Configuring Product Determination

This section helps the user to understand the configuration of product determination

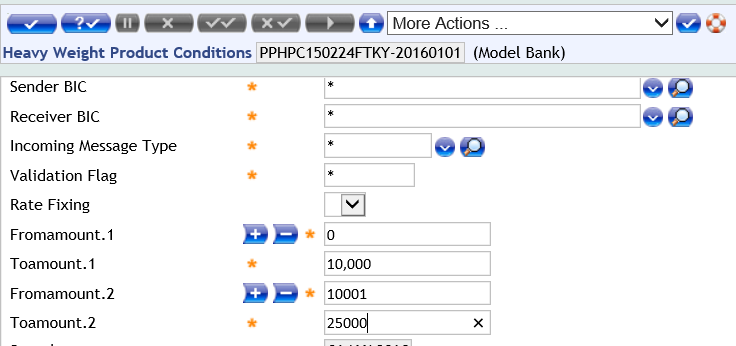

Heavy Weight

- To configure heavy weight products, go to Admin Menu > Payment Hub > Product Determination > Product Condition – Heavy. It displays the list of heavy weight products defined in the system.

- Do one of the following:

- To view a record, click

.

. - To amend or edit a record, click

.

. - To create a new product, click

.

.

This page is used to define the product conditions (input attributes) to determine a product for heavy weight payment and corresponding output attributes. A product is determined and output attributes are linked to various subsequent processing components given below.

- Fee

- Ledger

- Client Condition

- Posting and Routing

This is based on the payment characteristics that are defined by using the product conditions. Additionally, it is linked to various transaction codes that are used for booking the payments. It also influences the payment flow based on the STP indicator, imposed flag, and message priority.

A heavy weight product is defined for each company. This is the company of the debit account and processing company of the payment. The bank user uses the following input attributes to configure heavy weight products:

- To enter a new amount range, click

.

. - To delete an amount range, click

.

.

The entire set of output attributes are configured in the Output Parameters tab for each amount range. For example, if the input attributes are defined for two amount ranges, then two sets of output parameters are configured corresponding to each amount range.

| Field | Description |

|---|---|

| Client Condition Group |

Client condition product. It is used as an input for client condition component. |

| Source Product Group |

Configure one of the following values:

If the Source Indicator is S, product determination refers it and enters the ‘Source’ product with Originating Source.

|

| Routing Product Group | Routing product that becomes an input for Routing & Settlement. |

| Impose Routing Flag | Indicates the system’s actions when the routing product configured in Routing Product Group is not found during processing.

|

| Fee Product Group | Fee product that is used as an input parameter for fees. |

| Posting Product Group | Posting product that is used as an input parameter for posting scheme. |

| Filtering Product Group | Payment Filtering product that is used as an input parameter for filtering component. |

| Duplicate Type |

ID of the EB.DUPLICATE.TYPE core application. It is used for functional duplicate check processing. |

| Debit Book Code | Booking code for the debit entry on the payment transaction amount.

|

| Debit Charge Book Code | Booking code for the charge debit. |

| Debit VAT Book Code | Booking code for VAT debit. |

| Credit Book Code | Booking code for the credit entry on the payment transaction amount. |

| Credit Charge Book Code | Booking code for the charge credit. |

| Credit VAT Book Code | Booking code for VAT credit. |

|

The user needs to configure the Debit Book Code, Debit Charge Book Code, Debit VAT Book Code, Credit Book Code, Credit Charge Book Code, and Credit VAT Book Code fields, which becomes an input parameter for posting scheme.

|

|

| Regulatory Reporting Indicator |

Indicates whether the payment meets regulatory reporting requirements. Configure one of the following values:

|

| New Priority |

Configure one of the following values:

New priority of the payment. The user can ignore the existing priority and define a new priority.

|

| Non STP Indicator |

Enables to move the payment to Manual Repair instead of processing using STP. Configure one of the following values:

|

| PSD Compliant Flag | Defines whether the payment is PSD compliant. onfigure one of the following values:

Used by Date Determination and Fee components for processing the payment.

Ensure to install PPPSDC component to configure this parameter. |

| EC Compliant Flag | Defines whether the payment is EC compliant. Configure one of the following values:

|

| Forward Entry Flag | Defines whether forward entries are raised for the payment. Configure one of the following values:

|

| Switch Account |

Allows to enable or disable account switching in Temenos Payments at product determination level. This is applicable for inward payments and book payments. If configured, Temenos Payments validates whether the credit main account is switched out. Configure one of the following values:

This feature is available with PH license.

|

| STP Indicator Payment Order |

Decides whether a payment coming from

|

| Currency Market | Identifies the correct exchange and revaluation rates to be applied to each Currency in case of FX transactions.

|

| Txn Stop Map Rule |

If this field is configured, it denotes that Transaction Stop Check needs to be performed on the debit main account. A stop instruction is captured in this field and it links to the Transaction Stop Module, which performs blacklist checking for the debit main account. If this field is not configured, then Transaction Stop check is not performed on the account. The value configured needs to be a valid record in

TZ.TRANSACTION.STOP.MAP.RULES. |

| Rate Fixing | Configure one of the following values in this field

Indicates the definition of rate fixing at product condition level precedes over the configuration at company level (PP.COMPANY.PROPERTIES) |

| Dates Product Group |

Defines the date product, which is the input for selecting boundary date record. It is not a mandatory field. If the date product is not configured, then default record is used for processing the payment.

|

Medium Weight

- To configure medium weight product, go to Admin Menu > Payment Hub > Product Determination > Product Condition – Medium. It displays the list of medium weight products defined in the system.

- Do one of the following:

- To view a record, click

.

. - To amend or edit a record, click

.

. - To create a new product, click

.

.

- To view a record, click

This screen defines the product conditions, determines a product for medium weight payments and corresponding output parameters. The product is determined and output attributes are linked to various subsequent processing components given below.

- Fee

- Ledger

- Client Condition

- Posting and Routing

This is based on the payment characteristics defined using the product conditions. Additionally, it is linked to various transaction codes that are used for booking the payments. It also influences the payment flow based on the STP indicator, imposed flag, and message priority.

A medium weight product is defined for each company. This is the company of the debit account and processing company of the payment. The bank users can configure medium weight products by using the following product conditions (input attributes):

| Field | Description |

|---|---|

|

Payment Direction |

Configure one of the following values:

Invokes the following:

The Payment Direction field along with Charge Type field (BEN, SHA, OUR or *) determines the fee processing.

|

| Clrg Trn Type |

Clearing transaction type for the payment.

Example

|

| Domestic International |

Configure one of the following values:

Payments are categorised as Domestic or International based on currency and geography.

|

| Single/Batch/Clg |

Configure one of the following values:

Bank receives single payments or batch payments (such as salary processing).

|

| Charge Type |

Configure one of the following values :

The Use Charge Type field along with the Direction field for processing the payment charges.

|

| Currency |

Configure one of the following values:

|

| From Amount |

Start of the amount range.

|

| To Amount |

End of the amount range.

|

- To enter a new amount range, click

- To delete an amount range, click

.

.

The entire set of output attributes are configured in the ‘Output Parameters’ tab for each amount range. For example, if the input attributes are defined for two amount ranges, then configure two sets of output parameters corresponding to each amount range.

| Field | Description |

|---|---|

| Source Group | Source group of the payment |

| Message Type | Type of the payment message |

| Clearing Nature Code | Nature of the clearing payment |

|

The user can configure one of the following values in Source Group, Message Type, and Clearing Nature Code fields:

|

|

| Ben Pty IBAN Ctry | Country code or country group in the IBAN of the beneficiary party. |

| Ord Pty IBAN Ctry | Country code or country group available in the IBAN of the ordering party. |

|

The user can configure one of the following values in Ben Pty IBAN Ctry and Ord Pty IBAN Ctry fields:

|

|

| Beneficiary Party IBAN Present | Indicates presence of beneficiary party IBAN. |

| Ordering Party IBAN Present | Indicates presence of ordering party IBAN. |

| Ben BIC Present | Indicates presence of beneficiary party BIC. |

| Ord BIC Present | Indicates presence of ordering party BIC. |

|

The user can configure one of the following values in Ordering Party IBAN Present, Ben BIC Present, and Ord BIC Present fields:

|

|

| Ord Pty Residency | If the ordering (debit) party is a non-resident, special requirements can be available for regulatory reporting. Configure one of the following values:

|

| Final Codeword | Codeword component assigns a final codeword, which becomes an input to product determination as multiple codewords in a payment message can be available. Configure one of the following values:

|

| Field | Description |

|---|---|

| Client Condition Group | Defines the Client Condition product, and is used as an input for client condition component. |

| Source Product Group |

|

| Routing Product Group | Defines the Routing product and is used as an input for R&S. |

| Impose Routing Flag | Indicates the system’s actions, when the Routing product configured against Routing Product Group is not found during processing.

|

| Fee Product Group | Fee product that is used as an input parameter for fees. |

| Posting Product Group | Posting product that is used as an input parameter for posting scheme. |

| Filtering Product Group | Payment Filtering product that is used as an input parameter for filtering component. |

| Duplicate Type |

|

| Debit Book Code | Booking code for the debit entry on the payment transaction amount.

|

| Debit Charge Book Code | Booking code for the charge debit. |

| Debit VAT Book Code | Booking code for VAT debit. |

| Credit Book Code | Booking code for the credit entry on the payment transaction amount. |

| Credit Charge Book Code | Booking code for the charge credit. |

| Credit VAT Book Code | Booking code for VAT credit. |

|

The user needs to configure the Debit Book Code, Debit Charge Book Code, Debit VAT Book Code, Credit Book Code, Credit Charge Book Code, and Credit VAT Book Code fields, which becomes an input parameter for posting scheme.

|

|

| Regulatory Reporting Indicator | Indicates whether the payment meets regulatory reporting requirements.

|

| New Priority | New priority of the payment.

|

| Non STP Indicator |

|

| PSD Compliant Flag | Defines whether the payment is PSD compliant.

PPPSDC component needs to be configured. |

| Settlement Type | Specifies whether the product is determined for a pre or post settled direct debit clearing.

|

| Clearing Holiday | Indicates the clearing for which the non-working days are checked for the payment (during date calculation).

Calculates the settlement date considering the clearing business date. This is used to settle the child payments . |

| EC Compliant Flag | Defines whether the payment is EC compliant.

|

| Switch Account |

Allows to enable or disable account switching in Temenos Payments at product determination level. This is applicable for inward payments and book payments. If configured, Temenos Payments validates whether the credit main account is switched out. Configure one of the following values:

This feature is available with PH license.

|

| Currency Market | Identifies the correct exchange and revaluation rates to be applied to each currency (during FX transactions).

|

| Txn Stop Map Rule |

If this field is configured, it denotes that Transaction Stop Check needs to be performed on the debit main account. A stop instruction is captured in this field and it links to the Transaction Stop Module which performs blacklist checking for the debit main account. If this field is not configured, then the Transaction Stop check is not performed on the account. The value configured needs to be a valid record in TZ.TRANSACTION.STOP.MAP.RULES.

|

| Rate Fixing | Configure one of the following values in this field:

Indicates the definition of rate fixing at product condition level precedes over the configuration at company level (PP.COMPANY.PROPERTIES). |

| Dates Product Group |

Defines the date product, which is the input for selecting boundary date record. It is not a mandatory field. If the date product is not configured, then default record is used for processing the payment.

|

Light Weight

- To configure light weight products, go to Admin Menu > Payment Hub > Product Determination > Product Condition – Light. It displays the list of light weight products defined in the system.

- Do one of the following:

- To view a record, click

.

. - To amend or edit a record, click

.

. - To create a new product, click

.

.

- To view a record, click

This screen is used to define the product conditions to determine a product for light weight payments and corresponding output parameters. A product is determined and output parameters are linked to various subsequent processing components given below.

- Fee

- Ledger

- Client Condition

- Posting and Routing product

This is based on the payment characteristics defined using the product conditions. Additionally, it is linked to various transaction code that are used for booking the payments. It also influences the flow of payment based on the STP indicator, imposed flag, and message priority.

A light weight product is defined for each company. This is the company of the debit account and processing company of the payment. The bank users can to configure light weight products by using the following product conditions (input attributes):

| Field | Description |

|---|---|

| Source |

Identifies the originating source group of the payment. Configure one of the following values:

|

| Msg Type | A valid message type of the payment. |

| Domestic International |

Configure one of the following values:

Payments are categorised as Domestic or International based on currency and geography. Output channel, different charges to be applied, R&S and Fee product are defined based on this parameter. |

|

Clearing Transaction Type |

Identifies the clearing transaction type. Distinguishes between returns or refunds, credit transfers or direct debits, and so on. Configure one of t,he following values:

|

| Clearing Nature Code |

Nature of the clearing transaction. Configure one of the following values:

|

| Settlement Indicator | Identifies whether the payment is a settlement transaction or not. Configure one of the following values:

|

| Payment Direction | Direction of the payment. Configure one of the following values:

|

| Field | Description |

|---|---|

| Client Condition Group | Client Condition product that becomes the input for client condition component. |

| Source Product Group |

Configure one of the following values:

To enable Product Determination to refer the Source Indicator and enter ‘Source’ product with Originating Source, set the Source Indicator as ‘S’.

|

| Routing Product Group | Routing product that is used as an input for R&S. |

| Impose Routing Flag | Indicates the system’s actions when routing product configured against Routing Product Group is not found during processing.

|

| Fee Product Group | Fee product that is used as an input parameter for Fees. |

| Posting Product Group | Posting product that is used as an input parameter for posting scheme. |

| Filtering Product Group | Payment Filtering product that is used as an input parameter for filtering component. |

| Duplicate Type |

|

| Debit Book Code | Booking code for the debit entry on the payment transaction amount.

|

| Debit Charge Book Code | Booking code for the charge debit. |

| Debit VAT Book Code | Identifies the booking code for VAT debit. |

| Credit Book Code | Booking code for the credit entry on the payment transaction amount. |

| Credit Charge Book Code | Booking code for the charge credit. |

| Credit VAT Book Code | Booking code for VAT credit. |

|

The user needs to configure Debit Book Code, Debit Charge Book Code, Debit VAT Book Code, Credit Book Code, Credit VAT Book Code and Credit VAT Book Code fields, which is used by the posting scheme.

|

|

| Regulatory Reporting Indicator | Indicates whether the payment meets regulatory reporting requirements.

|

| Non STP Indicator | Indicates whether to process the payment using STP or Non-STP.

|

| PSD Compliant Flag | Defines whether the payment is PSD compliant. Configure one of the following values:

|

| Settlement Type | Specifies whether the product that is determined, is for a pre or post settled direct debit clearing.

|

| Clearing Holiday | Indicates the clearing for which the non-working days is checked for the payment during date calculation.

