Business Enrollment

Use the feature to enroll your business into the banking application to view and manage your accounts online. The enrollment feature is for existing business customers of the bank who do not have any login credentials to access the accounts online. After you enroll into online banking and create a username and password combination, you can sign in to the banking application from a computer, mobile device, or a tablet as applicable to access all your eligible accounts.

An authorized user can choose the services for the virtual company (contract) or individual business entities based on the nature of the service contract the user has with the Financial Institution (FI)/Bank. The application authenticates such users before allowing them to proceed with the enrollment. An authorized user (business owner) can enroll in business banking only after the authorized person has already connected with the bank and the bank has created and set up the business accounts. The bank verifies the authorized person details in the core banking system (Transact), and then only the authorized person can self-enroll.

- In case of combined access or standalone business banking user, the user can have access to multiple Companies (Customer ID) with multiple accounts within a Company. In such cases for easy identification and better experience, the accounts to be grouped within a Company and it must be displayed with clear distinction at various. The name of the Company name is displayed at all places relevant in the online banking application. In alignment with the display of company name in other portions of the application, the enrollment process is augmented to lend itself to the experience of multiple Customer IDs within the same virtual company.

- The business enrollments can be auto approved, where no manual intervention is required from the bank and the business customer can sign in and start using the online banking application right away. Alternatively, financial institutions may choose to evaluate the requests for enrollments and approve or reject them. This is based on the configuration set in the Spotlight application.

- The application integrates with customer-centric core in Transact and allows for virtual business entities to be created by aggregating a set of customer IDs.

- After enrollment, the default role to be assigned to the new user enrolling can be set up by the Financial Institution through the Spotlight application. The authorized person will have access to all the company accounts. The transaction limit on all the services (for the business) is set to the maximum allowable by the bank. The permissions and transaction limits for the business authorized person is set to the maximum allowable by the bank (based on the default role). The authorized person can add business users who can access or transact over the company accounts.

- An authorized person cannot attempt to enroll a business more than once. Other business users cannot enroll for business banking.

- Disclaimer: The retail and business enrollment flows are for demo purposes.

