Introduction to Recognition of Fees and Costs under FAS91

The FAS91 standard (Accounting for Non-refundable Fees and Costs Associated with Originating or Acquiring Loans and Initial Direct Costs of Leases), issued by the Financial Accounting Standards Board, establishes the standard principles for the accounting of non-refundable fees and costs associated with lending, committing to lend or purchasing a loan or group of loans.

The basic principle is that these fees are not recognised to income as soon as the lender receives them. Instead, origination fees are netted with origination costs, and in most cases the resulting net fee is amortised over the remaining life of the loan using the effective interest method.

The statement from FAS91 is summarised below***:

"Loan origination fees shall be recognised over the life of the related loan as an adjustment of yield. Certain direct loan origination costs shall be recognised over the life of the related loan as a reduction of the loan's yield. All loan commitment fees shall be deferred except for certain retrospectively determined fees; commitment fees meeting specified criteria shall be recognized over the loan commitment period; all other commitment fees shall be recognised as an adjustment of yield over the related loan's life or, if the commitment expires unexercised, recognised in income upon expiration of the commitment.

Loan fees, certain direct loan origination costs, and purchase premiums and discounts on loans shall be recognised as an adjustment of yield generally by the interest method based on the contractual terms of the loan. However, prepayments may be anticipated in certain specified circumstances".

The non-refundable fees or associated costs with lending are mostly customer facing non-refundable loan fees and non-customer facing costs as shown below:

Customer facing non-refundable loan fees include:

- Origination Fees (DEBIT Charge) – Fees charged to the borrower in connection with the process of originating, refinancing, or restructuring a loan.

- Commitment Fees (DEBIT Charge) – Fees received for a commitment to originate or purchase a loan or group of loans shall be deferred.

Non-customer facing costs include:

- Initial Direct Costs (CREDIT Charge) – Costs to originate a loan that (a) result directly from and are essential to the lending transaction and (b) would not have been incurred by the lender had that lending transaction not occurred.

- Commitment Costs (CREDIT Charge) – Costs incurred to make a commitment to originate a loan shall be offset against any related commitment fee and the net amount recognised.

- Purchase Premium (DEBIT Charge) – The initial investment in a purchased loan or group of loans shall include the amount paid to the seller plus any fees paid or less any fees received.

- Purchase Discount (CREDIT Charge) – The initial investment in a purchased loan or group of loans shall include the amount paid to the seller plus any fees paid or less any fees received.

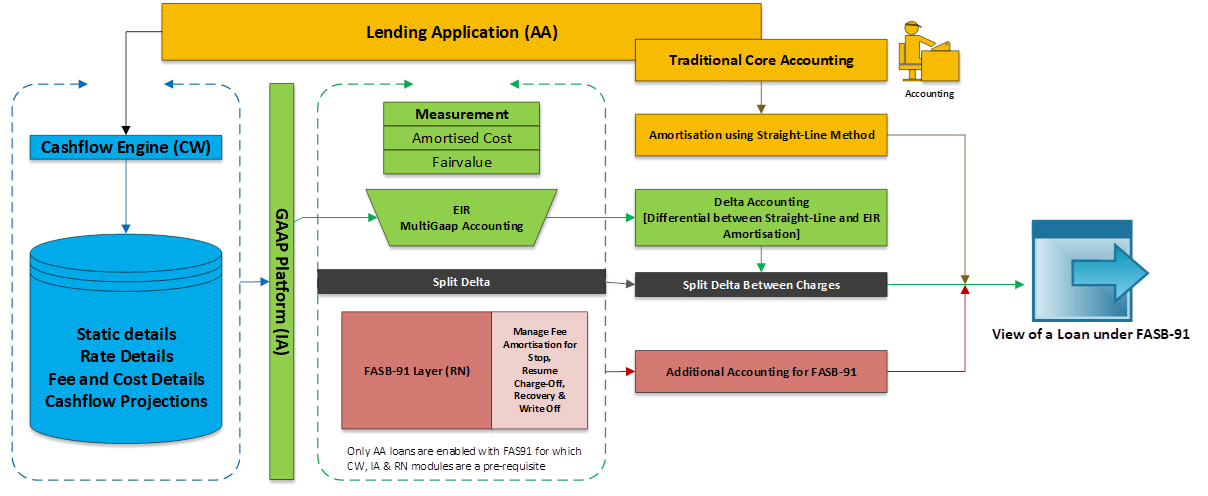

Temenos FAS91 Solution

The Temenos FAS91 solution focuses on Retail Lending and Corporate Lending under the Temenos Arrangement Architecture. The diagram below shows the process and data flow of the FAS91 solution.

