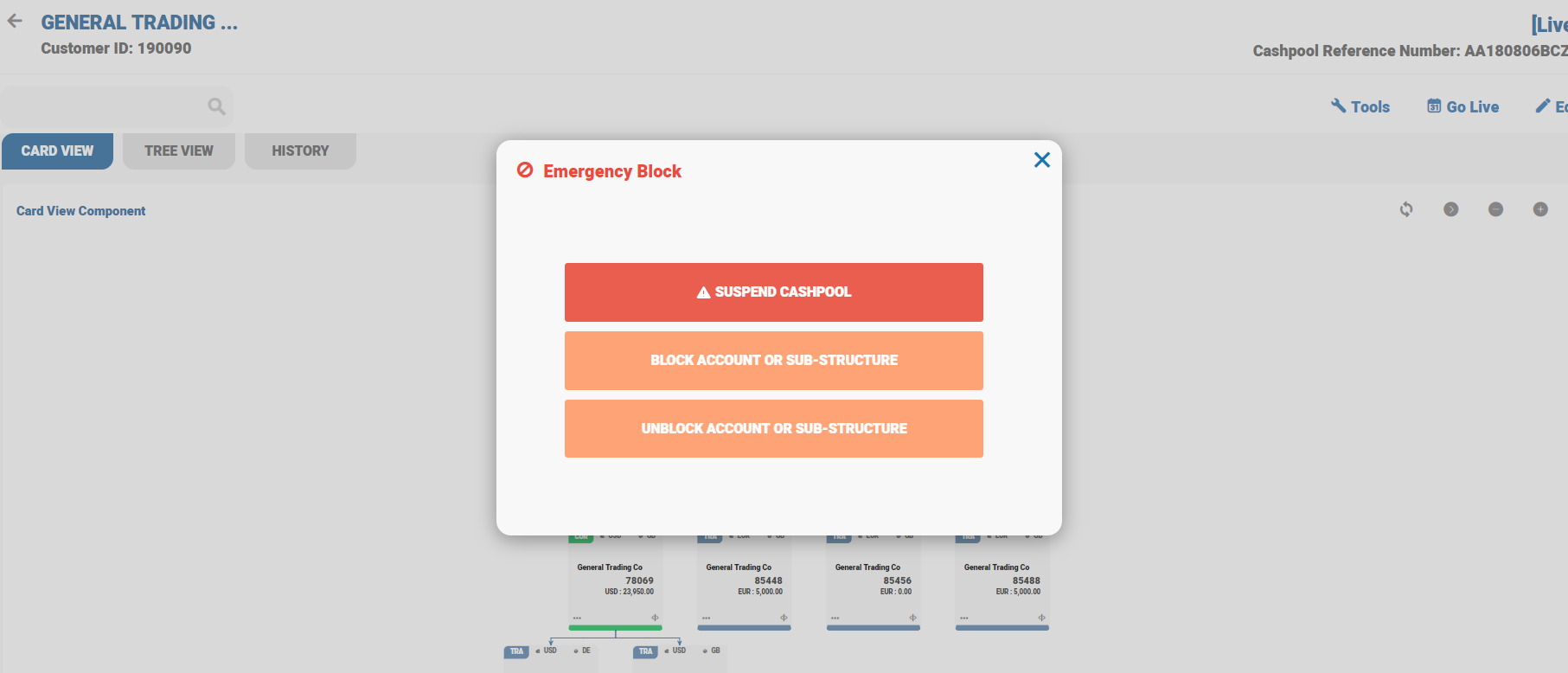

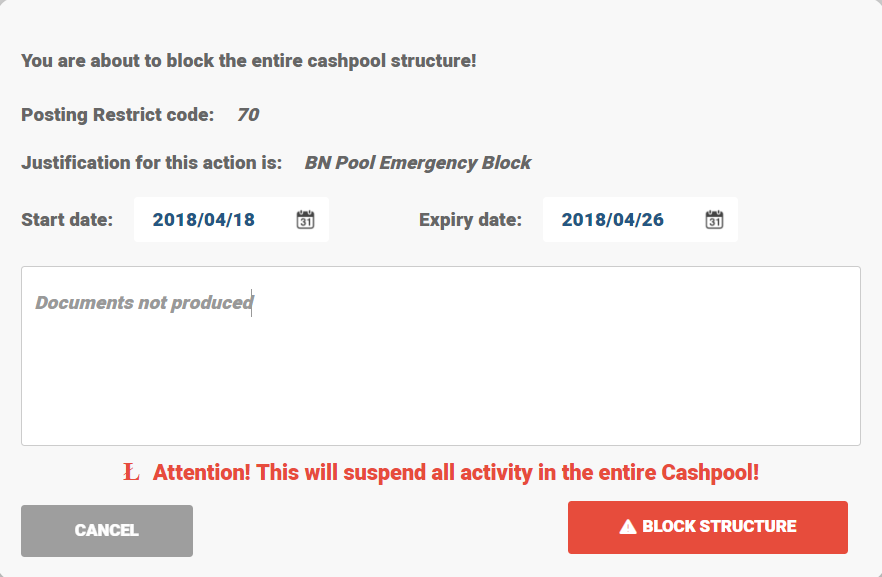

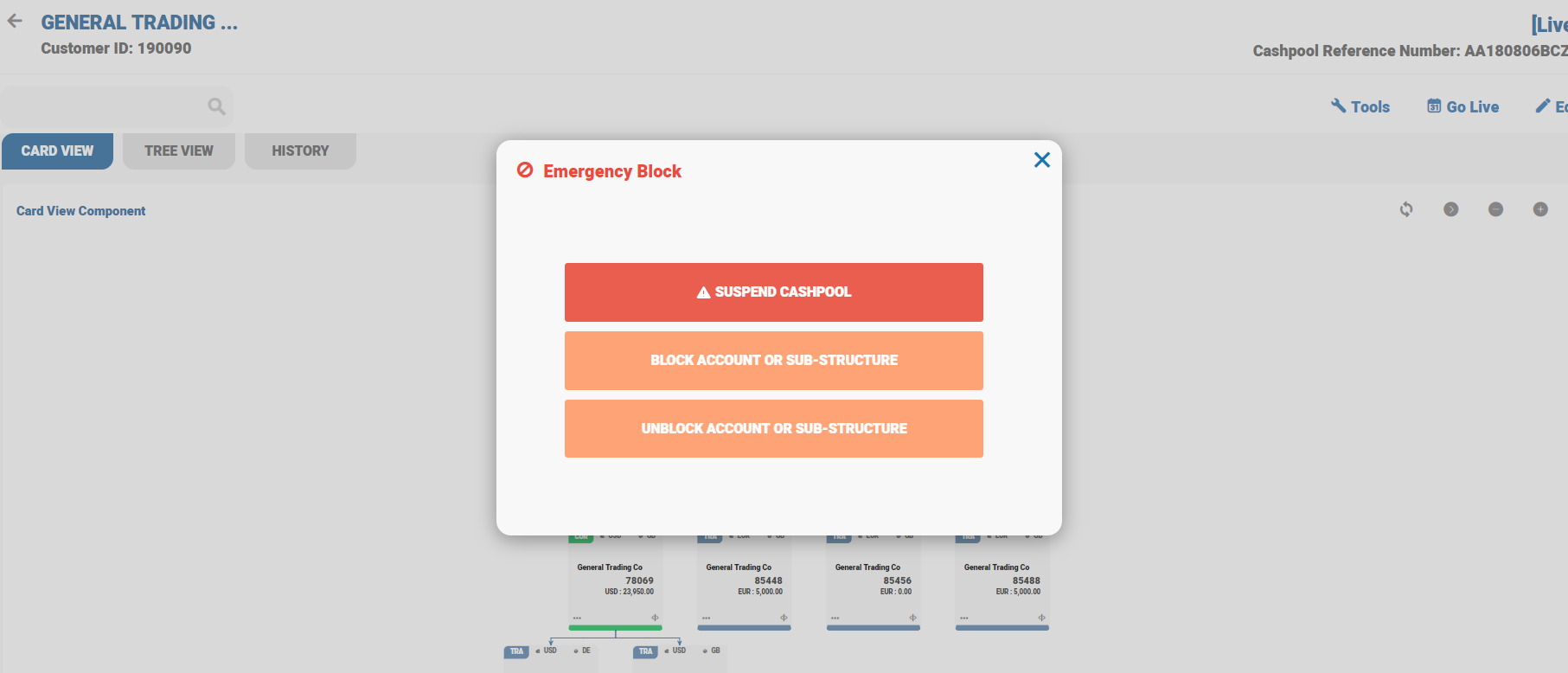

To block the entire BN structure, select Emergency Block from Tools menu. Select SUSPEND CASHPOOL to block all accounts, which are part of the respective bundle for transaction processing.

- Start date is a mandatory field.

- Expiry date is an optional field.

Suspend can be done with future start date and expiry date. Once the Temenos Transact reaches the particular Start of Day (SOD), all the accounts which are part of that Bundle are blocked for Transactions. Fund transfer, standing order and sweeping scheduled (between the accounts in the bundle structure) are also suspended.

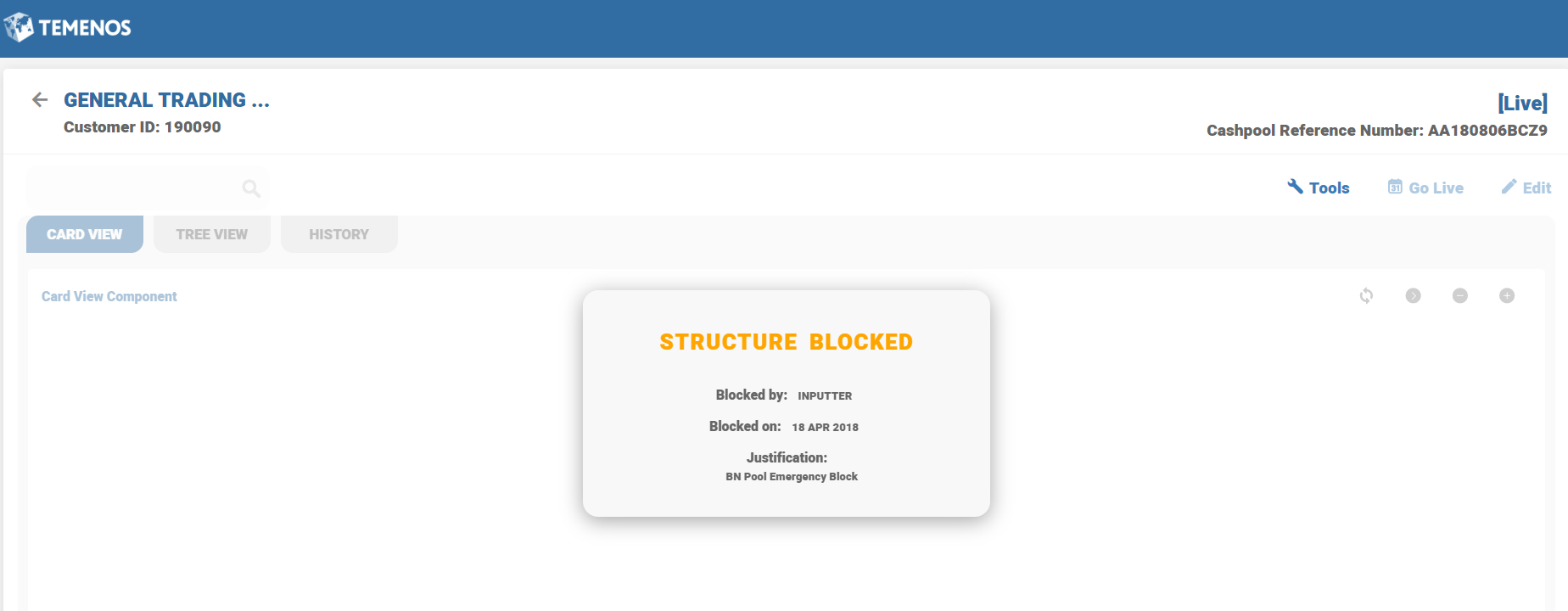

Once the BN pool structure is blocked, further maintenance on accounts is also suspended and the structure blocked message is displayed.