Calculate the settlement date considering the clearing business date using which the child payments are settled. |

| EC Compliant Flag | Defines whether the payment is EC compliant. Configure one of the following values:

|

| Forward Entry Flag | Defines whether forward entries needs to be raised for the payment. Configure one of the following values:

|

| Switch Account |

Allows to enable or disable account switching in Temenos Payments at product determination level. This is applicable for inward payments and book payments. If configured, Temenos Payments validates whether the credit main account is switched out. Configure one of the following values:

This feature is available with PH license.

|

| Currency Market | Identifies the correct exchange and revaluation rates to be applied to each currency (during FX transactions).

|

| Txn Stop Map Rule |

If this field is configured, it denotes that Transaction Stop Check needs to be performed on the debit main account. A stop instruction is captured in this field and it links to the Transaction Stop Module, which performs blacklist checking for the debit main account. If this field is not configured, then Transaction Stop check is not performed on the account. The value configured needs to be a valid record in TZ.TRANSACTION.STOP.MAP.RULES.

|

| Rate Fixing | Configure one of the following values in this field:

Indicates the definition of rate fixing at product condition level precedes over the configuration at company level (PP.COMPANY.PROPERTIES). |

| Dates Product Group |

Defines the date product, which is the input for selecting boundary date record. It is not a mandatory field. If the date product is not configured, then default record is used for processing the payment.

