Retail Loan Origination

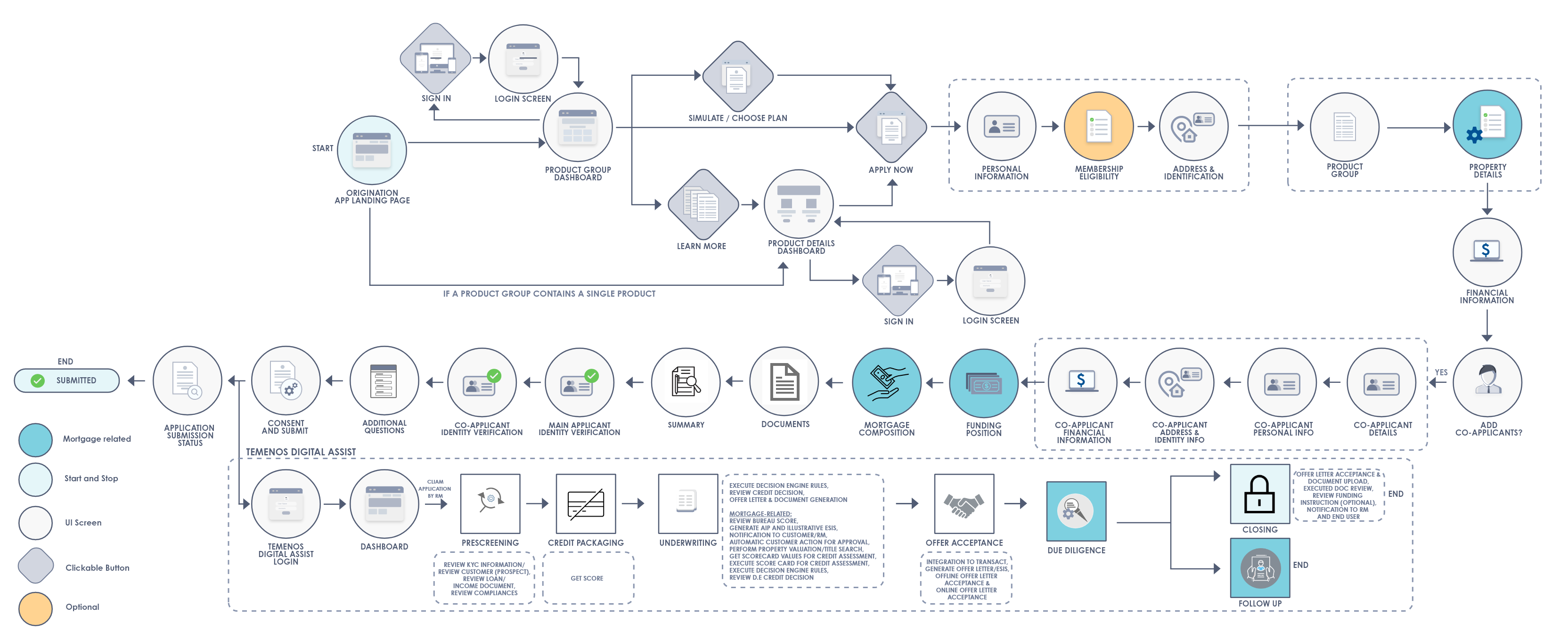

The Retail Loan Origination journey is a process where an existing customer or prospect customer can apply for loan products such as Personal loan, Overdrafts, Credit cards, Mortgage, Remortgage etc. The lending journey generally involves various stages from creating a loan application to submitting the application, and then up to disbursal of funds (where the status of the application is moved to completed). Thus, the lending journey of a retail user can be categorized as follows:

- Origination: The Origination part of the Lending journey includes creation of a loan application by a retail user till submission.

- Temenos Digital Assist: The Temenos Digital Assist App of the Lending journey involves bank users who process the submitted loan application.

- CSR journey in Spotlight: A Customer Service Representative (CSR) can process the application on behalf of the customer through the Customer Service Representative Temenos Digital Assist feature. To know more about the CSR journey in Spotlight click here.

