Accounting

The AA module utilises Temenos Transact rules-based accounting to generate its accounting movements.

The Accounting Property Class is used by all financial products and this controls the link between the accounting events generated by the property actions and the accounting allocation rules to be applied to these events.

Accounting rules can be defined either based on Property, Property Class or combination of them. If it is defined based on Property Class, then for all instances of the Property Class the same action and allocations are triggered. If accounting is defined based on Property Class and Property, then Property takes precedence.

Product Lines

The following Product Lines use the Accounting Property Class:

- Accounts

- Agent

- Asset Finance

- Deposit

- External Product Line

- Facility

- Lending

- Rewards

- Safe Deposit Box

Property Class Type

The Accounting Property Class uses the following Property Class Types:

- Dated

- Enable External Financial

- Enabled For Memo

- Merging

- Tracking Only

Property Type

The Accounting Property Class is associated with the Product Only Property Type. The users can create and maintain properties.

Balance Prefix and Suffix

The Accounting Property Class is not associated with balance prefix and suffix.

The following are the associated attributes:

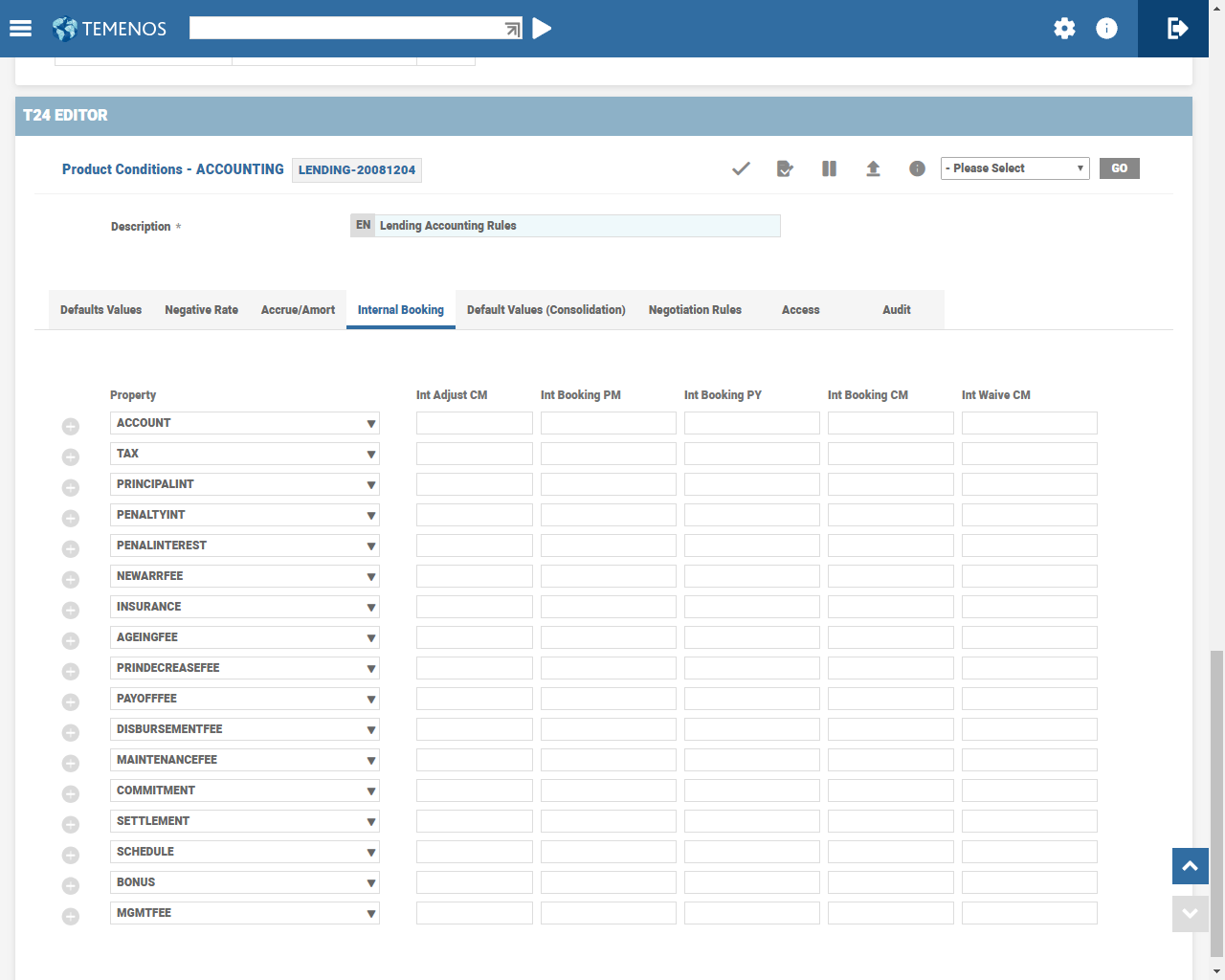

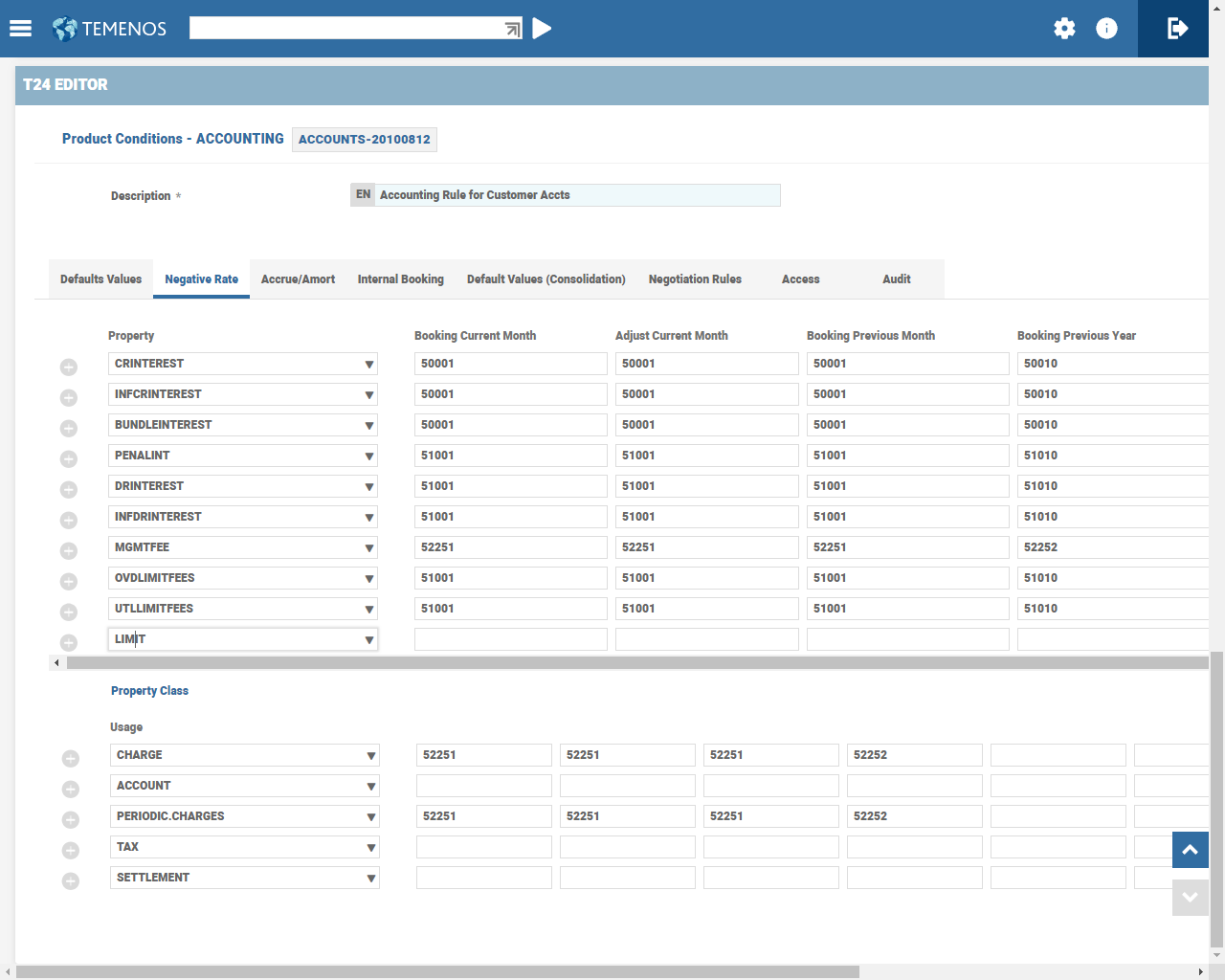

It allows to indicate the Property to which the following accounting rules apply. The Properties that are used by Products linked to this condition can be specified. This attribute is part of a multi-value set with Action and Accounting Rule

It allows to indicate the action for which the rule is defined.A valid action for the Property has to be stated. System validates the action stated with the list of actions stated in AA.PROPERTY.CLASS to which the Property belongs.

All actions which have Accounting stated as Yes finds a rule in this table. This attribute is part of a sub-value set with Property and Accounting Rule

It allows the user to indicate the accounting rule that is associated with the PROPERTY and ACCT.ACTION within the same multi-value set. This attribute is part of a sub-value set with Property and Action.This has to be a valid record from AC.ALLOCATION.RULE.

