This module will not be further enhanced. Support is limited to defect fixing only.

Introduction to Accounts

The Accounts module delivers Arrangement Architecture (AA) products like the Exchange Earners Foreign Currency (EEFC) account and the Diamond Dollar Account (DDA) with the related regulatory operating guidelines as set out by the Reserve Bank of India.

Click here to understand the terms and abbreviations used in this module.

The functionalities of this module are described below.

Corporate Customer Account Types

In the Indian banking scenario, various types of accounts are allowed to be operated by corporates. The different types of corporate accounts that can be opened, their eligibility, validations, and transfer and closure process are configured.

The corporate accounts of accounts that can be in Local Currency (LCY) and those that can be maintained in Foreign Currency (FCY).

The corporate accounts FCY consist of:

- Exchange Earners Foreign Currency (EEFC).

- Special Economic Zone (SEZ).

- Project Specific Foreign Currency (FC) account.

- Other Foreign Currency (FCY) accounts.

- Diamond Dollar Account (DDA).

- International Air Transport Association (IATA) account.

- Temporary Foreign Currency (FC) account.

The corporate accounts Indian Rupees (INR) consist of:

- ESCROW Account.

- Special Non Resident Rupee Account (SNRR).

To facilitate the creation of India layer requirements, certain account products have been introduced to include India-specific features regulations, taxations, and statutory requirements. The same reflects across the FUNDS.TRANSFER and TELLER applications.

The new functionality contains the following:

- The eligibility rule for obtaining the Importer-Exporter Code (IEC), is being a resident, non-resident, or corporate.

- Activity restriction to allow only some currency transactions in the account.

- Arriving at the amount of foreign currency that can be converted into the local currency based on Reserve Bank of India (RBI) regulations.

This functionality allows new rules to be defined for the FCY corporate accounts.

Internal Account Restriction

The Internal Account Restriction functionality allows the bank to reverse any charges that may have been charged to or paid to a customer. During such a reversal, the Profit and Loss (P&L) account number that was part of the original transaction is not allowed for edit. The original transaction reference number is referred to during such reversals. The amount of transaction can be edited but is checked that it is not more than the original amount.

In Temenos Transact, the payment order application facilitates the transfer between the accounts, as well as between the P&L accounts and customer accounts. This application will be used for doing any reversal of charges, fees, or commission that may be charged to or taken from a customer, whenever a need arises for such a reversal.

While using the internal P&L accounts for reversing charges, the P&L account leg of the transaction is not allowed for edit. The transaction reference of the original transaction is keyed in mandatorily.

An enquiry is built that lists out the transactions that were performed (with specific selection criteria) and gives the provision to reverse a specific entry with the help of the reference of the original transaction.

Booking Branch Information on Account Statements and Dr/Cr Advices

Based on regulatory guidelines by the Reserve Bank of India (RBI), the address and telephone number along with other details of the branch need to be displayed in passbooks or the statement of accounts.

To improve the quality of the service available to customers in branches, it would be useful if the address and telephone number of the branch are mentioned in the passbooks and statement of accounts. Banks are advised to ensure that the full address and telephone number of the branch are invariably mentioned in the passbooks or statement of accounts issued to the account holders.

Temenos Transact stores the booking branch details for the account. The BNK/IN.PRINT.STATEMENT service is used to generate the account statement report for printing purposes.

By printing the booking branch details in the account statement, the quality and service available to the customers are improved.

TDS on Deposits

Fixed Deposits (FD) related interest accruals and tax deduction calculations involve multiple scenarios and eligibility criteria for the bank’s customers. Tax Deduction (TDS) can be calculated according to these different scenarios.

This functionality allows banks to outline the exact eligibility criteria and applicable scenarios for calculating the interest and Tax Deduction (TDS) for fixed deposits. Whenever the interest on customer deposits crosses the threshold, the tax will be deducted.

The following applications have been released with this functionality:

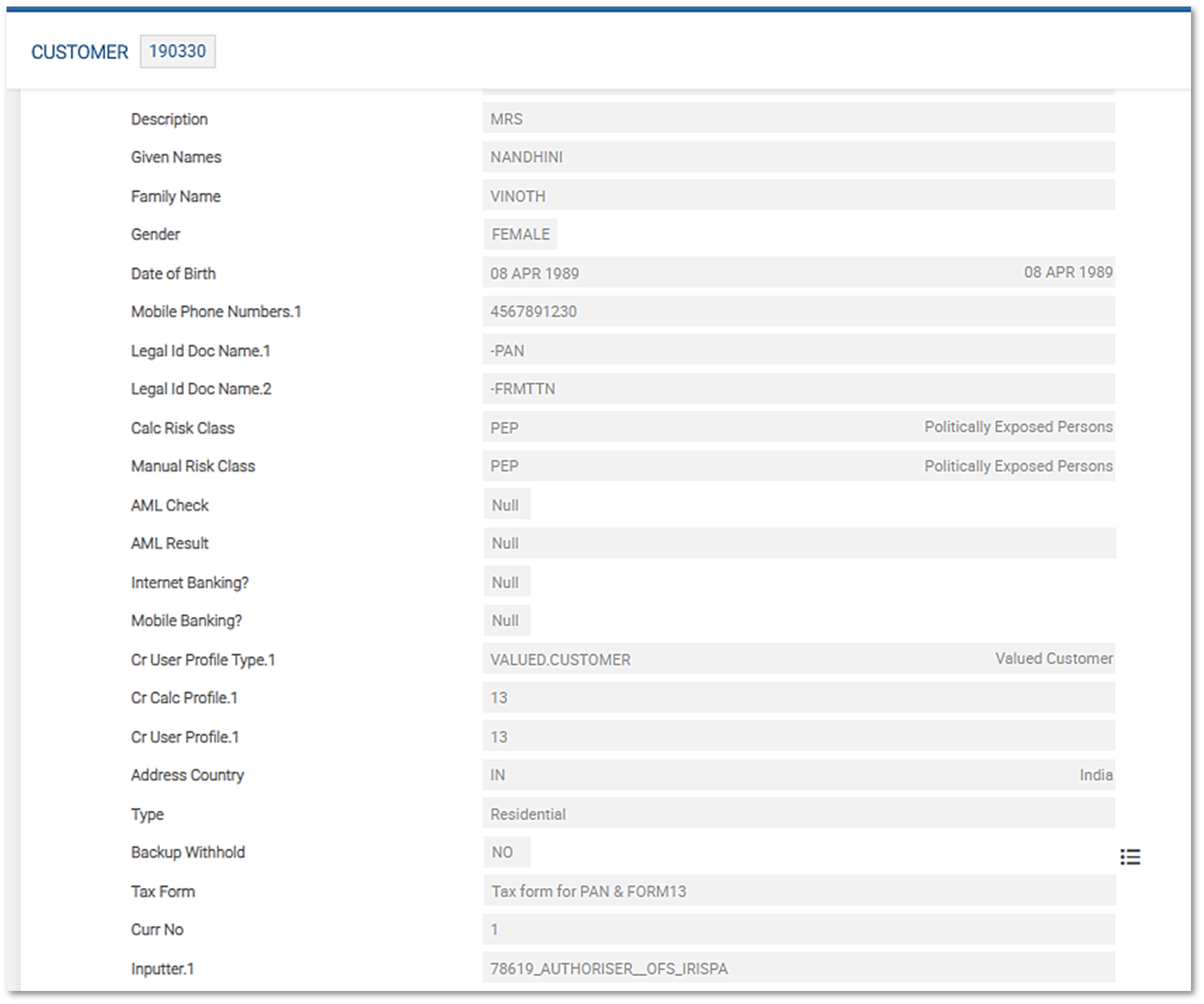

- The INBASE.TAX.FORM.PARAMETER application is used to define the forms that are obtained through the Legal Doc Name field from the CUSTOMER application.

- The INACCT.INTEREST.TAX.INFO application is used to store the details of the interest and tax deducted on the customer account. The application is updated every time there is interest capitalisation.

- The INACCT.TAX.CALC.PARAM application is used to define the internal suspense account from where the tax will be deducted and credited to the tax payable account on every year-end for the deposits where the interest is payable only at maturity.

TDS can be calculated on fixed deposits in the following conditions:

- TDS calculation on fixed deposits based on tax waiver forms submission and customer-wise deposits put together.

- TDS calculation on fixed deposits where lower deduction of a tax certificate is produced.

The Tax Form field has been introduced in the CUSTOMER application, and it contains the marking of the customer with respect to tax, based on the forms that the customer submits.

The drop-down values in the Tax Form field are based on the documents that are submitted by the customer. The values that are shown in the Tax Form value are picked from the Id of the LEGAL.DOC.NAME application.

| 15G | PAN | 15H | FORM.13 | Tax Form Value |

|---|---|---|---|---|

| Yes | Yes | PAN.15G | ||

| Yes | Yes | PAN.15H | ||

| No | Yes | No | PAN | |

| No | No | No | NOPAN | |

| Yes | Yes | PAN.FORM13 |

In this topic