Introduction to Confirmation of Payee (CoP)

Confirmation of Payee (CoP) is one of the many ways the finance industry handles fraud. The CoP service checks the account and reference details when a new beneficiary or payee is setup by the payer before initiating payments such as CHAPS, Faster Payment or standing orders. Once this beneficiary or payee is successfully added to the payer’s beneficiary list, it assures the payer that his payments are not sent to an incorrect account by mistake.

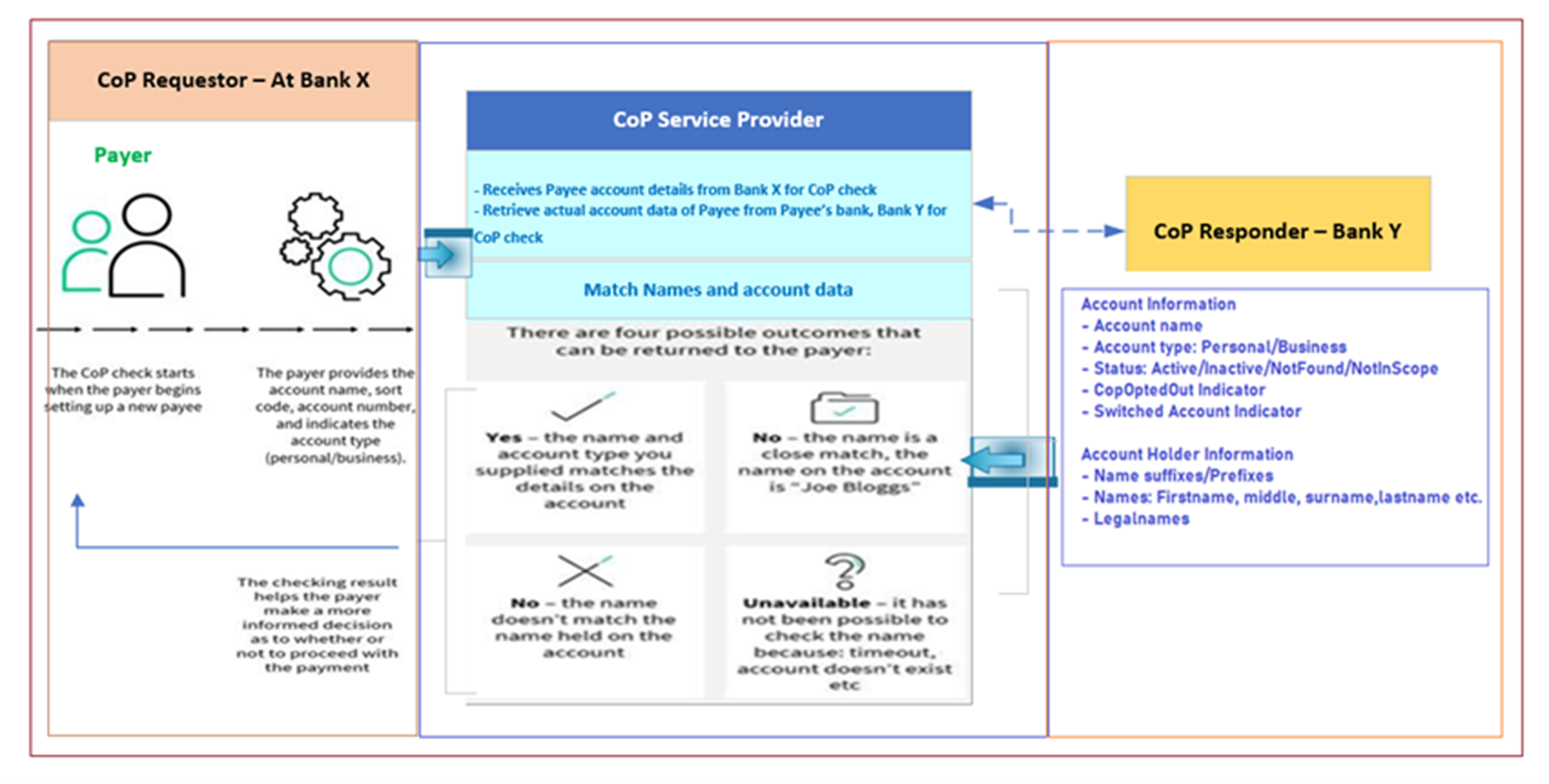

The CoP capability is explained below.

