SME Lending Journey

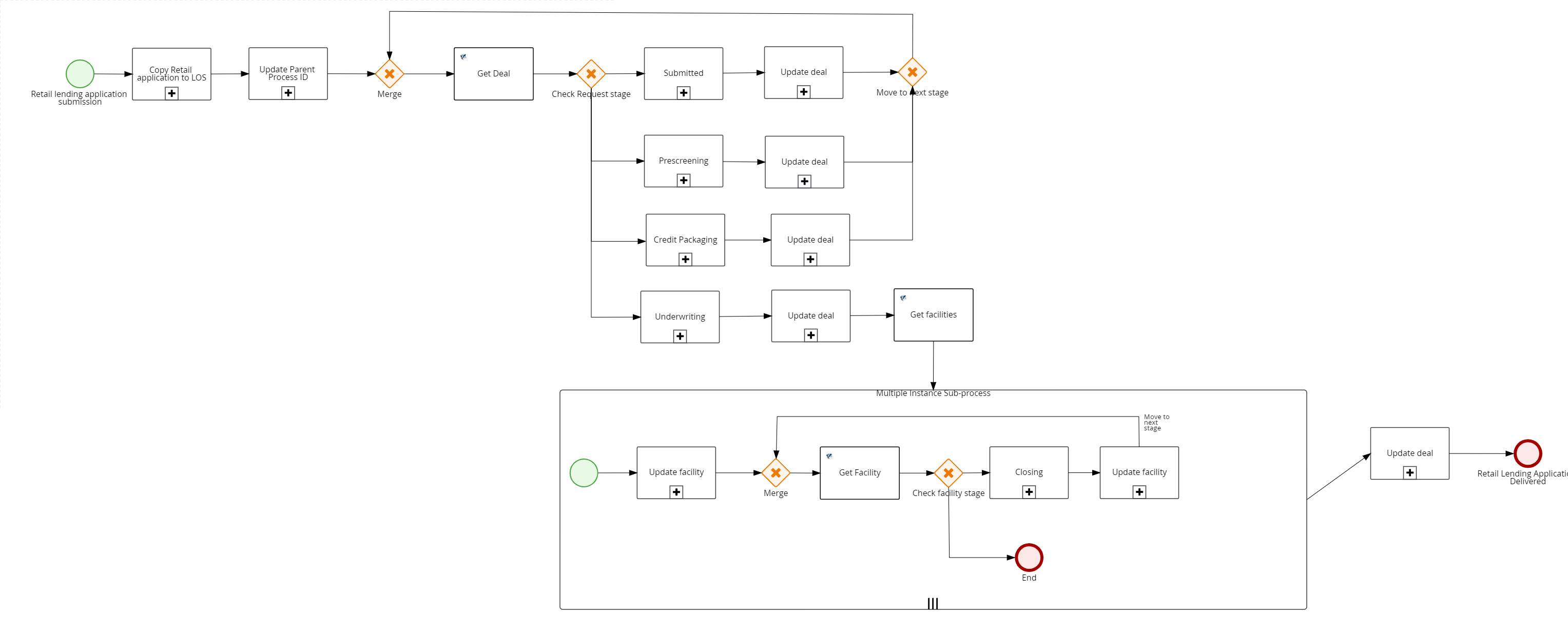

Loan origination is the process by which a borrower applies for a new loan through a request or application form and a lender processes the application. The lending journey generally comprises various stages from submitting a loan application up to disbursal of funds where the request is treated as completed. But there can be exceptions where journeys can complete after going through only a few stages.

Journey Overview

After an application requesting for a SME lending product such as overdraft or business loan is submitted by the applicant or a CSR using the Temenos Digital Origination (Self Service) application, the submitted request is received in the Temenos Digital Assist solution and processed by the bank users. The data which was originally captured in Origination Data Storage microservice (ODMS) is transferred to Origination Processing microservice after the request is submitted in the Temenos Digital Origination application. The Origination Processing MS is enhanced to classify data based on lending journeys using Line of Business attribute. Since the requests will be processed in various stages, the initial stage of the request received in the Assist solution will be Submitted. Every stage has preconfigured (auto) and manual tasks where the bank user with specific user role and necessary permissions is expected to complete the tasks before the request can be sent to the next stage.

The SME lending request goes through the following lending stages:

- Submitted: After a lending request for overdraft or term loan is submitted, the request is received in the Temenos Digital Assist solution and assigned the Submitted stage.

- Prescreening: The lender screens the customer to determine whether to extend an offer of credit.

- Credit Packaging: The lender calculates the credit worthiness of a business or organization involving financial analysis techniques and a detailed analysis of cash flows.

- Underwriting: Request application is approved or denied.

- Closing: The executed items are reviewed and the request application is boarded to the servicing system for servicing.

The SME lending journey stages and tasks are created and managed in

- Auto tasks: System evaluated tasks. In case of auto tasks, the evaluates the task criteria and when all the conditions are met, marks the task as completed. These tasks are executed at the back-end and are not visible to the user. In case the evaluation criteria is not met, the auto tasks are failed and come to remedy user for taking action.

- The manual tasks are created in PAM but since no data evaluation points are there, these tasks are completed by the bank user always.

After a task is completed, the Process Automation Manager (PAM) processes the data at the back end and makes sure that all the tasks in a specific stage are processed for completion before moving the request to the next stage. For information on the Red Hat PAM flows for the lending applications, click here.

The request is received initially by the Relationship Manager (RM) of a financial institution or bank and further processed by the RM and other bank users (Underwriter, Operations, Supervisor) by completing the tasks assigned to them.

Journey Stages and Tasks

This section explains the lending journey categorized into Automated Retail Lending Process and Problem Loan Management (manual process) depending on the type of the applicant.

- Automated Lending Process is enabled for the applications whose applicants are existing customers, provided there is no change in customer data.

- Problem Loan Management Process is enabled for the applications whose applicants are prospects and existing customers with change in customer data.

After the request is received in the Assist solution, the PAM server sends out the auto tasks that are to be performed in each of the stages. The bank users are expected to complete all the assigned tasks before sending the request to the next stage until the request is fulfilled. Each stage has a set of tasks (auto and manual) that are to be completed before the request application is moved to the next stage. For the complete list of tasks created per stage, refer to the enclosed document (compressed file in .zip format).