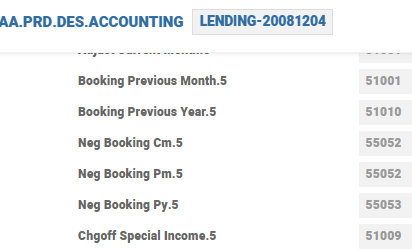

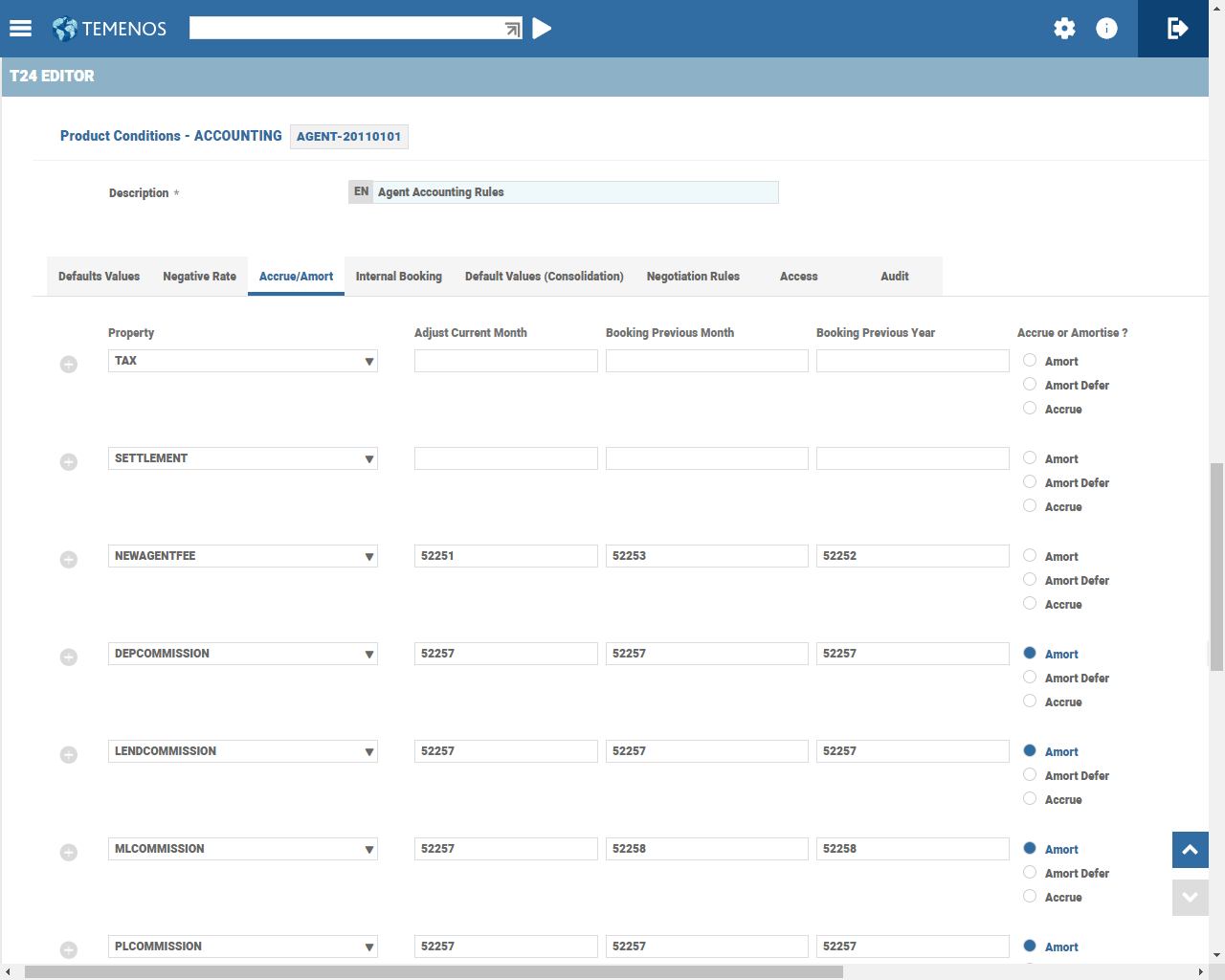

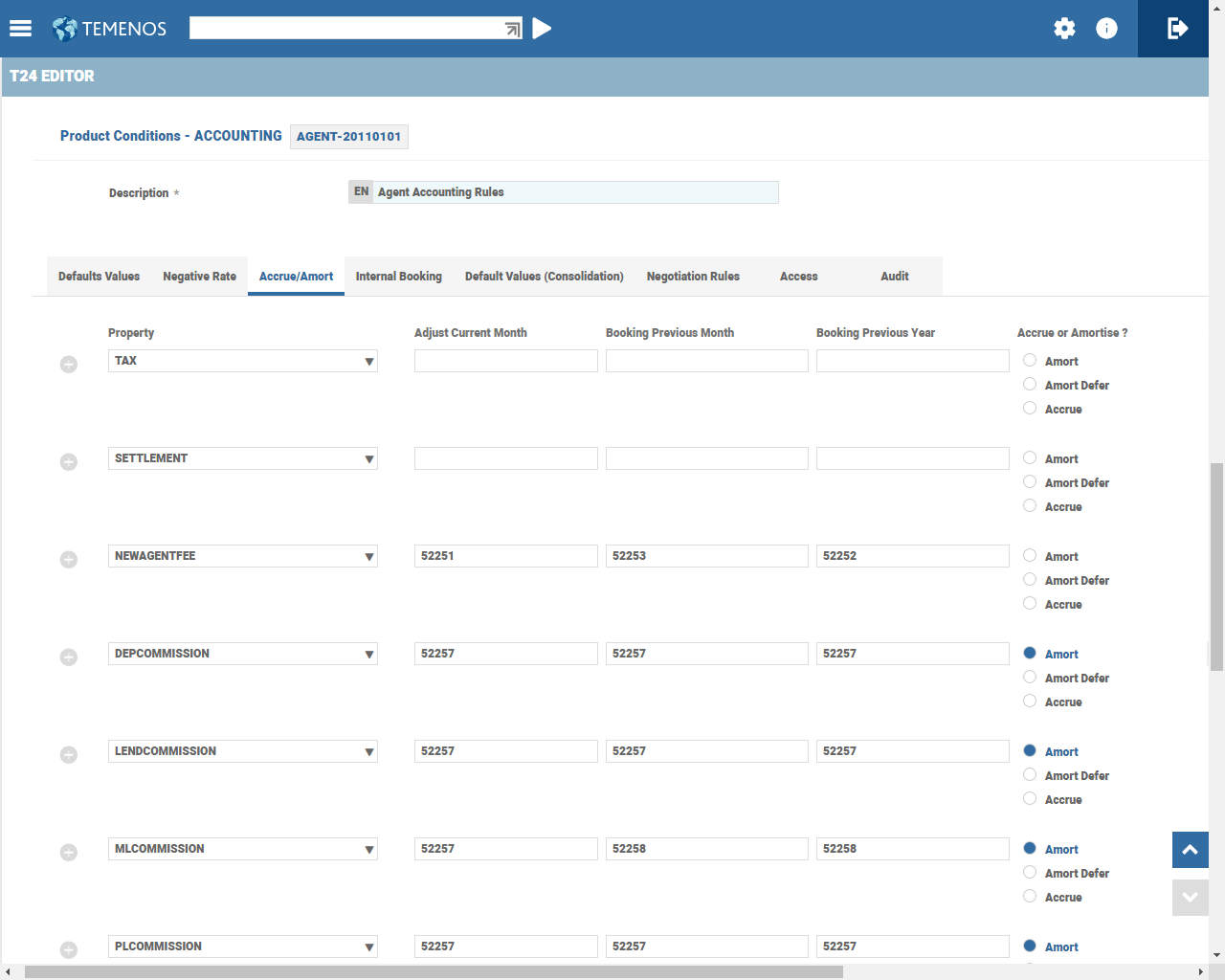

It specifies the Profit and Loss category code that is credited or debited when booking accruals for the current month, for the associated Property. This has to be a valid entry in the CATEGORY table between the range 50,000 and 59,999.

It specifies the Profit and Loss category code that is credited or debited when adjusting accruals for the current month, for the associated property.This has to be a valid entry in the CATEGORY table within the range 50,000 and 59,999

It specifies the Profit and Loss category code that is credited or debited when booking accruals for the previous month, for the associated Property.This has to be a valid entry in the CATEGORY table within the range 50,000 and 59,999

It specifies the Profit and Loss category code that is credited or debited when booking accruals for the previous year, for the associated Property. This has to be a valid entry in the CATEGORY table within the range 50,000 and 59,999

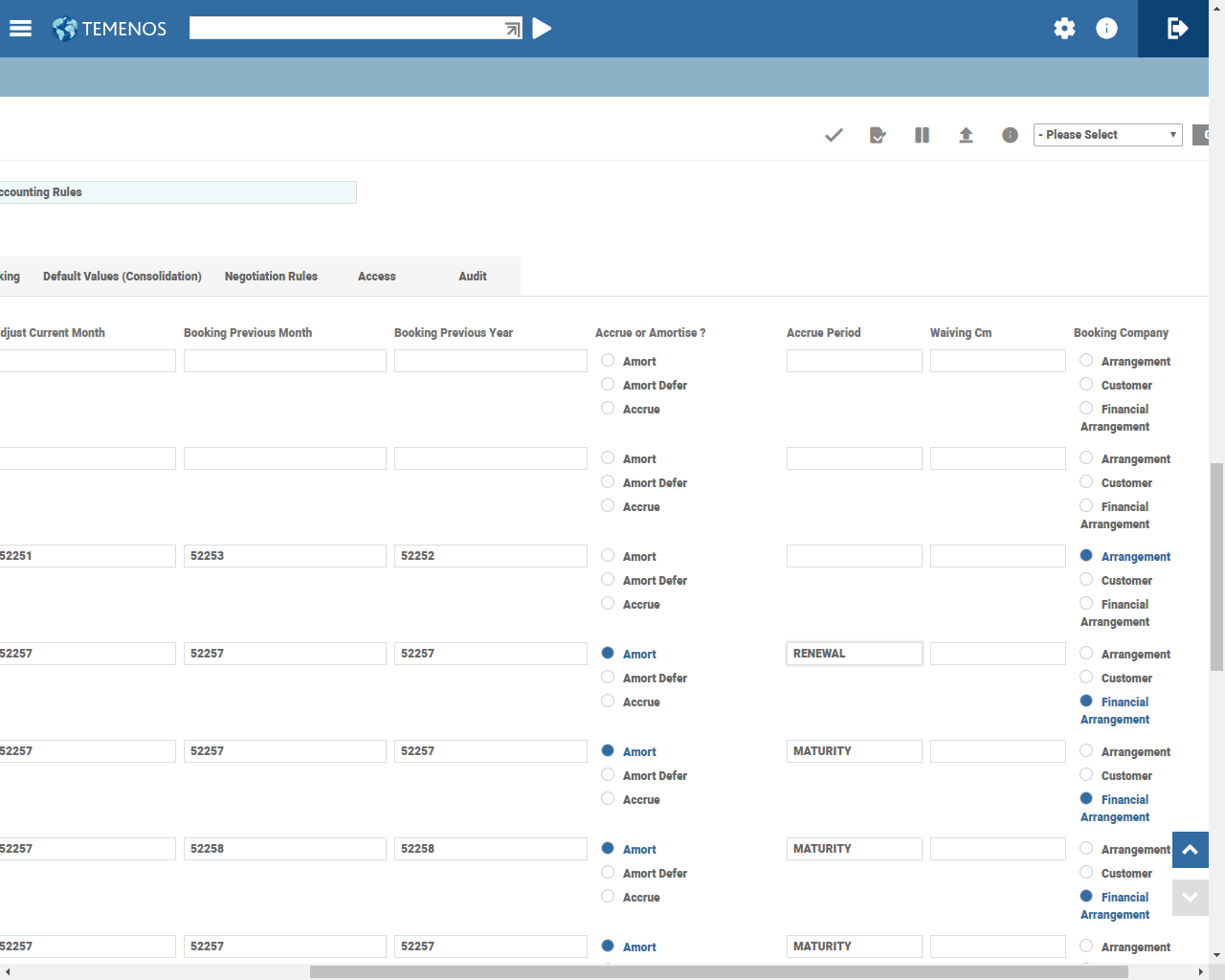

It specifies if the associated Property has to be accrued or amortised. If flagged as Amort when the associated Property is made-due (either scheduled or ad-hoc) the due amount is amortised using central EB.ACCRUAL processing outside of AA. The associated transaction codes and PL category are required for either accrual or amortisation.Currently, this is applicable only for Charge Property Class.

Following are the values allowed:

- Amort - Charges are amortised from the make-due date until the period specified in Accrue.Period.

- Accrue - Allowed only for scheduled Charge property. However, if Charge Property is of type REBATE.UNAMORTIZED then this option is not allowed. If Accrue is set for Charge property other than scheduled charge, then charge amount gets posted to PL directly instead of handover to EB.ACCRUAL for accrual processing.

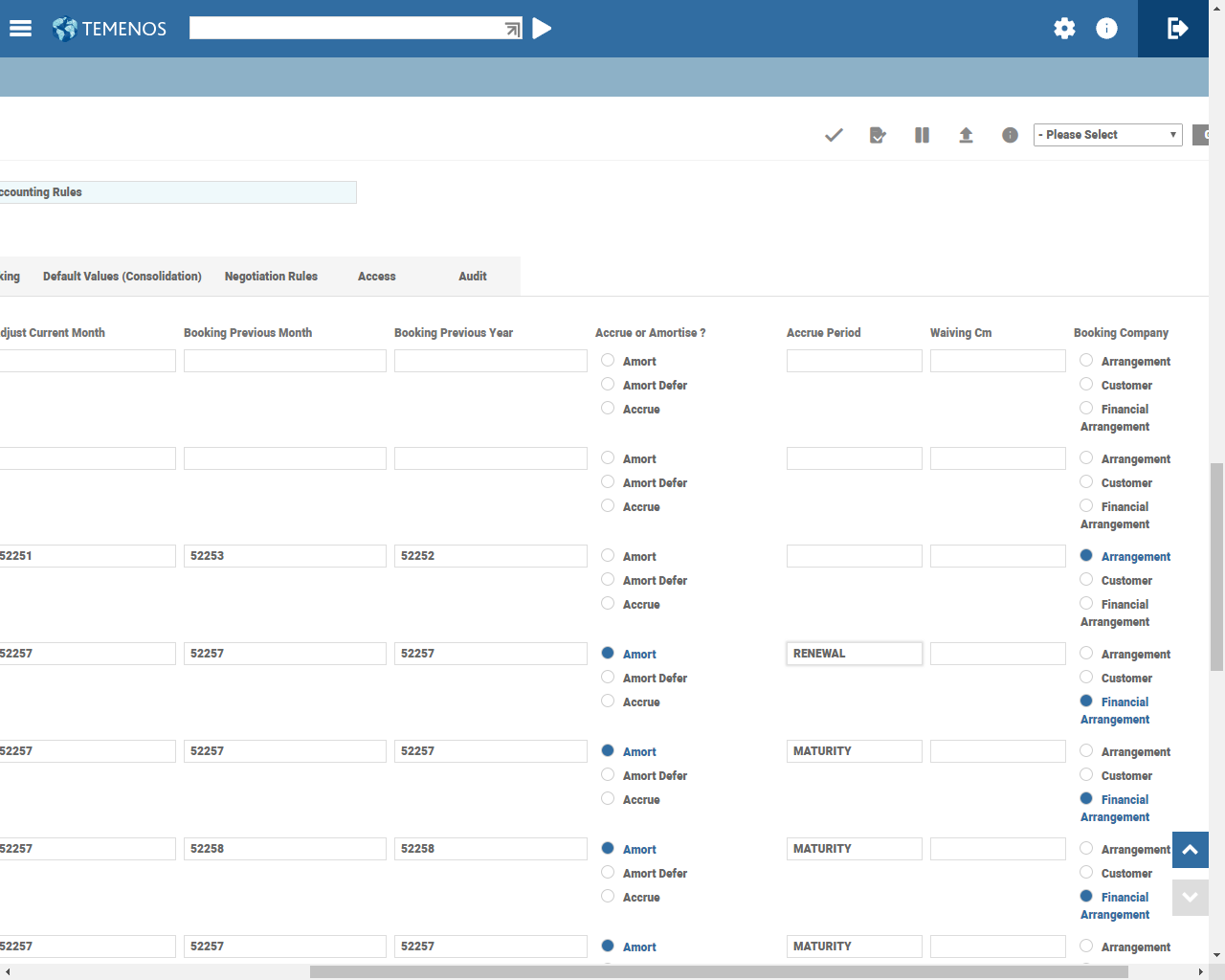

It allows to indicate the period of amortisation or accrual for the associated Property. Applicable only for Charge Property Class.Available values are:

- Maturity - Applicable when the Property is flagged to Amortise. Amortisation end date is the maturity date of the arrangement

- Period - Any valid period in the Pnnn format, where P can be Month (M), Days (D), Year (Y) or Week (W), and nnn can be any number between 1 and 999. If a period is defined, the end date is the date calculated as the amortisation start date (usually the make-due date) plus the period specified in calendar days.

- Schedule - To perform accrual until next schedule date

It allows to indicate the expense (Profit and Loss) category that is debited when a loan is charged-off for the corresponding Account Property.

It allows the user to indicate the Income (Profit and Loss) category that has to be credited when the Extraordinary Income accounting is posted for the corresponding property. Extraordinary Income can occur when a loan is repaid in its entirety but the book interest is less than the customer interest due to accelerated repayment of principal. This has to be a valid entry in the CATEGORY table within the range 50,000 and 59,999.

It allows the user to indicate the credit transaction code used in Statement or PL entries for the associated Property. Currently, this is applicable only for charge amortisation. The transaction code is updated in EB.ACCRUAL when the associated Property is to be amortised. This has to be a valid entry in the TRANSACTION table.