|

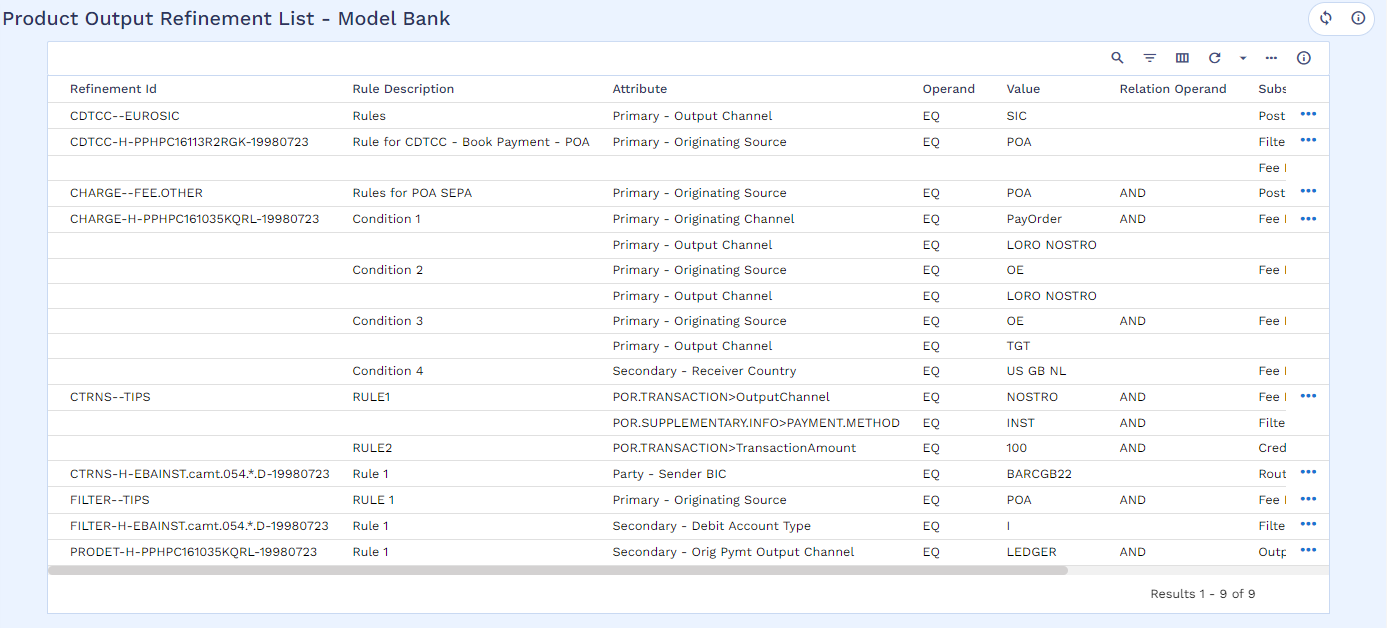

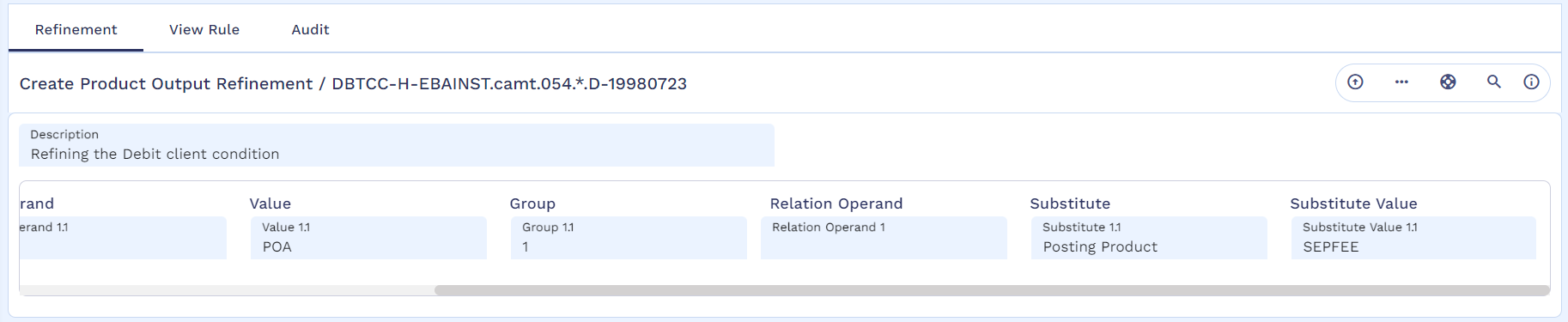

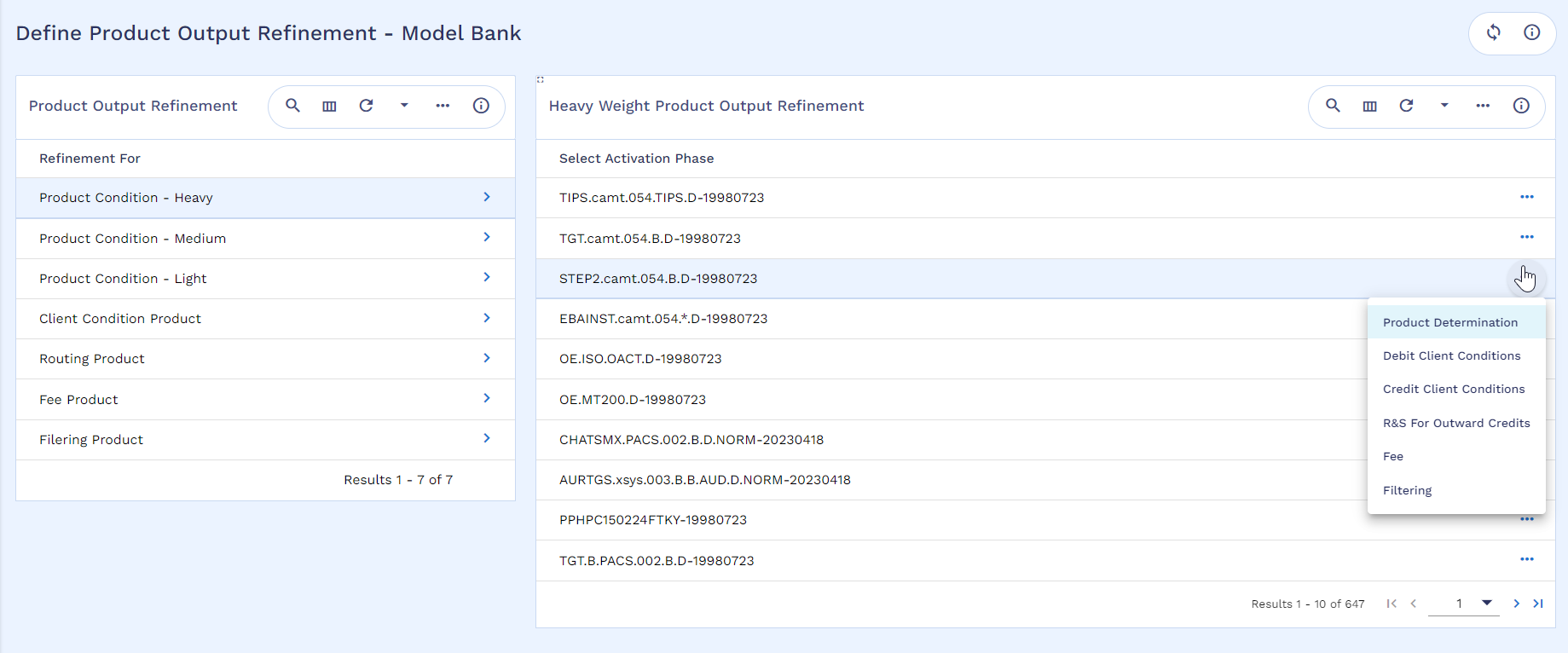

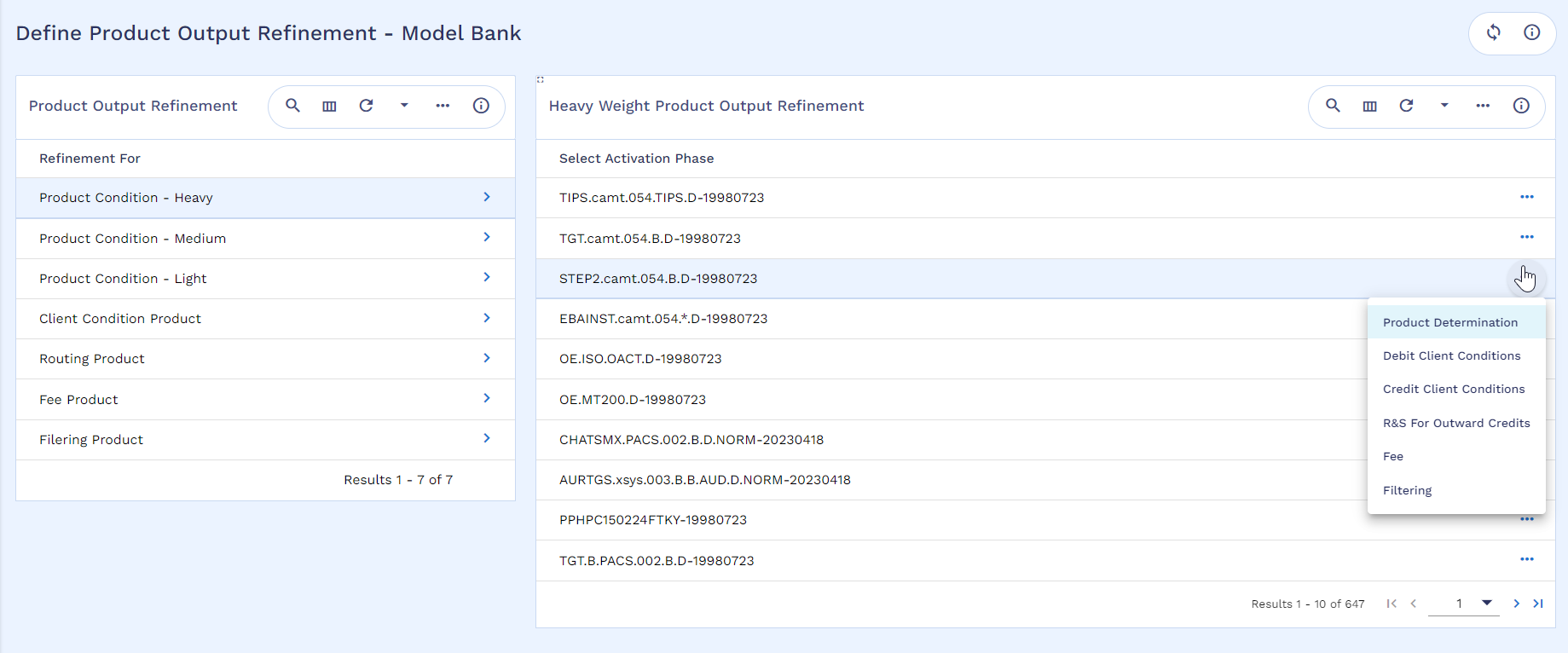

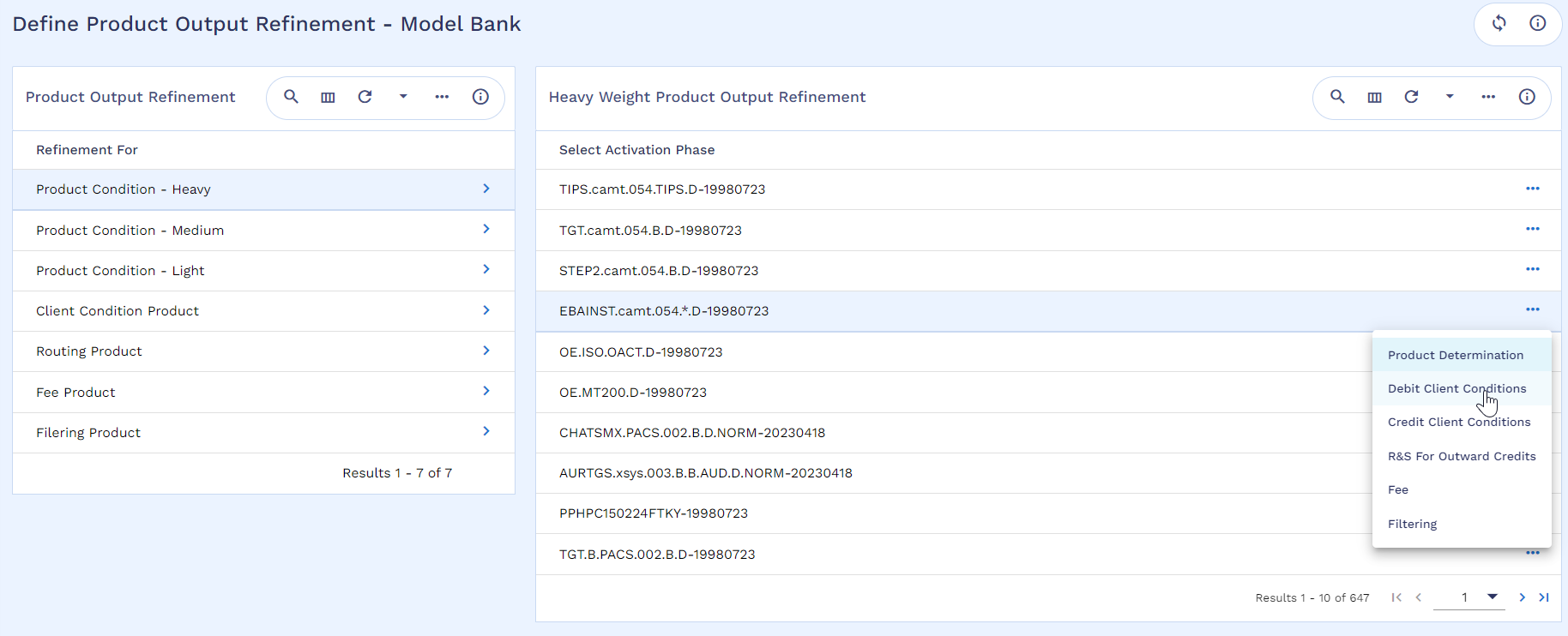

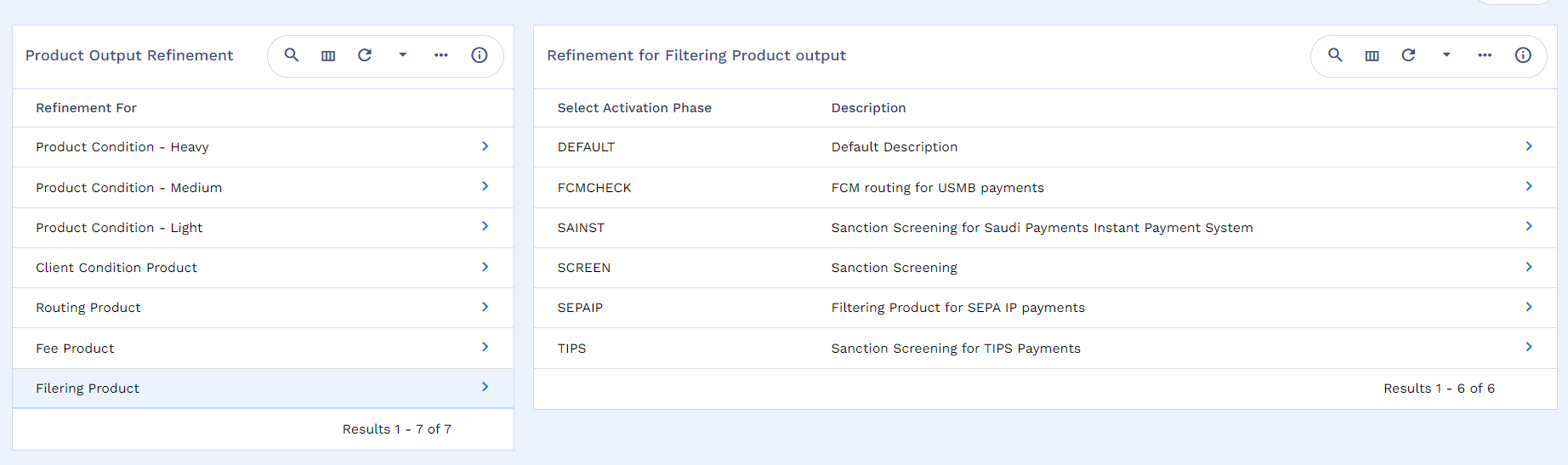

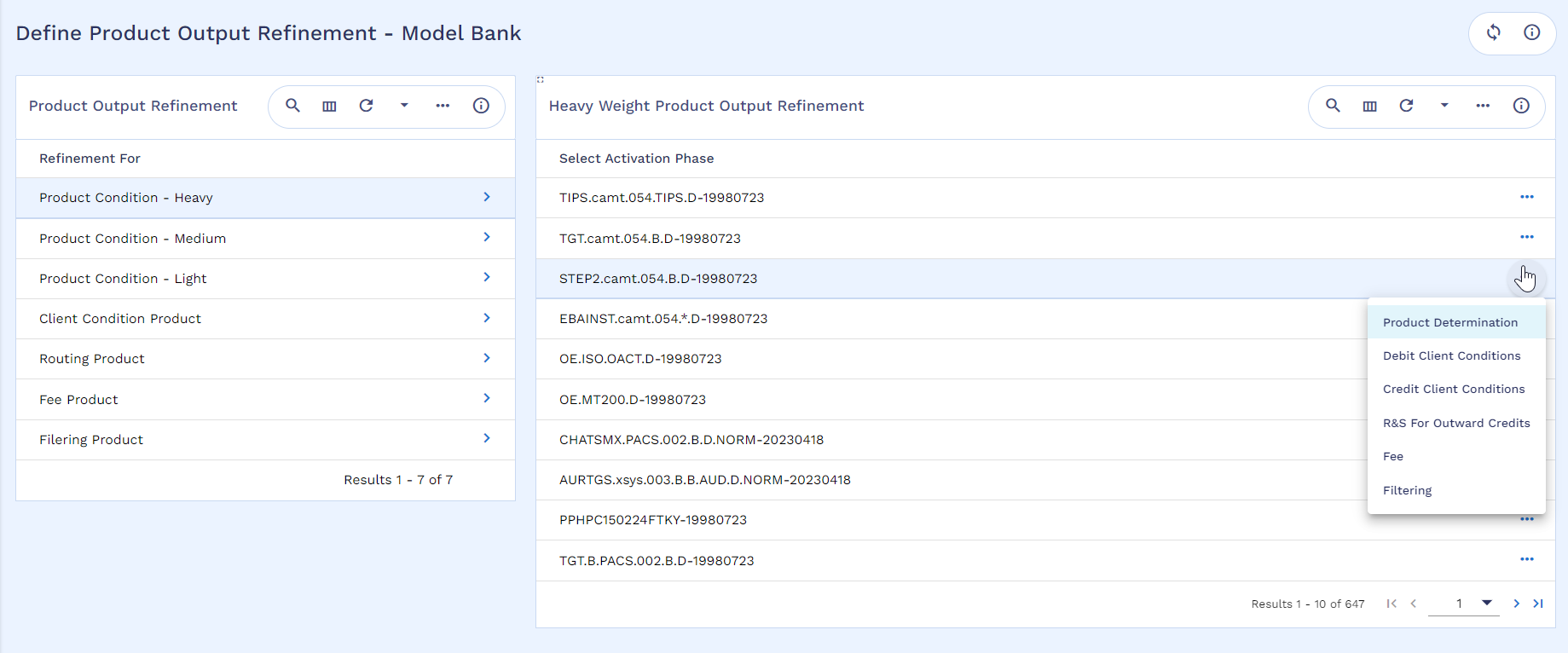

Product Output Refinement

Configuring product output refinement involves creating refinement ID as discussed below.

Creating Refinement ID

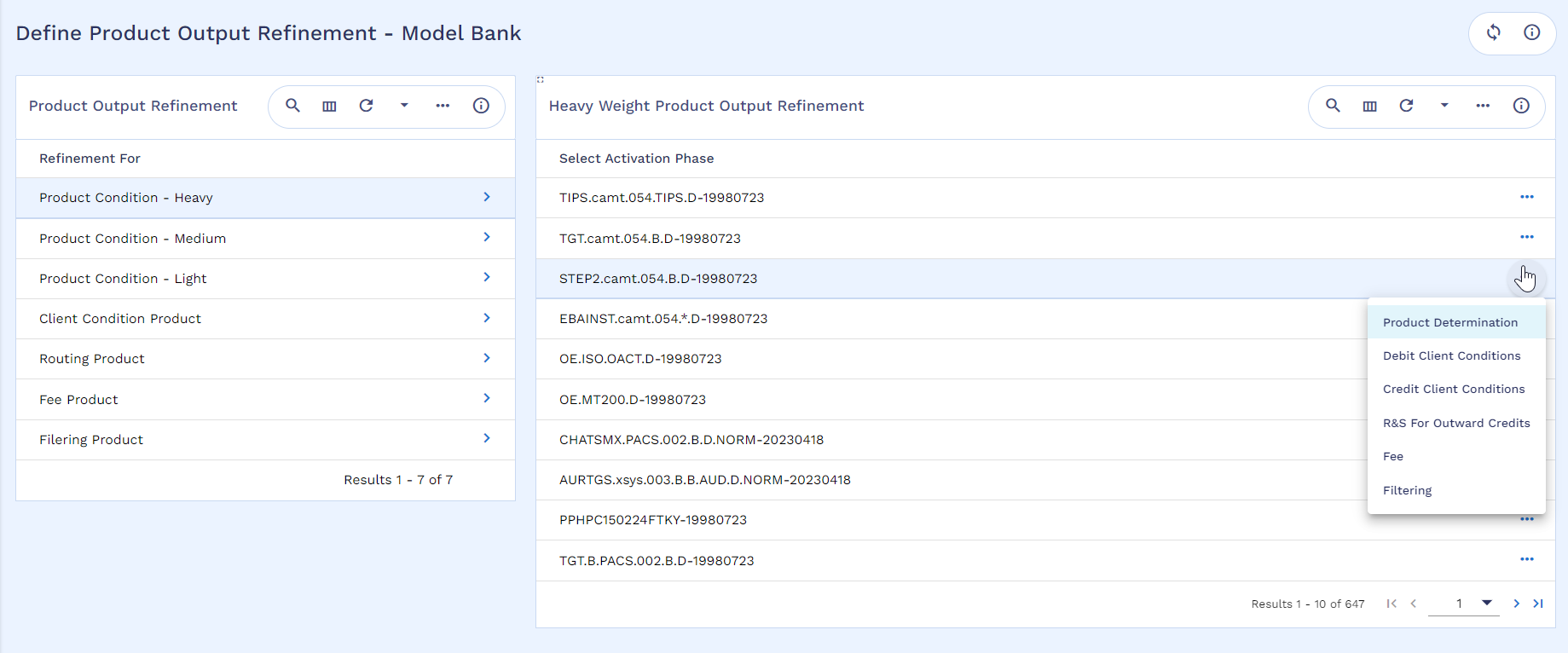

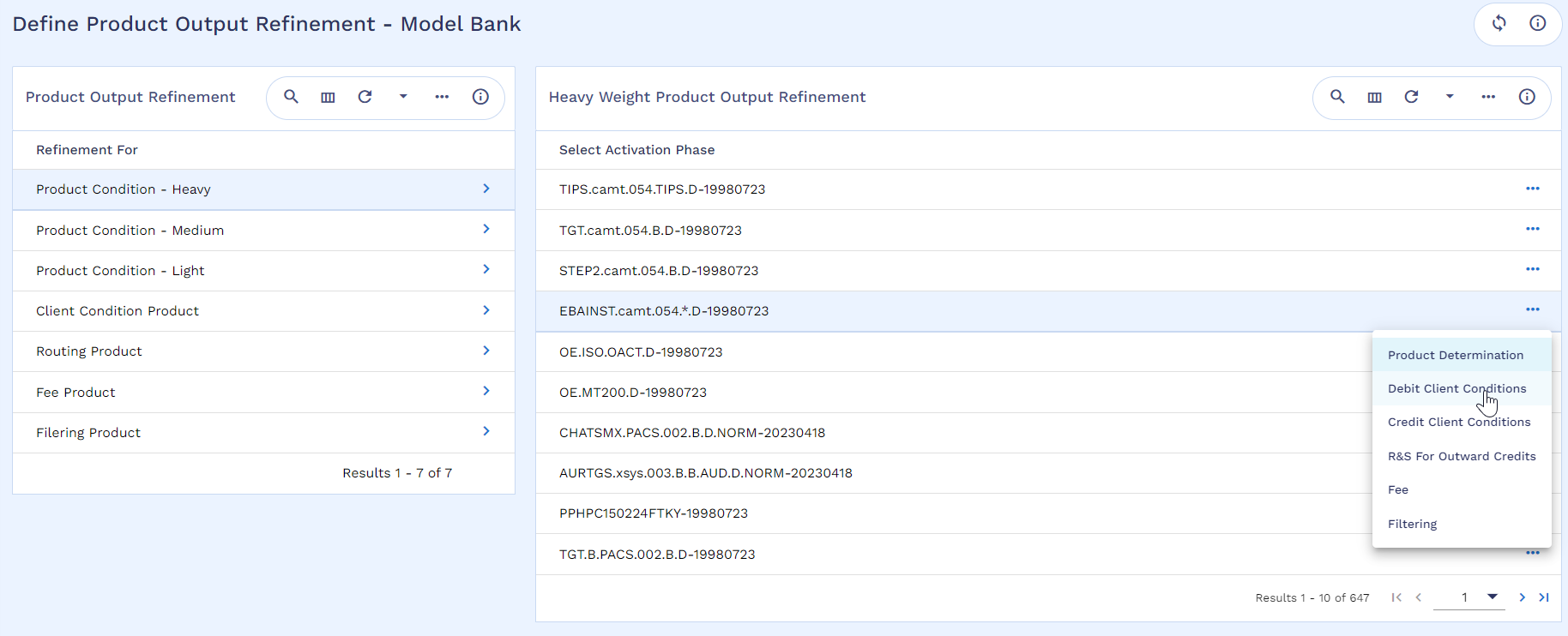

Below table shows the refinement IDs for different activation phases.

|

Component |

Refinement ID |

|---|---|

|

Product Determination |

Activation Phase-Weight-Product Determination ID

All the above-mentioned parameters are mandatory.

|

|

Debit Client Condition |

There are two types of refinement IDs.