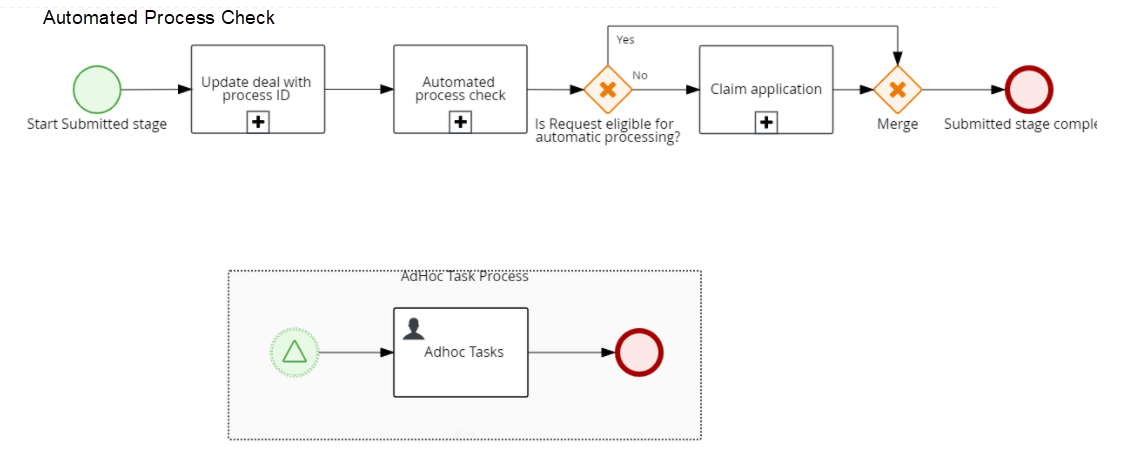

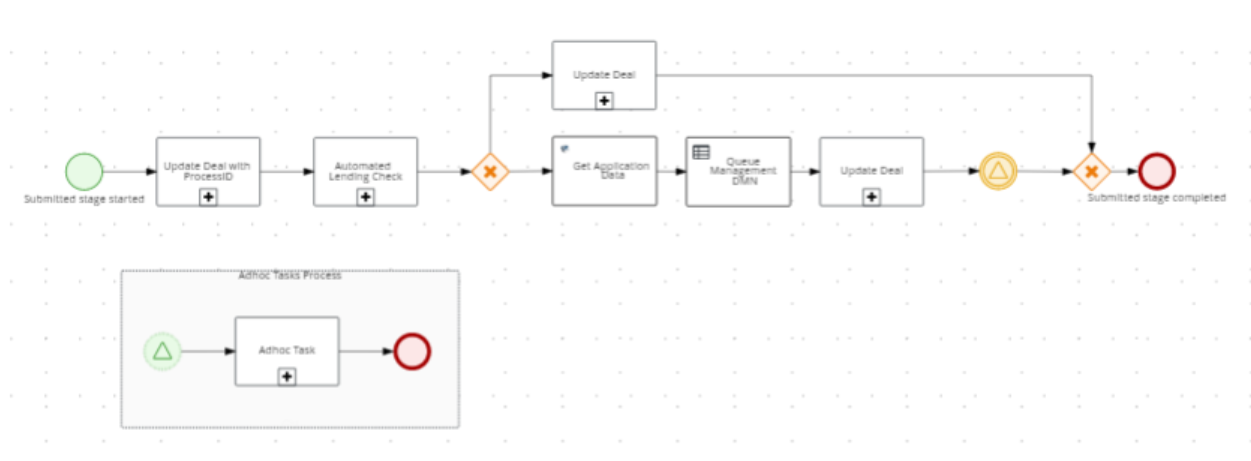

Automated Lending Process

Automated Process is enabled for the applications whose applicants are existing customers provided there is no change in customer data.

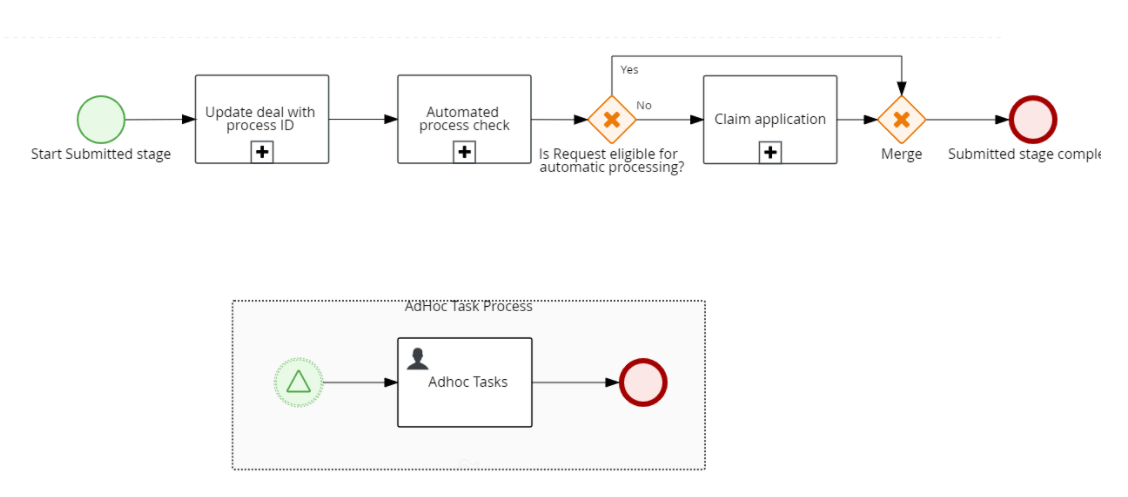

After the request application is submitted Temenos Digital Origination (Self Service) application, the system goes through the workflow as shown in the diagram to automate the lending process.