It allows the user to indicate the debit transaction code used in Statement or PL entries for the associated Property. Currently this is applicable only for charge amortisation. The transaction code is updated in EB.ACCRUAL when the associated Property is to be amortised. This has to be a valid entry in TRANSACTION table

It allows the user to specify the internal account category code that is credited or debited when posting amortization entries for the corresponding Property Class. This has to be a valid entry in the CATEGORY table within the range 10000 and 19999

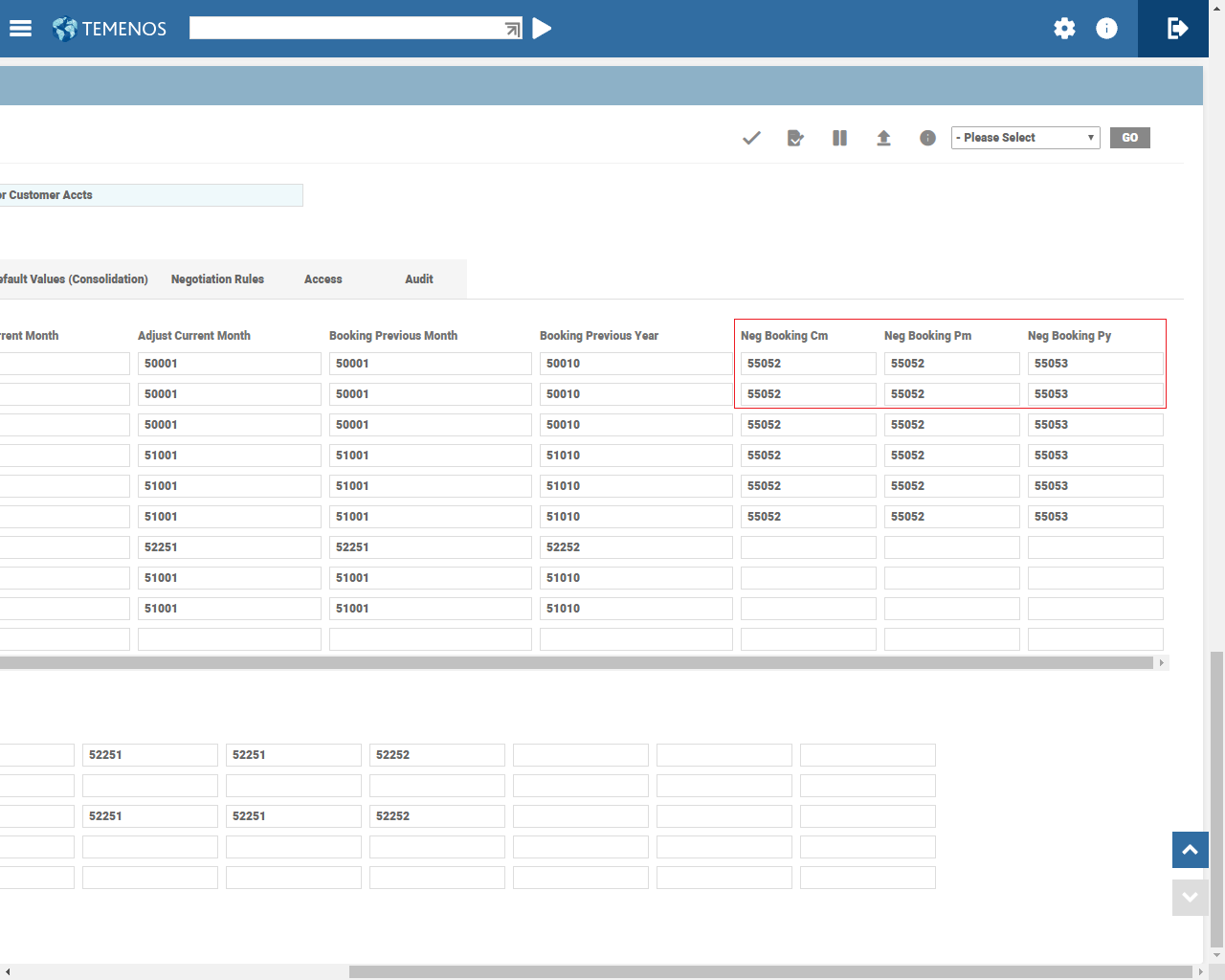

It allows the user to indicate the Profit and Loss category code that is credited or debited, when booking negative rate accruals for the current month for the associated Property

It allows the user to indicate the Profit and Loss category code that is credited or debited, when booking negative rate accruals for the previous month for the associated Property

It allows the user to indicate the Profit and Loss category code that is credited or debited, when booking negative rate accruals for the previous year for the associated Property

This holds the charge that is waived and booked against the PL category specified.

Accounting Property Class defines the branch P and L that is used for commission booking. This specifies the company’s GL to be used for booking income or expense. Available values are:

- Arrangement or None – booked against agent arrangement’s branch PL

- Customer – booked against financial arrangement’s customer branch PL

- Financial Arrangement – booked against financial arrangement’s branch PL

It specifies the Profit and Loss internal category code that is credited or debited, when adjusting accruals for the current month for the associated Property. This has to be a valid entry in the CATEGORY table within the range 10000 and 19999

It specifies the Profit and Loss internal category code that is credited or debited, when booking accruals for the current month for the associated Property. This has to be a valid entry in the CATEGORY table within the range 10000 and 19999

It specifies the Profit and Loss internal category code that is credited or debited, when booking accruals for the previous month for the associated Property. This has to be a valid entry in the CATEGORYtable within the range 10000 and 19999

It specifies the Profit and Loss internal category code that is credited or debited, when booking accruals for the previous year for the associated Property. This has to be a valid entry in the CATEGORY table within the range 10000 and 19999

It specifies the Profit and Loss internal category code that is credited or debited, when waiving accruals for the current month for the associated Property. This has to be a valid entry in the CATEGORY table within the range 10000 and 19999

It allows the user to indicate the Property Class to which the following accounting rules apply. This attribute is part of a multi value set with PC.ACTION and PC.RULE. Input must be a valid record in AA.PROPERTY.CLASS

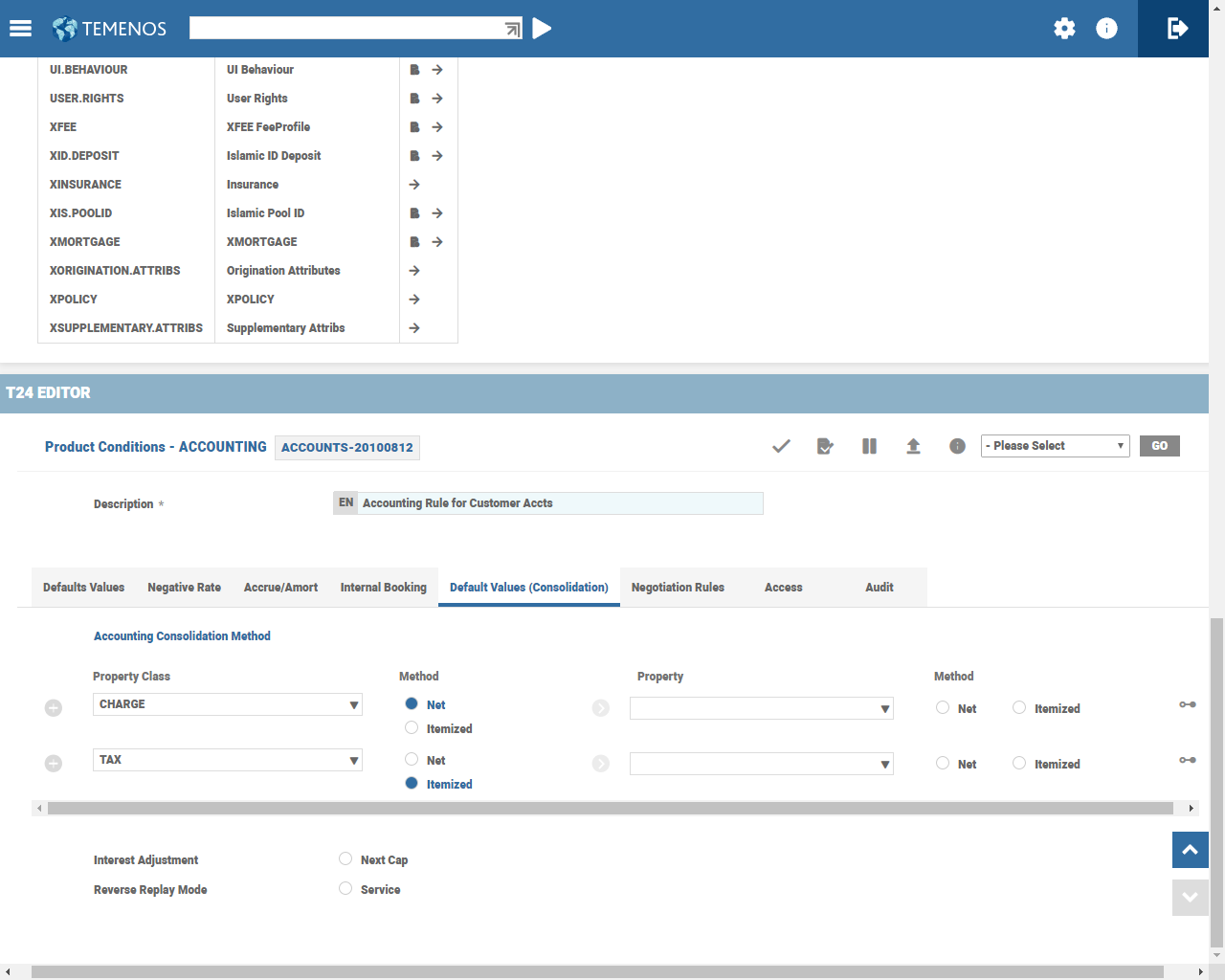

It allows the user to indicate the consolidation method that applies to the associated Charge or Tax Property. Input is mandatory when value defined in associated Consolidation attribute. Allowed values are:

- NET

- When Consolidation Method is set to 'Net' for Tax Property the accounting is done only for the net of tax amount.

- When Consolidation Method is set to 'Net' for Charge Property the net of the calculated amount and the waived amount are generated as a single entry.

- ITEMISED

- When Consolidation Method is set to ITEMISED for Tax Property, two separate set of entries for tax and calculated interest or charge amount are raised.

- When Consolidation Method is set to ITEMISED for Charge Property, two separate set of entries are raised. One for charge calculated amount and another for waived amount.

If this attribute is left blank, the reverse and replay happens during COB, EOD or AA.RR.SERVICE service for any backdated transaction. If the value is NEXT.CAP, the reverse and replay happens during next capitalisation date and adjustment bills are raised for the changes (if any). This attribute is applicable only for Accounts Product Line.

This attribute allows the user to define the Internal Account or Account Class or PL category against which the NCFC (Non Customer Facing Charge) due or pay type needs to be settled. This is mandatory, if the product involves a NCFC property.

If Adjust current period interest along with next cap? (FULL.ADJUSTMENT) is set (and Interest Adjustments due to back dated txns set to as Next Cap), and a back value dated activity is performed within the current interest period, the system

- Adjusts the interest accruals in AA.INTEREST.ACCRUALS table on the next capitalisation day

- Posts the capitalisation entries (on the next capitalisation date’s COB) for the respective value date

If Adjust current period interest along with next cap? is not set, and a back value dated activity is performed within the current interest period, the system adjusts the interest accruals (from the back-value date till current date) during the next accrual. If the back value dated transaction is outside the current interest period, only the current period interest adjustments are posted during the next accrual. The previous period’s interest adjustments are posted only during the next capitalisation day.

- Adjust current period interest along with next cap? (FULL.ADJUSTMENT) can be set only when Interest Adjustments due to back dated txns (ADJUSTMENT.OPTION) is set to as Next Cap. Else, the system raises a proofing error.

- The system raises a proofing error if the Adjust current period interest along with next cap? (FULL.ADJUSTMENT) field is set for any Product line other than ACCOUNTS.

Key Features of Soft Accounting

The following section describes the key features of soft accounting.

- An action can generate a number of accounting events.

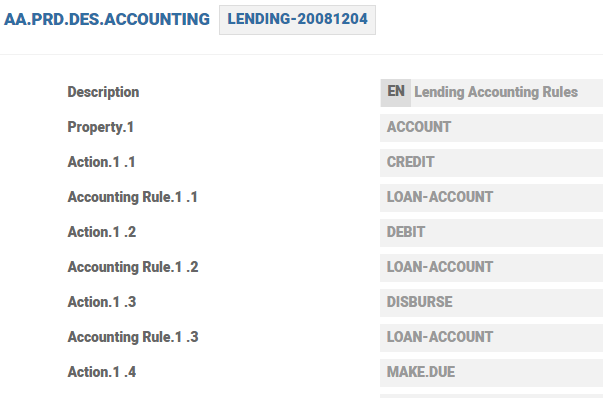

- For each Property, the allocation rule to be applied with each action has to be specified using the sub-valued Action and Accounting Rule attributes.

- The same Accounting Property Conditions are shared between multiple products, which are not in the same product group. So, accounting rules can be defined at the Property Class level, which increases the usability of the condition across products that reduces the definition of rules for each Property.

- Alternatively, a number of accounting conditions can be defined and the publishing process merges the content of the parent product condition with the record published.

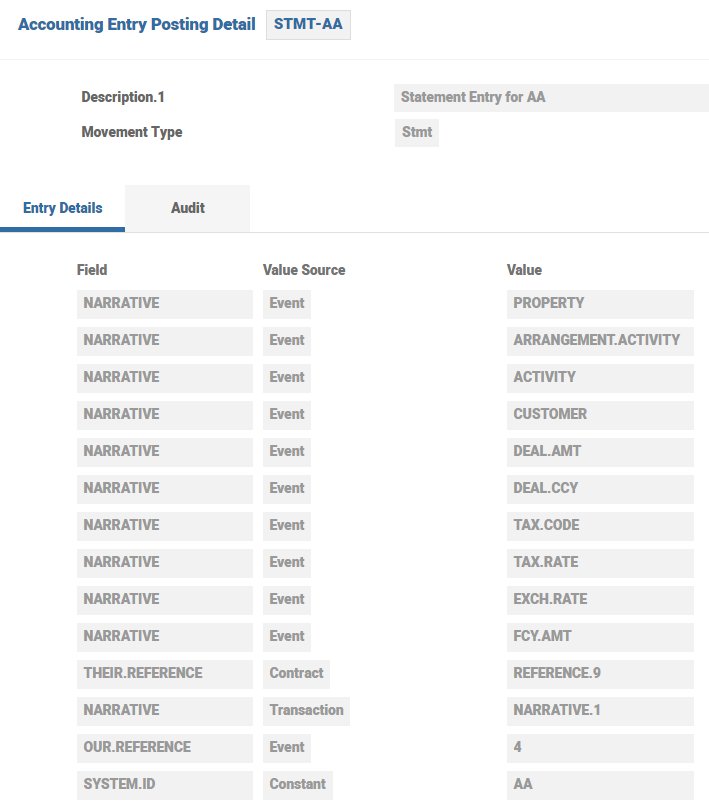

- The AC.POSTING.DETAIL application and its defined contents are used to control the mapping of values, that is, references and narratives of accounting entries, such as STMT.ENTRY, CATEG.ENTRY, and RE.CONSOL.SPEC.ENTRY.