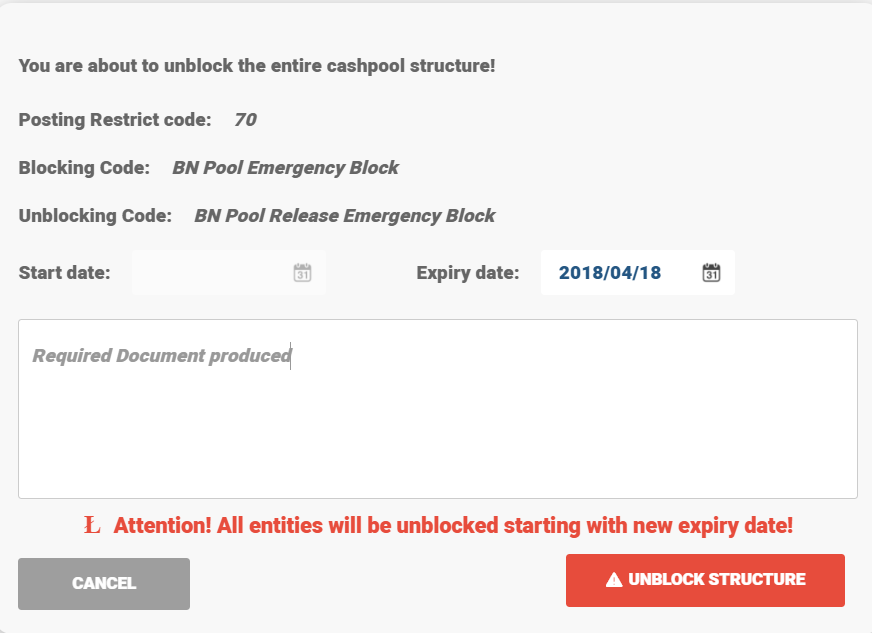

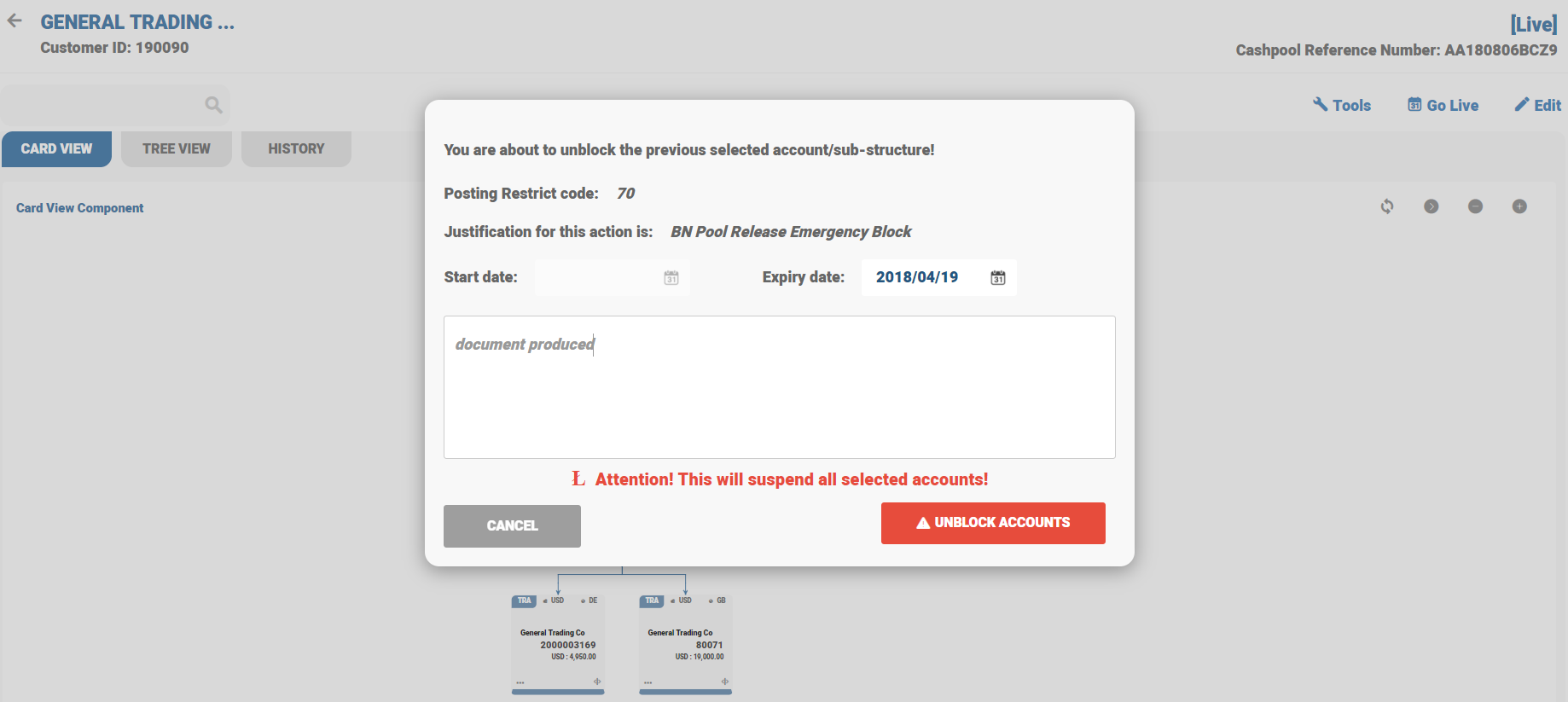

To unblock the BN structure, select Unblock Structure from the Tools menu. Enter the date in the Expiry date field and provide the reason and click UNBLOCK STRUCTURE button.

- Current date is provided, the structure is unblocked immediately and the user can perform transactions on BN accounts.

- Future date is provide, Temenos Transact removes the blocked status during the start of day of the particular end date.

