Mortgage Composition

The Mortgage Composition section provides the end customer the optimal mortgage product either as a single part or multi part mortgage. The product features are collected from the customer and the best fit product is recommended to the customer.

Mortgage Origination gives two different options for mortgage composition. The applicant can choose either of the following:

Mortgage Composition with Transact Integration

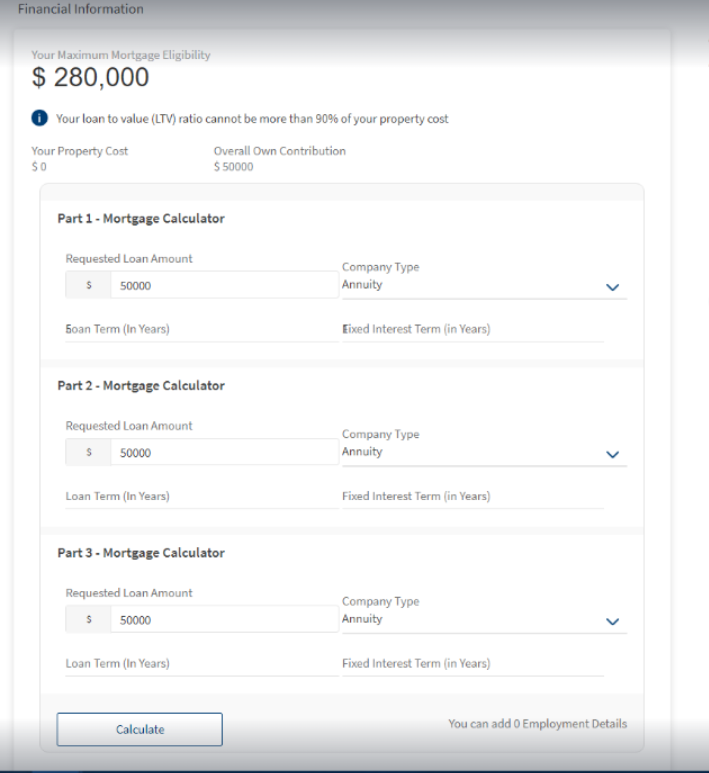

The Mortgage Composition section allows the applicant to add mortgage calculation for mortgage loan in parts and simulate the repayment schedule. Based on the details captured in the Funding Position screen, the requested loan amount is pre-populated in Mortgage Composition screen.

UX Overview

This section provides an overview of the Mortgage Composition details.

Mortgage Composition Details

The Mortgage Composition screen displays the Maximum Mortgage Eligibility amount based on the details you have provided in the Funding Position. Help Icon displays beneath the Max Mortgage Eligibility amount as 'Your Loan to Value (LTV) ratio cannot be more than 90% of your property cost'.

Property Cost: Pre-populates from the Property Details screen. You cannot edit this field. If you click the back button and navigate to the previous section to make changes in the Cost of Property, the same value updates and reflects in the Mortgage Composition screen.

Overall Own Contribution: Pre-populates the down payment amount contributed by the Borrower from the Funding Screen. Down Payment value is calculated as [Customer Contribution + Customer Contribution co-applicant + other sources]

The mortgage composition screen has the following drop-downs and input fields:

Requested Loan Amount : It pre-populates from the Funding Position screen, based on the value provided. On editing the Requested Loan Amount, it must not exceed the maximum eligible amount.

On editing, if the amount exceeds the maximum eligible amount, an error message prompts as the "Requested amount cannot be greater than the Maximum eligible amount".

Type of Mortgage : This section displays the different types of mortgage with the following drop-down options.

- Annuity

- Linear

- Interest Only

Each mortgage type is associated with a product, and the corresponding product group is defined in Spotlight Configuration.

-

Loan Term (in Years): This section captures the Loan Term in years. The maximum repayment allowed age value is 70 years.

- The maximum repayment term value allowed by Bank is 30 years

- The Maximum Allowed Repayment Term is calculated using the formula, (n) - Minimum (Bank allowed maximum repayment term, (Maximum allowed Repayment age - Current age))

- In case of Joint Applicants, take the applicant that has a minimum( Maximum allowed Repayment age - Current age)

- The loan term for each Mortgage must not be greater than the maximum mortgage term calculated

Value entered in Loan Term, must be in numeric and accepts inputs in 2 digits without decimals. The maximum value (in Year) is 30 Years, and saved as Max Allowed Term in the Product Selection entity.

