Disputed Transactions

You can dispute any transaction to avoid fraudulent activities. If you wish to dispute any of the posted transactions, you can reach out to the bank for support.

Either debit, credit, or all transactions can be disputed based on the configuration from the Spotlight. The specific type of transactions available for dispute is configured in Spotlight.

You can dispute only the transactions that are performed in the last "X" number of days. The number of days for for which the disputed transactions can be viewed is configured in Spotlight. The dispute option is not displayed for the transactions that are performed beyond the X days.

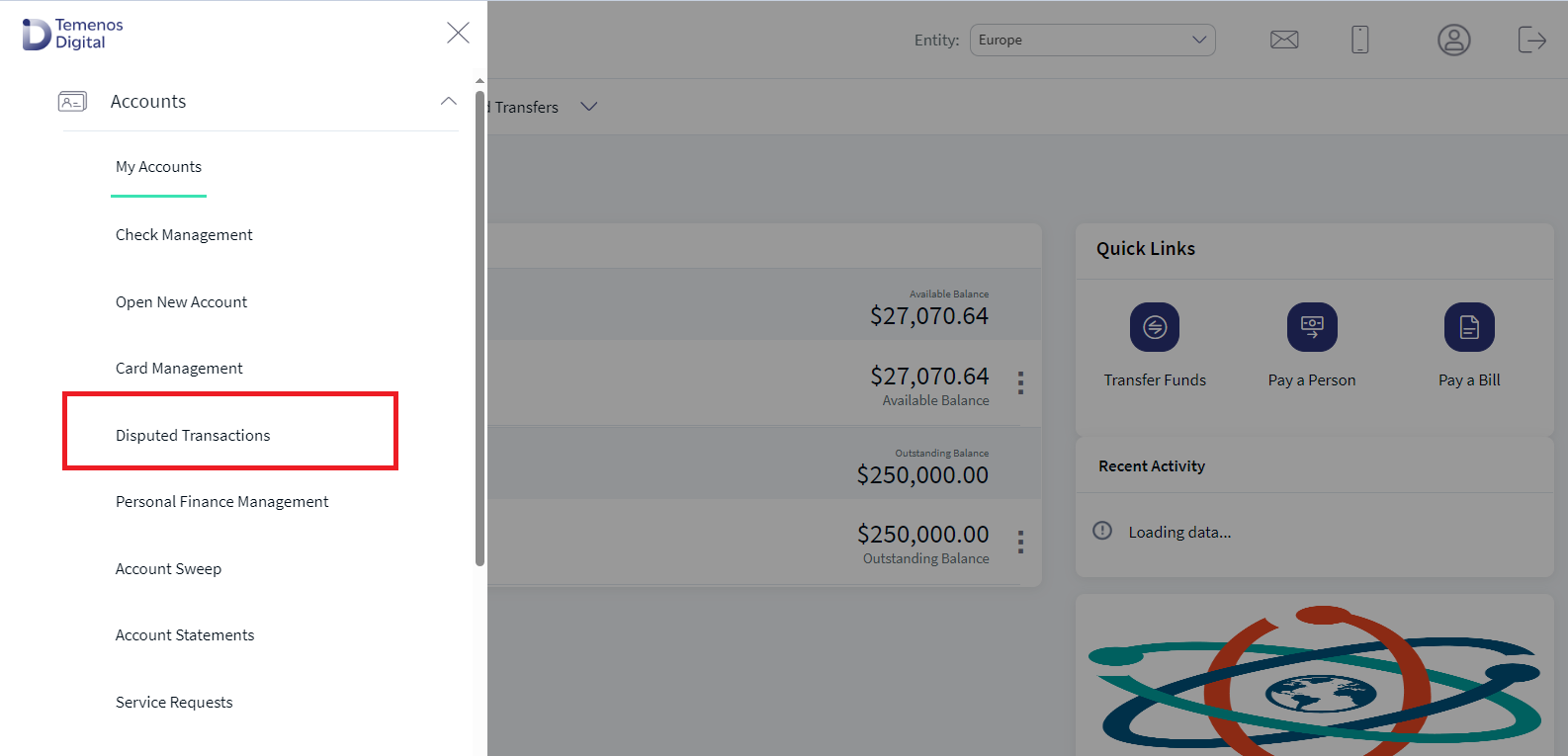

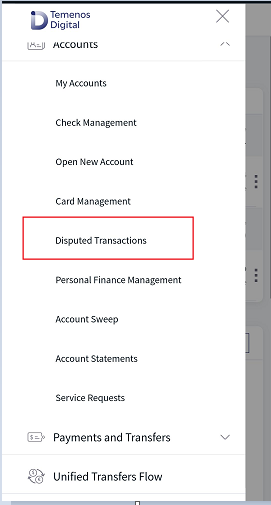

Menu path:

- OLB: Side menu > Accounts and Transactions > Disputed Transactions

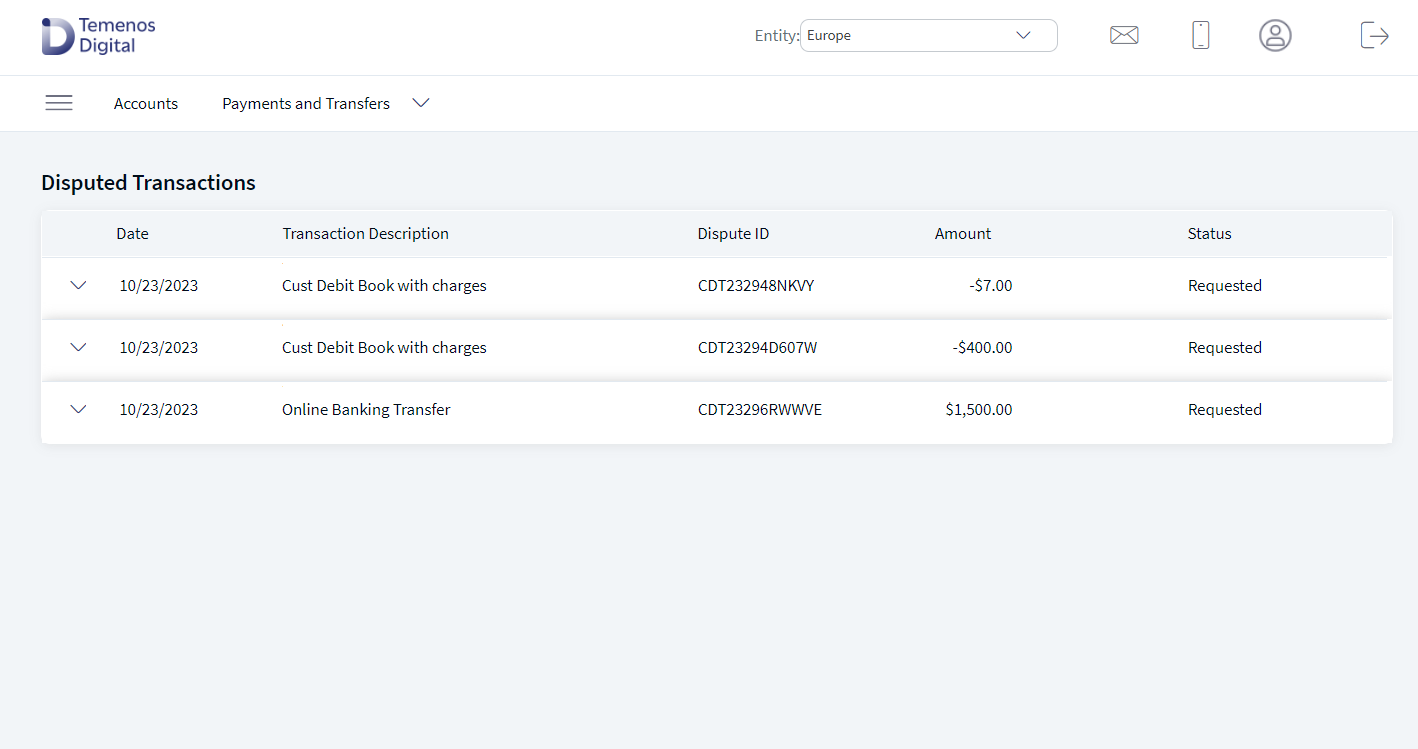

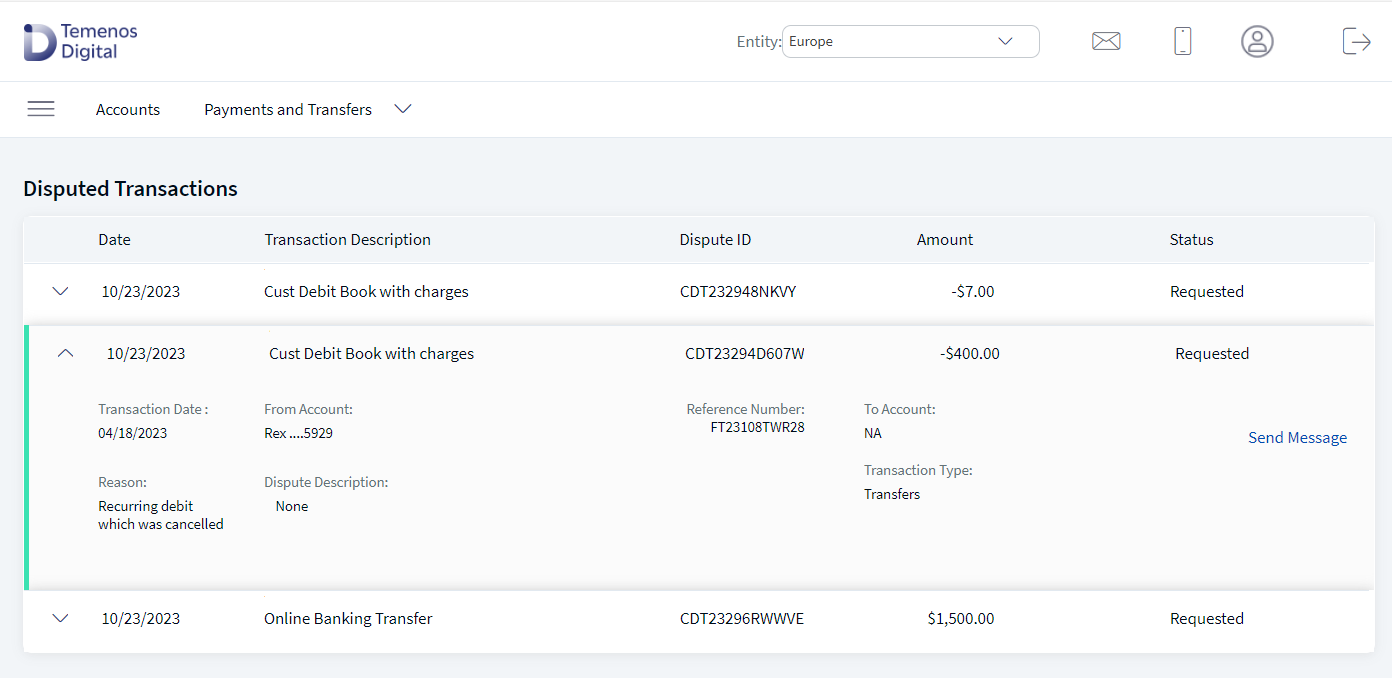

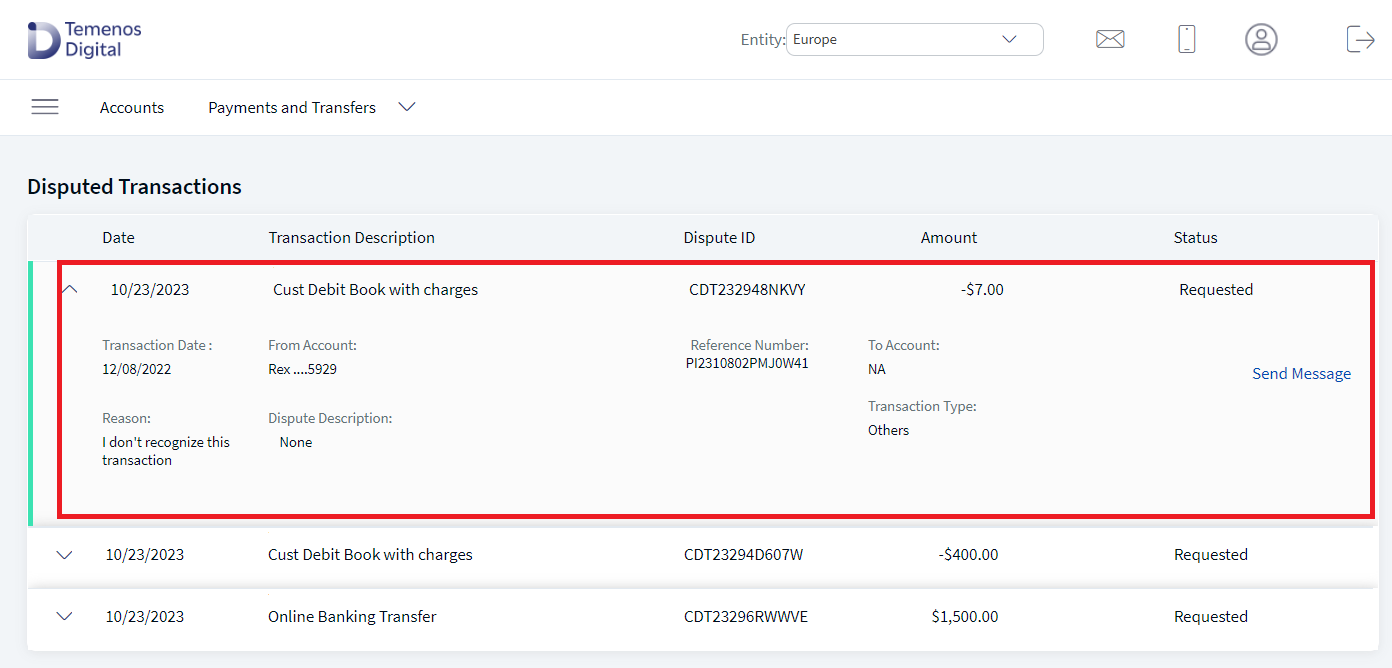

The application displays the list of disputed transactions.

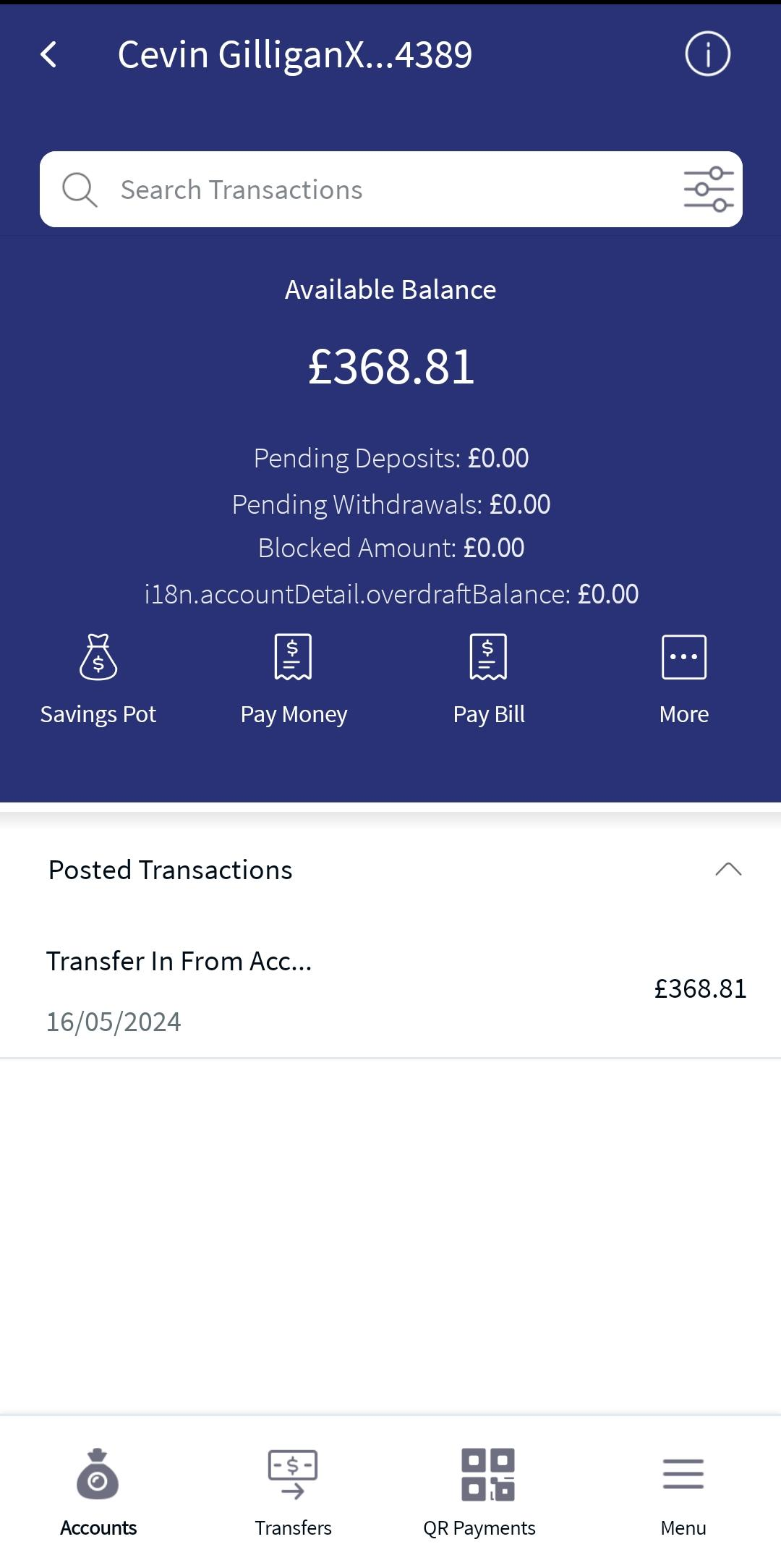

- Mobile: In the Accounts section, select an account and tap the Contextual menu (...). A pop-up appears. Tap View Disputed Transactions.