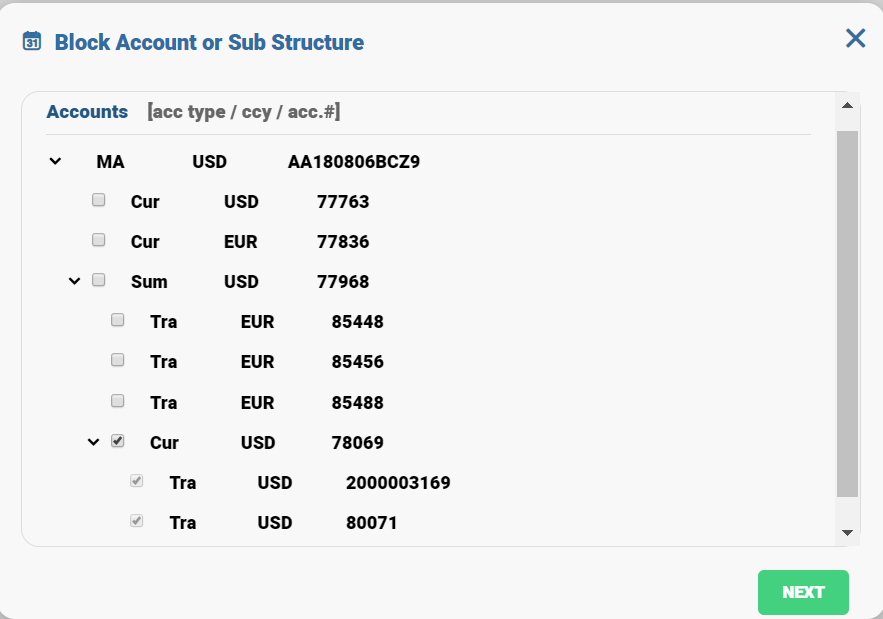

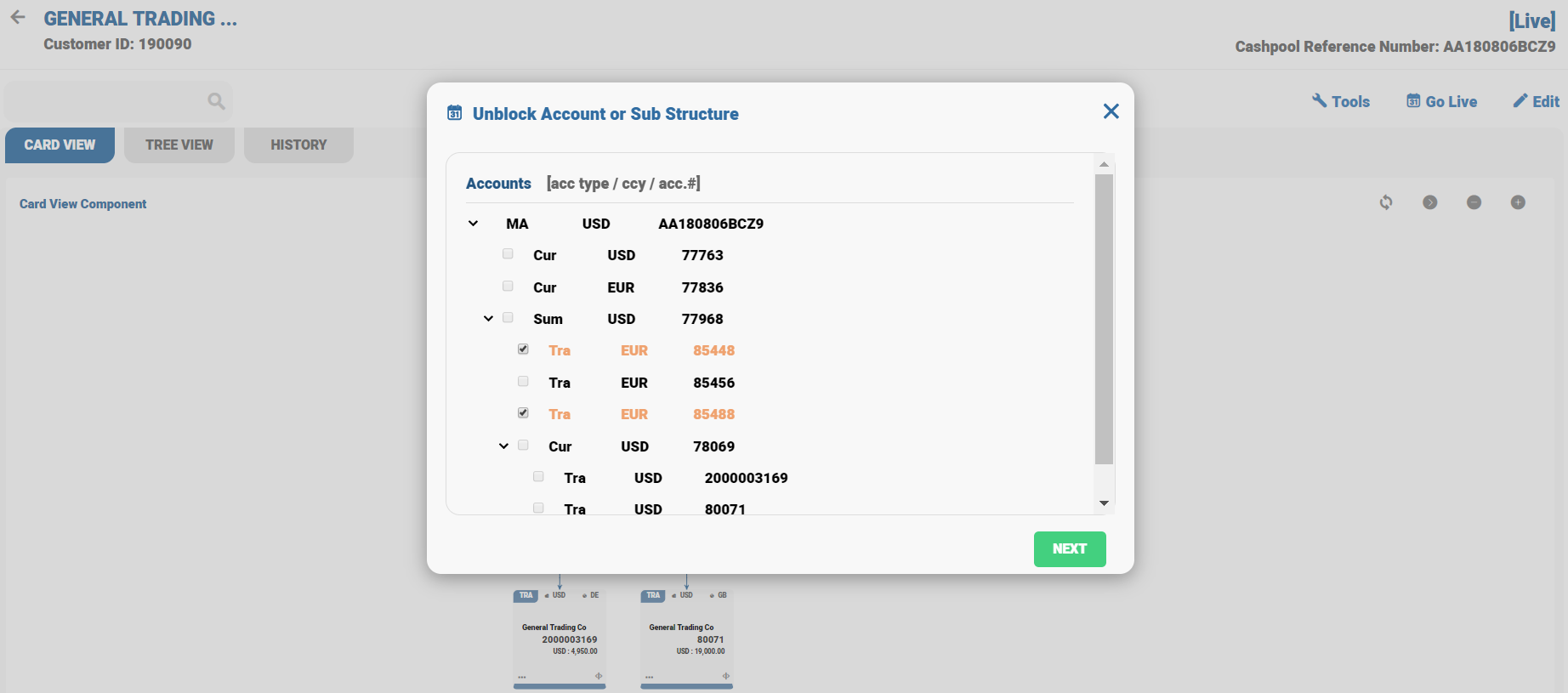

To block the sub-structure, Select Emergency Block from Tools menu and click BLOCK ACCOUNT OR SUB- STRUCTURE. By selecting the parent accounts GUI blocks the child accounts linked under the parent account. In Temenos Transact child accounts are not blocked and only parent account is blocked. When the user initiates the transaction on TR accounts, Temenos Transact displays an error message and further transactions are not allowed. Enter date in Start date and Expiry date fields to block the sub-structure and a particular account. Temenos Transact allows to block the sub-structure or an account with future start date and end date.

When the user selects the parent account, the child accounts linked under the parent are selected automatically and in GUI, the status is shown as blocked.

Once the sub-structure and accounts are blocked, the status is updated on each account and the tool tip is shown on each card with the date on which the account is blocked. When the parent is blocked, the child account details are also updated as blocked in GUI.

Block details are updated in card and tree view.

To unblock sub-structure or an account, select Unblock Account or Sub Structure. The blocked accounts are selected by default. The user can deselect an account when there is no need to unblock. Enter the Expiry date and click UNBLOCK ACCOUNTS to commit the changes in Temenos Transact. Expiry date can be current or future dated. When current date is used to unblock the account, it is unblocked immediately and Temenos Transact allows to initiate transactions.

BN pool GUI structure is refreshed with the changes in Temenos Transact and the blocked status is updated in GUI. Once the account is unblocked, the strike line on an account is removed immediately.

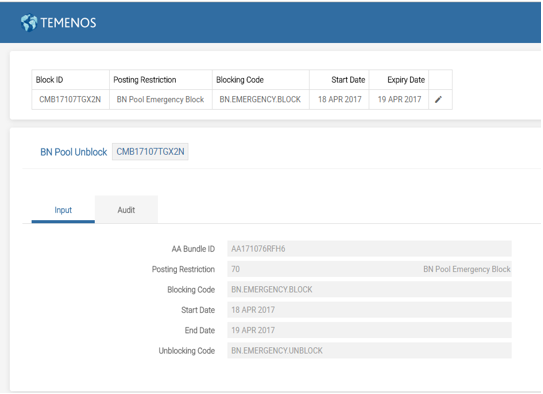

A CUSTOMER.MASS.BLOCK record is created to block the two CT accounts starting 18 April 2017, until 19 April 2017.

By giving the bundle arrangement ID and committing this record, the CT accounts are blocked and no transactions are posted against any transaction accounts linked to these currency top accounts.

The accounts are unblocked by giving the expiry date and an unblocking code.

This bundle arrangement has two currency top accounts: AA17107RHMWK (EUR) and AA17107BB6H6 (USD).

A TR account can be disconnected from a BN pool and then it can be ultimately closed. In such cases, the balances, capitalised interest and charges are transferred to another account.

The general process to disconnect and close an account from the BN structure is as follows:

- The user switches the TR account from off balance sheet to on balance sheet. This is done when user executes an activity to remove the TR account from the pool, a change product is also executed.

Click here to refer Arrangement Closure.

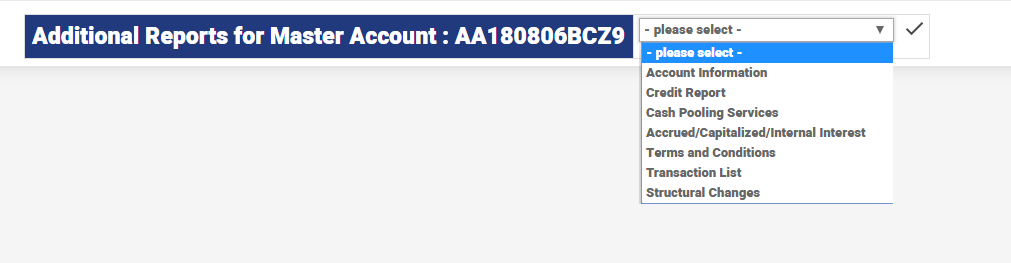

These reports are accessible through the Corporate Single Customer View (SCV) of corporate user menu under balance netting or in the role based home page for balance netting administrator.

The key reports are explained below.

