Configuring Due Diligence

The parameterisation required for the Due Diligence feature are as follows:

- Set up

CRS.CLIENT.TYPE - Set up the

RT.REGULATORY.RULEStable for field and indicia mapping - Set up

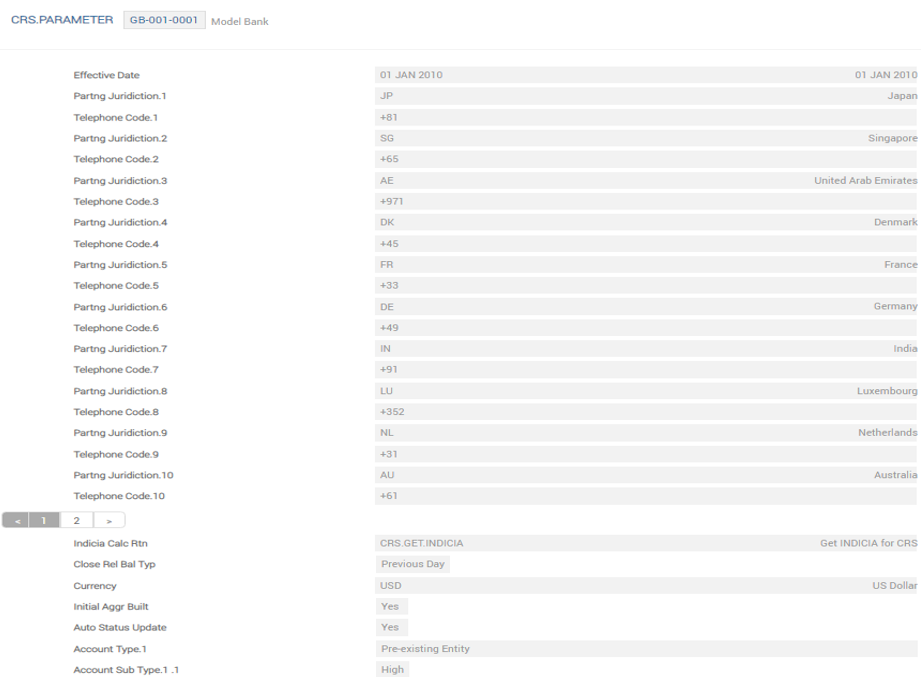

CRS.PARAMETER - Set up BNK/RT.CREATE.REGULATORY.RECS – online service

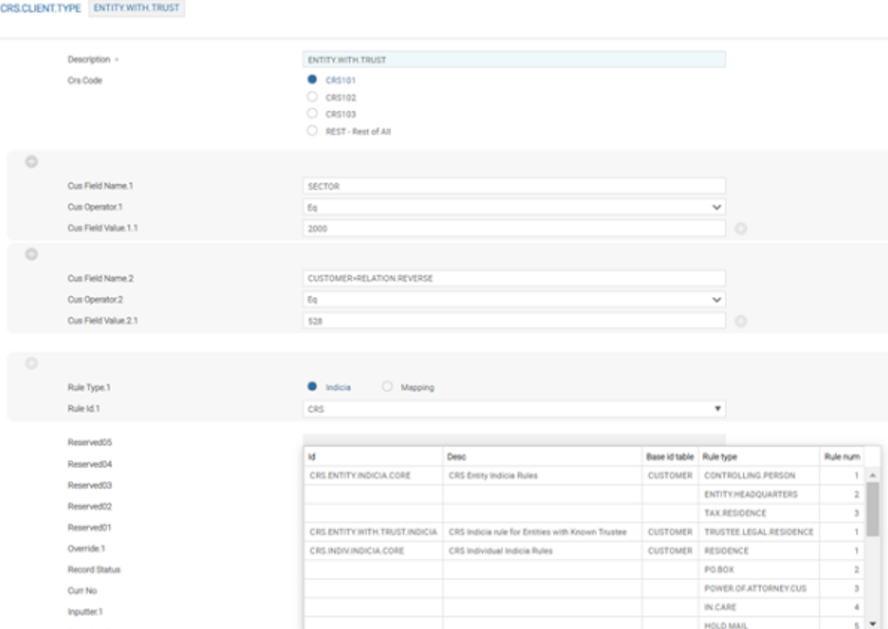

Configuring CRS.CLIENT.TYPE

The CRS standards require the Financial Institutions to identify the reportable customers and then report them as individual and entities. The controlling person (s) of the Entities must also get reported.

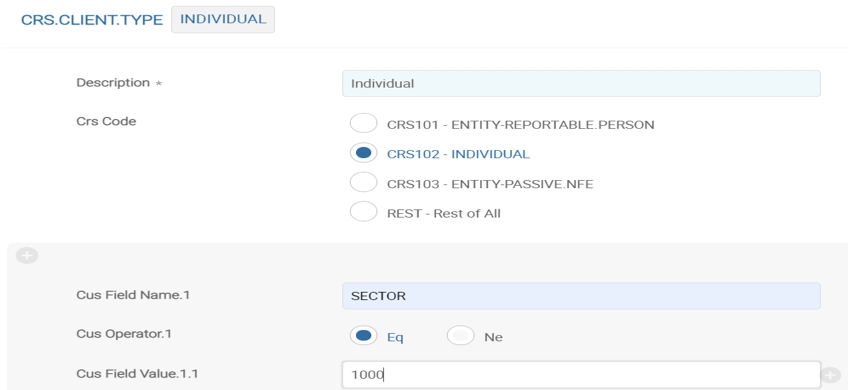

Using CRS.CLIENT.TYPE, the user can configure the attributes that define a CORPORATE (entity) or a PERSONAL (individual) customer. The Cust Field Name field from this table accepts any field in CUSTOMER. The ID of the table is free text. In the screenshot below, any customer with SECTOR set to 2000 is a Legal Entity (Corporate customer).

In the screenshot below any customer with SECTOR set to 1000 is an Individual Customer (Personal).

In the screenshot above, the user can configure the Customer field names to be used to determine whether a customer is a corporate or personal customer.

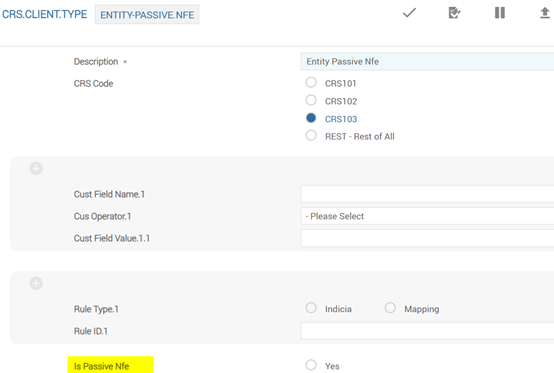

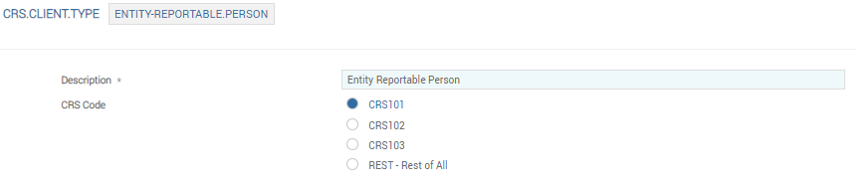

In the CRS.CLIENT.TYPE table, the Crs Code field helps identify the customer classification based on the CRS schema. Entity client types are the records with the Crs Code field set to one of the following:

- CRS101

- CRS102

- CRS103

If an entity is considered as Passive Nfe, then the Is Passive Nfe field must to be set as Yes.

Allowed only for Entities.

Some of the key fields for customer identification and corresponding descriptions are provided below.

Configuring RT.REGULATORY.RULES

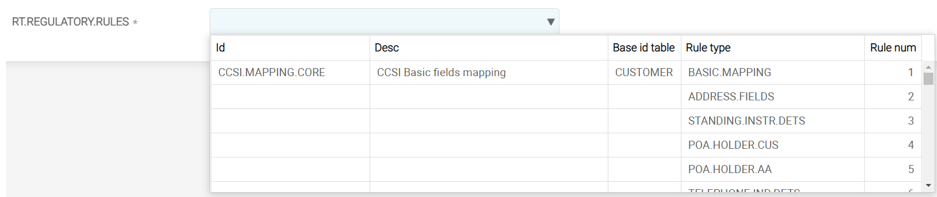

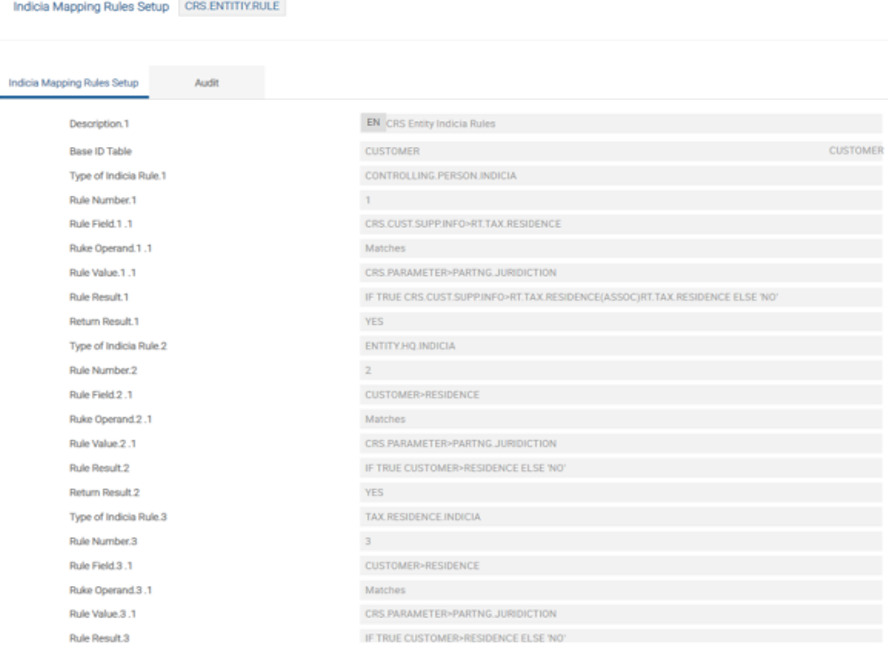

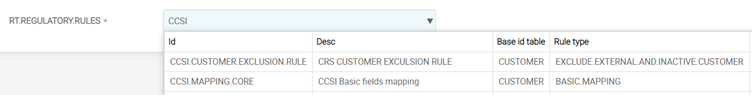

This application allows banks to configure mapping rules based on a set of user-defined data elements. For CRS, this application constitutes the following:

- Customer Identification Rule

- Document submission and status determining rule

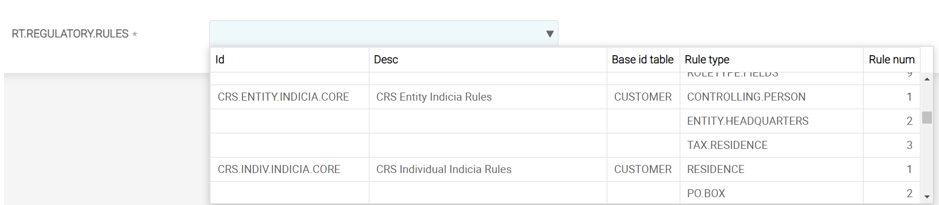

- Indicia Determining Rules

- Mapping rule to auto create or update the record in

CRS.CUST.SUPP.INFO

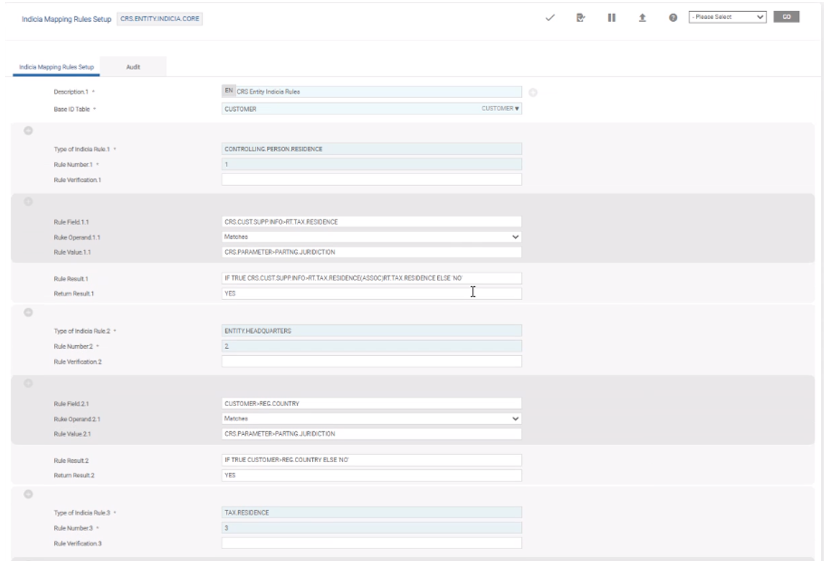

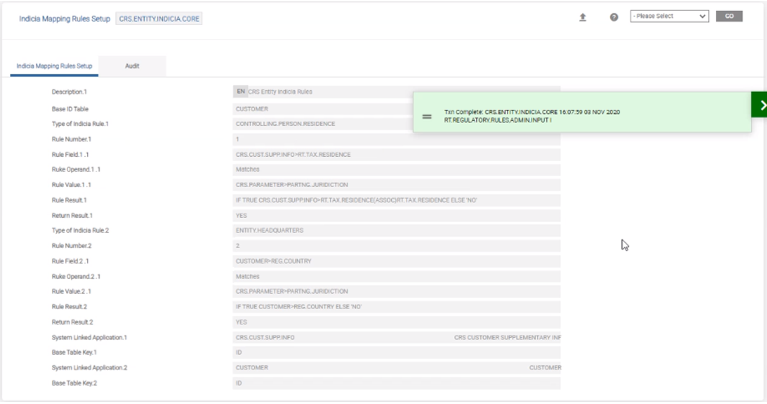

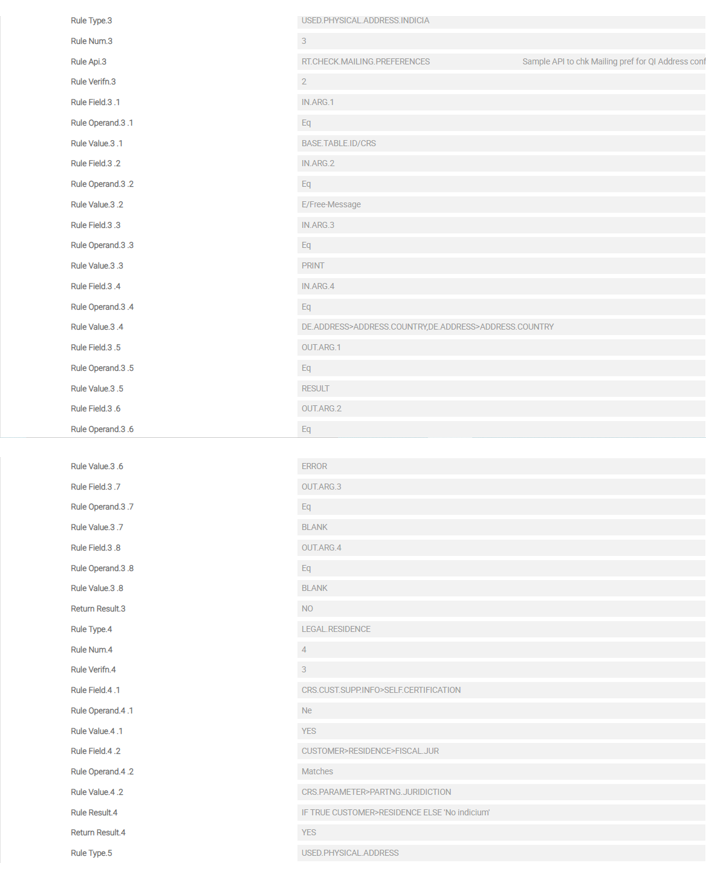

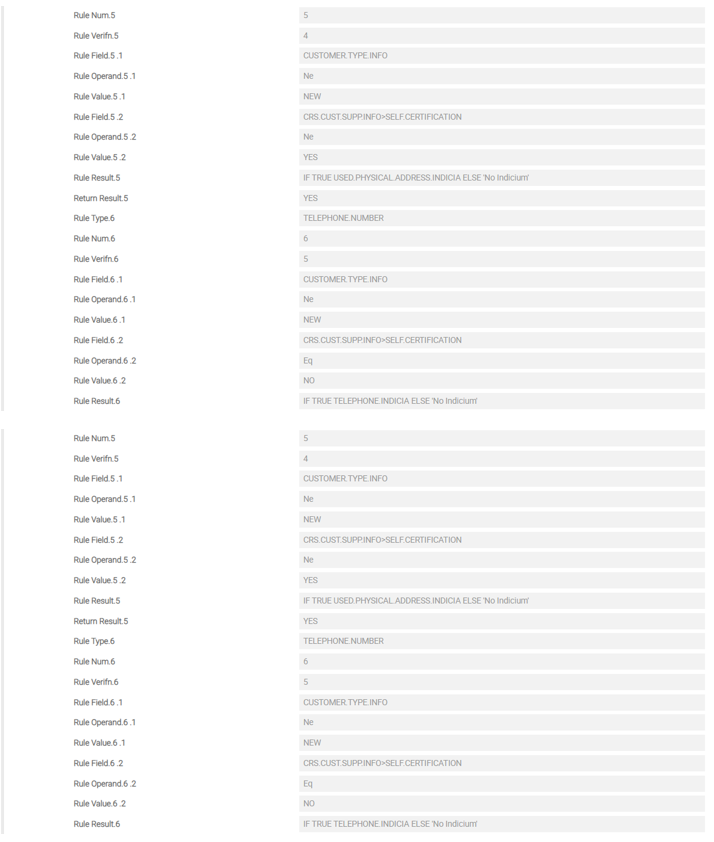

The indicia mapping rules for both corporate and/or individual customers as shown in the below screenshot.

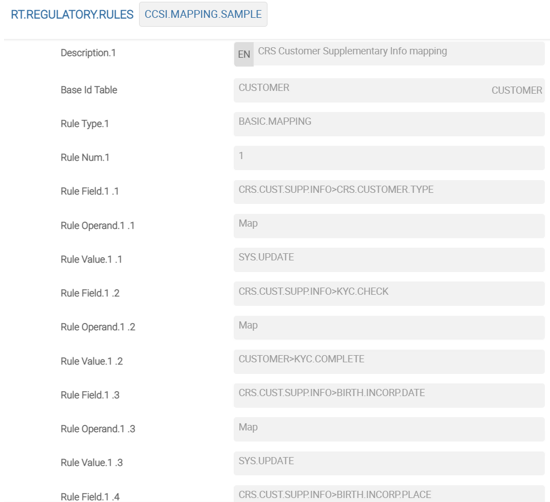

A sample pre-defined rule screen is shown below:

The user can configure fields in the CRS.CUST.SUPP.INFO application to be automatically updated with field values from the specified underlying core applications selected.