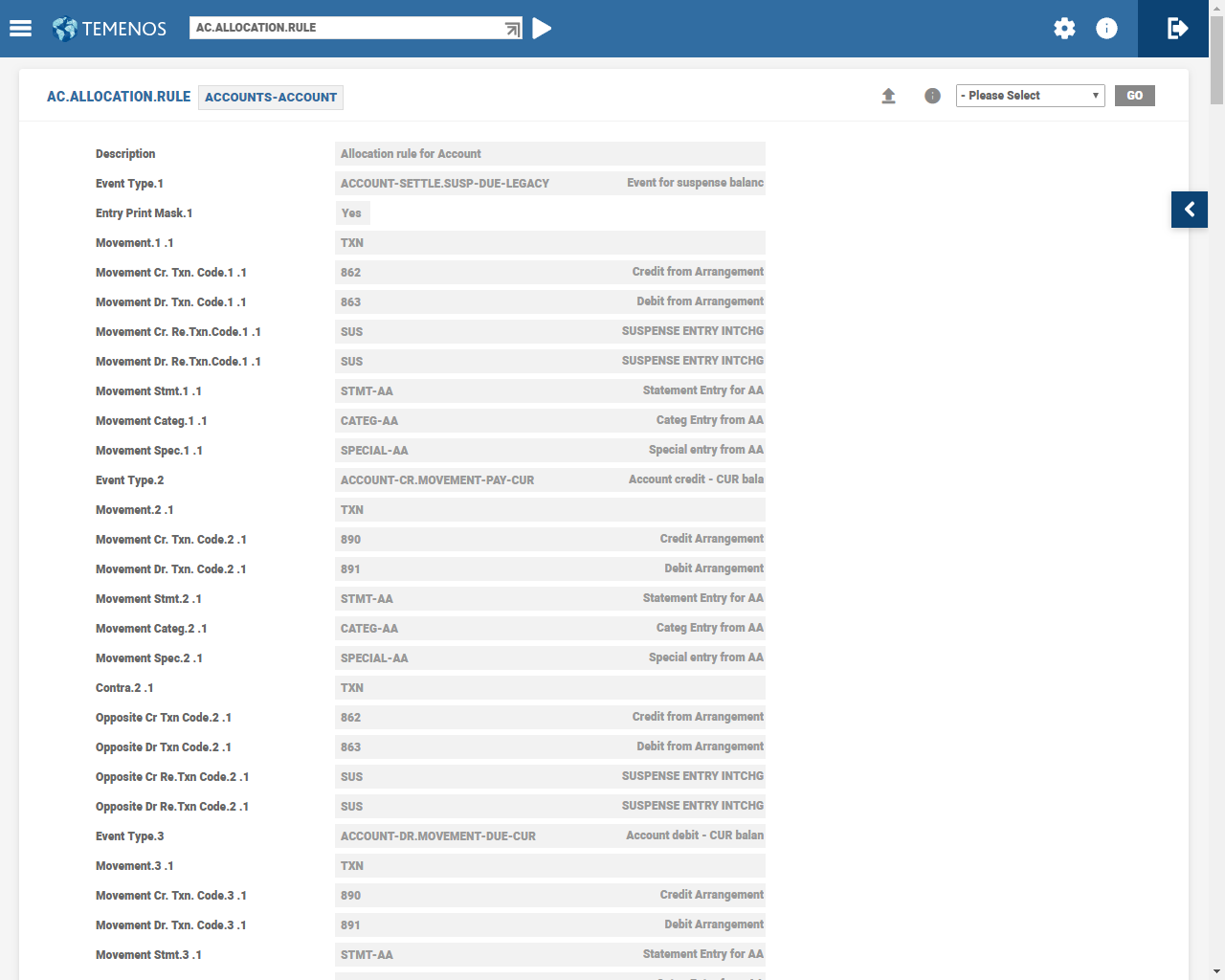

- A STMT.ENTRY (STMT-AA) record created in AC.POSTING.DETAIL for AA is linked to the AC.ALLOCATION.RULE table. This table is used to define accounting events used by the soft accounting processing where the event is used to identify mapping tables to determine the type of accounting entries to raise and the content of these entries.

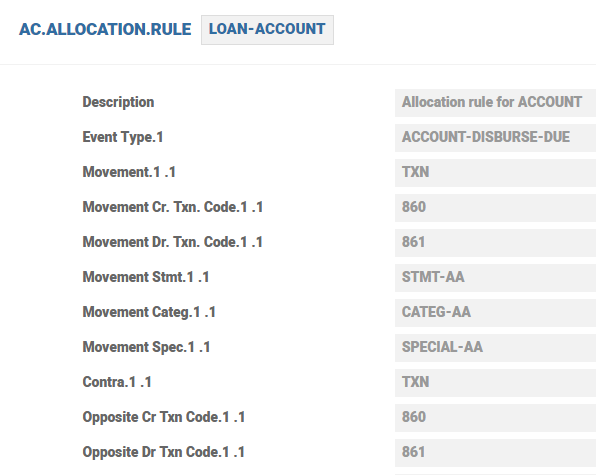

- In the AC.ALLOCATION.RULE table, debit and credit Txn Codes and Re Txn Codes, ACCOUNT.CLASS and AC.POSTING.DETAIL records are combined to create a catch all for each accounting event.

- If required depending on individual configuration, different tables can be created for different classes and purposes (that is, interest or overdue).

- The AC.ALLOCATION.RULE tables are then linked to the Product Condition records per Property.

- The Property attribute and its associated attributes (Action and Accounting Rule) along with Property Class attribute and its associated attributes (PC.ACTION and PC.RULE) are used to define allocation rules for the actions which need accounting based on the Property and Property Classes used in the Product.

- The Accounting condition also specifies the categories to be used when the opposite target is a P and L account. The Property multi-value set uses Booking Current Month, Adjust Current Month, Booking Previous Month and Booking Previous Year attributes to define the current month booking, current month adjustment, previous month booking and previous year booking of profit and losses respectively. Similarly, Property Class multi-value set uses the PC Booking CM , PC Adjust CM, PC Booking PM and PC Booking PY attributes.

- Each ACTION value as defined in AA.PROPERTY.CLASS can be allocated in these multi-value set of fields.

- Once the product has been published by AA.PRODUCT.MANAGER, these are the accounting rules that the contracts now ad-ea to.

- The AA module uses rules based accounting to control the accounting movement generation. Using the soft accounting set-up system, the actual accounting entries are generated or updated in Temenos Transact at given actions and events for each Property.

- It also describes the mechanism and relationships with Properties.

- Actions performed by Properties on an arrangement can result in the movement of one or more balances associated with that property. When a balance movement is required, the action generates an accounting event.

- The accounting event contains basic details of the change to the balance such as:

- Affected Balance

- Movement Amount

- Movement Sign

- Event (or Value) Date

- Arrangement ID

- Initiating Transaction Reference

- In AA processing, each event is targeted to an arrangement balance (which has to be defined in the AC.BALANCE.TYPE table).

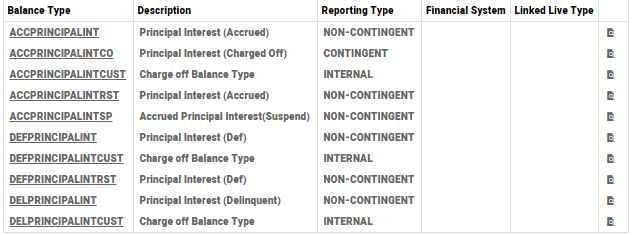

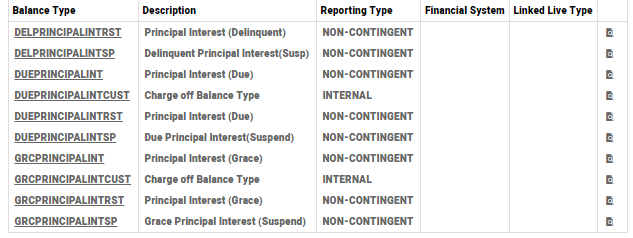

- For each BALANCE.PREFIX value defined in AA.PROPERTY.CLASSAccount record, a unique AC.BALANCE.TYPE record needs to be defined for accounting purposes.

- The IDs of these records are made up from a combination of these balance prefix values and AA.PROPERTY IDs associated with the Account Class.

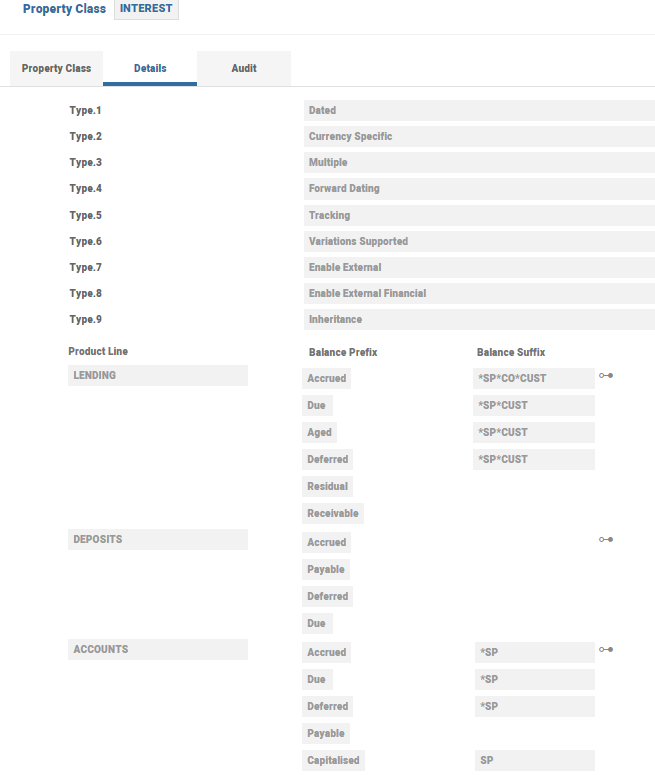

An example of this setup is shown below:

The AA.PROPERTY.CLASS Interest record has the following balance prefix defined.

An AA.PROPERTY record of PRINCIPALINT is then associated to the above account class. For this combination of setup, AC.BALANCE.TYPE records need to be established.

The individual AC.BALANCE.TYPE record can be configured as required. The Entry Type attribute specifies the type of accounting movement to be used when an entry is generated to this balance type through rules based accounting. The attribute allows specification of whether Stmt or Special entry types would be generated.

- Similar to traditional Temenos Transact accounts, the balances of the underlying arrangement accounts in the Accounts Product Line move from debit to credit or vice-versa based on the Signed Type attribute in AC.BALANCE.TYPE set to Yes.

- This attribute can only be set to Yes, if the prefix of the record ID is ‘CUR’, followed by an Account Property Class. For example, CURACCOUNT where Account is a Property of the Account Property Class.

- Each event raised by the action is the basis for generation of actual accounting entries. In Temenos Transact, three types of accounting entries can be generated from a single accounting event, such as:

- STMT.ENTRY – A movement to a Temenos Transact account optionally with a specific balance type. Accounts can be Customer, INTERNAL, or NOSTRO Accounts.

- CATEG.ENTRY – A profit and loss movement with a specific profit and loss category.

- RE.CONSOL.SPEC.ENTRY – A movement to the arrangement contract with a specific balance type.

- Each entry generated has a Transaction code that is used to identify the type of movement generated.

- An allocation rule is used to specify the types of entry and target account, balance type or profit and loss category that the event has to generate. It also specifies how the details of the entry record are to be built including the transaction code to be used.

- The AC.ALLOCATION.RULE application is where allocation rules are defined and has the following features

- Separate posting detail definitions for Special, Stmt and Categ entries for each event type for both Mvmt and Opp side. Movement Stmt, Movement Categ and Movement Spec attributes are mandatory input attributes and Opposite Stmt, Opposite Categ and Opposite Spec are optional. While creating the Mvmt side of the transaction, the Mvmt attributes are used and while creating the Opp side of the transaction, the Opp attributes are used, if they have been input but the Mvmt attributes is used, if the Opp attributes are blank.

- It is possible to specify both Txn Code and Re Txn Code for the same event to allow the correct transaction code to be used while forming entries. If for any event type the Txn Code or Re Txn Code has not been supplied, then it is possible the system to use the default codes provided in the Default Cr Txn Code, Default Dr Txn Code, Default Cr Re Txn Code and Default Dr Re Txn Code mandatory attributes.

- The entries in theMovement Stmt, Movement Categ, Movement Spec,Opposite Stmt, Opposite Categ and Opposite Specattributes have to be valid records in AC.POSTING.DETAIL application. The Event Type attribute holds a record from the AC.EVENT application and it holds descriptions about what the event does and are released by Temenos.

- Each accounting entry contains a number of detailed attributes. This contains information used by system in financial reporting and also in production of customer statements and other enquiries.

- Certain details in the entries generated as a result of the application rules can be configured, for example:

- System ID

- Customer Narrative

- Customer References

- Internal References

- The source and value of these details is specified in the AC.POSTING.DETAIL table which in turn is linked to the AC.ALLOCATION.RULE table.

- The soft accounting configuration is therefore flexible enough so any given accounting can be generated at any given event time.

- The Accounting Property is used to define the link between an Action for a Property product and the AC.ALLOCATION.RULE to be applied to the events generated by an action.

- The Property therefore allows the format, target and detail of accounting movements to be configured according to the product.

- The Interest Adjustment attribute has two options, such as NEXT.CAP and NULL.

- When Interest Adjustment option is selected as NEXT.CAP during the Close of Business, system recalculates the accrual amounts for all effected periods, adjustment entry is suppressed and posted only during the next scheduled interest capitalization date with the back value date.

- If the Method field in Payment Schedule is selected as PAY or DUE instead of CAPITALIZE amount is settled as per adjusted amount.

- When Interest Adjustment option is selected as NULL during the Close of Business, system recalculates the accrual amount for all effected periods and adjustment entry is posted during the close of business with back value date.

- AA Islamic Loans can now be configured to raise an upfront accounting for the total interest amount in order to allow banks to report the unearned income on financial statements.

- AA can now be configured to post the income from Interest and Charges to an internal account instead of PL.

- A loan can be marked as Non-Sharia for various reasons during the life cycle of the loan. Once the loan is marked as Non-Sharia, income from that loan is credited to charity account. The Internal account category to which the income or expense can be posted.

- Internal Booking attribute is used to Interest, Charge and Periodic Charge Property Classes. When this attribute is marked as YES, any income or expense is posted to the internal account category defined in Accounting condition as opposed to PL categories.

- Charges in AA can be made due or capitalised either in advance (by way of amortising) or directly made due or capitalised on the schedule date.

- The Accounting Product Condition needs to be configured for the necessary Charge Properties to be set to ACCRUE.

- The Accrue Period in this case, can only accept a value of SCHEDULE. This restriction is put in place to avoid any conflict of the accrual period and the actual make due or capitalisation period as defined in the Payment Schedule Condition.

- The Accrue Period SCHEDULE means that the accrual period has to follow whatever the schedule is, for that Property.

- This also means that the schedule itself could be a relative date (relative to Maturity or Renewal) or a fixed schedule or fixed periods (Last Day of the Month or Quarter, etc.).

- Back dated changes to the charge amount or payment schedule results in reversal and rebooking of the accruals.

- If an account is closed mid-period, any unaccrued portion of the charge is accrued and capitalised.

- If during assessment (scheduled or closure), because of a Charge routine or a Charge Adjustment routine, if the charge amount is different to what was initially set to be accrued, appropriate adjustments are done by the system based on the new amount.

Based on accounting requirements, the financial institutions vary the requirements on how accounting has to be done for charge waiver, tax and interest. In order to provide the option, following fields are added to Accounting Property Class to capture whether Net or Itemized accounting should be done.

- For charge, in order to differentiate the waived charge amount from the calculated charge amount , the system raises separate accounting entries for calculate charge and waived amount.