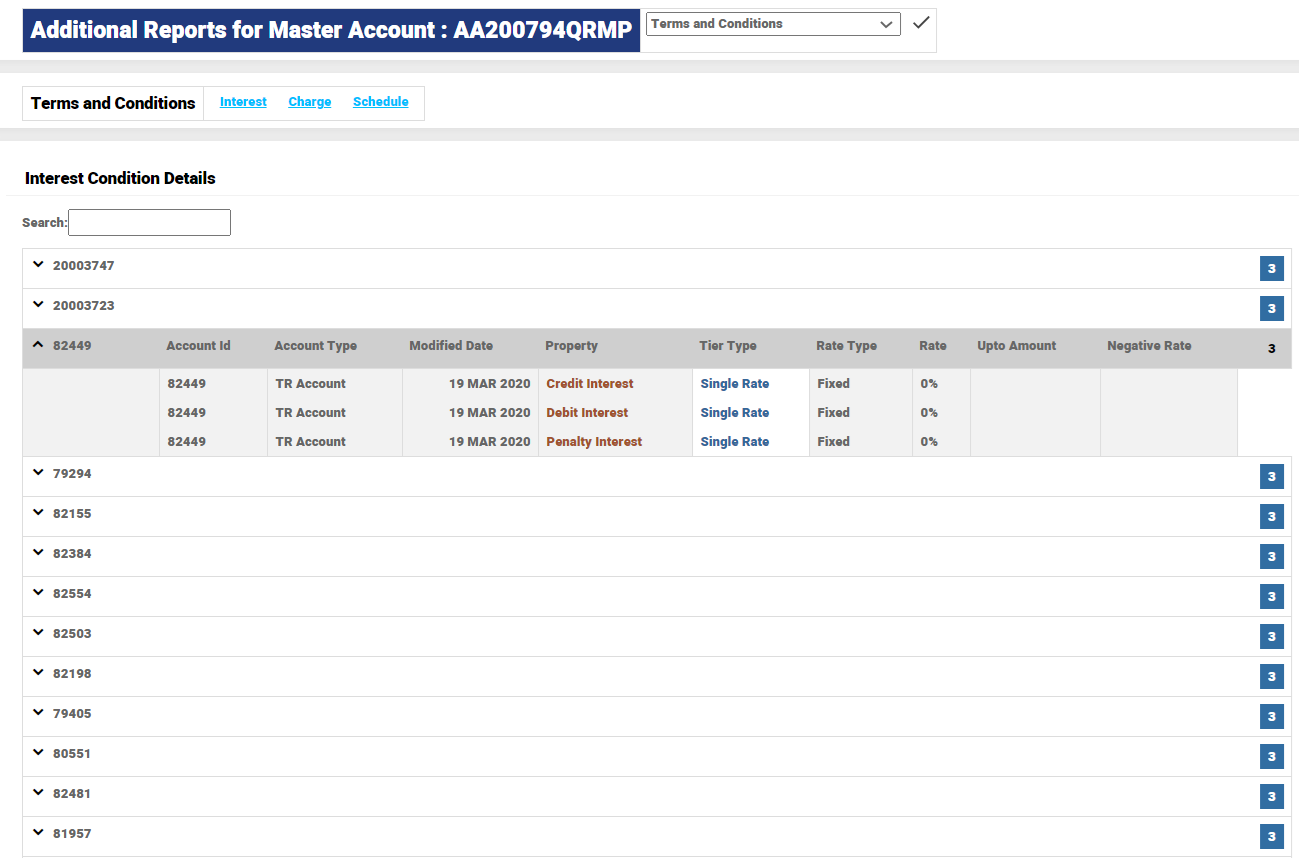

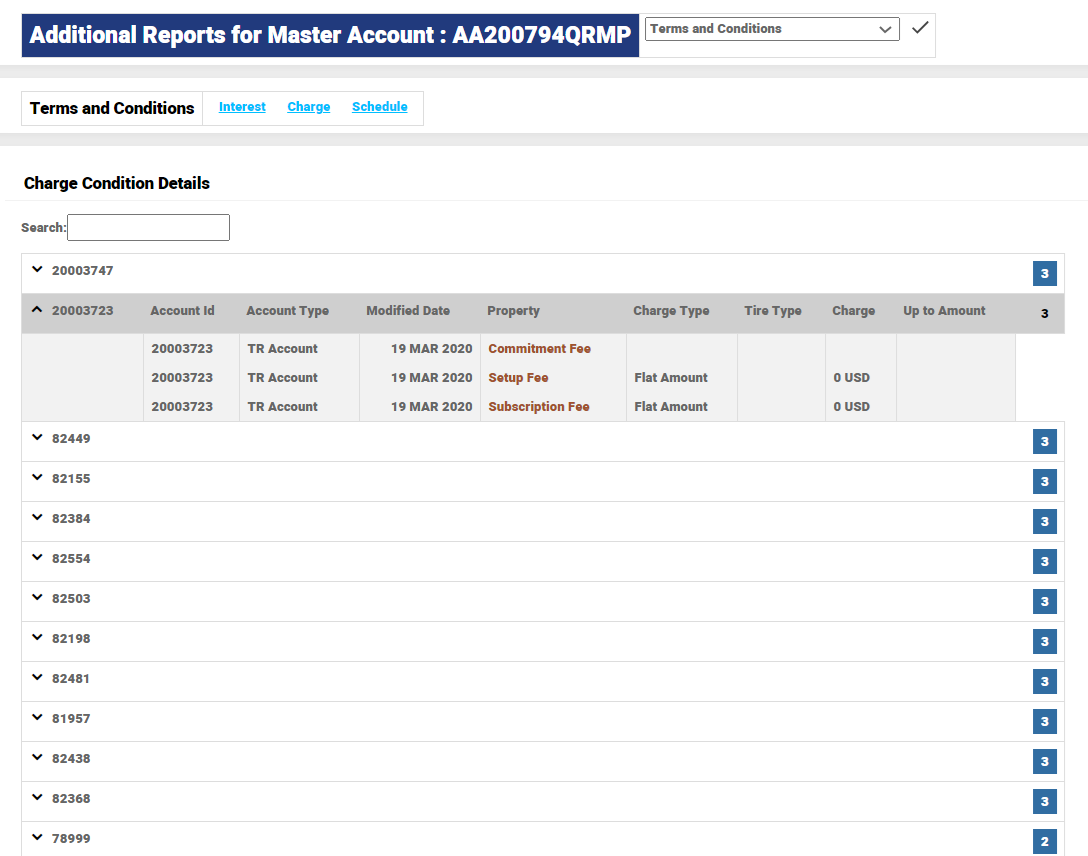

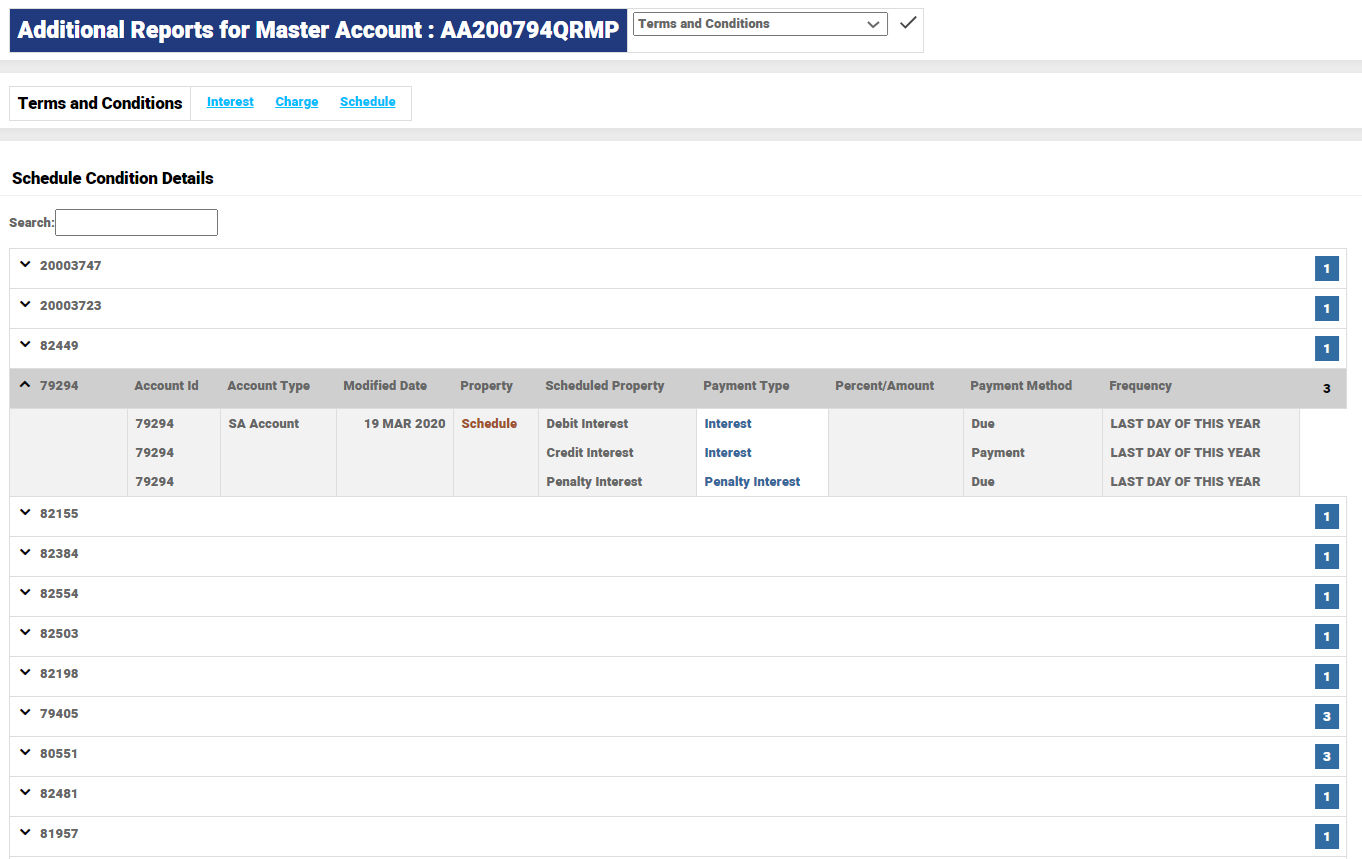

This report provides an overview on the latest terms and conditions registered in the account. The details include cover control, internal or external credit limits, payment restrictions and blocked amounts.

The details provided in this report are:

- Account type

- Account number

- Currency

- Date for latest modifications

- Cover control (on/off)

- Capitalisation account

- Frequency of capitalisation

- Settlement account

- Deposit interest (margin and base rate used)

- Deposit fee (negative interest as a fee)

- Lending interest

- Lending fee

- Unauthorised overdraft interest

- Unauthorised overdraft fee

- Penalty fee (in regards unauthorised overdraft)

- Day method

- Inheritance

- Thresholds

- Blocked amounts

- Unable to check if conditions and terms seen are internal or external

When the user selects several accounts, the search can be limited to comprise only accounts in a certain currency.

The below screenshot shows the terms and condition of master account - Interest:

The below screenshot shows the terms and condition of master account – Charge:

The below screenshot shows the terms and condition of master account – Schedule:

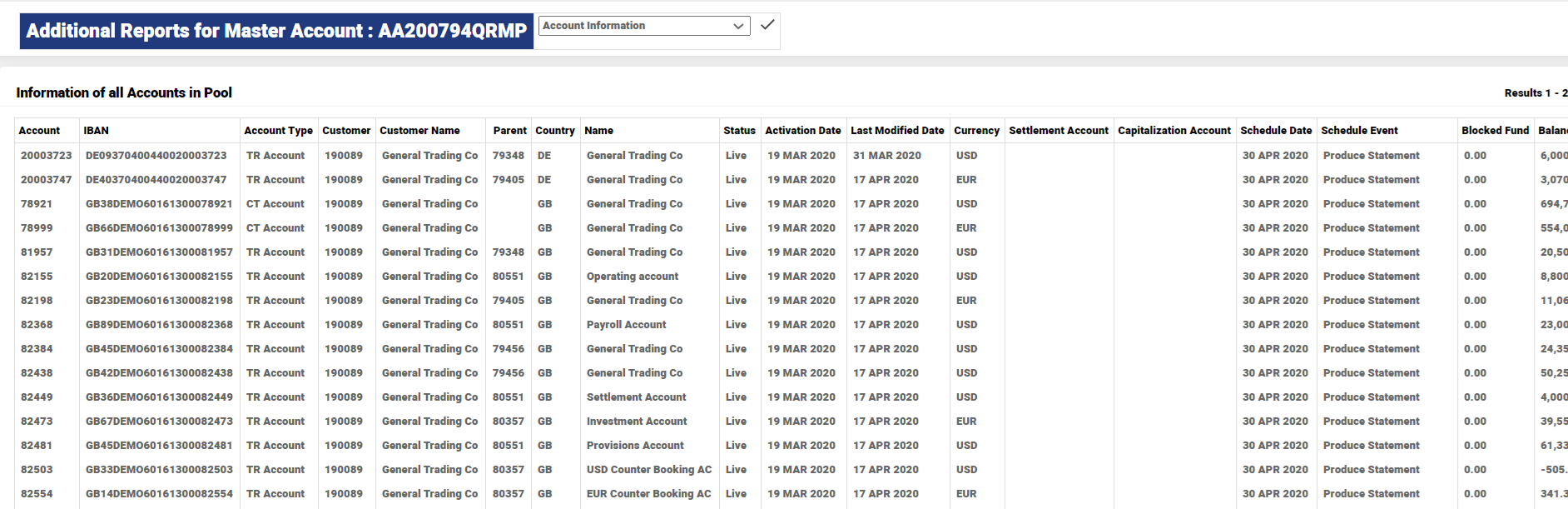

The basic account information per current day for a BN cash pool account are shown below:

- Account type

- Activation date

- Disconnected date

- Date for latest modifications

- Scheduled event(s) and the date for it

- Account number both BBAN and IBAN format

- Account country (that is, the country in which the account is located)

- Currency

- Balance reporting (which type, for example, account statements such as MT940, MT941)

- Frequency of the statement (for transaction accounts only)

- Parent account

- Settlement account

- Capitalisation account

- Customer name

- Customer ID

The below screenshot shows that a search on master account displays the summary and currency summary account and transaction account in the hierarchy.