-

Fixed Interest Term(in Years): This section captures the Fixed interest term in years. Value entered in Fixed Interest term must be a Numeric field and accepts inputs 2 digits without decimals. Fixed Interest Term must be less than Loan Term.

Add Multiple Mortgage Parts for Mortgage - First Time Buyer

- You can Add/Delete/Amend mortgage calculations by clicking on the Add Part button. You can configure to a maximum of three mortgage parts to the existing mortgage. Post addition of more than one mortgage part, the applicant has the option to delete other mortgage parts.

- You can edit the Loan term in all the mortgage parts and cannot be greater than maximum mortgage part. Also, the changes you do make in the first loan term reflect in the other parts.

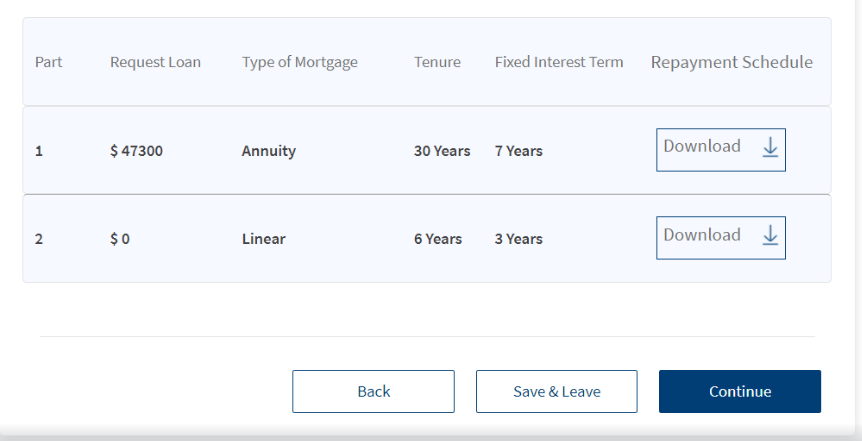

- After adding the required mortgage parts, click on Calculate button. Based on the information you provide, Origination App integrates with Transact to fetch the stimulation results. After calculation of the simulation results, the Continue button is enabled.

- The correct mortgage product based on the features which you select is configurable in Spotlight Configurations.

- When you click download, a trigger is sent to formpipe to generate the download of data as a PDF version. For ex: If you have not provided details of co-borrower details, download results do not have the co-borrower field visible in the generated artefact.

- Applicant can view the simulation results along with the repayment schedule. It has the following fields:

- Requested Loan

- Type of Mortgage

- Tenure

- Fixed Interest Term

- Repayment schedule

Simulation results fetched from the core banking system is stored in Origination Data Microservice (ODMS). Post submission, simulation results are moved to OPMS for further processing in Assist.

The XAI mortgage optimizer service acts as a self-service assistant, to the mortgage origination self-service product for New Mortgages and Re-mortgages. It is designed to gather the credit fact find data from the end customer and find the optimal mortgage product for any customer looking for a single part or multi part mortgage. This tool has been designed to assist the bank users in providing the suitable advice by gathering the credit fact find data upfront via the application form. This tool will also help the end customers in understanding how their payments may look like through the mortgage term with the help of in-built calculator. Customer can further modify these values to further refine what they are looking for.

How does XAI model work?

By collecting a few core parameters of a customer's profile or preferences, we can define the bounds of the mortgage product search. The details collected here can be as simple as the property price, the mortgage amount, maximum monthly payment, and maximum term length. This can be extended to include a full needs-based analysis. if in depth analysis is preferred by the bank. This needs-analysis can be done to add more suitable options, such as constraints and sensitivity to interest rates, which will reduce offering of more volatile variable rate mortgages.

Many of the attributes required to generate the mortgage product for the customer, can be pre-populated from the service steps. For example if the income has been declared, then the maximum monthly payment can be derived based on affordability rules. Mortgage optimiser rules can allow the best product to be presented to the customer, with easy to understand options available to them. This would be presented in an easily accessible format

In the out of the box offering, the model displays three or two possible best options for New Mortgages and Re-mortgages.

- The products offering the best interest rate

- The products offering best total repayable amount

- The products offering the smallest deposit

This is entirely API driven, serverless microservice, that can be integrated into any mortgage catalogue. The base inputs can be extended to account for any additional rules or constraints, and the outputs can be extended to include more detailed catalogue such as charges or cashback options. The self-service platform can champion responsible lending, by having a stream-lined, need based approach to mortgage lending and also provide the customer with the seamless experience.