Submitted

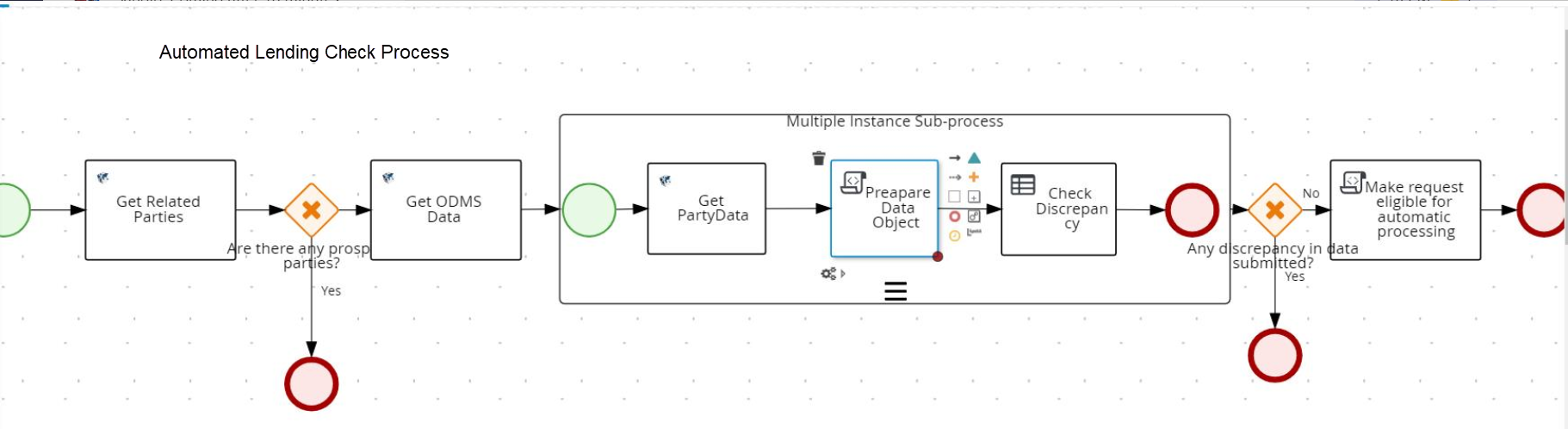

After the request application is submitted, a service task process is called to first check if the applicant is an existing customer and then if there is any data discrepancy in company Information, registration information, company address, related parties personal details, related parties identity details, and related parties home address. The data is compared between party record of Party MS and customer details present in ODMS. If there is no data discrepancy, the automated lending flow is followed. The application is assigned to Supervisor RM and the system processes the next task. Otherwise, if there is any discrepancy in data, then the problem loan management flow kicks in.

After the rule in Automated Lending Process check task is satisfied, the Application Claim task is automatically closed.