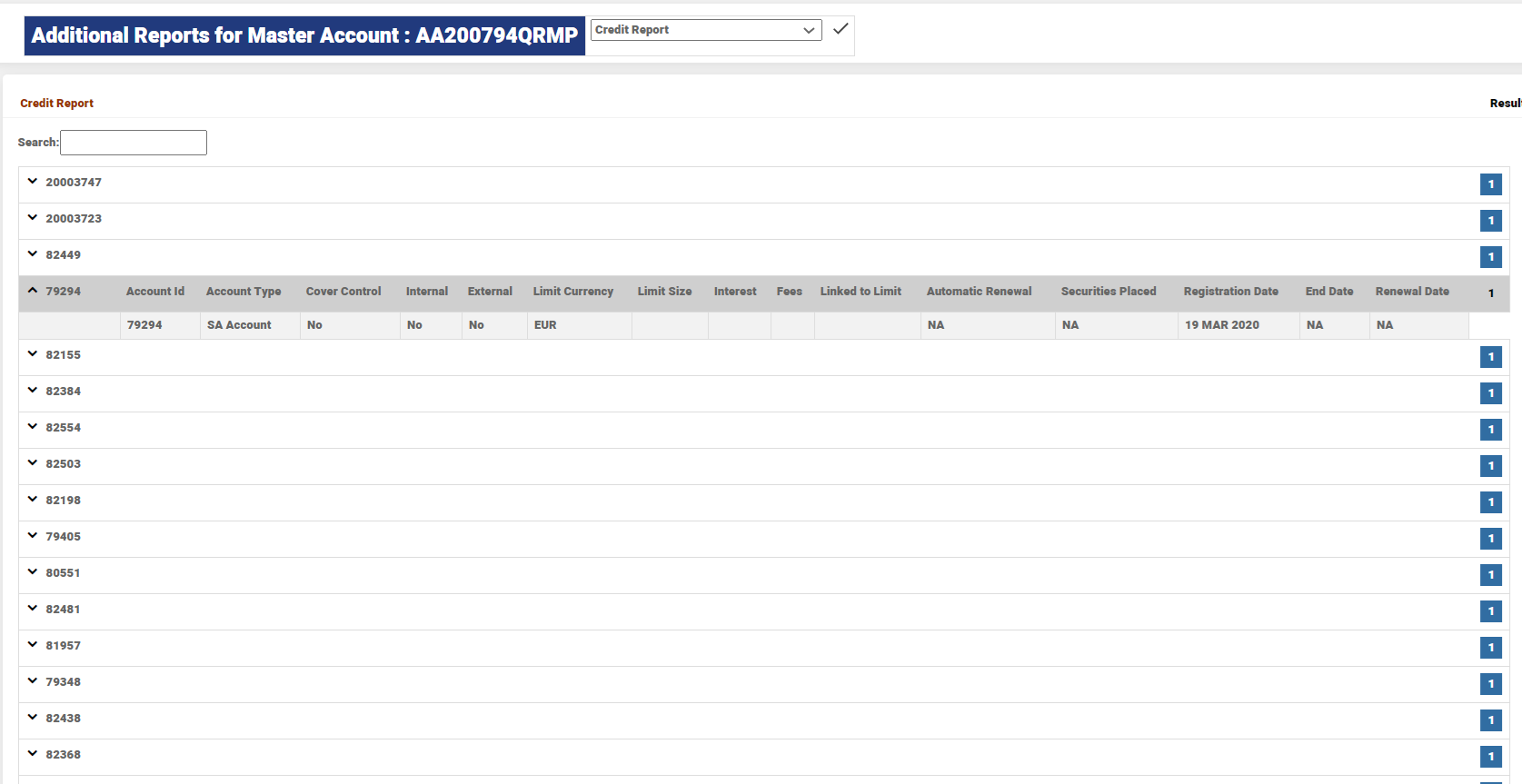

The user Credit report for BN accounts is available with the below details:

- Account number and account type

- Limit attached to accounts within the structure

- Type of limit

- The size of the limit

- Currency of the limit

- Interest and fees linked to the limit

- Automatic renewal

- Placed securities (type of collateral)

- Registration date

- End date

- Renewal date

The below screenshot shows that a search on master account displays the summary and currency summary account and transaction account in the hierarchy.

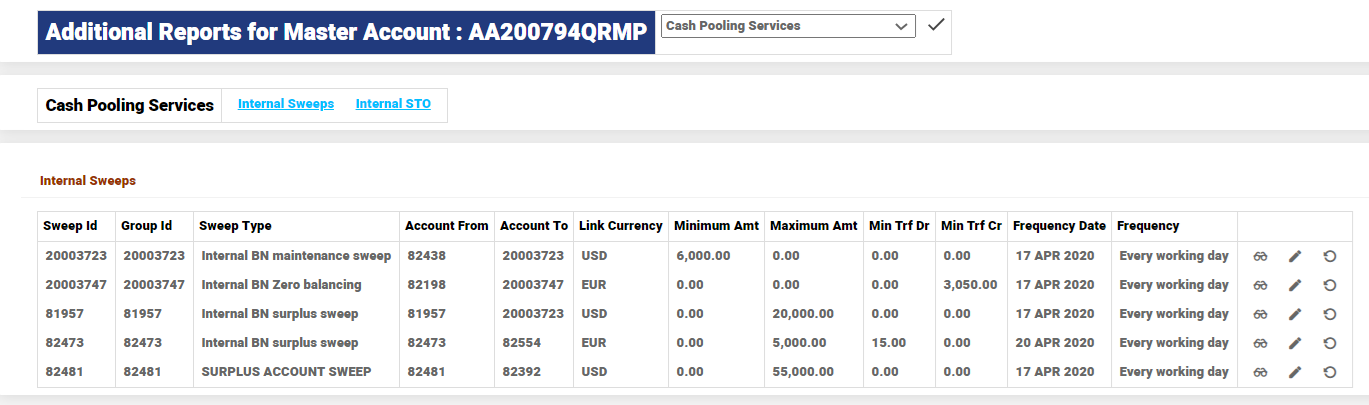

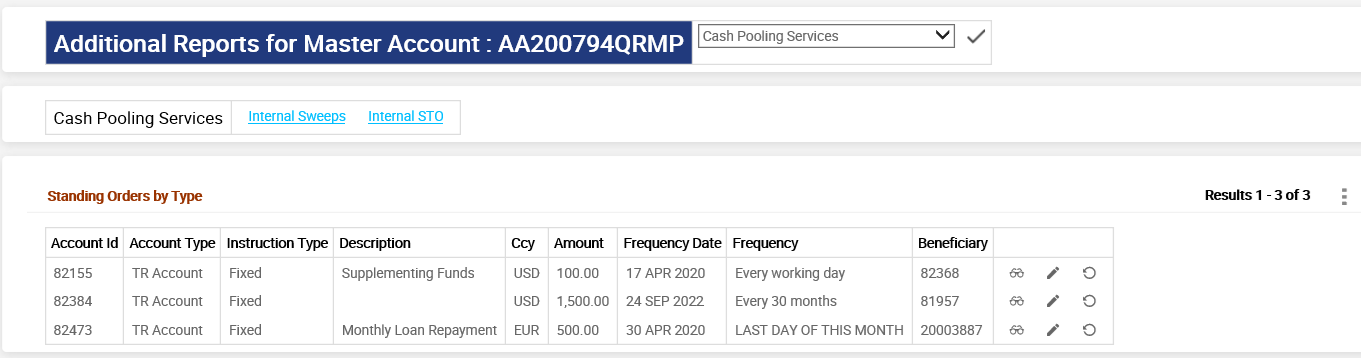

This report displays all the internal cash pool services that are linked to the accounts in the hierarchy.

- Automated balance transfer

- Internal automated balance zeroing

- Internal FX balance transfer

- Internal standing order

The below screenshot shows that a search on master account displays the summary and currency summary account and transaction account in the hierarchy.

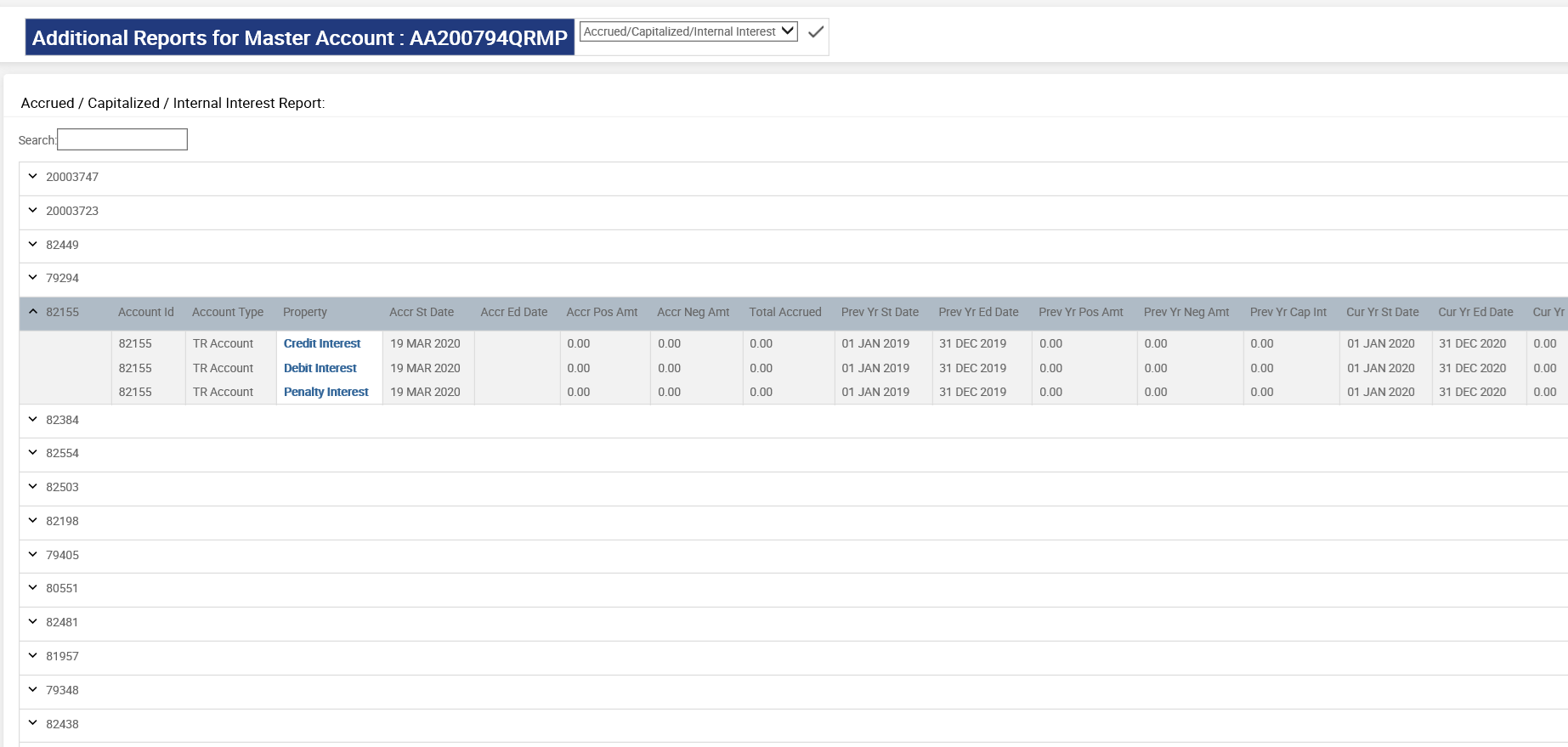

The following details are found for a selected balance netting account:

- Account number and account type

- Interest type

- Accrued interest

- Capitalised interest current year

- Capitalised interest previous year

- Capitalised interest latest period

- Date for latest capitalisation

- Specification of accrued interest

- Internal interest calculated but requested not to be capitalised for the current year

- Internal interest calculated but requested not to be capitalised for the previous year

- Internal interest calculated but requested not to be capitalised for the latest period

The below screenshot shows that a search on master account displays, the summary and currency summary account and transaction account in the hierarchy. The results can be exported to an excel.