UX Overview

This section provides an overview of the Mortgage Composition details which is applicable for Mortgage loan- First Time Buyer and Remortgage.

Mortgage Composition screen is applicable for Mortgage loan (First Time Buyer) and Remortgage loan.

Mortgage Composition Details

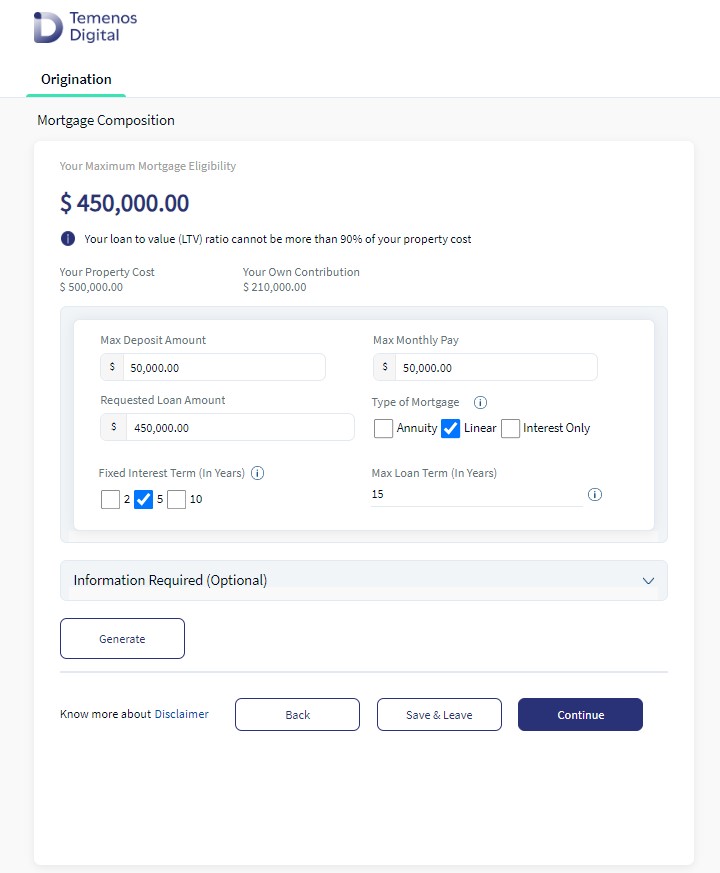

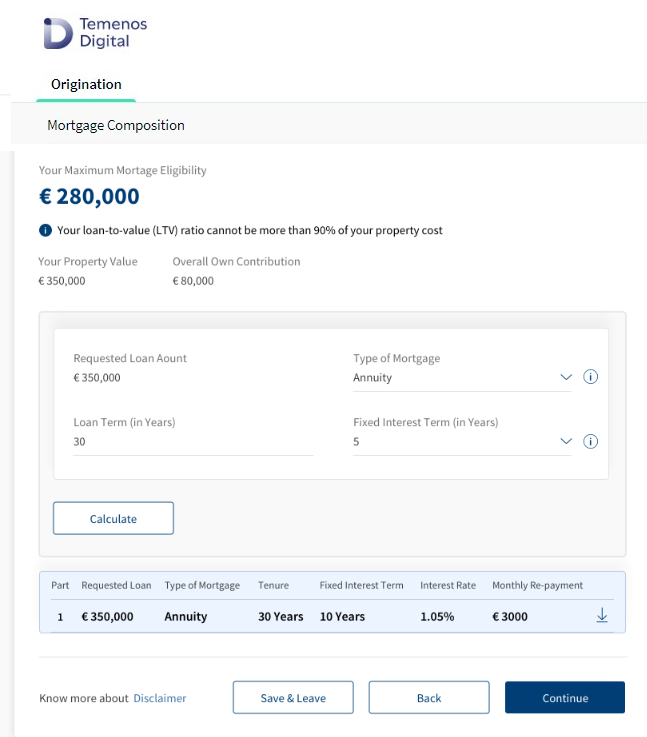

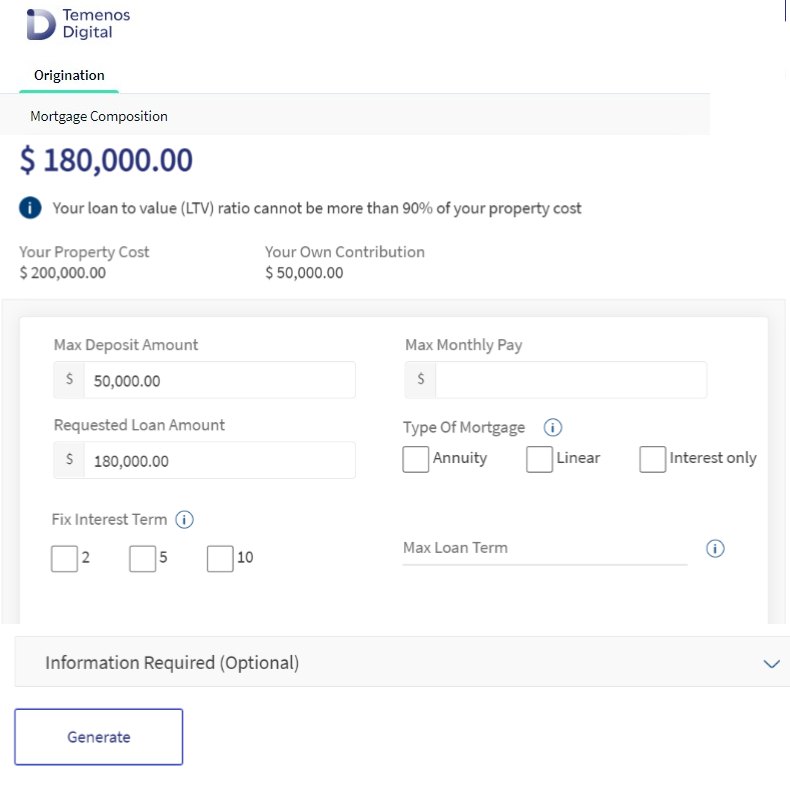

The Mortgage Composition screen displays the Maximum Mortgage Eligibility amount based on the details provided in the Funding Position screen. Help Icon displays beneath the Max Mortgage Eligibility amount as the Loan to Value (LTV) ratio cannot be more than 90% of the property cost which is configurable.

Property Value: Pre-populates from the Property Details screen. Applicant cannot edit this field and has to click the Back button to navigate to the Property Details screen if there are any changes to be made in the Cost of Property, for it to be updated and reflects in the Mortgage Composition screen.

Overall Own Contribution: Pre-populates from the down payment amount contributed by the Applicant from the Funding Screen. Down Payment value is calculated as [Customer Contribution (Primary applicant) + Customer Contribution co-applicant + other sources].

The Mortgage Composition screen has the following drop-down and input fields:

- Max Deposit Amount: The applicant can amend Max Deposit Amount value which is defaulted from the Overall Own Contribution field. This is a mandatory field. The Max Deposit Amount is calculated as Property Cost - Requested Loan Amount. The Max Deposit Amount must not be less than the Overall Own Contribution value. The Max Deposit Amount can be greater than or equal to the Overall Own Contribution value. To decrease the Max Deposit Amount, click the back