Introduction to Transaction Restriction

The Transaction Restrictions module allows the bank to define stop instructions for an account, which is evaluated when a payment or booking request is processed on the debit account. This module provides an exception approval flow when the stop instruction is triggered on a transaction.

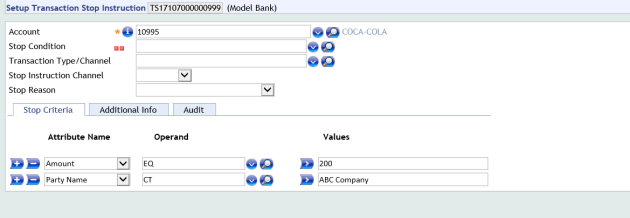

The transaction stop instruction defined for the account can be specified to be in place for an indicated period of time. The stops can be defined using generic attributes such as cheque number, amount, party identifier and party name. The user can combine the attributes to define the stop criteria such as amount less than a specific value and cheque number in a specific range.

- For amount, user can use the operands equal, range, less or equal and less than.

- For cheque number, user can use the operands equal and range.

The module has several parameterisation tables allowing the bank to:

- Define the transaction sources.

- Determine which are in scope of stop check.

- Customise what can be captured in a stop instruction.

- Define how to handle a transaction which matches at least one stop instruction.

Based on configuration, the Temenos Core Banking System verifies transactions initiated via Generic Account Interface (GAI also known as OFS clearing) to find if they are in scope of stop check. If it is in scope, the transactions are evaluated to verify if they satisfy the stop instructions set on the account:

- If the transaction matches a stop instruction and the default decision is to return, then GAI rejects the entry (SNP mode) or post this to suspense (SSS or SAO) and creates an AC.FUNDS.AUTHORISATION record as an investigation item.

- If the transaction matches a stop instruction and the default decision is to pay, then GAI processes the transaction further but creates an AC.FUNDS.AUTHORISATION record as an investigation item.

- If the transaction does not match any stop instruction, the entry is processed further.

Core Banking provides an enquiry to monitor the investigations items. The process to post or return the transaction raised by the GAI based on the outcome of the account or payment officer decision is covered by local implementations.

Other business applications (for example, Temenos Payments Hub (TPH) are linked with the Transaction Restrictions module. The stop instruction check is not triggered at the account layer. The sources, which are in scope of stop check are parameterised and the business application invokes a stop check API, provided by Temenos Core Banking, and handles the response returned for the stop check.

Product Configuration

The parameterisation of the Transaction Restriction module is covered using the following tables:

- TZ.TRANSACTION.STOP.PARAMETER – It stores the main parameters that apply to stop instructions. For example:

- Default expiry days, the day after which cancelled and expired stop instructions are moved to history.

- Duplicate check criteria for stop instructions.

- TZ.TRANSACTION.STOP.TYPE – It allows the bank to define stop types (usually per source or channel) and specifies various match type rules which meet the stop instruction. For each match type a decision on how to handle the transaction is specified. The transaction can be either returned or paid but an investigation process is triggered for the user to confirm the system decision.

- TZ.TRANSACTION.STOP.CONDITION – This can be used when the bank wants to impose limitations on the stop criteria, which can be captured by the user. For example, stop by cheque number and amount.

- TZ.TRANSACTION.STOP.MAP.RULES – It allows the bank to define the transaction sources for which the stop instructions are checked and how the value of the stop attributes can be extracted from the transaction.

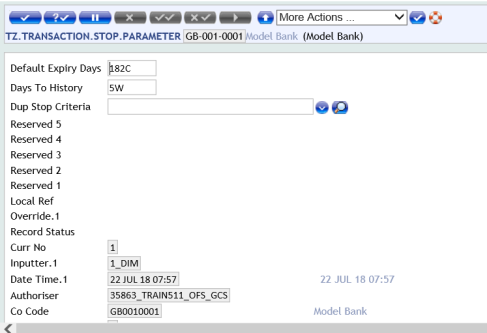

The TZ.TRANSACTION.STOP.PARAMETER allows the bank to define:

- Default Expiry Days (for the stop instruction) – If Default Expiry Days is parameterised here and if Expiry Date is not captured in the instruction, the Expiry Date is automatically set at the authorisation of the stop instruction. The Default Expiry Days is added to the current business date to determine the expiry date. Maximum allowed is 999W or 999C.

- If this field is set to 90C, then the Expiry Date in the TZ.TRANSACTION.STOP.INSTRUCTION is calculated by Core Banking as the current business date plus 90 calendar days.

- If this field is set to 90W, then the expiry date in the Transaction Stop Instruction is calculated by the Core Banking as the current business date plus 90 working days.

- If this field is blank, it is not defaulted by Core Banking.

- Days to History – This field indicates the number of working days after which a cancelled or expired stop Instruction is moved to history (max 99W).

