Mobile Banking

The Temenos Digital Mobile Native application is a combination of Retail Banking and Business Banking. This is a typical banking application that helps customers to perform their banking activities.

The following security features are available for the user to enhance mobile banking security.

Prerequisites

- mobile application

- User ID and activation code

The following authentication mechanisms are enabled in the Mobile Native device to enhance the security of the banking application.

- PIN-based

- Biometrics

- Fingerprint

- Face ID

- Username and Password

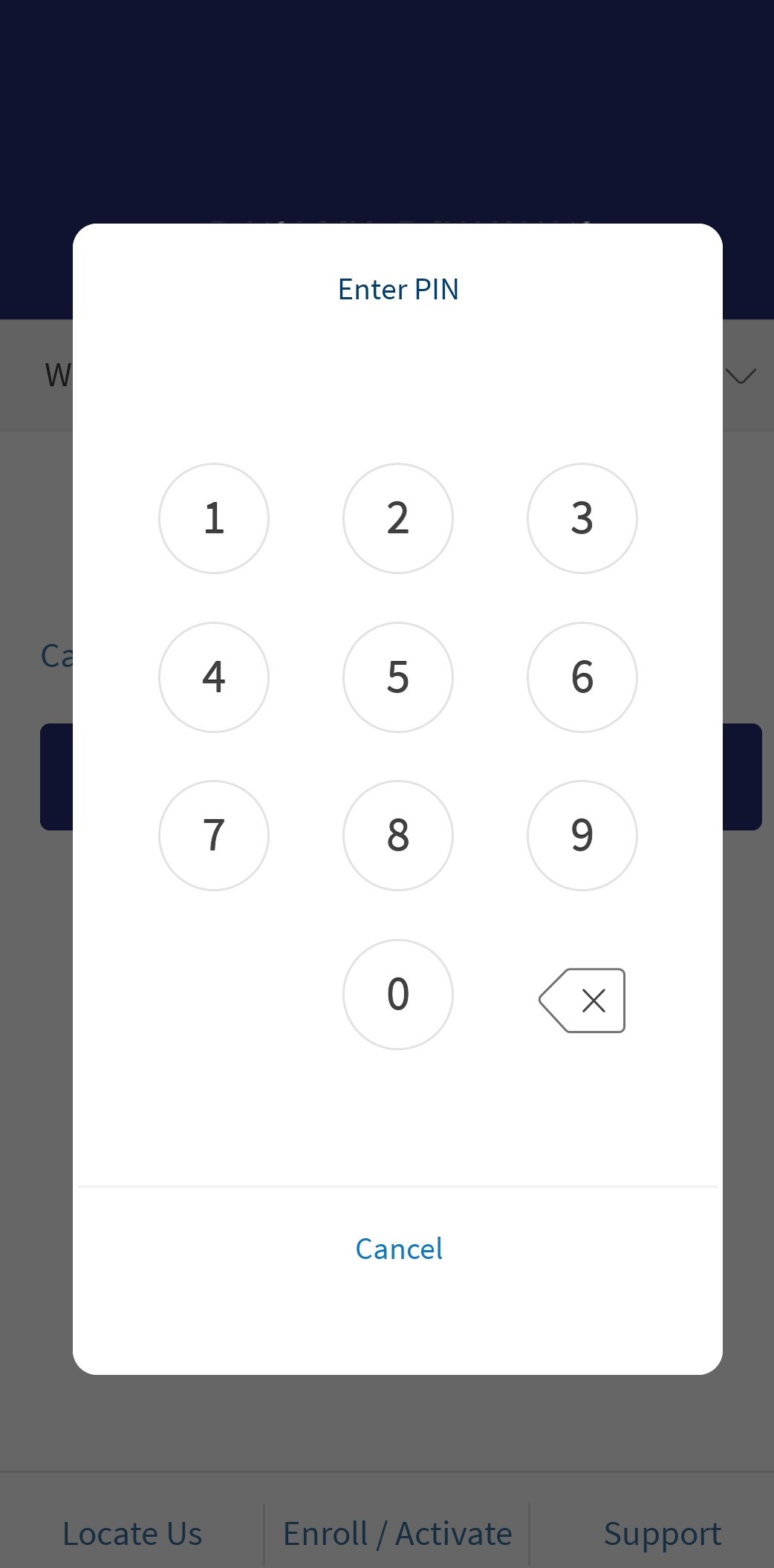

PIN-Based

PIN-based authentication method helps the user to sign in to the application using a PIN(combination of numbers). This feature allows the user to set a PIN while activating the user profile.

While mobile banking activation, if the user is not choosing Biometric authentication, the user must enter the PIN every time he signs in to the mobile application.

The following are the characteristics of the PIN and depends on the third-party authentication providers configuration such as:

- Combination of total numbers(4 or 6 digits).

- Excludes simple and easy combinations(1111, 1234).

- Limitations for password wrong entry.

Biometric Authentication

The Biometrics authentication methods rely on physical characteristics such as Fingerprint and Face Identification. The following are the preferred authentication mechanisms based on the devices.

| Face ID | Fingerprint | Preferred Authentication |

|---|---|---|

| ✓ | ✓ | Face ID |

| ✓ | ✗ | Face ID |

| ✗ | ✓ | Fingerprint |

| ✗ | ✗ | Pin-based |

Face Authentication

The user configures Face ID while activating a bank account in mobile banking. The application has its unique algorithm for facial recognition and does not depend on the native mobile face ID authentication method.

To refactor the Face ID authentication, the user must reinstall the mobile banking application. There is no option for changing or resetting the Face ID in the mobile banking application.

Fingerprint Authentication

The user configures the Fingerprint authentication while activating a bank account in mobile banking. The user needs to set up a fingerprint as the application does not depend on the native mobile fingerprint authentication method.

To refactor the Fingerprint authentication, the user must reinstall the mobile banking application. There is no option for changing or resetting the fingerprint in the mobile banking application.

After login, users can switch from Biometric Authentication to PIN Authentication and PIN Authentication to Biometric Authentication.

Self Enrollment

Use this feature for Self Enrollment and activating the digital profile. See Self Enrollment for more information.

Activate Digital Profile

Use the feature to register for mobile banking. Registering a device allows you to use several other features of the application. The device gets auto register when you successfully sign in to the mobile banking app for the first time. See Activate Profile for more information

