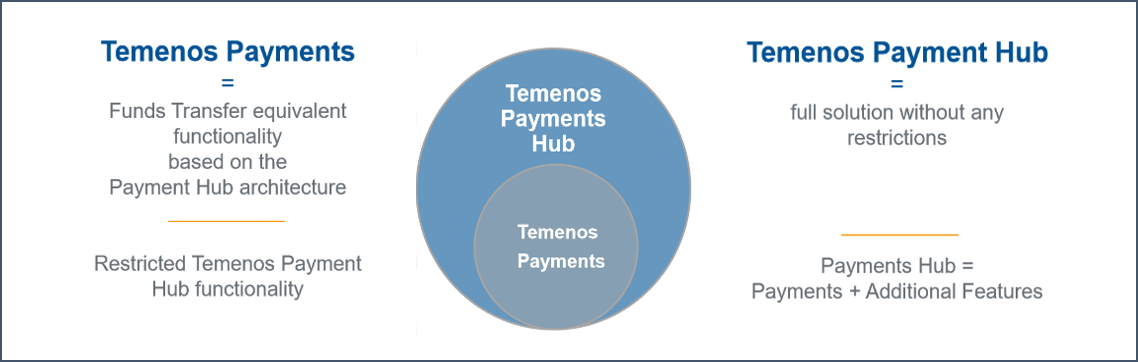

Temenos Payments vs Temenos Payments Hub

Temenos Payments is a light weight payment solution that aims at processing client’s core payments (domestic and international) with low volumes and up to three clearings (for example, ACH or SEPA, RTGS and Cheque Clearing). It offers the major features, payment enrichment functionalities, and rule driven processing. It can be deployed only in embedded mode with Temenos Core Banking.

Temenos Payments Hub (TPH) is an enterprise grade payment hub solution, which can configure different payment types (high value, batch and instant) by parameterisation without any software changes. The payment management feature can do the following:

- Skip, prioritise, and specify later date execution or override changes (manually)

- Manage service level agreements by using parameterisation

It maximises Straight-Through Processing (STP) with the ability to configure automated actions for exceptions. Additionally, it reduces risk and improves efficiency by minimising manual intervention. TPH eliminates redundancies and helps in consolidation of disparate payment systems in a single solution. The solution can be deployed in embedded mode with Temenos Core banking (USP of the Temenos offering) or standalone mode with an external Demand Deposit Account (DDA) or accounts system.

Ready Reckoner to Features in Temenos Payments vs Temenos Payments Hub

| Feature | Temenos Payments | Temenos Payments Hub |

|---|---|---|

| Universal payment process (maximise STP rates) | No automated exception handling | ü |

| Stand-alone processing | Only embedded | ü |

| Intelligent routing |

|

ü |

| Advanced payment monitoring | Pending and processed payments monitor | Enhanced monitoring including cut-off time monitor, virtual queue monitor, etc. |

| Automated rate request to Treasury | On FX threshold breach, rate needs to be entered manually. | ü |

| Automated return handling | û | ü |

| Funds Check |

|

Automatic cancellation when rejected by department account officer |

| Trigger auto investigation messages | û | ü |

| Agency banking | û | ü |

| Corporate customer agreements | û | ü |

| Automated cancel of payment initiations | û | ü |

| Group claims | Only supports individual claims | ü |

| Refund of direct debits | û | ü |

| Value dates for return payments | û | Use value dates (original payment) |

| Automated negative response to payment recall | û | ü |

| Expiry of unanswered recalls | û | ü |

| Acceptance of customer initiated recall | û | ü |

| Advanced option for filtering response handling | û | Automatic return, cancel or seize funds |

| Define cut-off time based on payment currency | û | ü |

| Non STP rules for customer and bank transfer for correspondent banks | û | ü |

| Warehouse payments from correspondent banks | û | ü |

| Customer or customer group specific statement formats | û | ü |

| Customer or customer group specific non STP rules | û | ü |

| Customer or customer group special instructions for statements | û | ü |

| Customer or customer group specific lead times for cut-off | û | ü |

| Risk filtering | û | ü |

Features

The following are the features available:

| Features | Description | |||

|---|---|---|---|---|

| Universal Payment Process (maximise STP Rates) | Handles the following payment types in a single workflow:

Enables centralisation of payments in a single payment engine and determines the payment product based on the following:

Triggers the appropriate processing of SLAs, routing (clearing or correspondent to send the payment), pricing, booking and confirmations |

|||

|

Restricted Support in TPH

|

Processes different payment types in a single system along with the following restrictions:

|

|||

| Supported in TPH |

Processes all payment types in a single system with the following supporting features:

|

|||

| Stand-Alone Processing | Executes payments with accounts residing in an external Core Banking System (CBS) or DDA. The system communicates with an external CBS or DDA by using asynchronous messages.

|

|||

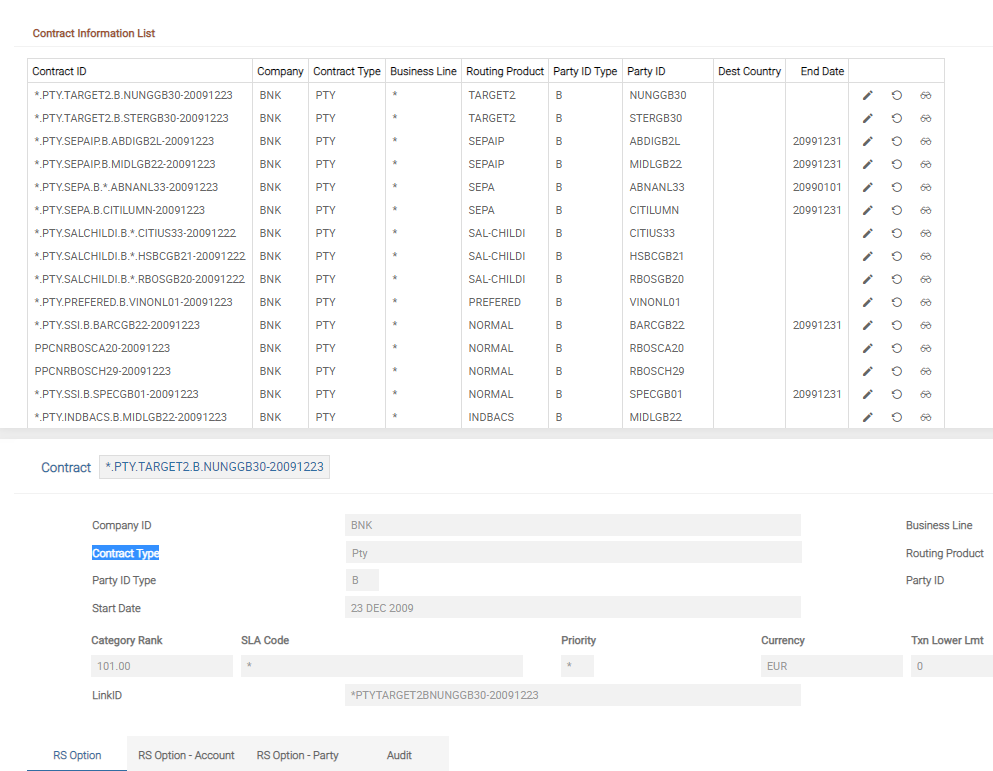

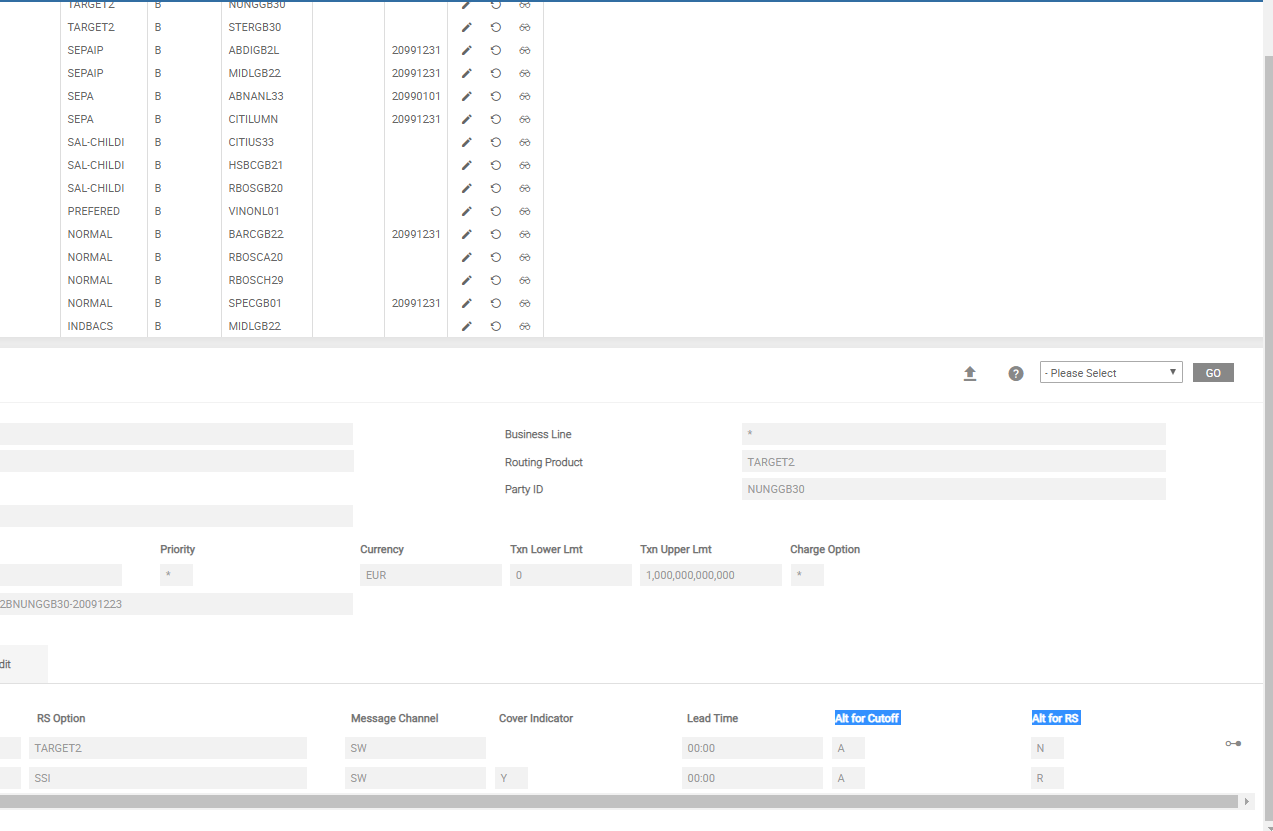

| Intelligent Routing | Enables definition of routing rules to determine the correspondent or clearing using which the payment needs to be sent. Routing can be based on message priority.

Channel validations, reachability check and directory support are performed as part of routing. The following are the available routing options:

Allows to define multiple routing options and select appropriate route. If a payment misses the cut-off or the channel cannot be reached, the following options are available:

|

|||

| Restricted Support (Temenos Payments) | Does not support dynamic routing of automatically selecting the appropriate channel (based on reachability, cut-off time, routing to instant payments clearing). If the payment misses cut-off or the chosen channel is not reached, it routes the payment to repair. Allows only ‘BNK’ (bank) level contract definition. Channel validations, reachability check, and directory support are available. |

|||

| Advanced Payment Monitoring | Allows payments in different statuses to be monitored easily and to take appropriate action. Different types of payment monitors are available in the system:

|

|||

| Restricted Support (Temenos Payments) | Supports only pending or processed transactions. | |||

| Automated Rate Request to Treasury | FX processes foreign currency payments with conversions using real time rates. Real time rates can be entered from Temenos CBS or any external DDA or rates system. Payments breaching currency threshold can be sent to FX dealer:

Additionally, it is sent to the manual repair queue for an operator to enter the treasury rate. FX rates can be imposed by an operator in Manual Order Entry and Repair pages. Payments can be processed by taking input of a pre-approved deal rate (by imposing the deal rate). |

|||

| Restricted Support (Temenos Payments) |

|

|||

| Automated Return Handling | Can return a payment (credit transfer, direct debit, cheque) received from clearing exceptions (such as invalid or missing account, missing or invalid mandate, restrictions on the account, insufficient funds, and screening failure). | |||

| Restricted Support (Temenos Payments) |

|

|||

| Funds Check | If funds are unavailable, the system routes the payment to one of the following: Manual action – The Department Account Office performs the below actions.

|

|||

| Restricted Support (Temenos Payments) | If payment is rejected, it parks the payment in manual repair queue. | |||

| Triggering Auto Investigation Messages | Auto-triggering of investigation messages (Pacs.028) to ascertain status of the payments, when conformation is not received from clearing. It is only supported in TPH. |

|||

| Agency Banking | Receives and forwards the payment or file from or to Indirect Participants (IP). It is available only with TPH. |

|||

| Corporate Customer Agreements | When a payment batch (credit or debit) is initiated by a corporate customer and the payments within the batch fails, it is routed to repair.

When a payment (single or batch) is initiated by a corporate customer, the user needs to defines the following:

|

|||

| Automated Cancel of Payment Initiations | Auto-cancel payment initiations from customers (credit transfers, direct debits) for exceptions (such as invalid or missing account, restrictions on the account, insufficient funds, and screening failure). | |||

| Restricted Support (Temenos Payments) | Routes the payment to repair for all other exceptions. | |||

| Group Claims | Supports both the bank claims (individual and group). | |||

| Restricted Support (Temenos Payments) | Supports only individual claims. | |||

| Refund of Direct Debits | Allows a refund for a direct debit which is paid based on an authorised or unauthorised mandate. It is only supported in TPH. |

|||

| Value Dates for Return Payments | Imposes the value date for a return payment to be the same as the original payment. It is only supported in TPH. |

|||

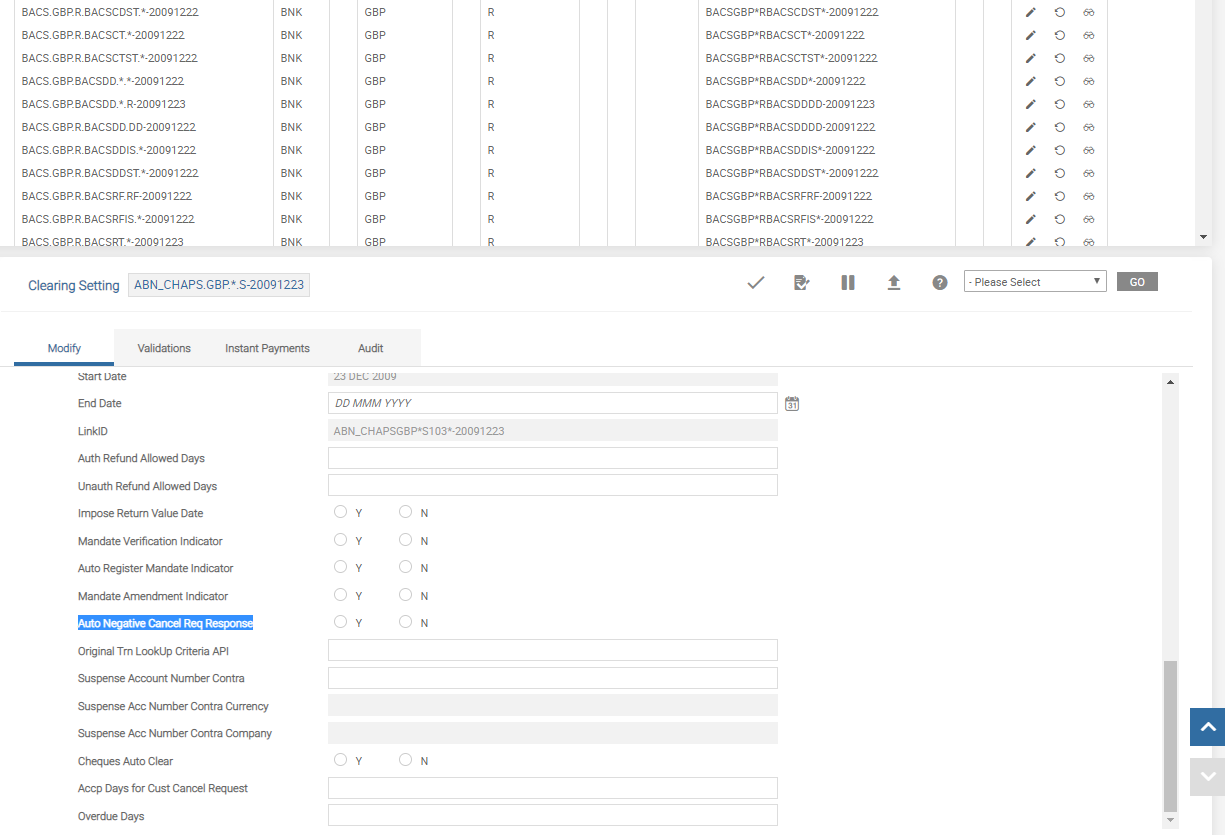

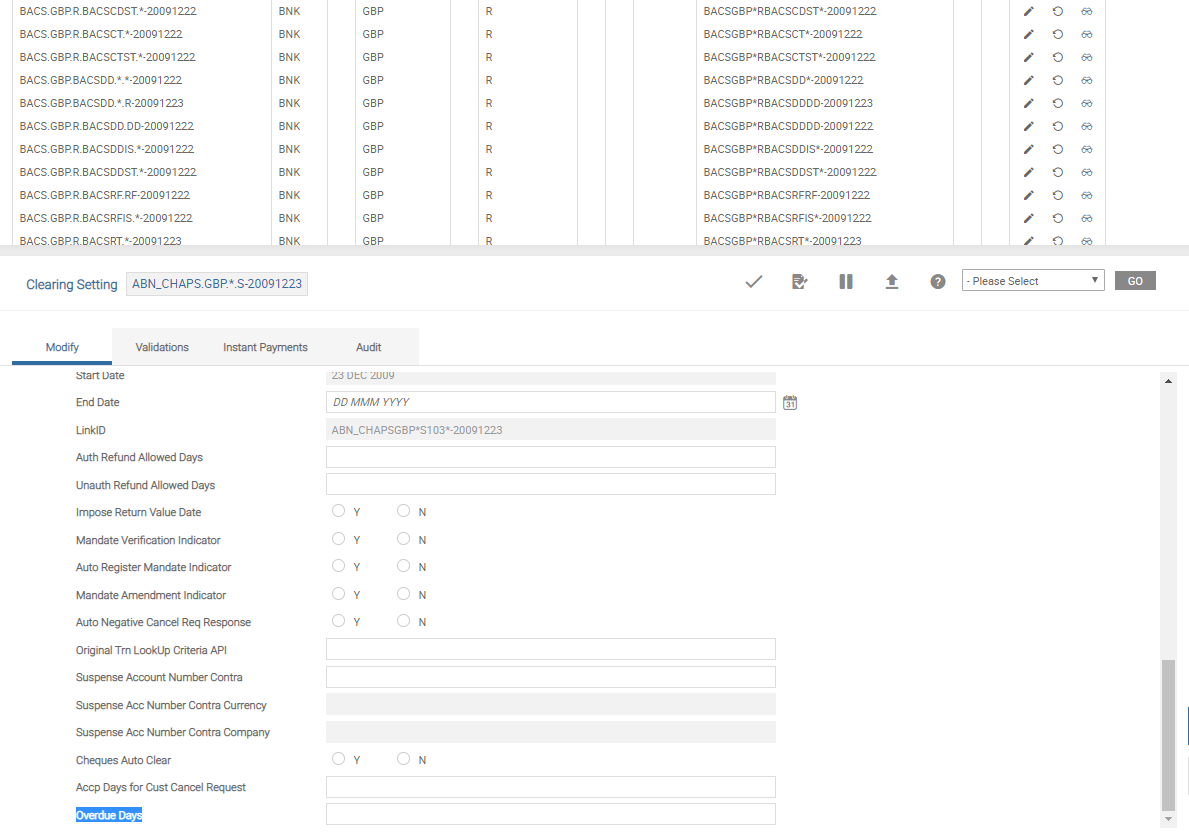

| Automated Negative Response to Payment Recall | Negative response for a cancellation request can be automatically sent when the original transaction is not found or cancellation request is received after cut-off days. | |||

