Summary

The Summary section provides a synopsis of the information which the primary applicant & co-applicant has entered in the Origination App. This section enables the applicant to review the data before submitting the application.

UX Overview

This section provides an overview of the Summary screen which summarizes the information of the product selected.

The Summary page displays the list of documents submitted for Mortgage loan both as a prospect and existing customer. The applicant can view the documents that are uploaded in the document section. The Summary section is read-only. Users can expand the drop-down to review and confirm the details provided. Click Back button to navigate to the previous sections to enable the users to make any required changes. The changes done reflect in the summary screen. The applicant can add a new document, replace an existing document, or delete the existing document. If all the details are correct, click Continue to proceed.

Prospect/Existing customer without Co-applicant

When the applicant log in to the Origination App as a Prospect and select Mortgage in the Landing page and mortgage purpose from the product dashboard to initiate the Mortgage application, the following details are captured in the screens below to submit the application successfully. As an existing customer, when the applicant logins to the Origination app using OLB credentials, data pre-populates from Party Microservice, and applicant can modify the information if required. The summary screen displays the following sections as shown below.

- Personal Information:

- Prospect: This field captures Personal Information.

- Existing Customer: This field is auto-populated. The applicant can modify it if required.

- Address & Identification:

- Prospect: This field captures Address & Identification details.

- Existing Customer: This field is auto-populated. The applicant can modify it if required.

- Financial Information:

- Prospect: This field captures Financial Information details.

- Existing Customer: This field is auto-populated. The applicant can modify it if required.

- Co-Applicant Information: Select No

- Property Details: This field captures Property Details for Prospect and Existing Customer.

- Funding Position: This field captures Funding Position details for Prospect and Existing Customer.

- Mortgage Composition: This field captures Mortgage Composition details for Prospect and Existing Customer.

- Document checklist: This field captures the documents which Existing Customer has uploaded.

- Summary: Prospect and Existing Customer can review the details in the Summary section. Clicking Back button will enable the applicant to make the necessary changes in the required sections.

- Verification:

- Additional Questions: This section displays post submission of the application and enables if there are any customer actions.

- Terms and Conditions: Select the checkbox to agree to the Terms and Conditions.

- Submit: After entering all the information, applicant clicks Submit button to submit the application.

Prospect/Existing Customer with Co-applicant

Summary section has the following fields when a prospect or existing customer has a co-applicant in the Origination App.

- Personal Information:

- Prospect: This field captures Personal Information screen

- Existing Customer: This field is auto-populated. The applicant can modify it if required.

- Address & Identification:

- Prospect : This field captures Personal Information screen

- Existing Customer: This field is auto-populated. The applicant can modify it if required.

- Financial Information:

- Prospect : This field captures Financial Information.

- Existing Customer: This field is auto-populated. The applicant can modify it if required.

- Co-applicant Information: Select Yes

- Add Co-applicants and fill all below details for each Co-applicant added

- Personal Information

- Address and Identification Details

- Financial Information

- Property Details: This field captures Property details for Prospect and Existing Customer.

- Funding Position: This field captures Funding Position details for Prospect and Existing Customer.

- Mortgage Composition: This field captures Mortgage Composition details for Prospect and Existing Customer.

- Document Checklist: This field displays the document checklist for primary applicant and co-applicant (Prospect).

- Summary: The details of both the primary applicant and all the co-applicants can be reviewed in the summary screen. Clicking Back button will enable the applicant to make any necessary changes in the required sections.

- Verification:

- Additional Questions: This section displays post submission of the application and is enabled if there are any customer actions defined.

- Terms and Conditions: Select the checkbox to agree to the Terms and Conditions.

- Submit Application: After entering all the information, click Submit button to submit the application.