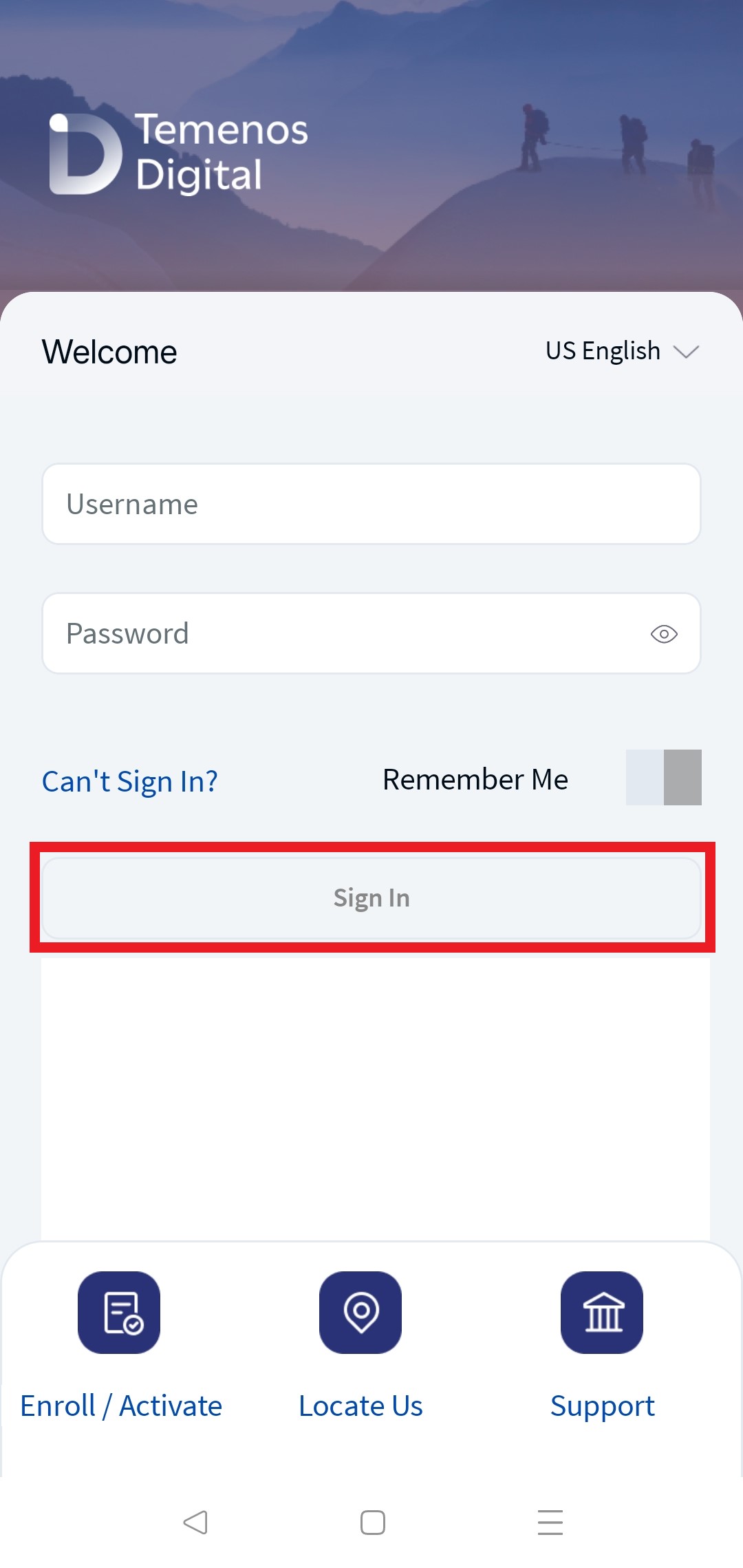

Sign In - Single User

After you open the application, the application displays the Sign In screen. Use the feature to sign in to the application securely.

To sign in the mobile banking, follow these steps:

- Open the mobile banking application.

- Enter the username and tap Sign In

- The application ask for biometric authentication. see Biometric Authentication for more information.

- If Biometric Authentication is recognized, the application displays dashboard page.

- If Biometric Authentication is not recognized multiple times, the user can use the PIN to sign In.

- After successful Authentication, the application displays the dashboard page with the financial information.

Sign In - Multiple User

A single user can have one or more than accounts with multiple user ID. The same mobile banking application is used to sign in all the accounts. The accounts are segregated as primary and secondary accounts.

- Primary account is the first account activated in the mobile device.

- Secondary accounts is the subsequent accounts added to the mobile device after activating the primary account

After you open the application, the application displays the Sign In screen with primary user ID as default. For the Primary user ID, user need to sign in with Face ID and for the secondary or subsequent user IDs user need to sign in with PIN.

To Sign In the mobile banking from the multiple user IDs, follow these steps:

- Open the Mobile banking application.

- Select the required User ID from the drop-down list of User IDs.

- Tap Sign in

- For the Primary user ID, the application need Biometric Authentication. See Biometric Authentication for more information.

- For the secondary or subsequent user IDs application need for PIN-Base Authentication.

- After successful authentication, the application displays the dashboard page with the financial information.

