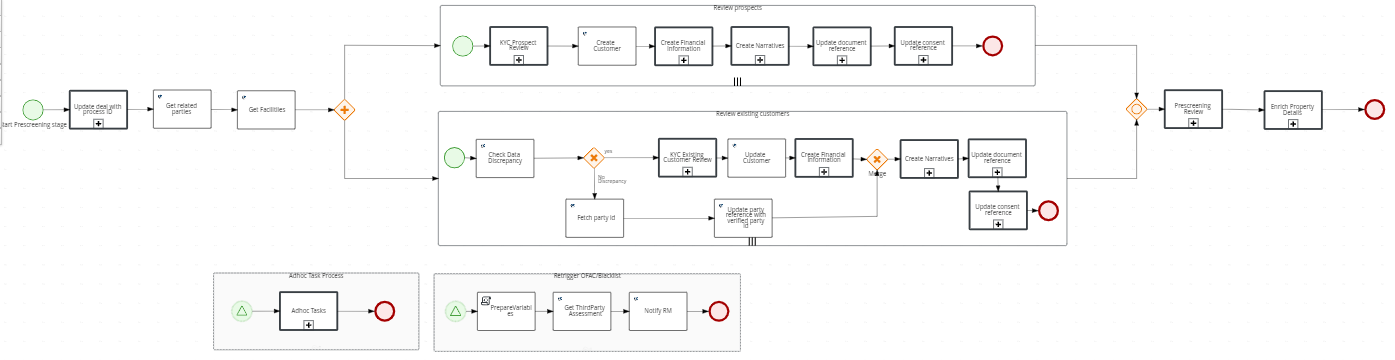

Mortgage - Post Submission PAM Workflow

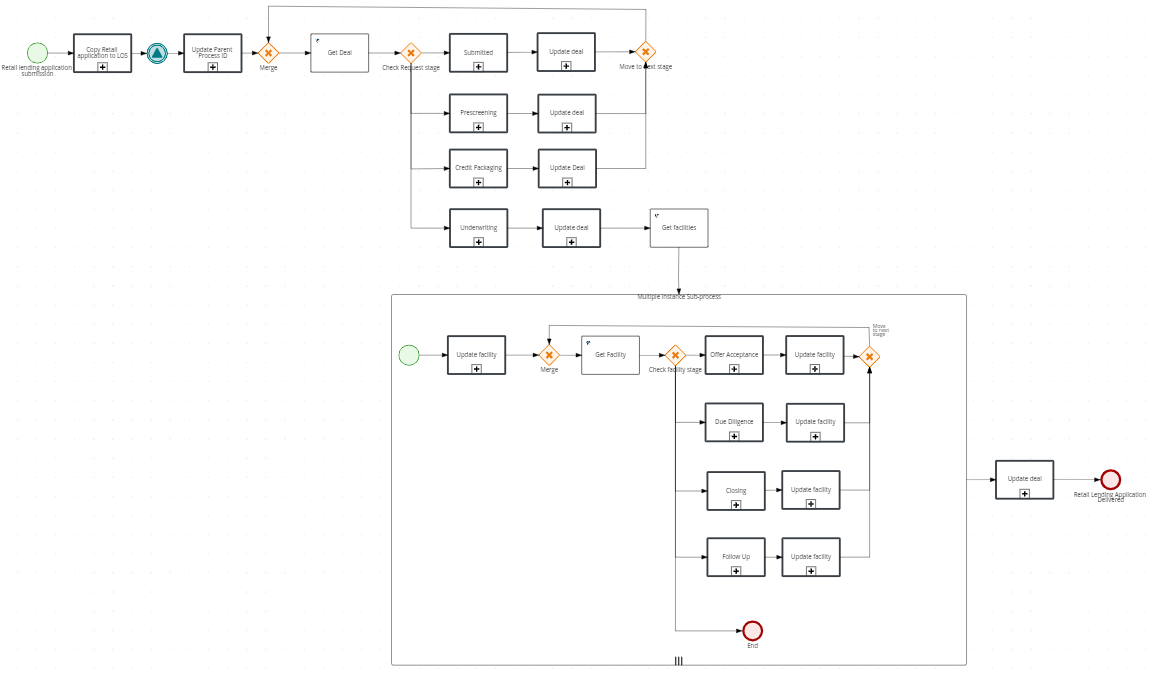

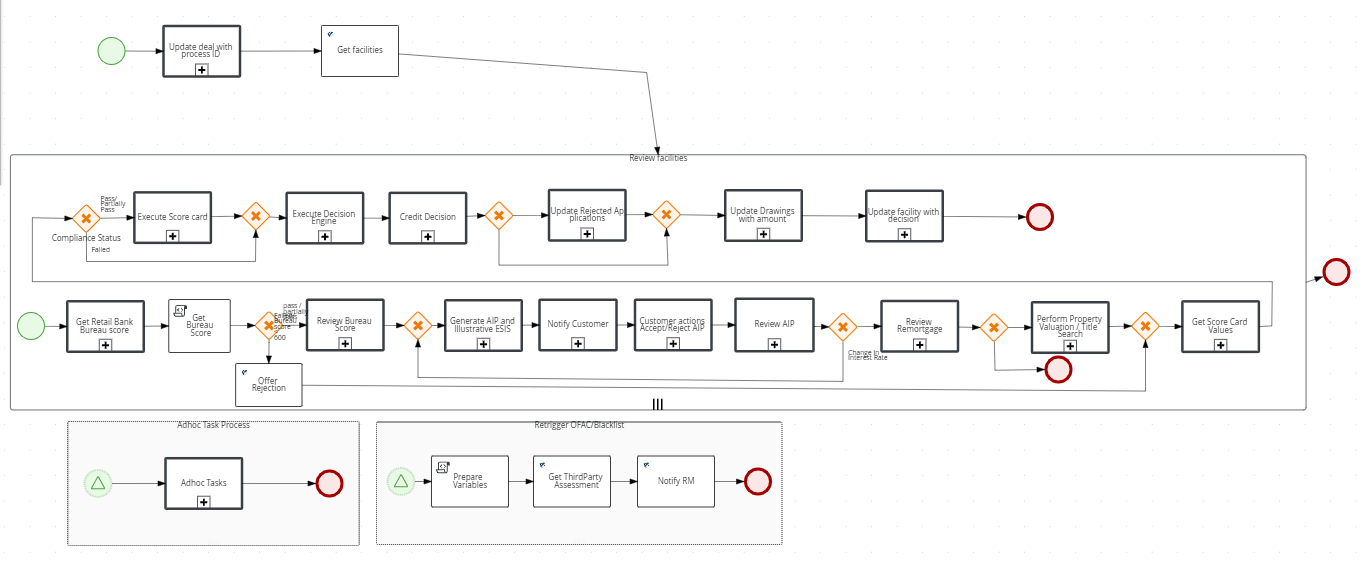

The Retail Mortgage Flow illustrates the back-end flow of operation after an applicant submits a Retail Mortgage application.The products in this flow are First Time Buyer and Remortgage.

For a new application,when a product from a mortgage product group (mortgage or remortgage) is selected, the ProductType is updated as Facility in ODMS if it is mortgage.This is used in application status DMN to update the application status as Submitted for all loan applications.Once the status of the application gets updated in ODMS, an event is sent from the ODMS to Quantum Fabric which interprets the event and starts the application submission process in the Red Hat PAM. The Application submission flow is as follows:

The retail mortgage application submission flow is categorized into the Automated Retail Lending Process and Problem Loan Management, depending on the type of the applicant.

- The automated process is authorized for applications where the applicants are existing customers and there is no change in customer data.

- The problem loan management process is authorized for applications where the applicants are prospects and existing customers with change in customer data.

Click here for details regarding Mortgage Flow in Origination (Pre-Submission) and here for Mortgage - First Time Buyer Lending Tasks.