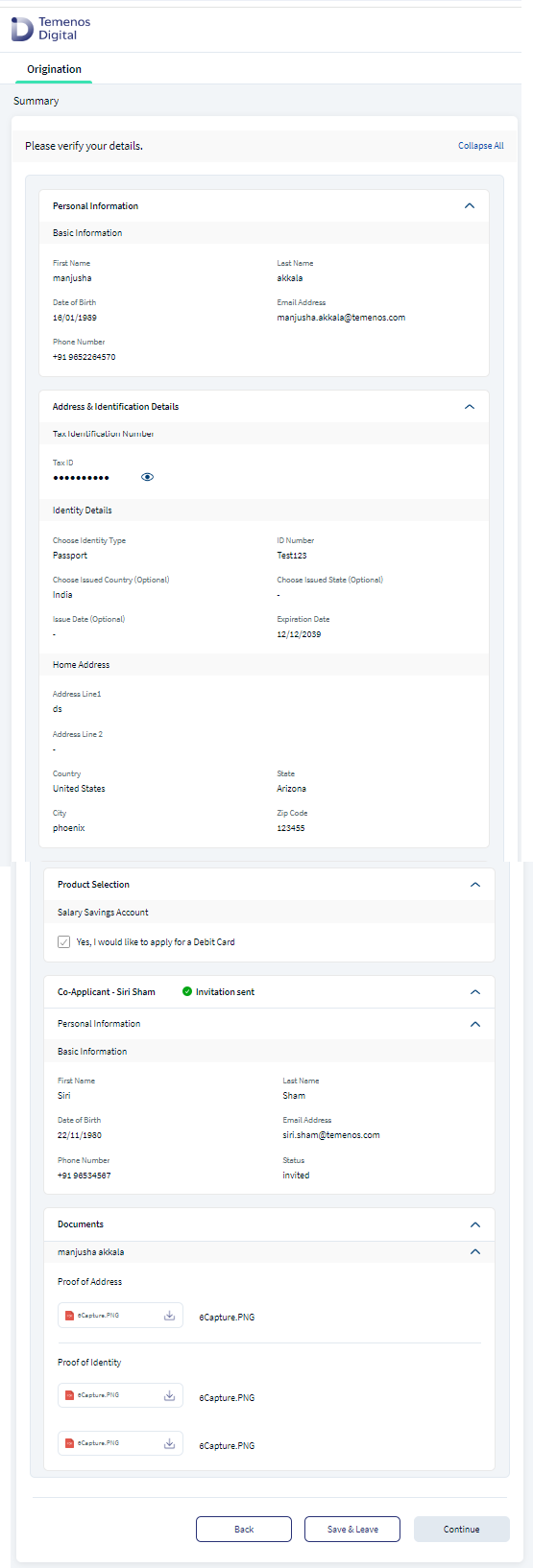

Prospect/Existing Customer with Co-applicants

Summary section has the following fields when a prospect or existing customer has a co-applicant in the Origination App. following fields:

- Personal Information:

- Prospect: This field captures the Personal Information details.

- Existing Customer: This field is auto-populated Personal Information details. The applicant can modify it if required.

- Address & Identification Details:

- Prospect: This field captures the Address & Identification details.

- Existing Customer: This field is auto-populated Address & Identification details. The applicant can modify it if required.

- Financial Information:

- Prospect: This field captures the Financial Information details.

- Existing Customer: This field is auto-populated Financial Information details. The applicant can modify it if required.

- Co-applicant Information: Select Yes

- The applicant can Add Co-applicants who is an existing customer and send Invite. The below sections do not display for Invited Co-applicant.

- Personal Information

- Address and Identification Details

- Financial Information

- Property Details: This field captures Property details for Prospect and Existing Customer.

- Funding Position: This field captures Funding Position details for Prospect and Existing Customer.

- Mortgage Composition: This field captures Mortgage Composition details for Prospect and Existing Customer.

- Document Checklist: This section displays document checklist for the primary applicant and co-applicant (Prospect)

- Summary: The applicant can only review the primary applicant details in the Summary screen. Only the invited Co-applicant’s basic information and status displays in the summary screen. Clicking Back button will enable the applicant to make any required changes.

- Note : Invited co-applicants Personal Information, Address and Identification details, Financial details, and the uploaded documents do not appear in the summary section.

- Verification:

- Additional Questions : This section displays after post submission and enables if there are any customer actions

- Terms and Conditions: Select the checkbox to agree to the Terms and Conditions

- Submit Application: After entering all the information, click Submit button to submit the application

The System Administrator will have the capability to enhance the Summary screen to display the below listed additional sections in the respective screens. The incremental sections display as per the product selected, which can be enabled or disabled.

Below are the sections and details under each component displayed as per fields in respective screen, for Onboarding and Origination - applicable for all Products.

- Personal Information: (For primary Applicant and each Prospect Co-applicant)

- Address and Identification Details: (For primary Applicant and each Prospect Co-applicant)

- Document Section

Below sections and details under each component display as per fields in the respective screen and is applicable for all Retail Lending Products.

- Financial Information for applicant/co-applicant (Prospect)

All the features including collapse, expand sections, and navigation buttons (Back, Save & Leave, Continue) display in the Summary screen.

Invited Prospect Co-Applicant Summary

The invited co-applicant can review the following tabs in the summary screen of the Origination App road map.

- Co-applicant Personal Information

- Co-applicant Address and Identification

- Product Information - Product description

- Product Information - Product Features/ Loan details Selected

- Co-applicant Financial Information (conditional on product)

- Documents uploaded

- Verification

- Additional Questions

- Submit Application : Click Save & Leave button to save the information entered and the co-applicant will logout of the application. On relogin, the co-applicant can continue from the summary screen.