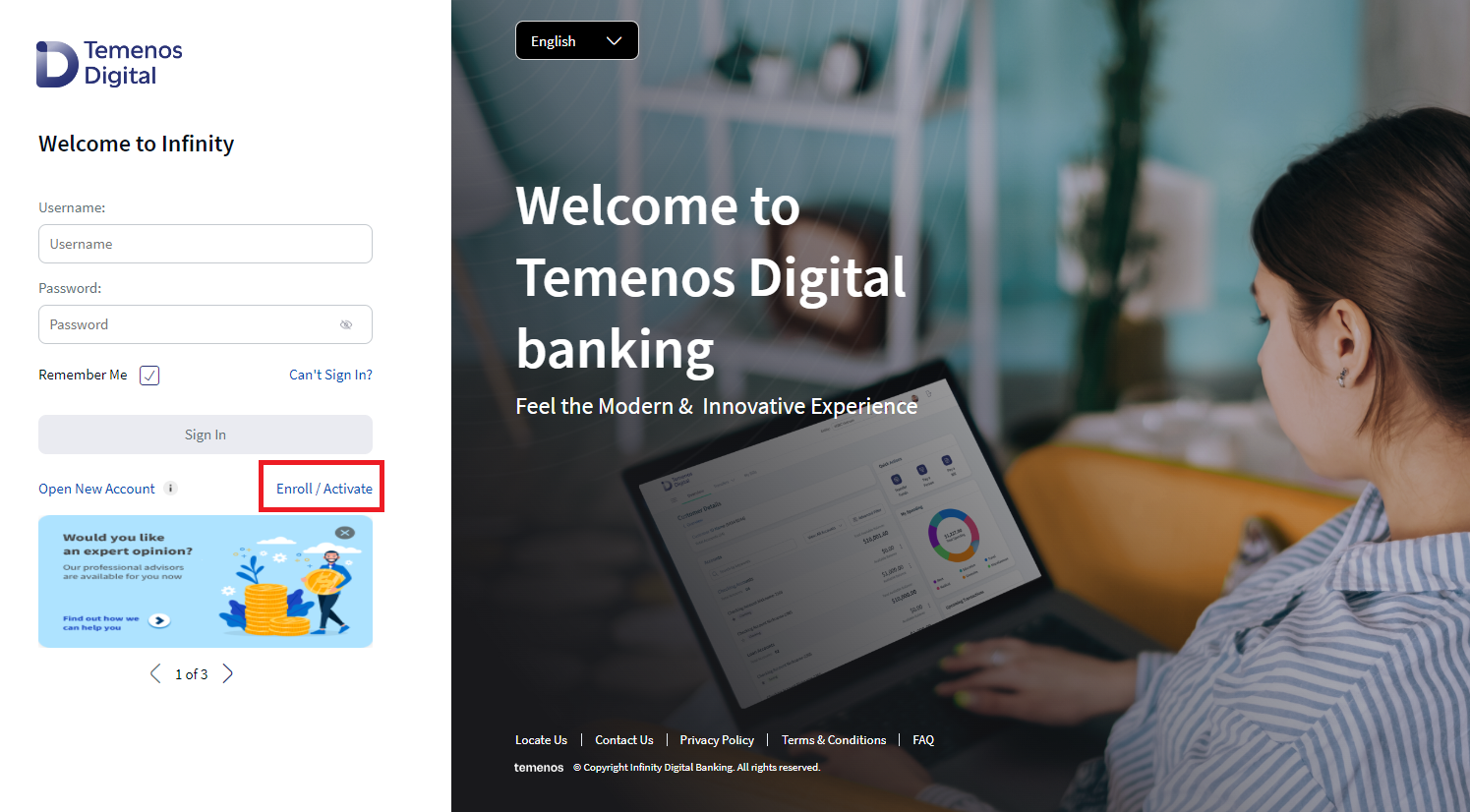

Menu path: On the sign in screen, click Enroll/Activate.

Enroll Business

To enroll business, follow these steps:

- On the sign in screen, click Enroll/Activate. This navigates to legal entity screen.