Functional Flow

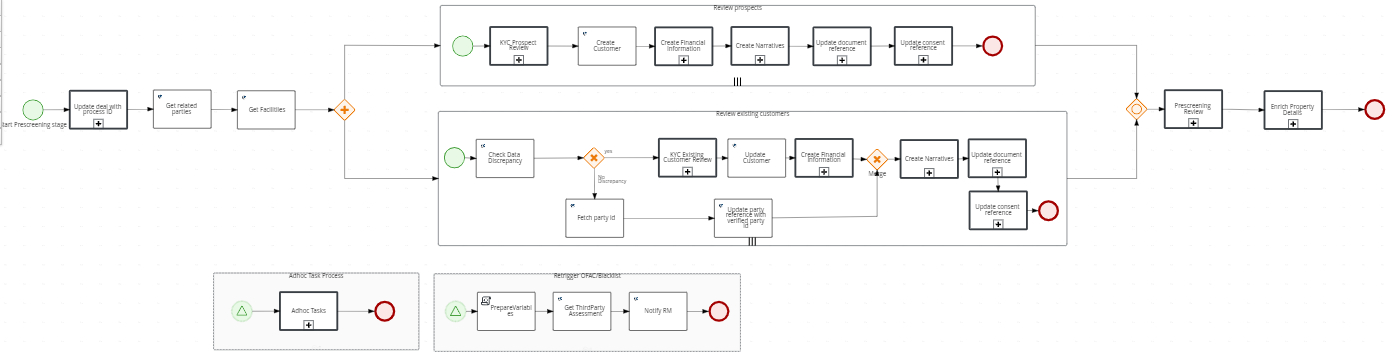

All the below tasks take place in a sequence in the workflow, when application has a prospect/existing customer.

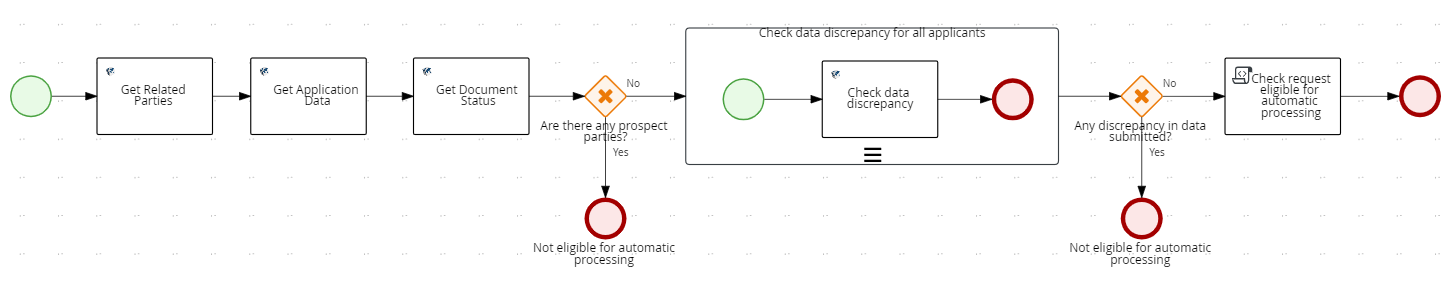

Automated Retail Lending Process

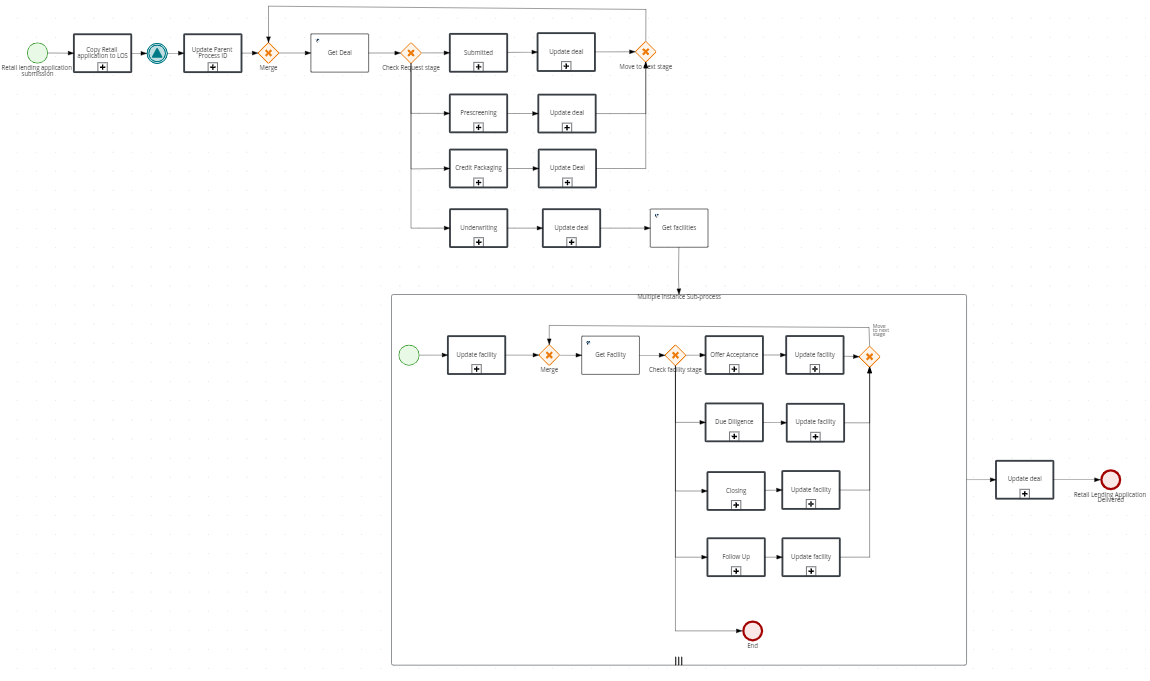

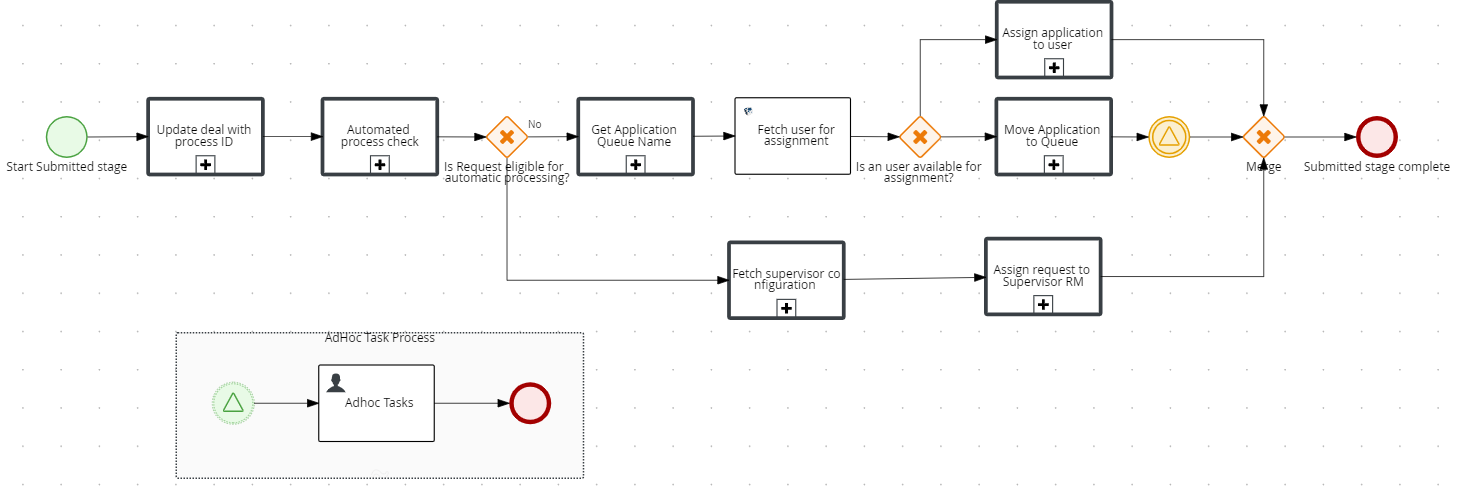

Submitted Stage :

- Automated Lending Process Check:

- The party details and ODMS details are retrieved and compared. A flag is set for any data change in the KYC details(Personal, Address and Identity), Income and Employment details,Documents(Proof of Address, Proof of Identity, Proof of Income, Supporting financial documents) to be in Approved Status.

