Credit Score Modeling and Automated Decision Rules

This section defines the credit scoring model for various Retail and SME loan products and rules for automated decision for Retail and SME journeys, which automates the decision process. The decision logic rules are created in Red Hat Process Automation Manager (PAM).

Reference Documents

Click to download the documents.

- SME Score Card

- SME Decision Engine Rules

- Retail Unsecured Loans - Score Card and Credit Risk

- Retail Secured Loans - Score Card and Credit Risk

- Approver Matrix when the Decision Engine Output is Manual Review

Credit Score Card

Credit Score Card is a mathematical model to provide quantitative estimates of probability of borrower behavior towards repayment of loans and forms the base for lending decisions. A bank user with the necessary permissions can configure product wise score card in the Red Hat PAM- DMN and set the value of each variable and corresponding values range and score. A credit score is derived from number of parameters which are also called as variables, and score cards can be created product wise. Based on the product (Retail and SME), when a score card calculation is triggered in Red Hat PAM, the system gives the output as a score. The score card and each variable wise score are stored in Origination Processing microservice facility wise. The score can be further used in Decision Engines and Credit Risk Assessment.

- Value Range: A bank user can define value range for each variable in the score card in PAM-DMN product wise. The range can be in numerical, years, percentage, or text.

- Score: The score for value range of a variable are defined in the PAM- DMN product wise. The same value range can have varied score in different products, for example, for the Related Party Bureau variable, for 701-800 range, the score in SME Business loan is 10, whereas, the score in SME Credit card is 25.

- Variable Source Field: A bank user can define the source for each variable used in the Retail and SME score card. The source is available as a field in the Temenos Digital Assist application. Refer to the attached document for variables and their source fields - Retail variables and SME variables.

- Score Card Calculation: After all the variables defined in the product wise score card has values and triggered at specific point in Credit Packaging stage, the system calculates score for parameter and sum total of all to arrive at the total score. The total score can be between the range 0-100. If for a variable, more than one value is available for the score card, always the most latest value is considered. For Retail, the score card calculation is triggered per facility in Credit Packaging stage after Credit Bureau Check Task is completed. For SME, the score card calculation is triggered per facility in Credit Packaging stage after Financial Spreading Task is completed.

- For SME - Business Loan score card, refer to the BL tab in the attached document.

- For SME - Overdraft score card, refer to the OD tab in the attached document.

- For SME - Credit Card score card, refer to the CC tab in the attached document.

- For Retail - Unsecured Loans score card, refer to the attached document.

- For Retail - Secured Loans score card, refer to the attached document.

- For Retail Co-applicants: In case of co-applicants in an application, the following scenarios are considered for calculating the total score:

- Least score is considered for score calculation in total score.

- Cumulative DTI ratio based on the Do you want to consider this income and expenses for Loan eligibility calculation - Yes field confirmed by each applicant in Income and Employment screen in ODMS is considered for score calculation in total score.

- Only the Year of Employment/Business of main applicant is considered for score calculation in total score.

- For SME Related Party: In case of multi-related parties in an application, the following scenarios are considered:

- For Related Party Bureau: The least score of all the related party is considered.

- Years of operation and Relationship with Bank is considered for the main Company alone.

- For Blacklist Compliance status, the system checks for all parties and if any one of their status is Fail, then the system considers that.

Decision Engine

Decision Engine is a set of rules or decisions meant to automate credit decision based on a scorecard. The rules are defined product wise. These rules are configured in Red Hat PAM- DMN and are a set of AND and OR conditions. Based on the condition, the loop runs and the output is given by the Decision Engine. The rule also contains credit score card output.

- Decision Category: The following decision categories are used: Auto Approved, Auto Declined, and Manual Review. The approver field displays value as System approver for Auto Approved and Auto Declined decision categories.

- Trigger Point: Decision Engine is triggered in Underwriting stage after Execute Score Card task is completed.

- Output: When the Decision Engine (DE) rules are executed, there can be any of the following outputs:

- Auto Approval: When the rules for Auto Approval are met, the DE creates a decision with status as Auto Approved and the Approver field value is System Approver. As a part of this decision, a decision record against the facility is created on the Request Overview and Facility Overview screens. The decision cannot be edited or deleted.

- Auto Denied: When the rules for Auto Decline are met, the DE creates a decision with status as Auto Declined and the Approver field value is System Approver. As a part of this decision, a decision record against the facility is created on the Request Overview and Facility Overview screens. The decision cannot be edited or deleted.

- Manual Review: When the rules for Manual Review are met, the DE creates a decision with status as Manual Review and the Approver field displays the name of the Approver or Credit Committee. As a part of this decision, a decision record against the facility is created on the Request Overview and Facility Overview screens. After the system identifies that it requires manual review, then based on the Approver Matrix, a credit decision task for the approver is created in the Temenos Digital Assist application. The task is available on the My Tasks tab with status as Under review and on clicking the task, the approver can add a decision on the Request Overview screen, Credit > Decision section. On completion of the task, the system updates the existing decision status to what the approver has selected - Approve or Decline.

Decision Rules

Using business rules and data for making an automated decision (without human intervention) process. The rules can be set product wise and customized by the customer. The output of the decision engine is a decision line item on the Request Overview and Facility Overview screens.

- For more information on Decision Engine rules for SME business loan, SME overdraft, and SME credit card products for various decision categories (auto approve, auto decline, and manual review), refer to the attached document.

- For more information on Decision Engine rules for Retail unsecured lending for various decision categories (auto approve, auto decline, and manual review), refer to the attached document.

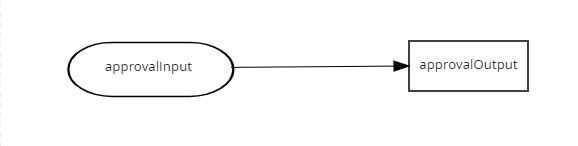

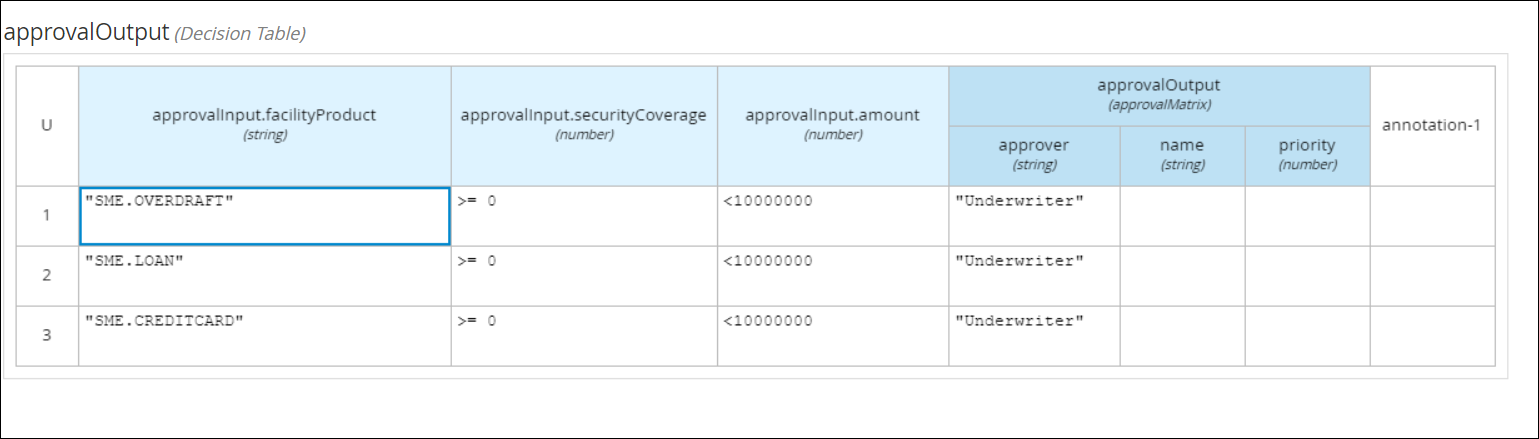

Approver Matrix

A bank user with necessary permissions can define Approver Matrix product wise. Based on the Approver Matrix, the approver is identified for cases only when the output of the Decision Engine is Manual Review. Based on the Approver Matrix configuration, a manual review task is created for the approver. For more information, refer to the attached document.