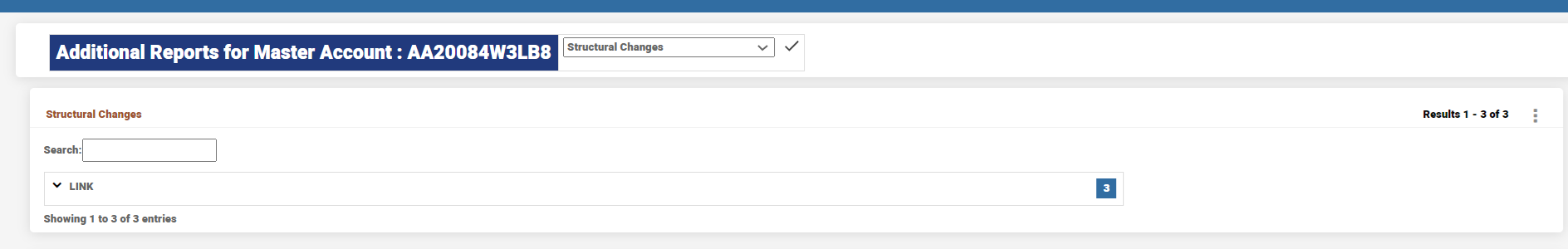

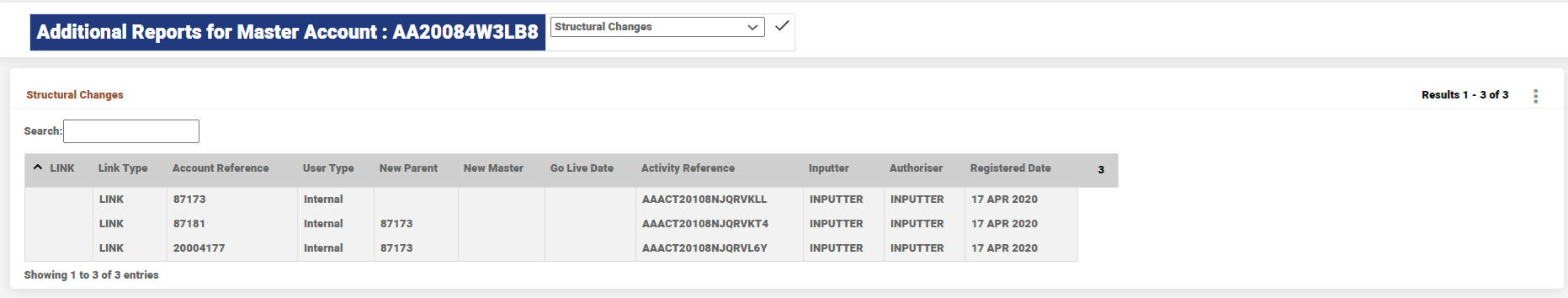

The user can extract information on structural changes in a hierarchy at account closed and accounts moved level. The latter is within a structure or to another BN structure in a bank. Only live structures apply for structural changes (not draft or preliminary).

A below report on structural changes of all MA bundles in Temenos Transact are:

- The list is sorted by MA bundle owner and not by the change.

- Specify the account type taking part in the structural change

- Specify the type of structural change (add, delete and move)

- Specify if the structural change is conducted by a bank user or the customer

- Specify the ID of the user who registered or entered the change

- Account number and customer ID of account involved in the structural change

- If account is moved, then the user should specify the parent account number to which the account is moved ( MA /SA/ CS)

- The go live date of the structural change

- The date the structural change was registered

- Total number of structural changes (aggregate of added, closed and moved respectively) in each MA bundle. This can be used to simplify charging the customer of the structural changes.

A report on structural changes in a specific MA bundle:

- State the MA bundle the structural changes are extracted from

- Specify the account type taking part in the structural change

- Account number and customer ID of account involved in the structural change

- Specify the type of structural change (add, delete and move)

- Specify if the structural change is conducted by a bank user or the customer

- Specify the ID of the user who registered/entered the change

- If account is moved, specify to which parent account number the account is moved ( MA /SA/ CS)

- The go live date of the structural change

- The date the structural change was registered

- Total number of structural changes (aggregate of added, closed and moved respectively) in the specific MA bundle. This is done to simplify charging the customer of the structural changes.

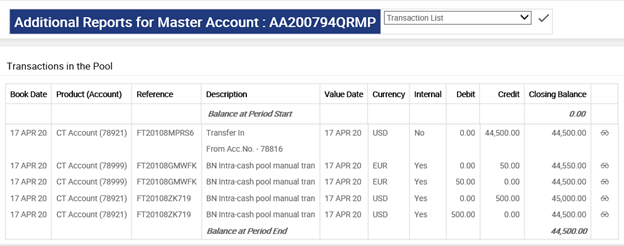

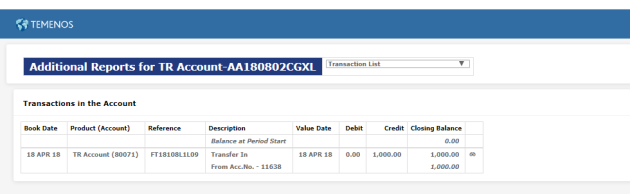

This report displays all transactions (booked during the given period of dates) and transfer details (such as, reference number) if attached to the payment.

If a TR is moved from one structure to another and the search date is before start date in new structure, the system displays the historical transactions only for searches on TR account.

Transactions can be filtered by:

- Transactions within a certain currency

- Customer internal transactions

- Intra-cash pool transactions

- Transactions between certain amounts

- All debit and credit transactions

A search on master account displays the summary and currency summary account and transaction account in the hierarchy

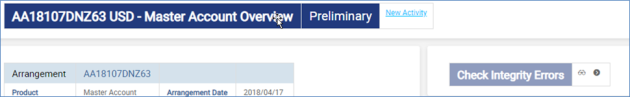

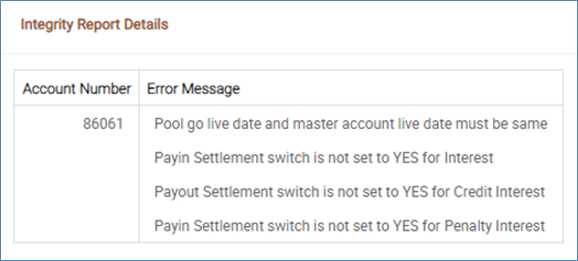

The Integrity Check Days attribute in Bundle Hierarchy Property Class is used to schedule an evaluation on ‘n’ number of days before an event is triggered in the bundle.

The first integrity check is run ‘n’ number of days before go live date for a pool in preliminary status.

This validation runs on continuous basis ‘n’ number of days before every event in the Bundle.

- Integrity check orchestrates the validations from MA level to the underlying accounts in the hierarchy.

- The system triggers the Activity Class BUNDLE-INTEGRITY.CHECK-ARRANGEMENT to run the integrity check.

- The user can trigger ad-hoc integrity checks by manually running the activity class for integrity check.

- The system automatically runs the pool orchestration service and generates integrity report.

- Validations are run on the bundle and results are recorded in AA.POOL.EXCEPTION.LOG.

- The record ID is Arrangement Number-INTEGRITY.REPORT.

- It is possible to query on this table using the bundle (arrangement) number.

- This displays a single screen that contains all the validations related to all the accounts in the bundle, especially the failures

- Drilldown to the individual accounts are available to take correction actions.

The below are the validations based on pool events.

A complete scan is carried out when go live date is set.

When the live date is given (not null), the scan is carried out at the pool level.

- Pool cannot go live without even a single CT.

- CT cannot exist without MA and TR.

The system validates,

- If the bank is working on the dates in which pool has tasks scheduled at SOD

- If previous calendar date is a working day

- A warning message giving the childless CS or SA or CT is closed automatically

- Currency availability in weighted rate calculation (CT and SA)

- CT: When 4 CTs are in bundle but only three currencies are specified in custom type in Recipient CT Interest property, then exception message is raised for the missing custom type in that currency

- SA: Validates if all the currencies for which balance is maintained in ECB, are specified in the custom type

- Currency market rate for currencies in secondary currency market

- Takes recipient’s secondary currency market, and scan through CURRENCY table in recipient CT company for each allowed currency of the bundle and see if there is a rate definition for this secondary currency market. An exception is recorded for the missing rate definition

- Settlement account validation

- All properties, payment types have settlement accounts (payment schedule, activity charges and rule break charges)

- Settlement and counter booking belong to the same pool and currency, the status of those accounts for the date (this account’s go live date atleast) required

- Settlement account specified in bundle settlement

- Settlement instruction switched on (if not, warning message)

- Settlement and counter booking account should be available for the go live date of the CS or SA or TR

- During new offer of SA or CS, a new offer TR can be attached as a settlement account but it must be set to go live for the SA or CS Go live date

When an account is linked to the pool, the below validations are performed:

- External sweeps are set for the account

- External STOs are set for the account

- Account with negative balance (error is raised when TR account is linked)

- AC pre closure validations are performed

- Account is scheduled for closure

- TR has external sweep or STO

When an account is delinked from the pool, the below validations are performed:

- Internal sweeps are set for the account

- Internal STOs are set for the account

- AC Pre closure validations

- Account scheduled for closure

- TR has internal sweep or STO

During the closure of an account, the below validations are performed:

- Negative balance in account

- Sweeps setup in account

- Accounts has a record already in AC block closure

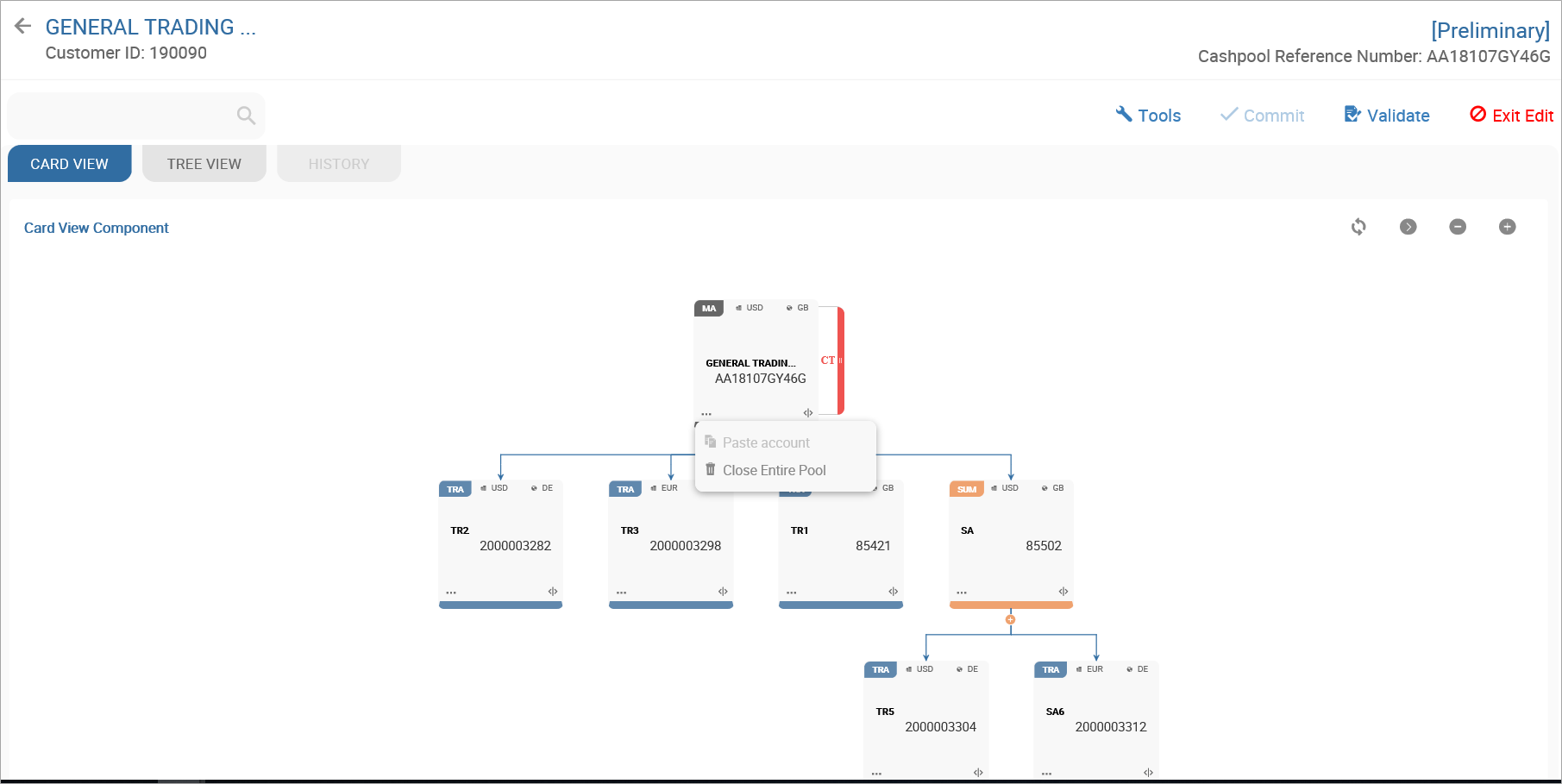

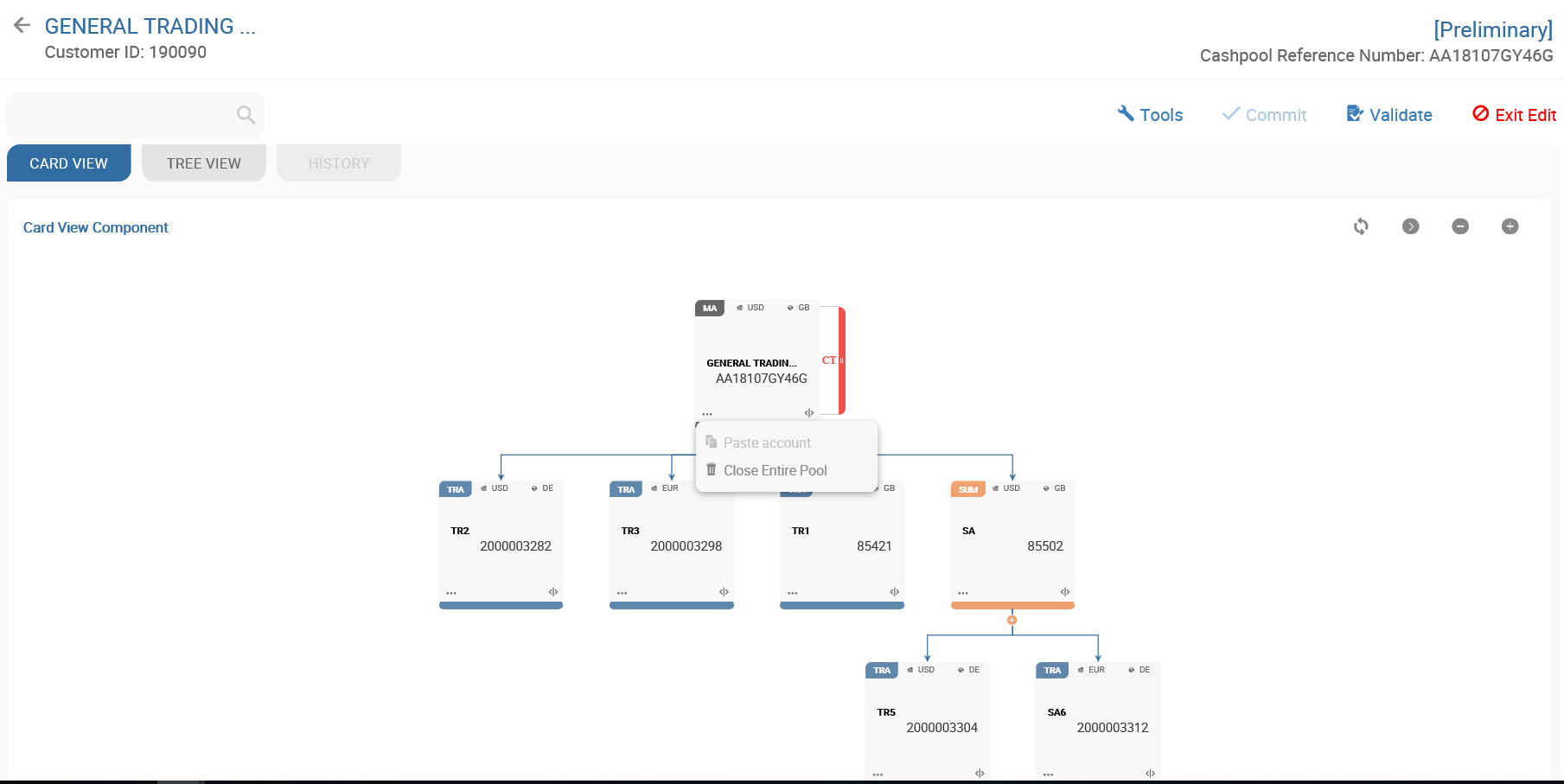

Closure of entire pool structure (GUI)