If both types of refinements are present, then the refinement with the product determination ID takes precedence.

Activation Phase

Weight

Product Determination ID/Output Attribute

|

|

Routing Product |

|

|

Credit Client Condition |

|

|

Filtering Product |

|

|

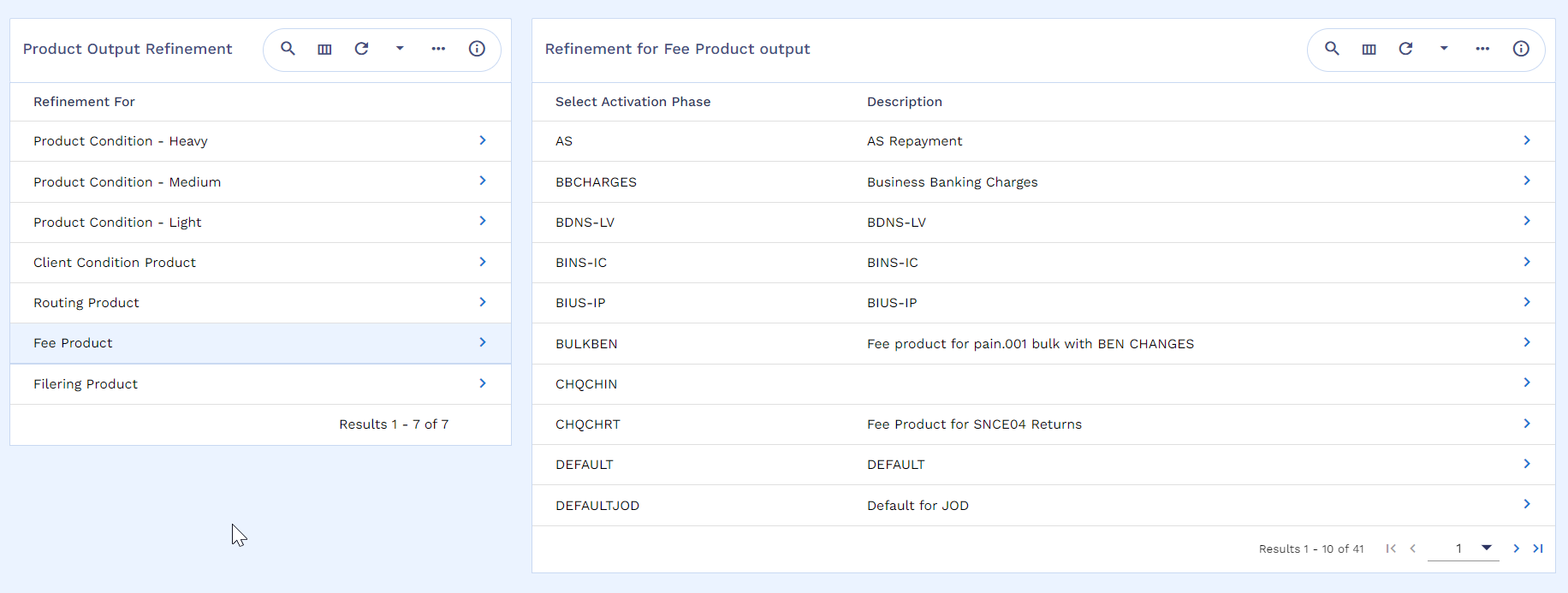

Fee Product |

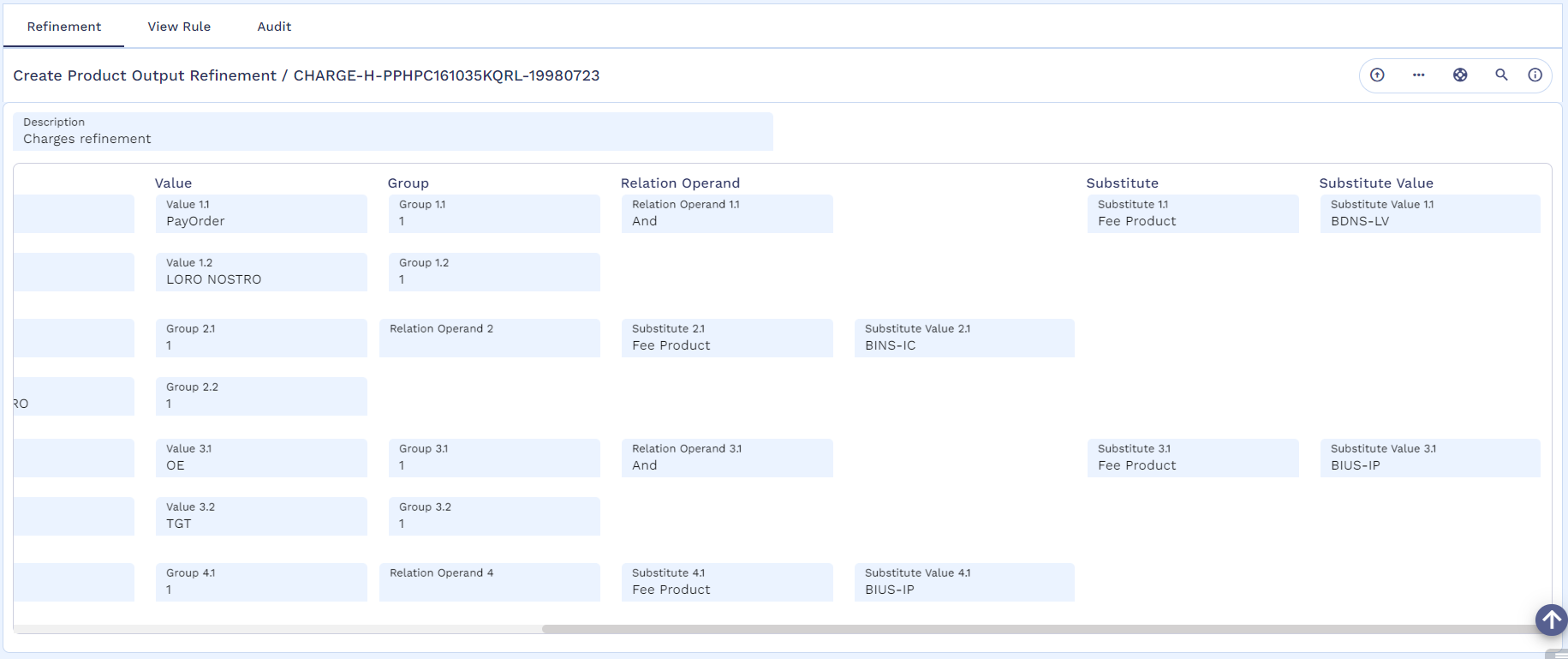

Below image shows the various refinement records created in different activation phases.