button to navigate to the Funding Position screen to edit or decrease the Amount, but the edited value must not be less than the defaulted value. If the Max deposit value is greater than the defaulted value, then the Sum of Loan amount which XAI returns will decrease accordingly. The Property cost must be equal to the sum of loan amount returned by XAI + Max deposit amount.

- Max Monthly Payment: The applicant can update the Max Monthly payment. This is a mandatory field. The Max Monthly payment must not be greater than Requested Loan amount and Maximum Eligible Amount.

- Requested Loan Amount: The Requested Loan amount auto-populates from the Funding Position screen and the Requested Loan Amount must be equal or less than the Maximum Mortgage Eligibility. The Requested Loan Amount should not be less than the Request Loan Amount in the Funding Position screen. To decrease the Requested Loan Amount, applicant must click the Back button to navigate to the Funding Position screen to edit the Requested Loan Amount. If the Requested loan amount is greater than the Maximum Loan Eligibility Amount, an error message displays as Requested amount cannot be greater than the Maximum eligible amount.

- Type of Mortgage: The applicant can check and uncheck the type of mortgage value. The available options for the Type of Mortgage are:

- Annuity Mortgage

- Linear Mortgage

- Interest Only Mortgage

- Fixed Interest Term (In Years): This section captures the Fixed interest term, the applicant can check or uncheck the Fixed Interest Term for the Mortgage Loan. Fixed Interest Term value or options is configurable in Spotlight Configurations. The Fixed Interest Term must be less than the Loan Term, else the System prompts an error notification as Fixed Interest Term cannot be greater than Mortgage Loan Term.

