Introduction to System Tables

The System Tables user guide explains the Customer and related reference tables and the Core Reference tables.

- Customer and related reference tables – This includes the following:

- The customer application and associated static tables.

- The customer centric functionalities.

- Core Reference tables – This includes core tables that act as reference for transaction processing as listed below:

- Country and related tables (like

REGION,HOLIDAYandDATES) - Currency

- Category

- Interest related tables (like Accrual Parameter, Interest Basis, Basic Interest and Periodic Interest)

- Charge related tables

- Tax related tables

- Card Management tables

- Cheque Management tables

- Treasury and Settlements related tables

- Other Core Reference Tables

- Country and related tables (like

Product Configuration

The following system-wide applications help in grouping the customers and defining rules for the group based on the business purposes, like defining customer group specific charges and tax.

CONDITION.PRIORITY- XXX.GEN.CONDITION and XXX.GROUP.CONDITION, where XXX refers to the business application.

APPL.GEN.CONDITION

Condition Priority

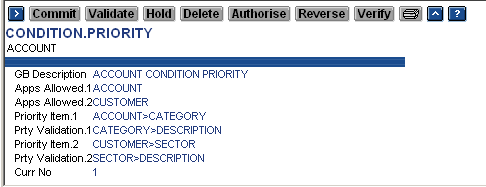

The purpose of the CONDITION.PRIORITY application is to specify, for certain applications, which data elements in other reference applications can be specified to determine condition groups. CONDITION.PRIORITY records can be created with the following IDs:

- ACCOUNT

- FIDUCIARY

- FUNDS.TRANSFER

- FX.MARGIN

- LETTER.OF.CREDIT

- SC.MANAGEMENT

- SC.SAFEKEEPING

- SC.TRADING

- STATEMENT

- TAX

- POR.TRANSACTION

CONDITION.PRIORITY is a CUS level application. Records of this application can be shared between companies, which share the same customer company, or there could be company-specific CONDITION.PRIORITY records by suffixing a hyphen and a Company Code in the ID.

ACCOUNT application, it is possible to have a specific record for the Company DE0010001 with the ID ACCOUNT-DE0010001.

The (parameters) records without a Company ID suffixed is applicable to the Master Customer Company (specified as Customer Company in the COMPANY application) as well as to Companies that do not have their own CONDITION.PRIORITY records.

An existing CONDITION.PRIORITY record cannot be modified. However, it is possible to specify parameters that are applicable in future (after the COB processing on a specified date, which can be either the processing date or any future date) by creating CONDITION.PRIORITY records by suffixing a hyphen and a date after the company code in the ID.

It is possible to specify the priority items (fields) using the Priority Item field. This is a multi-valued field which defines the order in which fields are used, when matching conditions against values specified in the XXX.GEN.CONDITION records.

- Fields from

CUSTOMERapplication can be specified in allCONDITION.PRIORITYrecords. - Fields from

ACCOUNTapplication can be specified only in theCONDITION.PRIORITYrecords related to ACCOUNT or STATEMENT. - Fields from

SEC.ACC.MASTERcan be specified only in the threeCONDITION.PRIORITYrecords related to Wealth application (with IDs SC.MANAGEMENT, SC.SAFEKEEPING and SC.TRADING).

The priority items specified in the CONDITION.PRIORITY records are defaulted as the field names in the corresponding XXX.GEN.CONDITION records.

While determining the condition groups of applications, the priority of the data items (specified as Priority Item) is determined by their relative position in the CONDITION.PRIORITY record.

For each priority item specified in CONDITION.PRIORITY, users can also specify a validation, which ensures that a value entered for a priority item (in XXX.GEN.CONDITION applications) exists as a record ID in another table. This can also be used to display an enrichment when the value is entered.

CONDITION.PRIORITY record for ACCOUNT, the Priority Item ‘ACCOUNT>CATEGORY’ can have a validation specified in the Prty Validation field as ‘CATEGORY>DESCRIPTION’. In this case, when a value for the CATEGORY is entered in ACCT.GEN.CONDITION, the value entered should be a valid record ID in the CATEGORY application, and the value of the Description field in that CATEGORY record will be displayed as an enrichment.

