Introduction to Agency Commissions

ⓘContent enriched:New structure and revised (Docs 2.0)

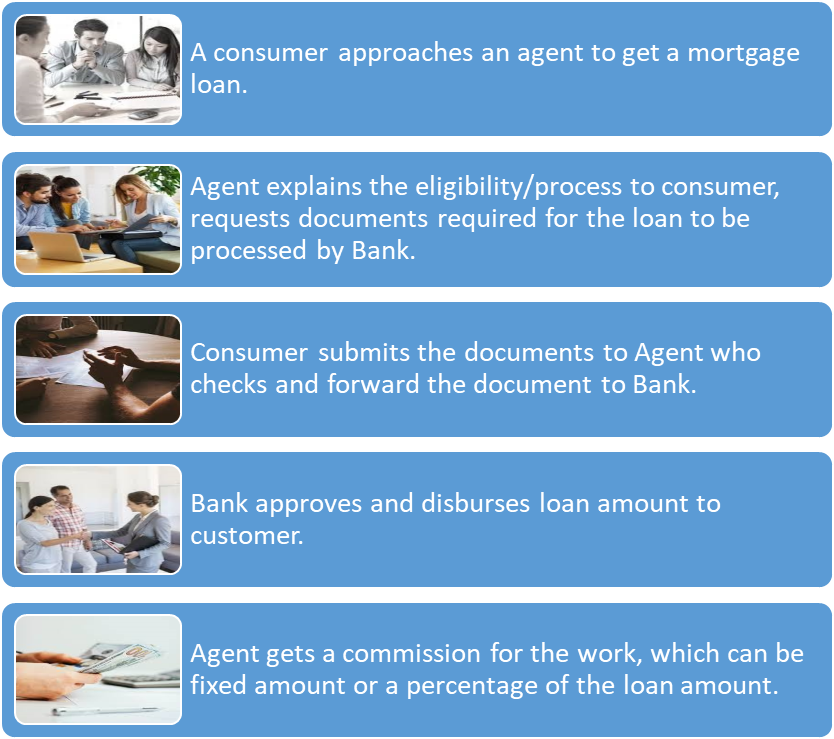

For financial marketplaces to function effectively, investing participants link up with those who require funds, which is not always direct. Financial intermediaries smoothen this flow of funds to needy participants by linking them and providing essential services.

An agent refers to an individual, group of individuals or firm or company playing the role of an intermediary between the consumer and the bank or financial institution.

To assist the consumers, an agent or broker

- Takes up preparatory work or other pre-contractual administration of loan agreements

- Support in their execution between consumers and the bank.

- Maintain details of the customer transaction and follows up on subsequent events between both parties.

Agents can facilitate consumers availing loans for acquisition of homes, cars, expenses on vacations, weddings, medical expense and business needs. They also support the bank or financial institution and the customer, in the process of opening an account and booking a deposit.

Agents are paid one-time through commissions. When an agent facilitates a contract between the consumer and the bank, they get a fixed amount or a percentage of the amount.

In case of loans and deposits, they can also get commission on regular intervals (say monthly) during the life-cycle of the loan or deposit.

A typical consumer-agent-bank process workflow is shown below:

In Temenos Transact , the Agent Product Line is part of the Retail Banking Suite. It facilitates the agreement of terms and conditions between banks / financial institutions and agents.

The Agency Commission (AG) module along with AA framework provides the agency or brokerage requirements to link with the financial AA products such as loans, deposits, accounts, external products (financial products marketed by the bank for a fee) and safe deposit box.

The Agent Product Line offers to create products, which enable commission payment to the agent who are sourcing the business for the bank.

The features of AG module are:

- Activity-based commission

- Online commission

- Scheduled commission

- Volume-based commission

- Context value-based commission

- Clawback of commission

- Deferring commission

- Multiple agents

Configuring Agency Commission

This topic helps the user to design module level configuration.

AGENT in AA.PRODUCT.LINE application provides the base definition of the business components that are required to create a product under the Agent Product Line.

