Introduction to Payment Initiation

Temenos provides support to allow Payment Initiation through regulated TPPs. Temenos supports the Berlin Group API Guideline. The Berlin Group outlines a set of standardised workflows and APIs/endpoints, which banks can use to facilitate their own PIS flows.

Every API endpoint consists of a request and a response.

The high level flow for Payment Initiation includes:

- Payment Initiation Request API (sent from a regulated TPP)

- User Authentication for the Payment (in bank’s domain)

- User Review and Confirmation/Cancellation for the Payment (in bank’s domain)

- Get Payment Details and Status (requested by TPP)

- Delete Payment (requested by the TPP)

The payload data of the Payment Initiation Request consists of all payment-related data of the payment initiation. Read the Initiation of a Payment section for more information on the types of payments supported.

The PSD2 Payment Initiation module (PX) assists banks with Payment Initiation APIs to support the following:

- Berlin Group (v1.3.4)

- Temenos First-Generation APIs

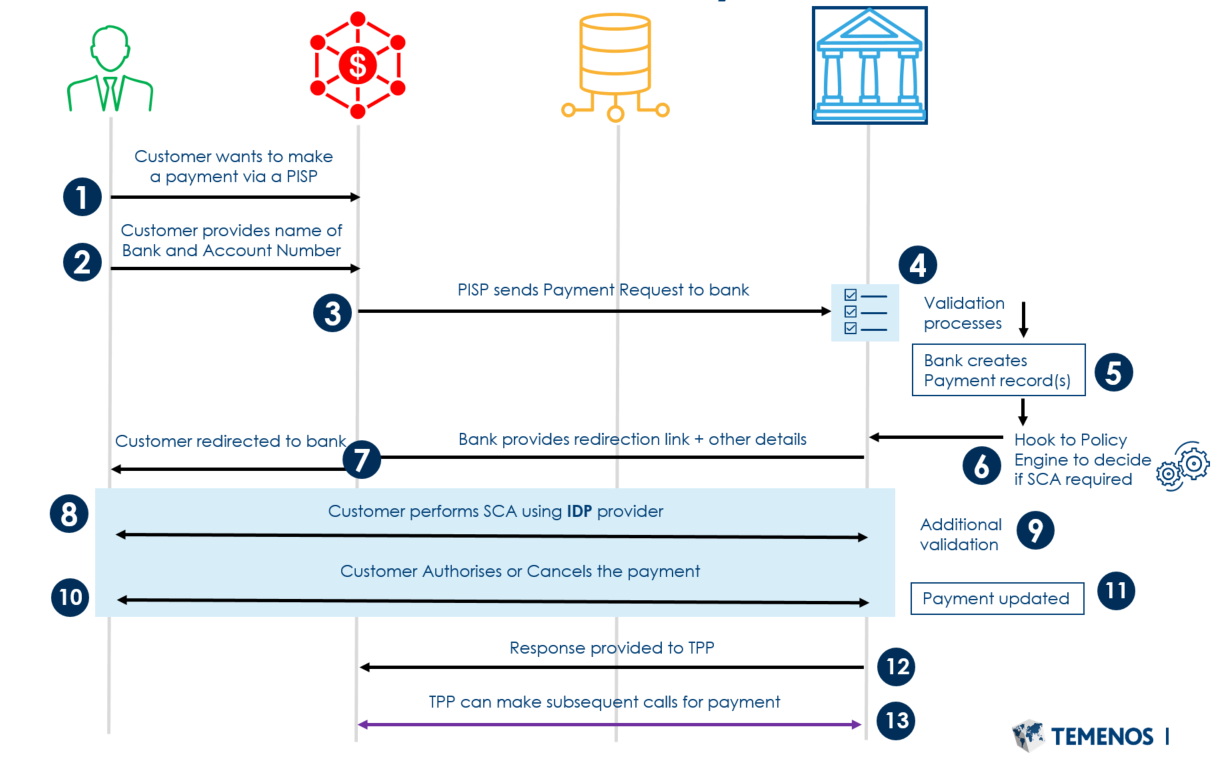

The following is a high level overview of the Payment Initiation workflow:

- A customer initiates a payment through a TPP. The TPP is a PISP, which can be a merchant or a payment app.

- The customer selects their bank and provides the account number they wish to pay from.

- The TPP uses this information and sends a payment initiation request to the bank.

- The bank receives the request and the following are validated:

- eIDAS, throttling and security checks - Managed by the bank’s own API gateway (not in scope of Temenos Transact)

- TPP role validation is performed at the bank’s API Gateway.

- If both above checks are passed, the system accepts the request and performs some basic account validations, like account validity and eligibility.

To determine eligibility, the system compares the debit account to the Payment Account Definition within PX.PARAMETER.

- If the debit account does not match the Payment Account Definition, the payment is rejected at this stage.

- If the debit account matches the Payment Account Definition, the system creates a payment record in the system, which holds the details of the payment request. Additional information regarding the payment is held in the PX.PYT.RESOURCE payment resource.

- The details of the payment can be sent to a Policy Engine to assist with SCA requirements. At least one level of authentication is always required. From a Temenos perspective, SCA can be defaulted.

- A Redirect URL and Payment ID is returned to the TPP. The TPP uses this URL to redirect the customer to the bank’s Identity Provider (IDP) to authenticate.

- The customer authenticates with the bank’s chosen SCA provider. The SCA provider returns a JWT with the transaction context to the bank.

- After the bank verifies the JWT, the customer is identified and a check is performed to identify whether the customer has access to initiate and authorise payments (through an online channel) from the requested account.

- If unsuccessful, the payment is rejected.

- If successful, the customer is able to choose whether to provide approval or cancel the payment.

- The payment is updated in the bank’s system with the decision of the customer.

- The system provides a response to the TPP.

- The TPP can make subsequent calls on the payment (that is, to check the payment status).

Read the Working with section of this user guide for more information on the lower level flows and support .

Illustrating Model Parameters

The high-level configurations available in the Model Bank are given below:

Illustrating Model Products

Payment Services Directive (PSD) is a set of laws and regulations for payment services in EU and EEA. Some of the PSD features available in the Model Bank are listed below:

| Product Name | Features |

|---|---|

| PSD Regulation |

|

| Payment Initiation Service Provider (PISP) |

|

In this topic