What is CoP?

When the consumers and businesses make a payment, Confirmation of Payee (CoP) shows them whether the money is transferred to the right account or not. Before the transfer of funds, they can verify that the name on the recipient account is the same person or business they intend to send the money to, so the funds end up at the right place.

CoP plays a central role in protecting against certain types of Authorised Push Payment (APP) fraud – if the name on the account does not match, CoP highlights the risks.

Who can sign up for CoP service?

The organisations that can sign up for the CoP service are:

- An account-holding payment service provider (PSP) – that is, accessible by a sort code and account number.

- PSPs regulated by the FCA or National Competent Authorities (NCAs), such as those in Jersey, Guernsey and the Isle of Man (Crown Dependencies).

- PSPs that do not own their own sort code in the Extended Industry Sort Code Directory (EISCD).

- Organisations that offer accounts accessible through secondary reference data.

Why take part in CoP?

- Protect the organisation and its customers against APP fraud and misdirected payments.

- If CoP is unavailable, the customers are warned against paying money into such accounts.

- Customer uncertainty could result in a loss in deposits and revenues, with funds flowing to providers which offer CoP.

How do firms register for CoP service?

Organisations that prefer to onboard CoP must agree with the commercial and legal terms with both Pay.UK and OBL and complete the onboarding journey.

How does CoP work?

CoP allows an account name to be checked (including a personal and business account indicator) before initiating or collecting a payment.

It is an API-based peer-to-peer service, with no central infrastructure in place.

Temenos supports CoP functionality by integrating with the CoP service provider, a third-party integration partner on Temenos’s exchange.

Temenos has an integration with SurePay. SurePay has been providing CoP API services both in Netherland and UK making it possible for the banks to check each other’s bank accounts using their specifically designed algorithm for CoP services, including real-time name-checking solution.

Temenos strategy allows integration extensions with other CoP service providers and is considered at appropriate and based on strategic needs.

The CoP workflow is illustrated below.

The end-to-end solution involves the following flows:

- CoP Requestor Journey:

- Payer initiates the Confirmation of Payee request at Bank A while setting up a new payee.

- Interfaces with CoP service provider to avail its API gateway services for CoP check. Bank A initiates a formal CoP check request by invoking an API call with the service provider (Request format and schema as per the specifications offered by the CoP service provider).

- Receives the CoP validation response from the CoP service provider, plays it back to the payer on his screen (as part of setting up new payee) and captures the customer action. Finally, records the payee information at the end of a successful journey or allows for amendments and resubmission of payee information for next iterative check with respect to CoP in circumstances where the response is not completely positive.

- CoP Service Provider Involvement:

- The CoP service provider retrieves the account data of the payee from the payee’s bank, Bank B on receiving a request for CoP check from Bank A.

- Performs name match against the account data. Returns the outcome of the CoP check to the payer bank, Bank A.

- CoP Responder Journey:

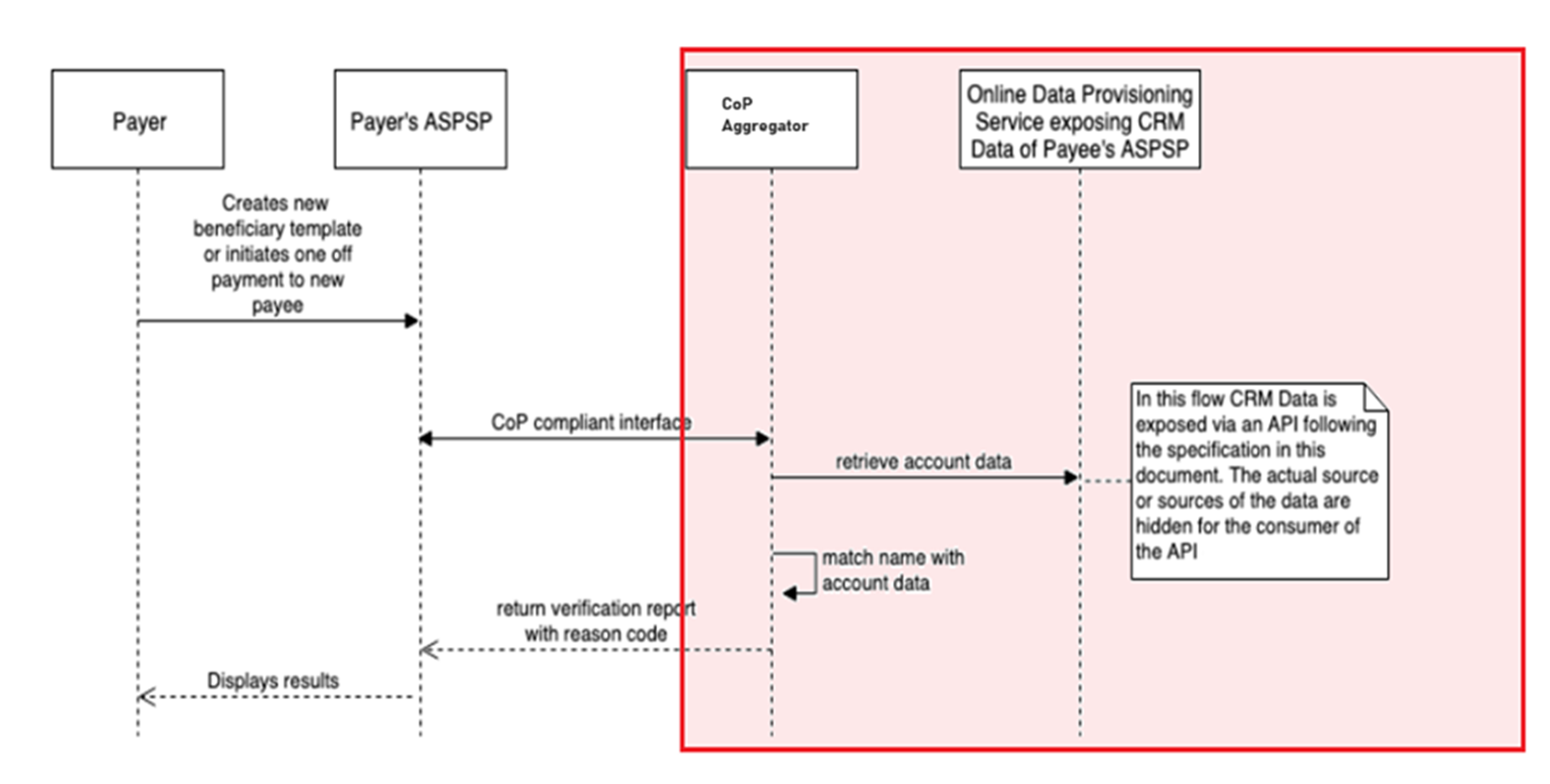

- Using the payee information received in the CoP check request from the payer bank, Bank A, the CoP service provider reaches out to payee bank, Bank B to retrieve the account information of payee as recorded in Bank B’s system.

- The data is retrieved through an API call exposed by Bank B. This process facilitates an action from Bank B to include payee account information in its response to CoP service provider’s request which is a real time online data provisioning whenever the request is placed via API data exchange (in the pre-agreed format and schema with the CoP service provider).

This user guide describes the CoP responder journey that is, exposing a Transact API for the service provider to invoke and to get the corresponding account information from Transact.

Illustrating Model Parameters

Model Parameters are not applicable for this module.

Illustrating Model Products

Model Products are not applicable for this module.

In this topic