| Restricted Support (Temenos Payments) | Response to a recall request is manual. | |||

| Expiry of Unanswered Recalls | Defines the number of days within which the incoming cancellation request needs to be accepted from the date of original settlement or the system marks it as overdue. It is only supported in TPH. |

|||

| Acceptance of Customer Initiated Recall | Defines the number of days within which the incoming customer initiated cancellation request needs to be accepted from the date of original settlement. It is only supported in TPH. |

|||

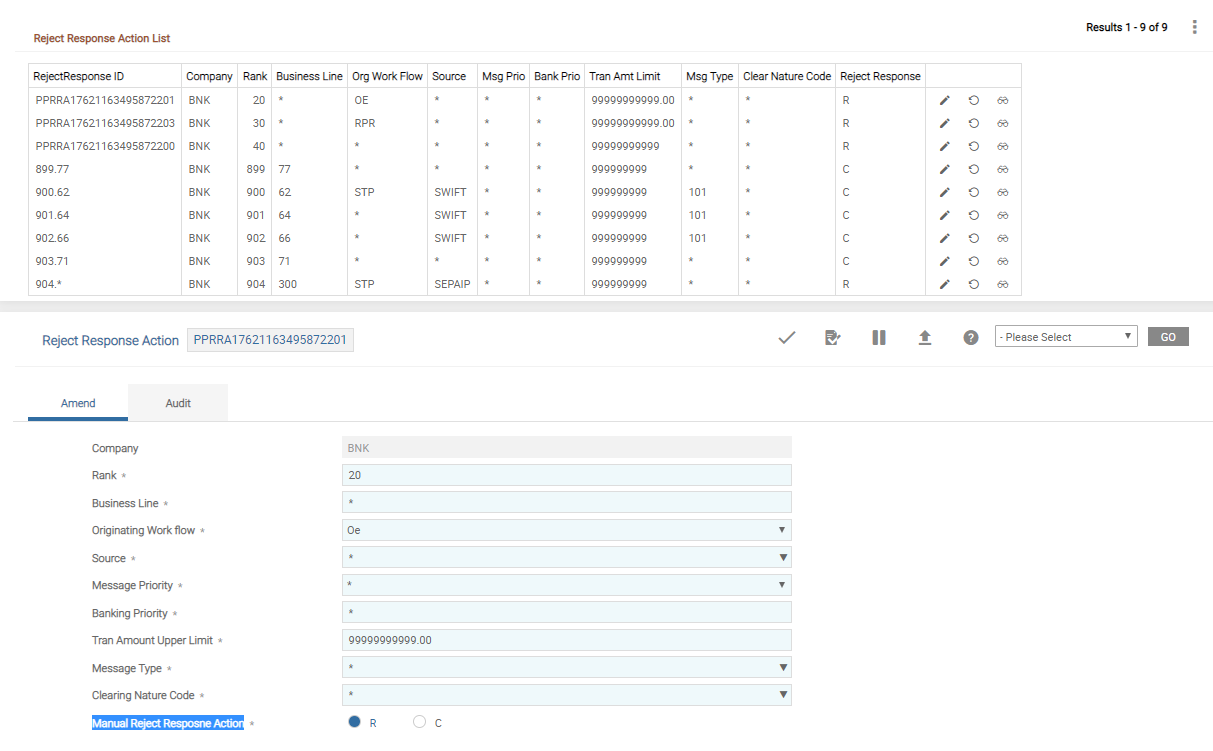

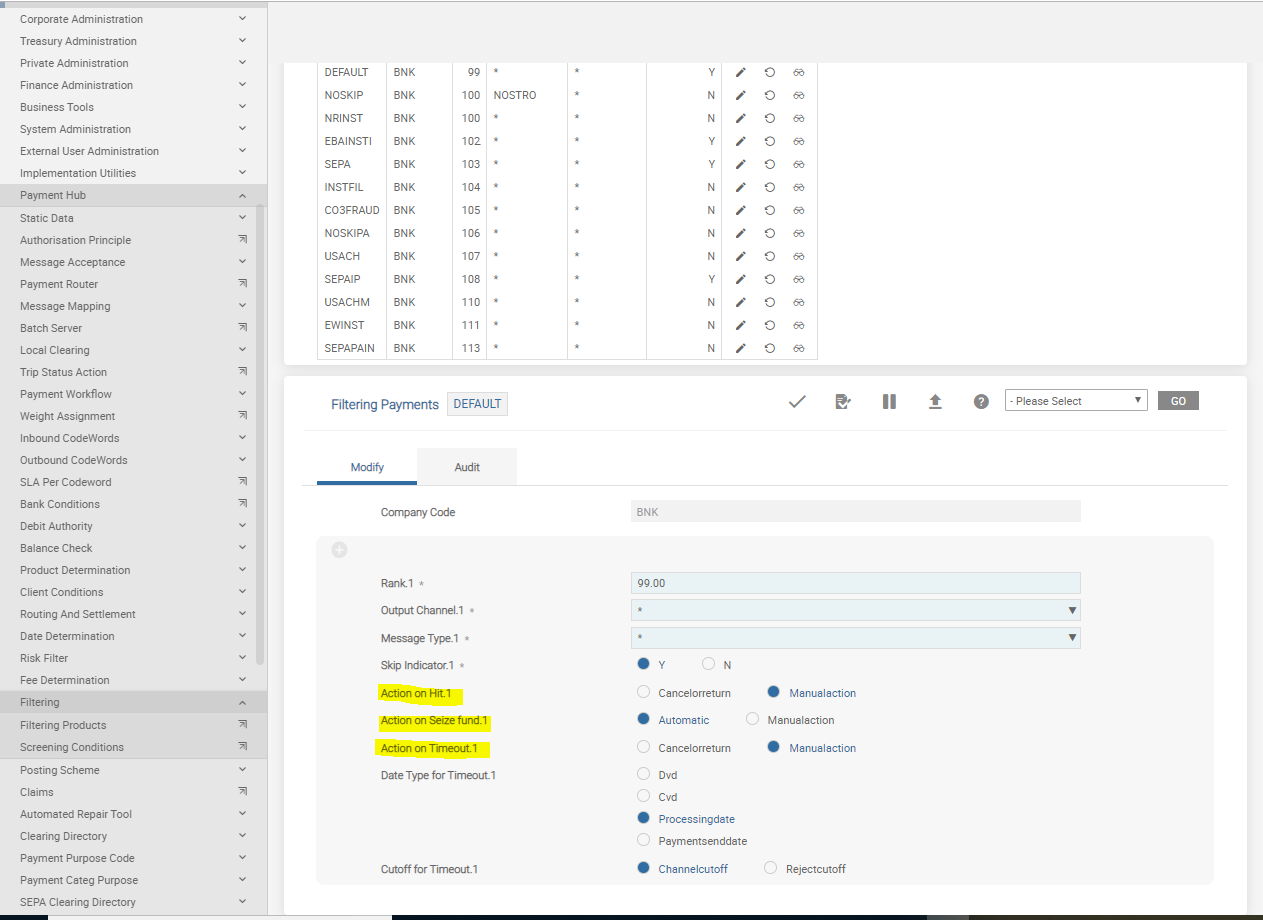

| Advanced Option for Filtering Response Handling | Payments that are screened for (AML check) and if the response is a hit, the following options are available:

|

|||

| Restricted Support (Temenos Payments) | Allows only to park for manual actions. | |||

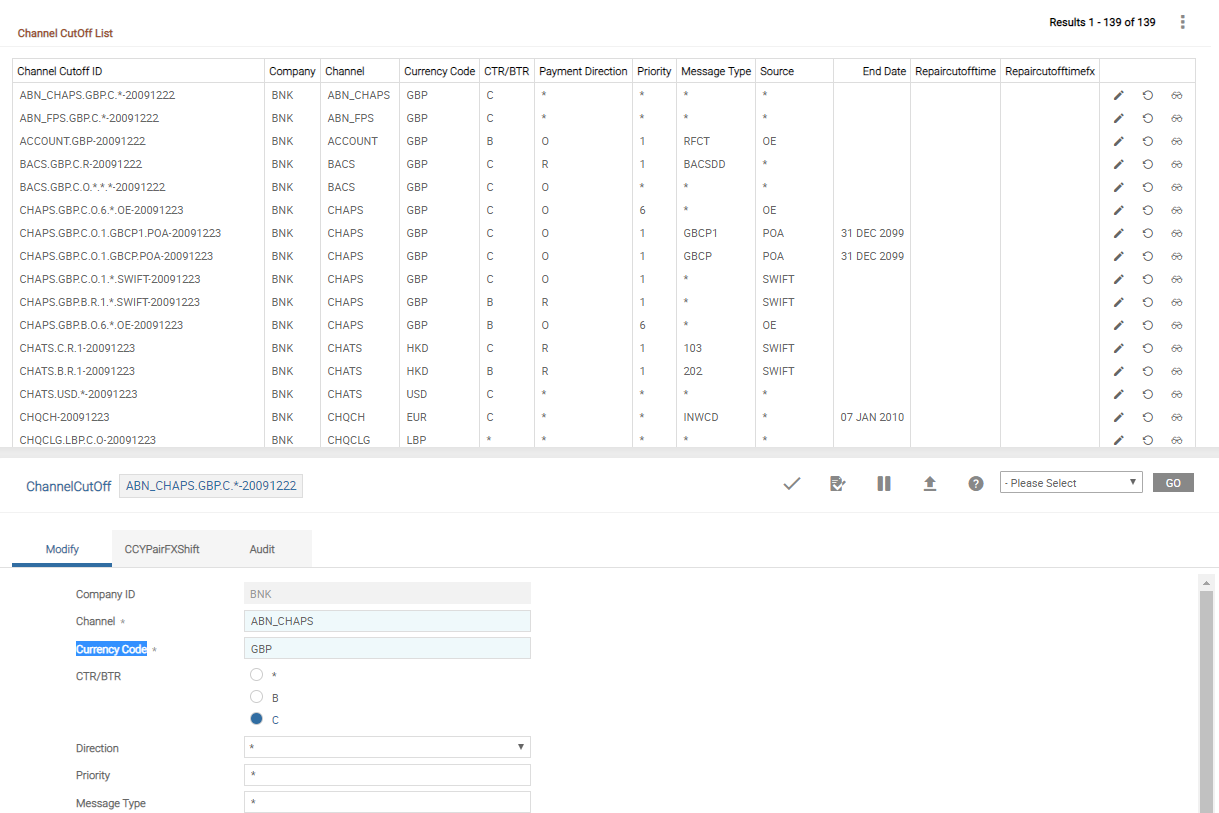

| Define Cut-off Time Based on Payment Currency | Defines cut-off times for a channel based on currency of the payment. It is only supported in TPH. |