Push Notifications

The Push Notification feature is only for Mobile Native devices. This feature creates a notification or alert on the mobile device. This Push Notification notifies the user when there is a monetary or non-monetary request to the banking application.

- Expand the notification to Approve or Reject the request.

- Tap the notification banner, a dialog box displays on the screen(the display can display over another app from background), stating the request and options to Approve or Reject.

The bank mobile application has an alternate way to see a Push Notification if it is not displayed on the home screen.

The following procedure is to approve or reject a Push Notification from the home screen.

- A security notification is sent to your registered mobile device.

- If notification is shown on your mobile screen, you can Approve or Reject.

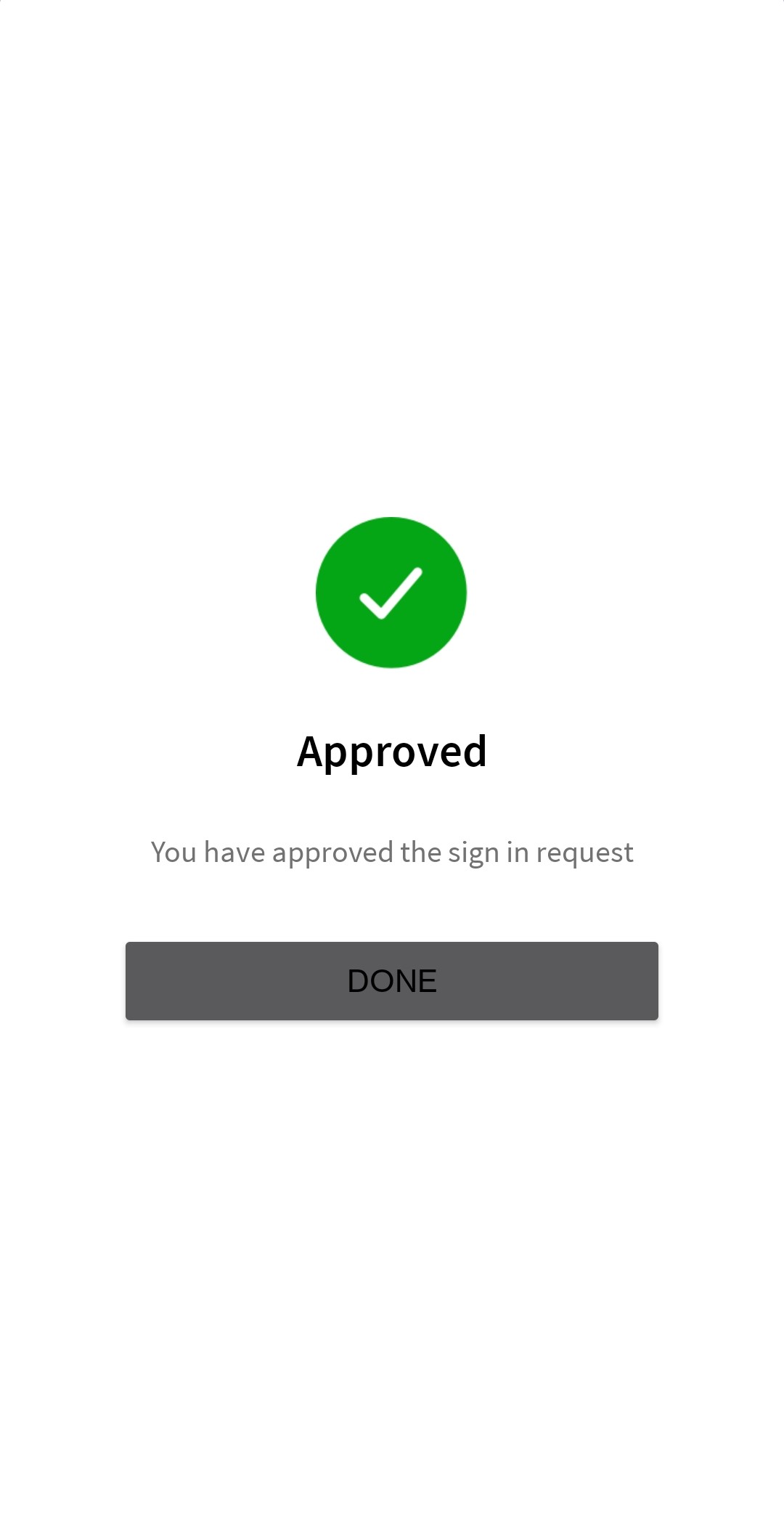

Approve: Click approve, you can see a Biometric Authentication. See Biometric Authentication for more information.

Reject: To Reject, click Deny.

It is considered a rejection of request if the user Rejects or does not open the Push Notification.

