Introduction to Financial Risk Management (FRM)

The FRM application is integrated with Temenos Transact and is delivered as a pre-packaged and upgradeable risk management software. It enables the clients to:

- Measure and monitor financial risks

- Reduce cost of capital and compliance

- Improve profitability in lending

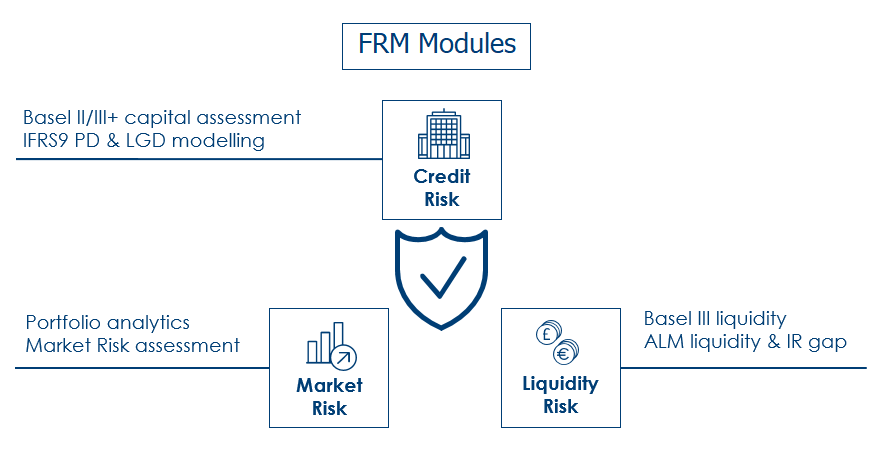

The FRM application consists of three modules and they are:

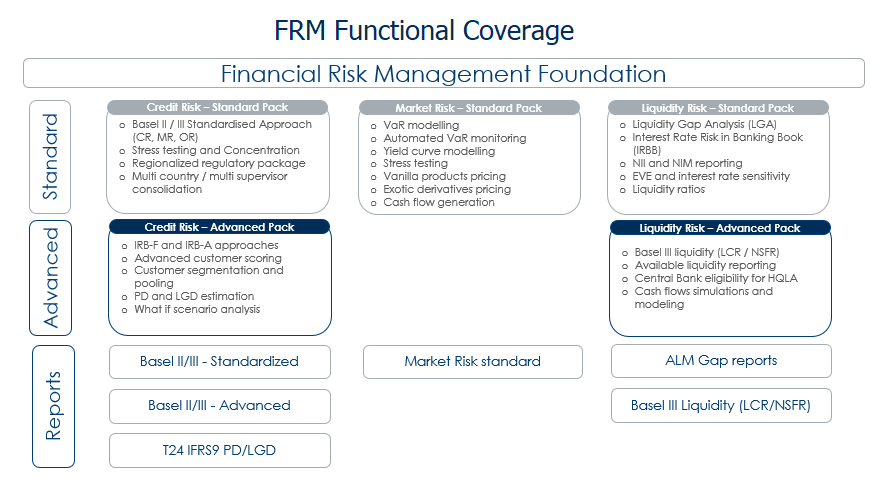

The modules are segregated to various features. The below capture illustrates:

- Features of FRM modules

- Functional areas supported by each feature

- Various approaches or methodologies for risk management

Liquidity Risk Overview

The Liquidity Risk module is an advanced liquidity risk analytical tool that supports standard liquidity and interest rate gap reports through the Standard Pack edition. It aids the banks in being compliant with Basel III liquidity reforms through its Advanced Pack edition.

The module has a pre-configured interface with Temenos Transact and is designed to operate in both batch and interactive mode. This module supports banks to measure and monitor the interest rate risk and liquidity risk across banks trading and bank book.

The Standard Pack feature comprises of the following functional areas that enable the user to display reports and output information along with flexible timing bucket and tools that enable the forecast of income and corresponding margins.:

- Wealth of Reports and output information by Asset Liability Management (ALM) – calculates and stores a variety of financial risk indicators including duration and liquidity gaps based on pricing and liquidity bucket definitions. The following ALM Reports are complete solutions that offer intuitive intelligence:

- Duration Gap Analysis Report

- Liquidity Gap Analysis Report

- Liquidity Ratio and top fund providers Report

- Interest Rate Sensitivity Report

- Flexible timing bucket for reporting – plays vital, meeting the forecasting requirements of financial institutions.

- Tools to accurately forecast – calculates the Net Interest Income (NII) and Net Interest Income Margin (NIM)

The Advanced Pack feature comprises of the following functional areas that enable the system to support the banks' compliance with Basel III liquidity reforms.

- Support compliance with Basel III Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) requirements

- Analysis and simulation of cash-flows

- Determine security liquidity classifications and central bank eligibility

- Available liquidity position and computation of High Quality Liquid Assets (HQLA)

In this topic