Configuring FATF and WTR 2

This section helps the user to enable Financial Action Task Force (FATF) and configure country groups.

Enabling FATF Validations

Install the PPFATF module for Temenos Payments to perform FATF and Wire Transfer Regulation 2 (WTR 2) regulation checks on inward and outward payments.

To enable FATF regulations,

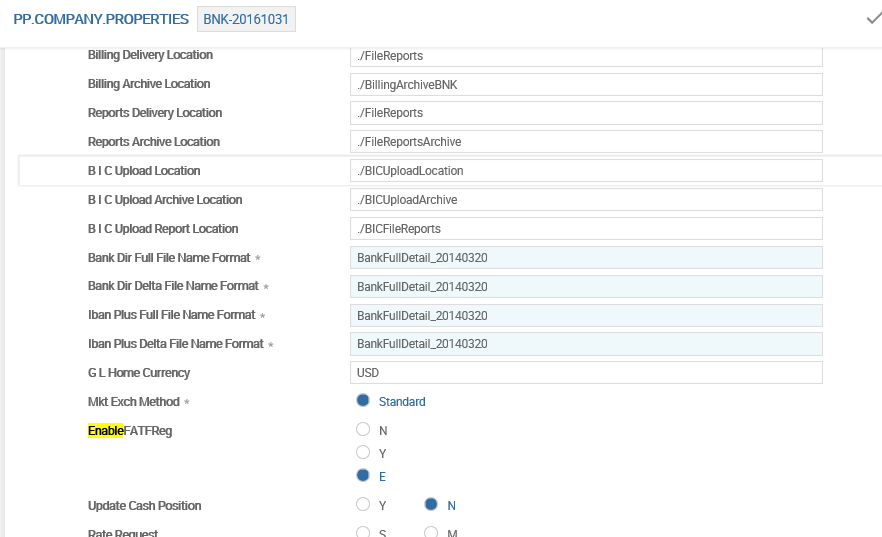

- In the PP.COMPANY.PROPERTIES table, set the Enable FATF Reg field as follows:

- E – European regulation

- Y – Global regulation

- N or blank – FATF regulation check not required

- To override FATF validations (performed by the system) and perform custom regulation checks, configure an API in FATF Check API field in PP.COMPANY.PROPERTIES table.

The system validates the following FATF validations on configuring the Enable FATF Reg field in PP.COMPANY.PROPERTIES table.

In global regulation, set the Enable FATF Reg field as Y in PP.COMPANY.PROPERTIES table. The following fields are mandatory irrespective of the originating and beneficiary country code:

- Debtor Account

- Debtor Name

- Debtor Address

In European regulation, set the Enable FATF Reg field as E in the PP.COMPANY.PROPERTIES table. The following fields are mandatory when the originator and beneficiary are in European Economic Area (EEA):

- Payer Name

- Payee Name

- Account Number

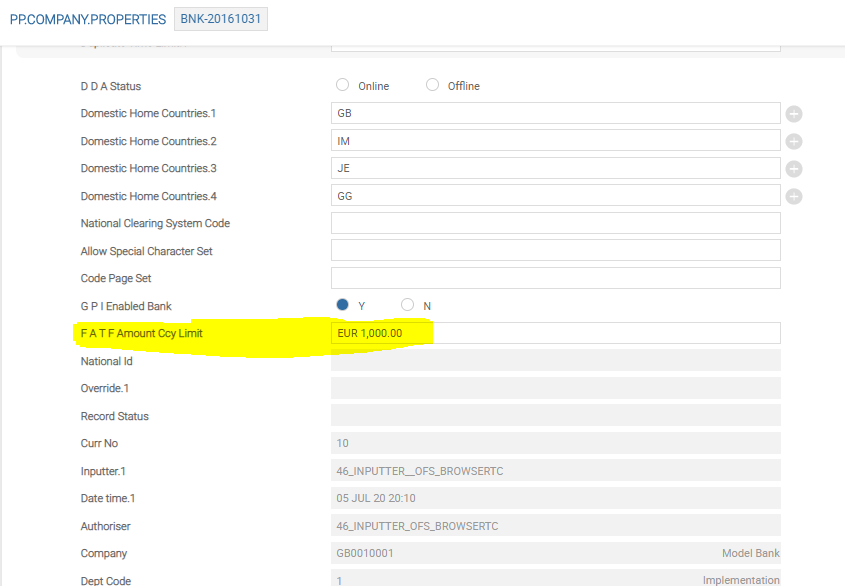

- If the party is outside EEA, the transaction amount is checked. The FATF Amount Ccy Limit in PP.COMPANY.PROPERTIES table is an optional field.

