Introduction to Temenos Payments

Temenos Payments is an enterprise payment hub solution that provides the bank with a single solution to configure different payment types without any software changes. The payment management features enable the users to prioritise and specify date execution, override changes manually, and manage service level agreements through parameterisation.

It is designed to maximise Straight-Through Processing (STP) to configure automated actions for exceptions and minimise manual interventions to reduce risk and improve efficiency. It can also eliminate redundancies and help in consolidation of different payment systems in a single solution. This is performed when the solution is deployed as follows:

- ‘Embedded’ with Temenos Core Banking

- ‘Standalone’ with an external DDA or accounts system

This section is designed to help the Temenos Transact users to understand the application features, navigation and functionalities related to the Temenos Payments module in Temenos Transact. The user can process all payment types in a single system by using the following features:

- Receive, process, and send cheque requests between same or different banks

- Add a code word to the payment message to convey processing information that can help the financial institution

- Execute dynamic routing between different payment types

- Maximise STP by using automated exception handling

- Handle large volumes of payment requests or transactions

- Process instant payments with 24/7 processing and real time connectivity to clearing

- Screen a payment before processing to monitor and control risk

- Debit an account on regular basis based on the requirement

- Support cross-border payments that involves fund transfer between customers and banks in different countries with different currencies

- Allow manual intervention to continue the process of payment

- Define a charge type based on the customer to apply on different transactions

- Check an account for sufficient funds to perform a debit posting

- Schedule future payments in advance

- Transfer different or same currency between accounts within the bank

- Investigate the status of the payment and generate a report

- Identify a channel to send the payment to its customer

- Support UTF8 character set that can be configured and linked to each clearing.

Temenos Payments is the central payment processing engine of the Temenos Payments suite that converges and processes all payments. It is designed as a back-office application, which receives payments simultaneously from multiple channels and processes them parallelly in large quantities in Straight-Through Processing (STP) mode. Payments can be initiated from the banks’ front office applications (such as branch systems) and back-office applications (such as Treasury, external clearings and settlement systems). Temenos Payments is a multi-company, multi-currency and multi-lingual system built for enterprise wide use by global banks. It processes the following:

- Single and batch-based payments

- Domestic and international payments

- Variety of payment instruments

Additionally, it comprises of the following:

- Scalable STP engine

- Non-stop support that allows to enter payments any time in the day (even while close of business is in progress)

- Processing of multiple payments at the same time

- Payment processing workflows

- Workflow orchestration manager to create and amend processing workflows

- Business rules that define the characteristics of processing

- Generic payment object with attributes that span universal messaging standards

- Functional components to process different types of payments, with a set of configurable parameters that allow simple plug-and-play operation for an elaborate set of payment products and processing capabilities

- Manual action screens to repair payments that fail STP processing

- User interface for full-fledged support for R-processing and exception handing of payments (such as, reject, return, refund, and recall)

- User interface to create payments orders

- Intuitive monitoring dashboards and enquiries for effective management of the whole enterprise

- User accessible security and user agent-based definition

- Technical framework to configure new clearing systems and message mapping works using XSLT transformations

- Interfaces to bank host systems and clearing gateways

This processes the request (automatically) end-to-end within the payments processor using a set of pre-defined static data configurations and business rules. If the payment destination is external (to an entity outside the bank), it distributes the payment outward. If the payment cannot be processed automatically due to errors, it moves the payments to manual processing (by dedicated users in operation roles).

Temenos Payments interacts with various banking systems that require an external interaction to supplement payment processing. It parks the payment in ‘Waiting’ queues within the processor for an external interaction. The payments processing resumes automatically when it receives a response.