Creating a new Application

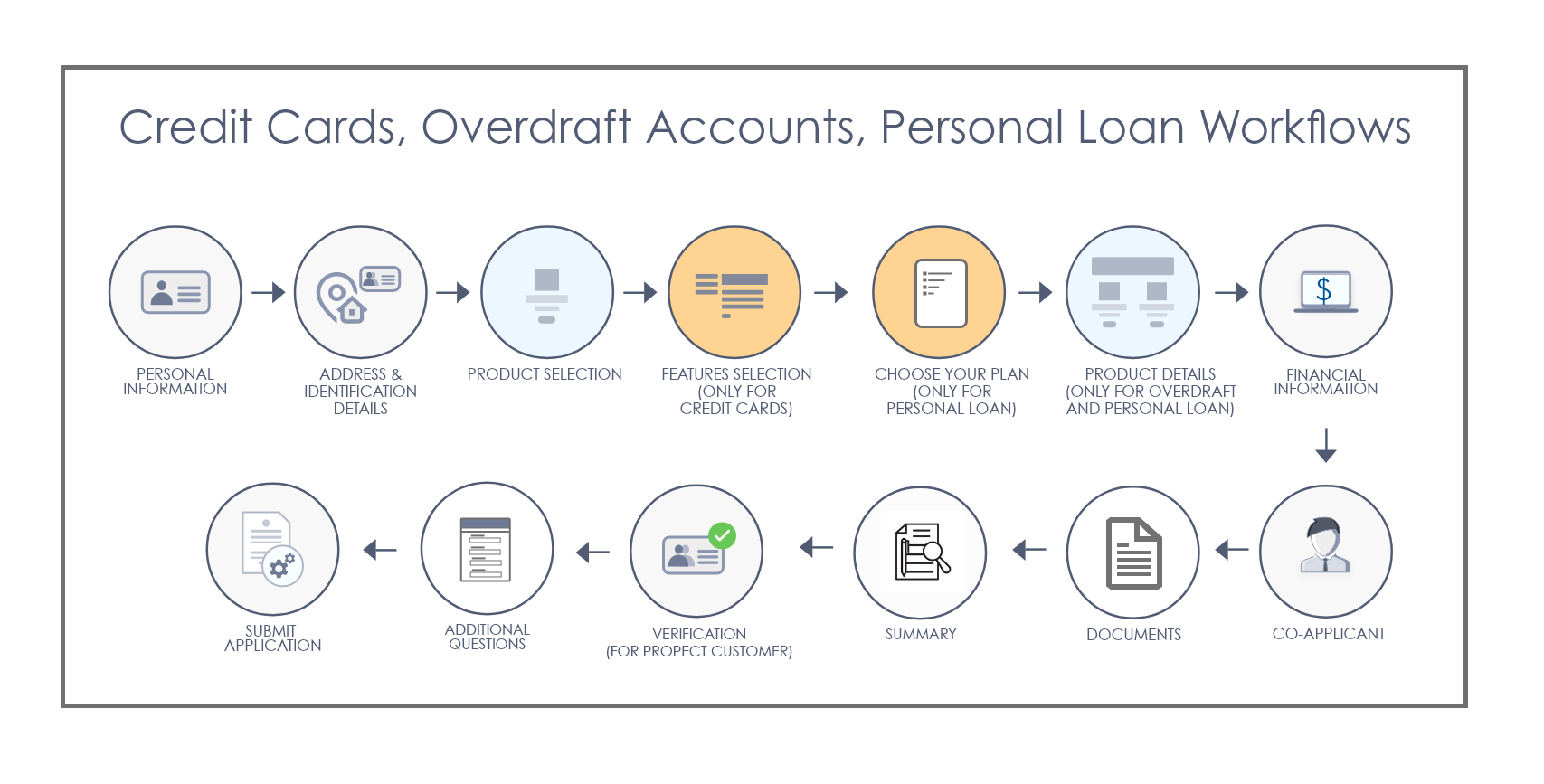

Retail Loan Origination supports the following work flows as shown below, which provides a high-level understanding of the user journey.

For the Joint application, the Co-applicant can be a existing customer or a prospect. To know more about the co-applicant flow, click here.