Flag Variables

A Flag parameter is stored in the Score Card and if the value is True, then in the Score Card, this parameter is flagged in red color. Flagging rules are defined per score card. When a score card is run, the flag conditions are also identified and displayed in Decision field and highlighted in the score card displayed in the Credit Decision section.

- Retail Flag Variables: To flag the following alerts to the Approver on the approver screen for Retail Lending applications.

- DTI ratio is 71-84%

- LTV ratio is between 71 %-84% (For secured loan).

- SME Flag Variables: To flag the following alerts to the Approver on the approver screen for SME Lending applications.

- Company Bureau Score <650

- D/E ratio >3.5

- DSCR< 2

- Current Ratio <2

- Operating Margin< 0.20

Storing Credit Score Values in Origination Processing MS

The processed score card for credit decision is stored in the Origination Processing microservice. The score card details displayed in the Decision section in Temenos DigitalAssist application is retrieved from this table. The following details are stored in the Origination Processing microservice:

- The facility wise score card that is generated after the Execute Score Card.

- The date and time when score card was executed.

- If a request/application has multiple facilities, the score card is stored facility wise.

- The following details are stored:

- Parameter

- Value (value of that parameter)

- Score (respective score of that parameter)

- Total score (summation of all the individual parameter scores).

Storing Decision Engine Output in Origination Processing MS

The DE rules output which is used for processing is stored in the Origination Processing microservice.The following details are stored in the Origination Processing microservice :

- The facility wise DE output that is generated after Execution of DE task.

- The date and time when decision engine was executed.

- If a request/application has multiple facilities, the decision engine output is stored facility wise.

- The following details are stored:

- For each DE rule, Parameter and Value (value of that parameter).

- Final DE Output.

Adding New Parameter DTI in Origination Processing MS

A new parameter, Debt to Income Ratio (DTI) is added in Origination Processing MS under Financial Ratios. Th structure is Financial ratio > Income Ratio > Debt to Income Ratio and is a percentage field. The field can accept upto two places after the decimal value.

Default Value for Debt to Income Ratio

When a lending request is created in Retail journey - Personal loan, Overdraft, and Credit Card, on submission of the application, the following values are set as default:

- DTI ratio for the applicant to be defaulted to 50%.

- DTI ratio for the co-applicant(s) to be defaulted to 50%.

- The value is created in the Origination Processing MS in Financial Ratio with the date as application submission date.

Default Value for Financial Ratio

When a lending requested is created in SME journey - Business loan, Overdraft, and Credit Card, on submission of the application, the following financial ratio values are set as default:

- DE - 1.1

- Net Profit Margin - 0.40

- Operating Margin - 0.30

- Current Ratio - 1.8

- DSCR - 3.5

These ratios are set as default only for the Company and the value is created in the Origination Processing MS in Financial Ratio with the date as application submission date.

Technical Specification

This section provides a detailed overview of changes required to implement Credit Score Cards and Decision Engine.

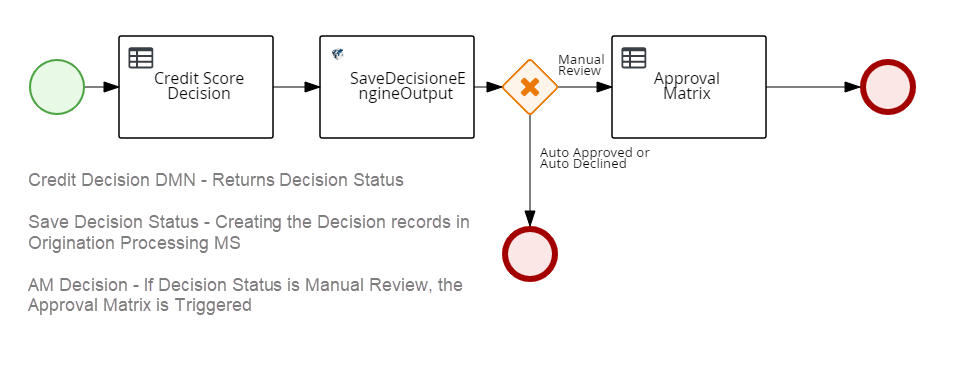

Functional Flow

In the Credit Packaging stage, Automated process is triggered for calculating the Score Card and generate Decision for each facility.

This process is called after,

- Credit Bureau Check Task completion in Retail flow.

- Financial Spreading Task completion in SME flow.