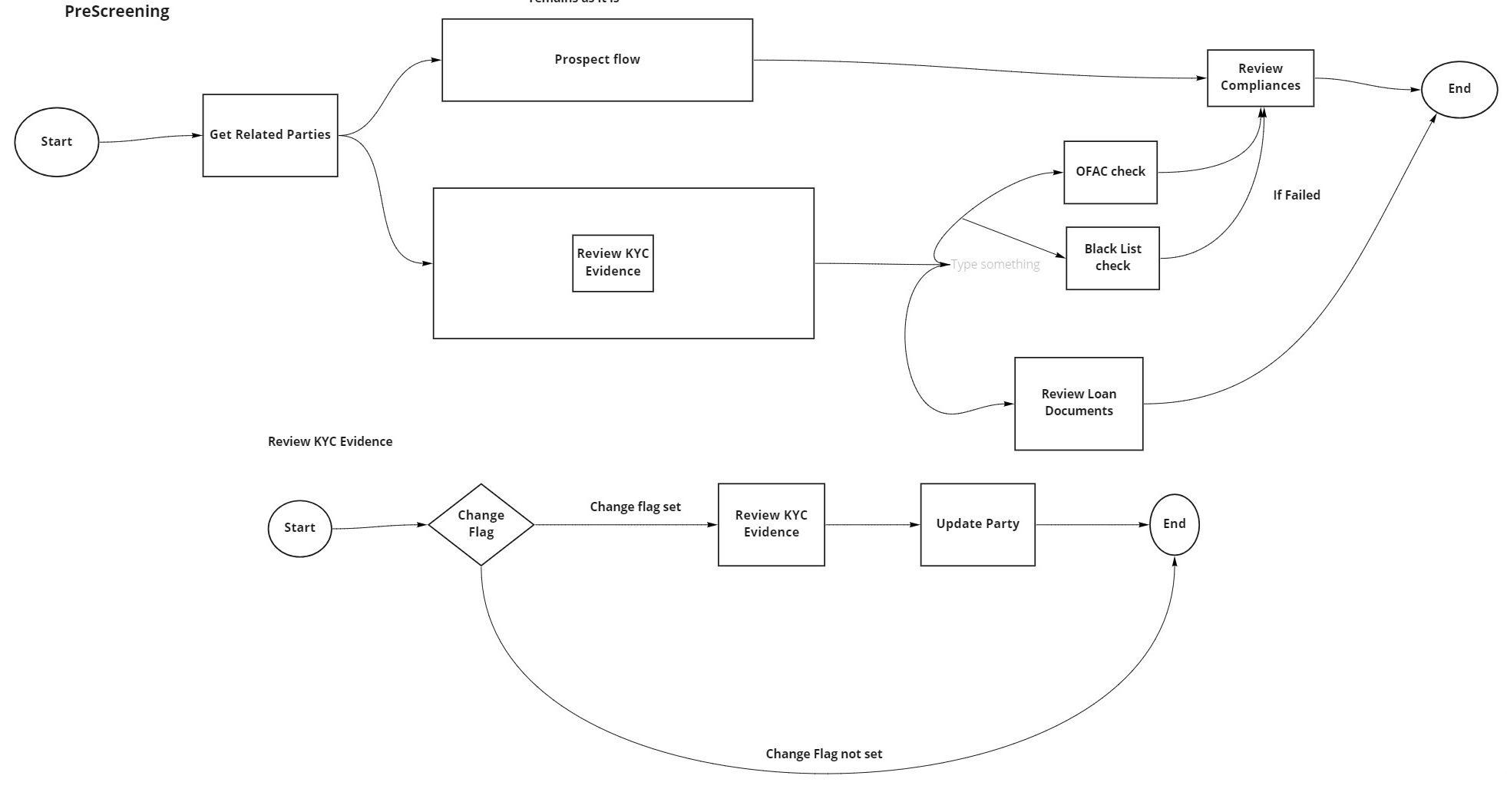

Prescreening

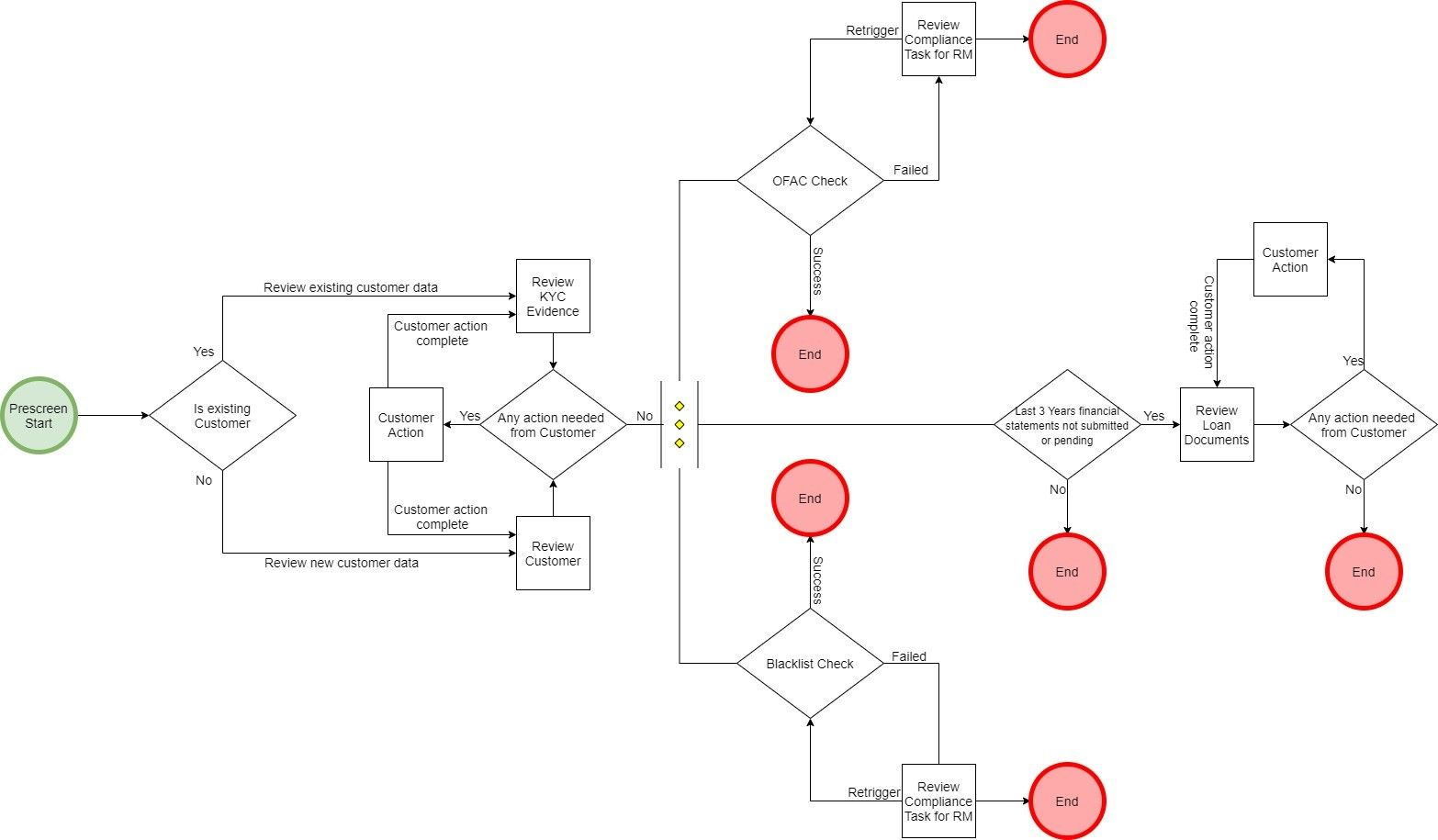

An applicant review task is created for each prospect. All mandatory information required to create a party is reviewed and edited by a Relationship Manager (RM) and then a customer ID is created in Party microservice and Temenos Transact. If the applicant is an existing customer, the evidence review and compliance review tasks are created. The customer data is updated in Party microservice and Temenos Transact.

Review KYC Information

For existing customers, data discrepancy is checked. If the automated lending process is set, then the evidence review is automatically closed.

Review Loan Document

If the annual financial statements of Last three years are in Verified state, then this task is automatically closed.

OFAC Check

The system checks if there is an existing OFAC report for the applicant and related parties in Party MS. For the existing party ID, party assessments are fetched for OFAC if available. The system checks the conclusion date available in the party assessment data and today date with the Spotlight runtime config, SME_OFAC_CHECK_REPORT_WITHIN_DAYS, the difference can be within the number of days configured. If the report is older than the expected date (configured date in Spotlight), then the report is fetched from the external or third-party system which will be mocked by the runtime configuration parameter, SME_OFAC_THIRD_PARTY, and the same data is updated in the Party MS. On the contrary, If the report is within the expected date (configured date), then the report data is updated in the Compliance section of the Assist application.

Once the results are received, this task is automatically updated with the results and closed.

Blacklist Check

The system checks if there is any existing black list report for the applicant and related parties in Party MS. For the existing partyID, the party assessments for blacklist is fetched if available. The system checks the conclusion date available in the party assessment data and today date with the Spotlight runtime config, SME_BLACKLIST_CHECK_REPORT_WITHIN_DAYS, the difference can be within the number of days configured. If the report is older than the expected date (configured date in Spotlight), then the report is fetched from the external or third-party system and updated in the Party MS. If the report is within the expected date (configured date), then the report data is updated in the Compliance section of the Assist application.

Once the results are received, this task is automatically updated with the results and closed.

Review Compliance

If the status of OFAC and Blacklist check is Pass, then the review compliance task is automatically closed.