- The document discrepancy check - examines if any of the Proof of Address, Proof of Identity, Proof of Income, Supporting financial documents have any documents in Pending status. If any document is in pending status the document discrepancy is true else false.

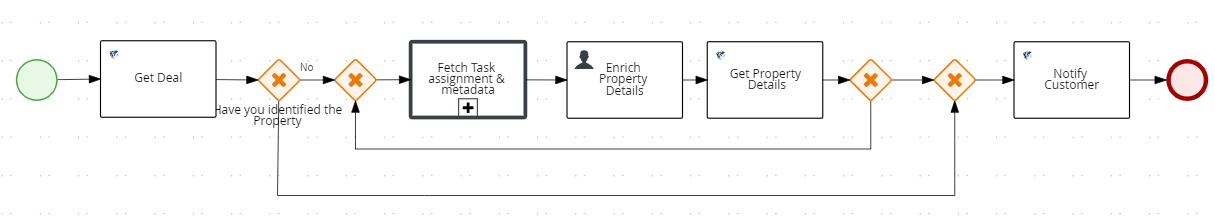

- The Have you Identified the Property check gets implemented in the Automated Lending process task sub process in PAM after the data discrepency check. If Have you Identified the Property property for the application is Yes the discrepancy is false and Have you Identified the Property flag is set to true.

- If the Data discrepancy flag is false and Have you Identified the Property flag is true, the application gets auto assigned to Supervisor user and follows the Automated Lending Flow.

- Move Application to User/Queue:

- The flag set in the process “Automated Lending Process task” is input.

- If the conditions in Automated Lending Process check task are satisfied then the application will follow automated process and should be assigned to Supervisor RM and will directly process the next task.

- Task is closed automatically.

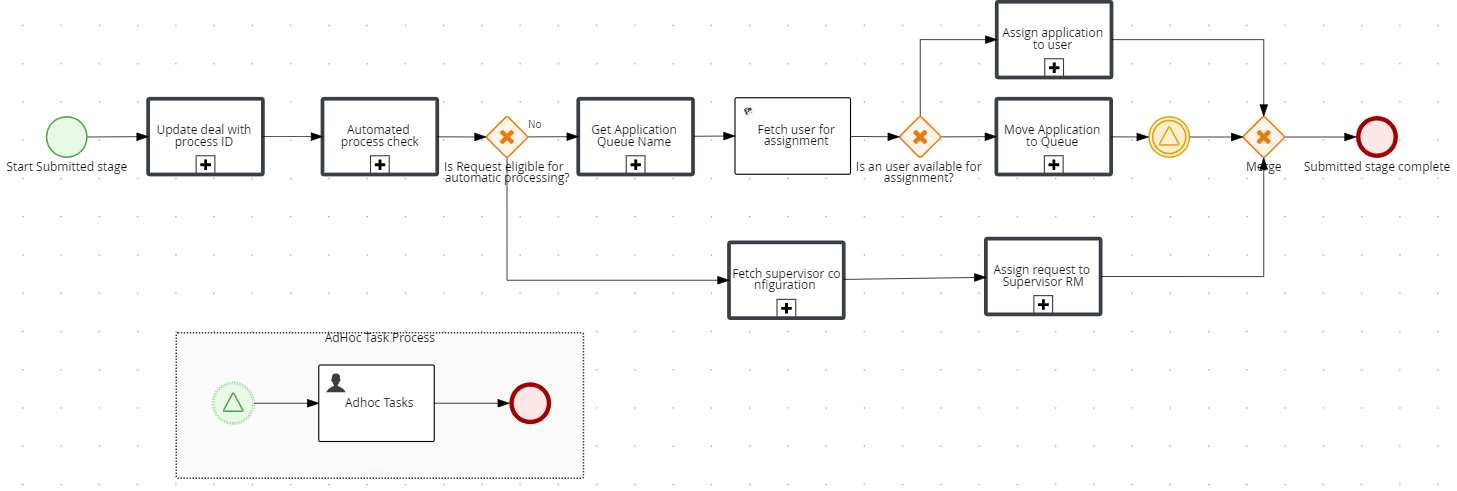

Pre-screening Stage:

- Review KYC - Existing Customer task:

- If the data discrepancy flag is false and there is no change in the KYC data and the Proof of Identity ,Proof of Income documents are approved , the Review KYC - Existing Customer task is skipped.

- Review KYC - Prospect task:

- If applicant is existing customer then Review KYC-Prospect task will be automatically closed.

- Prescreening Review:

- Review Documents:

- If the income Employment Info Discrepancy flag is false (no change in the financial information - the auto lending process flow follows and the task gets auto completed.

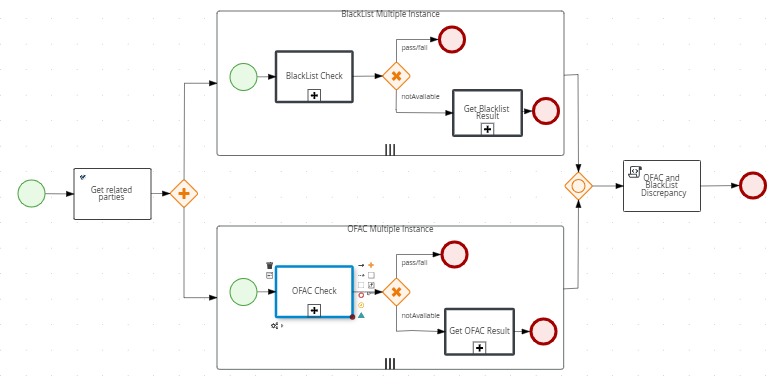

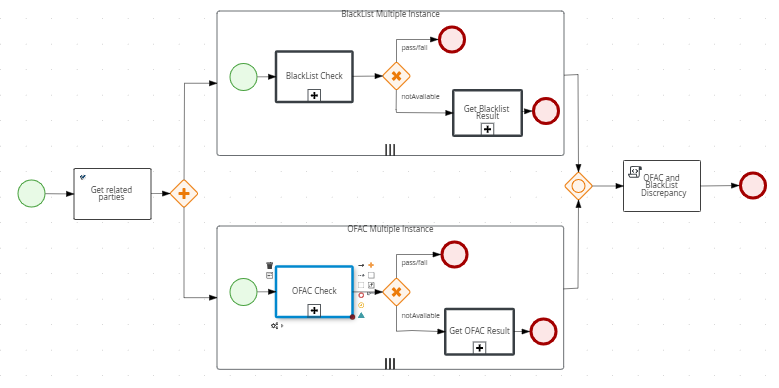

- OFAC Check(Existing scenario):

- The system checks if there is an existing OFAC report for the applicant in the Party MS. If the report is not older than 5 days, the existing data is updated.

- If the report is older than the expected days, a new report is fetched from an external system and stored in the Party MS. The number of days (here 5 days), is configurable from Spotlight.

- Third party service is mocked by ofac_mock_flag flag in the spotlight config param ASSESSMENT_MOCK_SERVICE_STATUS.

- Review Documents:

- BlackList Check(Existing scenario):

- The system checks if there is any existing Black list report for the Applicant in the Party MS. If a report is not older than 5 days, the existing data is updated.