Credit Score Calculation

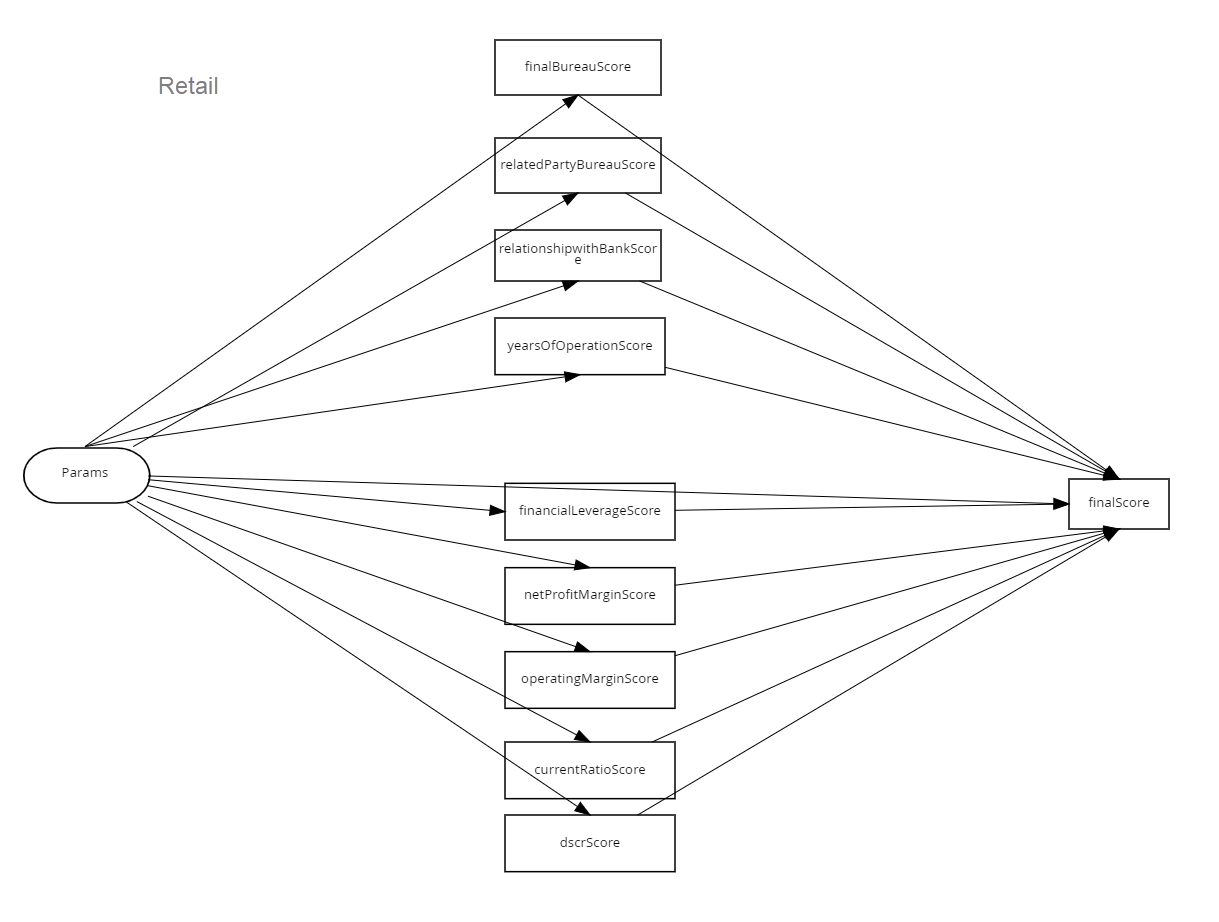

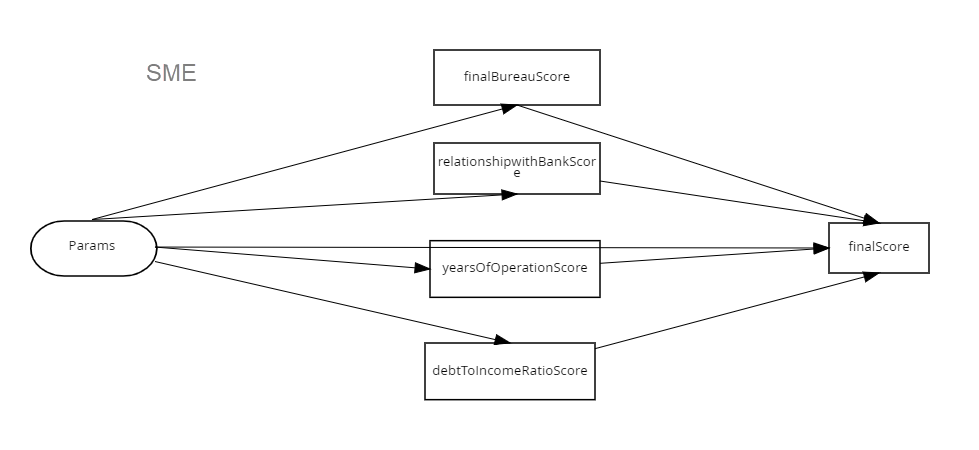

The credit score rules are defined in PAM-DMN and is the total of some variables like bureau score, years of operation of the respective applicant. All the required parameters are configured in the PAM-DMN based on the product type and the score is further used in the Decision Engine.

Decisions Generation with Automated Rules

The Decisions are generated by the Decision Engine which is a set of rules defined product wise to be configured in PAM- DMN. The rules are a set of “And” and “Or” conditions including Credit score card output and variables like Bureau score, DCSR value depending on the product.

Decision Engine rules for SME Business Loan

1. Auto Approval Rule( If all the rules are met “AND “ condition)

- Rule 1: Total Score >70

- Rule 2: DCSR value = 1.60-3.5

2. Manual Review Rule( If any of the rule is met “ OR” condition)

- Rule 1: Total Score is between 30-70

- Rule 2: DSCR Value < 1.60

3. Auto Decline Rule ( If any of the rule is met “OR” condition)

- Rule 1 : Company/Related Party (any one of them) Blacklist Compliance Status = Fail

- Rule 2: Total Score < 29

- Rule 3: Company Bureau < 600

- Rule 4: Related Party Bureau < 600

The least score is considered for the Related Parties Bureau.

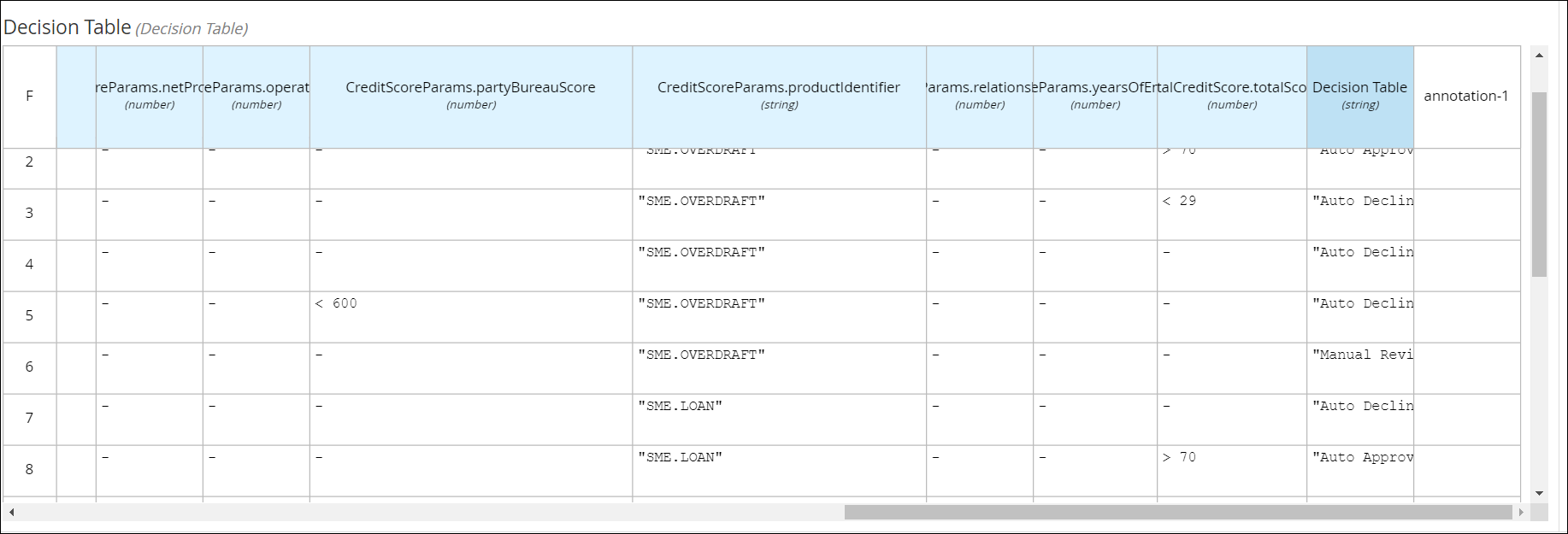

Decision Engine rules for SME Overdraft

1. Auto Approval Rule( If all the rules are met “AND “ condition)

- Rule 1: Total Score >70

2. Manual Review Rule( If any of the rule is met “ OR” condition)

- Rule 1: Total Score is between 30-70

3. Auto Decline Rule ( If any of the rule is met “OR” condition)

- Rule 1 : Company/Related Party (any one of them) Blacklist Compliance Status = Fail

- Rule 2: Total Score < 29

- Rule 3: Company Bureau < 600

- Rule 4: Related Party Bureau < 600

The least score is considered for the Related Parties Bureau.