System Context

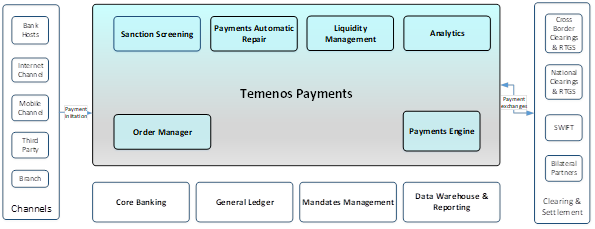

Temenos Payments processes the payments in association with a set of bank host systems that are part of the suite:

| System | Description |

|---|---|

| Channel | Path through which the message reaches Temenos Payments |

| Clearing and Settlement | Determines the channel through which an outgoing or redirected payment is sent to the intended customer |

| Sanction Screening | Offers watchlist screening, and a range of intelligent and flexible fraud checking modules to ensure highest detection rates at lowest costs |

| Payments Repair | Conducts payment transactions electronically without the need to re-enter or manual interventions |

| Liquidity Manager | Provides mechanisms to set business rules and processes, which allows the bank to implement strategies to satisfy its payment obligations |

| Analytics | Receives payment data published by Temenos Payments and generates analytical reports |

| Core Banking | Performs account authorisation (validation, funds check and reservation) and posting (debit and credit posting) |

| General Ledger | Receives general ledger bookings generated as part of payment processing |

| Mandate Management | Validates mandates associated with a direct debit, amends an existing mandate or registers new mandates |

| Data Warehousing and Reporting | Extracts payments data for data warehousing and MIS reporting |

Temenos Payments is installed as a standalone product or an embedded module with Transact and Temenos core banking system. When it operates as a core banking system, all interactions with Transact are through internal interfaces, which offer faster turnaround times as all interfaces are supported out-of-the-box.

