Introduction to Financial Services Compensation Scheme (FSCS)

The United Kingdom’s Financial Services Authority (FSA) introduced the Financial Services Compensation Scheme (FSCS) to ensure the speedy pay out of funds for depositors within a set period when a financial institution becomes insolvent. FSCS regulation is the UK implementation of the European Deposit Guarantor Scheme (DGS).

As part of the monitoring mechanism for financial institutions, which fall within the ambit of the FSCS scheme, the financial institutions are required to submit reports on deposit products, balances, and other data, as required by the prudential authority, from time to time.

FSCS require each bank to provide them the data for all the customers who hold an account or deposit and what are their corresponding balances.

This is an extract that is generated from Temenos Transact where the bank will be able to submit through the regulatory body the list of all customers that the bank holds and the accounts held by these customers and the balances.

This report is required whenever a bank becomes insolvent, FSCS will need to know how much the bank will need to repay the customers. This report is extracted based on an ad hoc request from FSCS or when the bank becomes bankrupt.

This functionality allows banks to generate a Single Customer View (SCV) containing accounts that Fit for Straight through Processing (FFSTP) and Not Fit for Straight through Processing (NFFSTP) from Temenos Transact based on the UK FSCS regulations act.

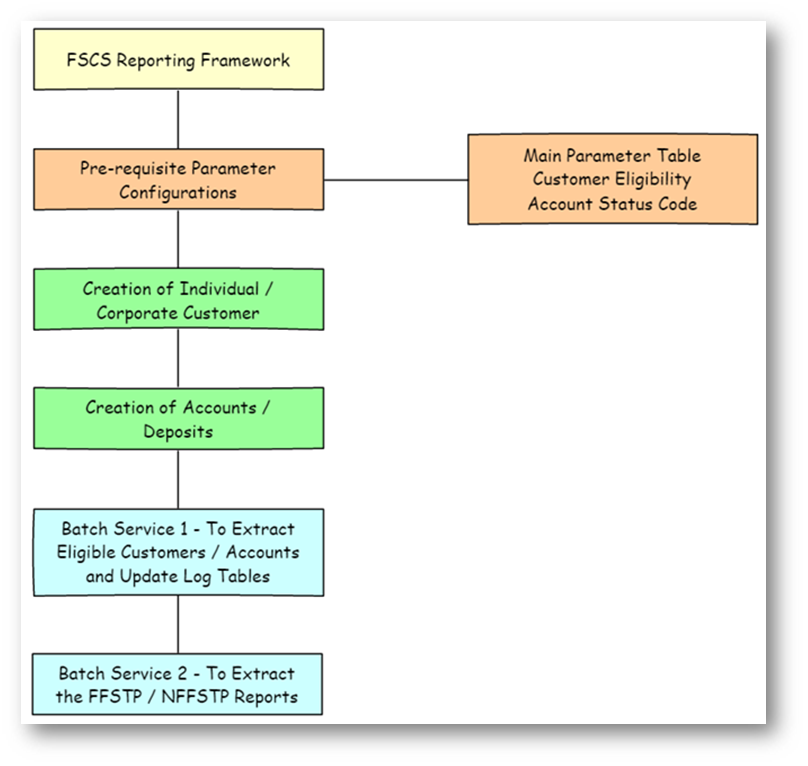

There is a pre-requisite parameter application, which the bank will need to configure during the implementation of this functionality. Then there is a process of customer on-boarding, either individual or corporate customers, and once the customers are created, they can open account or deposits with the bank.

This functionality also allows banks to generate the summary report which contains a summary of all the customer and account details for the bank that are eligible for FSCS reporting.

An additional Summary report (csv file) will help the client to fill in the FSCS Effectiveness report. The Summary reports shows:

- Total number of eligible customers.

- Total number of eligible and active accounts.

- Total balances of accounts including accrued interest.

- Total balances of accounts excluding accrued interest.

Click here to understand the terms and abbreviations used in describing the Financial Services Compensation Scheme (FSCS) module.

FSCS Closed Account

The current FSCS report considers only the customer accounts which are not closed in Temenos Transact. The report gets the balance from the EB.CONTRACT.BALANCES application of the account record. The FSCS solution always refers to the Account`s Beneficial owner for the FSCS protection limit calculation.

The unclaimed funds from a closed account that are moved to suspense account of the bank are not reported in the UKFSCS report, however these funds also belongs to customer and it has to be reported as part of the FSCS purposes.

The new fields have been introduced in the FSCS.DEPOSIT.EXCEPTION application, to capture the unclaimed house cheque balances in the suspense account for an account that is in the closed status. The Id of this application will be a valid account number. There will be a validation to check if the valid account number is being input.

The existing FSCS.DEPOSIT.EXCEPTION.AMEND enquiry has been modified to include the values from the new Unclaimed Balance field as part of the enquiry result. This enquiry can be used to reconcile the balances in the suspense account.

This module covers the following interface or regulation version:

- FSCS Regulation, SCV Guide Jan 2021.

Auto Population of Customer Eligibility and Account Status

The Fscs Eligibility and Fscs Acc Status fields of the CUSTOMER application are required for FSCS reporting functionality.

This functionality enables the automatic population of FSCS eligibility and account status in the CUSTOMER application during the customer onboarding based on customer sector codes. The account status will automatically change to LEGDOR when the account becomes dormant. The customer status will automatically change to LEGDOR when all the account of the customer becomes dormant.

The following items have been released as part of this functionality.

-

New fields have been added to the

FSCS.PARAMETERapplication as part of this functionality to configure the FSCS eligibility and FSCS account status based on the sector of the customer. -

The FSCS.DORMANCY.EXCEPTION enquiry has been released as part of this functionality to display the list of accounts for which the dormant status was not updated due to an existing FSCS account status.

In this topic