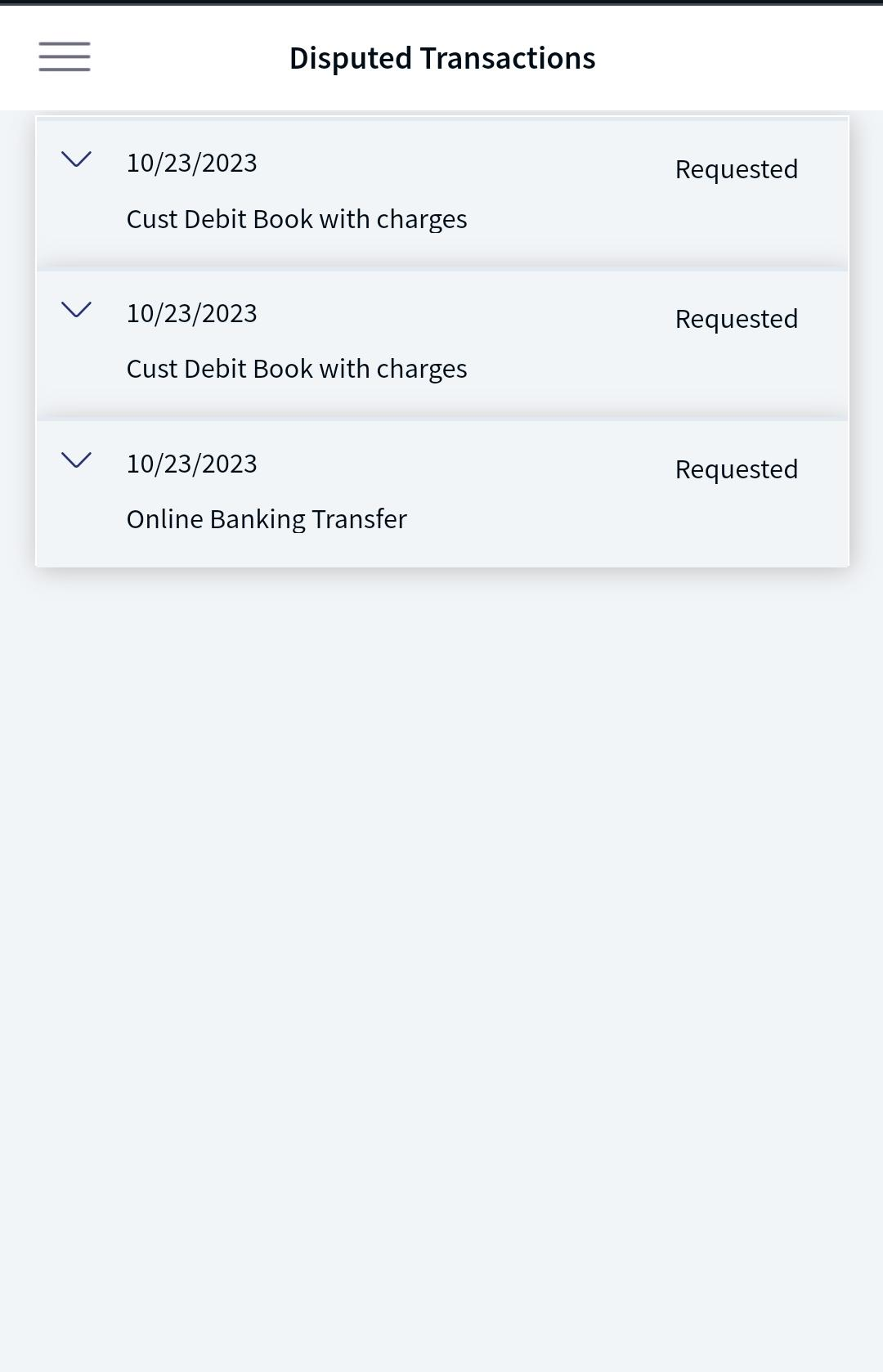

List of disputed transactions.

Web Channel

Mobile Native

You can view the primary information of the requests in the list. You can also select a request to view the additional details.

The following primary information is displayed in the list of disputed transactions:

- Date of Request

- Transaction description

- Reference Number (This is a system generated number)

- Amount

- Status - Any dispute raised is categorized among the following three statuses.

- In progress

- Resolved

- Declined

You can perform the following actions in this screen:

- View Disputed Transaction Request Details

- Sort the disputed transactions list

You can sort the list based on columns which have the sort icon.

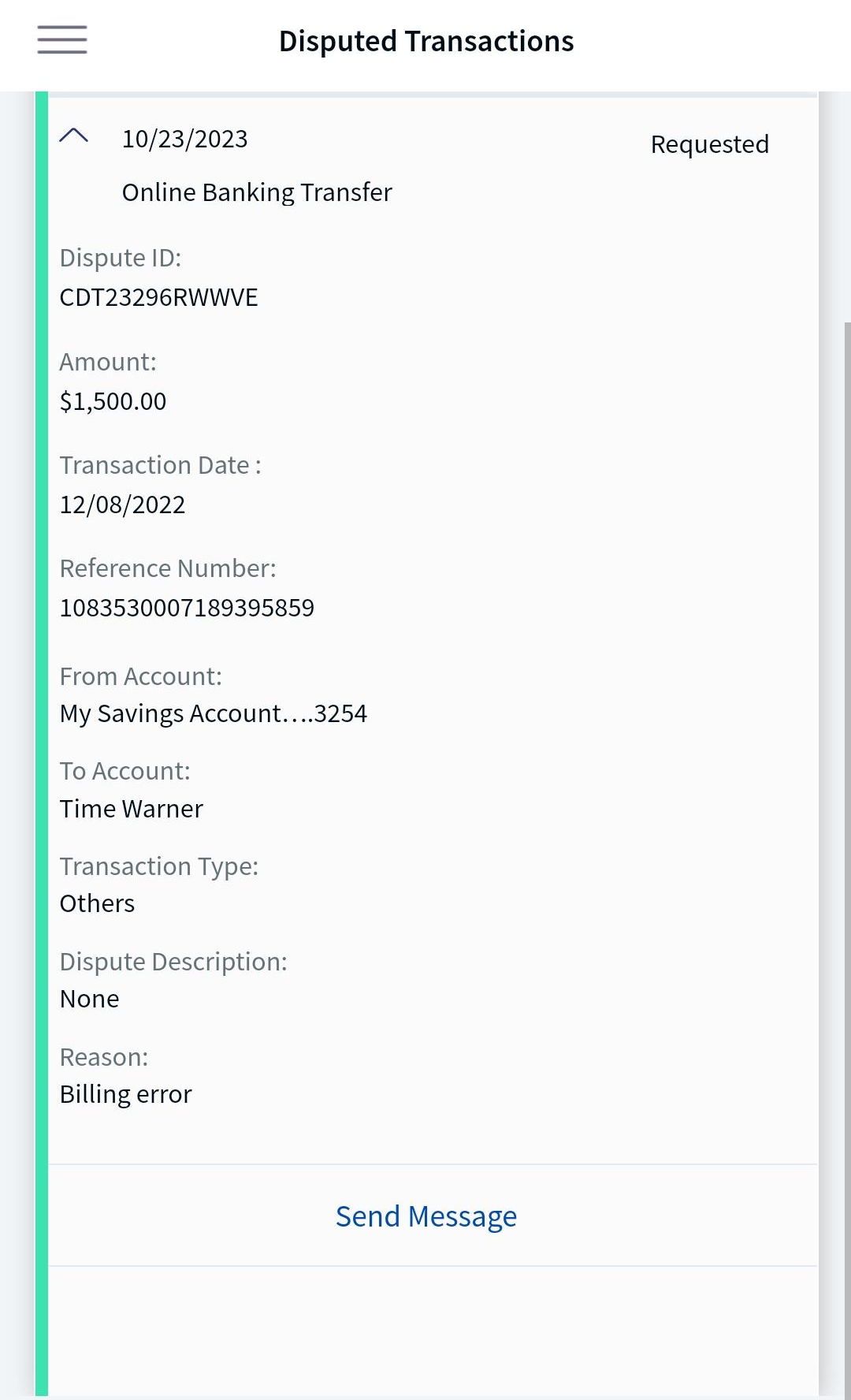

Disputed Transaction Request Details

You can view the additional details of the disputed transaction request.