- For tax, the system exclusively raises separate set of accounting entries for tax or accounting, only for the net of tax amount.

- Property Class : This is a Charge ,Tax or Interest Property Class with a specific method for raising entries and can be used in conjunction with the Method defined in Method field.

- Method: This is a method that applies to the associated Charge or Tax Property Class. Anyone of the value ‘Net’ and ‘Itemized’ can be given and this field is mandatory if Property Class is populated.

- Property: This is a Charge or Tax Property with a specific method for raising entries. This is used override the method defined at the property class level.

- Method: This is a method that applies to the associated Interest or Charge Property. The options are identical to Method and this field is mandatory if Property field is populated.

Following are the methods added to the Charge, Tax and Interest Properties:

- Net

- If Net option is defined for Charge Property Class or Property, then net of the calculated amount and the waived amount can be generated as a single entry.

- If Net option is defined for Tax Property Class or Property, then accounting can be done only for the net of tax amount as explained below in the accounting example.

- If Net option is defined for Interest Property Class or Property, then one STMT.ENTRY record is generated. Depending on the calculation the netted amount of interest is generated and posted.

- Itemized

- If Itemized option is defined for Charge Property Class or Property, then two separate set of entries for charge calculate amount and waived amount can be raised.

- If Itemized option is defined for Tax Property Class or Property, then there is possibility of raising of two separate set of entries for Tax and Calculated interest or charge amount.

- If Itemized option is defined for Interest property, then two STMT.ENTRY records are generated for the

- Credit Interest amount.

- Debit Interest amount.

If the payment method (debit interest) is set to Due, it is possible for both the options Net and Itemized to raise the same accounting as netting is not possible. Similarly, tax on charges is also enhanced to raise accounting based on the Tax consolidation method configuration.

Accounting Property Class is enhanced to include the below fields through which bank can define whether Net or Itemized accounting is to be done for Tax and Charge.

Tax Consolidation set to Net

| Pay Method "Capitalize" - Debit |

Pay Method "Capitalize" - Credit |

Pay Method "Due" |

Pay Method "Pay" | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

|

Dr/Cr |

Balance / Account |

Amount |

Dr/Cr |

Balance / Account |

Amount |

Dr/Cr |

Balance / Account |

Amount |

Dr/Cr |

Balance / Account |

Amount (USD) |

|

Dr |

CUR<Account> |

(110) |

Dr |

ACC<Interest> |

(100) |

Dr |

DUE<Interest> |

(100) |

Dr |

ACC<Interest> |

(100) |

|

Cr |

ACC<Interest> |

100 |

Cr |

CUR<Account> |

90 |

Cr |

ACC<Interest> |

100 |

Cr |

PAY<Interest> |

90 |

|

Cr |

Tax Account |

10 |

Cr |

Tax Account |

10 |

Dr |

DUE<TAX> |

(10) |

Cr |

Tax Account |

10 |

|

|

|

|

|

|

|

Cr |

Tax Account |

10 |

|

|

|

Tax Consolidation set to ‘Itemized’

| Pay Method "Capitalize" - Debit |

Pay Method "Capitalize" - Credit |

Pay Method "Due" |

Pay Method "Pay" | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

|

Dr/Cr |

Balance / Account |

Amount |

Dr/Cr |

Balance / Account |

Amount |

Dr/Cr |

Balance / Account |

Amount |

Dr/Cr |

Balance / Account |

Amount |

|

Dr |

CUR<Account> |

(100) |

Dr |

ACC<Interest> |

(100) |

Dr |

DUE<Interest> |

(100) |

Dr |

ACC<Interest> |

(100) |

|

Cr |

ACC<Interest> |

100 |

Cr |

CUR<Account> |

100 |

Cr |

ACC<Interest> |

100 |

Cr |

PAY<Interest> |

100 |

|

Dr |

CUR<Account> |

(10) |

Dr |

CUR<Account> |

(10) |

Dr |

DUE<TAX> |

(10) |

Dr |

PAY<Interest> |

(10) |

|

Cr |

Tax Account |

10 |

Cr |

Tax Account |

10 |

Cr |

Tax Account |

10 |

Cr |

Tax Account |

10 |

Accounting engine can be populated with the following values in narrative field of statement entry raised for Tax account:

- Customer Number

- Deal Amount

- Deal Currency

- Tax Code

- Tax Rate

In case of foreign currency transaction, it is possible for the exchange rate and foreign currency amount to be populated.

A Int Waive CM attribute is introduced in Accounting Property Class, to input P&L category for waived charges

Accounting Property Class allows defining amortization period as ‘Renewal” for commission properties that require amortizing the commission until renewal date of the financial contract.

When Amortization period is set to ‘Renewal’ for a commission, amortization of charge is done until renewal date of the corresponding financial contract.

For example, if a loan contract is created on Jan 1, 2016 with renewal date as Jan 1, 2021 and the commission is configured to be paid to be upfront, then the commission calculated is amortized linearly over a period five years that is, from Jan 1, 2016 to Jan 1, 2021.

In case, renewal date is not available, maturity date of the financial contract is used for amortization. This can happen when renewal conditions are not defined or the contract is in the final rollover period.

- In case Renewal date and maturity date is not available, that is, in case of a call contract or non-term based arrangement, whenever the commission is made due, system books it to PL instead of processing it through the amortization process.

- For any reason if the ‘Renewal date’ changes, system amortizes the remaining un-amortized amount until the new renewal date.

Accounting Property Class defines the branch PL that is used for commission booking. BOOKING.COMPANY specifies the company’s GL to be used for booking income or expense.

Available options are:

- Arrangement or None

- Customer

- Financial Arrangement

When the attribute is defined in Agent Product or Financial Product:

- Arrangement or None – Booked against Agent Arrangement’s Branch PL

- Customer – Booked against Financial Arrangement’s Customer Branch PL

- Financial Arrangement – Booked against Financial Arrangement’s branch PL

The Interest Adjustment attribute is only applicable to AR Product Line. The proofing and publishing process validates this configuration and if it has been configured for any other Product Line system produces a suitable error message.

CATEGORY codes are available for Income and Expense.It is possible to configure negative rate PL categories in Accounting Property Class.

| Field | Description |

|---|---|

| PC Neg Booking CM | It specifies the Profit and Loss category code that is credited ordebited when booking negative rate accruals for the current month for the associated Property Class. |

| PC Neg Booking PM | It specifies the Profit and Loss category code that is credited or debited when booking negative rate accruals for the previous month for the associated Property Class. |

| PC Neg Booking PY | It specifies the Profit and Loss category code that is credited or debited when booking negative rate accruals for the previous year for the associated Property Class. |

| Neg Booking CM | It specifies the Profit and Loss category code that is credited/debited when booking negative rate accruals for the current month for the associated property. |

| Neg Booking PM | It specifies the Profit and Loss category code that is credited or debited when booking negative rate accruals for the previous month for the associated Property. |

| Neg Booking PY | It specifies the Profit and Loss category code that is credited or debited when booking negative rate accruals for the previous year for the associated Property. |

Under specific conditions, it may be necessary to mask STMT.ENTRY records from being printed in the customer statements, passbook printing and enquiries. The Entry Print Mask field in the AC.ALLOCATION.RULE table is used to do this. This is an associated multi valued field with Event Type; when this field is set to Yes, it is possible for the statement entries raised by this Event Type to be masked and the field in PRINT.MASK in STMT.ENTRY to be set to Yes. The entries can only be masked for an Event Type if:

- The STMT.ENTRYs are raised over the same account

- The sum of entries net to zero

Publishing - Merging property conditions

With standard business Property Classes (For Example: Interest), a Defined Property defined for a Child Product overrides a Defined Property specified for a Parent Product. The ACCOUNTING property allows merging of conditions between the child and parent product at the time of publishing.

When published, the Accounting Property Class is merged with the published parent definition as follows:

- The Parent Record is taken as the base record.

- Property definitions in the child record override the parent record definition if already defined.

- Child property definitions that do not appear in the parent record are added to the base record.

Publishing Validation and Errors

At publishing time, the system applies the following specific validation to the Accounting Property that is to be published:

- All properties and associated actions that result in the generation of accounting events must be specified in the property definition

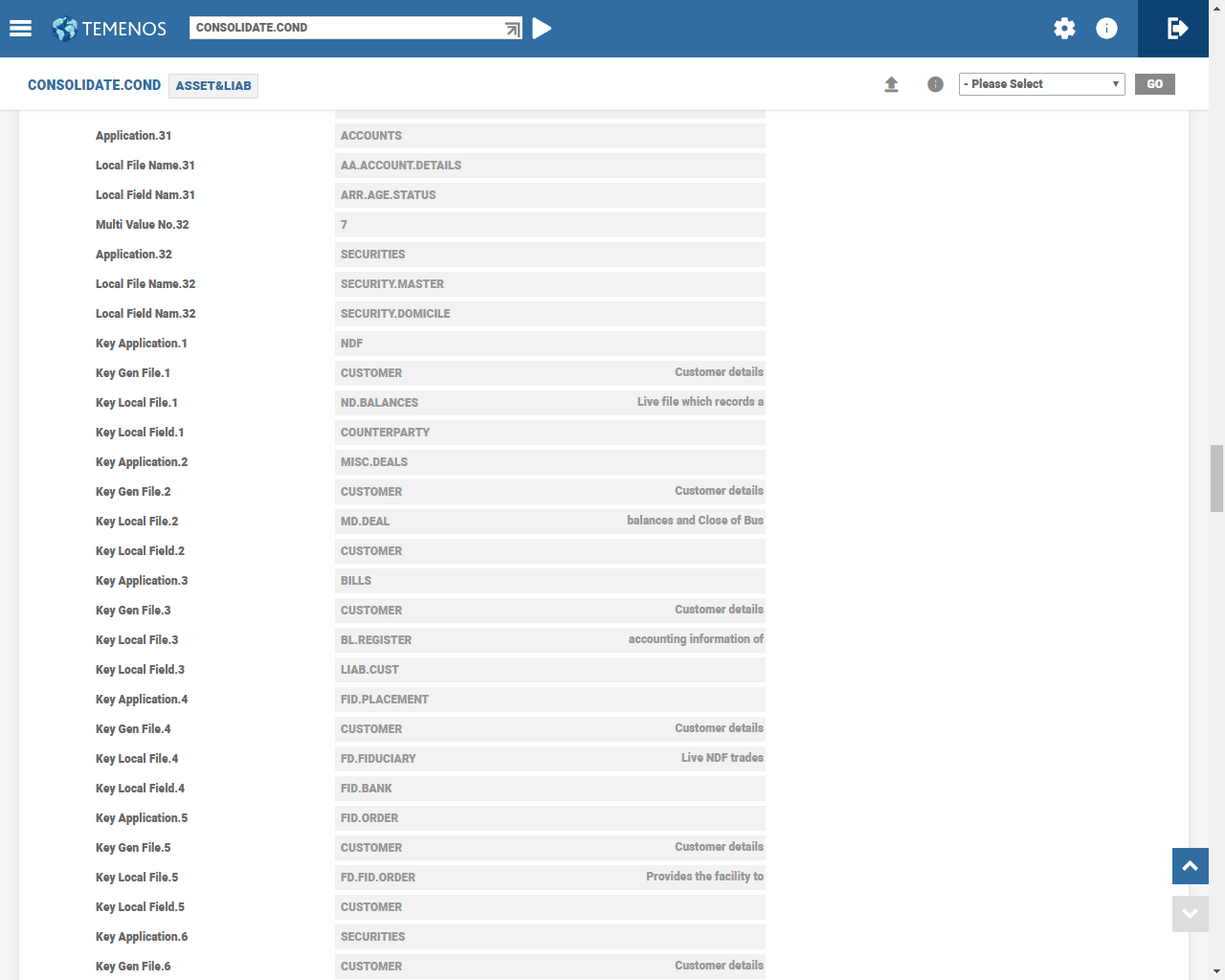

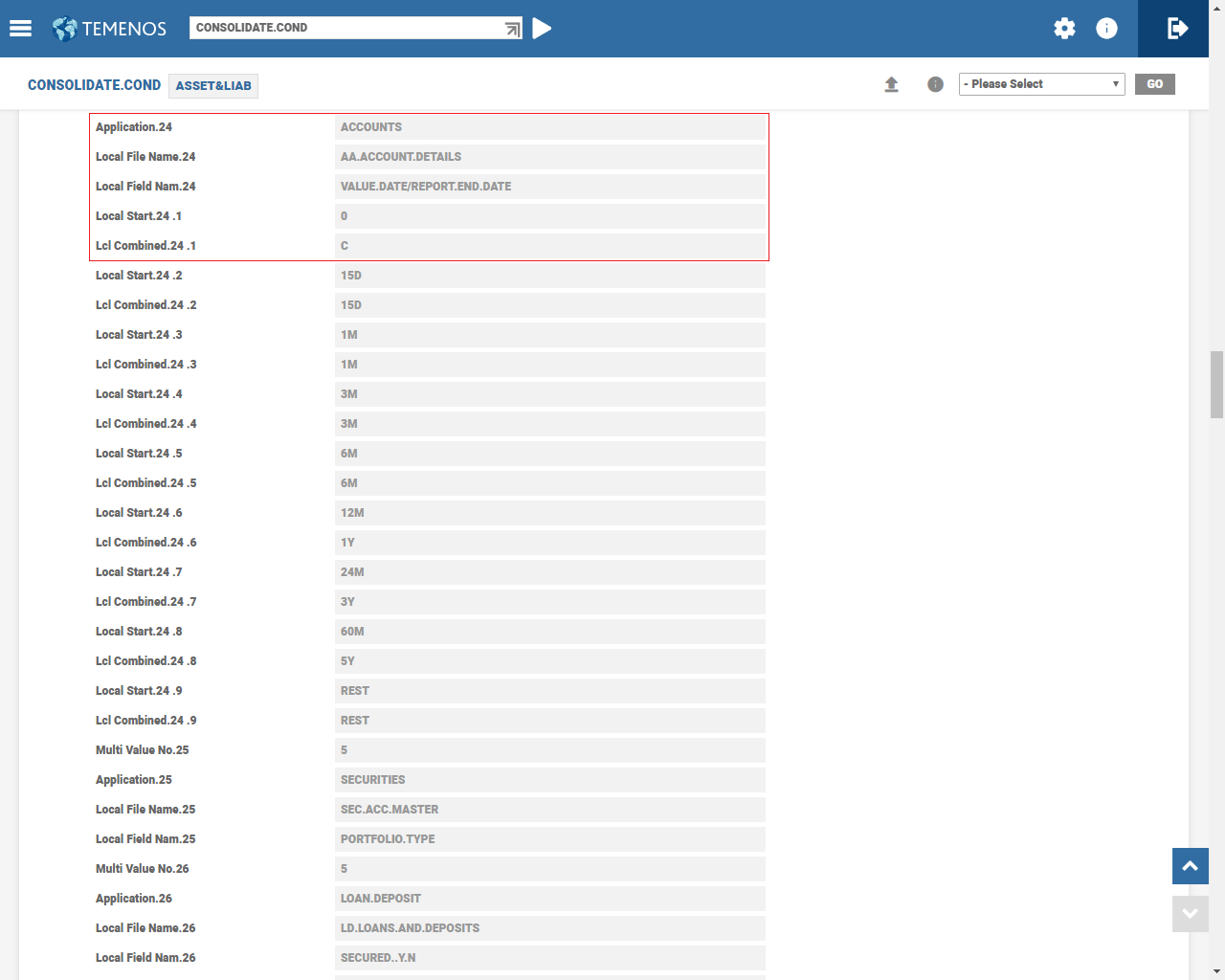

AA contracts can be reported, if required, based on the TERM or MATURITY date and overdue status of the contract. The CONSOLIDATE.COND records needs to be configured for ACCOUNT to accept fields from AA.ACCOUNT.DETAILS, the consol key is built based on the values defined in this record.