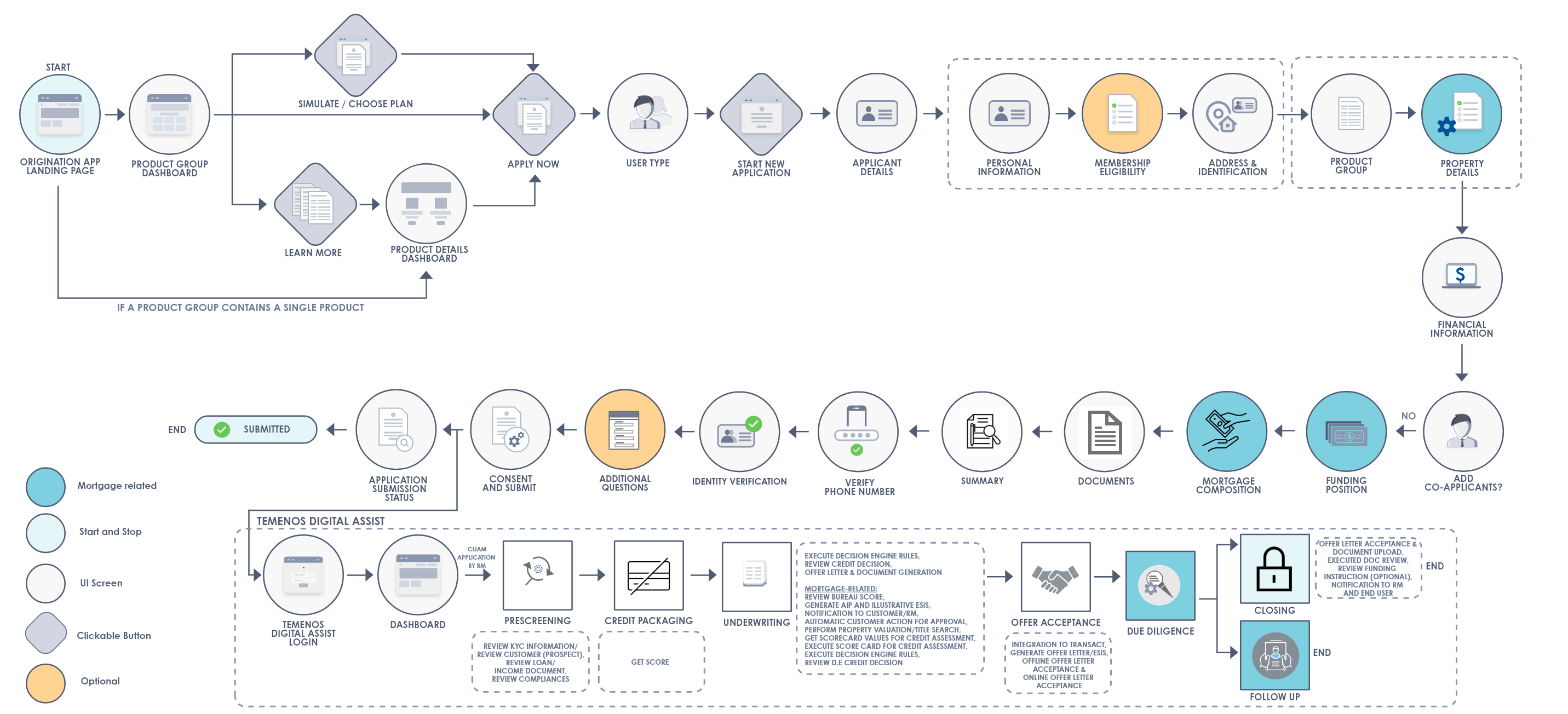

- Prospect Customer Without Co-Applicant: This scenario applies to a prospect customer who wants to apply for a loan product, without any co-applicant. The following flow diagram illustrates the Origination app flow in this scenario.