Click the down arrow on the required disputed transaction. The app displays the following information:

- From Account

- To Account

- Date of Transaction

- Transaction type (Bill Pay, P2P, POS, and so on)

- Reason (selected while disputing a transaction)

- Description (provided while disputing a transaction)

You can perform the following action in this screen:

- Send a message to the bank. Click Send a Message to communicate with the bank about the raised request which is in in-progress or resolved status.

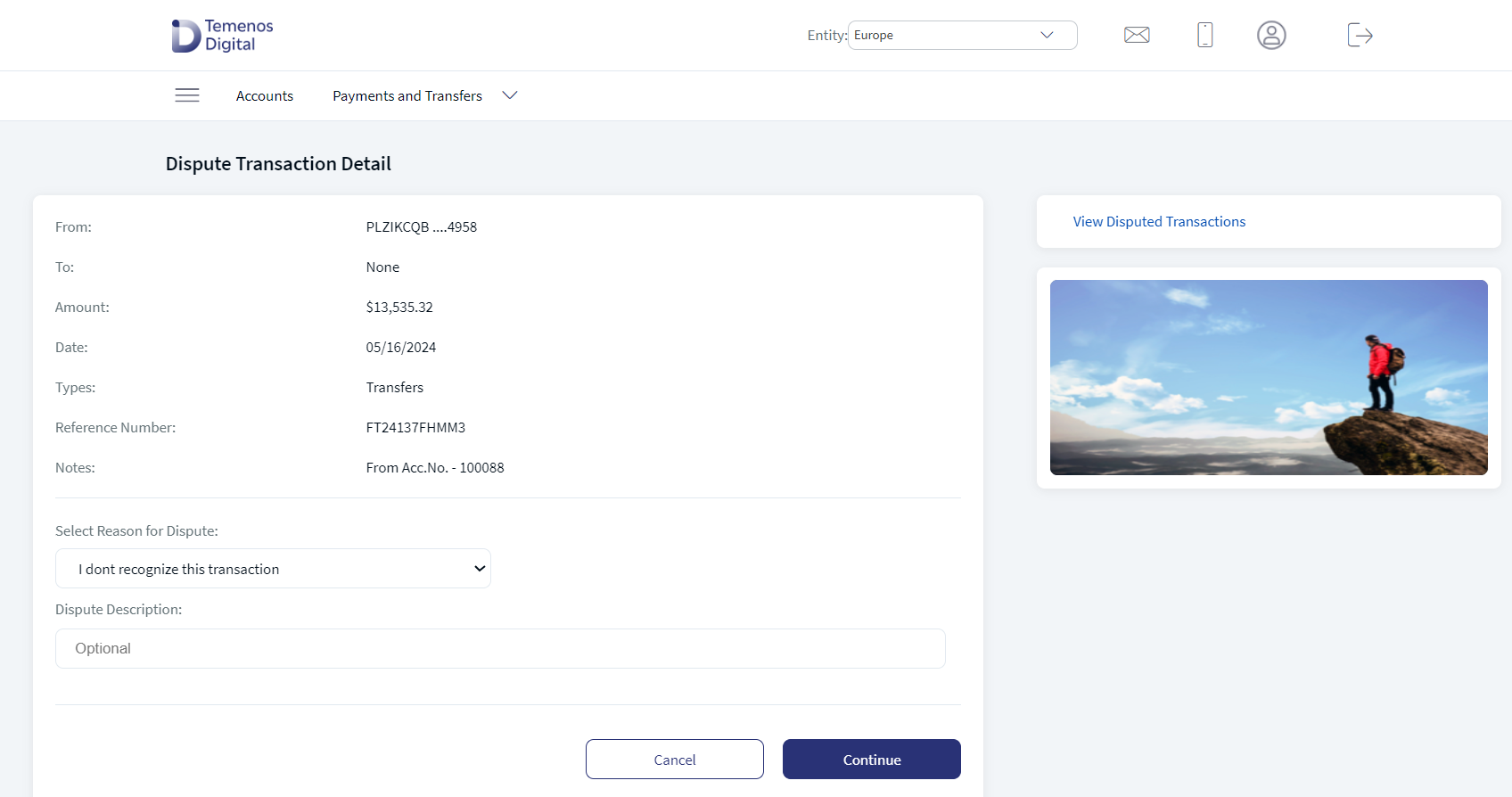

Dispute a Transaction

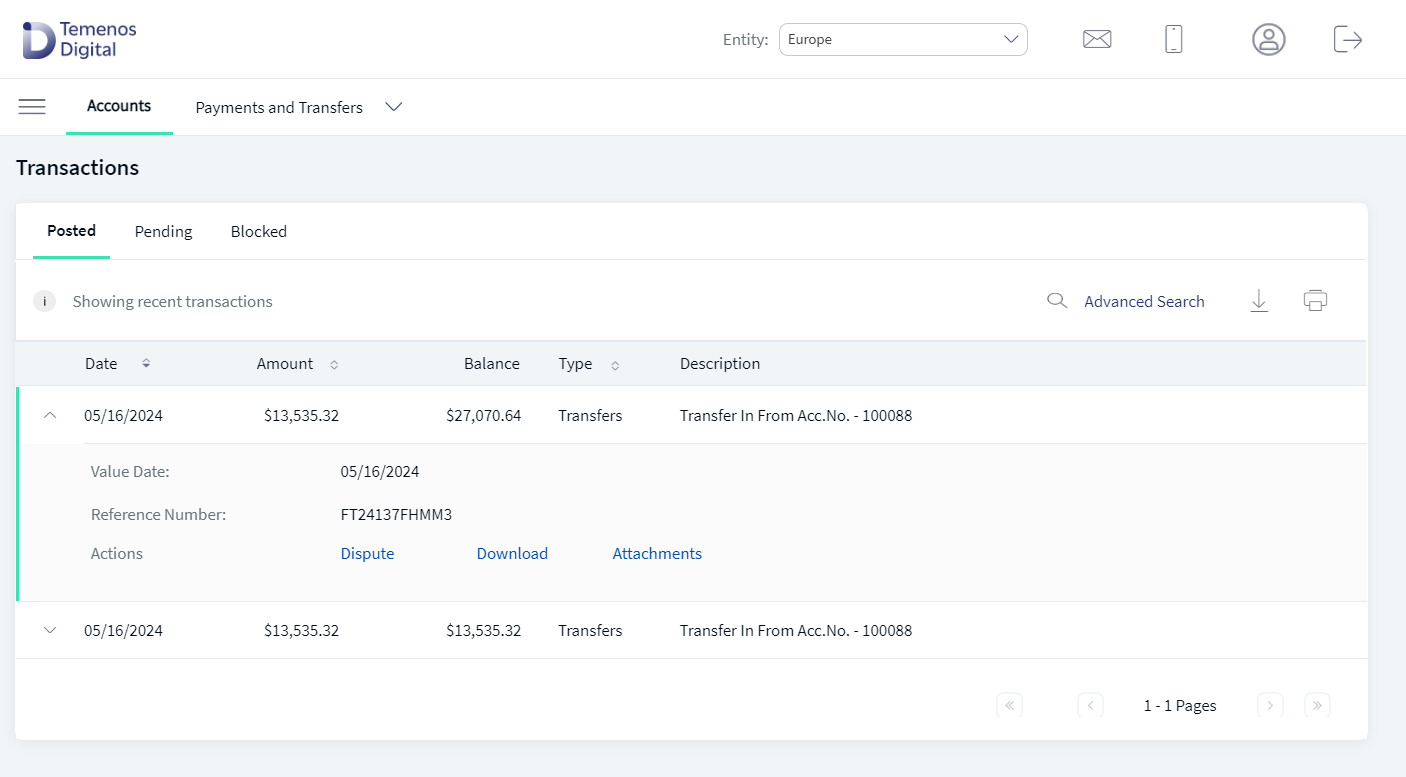

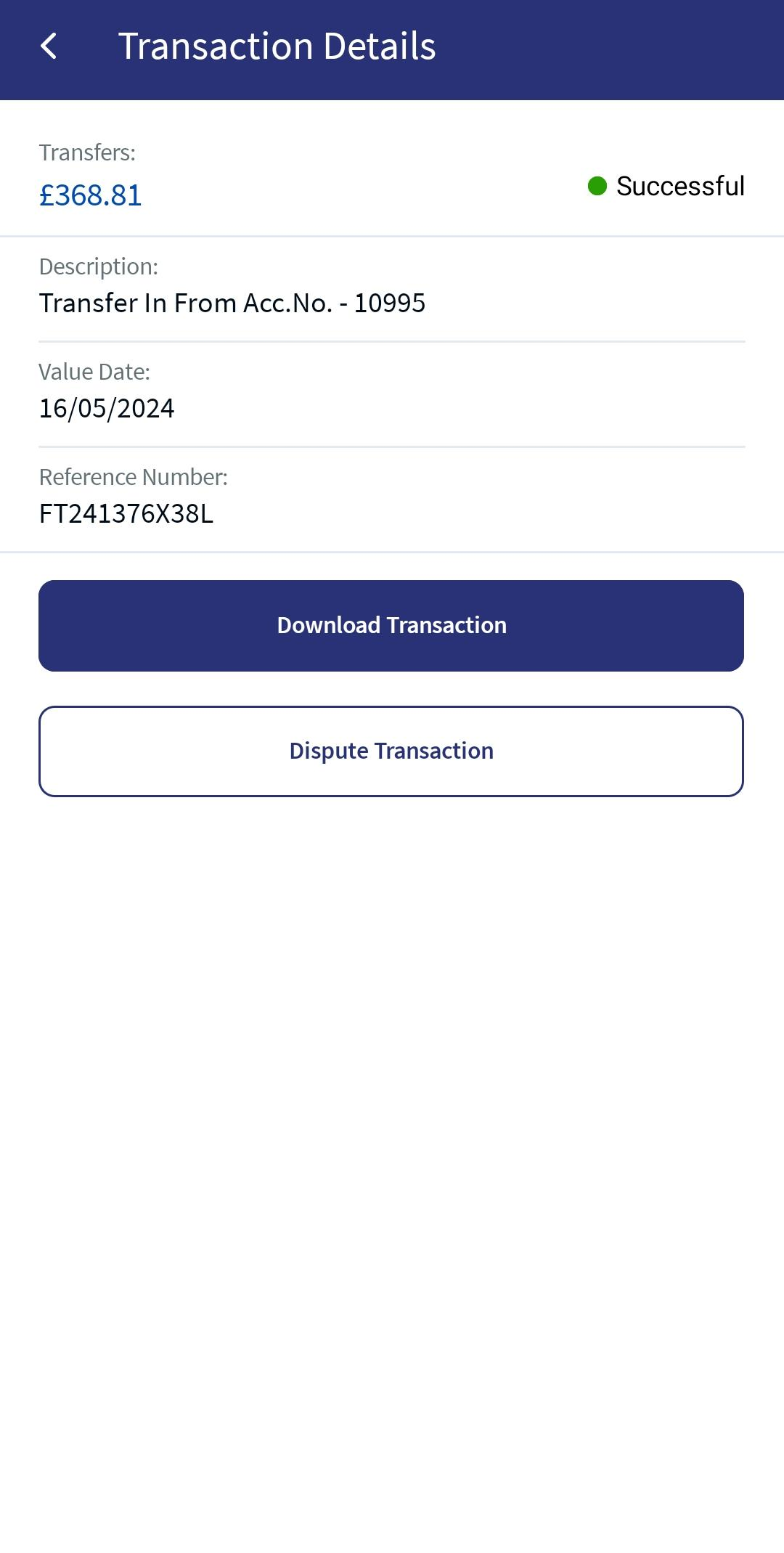

You can dispute any recent transaction for a selected account from the Transactions list screen.