The Product Commission Property Class defines the Product Lines, Product Groups and Products that qualify for commission. This Property Class links all other AA financial Product Lines and allows any arrangement to be included in an agent’s commission.

For the agents to receive commission payments, the financial arrangement and the product associated to it must have the Agent Commission Property Class included in the financial product.

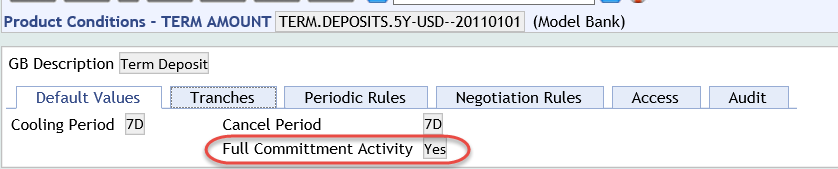

An agent can receive a commission payment once at the time of either full funding of deposits or full disbursement of loans. To achieve this, the Full Commitment Activity field has to be checked as Yes in the Term Amount Product Condition.

The activities can then be configured in the Product Commission Property to trigger the payments.

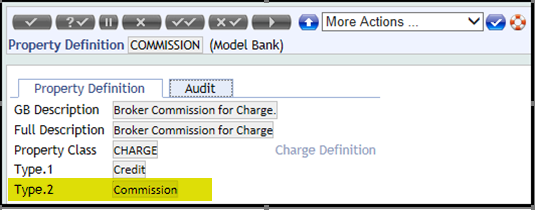

AG module allows the user to configure the AA.PROPERTY application to pay commissions to agents or intermediaries. Different types of payments made to agents or intermediaries are defined in the Charge Property class.

- In the

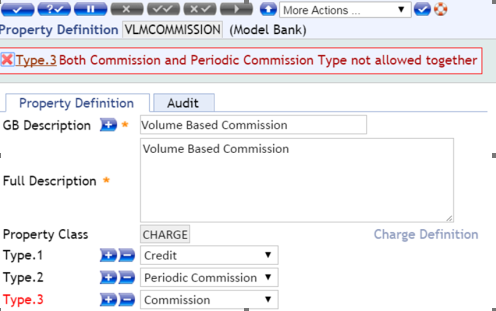

AA.PROPERTYapplication, the user has to define the Property Type field as Commission.

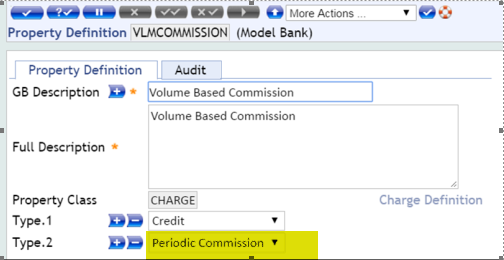

- For volume-based commission, online payment of commission is disabled. This can be paid only through batch service on a defined periodic frequency. To define such property condition, the user has to define the Property Type field as Periodic Commission.

- Both Commission (to pay online) and Periodic Commission (to pay at regular frequencies) values cannot be defined in the Property Type field, being mutually exclusive.

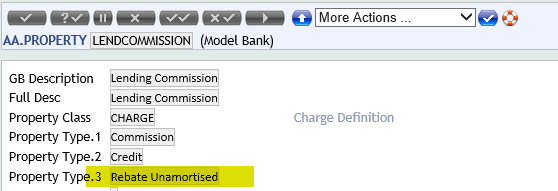

- When a loan or deposit is pre-closed before the contracted period, the commission paid to agents at the time of initiation can be claimed back (claw back). For a Charge Property to be eligible for claw back, the user has to update the Property’s Type field as Rebate Unamortised.