After RT.REGULATORY.RULES is configured, the system automatically synchronises any data values due to the value changes made in the specified underlying application in Temenos Transact until the configuration rule is deactivated.

The RT.CREATE.REGULATORY.RECS service identifies changes to the relevant field value in the underlying application (as defined in RT.REGULATORY.RULES) and updates the corresponding values in the CRS.CUST.SUPP.INFO record. This application also supports APIs and the mapping of the local fields, if required.

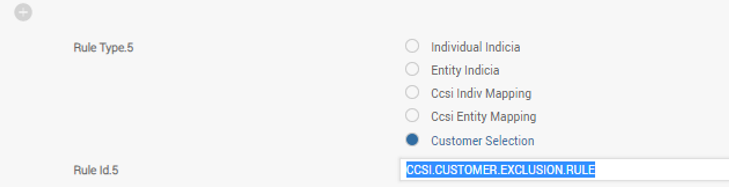

While the actual rule or mapping is defined using RT.REGULATORY.RULES, the CRS.CLIENT.TYPE application provides a provision to allow the user to attach the indicia rule and mapping rule ID from RT.REGULATORY.RULES for the relevant customer type using the Rule Type and the Rule Id fields. For example, if the user selects Mapping as the Rule Type, the user then needs to select an appropriate mapping rule from the drop-down options in the Rule Id field.

CRS.PARAMETER are applied.

The ST.IDENTIFY.INDICIA service identifies the indicia conditions for both individual and corporate customers based on the rules defined in the RT.REGULATORY.RULES application. This service creates the CRS.CUST.SUPP.INFO records for those customers who satisfy any of the indicia rules defined.

The RRR.TRIGGER table tracks the changes in the applications that are used to identify and map the indicia, for example, when the Residence field in the CUSTOMER application is changed, the ID in the RRR.TRIGGER table acts as a trigger for indicia identification through the RT.CREATE.REGULATORY.RECS service. This job is run in the background in auto mode and checks all the records in RRR.TRIGGER and recalculated the indicia based on the amendments in real time..

Scenario-based Configurations

Following are the scenario-based configurations:

The following screenshot shows that the user can configure the CRS Indicia rule for Trusts with Known Trustees within CRS.CLIENT.TYPE using the Rule Type and Rule Id fields and then select the Rule Id from the drop-down options.

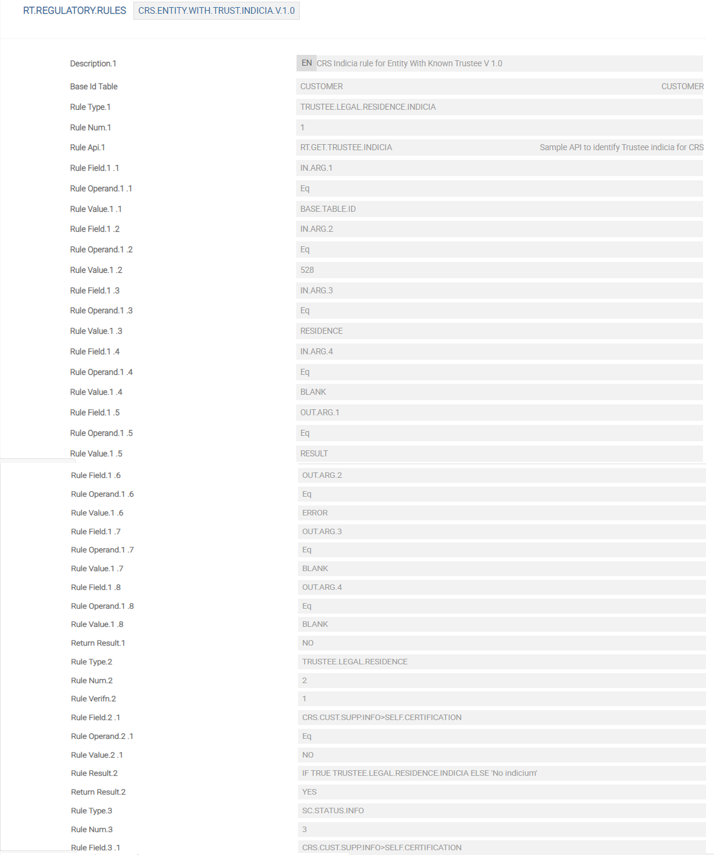

The mapping and the indicia sample rules for 'Entity Trusts whose Trustees are Known' can also be found in the RT.REGULATORY.RULES application.

The following screenshot shows the sample use of Rule API field. A sample API RT.GET.TRUSTEE.INDICIA has been set up.

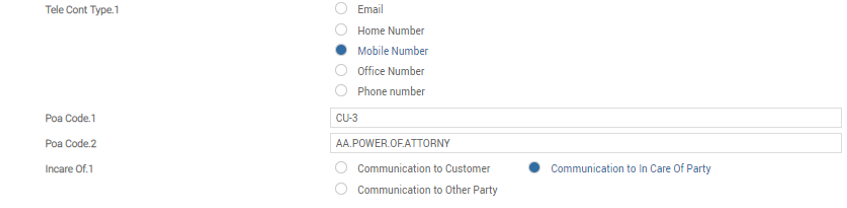

The RT.GET.TRUSTEE.INDICIA API uses the Address Country field in the CUSTOMER application to check the reportable jurisdiction to identify the trustee indicia. This API is modified to allow the user to select the preferred country field for indicia check, which is subject to the accurate configuration of the Residence field in the CUSTOMER application to be considered for indicia check. This modification is also based on the configuration of the RELATION.CODE (which defines the trustee) in the Poa Code field in CRS.PARAMETER.

Following are the steps required:

- Configure the reporting jurisdiction in the

CRS.PARAMETERapplication.

- Configure

CRS.CLIENT.TYPEfor both individual customers and entities as shown in the following screenshot.

The user can configure which types of customers will have a CRS.CUST.SUPP.INFO record created prior to the indicia assessment.

Following are the configuration steps for the CRS exclusion functionality:

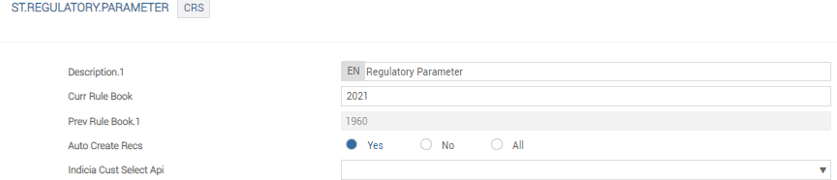

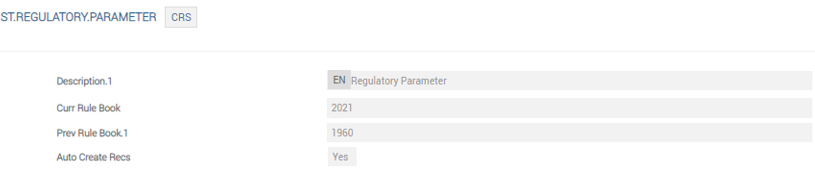

- Set the Auto Create Recs field as All in

ST.REGULATORY.PARAMETER.

- Create a new rule in the

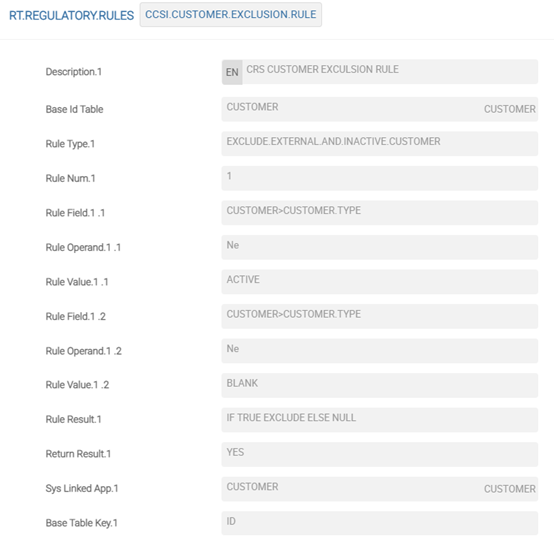

RT.REGULATORY.RULESapplication with the required exclusion condition definitions.- The user can refer to the CCSI.CUSTOMER.EXCLUSION.RULE sample record that is released with the CUSTOMER.TYPE exclusion definition.

- Each Rule Type works as OR condition, that is, if any one of the conditions are satisfied, then the customer is excluded from the

CRS.CUST.SUPP.INFOprocessing during COB (close of business).

- Attach the CRS CUSTOMER EXCLUSION rule in

CRS.PARAMETER.- The Rule Type should be selected as Customer Selection.

- The Rule Id should be the above created exclusion condition RT.REGULATORY.RULES rule.

- After the user creates a customer record and runs a COB (close of business), the user can check the exclusion in the CRS.CUST.SUPP.INFO record. A CRS.CUST.SUPP.INFO (CCSI) record is created for every customer who has not been excluded under the configuration facility.