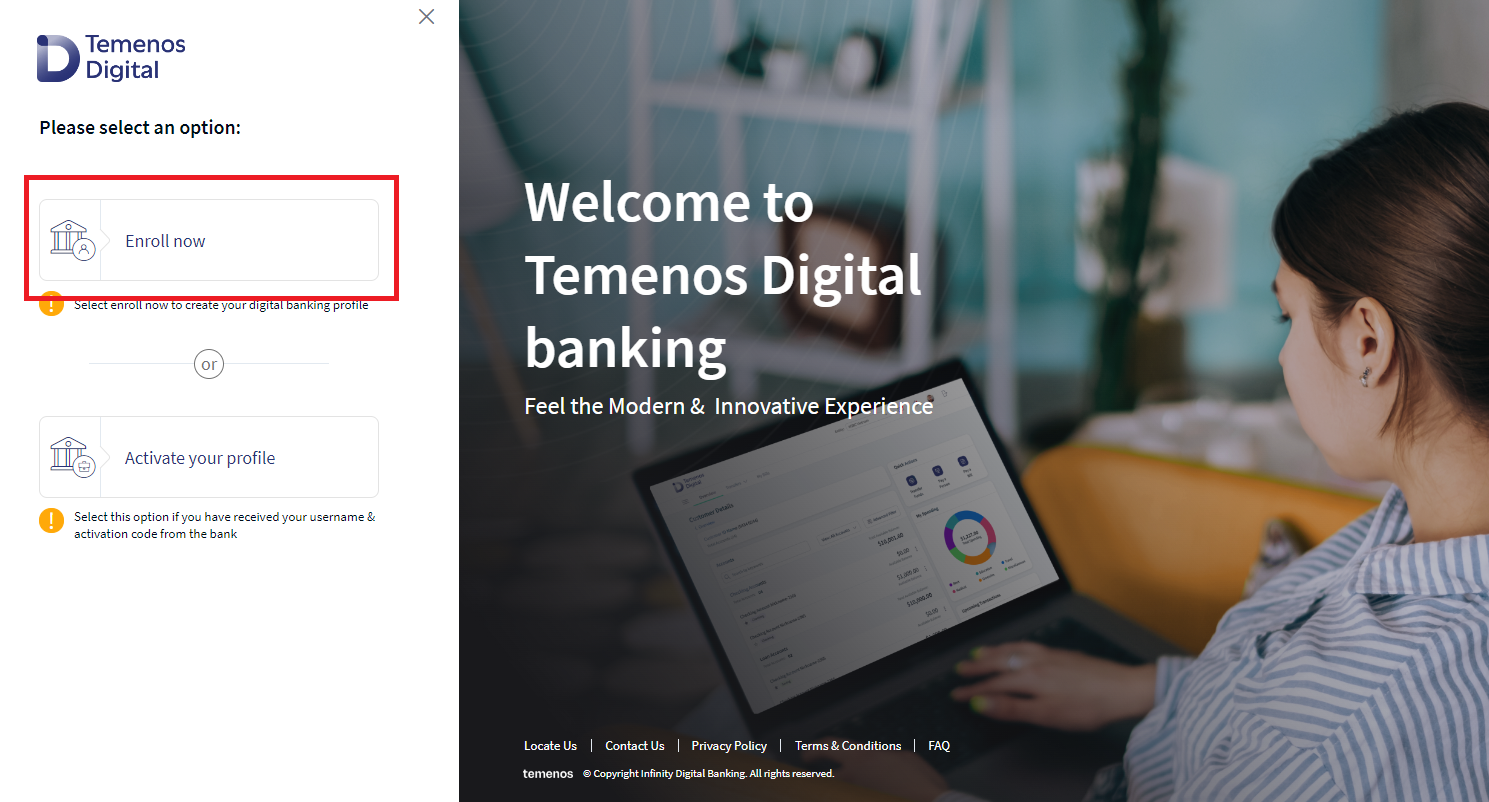

- Click Enroll Now.