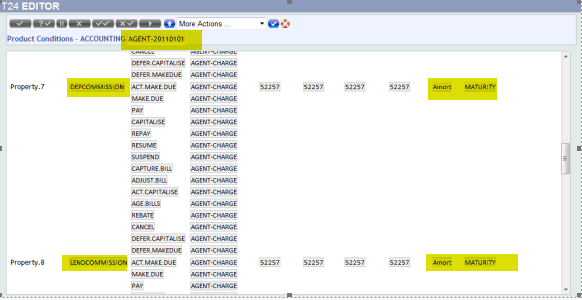

A commission paid previously to an agent can be recovered in case the contract, loan or deposit is terminated before the agreed period. To implement the commission claw-back, it is required to set up amortization in the Accrue or Amortise field of Accounting Product Condition.

The following are the set of Activities that are also used in the AG module:

Using the below Activities, commission can be paid as one time amount on loan disbursement or funding of deposits:

- Full Disbursement Activity (LENDING-FULL.DISBURSE-ARRANGEMENT)

- Full Funding Activity (DEPOSITS-FULL.FUND-ARRANGEMENT)

These Activities are used when the commission has to be paid only if the entire loan is disbursed or deposit is fully funded.

As an additional check, the Term Amount Product Condition has a field called Full Commitment Activity, which is updated as Yes to trigger the one time commission payment to agents.

The Disburse committed funds (LENDING-DISBURSE-TERM.AMOUNT) and Apply payment rules for arrangement (DEPOSITS-APPLYPAYMENT-PAYMENT.RULES) Activity Classes can be used to initiate the payment of commission to the agent every time the Activity is triggered (which can be multiple times).

For example, commission is paid every time a deposit is partially funded.

The following Activity Class is applicable only for Charge Properties with Property Type field defined as Commission. The commission payment is performed online or scheduled.

AGENT-TRIGGER-<CHARGE>*MONTHLY

Where, <CHARGE> in the above Activity specifies Charge Property and frequencies are defined in AA.AGENT.COMMISSION.FREQUENCY. For example, AGENT-TRIGGER-ACCHARGE*MONTHLY, where ACCHARGE is a Charge Property.

Online processing is done using Update Activity Charges (AGENT-TRIGGER-<CHARGE>) while Scheduled processing is done by appending the frequency after the Charge Property.

The ACTIVITY.CHARGES-CALCULATE.COMM action calculates and processes the commission on the agent arrangement.

The <PRODUCT.LINE>-HANDOFF-AGENT.COMMISSION*<FREQUENCY>Activity Class is used for financial arrangements that pay scheduled commissions to its agents:

This applies to all the financial arrangements linked with an agent, creating an agent event record which provides the balances for commission calculation; the balances are the same as that used to calculate interest for the arrangement.

Consider the commissions on deposits are paid on a monthly frequency, the linked Interest Property is DEPOSITINT and the interest is calculated on the CURACCOUNT balances.

The Handoff activity for Agent Commission (DEPOSITS-HANDOFF-AGENT.COMMISSION*MONTHLY) schedules commission processing.

This creates an agent event record on the scheduled processing date with the details that are used for calculating DEPOSITINT; Commission is calculated on the same CURACCOUNT balance based on which DEPOSITINT is calculated and the frequency of commission payment is monthly.

A commission paid online is set up for amortization at the agent arrangement and in case, the financial arrangement is pre-closed before the contracted period. At the agent arrangement, the Recognize Product Commission (AGENT-RECOGNIZE-PRODUCT.COMMISSION) Activity for amortization recognizes the pending unamortised amount to P&L (Profit and Loss).

Different frequencies have to be created for defining scheduled commission.

A virtual table in EB.LOOKUP called AA.AGENT.COMMISSION.FREQUENCY, with different frequency records, is used for creating different frequencies. Records created in the virtual table are available for input into the Schedule Name field in the Product Commission Product Condition.

Sample from virtual table EB.LOOKUP > AA.AGENT.COMMISSION.FREQUENCY and the frequencies are given below.

The frequency names created are appended to the Activities when scheduled commissions are defined.