- If either the originator or beneficiary is outside EEA, then the system applies Global regulations for such payments.

The bank validates the configured amount limit in FATF Amount Ccy Limit field for the following:

| Type of Payment | Description |

|---|---|

| Outward | Checks the amount limit, when:

Address is mandatory when the transaction amount is greater than the configured amount. |

| Inward | Does not check the amount limit. |

| Redirected | Checks the amount limit, when the payee is in non-EEA. Address is mandatory when the transaction amount is greater than the configured amount. |

DD Transaction

The following validations are performed in DD transactions:

| Type of Payment | Description |

|---|---|

| Outward | Checks the amount limit, when:

Address is mandatory when the transaction amount is greater than the configured amount. |

| Inward | Does not perform the WTR 2 validation for inward DD transactions |

| Redirected |

No FATF Regulation

If the bank does not require any FATF validation for the messages, the user can set the Enable FATF Reg field as N.

Country Groups

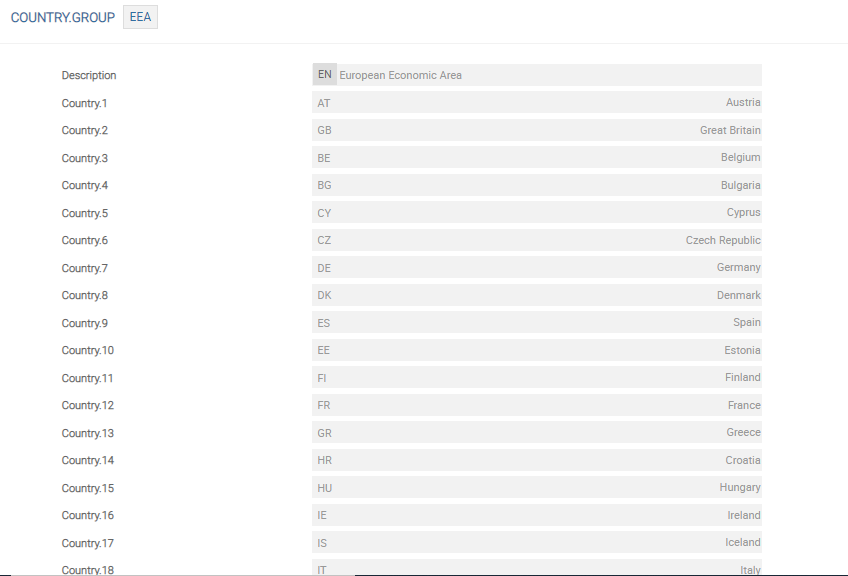

The COUNTRY.GROUP table is used to group currencies and countries based on European Union (EU) or EEA.

| Country Group | Description |

|---|---|

| EEA | Has all the 28 countries that belong to EU including the following EEA countries:

|

| SNONEU | Has all the non-EEA SEPA countries:

|

The screenshot below shows the country group created for EEA region.

Enabling Name Comparison Check

Temenos Payment can be set to perform Account Number and Account Name matching on inward message. The beneficiary details (Account number or IBAN and Name) in an inward payment is compared against the static data table (that contains customer and account information) and further processing is continued based on the successful match. The validation check is enabled by mapping name comparison API in component API hook table.

To enable the validation, go to Admin menu > Payments > Payments Hub > Static System Configurations > Component API Hook.

| Field Name | Value | Description |

|---|---|---|

| @ID | CreditNameComparision | Indicates the calling component for the API |

| HookAPIName | CreditPartyDeterminationService.nameComparisonDpdAPI | Indicates the name of the API which does the Name validation check |

| InvokeCall | Post | Indicates when API hook should be called |

In this topic