Introduction to Payment Initiation

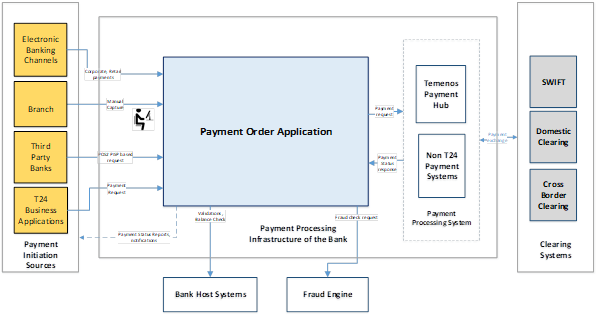

PAYMENT.ORDER (PO) application is an integral part of the Temenos Payment Solution, which is part of the Temenos Transact core banking suite. This handles order capture and management functionality, and supplements the payments processing engine, Temenos Payments Hub. The key features of PO application are as follows:

- Interfaces with a variety of payment initiation channels, both in interactive and Straight-Through Processing (STP) modes. Initiation channels include customer facing and electronic feeder channels (STP), bank’s branch or potentially in-house bank host systems that can raise a payment request.

- Performs order validation, pre-processing and storage until processing date.

- Performs manual repair and release for payments in exception.

- Helps in routing of the orders to appropriate payment system based on payment characteristics.

- Generates payment status reports, and customer advices and alert notifications

- Supports the following:

- Payment capture for different types of clearings (such as RTGS, Automated Clearing Houses (ACH), Cross-Border and Instant Payments Clearings).

- Popular clearing systems (such asTARGET2, SEPA using EBA, SEPA using RPSSCL, SEPA Instant, EQUENS, UK CHAPS, UK Faster payments, Hungary Instant (RT1), UK BACS, and SWISS RTGS).

- Credit transfer, single and bulk payments, and a variety of payment types within credit transfers.

- Customer payments and bank-to-bank transfers.

- Complies with ISO20022 payments messaging standards.

- Has a submodule of TPH that is offered by Temenos. However, banks can choose to use

POapplication as an independent module without TPH. In such installations,POapplication interacts with bank’s non-Temenos payment systems to process payments captured or aggregated inPOapplication. - Depends on Temenos Transact submodules to provide payment services. To know more, refer to

POapplication and associated Temenos Transact applications section.

PO Application in Business Context

The following are the payment processing infrastructure of the bank.

PO Application

The functionalities of PO application are as follows:

- Receives payments using standard Temenos Transact interfaces, validates, enriches, and routes them to appropriate destination payment system.

- Sends the payment status back to initiating source in response to the acknowledgements received from the payment system.

- Generates payment advices as customer notifications.

The payment processing system (such as TPH or bank’s non-Temenos Payment system) validates, books and routes the payment to an appropriate clearing system. Payment instruction exchanges are in embedded mode when PO application operates with TPH, whereas, uses the standard message formats and interfaces in an external system. In-house payment requests are settled within the bank’s core banking, instead of sending it to clearing.

PO application supports the capture of payments, which are cleared by the following clearing systems:

| Clearing System | Description |

|---|---|

| Domestic | High-value RTGS payments, instant payments clearing systems or ACH that processes bulk payments |

| SWIFT | International payment message interchange |

| Cross-Border | Operate across borders, such as Pan European ACH |

All systems in the bank that supplements payment processing, such as bank’s core banking system.

PO application can be accessed using APIs when deployed with Temenos Interaction Framework (IRIS) or third-party API gateway. This feature helps the bank to support PSD2 related open banking requirements, where the bank acts as a PISP or serves a PISP (as an account owning bank). The PO application supports the following APIs that supports both immediate and future dated payments:

| Release | API |

|---|---|

| Berlin Group Standards Release 1.3 | Payment Initiation |

| Payment Status | |

| Payment Cancellation | |

| Payment Completion | |

|

STET Standards Release 1.4 |

Payment Initiation |

| Payment Status | |

| Payment Completion | |

| Payment Cancellation |

This feature requires Temenos Transact PI module (PX) to be installed (Dependent modules are PZ and CK for processing permissions and third-party payment initiator validation).