The following checks are performed in parallel:

- Review Loan Document

- OFAC

- Blacklist

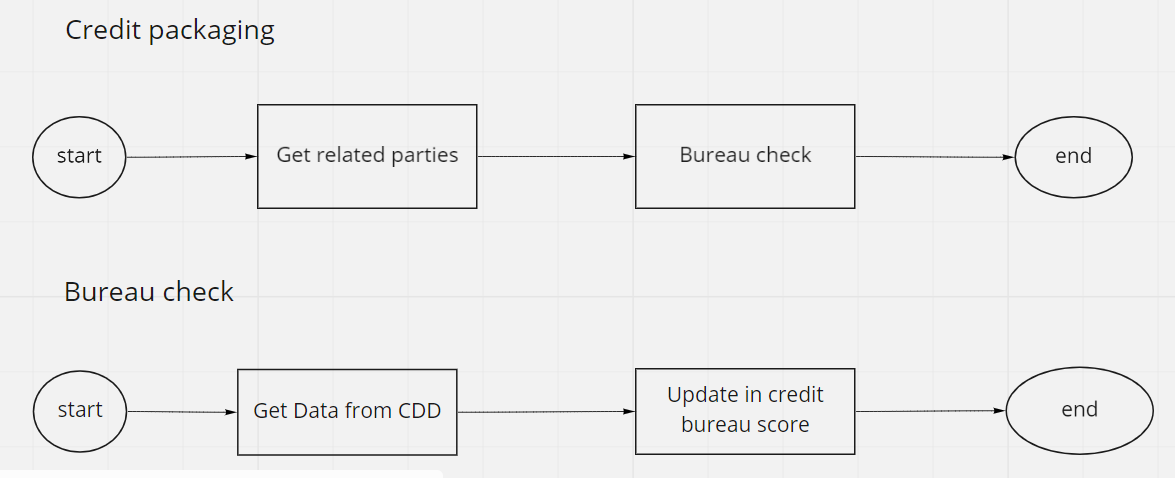

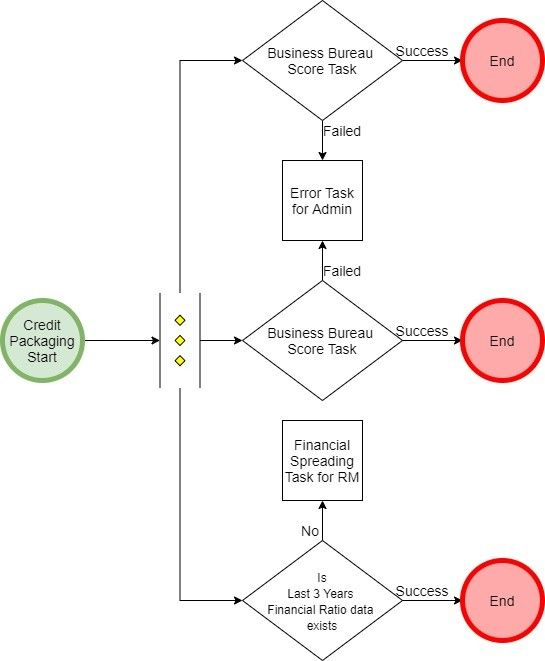

Credit Packaging

Bureau Check

After the loan documents review and compliance review tasks are complete, bureau check task is initiated.

If all the compliance results are Pass or if the results are Partially Pass, the system continues fetching the Bureau Score. Also, the system checks if there is any existing bureau report for the applicant in Due Diligence MS for the existing party and the validity of the report is checked based on the runtime configuration, SME_BUREAU_CHECK. If the report is older than the validity time, the new report is fetched from the external system. If the report is within the configured days, the task is updated with existing data. Otherwise, if the report is within the configured days, the task is updated with existing data. The reports received from third-party services are stored in Due Diligence MS.

A customer can have credit scores from different providers which are stored in Due Diligence MS. The system can query the credit score based on the providers. The providers whose credit score must be fetched from Due Diligence MS can be configured from Spotlight.

The Entity Overview displays the history of credit score and the Request Overview displays the current credit score.

Financial Spreading

Financial Spreading task is created in parallel with business bureau and business score task. The system checks the Financial Ratios Results under Entity Overview section. If the financial ratios data for the last three years is already present, then it is auto-completed.