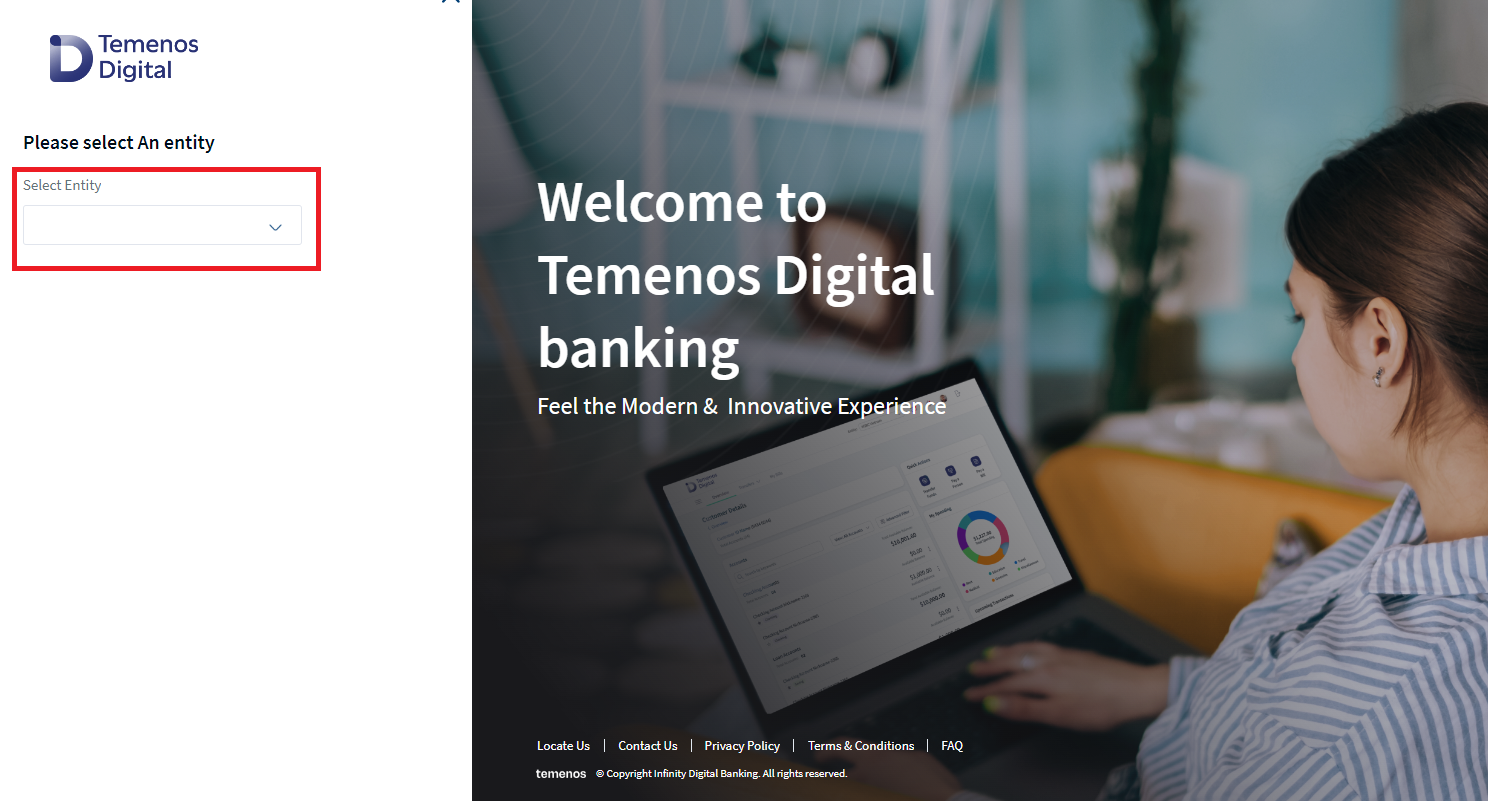

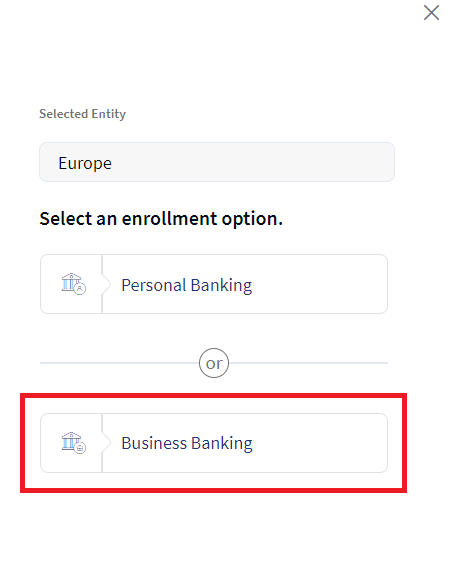

- Select the legal entity from the drop-down list. The application displays the screen to select the enrollment option.

- On the Select an enrollment option screen, click Business Banking.

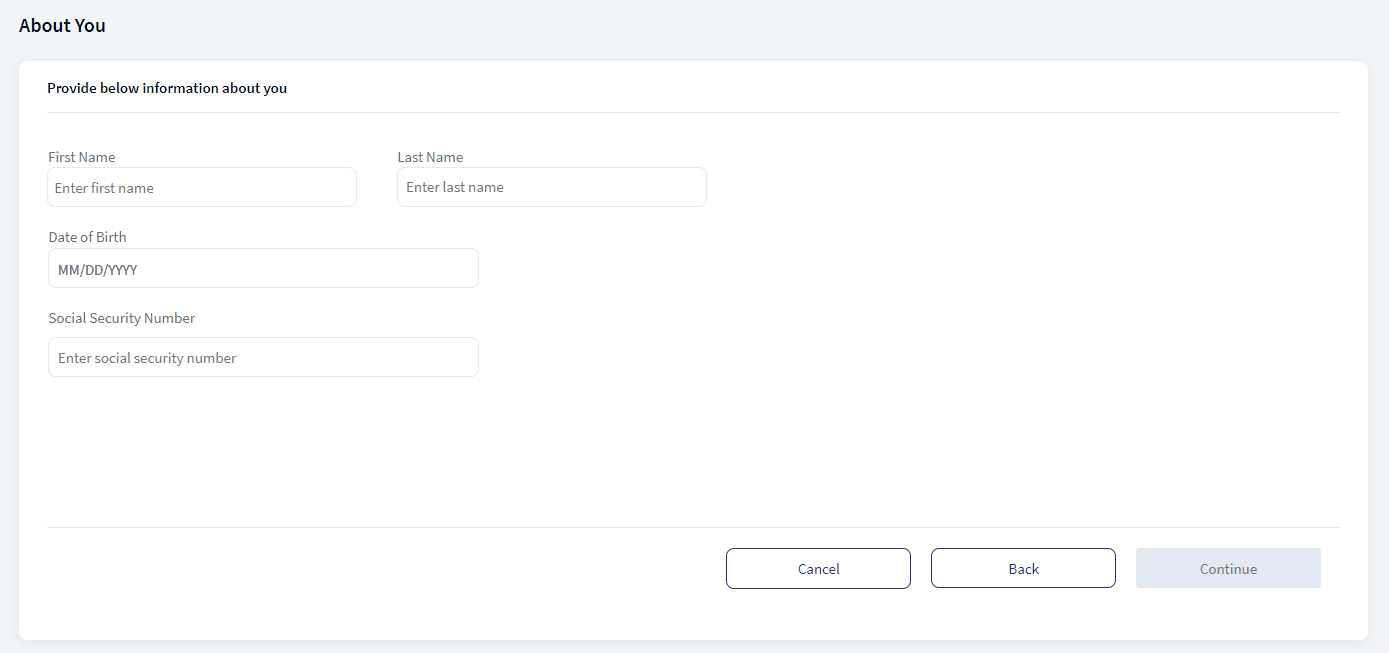

- Enter the following details as a proof of identification. Make sure that you enter valid data. All fields are mandatory.