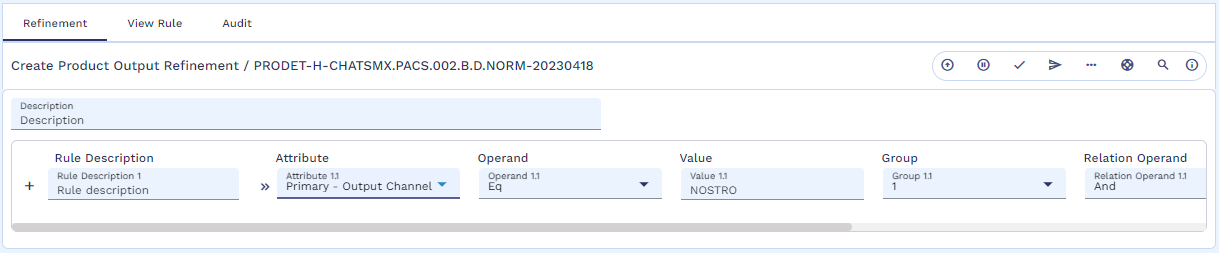

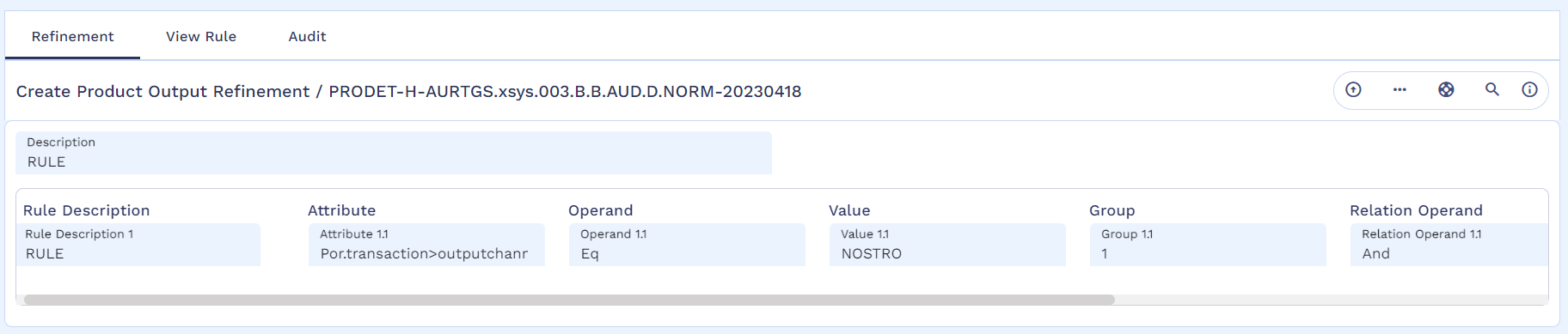

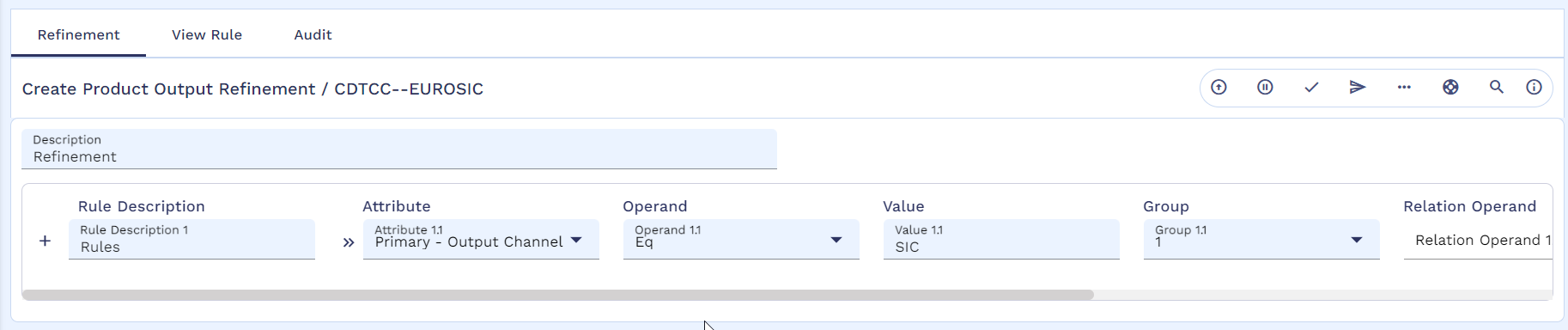

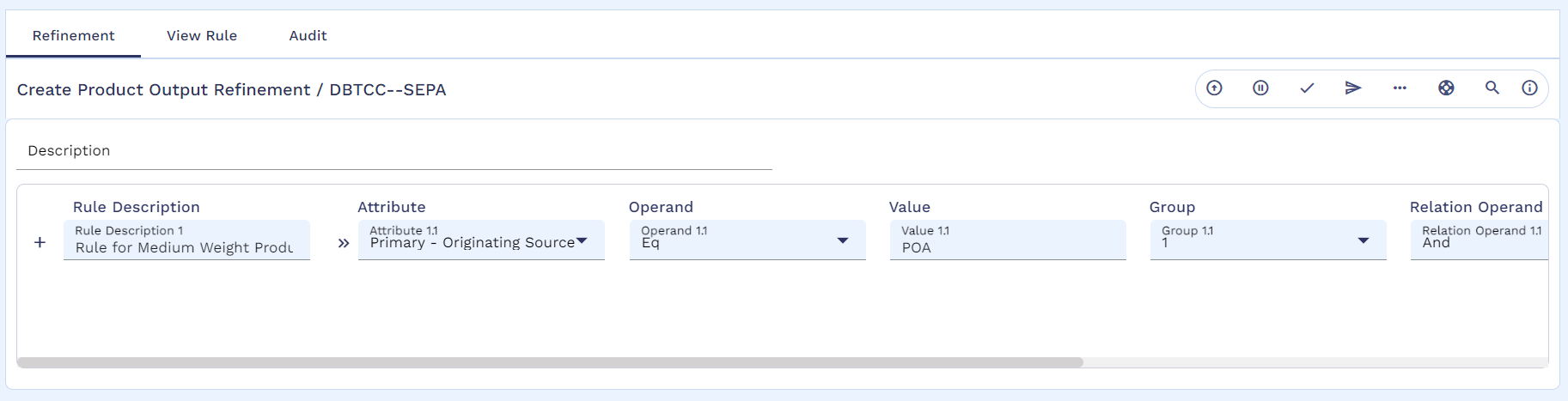

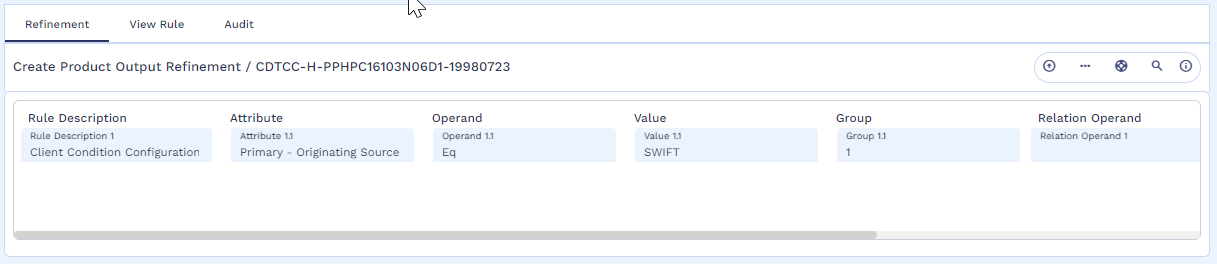

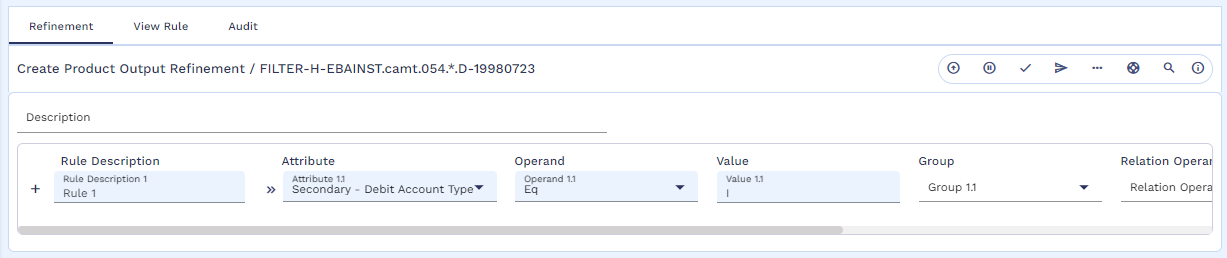

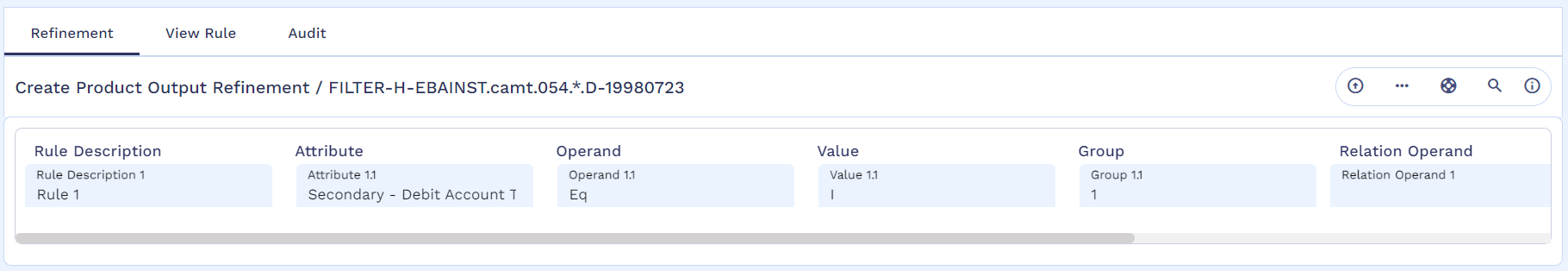

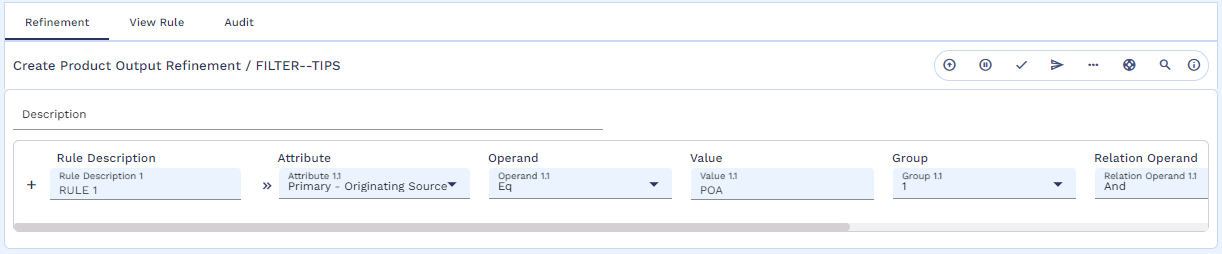

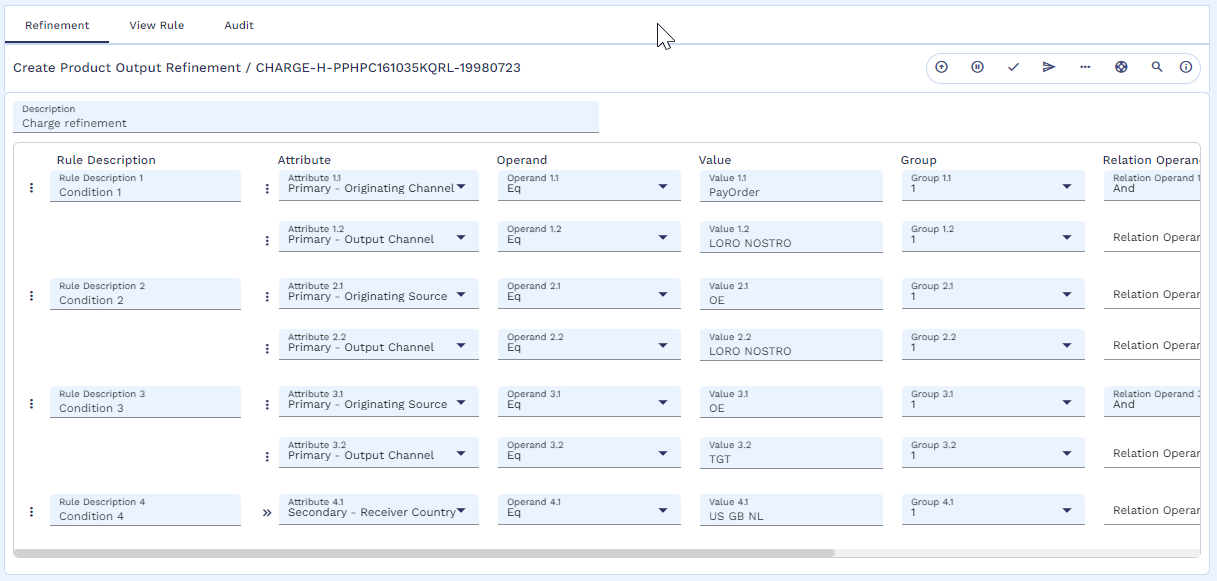

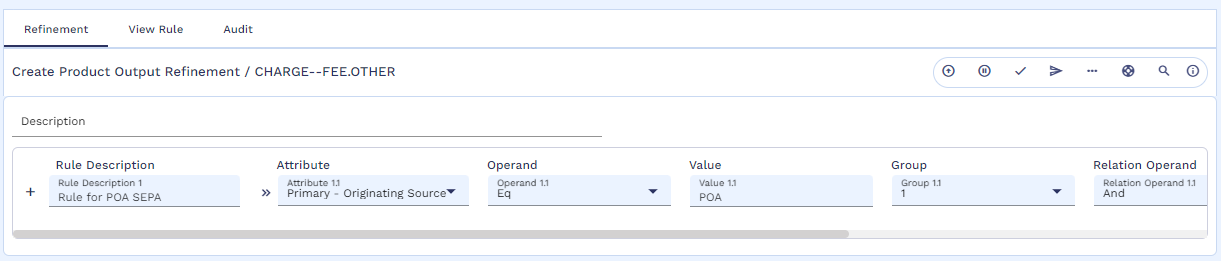

Input Parameter of Refinement

Expand the following sections for more information on each input parameter:

Indicates the attribute of the payment to which the rule is to be applied. This contains three groups.

Click the respective buttons for more information about the Primary, Secondary, and Party groups.

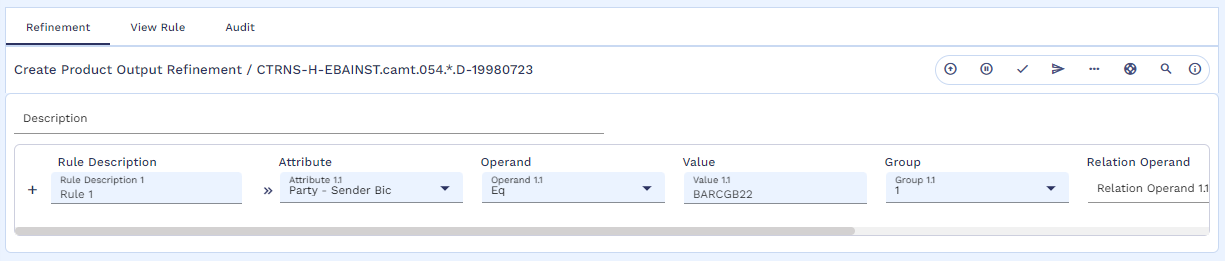

Comparison operand is applied on Attribute and Value parameters to form a rule. Allowed values are 'EQ' and 'NE' only.

Value of the defined attribute compared against the payment attribute using the operand to arrive at the rule's result as satisfied or not. 'Blank' as a value is also allowed.

Multiple values can be provided with space as separator to apply OR function between the values. If the value itself contains space, each value can be separated using single or double quotes. For example, when configuring multiple sender BIC, select sender BIC in the Attribute field and define multiple BIC in the Value field separated by space like BARCGB22 IPSDID21 or ‘BARCGB22' 'IPSDID21’ or 'BARCGB22' 'IPSDID21'. The maximum length that can be defined is up to 255 characters including spaces.

If more than one combination of Attribute-Operand-Value is defined, each set can be grouped to execute the rule within the group and all group results are evaluated to arrive at the final result of the rule. This is a numeral value that represents the group to which the Attribute-Operand-Value combination belong. A maximum of 10 groups can be defined.

This is the logical 'AND' or 'OR' that is applied to each Attribute-Operand-Value combination within a group and once group results are obtained, the last logical value in the group is applied to the next group's result. This kind of evaluation is sequential in the increasing order of groups defined.