Decision Engine Rules for SME Credit Card

1. Auto Approval Rule( If all the rules are met “AND “ condition)

- Rule 1: Total Score >70

- Rule 2: Company Bureau > 749

- Rule 3: Related Party Bureau > 700

2. Manual Review Rule( If any of the rule is met “ OR” condition)

- Rule 1: Total Score is between 40-80

- Rule 2: Company Bureau : between 650-749

- Rule 3: Related Party Bureau: between 650-700

3. Auto Decline Rule ( If any of the rule is met “OR” condition)

- Rule 1 : Company/Related Party (any one of them) Blacklist Compliance Status = Fail

- Rule 2: Total Score < 40

- Rule 3: Company Bureau < 650

- Rule 4: Related Party Bureau < 650

The least score is considered for the Related Parties Bureau.

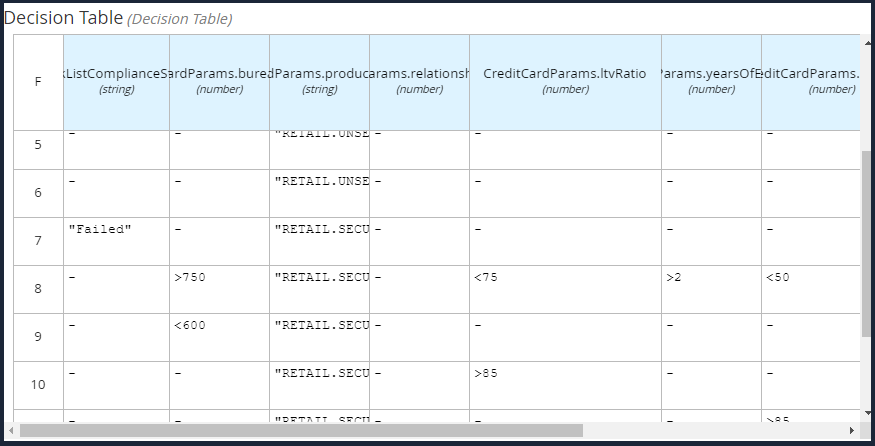

Decision Engine Rules for Retail Unsecured Lending

The below Decision Engine rule is applicable for all unsecured products like Personal Loan, Overdraft and Credit Card.

1. Auto Approval Rule( If all the rules are met “AND “ condition)

- Rule 1: Bureau Score > 721

- Rule 2: DTI Ratio < 50%

- Rule 3: Years of Employment/ Business> 2 yrs

- Rule 4: Total Score > 70

2. Manual Review Rule( If any of the rule is met “ OR” condition)

- Rule 1: Bureau Score : 600-720

- Rule 2: DTI Ratio : 50%- 85%

- Rule 3: Total Score : 30-70

- Rule 4: Years of Employment/Business < 2 yrs

3. Auto Decline Rule ( If any of the rule is met “OR” condition)

- Rule 1 : Applicant / Co Applicant (any one of them) Blacklist Compliance Status = Fail

- Rule 2: Bureau Score < 600

- Rule 3: DTI Ratio > 85%

- Rule 4: Total Score < 29

Decision Engine Rules for Retail Secured Lending

The below D.E rule is applicable for secured products like Vehicle Loan

1. Auto Approval Rule( If all the rules are met “AND “ condition)

- Rule 1: Bureau Score > 750

- Rule 2: DTI Ratio < 50%

- Rule 3: Years of Employment/ Business> 2 yrs

- Rule 4: LTV Ratio < 70%

- Rule 5: Total Score > 70

2. Manual Review Rule( If any of the rule is met “ OR” condition)

- Rule 1: Bureau Score : 600-750

- Rule 2: DTI Ratio : 50%- 85%

- Rule 3: LTV Ratio : 71%-84%

- Rule 4: Total Score : 30-70

- Rule 5: Years of Employment/Business < 2 yrs

3. Auto Decline Rule ( If any of the rule is met “OR” condition)

- Rule 1 : Applicant / Co Applicant (any one of them) Blacklist Compliance Status = Fail

- Rule 2: Bureau Score < 600

- Rule 3: DTI Ratio > 85%

- Rule 4: TLTV Ratio> 85%

- Rule 5: Total Score < 29

Please refer to the attachment : Retail Secured Loans(Mortgage)- Score Card and Credit Risk.

Please refer to the attachment : Retail Unsecured Loans - Score Card and Credit Risk.

Please refer to the attachment : Decision_score_permissions

Retail : Co-applicant Score Card Calculation:

- For co-applicants in an application, the least score is considered for score calculation in Total score.

- The cumulative DTI ratio based on the field Do you want to consider this income and expenses for Loan eligibility calculation - Yes confirmed by each applicant in Income and Employment screen in ODMS) is considered for score calculation in Total score.

- Only the Year of Employment/Business of Main applicant is considered for score calculation in Total score.

SME : Related Party- Score Card Calculation

Incase of multiple related Parties in an Application:

- Related Party Bureau: The least score of all the related party is considered .

- The number of Years of operation and Relationship with Bank is considered for only the main Company.

- For the Blacklist Compliance status, all the parties and any of their status = Fail, the system needs to consider that .