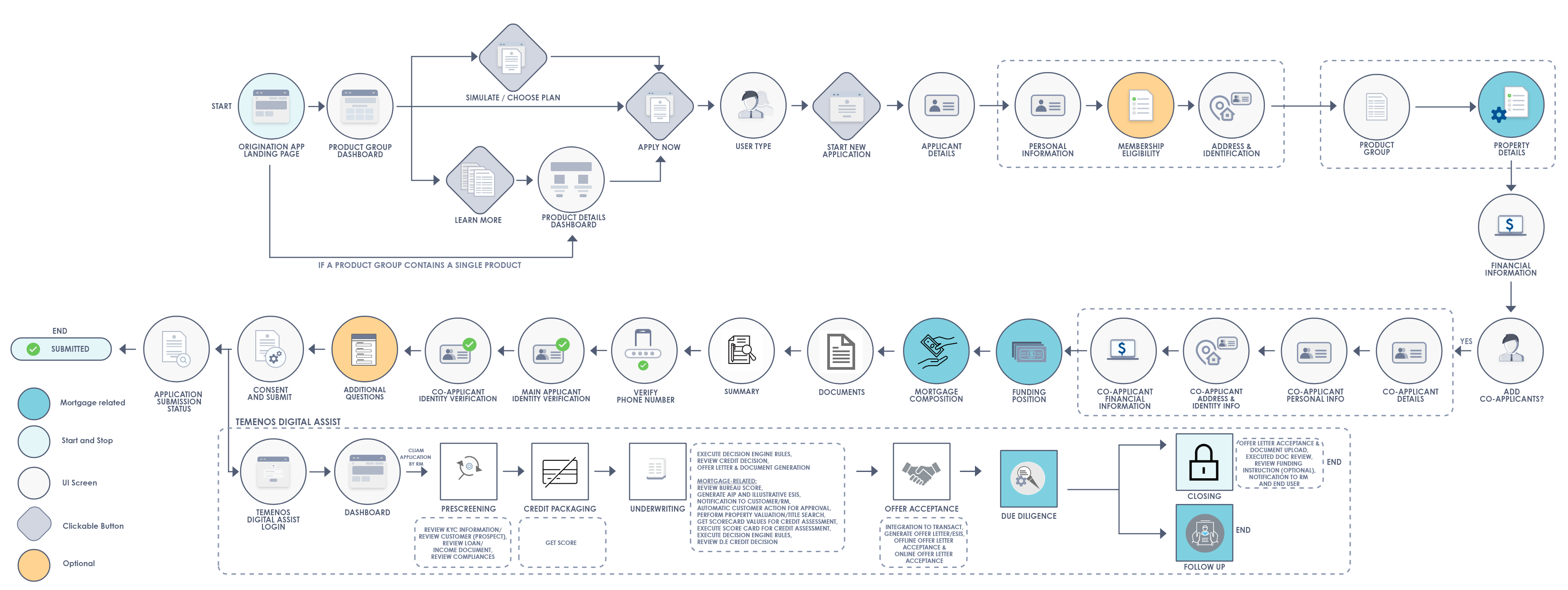

- Prospect User With Co-Applicant: This scenario applies to a prospect customer who wants to apply for a loan product, with a co-applicant. The following flow diagram illustrates the Origination app flow in this scenario.