- If the report is older than the expected days, a new report is fetched from an external system and stored in the Party MS.

- Third party service is mocked by blacklist_mock_flag flag in the spotlight config param ASSESSMENT_MOCK_SERVICE_STATUS .

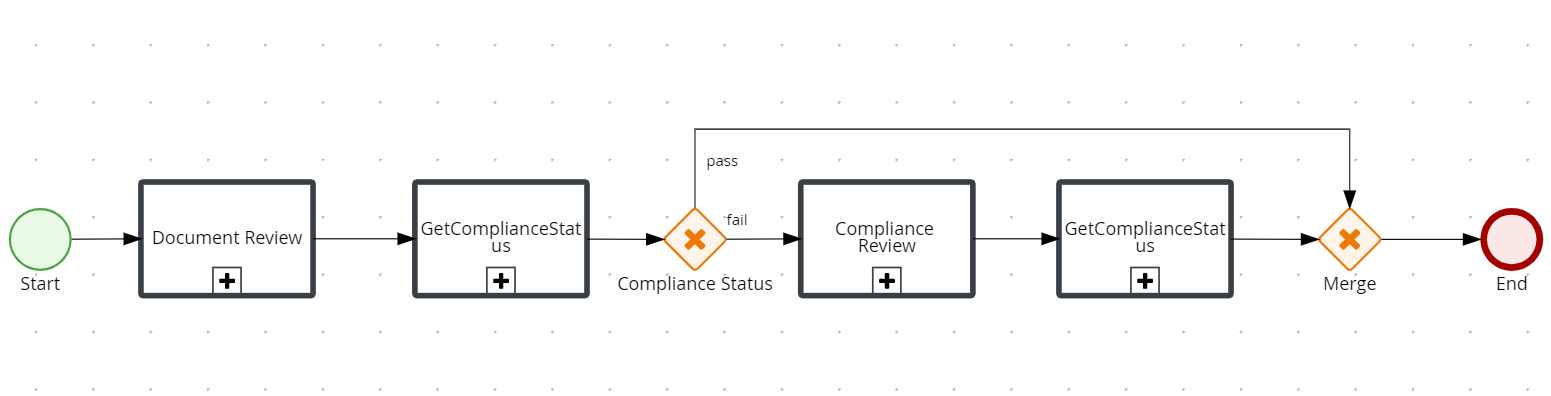

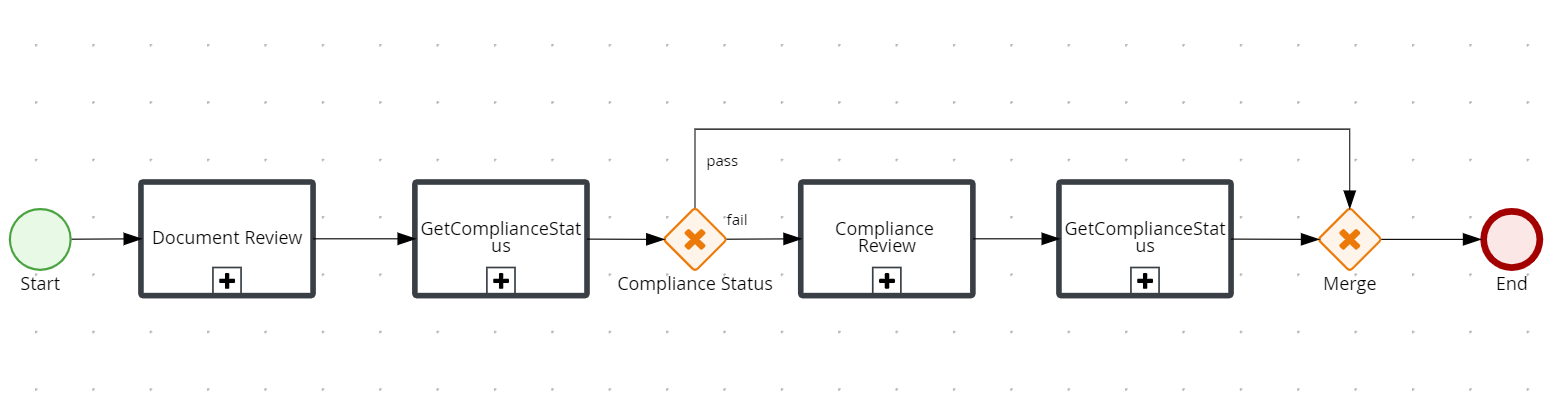

- Review Compliance Check (Existing scenario) :

- OFAC_Status and BlackList_Status are the two output flags.

- If both the flags are set to pass the Compliance Review process gets closed automatically.

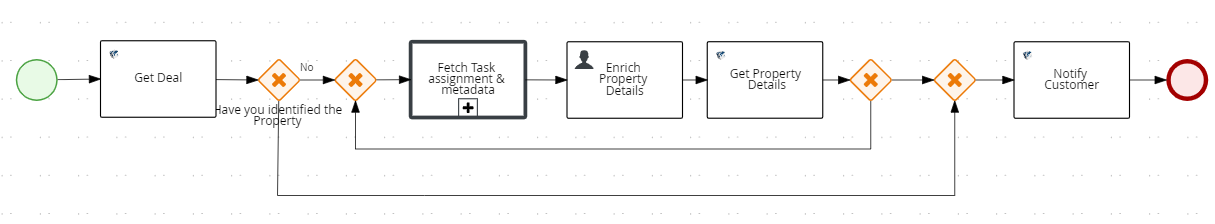

- Enrich Property Details Task:

- System checks the Flag Have you identified the Property and compliance results, if the value is yes and compliance results pass, the task gets auto closed.

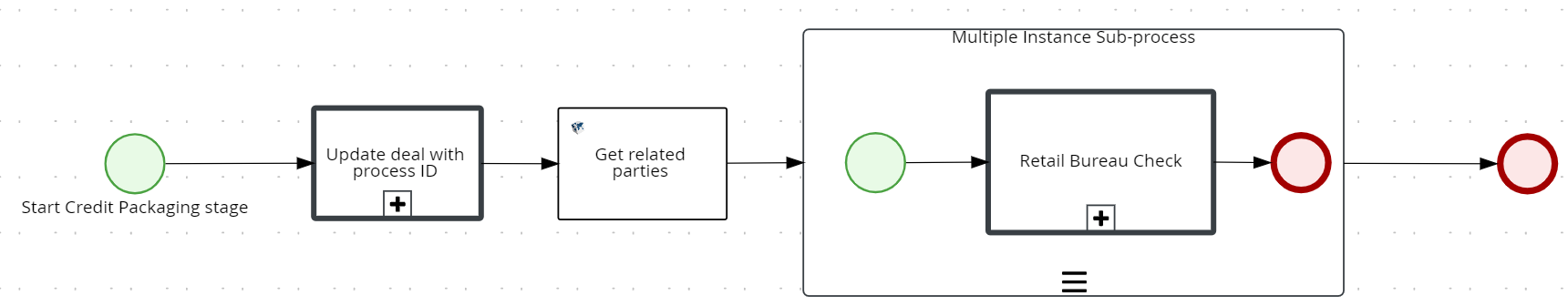

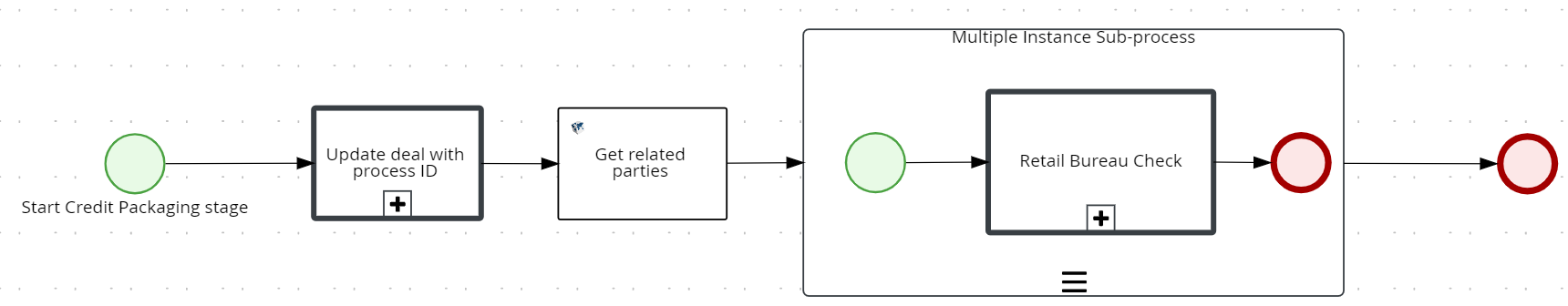

Credit Packaging Stage:

- Bureau Check:

- Review Compliance status output is passed as input.