- If there are any changes in the rules or criteria, the user can amend them in the

RT.REGULATORY.RULESapplication.- When there is a change in

CRS.CLIENT.TYPE(where the customer types are defined), all the customers in theCUSTOMERapplication are validated against the new definition and the corresponding CCSI creation or update will be done by the ST.IDENTIFY.INDICIA COB job. - When the information in the

CUSTOMERapplication changes, RT.CREATE.REGULATORY.RECS revalidates the customer type against the definition inCRS.CLIENT.TYPE.

- When there is a change in

CRS.CUST.SUPP.INFO

The below configurations are necessary for the automatic creation of CRS customer supplementary information:

- Set the value of the Auto Create Recs field to Yes in the

ST.REGULATORY.PARAMETERapplication to enable the automated creation of the CRS supplementary information record and the associated indicia identification.

- The required setup in

CRS.PARAMETERis available. - The selection criteria to distinguish individual and entity type customers is defined using the

CRS.CLIENT.TYPEapplication. - The

RT.REGULATORY.RULESapplication is configured for the customer identification rules, document rules and indicia determining rules. - The

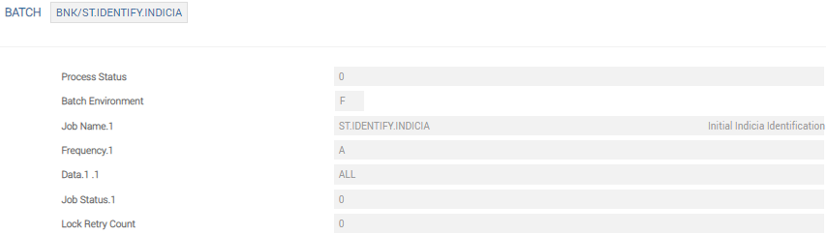

RT.REGULATORY.RULESapplication is configured with field mappings that are required to populate the CRS.CUST.SUPP.INFO record including the mapping for indicia fields. - The batch job, ST.IDENTIFY.INDICIA controls the creation and update of CRS.CUST.SUPP.INFO records of the eligible customers. The ST.IDENTIFY.INDICIA service identifies the indicia conditions for both individual and corporate customers based on the rules defined in the

RT.REGULATORY.RULESapplication. This service creates or updates the CRS.CUST.SUPP.INFO records for those customers who satisfy any of the indicia rules defined. This service can be configured to review all customers in the database and assess their indicia conditions as a one-time activity as shown below.

This service is also auto triggered during COB in the below circumstances:

- If there is an amendment to the rule definition in

RT.REGULATORY.RULES - If there is an amendment to the rule ID or indicia details in

CRS.PARAMETER

The

RRR.TRIGGERtable tracks the changes in the applications, which are used to identify and map the indicia, for example, when the Residence field in theCUSTOMERapplication is changed, the ID in theRRR.TRIGGERtable acts as a trigger for indicia identification through the RT.CREATE.REGULATORY.RECS service. - If there is an amendment to the rule definition in

- The mapping rules for documents are defined in the mapping definition records like CRS.INDIVIDUAL.MAPPING.RULE and CRS.ENTITY.MAPPING.RULE in the

RT.REGULATORY.RULESapplication for CRS. - An API that is attached to the above records fetches the mapping data corresponding to the documents from

CUST.DOCUMENT(application name defined using the User Application field inRT.REGULATORY.RULES) and updates the CRS.CUST.SUPP.INFO record for the customer.- The API accepts the Customer ID and CCSI record as input parameter.

- This Customer ID is used to validate if the document defined in

CUST.DOCUMENTcorresponds to the CRS documents defined inCRS.PARAMETER, in which case, the details are updated in the corresponding CCSI of the customer with the Sc Cust Ref field updated for primary owner. - In addition, if a controlling person is identified for the primary owner, relevant documents are validated against the document names parametrised in

CRS.PARAMETERfor each of the linked controlling persons. For CRS-related documents, details are updated in CCSI with the Sc Cust Ref field updated for controlling person. - The CRS.ROLE.CUSTOMER is an internal system maintained file that contains the list of controlling persons linked to the primary customer owning a record in the

CRS.CUST.SUPP.INFOapplication . - After the initial document update in CCSI, any modifications to the document data in

CUST.DOCUMENTis tracked online and updated by the jobs indicated above. This API facilitates tracking of the changes made to the documents inCUST.DOCUMENTsuch as DOC.STATUS, EXPIRY.DATE and EFFECTIVE.DATE, online.

- The update to this file is managed as part of RT.CREATE.REGULATORY.RECS.

The following configuration is required for the standing instruction indicia functionality to work:

- Configure the applications used for standing instruction indicia processing in the

RT.REGULATORY.RULESapplication defined for individual indicia identification.

The CRS indicia associated with Power Of Attorney (POA) and Authorised Signatory conditions can be tracked. These are defined using the Customer Relationship and Arrangement Role fields respectively.

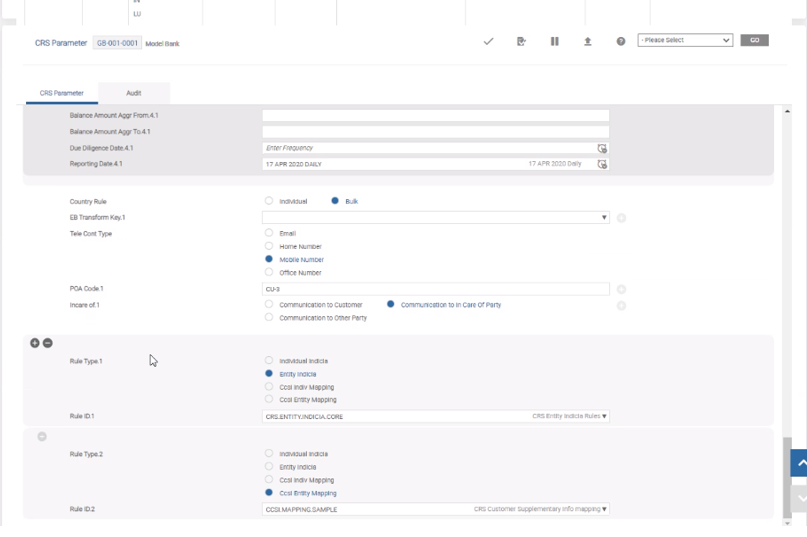

Customers might have configured their transact system to utilise different customer relationship codes to define the POA and/or different arrangement role codes to define the authorised signatory conditions. The following fields are added in the CRS.PARAMETER application.

- Poa Code.1 - Defines the customer relationship code used to define a POA condition by the client.

- Poa Code.2 - Defines the arrangement role code used to define an ‘Authorised Signatory’ condition by the client.

The system accounts for different indicia depending on the availability and validity of the self-certification form. These conditions are pre-configured in RT.REGULATORY.RULES corresponding to the different client types and using the matrix indicated under each client type head, below.

The customer’s self-certification submission status is managed by the bank’s Document Management system. This could be within Temenos Transact or in any external system. It is expected that banks manage at least the meta data information of the document within Temenos Transact with the help of Transact’s Document Management module.

The indicia conditions related to the self-certificate document status is pre-configured in the RT.REGULATORY.RULES application. Sample CRS documents considered by the RT.REGULATORY.RULES application, both at the time of reception and expiry of the document is shown below.

