This module will not be further enhanced. Support is limited to defect fixing only.

Introduction to Lending

The NOLEND feature will enable Financial Institutions in Norway to calculate a Premium or a Discount whenever there is a breach in the Fixed Rate Agreement.

Fixed Rate Agreement

Borrowers in Norway enter into a Fixed Rate Agreement with the Lenders during which the Lenders expect that the Fixed Rate Agreement will not be breached until the agreement end date. When the borrower terminates a fixed rate agreement before the agreement end date, the bank (Lender) is entitled to calculate any interest losses/gains. Losses to the Lender will be levied as a Premium to the Borrower and Gains (Discount) to the Lender will be refunded back to the borrower through a Principal Decrease equivalent to the discount amount.

The following business events are considered as a breach of the Fixed Rate Agreement by the borrower:

- Modification of Customer.

- Modification of Interest.

- Prepayment of Loan.

- Preclosure of Loan.

Additionally, if a Fixed Rate Agreement breach happened once, then system restricts the event of another breach of the Fixed Rate Agreement in next 6 months period.

Presently, the Fixed Rate Agreements specified for Norway are mentioned below:

- 3 Year Fixed Rate Agreement.

- 5 Year Fixed Rate Agreement.

- 7 Year Fixed Rate Agreement.

- 10 Year Fixed Rate Agreement.

Banks can also introduce additional Fixed Rate Agreements Periods in the Future as per their convenience.

This module will also enable to determine how the Core Banking System arrived at the Premium Value or the Discount Value thereby enabling the bank to communicate the same to the Customer.

The following component has been released as a part of this module:

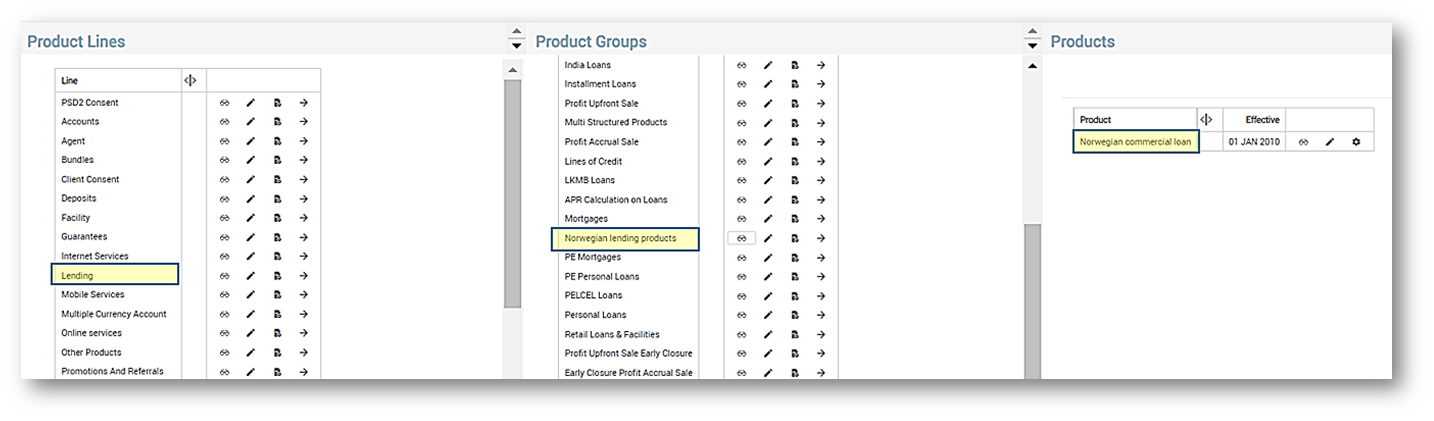

A Model Product Group and Product has been provided where the bank can refer the Product Configurations.

In this topic