- The contractual cashflow projections originating from the Lending contracts (includes, Principal, interest, fees and costs)

- These are fed into the Temenos cashflow engine to record the contractual cash flows.

- The contractual cashflows forms the basis for deriving the EIR and NPV within the Multi-GAAP platform and to generate the Delta Accounting as the difference between the straight-line method and the EIR method.

- The FAS91 solution uses these details to apply the corresponding accounting treatment for the different status of loan, that is performing, non-performing, charge-off, recovery, write-off.

The lending application manages contracts throughout the lifetime of the contract, where users capture the loan arrangement contract with basic details such as loan amount, interest rate, contract term and payment schedule and passes the cash flow projections along with static details, rate details, fees and cost details to the cash flow engine, which is stored in cash flow record.

The IA GAAP platform provides the framework using the following calculations:

- Calculate the EIR using the projected cash flows along with the dates.

- When future cash flows are discounted using the EIR, the Net Present Value (NPV) of the contractual cash flows of the contract is calculated.

- When future cash flows are discounted using the Market Rate, the Net Present Value of the contract at market rate is calculated.

- Raising multi-GAAP accounting adjustments.

Under the traditional accounting principles, the lending application uses the transactional interest rate for interest recognition and fee/cost amortisation are allowed using the straight-line amortisation method.

The accounting framework allows to raise the accounting movements for the delta between contract balances and the calculated value using the NPV method and is termed as Delta Accounting and is a consolidated delta.

Under FAS91, the accounting of non-refundable fees or cost are amortised using the EIR.

- Temenos Transact supports the FAS91 regulation with the RN module built on top of the GAAP platform.

- The FAS91 layer splits the consolidated delta amount into fees and cost on a pro-rata basis by arriving at a split percentage when loans are in performing status.

- It also supports the managing of fee and cost amortisation during various events on a loan such as:

- Performing loan moving to non-performing status and resuming back to performing status

- Charge-off in case of non-performing loan

- Recovery on charged off loans

- Write offs in case of non-performing loans

The Retail Lending and Corporate Lending applications under the Arrangement Architecture (AL) applies the FAS91 accounting for which the Cash Flow Generation (CW), Multi-GAAP Framework (IA) & Recognition of Fees (RN) modules are a pre-requisite.

The GL View provides two views of the sub-ledger:

- Traditional accounting - Shows revenue recognition from the Lending application using core accounting under the straight-line method

- FAS91- Includes the revenue recognition under straight-line method, the delta accounting as the difference between the straight-line method and EIR method and the additional accounting treatment based on the loan status.

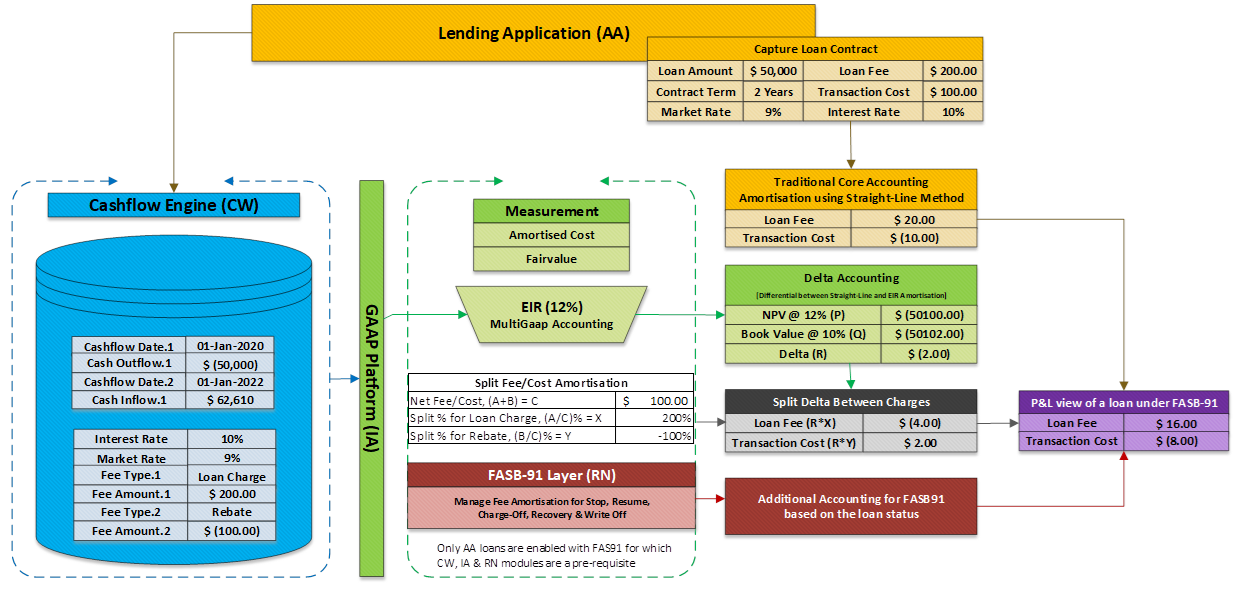

The diagram below is an example of revenue recognition under Traditional Accounting and FAS91.

