This module will not be further enhanced. Support is limited to defect fixing only.

Introduction to Securities Reporting

The Securities Reporting module describes the regulatory reporting covering the adhoc requests of the securities and derivatives orders processed during the requested period. Also includes, daily reporting of the Swiss and non-Swiss securities traded in the Swiss stock exchange or foreign Swiss Financial Market Supervisory Authority (FINMA) recognized stock exchanges.

Click here to understand the terms and abbreviations used in this module.

Securities Journal

The Financial markets Infrastructure Act (FMIA), the Financial Market Infrastructure Ordinance (FMIO) as well as the Financial Market infrastructure Ordinance (FMIO-FINMA) of the Swiss Financial Market Supervisory Authority (FINMA) entered into force on 1 January 2016.

Among other things, these three pieces of legislation address the duties of operators of organized trading venues and the notification duties related to the securities trading.

In order to define the related supervision practice, FINMA published the revised circulars 2018/2 - Duty to report securities transactions and 2008/4 - Securities Journal as well as the newly created circular 2018/1 - Organized trading facilities. These three circulars have now become effective as of 1 January 2018.

Every security dealer or participant under the Financial Market Infrastructure Act is obliged to track its securities and derivatives transactions in a securities journal as per FINMA circular 2008/04. This circular shall govern the requirements to keep record and maintain a journal in accordance to various regulatory ordinances and acts (FMIO / SESTA / FMIA / SESTO).

The duty to keep a journal shall begin with the reception of an authorization to a trading venue as in Article 34(2) FMIA and (or) its license as per Article 10 SESTA and shall end once the institution no longer has such a license or authorization.

Upon request of the FINMA or an audit firm, data must be made available in journal format within three working days. If it is justified, the FINMA may authorize a longer preparation period (e.g. Large trading volume, long period, etc.) or exceptions.

Every participant shall be in a position to make the orders and transactions subject to the duty to be recorded in a securities journal available, broken down according to the beneficial owner (FINMA circular – Disclosure requirements for securities transactions).

In principal, an obligation to maintain a securities journal exists if the securities:

- Are admitted for trading on a trading venue (in Switzerland or abroad) or are traded on another Organized Trading System (OTS) (e.g. shares, participation certificates, dividend certificates, units of investment funds, option certificates, warrants, debenture bonds, mortgage bonds of mortgage bonds issuing institutions, shares in cooperation (provided they are freely transferable), traded options, financial futures), or

- Are tradable on other markets only outside a trading venue, in part, as instruments of limited marketability (e.g. notes, second-line stocks, note loans, OTC derivatives).

There is no obligation to maintain a journal for transactions in securities and derivatives, which are only repayments (e.g. bonds), repurchases (e.g. of bonds and shares) or redemptions (e.g. of fund units via the custodian bank).

There is no duty to keep a journal for securities or financial products that are usually not traded. This includes the following financial products, which are only brokered by participants and not freely transferable:

- Money-market products such as bankers acceptances, commercial papers, treasury bills, promissory notes, certificate of deposit as well as money market book claims.

- Medium-term notes.

- Cooperative shares where the change of ownership requires the consent of the cooperative.

- Units of in-house collective funds of banks in accordance with the Article 4 of the collective investment schemes act.

The structure of the journal or sub-journals is as follows:

- Name of securities and derivatives.

- Date and precise time of received orders.

- Identification of trade and order type.

- Size of the order.

- Date and time of execution of trade.

- Size of trade.

- Realized or allocated price.

- Place of execution.

- Identification of trading venue or mention no trading venue.

- Identification of client and (or) counter-party.

- Identification of beneficial owner.

- Value date.

The journal is a business book as per the Article 958 CO and must be retained for 10 years. This period begins after the business year has ended.

Six Transaction Reporting

The Article 39 of the Financial Market Infrastructure Act (FMIA; SR 958.1) sets out the duty of participants admitted to a trading venue under Article 34 para. 2 FMIA to report all the information necessary for transparent securities trading (reporting duty).

The trading supervisory body needs to have access to records of reportable transactions for the purpose of supervision (see Article 31 FMIA), so as to ensure that the trading venue can notify FINMA in the event of suspected violations of the law.

Securities: The securities that are admitted to trading on a trading venue in Switzerland. This definition also includes the standardised derivatives suitable for mass trading such as exchange-traded derivatives (ETDs), warrants and structured products, including the exchange-traded products (ETPs), a cover-all term for collateralised exchange-traded commodities (ETCs) and exchange-traded notes (ETNs).

Derivatives: Derivatives are deemed to comprise the financial contracts whose price is derived specifically from:

- Assets such as shares, bonds, commodities and precious metals.

- Reference values such as currencies, interest rates and indices.

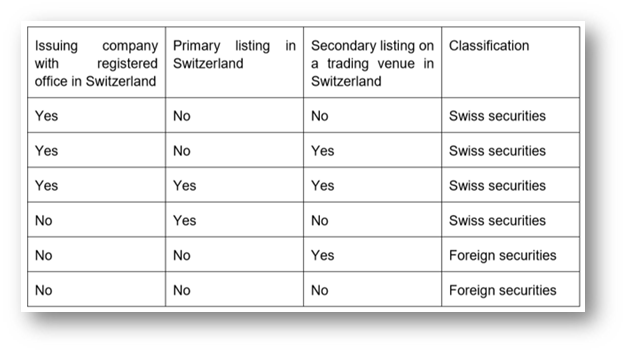

Swiss and foreign securities: The Swiss securities issued by a company with its registered office in Switzerland or listed in Switzerland. The foreign securities issued by a company with its registered office outside Switzerland and not listed in Switzerland.

Primary and Secondary listing:

- Primary listing: If a company is not yet listed on any other exchange when it applies for a listing on a Swiss exchange, its only option is a primary listing.

- Secondary listing: Listing of securities in a country other than the one where the company first had its shares listed. The following possibilities therefore exist:

There is a legal duty to report and to distinguish between reports, regarding the securities dealers’ subject of Swiss trading participants, remote members, Swiss reporting members and foreign branches of Swiss securities dealers.

The securities dealers subject to the reporting obligation are required to report all the information necessary to ensure a transparent market.

In order to improve the existing functionality which already covers the uploading of the ISIN’s (International Securities Identification Number) file received from SIX server and the eligibility of a report transaction, some fields were included, removed or amended in the existing SIX reporting file, to comply with the changes in the regulation.

The new underlying file covers the duty to report trades and order transmissions in derivatives with one or several underlying instruments. It applies if at least one underlying instrument is subject to reporting obligations and has a weighing more than 25% in the financial instrument traded.

The improvements made to the existing SIX Reporting functionality ensures the duty to report the trades and the order transmissions, in derivatives, through one or more underlying instruments.

FinFrag Reporting

The Swiss Financial Market Infrastructure Act (FMIA), also known under the German denomination FinFrag, came into force on 1 January 2016.

It regulates the organisation and the operation of financial market infrastructures, for example: stock exchanges and central counterparties, the trading of derivatives and the conduct of business rules, for example, insider trading and market manipulations, shareholding disclosures and public takeovers offers.

The main rationale behind FinFrag regulation is to increase transparency in the Swiss OTC derivatives market, and to mitigate systemic, counterparty and operational risks.

In this topic