Introduction to FATCA Reporting

A Participating Foreign Financial Institution (PFFI) reports information based on the time and manner prescribed in the regulation. The reporting information corresponds to those U.S. accounts maintained at any time during each calendar year and is required to be reported to the IRS under the FFI agreement.

Some of the key reporting information obtained and exchanged by the PFFI with the IRS is described below:

- The name, address, and U.S. TIN of each specified U.S. person, that is, an account holder of such accounts. For a non-U.S. entity, after the due diligence procedures are applied, the entity is identified as having one or more Controlling Persons who is a specified U.S. person. Under these circumstances, the name, address, and U.S. TIN (if any) of such an entity and specified U.S. person is considered.

- The account number (or functional equivalent in the absence of an account number).

- The account balance or value (including, in the case of a cash value insurance contract or annuity contract, the cash value or surrender value) at the end of the relevant calendar year, other appropriate reporting period or, if the account was closed during that year, immediately before closure.

- For a Custodial account:

- The total gross amount of interest, the total gross amount of dividends, and the total gross amount of other income generated regarding the assets held in the account, in each case, paid or credited to the account (or regarding the account) during the calendar year or other appropriate reporting periods.

- The total gross proceeds from the sale or redemption of property paid or credited to the account during the calendar year or other appropriate reporting periods with respect to which, the Reporting Financial Institution acts as a custodian, broker, nominee, or an agent for the account holder.

- In the case of any depository account, the total gross amount of interest paid or credited to the account during the calendar year or other appropriate reporting period.

- All with holdable income in the case of depository accounts:

- The aggregate gross amount of interest paid or credited to the account during the calendar year.

- All with holdable income in the case of custodial accounts:

- The aggregate gross amount of dividends paid or credited to the account during the calendar year.

- The aggregate gross amount of interest paid or credited to the account during the calendar year.

- The gross proceeds from the sale or redemption of property paid or credited to the account during the calendar year with respect to which the FFI acted as a custodian, broker, nominee, or otherwise as an agent for the account holder.

- The aggregate gross amount of all other income paid or credited to the account during the calendar year.

- For Foreign reportable amounts:

- The aggregate gross amount of foreign reportable amounts paid or credited to a Nonparticipating FFI is reported as 'FATCA Other' payment.

As part of its reporting responsibilities under its FFI agreement, an FFI reports the following groups of account holders separately and for each calendar year.

1. The aggregate number and aggregate value of accounts held by recalcitrant account holders at the end of the calendar year, other than accounts that have U.S. indicia.

2. The aggregate number and aggregate value of accounts held by recalcitrant account holders at the end of the calendar year, other than accounts described that do not have U.S. indicia.

3. The aggregate number and aggregate value of accounts held by recalcitrant account holders at the end of the calendar year that are dormant accounts.

Account balance or value, and any reportable payment, is reported in U.S. dollars or in the currency in which the account or payment is denominated.

Product Configuration

This section orients the user towards the parameter setup required for building the reporting database and reporting under FATCA. The FATCA reporting feature is licensed under the FATCA Reporting (FE) module. This module has a dependency with FATCA (FA) module that deals with FATCA client identification.

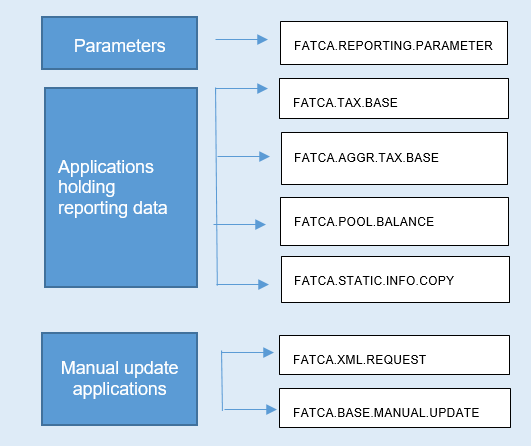

The bank configures the parameters required for FATCA reporting. The screenshot below outlines the components in the FE module.

The table below explains the parameter details:

| Application | Description |

FATCA.REPORTING.PARAMETER

|

Allows the user to define the

high-level parameters that govern the yearly reporting required under FATCA.

The configuration helps determine the following:

The above is not the complete list but highlights a few key determinants. |

Read the configuration section of the FATCA Reports feature for more information.

Illustrating Model Parameters

Parameters configured in Model Bank are given below:

| Parameters | Description |

|---|---|

|

|

|

FATCA.TAX.BASE

|

User can access this system-generated file with data to be reported such as Customer name, address, tax identification number (TIN)/EIN/GIIN details, ownership details (passive NFFEs, Owner documented FFIs), client type and account balance details (in 2015, the 2014 year-end account balance is reported) including details of accounts or in which the client is a joint owner |

Illustrating Model Products

Model products are not applicable for this module.

In this topic