|||

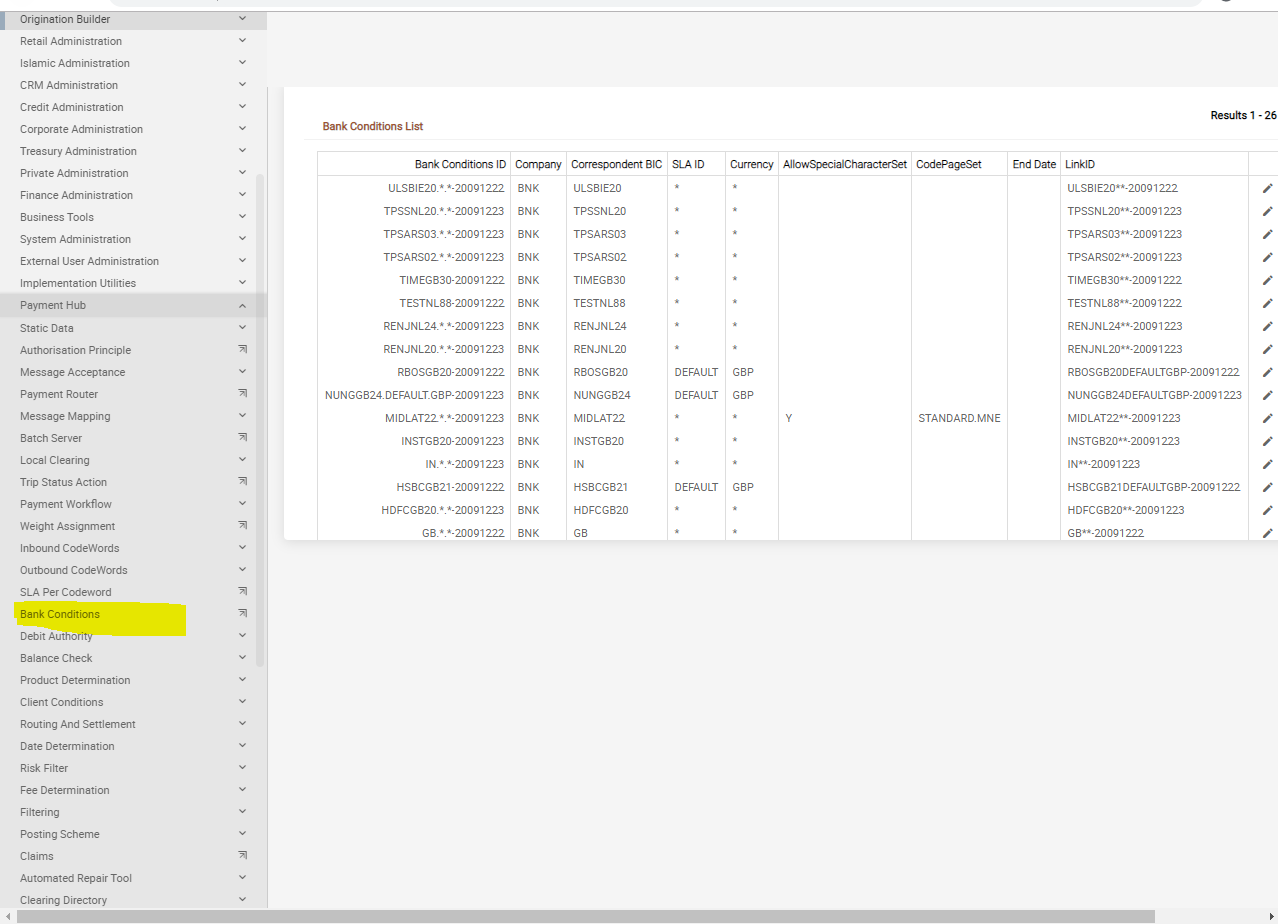

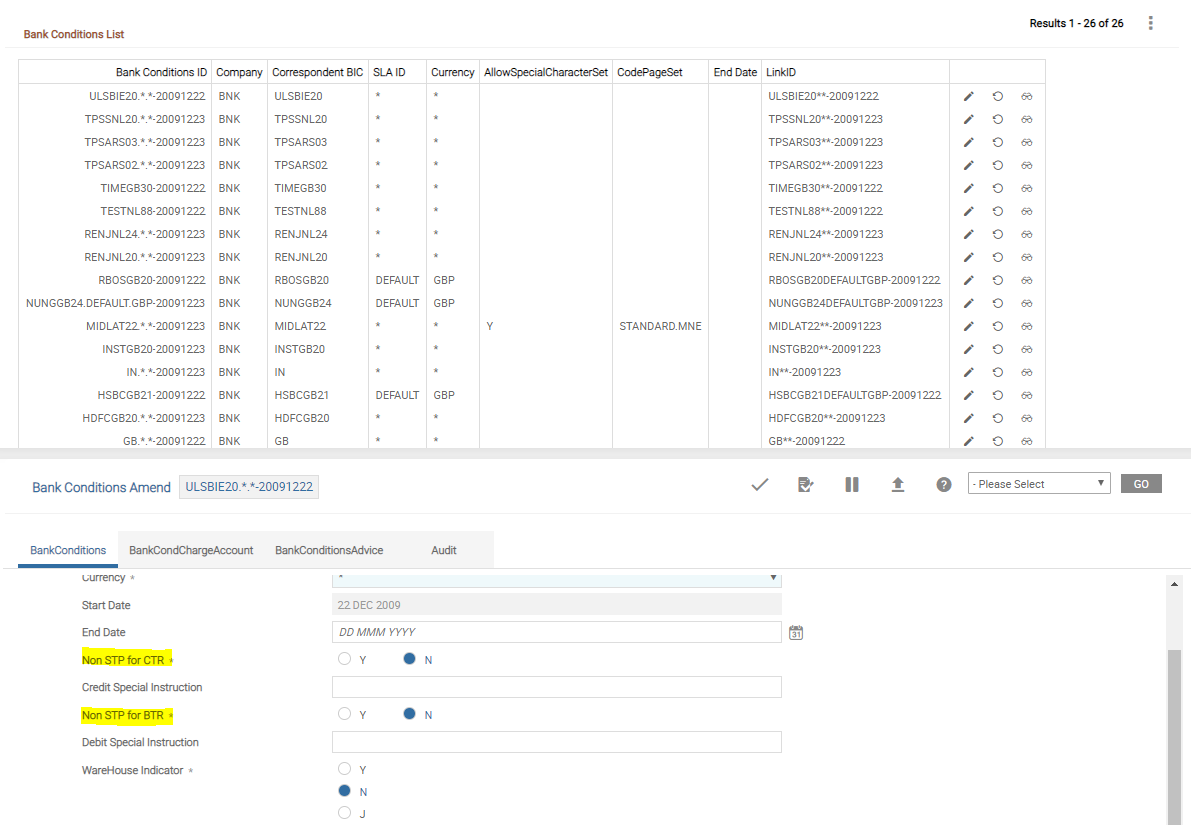

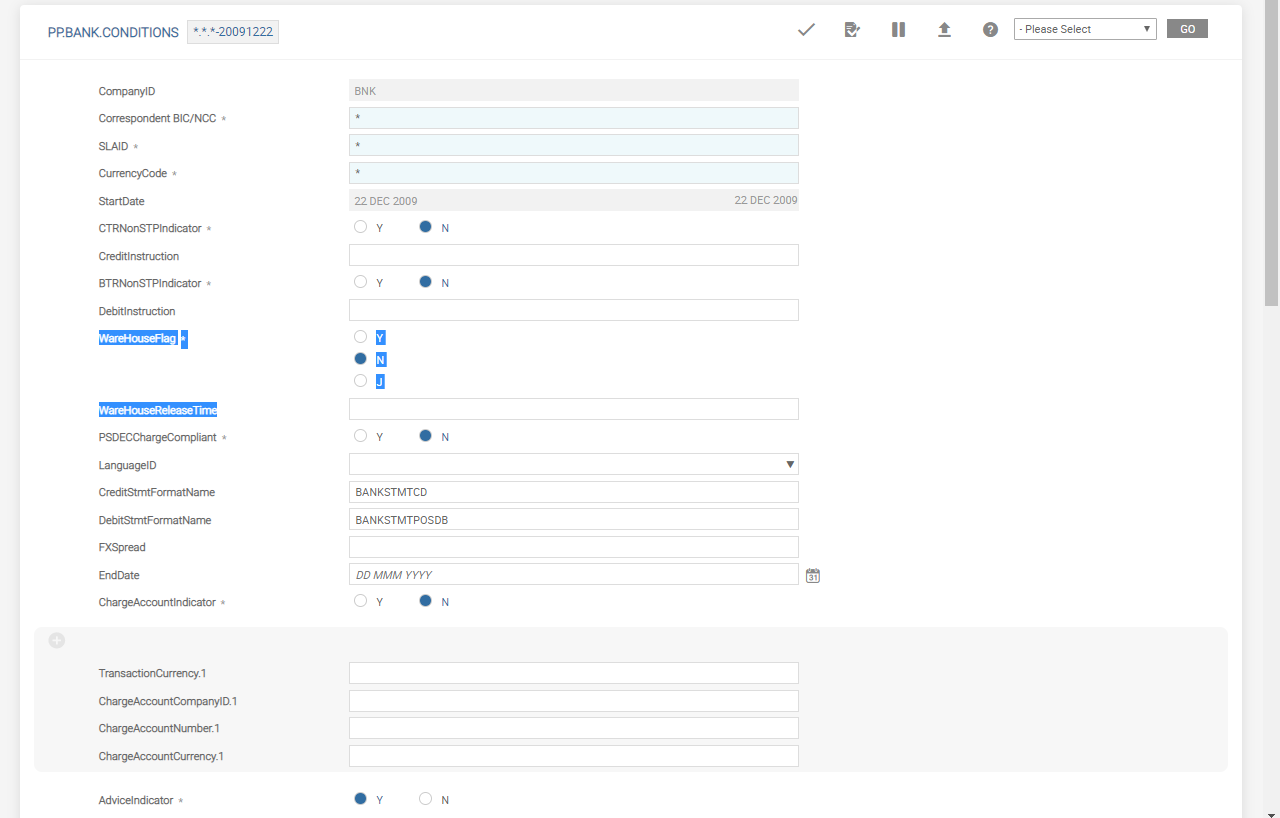

| Non-STP Rules for Customer and Bank Transfer for Correspondent Banks | Allows to set non-STP rules to park payment for manual intervention, for customer and bank transfers received from specific correspondent banks. It is only supported in TPH. |

|||

| Warehouse Payments from Correspondent Banks | Enables warehousing for customer and bank transfers received from specific correspondent banks. It parks the payments in warehouse until the requested execution date or credit value date. It is only supported in TPH. |

|||

| Customer or Customer Group Specific Statement Formats | Defines specific statement formats for a customer or group of customers. It is only supported in TPH. |

|||

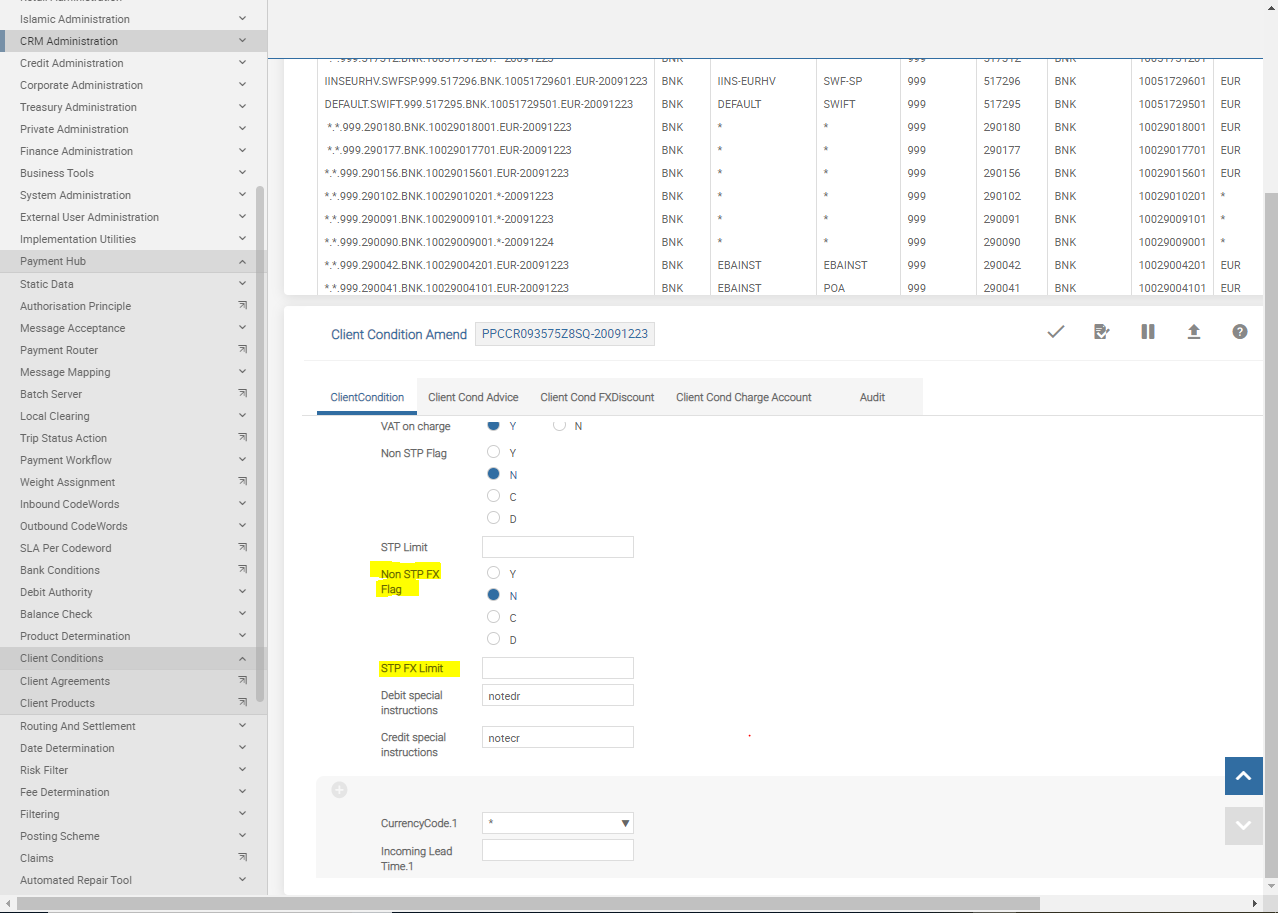

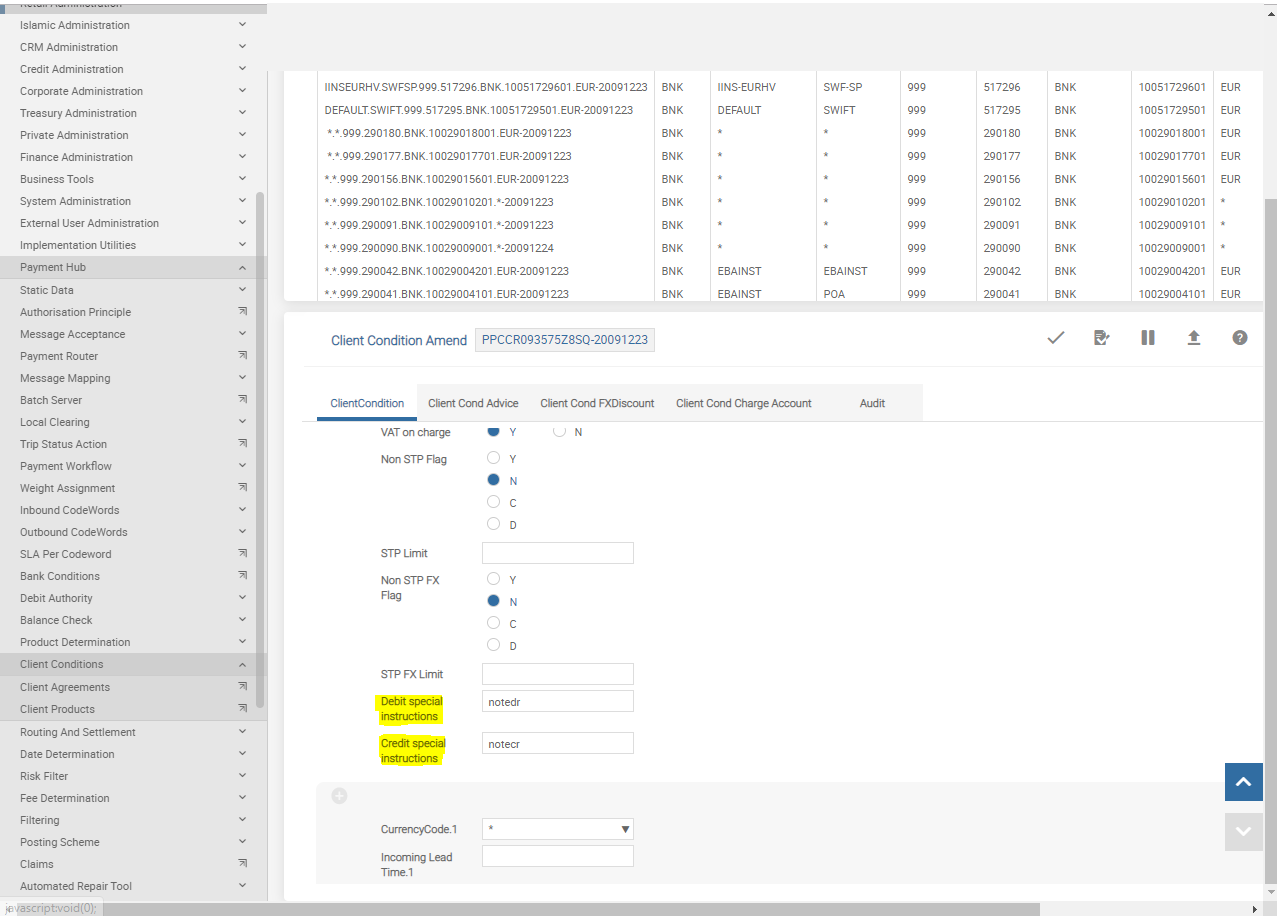

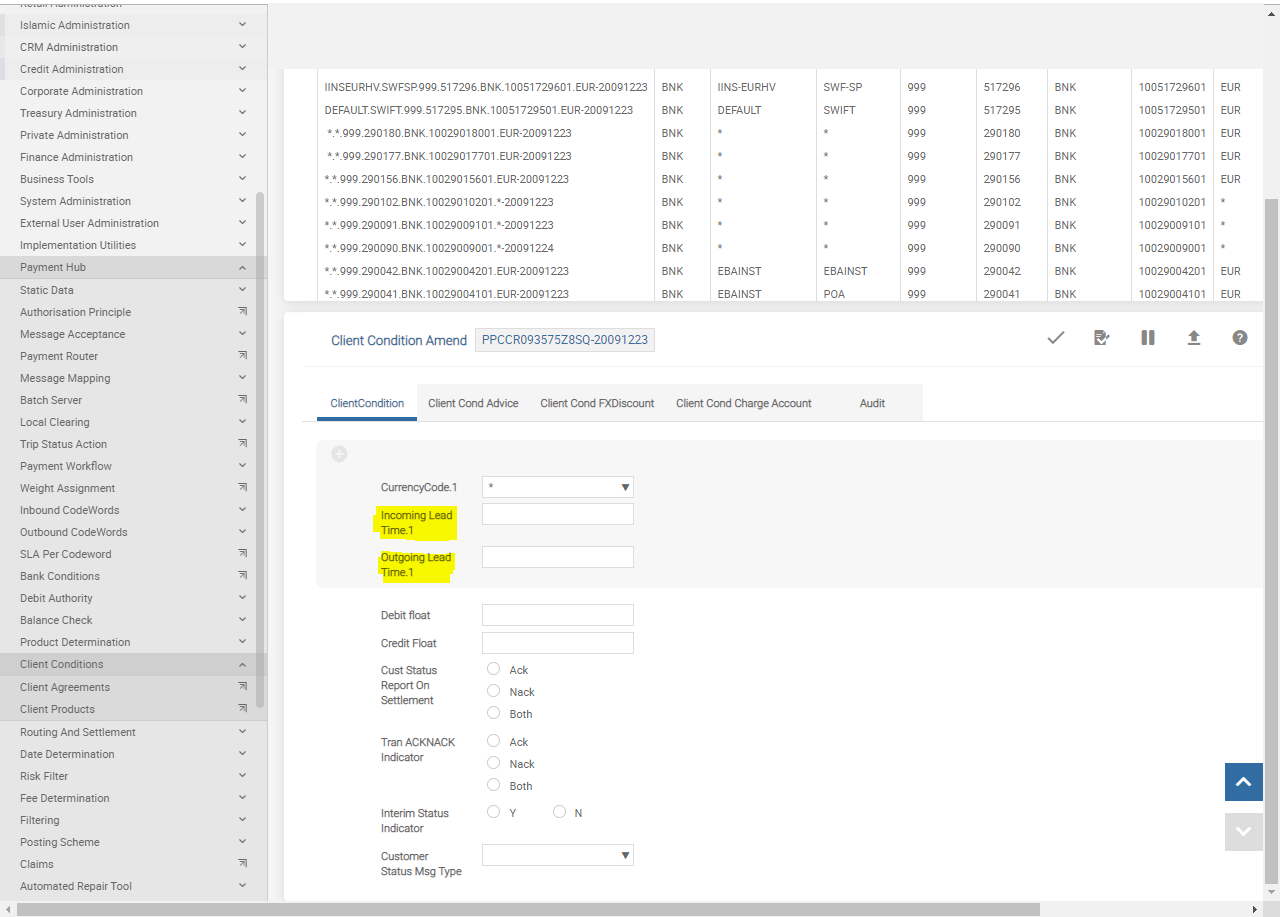

| Customer or Customer Group Specific Non STP Rules | Payments processed for a customer or group of customers can be made non-STP based on their configuration. It is only supported in TPH. |

|||

| Customer or Customer Group Special Instructions for Statements | Defines special instructions to be sent when producing account statements for customer or group of customers. It is only supported in TPH. |

|||

| Customer or Customer Group Specific Lead Times for Cut-off | Defines lead times to be used while arriving at the cut-off time for channel, customer or group of customer. It is only supported in TPH. |

|||

| Risk Filtering | Performs country, currency, counter party and transaction amount limit. It is only supported in TPH. |

|||

Configuring Temenos Payments vs Temenos Payments Hub

This section helps the user to understand the configuration of the below features.