Configuration for Aging Status

CONSOLIDATE.COND is set to Age.

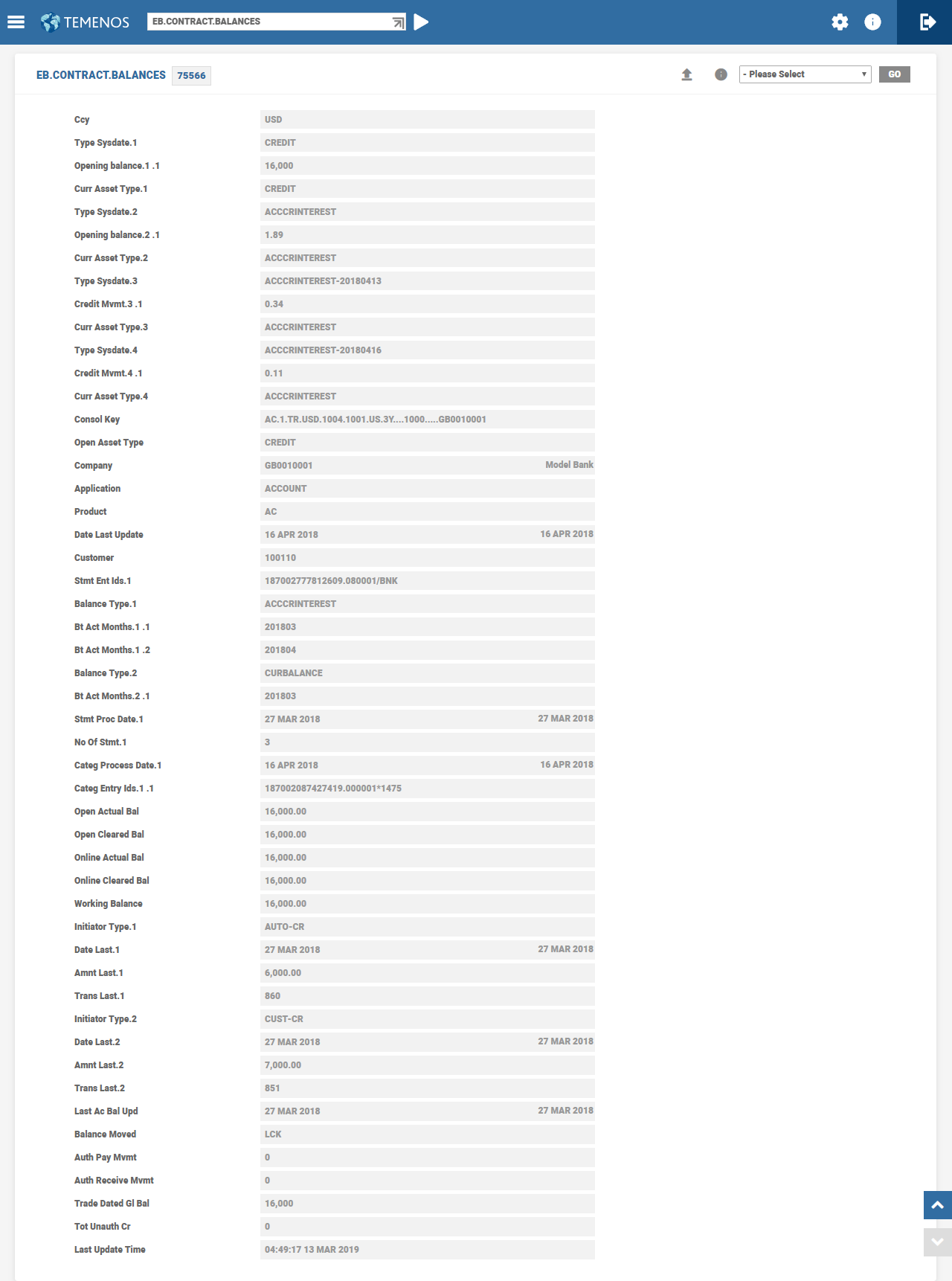

The above screen shot depicts the CONSOLIDATE.COND record configured when we require the consol key in EB.CONTRACT.BALANCES to be updated with the aging status of the arrangement.

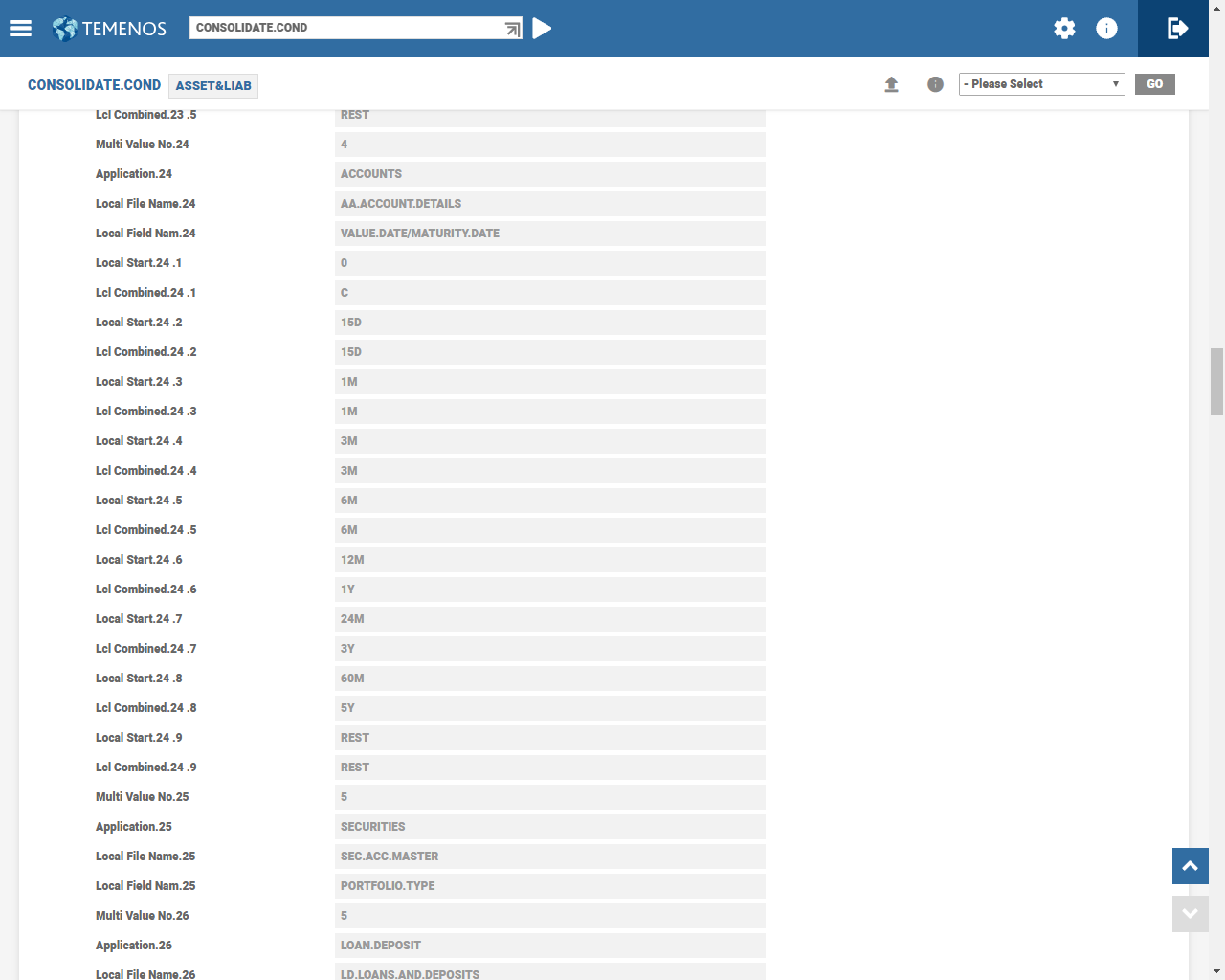

Configuration for START.DATE or VALUE.DATE or MATURITY.DATE

The system can be configured one of two ways but not both.

- VALUE.DATE or MATURITY.DATE combination.

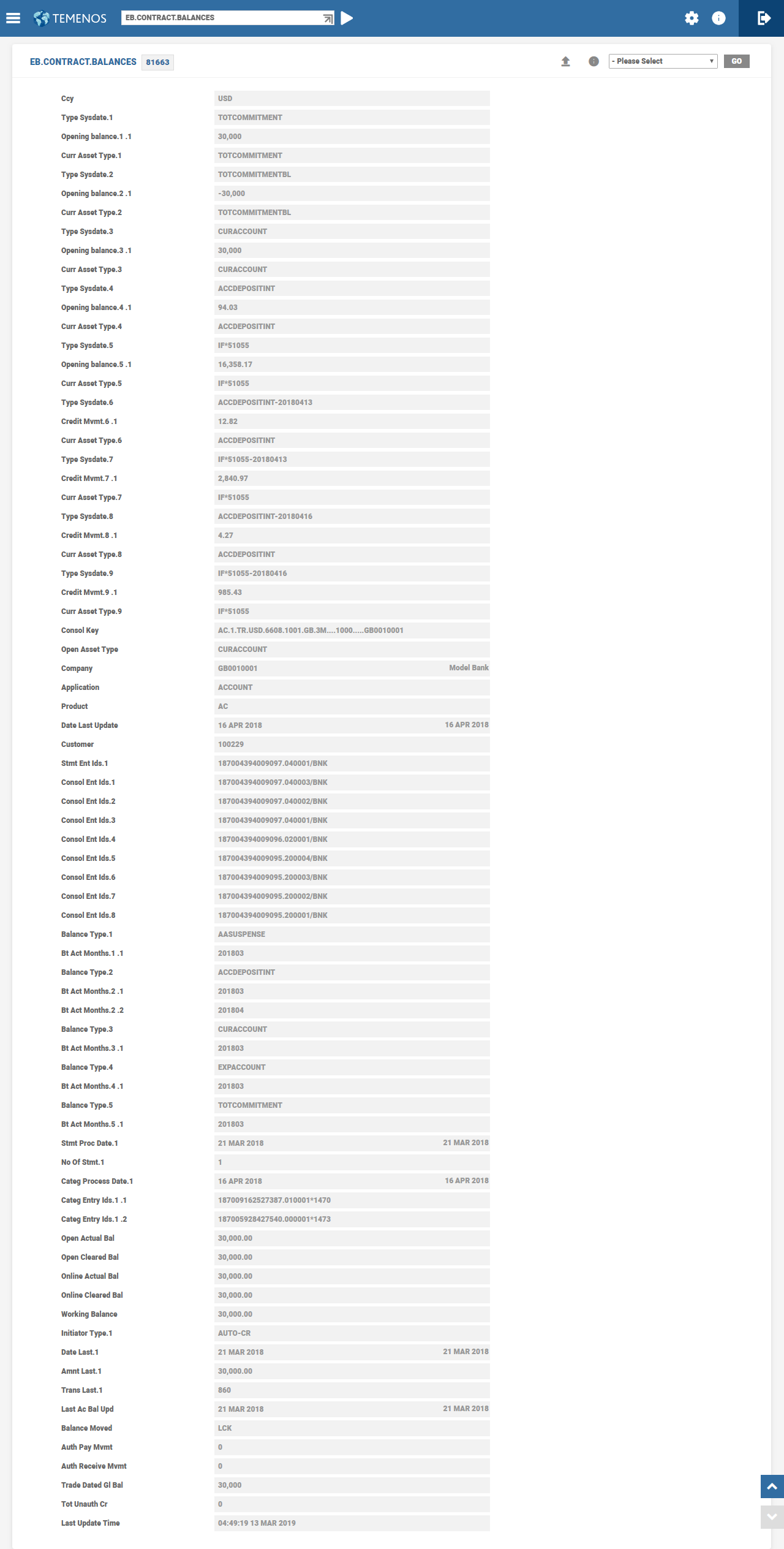

For the EB.CONTRACT.BALANCES to be updated with the difference of Value Date to Maturity Date the following configuration can be made.

CONSOLIDATE.COND set as Value Date or Maturity Date.