- Enter the first name.

- Enter the last name.

- Enter your date of birth in MM/DD/YYYY format.

- Enter your nine-digit Social Security Number (SSN)/National Identification Number.

- Click Continue. The Continue button is enabled only if all valid details are entered.

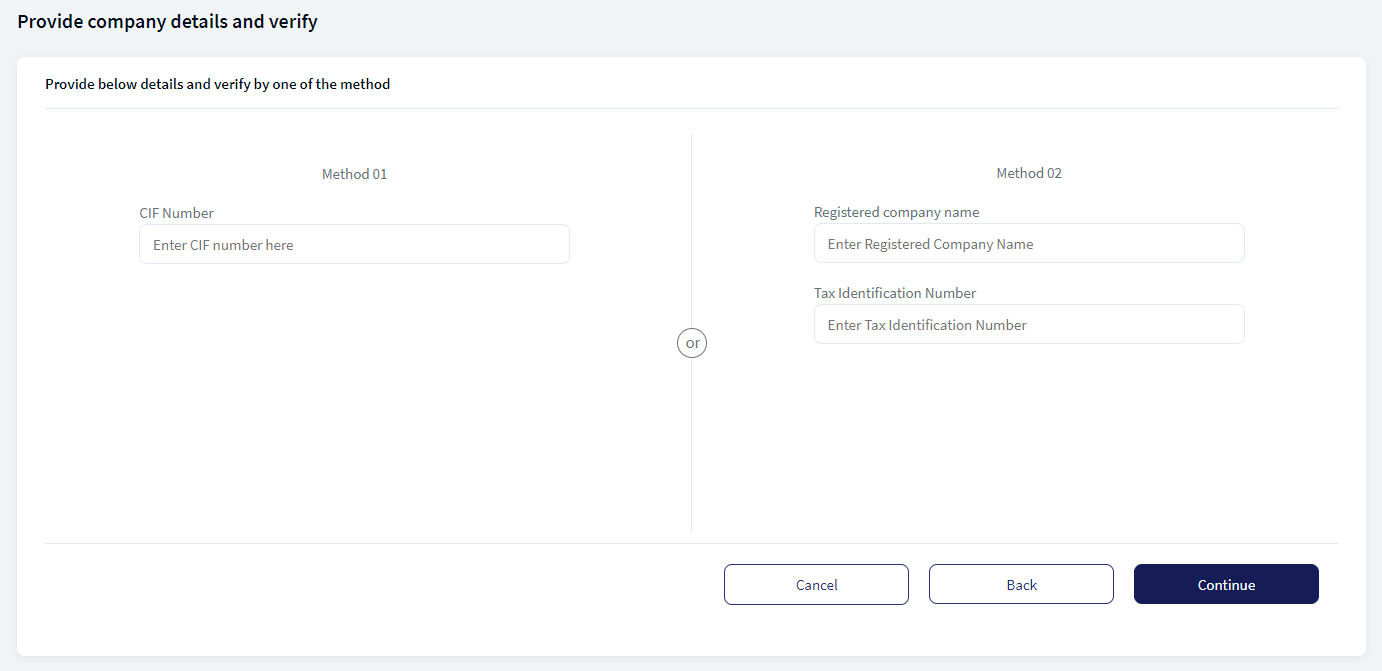

- The application displays the screen to enter the company details and verify. All fields are mandatory.

- Follow any one of the following methods:

- Method 01: Enter the CIF Number.

- Method 02: Enter the Registered company name and Tax Identification Number.

- Click Continue. The Continue button is enabled only if the required values are entered.

- Follow any one of the following methods:

- The application verifies the information with the information stored in the core banking system (Transact) to ensure the following:

- A business customer is already created and set up.

- The person who is trying to enroll is an authorized person associated with the business.

- If the details do not match with the records available with the bank, the application displays an appropriate message to contact the bank for assistance in enrolling the business.

- If the verification is successful, complete the second factor of authentication for security reasons.

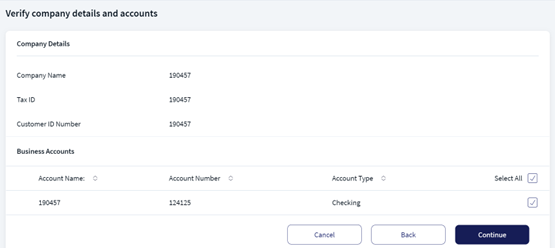

- After the code is successfully verified, the application displays the screen to verify the company and business accounts details.

- Company Details: Company Name, Tax ID, and Customer ID Number.