STP Flow in Temenos Payments

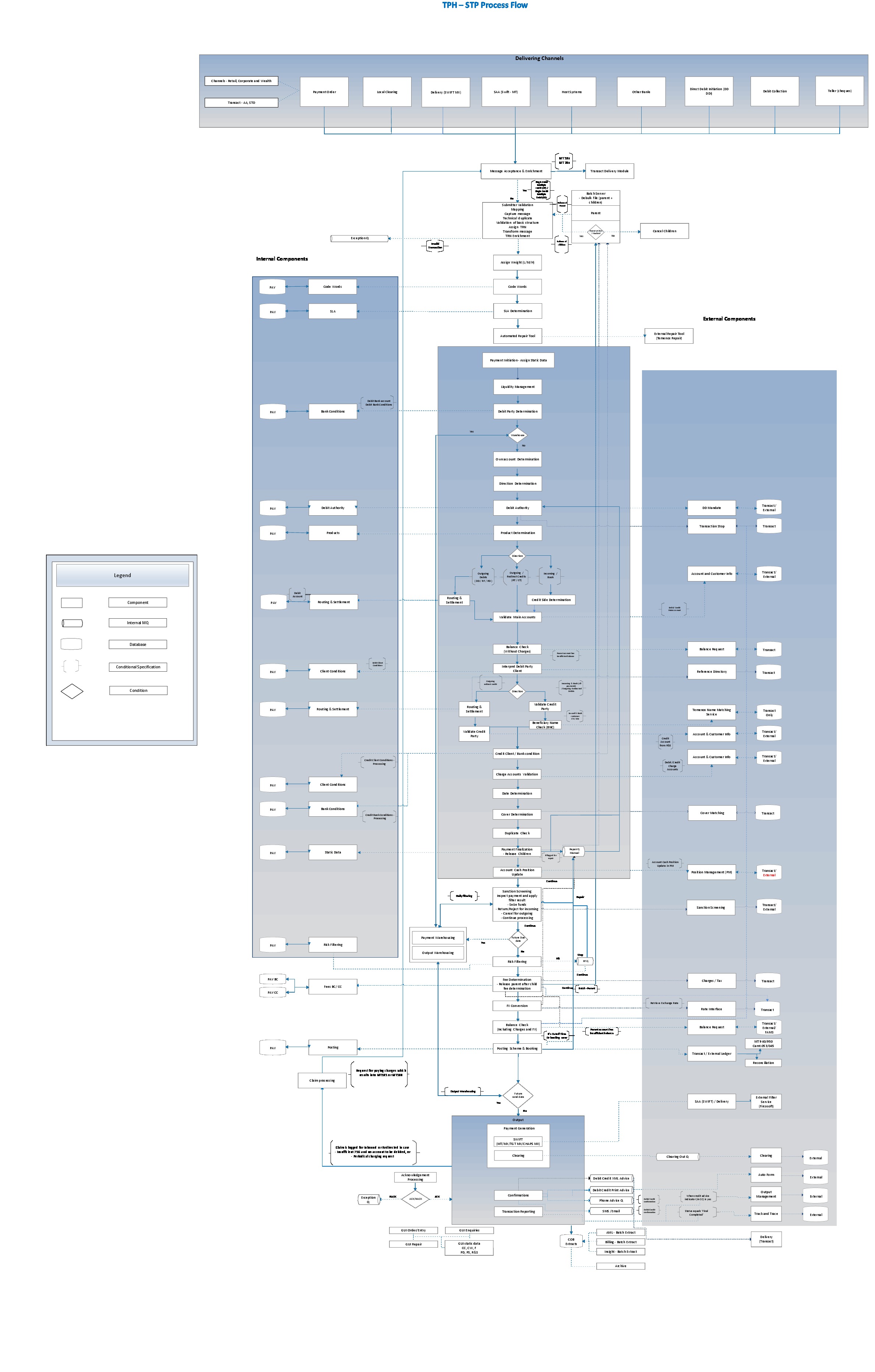

The following chart shows the Straight Through Processing flow from Temenos Payments. This flow is generally adopted for processing payments.

Key Functions

Temenos Payments performs the following important payment functions:

| Feature | Description |

|---|---|

|

Payment Order Manager (Front Office) |

Allows bank users to manually input or electronically collate payment order capture and enquiries from various online channels using APIs or messages. Performs preliminary validations, such as, BIC validation, IBAN validation, clearing reachability check, funds check and fraud check. Sends the accepted orders to bank’s payment system for further processing. It also allows capture of single payments or bulk payments. This feature is available as a standalone module. To know more, refer to Payment Initiation. |

| Payment Product | Allows banks to define payment processing products that cater to various business needs of banks (corresponding to business products in real world). It enables to configure various processing capabilities and characteristics in the payment workflow. Products can be defined based on following payment characteristics:

In addition to defining the product, the product can also be refined further with the payment parameters. Refer to the Product Determination guide for more information. |

| Agreements | Allows to set bank (correspondent bank) or client specific agreements and conditions as follows:

|

| Beneficiary Name Comparison (BNC) |

Supports comparison of beneficiary or creditor name details in the inward or book credit transfer and direct debit messages against the main and joint account holder details (value in Name 1 and Name 2 fields) in the customer database to ensure the money is credited to the right recipient and reduce the risk of fraudulent activity or errors caused by incorrect details in the payment instruction regarding the beneficiary. Further processing continues only based on a successful match. Additionally, Temenos offers a basic name comparison solution that is linked to FATF/ WTR2 regulation. Read below section for further information on Temenos Beneficiary Name Comparison feature. |

| Routing and Settlement | Determines the routing channel and settlement account by configuring business rules based on payment attributes. The routing channel can be a ledger (in-house), clearing house or RTGS, bilateral participant bank, preferred correspondent, or SSI correspondent through SWIFT. |

| Clearing | Supports various clearing schemes including RTGS, ACH and Instant. It allows the bank to configure and use clearings in plug-and-play model, with extensive capabilities for message transformations and clearing gateway interfaces. The RTGS and ACH clearing framework modules (PPRTGF and PPACHF) act as base for any RTGS or ACH type clearing messages to be processed in Temenos Payments. |

| Clearing Directory and Reachability | Allows upload and management of clearing directory file received from clearings, and performs reachability check during payment processing. Each clearing directory has a separate license. |

| Warehouse | Allows the bank customer to schedule future dated payments. These payments are held in Temenos Payments, as the customer has requested for future date. The user can cancel the payment, amended or force released manually while in warehouse. |

| Business Dates | Calculates various business dates of a payment (such as value, execution, debit, payment send date) that are necessary to process the payment. The calculation varies based on characteristics and attribute of the payment. Temenos Payments provides banks with a provision for custom development that can influence the date calculation for local requirements. |

| Fees and Billing | Provides comprehensive and flexible fee definition functionality. It supports the following:

|

| Tax |

Supports tax calculation on principal and charge. Ability to define tax rules as part of client agreements and customer groups. |

