Goods and Services Tax Installation Guide

The Goods and Services Tax installation guide describes the installation procedures required to install this package successfully in Temenos Transact and covers the release mechanism of the package.

Terminology Used

Naming standards for the components.

System Requirements

The following are the pre-requisites for installing this package:

General Considerations

When transferring the pack via FTP the transport method must be set to binary.

Contents of the Package

The pack contains the following:

- GST.ACCT.SUB.RTN

- TAXGST.UPDATE.ACCRUED.INCOME

- TAXGST.UPDATE.ACCRUED.INCOME.SELECT

- TAXGST.UPDATE.ACCRUED.INCOME.LOAD

- TAXGST.UPDATE.VAT.DETAILS

- TAXGST.VAT.DETAILS

- TAXGST.VAT.DETAILS.FIELDS

- TAXGST.VAT.TRANS.REF

- TAXGST.VAT.TRANS.REF.FIELDS

- TAXGST.TAXRATE.CHANGE

- TAXGST.TAXRATE.CHANGE.ID

- TAXGST.TAXRATE.CHANGE.FIELDS

- TAXGST.TAXRATE.CHANGE.VALIDATE

- TAXGST.TAXRATE.CHANGE.AUTHORISE

- TAXGST.UPADTE.NEW.TAX

- TAXGST.UPADTE.NEW.TAX.SELECT

- TAXGST.UPDATE.VAT.ADJ.AMOUNT

- TAXGST.UPDATE.VAT.ADJ.AMOUNT.SELECT

- TAXGST.VAT.CALC.BASE.AMT

- GST.RETRIEVE.MD.DEAL.DETAILS

- TAXREG.PARAMETER.FIELDS

I_TAXGST.UPDATE.ACCRUED.INCOME.COMMON

- STANDARD.SELECTION>TAXGST.VAT.DETAILS

- STANDARD.SELECTION>TAXGST.VAT.TRANS.REF

- FILE.CONTROL>TAXGST.VAT.DETAILS

- FILE.CONTROL>TAXGST.VAT.TRANS.REF

- FILE.CONTROL>TAXGST.ACCRUAL.CATEG.ENTRY.LIST

- PGM.FILE>TAXGST.VAT.DETAILS

- PGM.FILE>TAXGST.VAT.TRANS.REF

- PGM.FILE>TAXGST.UPDATE.ACCRUED.INCOME

- EB.API>TAXGST.UPDATE.VAT.DETAILS

- VERISON>PAYMENT.ORDER,VAT

- VERSION>FUNDS.TRANSFER,VAT

- BATCH>TAXGST.UPDATE.ACCRUED.INCOME

- TSA.SERVICE>TAXGST.UPDATE.ACCRUED.INCOME

- BATCH.NEW.COMPANY>TAXGST.UPDATE.ACCRUED.INCOME

- LOCAL.TABLE>VAT.TAX

- PGM.FILE>TAXGST.TAXRATE.CHANGE

- FILE.CONTROL> TAXGST.TAXRATE.CHANGE

- STANDARD.SELECTION> TAXGST.TAXRATE.CHANGE

- BATCH>TAXGST.TAXRATE.ADJUSTMENT

- BATCH.NEW.COMPANY> TAXGST.TAXRATE.ADJUSTMENT

- TSA.SERVICE> TAXGST.TAXRATE.ADJUSTMENT

- EB.ERROR>EB-ADJEFF.DATE.GT.TODAY

- EB.ERROR>EB-CONTRACT.NOT.FOUND

- EB.ERROR>EB-INVALID.OLD.TAX

- EB.ERROR>EB-GST.RATECHANGE.SHOULD.BE.TODAY

- FILE.CONTROL>TAXGST.ADJ.VAT.AMOUNT.LIST

- PGM.FILE>TAXGST.UPDATE.NEW.TAX

- PGM.FILE>TAXGST.UPDATE.VAT.ADJ.AMOUNT

- EB.API>TAXGST.VAT.CALC.BASE.AMT

- ENQUIRY>VAT.DETAILS

- PGM.FILE>TAXGST.VAT.CALC.BASE.AMT

- STANDARD.SELECTION>TAXREG.PARAMETER

Steps for Installing the Package

The following steps need to be followed for installing the package:

- TAXGST product has to be installed in the environment before installing this package.