Parameters and Rules for Groups

The XXX.GEN.CONDITION applications provide the parameters to calculate the default groups for some applications. The priority data items, which are used in the XXX.GEN.CONDITION tables, are defaulted from the corresponding CONDITION.PRIORITY records.

The XXX.GEN.CONDITION applications and the corresponding CONDITION.PRIORITY records from which the priority data items are defaulted are listed below:

| XXX.GEN.CONDITION Applications | CONDITION.PRIORITY record ID from which priority data items are defaulted |

|---|---|

ACCT.GEN.CONDITION

|

ACCOUNT |

FD.GEN.CONDITION

|

FIDUCIARY |

FT.GEN.CONDITION

|

FUNDS.TRANSFER |

LC.GEN.CONDITION

|

LETTER.OF.CREDIT |

SCPM.GEN.CONDITION

|

SC.MANAGEMENT |

SCSK.GEN.CONDITION

|

SC.SAFEKEEPING |

SCTR.GEN.CONDITION

|

SC.TRADING |

STMT.GEN.CONDITION

|

STATEMENT |

TAX.GEN.CONDITION

|

TAX |

FX.GEN.CONDITION

|

FX.MARGIN |

PP.GEN.CONDITION

|

POR.TRANSACTION |

The parameters specified in FD.GEN.CONDITION, FT.GEN.CONDITION, LC.GEN.CONDITION, SCPM.GEN.CONDITION, SCSK.GEN.CONDITION, SCTR.GEN.CONDITION, TAX.GEN.CONDITION, and PP.GEN.CONDITION are used to default the condition groups in the CUSTOMER.CHARGE application.

The parameters specified in ACCT.GEN.CONDITION are used to default the account group (Condition Group) in ACCOUNT, while those specified in STMT.GEN.CONDITION are used to default the frequency in ACCOUNT.STATEMENT.

For each XXX.GEN.CONDITION application, there is a corresponding XXX.GROUP.CONDITION application (except for STMT.GEN.CONDITION) to define the various parameters for each group. The following XXX.GROUP.CONDITION applications exist:

ACCT.GROUP.CONDITIONFD.GROUP.CONDITIONFT.GROUP.CONDITIONLC.GROUP.CONDITIONSCPM.GROUP.CONDITIONSCSK.GROUP.CONDITIONSCTR.GROUP.CONDITIONTAX.TYPE.CONDITIONFX.GROUP.CONDITION

All the XXX.GEN.CONDITION and XXX.GROUP.CONDITION applications referred here are of the FTD level, which may be company specific or shared between companies depending on the configuration of Default Finan Com or Spcl Fin File fields in the COMPANY record.

ACCT.GEN.CONDITION records for the Company DE0010001 can have the data items defaulted from the CONDITION.PRIORITY record with ID as ‘ACCOUNT-DE0010001’ if that record exists, else from the default CONDITION.PRIORITY record with ID as ‘ACCOUNT’.

While defining CONDITION.PRIORITY records to be applicable in future, it is possible to specify which XXX.GEN.CONDITION and XXX.GROUP.CONDITION records need to be retained, by specifying their IDs in the Gen Cond Keep and Group Cond Keep fields respectively. During COB processing on the specified date, these XXX.GEN.CONDITION records are automatically modified with priority data items applicable for the new structure, by retaining existing priority data items and their values. New priority data items are updated with null values.

Further, in conjunction with dated CONDITION.PRIORITY records, it is also possible to specify dated XXX.GEN.CONDITION records, which can become effective in future. Such XXX.GEN.CONDITION records are defined by suffixing a hyphen with a date (either processing date or a future date) in the ID. Priority data items in these records are defaulted from the corresponding dated CONDITION.PRIORITY records. These record IDs must not be defined as retention record IDs in the Gen Cond Keep field of CONDITION.PRIORITY.

After COB processing on the specified date, the dated XXX.GEN.CONDITION records replace the corresponding records without a date in the ID.

Those XXX.GEN.CONDITION records that are not included in the Gen Cond Keep field of the corresponding dated CONDITION.PRIORITY record or those records that do not have a corresponding dated XXX.GEN.CONDITION record are dropped after the COB processing on the specified date.

