Introduction to Obligor Objects

The Obligor Objects (OX) module is designed to support the structural component of the regulatory requirements associated with the following to provide the basis for assessing contagion:

- European Banking Association (EBA)

- Banking Commission of Central Africa (COBAC)

The Capital Requirements Regulation (CRR) Regulation (EU) No 575/2013 established the definition for a default obligor. This is used for the Internal Ratings Based (IRB) and Standard approach (SA) to measure the credit risk in regulatory capital calculation.

The EBA resolved to harmonise the supervisory approaches across the European Union (EU), after identifying the areas that IRB showed extreme flexibility in its application.

In Sept 2016, the EBA and RTS published the following:

- EBA – Final guidelines on the definition of default.

- RTS – Materiality threshold of credit obligations that are past due.

Following are the links to the guidelines and RTS relating to Regulation (EU) No 575/2013:

The key guidelines of the above regulations that define the scope of the functionalities available in the Obligor Objects module are as follows:

|

Key Regulatory Guidelines |

Functionality Offered |

|---|---|

| A joint obligor, is a specific set of individual obligors that have a joint credit obligation towards an institution. The joint obligor must be treated as a separate obligor and not linked to the individual obligors. |

A unique identity is assigned to a joint obligor to facilitate their identification of default. |

| Applying the definition of default at obligor level. |

|

| Institutions that decide to apply the definition of default for retail exposures at the obligor level need to specify the rules in detail, when handling joint credit obligations and default contagion, between exposures in their internal policies and procedures. | The PV module

or an external system identifies the default details that the Obligor object holds

along with the contagion results. Hence, it provides the default status of all the

obligors (including the default by contagion) for the following purposes:

|

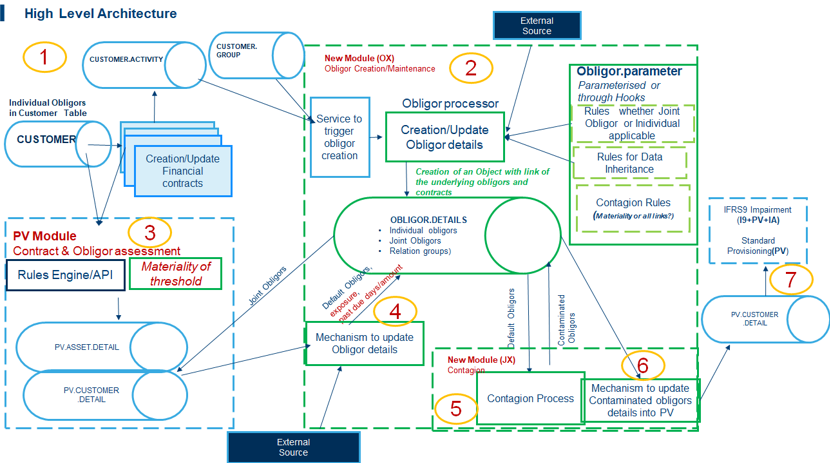

The Obligor Objects module is the foundation of the overall solution, which include:

- Default assessment of individual and joint obligors independently.

- Contagion effect on default in the case of retail exposures.

It supports the provisioning and regulatory capital requirement calculations. The following diagram shows the overall solution (supported by Obligor Objects), aimed at meeting the regulatory requirements as mentioned above.

Illustrating Model Parameters

This sections allows the user to view the below Model Parameters:

Illustrating Model Products

Model Products are not applicable for this module.

In this topic