- After adding the class file of the routines to TAXGST_Foundation.jar, transfer the TAXGST_Foundation.jar file-using ftp in BINARY mode to t24lib folder.

- In the tafj.properties file, setup the precompile path to refer the TAXGST jars.

- Configure the TAXGST_Foundation.jar in the Web application server.

The data records package has been delivered as a BCON pack, then

If the package has been delivered as a Build Control Unit, then:

- Open a new record TMNS000-3733297 in BUILD.CONTROL, in input mode.

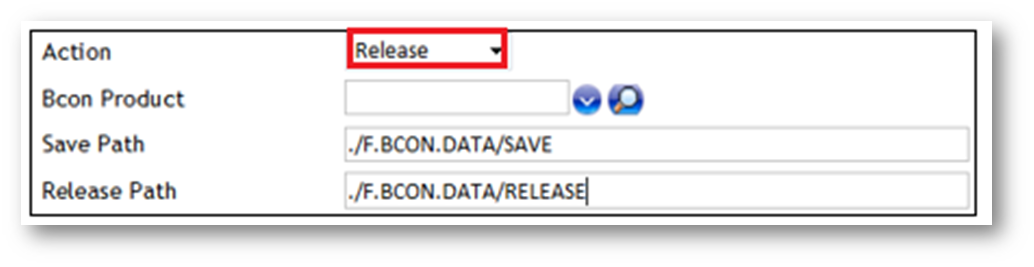

- Enter Release in the Action field.

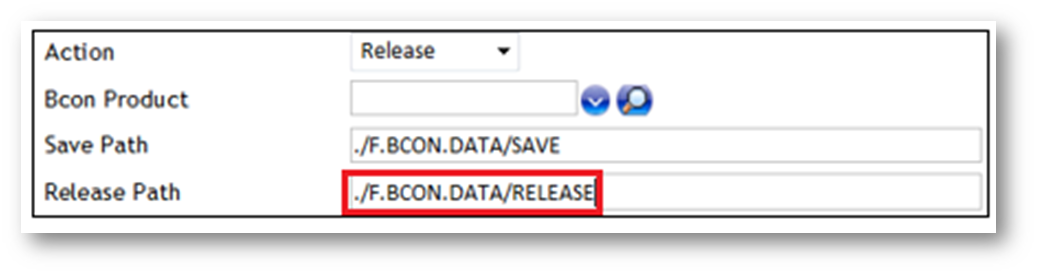

- Enter the path where the package has been placed (for example, ./F.BCON.DATA/RELEASE).

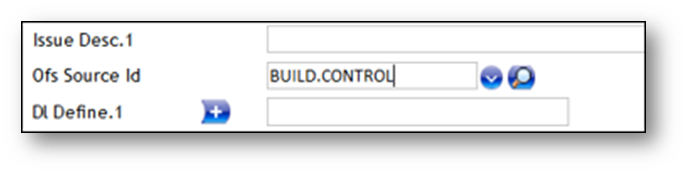

- Enter BUILD.CONTROL in the OFS.SOURCE record.

- Enter the value in the Program OS field by referring the value in SPF record SYSTEM with the value in the Operating System field.

- Commit the record.

- Open the record in verify mode and commit.

- BUILD.CONTROL will now create local ref definitions, create I–descriptors, restore the records and authorise them. If any of the records are not authorised, then they have to be authorized manually. (Refer the saved list for the complete list of items shipped for this development). If in case, the records are not authorised, authorise manually those records.

In this topic