Introduction to Tax Engine

The Tax Engine (TX) module interfaces Temenos Transact transactions to external tax systems mainly for tax calculations and tax reporting. This module enables the user to:

- Maintain user defined tax databases for tax reporting.

- Interface Temenos Transact data to an external or local tax calculation system.

The main features of the Tax Engine module are:

- Allows a user exit in the tax calculation API, which allows local routines to modify or calculate tax amounts.

- Allows definition of tax databases, which will be user-defined fields to hold tax related information for reporting purpose.

- Allows specification of mapping between different applications and tax databases.

- Allows definition of conditions for each application based on which the tax databases should to be updated.

The Temenos Transact European Savings Directive module (ET) requires the Temenos Transact Tax Engine module to be setup. Read the Tax Engine section of the EUSD user guide for information on setting up the Tax Engine for that particular module.

The TAX module consists of three main components:

- Tax Engine (TE) – The interface between Temenos Transact and the TAX Module.

- Tax Module (TM) – Processes the tax events, updates the data relevant for calculation of taxes reporting and calculating the amount of tax. This is developed locally, depending on the tax requirement of the region.

- Tax Interface (TI) – Transfers the information back to Temenos Transact so that accounting entries are raised and advices to the customers are produced.

Product Configuration

This section covers the configuration required for the Tax Engine.

The following sequence summarises the configuration required for the Tax Engine:

- Set the details of the message, which needs delivery actions, in the

TX.CONDITIONapplication. - Set the local key list file details in the

TX.CONDITION. - Set the common class ID record in

TX.CONDITIONfor simplified set up. - Set-up the TI.DELIVERY.APP.MAPPING file to get portfolio details for each delivery message.

- Set the TI.HANDOFF.MAPPING file for each message and application combination to hold the handoff mapping information.

- Enable the phantom TX.IN.PROCESS active, to process the header records.

This table is used to specify conditions, based on which the tax databases are updated. This table is also used for interfacing to the external systems for tax processing. It has the transaction application as the ID. Tax processing happens only when corresponding transaction application has an entry in this table.

The TX parameter file is also used to handle Tax Interface processing:

- The Msg Number and De Process fields determine the course of action of the delivery messages.

- The Msg Number field is a valid message from the

DE.MESSAGEapplication and the De Process field indicates the action to be carried out on the message while authorising the transaction.

The TI.HEADER produces records to indicate that the transaction has been authorised. This record is processed by the TI phantom to authorise accounting entries and TI.TRANS.DETAILS.

To raise these header records, the system should pass indication to the local tax key list files at the time of authorising the contract.

- The Auth Write File field holds the name of the local file

- The Auth File Id field holds the details about the detail that is to be updated to the above key list file. The field can have the following values:

- String

- DATETIME

- TXNREF – Transaction reference

- COMPANY – Contract company

Common Class Id – TX.CONDITION

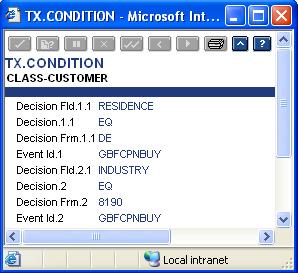

The following screenshot shot shows the RESIDENCE and INDUSTRY used as conditions for Decision Fld.

To simplify the process of setting up the conditions in TX.CONDITION, repeated conditions from common tables (CUSTOMER and SECURITY.MASTER) are given in the file as Class IDs. Later, the class ids are mentioned in the Decision field of the condition file for other application records where the common conditions are needed. In this example, the @ID of the record begins with class-application name.

The valid applications mentioned as class are:

- CUSTOMER

- SC.TRANS.NAME

- SECURITY.MASTER

- DIARY.TYPE

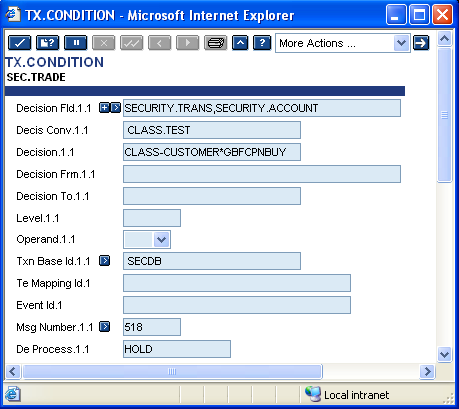

The following screenshot shows the TX.CONDITION for SEC.TRADE.

The above set up shows the common condition set for the customer application that is used the RESIDENCE and INDUSTRY fields as conditions for SEC.TRADE record in TX.CONDITION. This class id is used for the other application condition fields, which need these conditions as given. Using the value in the Decision Fld, the customer number is obtained and this is used to validate the class Id mentioned in the DECISION table. The Level field performs the grouping of decisions. The Operand field is used for joining single decisions as a group of decisions. Based on the values given in the Level field all the decisions are grouped and are joined using the values in the Operand field. The decisions are processed sequentially. The Search Type field decides the type of search needed to evaluate the conditions set. It can either be a best fit or first fit based on the requirement.

This file is used in APPLICATION.HANDOFF to find the handoff record position for the portfolio number while holding the delivery messages. This is used only for security applications.