| VAT |

Supports VAT calculation on principal and charge. Ability to define VAT rules as part of client agreements and levy VAT on specific charges. |

| Forex (FX) | Supports cross-currency payments. Foreign Exchange (FX) rates are fetched or configured from:

|

| Sanction Screening | Sends payment information to sanction screening system for screening against OFAC or other screening lists. When operating with Temenos screen as the screening engine, Temenos Payments offers extended functionalities (including a standard out-of-the-box interface). |

| Risk Filtering | Supports risk filtering to monitor and control risks and limit exposure based on Country, Currency, and Counterparty before the payment is allowed to be booked successfully. |

| Investigations and Enquiries | Performs investigations on payments based on queries from customer or internal banking departments. It provides a set of enquiries and audit trails that helps users to investigate and report on status and reason for errors. |

| Funds Reservation | Performs funds reservation based on transaction amount (or amount plus charges) by interfacing with bank’s core banking system. If the funds are insufficient, it allows to perform the following:

Temenos Payments can also skip reservation when a fund is pre-authorised for a payment. |

| R-Processing | Supports R-processing functions for payments (such as reject, return, reversal, refund and recall). It provides necessary pages for handling manual exception and processing workflow to process R-transactions. |

| Status Reporting | Generates debit or credit advice, payment confirmation notifications and alerts (as an SMS, e-mail, messages, fax) to customers on their payment order status. |

| Monitoring Dashboard | Provides an enterprise-wide dashboard for monitoring the payments that Temenos Payments processes as it passes through various components within the payment flow depending on the payment characteristics. |

| Agency Banking | Supports the bank to run agency banking service, and acts as an intermediary or correspondent to indirect participants in a clearing. |

| Direct Debits | Supports Direct Debit (DD) payments processing. IT also allows mandate validation and storage (if required) for DD processing. |

| Cheques and Drafts | Receives and processes cheques and drafts deposit requests, and supports inward and outward collection process. |

| Workflow Management | Allows to build, amend and maintain payment processing workflows. |

| Bulk Payments |

Processes bulk files that are sent by corporate clients. The bulks are processed in-house or through a clearing using respective scheme guidelines. Temenos Payments also allows bulk file upload and manual capture functions for SME and corporate clients. |

| Manual Payment Capture | Provides a comprehensive set of payment capture options specifically designed for mid and back office requirements. |

| Posting | Performs debit and credit posting by interfacing with bank’s core banking system. |

| Security | Supports users and user agents, roles and rights configuration, and user authentications. |

| Duplicate check | Checks for technical duplicates while receiving files and at the individual payment level. |

| Mandate support | Receives mandate information, auto register mandates, and process recurring as well as one-off mandates. |

| Force Non-STP option | Forces Non-STP processing based on high-value payments, amount, customer or group of customers or correspondent banks and code words |

| Batch file processing | Supports receiving, debulking, and processing batch files (contains one or more credit transfers or direct debit bulks). Supports settlement per bulk or per individual payment within each bulk. |

| Code word support | Supports processing based on special agreements between banks using code words that are added as part of the payment message. Supports SWIFT code words, as well as bilaterally agreed codewords |

| SLA support | Supports Service Level Agreements (SLA) influenced payment processing by applying special bank agreements, warehousing rules, routing and settlement rules, special fees, and generating specific advice. |

| Claims processing | Supports processing of claims raised against a deficit in the charge to be received on processing incoming payments with OUR charge. Generates claims individually or grouped by correspondent BIC, at a pre-defined frequency during Close of Business. |

| PSD regulation support | Supports Payment Services Directive (PSD) compliance check for transactions where one of the Payment Service Providers (PSPs) is located outside the European Economic Area (EEA), all transactions that start or finish in the EEA and in any currency and non-member state currency payments that have both payer and payee in the EU or EEA. |

| FATF support |

Supports the following:

|

| Holiday Logic | Supports processing based on the holiday calendar, which influences the processing date, value dates and settlement dates of the payment. Supports definition of country-wise, currency-wise, or clearing wise non-working days. |

| Standalone support | Functions as a standalone payments hub and connects to a DDA which can be another instance of Temenos Transact or external DDA. Holds frequently used non-customer accounts in the Temenos Transact instance of the payments system to avoid making calls to external DDA. |

| Close of Business | Supports processes to end the business transactions in a day and move to the next business date such as the release of payments from the warehouse, extracting data to be sent to Insight, Billing, and sending customer status reports for customers who have sent payment initiation messages and so on. |

| Archiving | Supports automatic archiving of all payment data and its related information as part of the close of business for a defined period, based on configuration. |