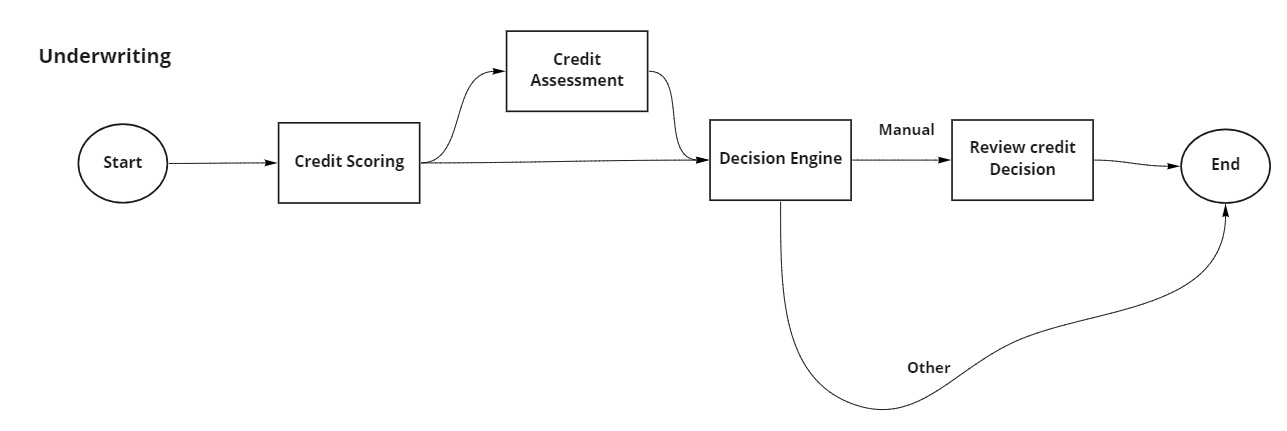

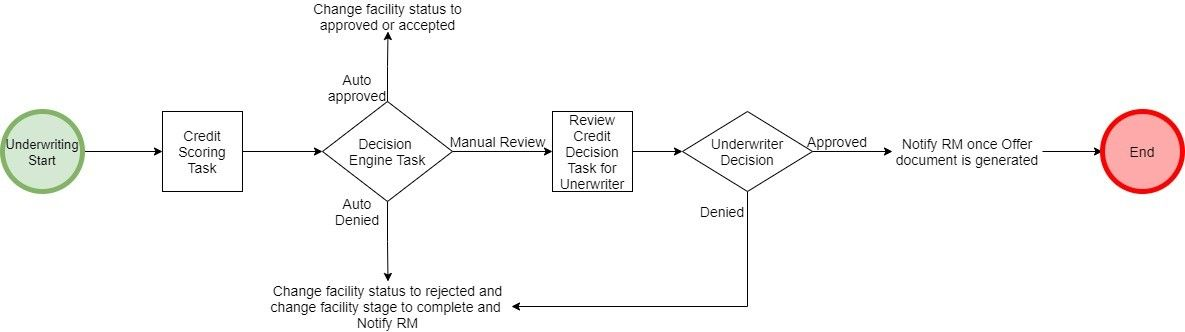

Underwriting

Credit Scoring

If all the compliance results are Pass or Partially Pass, then the system continues executing the Credit Scoring task. When the scoring is complete, the system updates the results and closes the task automatically.

The Entity Overview displays the history of credit score and the Request Overview displays the current credit score.

Credit Assessment

After the credit scoring task is completed, the credit assessment task is triggered automatically and after the risk assessment is completed, the credit assessment task is automatically closed. The system first checks the results of compliance results. Only if the results of all the compliance for all the applicants are “Pass”, the system continues executing the credit assessment task. After the credit assessment is done, this task is automatically closed.

Decision Engine

After the credit scoring task is completed, the decision engine task is triggered automatically. Based on the decision outcome received, the decision engine task can be automatically closed. The decision can be either be Auto Approved, Auto Denied, or Manual Review.

Decision status for the Facility is updated with the final decision if it is Auto Approve or Auto Denied.

Review Credit Decision

The review credit decision task is created only when there is a requirement of manual decision. If the outcome of Decision Engine is either Auto Approved or Auto Denied, the review credit decision task is automatically closed.

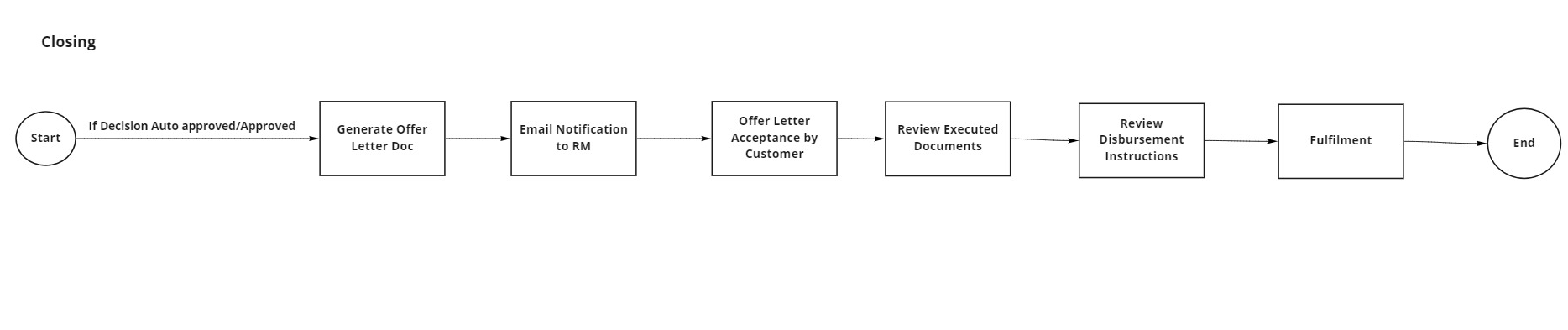

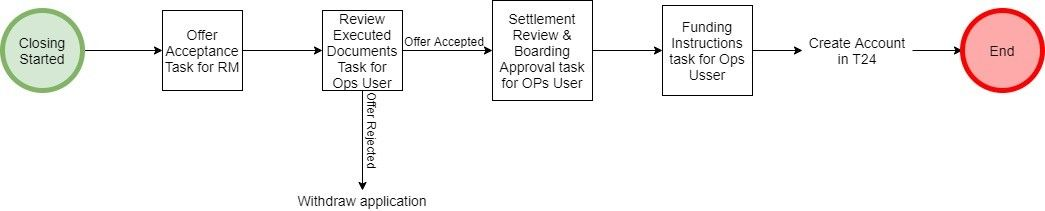

Closing

Generate Offer Document

If the decision is marked as Approved or Auto-Approved, the offer letter document is generated. The generated offer letter is updated under the Documents section in Facility Overview.

Notification to RM: An email notification is sent to the RM after the offer letter document is generated. This task is closed automatically after the email is sent successfully.

Offer and Acceptance by Customer

There are two ways of offer acceptance to the customer - Offline and Online.

The applicable offer acceptance method can be configured by using the Spotlight configuration: SME_OFFER_ACCEPTANCE_MODE. The default value is Online. The value can set to Offline or Online.

- Offline: An offer acceptance task is raised and assigned to the RM to handle the offer acceptance process offline.

- Online: A customer action is raised to upload the signed document. If the customer accepts the customer action, another customer action to fetch the disbursement details from the customer is raised. After the customer action is completed, the RM manually closes the offer acceptance task. After the offer acceptance task is closed, the disbursement details are updated and the status of disbursement is Approved.

Review Executed Document

After the offer acceptance task is closed by the customer, a review executed document task is created and is assigned to Ops User. After the document is reviewed by Ops User, the task is manually closed.

Review Disbursement Instructions

After the review documents task is completed, the system checks if the status of the disbursement instructions is Approved. If yes, the system automatically closes the disbursement instructions task.

Trigger Fulfillment

Fulfillment is automatically triggered once the disbursement instructions are reviewed. After the fulfillment is complete and the loan account is created, the system automatically marks the task as Completed.

Loan Completion

After the fulfillment task is completed and the loan account is created, the application is marked as Completed and this task is automatically closed.