- Business Accounts: The list of applicable business accounts with the company with details such as account name, account number, and account type. Select the required accounts for which you want the online banking facility.

- Click Continue.

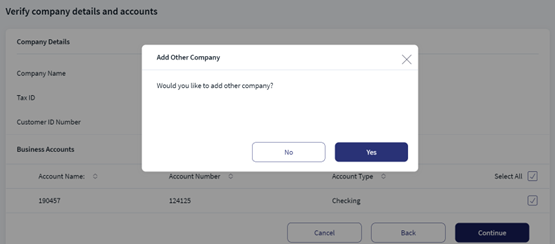

- The application provides an option to add another company in the enrollment flow and displays a screen asking if you want to add another company. Adding another company in the enrollment flow allows for an aggregation of multiple companies by which business users can have a combined view of the accounts associated with multiple companies and be able to centrally manage the users, authorizations, and beneficiaries for the two companies.

- Click Yes if you want to add another company. The application navigates to the company details screen where you will enter the details of the aggregated business entity.

- Click No to continue the enrollment flow.

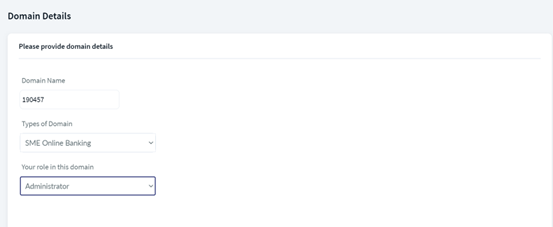

- The application displays the Domain Details screen. Do the following:

- Domain Name: The domain name or the company name is pre-populated in the field if you have not aggregated multiple companies. If you are enrolling for multiple businesses, then you must enter the contract name.

- Select the Service from the list (for example, SME Online Banking). The domain types are configurable.

- Select the Default Role from the list. By default, Administrator role is selected on selecting the service. The roles are configurable through Spotlight application.

- Click Continue. The button is enabled only after a service is selected.

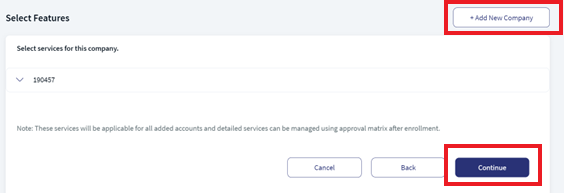

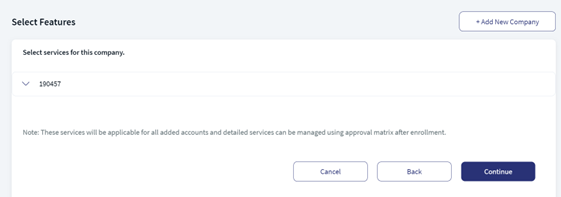

- The application displays the Select Features screen. The services are applicable to all the added accounts and detailed services can be managed using the approval matrix after enrollment.

- All Available Services: Clear or select the required services from the list of available services as required. By default, all the services are selected.

- Default Services: The list of default or mandatory services that are available to all businesses enrolling for online banking access and are applicable to all selected accounts.

- Add New Company: Click to add a new company.

- Click Continue.

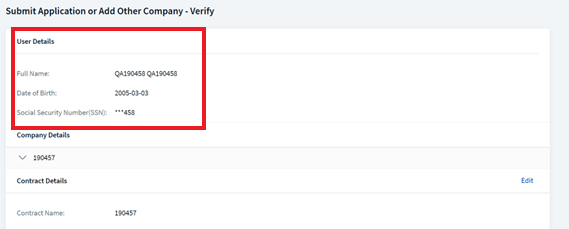

- The application displays the submit application screen where you can review the details that you have entered so far.

- User Details: Displays the full name, date of birth, and the social security number.

- Contract Details:

- Click the down arrow to view and edit the account details.

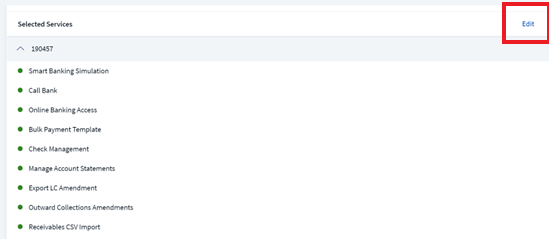

- Displays the contract name, service, and default role. Click Edit to modify the details as required.

- Selected Services: Click Edit to modify the details as required.