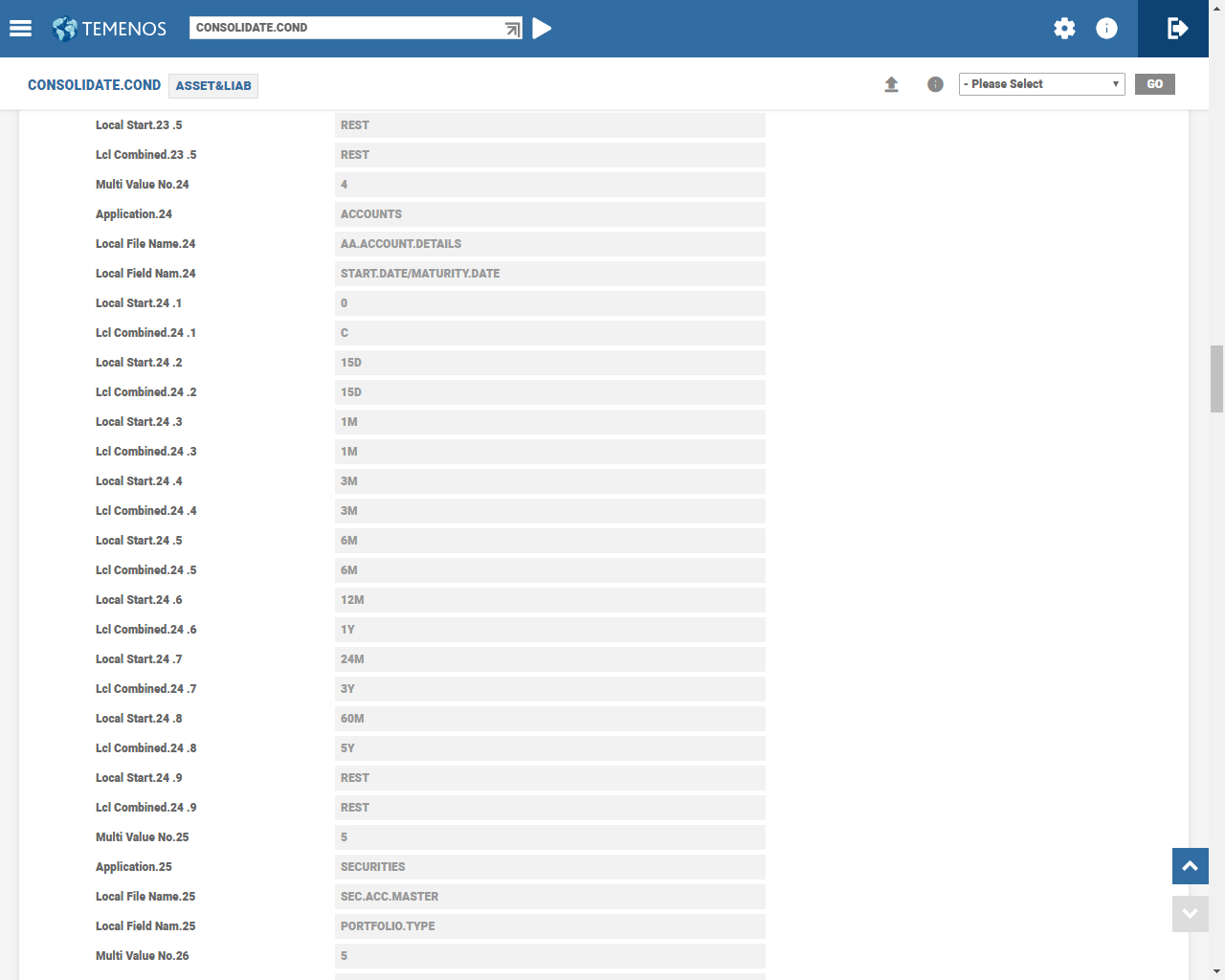

- START.DATE or MATURITY.DATE combination.

For the EB.CONTRACT.BALANCES to be updated with the difference of Start Date to Maturity Date the following configuration can be made.

CONSOLIDATE.COND set as Start Date or Maturity Date.

In this case CONSOLIDATE.COND has been configured for VALUE.DATE or MATURITY.DATE and ARR.AGE.STATUS as detailed above.

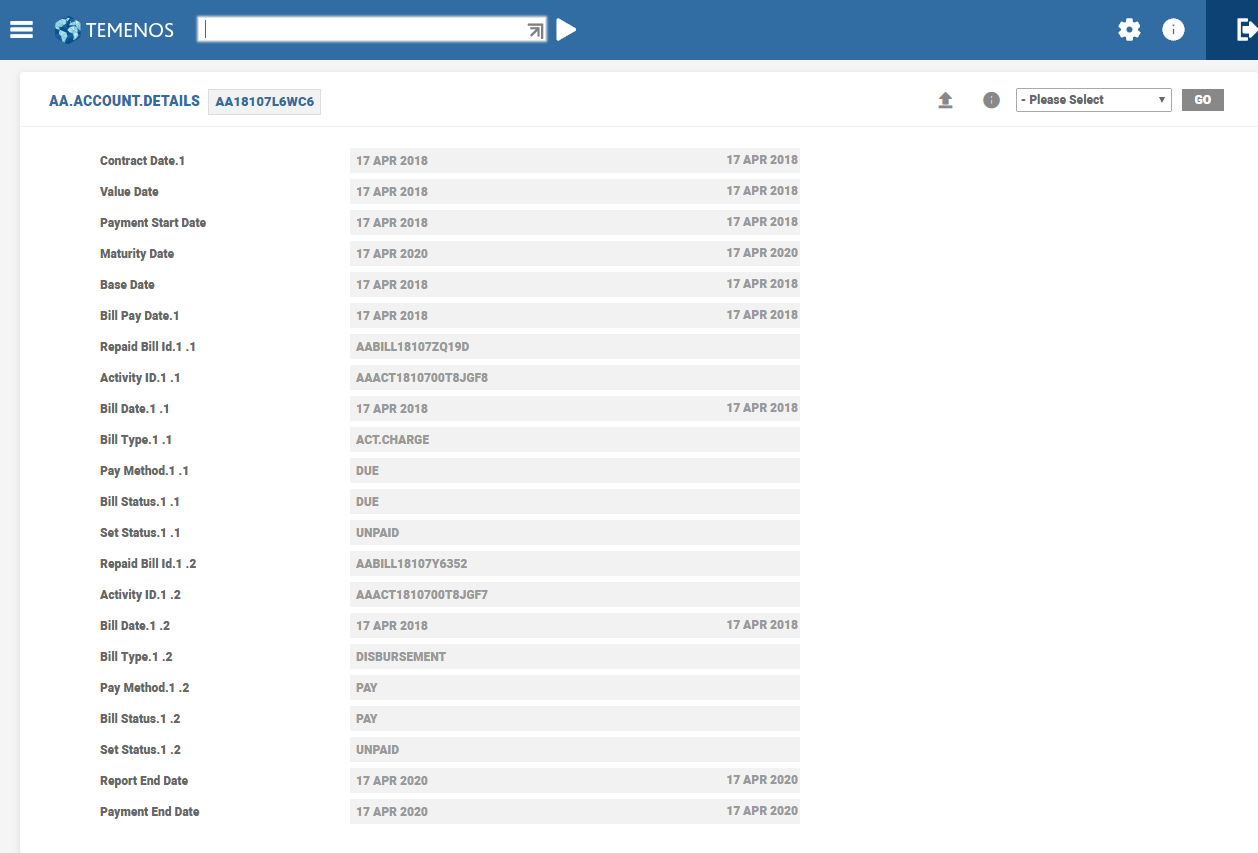

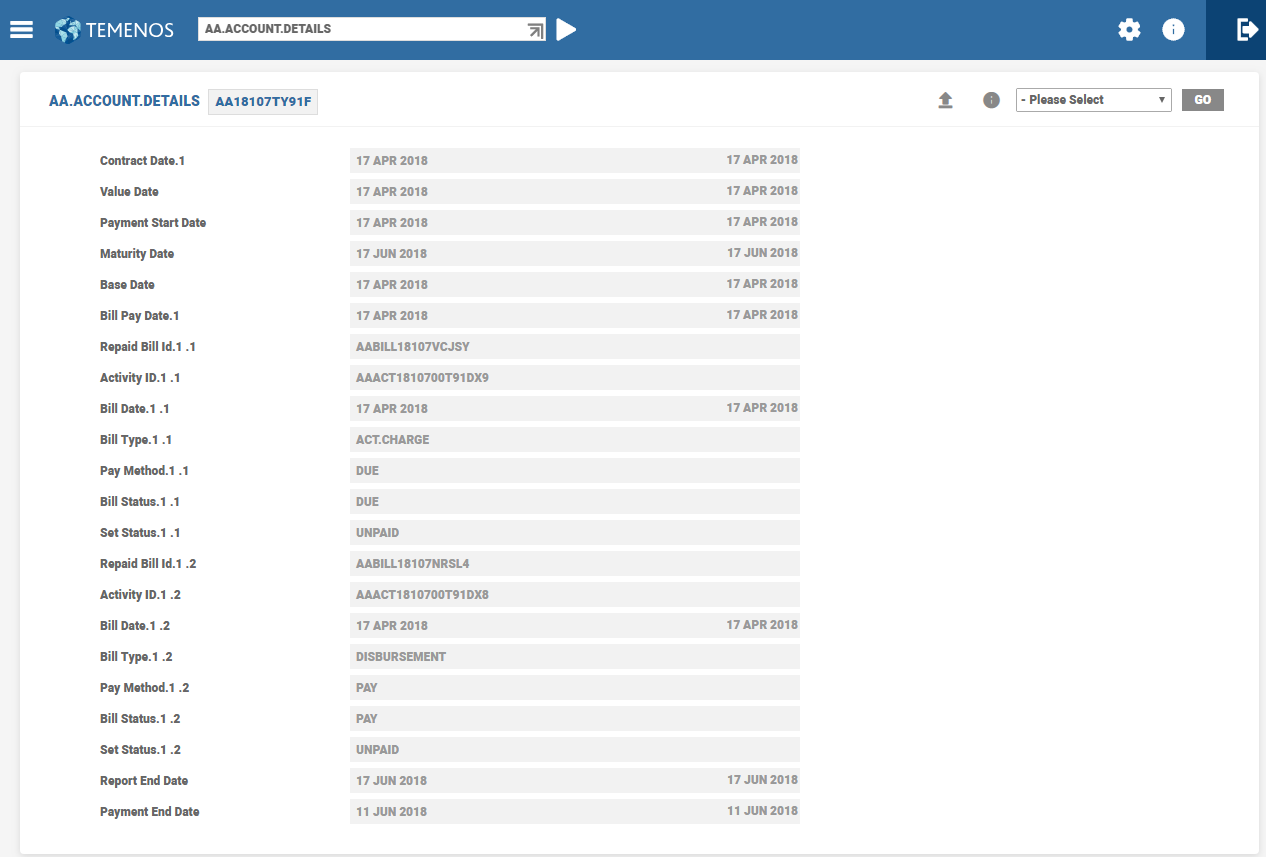

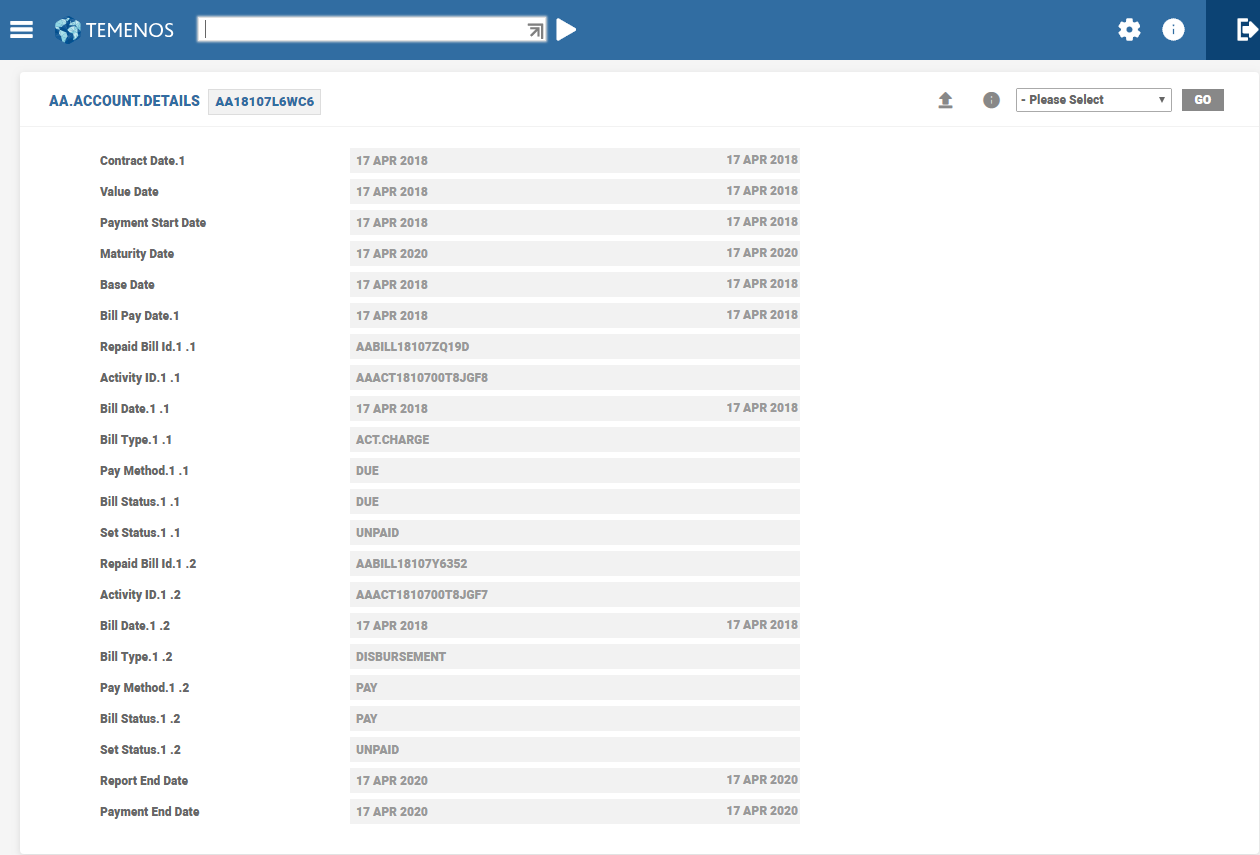

AA.ACCOUNT.DETAILS showing a duration more than 24M.

The EB.CONTRACT.BALANCES is updated with the appropriate bucket that is 36M as in the below screenshot.

CONSOL.KEY is built with 36M.

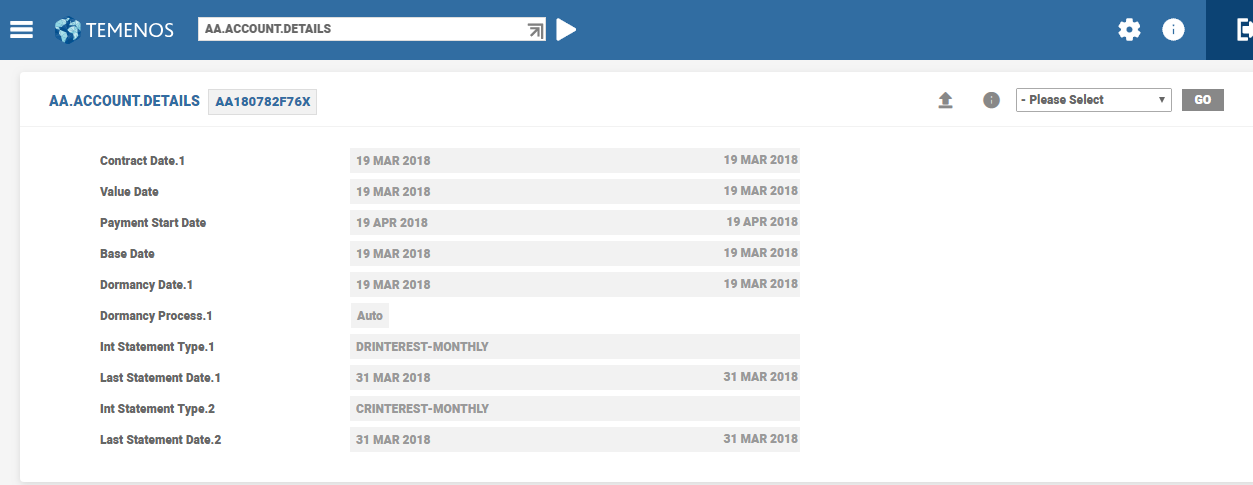

In this case CONSOLIDATE.COND has been configured for START.DATE or MATURITY.DATE.