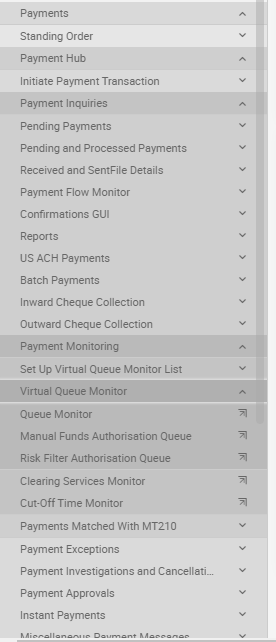

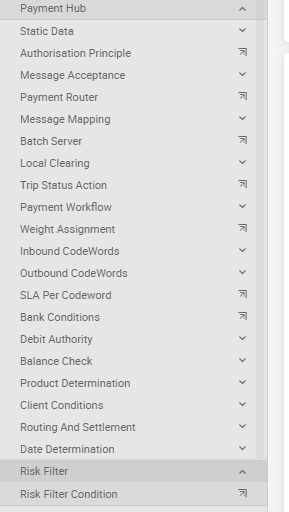

- To configure intelligent routing, go to Admin Menu>Payment Hub>Routing and Settlement>R & S Rule Definition.

- Perform any of the following actions:

- To view the record, click

.

. - To edit the record, click

.

.

- To view the record, click

To configure advanced payment monitoring, go to User Menu > Payments > Payment Hub > Payment Inquiries > Payment Monitoring.

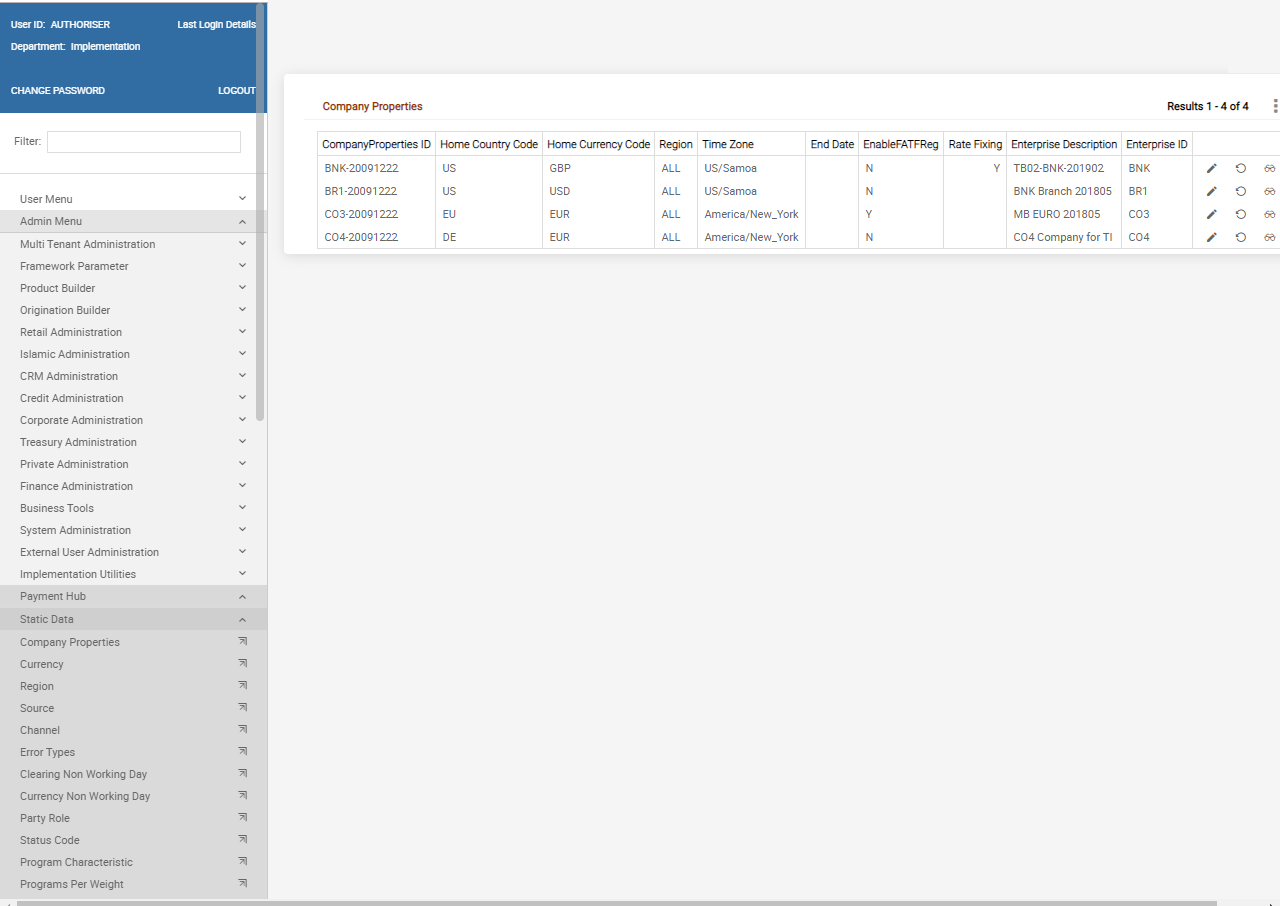

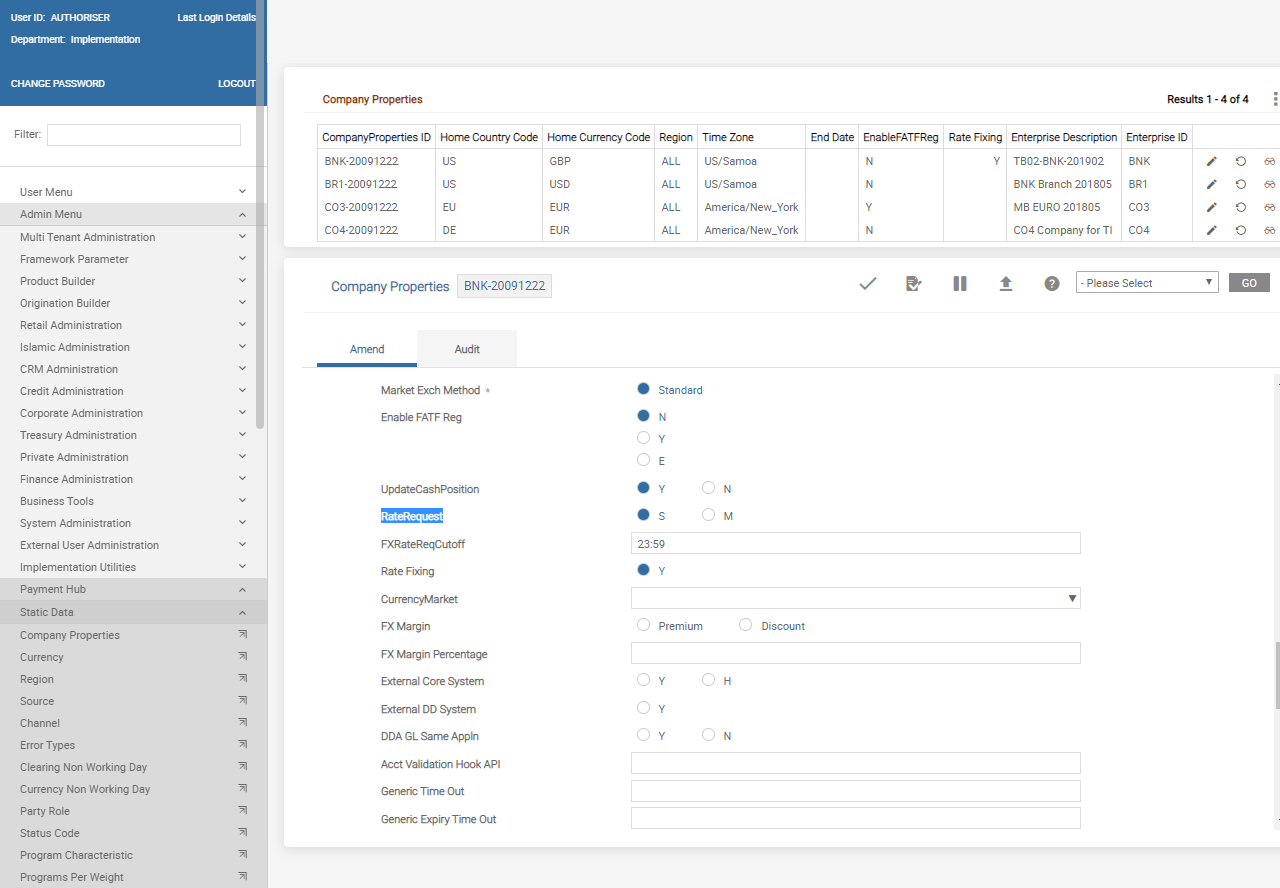

To configure automated rate request in treasury, go to Admin Menu > Payment Hub > Static Data > Company Properties.

To configure funds check, go to Admin Menu > Payment Hub > Balance Check > Action for Failure Funds Reservation/Postings.