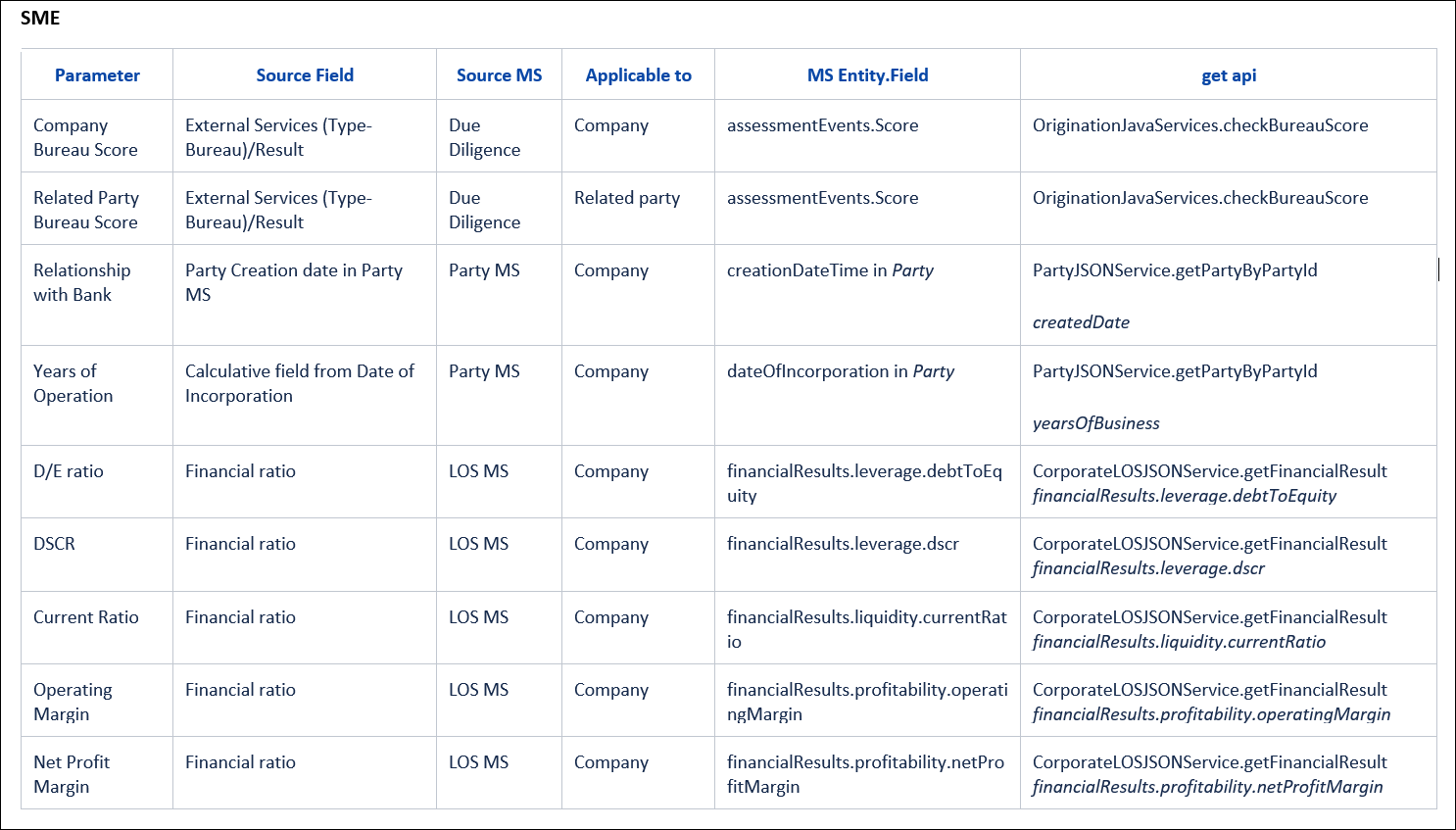

SME Variables:

| Parameter | Source Field | Source MS |

|---|---|---|

| Company Bureau Score | External Services (Type-Bureau)/Result | LOS MS /Party MS |

| Related Party Bureau Score | External Services (Type-Bureau)/Result | LOS MS /Party MS |

| Relationship with Bank | Party Creation date in Party MS | Party MS |

| Years of Operation | Calculative field from Date of Incorporation | Party MS for Date of Incorporation |

| D/E ratio | Financial ratio | LOS MS |

| DSCR | Financial ratio | LOS MS |

| Current Ratio | Financial ratio | LOS MS |

| Operating Margin | Financial ratio | LOS MS |

| Net Profit Margin | Financial ratio | LOS MS |

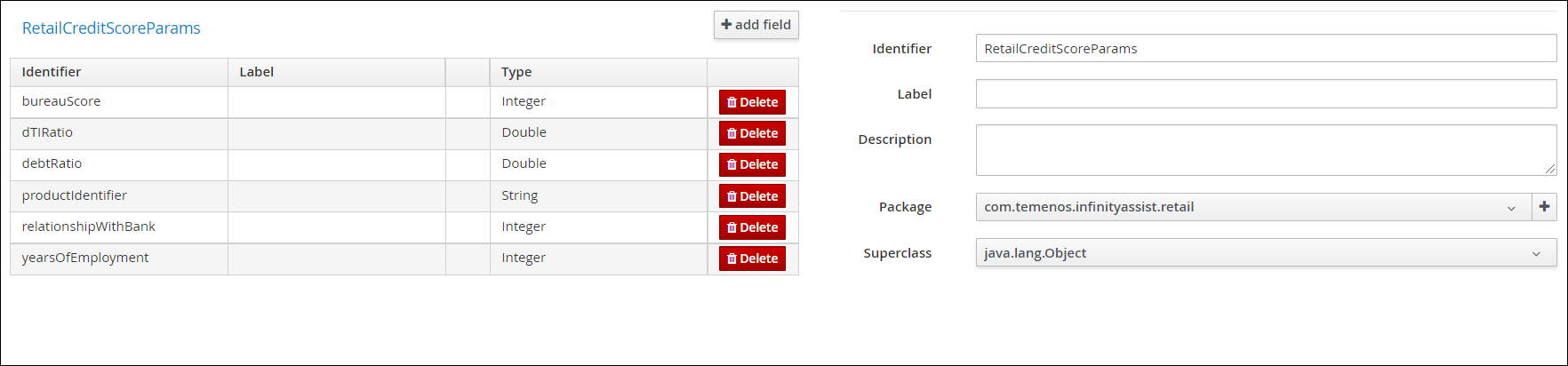

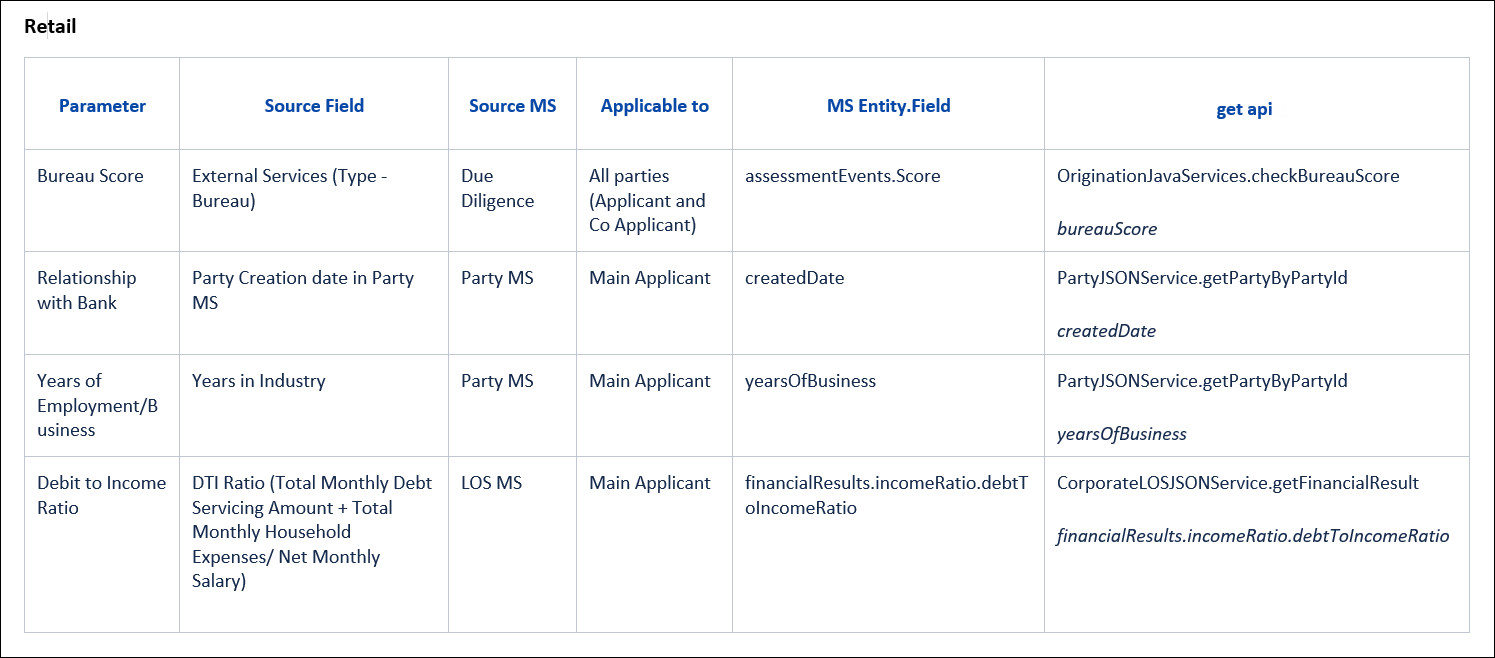

Retail Variables:

| Parameter | Source Field | Source MS |

|---|---|---|

| Bureau Score | External Services (Type-Bureau) | LOS MS /Party MS |

| Relationship with Bank | Party Creation date in Party MS | Party MS |

| Years of Employment/Business | Years in Industry | LOS MS /Party MS |

| Debit to Income Ratio | DTI Ratio (Total Monthly Debt Servicing Amount + Total Monthly Household Expenses/ Net Monthly Salary) in Financial Ratio | LOS MS /Party MS |

| Loan to Value Ratio (LTV) | LTV Ratio (Sum of Loan Value/ Asset Value) | LOS MS /Party MS |