- If all the compliance result pass or partially pass, the system continues fetching the Bureau Score.

- System checks if there is any existing Bureau report for the Applicant in CDD. If the report is not older than the expected days the existing data gets updated.

- If the report is older than the expected days,a new report needs to be fetched from an external system.

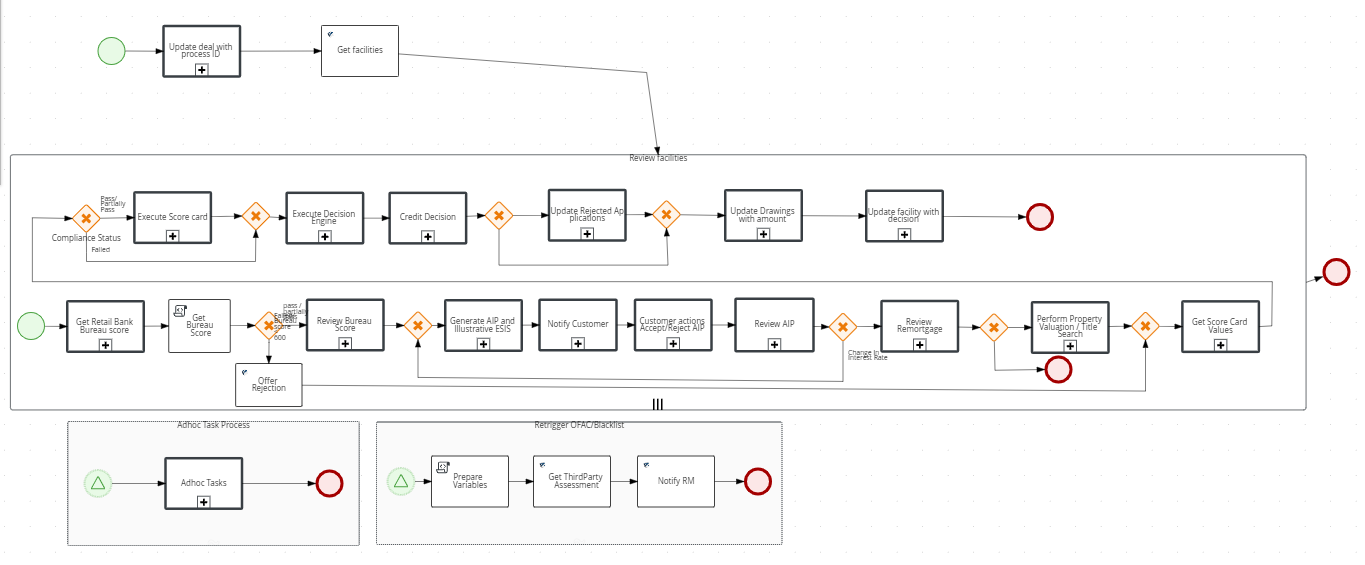

Underwriting Stage:

- Review Credit Bureau Score:

- System auto closes Review Credit Bureau Score task when the Credit Bureau score is > “700”

- The Bureau Score configuration is configurable in mock_bureau_score field in Spotlight param ASSESSMENT_MOCK_SERVICE_STATUS.

- Generate AIP and Illustrative ESIS

- System generates approval in-principal and illustrative ESIS document , when the Credit Bureau score is > “400” and the compliance is pass/partial pass.

- Customer Action for AIP:

- System initiates the customer action for the user to complete.

- Once the customer action is completed and the AIP is rejected/accepted by the customer the task gets completed.

- System initiates the customer action for the user to complete.

- Review AIP:

- The system auto closes the Review AIP task when the AIP is accepted by the customer.

- Review Re-mortgage:

- This task gets created only for remortgage application.

- The system auto closes “Review Re-mortgage Details” task if the "Existing Loan - Loan Outstanding Statement" is "Approved / Reviewed".

- Perform Property Evaluation/Title search :

- This task gets closed automatically when the "Valuation document" is "Approved / Reviewed".

- Get Score card Values:

- This is a system task which gets auto completed once the Property Evaluation task is completed.

- Execute Score card Values:

- This is a system task which gets auto completed once the Get Score card Values task is completed.

- Execute Decision Engine Rules:

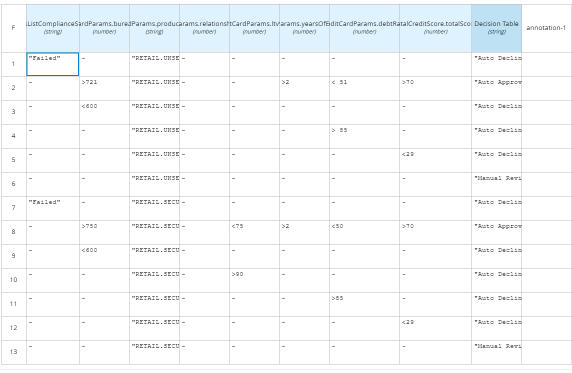

- The three possible outcomes of Decision engine are:

- Auto Approved

- Auto Denied

- Manual Review

- Auto Approved:

- If the bureauScore is greater than 721,years of employment is greater than 2 ,debt ratio is less than 51 ,total score is greater than 70 and productIdentifier is RETAIL.UNSECURED

- If bureauScore is greater than 750 ,Itv ratio is less than 75,year of employment is greater than 2 ,debt ratio is less than 50,total score is greater than 70 and productIdentifier is RETAIL.SECURED

- Auto Declined:

- If BlackLIstComplianceStatus is failed and productIdentifier is RETAIL.UNSECURED

- If bureauScore is less than 600 and productIdentifier is RETAIL.UNSECURED

- If debt ratio is greater than 85 and productIdentifier is RETAIL.UNSECURED

- If total score is less than 29 and productIdentifier is RETAIL.UNSECURED

- If BlackListComplianceStatus is failed and productIdentifier is RETAIL.SECURED

- If bureauScore is less than 600 and productIdentifier is RETAIL.SECURED

- If itv ratio is greater than 90 and productIdentifier is RETAIL.SECURED

- If debtRatio is greater than 85 and productIdentifier is RETAIL.SECURED

- If totalscore is less than 29 and productIdentifier is RETAIL.SECURED

- The three possible outcomes of Decision engine are:

- When the Decision outcome is received, the Execute Decision engine Rules task gets closed automatically.

- Review Credit Decision:

- This task gets created only when there is requirement of manual decision.

- If the outcome of Decision Engine is either “Auto Approved” or “Auto Denied”, the Review Credit Decision task gets closed automatically.