Beneficiary Name Check

Temenos Payments performs the beneficiary name check using the Temenos Name Matching service in the following scenarios:

- If it is configured for the source and message type to perform beneficiary name check, then the following condition must also be met.

- The transaction amount falls in the range of amount for which the beneficiary name check needs to be performed for a payment from the source.

- Inward or book customer transfer with creditor account is held in a TPH bank.

- Inward or book customer direct debits (DD) with debtor account are held in a TPH bank.

- It is a customer transfer.This feature does not apply for a bank transfer.

- If the account for which the name check must be performed is valid (active and dormant). BNC is not invoked in case of Closed and Account not found.

- If the account for which the name check must be performed is a customer account.

- Beneficiary Name Check is performed only once in the payment life cycle. Name matching is not performed if the payment is accepted from the repair queue, irrespective of the first name matching validation result.

TPH does not support external name comparison service.

TPH moves the payment for further processing if the name comparison is successful. In case of failure,

- Non-instant payment or DD is moved to the repair queue with a warning message. The user can either accept or reject the mismatch. Auto-enriching of the whitelist table when a mismatch is approved by user is not supported.

- Instant inward payment or DD is auto-rejected. A reject message is generated with an appropriate ISO reason code.

- Read Introduction to FATF and WTR 2 section for more information about basic name comparison feature.

- Read Introduction to Static Data for more information on setting up enhanced name comparison (BNC) feature in TPH.

- Read Temenos Name Matching Services to understand more about Name comparison algorithm.

- If account is held in the AC Module, matching takes place against customer names configured as joint holders. Read Working with Account Creation for further details on configuring Joint Account Holder details when the customer and account details are held in AC module.

- If an account is held in the AA module, the Customer ID with beneficial owner enabled alone are considered for name comparison. Read Customer Property Class for further details on configuring as Beneficial Owner when customer and account details are held in AA module.

Payment Instruments

The different payment instruments available in Temenos Payments are as follows:

| Payment Instrument | Description |

|---|---|

| Credit Transfers (CT) | Initiating party is debited by the originating bank and a credit is passed to the counterparty bank where beneficiary party is held. Temenos Payments supports full life cycle of all available types of credit transfers including intra-bank transfers (within bank, also known as book transfers), inter-bank transfers within country and across borders, with its different flavours and schemes across countries and regions. It also supports many instant CT schemes that demands real time processing of credit transfers. |

| Direct Debits | Recurring or one-off request to collect money from a payer, based on a prior agreement (generally known as mandates). Direct debits are setup by corporate utility companies, who raise collection requests on a recurring basis to collect monies towards bills and invoices. Temenos Payments fully supports initiation and processing of DD with an external mandate management system holding mandate information. |

| Cheques and Drafts | Supports processing of cheque payment processing, including cheque deposit, outward collection and inward collection, manual return and repair of cheque payments. Supports banker’s draft or demand draft in local currency or foreign currency. |

| Request To Pay (RTP) | Allows payee to collect funds from a payer based on online authorisation (typically based on mobile devices). Temenos Payments supports processing of RTP requests that include generation, receipt and processing of the request at payer bank side based on consent provided by the payer. |

Payment Types

The different types of payment in Temenos Payments are as follows:

| Type | Description |

|---|---|

| Single | These payments are of high value, demanding gross settlement or international FX transactions. They can also be instant payments of low or high values. Temenos Payments supports single payments in all possible cases, including national and cross border payments. |

| Batch | To achieve cost effectiveness, transactions from corporate customers are combined into a batch and sent to their bank for processing. The batch transaction is an in-house transaction, while individual transactions in the batch are in-house or non-inhouse (off-us). Temenos Payments supports single-debit multiple-credit CT and single-credit multiple-debit DD batches. It also supports splitting of batches into single individual transactions and processing them as individual transactions. |

API Capabilities

Temenos Payments provides extensive capabilities around APIs. It provides functionalities that are exposed for consumption through its published APIs, API middleware, and powerful tools that allow banks to interface their systems with Temenos Payments with ease and effectiveness. The tools also allow on-the-fly creation and deployment of new APIs that a bank can develop to meet their specific channel and third-party requirements.