Red Hat

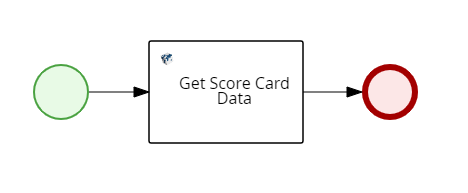

New process is defined for the Get Credit Score Inputs, Credit Score Calculation, and Automated Decision generation.

Get Credit Score Inputs

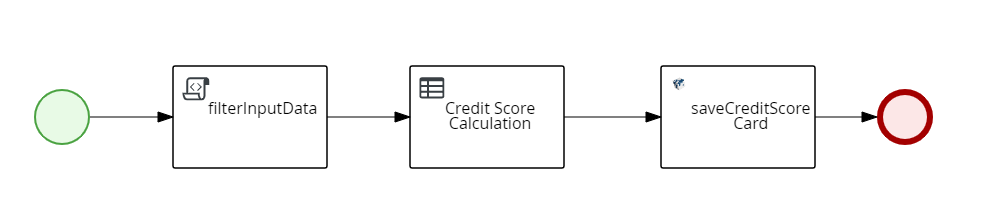

Credit Score Calculation

- Script Task to filter the input data required for the calculation.

- DMN to calculate Credit Score.

- Java Service to Store the Credit Score value and Score Card in Origination Processing MS.

- There are separate Business Process for Retail and SME flows.

Automated Credit Decision Generation

- DMN - Decision Engine to generate Decisions per product.

- Java Service to Store the Decision records in Origination Processing MS in Request and Facility Overview.

- Based on DMN output

- Auto Approval and Auto Declined scenario's - The Status and Approver name is updated to Origination Processing MS.

- For Manual Review - Approval Matrix is Triggered.

- There are separate Business Process for Retail and SME flows

Approval Matrix

Based on the Approver Matrix configuration, the manual review task to the approver is created.

There are separate Approval Matrix DMNs for Retail and SME flows.

Additional tasks post output of Decision Engine

When the Decision is Auto Denied, facility will be marked as Rejected.

If the application has one facility, then the application will also be marked as Rejected.

DMN

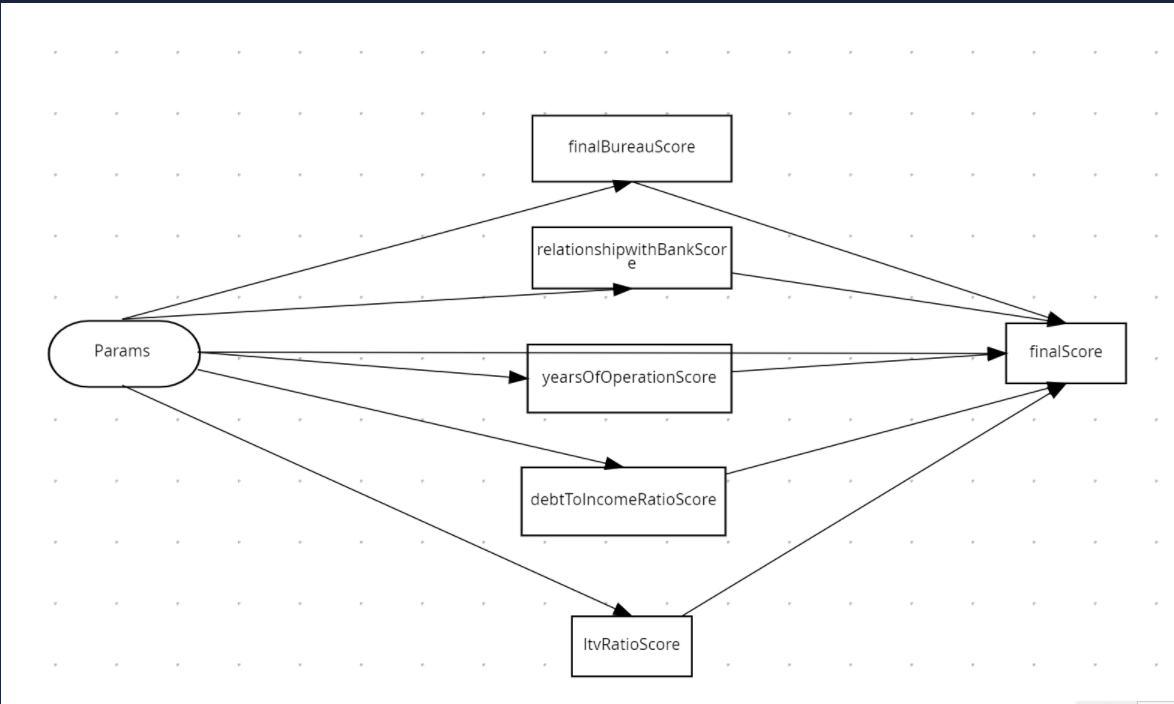

CreditScoreDecision

Takes all the parameters as input and provides the total credit score. This is used in credit score calculation process,

