Introduction to Cheques and Cards Management

A cheque (or check) is an instrument that orders payment of money from a bank account. The person writing the cheque, the drawer, usually has an account with a bank where the money was previously deposited. The drawer writes various details (including the amount, date and a payee name) on the cheque and signs it, ordering the bank (known as the drawee) to pay that person or company, the amount of money stated.

A Demand Draft (DD) is a negotiable instrument issued by the bank, similar to a bill of exchange. Bank issues a DD to a client, directing another bank or one of its own branches to pay a certain sum to the specified party.

The Card Management feature supports the issue and maintenance of various types of cards. The card management life cycle includes processes like issuing of new card, monitoring the card usage, blocking the cards, card expiry, and re-issuing the cards (expired, lost or stolen).

Product Configuration

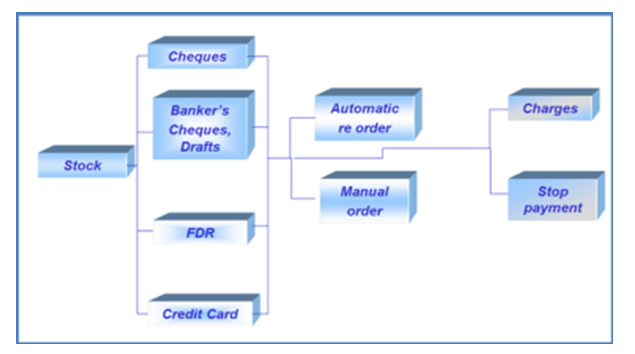

The first step in cheque or draft issue management involves managing the stock. This is common for banker’s cheque, drafts, fixed deposit receipts and credit cards as well as cheques issued to customer accounts.

For cheques, it is possible to record receipt of stock, receiving requests for cheque book from customers, sending a cheque for further local printing and actual issue to customers.

The following flowchart shows the process of stocking and issue of cheque or draft.

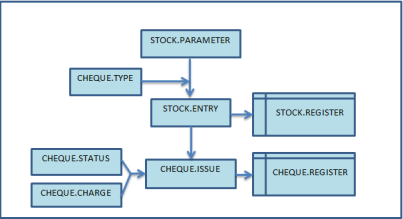

The following flowhcart shows the cheque stocking and issue process in Temenos Transact.

Illustrating Model Parameters

The high-level configurations available in the Model Bank are given below:

Illustrating Model Products

Different CHEQUE TYPE available are listed below:

| Cheque type | Description |

|---|---|

| SB | Savings Bank Account Cheques |

| CURR | Current Account Cheques |

| DD | Demand Drafts or Managers Cheques |

In this topic