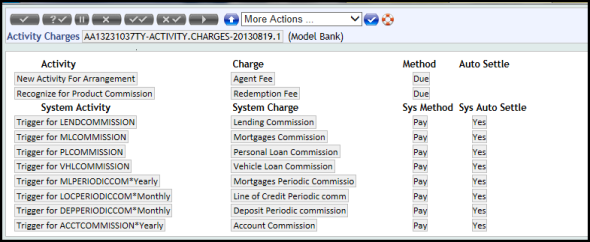

Commission processing on agent arrangements can be triggered and processed using the Activity Charges Property Class. When a charge is configured in Product Commission, the system automatically creates an Activity Charge record for it. This update is done when an agent arrangement is created and monitored for changes to Product Commission conditions at the arrangement level.

The following Activities are used:

- For online commissions, the system captures the Trigger Activity for Accharge (AGENT-TRIGGER-<CHARGE>). For example, AGENT-TRIGGER-ACCHARGE.

- For scheduled commissions, Trigger Activity for Accharge (AGENT-TRIGGER-<CHARGE>*<FREQUENCY.NAME>) is used. (For example, AGENT-TRIGGER-ACCHARGE*MONTHLY)

In the Activity Charge Property, the system defaults the following fields.

The Sys Activity Id field defaults the Activity that can attract a charge. The Sys Charge field has the Property value of the charge, which is used to calculate commission based on the associated Activity.

The Sys App Method field is associated with the method of payment. It can be updated as,

- Due - If the associated charge is a debit.

- Pay - If the associated charge is a credit.

The Sys Auto Settle field is associated with the auto-settle method of the associated commission, which is always updated as Yes.

The system fields in Activity Charge record are updated as shown below:

When the system fields in activity charges are updated as shown above, it means:

- Online commissions namely LENDCOMMISSION, MLCOMMISSION, PLCOMMISION and VHLCOMMISSION are used to pay to the agent.

- Scheduled commissions namely MLPERIODICCOM, LOCPERIODICCOM, DEPPERIODICCOM and ACCTCOMMISSION are used to pay yearly, monthly, monthly and yearly respectively.

To cater for the automatic payment of commission, it is mandatory that the TSA.SERVICE record BNK/AA.AGENT.COMMISSION.SERVICE is active for processing the eligible commission payments.

This is a system maintained table used to hold information on the event raised by financial arrangement to raise commission in agent arrangement.

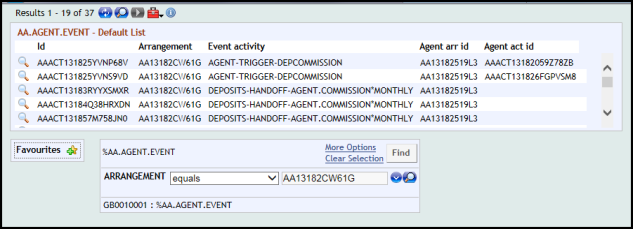

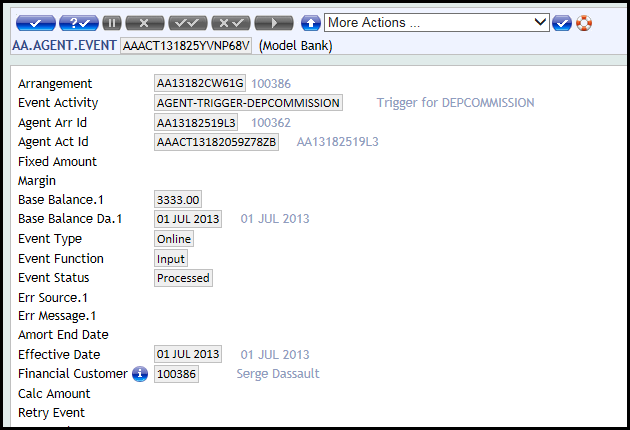

A sample AA.AGENT.EVENT is given below.

The application stores each commission payment event with AA.ARRANGEMENT.ACTIVITY (AAA) ID. The Event Activity field holds the activity reference which triggers the agent commission.

The Event Type field holds either Online or Scheduled value to indicate that the event is for processing online or scheduled commission.

The Event Function field represents if the agent event is for Input or Reverse (for reversal) of commission.