Consider the 'Bank', a financial institution, originating a 2-year loan to one of its customers. The loan's principal amount is USD 50,000, and carries an interest rate of 10%. The loan agreement specifies that the borrower will make a bullet payment of both principal and when the loan's matures.

As part of the loan origination process, the bank charges the borrower a non-refundable loan origination fee of USD 200 and incurs direct loan origination costs of USD100. The bank decides to account for this loan under the Amortised Cost method using the Effective Interest Rate (EIR) approach. The EIR, which is the discount rate to discount all future cash flows to the initial carrying amount of USD 49,900, is estimated to be 12%.

| Description | Loan Details |

|---|---|

| Loan Term | 2 years |

| Principal Amount | USD 50000 |

| Interest Rate | 10% |

| Payment Type | Bullet payment |

| Loan Origination Fee | USD 200 |

| Direct Loan Origination Costs | USD 100 |

| Accounting Method | Amortised Cost |

| Effective Interest Rate (EIR) | 12% |

| Initial Carrying Amount | USD 49,900 |

The initial carrying amount of the loan is calculated as follows:

| Description | Amount |

|---|---|

| Loan Principal | USD 50,000 |

| Loan Fee | USD 200 |

| Transaction Cost | USD100 |

| Initial Carrying Amount | USD 49,900 |

The bank then uses the Accounting Straight-Line method to amortise the loan fee and transaction cost. At present, USD 20 has been amortised from the loan fee and USD10 from the transaction cost using the core amortisation framework.

| Description | Amount |

|---|---|

| Loan Fee | USD 20 |

| Transaction Cost | USD10 |

The delta accounting between Straight-Line and Effective Interest Rate (EIR) methods is calculated below.

| Description | Amount |

|---|---|

| Net Present Value (EIR, 12%) | USD 50,100 |

| Book Value (Interest Rate, 10%) | USD 50,102 |

| Delta (D) | USD 2 |

The proportionate (%) amortisation split is then determined by dividing the initial charge amount of the fee or cost by the net of all related charges.

| Description | Amount |

|---|---|

| Loan Fee (A) | USD 200 |

| Transaction Cost (B) | USD100 |

| Net Fee/ Cost (C) | USD 100 |

| Proportionate (%) Split for Loan Fee (X) | 200% |

| Proportionate (%) Split for Transaction Cost (Y) | -100% |

Using the proportionate splits and delta, the bank determines the split amortised amount and posts it accordingly to its respective Profit and Loss (P&L) categories.

| Description | Amount |

|---|---|

| Loan Fee (D * X) | USD 4 |

| Transaction Cost (D * Y) | USD 2 |

The bank's accounting view for the loan is summarised below

The traditional accounting view shows revenue recognition from the lending application using the straight-line method.

| Description | Amount |

|---|---|

| Loan Fee | USD 20 |

| Transaction Cost | USD10 |

The FASB91 view shows the revenue recognition under the straight-line method + delta accounting + additional accounting based on the loan status.

The table below shows the revenue recognition under the straight-line method.

| Description | Amount |

|---|---|

| Loan Fee | USD 20 |

| Transaction Cost | USD 10 |

The table below shows the delta accounting under the straight-line method.

| Description | Amount |

|---|---|

| Loan Fee | USD 4 |

| Transaction Cost | USD 2 |

Since the additional accounting method based on the loan status is not applicable in this scenario, the net P&L view of a loan under FASB91 is as below.