| Type of Customer | Document Code in

CUST.DOCUMENT |

Document Code in CCSI |

| Individual | AUTP | AUTP |

| Entity | AUTM | AUTM |

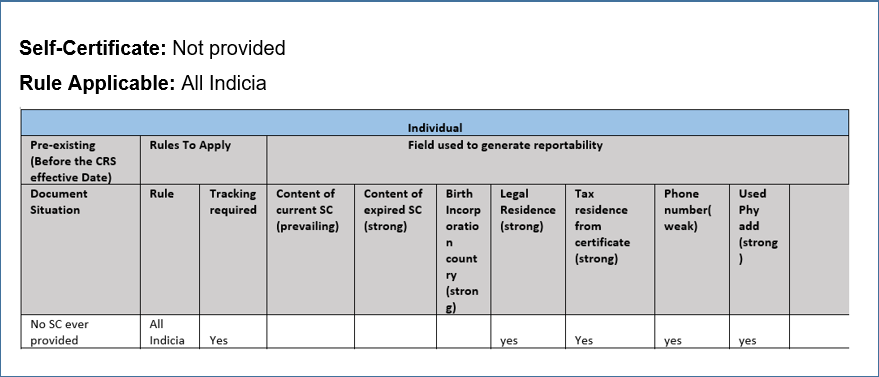

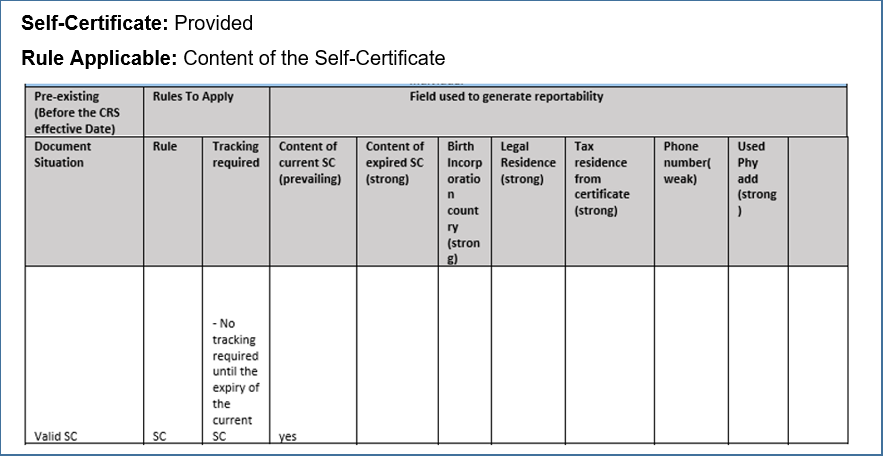

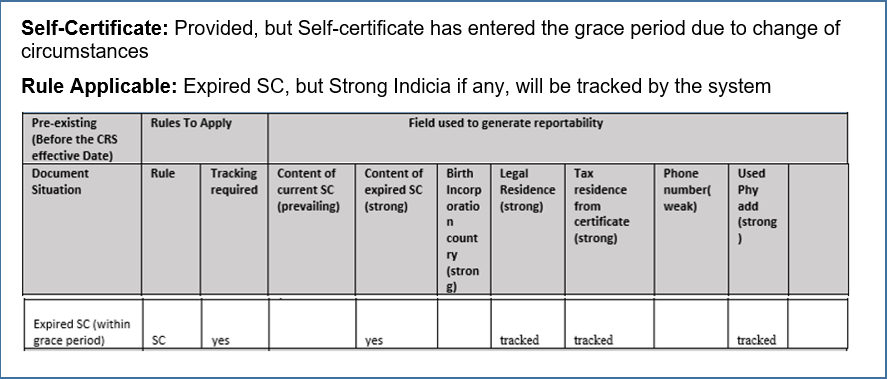

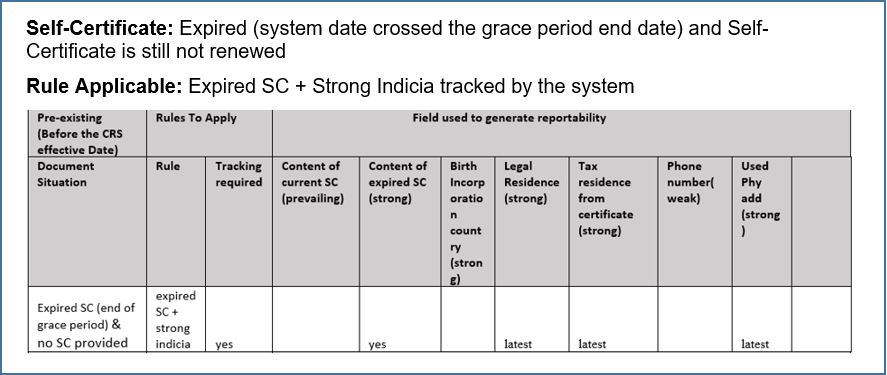

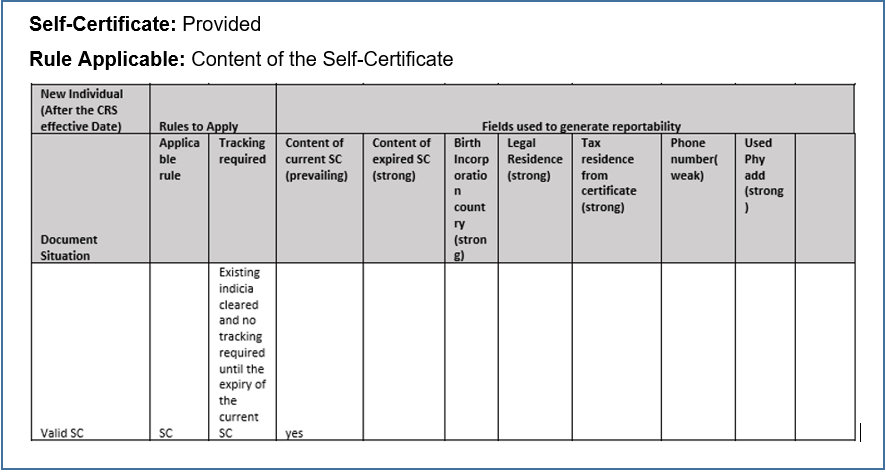

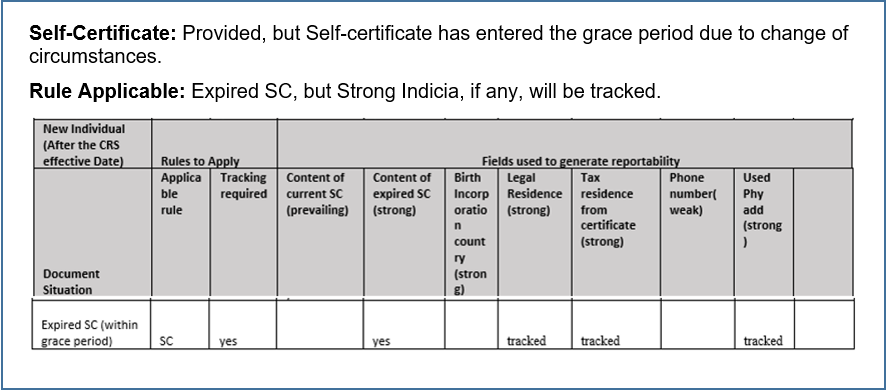

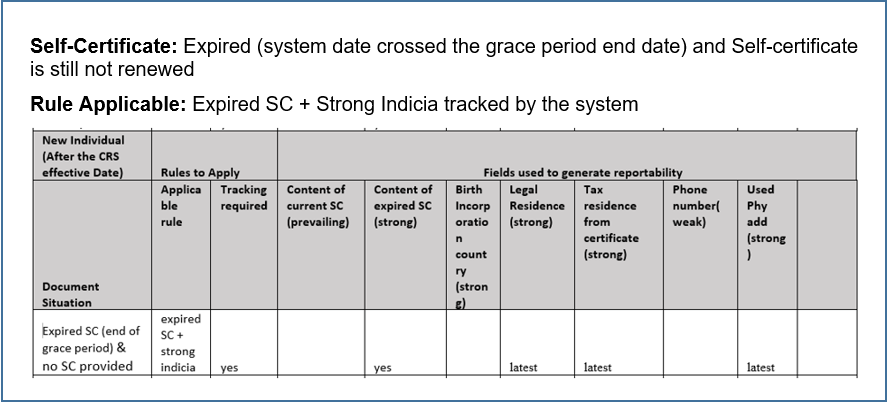

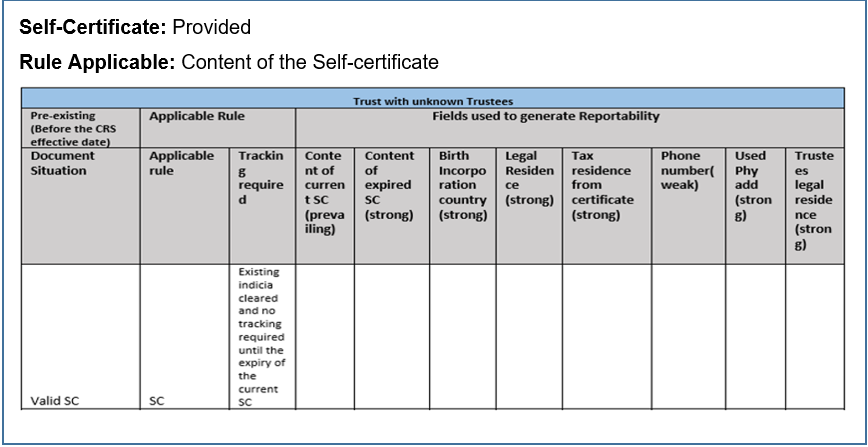

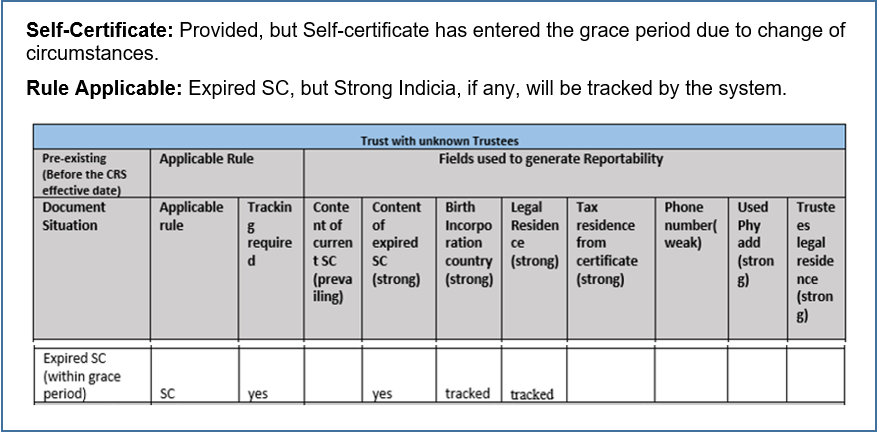

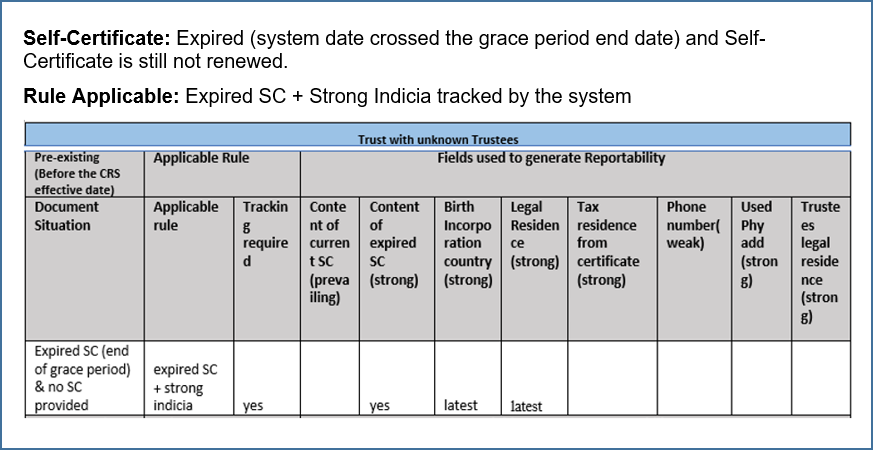

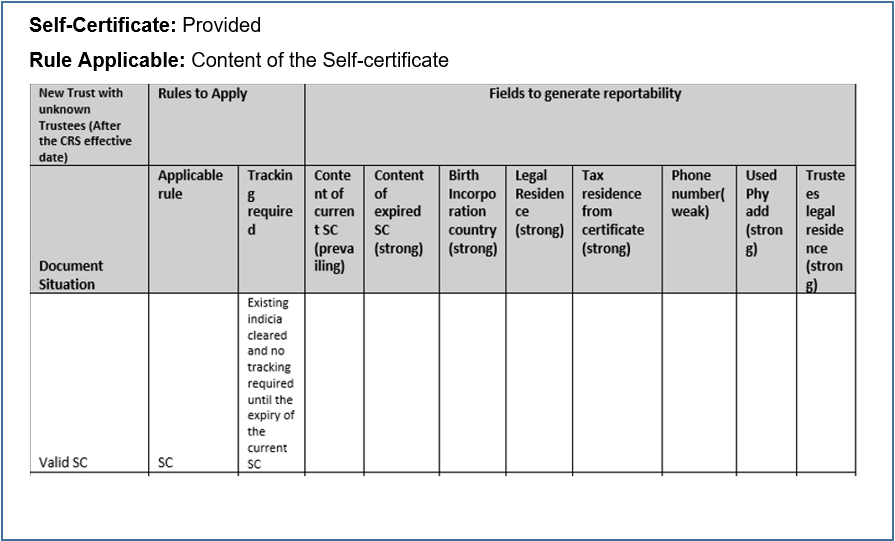

Depending on the self-certificate submission status and its validity, the system derives the reportability factor. The attributes used to generate the reportability depends on the type of the customer and indicia rules applied. The following matrices describe the indicia conditions to be configured in