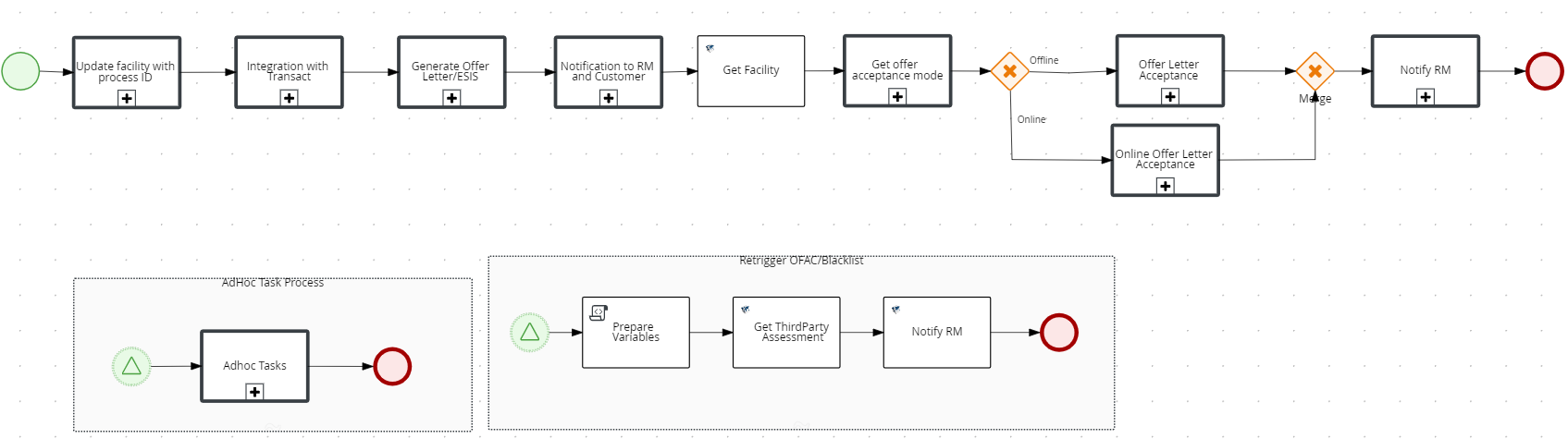

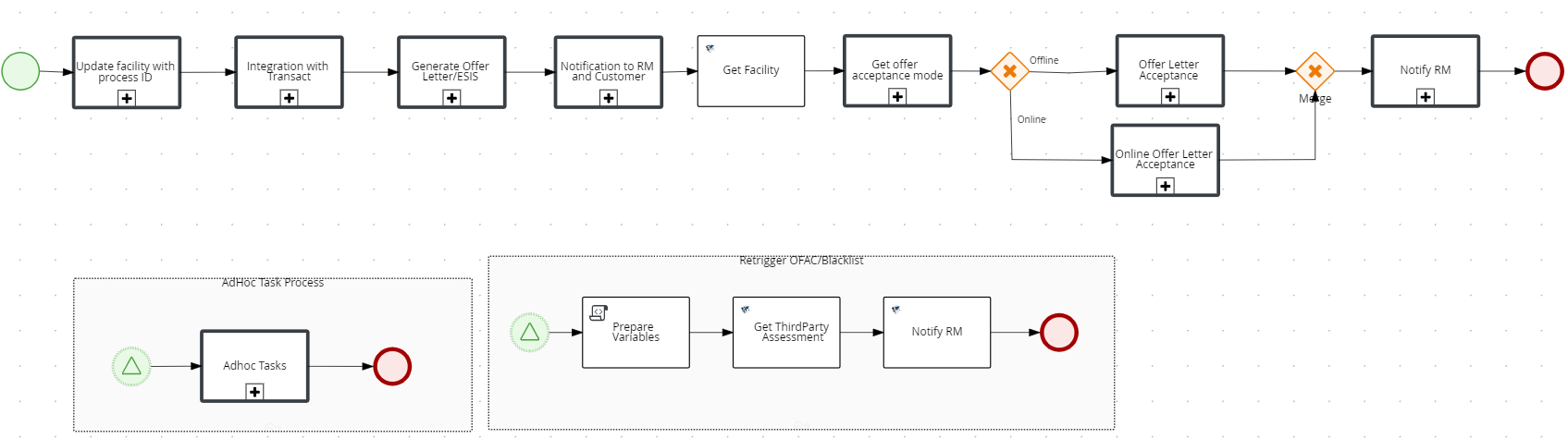

Offer Acceptance Stage:

- Generate Offer Letter/ESIS:

- If the decision marked is Approved or Auto Approved, the system sends an email notification to the customer regarding the notification of Offer Approval.Once the Offer document is successfully generated and an email is sent to the customer, this task gets closed automatically.

- Offer and Acceptance by Customer:

- Offline Mode :

- Spotlight Configuration “RETAIL_OFFER_ACCEPTANCE_MODE” is configured as offline.

- A Manual task is raised for the RM.

- The RM downloads the offer letter, gets it signed by the Customer, updates the Acceptance status and closes the task manually.

- Online Mode :

- Spotlight Configuration “RETAIL_OFFER_ACCEPTANCE_MODE” is configured as Online.

- In this mode the customer actions are raised for customer's consent regarding the Offer, when accepted by the customer the Disbursement and Repayment account instructions,customer actions are raised.

- Offline Mode :

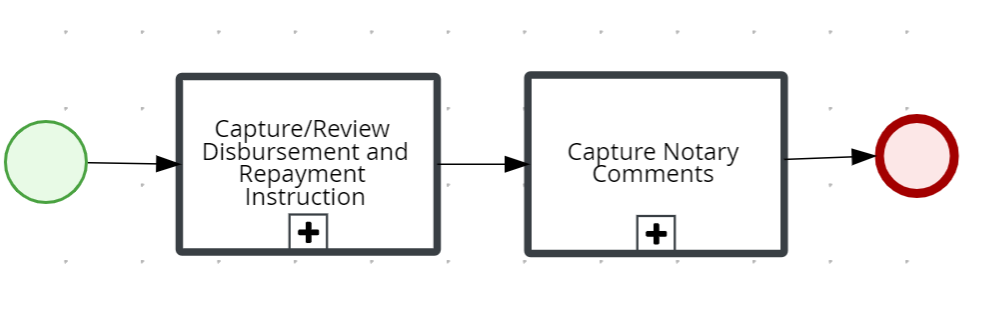

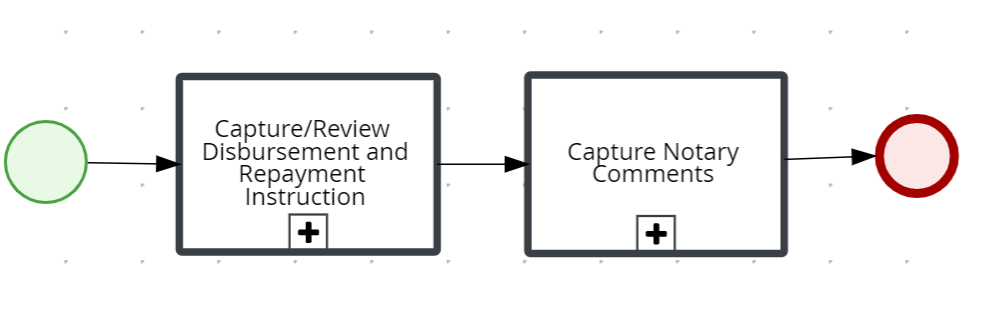

Due Diligence Stage:

- Review Disbursement/Repayment Instructions:

- System auto closes the task if the funding instructions are updated as approved and the Acceptance status is approved.