Multi-Function Capabilities

The multi-function capabilities of Temenos Payments are as follows:

| Capabilities | Description |

|---|---|

| Multi-Company | Supports several banks with separated business rules and strictly segregated data. A company headquarter is defined at the highest level, under which multiple country level companies and branches within the country (if required) are defined. The payment transaction and static data within Temenos Payments are associated with a company. Data visibility mechanism restricts users from viewing the company data (for defined companies). User application rights restricts the user from using system functions. It also allows companies to share data with each other, which enables the common set of users to manage payments for a group of companies. |

| Multi-Currency | Allows to configure multiple currencies with full-fledged set of currency attributes (such as currency markets, exchange rates, holidays, and possibility) to maintain them through manual or automatic feeds. It also supports cross-currency transactions with externally or internally stored exchange rates. |

| Multi-Lingual | Supports multitude of languages and raises multi-lingual alerts, notifications, and processes payment transactions with multi-lingual fields. |

| Multi-Time Zone | Supports multi-time zone operations and assigns a time zone for each user and company. Users who belong to multiple companies can switch between time zones to operate effectively. |

Instant Payments

Instant Payments processing framework is an extension of the Temenos Payments STP engine to meet the higher demands of instant processing payments. It offers the following features:

- Receives, processes and responds to payments sent out in real-time (in milliseconds) in synchronous processing mode

- 24*7 processing throughout the year with no downtimes

- Near real-time synchronous processing (in seconds) for slower instant payment instruments to cope to bank’s technical infrastructure

- Lightweight processing flows to achieve quick turnaround time

- Automated investigation messages based on the needs of the instant clearing schemes

- Time stamping (before release to clearing) and validation of the timestamp (on receipt from clearing)

- Immediate booking or booking on confirmation from clearing

- Parallel processing capabilities to ensure maximum usage of time spent while waiting for external interfaces

- Special R-processing functionality to meet instant payment schemes (for example, automatic scheme returns by instant clearing)

- Real-time monitoring dashboard

- Standby processing when bank hosts are offline due to (planned or unplanned) downtimes

- Timeout and expiry mechanisms at integration layer

- Send and receive clearing status reports

- Working in standalone mode as well (DDA is external)

Parallel Processing

Temenos Payments can continue processing payments in STP without stopping at some components though a response is not received for that exit point. Parallel processing happens when a request is made to an external system (that is, for filtering the payment). To parallelly process payments, the core system must be either external or hybrid. Once the request is sent to the external system, the system does not wait for the response from the external system but continues to process the payment in parallel and proceeds to the next component in the STP flow.

After the balance reservation is successfully completed, the system checks for a response from the external system to continue processing the payment. If the response is available, the payment processing continues based on the response received, else the payment is parked (or stopped) until a response is received. The payment is parked in a specific state unless the response is received from the external system. Payment processing is resumed automatically after the response is received from the external system.

Illustrating Model Parameters

This section covers the high-level specifications required for the Temenos Payments module.

Read the Temenos Payment (PP) and Payment Suite (PH) user guides for information on parameter setup for camt.055.

Inward/Outward Message Flow

Messaging Framework is a component of Temenos Payments that deals with validation, transformation, mapping and handling of the messages (XML, non-XML) in Temenos Payments, from and to the clearing or external systems.

Refer Messaging Framework and Configuring Message Framework for more information.

Illustrating Model Products

This section covers model products for Temenos Payments module.

| Product Name | Features |

|---|---|

| International |

|

| Book Transfer |

|

| Cheque |

|

| Draft |

|

Temenos Payments module provide the facility to receive customer cancellation message camt.055 for pain.001 message.

In this topic