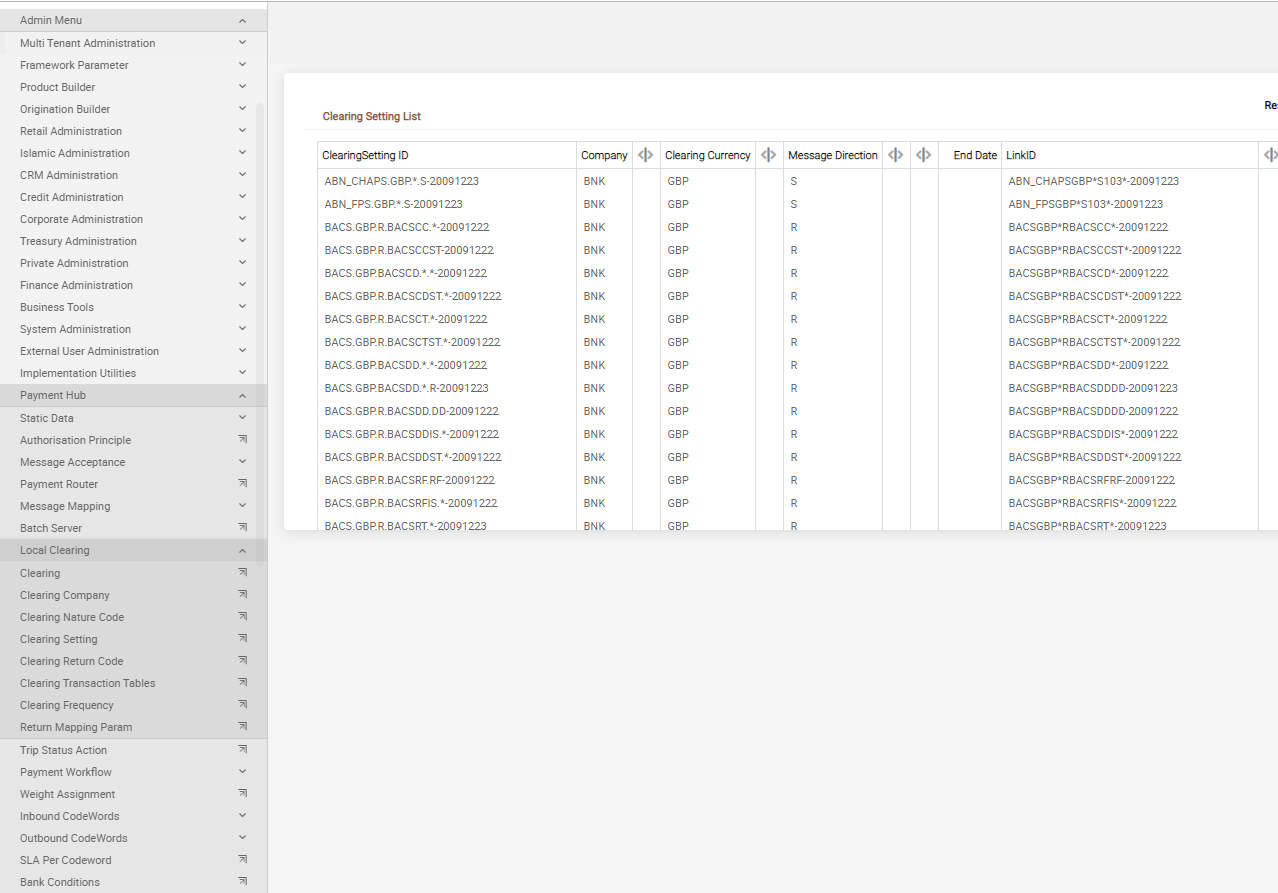

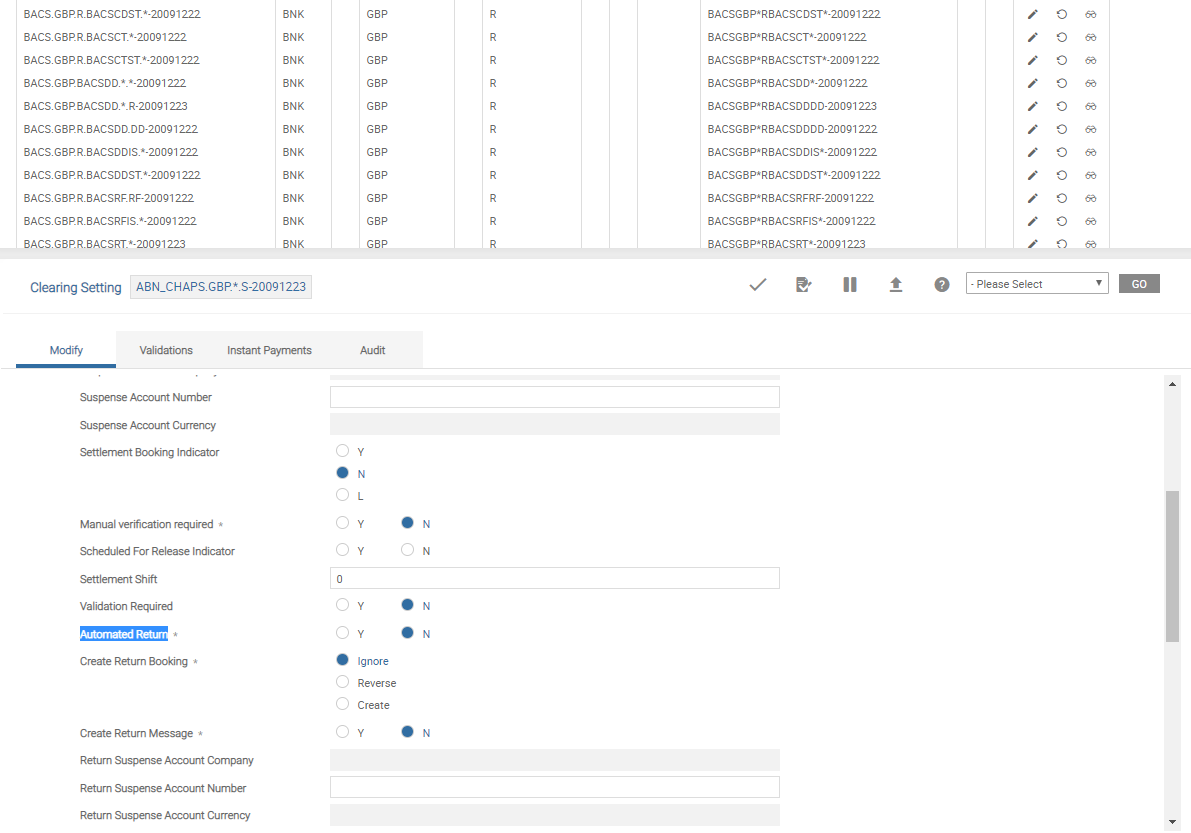

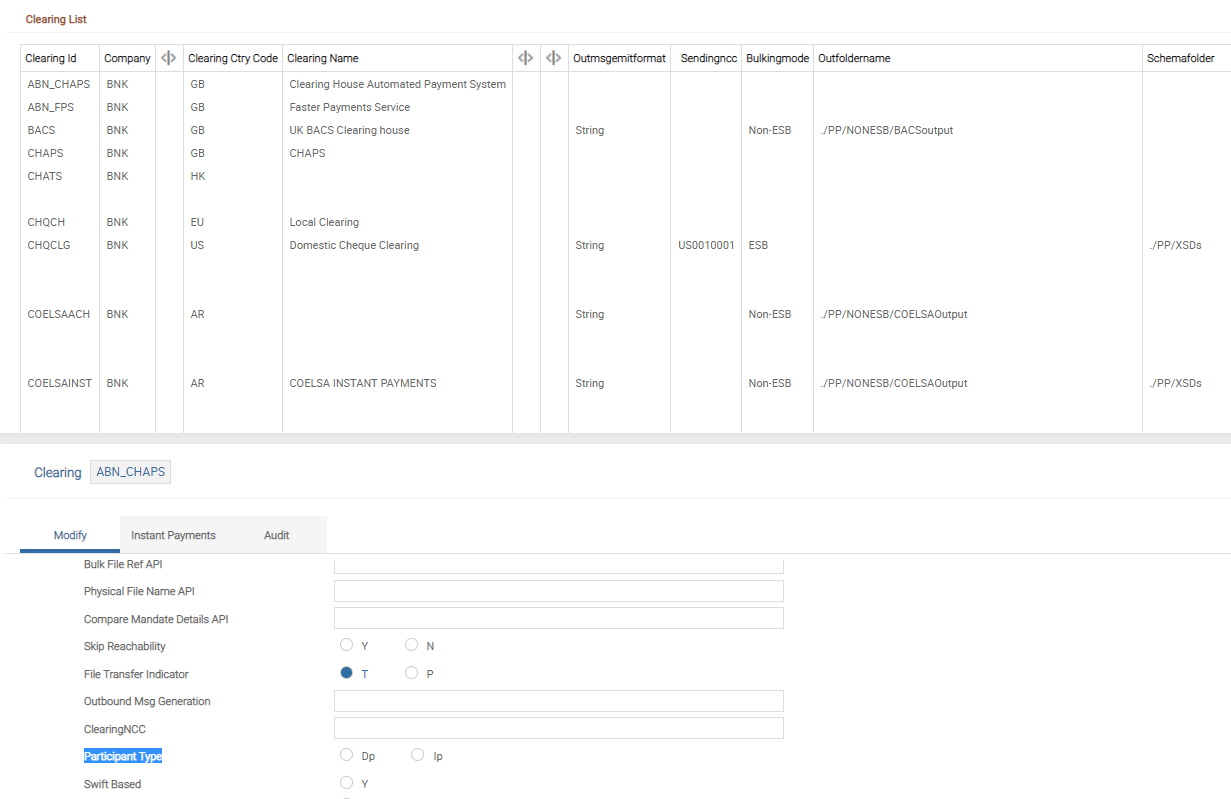

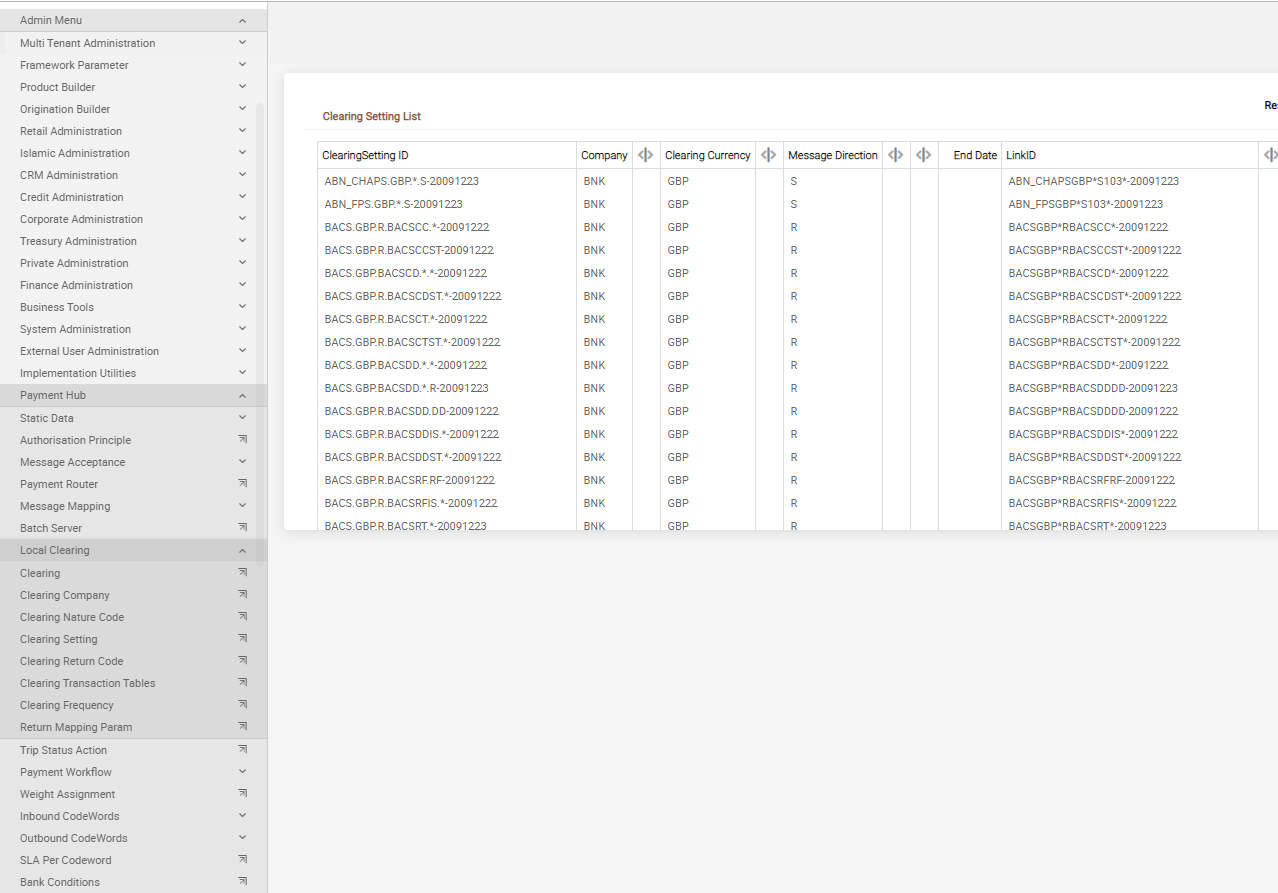

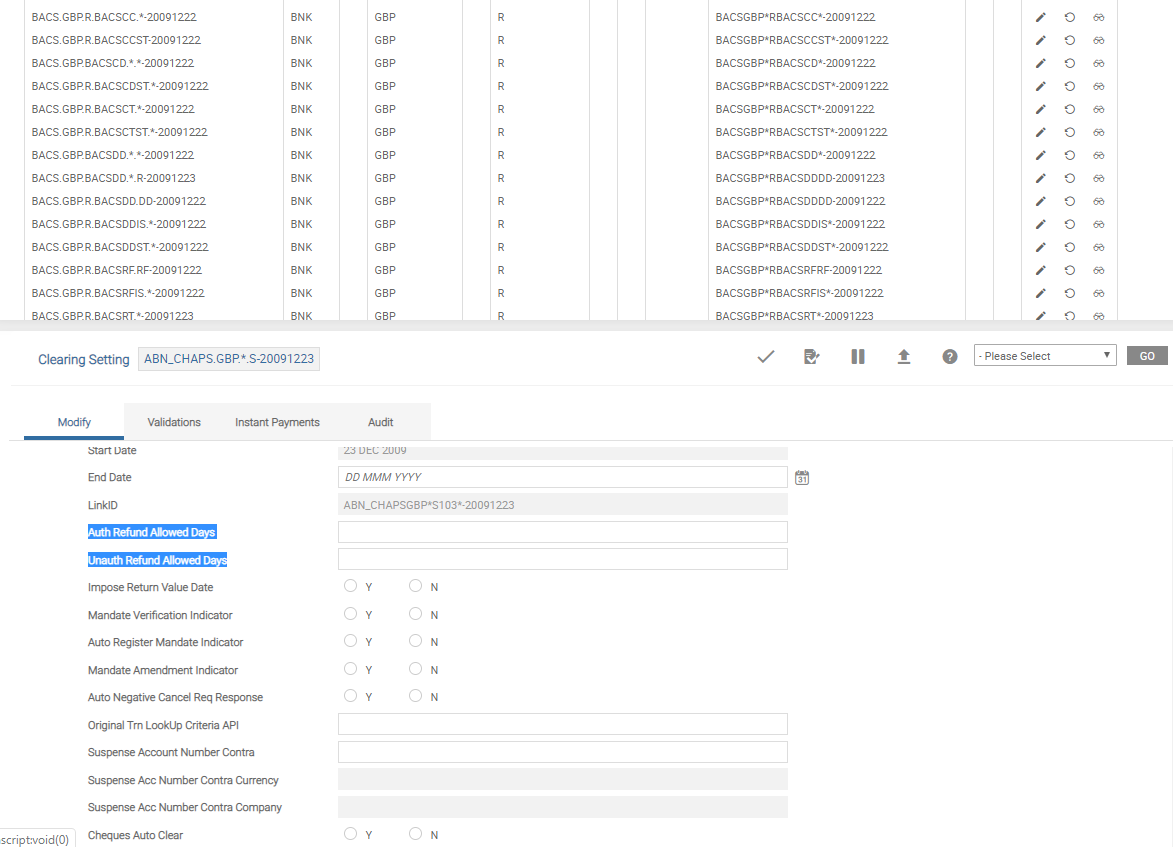

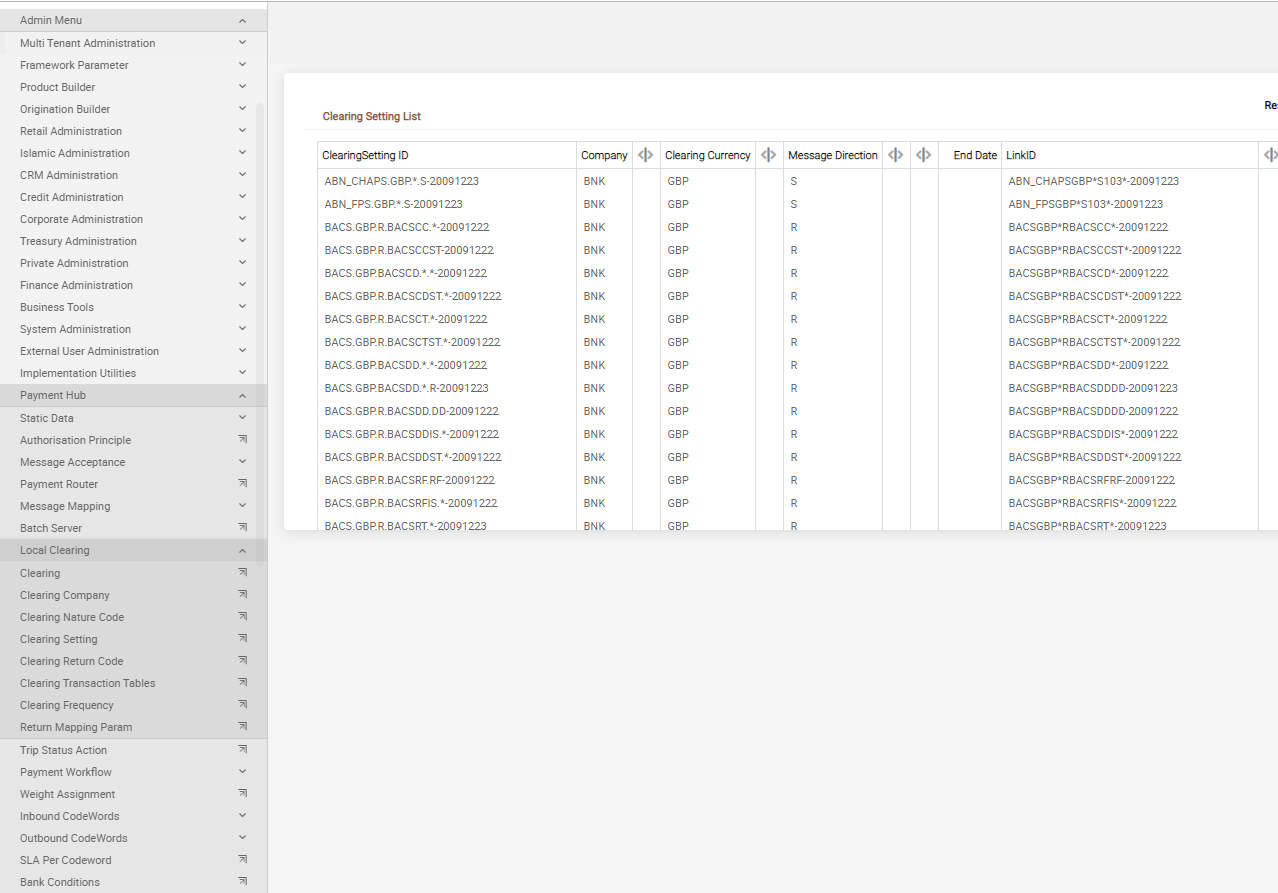

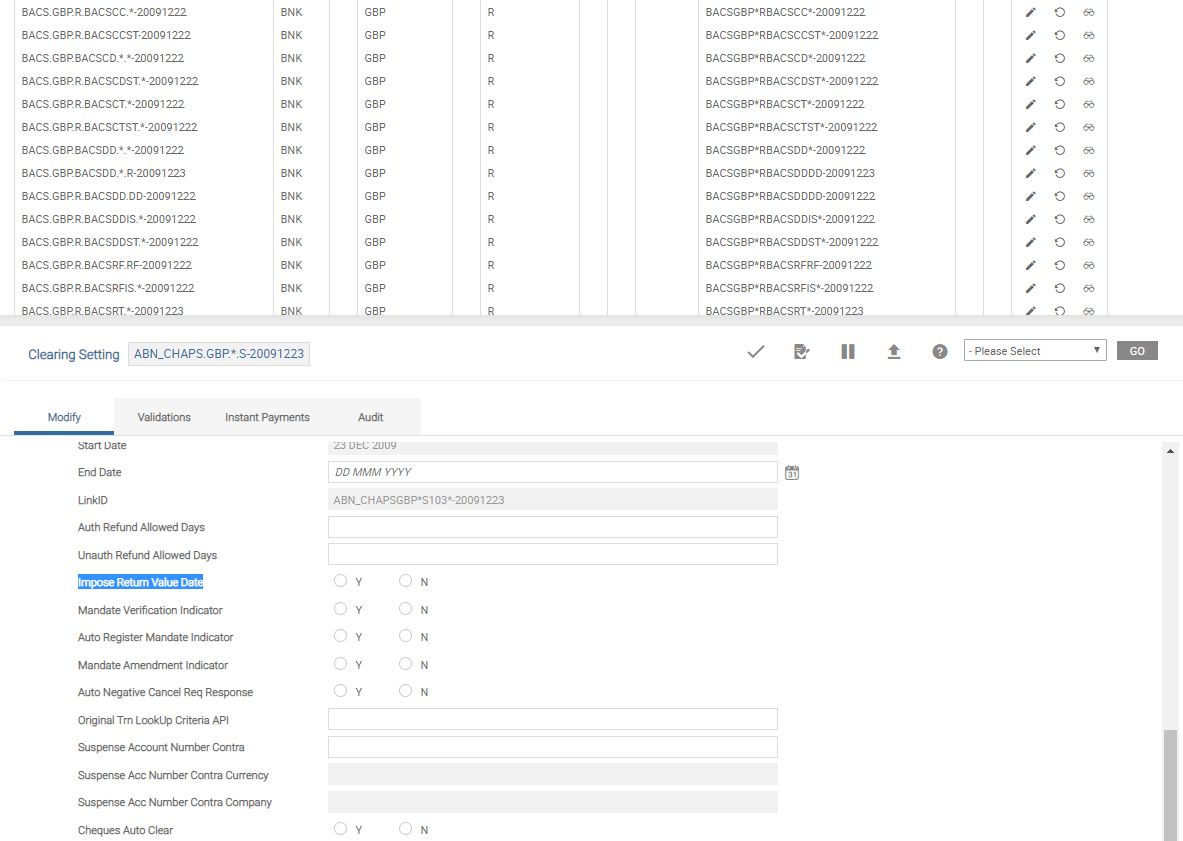