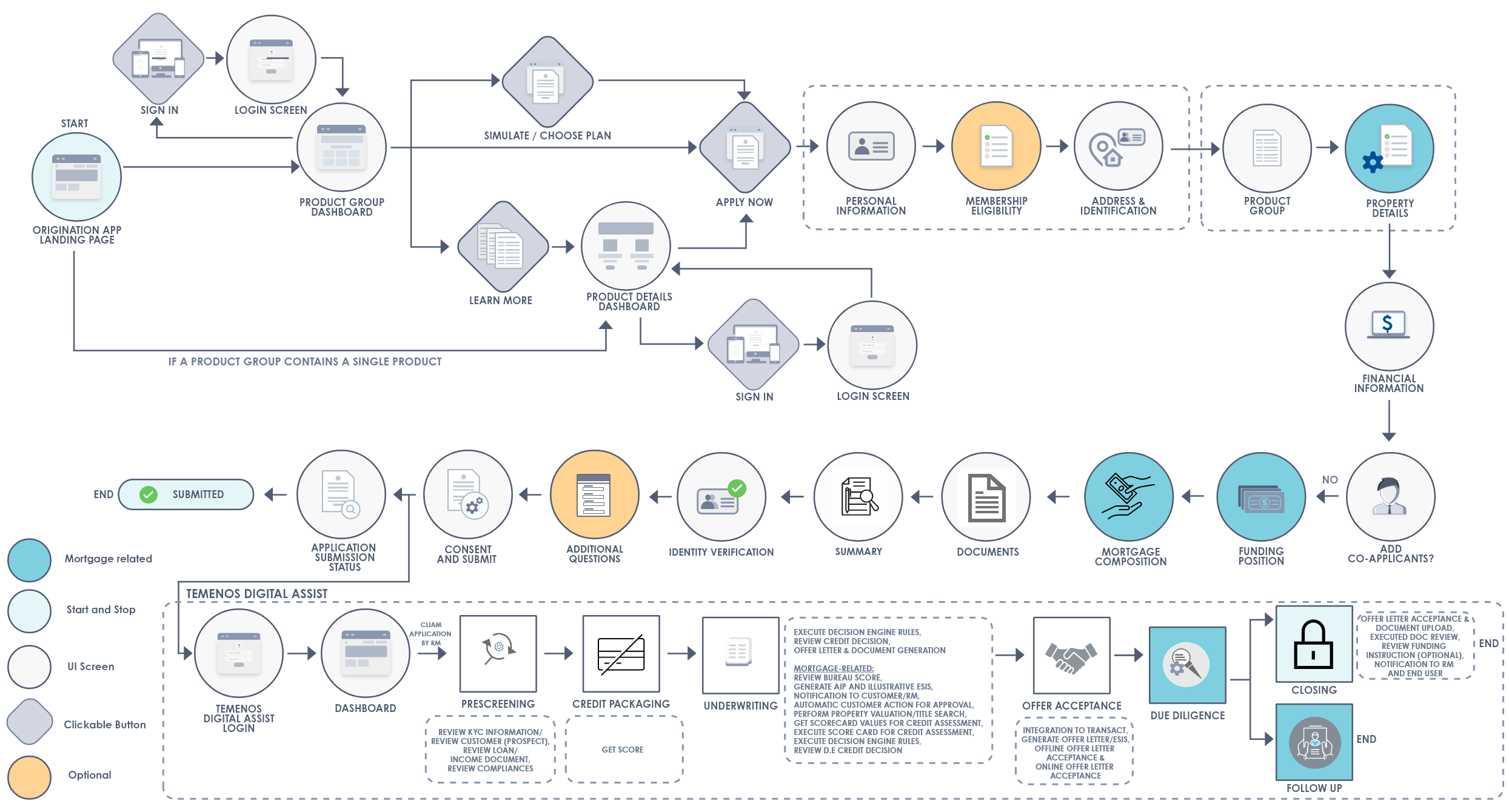

- Existing Customer Without Co-Applicant: This scenario applies to an existing customer of the bank who wants to apply for a loan product, without a co-applicant. The following flow diagram illustrates the Origination app flow in this scenario.

- Existing Customer With Co-Applicant: This scenario applies to an existing customer of the bank who wants to apply for a loan product, with co-applicant. The following flow diagram illustrates the Origination app flow in this scenario.