- Capture Notary comments :

- Manual task to capture Notary comments is created when the Acceptance status is “Approved”

- Manual task to capture Notary comments is created when the Acceptance status is “Approved”

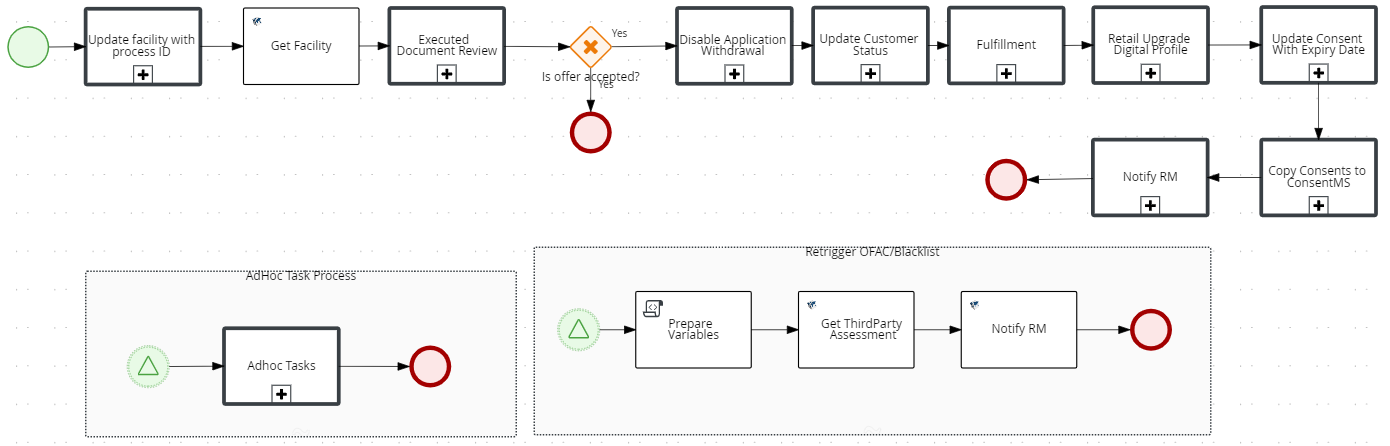

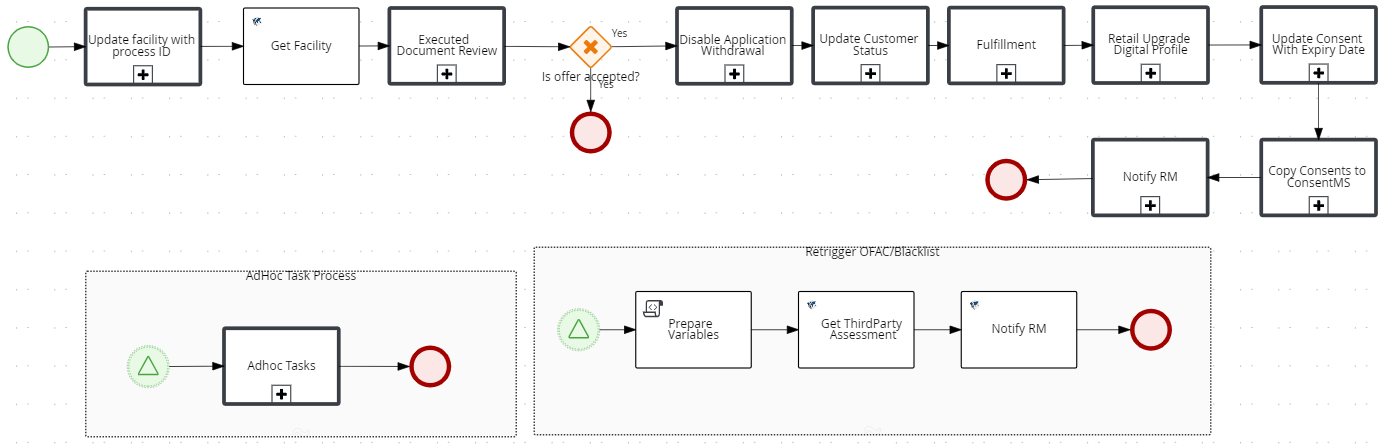

Closing Stage:

- Review Executed documents:

- The system auto closes the Review Executed Documents task when the status of the offer document is approved and the Acceptance status is approved.

- Fulfilment (Customer, Account, Collateral) creation in transact:

- The system triggers the fulfilment tasks automatically when the Funding Instructions task gets completed.

- Once the fulfilment is complete and the loan account is created and disbursed, the System automatically marks the task as complete.

- Loan Completion Notify Customer/RM:

- This is to notify the RM of the completion of the application workflow.

- If the fulfilment task is successfully completed by creating a loan account the system closes the Loan application. The Loan completion task gets closed automatically.

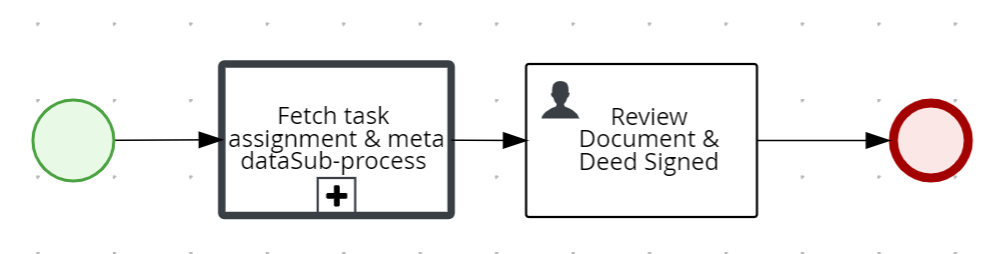

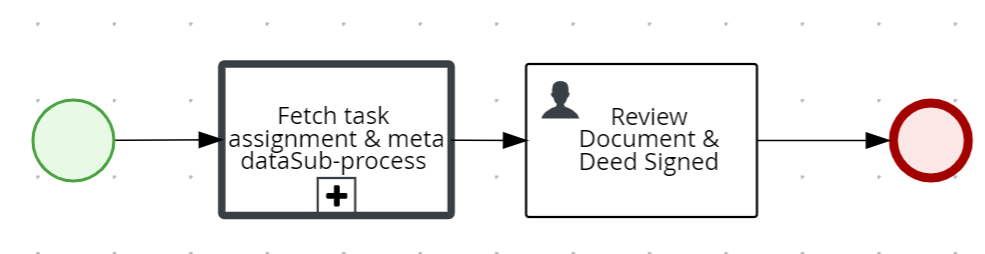

Follow-up Stage:

- Review Signed Deed:

- The system creates Review Signed deed task when the loan processing is complete.

- This is a manual task addressed by OPS user.

Problem Loan Management:

- Automated Lending Process Check:

- The party details and ODMS details are retrieved and compared. A flag is set if there is any data change in the KYC details(Personal, Address and Identity), Income and Employment details and also Documents(Proof of Address, Proof of Identity, Proof of Income, Supporting financial documents) to be in Approved Status.

- The document discrepancy check verifies if any of the Proof of Address, Proof of Identity, Proof of Income, Supporting financial documents have any documents in “Pending” status. If any document is in pending status the “documentDiscrepancy” is set as true else false.

- The “Have you Identified the Property” check is implemented as Automated Lending process task sub process in PAM after the data discrepency check. If “Have you Identified the Property” property for the application is No the discrepancy is true and the application moves to Problem Loan Management.

- Move Application to User/Queue:

- The flag set in the process “Automated Lending Process task” is input.

- If flag is true or if it is a new application, the application is auto assigned to the RM user or moved to the RM Queue where it is claimed by any RM user.

- Task is closed automatically.

Pre-Screening Stage:

- Review KYC - Existing Customer task :

- The output of the “Automated lending Process task” along with the existing customer data is the input of the process.

- If the dataDiscrepancyflag is true and also has change in the KYC data,this process gets initiated for the RM to review.

- The RM reviews the changed data in the Temenos Digital Assist app and has a button/option to raise Customer Action, if any personal data or document is additionally needed from the customer's end.

- The RM checks the data manually and raises an action again if required.

- The RM closes the task manually.

- Review KYC - Prospect task:

- When applicants are prospects, the “Review KYC - Prospect” process is initiated.