Each mortgage type is associated with a product and the corresponding product group is defined in Spotlight Configuration. Below parameters and values are configured to determine the eligible Loan Term based on the age of the applicant applying for Mortgage First Time Buyer Loan. Below values are configurable via Spotlight as required by each bank.

- Loan Term(In Years): This section captures the Mortgage Loan Term in years. System allows the applicant to update the Mortgage term in the mortgage composition screen. The Maximum repayment allowed age value is 70 years. The Loan Term field is configurable and is validated based on the Spotlight Configuration. The Loan Term must not exceed the Maximum Loan Term

- The Maximum repayment term value allowed by Bank is 30 years.

- Maximum Allowed Repayment Term is calculated using the formula, (n) - Minimum (Bank allowed maximum repayment term, (Maximum allowed Repayment age - Current age)).

- In case of Joint Applicants, take the applicant that has minimum( Maximum allowed Repayment age - Current age).

- The Loan term for each Mortgage must not be greater than the maximum mortgage term calculated.

Value entered in Loan Term, must be numeric and in 2 digits without decimals.

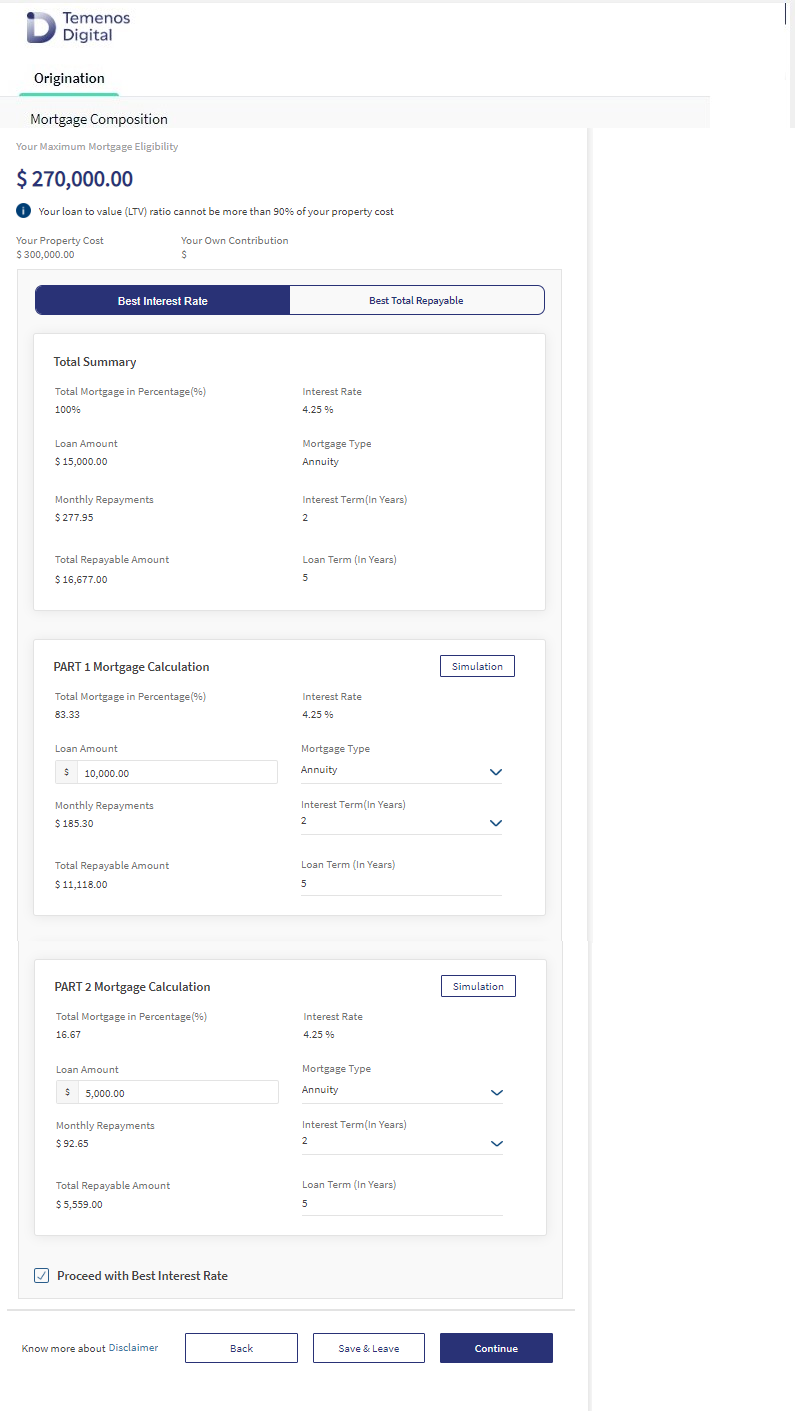

Generate : After entering the inputs in all the fields in the Mortgage Composition screen, click the Generate button. On hitting the generate button, the System will interact with XAI which triggers the Marketing Catalog Microservice (MCMS) and suggests the best product based on the criteria provided by the applicant.

The XAI output displays the best suitable product suggestion from the three tabs available:

- Best Interest Rate

- Best Total Repayable

- Smallest Deposit

If the System does not find any suitable product based on the applicant's inputs, XAI returns a notification as No suitable product available. If the Max Monthly repayment amount is lesser then XAI displays a notification as Max Monthly repayment amount should be a minimum of <amount> for the requested loan amount.

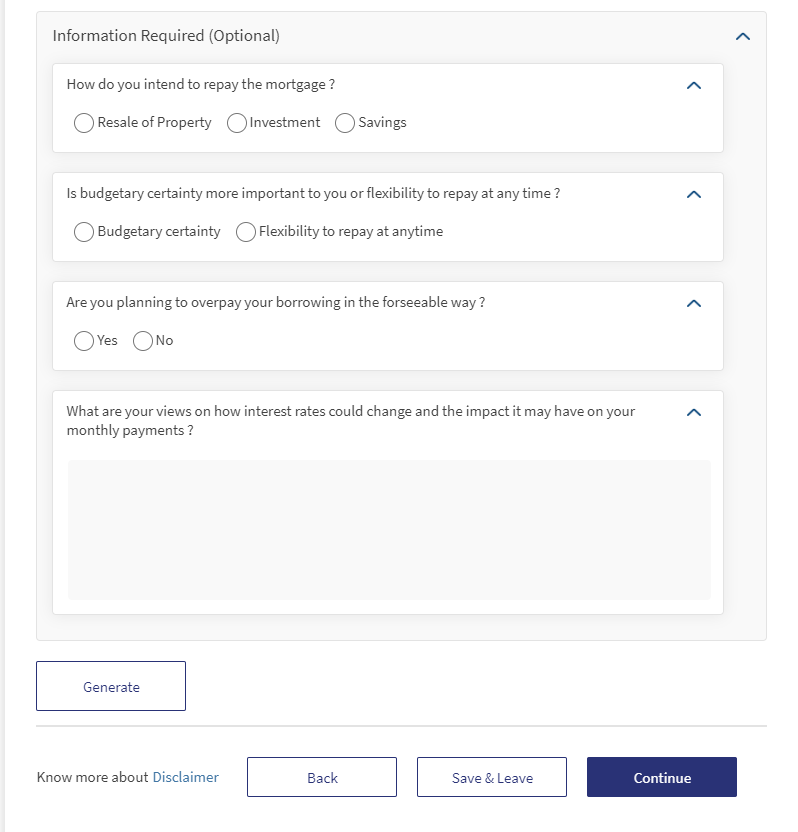

Information Required (Optional):

Additional Information Required (optional field) screen is located at the end of the Mortgage Composition screen. It has the following questions, the applicant can check and uncheck the options from the radio buttons.

- How do you intend to repay the mortgage?

- Resale of Property

- Investment

- Savings

- Is budgetary certainty more important to you or flexibility to repay at any time?

- Budgetary certainty

- Flexibility to repay at anytime

- Are you planning to overpay your borrowing in the foreseeable future?

- Yes

- No

- What are your views on how interest rates could change and the impact it may have on your monthly payments?

Applicants can enter their views as a text in the box provided.

Mortgage Parts

Add Mortgage Part screen displays the following fields.

- Total Mortgage in Percentage%

- Interest Rate

- Loan Amount

- Mortgage Type

- Monthly Repayment

- Interest Term (In Years)

- Total Repayable Amount

- Loan Term (In Years)

To add a new mortgage part for Mortgage loan- First Time Buyer, click Add Part button. You can configure to a maximum of three mortgage parts to the existing mortgage. Post addition of more than one mortgage part, the applicant has the option to delete other mortgage parts.

