Introduction to Impairment of Assets under IAS36

IAS36 is an accounting standard issued by the International Accounting Standards Board (IASB) that outlines the procedures to be followed for recognising, measuring, and disclosing impairments of assets.

This standard applies to all assets except those that are specifically covered by other IFRS standards (For example, inventories, financial assets, and assets arising from construction contracts). It defines when an asset is impaired, how to recognise an impairment loss, when an entity should reverse this loss, and what information related to impairment should be disclosed in the financial statements.

Following are the terminologies used in IAS36:

| Term | Definition |

|---|---|

| Carrying Amount | Amount at which an asset is recognised after deducting any accumulated depreciation and accumulated impairment losses thereon. |

| Recoverable Amount | Indicates fair value less costs of disposal (FVLCOD). |

| Impairment Loss | Indicates the amount by which the carrying amount of an asset exceeds its recoverable amount. |

Objective of IAS36

The core principle in IAS36 is that an asset must not be carried in the financial statements at more than the highest amount to be recovered through its use or sale. If the carrying amount exceeds the recoverable amount, the asset is considered impaired. In such cases, the bank must reduce the carrying amount of the asset to its recoverable amount and recognise an impairment loss.

IAS36 Solution for Banks

The IMPA36 module is specifically designed to align with IAS36 standards to support regulatory reporting under the cost model for assets managed under the FIXAMT module.

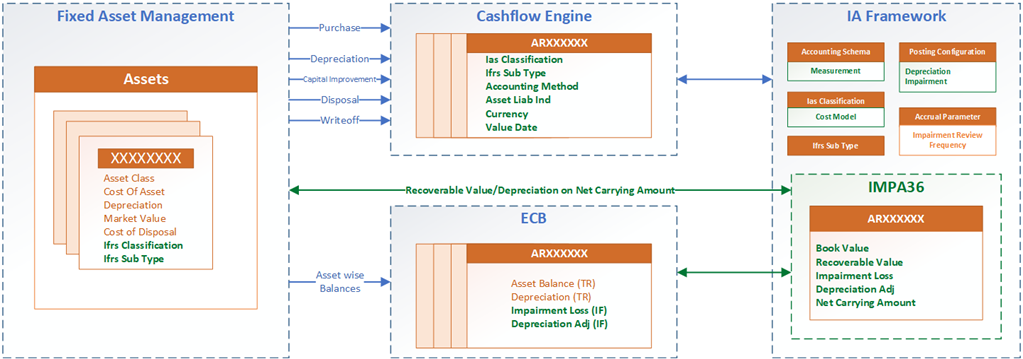

The fully integrated architecture of the IAS36 solution is as below:

Architecture Diagram Explained

The following explains the architecture of the IAS36 solution.

- The Fixed Asset Management (FIXAMT) module provides banks with complete financial control over fixed assets throughout their life cycle, from acquisition through depreciation to disposal, thereby preventing any misappropriation of bank assets.

- Fixed assets includes items such as land and buildings, motor vehicles, furniture, office equipment, computers, fixtures and fittings, and plant and machinery.

- Each asset is treated as a separate contract under contract-based fixed asset accounting.

- Assets can be flagged to indicate they fall under the scope of IAS 36 by specifying the IFRS classification and accounting schema at the

FIXED.ASSET.TYPElevel or at theASSET.MAINTENANCElevel during the asset registration process. - Supports the following activities:

- Registration

- Purchase or Acquisition

- Depreciation

- Capital Improvement

- Disposal

- Write-off

- The asset type, cost of the asset, depreciation frequency, market value, and the cost of disposal can be specified in the

ASSET.MAINTENANCEapplication during the respective activities. - Depreciation expense is calculated based on the asset's carrying amount (cost less accumulated depreciation) and is periodically posted for an asset according to the chosen depreciation method and frequency, as part of the depreciation process.

Refer the Fixed Asset Management user guide for more information on Fixed Asset Management.

- EB.CONTRACT.BALANCES (ECB) maintains individual asset-wise balances, including the cost, depreciation expense, and so on, under the contract-based fixed asset accounting.

- The initial handoff to the cashflow engine is provided when an asset is purchased, including static asset details, and is maintained in the EB.CASHFLOW table.

- The cashflow engine then receives handoffs for every capital improvement, depreciation, disposal, and write-off activities.

- Accounting schema and posting details can be configured to measure fixed assets under the cost model of the IAS36 accounting standards.

- Impairment review frequency can be configured at the IFRS.SUB.TYPE level.

- Assets are tested for impairment on the review date based on the defined frequency.

- The IMPA36 framework fetches the carrying value and fair value (market value less cost of disposal) from the ECB and Fixed Asset Module, respectively.

- During impairment review, if the recoverable value is less than the carrying value, the system books an impairment loss under the IF position type.

- If the carrying value is less than the recoverable value for an already impaired asset, the impairment loss is reversed under the IF position type, considering limitations.

- For impaired assets, the new depreciation expense is calculated based on the asset's net carrying amount (cost of asset less accumulated depreciation less accumulated impairment losses).

- The difference between this new depreciation expense and the posted depreciation expense is then recorded as the depreciation adjustment under the IF position type.

- Individual asset-wise balances, including the cost of the asset, depreciation expense, and so on, are recorded within the TR position type under contract-based fixed asset accounting.

- Impairment Loss and depreciation adjustments made on the net carrying amount (after deducting impairment losses) are recorded within the IF position type under IAS36 accounting.

Pre-requisites

To enable IAS36 accounting:

- Fixed Asset Management (FIXAMT)

- Cash Flow Generation (CW)

- Multi-GAAP Accounting Framework (IA)

- Impairment of Assets under IAS36 (IMPA36)

In this topic