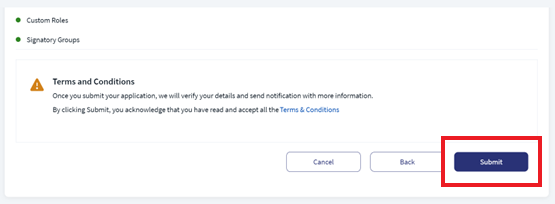

- Click Submit. It is understood that the user has read and accepts all the terms and condition before submitting the application.

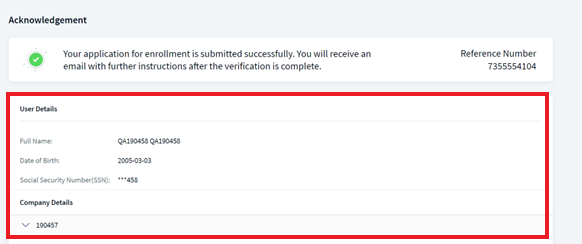

- User Details: Displays the full name, date of birth, and the social security number.

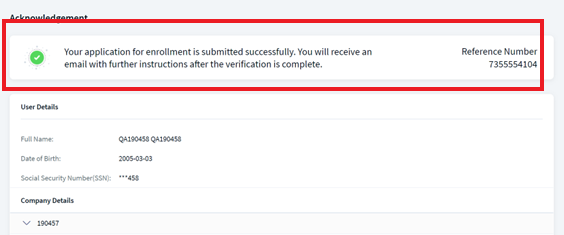

- The application displays an acknowledgment screen with a unique reference number depending on the auto approval option for business enrollment (approval configuration set up in the Spotlight application). Accordingly, an email is triggered to your email address with instructions.

- Acknowledgment message:

- Auto approval: If this method is enabled, the acknowledgment screen shows the message, "Your application for enrollment is submitted successfully. You will receive an email with instructions to set up your credentials".

- FI/Bank approved: If this method is enabled, the acknowledgment screen shows the message, "Your application for enrollment is submitted successfully. You will receive an email with further instructions after the verification is complete".

- The following details are displayed on the acknowledgment screen:

- User details

- Company details

- Business accounts

- Selected services

- Click Back to Login to go to the sign in screen.

- Acknowledgment message:

- Enrollments initiated through the online banking application can be self-approved and the user can sign in into the application and use it right after the application process after following the instructions in the email.

- Enrollments initiated through the online banking application can require approval by the FI (maintained in Spotlight) before the user can sign in to the application and start to use it for online transactions.

- In the Spotlight application, if the auto approval option for business enrollment approval is turned on, then the enrollment request is automatically approved, and the user can use the banking application right away. Otherwise, on submitting, the request is sent to the bank and approved by the bank employee in the Spotlight application. After approval, an email is triggered to the user's email address with login information using which, the user can set the password and sign in to the banking application.

Method 1 - Auto-approval

Enrollments initiated through the online banking application are self-approved and the user can sign in to the application and use it right after the enrollment application process.

The following are done after the request is submitted:

- A virtual company is created automatically with the given domain details.

- The Customer IDs and accounts provided are associated with the virtual company.

- The features selected are enabled and the rest disabled for the virtual company.

- The limits set for each feature for the company are left as the default.

- A default approval matrix is created.

- A user profile for the type - Business User (Authorized Signatory) - is created for the user.

- The details of the user are populated from the authorized signatory details (fetched from the core).

- The user will be assigned the role which is Default for the "Business type" that was set for the company.

- The permissions and limits will be same as what is applied by default for new users.

- The user is given access to all the accounts that are associated with the virtual company.

- There will be no username and password set for the profile yet.

- The profile status will be "New".

- The application displays an acknowledgment page informing the user that the process is completed.

- The user is sent an email with a link to the application that allows the user to complete the process by setting up the user name and password (see mail responses).

- This page is same as that which exists for the Retail User enrollment.

- The user can select a username and if the user name is available it is indicated to the user.

- The password needs to be entered twice and must match.

- The password rules apply.

- After the user name and password has been set, the user can sign in to the application and start transacting online.

- Apart from the user who enrolled, the application sends an email to all the authorized persons on the Customer IDs that have been enrolled. This is to inform them that their accounts have been set up for online banking (see mail responses).

Method 2 - FI approved

Enrollments initiated through the online banking application require approval by the financial institution (FI) before the user can sign in to the application and start to use it for online transactions.

The following are done after the request is submitted:

- A request is created and submitted to the FI. The request contains the following details:

- User who enrolled

- Service

- Associated Customer IDs and accounts

- Services selected

- The request is shown in the Spotlight application as pending approval/rejection.

