This module will not be further enhanced. Support is limited to defect fixing only.

Introduction to Fees and Charges

This document briefly explains about the new functionality of calculating the early repayment fees. Banks need to charge the customers who may want to close the loan earlier than the maturity date or pay an amount in advance. Early repayment fees are calculated based on few criteria and if those are satisfied the early repayment fees as per formula is calculated.

Early repayment fees are calculated based on the formula suggested by ABBL (Luxembourg Banker’s Association). If this amount is more than the minimum chargeable amount (parametrized), it applies that amount, else it applies the minimum charge.

Two conditions apply on the early repayment fee amount:

- Cap (in case of these rules: mortgage loan; 450,000 EUR or less in principal repayment; primary residence; loans after 21/03/2016), then the fee should be calculated by applying the fixed interest rate from the loan contract. Repaid amount: 100,000 EUR, client rate: 2% p.a. interest on the 6 months => 1,000 EUR (repaid principal amount x interest rate from the loan contract x 6/12).

- Cap of 250 EUR if the calculated fee is less than 250 EUR. This is the minimum liveable.

If the amount of principal repaid exceeds EUR 450000, then any amount above this cap, invites an early repayment fee as per the formula. For any amount within this cap, a comparison is made of the amount derived from the formula and the simple interest formula and the least of the two is applied subject to the minimum amount (see points 1 and 2 above).

The early repayment fees calculation is based on the remaining balance of the loan and the interest that still need to be paid by the client. Early repayment fees uses the interbank market rate as reference rate, as the price which bank pays is different from what customer pays.

Early repayment fees is applicable only for the fixed interest mortgage loans and it is not applicable for the floating rate loans.

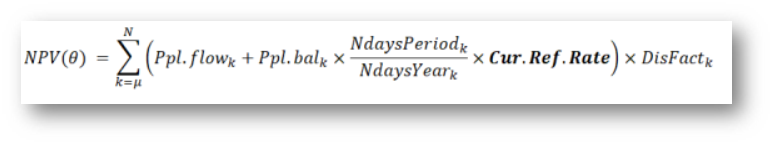

The formula used for the early repayment fees is given below:

- NPV - Net present value

- Ppl.flow - Principal flow

- Ppl.bal - Principal balance

- NdaysPeriod - Number of days in the period

- NdaysYear - Number of days in a year

- Cur.Ref.Rate - Current refinancing rate

There is an iterative method to identify the early repayment rate as precise as possible.

Click here to understand the terms and abbreviations used in this functionality.

In this topic