Introduction to PSD2 Account Information

PSD2 Account Information module (PZ) provides functionality that assists the Account Information Service flows under the Berlin Group.

It consists of the following:

- Parameter table

- Account Consent Framework using AA

- Account Information Service Provider (AISP) APIs and workflows

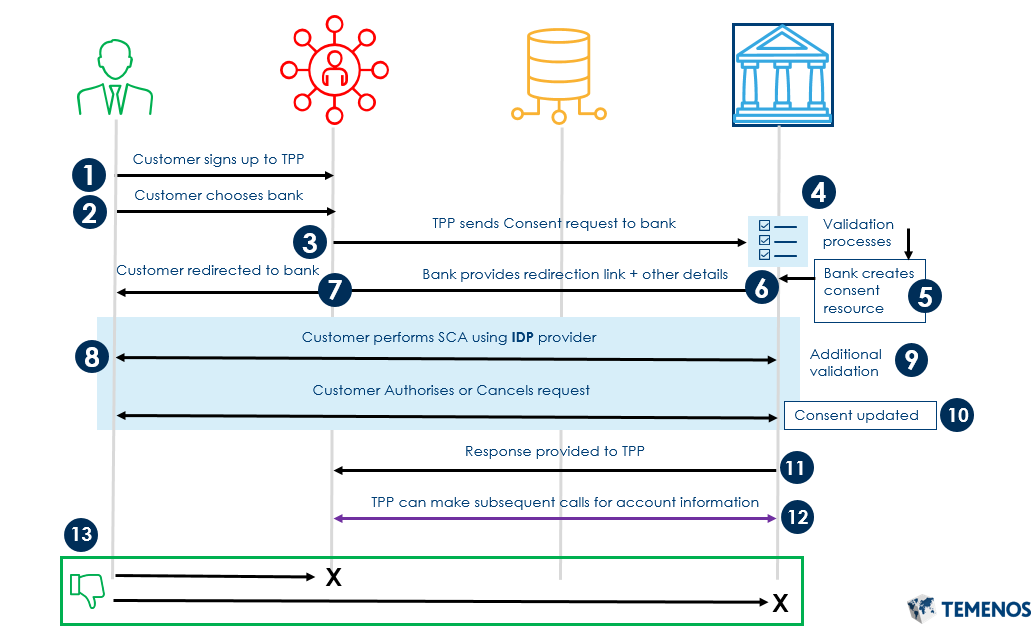

A high-level summary of the facilitated Berlin Group flow is shown below.

- A customer signs up to a Third Party Provider (TPP), which is an AISP that offers Account Aggregation services.

The TPP outlines the terms and conditions of their service, including the details they will be requesting from the customer’s bank. The customer then accepts the T&Cs. - In the TPP, the customer chooses the bank they want to aggregate their accounts from.

- The TPP sends a consent request to the customer’s chosen bank, which contains the details of the customer’s accounts and services that TPP requires access to.

- The bank receives the request and the following are validated:

- eIDAS check by the API gateway

- TPP role validation is performed at the bank’s API Gateway.

- Based on a successful request, the bank creates a consent resource with an ID. The consent ID is used throughout the consent lifecycle.

- The bank provides a response to the TPP, including the consent ID and a redirect link. This is used to redirect the user to authenticate themselves.

- The TPP redirects the user to a bank landing page (user agent).

- The user performs Strong Customer Authentication (SCA) to prove the request is genuine (by authenticating the requesting user). The SCA process is handled by the bank’s own identity or authentication provider (IDP).

- After authentication, a check is done to identify whether the user has access to the requested accounts through an online channel and whether they are PSD2 eligible.

- After the list of eligible accounts is generated, the user reviews the request at the bank in the user agent screens, including the details of the TPP's access request access. The user can then authorise or cancel the request.

- Depending on the customer’s decision, a response is provided to the TPP.

- If the customer authorises the request, the TPP can make subsequent requests for certain account information.

- If the customer cancels the request, the TPP cannot access any customer data.

- The TPP uses the consent ID to request account information from the user’s accounts.

- The user can withdraw consent at any time at the TPP or their bank directly.

Configuring PSD2 Account Information

This section helps the user configure the PZ module.

PZ.PARAMETER

The PZ.PARAMETER application is used to configure the PZ module and can be used to:

- Identify the types of accounts that are considered ‘payment’ accounts (and are eligible for PSD2 processing). This can be based on specific category codes or AA Products.

- Identify where Consent Management is handled (internally or externally to Temenos Transact).

- Identify where TPP Validation is handled (internally or externally to Temenos Transact).

- Identify where user permissions are managed and checked (internally or externally to Temenos Transact).

- Configure housekeeping service for consent requests.

- Configure Tokenised Account IDs in the consent.

The record ID is the COMPANY of the bank the parameterisation is applicable for.