- The RM has a button/option to raise customer action, if any additional data or document is required from the customer's end.

- The RM checks the data manually and raise an action again if needed.

- The RM closes the task manually.

- Prescreening Review:

- Review Documents:

- If any one of the incomeEmploymentInfoDiscrepancy flag is true and Proof of Income documents are not in approved status then the Review Documents task is created and assigned to RM user.

- OFAC Check(Existing scenario):

- The system checks for the OFAC report. If the OFAC report status is not available or has expired in the Party MS, the OFAC check is handled in the Automated Lending Process.

- Third party service is being mocked by ofac_mock_flag flag in spotlight config param ASSESSMENT_MOCK_SERVICE_STATUS.

- If it is false an exception is raised.

- The Error task is automatically generated and assigned to admin user.

- BlackList Check:

- The System checks for the blacklist check report. If the OFAC report status is not available or expired in the Party MS, the OFAC check is handled in Automated Lending Process.

- Third party service is being mocked by blacklist_mock_flag flag in spotlight config param ASSESSMENT_MOCK_SERVICE_STATUS .

- If it is false, an exception is raised.

- The Error task is automatically generated and assigned to the admin user.

- Review Compliance Check:

- OFAC_Status and BlackList_Status are the two output flags.

- Validating the OFAC/BlackList status is handled as in the Automated Lending Process.

- If either of the two flags or both of them are failed, then “Compliance Review” process is initiated and assigned to RM

- On click of “Create New Task” button in Temenos Digital Assist app, “ReTrigger Tasks” is can be selected in dropdown of checklist

- “Retrigger Tasks” is present under CheckList.

- When selected Blacklist check, a task similar to adhoc task is created.

- Blacklist check is again achieved by the above integration service

- Notification is sent to RM that rerun task is completed

- The RM can open the existing Review compliance task and check the status in the task overview screen.

- Task Overview screen is updated with compliance status for each party(existing scenario)

- Similar flow is followed for OFAC check also.

- Task is marked as complete by the RM manually.

- Enrich Property Details Task:

- If the value of "Have you identified the Property" is false and the compliance results fail, the task is raised and assigned to the RM user to capture the property details.

- If the value of "Have you identified the Property" is false and the compliance results fail, the task is raised and assigned to the RM user to capture the property details.

- Review Documents:

Credit Packaging Stage:

- Bureau Check:

- Review Compliance status output pass as input.

- If the status of all applicants is FAIL then,

- Process is closed automatically.

- If the status of all applicants is PASS/partially PASS, then

- Report is fetched from CDD.

- If report is not available then,

- Third party service is being mocked by bureau_mock_flag flag in spotlight config param ASSESSMENT_MOCK_SERVICE_STATUS.

- If it is false an exception is raised.

- Error task is automatically generated and assigned to admin user.

Underwriting Stage:

- Review Credit Bureau Score:

- The system creates Review Credit Bureau Score task when the Credit Bureau score is between 700 and 400.

- Review bureau score task is auto closed if the score is below 400 or if all the compliance results failed.

- The Bureau Score configuration is configurable in mock_bureau_score field in Spotlight param ASSESSMENT_MOCK_SERVICE_STATUS.

- Generate AIP and Illustrative ESIS:

- If the Credit Bureau score is < “400” or if all the compliance results fail,the AIP gets rejected automatically and the task gets auto closed.

- Review AIP:

- This task is created when the AIP gets rejected or the customer action is waived by the RM or validity of the AIP has expired.

- When closing the Review AIP task if the Acceptance Status is AIP rejected, the workflow does not process further and the RM withdraws the application.

- Review Re-mortgage:

- This task is created only for remortgage application.

- The system creates “Review Re-mortgage Details” task if the “Existing Loan - Loan Outstanding Statement” is NOT Approved/Reviewed.

- Perform Property Evaluation/Title search :

- If the collateral document is not approved/reviewed the task gets created.

- Get Score card Values:

- This is a system task that gets auto completed once the Property Evaluation task is completed.

- Execute Score card Values:

- This is a system task that gets auto completed once the Get Score card Values task is completed.

- This is a system task that gets auto completed once the Get Score card Values task is completed.

- Execute Decision Engine Rules:

- The three possible outcomes of Decision engine are

- Auto Approved

- Auto Denied

- Manual Review

- Decision Status for the Facility must be updated with the final decision if it is “Auto Approved” or “Auto Denied”.

- The three possible outcomes of Decision engine are

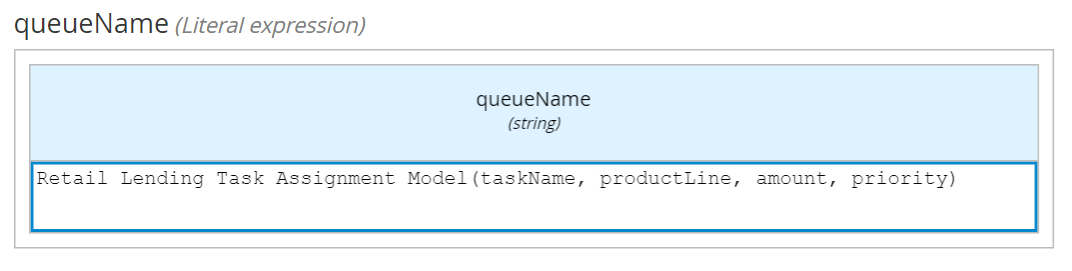

- Review Credit Decision :

- “Decision Engine” process response is input.

- If response is “Manual Review”, then this process is initiated.

- Review task is raised to UnderWriter to provide the decision for facility.

- Task Name,priority, productLine and amount are the deciding factor for assigning it to a queue.

- When Decision status is “Denied”,

- Decision status is marked as “Rejected”.

- Task is manually closed by the Under Writer.

Offer Acceptance Stage:

- Generate Offer Letter/ESIS Document (Existing scenario) :

- “Decision Engine” process response is input.

- If response is “Auto Denied”, then the task is closed.

- Notification to RM:

- “Decision Engine” process response is input.

- If response is “Auto Denied”, then email is sent to RM.

- Email Template “FACILITY_DENIED”, is used to send notification to RM.

- Offer and Acceptance by Customer:

- Offline Mode :

- Spotlight Configuration “RETAIL_OFFER_ACCEPTANCE_MODE” is configured as offline.

- Manual task is raised for RM.

- RM will download the offer letter , get it signed by Customer, update the Acceptance status and close task manually.

- Offline Mode :

Due Diligence Stage:

- Review Disbursement/Repayment Instructions:

- System will create this task if Acceptance status is “Approved” and status of funding instructions is not Approved.

- Capture Notary comments :

- Manual task to capture Notary comments is created when Acceptance status is “Approved”.

- Manual task to capture Notary comments is created when Acceptance status is “Approved”.

Closing Stage:

- Review Executed documents :

- If the offer is accepted by the customer and if the status of the offer document is not Approved manual task is raised for OPS User.

- Once the review is done OPS user will close the task manually.

- If the customer has rejected the offer then OPS user will withdraw the application and close the task.

- Fulfilment (Customer, Account, Collateral) creation in transact:

- System will trigger the fulfilment tasks automatically when Funding Instructions task is completed.

- Once the fulfilment is complete and the loan account is created and Disbursed.

- Loan Completion Notify Customer/RM:

- This is to notify the RM of the completion of the application workflow.

- If the fulfilment task is successfully completed by creating a loan account. System will close the Loan application. Loan completion task will be automatically closed.

Follow-up Stage:

- Review Signed Deed :

- System will create Review Signed deed task when the loan processing is complete

- This is a manual task which will be addressed by OPS user.

Please refer to the link for information regarding Overview navigation and stages for Mortgage Lending Tasks.

The following features are applicable to all user roles in the solution who are assigned a task to work on.

In this topic