After running the batch service, the AA.AGENT.EVENT record is created and the status is updated as New in the Event Status field. On processing, the status of the event moves to Processing, Processed or Error, which is based on the success or failure of the commission payment process.

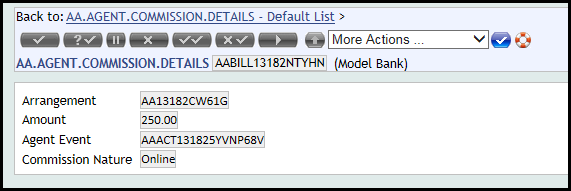

AA.AGENT.EVENT record.The commission calculated from each financial arrangement is stored in AA.AGENT.COMMISSION.DETAILS. This information is useful while sending account statements to agents and showing how the scheduled commission amount was derived.

- The record Id in this application is the ID of

AA.BILL.DETAILSlinked to the agent arrangement. - The Arrangement field is the financial arrangement that triggered the commission payment.

- The Amount field has the amount of commission paid.

- The Commission Nature field details the type of commission. In this case, it is an online event.

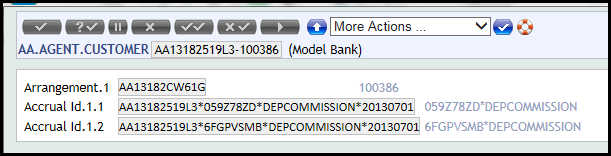

The AA.AGENT.CUSTOMER application is a live file, which is used to maintain a tree like structure between agents, their customers, and customer’s arrangements. The record is created at agent and customer level and stores their arrangements and EB.ACCRUAL IDs of commissions paid out.

EB.ACCRUAL ID gets stored only when the commission is amortised on the agent arrangement.In the example below,

- AA13182519L3 – Agent arrangement ID

- 100386 – Customer, whose financial arrangement is linked to the agent’s arrangement.

The Arrangement field has the customer’s financial arrangement’s ID. The Accrual Id multi-value field has EB.ACCRUAL for the agent arrangement records. The format of the ID is Arrangement*Unique reference of the AAA record*Property*Date.

Illustrating Model Parameters

Product Conditions of a Property Class are evaluated to bring out the features of the Property Class. The values in the Product Condition are defaulted in an arrangement during its creation. The negotiability or default values and other restrictions are also defined in the Product Condition. These Product Conditions along with the Properties derived from the Property Classes are grouped together to build Products.

Product Conditions are dated and some of them have currency as part of their ID. When currency forms part of the Product Condition ID, then the user has to create different conditions for each currency in which the product is available. When a new condition is created or an existing condition is amended, the product that is linked to the condition has to be proofed and published.

|

S.NO |

Parameters |

Description |

|---|---|---|

| 1 | PRODUCT.COMMISSION

|

This Property Class is used to configure financial Product Line / Product Group / Products those are eligible for commission calculation. It provides the option to calculate commission (Online/Scheduled) as either percentage or fixed amount with an option to claw-back commission when generated business is closed ahead of the agreed term |

| 2 | AGENT.COMMISSION

|

This Property Class allows to setup linkage between financial product and corresponding Agent arrangement. Blank Agent Commission is attached to financial product in turn referring to Product Commission condition setup at Agent. |

Illustrating Model Products

Retail Agents (AG) Product Line provides the broker commission functionality for Temenos Transact and allows the user to create Affiliated/Non-Affiliated agent arrangements using the AA framework under the AGENTS Product Line.

|

S.No |

Product Name |

Product Attributes |

|---|---|---|

| 1 | Affiliated Agent | Agent with Scheduled commission enabled for Long Term Deposit and Account |

| 2 | Non Affiliate Agent | Agent with commission enabled for activities on Financial Arrangement |

| 3 | Negotiable Agent | Fully Negotiable Agent commission can be enabled for any activity. Both Online and schedule commission could be set while arrangement creation. |

| 4 | Manufacturer | Agent with Commission enabled for third party manufacturers |

In this topic