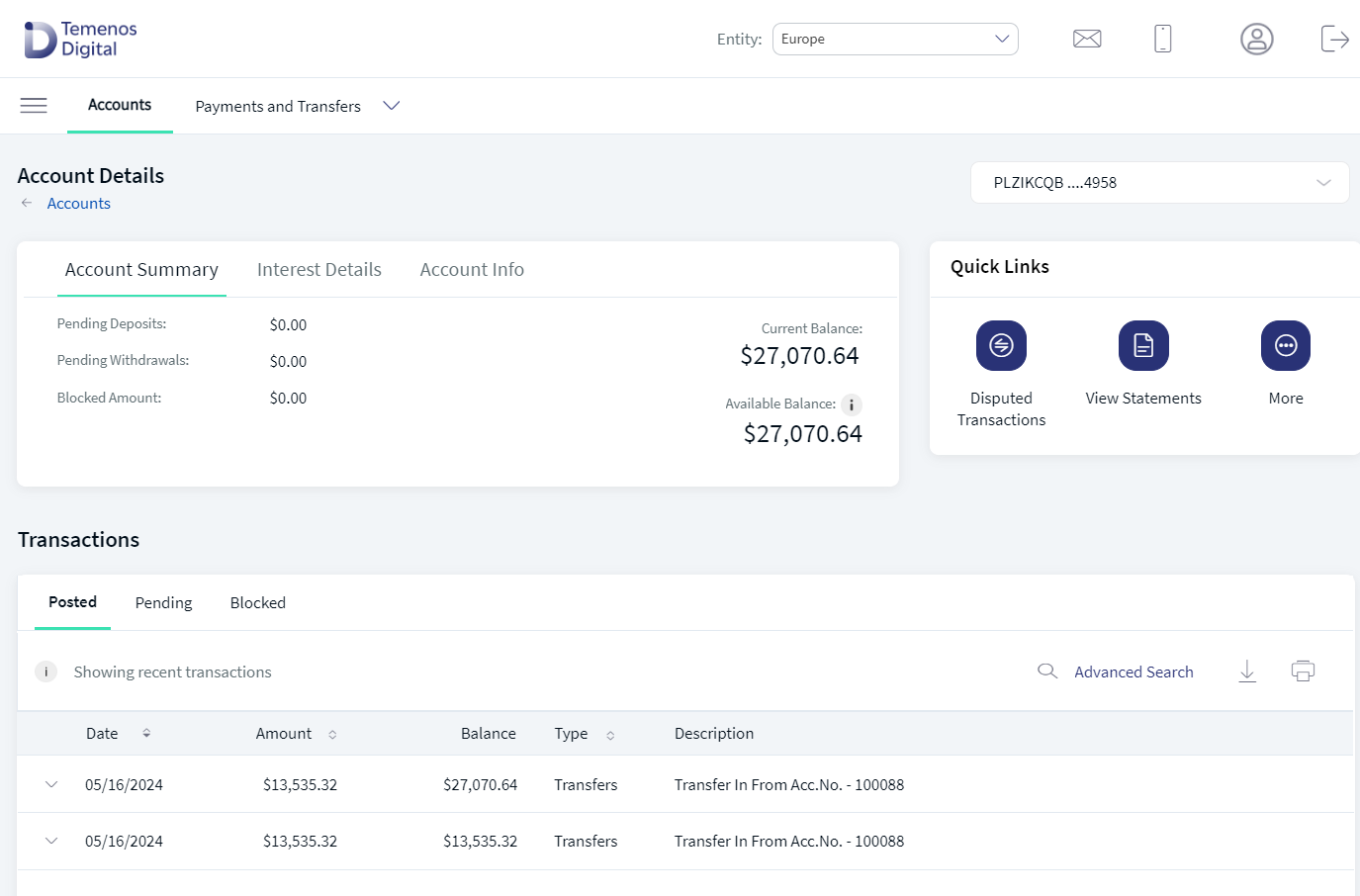

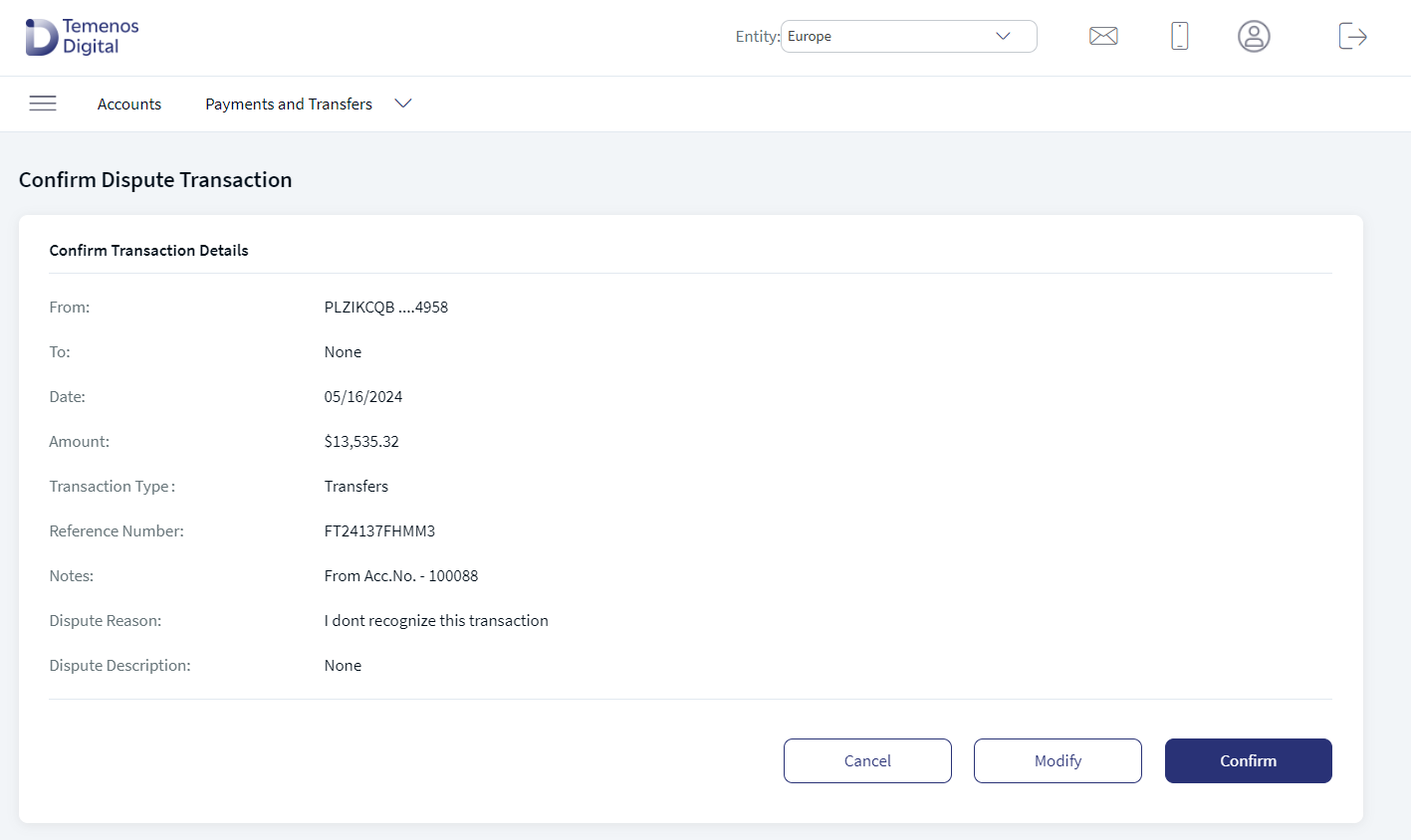

Web Channel

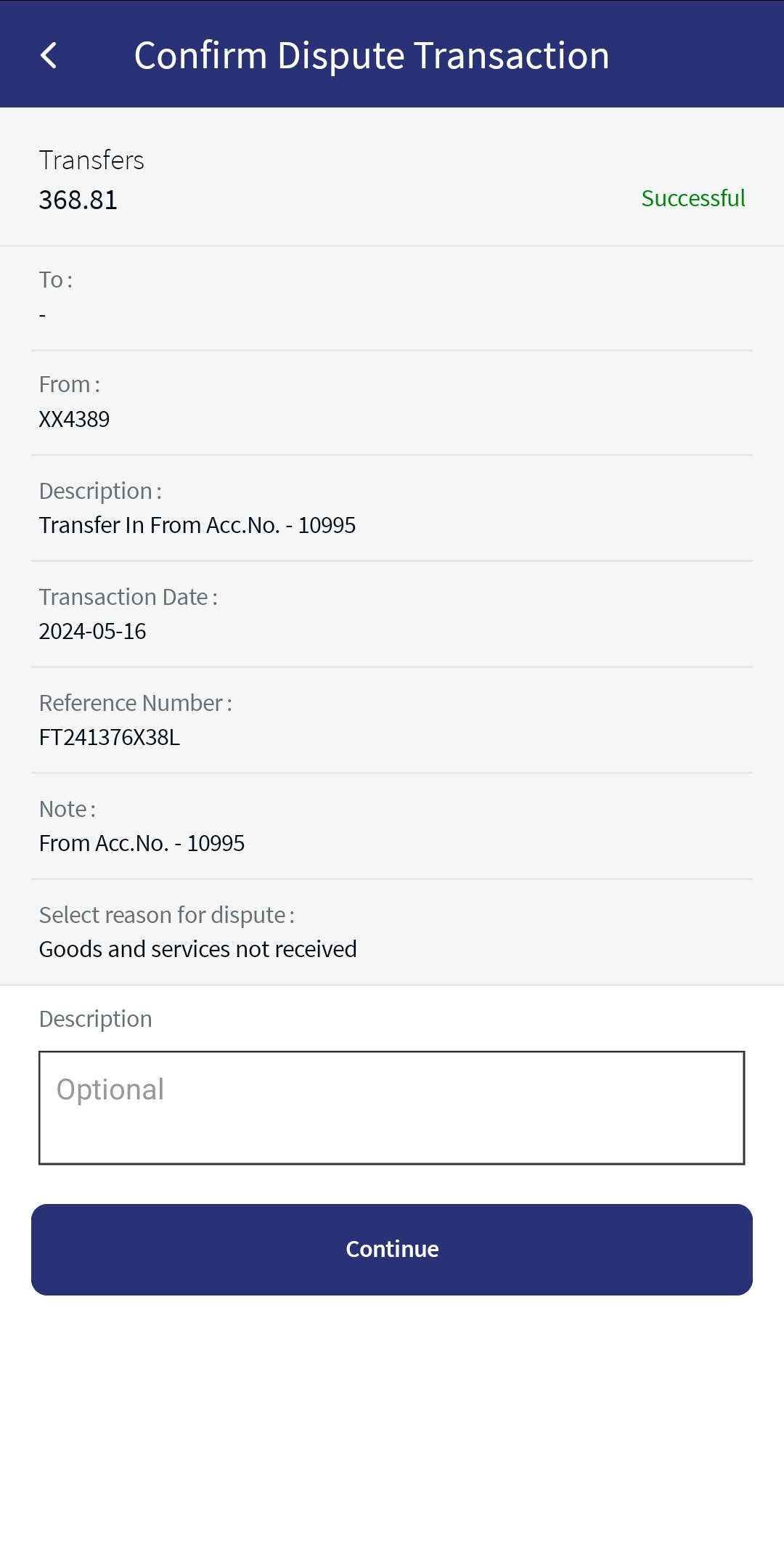

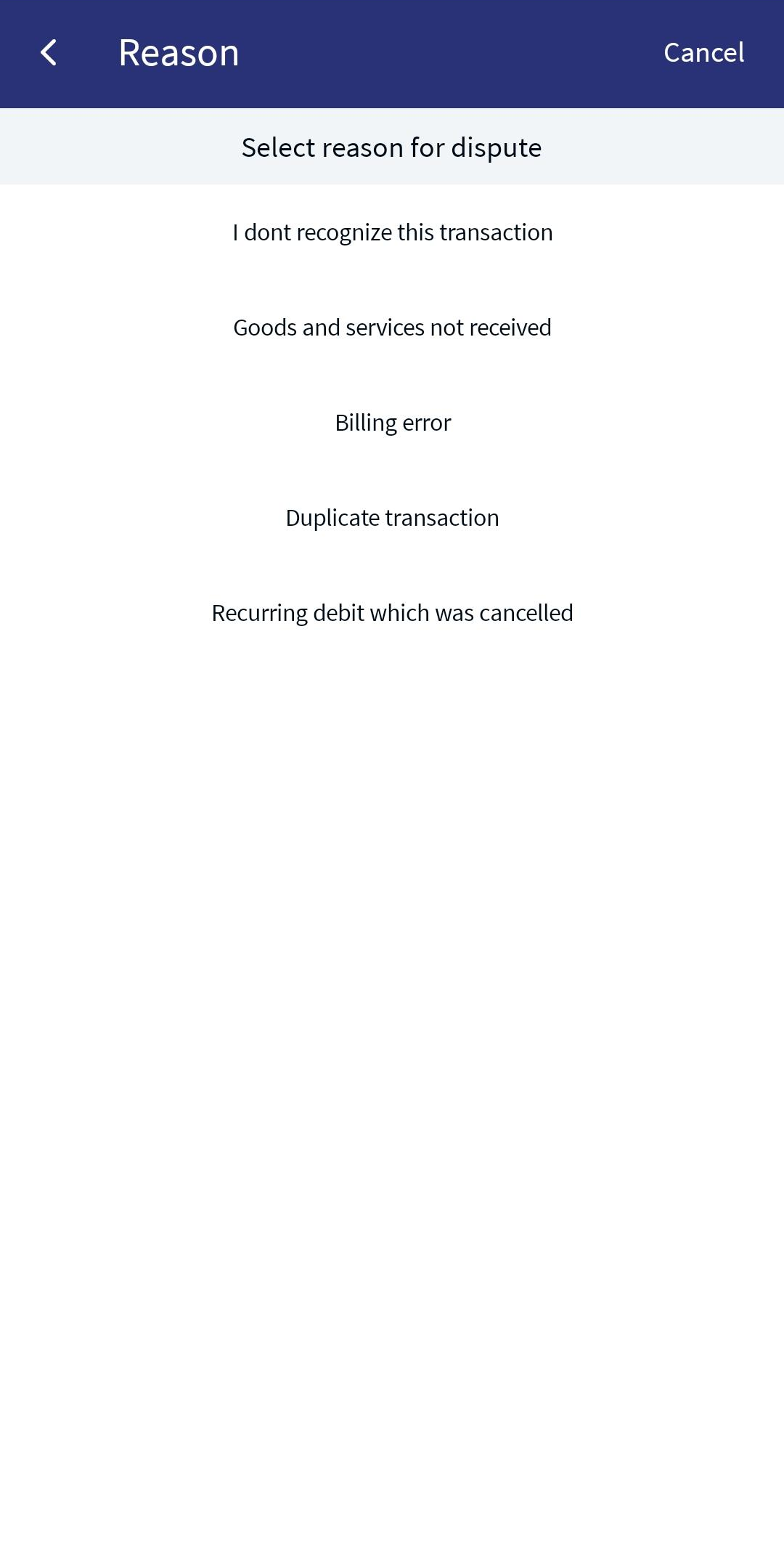

Mobile Native

You can do the following:

- Click on the required account from the home page and navigate to the Transactions section.

- Click the down arrow and select dispute transaction.

- Select the reason for dispute from the list. All the transaction details are auto-filled and non-editable.

- Enter the description for the request.

- Click Continue and confirm the same. If you want to change any details, click Modify.