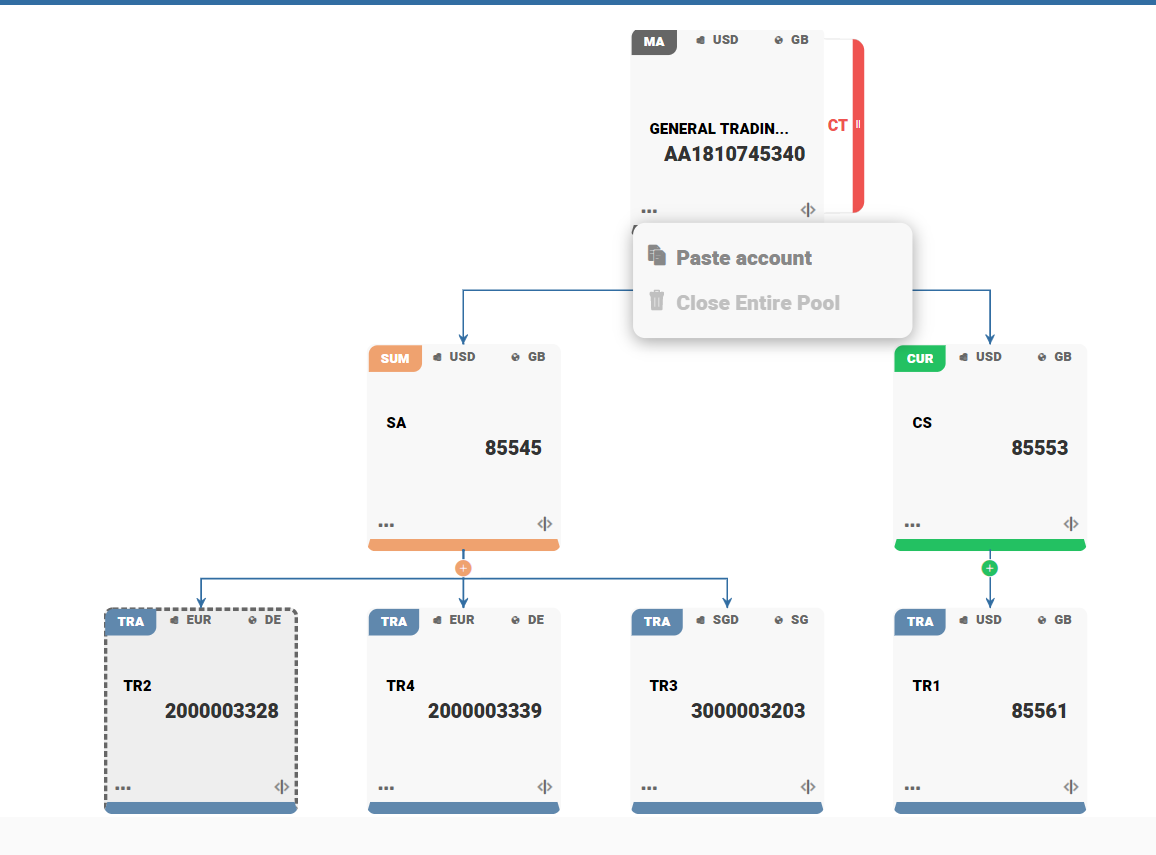

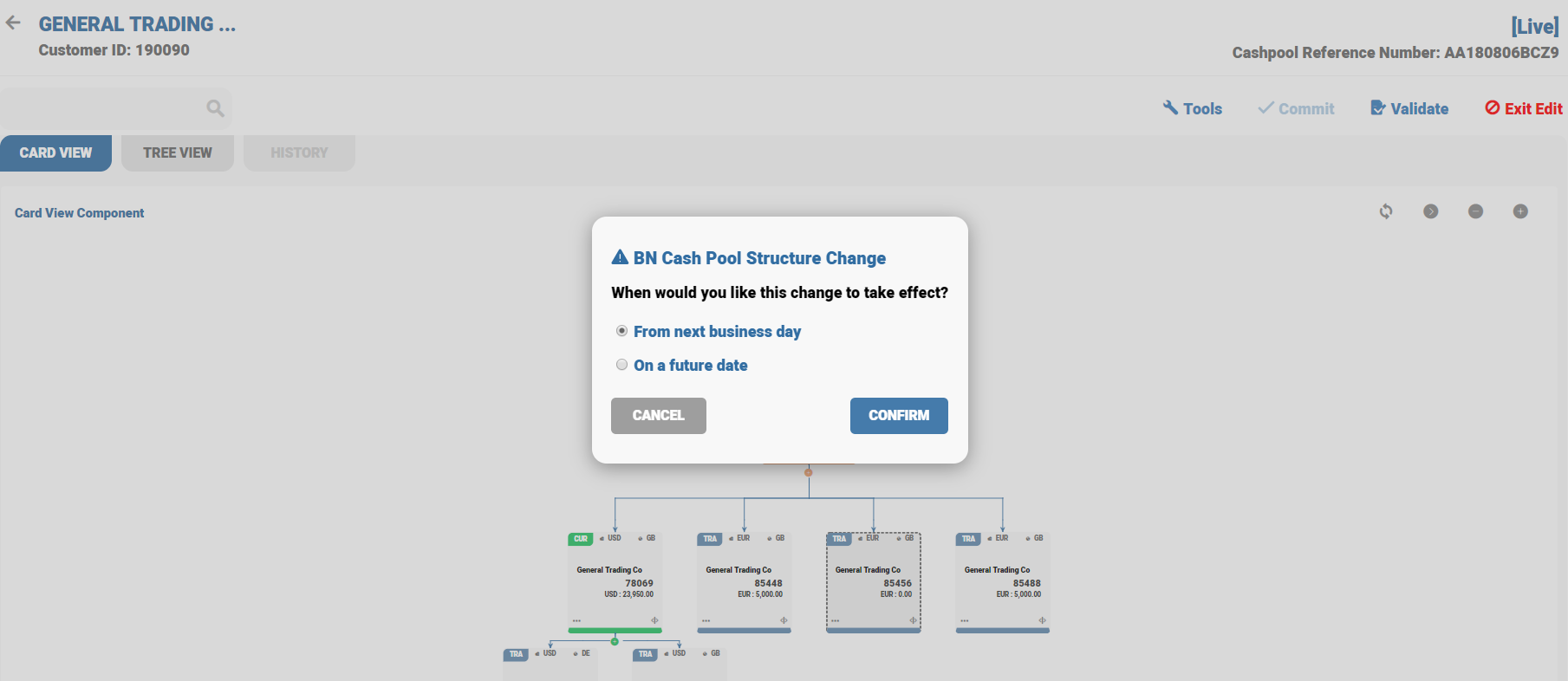

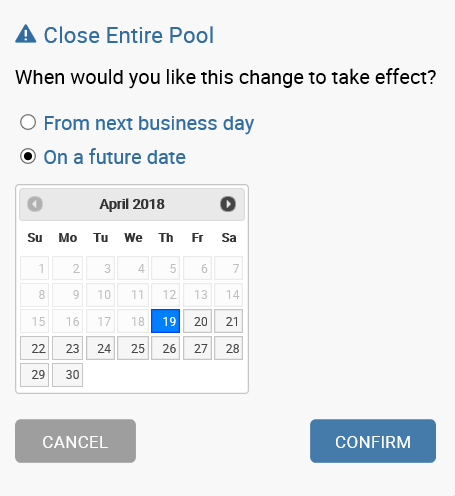

BN pool can be closed during Draft, Preliminary and Live status. To close the BN pool structure, right-click the 3 dots on Master card and select Close Entire Pool. Closure of live BN pool online is not possible. It is possible on the next business day or on a future date.

Closing the preliminary BN pool is done online and future scheduling is not possible. Master arrangement and SA, CS, TR or MTR accounts linked to the pool is closed online and Tree or Card view is updated accordingly. GUI displays a warning message to the user before closing the entire BN pool. When the user clicks on YES, GUI passes the information to Temenos Transact and the accounts are closed.

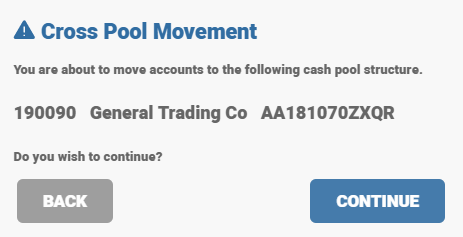

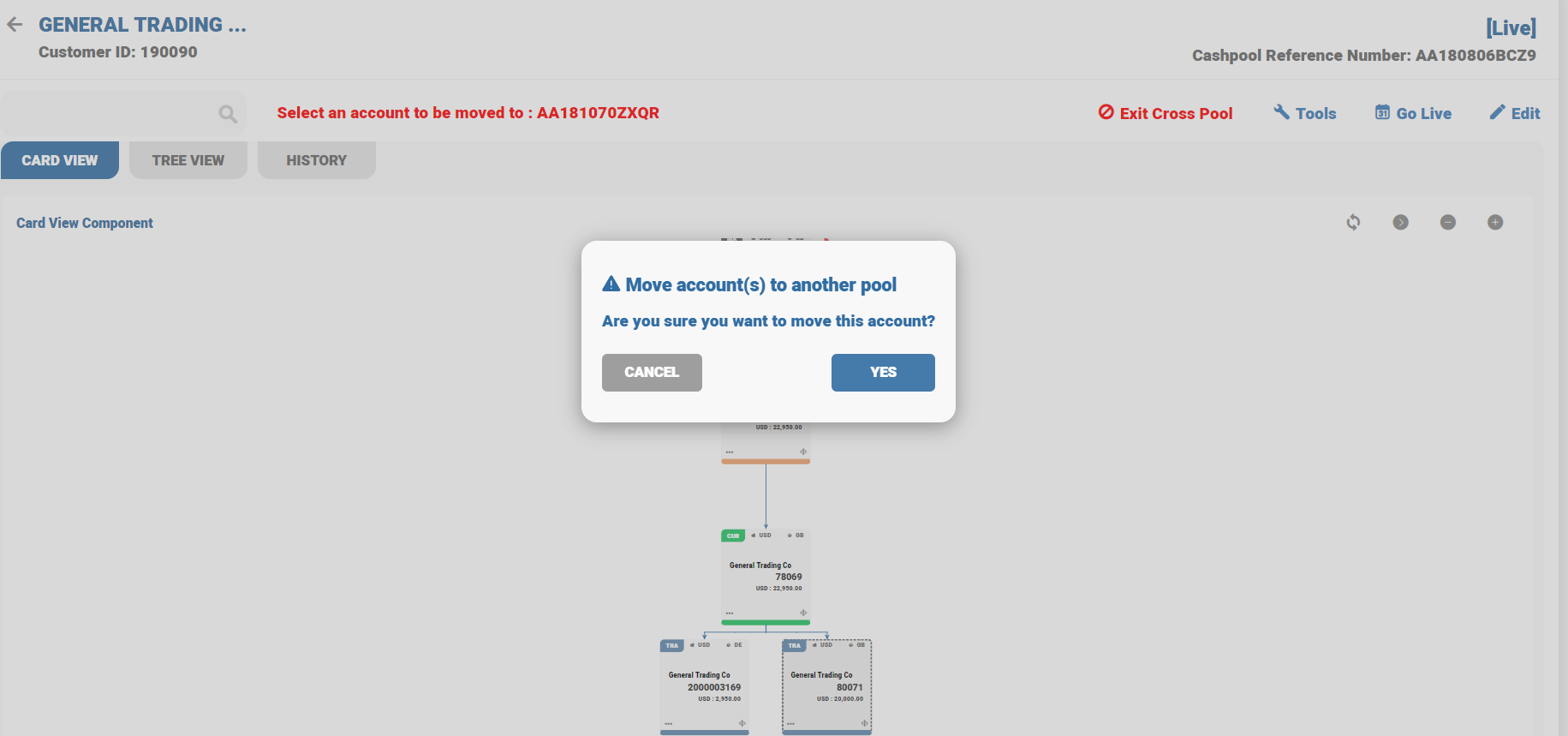

Cross pool event go live date against destination pool go live date and parent go live date is validated and exceptions are logged in case of breach.

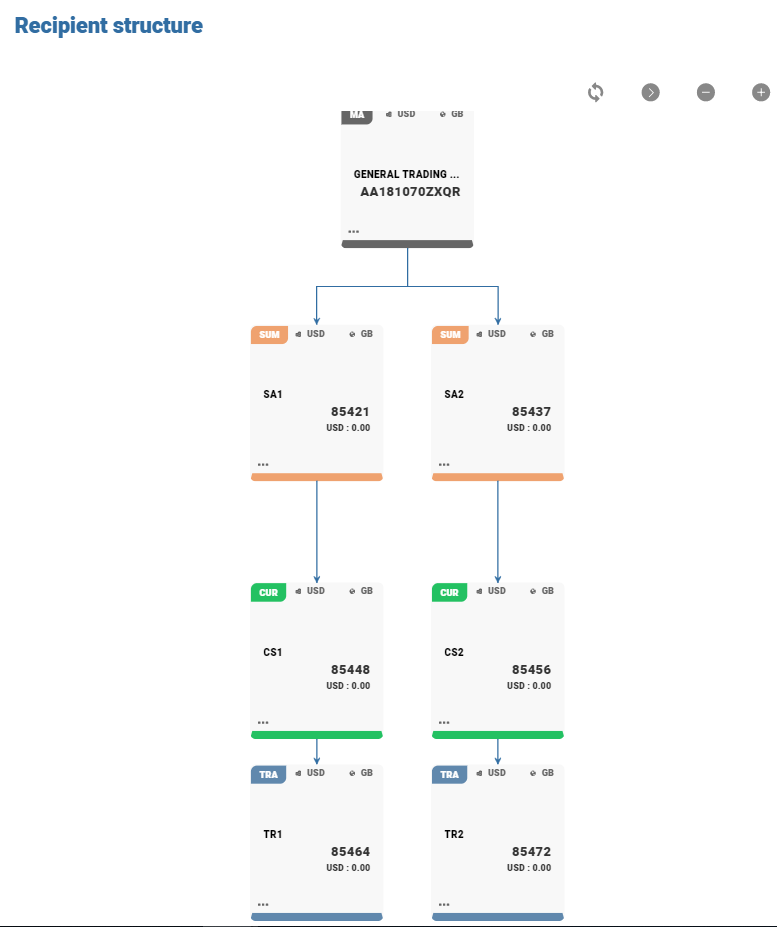

Cross-pool movements of the Sub-structure

When arrangement is part of a hierarchy of accounts such as, a cash pool hierarchy, the arrangement interest, charge and capitalisation frequencies need to be set (not at product level but at another arrangement higher up in the hierarchy). In a cash pool structure, this means setting conditions for inheritance at the (parent or grandparent) or (pool or currency specific concentration level).This helps in easy maintenance of these conditions in a single place instead of having to deal with the individual arrangements at the lowest level, which also happen to be the normal transaction accounts.

In this topic