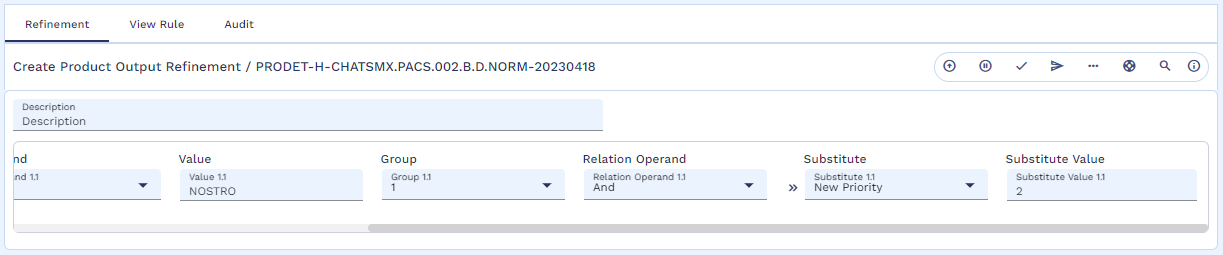

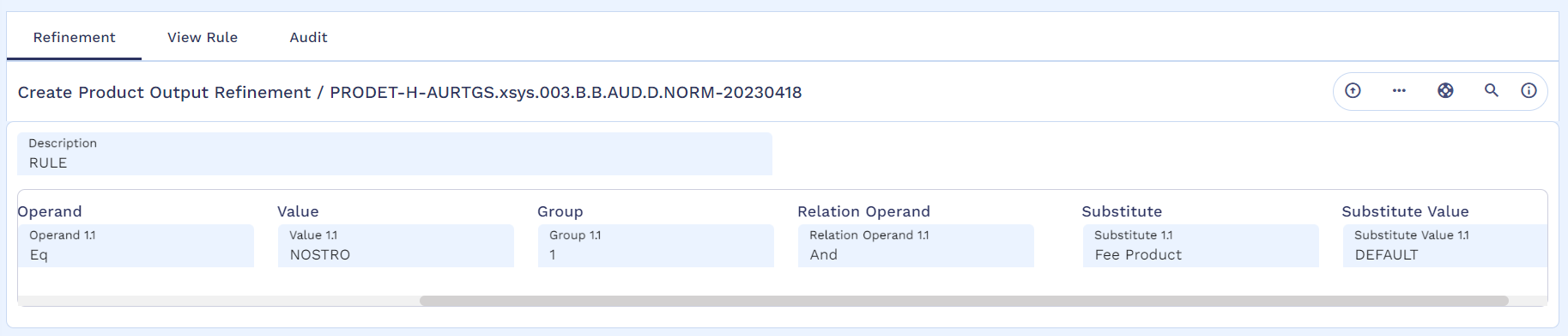

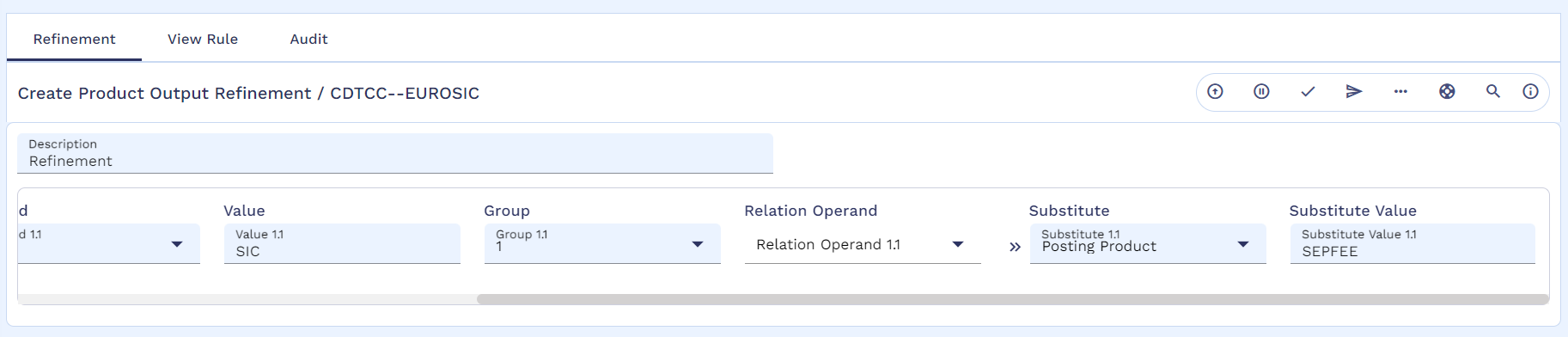

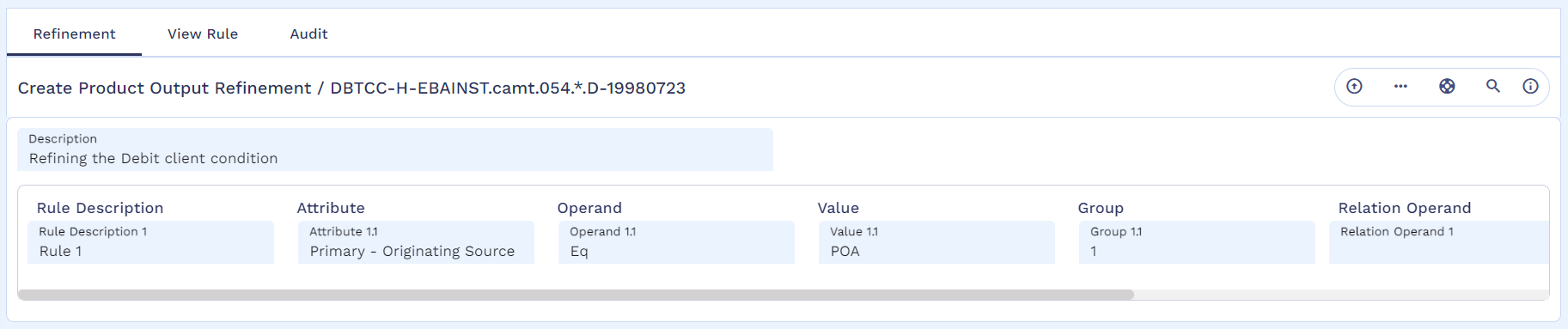

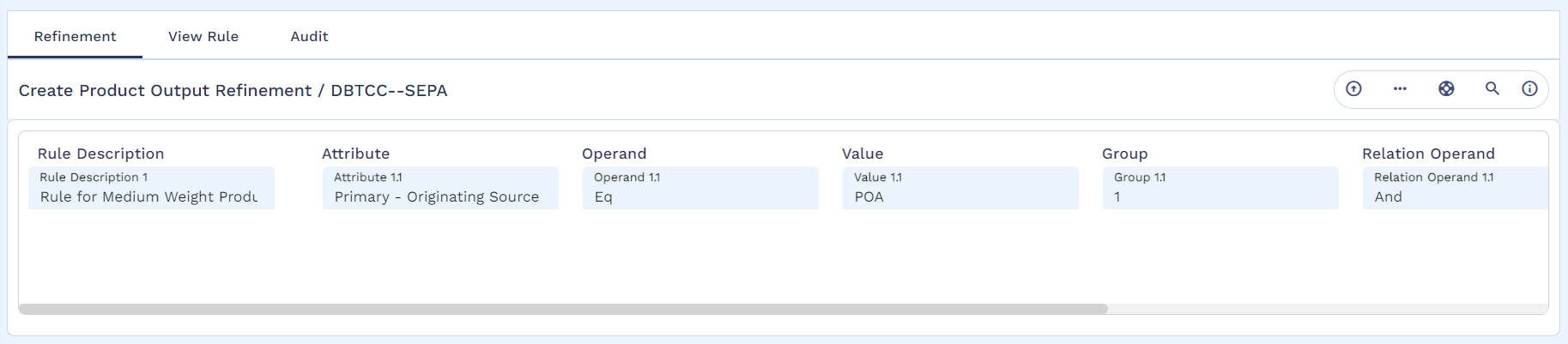

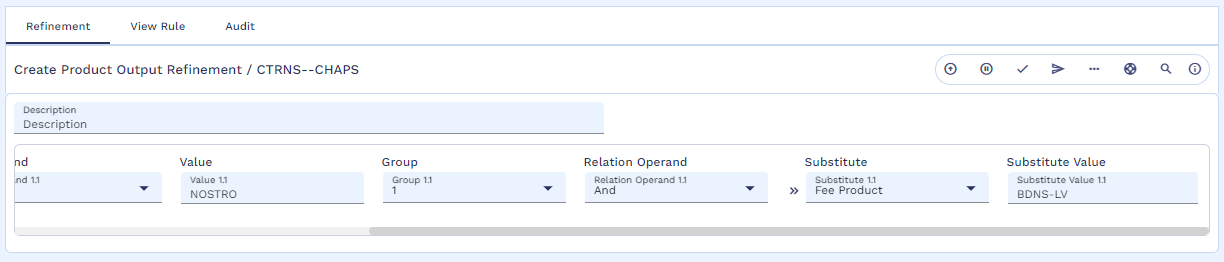

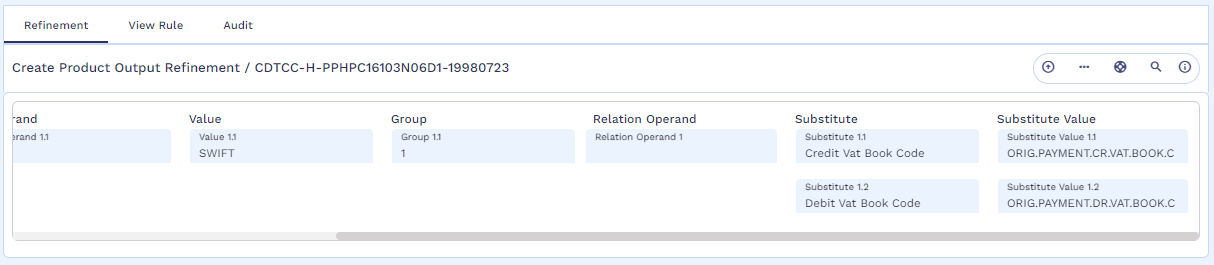

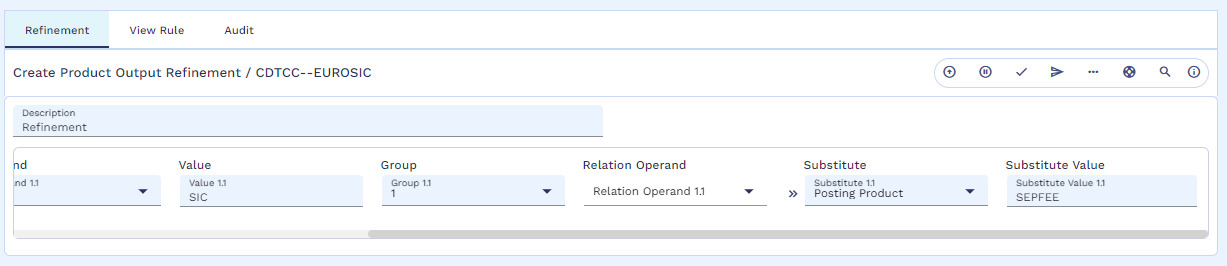

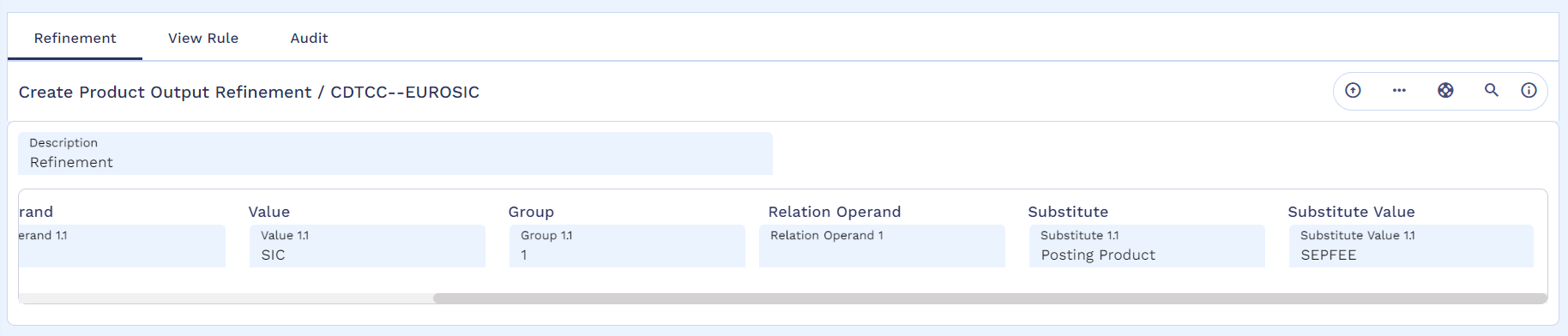

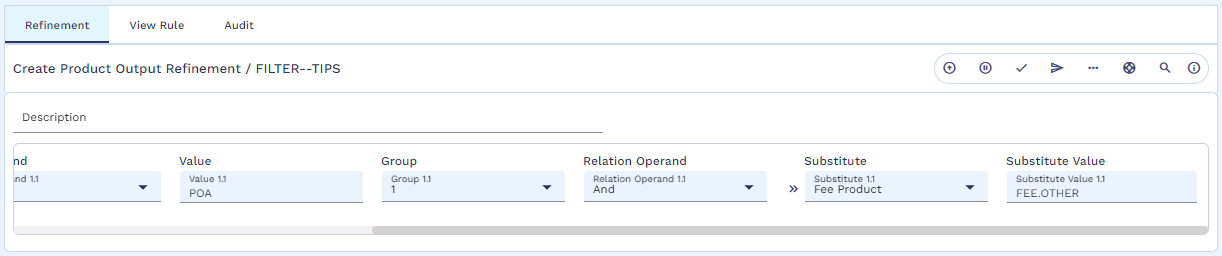

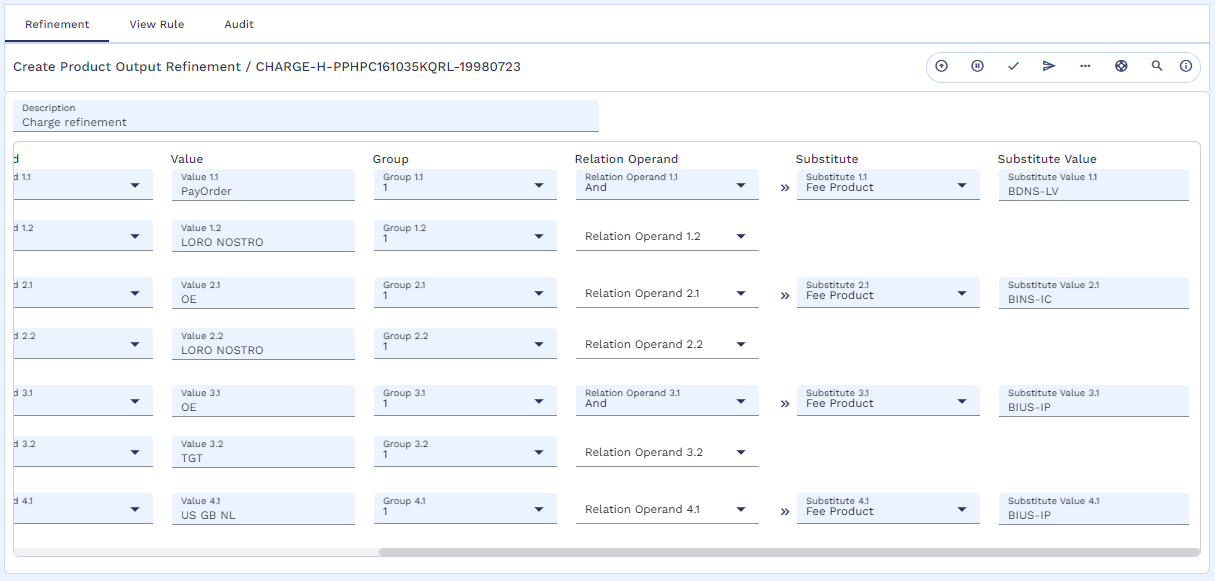

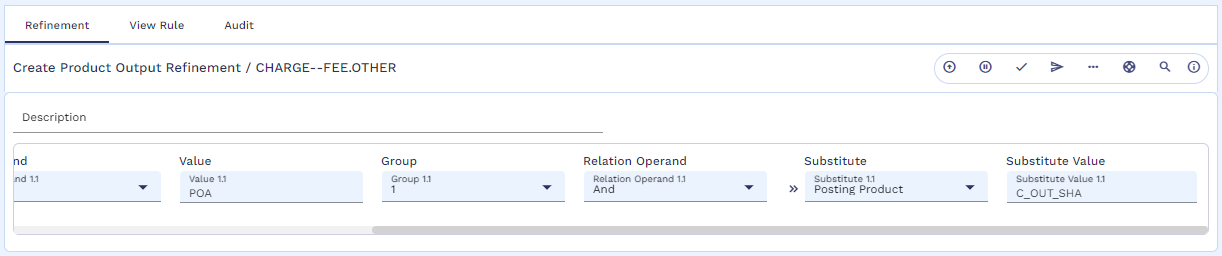

Output Parameters of Refinement

Expand the following sections for more information on each output parameter:

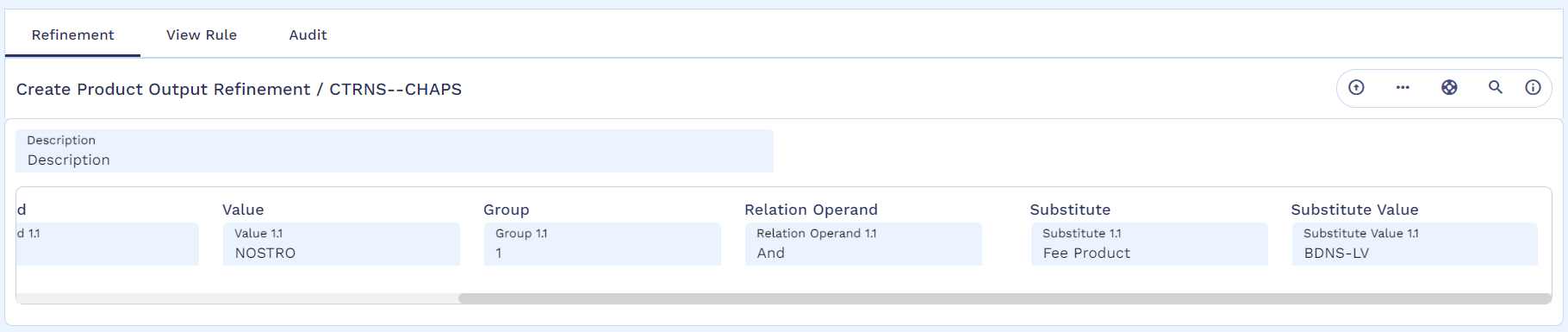

If the rule is satisfied, then the output that needs to be applied can be defined in this field. The output can vary based on the refinement record defined for various activation phases such as PRODET, DBTCC, CTRNS, CDTCC, FILTER, and CHARGE.

| Activation Phase | Description |

|---|---|

| PRODET | Any output of Heavy, Medium or Light weight product condition |

| DBTCC | Client conditions product, Routing product, Impose Routing product flag, Filtering product, Debit book code, Credit book code, Debit charge book code, Credit charge book code, Debit VAT book code, Credit VAT book code, Fee product, output channel, posting product |

| CTRNS | Routing product, Impose Routing product flag, Filtering product, Debit book code, Credit book code, Debit charge book code, Credit charge book code, Debit VAT book code, Credit VAT book code, Fee product, posting product, output channel. CTRNS is applicable only for outward and redirect credits. |

| CDTCC | Client conditions product, Filtering product, Debit book code, Credit book code, Debit charge book code, Credit charge book code, Debit VAT book code, Credit VAT book code, Fee product |

| FILTER | Filtering product, Debit book code, Credit book code, Debit charge book code, Credit charge book code, Debit VAT book code, Credit VAT book code, Fee product, posting product |

| CHARGE | Fee product, posting product |

It is possible to define multiple substitute field but the feature is limited to unique values. The system does not allow duplicate fields and values.