| Description | Amount |

|---|---|

| Loan Fee | USD 16 |

| Transaction Cost | USD 8 |

Product Configuration

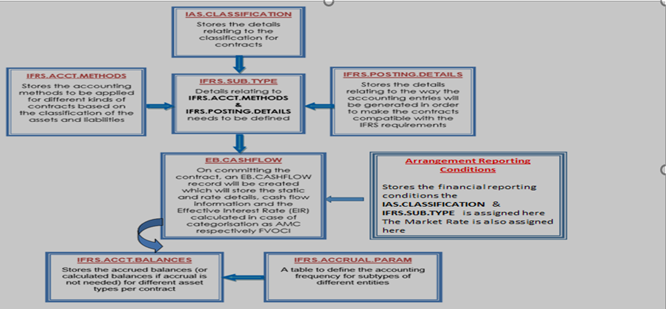

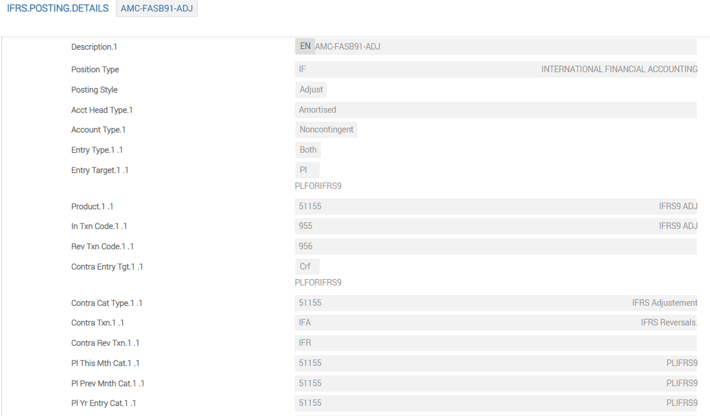

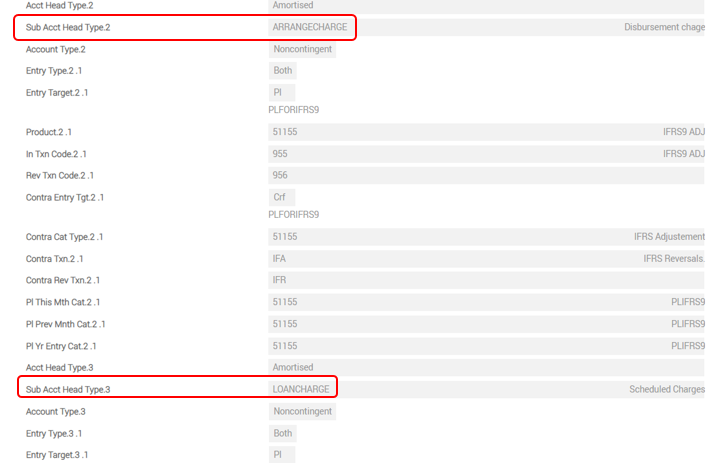

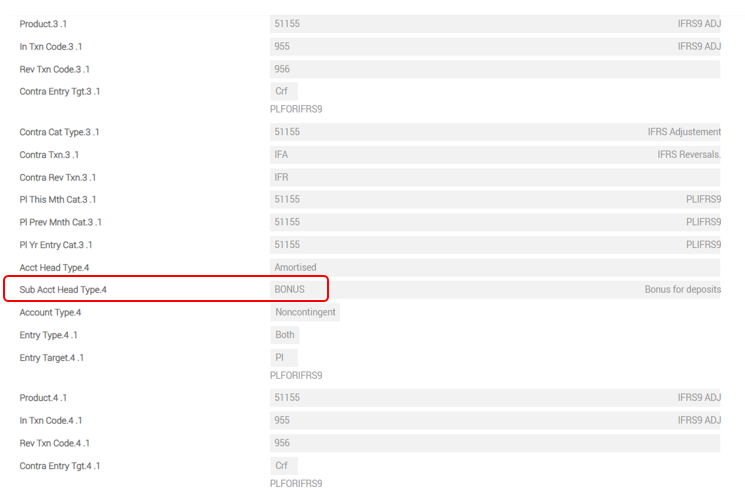

The parameter configuration required under the accounting framework for the classification and measurement of financial assets are as below:

The following tables are to be configured along with the module configuration under IA:

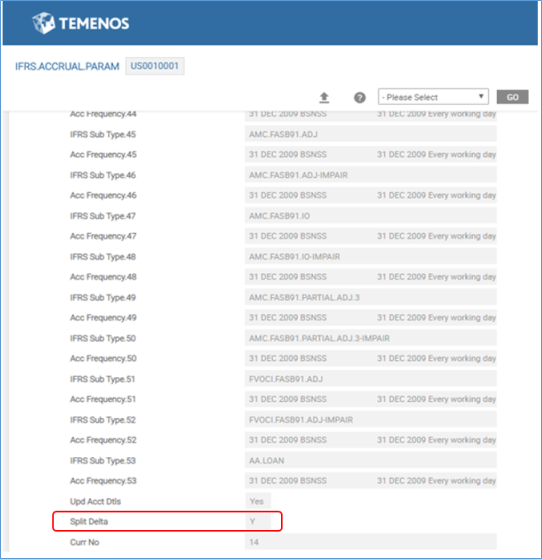

- Set the Split Delta field to Y in the IFRS.ACCURAL.PARAM application.

- Define the non-refundable fee and cost in the Sub Acct Head Type field as Amortised in the IFRS.POSTING.DETAILS application.

In this topic