Problem Loan Management Process

Problem Loan Management Process is enabled for the applications whose applicants are prospects and existing customers with change in customer data.

Submitted

After the application is submitted, a service task process is called to first check if the applicant is an existing customer and then if there is any data discrepancy in company Information, registration information, company address, related parties personal details, related parties identity details, and related parties home address. The data is compared between party record of Party MS and customer details present in ODMS. If there is data discrepancy, the problem loan management is followed. In either case (data change or no change), an application claim task is created and assigned to the Relationship Manager (RM). This task appears on the dashboard in team tasks (queued for RM to claim) when RM signs into Assist application. After the task is claimed by the RM, the task is closed automatically and moves the application stage to Prescreening where customer details are verified manually.

Prescreening

The following customer details are verified in Prescreening stage after the RM claims the application in Submitted stage.

Review KYC Evidence

If the customer is an existing customer and if it is found that there is a change in customer details (based on the dataDiscrepancy flag from Automated Lending Check Process) between ODMS and Party MS of that party, then Review KYC Evidence task is created and assigned to the RM. As part of this task, RM will verify customer details manually and update them, if any, in Assist app. If there is any action needed from customer to complete KYC verification, then RM has an option to raise customer action. The RM is notified after customer action is complete and is reviewed again and the cycle continues until all the customer details are verified properly and there is no further action needed from the customer. After the details are verified and updated from Assist app, Review KYC Evidence task is closed manually by the RM.

Review Customer

If customer is a prospect, then Review Customer task is created and assigned to the RM. As part of this task, the RM verifies customer details manually and update them, if any, in Assist app. If there is any action needed from customer to complete KYC verification, then RM should has an option to raise customer action. The RM is notified after customer action is complete and is reviewed again and the cycle continues until all the customer details are verified properly and there is no further action needed from the customer. After the details are verified and updated from Assist app, Review Customer task is closed manually by the RM.

OFAC Check

The system checks for the OFAC report. If the OFAC report status is not available or expired in the Party MS, then the OFAC check is handled as in Automated Lending Process. In case of any error, an error task is raised automatically and assigned to the admin user. The admin user can re-trigger OFAC check.

The OFAC check can be run again by an RM in the adhoc tasks section of the Assist application. The RM has the option to choose for which entity the task is to be run again. A drop-down list "Applies to” field lists the entities related to the request and this field is placed adjacent to the Checklist field. The Checklist field is editable and has an additional "Re-trigger tasks" value in the drop-down list.

Blacklist Check

The system checks for the Blacklist Check report. If the OFAC report status is not available or expired in the Party MS, then the check is handled as in Automated Lending Process. In case of any error, an error task is raised automatically and assigned to the admin user. The admin user can re-trigger Blacklist check.

The Blacklist check can be run again by an RM in the adhoc tasks section of the Assist application. The RM has the option to choose for which entity the task is to be run again. A drop-down list "Applies to” field lists the entities related to the request and this field is placed adjacent to the Checklist field. The Checklist field is editable and has an additional "Re-trigger tasks" value in the drop-down list.

Review Compliance

Validating the OFAC and Blacklist status is handled as in the Automated Lending Process. OFAC_Status and BlackList_Status are the two output flags. If either of the two flags or both of them fails, then the Review Compliance task is created and assigned to the RM.

RM can re-trigger OFAC or Blacklist checks again by creating an adhoc task using the Assist application. On clicking the Create New Task button in Temenos Digital Assist application, “Re-trigger Tasks” is added in drop-down of checklist. The status of each party compliance is updated from Compliance table of Origination Processing MS. Then the OFAC check is completed using the integration service as in the automated lending process and a notification is sent to the RM. The RM can open existing Review compliance task and check the status in task overview screen. Also, the task overview screen is updated with compliance status for each party. The Admin User can re-trigger OFAC check. The RM can also raise adhoc task to Underwriter and add comments on the Narratives tab, if necessary. After the compliance review is done, the RM can manually mark the task as complete.

Review Loan Documents

Review Loan Documents task is created for the RM if last three years of financial statement is not submitted or in pending state. As part of this task, the RM has an option to raise customer action if any information or document is required from the customer. After the customer fulfills the required document or information, the RM reviews the documents again and this cycle continues until all the documents are reviewed and verified after which, the RM can close the task manually.

Credit Packaging

Business Bureau Score

If the Business Bureau Score task fails while fetching report from external systems as described in the automated lending process, then an error task is automatically generated and assigned to admin user.

If all the compliance results are Pass or if the results are Partially Pass, then the system continues fetching the Business Bureau Score. Also, the system checks if there is any existing bureau report for the applicant in Due Diligence MS for the existing party. If the report is older than the validity time, the new report is fetched from the external system. Reports received form third-party services are stored in Due Diligence MS. Otherwise, if the report is within the configured days, then the task is updated with the existing data.

If the report is not available, a third-party service is mocked by using a run time parameter flag (Bureau_ThirdParty). In case of any false exception, an error task is automatically generated and assigned to admin user.

Related Parties Business Bureau Score

If the Related Parties Business Bureau Score task fails while fetching report from external systems as described in the automated lending process, then an error task is automatically generated and assigned to admin user.

Financial Spreading

Financial Spreading task is created in parallel with business bureau and business score task and assigned to the RM if there are no financial ratios of last three years. The system checks the Financial Ratios Results under Entity Overview section. The RM can enter or update financial ratios data manually and close the task. If the financial ratios data for the last three years is already present, then it is auto-completed.

Underwriting

Credit Scoring

If all the compliance results are Pass or Partially Pass, then the system continues executing the Credit Scoring task. When the scoring is complete, the system updates the results and closes the task automatically. The Entity Overview displays the history of credit score and the Request Overview displays the current credit score.

After the Credit Scoring task is completed, the following tasks are created.

Decision Engine

After the Credit Scoring task is completed, the Decision Engine task is triggered automatically. Based on the decision outcome received, the Decision Engine task can be automatically closed. The decision can be either Auto Approved, Auto Denied, or Manual Review.