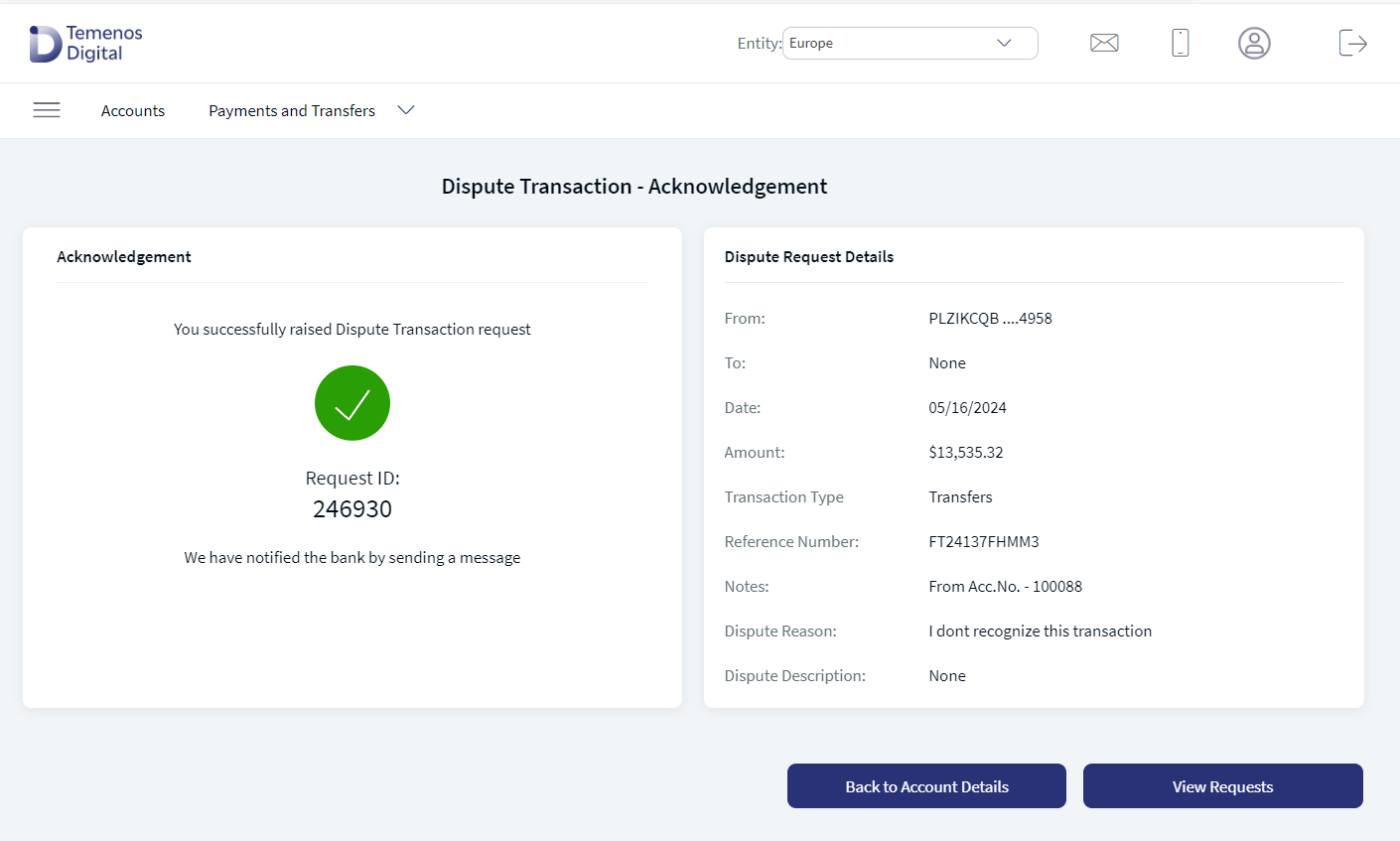

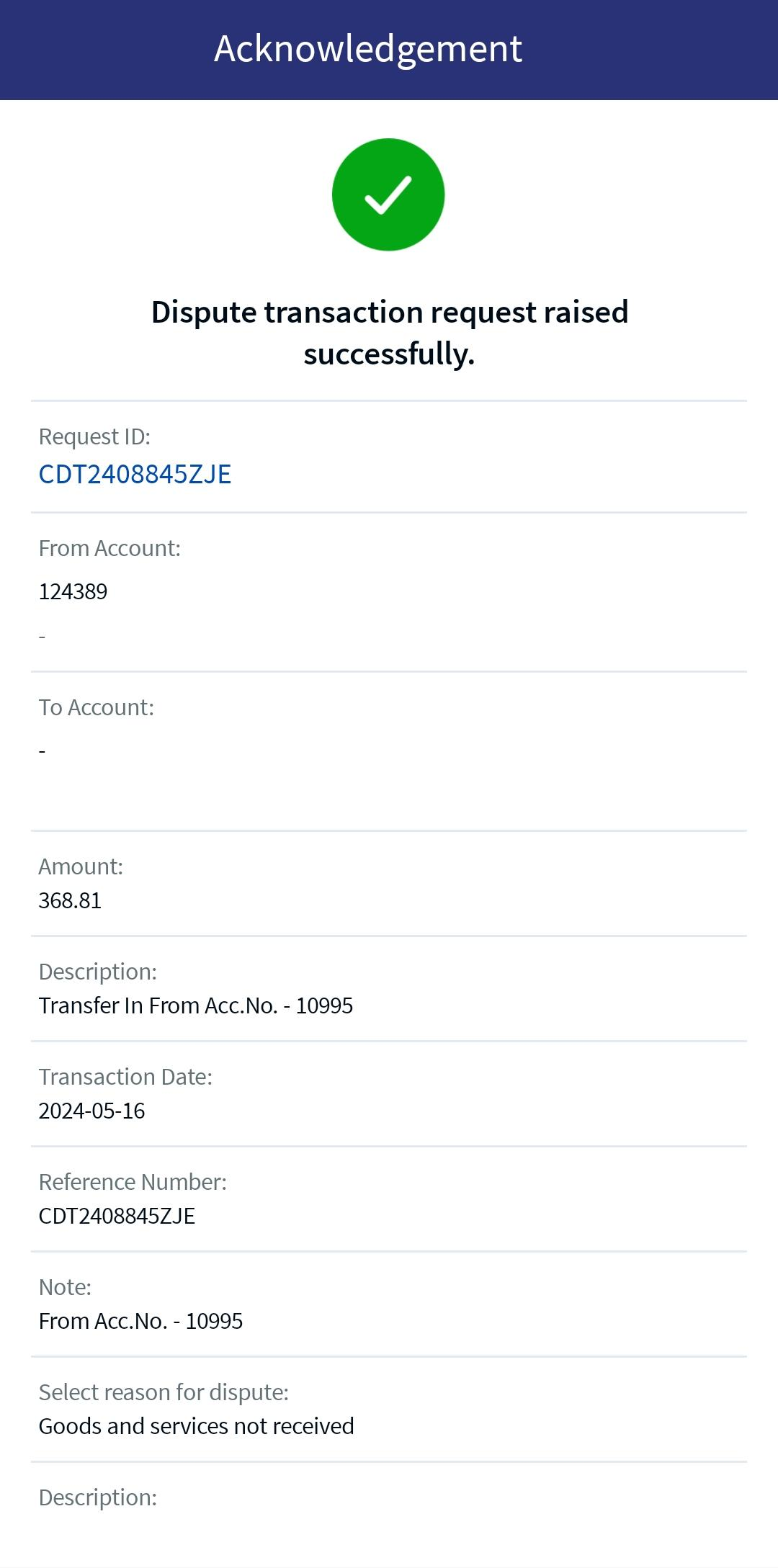

Once the transaction is disputed, the app displays the acknowledgment screen.

Service Request ID will be displayed on the acknowledgment screen when the dispute request is submitted. The service request ID can be used as a reference for all the follow up discussions with the bank. A message is displayed on the acknowledgment screen about the secure message that is sent to notify the bank about the dispute request.

- The user cannot raise multiple dispute requests for the same transaction.

- This feature uses a mock service and there is no real time integration. The implementation team must perform end to end integration for Dispute Transaction to work.

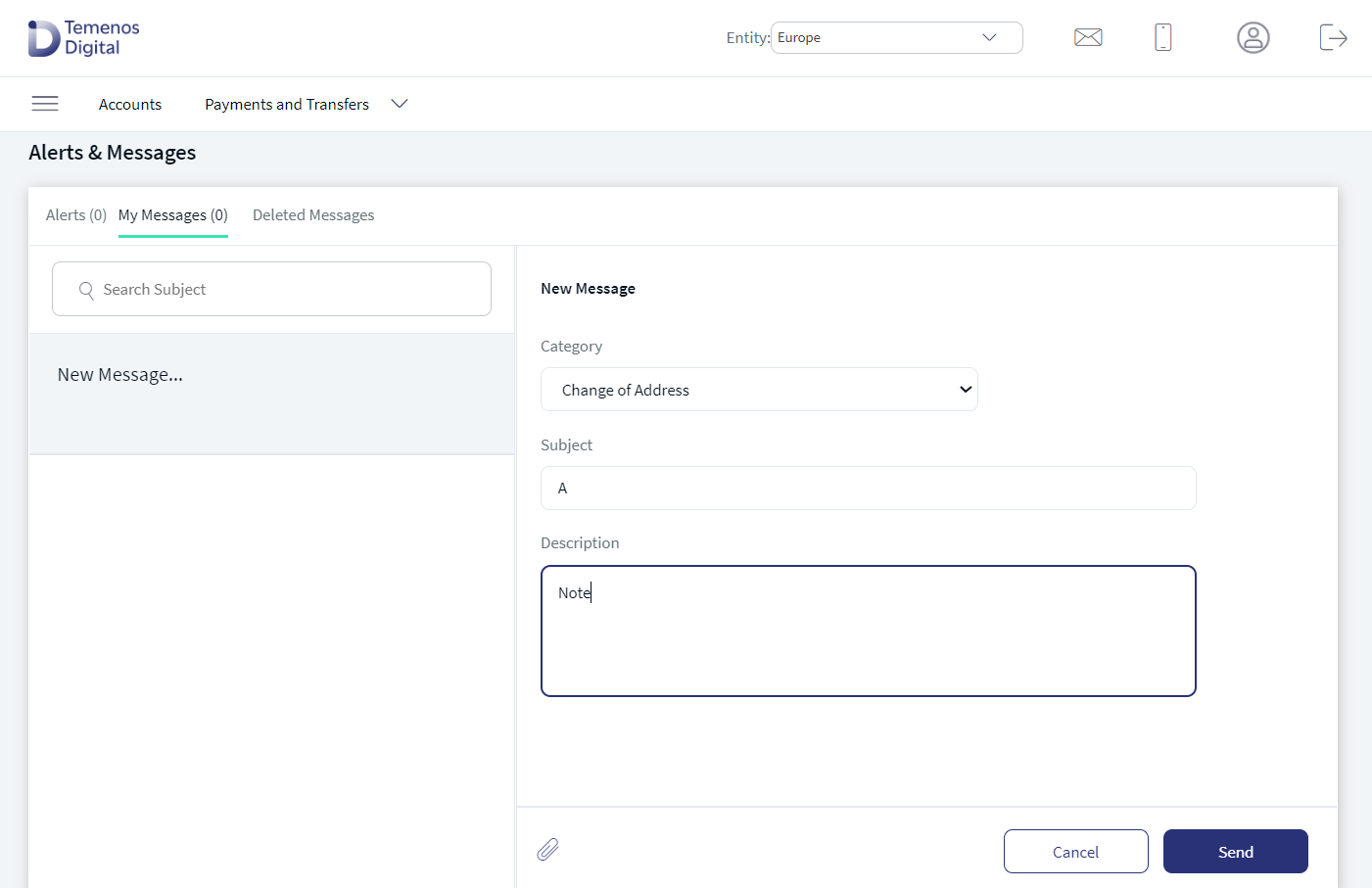

Send a Message

Click Send Message to follow-up the bank about the dispute payment request. Clicking this button will redirect to Secure Messages screen.

The following details of the transaction along with the dispute request are sent to the banks.

- Message Title - "Dispute Transaction Request #Order Management Request ID"

- Dispute Reason

- Dispute Description

- Transaction Details:

- Date

- Amount

- Reference Number

- Transaction Type

- From Account

- To Account (Beneficiary / Payee / Recipient) - In case of POS transaction/internet transaction where the To Account is not applicable, NA should be displayed

- Notes

You can view the reply from the banks and the updates for the dispute request raised under the same thread.

Click Cancel or Back to return to the dispute transactions screen.

Mobile Native

Configurations in Spotlight

The following configurations are made in Spotlight under System Configurations for Dispute Transactions.