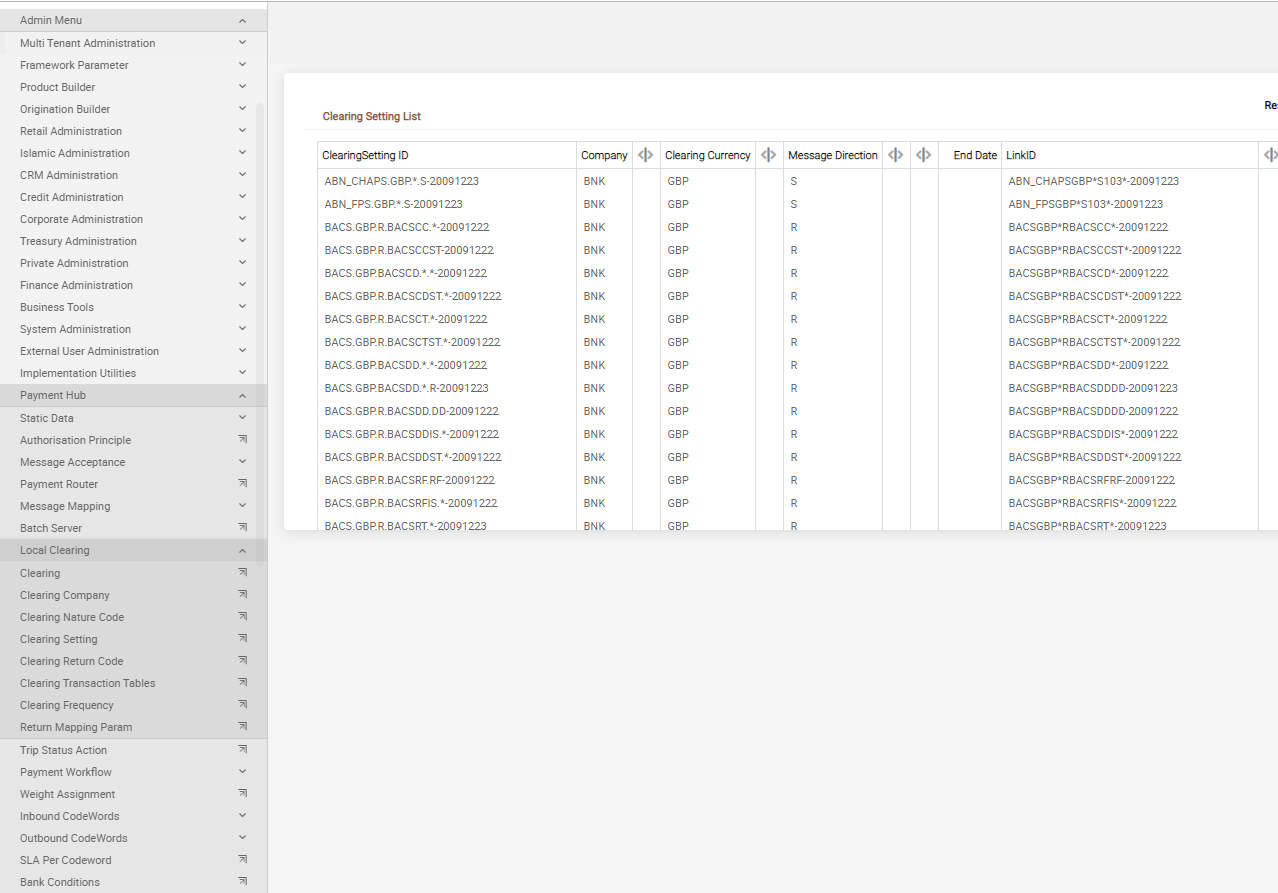

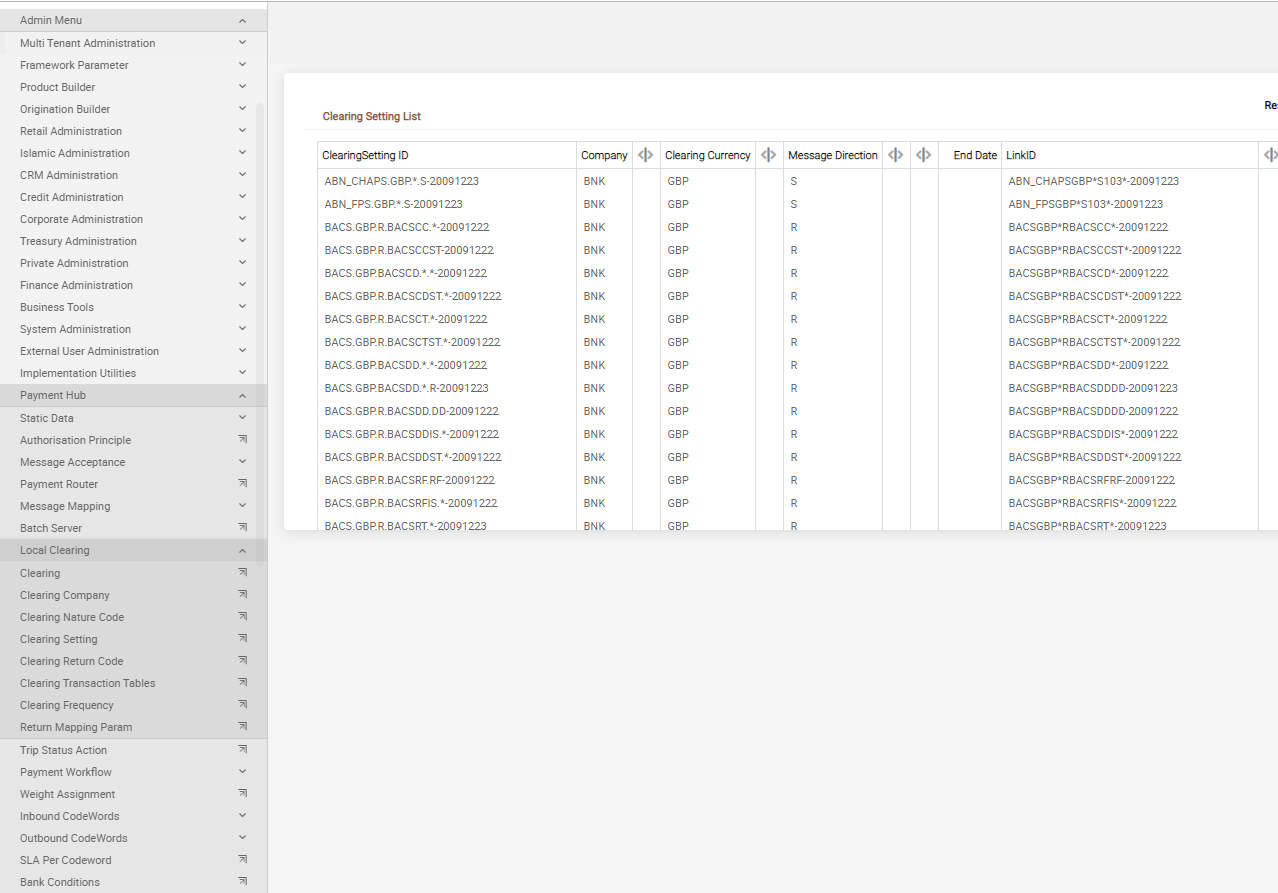

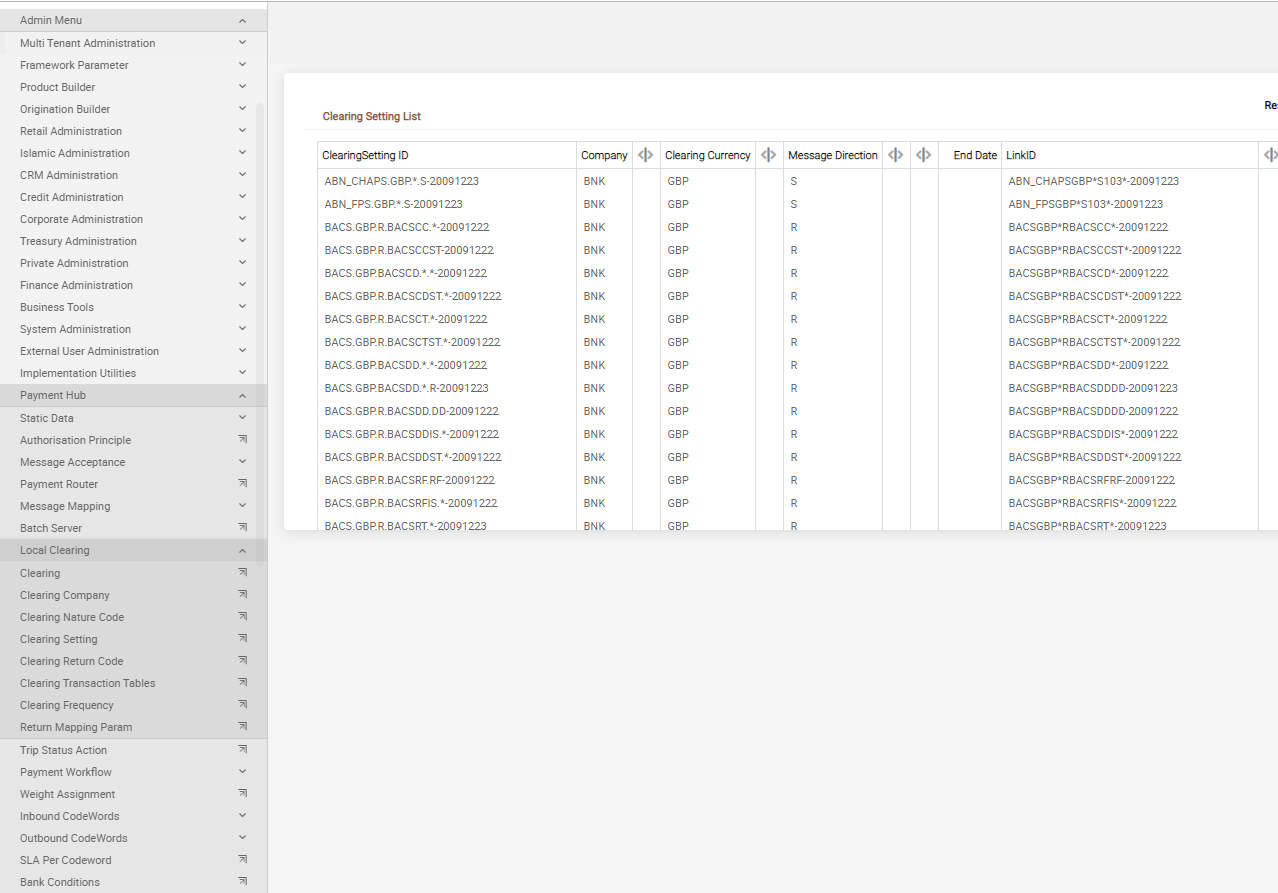

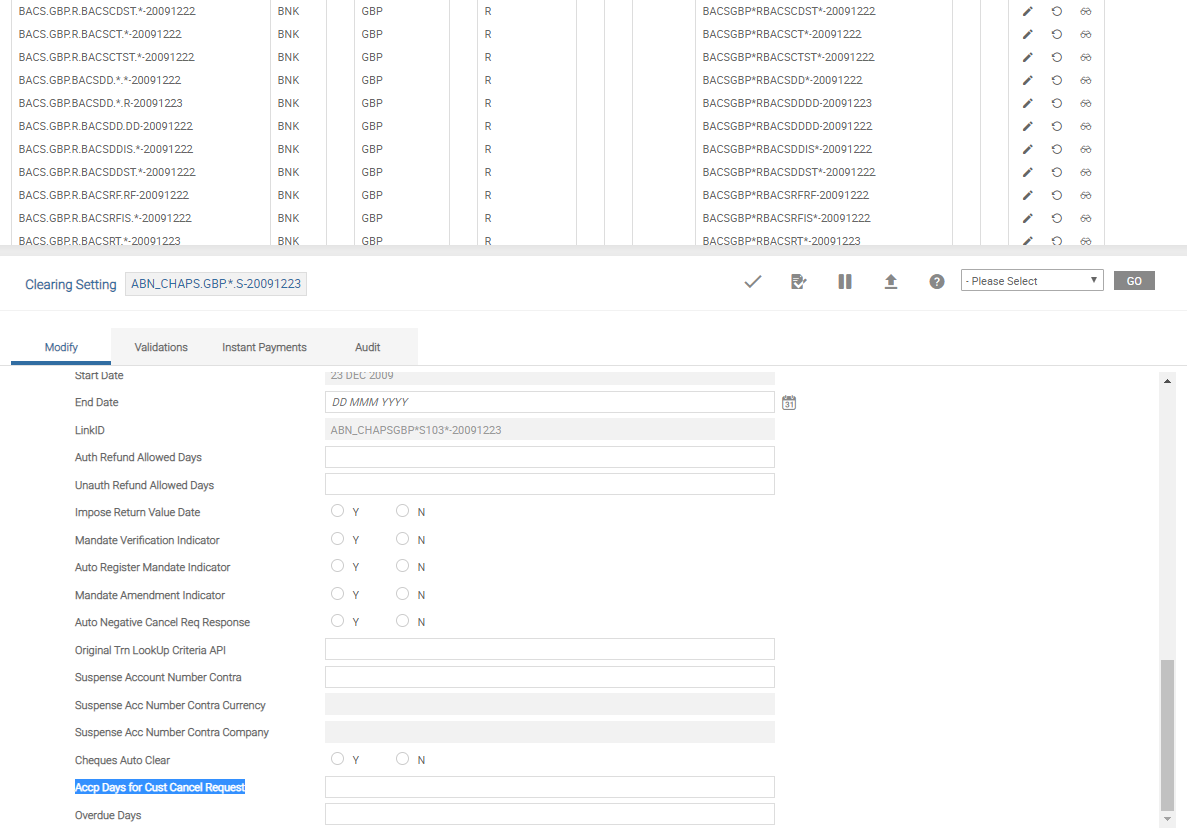

To configure automated return handling, go to Admin Menu > Payment Hub > Local Clearing > Clearing Setting.