If the decision is Auto Approved, the corresponding facility is marked as accepted or approved, and moves to the Closing stage. If the decision is Auto Denied, the corresponding facility in the Assist application is marked as rejected, the facility stage is changed to Complete and the RM is noticed about the denial of facility. If the decision is Manual Review, a Review Credit Decision task is created and assigned to the Underwriter.

Review Credit Decision

The Review Credit Decision task is created and assigned to the Underwriter when the outcome of Decision Engine task is Manual Review. The Underwriter manually reviews the decision. As part of this task, the Underwriter’s decision could be either Approved or Denied. If it is Denied, the corresponding facility in the Assist application is marked as rejected, the facility stage to is moved to Complete and the RM is noticed about denial of facility. The Underwriter manually closes the task after credit decision is reviewed and provided a decision. If the decision is Approved, the facility is marked as approved and the RM is notified after the offer document is generated.

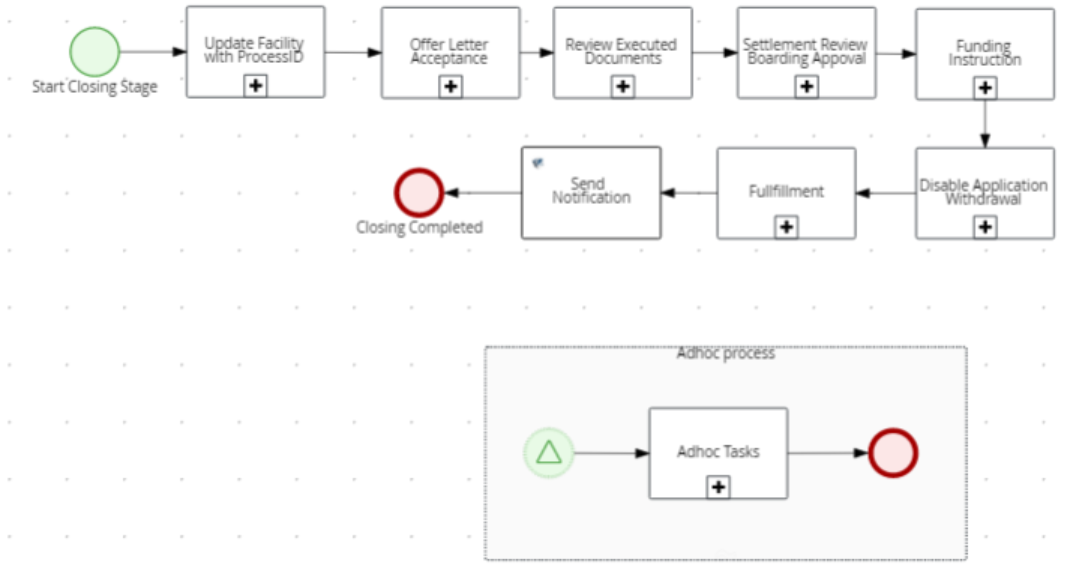

Closing

After credit decision outcome is approved, the following tasks are created as part of Closing stage.

Generate Offer Letter Document

The Decision Engine task response is the input. If the response is Auto Approved, the task moves to the Closing stage.

Notification to RM: If the response is Auto Denied, an email is sent to the RM. The email template, FACILITY_DENIED, is used to send notification to the RM.

Offer Acceptance by Customer

The mode of offer acceptance is set through Spotlight Configuration, SME_OFFER_ACCEPTANCE_MODE as offline. Therefore, an Offer Acceptance manual task is raised for the RM. The RM can download the offer document, get it signed by the customer, upload the signed document in the documents section of Assist application, and update the acceptance status. The RM closes the task manually.

Review Executed Documents

The Review Executed Documents task is created and assigned to Operations user. In this task, Operations user reviews the offer acceptance documents of the customer and can create adhoc task for the RM to get additional information of customer. After the offer acceptance documents are reviewed, the Operations user closes the task manually. In case the customer rejects offer, then Operations user withdraws the application in the Assist application and closes the task.

Settlement Review and Boarding Approval

After the offer is accepted by the customer, then Settlement Review & Boarding Approval task is created for Operations user. The Operations user can navigate to Facility Overview > Settlement screen of Assist application to ensure that all stages are Complete and in Acceptable status for boarding approval.

Funding Instructions

After Settlement Review & Boarding Approval task is completed, Funding Instruction task is created and assigned to Operations user. As part of this task, the Operations User can navigate to Facility Overview > Funding Summary screen of Assist application to create funding instructions to release funds. After funding instructions are created, the Operations user manually closes the task and this action triggers account creation in Transact (T24).

- Withdraw request/application: The RM can withdraw an application on behalf of a customer or prospect at any stage of the application until the limit or arrangement is created in Transact or Core banking System (CBS). After the application is withdrawn, no more user action is allowed, and the application is marked with Withdrawn status.

- All other functionality of tasks as it exists in the Temenos Digital Assist solution are available to all tasks created for retail lending requests.

- A user is not be allowed to act on a task when its dependent task is not completed.

- After the required activities for a task are complete, the user can complete the task with options as available and supported currently in the Assist solution.

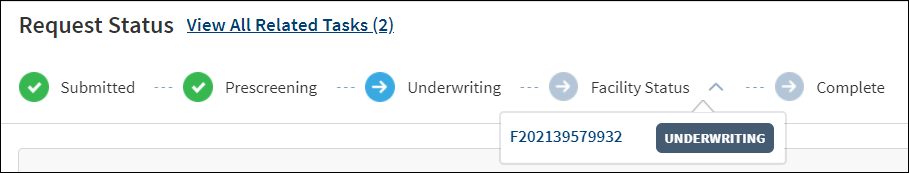

Stage Indicator

The stage indicator is displayed on top of the request and facility overview screens. A bank user can see the current stage of the request with status and view the tasks by clicking the View All Related Tasks link with the count of related tasks in parenthesis. The following color codes are used to indicate the status of tasks in the respective stages:

-

The stage is yet to be visited.

The stage is yet to be visited. -

The tasks are in progress and one or more tasks are to be completed. The application is still in the stage.

The tasks are in progress and one or more tasks are to be completed. The application is still in the stage. -

All tasks in the stage have been completed. The application is moved out of the stage.

All tasks in the stage have been completed. The application is moved out of the stage.

In this topic