Mortgage & Remortgage Workflows

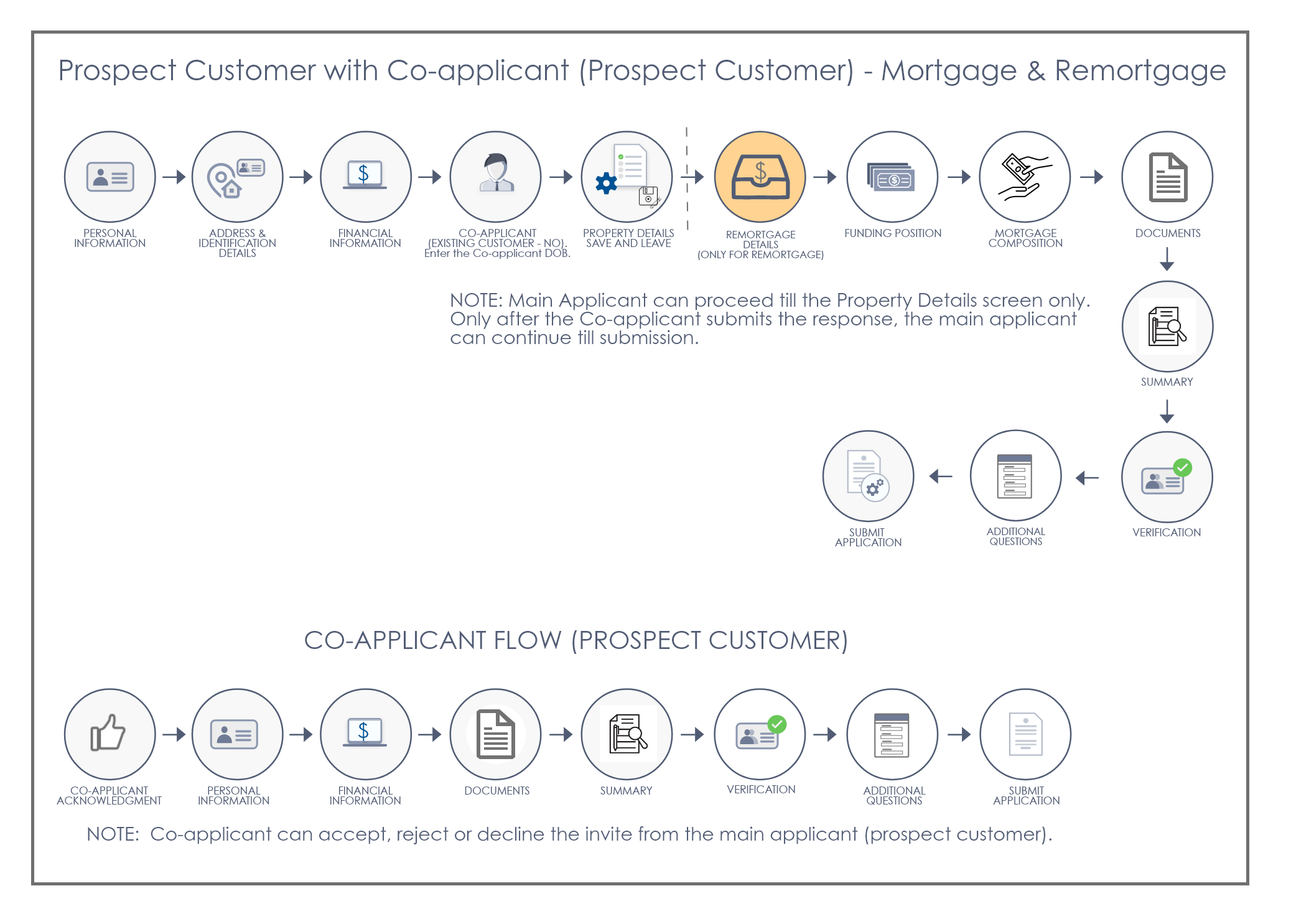

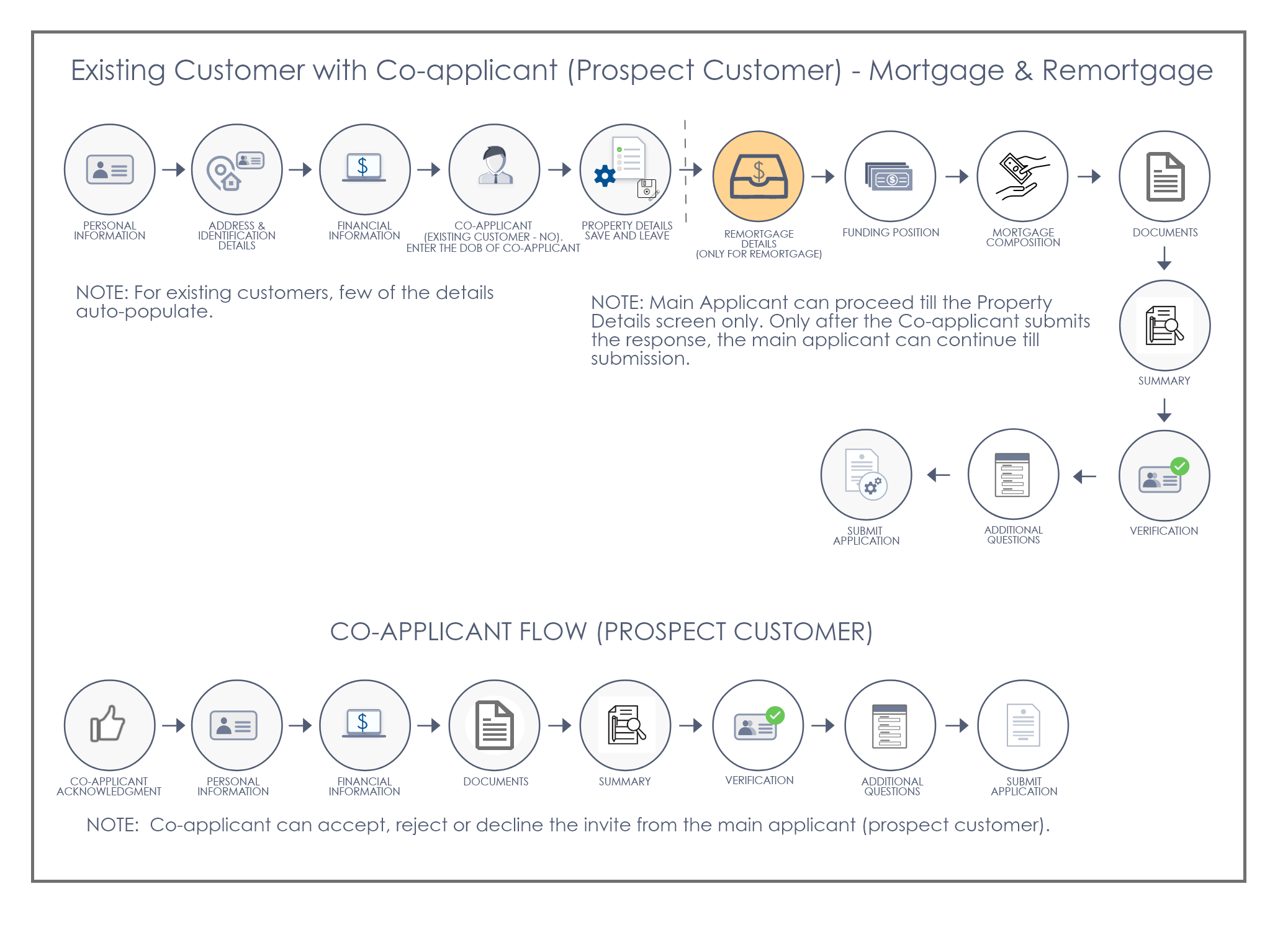

Mortgage loan supports the followings work-flows which are specific to Mortgage and Remortgage only.