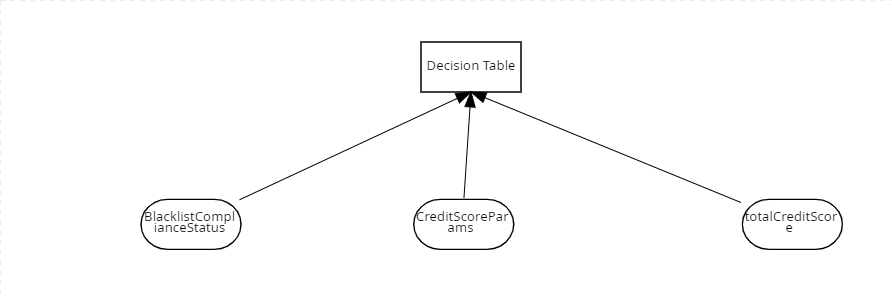

CreditDecisionDMN

- CreditDecisionDMN takes the ScoreCardData and ProductGroup as Inputs

- Three Possible Outputs from Decision Engine

- Auto Approved

- Auto Declined

- Manual Review

Data Objects

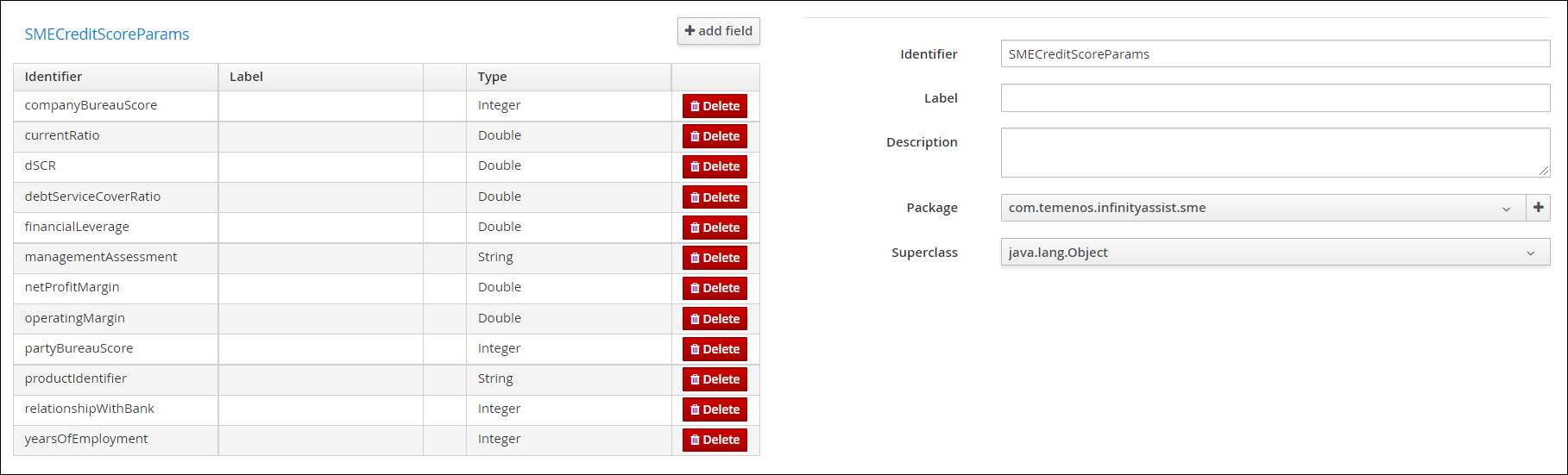

- CreditScoreParams - Contains all the parameters for score card as data types to support the CreditScoreDecision DMN.

- There are separate data objects for Retail and SME.

This JSON is maintained in the Spotlight configuration with the name PRODUCTID_MCMS_REDHAT_MAPPING under Temenos Digital Assist bundle.

{

"ADVANCED.CHECKING.ACCOUNT": "RETAIL.UNSECURED",

"BASIC.CHECKING.ACCOUNT": "RETAIL.UNSECURED",

"PREFERRED.CHECKING.ACCOUNT": "RETAIL.UNSECURED",

"SAVINGS.PRIME.INFINITY": "RETAIL.UNSECURED",

"SAVINGS.STANDARD.INFINITY": "RETAIL.UNSECURED",

"SAVINGS.SALARY.INFINITY": "RETAIL.UNSECURED",

"INFINITY.ADAMANTIUM.CARD": "RETAIL.UNSECURED",

"INFINITY.VIBRANIUM.CARD": "RETAIL.UNSECURED",

"INFINITY.BESKAR.CARD": "RETAIL.UNSECURED",

"OVERDRAFT.ACCOUNT": "RETAIL.UNSECURED",

"PERSONAL.LOAN": "RETAIL.UNSECURED",

"OVERDRAFT.ACCOUNT.SME": "SME.OVERDRAFT",

"INFINITY.TRAVEL.CARD": "SME.CREDITCARD",

"INFINITY.FUSION.BUSINESS.CARD": "SME.CREDITCARD",

"INFINITY.UNLIMITED.REWARDS.CARD": "SME.CREDITCARD",

"SMALL.BUSINESS.LOAN": "SME.LOAN"

}

Data Model Changes

Origination Processing MS

- Decisions table

- Added totalScore field to Store the total credit score, which is used to display credit score in UI.

- Credit Score Card table

- Credit score card entity is not present in Origination Processing MS previously.

- Added ScoreCard table to store the credit score card values and final scores. This supports create, update, delete, and get operations.

API Changes

Integration Services

New APIs invoked from Red Hat.

| Operation | Description | Parameters |

|---|---|---|

| getInputsForCreditScore(Java Service) |

|

|

Sample request

//SME Flow

{

"requestId": "R202127518768",

"facilityId": "F202127518771",

"flowType": "SME"

}

//Retail Flow

{

"requestId": "R202127518768",

"facilityId": "F202127518771",

"flowType": "Retail"

}

Sample Response

{

"ScoreCardInputs": {

"netProfitMargin": "0.40",

"operatingMargin": "0.30",

"productIdentifier": "SME.OVERDRAFT",

"companyBureauScore": "1000",

"partyBureauScore": "700",

"relationshipWithBank": "2021-10-21",

"financialLeverage": "1.1",

"currentRatio": "1.8",

"yearsOfEmployment": "21"

},

"opstatus": 0,

"httpStatusCode": 200

}

Sample Response

RETAIL :

{

"ScoreCardInputs": {

"productIdentifier": "RETAIL.UNSECURED",

"partyBureauScore": "700",

"relationshipWithBank": "2021-10-21",

"dTIratio": "1.8",

"yearsOfEmployment": "21"

},

"opstatus": 0,

"httpStatusCode": 200

}

RETAIL MORTGAGES:

{

"ScoreCardInputs": {

"productIdentifier": "RETAIL.SECURED",

"partyBureauScore": "700",

"relationshipWithBank": "2021-10-21",

"dTIratio": "1.8",

"ltvRatio":"20"

"yearsOfEmployment": "21"

