Introduction to Financial Risk Management (FRM)

The FRM application is integrated with Temenos Transact and is delivered as a pre-packaged and upgradeable risk management software. It enables the clients to:

- Measure and monitor financial risks

- Reduce cost of capital and compliance

- Improve profitability in lending

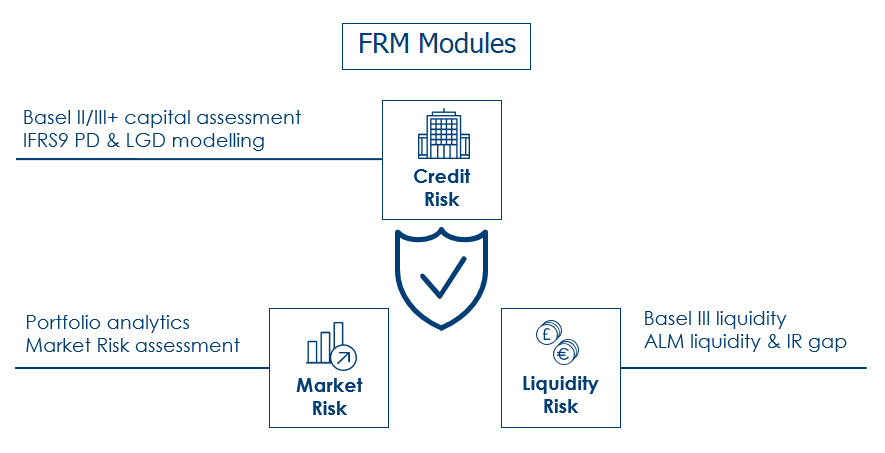

The FRM application consists of three modules and they are:

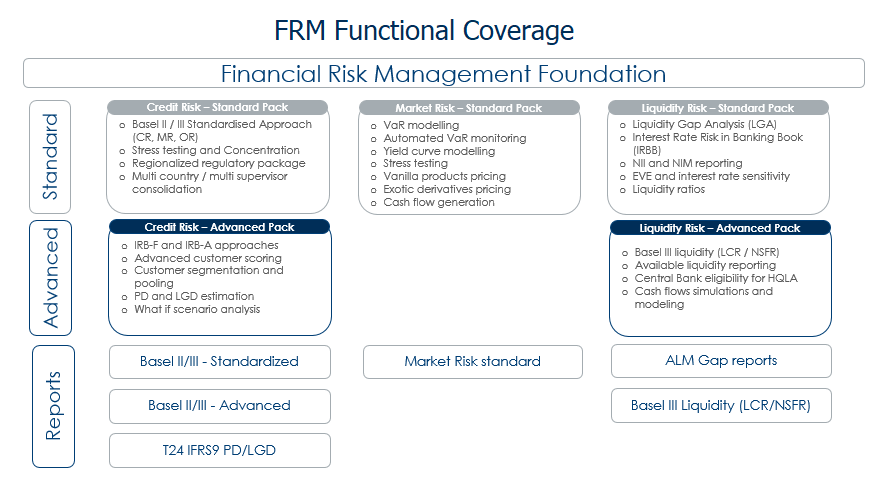

The modules are segregated to various features. The below capture illustrates:

- Features of FRM modules

- Functional areas supported by each feature

- Various approaches or methodologies for risk management

Credit Risk Overview

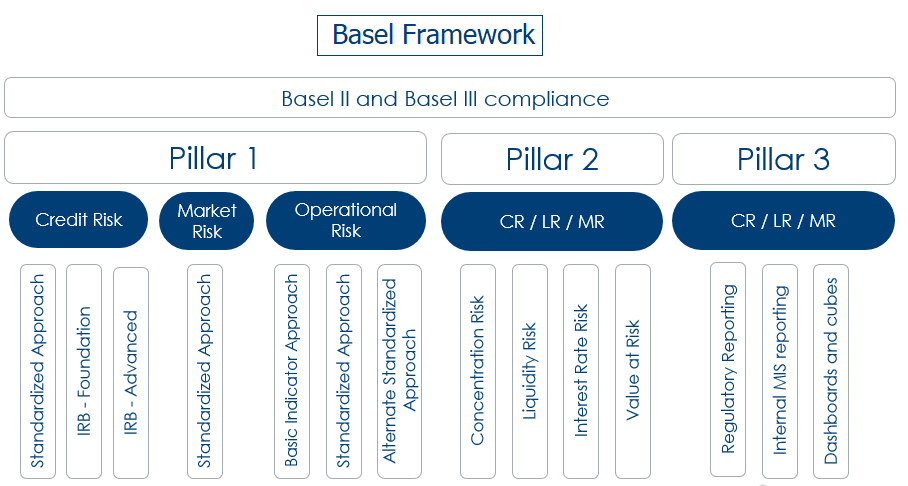

The Credit Risk module is a comprehensive Basel II and Basel III analysis and reporting tool, which calculates Risk Weighted Assets (RWA) and capital ratios through Standard Pack edition.

The module has a pre-configured interface with Temenos Transact that supports both the Internal Rating Based Approaches (IRB- Foundation and IRB- Advanced) through Advanced Pack edition. The module also calculates Probability of Default (PD) and Loss Given Default (LGD) using various models as per the International Financial Reporting Standard - Nine (IFRS9) requirements.

The below screens capture illustrates Basel II and Basel III framework and various approaches supported by the FRM modules.

In this topic