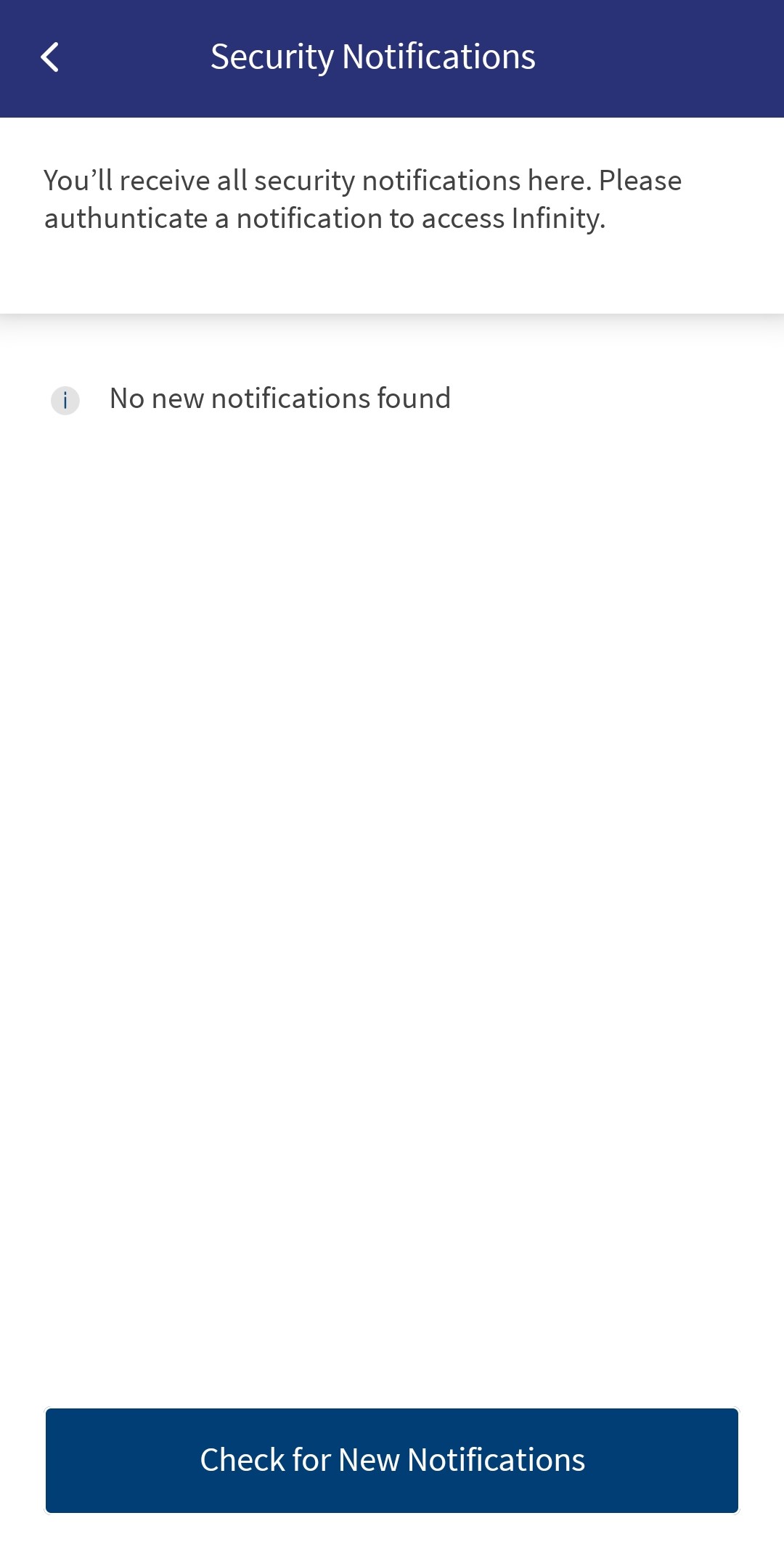

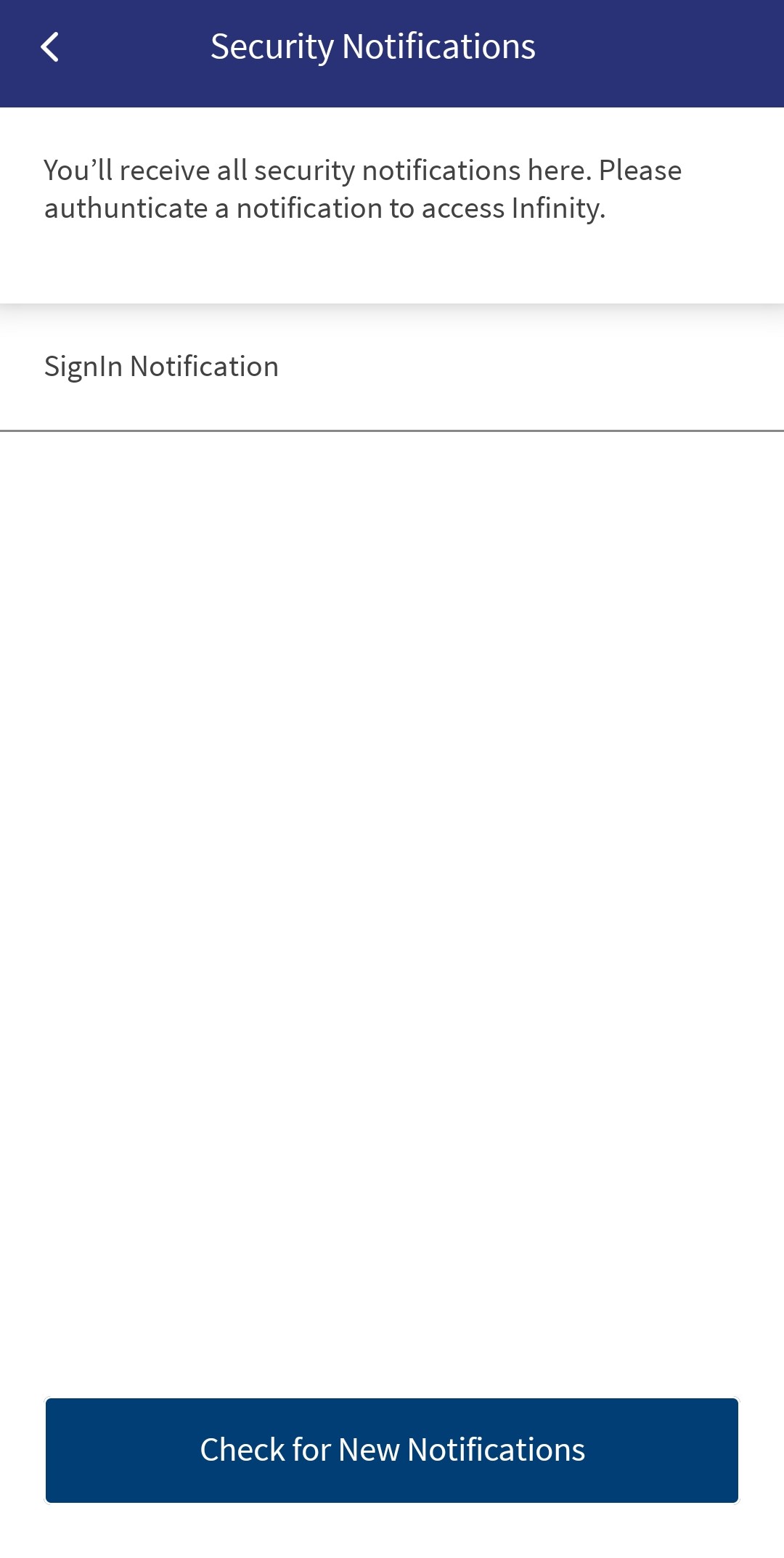

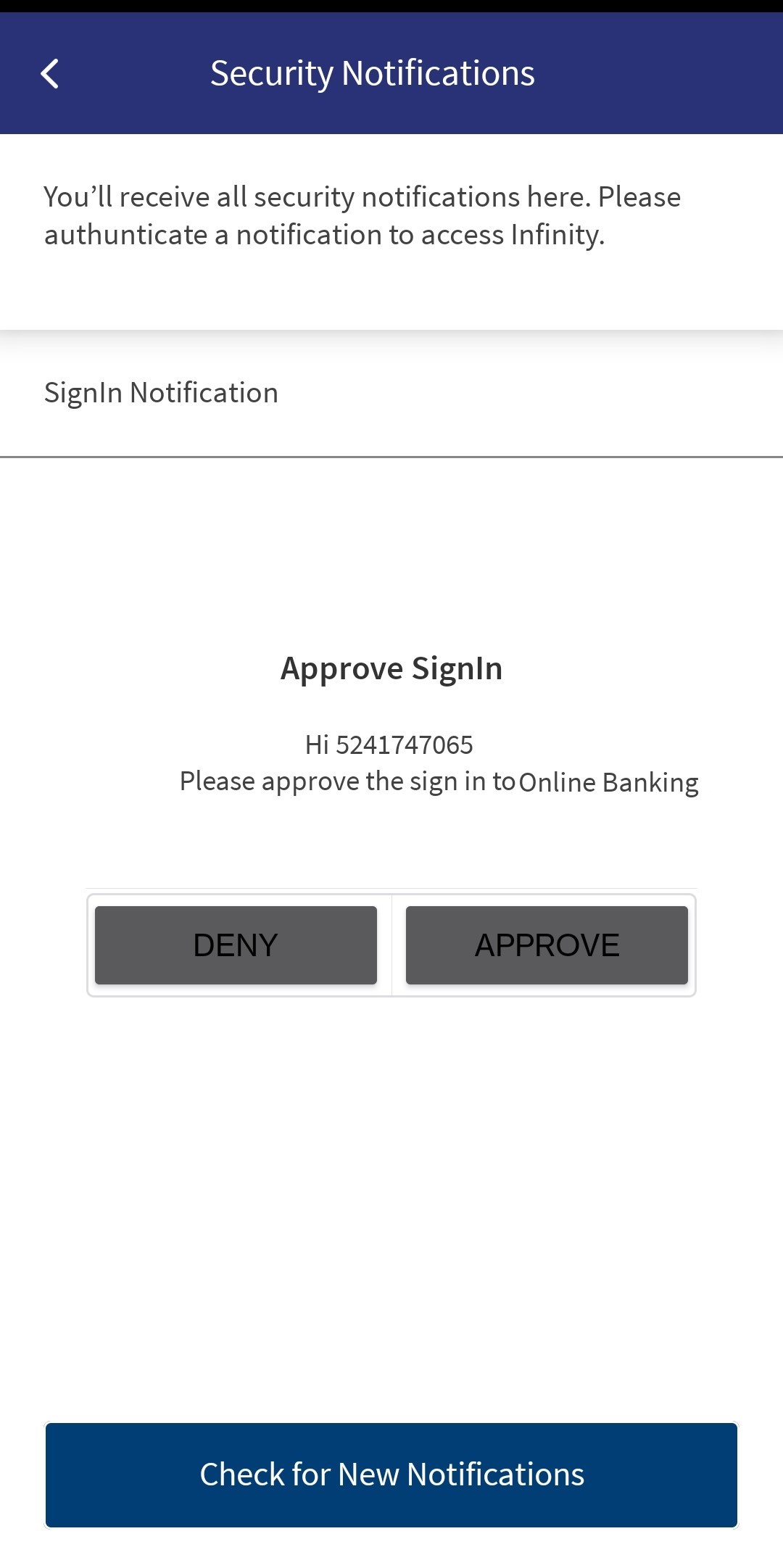

The following procedure is to approve or reject the Push Notification in bank mobile application.

- Sign in to mobile application.

- Navigate to Settings > Security Notifications.

- Refresh the page.

Approve: Click approve, you can see a Biometric Authentication. See Biometric Authentication for more information.

Reject: To Reject, click Deny.

Refresh the Push Notification screen, if the user is expecting a notification and not appearing on the screen.

Secure Payments

The feature helps the user secure to the payment with SCA authentication and helps the bank to protect the electronic payment.

The secure payment is a push notification approval method added to the payment flow. This authentication mechanism is triggered after clicking transfer or creating a transfer request in the payment flow. This authentication mechanism is activated for all monetary transactions.