RT.REGULATORY.RULES for each client type. For this purpose, the bank is assumed to have maintained the meta data information related to self-certificate within Document Management module and in the CUST.DOCUMENT application.

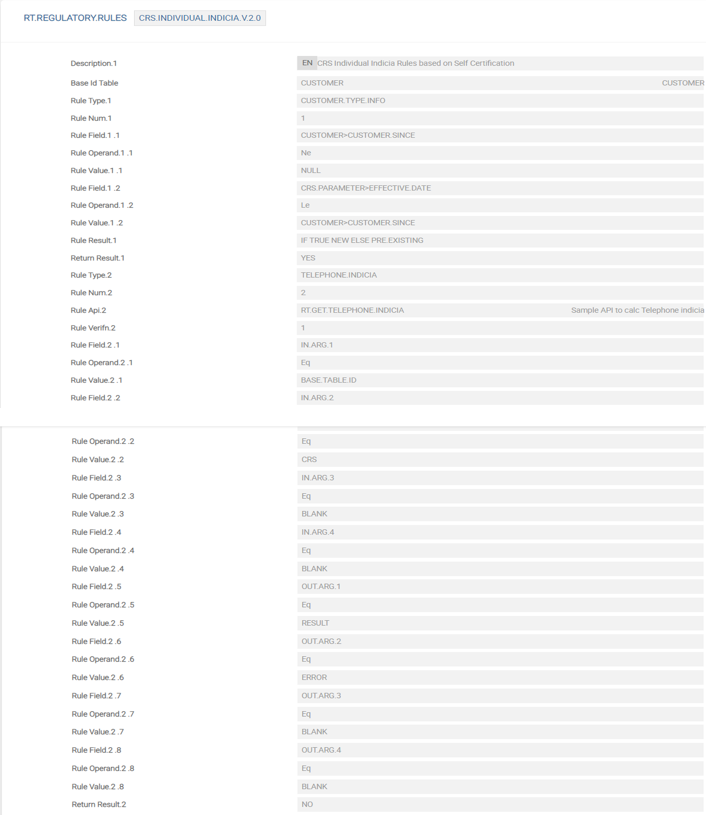

For individual customers, the self-certification linked indicia logic is configured in the CRS.INDIVIDUAL.INDICA.V2.0 record in RT.REGULATORY.RULES.

The following matrix is for pre-existing Individuals (customers who are on-boarded by the bank prior to the CRS effective date) and its corresponding self-certificate form status.

The following matrix is for new Individuals (customers who are on-boarded by the bank after the CRS effective date) and its corresponding self-certificate form status.

The following screenshots show RT.REGULATORY.RULES configured to define the indicia determination rules based on the self-certificate form status.