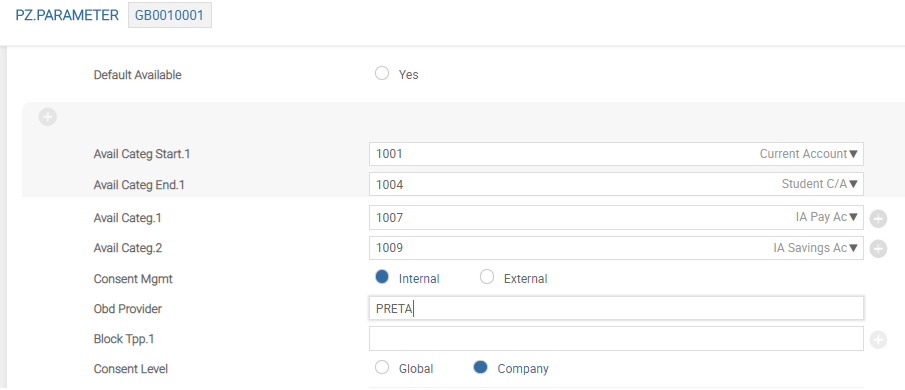

A screenshot of the PZ.PARAMETER application with a description of each field’s intended use is shown below:

Only one of the following combinations is allowed for defining the Payment Account Definition:

- Default Available field

- Avail Categ field

- Avail AA Prod field

| Field | Description |

|---|---|

| Default Available | Used to flag all types of accounts offered by the bank that are ‘Available’.

This value must be set only when all account types offered by the bank are payment accounts. If the bank offer accounts types that are eligible for TPP access, this field is not set. Instead, the bank must configure the eligible account types using the CATEGORY or AA Product field-sets. |

| Avail Categ Start | Holds the start number of the CATEGORY range for accounts that are considered ‘Available’ under PSD2.It should be used in conjunction with Avail Categ End to allow the client to define a range of CATEGORYs that are eligible for PSD2 processing. The bank has the below

The bank considers the accounts highlighted in blue as eligible accounts under PSD2. The value of the Avail Categ Start field is 1001. The value of the Avail Categ End field is 1004. All CATEGORY codes between 1001 and 1004 are considered ‘Available’. A customer need not enter every Individual |

| Avail Categ End | Holds the end number of the CATEGORY range for accounts that are considered ‘Available’ under PSD2.It should be used in conjunction with Avail Categ Start to allow the client to define a range of CATEGORYs that are eligible for PSD2. The bank has the below

The bank considers the accounts highlighted in blue as eligible accounts under PSD2. The value of the Avail Categ Start field is 1001. The value of the Avail Categ End field is 1004. This means all A customer need not enter every Individual |

| Avail Categ | Used in addition to or separately from the Avail Categ Start or Avail Categ End field. It allows the user to enter each CATEGORY code one by one, which is considered available for PSD2.

The bank has the below

The bank considers the accounts highlighted in blue as eligible accounts under PSD2. The bank can manually enter ‘1007’ and ‘1009’ to mark these as PSD2 eligible accounts. |

| Consent Mgmt | Allowed values are Internal or External.

A null value denotes as Internal. |

| Obd Provider |

This field determines where TPP role validation occurs. Allowed values are:

When this field is not set to External, the Open Banking Directory is populated with the data from an external source. TPP role validation is one of the checks required to be performed on a TPP prior to accepting a TPP request. API Gateway performs required mandatory checks before the TPP role check. |

| Block Tpp | Intended to be used only when the Obd Provider field is External.

|

| Consent Level |

Defines the level at which consent is managed within Temenos Transact. Allowed values are:

|

| Avail AA Prod Mode |

Allows the bank to define the payment account definition through AA Products. Allowed values are:

In the following screenshot, all AA Products in CURRENT.ACCOUNTS of the AA Product Group, except STUDENT.ACCOUNTs and STAFF.ACCOUNTs, are considered ‘available’ under PSD2.

In the following screenshot, only the AA Products that are STUDENT.ACCOUNTs or STAFF.ACCOUNTs are considered ‘available’ under PSD2.

|

| Avail AA Prod Group |

Defines the AA Product Group, which includes a payment account types that are eligible for sharing with TPPs. This field only allows a valid AA Product Group ID from the ACCOUNT product line.

This field allows multiple values.

|

| Avail AA Prod Excpt |

Defines the AA Products that are to be:

This field allows multiple values.

|

| Permissions Check |

Defines if the user’s channels permission during PSD2 workflows will be checked within Temenos Transact or within an external system. Allowed values are:

Once this field is set as External, it cannot be changed to Null. The system displays an override message to warn the user, when this flag is set to External.

|

| Retention Period | Holds the time period for how long the unprocessed PSD2 consent requests are held in the system before they are deleted automatically.

|

| Tokenise Account ID |

This field allows the bank to generate random account ID for each populated account within the Account Consent Arrangement. If set to Yes, a unique ID will be populated for each account in the Account Consent Arrangement. The random value is used by the TPP to address the account in the AIS endpoints. Allowed values are:

Validation: When set to Yes, this value cannot be changed back to No or Null. |

Illustrating Model Parameters

Covers the high-level specifications required for the PZ module.

Illustrating Model Products

PSD2 of the European Union and the Open Banking Implementation Entity (OBIE) have introduced the Third Party Provider services and as a result the customers can able to sign-up for account aggregation services from regulated TPPs. TPP can act as Account Information Service Provider (AISP), Payment Initiation Service Provider (PISP) and Payment Instrument Issuing Service Providers (PIISP).

In this topic