- The application sends an email to all the authorized persons on the Customer IDs that have been enrolled including the person who has done the enrollment. This is to inform them that a request has been raised for enrolling into the online banking services (see mail responses).

- The application displays an acknowledgment page informing the user that a request has been raised for enrolling into the online banking services.

- For auto approval: Enrollments initiated through the online banking application are self-approved and the user can sign in to the application and use it right after the application process. The application sends an account activation email with a link to the application that allows the user to complete the process by setting up the username and password. The application follows up with a confirmation email to all the authorized persons on the Customer IDs that have been enrolled including the user who enrolled. This is to inform them that their accounts have been set up for online banking.

- For FI/Bank approved: Enrollments initiated through the online banking application require approval by the FI/bank before the user can sign in to the application and start using for online transactions. The application sends an email to all the authorized persons on the Customer IDs that have been enrolled including the user who enrolled. This is to inform them that a request has been raised for enrolling into the online banking services. After approval, the application sends an email to all the authorized persons on the Customer IDs that have been enrolled. This is to inform them that their accounts have been set up for online banking.

- For enrollment rejection: The application sends an email to all the authorized persons on the Customer IDs that have been enrolled including the user who enrolled. This is to inform them that the request that has been raised for enrolling into the online banking services has been rejected.

Configuration

Enrolling capability

Providing the enrollment capability to retail and business banking is managed in the Spotlight application.

Enrollment status

A user's enrollment status is visible in the Spotlight application. In case the user has not enrolled yet, the bank employee has an option to send an enrollment link to the business user.

Auto approval option

The auto approval option for business enrollment approval is configured in the Spotlight application - Configurations > Business Configurations > Business Banking Configurations.

- Configuration name: Business Enrollment Approvals

- This configuration allows the FI to choose whether they want to auto-approve all business enrollment requests from the business banking application or want to review them before approving them and creating a company.

- The application indicates the current configuration that is enabled.

- The user has only one action, choose whether to enable or disable the approval flow. On selecting the action, the application asks for confirmation to change the approval flow.

- For the out-of-the-box application, the default setting is auto-approval.

Type of organization

The list items (SME Online Banking, Sole Proprietor, Partnership, Trust and more) are configurable in the Spotlight application.

Role in the company

The list items (Administrator, Authorizer, and more) are configurable in the Spotlight application.

Integration

This feature is integrated with Temenos Transact.

APIs

The following APIs are shipped as part of this feature. For the complete list of APIs with more information, see Experience APIs documentation.

| API | Description |

|---|---|

| getBusinessTypes | Fetches the list of supported business types. |

| getCompanyAccounts | Fetches the company details and accounts after OTP verification. |

| getCompanyDetails | Fetches the company details for business enrollment from Spotlight. |

| getDbxOrganizationDetails | Fetches the organization details based on search. |

| createOrganization | Creates an organization in DBX. Additionally, the address, owner, accounts and membership data can also be created. |

| getBusinessTypeRoles | Fetches the roles/groups which are associated with the specific business-type. |

| getAllAccounts | Fetches all matching accounts based on the search criteria. |

| getAllFeatures | Fetches the list of services/features at the FI Level. |

| AccountType | Fetches the list of account types. |

| checkIfCompanyExists | Checks for authorized signatory and company availability in DBX. |

| fetchAuthorizedSignatories | Fetches authorized signatories of a company. |

| updateOrganizationStatus | Rejects the organizations which are pending for approval. |

| enrollOrganization | If the business enrollment is auto approved and virtual company creation is successful, email is triggered to all the authorized signatories associated with the Customer ID. |

| getListOfOrganizationsByStatus | Fetches the list of organizations which are pending for approval. |

| getOrganizationBusinessTypeSignatories | Fetches the signatory types associated with the organization’s business type. |

| IsEmailLinkActive | Confirms whether the email link is active or not. |

| SetOrgEmployeePassword | Sets up a user name and password. |

| updateOrganization | Updates the details of an organization. |

| verifyOTPPreLogin | Validates and verifies the OTP passed in from the application for the given pre-login scenario like reset password or user enrollment. |

| requestEnrollOTP | Initiates the SCA process or fetches additional parameters required to initiate the SCA process. This service is invoked in pre-login flows like password reset and user enrollment. |

| createOrganization | Creates an organization for the business user in the application. |

| getCustomerTermsAndConditionsPreLogin | Fetches the terms and conditions of business enrollment. |

| getDbxOrganizationDetails | Fetches the organization details based on ID, email, and name. |

In this topic