If the rule is satisfied, then the value of the output that needs to be applied can be defined in this field. This field supports the following values.

- ORIG.PAYMENT.CREDIT.BOOK.CODE

- ORIG.PAYMENT.DEBIT.BOOK.CODE

- ORIG.PAYMENT.DR.CHG.BOOK.CODE

- ORIG.PAYMENT.CR.CHG.BOOK.CODE

- ORIG.PAYMENT.CR.VAT.BOOK.CODE

- ORIG.PAYMENT.DR.VAT.BOOK.CODE

It is possible to refine based on local field conditions in payment processing. Refer to the Refining Payment Processing using Local Field Names and Values section.

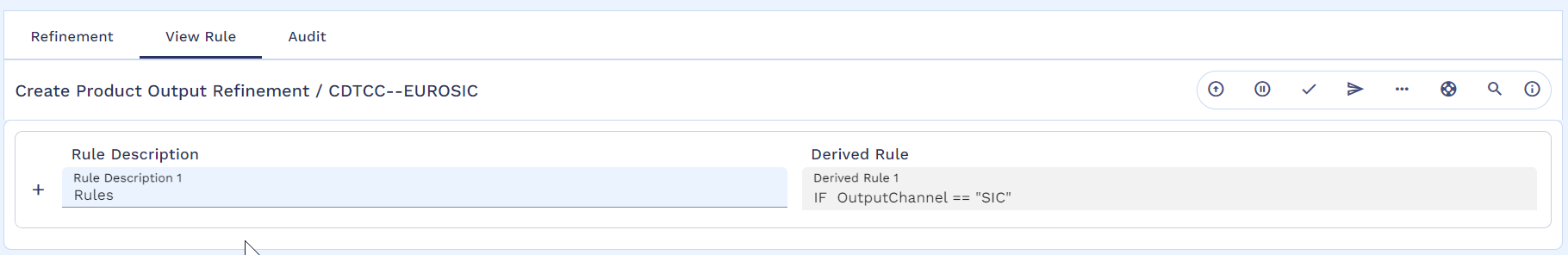

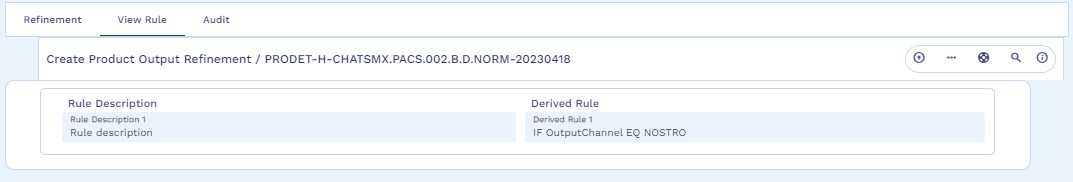

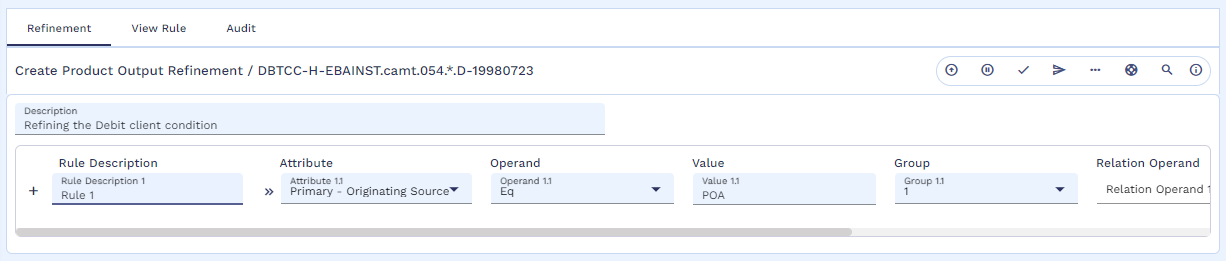

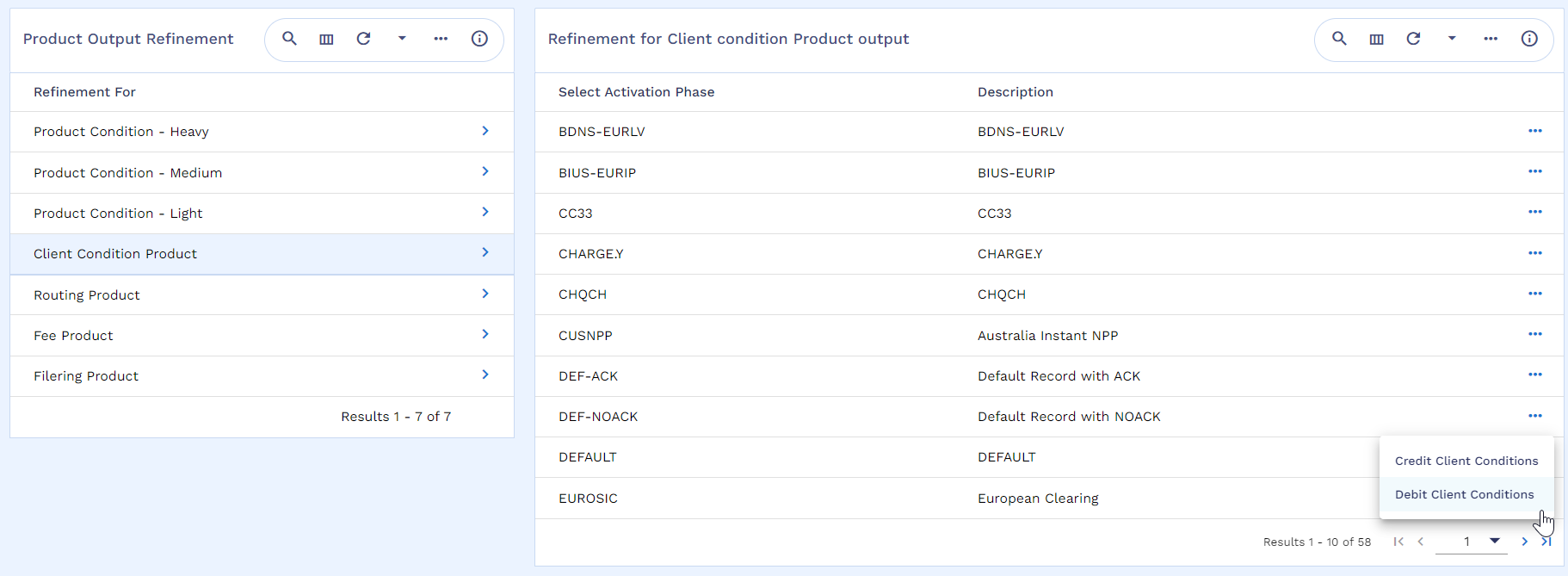

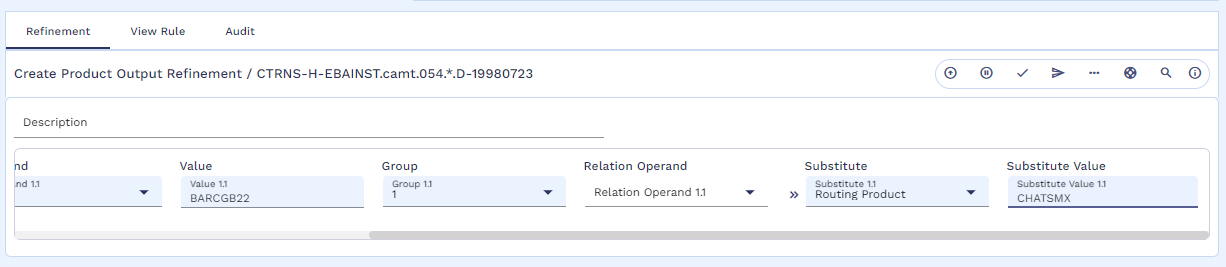

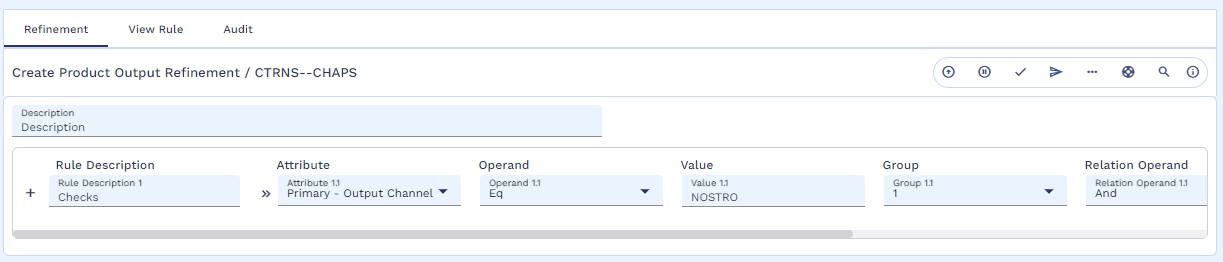

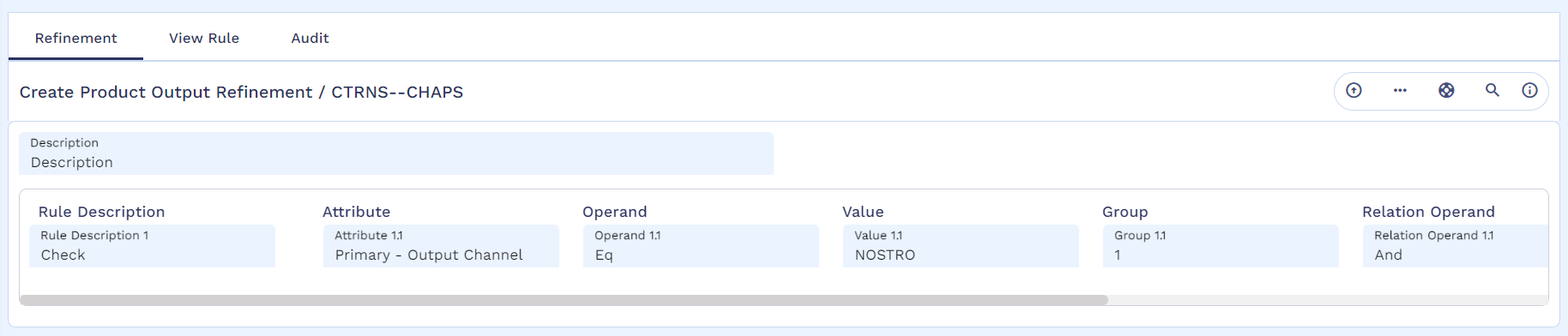

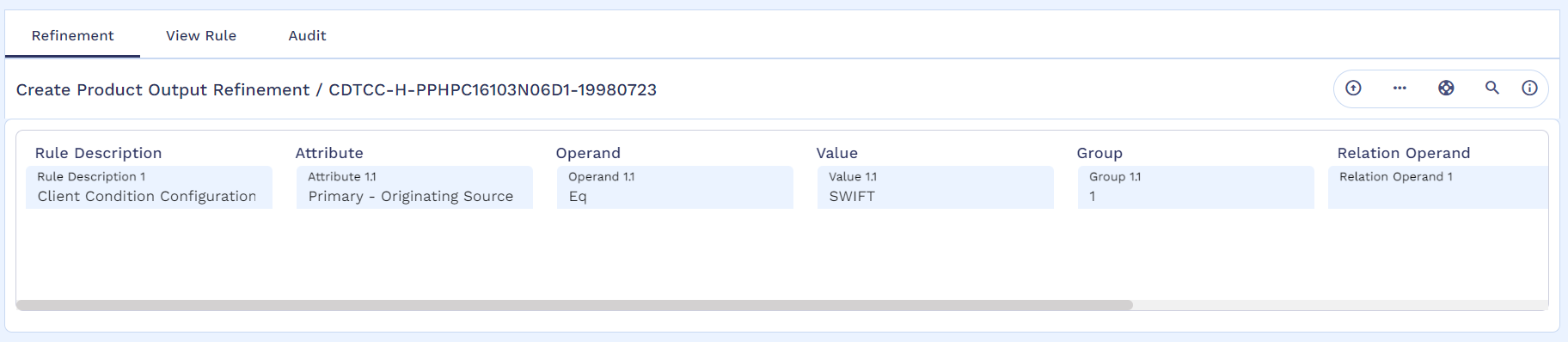

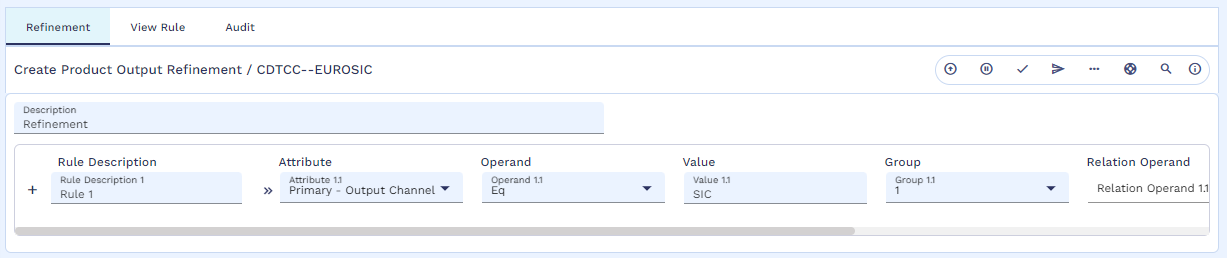

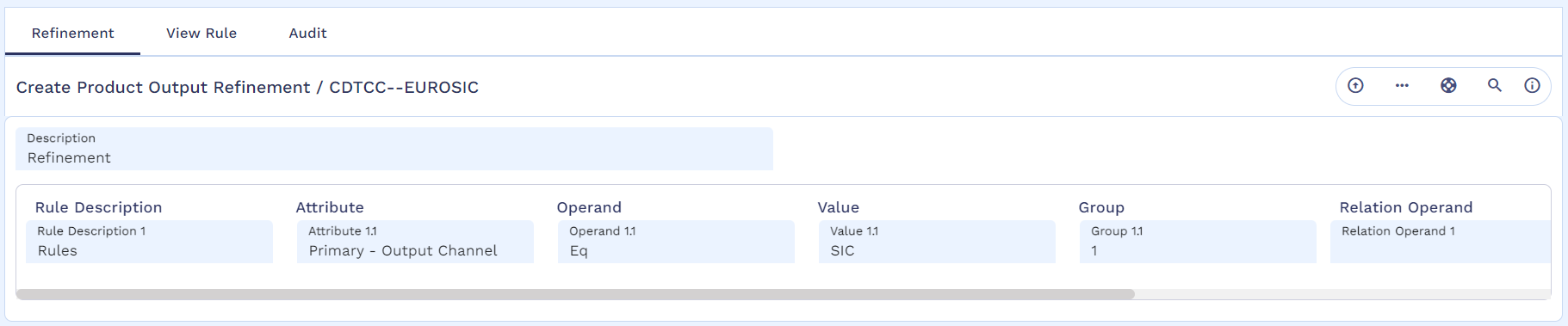

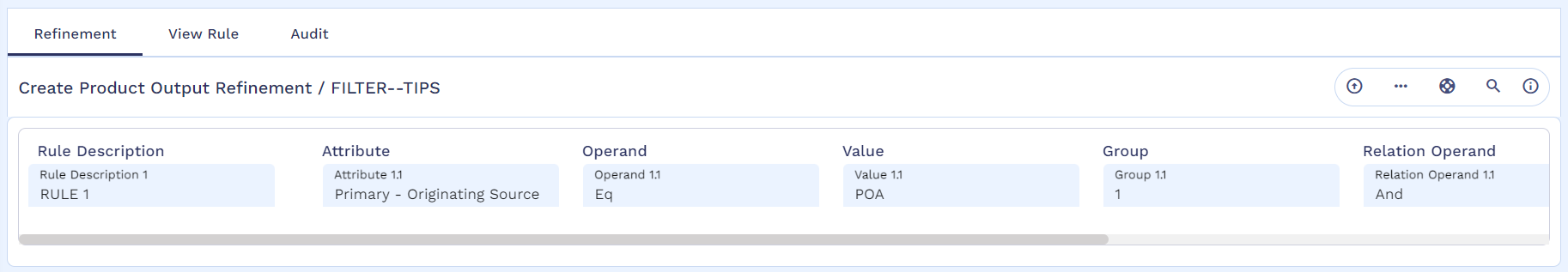

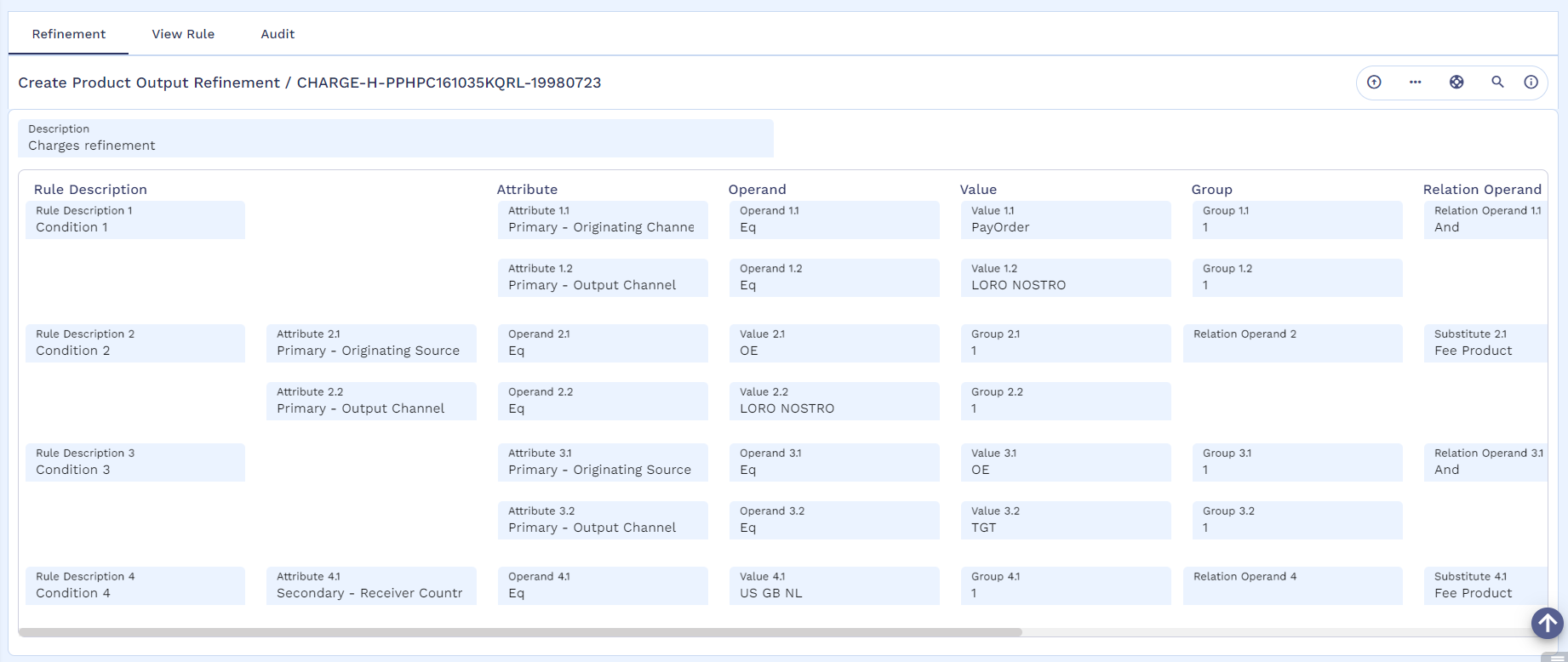

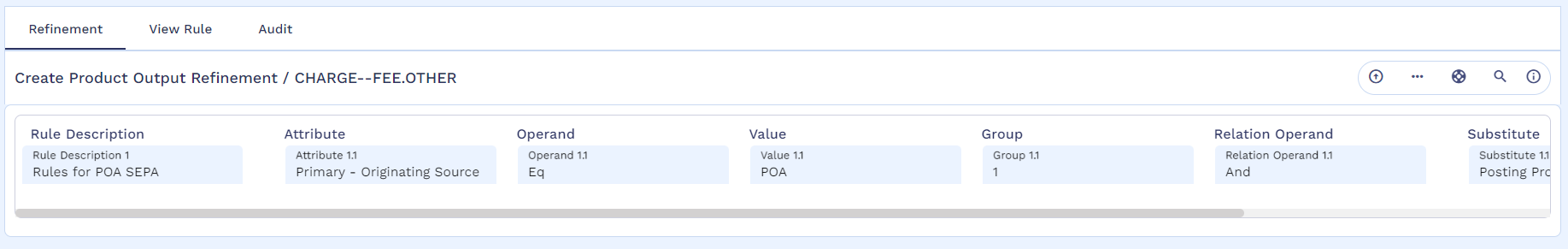

Below screenshots represent the input and output parameters of the Refinement table.

Refining Output at Product Determination Stage

Following steps explain how to refine product determination.

- To configure the refinement, go to Admin Menu > Payments > Payment Hub > Bank operations configuration > Product determination > Define product output refinement.

- In the Product Output Refinement section, select the Product Condition (heavy or medium or light) to be refined (user can select any PD ID for which the output of the product is to be refined) and select Product Determination in the dropdown.

- Configure the conditions in the Refinement tab.

- Configure the condition and commit the record.

In PRODET activation phase - Any output of Heavy, Medium or Light weight product condition can be refined. After validating the descriptions and conditions that are configured in the Refinement tab, the user can view them in the Derived Rule tab. If the condition mentioned in the derived rule is satisfied, then the particular refinement becomes successful.

Refining Output at Debit Client Condition Stage

The following sections explain how to refine debit client condition using product determination ID and client condition output derived from product determination. The user can use anyone of the methods.

To configure the refinement, go to Admin Menu > Payments > Payment Hub > Bank Operations Configuration > Product Determination > Define Product Output Refinement.

To refine using the product determination ID,

- In the Product Output Refinement section, select the Product Condition (heavy or medium or light) to be refined (user can select any PD ID for which the debit client condition is to be refined) and select Debit Client Condition in the dropdown.

- Configure the condition in the Refinement tab.

- Enter the conditions and commit the record.

The payment parameters to be influenced are limited to respective activation phase. Refer to the Product Output Refinement section for more details on the field details and influential factors.

To refine using the client condition derived from the product determination,

- In the Product Output Refinement section, select debit Client Condition Product against the respective client condition product output.

- Configure the condition in the Refinement tab.

- Configure the condition and commit the record.

The payment parameters to be influenced are limited to respective activation phase. Refer to the Product Output Refinement section for more details on the field details and influential factors.

Refining Output at Routing and Settlement Stage

The following sections explain how to refine routing and settlement using product determination ID and routing product output derived from product determination.

To configure the refinement, go to Admin Menu > Payments > Payment Hub > Bank Operations Configuration > Product Determination > Define Product Output Refinement.

To refine using the product determination ID,

- In the Product Output Refinement section, select the Product Condition (heavy or medium or light) to be refined (user can select any PD ID for which the Routing and settlement is to be refined) and select R&S for Outward Credits in the dropdown.

- Configure the condition in the Refinement tab.

- Enter the conditions and commit the record.

The payment parameters to be influenced are limited to respective activation phase. Refer to the Product Output Refinement section for more details on the field details and influential factors.

To refine using the client condition derived from the product determination,