- Dup Stop Criteria –This field allows the bank to indicate a duplicate criteria (defined via Temenos Transact standard duplicate check feature – EB.DUPLICATE.TYPE application) that is applied when a transaction stop is created to verify if the same transaction stop instruction is already entered.

When a new transaction stop instruction is entered or amended, the system verifies the appropriate record in the TZ.TRANSACTION.STOP.PARAMETER table. If a duplicate stop criteria (EB.DUPLICATE.TYPE) is indicated here, the duplicate validation is triggered. Before the details are passed to EB.DUPLICATE table, the attribute names are ordered alphabetically to ensure the duplicate check does not depend on the order of the stop attributes in the stop instruction.

The following screenshot shows the TZ.TRANSACTION.STOP.PARAMETER.

The following instructions are setup on Account 12345678:

| Transaction Stop TS1234 | Transaction Stop TS2354 |

|---|---|

|

|

According to the Dup Stop Criteria defined earlier, these two instructions are actual duplicates, though the order in which the attribute name, operand and values indicated in the instruction is different.

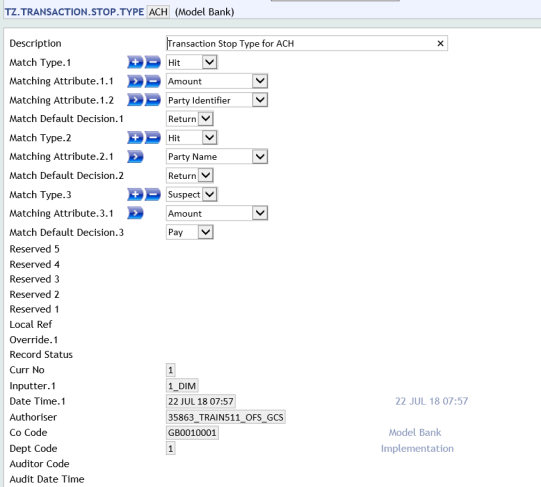

The TZ.TRANSACTION.STOP.TYPE table allows the bank to define stop types (usually per source or channel) to specify various matching types. One or more matching types can be defined by combining attributes which once matched, the stop instruction is considered satisfied, irrespective if not all of its criteria are actually met.

For each matching type, a default decision on how to handle a transaction that matches at least one instruction are also defined here:

- Return – The transaction is rejected

- Pay – The transaction is posted

The rules defined here are evaluated in order. A stop is found when a match type is met. The default decision of the satisfied matched type is considered and the next match type rule does not get verified.

Consider that the stop instruction on Account 12345678 has the following stop criteria:

- Amount Equal 100.

- Party Name Equal ABC company.

An ACH transaction REF123 is received and evaluated against the rules defined in this. The transaction is on the Account 12345678, amount 200, party name is ABC Company and party identifier is AB123456.

The amount and the party identifier in the transaction does not match the amount in the stop instruction. Party identifier is not part of the stop criteria and therefore the first match type in the ACH record is not satisfied. The next match type is based on party name. As the party name in the transaction and stop instruction is equal, the second match type is satisfied and the default decision of this match type is to reject the transaction.

Another ACH transaction REF129 is received and evaluated against the rules defined in the ACH record. The transaction is on the account 12345678, amount 100, party name is XYZ Company and party identifier is XY123456.

The amount and the party identifier in the transaction does not match the amount in the stop instruction. Party identifier is not part of the stop condition and therefore the first match type in the ACH record is not satisfied. The party name in the transaction and stop instruction is different and therefore the second match type is not satisfied. The amount in the transaction and stop instruction is equal and therefore the third match type is satisfied and transaction is paid.

In both cases, an investigation item is created for the bank user to monitor the exceptions and take a decision.

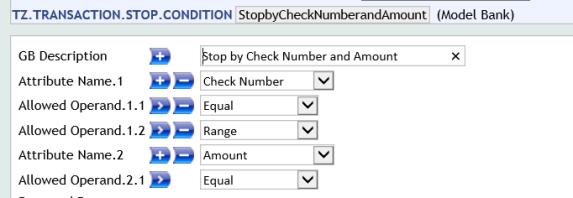

TZ.TRANSACTION.STOP.CONDITION parameterisation table can be used when the bank wants to impose limitations on the stop criteria, which can be captured in the stop instruction. For example, stop by cheque number and amount. The stop condition, once indicated in the stop instruction, validates that the stop criteria input by the user is aligned with the rules imposed by the bank.

The following condition record indicates that for the stop criteria in the instruction, it is mandatory to have cheque number and amount and the operands allowed for each of them.