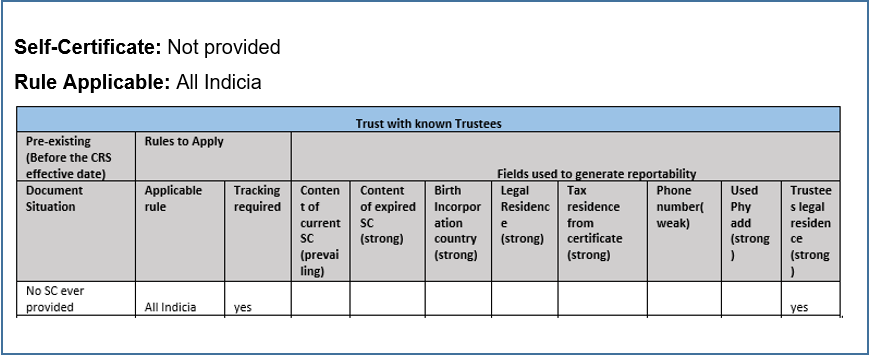

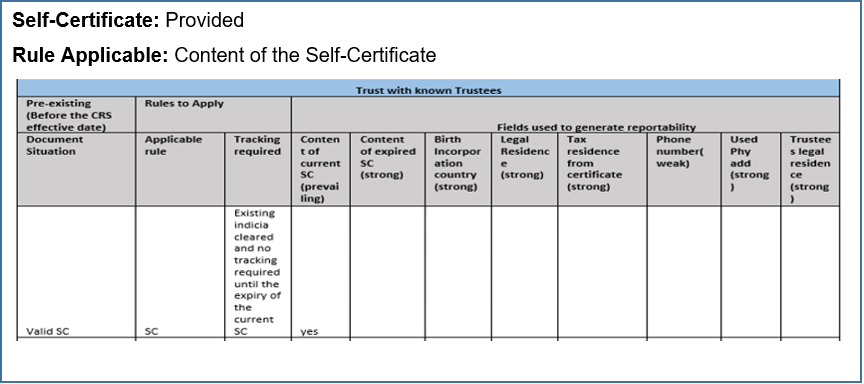

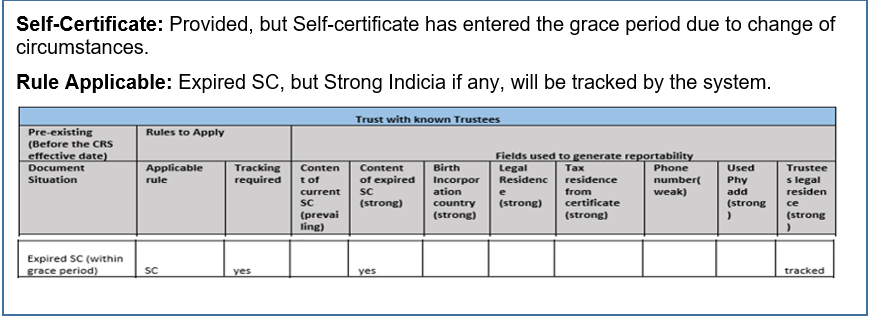

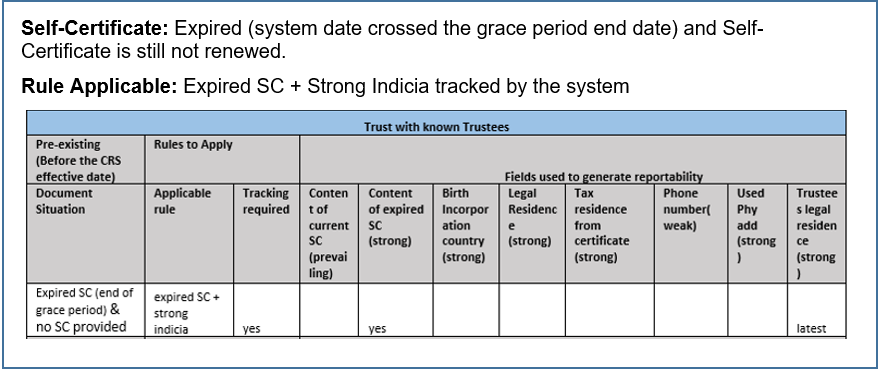

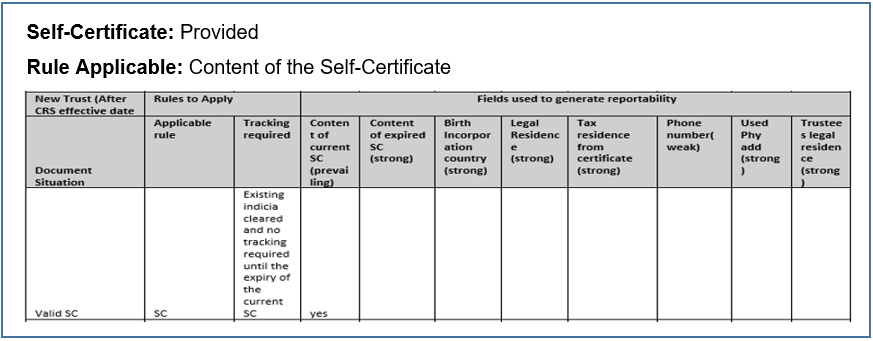

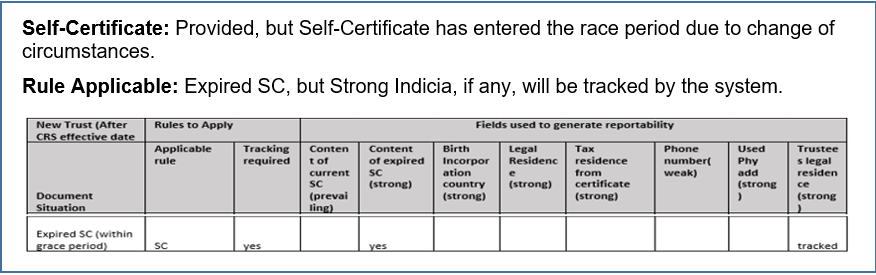

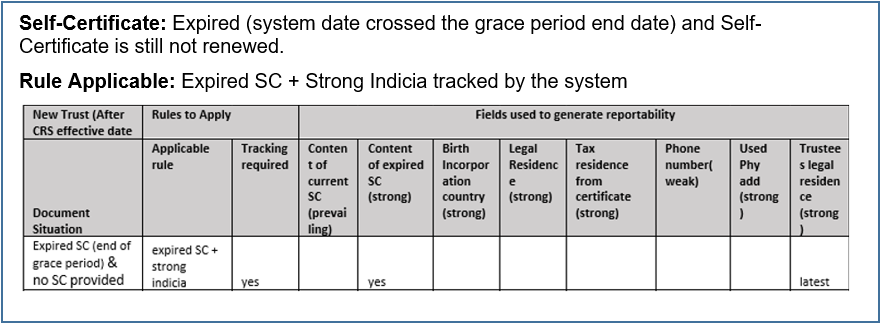

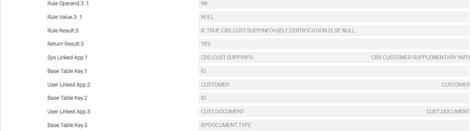

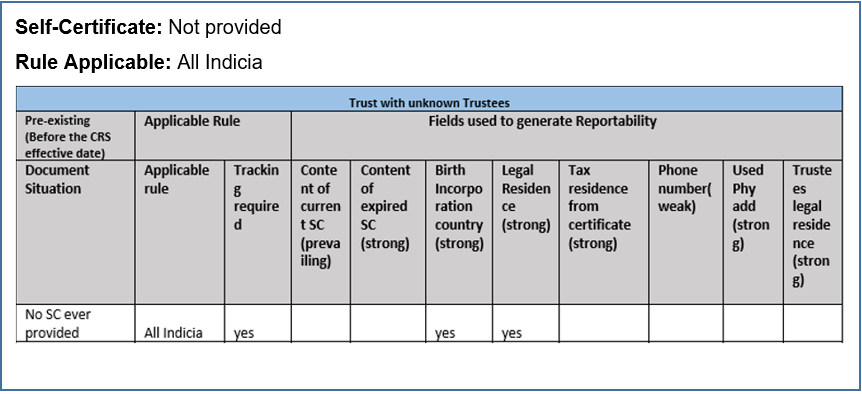

For trusts with known trustees, the self-certification linked indicia logic is configured in the CRS.ENTITY.WITH.TRUST.INDICA.V1.0 record.

The following matrix is for pre-existing trusts with known trustees (customers who are on-boarded by the bank prior to the CRS effective date) and its corresponding self-certificate form status.

The following matrix is for new trusts with known trustees (customers who are on-boarded by the bank after the CRS effective date) and its corresponding self-certificate form status.

The following screenshots show RT.REGULATORY.RULES configured to define the indicia determination rules based on the self-certificate form status.

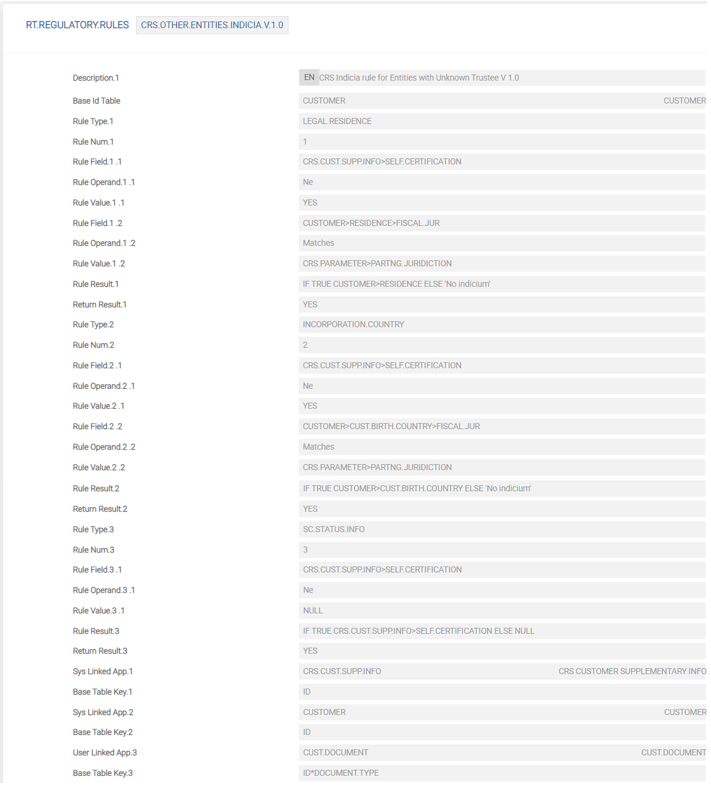

For Non-Trusts or Other Entities, the self-certification linked indicia logic is configured in the CRS.OTHER.ENTITIES.INDICIA.V1.0 record.

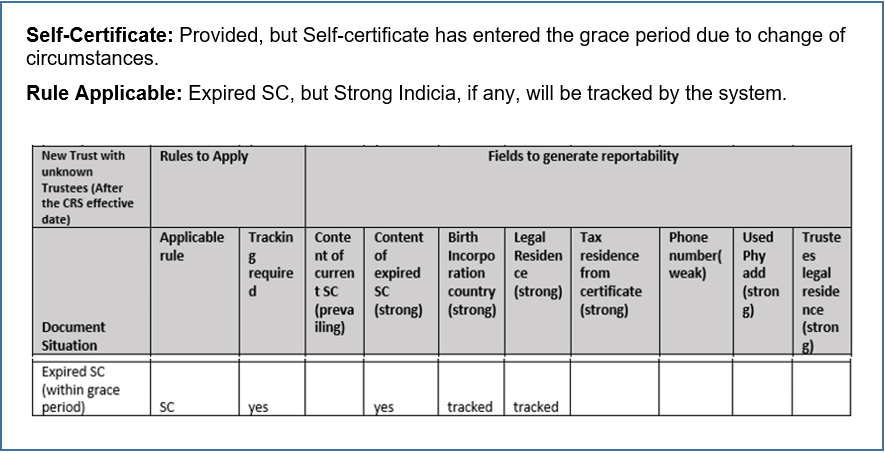

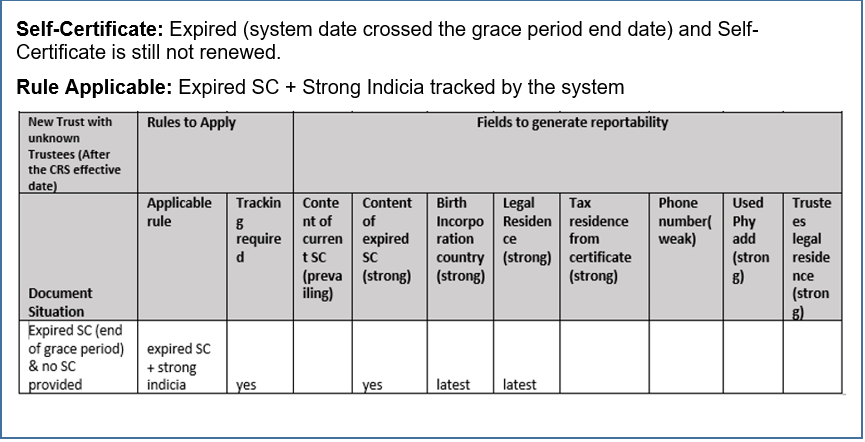

The following matrix is for new trusts without or unknown trustees (customers who are on-boarded by the bank after the CRS effective date) and its corresponding self-certificate form status.

The following screenshot shows RT.REGULATORY.RULES configured based on the rules described above.

