This module will not be further enhanced. Support is limited to defect fixing only.

Introduction to Clearing

This Clearing module allows banks to process the SIBTEL Clearing DD Mandate files (inward and outward).

Click here to understand the terms and abbreviations used in this module.

The following functionalities are available as part of the Clearing module.

Direct Debit Clearing – File Processing

Direct debits are offered almost universally among banks, as a means to enable their customers to meet their payment obligations for services enjoyed, or for repayments of credit cards or loans. In order to facilitate the direct debit process, a customer issues a mandate to their bank, permitting the debit of the payment amount at a given frequency. A direct debit mandate, as the name implies, is an instruction, which allows the bank to debit a customer account and to send the payment to the beneficiary.

This functionality allows banks to register, amend and cancel Tunisian direct debit mandates through the Tunisia Clearing House (SIBTEL). It also allows banks to generate outward DD mandate files for mandate records created in the system and sending them to SIBTEL.

Temenos Transact allows the capturing of direct debit mandates using the DD.DDI application. The following applications are involved with respect to direct debit mandates:

- The DD.PARAMETER application allows users to define various high level parameters such as the account classes involved in handling direct debit claims arising from a mandate, the number of days before the due date that a claim must be raised, currencies allowed and so on.

- The DD.DDI application stores the mandate instructions. Mandates are classified as inward – in which case Temenos Transact receives a direct debit claim against the mandate, or outward, in which case a claim is originated from Temenos Transact to the debtor bank.

The following applications and enquiries have been introduced as part of this functionality:

- The DD.DDI,PPTNCL.MANDATE.CREATE version allows users to create or amend outward mandates.

- The DD.DDI,PPTNCL.MANDATE.CANCEL version allows users to cancel outgoing mandates.

- The DD.DDI,PPTNCL.MANDATE.INWARD version is used to create inward mandates through OFS and also to view or delete erroneous mandate records.

- The CMBASE.BATCH.INTRF.EXTRACT.LOGGING application is used to log the error details captured while processing the direct debit mandates records from the inward file from SIBTEL.

- The PPTNCL.ERROR.LOG enquiry allows users to view the error details for the inward mandate file from SIBTEL.

- The PPTNCL.IHLD.MANDATES enquiry allows users to view or delete failed mandates.

- The AUTH.NEW.MANDATE enquiry displays the records from the DD.DDI$INAU file. Upon selecting the Authorise button the DD.DDI,PPTNCL.MANDATE.CREATE version will be launched.

- The AUTH.CANCEL.MANDATE enquiry displays the records from the DD.DDI$INAU file. Upon selecting the Authorise button the DD.DDI,PPTNCL.MANDATE.NEW.CANCEL version will be launched.

Cheque Clearing – Outward

The Clearing House in Tunisia (SIBTEL) has introduced the e-clearing system. The e-clearing system is part of the modernisation of the Tunisian banking system. It aims to reduce recovery times by means of reliable, secure, efficient and fast electronic clearing.

The Tunisia e-clearing system is based on:

- An exchange of computer data of the values to be compensated as well as scanned images of the values by means of e-transmission.

- Non-physical exchange of values (except for non-standard bills of exchange and other temporary effects).

E-clearing concerns transfers, cheques and bills of exchange.

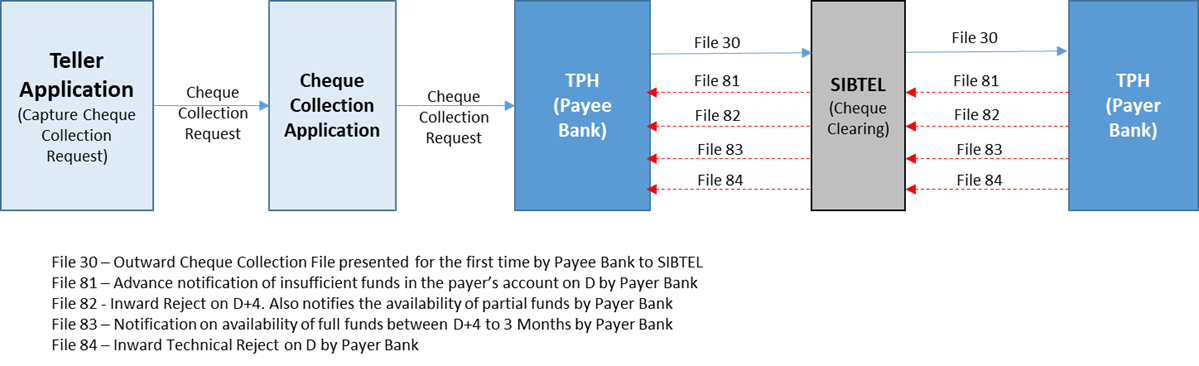

The outward cheque collection high-level business process flow is provided below:

This functionality allows banks to capture and validate the cheque collection request for the cheques that are being presented for the first time (code 30) and also for the cheques that are being represented (code 31, 32, 33).

SIBTEL Inward Cheque Clearing

The Tunisia e-clearing system is also based o the electronic archiving for an online consultation, for a two-year extendable period.

All participant banks enrolled with the Tunisia cheque clearing are allowed to initiate their clearing as direct participants.

This functionality allows banks to process transfers, withdrawals, cheques, and bills of exchange using the e-clearing system.

The following items have been introduced as part of this functionality:

- The PPTNCL.CHEQUE.ADDNL.DETAILS application is used to store the blocked amount details of rejected cheques during the generation of file 82.

- The Amt Block 84 field is added to the PP.CLEARING.RETURNCODE application to allow users to select the Yes or No option for the block to be created for the transaction amount (cheque amount) using the AC.LOCKED.EVENT application.

- The PPTNCL.GENERATE.FILE81.MSG service is created to identify the corresponding POR.CLG.IN.SETTLEMENT.PENDING record. The service will be triggered at the reject cut-off (09:00 PM) and pick all the cheque transactions.

Inward Cheques Collection (Day 5 to Payment Day)

This functionality allows banks to process the incoming cheque collections when funds are not available in the payer account after D+4, where D is the clearing date.

On D+4, banks will appoint an officer to contact the customers and inform them to fund the account in order to clear the cheque.

The following items have been introduced as part of this functionality:

- The

PPTNCL.CLEAR.PENDING.CHEQUEapplication is used to approve the cheque once the customer funds the full cheque amount along with the interest (if any). - New fields have been added to the

PPTNCL.CHEQUE.ADDNL.DETAILSapplication to capture the Aclkreference2 and Is31received details. - The

PPTNCL.BAILIFF.CHARGE.PARAMapplication is used to configure the bailiff interest and charges according to the legal period.

In this topic