The following is expected mobile banking application for monetary transaction with secure payment feature.

- Sign in to the mobile banking application.

- Navigate to payments and initiate Transfer request.

- Enter the required details and click Transfer.

- A success message appears on the screen.

The monetary transactions scenarios are added in the Spotlight application.

Secure Payments - High Value Transaction

The feature helps the user to secure the high value payment with SCA authentication by adding an extra layer of security and helps the bank to protect the electronic payment.

The secure payment is added with push notification along with biometric authentication method. This authentication mechanism is triggered after clicking transfer or creating a transfer request in the payment flow. This is configured in the backend.

The following is expected Mobile Native application for high value transaction with secure payment feature.

- Sign in to the mobile banking application.

- Navigate to payments and initiate Transfer request.

- Select the Transfer type.

- Select the Accounts Transfer from and Transfer To.

- Enter the Amount details and click Continue.

- You can verify details and click Confirm.

- Once the user click confirm, the application checks for Face ID.

If Face ID Authentication is successful, the transaction shows as Done. If Face ID Authentication is failed, you can choose the Use PIN option. If the PIN Authentication is successful, the transaction shows a successful message.

The monetary transactions scenarios are added in the Spotlight application.

Third party authentication SDK vendors protects the monetary related activities.

Non - Monetary Transactions

The Non-Monetary Transactions are the regular transactions in the banking the application where money is not involved. These are the transaction between the customer and the bank. The transaction like cheque book request, balance enquiry and many more scenarios comes under this section.

The push notification security layer is added for these transaction to enhance the security. The non-monetary transactions scenarios are added in the Spotlight application.

Forget Username and Password

Use the feature to retrieve the forgotten user name or reset the password by providing identification details.

To retrieve the forgotten user name or reset the password, follow these steps:

- On the sign in screen, tap Can't Sign In ?. The application displays the Forgot Credentials screen.

- Enter the registered Email address.

- Enter the registered Mobile Number.

- Enter the Date of Birth in MM/DD/YYYY format.

- Enter the security captcha.

- Click Continue. The application displays the verification confirmation (Welcome Back) screen.

- You can either retrieve the username or reset the password.

- If you are not registered or enrolled for banking, the application displays an appropriate message and displays the link to enroll.

- If the information provided is incorrect, the application displays an appropriate message.

In this topic