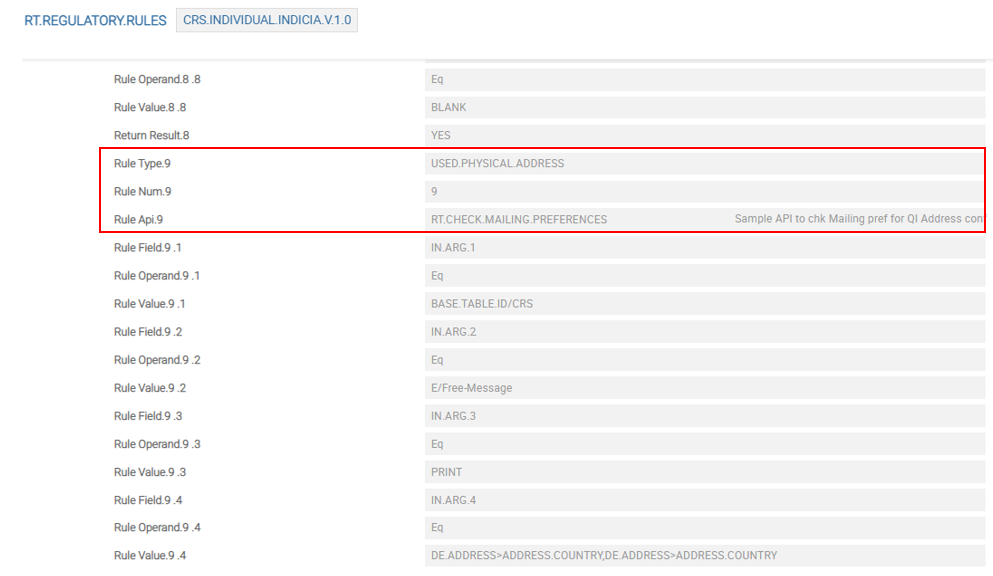

In the RT.REGULATORY.RULES application, the user can find a number of pre-defined sample rules and APIs. The following screenshots demonstrate an API, which has been introduced to support the USED.PHYSICAL.ADDRESS Rule Type indicia for individuals.

In the screenshot below, the RT.CHECK.MAILING.PREFERENCES API checks the address preference in the DE.CUSTOMER.PREFERENCES application and the address country in DE.ADDRESS. If the address country is a CRS reportable jurisdiction, the USED.PHYSICAL.ADDRESS Rule Type will be identified as an Indicia for the particular customer.

This API supports the customer mailing preferences created at the customer, account and portfolio levels. Whenever changes are applied in the DE.CUSTOMER.PREFERENCES and DE.ADDRESS applications, the indicia is updated for both the ‘owning’ customers and all applicable related and/or joint customers.

The system tracks the addition and removal of customers in the ACCOUNT, SEC.ACC.MASTER and CUSTOMER.RELATIONSHIP tables. Whenever there are changes to these tables, the Used Address Indicia is recalculated for the impacted customers. This is applicable only for individual customers.

RT.REGULATORY.RULES application provides users the flexibility to create new indicia rules and field mapping as required.

Following are the steps to set up the additional indicia for CRS for corporate customers:

- CRS indicia mapping rules are defined for corporate customers with the following field values:

- Controlling Person Residence

- Entity Headquarters

- The record is authorised as shown in the below screenshot.

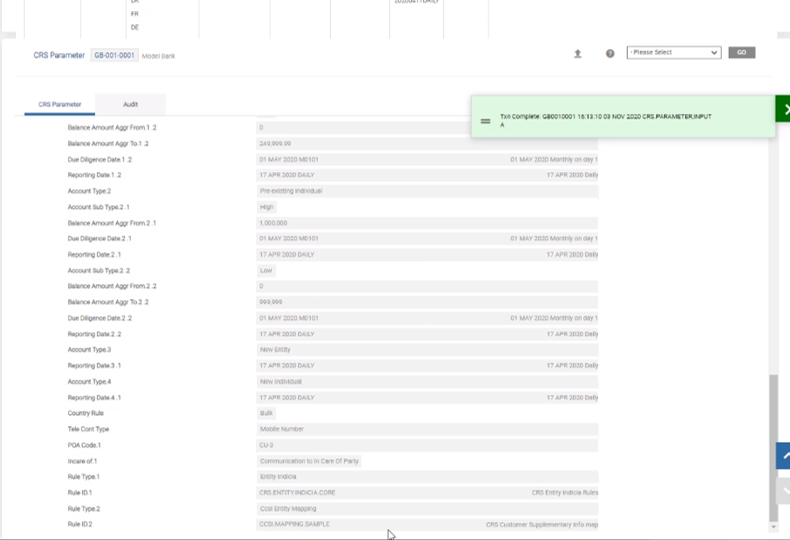

- Once the rules are defined for CRS indicia, the user must link (associate) the field mapping with the indicia mapping (set up previously) in the

CRS.PARAMETERapplication. - The record is authorised as shown in the below screenshot.

- Set the value of the Auto Create Recs field to Yes in the

ST.REGULATORY.PARAMETERapplication to enable the automated creation of the CRS supplementary information record and the associated indicia identification. - Set up the

CRS.CLIENT.TYPEapplication for corporate customers. - The user can now view the

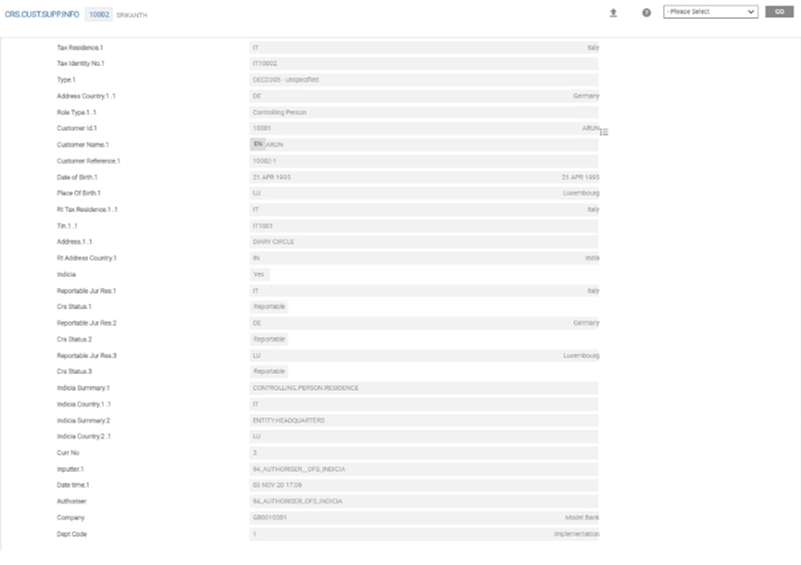

CRS.CUST.SUPP.INFOapplication to ensure that the configuration steps are configured correctly and the system is operating accordingly. - Controlling Person Residence

- Entity Headquarters

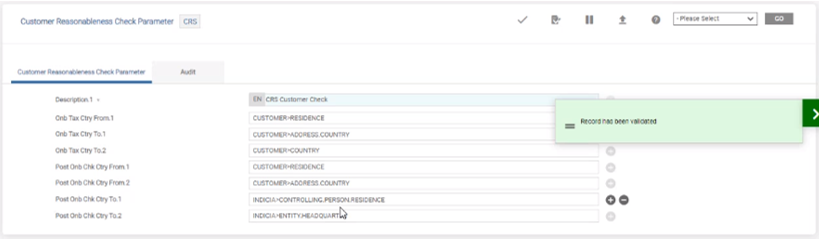

- Once all the indicia configuration steps are completed, the user needs to ensure that the updated indicia conditions are reflected in the configuration of the reasonableness check. The

CUSTOMER.REASONABLENESS.CHECK.PARAMETERapplication needs to be updated to accommodate the Controlling Person Residence and Entity Headquarters indicia conditions as shown in the below screenshot.

The following screenshot shows the results of the above configuration, where the newly configured corporate indicia conditions are populated. The Indicia Summary multivalue field in the screenshot below shows:

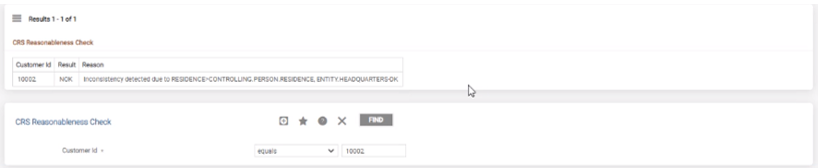

After the above configuration steps are completed, CRS Customer Reasonableness Check considers the updated indicia conditions and checks for inconsistencies in the following field values:

- Controlling Person Residence

- Entity Headquarters

If any inconsistencies are detected in the above fields, the CRS Reasonableness Check (CRS.CUSTOMER.REASONABLENESS.CHECK) enquiry will return an NOK result with the reason for inconsistency, as shown in the below screenshot.

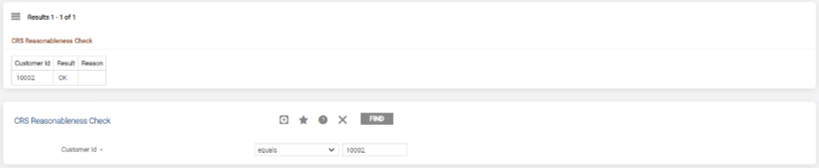

If there are no inconsistencies, the CRS Reasonableness Check (CRS.CUSTOMER.REASONABLENESS.CHECK) enquiry will return an OK result, as shown in the below screenshot.

In this topic