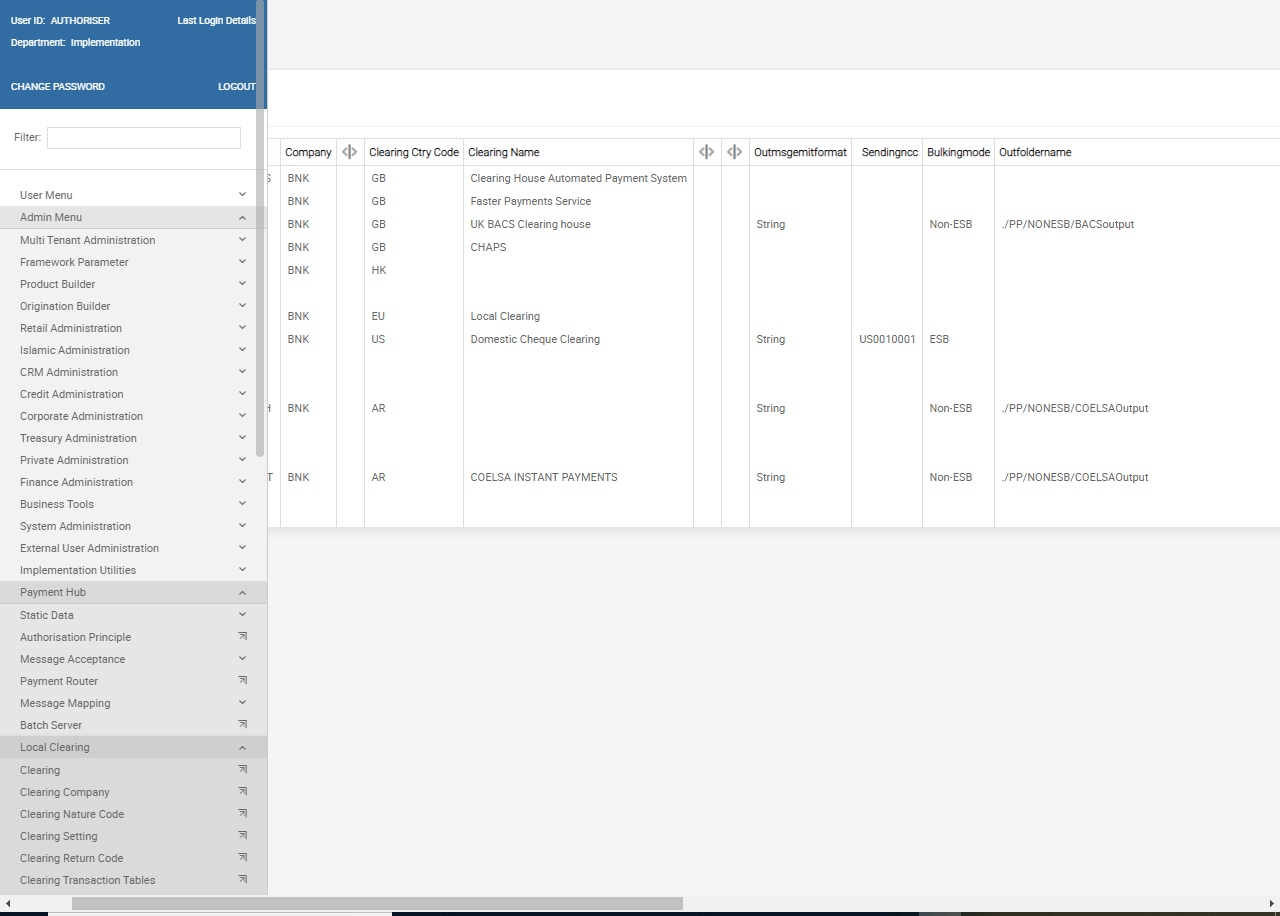

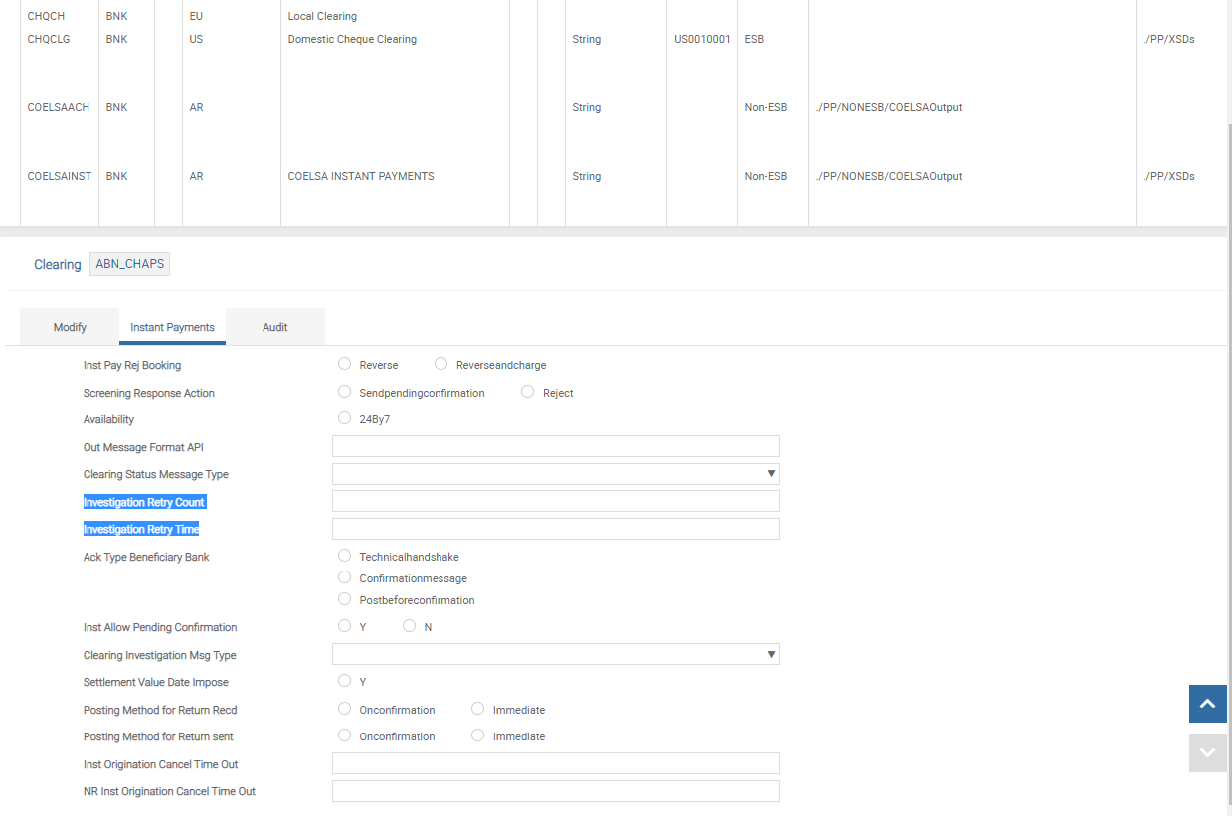

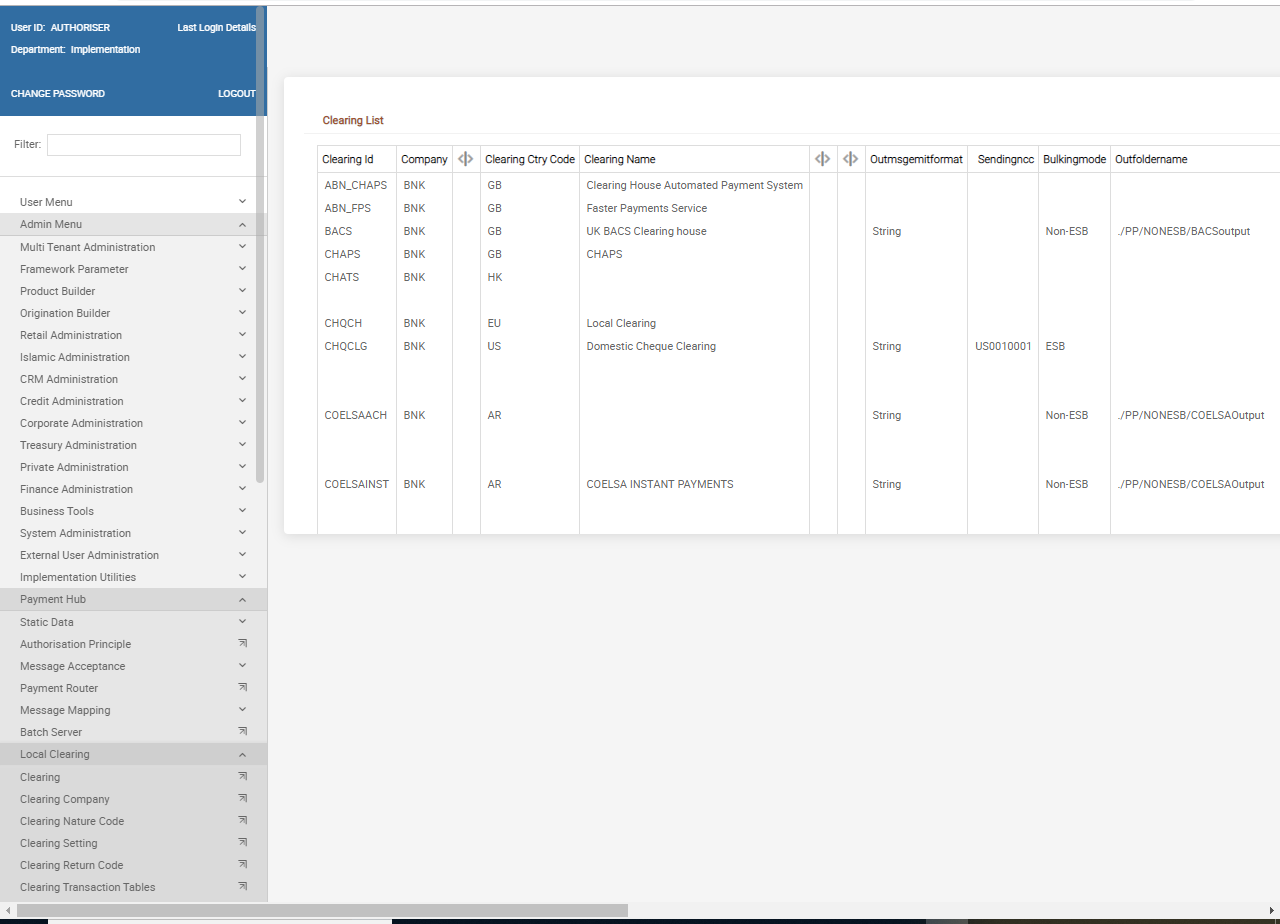

To trigger an auto investigation message, go to Admin Menu > Payment Hub > Local Clearing > Clearing.

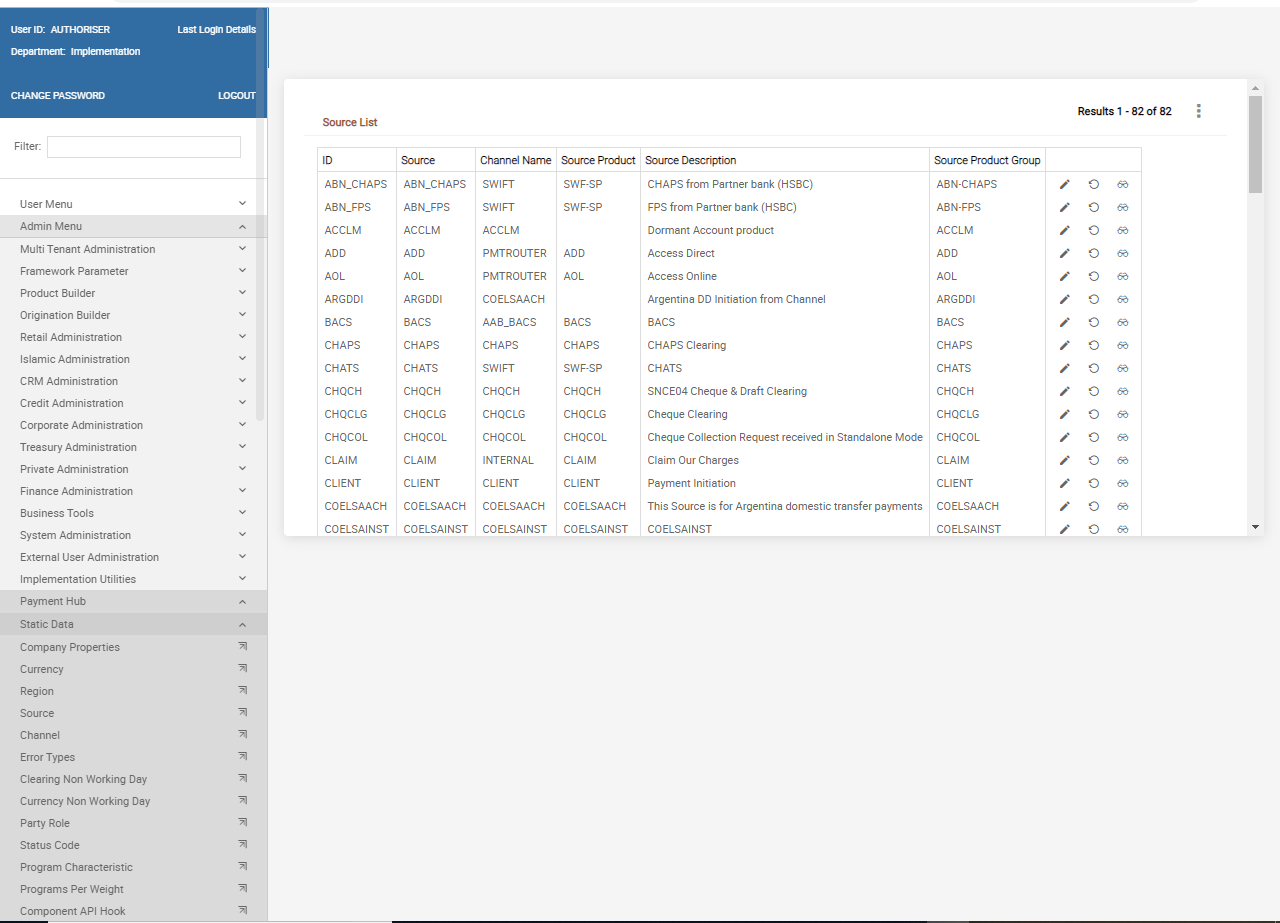

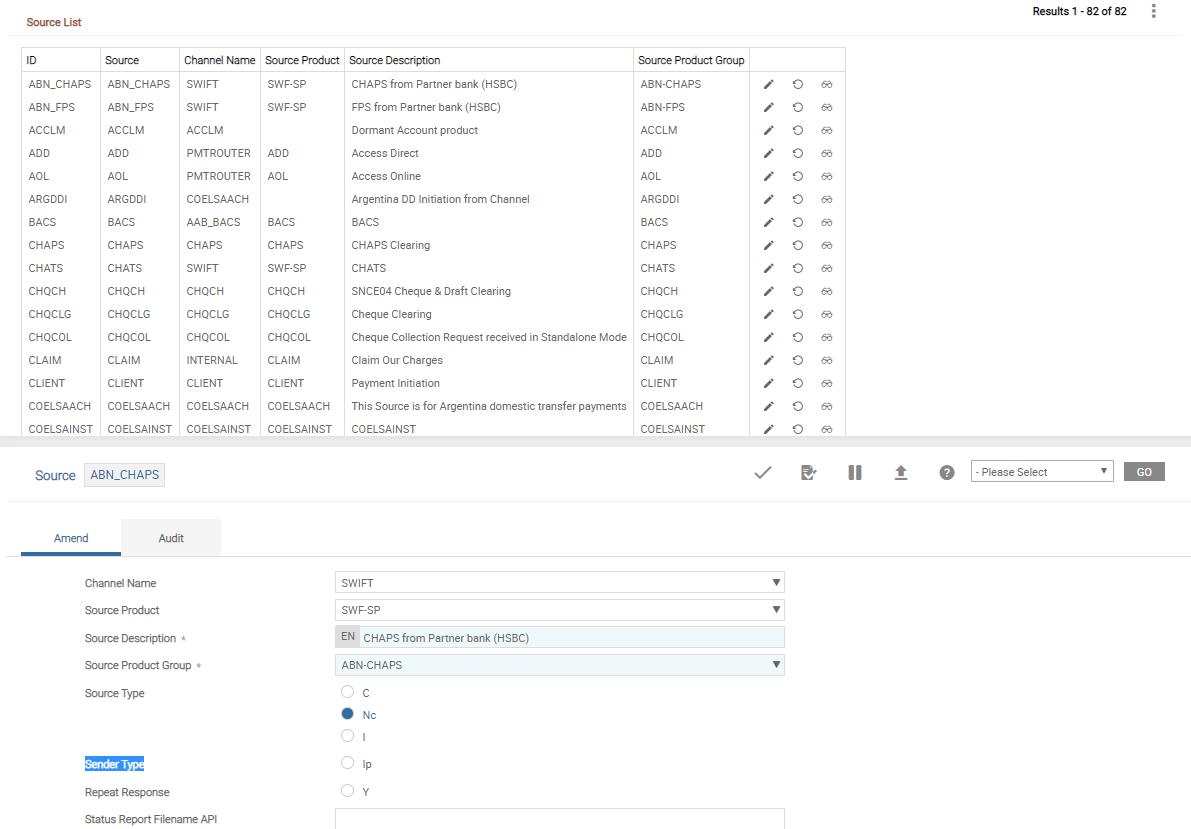

- To configure agency banking, go to Admin Menu > Payment Hub > Static Data > Source.

- Then go to Admin Menu > Payment Hub > Local Clearing > Clearing.

- The Sender Type field in PP.SOURCE table is disabled

- The ParticipantType field in PP.CLEARING table allows the user to select DP when Temenos Payments is installed

- PPIPCL license is required for enabling agency banking

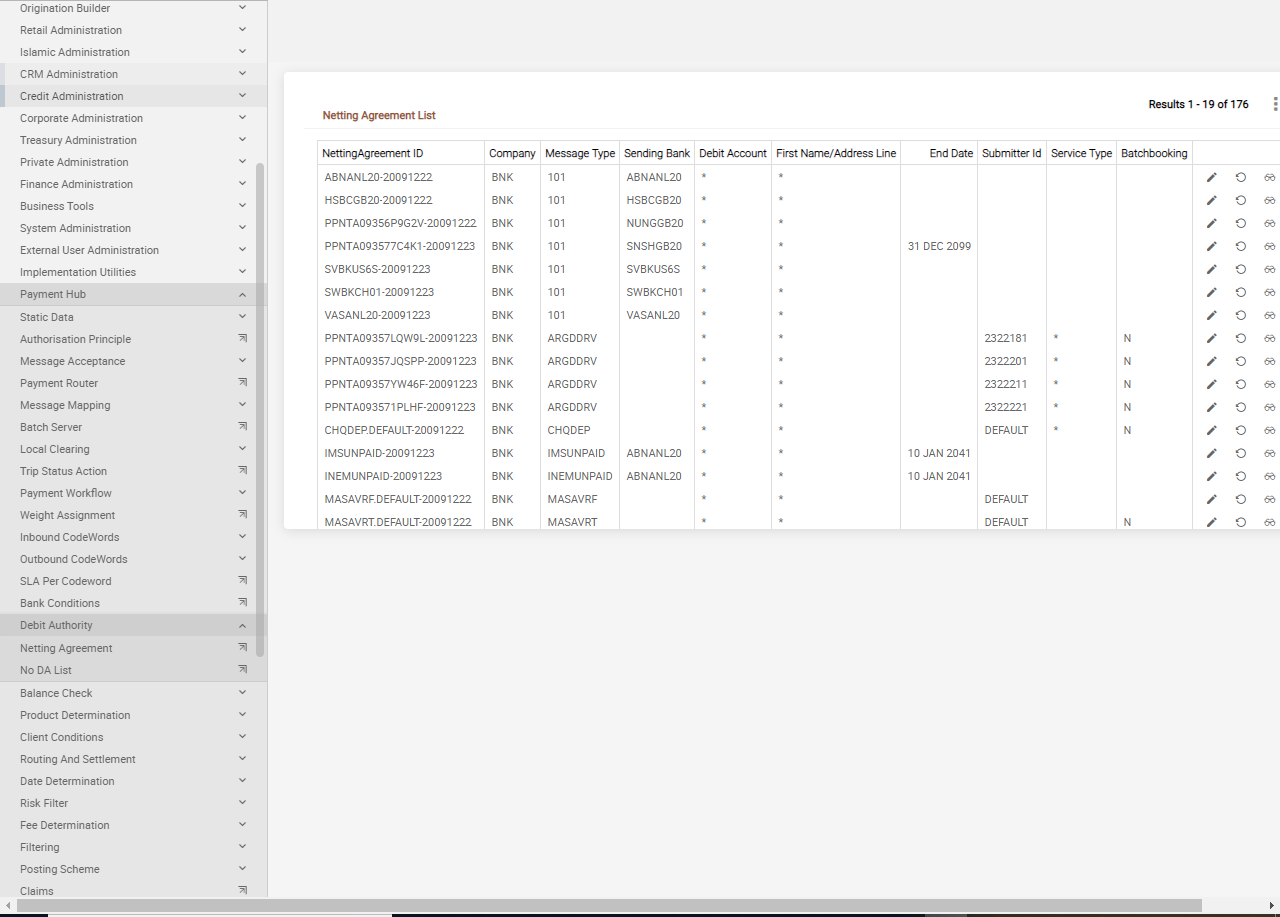

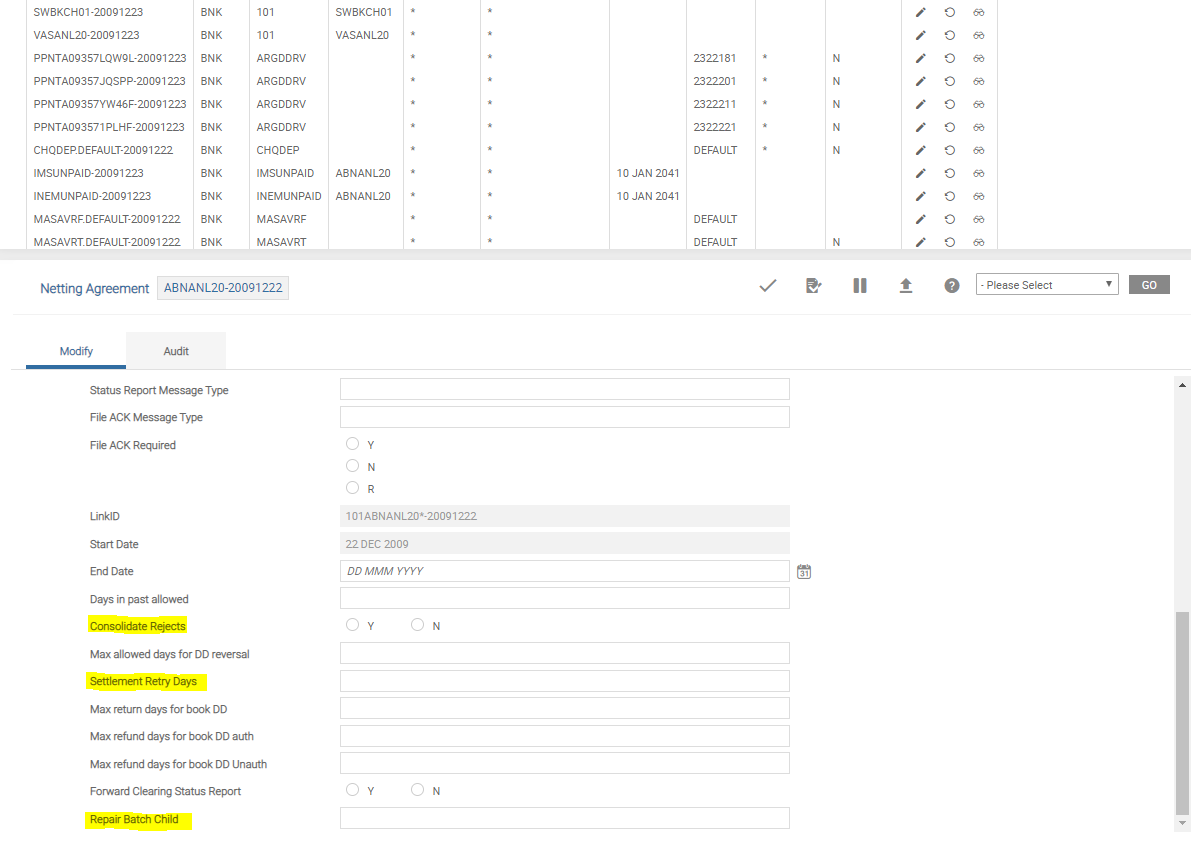

To configure corporate customer agreements, go to Admin Menu > Payment Hub > Debit Authority > Netting Agreement.