- Prospect customer with Co-applicant (Prospect Customer): This scenario applies to a prospect customer of the bank who wants to apply for mortgage or remortgage and add a co-applicant who is a prospect customer. The following flow diagram illustrates the Origination app flow in this scenario.

- Prospect Customer with Co-applicant (Existing Customer): This scenario applies to a prospect customer of the bank who wants to apply for a mortgage or remortgage and add a co-applicant who is an existing customer. The following flow diagram illustrates the Origination app flow in this scenario.

- Existing Customer with Co-applicant (Prospect Customer): This scenario applies to an existing customer of the bank who wants to apply for a mortgage or remortgage and add a co-applicant who is a prospect customer. The following flow diagram illustrates the Origination app flow in this scenario.

-

Existing Customer with Co-applicant (Existing Customer): This scenario applies to an existing customer of the bank who wants to apply for a mortgage or remortgage and add a co-applicant who is an existing customer. The following flow diagram illustrates the Origination app flow in this scenario.

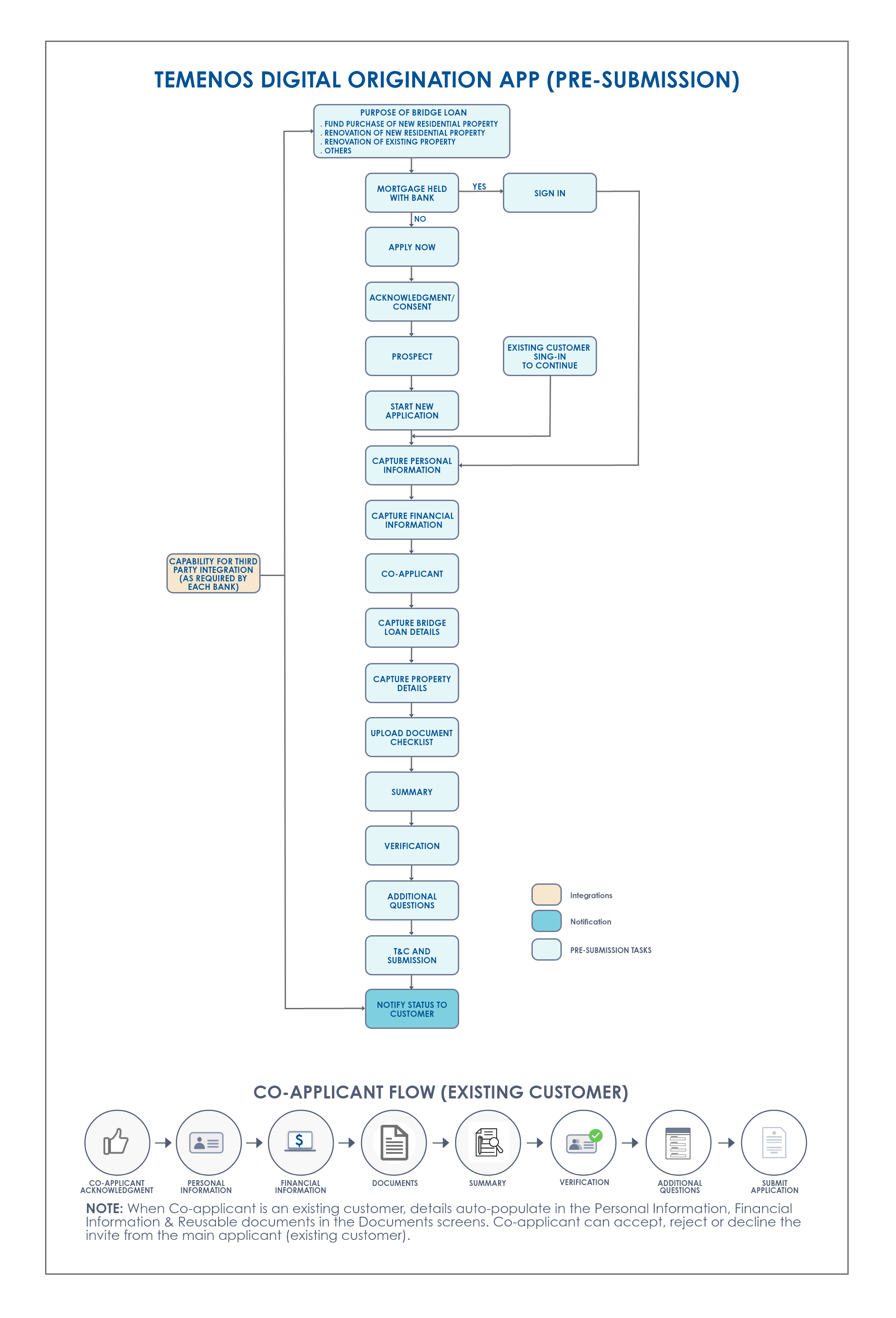

Bridge Loan Workflow

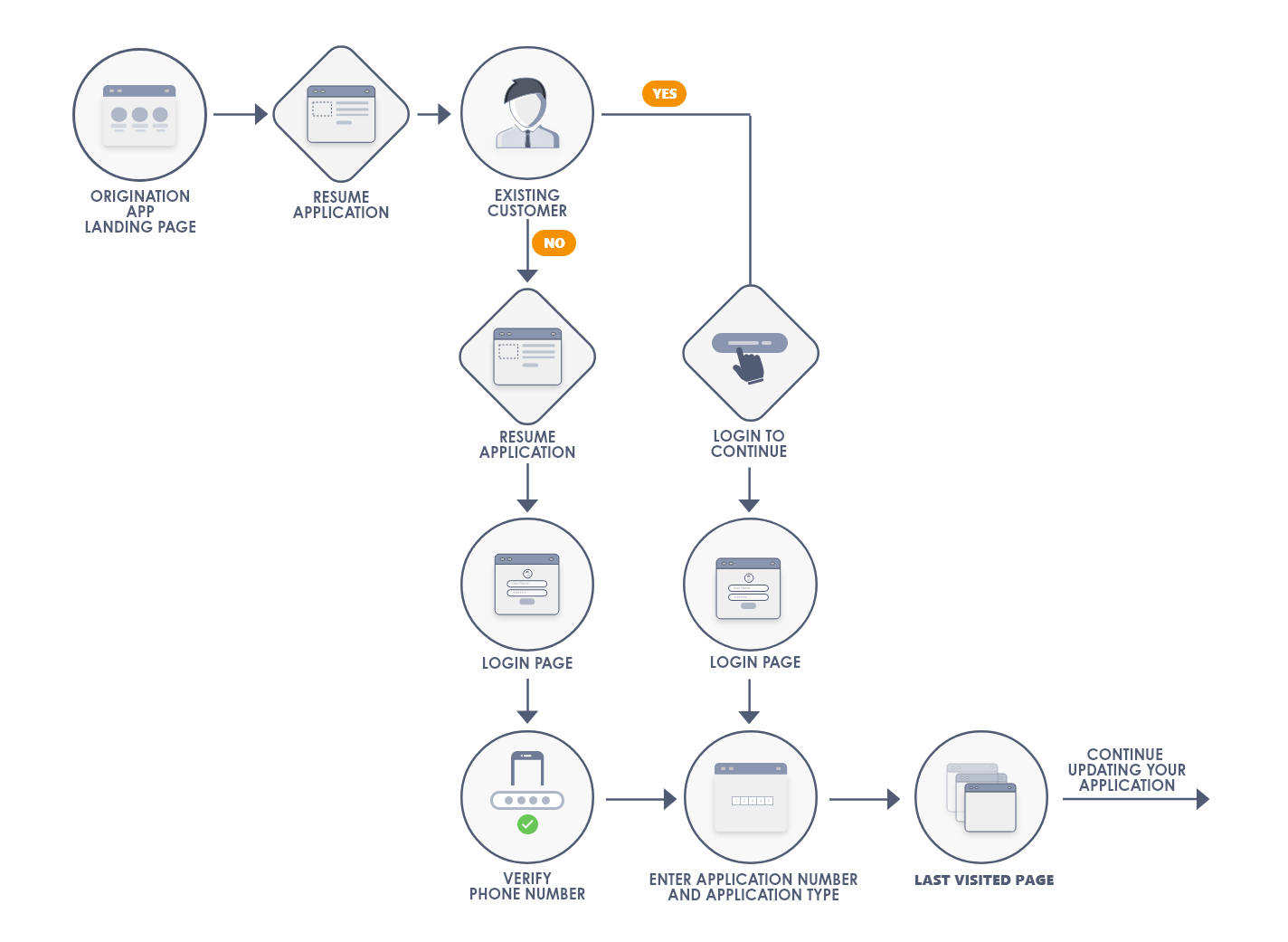

Resume Application

This scenario is applicable when a user quits the application and can resume an application to complete till submission. The following flow diagram illustrates the Resume Application flow in the Temenos Digital Origination app.

Quick Reference Links for other journeys

In this topic

.PNG)

.PNG)