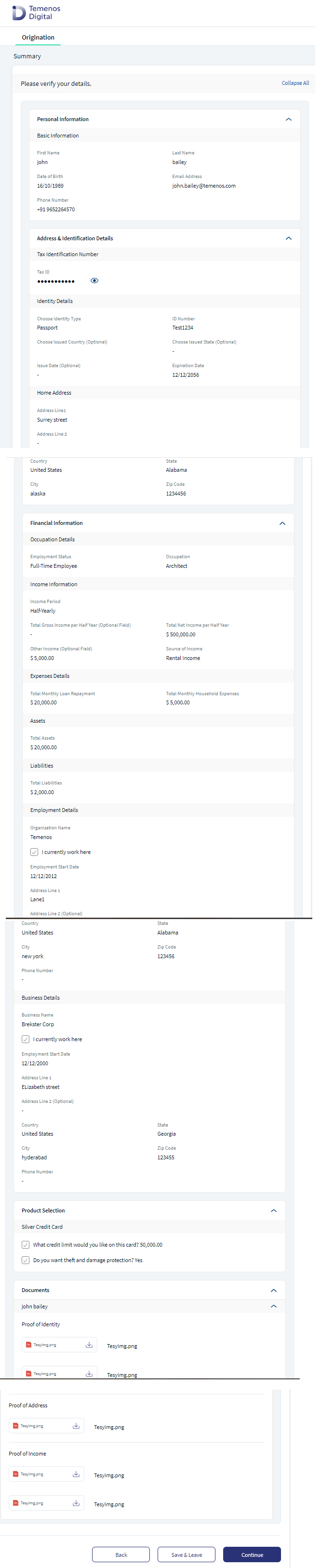

Roadmap for Retail Onboarding and Retail Lending Products (except Mortgage loans)

For Retail Account Origination applications (Savings, Account, Current Account and Deposit) or for Retail Loan Origination applications (Personal Loan, Overdraft, Credit Card), the following sections display in Onboarding and Lending Roadmap.

- Personal Information

- Product Selection: Displays for the respective Retail Onboarding and Lending products

- Financial Information: This field is enabled by default only for Retail Lending Products. It is optional for Onboarding applications

- Co-applicant: If the applicant selects Yes and Co-applicant is added, then the subsections for each co-applicant displays along with the co-applicant name

- Document Checklist: This field displays a separate section for each primary applicant and Prospect Co-applicant.

- Summary

- Verification

- Additional Questions

- Submit Application

- Additional Information: This section displays post submission and is enables if there are any customer actions

On click of Continue, the Additional Questions/ Verification screens are displayed if configured in Spotlight. Else, the Submit Application screen appears

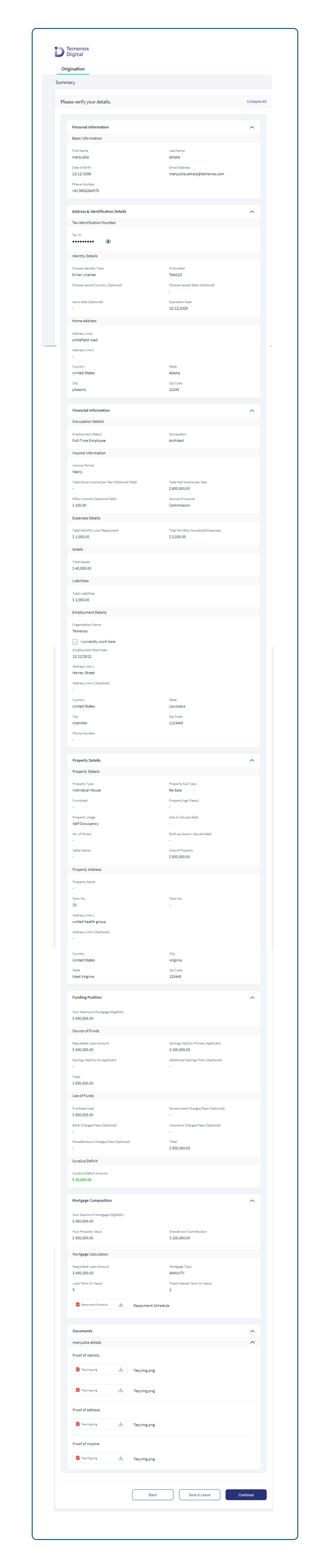

Roadmap for Mortgage Loans

Below sections and details under each component display as per fields in the respective screen, applicable only for Mortgage Loans.

- Personal Information

- Address & Identification details

- Financial Information

- Co-applicant : If you select Yes, and add Co-applicant, display sub-pages for each co-applicant showing co-applicant name

- Property Details

- Funding Position

- Mortgage Composition

- Document Checklist : Displays a separate checklist for the primary applicant and prospect Co-applicant

- Summary

- Verification

- Additional Questions

- Submit Application

- Additional Information: This section displays post submission and enables if there are any customer actions.

For Mortgage First Time Buyer, if Have you identified Property is selected as Yes in the Property Details screen, then Summary screen displays the following sections:

For Mortgage First Time Buyer, if Have you identified Property is selected as No in the Property Details screen, Estimated Property Value field displays in Summary section with the following sections:

Components

The Summary module contains the following list of components:

| Component Name | Instance Name |

|---|---|

| com.dbx.summary | BrowserCheckPopup |

Experience APIs

| API | Description |

|---|---|

| getData | This object service retrieves the application details from the Origination Data Storage Microservice. |

Configurations

The system administrator will have the capability to configure this module from the Spotlight app. For more information about configuring the Summary section, click here.

Extensibility

By using the Extensibility feature, you can customize the modules based on your requirements. For more information, refer to Extensibility.

In this topic