- Once a dispute request is raised, bank agents will receive a notification on Spotlight through the secure message under Dispute Request category. The bank agent can view the details of the disputed transaction as part of the secure message.

- Bank agent can reply to the same thread to communicate with the customer on the raised dispute transaction.

- Bank agent can search for the message received from the customer by providing the order management request ID along with the existing search fields Request ID, Customer ID, and Username.

- Number of days for which the disputed transactions can be viewed.

- Under System Configurations > Edit the DBP bundle, and search for DISPUTE_DURATION configuration. Edit the configuration to update the value with number of days to view the disputed transactions.

- Configure the reason while making a dispute request from configuration bundles in Spotlight. You can configure the following:

- Add a new dispute reason from Spotlight.

- Update one of the reasons from Spotlight.

- Delete one of the reasons from Spotlight.

- A bank agent can reroute the dispute request to either card management system, bill payment system, or person-to-person based on the transaction type.

- The specific type of transactions that are available for dispute such as Debit and Credit transactions are configured in Spotlight.

Current Dispute Transactions functionality is via SRMS, as per the requirement, configuration name and configuration values should be as following:

| Module | Configuration name | Config Possible values |

|---|---|---|

| Dispute Transactions | DISPUTETXNS_BACKEND | STUB/SRMS |

In this topic