Introduction to Qualified Intermediary

Identifying a customer’s or portfolio’s status, from a Qualified Intermediary (QI) perspective, is important in applying withholding tax on income received from US Securities by QI's Customers'. The QI module in Temenos Transact enables banks that act as a QI to comply with the regulation as per Chapter III of Internal Revenue Code (IRC) of USA.

Chapter III of the IRC (Sections 1441 - 1446) requires withholding at a rate of 30% on US-source Fixed or Determinable, Annual or Periodic income (FDAP) paid to non-resident aliens. However, a reduced rate of Withholding is applicable based on the payee’s tax residence country, which may enter into a Double Taxation Avoidance Agreement (DTAA) or simply ‘Treaty Agreement’ with the United States.

A Qualified Intermediary (QI) is a non-US financial institution that has entered into a QI agreement with the IRS. The QI agreement requires that the QI must implement certain documentary procedures to identify its bank’s customers that invest in US securities and apply withholding tax on withholdable payments considering the tax treaty agreements between the customer’s tax residence and the United States, besides several reporting requirements.

A US person (either individual or entity), who is the beneficiary of income on US securities and exempted from withholding under Chapter III, is, however, subject to Withholding under Chapter IV of the FATCA regulation. Withholding under chapter IV is based on the FATCA status of a customer and the Inter-Governmental Agreement (IGA) between the United States and tax residence country of a QI customer.

A Non-US person (either individual or entity), who is the beneficiary of income on US securities and subjected to withholding under chapter III, is also subject to FATCA withholding under Chapter IV, if the FATCA status of the person is Non-Participating FFI, undocumented FFI or a Recalcitrant/Renitent.

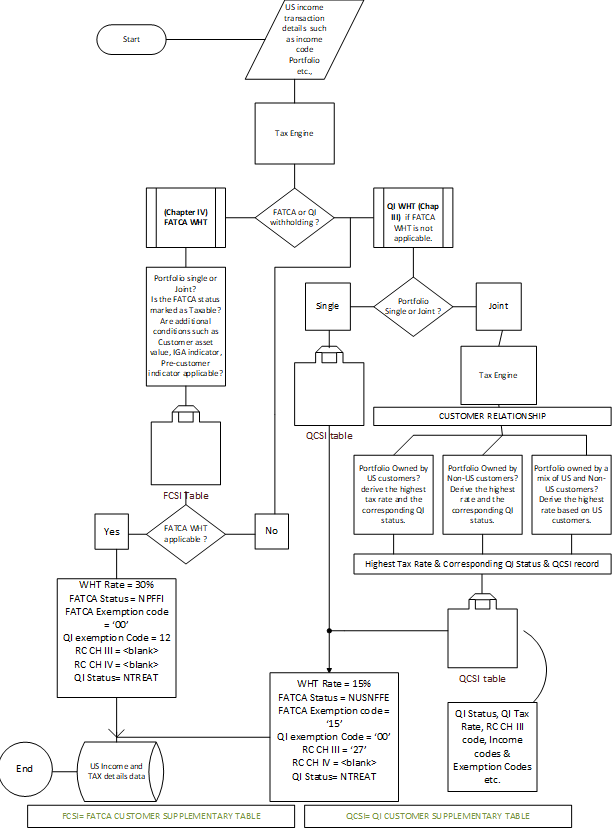

Therefore, a transaction involving income from US securities is subject to withholding as per Chapter III (QI) or Chapter IV (FATCA), and not both, the priority being Chapter IV.

The QI functionality has three key features that enable QI banks to comply with the IRS regulations as mentioned above.

The FATCA customer and portfolio classification functionality is available in the FATCA module and the customer and portfolio status identification or QI Status functionality is covered under this feature.

Read the FATCA module for more information.

The Securities (SC) module in Temenos Transact handles the corporate events relating to income on US securities. The SC module along with the core TAX application in Temenos Transact processes income transactions, including the income from US securities. It is during this process, that applying withholding tax on US income transactions from either FATCA or QI withholding perspective, is relevant under Chapter III and IV of IRS.

The customer or portfolio QI status is a key consideration in applying withholding tax as per Chapter III of IRS.

Read US income transaction processing and Withholding Tax for more information.

One of the responsibilities of a QI is to issue tax forms to the payees of the US income and submit tax returns to IRS such as 1042-S and 1099.

Reporting requires data availability. A dedicated US tax data base holds the transaction data pertaining to US income and tax. This enables banks assuming the QI role to do the reporting using their own or third party report generation tool.

The following screenshot shows the three features integrated to provide the functionality.

Configuring QI Parameter

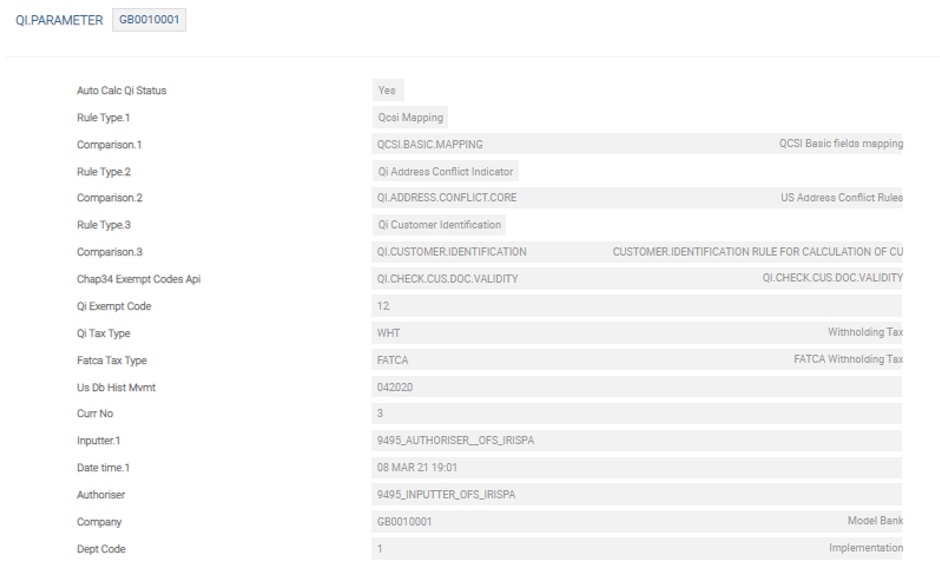

The module level parameter, that is, QI.PARAMETER, holds the bank’s user-defined parametric values and are referred to by the three key features of the QI module in delivering the QI functionality.

Illustrating Model Parameters

Covers the model parameters required for the QI module.

Illustrating Model Products

Model Products are not applicable for this module.

In this topic