AA.ACCOUNT.DETAILS showing a duration more than 2M.

CONSOL.KEY is built with 3M.

Here we observe the difference between START.DATE and MATURITY.DATE is close to 2 months so it should fall in the 3 month bucket as per the set up in the CONSOLIDATE.COND.

If the system has to report call accounts in the General ledger the following set up is optional and can be configured if required, this adds additional details like field name, value date and report name to the CONSOLIDATE.ASSET.LIAB key and >EB.CONTRACT.BALANCES records.

In AA.ACCOUNT.DETAILS file, Report End Date field updates

- The next renewal date if it precedes the maturity date, or

- The maturity date if there is no renewal scheduled before the maturity date, or

- NULL if it is a call contract and there is no renewal scheduled.

For example, when the call contract (arrangement) is created with change product scheduled on 01/06/2011, then it is possible for the Report End Date field to be updated as 01/06/2011. On crossing the renewal date, if there is no further renewal is scheduled, Report End Date field gets updated as null.

When change product is scheduled on 29th Dec. 2000, Report End Date is updated as shown below :

On crossing the scheduled changed product and when there is no further renewal activity scheduled for a call contract, Report End Date is updated as shown below:

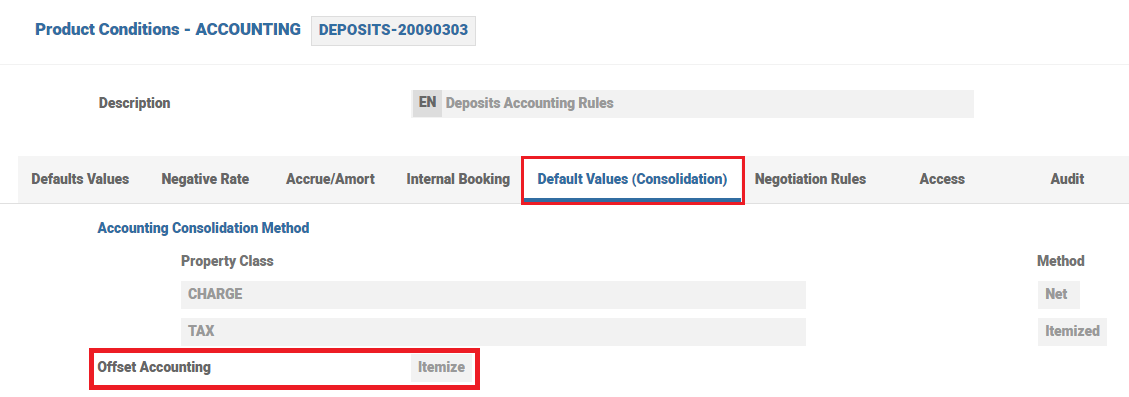

By default, the system generates combined entries for which the Offset Accounting attribute has to be set to blank in the Accounting Condition.

Separate accounting entries would be generated to offset charges against interest or principal components, when the Offset Accounting attribute in the Accounting conditions is set to Itemize. Related transaction codes with relevant descriptions for charge offset should be assigned for identification of entries.

The following section details the scenario, which results in different entries when Offset Accounting is set as Itemize.

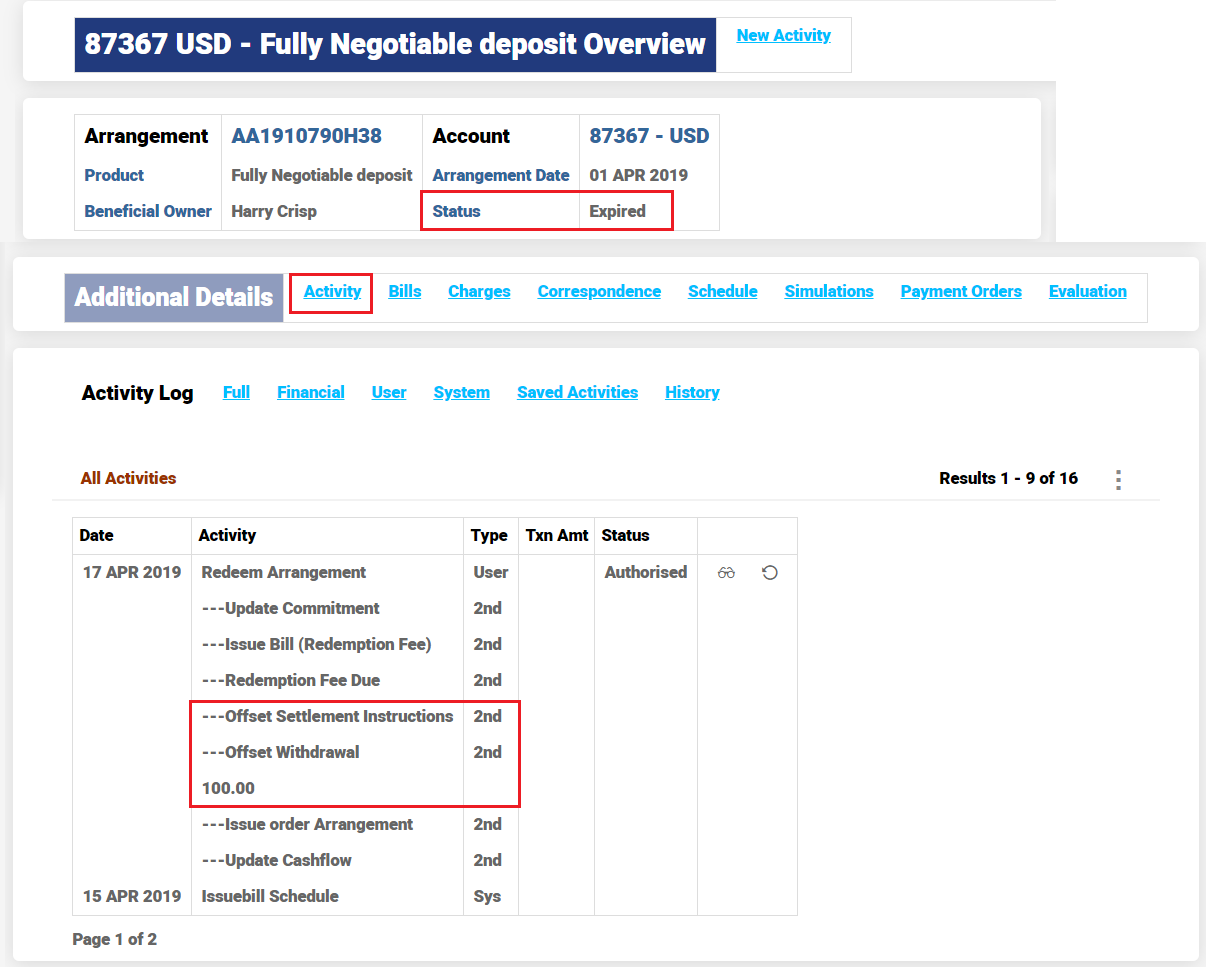

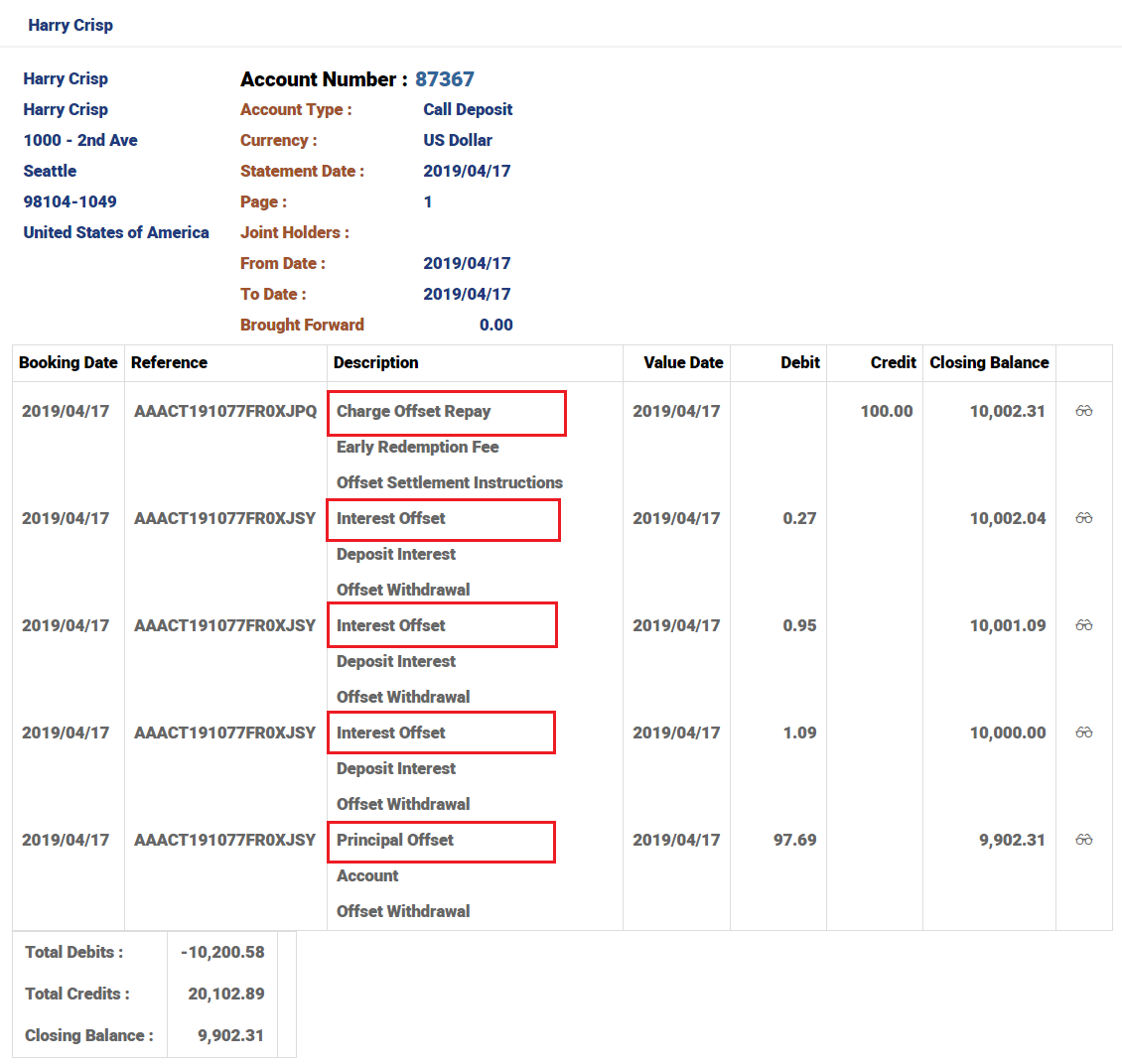

The bank user creates a deposit for 10,000 USD for a tenure of one year. As per the agreement entered into with the customer, when the deposit is pre-closed before the end of the tenure, the system applies pre-closure charges. Since Offset Accounting is set as Itemize, the system offsets the charges against interest, account and displays as separate entries in the account statement.

Overview of the arrangement after pre-closure of deposits displayed below.

The system posts separate entries for charge offset against interest and account. The account statement reflects the same as shown below.

For FASB, which is a regulatory body in US, all loan origination related fees or costs both customer and non-customer are booked upfront and non-refundable in nature. Additionally, these CFC and NCFC charges are amortised over the life of the contract.

For a FASB compliant product, It is recommended to configure Accounting Product Condition as given below:

- Link all CFC and NCFC to Disburse activity since the real cashflow gets updated only upon disbursement.

- Set the Accrue Amort field uniformly to either Amort or Amort Defer in the Accounting condition. This field indicates the amortisation treatment of all associated FASB charge properties.

- Define a valid Internal Booking Account for handling NCFC.

- Define a valid Amort Category for handling CFC.

- Set all charges to amortise until maturity with or without defer option.

- The user can suspend or resume the accrual or amortisation of a ‘Credit’ charge when the underlying loan moves between performing and non-performing status.

- It is possible to setup whether Credit charge needs to be accounted immediately, amortized over life of the contract, or Amortization need to defer until end date (for instance, Maturity date, 12M, Renewal date etc.) by using the Accounting product condition setup.

The enquiries are modified to display entries based on Arrangement ID and Activity ID.

To avoid listing all the entries of an arrangement account, the TXN.ENTRY.MB enquiry provides a selection criteria to list the following:

- Entries are listed for an arrangement account based on the arrangement activity reference. The entry can be a statement entry, categ entry or spec entry. The user can search for entries based on arrangement activity reference, value date, booking date, trans reference.

- Entries raised during events like repayment from external applications (like funds transfer, teller etc) are listed.

More Actions Tab (Arrangement Activity)

- Entries related to a specific activity can be listed (using List of enquiries authorised) using the above tab.

Consider a loan arrangement is created with auto disbursement and an activity charge attached to new arrangement. An instalment is made due and repaid manually by the customer.

- The user can query TXN.ENTRY.MB using the Arrangement ID to list all accounting movements

- Or using the new arrangement activity to list the entries related to:

- Commitment movements of new arrangement activity

- Activity charges linked with new arrangement

- Auto disbursement, the credit to the settlement account

- If the repayment activity is queried using “List of entries authorised” it shows details related to that specific repayment activity only:

- Debit of the source account

- Credit to the arrangement account

Periodic Attribute Classes

The Accounting Property Class is not associated with any Periodic attribute class.

Actions

The Accounting Property Class supports the following actions:

| Action Name | Description |

|---|---|

| UPDATE | Allows the User to change any of the ACCOUNTING attributes. This action is initiated as part of the NEW-ARRANGEMENT and UPDATE-ACCOUNTING activities and amends the accounting rules. |

Accounting Events

The Accounting Property Class does not perform any actions that generate accounting events.

Limits Interaction

The Accounting Property Class does not perform any actions that impact the limits system.

In this topic