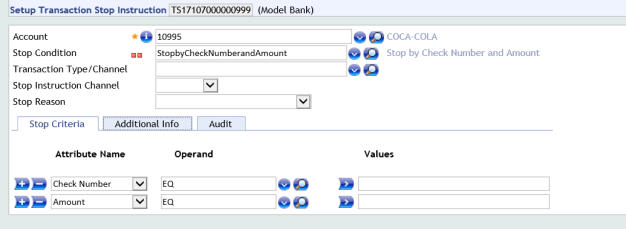

Based on this setup, when a stop instruction is initiated by the user and the Stop Condition is ’Stop by Check Number and Amount’, the Stop Criteria is auto-populated from the Stop Condition.

If the Stop Condition is left blank, the user can select the attributes from those which are defined in the DEFAULT record in TZ.TRANSACTION.STOP.CONDITION.

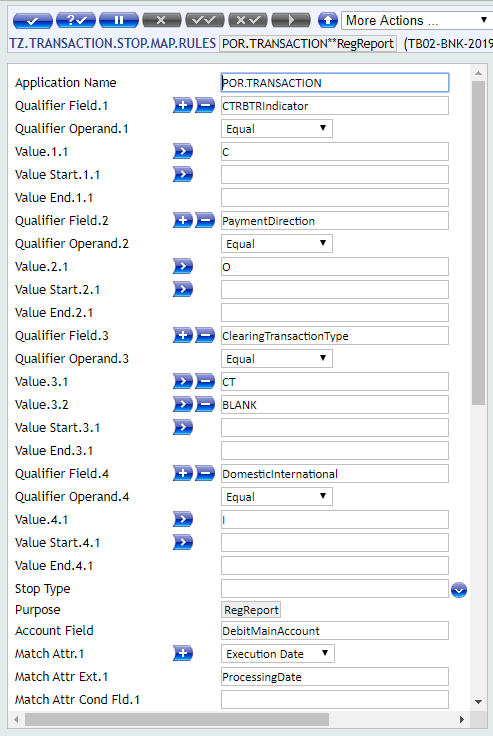

TZ.TRANSACTION.STOP.MAP.RULES parameter table defines the sources to which a transaction stop check applies.

The above record shows the setup for transactions initiated though the Generic Accounting Interface (OFS Clearing), posting rule for local clearing (LCLG – the ID of the AC.ENTRY.PARAM record).

A qualifier condition is added to indicate that only specific transactions received through this interface are checked against stop instructions (in this example, if Transaction Code = 1).

The channel or transaction type, which is assigned to these transactions, is defined in the Stop Type and are used:

- To identify the stop instructions that apply to these transactions.

- A Stop Instruction for a transaction type = ACH applies to a transaction received from this source.

- A Stop Instruction with transaction type left blank applies to all transactions received from all channels.

- A Stop Instruction for a transaction type different than ACH (for example, cheque and DD) cannot apply to a transaction received from this source.

- To identify the TZ.TRANSACTION.STOP.TYPE record which defines the matching criteria and the default decision.

The Account field indicates the field in the transaction’s business application (identified in Application Name) from where the account is extracted.

In the above example, the account number in AC.INWARD.ENTRY table stores the account where the funds are posted, the active stop instructions on this account is retrieved. The matching attributes and rules on how to extract them from the transaction’s business application are defined in Matching Attribute and Attribute field Extract fields.

In the above example, Amount Lcy is a core field in AC.INWARD.ENTRY but Party Name and Party Id are local fields in the same application.

Illustrating Model Parameters

This section covers the high-level specifications required for the Transaction Restriction (TZ) module.

| S.No | Parameters | Description |

|---|---|---|

| 1. | TZ.TRANSACTION.STOP.PARAMETER

|

This application allows the user to define the default expiry days of the transaction stop capture instruction. If default date is not mentioned at the parameter level, then it has to be captured at each instruction level. Number of working days is also defined post which expired or cancelled instructions will be moved to HISTORY. The Dup Stop Criteria field is defined to check if the transaction stop instruction captured is already entered or not. |

| 2. | TZ.TRANSACTION.STOP.TYPE

|

This application allows the user to define Stop Type using various matching types. Different matching types can be defined by combining various matching attributes. For each matching type combinations defined in Stop type, Match Type field allows the user to define if the transaction must be rejected (return) or posted (pay) using matching attributes. |

| 3. | TZ.TRANSACTION.STOP.CONDITION

|

This application allows the user to default or impose limitations on transaction stop criteria, which can be used to stop instruction. Different stop attributes like Cheque Number, Amount, Party Identifier, Party Name (values in Attribute Name field) and so on are available. Additional attributes can be defined in the EB.LOOKUP application in Model Bank. |

| 4. | TZ.TRANSACTION.STOP.MAP.RULES |

This application allows the user to define the sources to which a transaction stop check applies. Mapping rules can be defined for the transaction initiated through different sources like OFS clearing, fund transfer, for all the incoming debits processed through TPH. |

In this topic