},

"opstatus": 0,

"httpStatusCode": 200

} | ||

| getScoreCard(Object Service) |

|

|

() Sample Request : {

"requestId":"R202220247025",

"facilityId": "F202220247067",

}Sample Response: {

"opstatus": 0,

"message": "GetScoreCardOperation executed successfully",

"scorecardItems": [

{

"lastChangeUserId": "12345678",

"facilityId": "F202225158591",

"scores": [],

"requestId": "R202225158546",

"scoreCardId": "478212411282475",

"lastChangeDateTime": "2022-02-21 07:00:21.646",

"partyId": "1033562458",

"totalScore": 100,

"extensionData": {}

},

{

"lastChangeUserId": "12345678",

"facilityId": "F202225158591",

"scores": [],

"requestId": "R202225158546",

"scoreCardId": "588809768254151",

"lastChangeDateTime": "2022-02-21 12:19:12.329",

"partyId": "1033562458",

"totalScore": 29,

"extensionData": {}

},

{

"lastChangeUserId": "12345678",

"facilityId": "F202225158591",

"scores": [],

"requestId": "R202225158546",

"scoreCardId": "764854846820655",

"lastChangeDateTime": "2022-02-21 12:20:28.042",

"partyId": "1033562458",

"totalScore": 50,

"extensionData": {}

},

{

"lastChangeUserId": "12345678",

"facilityId": "F202225158591",

"scores": [

{

"score": 26,

"scoreType": "Company Bureau Score",

"value": 640

},

{

"score": 10,

"scoreType": "Related Party Bureau Score",

"value": 700

},

{

"score": 10,

"scoreType": "Relationship with Bank",

"value": 5

},

{

"score": 10,

"scoreType": "Years of Operation",

"value": 2

},

{

"score": 10,

"scoreType": "Bureau Score",

"value": 700

},

{

"score": 10,

"scoreType": "Years of Employment/Business",

"value": 700

},

{

"score": 8,

"scoreType": "D/E ratio",

"value": 0.82

},

{

"score": 10,

"scoreType": "DSCR",

"value": 700

},

{

"score": 4,

"scoreType": "Current Ratio",

"value": 0.2

},

{

"score": 3,

"scoreType": "Net Profit Margin",

"value": 3.7

},

{

"score": 5,

"scoreType": "Operating Margin",

"value": 0.15

},

{

"score": 10,

"scoreType": "Loan to Value Ratio (LTV)",

"value": 700

},

{

"score": 10,

"scoreType": "Debit to Income Ratio",

"value": 700

}

],

"requestId": "R202225158546",

"scoreCardId": "590985806157348",

"lastChangeDateTime": "2022-02-22 07:06:07.062",

"partyId": "1033562458",

"totalScore": 50,

"extensionData": {}

}

],

"httpStatusCode": 200

} | ||

| saveCreditScoreCard | Map of credit score card data from Red Hat is sent as input to the Java service including the credit score value which are then saved in Origination Processing MS. |

|

Sample request

{

"requestId":"R202123575720",

"facilityId": "F202123575725",

"totalScore": "33",

"finalScores": {

"relationshipWithBank": "5",

"yearsOfEmployment" : "2",

"dTIRatio": "20",

"bureauScore": "6"

},

"scoreCardValues": {

"relationshipWithBank": "1",

"yearsOfEmployment" : "5",

"dTIRatio": "1.3",

"bureauScore": "600"

}

}

Sample Response

{

"scoreId": "dTIRatio,bureauScore,relationshipWithBank,yearsOfEmployment",

"scoreCardId": "109987719955984",

"opstatus": 0,

"message": "Score Card created successfully",

"httpStatusCode": 200

}

| ||

| saveDecisionEngineOutput | This Java service takes the decision generated by the DE as input and creates a decision record in Origination Processing MS in the Request overview and Facility Overview screens. |

|

Sample request

{

"requestId": "R202130896457",

"facilityId": "F202130896461",

"partyId": "2119322192",

"approverUserId": "System Approver",

"finalDecision": true,

"decisionId": "09",

"decisionComment": "Comment test",

"decisionDate": "2021-05-31",

"expiryDate": "2021-05-31",

"totalScore": 20,

"approvedAmount": "24000"

}

Sample Response

{

"conditionId": "",

"creditDecisionId": "123980796047079",

"opstatus": 0,

"message": "CreditDecision created successfully",

"httpStatusCode": 200

}

| ||

| Retail Credit Score Decision | ||

Sample Request: {

"model-namespace": "https://kiegroup.org/dmn/_CF3F9D1B-B0DE-40E5-A626-762826E1054A",

"model-name": "Retail Credit Score Decision",

"dmn-context": {

"CreditCardParams": {

"bureauScore": 750,

"productIdentifier": "RETAIL.SECURED",

"relationshipWithBank": 25,

"yearsOfEmployment": 5,

"ltvRatio":74,

"debtRatio": 50

},

"BlackListComplianceStatus":"",

"totalCreditScore":{

"totalScore": 72

}

}

}

Sample Response: {

"type" : "SUCCESS",

"msg" : "OK from container 'InfinityAssist'",

"result" : {

"dmn-evaluation-result" : {

"messages" : [ ],

"model-namespace" : "https://kiegroup.org/dmn/_CF3F9D1B-B0DE-40E5-A626-762826E1054A",

"model-name" : "Retail Credit Score Decision",

"decision-name" : [ ],

"dmn-context" : {

"totalCreditScore" : {

"totalScore" : 72

},

"CreditCardParams" : {

"debtRatio" : 50,

"ltvRatio" : 74,

"productIdentifier" : "RETAIL.SECURED",

"bureauScore" : 750,

"relationshipWithBank" : 25,

"yearsOfEmployment" : 5

},

"Decision Table" : "Manual Review",

"BlackListComplianceStatus" : ""

},

"decision-results" : {

"_5C91C185-9795-4114-8F90-22D9B8DD82E8" : {

"messages" : [ ],

"decision-id" : "_5C91C185-9795-4114-8F90-22D9B8DD82E8",

"decision-name" : "Decision Table",

"result" : "Manual Review",

"status" : "SUCCEEDED"

}

}

}

}

} | ||

Retail Credit Score Decision Table:

The Score Card displays in the Decision section both in Request Overview and Facility Overview.

| Overview-Section | Functions | Component | Implementations |

|---|---|---|---|

| Request- Credit | Add Decision | com.temenoscb.adddecisioncommitteeandindividual |

|

| Request- Credit | View Decision | com.temenoscb.viewdecisionindividual |

|

| Facility- Credit | Add Decision | com.temenoscb.adddecisioncommitteeandindividual |

|

| Facility- Credit | View Decision | com.temenoscb.viewdecisionindividual |

|

Chartjs custom widget used for Score Card Chart:

- Widget Name: Chartjs-kony-ui

- Implementation:

var chartObject = new kony.ui.CustomWidget({

"id": "chartObject",

"isVisible": true,

"left": "0",

"top": "0",

"width": "200dp",

"height": "128dp",

"clipBounds": false

}, {

"padding": [0, 0, 0, 0],

"paddingInPixel": false

}, {

"widgetName": "Chartjs",

"data": {

"selectedValue": ""

}

});

this.view.<ParentFlexContainer>.add(chartObject);

chartObject.data = dataObject; // dataObject contains the chart data. Configurations:

Spotlight Configurations

- Configuration to map MCMS Product id to Redhat product identifier is added

- Bundle Name - INFINITY_ASSIST_CONFIG_BUNDLE

- Config Key - PRODUCTID_MCMS_REDHAT_MAPPING

- Config Value - '{"ADVANCED.CHECKING.ACCOUNT":"RETAIL.UNSECURED","BASIC.CHECKING.ACCOUNT":"RETAIL.UNSECURED","PREFERRED.CHECKING.ACCOUNT":"RETAIL.UNSECURED","SAVINGS.PRIME.INFINITY":"RETAIL.UNSECURED","SAVINGS.STANDARD.INFINITY":"RETAIL.UNSECURED","SAVINGS.SALARY.INFINITY":"RETAIL.UNSECURED","INFINITY.ADAMANTIUM.CARD":"RETAIL.UNSECURED","INFINITY.VIBRANIUM.CARD":"RETAIL.UNSECURED","INFINITY.BESKAR.CARD":"RETAIL.UNSECURED","OVERDRAFT.ACCOUNT":"RETAIL.UNSECURED","PERSONAL.LOAN":"RETAIL.UNSECURED","OVERDRAFT.ACCOUNT.SME":"SME.OVERDRAFT","INFINITY.TRAVEL.CARD":"SME.CREDITCARD","INFINITY.FUSION.BUSINESS.CARD":"SME.CREDITCARD","INFINITY.UNLIMITED.REWARDS.CARD":"SME.CREDITCARD","SMALL.BUSINESS.LOAN":"SME.LOAN","MORTGAGE.OFFER":"RETAIL.SECURED"}'

- The new Config value added to the mapping is “MORTGAGE.OFFER":"RETAIL.SECURED”

Field Mapping

For the input fields required, the source fields are mapped below with basic information.

Retail

SME

In this topic