The applicant can edit the Loan term in all the mortgage parts and cannot be greater than maximum mortgage part.

After adding the required mortgage parts, click Calculate button. Based on the information the applicant provides, Origination App integrates with Transact to fetch the simulation results of repayment schedule. After calculation of the simulation results, Continue button is enabled.

The correct mortgage product based on the features which you select is configurable in Spotlight Configurations.

Total Summary: The Total Summary screen has the detailed summary of the mortgage parts for the suggested product.

The XAI takes the input of the following fields to calculate the mortgage part.

- Requested Loan Amount

- Max Deposit Amount

- Max Monthly Payment

- Interest Term

- Loan Term

- Mortgage Type

Based on the inputs provided, the result of the Total Summary is generated which includes the following fields Requested Loan Amount, Max Deposit Amount, Max Monthly Payment, Interest Term, Loan Term and Mortgage Type. This section is not- editable and the fields are updated only if there is a simulation in the mortgage parts for calculation

Total Mortgage Percent : This field displays the applicant's percentage usage of the mortgage eligible amount. Total Mortgage Percent is calculated by XAI and the percentage displays. This field is non-editable.

Interest Rate: The applicant can view the average Interest Rate of all the parts of mortgage calculation. This field is non-editable.

Loan Amount : This is an editable field. The applicant can view the Loan Amount which is the total of all the loan amount in the parts of mortgage calculation.

Mortgage Type : This is an editable field. The applicant can view all the Mortgage Types which the applicant has selected.

Monthly Repayment : The applicant can view the Monthly Repayments having sum of all repayments for all the parts of mortgage calculation. This field is non-editable.

Fixed Interest Term(In Years) : This is an editable field. The applicant can view the fixed interest term in all the mortgage parts.

Total Repayable Amount : The applicant can view the Total Repayable Amount which is the total of the requested loan amount and monthly repayment amount in all the mortgage parts. This field is non-editable.

Loan Term (In Years) : This is an editable field. The applicant can view the mortgage Loan Term and it has the maximum of loan term in all the mortgage parts.

Repayment Schedule - AIP Approved - Mortgage Product

The applicant receives the illustrative ESIS which contains the Repayment Schedule. The applicant can view the Repayment Schedule button with the download icon in the Mortgage part only for the Transact API Integration and not for XAI Integration.

If the XAI is enabled in Spotlight, the Repayment Schedule button does not display or is disabled in the Origination App. If the XAI is disabled, the download button displays in the Origination App.

Simulation Mortgage Part: In the mortgage parts, Simulation button is only enabled if there is a change in the editable fields of the mortgage part

- Loan Amount

- Mortgage Type

- Interest Term (In Terms)

- Loan Term(In Years)

When you click the Simulation button, the System considers the updated values for any given editable fields and displays the updated values for the particular suitable products.

In the Mortgage Part screen, the applicant must be able to edit and update the Loan Amount. The Loan Amount in the particular mortgage part along with other parts must not exceed the maximum eligible amount.

The Loan Amount in the particular mortgage part along with other parts must not be less than the Loan Amount in Funding Position screen.

In the mortgage part, the applicant can only edit or modify the following fields mentioned below:

- Loan Amount - Mortgage Part Simulation:

The applicant can edit and update the Loan Amount in the Mortgage part. The Loan Amount in the particular part along with other parts provided must not exceed the maximum eligible amount. The Loan Amount in the particular part along with other parts provided must not be less than the loan amount in the Funding Position screen. The XAI takes the updated loan amount and provides the updated calculated values in the particular suitable product.

After the simulation is completed, the Loan Amount value gets updated in Total Summary screen. The change in the Total Mortgage Percentage in all the parts and in the Total summary values get updated accordingly. The Monthly Repayment Amount gets updates in the mortgage part in which the Loan Amount was modified. Also, Total monthly repayment gets updated in Total Summary screen. Total repayment gets updated in the mortgage part in which the loan amount was modified. Also, Total repayment gets updated in Total Summary screen.

If the amended Loan amount in mortgage part results in requested loan amount exceeding max eligible amount or if it goes below requested loan amount system should throw error. Temenos Digital passes all the part values along and a Flag is set for the part which is changed. During Amendment, when the Max monthly repayment exceeds the suggested max monthly repayment system raises a warning message. Temenos Digital Assist handles the validation part.