With the exceptions described below, future dated XXX.GROUP.CONDITION can be created with an ID of the format ‘xxx-Date’, provided the ID is not already specified in the Group Cond Keep field of the corresponding dated CONDITION.PRIORITY record. After COB processing on the specified date, the dated XXX.GROUP.CONDITION records replace the corresponding records without a date in the ID.

There is an exception to the above referred functionality (which existed before the CONDITION.PRIORITY application has been enhanced to accept dated records). The ID format of the SCPM.GROUP.CONDITION and SCSK.GROUP.CONDITION applications is ‘xxx.date’ (both parts mandatory and connected by a dot) to allow definition of parameters, which applies on various dates. The first part of the ID is validated against the first part of the corresponding XXX.GEN.CONDITION records. When the records in these applications are entered, there is no validation against the CONDITION.PRIORITY records.

The XXX.GROUP.CONDITION records whose IDs are not included in the Group Cond Keep field of the corresponding dated CONDITION.PRIORITY record, or which do not have a corresponding dated XXX.GROUP.CONDITION record (suffixed to the ID with a hyphen and date), will be dropped after the COB processing on the specified date. However, customer-specific XXX.GROUP.CONDITION records with ID format as ‘C-Customer ID’ is not dropped after COB processing.

For Payments, the parameters and conditions applicable for a group of customers is defined in PP.CLIENT.CONDITIONRECORD application. Please read Introduction to Client Conditions for more details.

Parameter to Default Groups Using Temenos Transact Routine

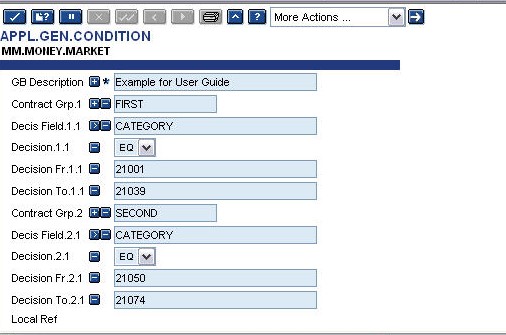

The APPL.GEN.CONDITION application is used to define group conditions for contracts based on a combination of decisions and calls to locally developed subroutines. For example, it allows specific tax codes to be applied to particular types of contract for particular types of customer.

There is one record per application for which many sets of group conditions can be defined. User must ensure that multiple set of groups are defined correctly, as the first set of conditions that pass the validation checks result in that contract group code being applied.

A Temenos Transact subroutine, APPL.GRP.CONDITION can be called to evaluate the current contract record using relevant APPL.GEN.CONDITON. It returns the first group code where all decision checks evaluate to true.

The MM.MONEY.MARKET and LD.LOANS.AND.DEPOSIT applications call the evaluation routine automatically. Other applications can call the evaluation routine from VERSION routines to update local reference fields with the relevant group code.

The subroutine processes these decisions and updates the Contract Group field in the application record whenever the contract is changed. If changes to the contract cause the conditions to break, then a new Contract Group code is generated, which results in a different tax code being applied. A default group code can be defined as the last group code without associated conditions, if required. TAX.TYPE.CONDITION allows the Contract Group code to be linked to the allocation of specific tax codes.

Illustrating Model Parameters

Specifications for System Tables are grouped into different functionalities.

Core Reference tables available in the model bank are given below:

Customer related tables available in the model bank are given below:

Interest related tables available in the model bank are given below:

| S.No. | Parameter | Description |

|---|---|---|

| 1. | BASIC.RATE.TEXT

|

Defines descriptions of the Basic Interest Rate table IDs to enable the user to identify each one of them easily. |

| 2. | BASIC.INTEREST

|

Defines and stores the frequently used floating rates accessed by Temenos Transact applications when required. |

| 3. | PERIODIC.INTEREST

|

Defines the interest rates based on the time period for each currency. |

| 4. | ST.PERIODIC.INTEREST

|

Acts as an index for PERIODIC.INTEREST. This application can be either manually created or through the ST.CREATE.PERIODIC.INDEX service. |

Illustrating Model Products

System table products available in the model bank are given below:

| S.No. | Products | Description |

|---|---|---|

| 1. | SECTOR

|

|

| 2. | INDUSTRY

|

|

| 3. | CATEGORY

|

|

| 4. | Exit Status

|

The below values can be held for exit status field:

|

In this topic