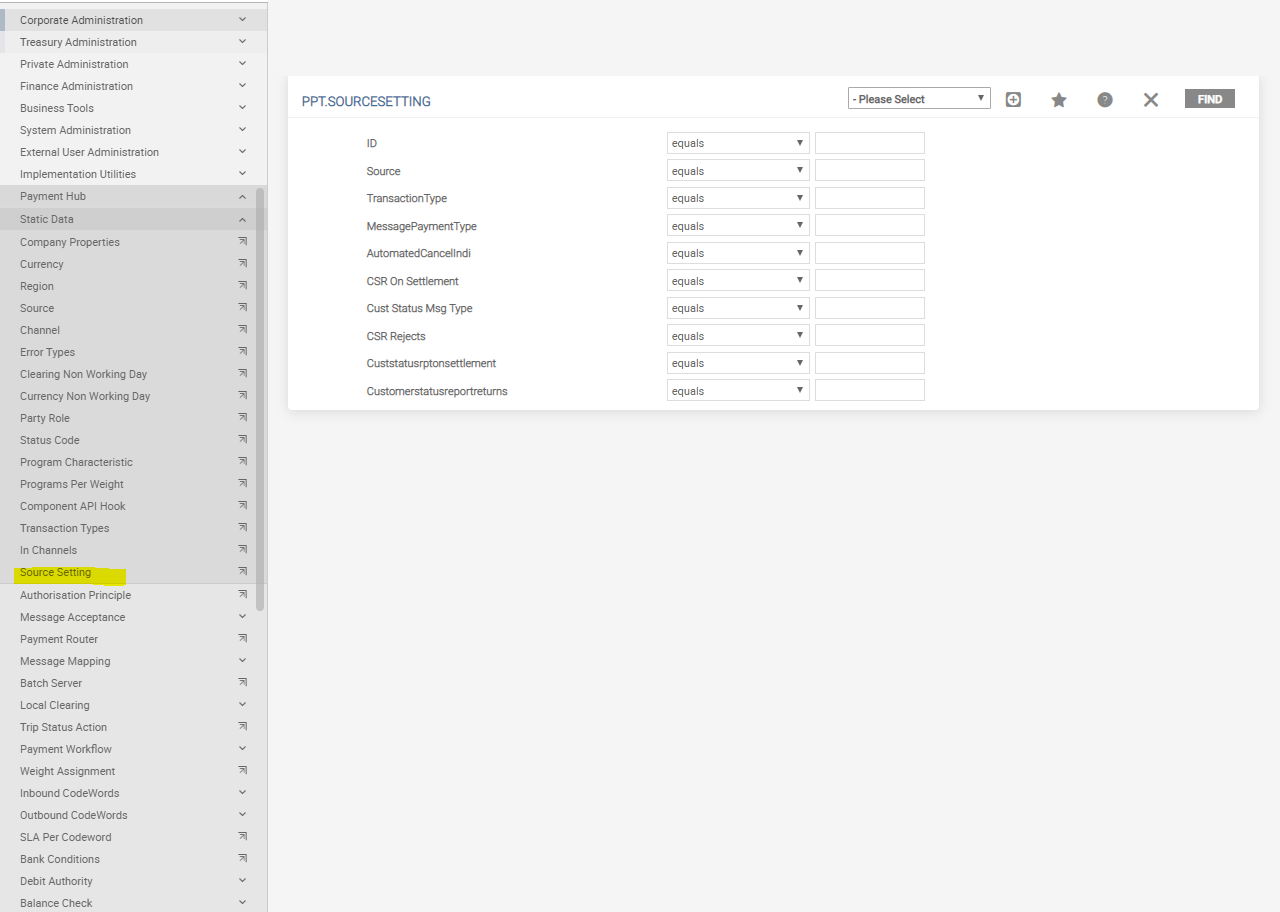

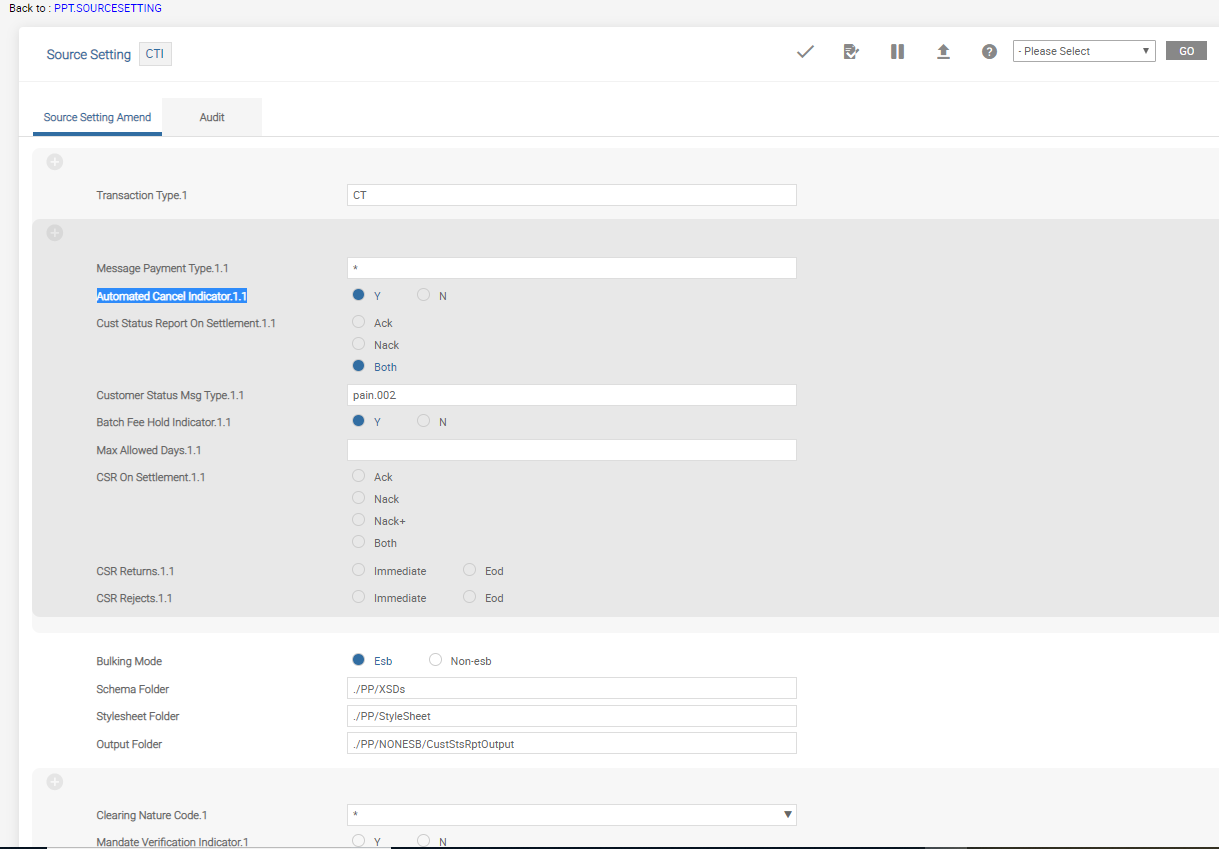

To configure automated cancel of payment initiations, go to Admin Menu > Payment Hub > Static Data > Source Setting.

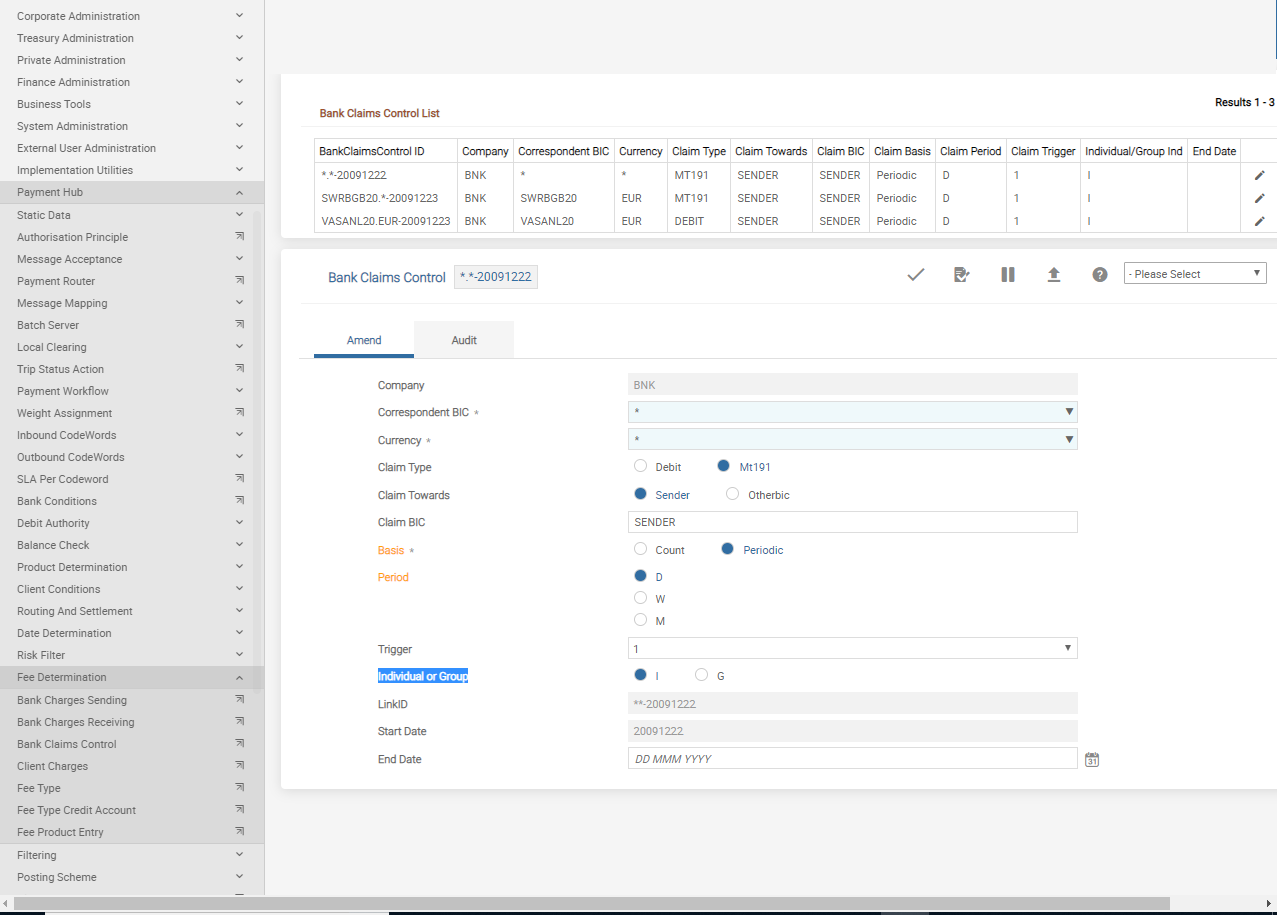

To configure group claims, go to Admin Menu > Payment Hub > Fee Determination > Banks Claim Control.

To configure refund of direct debits, go to Admin Menu > Payment Hub > Local Clearing > Clearing Setting.

To configure value dates for return payments, go to Admin Menu > Payment Hub > Local Clearing > Clearing Setting.

To configure automated negative response to payment recall, go to Admin Menu > Payment Hub > Local Clearing > Clearing Setting.

To configure expiry of unanswered recalls, go to Admin Menu > Payment Hub > Local Clearing > Clearing Setting.

To configure recall within certain number of days from original settlement, go to Admin Menu > Payment Hub > Local Clearing > Clearing Setting.

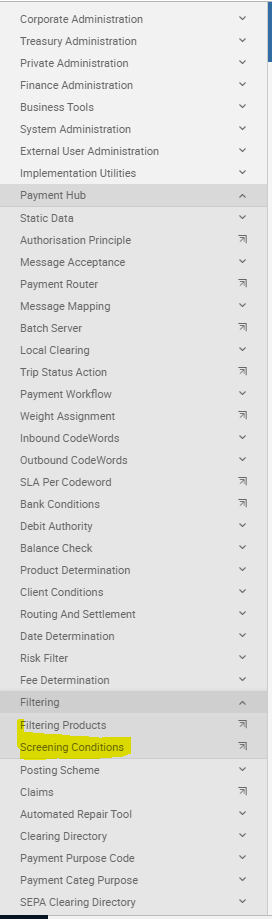

To configure advanced option for filtering response handling, go to Admin Menu > Payment Hub > Filtering > Screening Conditions.

To configure cut-off time based on payment currency, go to Admin Menu > Payment Hub > Routing and Settlement > Channel Cut-Off.

To configure non-STP rules for customer and bank transfer for correspondent banks, go to Admin Menu > Payment Hub > Bank Conditions.

To configure warehouse payments from correspondent bank, go to Admin Menu > Payment Hub > Bank Conditions.

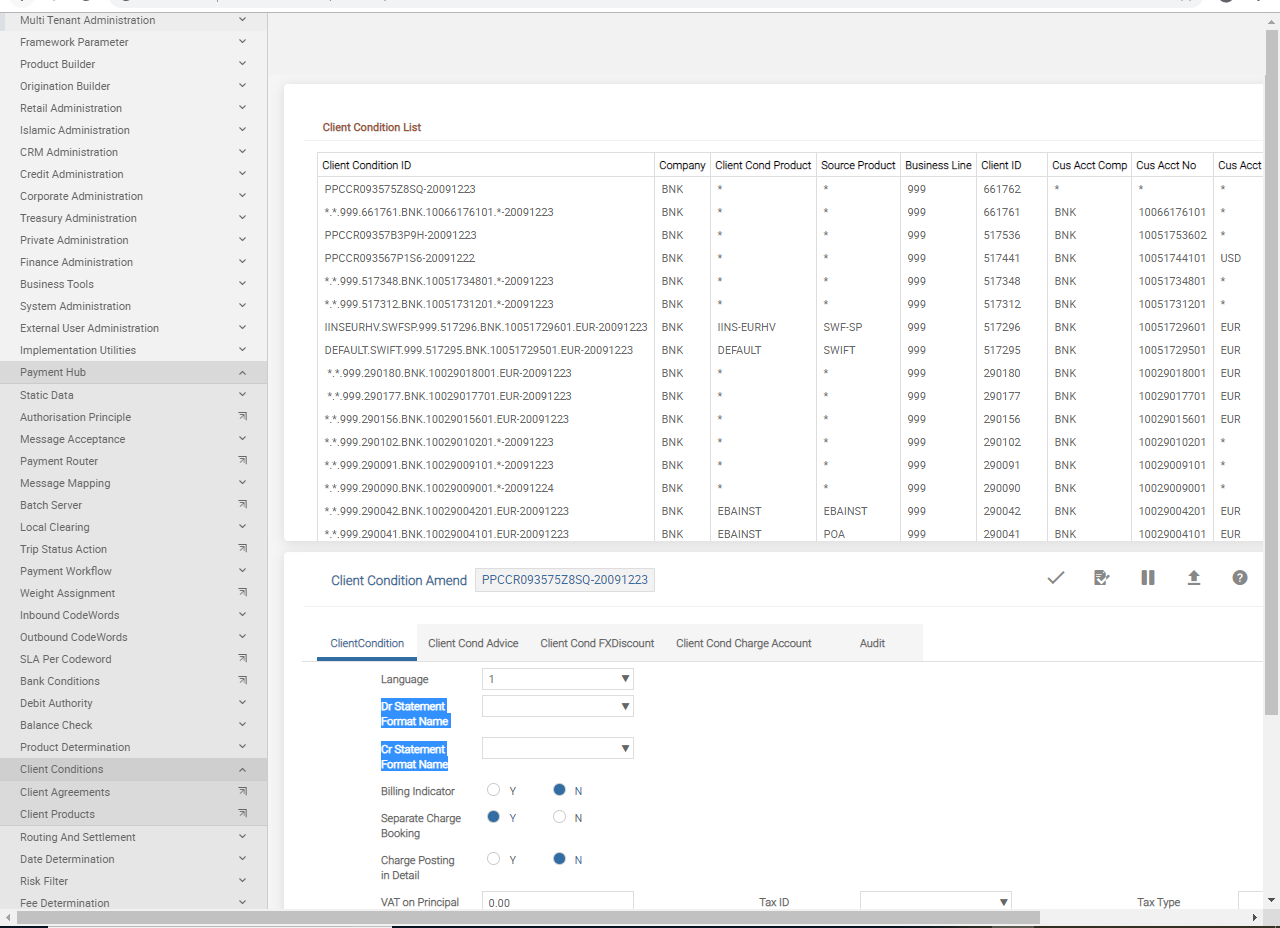

To configure customer or customer group specific statement formats, go to Admin Menu > Payment Hub > Client Conditions >Client Agreements.

To configure customer or customer group specific non-STP rules, go to Admin Menu > Payment Hub > Client Conditions > Client Agreements.

To configure customer or customer group special instructions, go to Admin Menu > Payment Hub > Client Conditions > Client Agreements.

To configure customer or customer group specific lead times for cut-off, go to Admin Menu > Payment Hub > Client Conditions > Client Agreements.

To configure risk filters, go to Admin Menu > Payment Hub > Risk Filter.

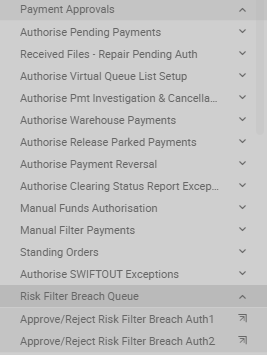

To configure the risk filter queue, go to User Menu > Payment Hub > Payment Approvals > Risk Filter Breach Queue.

In this topic