- Select Routing Product in the Product Output Refinement section and choose the required routing product to be refined in the refinement window.

- Configure the condition in the Refinement tab.

-

Configure the condition and commit the record

The payment parameters to be influenced are limited to respective activation phase. Refer to the Product Output Refinement section for more details on the field details and influential factors.

Refining Output at Credit Client Condition Stage

The following sections explain how to refine credit client condition using product determination ID and credit client condition output derived from product determination. To configure the refinement, go to Admin Menu > Payments > Payment Hub > Bank Operations Configuration > Product Determination > Define Product Output Refinement.

To refine using the product determination ID,

- In the Product Output Refinement section, select the Product Condition (heavy or medium or light) to be refined (user can select any PD ID for which the credit client condition is to be refined) and select Credit Client Condition in the dropdown.

- Configure the condition in the Refinement tab.

- Enter the conditions and commit the record.

The payment parameters to be influenced are limited to respective activation phase. Refer to the Product Output Refinement section for more details on the field details and influential factors.

To refine using the client condition derived from the product determination,

- Select Client Condition Product in the Product Output Refinement section and choose the required client condition product to be refined in the refinement pane and select Credit Client Condition in the dropdown.

- Configure the condition in the Refinement tab.

- Configure the condition and commit the record.

The payment parameters to be influenced are limited to respective activation phase. Refer to the Product Output Refinement section for more details on the field details and influential factors.

Refining Output at Filtering Stage

The following sections explain how to refine filtering product using product determination ID and filtering product output derived from product determination. To configure the refinement, go to Admin Menu > Payments > Payment Hub > Bank Operations Configuration > Product Determination > Define Product Output Refinement.

To refine using the product determination ID,

- In the Product Output Refinement section, select the Product Condition (heavy or medium or light) to be refined (user can select any PD ID for which the filtering product is to be refined) and select the required filtering option from the dropdown

-

Configure the condition in the Refinement tab.

The payment parameters to be influenced are limited to respective activation phase. Refer to the Product Output Refinement section for more details on the field details and influential factors.

-

Enter the conditions and commit the record.

To refine using the client condition derived from the product determination,

- Select Filtering product in the product output refinement.

- Configure the condition and commit the record.

- Configure the condition and commit the record.

The payment parameters to be influenced are limited to respective activation phase. Refer to the Product Output Refinement section for more details on the field details and influential factors.

Refining Output at Fee Stage

The following sections explain how to refine fee product. To configure the refinement, go to Admin Menu > Payments > Payment Hub > Bank Operations Configuration > Product Determination > Define Product Output Refinement.

The user can follow either one of the following procedures. If both are configured the refinement using product determination ID takes precedence.

To refine using the product determination ID,

- In the Product Output Refinement section, select the Product Condition (heavy or medium or light) to be refined (user can select any PD ID for which the fee product is to be refined) and select the Fee option in the dropdown.

- Configure the condition in the Refinement tab.

- Configure the condition and commit the record.

The payment parameters to be influenced are limited to respective activation phase. Refer to the Product Output Refinement section for more details on the field details and influential factors.

To refine using the client condition derived from the product determination,

- Select Fee product in the product output refinement.

- Configure the condition in the Refinement tab as shown in the screenshot below

- Configure the condition and commit the record.

The payment parameters to be influenced are limited to respective activation phase. Refer to the Product Output Refinement section for more details on the field details and influential factors.

In this topic