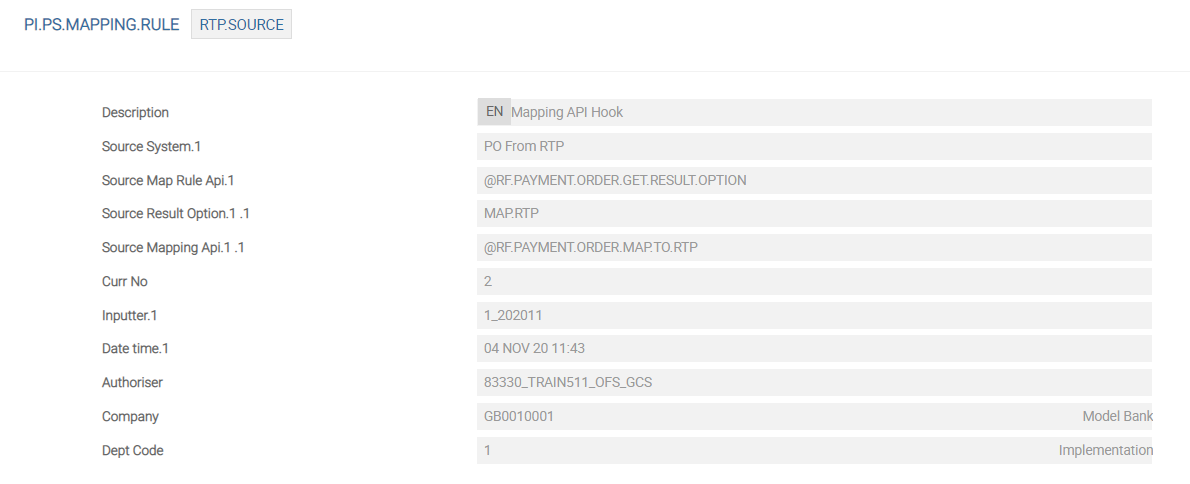

The PAYMENT.ORDER (PO) application can receive payments from various Temenos Transact systems such as RTP, Forex, and so on. After the payment is completed, the PO application can update the status of the payment to these source systems. This can be configured in Payment Order Ps Mapping Rule setup.

Configuring PO Application

PO application provides high level configuration with different aspects of payment capture.

This parameter allows the user to set characteristics of a PO application. The key parameters are as follows:

PO application are configured to adhere to payment rules that apply to payment identifiers of a given country (where the credit party holds an account). Following are the examples of country rules:

| Rule | Function |

|---|---|

| Allow or disallow IBAN | Validates whether an IBAN is allowed or disallowed in a payment. |

| Allow or disallow BIC | Validates whether a BIC of a beneficiary bank is allowed or disallowed in a payment. |

| Clearing code format | Mentions the format of clearing code for a specific country. System validates the clearing code format when initiating a payment to a country. |

| Allowed currencies | Inputs the list of currencies allowed to make a payment to a certain country. |

Payment products configured in PO application can be common across countries. However, country rules takes precedence (if set) over rules set at product level.

Every order is assigned a product attribute that determines the characteristics of the payment and the manner in which the payment is processed. Some of the generic products available in PO application are:

User chooses the Payment Order Product (during manual capture) or PO application automatically assigns it (based on the criteria defined by payment attributes). PO application products can also be based on message type (if there are specific requirements). For example, application product is UKFPS-SIP (Single Immediate Payments in UK FPS) or SEPA CT (SEPA Credit Transfer). Payment Product of PO application allows to set characteristics on how to capture, validate and process a payment order. Some of the key functionalities are as follows:

| Functionality | Description |

|---|---|

| Holiday calendar | Enables to check the holidays while making a payment request. |

| Usage of IBAN or BIC/Sort code | Allows IBAN or BIC/Sort Code for a certain product or not. However, country rules take precedence while making a payment. |

| FX rules | Allows FX for this product. If allowed, float is to be used. |

| Warehousing rules |

Marks the future dated payment request to warehouse in the PO application. |

| Allowed currencies | Inputs the list of currencies allowed to make a payment with the selected PO product. |

| Charging rules | Lists all the charges that are charged for a particular PO product and configures fixed and conditional charges. |

| Reachability check | Performs reachability check so that the payment is not rejected in the payment system. |

| Check transparency | Simulates a payment order, which helps to avoid any rejections in the payment system. |

PO application allows to hook bank specific APIs to determine its product.

| API | Description |

|---|---|

| Product Determination API | Changes product dynamically based on payment information. For example, amount greater than 10,000 EUR is changed to TARGET2 payment product. |

| Charging Rule API | Determines whether a configured fee is applied or not. For example, the bank can choose not to charge cross-border fee, when the country is non-EU. |

| External Account lookup | Validates the account that is in a non-Temenos Transact database.

|

| Payment Validation | Allows custom validations that can be implemented during business validation stage of a payment order. |

| Connection API | Creates logic to connect to a specific payment system based on payment characteristics. For example, bulk payments sent to bulk payments engine. |

| Fraud Routine API | Allows local site-based API hooked to send payment information for fraud check. |

To update the status of the payment to the source system, the user has to provide the following configurations:

| Field | Description |

|---|---|

|

Source Mapping Api |

The API defined in this field must have

the logic for one to one mapping from the |

|

Source Map Rule Api |

The API defined in this field determines

whether the |

Illustrating Model Parameters

The high-level configurations available in the Model Bank are given below:

| S.No. | Parameter | Description |

|---|---|---|

| 1. | PAYMENT.ORDER.PARAMETER

|

This parameter table contains high-level payment order configuration at the company level. This application facilitates the definition of the Payment Connection method, whether Warehouse is supported and the number of days the Payment order needs to be maintained in live status before moving to history. |

| 2. | PAYMENT.ORDER.COUNTRY.RULES

|

This parameter table defines any country specific rules checking for Beneficiary country for outward payments. This takes precedence over similar definition in Payment Order Product. It also has the provision to set rules if IBAN, BIC, Sort Code or Clearing channels are applicable for specific countries. |

| 3. | PAYMENT.ORDER.PRODUCT

|

Payment features that are specific to a product are defined here. |

Illustrating Model Products

Payment Initiation module captures the transaction details and forwards the instruction to the back office system configured in PAYMENT.ORDER.PARAMETER for further processing. It also applies some basic validations configured in the PAYMENT.ORDER.PRODUCT.

| S.No. | Product | Description |

|---|---|---|

| 1. | Payment Initiation | Payment Connection Method in PAYMENT.ORDER.PARAMETER is set as Tps, so that all the payment initiated from PAYMENT.ORDER gets routed to TPH for further processing. |

In this topic