- Mortgage Type- Mortgage Part Simulation :

The applicant must be able to edit and update the mortgage type in the mortgage part. Click the Simulation button, the XAI takes the updated loan amount and provides the updated calculated values in particular suitable product. After the simulation is complete the Loan Amount value is updated in Total Summary screen. The change in the Total Mortgage Percentage in all the parts and in the Total Summary is updated accordingly.

The Monthly Repayment Amount gets updated in the Mortgage part in which the Loan Amount is changed. Total Monthly Repayment gets updated in Total Summary. Total Repayment gets updated in the mortgage part in which the Loan Amount is changed.

While amending the Loan Amount in the Mortgage parts, if the Requested Loan Amount exceeds the Max Eligible Amount or if it is less than the Requested Loan Amount, System displays a error notification. Temenos Digital passes all the part values along and a Flag is set for the part which is changed. During Amendment when the Max Monthly Repayment exceeds the suggested Max Monthly Repayment, System displays a warning message and Temenos Digital Assist handles the validation.

Edit Monthly Repayment: The applicant must be able to edit and update the Monthly Repayment in the mortgage part. Click the Simulation button, XAI takes the updated Monthly Repayment Amount and displays the updated calculated values in best suitable products. After the simulation is complete the value is updated in Total Summary screen.

- Interest Term- Mortgage Part Simulation: The applicant must be able to edit and update the Interest Term in the mortgage part. Click the Simulation button, XAI takes the updated Interest Term and displays the updated calculated values in best suitable products. After the simulation is complete the value is updated in Total Summary screen.

Interest Term must always be less than the Loan Term, otherwise System displays an error Fixed Interest Term cannot be greater than Mortgage Loan Term of that particular part.

The Monthly Repayment Amount gets updated in the Mortgage part in which the Loan Amount is changed. Total Monthly Repayment gets updated in Total Summary. Total Repayment gets updated in the mortgage part in which the Loan Amount is changed.

While amending the Loan Amount in the Mortgage parts, if the Requested Loan Amount exceeds the Max Eligible Amount or if it is less than the Requested Loan Amount, System displays a error notification.

Temenos Digital passes all the part values along and a Flag is set for the part which is changed. During Amendment when the Max Monthly Repayment exceeds the suggested Max Monthly Repayment, System displays a warning message and Temenos Digital Assist handles the validation.

- Loan Term- Mortgage Part Simulation: The applicant must be able to edit and update the Loan Term in the mortgage part. Click the Simulation button, XAI takes the updated Loan Term and displays the updated calculated values in best suitable products. After the simulation is complete the value is updated in Total Summary screen.

Loan Term must not be greater than Max Allowed Term, otherwise System displays an error Mortgage Loan Term cannot be greater than the Maximum Loan Term.

If Loan term is beyond the Loan term requested in the previous screen, System throws an throw Error and Temenos Digital handles the validation. The Monthly Repayment Amount gets updated in the part in which the Loan amount is changed. Also, Total monthly repayment gets updated in the Total Summary.

Total repayment value gets updated in the part in which the loan amount was changed. Similarly Total repayment should be updated in Total Summary. Temenos Digital passes all parts value along and sets a Flag for the part which is changed.

In the initial mortgage composition screen, the additional questions section displays to suggest the best product based on the applicant's input. screen. The Continue button is disabled only while editing the information.

In the summary page, when the mortgage screen displays the best suitable product, the Continue button is enabled. If there is a change in the mortgage parts, the Continue button is disabled. On click of Continue button, a notification displays as Would you like to continue with Best Interest Rate option from Mortgage Composition.

Click the Back button to go to the mandatory fields and additional question screen, the applicant can edit and update the existing fields if required. Based on the applicant's inputs, the System regenerates the best suitable products and the Continue button is disabled. Click the Continue button, when there is no change in the mandatory fields and additional question. On click of Continue button, the control navigates to the Documents screen.

Configurations

The System administrator will have the capability to configure this module from the Spotlight app. For more information about configuring the Funding Position section, click here.

The following APIs are shipped as part of this feature:

| API | Description |

|---|---|

| getProductSelection | This API allows to get the Product Selection info stored in ODMS. |

| updateProductSelection | This API allows to create/update Product Selection details in ODMS. |

| generateDocument | This API allows to generate the document |

| updatePaymentSchedule | This API allows to update the schedule data in ODMS . |

In this topic