The Id for the file is the valid Temenos Transact security application name. The MESSAGE.NO is a valid message from the DE.MESSAGE application. The PORT.HANDOFF.POS field is the position in the handoff record for the respective message, which holds the portfolio number. The records for this file is released from Temenos Transact.

This file is used to define the tax information in the TI.HEADER file into the delivery handoff information.

The TI.HEADER.POSN field holds the TI.HEADER field position, which has the tax data to be mapped to the handoff. The records for this file is released from Temenos Transact.

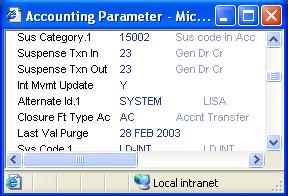

The tax database is updated whenever the INT.MOVEMENT table is updated. INT.MOVEMENT table is updated only when the Int Mvmt Update field is set to Y in the ACCOUNT.PARAMETER record.

The settings on this application are used to decide which interest movements are to be updated in the INT.MOVEMENT table. The INT.MOVEMENT table holds all the interest details of the transaction processed. For all applications other than SC applications, the tax database is updated only when the relevant details for the transaction application are set in this file with the correct System Id field.

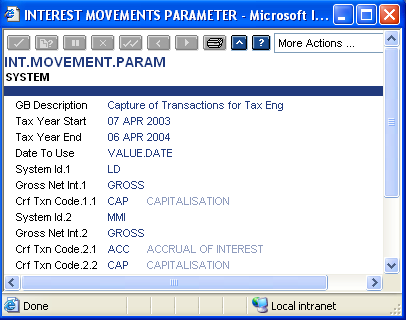

Based on the transaction and CRF code given in this application for the respective System Id, the corresponding transactions are captured in INT.MOVEMENT.

In the above example (screenshot), the parameter setting captures the following Interest movements:

- Accrual and capitalised movements of MM deposit

- Capitalised interest of LD deposit

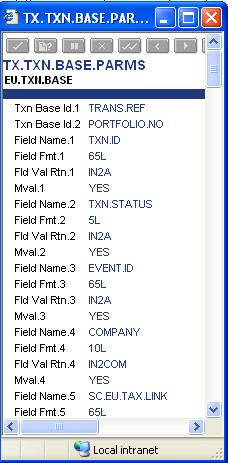

This application is used to define the tax database file. It holds the details about the fields and the properties of the fields in the tax database. The ID to this table is the name of the tax database. After defining, this table creates a work file for the tax database, which can be viewed by listing or through enquiries. Once this table is authorised, new fields for the tax database can be added only at the end. Insertion in the middle or deletion of an existing field after authorisation is not permitted.

- The Txn Base Id field is for the formation of ID for the records in the Tax database. It is mapped with the corresponding application values in the

TX.TXN.BASE.MAPPINGapplication - The Mval and Sval fields specifies whether the field is a multi-value field or a sub- value field in the tax database

- The Fld Val Rtn field formats the data according to the routine given

- The Rev Action field specifies the mode of data stored in database. If the value is DELETE, then the tax database does not store the old updates of the transaction. If the value is ACTION, it stores the history of the changes made previously for the transaction

- The Sort Field maintains the tax database in the sorted order. Data is sorted based on the tax database field specified in Sort Field

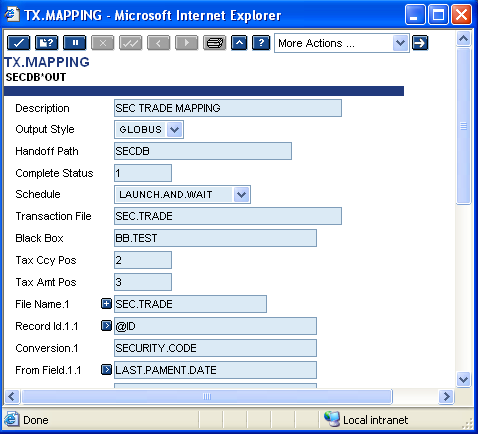

This table is used for Interfacing Temenos Transact data with the tax calculation routine for processing. It defines the data that is to be passed for tax processing. This table has a set of IDs for the IN or OUT mapping process. The ID has a mapping name with an IN or OUT process specification like SECMAP*OUT. The mapping can be called from version routines to call the GREYBOX, which selects the relevant mapping ID for tax processing of the transaction, based on the conditions specified in TX.CONDITION.

- The Transaction File field specifies the applications for which the mapping record is used. The tax details are returned from the Black Box in the positions specified in the Tax Ccy Pos and Tax Amt Pos fields.

- The Output Style field specifies the style in which data is sent out of Temenos Transact. It sends the data to the Temenos Transact work file or to a unix file in the path provided in the Handoff Path field.

Tax processing happens for a transaction only when there is an entry in mapping with the corresponding application in the Transaction File field.

The Ret Fld Pos and Ret Fld Conv fields are specific to the IN mapping process. The GREYBOX routine picks the data from the work file in the positions specified and updates the respective files given in the File Name field.

The routine specified in the Routine field does the specific processing on the mapped data. For example, if the returned data has to be updated for some more files other than the specified files, then it can be done by the routine.

In this topic